SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

(Commission File No. 001-32221)

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of registrant’s name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

Parent Company and Consolidated

Quarterly Information (ITR)

GOL Linhas Aéreas Inteligentes S.A.

September 30, 2023

with Review Report on the Quarterly Information

Gol Linhas Aéreas Inteligentes S.A.

Parent Company and Consolidated Quarterly Information (ITR)

September 30, 2023

Contents

| Comments on the Performance | | 2 |

| Report of the Statutory Audit Committee (“SAC”) | | 8 |

| Statement of the Executive Officers on the Parent Company and Consolidated Quarterly Information (ITR) | | 9 |

| Statement of the Executive Officers on the Independent Auditors’ Review Report | | 10 |

| Independent Auditor’s Review Report on the Quarterly Information (ITR) | | 11 |

| Balance Sheets | | 13 |

| Income Statement | | 15 |

| Comprehensive Income Statements | | 17 |

| Statements of Changes in Shareholders’ Equity | | 18 |

| Cash Flows Statements | | 19 |

| Value Added Statements | | 21 |

| Notes to the Parent Company and Consolidated Quarterly Information (ITR) | | 22 |

Comments on the Performance

GOL maintained its virtuous cycle in 3Q23 with a 5% growth in its supply (ASK) and an increase in unit revenues year-over-year. Combined with increased productivity and ancillary revenues contribution, the Company achieved a record-breaking revenue for the 3Q with a sustainable EBITDA margin.

“Our third-quarter net revenue increased 16.4% year-over-year, as GOL experienced a strong and steady domestic demand environment. Our operational fleet utilization remained high at 11.3 hours per day, and we saw strength in our forward bookings with our quarterly sales volume reaching R$5.4 billion. We believe that our discipline to maintain the lowest unit costs in the industry and our Team’s commitment to offering the best experience to Customers will reinforce GOL’s already consolidated competitive position in the market,” added Celso Ferrer.

Continuous Net Revenue Growth

The 16.4% increase in net revenue was driven by a balanced combination of increased capacity and higher yields, as well as the strengthening of leisure demand for air travel in Brazil and a gradual recovery in the corporate market, which saw an 17.3% increase compared to the previous quarter.

During the quarter, the Company focused on several strategic initiatives, including entering new regional markets, enhancing its digital channels to achieve a new level of 72% in self-service capabilities, and continuous growth of its cargo (Gollog) and loyalty (Smiles) business units. These combined efforts contributed to a 10.7% increase in RASK, with a 4.5% boost in yields and a significant 65.1% rise in ancillary revenues year-over-year.

“We continue to show quarterly growth compared to last year, both in total revenue and in unit revenue. The trend and consistency that our numbers have shown each quarter, with a steady recovery in demand, are indicators that we are harvesting results based on our strategy. We remain focused on delivering the best experience to our customers through our product and our Team of Eagles”, said Carla Fonseca, Vice President of Customer Experience, Marketing, Sales Channels and President of Smiles.

Additional Revenues Streams as Drivers of RASK Growth

Smiles Viagens, our tourism operator launched in 2Q23, maintained its pace of expansion during this quarter focusing on offering a unique experience for its members. With products such as airline tickets, hotels, car rental, tickets, transfers and more than 8000 activities throughout Brazil and the world, Smiles Viagens has been expanding its portfolio of products and partnerships, highlighting direct negotiations with hotels that already there are more than 800 in addition to important brokers in the Brazilian and international segment.

Gollog, the cargo transportation business unit, more than doubled its revenue year-over-year, reaching R$257 million in 3Q23. The Company added a fifth Boeing 737 freighter aircraft to its fleet, as part of the exclusivity agreement with Mercado Livre. The cargo transportation contract with Mercado Livre is for six cargo aircraft year end, with the possibility of further expansion to a total fleet of 12 cargo aircraft in the upcoming years.

Smiles expanded its customer base by more than 8% year-over-year, reaching 22.1 million customers in 3Q23. This demonstrates the high value opportunity that is being captured after the incorporation of Smiles by GOL in 2021.

“The combined revenue from Gollog and Smiles already represent 30% of the third quarter Company’s total revenue generation and the growth rate remained high in 65.1%. Since the integration of Smiles, synergies continue to be captured at an accelerated pace. Smiles has nearly doubled its turnover compared to the pre-pandemic period. Now, with the activities of Smiles Viagens, we see additional revenue potential to be captured that will further contribute to the sustained expansion of our ancillary revenues,” added Carla Fonseca.

Fleet Update

The Company has been impacted by delays and uncertainty in the delivery schedule of new Boeing 737-MAX 8 aircraft from its manufacturer. From the total of 15 new aircraft expected to be delivered this year, GOL added in this quarter, one new Boeing 737-MAX 8 aircraft to its fleet as well as its fifth Boeing 737-800BCF aircraft, as part of the exclusive agreement with Mercado Livre for cargo transportation. In line with its fleet renewal plan and to recover operational efficiency, the Company returned four Boeing 737-NG aircraft.

As of September 30, 2023, GOL had a total fleet of 141 Boeing aircraft including 39 737-MAX, 97 737-NG and five 737-800BCF freighters.

As of September 30, 2023, GOL had 106 firm orders for the acquisition of Boeing 737-MAX aircraft, 69 of which were for the 737-MAX 8 model and 37 for the 737-MAX 10 model.

Capacity Management and Productivity Increase

GOL maintains its focus on the optimization of its operational capacity through the expansion of new bases with sustainable demand, particularly in regional markets. Although impacted by the lower dilution of fixed costs due to delays in receiving new aircraft, which has caused the Company to reduce its growth for this year, the Company’s expanded its capacity (ASKs) by approximately 5% in the third quarter while improving load factor to 83.7%, a 2.4 p.p. year-over-year increase. CASK decreased by 8.0% while CASK for passenger operations decreased by 9.5% in comparison to 3Q22.

The operational aircraft utilization remained high, at 11.3 hours per day, corroborating GOL’s focus on improving its productivity indicators and reducing its unit cost, to remain the lowest-cost benchmark in the region. In the international market, the Company continued to increase its capacity (5.0% compared to 3Q22), reaching approximately 52% of its total capacity in the third quarter of 2019.

Network Update

GOL expanded the total number of flights by 13% year-over-year largely due to the reconfiguration of its network and the introduction of operations in regional markets. Cities such as Araçatuba (São Paulo) and Uberaba (Minas Gerais) are now being served by Boeing 737 aircraft, providing connections to various national destinations, including Rio de Janeiro, Salvador, Curitiba, and Brasília.

In the international market, the Company continues to grow. International ASKs grew 5.0% year-over-year, reaching approximately 52% of the same period in 2019.

“These positive results observed in the third quarter reflect the consistent and resilient management combined by a domestic market demand growing, that permitted to achieve the best August ever according to ANAC (8.2 million passengers transported in Brazil), and GOL’s disciplined process of resuming supply with high productivity and operational efficiency. These strong results were supported by our initiatives and continued strategic investments in recent months,” concluded Celso Ferrer.

Liability Management Initiatives

This quarter, the Company completed the refinancing of debentures of GOL Linhas Aéreas S.A. (GLA), resulting in the amortization of approximately R$100 million in September 2023, with the R$900 million balance to be repaid over 30 monthly installments starting January 2024. This extends the maturity date of the debentures until June 2026. This liability management initiative enhances GOL’s ability to maintain its financial discipline and extend the debt profile.

As of September 29, 2023, the Company concluded the conversion of US$1.2 billion in Senior Secured Notes (SSNs) with maturity date in 2028 issued by GOL Finance and held by Abra Global Finance, into US$1.2 billion in Exchangeable Senior Secured Notes (ESSNs) issued by GOL Equity Finance and maturing in 2028. ESSNs are an instrument convertible into shares and in this context, a total of 992 million warrants were issued by the Company, which can be subject to a future conversion into shares at the exercise price of R$5.82 per share, which would result in the reduction of R$5.9 billion in GOL's total debt.

Due to this conversion, and in compliance with international accounting standards (IFRS 9 – financial instruments), which requires that debt instruments with convertibility characteristics have design segregation between the fair value of the debt financial liability and the instrument derivative option to convert bonds into shares, a total of R$3.4 billion was calculated relating to the fair value portion of the option and recognized as a long-term liability for derivative operations with a counterpart in equity.

“Strengthening our balance sheet continues to be a top priority. Our fundamentals continue to improve as the reduction in our leverage from 9.5x at the end of last year to 4.0x on September 30, 2023 highlights. We remain focused on the execution of several initiatives to strengthen our balance sheet to sustain the Company’s operational performance”, said Mario Liao, CFO.

GOL and Air France-KLM Commercial Agreement

In October, the company renewed its exclusive commercial agreement with AirFrance-KLM for another ten years, including certain commercial conditions that bring value to GOL and AFKL. The renewal of the commercial agreement will provide better connectivity to more than 125 destinations covered in Europe and Brazil. Customers will benefit from an optimized network between Europe and Brazil, spanning over 80 European destinations, 45 destinations in Brazil, and in the future, new destinations across Latin America. The agreement includes expanded code-sharing, enhanced joint sales activities, and more benefits for customers via Air France-KLM’s Flying Blue and GOL’s SMILES frequent flyer programs and includes an expansion of the existing maintenance support by Air France Industries KLM Engineering & Maintenance (AFIKLME&M) to GOL’s CFM56 and LEAP engines.

ESG Developments

The Company has concluded and published its Stakeholder Relationship Policy to further advance its ESG strategies, and open space for the creation of initiatives and projects aimed at all GOL’s Stakeholders.

In September, the Company launched the Green Aircraft initiative in partnership with “Eu Reciclo” to further promote and maintain active its voluntary carbon compensation strategy via the “#MeuVooCompensa” program (joint project with MOSS Earth). The Green Aircraft initiative aims to recycle twice the amount of waste generated from in-flight service and provides for the compensation of 1,000 tons of material in one year.

Operational and Financial Indicators

| Traffic Data - GOL (in millions) | 3Q23 | 3Q22 | % Var. |

| RPK GOL – Total | 9,050 | 8,361 | 8.2% |

| RPK GOL – Domestic | 8,225 | 7,555 | 8.9% |

| RPK GOL – Foreign Market | 825 | 806 | 2.4% |

| ASK GOL – Total | 10,813 | 10,283 | 5.2% |

| ASK GOL – Domestic | 9,810 | 9,327 | 5.2% |

| ASK GOL – Foreign Market | 1,003 | 956 | 4.9% |

| GOL Load Factor – Total | 83.7% | 81.3% | 2.4 p.p. |

| GOL Load Factor – Domestic | 83.8% | 81.0% | 2.8 p.p. |

| GOL Load Factor – Foreign Market | 82.3% | 84.3% | -2.0 p.p. |

| Operating Data | 3Q23 | 3Q22 | % Var. |

| Revenue Passengers - Pax on Board ('000) | 8,082 | 6,945 | 16.4% |

| Aircraft Utilization (Block Hours/Day) | 11.3 | 11.1 | 1.8% |

| Departures | 57,284 | 50,636 | 13.1% |

| Total Seats ('000) | 9,997 | 8,938 | 11.8% |

| Average Stage Length (km) | 1,064 | 1,150 | (7.5%) |

| Fuel Consumption in the Period (mm liters) | 309 | 278 | 11.2% |

| Full-Time Employees (at period end) | 13,919 | 13,751 | 1.2% |

| Average Operating Fleet(4) | 108 | 102 | 5.9% |

| On-Time Departures | 87.3% | 92.7% | (5.4 p.p.) |

| Flight Completion | 97.6% | 99.6% | (2.0 p.p.) |

| Lost Baggage (per 1,000 pax) | 2.54 | 2.21 | 14.9% |

| Financial Data | 3Q23 | 3Q22 | % Var. |

| Net YIELD (R$ cents) | 46.99 | 44.97 | 4.5% |

| Net PRASK (R$ cents) | 39.33 | 36.56 | 7.6% |

| Net RASK (R$ cents) | 43.15 | 38.99 | 10.7% |

| CASK (R$ cents) | 35.52 | 38.60 | (8.0%) |

| CASK Ex-Fuel (R$ cents) | 22.53 | 21.24 | 6.1% |

| CASK for passenger operations (R$ cents) (5) | 34.92 | 38.60 | (9.5%) |

| CASK ex-fuel for passenger operations (R$ cents) (5) | 22.28 | 21.24 | 4.9% |

| Breakeven Load Factor Ex-Non Recurring Expenses | 68.9% | 76.0% | (7.1 p.p.) |

| Average Exchange Rate(1) | 4.88 | 5.25 | (7.0%) |

| End of Period Exchange Rate(1) | 5.01 | 5.41 | (7.4%) |

| WTI (Average per Barrel, US$)(2) | 82.26 | 91.56 | (10.2%) |

| Fuel Price per Liter (R$)(3) | 4.62 | 6.56 | (29.6%) |

| Gulf Coast Jet Fuel Cost (average per liter, US$)(2) | 0.58 | 0.64 | (9.4%) |

(1) Source: Central Bank of Brazil; (2) Source: Bloomberg; (3) Fuel expenses excluding hedge results and PIS and COFINS/liter s credits consumed; (4) Medium fleet excluding sub-leased aircraft and MRO aircraft. Some figures may differ from quarterly information - ITR due to rounding. (5) Excludes non-recurring expenses.

Domestic Market

Demand in the domestic market reached 8,225 million RPK, an increase of 8.9% compared to 3Q22.

Supply in the domestic market reached 9,810 million ASK, representing an increase of 5.2% compared to 3Q22.

Load factor was 83.8% and the Company transported approximately 7.8 million Customers in 3Q23, an increase of 16.5% compared to the same quarter of the previous year.

International Market

The supply in the international market, measured in ASK, was 1,003 million and the demand (in RPK) was 825 million. During this period GOL transported approximately 326,000 passengers in this market.

Volume of Departures and Total Seats

In 3Q23, the company's total take-off volume was 57,284, representing an increase of 13.1% compared to 3Q22. The total number of seats made available on the market was 9.9 million, representing an increase of 11.8% compared to the same period in 2022.

PRASK, RASK, and Yield

Net PRASK in 3Q23 was 7.6% higher compared to 3Q22, reaching 39.33 cents (R$). The Company's net RASK was 43.15 cents (R$), representing an increase of 10.7% compared to the same period of the previous year. Net yield recorded in 3Q23 was 46.99 cents (R$), resulting in an increase of 4.5% compared to 3Q22.

All profitability indicators for the quarter, described above, also showed significant evolution compared to the same period in 2019, demonstrating the Company's continued and efficient capacity management and pricing.

Fleet

At the end of 3Q23, GOL's total fleet was 141 Boeing 737 aircraft, of which 97 were NGs, 39 were MAXs, and 5 were Cargo NGs. The Company's fleet is 100% composed of medium-sized aircraft (narrowbodies), with 97% financed via operating leases and 3% financed via finance leases.

| Total Fleet at End of Period | 3Q23 | 3Q22 | Var. | 2Q23 | Var. |

| Boeing 737 | 141 | 145 | -4 | 143 | -2 |

| 737-700 NG | 19 | 21 | -2 | 19 | 0 |

| 737-800 NG | 78 | 87 | -9 | 82 | -4 |

| 737-800 NG Freighters | 5 | 0 | 5 | 4 | 1 |

| 737-MAX 8 | 39 | 37 | 2 | 38 | 1 |

As of September 30, 2023, GOL had 106 firm orders for the acquisition of Boeing 737-MAX aircraft, 69 of which were for the 737-MAX 8 model and 37 for the 737-MAX 10 model. Until the end of this quarter, the Company’s returned seven 737NG aircraft.

Glossary of Industry Terms

| · | AIRCRAFT LEASING: An agreement through which a company (the lessor). acquires a resource chosen by its client (the lessee) for subsequent rental to the latter for a determined period. |

| · | AVAILABLE SEAT KILOMETERS (ASK): The aircraft seating capacity is multiplied by the number of kilometers flown. |

| · | BARREL OF WEST TEXAS INTERMEDIATE (WTI): Intermediate oil from Texas. a region that refers to the name for concentrating oil exploration in the USA. WTI is used as a reference point in oil for the US derivatives markets. |

| · | BRENT: Refers to oil produced in the North Sea. traded on the London Stock Exchange. serving as a reference for the derivatives markets in Europe and Asia. |

| · | TOTAL CASH: Total cash. financial investments and restricted cash in the short- and long-term. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER (CASK): Operating expenses divided by the total number of available seat kilometers. |

| · | OPERATING COST PER AVAILABLE SEAT KILOMETER EX-FUEL (CASK EX-FUEL): Operating cost divided by total available seat kilometers excluding fuel expenses. |

| · | AVERAGE STAGE LENGTH: It is the average number of kilometers flown per stage performed. |

| · | EXCHANGEABLE SENIOR NOTES (ESN): Securities convertible into shares. |

| · | AIRCRAFT CHARTER: Flight operated by a Company that is out of its normal or regular operation. |

| · | BLOCK HOURS: Time in which the aircraft is in flight. plus taxi time. |

| · | LESSOR: The party renting a property or other asset to another party. the lessee. |

| · | LONG-HAUL FLIGHTS: Long-distance flights (in GOL’s case. flights of more than four hours). |

| · | REVENUE PASSENGERS: Total number of passengers on board who have paid more than 25% of the full flight fare. |

| · | REVENUE PASSENGER KILOMETERS PAID (RPK): Sum of the products of the number of paying passengers on a given flight and the length of the flight. |

| · | PDP: Credit for financing advances for the acquisition of aircraft. |

| · | Load Factor: Percentage of the aircraft’s capacity used in terms of seats (calculated by dividing the RPK/ASK). |

| · | Break-Even Load Factor: Load factor required for operating revenues to correspond to operating expenses. |

| · | Aircraft Utilization Rate: Average number of hours per day that the aircraft was in operation. |

| · | Passenger Revenue per Available Seat Kilometer (PRASK): Total passenger revenue divided by the total available seat kilometers. |

| · | Operating Revenue per Available Seat Kilometers (RASK): The operating revenue is divided by the total available seat kilometers. |

| · | Sale-Leaseback: A financial transaction whereby a resource is sold and then leased back. enabling use of the resource without owning it. |

| · | SLOT: The right of an aircraft to take off or land at a given airport for a determined period. |

| · | Sub-Lease: An arrangement whereby a lessor in a rent agreement leases the item rented to a fourth party. |

| · | Freight Load Factor (FLF): Measure of capacity utilization (% of AFTKs used). Calculated by dividing FTK by AFTK. |

| · | Freight Tonne Kilometers (FTK): The demand for cargo transportation is calculated as the cargo's weight in tons multiplied by the total distance traveled. |

| · | Available Freight Tonne Kilometer (AFTK): Weight of the cargo in tons multiplied by the kilometers flown. |

| · | Yield per Passenger Kilometer: The average value paid by a passenger to fly one kilometer. |

Report of the Statutory Audit Committee (“SAC”)

The Statutory Audit Committee of Gol Linhas Aéreas Inteligentes S.A., in compliance with its legal and statutory obligations, has reviewed the Parent Company and Consolidated Quarterly Information (ITR) for the three-month and nine-month periods ended on September 30, 2023. Based on the procedures we have undertaken and considering the independent auditors’ review report issued by Ernst & Young Auditores Independentes S/S Ltda., and the information and explanations we have received during the quarter, we conclude that these documents can be submitted to the assessment of the Board of Directors.

São Paulo, November 03, 2023.

Germán Pasquale Quiroga Vilardo

Member of the Statutory Audit Committee

Marcela de Paiva Bomfim Teixeira

Member of the Statutory Audit Committee

Philipp Schiemer

Member of the Statutory Audit Committee

Statement of the Executive Officers on the Parent Company and Consolidated Quarterly Information (ITR)

Under CVM Instruction 80/2022, the executive officers state that they have discussed, reviewed and agreed with the parent company and consolidated quarterly information (ITR) for the three-month and nine-month periods ended on September 30, 2023.

São Paulo, November 03, 2023.

Celso Guimarães Ferrer Junior

Chief Executive Officer

Mario Tsuwei Liao

Chief Financial Officer and Investor Relations Officer

Statement of the Executive Officers on the Independent Auditors’ Review Report

Under CVM Instruction 80/2022, the Executive Board states that it has discussed, reviewed and agreed with the conclusion of the review report from the independent auditor, Ernst & Young Auditores Independentes S/S Ltda., on the parent company and consolidated quarterly information (ITR) for the three-month and nine-months periods ended on September 30, 2023.

São Paulo, November 03, 2023.

Celso Guimarães Ferrer Junior

Chief Executive Officer

Mario Tsuwei Liao

Chief Financial Officer and Investor Relations Officer

| São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brasil Tel: +55 11 2573-3000 ey.com.br |

| | |

A free translation from Portuguese into English of independent auditor’s review report on quarterly information prepared in Brazilian currency in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (IFRS)

Independent auditor’s review report on quarterly information

To the

Management and Shareholders of

Gol Linhas Aéreas Inteligentes S.A.

Introduction

We have reviewed the accompanying individual and consolidated interim financial information, contained in the Quarterly Information Form (ITR) of Gol Linhas Aéreas Inteligentes S.A. (the Company) for the quarter ended September 30, 2023, comprising the statement of financial position as of September 30, 2023 and the related statements of profit or loss and of comprehensive income (loss) for the three and nine-month periods then ended, and of changes in equity and of cash flows for the nine-month period then ended, including the explanatory notes.

Management is responsible for preparation of the individual and consolidated interim financial information in accordance with Accounting Pronouncement NBC TG 21 – Interim Financial Reporting, and IAS 34 – Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), as well as for the fair presentation of this information in conformity with the rules issued by the Brazilian Securities and Exchange Commission (CVM) applicable to the preparation of the Quarterly Information Form (ITR). Our responsibility is to express a conclusion on this interim financial information based on our review.

Scope of review

We conducted our review in accordance with Brazilian and international standards on review engagements (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information performed by the Independent Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with auditing standards and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the individual and consolidated interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the accompanying individual and consolidated interim financial information included in the quarterly information referred to above are not prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation of Quarterly Information Form (ITR), and presented consistently with the rules issued by the Brazilian Securities and Exchange Commission (CVM).

| São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brasil Tel: +55 11 2573-3000 ey.com.br |

| | |

Material uncertainty related to the Company`s ability to continue as a going concern

We draw attention to note 1.2 to the individual and consolidated interim financial information, which states that, according to the individual and consolidated statement of financial position as of September 30, 2023, the Company presented negative shareholders’ equity of R$22,029 million, as well as an excess of current liabilities over current assets, individual and consolidated, by R$754 million and R$10,457 million, respectively. As disclosed in note 1.2, these events or conditions, together with other matters described in note 1.2, indicate the existence of a material uncertainty about the Company’s ability to continue as a going concern. Our conclusion is not qualified in respect of this matter.

Other matters

Statements of value added

The abovementioned quarterly information include the individual and consolidated statement of value added (SVA) for the nine-month period ended September 30, 2023, prepared under Company’s Management responsibility and presented as supplementary information by IAS 34. These statements have been subject to review procedures performed together with the review of the quarterly information with the objective to conclude whether they are reconciled to the interim financial information and the accounting records, as applicable, and if its format and content are in accordance with the criteria set forth by NBC TG 09 – Statement of Value Added. Based on our review, nothing has come to our attention that causes us to believe that they were not prepared, in all material respects, consistently with the overall individual and consolidated interim financial information.

São Paulo, November 03, 2023.

ERNST & YOUNG

Auditores Independentes S/S Ltda.

CRC SP-034519/O

Original report in Portuguese signed by

| Bruno Mattar Galvão |

| Accountant CRC SP-267770/O |

| Balance Sheets September 30, 2023 and December 31, 2022 (In thousands of Brazilian Reais) | |

Balance Sheet

| | | Parent Company | Consolidated |

| Assets | Note | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| | | | | | |

| Current | | | | | |

| Cash and Cash Equivalents | 6 | 315,098 | 179 | 523,141 | 169,035 |

| Financial Investments | 7 | 4,483 | 4,814 | 381,788 | 404,113 |

| Trade Receivables | 8 | - | - | 1,044,733 | 887,734 |

| Inventories | 9 | - | - | 438,958 | 438,865 |

| Deposits | 10 | - | - | 277,569 | 380,267 |

| Advances to Suppliers and Third Parties | 11 | 34,347 | 36,996 | 387,387 | 302,658 |

| Taxes to Recover | 12 | 3,071 | 3,975 | 231,158 | 195,175 |

| Rights from Derivative Transactions | 33.2 | 769 | - | 16,418 | 16,250 |

| Other Credits | | 67,970 | 63,858 | 237,943 | 199,446 |

| Total Current | | 425,738 | 109,822 | 3,539,095 | 2,993,543 |

| | | | | | |

| Non-current | | | | | |

| Financial Investments | 7 | - | 1 | 88,784 | 19,305 |

| Deposits | 10 | 47,464 | 45,042 | 2,413,217 | 2,279,503 |

| Advances to Suppliers and Third Parties | 11 | - | - | 100,269 | 49,698 |

| Taxes to Recover | 12 | - | 12,925 | 14,548 | 53,107 |

| Rights from Derivative Transactions | 33.2 | - | 7,002 | - | 13,006 |

| Deferred Taxes | 13 | 75,829 | 76,907 | 76,169 | 77,251 |

| Other Credits | | 54 | 17 | 22,164 | 33,187 |

| Credits with Related Companies | 28.1 | 7,515,424 | 7,084,848 | - | - |

| Property, Plant & Equipment | 14 | 422,140 | 416,348 | 9,036,277 | 9,588,696 |

| Intangible Assets | 15 | - | - | 1,900,859 | 1,862,989 |

| Total Non-Current | | 8,060,911 | 7,643,090 | 13,652,287 | 13,976,742 |

| | | | | | |

| Total | | 8,486,649 | 7,752,912 | 17,191,382 | 16,970,285 |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Balance Sheets September 30, 2023 and December 31, 2022 (In thousands of Brazilian Reais) | |

| | | Parent Company | Consolidated |

| Liabilities | Note | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| | | | | | |

| Current | | | | | |

| Loans and Financing | 16 | 773,430 | 274,733 | 1,152,079 | 1,126,629 |

| Leases to Pay | 17 | - | - | 1,802,747 | 1,948,258 |

| Suppliers | 18 | 90,994 | 41,520 | 2,118,909 | 2,274,503 |

| Suppliers - Forfaiting | 19 | - | - | 40,253 | 29,941 |

| Salaries, Wages and Benefits | | 39 | 132 | 670,415 | 600,451 |

| Taxes Payable | 20 | 625 | 478 | 185,813 | 258,811 |

| Landing Fees | | - | - | 1,553,144 | 1,173,158 |

| Advance Ticket Sales | 21 | - | - | 3,637,213 | 3,502,556 |

| Mileage Program | 22 | - | - | 1,591,674 | 1,576,849 |

| Advances from Customers | | - | - | 373,511 | 354,904 |

| Provisions | 23 | - | - | 538,291 | 634,820 |

| Derivatives Liabilities | 33.2 | - | - | - | 519 |

| Other Liabilities | | 314,854 | 337,612 | 332,095 | 379,848 |

| Total Current | | 1,179,942 | 654,475 | 13,996,144 | 13,861,247 |

| | | | | | |

| Non-Current | | | | | |

| Loans and Financing | 16 | 8,542,198 | 10,149,073 | 9,267,296 | 10,858,262 |

| Leases to Pay | 17 | - | - | 8,005,255 | 9,258,701 |

| Suppliers | 18 | - | - | 112,204 | 45,451 |

| Salaries, Wages and Benefits | | - | - | 532,095 | 285,736 |

| Taxes Payable | 20 | - | - | 359,949 | 265,112 |

| Landing Fees | | - | - | 161,038 | 218,459 |

| Mileage Program | 22 | - | - | 172,387 | 292,455 |

| Provisions | 23 | - | - | 2,891,506 | 2,894,983 |

| Derivatives Liabilities | 33.2 | 3,409,360 | - | 3,409,360 | 17 |

| Deferred Taxes | 13 | - | - | 40,193 | 36,354 |

| Obligations to Related Parties | 28.1 | 142,832 | 145,434 | - | - |

| Provision for Investment Losses | 24 | 17,036,786 | 17,910,984 | - | - |

| Other Liabilities | | 204,535 | 251,761 | 272,959 | 312,323 |

| Total Non-Current | | 29,335,711 | 28,457,252 | 25,224,242 | 24,467,853 |

| | | | | | | |

| Shareholders’ Equity | | | | | | |

| Share Capital | 25.1 | 4,040,661 | 4,040,397 | 4,040,661 | 4,040,397 | |

| Treasury Shares | 25.2 | (17,534) | (38,910) | (17,534) | (38,910) | |

| Capital Reserve | | 441,472 | 1,178,568 | 441,472 | 1,178,568 | |

| Equity Valuation Adjustments | | (600,669) | (770,489) | (600,669) | (770,489) | |

| Accumulated Losses | | (25,892,934) | (25,768,381) | (25,892,934) | (25,768,381) |

| Negative Shareholders’ Equity (Deficit) | | (22,029,004) | (21,358,815) | (22,029,004) | (21,358,815) |

| | | | | | |

| Total | | 8,486,649 | 7,752,912 | 17,191,382 | 16,970,285 |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Income Statement Three-month and nine-month periods ending on September 30, 2023 and 2022 (In thousands of Brazilian reais - R$, except basic and diluted earnings (loss) per share) | |

| | | Parent Company |

| | | Three-month period ended on | | Nine-month period ended on |

| | Note | September 30, 2023 | September 30, 2022 | | September 30, 2023 | September 30, 2022 |

| Operating Revenues (Expenses) | | | | | | |

| Selling Expenses | 30 | - | (28) | | (261) | (314) |

| Administrative Expenses | 30 | (39,355) | (18,407) | | (92,582) | (49,594) |

| Other Revenues and Expenses, Net | 30 | 40,817 | (155,270) | | 42,427 | (91,191) |

| Total Operating Expenses | | 1,462 | (173,705) | | (50,416) | (141,099) |

| | | | | | | |

| Equity Income | 24 | (516,413) | (1,077,661) | | 693,614 | (1,315,154) |

| | | | | | | |

| Operating Profit (Loss) before Financial Income (Expenses) and Income Taxes | | (514,951) | (1,251,366) | | 643,198 | (1,456,253) |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenues | 31 | 80,504 | 76,222 | | 386,674 | 171,479 |

| Financial Expenses | 31 | (520,329) | (242,007) | | (1,196,043) | (658,281) |

| Derivative Financial Instruments | 31 | (11,232) | 6,341 | | 8,868 | 39,901 |

| Financial Revenues (Expenses), Net | | (451,057) | (159,444) | | (800,501) | (446,901) |

| | | | | | | |

| Loss before Monetary and Exchange Rate Variation | | (966,008) | (1,410,810) | | (157,303) | (1,903,154) |

| | | | | | | |

| Monetary and Foreign Exchange Rate Variations, Net | 31 | (321,111) | (137,849) | | 47,222 | 115,065 |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | (1,287,119) | (1,548,659) | | (110,081) | (1,788,089) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | (13,394) | - | | (13,394) | - |

| Deferred | | 146 | (210) | | (1,078) | (4,294) |

| Total Income Tax and Social Contribution | 13 | (13,248) | (210) | | (14,472) | (4,294) |

| | | | | | | |

| Loss for the Period | | (1,300,367) | (1,548,869) | | (124,553) | (1,792,383) |

| | | | | | | |

| | | | | | | |

| Basic and Diluted (Loss) | 26 | | | | | |

| Per Common Share | | (0.089) | (0.106) | | (0.008) | (0.126) |

| Per Preferred Share | | (3.110) | (3.714) | | (0.298) | (4.418) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Income Statement Three-month and nine-month periods ending on September 30, 2023 and 2022 (In thousands of Brazilian reais - R$, except basic and diluted earnings (loss) per share) | |

| | | Consolidated |

| | | Three-month period ended on | | Nine-month period ended on |

| | Note | September 30, 2023 | September 30, 2022 | | September 30, 2023 | September 30, 2022 |

| Net Revenue | | | | | | |

| Passenger Transportation | | 4,252,854 | 3,759,682 | | 12,509,755 | 9,767,176 |

| Cargo and Others | | 412,592 | 249,924 | | 1,221,811 | 704,937 |

| Total Net Revenue | 29 | 4,665,446 | 4,009,606 | | 13,731,566 | 10,472,113 |

| | | | | | | |

| Cost of Services | 30 | (3,116,941) | (3,248,879) | | (9,631,796) | (8,580,538) |

| Gross Profit (Loss) | | 1,548,505 | 760,727 | | 4,099,770 | 1,891,575 |

| | | | | | | |

| Operating Revenues (Expenses) | | | | | | |

| Selling Expenses | 30 | (311,552) | (284,857) | | (886,762) | (822,232) |

| Administrative Expenses | 30 | (515,688) | (345,151) | | (1,448,469) | (1,013,927) |

| Other Revenues and Expenses, Net | 30 | 103,790 | (89,994) | | 394,213 | (129,464) |

| Total Operating Expenses | | (723,450) | (720,002) | | (1,941,018) | (1,965,623) |

| | | | | | | |

| Loss before Financial Income (Expenses) and Income Taxes | | 825,055 | 40,725 | | 2,158,752 | (74,048) |

| | | | | | | |

| Financial Income (Expenses) | | | | | | |

| Financial Revenues | 31 | 48,005 | 61,139 | | 319,618 | 110,499 |

| Financial Expenses | 31 | (1,127,066) | (872,709) | | (3,046,078) | (2,452,018) |

| Derivative Financial Instruments | 31 | 910 | (28,388) | | (3,547) | 5,095 |

| Financial Revenues (Expenses), Net | | (1,078,151) | (839,958) | | (2,720,007) | (2,336,424) |

| | | | | | | |

| Loss before Monetary and Exchange Rate Variation | | (253,096) | (799,233) | | (561,255) | (2,410,472) |

| | | | | | | |

| Monetary and Foreign Exchange Rate Variations, Net | 31 | (1,002,461) | (737,982) | | 477,480 | 642,787 |

| | | | | | | |

| Loss before Income Tax and Social Contribution | | (1,255,557) | (1,537,215) | | (83,775) | (1,767,685) |

| | | | | | | |

| Income Tax and Social Contribution | | | | | | |

| Current | | (20,306) | (3,682) | | (36,013) | (6,769) |

| Deferred | | (24,504) | (7,972) | | (4,765) | (17,929) |

| Total Income Tax and Social Contribution | 13 | (44,810) | (11,654) | | (40,778) | (24,698) |

| | | | | | | |

| Loss for the Period | | (1,300,367) | (1,548,869) | | (124,553) | (1,792,383) |

| | | | | | | |

| | | | | | | |

| Basic and Diluted (Loss) | 26 | | | | | |

| Per Common Share | | (0.089) | (0.106) | | (0.008) | (0.126) |

| Per Preferred Share | | (3.110) | (3.714) | | (0.298) | (4.418) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Comprehensive Income Statements Three-month and nine-month periods ended on September 30, 2023 and 2022 (In thousands of Brazilian Reais - R$) | |

| | Parent Company and Consolidated |

| | Three-month period ended on | | Nine-month period ended on |

| | September 30, 2023 | September 30, 2022 | | September 30, 2023 | September 30, 2022 |

| Loss for the Period | (1,300,367) | (1,548,869) | | (124,553) | (1,792,383) |

| | | | | | |

| Other Comprehensive Income that will be Reversed to Income (Expenses) | | | | | |

| | | | | | |

| Cash Flow Hedge, Net of Income Tax and Social Contribution | 12,554 | (10,191) | | 177,834 | 164,429 |

| Cumulative Translation Adjustment from Subsidiaries | (3,950) | (1,786) | | (8,014) | (2,657) |

| | 8,604 | (11,977) | | 169,820 | 161,772 |

| | | | | | |

| Total Comprehensive Income (Expenses) for the Period | (1,291,763) | (1,560,846) | | 45,267 | (1,630,611) |

| | | | | |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statements of Changes in Shareholders’ Equity Periods ended on September 30, 2023 and 2022 (In thousands of Brazilian Reais - R$) | |

| | | | | Capital Reserves | Equity Valuation Adjustments | | |

| | Share Capital | Shares to Issue | Treasury Shares | Premium when Granting Shares | Special Premium Reserve of the Subsidiary | Share-Based Compensation | Unrealized Income (Expenses) on Hedge | Post-Employment Benefit | Other Comprehensive Income | Effects from Changes in the Equity Interest | Accumulated Losses | Total |

| Balances on December 31, 2021 | 4,039,112 | 3 | (41,514) | 11,020 | 83,229 | 114,462 | (918,801) | 14,855 | 1,032 | (150,168) | (24,206,908) | (21,053,678) |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | 164,429 | - | (2,657) | - | - | 161,772 |

| Loss for the Period | - | - | - | - | - | - | - | - | - | - | (1,792,383) | (1,792,383) |

| Total Comprehensive Income (Expenses) for the Period | - | - | - | - | - | - | 164,429 | - | (2,657) | - | (1,792,383) | (1,630,611) |

| Stock Option | - | - | - | - | - | 13,182 | - | - | - | - | - | 13,182 |

| Capital Increase due to Stock Options Exercised | 1,285 | (3) | - | - | - | - | - | - | - | - | - | 1,282 |

| Capital Increase | - | - | - | 946,345 | - | - | - | - | - | - | - | 946,345 |

| Transfer of Treasury Shares | - | - | 2,566 | (1,515) | - | (1,051) | - | - | - | - | - | - |

| Sale of treasury shares | - | - | 37 | - | - | - | - | - | - | - | - | 37 |

| Balances on September 30, 2022 | 4,040,397 | - | (38,911) | 955,850 | 83,229 | 126,593 | (754,372) | 14,855 | (1,625) | (150,168) | (25,999,291) | (21,723,443) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balances on December 31, 2022 | 4,040,397 | - | (38,910) | 955,744 | 83,229 | 139,595 | (613,353) | (2,659) | (4,309) | (150,168) | (25,768,381) | (21,358,815) |

| Other Comprehensive Income (Expenses), Net | - | - | - | - | - | - | 177,834 | - | (8,014) | - | - | 169,820 |

| Net Income for the Period | - | - | - | - | - | - | - | - | - | - | (124,553) | (124,553) |

| Total Comprehensive Income (Expenses) for the Period | - | - | - | - | - | - | 177,834 | - | (8,014) | - | (124,553) | 45,267 |

| Stock options exercised (Note 25.1) | 264 | - | - | - | - | - | - | - | - | - | - | 264 |

| Share-based payments expense | - | - | - | - | - | 10,764 | - | - | - | - | - | 10,764 |

| Fair Value Result in Transaction with Controlling Shareholder (Note 16.1.4) | - | - | - | (822,193) | - | - | - | - | - | - | - | (822,193) |

| Treasury shares transferred | - | - | 21,376 | (17,352) | - | (4,024) | - | - | - | - | - | - |

| Subscription Warrant (Note 25.3) | - | - | - | - | 95,709 | - | - | - | - | - | - | 95,709 |

| Balances on September 30, 2023 | 4,040,661 | - | (17,534) | 116,199 | 178,938 | 146,335 | (435,519) | (2,659) | (12,323) | (150,168) | (25,892,934) | (22,029,004) |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Cash Flow Statements Periods ended on September 30, 2023 and 2022 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| | | | | |

| Loss for the Period | (124,553) | (1,792,383) | (124,553) | (1,792,383) |

| Adjustments to Reconcile the Income (Loss) to Cash Generated from Operating Activities | | | | |

| Depreciation - Aircraft Right of Use | - | - | 677,287 | 806,750 |

| Depreciation and Amortization – Others | - | - | 554,525 | 451,563 |

| Allowance for Expected Loss on Trade Receivables | - | - | (2,952) | (557) |

| Provisions for Inventory Obsolescence | - | - | 492 | 575 |

| Provision for Impairment of Deposits | - | - | - | 6,284 |

| Provision for Losses on Advance to Suppliers and Third Parties | - | - | - | (1,087) |

| Adjustment to Present Value of Provision | - | - | 141,557 | 153,747 |

| Deferred Taxes | 1,078 | 4,294 | 4,767 | 17,929 |

| Equity Pickup | (693,614) | 1,315,154 | - | - |

| Write-off of Property, Plant & Equipment and Intangible Assets | - | - | 48,296 | 43,340 |

| Sale-Leaseback | - | 102,277 | (115,563) | (133,053) |

| Leases Contractual Amendment | - | - | (68,085) | - |

| Recognition (Reversal) of Provisions | - | - | 664,598 | 273,023 |

| Exchange Rate and Cash Changes, Net | (223,567) | (95,109) | (1,634,043) | (642,122) |

Interest on Loans and Leases and Amortization of Costs, Premiums and Goodwill | 1,087,517 | 510,570 | 2,176,064 | 1,732,379 |

| Discount on financing operations | (98,535) | - | (98,535) | - |

| Result of derivatives recognized in profit or loss | (8,867) | (39,901) | 94,079 | 79,125 |

| Share-Based Compensation | - | - | 10,764 | 13,182 |

| Other Provisions | - | - | (17,923) | (4,020) |

| Adjusted Net Income (Expenses) | (60,541) | 4,902 | 2,310,775 | 1,004,675 |

| | | | | |

| Changes in Operating Assets and Liabilities: | | | | |

| Financial Investments | 332 | (578) | 787,750 | (55,415) |

| Trade Receivables | - | - | (154,871) | (105,575) |

| Inventories | - | - | (585) | (150,729) |

| Deposits | (2,422) | (2,900) | (44,621) | (258,447) |

| Advance to Suppliers and Third Parties | 2,649 | (38,209) | (115,910) | (116,271) |

| Taxes to Recover | 13,829 | (3,577) | 2,576 | 743 |

| Variable Leases | - | - | 1,429 | 1,574 |

| Suppliers | (39,309) | (53,133) | (166,555) | 144,533 |

| Suppliers – Forfaiting | - | - | 10,312 | 7,208 |

| Salaries, Wages and Benefits | (93) | (105) | 316,323 | 362,887 |

| Taxes Payable | 147 | 131 | 21,839 | 274,815 |

| Landing Fees | - | - | 322,565 | 165,780 |

| Advance Ticket Sales | - | - | 134,657 | 1,044,790 |

| Mileage program | - | - | (105,243) | 238,853 |

| Advances from Customers | - | - | (29,162) | (103,348) |

| Provisions | - | - | (814,685) | (303,017) |

| Derivatives | - | - | (1,805) | (56,872) |

| Other Credits (Liabilities), Net | (74,132) | 94,901 | (114,421) | (171,909) |

| Interest Paid | (449,588) | (512,206) | (682,564) | (737,437) |

| Income Tax and Social Contribution Paid | - | (112) | - | (557) |

| Net Cash (Used in) from Operating Activities | (609,128) | (510,886) | 1,677,804 | 1,186,281 |

| | | | | |

| Cash Flow Statements Periods ended on September 30, 2023 and 2022 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| | | | | |

| Loans to Related Parties | (468,229) | 345,864 | - | - |

| Prepayment for Future Capital Increase in a Subsidiary | - | (1,128,568) | - | - |

| Advance for Property, Plant & Equipment Acquisition, Net | - | (81,648) | - | (156,081) |

| Acquisition of Property, Plant & Equipment | (7,305) | - | (511,035) | (507,524) |

| Sale-Leaseback Transactions Received | - | 69,819 | 232 | 69,819 |

| Acquisition of Intangible Assets | - | - | (104,791) | (91,898) |

| Net Cash Flows (Used in) from Investment Activities | (475,534) | (794,533) | (615,594) | (685,684) |

| | | | | |

| Funding of Borrowings | 1,409,181 | - | 1,409,181 | 110,000 |

| Loan Payments | (108,585) | - | (442,692) | (268,960) |

| Lease Payments - Aircraft | - | - | (1,677,102) | (1,586,217) |

| Lease Payments - Others | - | - | (31,539) | (30,453) |

| Loans from Related Parties | 3,254 | 135,252 | - | - |

| Capital Increase | 264 | 947,627 | 264 | 947,627 |

| Shares to Issue | 95,709 | - | 95,709 | - |

| Sale of treasury shares | - | 37 | - | 37 |

| Net Cash Flows (Used in) from Financing Activities | 1,399,823 | 1,082,916 | (646,179) | (827,966) |

| | | | | |

Foreign Exchange Variation on Cash Held in Foreign Currencies | (242) | 12,737 | (61,925) | (9,716) |

| | | | | |

| Net Increase (Decrease) in Cash and Cash Equivalents | 314,919 | (209,766) | 354,106 | (337,085) |

| | | | | |

| Cash and Cash Equivalents at the Beginning of the Fiscal Year | 179 | 210,941 | 169,035 | 486,258 |

| Cash and Cash Equivalents at the End of the Period | 315,098 | 1,175 | 523,141 | 149,173 |

| | | | | |

Transactions that do not affect cash are presented in Note 34 of this Quarterly Information.

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Statement of Value Added Periods ended on September 30, 2023 and 2022 (In thousands of Brazilian Reais - R$) | |

| | Parent Company | Consolidated |

| | September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| Revenues | | | | |

| Passenger, Cargo, and Other Transportation | - | - | 13,842,948 | 10,868,624 |

| Other Operating Revenues | 42,641 | 106,751 | 524,677 | 307,547 |

| Allowance for Expected Loss on Trade Receivables | - | - | 2,952 | 557 |

| | 42,641 | 106,751 | 14,370,577 | 11,176,728 |

| Inputs Acquired from Third Parties (includes ICMS and IPI) | | | | |

| Fuel and Lubricant Suppliers | - | - | (4,556,928) | (4,561,951) |

| Materials, Energy, Third-Party Services, and Others | (90,055) | (243,666) | (3,692,164) | (2,821,586) |

| Aircraft Insurance | - | - | (34,740) | (33,961) |

| Sales and Marketing | (261) | (285) | (653,897) | (619,190) |

| Gross Added Value | (47,675) | (137,200) | 5,432,848 | 3,140,040 |

| | | | | |

| Depreciation - Aircraft Right of Use | - | - | (677,287) | (806,750) |

| Depreciation and Amortization - Others | - | - | (554,525) | (451,563) |

| Net Added Value Produced by the Company | (47,675) | (137,200) | 4,201,036 | 1,881,727 |

| | | | | |

| Added Value Received on Transfers | | | | |

| Equity Income | 693,614 | (1,315,154) | - | - |

| Derivative Financial Instruments | 8,868 | 39,901 | (3,547) | 5,095 |

| Financial Revenue | 321,387 | 157,237 | 271,253 | 106,560 |

| Total Value Added (Distributed) to Distribute | 976,194 | (1,255,216) | 4,468,742 | 1,993,382 |

| | | | | |

| Distribution of Value Added: | | | | |

| Direct Compensation | 2,390 | 2,994 | 1,241,855 | 1,100,691 |

| Benefits | - | - | 164,767 | 164,698 |

| FGTS | - | - | 99,984 | 93,485 |

| Personnel | 2,390 | 2,994 | 1,506,606 | 1,358,874 |

| | | | | |

| Federal | 16,634 | 9,451 | 410,142 | 560,625 |

| State | - | - | 29,907 | 14,962 |

| Municipal | - | - | 1,885 | 1,137 |

| Taxes, Fees, and Contributions | 16,634 | 9,451 | 441,934 | 576,724 |

| | | | | |

| Interest and Exchange Rate Change - Aircraft Leases | - | - | 484,159 | 592,267 |

| Interest and Exchange Rate Change - Others | 1,081,715 | 524,682 | 1,896,775 | 1,035,519 |

| Rents | - | - | 163,415 | 75,020 |

| Others | 8 | 40 | 100,406 | 147,361 |

| Third-Party Capital Compensation | 1,081,723 | 524,722 | 2,644,755 | 1,850,167 |

| | | | | |

| (Loss) for the Period | (124,553) | (1,792,383) | (124,553) | (1,792,383) |

| Shareholders’ Equity Compensation | (124,553) | (1,792,383) | (124,553) | (1,792,383) |

| | | | | |

| Total Value Added Distributed (to Distribute) | 976,194 | (1,255,216) | 4,468,742 | 1,993,382 |

The explanatory notes are an integral part of the Parent Company and Consolidated Quarterly Information (ITR).

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

Gol Linhas Aéreas Inteligentes S.A. (“Company” or “GOL”) is a limited liability company incorporated on March 12, 2004 under Brazilian laws. The Company’s bylaws states that the corporate purpose is exercising the equity control of GOL Linhas Aéreas S.A. (“GLA”), which provides scheduled and non-scheduled air transportation services for passengers and cargo, maintenance services for aircraft and components, develops frequent-flyer programs, among others.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”) under the ticker GOLL4 and GOL, respectively. The Company adopts B3’s Special Corporate Governance Practices Level 2 and is part of the Special Corporate Governance (“IGC”) and Special Tag Along (“ITAG”) indexes, created to distinguish companies that commit to special corporate governance practices.

The Company’s official headquarters are located at Praça Comandante Linneu Gomes, s/n, portaria 3, prédio 24, Jardim Aeroporto, São Paulo, Brazil.

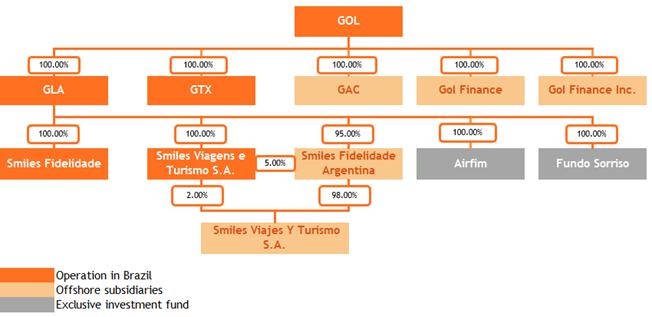

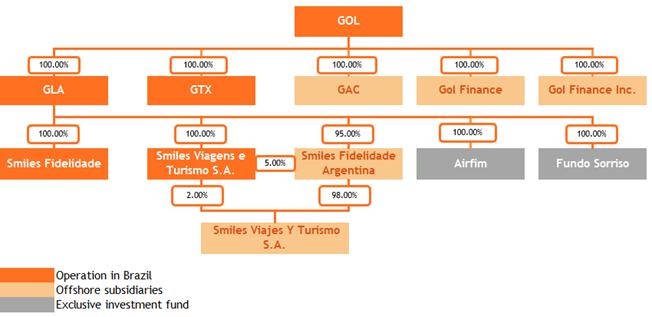

The corporate structure of the Company and its subsidiaries, on September 30, 2023, is shown below:

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The Company's equity interest in the capital stock of its subsidiaries, on September 30, 2023, is presented below:

| Entity | Incorporation Date | Location | Principal Activity | Type of Control | % of Interest

in the share capital |

| Sep 30, 23 | Dec 31, 22 |

| GAC | March 23, 2006 | Cayman Islands | Aircraft acquisition | Direct | 100.00 | 100.00 |

| Gol Finance Inc. | March 16, 2006 | Cayman Islands | Fundraising | Direct | 100.00 | 100.00 |

| Gol Finance | June 21, 2013 | Luxembourg | Fundraising | Direct | 100.00 | 100.00 |

| GLA | April 9, 2007 | Brazil | Flight transportation | Direct | 100.00 | 100.00 |

| GTX | February 8, 2021 | Brazil | Equity investments | Direct | 100.00 | 100.00 |

| Smiles Fidelidade | February 6, 2023 | Brazil | Loyalty program | Indirect | 100.00 | - |

| Smiles Viagens | August 10, 2017 | Brazil | Tourism agency | Indirect | 100.00 | 100.00 |

| Smiles Fidelidade Argentina (a) | November 7, 2018 | Argentina | Loyalty program | Indirect | 100.00 | 100.00 |

| Smiles Viajes y Turismo (a) | November 20, 2018 | Argentina | Tourism agency | Indirect | 100.00 | 100.00 |

| AirFim | November 7, 2003 | Brazil | Investment fund | Indirect | 100.00 | 100.00 |

| Fundo Sorriso | July 14, 2014 | Brazil | Investment fund | Indirect | 100.00 | 100.00 |

| |

| (a) | Companies with functional currency in Argentine pesos (ARS). |

The subsidiaries GAC Inc., GOL Finance, and GOL Finance Inc. are entities created for the specific purpose of continuing financial operations and related to the Company's fleet. They do not have their own governing body and decision-making autonomy. Therefore, their assets and liabilities are presented in the Parent Company.

GTX S.A., direct subsidiary by the Company, is pre-operational and its corporate purpose is to manage its own assets and have an interest in the capital of other companies.

Smiles Fidelidade, incorporated in February 2023, is also in a pre-operational stage and aims to development and management of a customer loyalty program, whether own or third-party; the sale of rights to redeem prizes within the scope of the customer loyalty program; and provide general tourism services, among others.

Smiles Viagens e Turismo S.A. (“Smiles Viagens”), has as main purpose intermediate travel organization services by booking or selling airline tickets, accommodation, tours, among others. The subsidiaries Smiles Fidelidade Argentina S.A. and Smiles Viajes Y Turismo S.A., both headquartered in Buenos Aires, Argentina, have the purpose to promote Smiles Program’s operations and the sale of airline tickets in that country.

The investment funds Airfim and Fundo Sorriso, controlled by GLA, have the characteristic of an exclusive fund and act as an extension to carry out operations with derivatives and financial investments, so that the Company consolidates the assets and liabilities of these funds.

| 1.2. | Capital Structure and Net Current Capital |

On September 30, 2023, the Company’s negative individual and consolidated net working capital reached R$754,204 and R$10,457,049, respectively (R$544,653 and R$10,867,704 negative on December 31, 2022). On September 30, 2023, the current liabilities for transport services to be performed and the mileage program total R$5,228,887 (R$5,079,405 on December 31, 2022), which are expected to be substantially settled by the Company.

On September 30, 2023, the Company still presents a negative equity position of R$22,029,004 (negative R$21,358,815 on December 31, 2022). The observed variation is primarily due to the recognition of fair value in a transaction with Abra (see explanatory note 16.1.4) and losses for the period.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The Company is highly sensitive to the macroeconomic scenario and Brazilian Real’s volatility, as approximately 94.0% of the indebtedness (loans, financing and leases) is linked to US dollars (“US$”) and 47.2% of costs are also linked to US dollars, while the capacity to adjust ticket prices charged to its customers in order to offset the U.S. dollar appreciation is dependent on capacity (offer) and ticket prices practiced by the competitors.

Over the past five years, Management has taken a series of measures to adjust its capital structure and preserve liquidity and efficiency in its cost indicators. During the pandemic, the focus was on adjusting the fleet size to match seat capacity with demand levels, thereby maintaining high occupancy rates while improving productivity and efficiency in fixed costs. By the end of 2022, having almost returned to the same level of capacity and operational fleet size to its pre-pandemic levels, the Company achieved dollar unit costs similar to those prior to the pandemic, mitigating the effects of inflationary cost pressures, currency devaluation, and higher aviation fuel prices. Consumer demand for leisure air travel remains robust, even amidst a slower recovery in corporate demand, which has resulted in a 40% increase in fare levels compared to pre-pandemic levels and occupancy rates above 80%.

During the nine-month period ending on September 30, 2023, the Company completed a capital markets structuring operation with Abra Group for up to $1.4 billion, through which it obtained new capital resources and refinanced approximately 63% of its debts due in 2024, 2025, and 2026, extending the average maturity to 2028 by over 3 years. The nearest maturity date, related to ESN 2024, had 90% refinanced under this arrangement. Additionally, the Company refinanced short-term debts. The Company continues to work on improving its operational efficiency, increasing profitability, and, along with its fleet transformation process, aims to deleverage and strengthen its balance sheet.

Although there is still significant uncertainty about how long it will take for the airline industry to recover, and this leads to a material uncertainty about our ability to remain in operation, the Company’s individual and consolidated quarterly information for the period ended on September 30, 2023, has been prepared on the assumption of a going concern, which assumes the realization of assets and satisfaction of liabilities and commitments in the normal course of business, in accordance with the business plan prepared by the Management, reviewed and approved at least annually by the Board of Directors. Therefore, these individual and consolidated quarterly information do not include any adjustments that may result from the inability to continue operating.

| 1.3. | Cargo and Logistics Services Agreement |

In April 2022, the Company signed a 10-year cargo service agreement with Mercado Livre. This agreement provides for a dedicated cargo fleet with 6 Boeing 737-800 BCFs, allowing including another 6 cargo aircraft by 2025. During the period ended on September 30, 2023, the Company received 3 cargo aircraft, totaling 5 cargo aircraft in operation on this date.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

GOL's agreement with Mercado Livre is part of the Company's investment to meet the needs of the growing Brazilian e-commerce market. As a result, the Company plans to expand its services and significantly increase the available cargo carrying capacity in tons in 2023 to generate additional revenue.

| 1.4. | Agreement between the Controlling Shareholder and Main Investors of Avianca |

In May, 2022, the Company announced that its controlling shareholder, MOBI Fundo de Investimento em Ações Investimento no Exterior (“MOBI FIA”), had entered into a Master Contribution Agreement with the main shareholders of Investment Vehicle 1 Limited (“Avianca Holding”).

Under the terms of the Master Contribution Agreement, MOBI FIA contributed its shares in GOL, and the main investors of Avianca Holding contributed their shares in Avianca Holding to Abra Group Limited (“Abra”), a privately held company, incorporated under the laws of England and Wales. Additionally, the parties agreed to enter into a Shareholders' Agreement to govern their rights and obligations as shareholders of Abra.

GOL and Avianca will continue to operate independently and maintain their respective brands and cultures.

| 1.5. | Acquisition of MAP Transportes Aéreos |

In June, 2021, GOL signed an agreement to acquire MAP Transportes Aéreos Ltda., a domestic Brazilian airline with routes to regional destinations from Congonhas Airport in São Paulo, considering the Company's commitment to expand the air transportation demand and rationally consolidate in the domestic market as the country's economy recovers from Covid-19.

In December, 2021, through SG Order 1929/2021, the Administrative Council for Economic Defense (CADE) approved the operation without restrictions. The conclusion of the transaction is subject to other precedent conditions, which have not yet been fulfilled, therefore, on September 30, 2023, there are no impacts on the individual and consolidated Company's Quarterly Information.

MAP may be acquired for R$28 million to be paid only after meeting all precedent conditions, through 100,000 preferred shares (GOLL4) at R$28.00 per share and R$25 million in cash in 24 monthly installments, with the assumption of up to R$100 million in MAP's financial commitments. On September 30, 2023, these conditions have not yet been finalized.

| 2. | Message from the Management, base to Prepare and Present the Parent Company and Consolidated Quarterly Information (ITR) |

The Company’s Parent Company Quarterly Information were prepared in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). The accounting practices adopted in Brazil include those in the Brazilian Corporation Law and in the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”), approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”).

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The Company’s Parent Company and Consolidated Quarterly Information (ITR) was prepared using the Brazilian real (“R$”) as the functional and presentation currency. Figures are expressed in thousands of Brazilian Reais, except when stated otherwise. The items disclosed in foreign currencies are duly identified when applicable.

The Parent Company and Consolidated Quarterly Information (ITR) preparation requires the Management to make judgments, use estimates, and adopt assumptions affecting the amounts presented of revenues, expenses, assets, and liabilities. However, the uncertainty inherent in these judgments, assumptions and estimates could give rise to results that require a significant adjustment to the book value of certain assets and liabilities in future reporting periods.

When preparing this Parent Company and Consolidated Quarterly Information (ITR), the Management used disclosure criteria, considering regulatory aspects and the relevance of the transactions to understand the changes in the Company’s economic and financial position and its performance since the end of the fiscal year ended December 31, 2022, as well as the update of relevant information included in the annual financial statements disclosed on March 21, 2023.

The Management confirms that all material information in this Parent Company and Consolidated Quarterly Information (ITR) is being demonstrated and corresponds to the information used by the Management in the development of its business management activities.

The Parent Company and Consolidated Quarterly Information (ITR) has been prepared based on historical cost, except for the following material items recognized in the statements of financial position:

· cash, cash equivalents and financial investments measured at fair value;

· derivative financial instruments measured at fair value; and

· investments accounted for using the equity method.

The Company’s Parent Company and Consolidated Quarterly Information (ITR) for the period ended September 30, 2023, has been prepared considering that the Company will continue as a going concern, as per Note 1.2.

| 3. | Approval of the Parent Company and Consolidated Quarterly Information |

The Board of Directors authorized this Parent Company and Consolidated Quarterly Information (ITR) at a Meeting held on November 03, 2023.

| 4. | Summary of Significant Accounting Practices |

The Parent Company and Consolidated Quarterly Information (ITR) presented herein was prepared based on policies, accounting practices and estimate calculation methods adopted and presented in detail in the annual financial statements for the year ended December 31, 2022, released on March 21, 2023.

| 4.1. | New Accounting Standards and Pronouncements Adopted in the Current Year |

The following amendments to accounting standards became effective for periods beginning after January 1, 2023:

· Definition of accounting estimates (Amendments to IAS 8);

· Disclosure of accounting policies (Amendments to IAS 1 and IFRS Practice Statement 2);

· Deferred Taxes related to Assets and Liabilities arising from a Simple Transaction (Amendments to IAS 12);

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

These changes did not impact the Company's quarterly information.

| 4.2. | Changes in standards that are not yet effective |

In May 2023, the IASB issued amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures to clarify the characteristics of supplier financing arrangements and require additional disclosure of these arrangements to assist financial statement users in understanding the effects of supplier financing agreements on an entity's liabilities, cash flows, and liquidity risk exposure. These amendments will be effective for annual reporting periods beginning on or after January 1, 2024. It is not expected to have a material impact on the Company's financial statements as a result of these changes. Finally, the Company has not opted for early adoption.

| 4.3. | Foreign Currency Transactions |

Foreign currency transactions are recorded at the exchange rate change prevailing on the transactions' date. Monetary assets and liabilities designated in foreign currency are calculated based on the exchange rate change on the balance sheet date. Any difference resulting from the translation of currencies is recorded under the item “Monetary and Foreign Exchange Rate Variation, Net” in the income statement for the period.

The main exchange rates in Brazilian Reais in effect on the base date of this Parent Company and Consolidated Quarterly Information (ITR) are as follows:

| | Final Rate | Average Rate |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | September 30, 2022 |

| U.S. Dollar | 5.0076 | 5.2177 | 5.0102 | 5.1325 |

| Argentinian Peso | 0.0143 | 0.0295 | 0.0215 | 0.0433 |

Under normal economic and social conditions, the Company expects revenues and operating income (expense) from its flights to be at their highest levels in the summer and winter vacation periods, in January and July, respectively, and during the last weeks of December and in the year-end holiday period. Given the high proportion of fixed costs, this seasonality tends to drive changes in operating income (expense) across the fiscal-year quarters.

| 6. | Cash and Cash Equivalents |

| | Parent Company | Consolidated |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| Cash and Bank Deposits | 311,241 | 47 | 430,643 | 121,660 |

| Cash Equivalents | 3,857 | 132 | 92,498 | 47,375 |

| Total | 315,098 | 179 | 523,141 | 169,035 |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

The breakdown of cash equivalents is as follows:

| | Parent Company | Consolidated |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| | | | | |

| Domestic Currency | | | | |

| Private Bonds | - | - | - | 10 |

| Automatic Investments | 3,857 | 132 | 92,498 | 47,334 |

| Total Domestic Currency | 3,857 | 132 | 92,498 | 47,344 |

| | | | | |

| Foreign Currency | | | | |

| Private Bonds | - | - | - | 31 |

| Total Foreign Currency | - | - | - | 31 |

| | | | | |

| Total | 3,857 | 132 | 92,498 | 47,375 |

| | | Parent Company | Consolidated |

| | Weighted Average Profitability (p.a.) | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| | | | | | |

| Domestic Currency | | | | | |

| Automated financial investments | 10.0% of CDI | - | - | 60,800 | - |

| Government Bonds | 100.4% of CDI | - | - | 1,987 | 3,880 |

| Private Bonds | 98.3% of CDI | 635 | 753 | 204,861 | 253,386 |

| Investment Funds | 78.8% of CDI | 3,848 | 4,062 | 10,077 | 10,576 |

| Total Domestic Currency | | 4,483 | 4,815 | 277,725 | 267,842 |

| | | | | | |

| Foreign Currency | | | | | |

| Investment Funds | 9.52% | - | - | 192,847 | 155,576 |

| Total Foreign Currency | | - | - | 192,847 | 155,576 |

| | | | | | |

| Total | | 4,483 | 4,815 | 470,572 | 423,418 |

| | | | | | |

| Current | | 4,483 | 4,814 | 381,788 | 404,113 |

| Non-current | | - | 1 | 88,784 | 19,305 |

Of the total amount recorded in the parent company and in the consolidated on September 30, 2023, R$4,355 and R$276,136 (R$4,701 and R$266,553 on December 31, 2022), respectively, refer to financial investments used as guarantees linked to deposits for lease operations, derivative financial instruments, lawsuits and loans and financing.

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

| | Consolidated |

| | September 30, 2023 | December 31, 2022 |

| Domestic Currency | | |

| Credit Card Administrators | 345,087 | 287,754 |

| Travel Agencies | 423,991 | 317,487 |

| Cargo Agencies | 71,104 | 45,986 |

| Partner Airlines | 10,541 | 12,465 |

| Others | 43,446 | 31,477 |

| Total Domestic Currency | 894,169 | 695,169 |

| | | |

| Foreign Currency | | |

| Credit Card Administrators | 97,008 | 80,812 |

| Travel Agencies | 46,084 | 83,517 |

| Cargo Agencies | 844 | 968 |

| Partner Airlines | 20,833 | 33,075 |

| Others | 5,391 | 16,741 |

| Total Foreign Currency | 170,160 | 215,113 |

| | | |

| Total Receivables | 1,064,329 | 910,282 |

| | | |

| Estimated Losses from Doubtful Accounts | (19,596) | (22,548) |

| | | |

| Total | 1,044,733 | 887,734 |

The aging list of trade receivables, net of allowance for estimated losses from doubtful accounts, is as follows:

| | Consolidated |

| | September 30, 2023 | December 31, 2022 |

| To be Due | | |

| Until 30 days | 217,547 | 722,923 |

| From 31 to 60 days | 419,364 | 48,923 |

| From 61 to 90 days | 252,422 | 16,681 |

| From 91 to 180 days | 36,764 | 381 |

| From 181 to 360 days | 32,490 | 23,590 |

| Over 360 days | 1,259 | 7 |

| Total to be Due | 959,846 | 812,505 |

| | | |

| Overdue | | |

| Until 30 days | 31,485 | 46,856 |

| From 31 to 60 days | 3,707 | 9,321 |

| From 61 to 90 days | 12,442 | 3,383 |

| From 91 to 180 days | 23,789 | 9,845 |

| From 181 to 360 days | 11,814 | 2,598 |

| Over 360 days | 1,650 | 3,226 |

| Total Overdue | 84,887 | 75,229 |

| | | |

| Total | 1,044,733 | 887,734 |

The changes in the expected loss on trade receivables are as follows:

| | Consolidated |

| | September 30, 2023 |

| Balance at the Beginning of the Fiscal Year | (22,548) |

| (Additions) reversals | 2,952 |

| Balance at the End of the Period | (19,596) |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

| | Consolidated |

| | September 30, 2023 | December 31, 2022 |

| Consumables | 35,506 | 26,494 |

| Parts and Maintenance Materials | 326,770 | 365,659 |

| Advances to Suppliers | 76,682 | 46,712 |

| Total | 438,958 | 438,865 |

The changes in the provision for obsolescence are as follows:

| | Consolidated |

| | September 30, 2023 |

| Balances at the Beginning of the Fiscal Year | (9,611) |

| Additions | (492) |

| Write-Offs | 787 |

| Balances at the End of the Period | (9,316) |

| | Parent Company | Consolidated |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| Maintenance Deposits | - | - | 1,183,380 | 1,134,389 |

| Court Deposits | 47,464 | 45,042 | 566,786 | 591,177 |

| Deposit in Guarantee for Lease Agreements | - | - | 940,620 | 934,204 |

| Total | 47,464 | 45,042 | 2,690,786 | 2,659,770 |

| | | | | |

| Current | - | - | 277,569 | 380,267 |

| Non-current | 47,464 | 45,042 | 2,413,217 | 2,279,503 |

| 10.1. | Maintenance deposits |

The Company makes deposits in US dollars for aircraft and engine overhauling, which will be used in future events as established in certain lease agreements. The Company has the right to choose to carry out the maintenance internally or through its suppliers.

Maintenance deposits do not exempt the Company, as a lessee, from contractual obligations related to the maintenance or the risk associated with operating activities. The Company has the right to choose to perform maintenance internally or through its suppliers. These deposits can be replaced by bank guarantees or letters of credit (SBLC - stand by letter of credit) as established in the aircraft lease. These letters can be executed by the lessors if the maintenance of the aircraft and engines does not occur according to the review schedule. On September 30, 2023, no letters of credit had been executed against the Company.

The Company has two categories of maintenance deposits:

| · | Maintenance Guarantee: Refers to one-time deposits that are refunded at the end of the lease and can also be used in maintenance events, depending on negotiations with lessors. The balance of these deposits on September 30, 2023, was R$194,796 (R$231,222 on December 31, 2022). |

| Notes on the Parent Company and Consolidated Quarterly Information (ITR) September 30, 2023 (In thousands of Brazilian Reais - R$, except when otherwise indicated) | |

| · | Maintenance Reserve: Refers to amounts paid monthly based on the use of components and can be used in maintenance events as set by an agreement. On September 30, 2023, the balance of these reserves was R$988,584 (R$903,167 on December 31, 2022). |

Court deposits and blocks represent guarantees of tax, civil and labor lawsuits, kept in court until resolving the disputes to which they are related. Part of the court deposits refers to civil and labor lawsuits arising from succession requests in lawsuits filed against Varig S.A. or also labor lawsuits filed by employees who do not belong to GLA or any related party. Bearing in mind that the Company is not a legitimate party to appear on the liability side of the said lawsuits, their exclusion and respective release of the retained funds are demanded whenever blocks occur.

| 10.3. | Deposits in guarantee for lease agreements |

As required by the lease agreements, the Company makes guarantee deposits (in US dollars) to the leasing companies, which may be redeemed if replaced by other bank guarantees or fully redeemed at maturity.

| 11. | Advances to Suppliers and Third-Parties |

| | Parent Company | Consolidated |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |

| Advance to Domestic Suppliers | - | - | 289,326 | 227,036 |

| Advances to Foreign Suppliers | - | 1,208 | 130,017 | 65,141 |

| Advance for Materials and Repairs | 34,347 | 35,788 | 68,313 | 60,179 |

| Total | 34,347 | 36,996 | 487,656 | 352,356 |

| | | | | |

| Current | 34,347 | 36,996 | 387,387 | 302,658 |

| Non-current | - | - | 100,269 | 49,698 |

| | Parent Company | Consolidated |

| | September 30, 2023 | December 31, 2022 | September 30, 2023 | December 31, 2022 |