UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-21591 |

| | |

| AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 07-31 |

| | |

| Date of reporting period: | 07-31-2019 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | July 31, 2019 |

| | |

| | One Choice® Portfolio: Very Conservative |

| | Investor Class (AONIX) |

| | R Class (AORHX) |

| | |

| | One Choice® Portfolio: Conservative |

| | Investor Class (AOCIX) |

| | R Class (AORSX) |

| | |

| | One Choice® Portfolio: Moderate |

| | Investor Class (AOMIX) |

| | R Class (AORMX) |

| | |

| | One Choice® Portfolio: Aggressive |

| | Investor Class (AOGIX) |

| | R Class (AORYX) |

| | |

| | One Choice® Portfolio: Very Aggressive |

| | Investor Class (AOVIX) |

| | R Class (AORVX) |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the funds' shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the funds or your financial intermediary electronically by calling or sending an email request to your appropriate contacts as listed on the back cover of this report.

You may elect to receive all future reports in paper free of charge. You can inform the funds or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request to your appropriate contacts as listed on the back cover of this report. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Portfolio Characteristics | |

|

| Shareholder Fee Examples | |

|

| Schedules of Investments | |

|

| Statements of Assets and Liabilities | |

|

| Statements of Operations | |

|

| Statements of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Approval of Management Agreement | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended July 31, 2019. Annual reports help convey important details about fund returns, including market factors that affected performance. For additional investment and market insights, please visit our website, americancentury.com.

Stocks Advanced Amid Volatile Climate

Most broad U.S. and global stock indices ended the year with gains. However, these positive results masked wide performance swings. For example, U.S. stocks, as measured by the S&P 500 Index, returned -3.00% in the first half of the period and 11.32% in the second half, leaving the index up 7.99% for the 12 months. Global stocks, as measured by the MSCI All Country World Index, returned -4.71% in the first half, 8.04% in the second half and 2.95% overall. For fixed-income securities, the path to positive performance was smoother, and U.S. and global bonds gained 8.08% and 5.73%, respectively, for the 12 months, according to the Bloomberg Barclays U.S. Aggregate Bond and Global Aggregate Bond indices.

Fed’s Flip Fueled Investor Optimism

Early in the period, mounting concerns about slowing global economic and earnings growth, tariffs and Federal Reserve (Fed) policy soured investor sentiment. After raising rates in September, the Fed hiked again in December and delivered a surprisingly bullish rate-hike outlook that fueled a steep sell-off among riskier assets. Meanwhile, the risk-off climate sparked a flight to quality, and government bond yields plunged.

A key policy pivot from the Fed helped improve investor sentiment beginning in early 2019. The central bank abruptly ended its rate-hike campaign and adopted a dovish tone amid moderating global growth and inflation. Additionally, investors’ worst-case fears about growth, trade and corporate earnings generally eased, which also aided stocks. At the same time, government bond yields continued to fall on moderating global growth data, muted inflation and accommodative central bank policy, including the Fed’s July rate cut. This backdrop supported continued gains for bonds and other interest rate-sensitive assets.

Looking ahead, we expect volatility to remain a formidable factor as investors react to global growth and trade trends, central bank policy and geopolitical developments. We believe this scenario underscores the importance of using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of July 31, 2019 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| One Choice Portfolio: Very Conservative | | | |

| Investor Class | AONIX | 5.31% | 3.70% | 4.99% | — | 9/30/04 |

| R Class | AORHX | 4.69% | — | — | 3.01% | 3/20/15 |

| One Choice Portfolio: Conservative | | | | | |

| Investor Class | AOCIX | 4.25% | 4.68% | 6.85% | — | 9/30/04 |

| R Class | AORSX | 3.73% | — | — | 3.68% | 3/20/15 |

| One Choice Portfolio: Moderate | | | | |

| Investor Class | AOMIX | 3.81% | 5.78% | 8.46% | — | 9/30/04 |

| R Class | AORMX | 3.29% | — | — | 4.61% | 3/20/15 |

| One Choice Portfolio: Aggressive | | | | | |

| Investor Class | AOGIX | 3.53% | 6.81% | 9.77% | — | 9/30/04 |

| R Class | AORYX | 2.94% | — | — | 5.38% | 3/20/15 |

| One Choice Portfolio: Very Aggressive | | | |

| Investor Class | AOVIX | 2.10% | 7.63% | 10.81% | — | 9/30/04 |

| R Class | AORVX | 1.58% | — | — | 6.00% | 3/20/15 |

| Russell 3000 Index | — | 7.05% | 10.95% | 13.97% | — | — |

| Bloomberg Barclays U.S. Aggregate Bond Index | — | 8.08% | 3.04% | 3.75% | — | — |

Average annual returns since inception are presented when ten years of performance history is not available.

The Russell 3000 Index represents approximately 98% of the investable U.S. equity market and provides a broad measure of equity performance. The Bloomberg Barclays U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market and provides a broad measure of bond market performance. Performance for these indices is provided for reference only. Neither index is intended to represent the composition of the portfolio, which invests in a mix of equity and fixed-income securities. (See the Schedule of Investments for each portfolio’s asset allocations as of the date of this report.)

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the funds, please consult the prospectus.

|

|

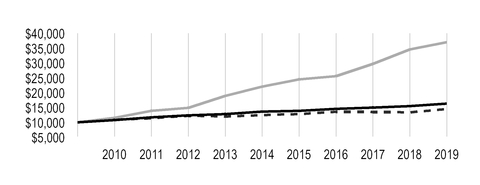

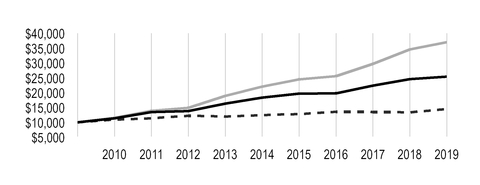

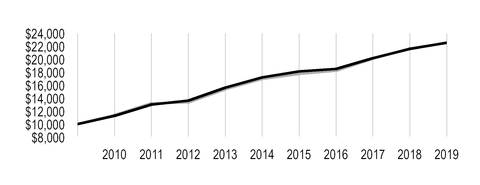

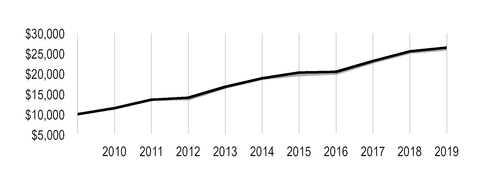

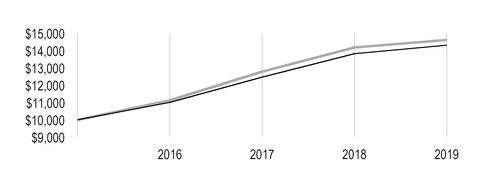

| Growth of $10,000 Over 10 Years of One Choice Portfolio: Very Conservative |

| $10,000 investment made July 31, 2009 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on July 31, 2019 |

| | Investor Class — $16,280 |

| |

| | Russell 3000 Index — $37,005 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,456 |

| |

|

|

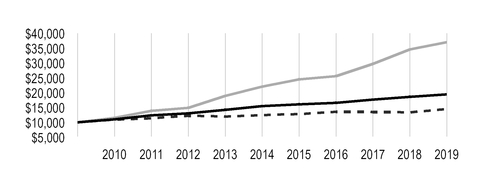

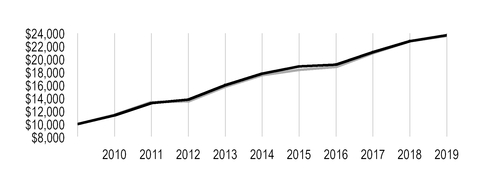

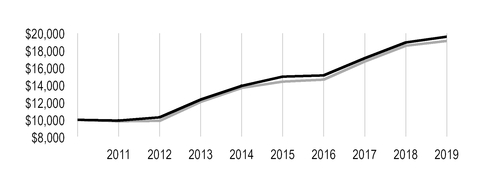

| Growth of $10,000 Over 10 Years of One Choice Portfolio: Conservative |

| $10,000 investment made July 31, 2009 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on July 31, 2019 |

| | Investor Class — $19,404 |

| |

| | Russell 3000 Index — $37,005 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,456 |

| |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the funds, please consult the prospectus.

|

|

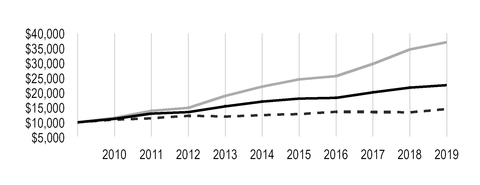

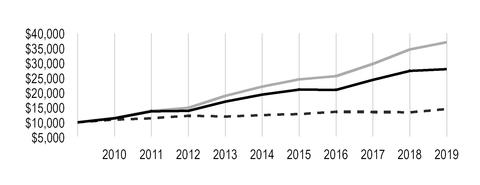

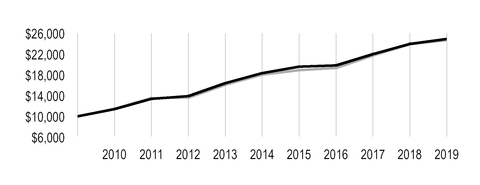

| Growth of $10,000 Over 10 Years of One Choice Portfolio: Moderate |

| $10,000 investment made July 31, 2009 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on July 31, 2019 |

| | Investor Class — $22,540 |

| |

| | Russell 3000 Index — $37,005 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,456 |

| |

|

|

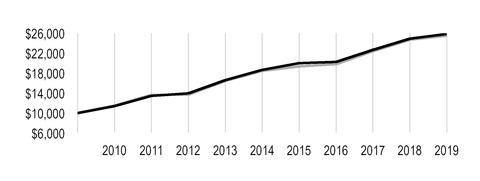

| Growth of $10,000 Over 10 Years of One Choice Portfolio: Aggressive |

| $10,000 investment made July 31, 2009 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on July 31, 2019 |

| | Investor Class — $25,421 |

| |

| | Russell 3000 Index — $37,005 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,456 |

| |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the funds, please consult the prospectus.

|

|

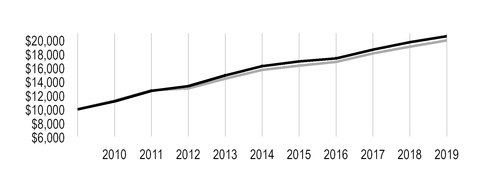

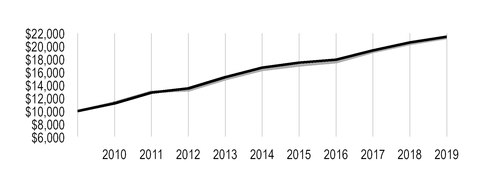

| Growth of $10,000 Over 10 Years of One Choice Portfolio: Very Aggressive |

| $10,000 investment made July 31, 2009 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on July 31, 2019 |

| | Investor Class — $27,930 |

| |

| | Russell 3000 Index — $37,005 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,456 |

| |

|

| | |

| Total Annual Fund Operating Expenses |

| | Investor Class | R Class |

| One Choice Portfolio: Very Conservative | 0.71% | 1.21% |

| One Choice Portfolio: Conservative | 0.81% | 1.31% |

| One Choice Portfolio: Moderate | 0.90% | 1.40% |

| One Choice Portfolio: Aggressive | 0.97% | 1.47% |

| One Choice Portfolio: Very Aggressive | 1.04% | 1.54% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the funds, please consult the prospectus.

Portfolio Managers: Rich Weiss, Scott Wilson, Radu Gabudean and Vidya Rajappa

During the period, David MacEwen left the portfolio management team.

Performance Summary

For the fiscal year ended July 31, 2019, returns of the One Choice® Target Risk Portfolios ranged from 5.31%* for One Choice Portfolio: Very Conservative to 2.10% for One Choice Portfolio: Very Aggressive (see pages 3-6 for more detailed performance information). Positive returns for the 12 months were largely provided by exposure to U.S. equity market performance. Both U.S. and non-U.S. bond allocations also contributed meaningfully to results during the year, largely due to a falling interest rate environment. However, many non-U.S. equity markets delivered negative results during the period, providing a headwind to returns for portfolios with non-U.S. equity exposure (all except Very Conservative).

Because of the portfolios’ strategic exposure to a variety of asset classes, a review of the financial market helps explain much of their performance.

Market Overview

The first several months of the fiscal year yielded healthy returns across most major global indices. However, financial market volatility picked up in the fall of 2018 as concerns about tariffs, trade tensions and the sustainability of economic growth resurfaced. A primary concern was the possibility that the U.S. Federal Reserve (the Fed) might continue to raise rates in excess of market expectations. In that environment, equity markets fell through December. In January, Fed Chairman Jerome Powell made comments which reassured investors, promising that the Fed would be cautious and patient with future increases, and would work to support economic growth. Central banks around the world also pledged to provide stimulus, if necessary, to aid continued economic expansion. In January, equity markets recovered. However, pockets of volatility prevailed throughout the remainder of the period, mainly due to trade disputes between the U.S. and China, which many fear would have a dampening effect on global economic growth. Amid the more challenging economic environment, corporate profit growth also slowed, with the companies in the S&P 500 Index reporting negative earnings growth for the first two quarters of 2019.

Against a backdrop of slowing global growth, stagnant corporate profits, trade difficulties and shifting central bank policies, global equity markets produced mixed results. Most major indices within the U.S. gained, ending the period at or near record highs. Meanwhile, many non-U.S. markets lost ground. In the U.S., large-cap companies outperformed their mid- and small-cap counterparts, and growth beat value across stocks of all sizes, according to the Russell family of indices. Small-cap stocks were the only major segment of the U.S. equity market to experience a negative return during the 12 months. Developed non-U.S. stocks mildly underperformed emerging markets, but both delivered a negative return and trailed U.S. equities. For the year, the S&P 500 Index’s gain of 7.99% dwarfed the -2.18% loss of the MSCI Emerging Markets Index and the -2.60% return of the MSCI EAFE Index.

Within fixed-income investments, the Fed increased its target overnight lending range twice during the first half of the period; once in September and once in December. On the final day of July 2019, the Fed decreased the range by 25 basis points, ending the 12-month period at 2.00%-2.25%. Worries about slower economic growth and volatility in equity markets supported demand for

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

longer-term U.S. Treasury bonds, with the benchmark 10-year Treasury yield falling and finishing the fiscal year just above 2.00%. (When bond yields fall, prices rise, and vice versa.) Investment-grade U.S. corporate debt generally outperformed other spread sectors of the market, although U.S. high-yield and non-U.S. debt also produced strong returns. The Bloomberg Barclays U.S. High Yield 2.00% Issuer Capped Bond Index gained 6.91%, while the Bloomberg Barclays U.S. Aggregate Bond Index returned 8.08%, and the Bloomberg Barclays Global Aggregate Bond Index (Unhedged) returned 5.73%.

Portfolio Performance

Each One Choice Target Risk Portfolio is a fund of funds that invests in other American Century Investments mutual funds to achieve its investment objective and target asset allocation. (See page 9 for the specific underlying fund allocations for each Portfolio.)

All U.S. equity sleeves across the portfolios generated positive absolute returns, with the exception of the U.S. small-cap core portfolio. Growth-oriented shares contributed most to performance. Across all portfolios, Growth Fund, Equity Growth Fund, Heritage Fund and Large Company Value Fund, were among the top absolute contributors to gains. In addition, all U.S. and non-U.S. fixed-income funds, as well as the NT Global Real Estate Fund, produced positive results. Within the fixed-income allocation, the Emerging Markets Debt Fund, Global Bond Fund and Diversified Bond Fund yielded the best absolute returns. Conversely, all non-U.S. equity portfolios produced negative absolute returns for the 12 months. On a relative basis, Heritage Fund, Global Real Estate Fund and Growth Fund were notable positive contributors. NT International Small-Mid Cap Fund, Small Company Fund and Core Equity Plus Fund were leading laggards. In fixed income, security selection helped the most in Global Bond Fund, as well as in Short Duration Fund and Emerging Markets Debt Fund in portfolios which held them.

Portfolio Strategy

Many of the tactical allocation decisions were positive, though negative manager selection effects meant the portfolios generally underperformed their benchmarks. For example, it was beneficial to hold an overweight position in U.S. stocks with a corresponding underweight allocation to non-U.S. funds. In addition, the portfolios generally held overweight allocations in growth equities relative to value, and large stocks relative to small during the period. Nevertheless, security selection was negative overall.

A Look Ahead

We have a cautious outlook for growth, as several major components of U.S. growth forecasts have been declining, including industrial production, disposable income and corporate profits. In addition, rising tariffs and ongoing trade disputes between the U.S. and many leading economies act as an additional drag on growth. Despite this uncertainty, unemployment remains historically low, and sharply lower interest rates should ultimately provide a boost to the economy. What’s more, the U.S. economy remains attractive on a relative basis, as most other countries are expected to expand at a slower pace. It should also be noted that we do not feel that a U.S. recession is on the immediate horizon. Add it all up, and with stock market volatility increasing, trade concerns a wild card and the late stage of the economic cycle, we believe investor expectations should probably be more muted regarding financial market returns going forward.

Given these conditions, we remain neutrally positioned—that is, well diversified—in terms of our stock, bond and cash allocations. Although U.S. equities do not appear overvalued at current earnings and interest rate levels, we continue to monitor relative valuations and risks and will adjust positioning accordingly. And while we remain diversified geographically, we are removing our long-standing overweight allocation to the U.S., reflecting the fundamental and technical analysis of our quantitative process.

|

|

| Portfolio Characteristics |

|

| | | | | |

Underlying Fund Allocations(1) as a % of net assets as of July 31, 2019 |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative | One Choice Portfolio: Moderate | One Choice Portfolio: Aggressive | One Choice Portfolio: Very Aggressive |

| Equity | | | | | |

| Core Equity Plus Fund | 1.5% | 2.3% | 3.4% | 3.6% | 3.8% |

| Equity Growth Fund | 5.0% | 7.3% | 9.9% | 10.7% | 11.5% |

| Growth Fund | 3.2% | 6.2% | 7.7% | 10.2% | 12.9% |

| Heritage Fund | 1.3% | 2.8% | 5.2% | 7.2% | 8.7% |

| Large Company Value Fund | 6.2% | 6.8% | 8.1% | 11.2% | 11.7% |

| Mid Cap Value Fund | 4.2% | 5.6% | 6.1% | 7.2% | 8.1% |

| NT Disciplined Growth Fund | 1.0% | 1.6% | 2.1% | 2.9% | 4.0% |

| Real Estate Fund | 1.5% | — | — | — | — |

| Small Company Fund | 1.0% | 1.2% | 2.3% | 2.7% | 4.7% |

| Emerging Markets Fund | — | — | 3.7% | 5.1% | 8.1% |

| International Growth Fund | — | 4.0% | 5.6% | 6.6% | 9.6% |

| NT Global Real Estate Fund | — | 1.5% | 2.1% | 2.6% | 3.1% |

| NT International Small-Mid Cap Fund | — | 1.1% | 2.1% | 2.6% | 5.1% |

| NT International Value Fund | — | 4.4% | 3.4% | 3.2% | 3.2% |

| NT Non-U.S. Intrinsic Value Fund | — | — | 2.4% | 3.5% | 5.5% |

| Total Equity | 24.9% | 44.8% | 64.1% | 79.3% | 100.0% |

| Fixed Income | | | | | |

| Diversified Bond Fund | 20.6% | 20.4% | 14.4% | 6.9% | — |

| Inflation-Adjusted Bond Fund | 10.0% | 7.1% | 5.0% | 2.9% | — |

| NT High Income Fund | 2.0% | 2.1% | 2.5% | 4.5% | — |

| Short Duration Fund | 7.0% | — | — | — | — |

| Short Duration Inflation Protection Bond Fund | 13.0% | 5.0% | 1.0% | 1.0% | — |

| Emerging Markets Debt Fund | 1.5% | 2.1% | 2.1% | 1.5% | — |

| Global Bond Fund | 8.0% | 7.1% | 5.1% | 3.0% | — |

| International Bond Fund | 7.0% | 5.5% | 2.0% | — | — |

| Total Fixed Income | 69.1% | 49.3% | 32.1% | 19.8% | — |

| U.S. Government Money Market Fund | 6.0% | 5.9% | 3.8% | 0.9% | — |

| Other Assets and Liabilities | —(2) | —(2) | —(2) | —(2) | — |

| |

| (1) | Underlying fund investments represent Investor Class. |

| |

| (2) | Category is less than 0.05% of total net assets. |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds. As a shareholder in the underlying American Century Investments funds, your fund will indirectly bear its pro rata share of the expenses incurred by the underlying funds. These expenses are not included in the fund’s annualized expense ratio or the expenses paid during the period. These expenses are, however, included in the effective expenses paid during the period.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from February 1, 2019 to July 31, 2019.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | | | |

| | Beginning

Account Value

2/1/19 | Ending

Account Value

7/31/19 | Expenses Paid

During Period(1)

2/1/19 - 7/31/19 | Annualized

Expense Ratio(1) | Effective

Expenses

Paid During

Period(2)

2/1/19 - 7/31/19 | Effective

Annualized

Expense

Ratio(2) |

| One Choice Portfolio: Very Conservative | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,055.40 | $0.00 | 0.00%(3) | $3.62 | 0.71% |

| R Class | $1,000 | $1,052.00 | $2.54 | 0.50% | $6.16 | 1.21% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.80 | $0.00 | 0.00%(3) | $3.56 | 0.71% |

| R Class | $1,000 | $1,022.32 | $2.51 | 0.50% | $6.06 | 1.21% |

| One Choice Portfolio: Conservative | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,064.70 | $0.00 | 0.00%(3) | $4.15 | 0.81% |

| R Class | $1,000 | $1,062.20 | $2.56 | 0.50% | $6.70 | 1.31% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.80 | $0.00 | 0.00%(3) | $4.06 | 0.81% |

| R Class | $1,000 | $1,022.32 | $2.51 | 0.50% | $6.56 | 1.31% |

| One Choice Portfolio: Moderate | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,073.70 | $0.00 | 0.00%(3) | $4.63 | 0.90% |

| R Class | $1,000 | $1,070.40 | $2.57 | 0.50% | $7.19 | 1.40% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.80 | $0.00 | 0.00%(3) | $4.51 | 0.90% |

| R Class | $1,000 | $1,022.32 | $2.51 | 0.50% | $7.00 | 1.40% |

| One Choice Portfolio: Aggressive | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,082.40 | $0.00 | 0.00%(3) | $4.96 | 0.96% |

| R Class | $1,000 | $1,079.10 | $2.58 | 0.50% | $7.53 | 1.46% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.80 | $0.00 | 0.00%(3) | $4.81 | 0.96% |

| R Class | $1,000 | $1,022.32 | $2.51 | 0.50% | $7.30 | 1.46% |

| One Choice Portfolio: Very Aggressive | | | | |

| Actual | | | | | | |

| Investor Class | $1,000 | $1,087.00 | $0.00 | 0.00%(3) | $5.49 | 1.06% |

| R Class | $1,000 | $1,084.50 | $2.58 | 0.50% | $8.06 | 1.56% |

| Hypothetical | | | | | | |

| Investor Class | $1,000 | $1,024.80 | $0.00 | 0.00%(3) | $5.31 | 1.06% |

| R Class | $1,000 | $1,022.32 | $2.51 | 0.50% | $7.80 | 1.56% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any underlying fund fees and expenses. |

| |

| (2) | Effective expenses reflect the sum of expenses borne directly by the class plus the fund's pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class's annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund's relative average investment therein during the period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements. |

| |

| (3) | Other expenses, which include directors' fees and expenses, did not exceed 0.005%. |

JULY 31, 2019

One Choice Portfolio: Very Conservative

|

| | | | |

| | Shares | Value |

MUTUAL FUNDS(1) — 100.0% | | |

| Domestic Fixed Income Funds — 52.6% | | |

| Diversified Bond Fund Investor Class | 8,089,094 | $ | 87,847,556 |

|

| Inflation-Adjusted Bond Fund Investor Class | 3,665,660 | 42,704,938 |

|

| NT High Income Fund Investor Class | 884,882 | 8,556,805 |

|

| Short Duration Fund Investor Class | 2,931,229 | 29,869,225 |

|

| Short Duration Inflation Protection Bond Fund Investor Class | 5,394,880 | 55,405,421 |

|

| | | 224,383,945 |

|

| Domestic Equity Funds — 24.9% | | |

| Core Equity Plus Fund Investor Class | 430,962 | 6,429,960 |

|

| Equity Growth Fund Investor Class | 655,696 | 21,152,755 |

|

| Growth Fund Investor Class | 386,600 | 13,728,176 |

|

| Heritage Fund Investor Class | 239,493 | 5,371,823 |

|

| Large Company Value Fund Investor Class | 2,562,612 | 26,420,529 |

|

| Mid Cap Value Fund Investor Class | 1,140,010 | 18,069,157 |

|

| NT Disciplined Growth Fund Investor Class | 341,904 | 4,297,739 |

|

| Real Estate Fund Investor Class | 213,950 | 6,390,685 |

|

| Small Company Fund Investor Class | 314,149 | 4,215,880 |

|

| | | 106,076,704 |

|

| International Fixed Income Funds — 16.5% | | |

| Emerging Markets Debt Fund Investor Class | 623,179 | 6,493,527 |

|

| Global Bond Fund Investor Class | 3,322,308 | 34,286,219 |

|

| International Bond Fund Investor Class | 2,280,591 | 29,693,297 |

|

| | | 70,473,043 |

|

| Money Market Funds — 6.0% | | |

| U.S. Government Money Market Fund Investor Class | 25,601,479 | 25,601,479 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $379,688,885) | | 426,535,171 |

|

OTHER ASSETS AND LIABILITIES† | | 5 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 426,535,176 |

|

|

|

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| † | Category is less than 0.05% of total net assets. |

| |

| (1) | Investments are funds within the American Century Investments family of funds and are considered affiliated funds. |

See Notes to Financial Statements.

JULY 31, 2019

One Choice Portfolio: Conservative

|

| | | | |

| | Shares | Value |

MUTUAL FUNDS(1) — 100.0% | | |

| Domestic Fixed Income Funds — 34.6% | | |

| Diversified Bond Fund Investor Class | 23,366,721 | $ | 253,762,590 |

|

| Inflation-Adjusted Bond Fund Investor Class | 7,522,253 | 87,634,243 |

|

| NT High Income Fund Investor Class | 2,664,028 | 25,761,154 |

|

| Short Duration Inflation Protection Bond Fund Investor Class | 6,079,706 | 62,438,580 |

|

| | | 429,596,567 |

|

| Domestic Equity Funds — 33.8% | | |

| Core Equity Plus Fund Investor Class | 1,937,865 | 28,912,945 |

|

| Equity Growth Fund Investor Class | 2,801,409 | 90,373,463 |

|

| Growth Fund Investor Class | 2,159,408 | 76,680,572 |

|

| Heritage Fund Investor Class | 1,563,571 | 35,070,890 |

|

| Large Company Value Fund Investor Class | 8,169,438 | 84,226,909 |

|

| Mid Cap Value Fund Investor Class | 4,357,338 | 69,063,803 |

|

| NT Disciplined Growth Fund Investor Class | 1,553,265 | 19,524,544 |

|

| Small Company Fund Investor Class | 1,159,543 | 15,561,060 |

|

| | | 419,414,186 |

|

| International Fixed Income Funds — 14.7% | | |

| Emerging Markets Debt Fund Investor Class | 2,483,244 | 25,875,406 |

|

| Global Bond Fund Investor Class | 8,520,843 | 87,935,097 |

|

| International Bond Fund Investor Class | 5,233,594 | 68,141,396 |

|

| | | 181,951,899 |

|

| International Equity Funds — 11.0% | | |

| International Growth Fund Investor Class | 4,282,231 | 49,973,631 |

|

| NT Global Real Estate Fund Investor Class | 1,811,737 | 19,168,176 |

|

| NT International Small-Mid Cap Fund Investor Class | 1,293,370 | 13,088,906 |

|

| NT International Value Fund Investor Class | 6,196,688 | 54,468,886 |

|

| | | 136,699,599 |

|

| Money Market Funds — 5.9% | | |

| U.S. Government Money Market Fund Investor Class | 73,609,544 | 73,609,544 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $1,087,761,397) | | 1,241,271,795 |

|

OTHER ASSETS AND LIABILITIES† | | 41 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 1,241,271,836 |

|

|

|

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| † | Category is less than 0.05% of total net assets. |

| |

| (1) | Investments are funds within the American Century Investments family of funds and are considered affiliated funds. |

See Notes to Financial Statements.

JULY 31, 2019

One Choice Portfolio: Moderate

|

| | | | |

| | Shares | Value |

MUTUAL FUNDS(1) — 100.0% | | |

| Domestic Equity Funds — 44.8% | | |

| Core Equity Plus Fund Investor Class | 4,298,701 | $ | 64,136,617 |

|

| Equity Growth Fund Investor Class | 5,762,606 | 185,901,684 |

|

| Growth Fund Investor Class | 4,069,447 | 144,506,045 |

|

| Heritage Fund Investor Class | 4,339,002 | 97,323,820 |

|

| Large Company Value Fund Investor Class | 14,867,938 | 153,288,444 |

|

| Mid Cap Value Fund Investor Class | 7,313,235 | 115,914,781 |

|

| NT Disciplined Growth Fund Investor Class | 3,221,245 | 40,491,052 |

|

| Small Company Fund Investor Class | 3,161,146 | 42,422,584 |

|

| | | 843,985,027 |

|

| Domestic Fixed Income Funds — 22.9% | | |

| Diversified Bond Fund Investor Class | 25,008,063 | 271,587,568 |

|

| Inflation-Adjusted Bond Fund Investor Class | 8,053,430 | 93,822,458 |

|

| NT High Income Fund Investor Class | 4,983,296 | 48,188,475 |

|

| Short Duration Inflation Protection Bond Fund Investor Class | 1,825,702 | 18,749,962 |

|

| | | 432,348,463 |

|

| International Equity Funds — 19.3% | | |

| Emerging Markets Fund Investor Class | 6,314,968 | 69,843,546 |

|

| International Growth Fund Investor Class | 9,034,273 | 105,429,968 |

|

| NT Global Real Estate Fund Investor Class | 3,783,621 | 40,030,711 |

|

| NT International Small-Mid Cap Fund Investor Class | 3,934,733 | 39,819,498 |

|

| NT International Value Fund Investor Class | 7,314,968 | 64,298,569 |

|

| NT Non-U.S. Intrinsic Value Fund Investor Class | 4,558,394 | 44,991,353 |

|

| | | 364,413,645 |

|

| International Fixed Income Funds — 9.2% | | |

| Emerging Markets Debt Fund Investor Class | 3,817,528 | 39,778,641 |

|

| Global Bond Fund Investor Class | 9,206,761 | 95,013,777 |

|

| International Bond Fund Investor Class | 2,905,887 | 37,834,650 |

|

| | | 172,627,068 |

|

| Money Market Funds — 3.8% | | |

| U.S. Government Money Market Fund Investor Class | 71,971,590 | 71,971,590 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $1,563,340,556) | | 1,885,345,793 |

|

OTHER ASSETS AND LIABILITIES† | | (1,029 | ) |

| TOTAL NET ASSETS — 100.0% | | $ | 1,885,344,764 |

|

|

|

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| † | Category is less than 0.05% of total net assets. |

| |

| (1) | Investments are funds within the American Century Investments family of funds and are considered affiliated funds. |

See Notes to Financial Statements.

JULY 31, 2019

One Choice Portfolio: Aggressive

|

| | | | |

| | Shares | Value |

MUTUAL FUNDS(1) — 100.0% | | |

| Domestic Equity Funds — 55.7% | | |

| Core Equity Plus Fund Investor Class | 3,256,350 | $ | 48,584,741 |

|

| Equity Growth Fund Investor Class | 4,413,250 | 142,371,439 |

|

| Growth Fund Investor Class | 3,851,055 | 136,750,967 |

|

| Heritage Fund Investor Class | 4,286,429 | 96,144,597 |

|

| Large Company Value Fund Investor Class | 14,456,517 | 149,046,689 |

|

| Mid Cap Value Fund Investor Class | 6,076,319 | 96,309,654 |

|

| NT Disciplined Growth Fund Investor Class | 3,104,256 | 39,020,501 |

|

| Small Company Fund Investor Class | 2,661,594 | 35,718,585 |

|

| | | 743,947,173 |

|

| International Equity Funds — 23.6% | | |

| Emerging Markets Fund Investor Class | 6,213,620 | 68,722,634 |

|

| International Growth Fund Investor Class | 7,559,609 | 88,220,638 |

|

| NT Global Real Estate Fund Investor Class | 3,251,444 | 34,400,275 |

|

| NT International Small-Mid Cap Fund Investor Class | 3,375,574 | 34,160,810 |

|

| NT International Value Fund Investor Class | 4,813,382 | 42,309,628 |

|

| NT Non-U.S. Intrinsic Value Fund Investor Class | 4,804,649 | 47,421,881 |

|

| | | 315,235,866 |

|

| Domestic Fixed Income Funds — 15.3% | | |

| Diversified Bond Fund Investor Class | 8,463,103 | 91,909,299 |

|

| Inflation-Adjusted Bond Fund Investor Class | 3,375,250 | 39,321,665 |

|

| NT High Income Fund Investor Class | 6,236,790 | 60,309,757 |

|

| Short Duration Inflation Protection Bond Fund Investor Class | 1,241,626 | 12,751,496 |

|

| | | 204,292,217 |

|

| International Fixed Income Funds — 4.5% | | |

| Emerging Markets Debt Fund Investor Class | 1,943,788 | 20,254,268 |

|

| Global Bond Fund Investor Class | 3,857,870 | 39,813,215 |

|

| | | 60,067,483 |

|

| Money Market Funds — 0.9% | | |

| U.S. Government Money Market Fund Investor Class | 12,471,560 | 12,471,560 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $1,079,752,884) | | 1,336,014,299 |

|

OTHER ASSETS AND LIABILITIES† | | (573 | ) |

| TOTAL NET ASSETS — 100.0% | | $ | 1,336,013,726 |

|

|

|

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| † | Category is less than 0.05% of total net assets. |

| |

| (1) | Investments are funds within the American Century Investments family of funds and are considered affiliated funds. |

See Notes to Financial Statements.

JULY 31, 2019

One Choice Portfolio: Very Aggressive

|

| | | | |

| | Shares | Value |

MUTUAL FUNDS(1) — 100.0% | | |

| Domestic Equity Funds — 65.4% | | |

| Core Equity Plus Fund Investor Class | 794,985 | $ | 11,861,169 |

|

| Equity Growth Fund Investor Class | 1,094,349 | 35,303,712 |

|

| Growth Fund Investor Class | 1,120,250 | 39,780,080 |

|

| Heritage Fund Investor Class | 1,196,897 | 26,846,399 |

|

| Large Company Value Fund Investor Class | 3,490,920 | 35,991,387 |

|

| Mid Cap Value Fund Investor Class | 1,582,551 | 25,083,429 |

|

| NT Disciplined Growth Fund Investor Class | 970,355 | 12,197,357 |

|

| Small Company Fund Investor Class | 1,071,086 | 14,373,973 |

|

| | | 201,437,506 |

|

| International Equity Funds — 34.6% | | |

| Emerging Markets Fund Investor Class | 2,269,435 | 25,099,947 |

|

| International Growth Fund Investor Class | 2,542,608 | 29,672,238 |

|

| NT Global Real Estate Fund Investor Class | 897,152 | 9,491,867 |

|

| NT International Small-Mid Cap Fund Investor Class | 1,540,949 | 15,594,404 |

|

| NT International Value Fund Investor Class | 1,132,884 | 9,958,054 |

|

| NT Non-U.S. Intrinsic Value Fund Investor Class | 1,711,913 | 16,896,581 |

|

| | | 106,713,091 |

|

TOTAL INVESTMENT SECURITIES — 100.0%

(Cost $226,586,377) | | 308,150,597 |

|

| OTHER ASSETS AND LIABILITIES | | — |

|

| TOTAL NET ASSETS — 100.0% | | $ | 308,150,597 |

|

|

|

| NOTES TO SCHEDULE OF INVESTMENTS |

| |

| (1) | Investments are funds within the American Century Investments family of funds and are considered affiliated funds. |

See Notes to Financial Statements.

|

|

| Statements of Assets and Liabilities |

|

| | | | | | | | | |

| JULY 31, 2019 | | | |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative | One Choice Portfolio: Moderate |

| Assets | | | |

| Investment securities in affiliates, at value (cost of $379,688,885, $1,087,761,397 and $1,563,340,556, respectively) | $ | 426,535,171 |

| $ | 1,241,271,795 |

| $ | 1,885,345,793 |

|

| Receivable for investments sold | 39,476 |

| 129,129 |

| 529,215 |

|

| Receivable for capital shares sold | 101,754 |

| 324,603 |

| 493,427 |

|

| Distributions receivable from affiliates | 361,427 |

| 886,614 |

| 1,071,940 |

|

| | 427,037,828 |

| 1,242,612,141 |

| 1,887,440,375 |

|

| | | | |

| Liabilities | | | |

| Payable for investments purchased | 361,422 |

| 886,580 |

| 1,071,878 |

|

| Payable for capital shares redeemed | 140,926 |

| 453,370 |

| 1,022,138 |

|

| Distribution and service fees payable | 304 |

| 355 |

| 1,595 |

|

| | 502,652 |

| 1,340,305 |

| 2,095,611 |

|

| | | | |

| Net Assets | $ | 426,535,176 |

| $ | 1,241,271,836 |

| $ | 1,885,344,764 |

|

| | | | |

| Net Assets Consist of: | | | |

| Capital (par value and paid-in surplus) | $ | 382,661,032 |

| $ | 1,071,162,080 |

| $ | 1,522,928,493 |

|

| Distributable earnings | 43,874,144 |

| 170,109,756 |

| 362,416,271 |

|

| | $ | 426,535,176 |

| $ | 1,241,271,836 |

| $ | 1,885,344,764 |

|

|

| | | | | |

| Fund/Class | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| One Choice Portfolio: Very Conservative |

| Investor Class, $0.01 Par Value |

| $425,814,367 |

| 34,935,630 | $12.19 |

| R Class, $0.01 Par Value |

| $720,809 |

| 59,111 | $12.19 |

| One Choice Portfolio: Conservative |

| Investor Class, $0.01 Par Value |

| $1,240,425,209 |

| 90,212,382 | $13.75 |

| R Class, $0.01 Par Value |

| $846,627 |

| 61,597 | $13.74 |

| One Choice Portfolio: Moderate |

| Investor Class, $0.01 Par Value |

| $1,881,575,179 |

| 120,088,208 | $15.67 |

| R Class, $0.01 Par Value |

| $3,769,585 |

| 240,686 | $15.66 |

See Notes to Financial Statements.

|

| | | | | | |

| JULY 31, 2019 | | |

| | One Choice Portfolio: Aggressive | One Choice Portfolio: Very Aggressive |

| Assets | | |

| Investment securities in affiliates, at value (cost of $1,079,752,884 and $226,586,377, respectively) | $ | 1,336,014,299 |

| $ | 308,150,597 |

|

| Receivable for investments sold | — |

| 223,237 |

|

| Receivable for capital shares sold | 466,944 |

| 48,586 |

|

| Distributions receivable from affiliates | 566,482 |

| — |

|

| | 1,337,047,725 |

| 308,422,420 |

|

| | | |

| Liabilities | | |

| Payable for investments purchased | 864,986 |

| — |

|

| Payable for capital shares redeemed | 167,827 |

| 270,904 |

|

| Distribution and service fees payable | 1,186 |

| 919 |

|

| | 1,033,999 |

| 271,823 |

|

| | | |

| Net Assets | $ | 1,336,013,726 |

| $ | 308,150,597 |

|

| | | |

| Net Assets Consist of: | | |

| Capital (par value and paid-in surplus) | $ | 1,031,393,207 |

| $ | 217,781,083 |

|

| Distributable earnings | 304,620,519 |

| 90,369,514 |

|

| | $ | 1,336,013,726 |

| $ | 308,150,597 |

|

|

| | | | | |

| Fund/Class | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| One Choice Portfolio: Aggressive |

| Investor Class, $0.01 Par Value |

| $1,333,116,008 |

| 79,279,851 | $16.82 |

| R Class, $0.01 Par Value |

| $2,897,718 |

| 172,645 | $16.78 |

| One Choice Portfolio: Very Aggressive |

| Investor Class, $0.01 Par Value |

| $305,967,073 |

| 17,009,943 | $17.99 |

| R Class, $0.01 Par Value |

| $2,183,524 |

| 121,573 | $17.96 |

See Notes to Financial Statements.

|

| | | | | | | | | |

| YEAR ENDED JULY 31, 2019 |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative | One Choice Portfolio: Moderate |

| Investment Income (Loss) | | | |

| Income from Affiliates: | | | |

| Income distributions from underlying funds | $ | 10,469,747 |

| $ | 30,355,501 |

| $ | 42,329,684 |

|

| | | | |

| Expenses: | | | |

| Distribution and service fees - R Class | 2,730 |

| 3,556 |

| 15,726 |

|

| Directors' fees and expenses | 11,760 |

| 34,526 |

| 51,831 |

|

| Other expenses | 78 |

| 124 |

| 218 |

|

| | 14,568 |

| 38,206 |

| 67,775 |

|

| | | | |

| Net investment income (loss) | 10,455,179 |

| 30,317,295 |

| 42,261,909 |

|

| | | | |

| Realized and Unrealized Gain (Loss) on Affiliates | | |

| Net realized gain (loss) on: | | | |

| Sale of investments in underlying funds | (633,459 | ) | (5,438,254 | ) | 1,283,732 |

|

| Capital gain distributions received from underlying funds | 8,037,857 |

| 41,069,636 |

| 84,462,359 |

|

| | 7,404,398 |

| 35,631,382 |

| 85,746,091 |

|

| | | | |

| Change in net unrealized appreciation (depreciation) on investments in underlying funds | 3,413,743 |

| (16,622,003 | ) | (61,732,736 | ) |

| | | | |

| Net realized and unrealized gain (loss) on affiliates | 10,818,141 |

| 19,009,379 |

| 24,013,355 |

|

| | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 21,273,320 |

| $ | 49,326,674 |

| $ | 66,275,264 |

|

See Notes to Financial Statements.

|

| | | | | | |

| YEAR ENDED JULY 31, 2019 | | |

| | One Choice Portfolio: Aggressive | One Choice Portfolio: Very Aggressive |

| Investment Income (Loss) | | |

| Income from Affiliates: | | |

| Income distributions from underlying funds | $ | 28,573,726 |

| $ | 5,102,503 |

|

| | | |

| Expenses: | | |

| Distribution and service fees - R Class | 11,944 |

| 8,735 |

|

| Directors' fees and expenses | 36,595 |

| 8,387 |

|

| Other expenses | 141 |

| 104 |

|

| | 48,680 |

| 17,226 |

|

| | | |

| Net investment income (loss) | 28,525,046 |

| 5,085,277 |

|

| | | |

| Realized and Unrealized Gain (Loss) on Affiliates | | |

| Net realized gain (loss) on: | | |

| Sale of investments in underlying funds | (1,518,822 | ) | 977,879 |

|

| Capital gain distributions received from underlying funds | 73,645,205 |

| 20,805,549 |

|

| | 72,126,383 |

| 21,783,428 |

|

| | | |

| Change in net unrealized appreciation (depreciation) on investments in underlying funds | (54,790,902 | ) | (21,308,204 | ) |

| | | |

| Net realized and unrealized gain (loss) on affiliates | 17,335,481 |

| 475,224 |

|

| | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 45,860,527 |

| $ | 5,560,501 |

|

See Notes to Financial Statements.

|

|

| Statements of Changes in Net Assets |

|

| | | | | | | | | | | | |

| YEARS ENDED JULY 31, 2019 AND JULY 31, 2018 |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative |

| Increase (Decrease) in Net Assets | July 31, 2019 | July 31, 2018 | July 31, 2019 | July 31, 2018 |

| Operations | | | | |

| Net investment income (loss) | $ | 10,455,179 |

| $ | 9,021,358 |

| $ | 30,317,295 |

| $ | 25,648,317 |

|

| Net realized gain (loss) | 7,404,398 |

| 6,113,224 |

| 35,631,382 |

| 31,105,288 |

|

| Change in net unrealized appreciation (depreciation) | 3,413,743 |

| (1,552,266 | ) | (16,622,003 | ) | 9,828,853 |

|

| Net increase (decrease) in net assets resulting from operations | 21,273,320 |

| 13,582,316 |

| 49,326,674 |

| 66,582,458 |

|

| | | | | |

| Distributions to Shareholders | | | | |

From earnings:(1) | | | | |

| Investor Class | (16,343,203 | ) | (14,537,694 | ) | (61,114,972 | ) | (41,062,884 | ) |

| R Class | (15,999 | ) | (6,368 | ) | (30,536 | ) | (12,081 | ) |

| Decrease in net assets from distributions | (16,359,202 | ) | (14,544,062 | ) | (61,145,508 | ) | (41,074,965 | ) |

| | | | | |

| Capital Share Transactions | | | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (18,331,163 | ) | (1,573,982 | ) | (48,851,563 | ) | 53,312,881 |

|

| | | | | |

| Net increase (decrease) in net assets | (13,417,045 | ) | (2,535,728 | ) | (60,670,397 | ) | 78,820,374 |

|

| | | | | |

| Net Assets | | | | |

| Beginning of period | 439,952,221 |

| 442,487,949 |

| 1,301,942,233 |

| 1,223,121,859 |

|

| End of period | $ | 426,535,176 |

| $ | 439,952,221 |

| $ | 1,241,271,836 |

| $ | 1,301,942,233 |

|

| |

| (1) | Prior periods presentation has been updated to reflect the current period combination of distributions to shareholders from net investment income and net realized gains. For One Choice Portfolio: Very Conservative, distributions from net investment income were $(8,760,553) and $(3,710) for Investor Class and R Class, respectively. For One Choice Portfolio: Very Conservative, distributions from net realized gains were $(5,777,141) and $(2,658) for Investor Class and R Class, respectively. |

For One Choice Portfolio: Conservative, distributions from net investment income were $(25,204,104) and $(6,666) for Investor Class and R Class, respectively. For One Choice Portfolio: Conservative, distributions from net realized gains were $(15,858,780) and $(5,415) for Investor Class and R Class, respectively.

See Notes to Financial Statements.

|

| | | | | | | | | | | | |

| YEARS ENDED JULY 31, 2019 AND JULY 31, 2018 |

| | One Choice Portfolio: Moderate | One Choice Portfolio: Aggressive |

| Increase (Decrease) in Net Assets | July 31, 2019 | July 31, 2018 | July 31, 2019 | July 31, 2018 |

| Operations | | | | |

| Net investment income (loss) | $ | 42,261,909 |

| $ | 39,098,268 |

| $ | 28,525,046 |

| $ | 26,206,275 |

|

| Net realized gain (loss) | 85,746,091 |

| 65,704,590 |

| 72,126,383 |

| 52,767,692 |

|

| Change in net unrealized appreciation (depreciation) | (61,732,736 | ) | 40,898,702 |

| (54,790,902 | ) | 43,375,495 |

|

| Net increase (decrease) in net assets resulting from operations | 66,275,264 |

| 145,701,560 |

| 45,860,527 |

| 122,349,462 |

|

| | | | | |

| Distributions to Shareholders | | | | |

From earnings:(1) | | | | |

| Investor Class | (110,287,075 | ) | (61,453,951 | ) | (82,628,385 | ) | (42,783,985 | ) |

| R Class | (163,681 | ) | (63,513 | ) | (132,435 | ) | (53,400 | ) |

| Decrease in net assets from distributions | (110,450,756 | ) | (61,517,464 | ) | (82,760,820 | ) | (42,837,385 | ) |

| | | | | |

| Capital Share Transactions | | | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (26,628,796 | ) | 28,468,288 |

| 13,670,695 |

| 54,828,883 |

|

| | | | | |

| Net increase (decrease) in net assets | (70,804,288 | ) | 112,652,384 |

| (23,229,598 | ) | 134,340,960 |

|

| | | | | |

| Net Assets | | | | |

| Beginning of period | 1,956,149,052 |

| 1,843,496,668 |

| 1,359,243,324 |

| 1,224,902,364 |

|

| End of period | $ | 1,885,344,764 |

| $ | 1,956,149,052 |

| $ | 1,336,013,726 |

| $ | 1,359,243,324 |

|

| |

| (1) | Prior periods presentation has been updated to reflect the current period combination of distributions to shareholders from net investment income and net realized gains. For One Choice Portfolio: Moderate, distributions from net investment income were $(38,568,784) and $(35,866) for Investor Class and R Class, respectively. For One Choice Portfolio: Moderate, distributions from net realized gains were $(22,885,167) and $(27,647) for Investor Class and R Class, respectively. |

For One Choice Portfolio: Aggressive, distributions from net investment income were $(24,481,377) and $(26,400) for Investor Class and R Class, respectively. For One Choice Portfolio: Aggressive, distributions from net realized gains were $(18,302,608) and $(27,000) for Investor Class and R Class, respectively.

See Notes to Financial Statements.

|

| | | | | | |

| YEARS ENDED JULY 31, 2019 AND JULY 31, 2018 |

| | One Choice Portfolio: Very Aggressive |

| Increase (Decrease) in Net Assets | July 31, 2019 | July 31, 2018 |

| Operations | | |

| Net investment income (loss) | $ | 5,085,277 |

| $ | 5,296,513 |

|

| Net realized gain (loss) | 21,783,428 |

| 15,350,633 |

|

| Change in net unrealized appreciation (depreciation) | (21,308,204 | ) | 15,643,810 |

|

| Net increase (decrease) in net assets resulting from operations | 5,560,501 |

| 36,290,956 |

|

| | | |

| Distributions to Shareholders | | |

From earnings:(1) | | |

| Investor Class | (20,097,458 | ) | (10,738,785 | ) |

| R Class | (109,353 | ) | (25,950 | ) |

| Decrease in net assets from distributions | (20,206,811 | ) | (10,764,735 | ) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (104,378 | ) | 8,320,217 |

|

| | | |

| Net increase (decrease) in net assets | (14,750,688 | ) | 33,846,438 |

|

| | | |

| Net Assets | | |

| Beginning of period | 322,901,285 |

| 289,054,847 |

|

| End of period | $ | 308,150,597 |

| $ | 322,901,285 |

|

| |

| (1) | Prior period presentation has been updated to reflect the current period combination of distributions to shareholders from net investment income and net realized gains. For One Choice Portfolio: Very Aggressive, distributions from net investment income were $(5,323,626) and $(10,658) for Investor Class and R Class, respectively. For One Choice Portfolio: Very Aggressive, distributions from net realized gains were $(5,415,159) and $(15,292) for Investor Class and R Class, respectively. |

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

JULY 31, 2019

1. Organization

American Century Asset Allocation Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. One Choice Portfolio: Very Conservative, One Choice Portfolio: Conservative, One Choice Portfolio: Moderate, One Choice Portfolio: Aggressive and One Choice Portfolio: Very Aggressive (collectively, the funds) are five funds in a series issued by the corporation. The funds operate as “funds of funds,” meaning substantially all of the funds’ assets will be invested in other American Century Investments mutual funds (the underlying funds). Each fund’s assets are allocated among underlying funds that represent major asset classes, including equity securities (stocks), fixed-income securities (bonds) and cash-equivalent instruments (money markets). The funds will assume the risks associated with their underlying funds. Additional information and attributes of each underlying fund are available at americancentury.com. Each fund's investment objective is to seek the highest total return consistent with its asset mix. The funds offer the Investor Class and R Class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the funds in preparation of their financial statements. Each fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The funds determine the fair value of their investments and compute their net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the funds' investment valuation process and to provide methodologies for the oversight of the funds' pricing function. Investments in the underlying funds are valued at their reported NAV.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Income and capital gain distributions, if any, from the underlying funds are recorded as of the ex-dividend date. Long-term capital gain distributions, if any, from the underlying funds are a component of net realized gain (loss).

Expenses — The expenses included in the accompanying financial statements reflect the expenses of each fund and do not include any expenses associated with the underlying funds.

Income Tax Status — It is each fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The funds file U.S. federal, state, local and non-U.S. tax returns as applicable. The funds' tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of each fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the funds are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly for One Choice Portfolio: Very Conservative, One Choice Portfolio: Conservative and One Choice Portfolio: Moderate. Distributions from net investment income, if any, are generally declared and paid annually for One Choice Portfolio: Aggressive and One Choice Portfolio: Very Aggressive. Distributions from net realized gains, if any, are generally declared and paid annually for all funds. Each fund may elect to treat a portion of its payment to a redeeming shareholder, which represents the pro rata share of undistributed net investment income and net realized gains, as a distribution for federal income tax purposes (tax equalization).

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the funds. In addition, in the normal course of business, the funds enter into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, American Century Investment Management, Inc. (ACIM), the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC. ACIM serves as the investment advisor for the underlying funds.

Administrative Fees — The corporation's investment advisor, ACIM, does not receive an administrative fee for services provided to the funds.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for the R Class (the plan), pursuant to Rule 12b-1 of the 1940 Act. The plan provides that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fee is computed and accrued daily based on the R Class's daily net assets and paid monthly in arrears. The fee is used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plan during the period ended July 31, 2019 are detailed in the Statements of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the funds. The directors receive detailed information about the funds and their investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The funds' officers do not receive compensation from the funds.

Acquired Fund Fees and Expenses — Each fund will indirectly realize its pro rata share of the fees and expenses of the underlying funds in which it invests. These fees and expenses are already reflected in the valuation of the underlying funds.

4. Investment Transactions

Investment transactions for the period ended July 31, 2019 were as follows:

|

| | | | | | | | | | | | | | | |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative | One Choice Portfolio: Moderate | One Choice Portfolio: Aggressive | One Choice Portfolio: Very Aggressive |

| Purchases | $ | 47,597,681 |

| $ | 141,888,437 |

| $ | 257,282,385 |

| $ | 332,097,565 |

| $ | 63,522,005 |

|

| Sales | $ | 63,795,245 |

| $ | 180,499,285 |

| $ | 267,637,682 |

| $ | 299,017,182 |

| $ | 57,942,368 |

|

5. Capital Share Transactions

The corporation is authorized to issue 6,000,000,000 shares. Transactions in shares of the funds were as follows:

|

| | | | | | | | | | |

| | Year ended

July 31, 2019 | Year ended

July 31, 2018 |

| | Shares | Amount | Shares | Amount |

| One Choice Portfolio: Very Conservative | | | |

| Investor Class | | | | |

| Sold | 5,854,106 |

| $ | 69,469,563 |

| 8,031,166 |

| $ | 97,107,941 |

|

| Issued in reinvestment of distributions | 1,413,870 |

| 16,124,599 |

| 1,192,711 |

| 14,352,299 |

|

| Redeemed | (8,808,069 | ) | (104,263,832 | ) | (9,383,351 | ) | (113,269,236 | ) |

| | (1,540,093 | ) | (18,669,670 | ) | (159,474 | ) | (1,808,996 | ) |

| R Class | | | | |

| Sold | 35,070 |

| 411,026 |

| 23,115 |

| 279,898 |

|

| Issued in reinvestment of distributions | 1,404 |

| 15,999 |

| 529 |

| 6,368 |

|

| Redeemed | (7,434 | ) | (88,518 | ) | (4,213 | ) | (51,252 | ) |

| | 29,040 |

| 338,507 |

| 19,431 |

| 235,014 |

|

| Net increase (decrease) | (1,511,053 | ) | $ | (18,331,163 | ) | (140,043 | ) | $ | (1,573,982 | ) |

|

| | | | | | | | | | |

| One Choice Portfolio: Conservative | | | | |

| Investor Class | | | | |

| Sold | 10,550,870 |

| $ | 141,509,994 |

| 16,334,249 |

| $ | 225,929,603 |

|

| Issued in reinvestment of distributions | 4,758,446 |

| 59,796,406 |

| 2,925,964 |

| 40,269,285 |

|

| Redeemed | (18,731,670 | ) | (250,428,815 | ) | (15,426,650 | ) | (213,156,789 | ) |

| | (3,422,354 | ) | (49,122,415 | ) | 3,833,563 |

| 53,042,099 |

|

| R Class | | | | |

| Sold | 30,384 |

| 402,929 |

| 24,046 |

| 332,673 |

|

| Issued in reinvestment of distributions | 2,442 |

| 30,536 |

| 877 |

| 12,081 |

|

| Redeemed | (12,130 | ) | (162,613 | ) | (5,339 | ) | (73,972 | ) |

| | 20,696 |

| 270,852 |

| 19,584 |

| 270,782 |

|

| Net increase (decrease) | (3,401,658 | ) | $ | (48,851,563 | ) | 3,853,147 |

| $ | 53,312,881 |

|

|

| | | | | | | | | | |

| One Choice Portfolio: Moderate | | | | |

| Investor Class | | | | |

| Sold | 11,978,818 |

| $ | 183,093,758 |

| 15,069,155 |

| $ | 239,970,284 |

|

| Issued in reinvestment of distributions | 7,758,117 |

| 108,699,313 |

| 3,821,969 |

| 60,473,949 |

|

| Redeemed | (20,896,367 | ) | (319,401,913 | ) | (17,135,963 | ) | (273,013,221 | ) |

| | (1,159,432 | ) | (27,608,842 | ) | 1,755,161 |

| 27,431,012 |

|

| R Class | | | | |

| Sold | 94,542 |

| 1,433,454 |

| 85,737 |

| 1,362,575 |

|

| Issued in reinvestment of distributions | 11,746 |

| 163,681 |

| 4,009 |

| 63,500 |

|

| Redeemed | (39,762 | ) | (617,089 | ) | (24,400 | ) | (388,799 | ) |

| | 66,526 |

| 980,046 |

| 65,346 |

| 1,037,276 |

|

| Net increase (decrease) | (1,092,906 | ) | $ | (26,628,796 | ) | 1,820,507 |

| $ | 28,468,288 |

|

|

| | | | | | | | | | |

| | Year ended

July 31, 2019 | Year ended

July 31, 2018 |

| | Shares | Amount | Shares | Amount |

| One Choice Portfolio: Aggressive | | | |

| Investor Class | | | | |

| Sold | 11,896,257 |

| $ | 190,398,301 |

| 13,007,609 |

| $ | 223,454,783 |

|

| Issued in reinvestment of distributions | 5,705,141 |

| 81,925,822 |

| 2,503,179 |

| 42,428,878 |

|

| Redeemed | (16,115,776 | ) | (259,352,780 | ) | (12,365,617 | ) | (211,720,004 | ) |

| | 1,485,622 |

| 12,971,343 |

| 3,145,171 |

| 54,163,657 |

|

| R Class | | | | |

| Sold | 67,155 |

| 1,096,747 |

| 69,695 |

| 1,187,311 |

|

| Issued in reinvestment of distributions | 9,207 |

| 132,391 |

| 3,128 |

| 53,079 |

|

| Redeemed | (32,190 | ) | (529,786 | ) | (33,462 | ) | (575,164 | ) |

| | 44,172 |

| 699,352 |

| 39,361 |

| 665,226 |

|

| Net increase (decrease) | 1,529,794 |

| $ | 13,670,695 |

| 3,184,532 |

| $ | 54,828,883 |

|

|

| | | | | | | | | | |

| One Choice Portfolio: Very Aggressive | | | |

| Investor Class | | | | |

| Sold | 1,838,298 |

| $ | 32,147,420 |

| 2,926,704 |

| $ | 54,528,756 |

|

| Issued in reinvestment of distributions | 1,309,240 |

| 19,730,250 |

| 574,965 |

| 10,556,366 |

|

| Redeemed | (2,994,513 | ) | (52,837,151 | ) | (3,098,815 | ) | (57,452,837 | ) |

| | 153,025 |

| (959,481 | ) | 402,854 |

| 7,632,285 |

|

| R Class | | | | |

| Sold | 69,753 |

| 1,223,516 |

| 50,194 |

| 933,811 |

|

| Issued in reinvestment of distributions | 7,247 |

| 109,353 |

| 1,412 |

| 25,950 |

|

| Redeemed | (27,681 | ) | (477,766 | ) | (14,699 | ) | (271,829 | ) |

| | 49,319 |

| 855,103 |

| 36,907 |

| 687,932 |

|

| Net increase (decrease) | 202,344 |

| $ | (104,378 | ) | 439,761 |

| $ | 8,320,217 |

|

6. Fair Value Measurements

The funds’ investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the funds. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

As of period end, the funds’ investment securities were classified as Level 1. The Schedules of Investments provide additional information on the funds’ portfolio holdings.

7. Federal Tax Information

The tax character of distributions paid during the years ended July 31, 2019 and July 31, 2018 were as follows:

|

| | | | | | | | | | | | |

| | 2019 | 2018 |

| | Distributions Paid From: | Distributions Paid From: |

| | Ordinary Income | Long-term Capital Gains | Ordinary Income | Long-term Capital Gains |

One Choice Portfolio: Very Conservative | $ | 10,575,811 |

| $ | 5,783,391 |

| $ | 9,750,425 |

| $ | 4,793,637 |

|

| One Choice Portfolio: Conservative | $ | 31,744,289 |

| $ | 29,401,219 |

| $ | 25,843,891 |

| $ | 15,231,074 |

|

| One Choice Portfolio: Moderate | $ | 44,946,253 |

| $ | 65,504,503 |

| $ | 39,755,078 |

| $ | 21,762,386 |

|

| One Choice Portfolio: Aggressive | $ | 31,258,319 |

| $ | 51,502,501 |

| $ | 25,609,515 |

| $ | 17,227,870 |

|

One Choice Portfolio: Very Aggressive | $ | 5,662,981 |

| $ | 14,543,830 |

| $ | 5,612,937 |

| $ | 5,151,798 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | | | | | | | |

| | One Choice Portfolio: Very Conservative | One Choice Portfolio: Conservative | One Choice Portfolio: Moderate |

| Federal tax cost of investments | $ | 389,748,349 |

| $ | 1,108,292,184 |

| $ | 1,608,729,046 |

|

| Gross tax appreciation of investments | $ | 37,891,198 |

| $ | 137,817,696 |

| $ | 284,616,889 |

|