0001293210N-1Afalse10,00010,5109,6099,87610,79110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4949,73210,13811,10710,00010,5109,6359,91210,85310,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4949,73210,13811,1079,4259,8879,0299,24610,07910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4949,73210,13811,10710,00010,4809,5409,74510,59810,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4949,73210,13811,10710,00010,5209,6579,95010,90910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4949,73210,13811,10710,00010,5209,6459,92210,85110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4609,72710,07111,01510,00010,5309,6619,95810,92410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4609,72710,07111,0159,4259,9069,0539,28910,13610,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4609,72710,07111,01510,00010,5009,5659,79010,65710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4609,72710,07111,01510,00010,5409,6839,99610,98010,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,4609,72710,07111,01510,00010,5509,5579,91310,91410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,5329,74610,24911,27610,00010,5609,5839,96010,97610,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,5329,74610,24911,2769,4259,9348,9709,29110,19410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,5329,74610,24911,27610,00010,5309,4889,79210,71910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,5329,74610,24911,27610,00010,5709,6059,99811,03310,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,5329,74610,24911,27610,00010,5809,4929,97111,03310,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6009,77110,42311,60710,00010,5909,52810,01811,10610,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6009,77110,42311,6079,4259,9628,9189,34510,31610,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6009,77110,42311,60710,00010,5609,4339,84910,85710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6009,77110,42311,60710,00010,5909,53910,05611,16410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6009,77110,42311,60710,00010,6109,41710,00011,15710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6749,80510,61011,96210,00010,6209,44310,04711,23110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6749,80510,61011,9629,4259,9918,8389,37210,43210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6749,80510,61011,96210,00010,5909,3489,87710,96910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6749,80510,61011,96210,00010,6209,46510,08511,28910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,6749,80510,61011,96210,00010,6509,40010,08911,33810,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7109,81610,76712,25910,00010,6609,42610,13711,41210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7109,81610,76712,2599,42510,0288,8229,44610,59010,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7109,81610,76712,25910,00010,6309,3319,96611,14710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7109,81610,76712,25910,00010,6609,44710,17511,47110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7109,81610,76712,25910,00010,6809,40410,20111,53110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7559,82910,91812,52610,00010,6909,43010,25011,60710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7559,82910,91812,5269,42510,0568,8369,55210,77210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7559,82910,91812,52610,00010,6609,34610,07711,33710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7559,82910,91812,52610,00010,7009,45210,27811,66710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7559,82910,91812,52610,00010,7109,41910,28611,71210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7649,82610,97612,67310,00010,7209,44510,33511,78910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7649,82610,97612,6739,42510,0858,8509,64010,94010,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7649,82610,97612,67310,00010,6809,35010,16111,50510,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7649,82610,97612,67310,00010,7209,46710,37311,83910,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7649,82610,97612,67310,00010,7309,42410,33711,79810,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7799,83510,99512,69010,00010,7309,45010,38611,87610,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7799,83510,99512,6909,42510,0948,8459,68911,03210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7799,83510,99512,69010,00010,7009,35510,21211,60110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7799,83510,99512,69010,00010,7409,47210,43511,94710,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7799,83510,99512,69010,00010,7309,42510,37511,87310,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7779,83211,01312,71410,00010,7309,45110,41311,94110,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7779,83211,01312,7149,42510,0948,8469,70411,09310,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7779,83211,01312,71410,00010,7009,35610,23911,66510,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7779,83211,01312,71410,00010,7409,46210,45212,00210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7779,83211,01312,71410,00010,7909,47310,42611,94410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7889,90311,09412,85210,00010,8009,49910,46512,01210,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7889,90311,09412,8529,42510,1608,8919,76211,14810,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7889,90311,09412,85210,00010,7709,40410,30011,73410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7889,90311,09412,85210,00010,8009,52110,50412,07410,00011,16810,34711,65514,11210,00010,2389,3058,9929,45010,00010,7889,90311,09412,85210,00010,20710,71011,04211,38811,99212,77814,23313,29813,32714,34110,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,0009,88710,32210,59810,87411,38512,08013,37712,44612,41013,28710,00010,00810,45312,14014,13015,12616,77923,27721,56624,29429,41410,0009,91210,50010,44610,36311,20012,33412,24711,13110,75611,30410,00010,40910,73411,43612,05712,57013,57015,85214,41214,89216,22610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,0009,89410,15910,76211,29011,71112,58114,63213,23613,59914,75510,00010,00810,45312,14014,13015,12616,77923,27721,56624,29429,41410,0009,91210,50010,44610,36311,20012,33412,24711,13110,75611,30410,00010,56610,73711,82012,76013,24614,41917,74915,79116,73018,52210,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,0009,90810,02410,98111,78712,17513,18916,16114,30715,08216,61410,00010,00810,45312,14014,13015,12616,77923,27721,56624,29429,41410,0009,91210,50010,44610,36311,20012,33412,24711,13110,75611,30410,00010,74410,81812,21213,43013,90415,17119,47317,14518,58820,83910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,0009,9189,93411,15812,21112,56913,65117,44615,27616,48518,37910,00010,00810,45312,14014,13015,12616,77923,27721,56624,29429,41410,0009,91210,50010,44610,36311,20012,33412,24711,13110,75611,30410,00010,88710,83912,55714,14914,44715,83621,31918,28720,27223,03610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,0009,9199,82811,32312,69612,89614,07118,84216,08117,74220,06210,00010,00810,45312,14014,13015,12616,77923,27721,56624,29429,41410,0009,91210,50010,44610,36311,20012,33412,24711,13110,75611,30410,00010,36610,65211,35911,98412,52913,36515,45514,20214,69016,08610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,10510,00010,37910,68711,41912,07112,65513,52615,66114,42014,94516,39810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,1059,4259,7459,98810,62511,18111,66812,41614,31313,11913,53614,78510,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,10510,00010,25910,44111,02211,51611,92012,59314,40713,10613,42614,55710,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,10510,00010,31310,54511,18911,74612,22812,98014,92813,64414,04415,30610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,10510,00010,41410,72411,47012,13212,73813,64015,81414,58915,14516,64810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,32710,70811,19211,66312,27713,19914,44713,38413,86015,10510,00010,46210,72911,58212,31912,87013,76916,08914,71515,24616,69410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,29910,00010,49010,77211,65212,41813,00813,93516,32514,95415,52417,04510,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,2999,4259,83610,06010,83411,49511,97812,78314,90013,59114,04515,35310,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,29910,00010,36410,51111,24211,83712,24812,97115,00713,58813,93515,10810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,29910,00010,41710,62811,41712,08412,56113,37015,54914,14414,57915,89910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,29910,00010,50510,80111,69712,47813,08414,03816,47015,11015,71017,27810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,41710,74111,68712,44013,00013,90416,15914,95215,72417,29910,00010,54310,76211,72812,56513,11514,09416,71815,15415,80817,37010,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,62010,00010,57310,81611,80912,66713,24914,26816,97115,40516,10317,72910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,6209,4259,91310,09310,97311,71912,20213,08115,48414,00614,56215,96510,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,62010,00010,44610,55311,38712,07712,47713,27315,59313,99214,44715,72010,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,62010,00010,49910,66311,56412,32012,79413,68116,15514,57415,11316,54110,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,62010,00010,59410,84011,84712,72513,32714,36617,11115,56616,29317,97010,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,44410,74711,83612,75213,27014,12417,00515,67416,72118,62010,00010,62510,79111,86812,82413,34514,40017,38915,61816,40618,10710,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,86810,00010,65210,84211,94612,92513,48514,58017,63715,87616,72218,47710,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,8689,4259,98910,11911,10211,96012,42913,37016,10614,42515,12616,64210,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,86810,00010,52510,58611,52112,31912,70513,56416,21714,42115,00716,38410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,86810,00010,57110,68911,69112,57113,02313,97316,79315,00915,68717,21910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,86810,00010,67410,87311,99512,99713,57714,68717,80616,04316,92418,73610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,46410,72811,93212,99313,46014,25417,72916,28617,62419,86810,00010,68410,82712,01213,09013,60414,71918,08916,10017,06618,91010,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,96410,00010,70510,87112,08513,19613,74214,89918,34616,37617,38019,29510,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,9649,42510,04410,15311,23812,20912,66413,66816,74914,87515,72817,38610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,96410,00010,57710,60711,65412,57612,94513,86616,86614,86215,59617,10710,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,96410,00010,63110,71811,82512,82613,27014,28517,46515,46816,31417,99110,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,96410,00010,71510,88912,12113,25113,82715,00718,50616,53117,59019,55810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,47910,72412,05913,25213,69114,37718,31516,78718,41320,96410,00010,72210,84912,15213,34113,84515,03318,80316,62417,75219,76710,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,78810,00010,75010,90012,23013,45213,98915,21919,07816,90618,08920,17810,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,7889,42510,08110,18011,36812,45112,88813,95917,42115,36716,36018,17410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,78810,00010,62110,64111,79412,82213,17714,16517,54815,36216,23317,89910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,78810,00010,67510,74511,97713,07813,50914,59518,17015,98516,98318,81910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,78810,00010,77210,94012,27613,53214,09015,35919,28017,11018,31920,47410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,49110,71612,13013,37913,81214,42018,70817,09818,99121,78810,00010,73710,85412,23213,50614,00015,24819,41617,11218,43120,62910,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,37910,00010,75810,89812,30313,61014,14615,43719,69917,39118,78221,04410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,3799,42510,09510,17811,44312,59613,03214,15917,98715,82016,99718,96610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,37910,00010,63010,64211,87412,98013,32714,36818,11915,81116,86018,67110,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,37910,00010,68410,75212,04913,24013,66414,80618,76416,45917,63819,63310,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,37910,00010,77610,93012,35313,68514,24015,56119,88317,59219,01121,34010,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,50010,70512,19013,47213,89414,53619,00817,35119,38322,37910,00010,75610,86612,29613,60114,07915,35019,71617,33718,80221,12610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,48110,00010,77810,91012,36913,70914,22015,53519,99317,61919,13321,55310,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,4819,42510,11410,19111,50512,69713,11014,24918,25616,01517,32519,41210,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,48110,00010,65110,65711,93613,07113,39314,45218,38916,00217,17819,11410,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,48110,00010,71110,76512,11513,33613,73514,90019,04116,66017,97620,10310,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,48110,00010,79010,94012,41213,78314,31815,65420,18117,80919,37421,85610,00011,12811,62313,49815,71116,81918,65725,88223,97927,01332,70510,00010,28210,89310,83710,75011,61912,79512,70511,54711,15811,72710,00010,51110,69512,23313,55213,95414,52919,09517,42419,47922,48110,00011,01212,47213,82414,30815,58820,15217,70219,26021,69110,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,79810,00011,02712,52413,90814,42315,73120,38617,94819,56622,07610,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,7989,42510,35311,69912,93713,35614,50318,71116,40117,78719,98710,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,79810,00010,92312,24313,44313,77614,85419,00816,53817,80919,86010,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,79810,00010,96712,35413,63614,04215,21119,56917,10418,51720,75810,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,79810,00011,03912,53113,94514,48215,82720,53718,10619,76322,33910,00011,44913,29615,47616,56718,37825,49523,62126,60832,21610,00010,53710,48310,39911,24012,37712,29011,17010,79411,34410,00011,12312,78214,18214,61915,32320,17318,40320,61323,79810,00013,00211,42112,44914,05410,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,74510,00013,01911,46112,51714,15810,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,7459,42512,21710,71111,64513,10710,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,74510,00012,88611,21412,10213,51410,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,74510,00012,94411,31712,27413,78110,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,74510,00013,04411,50312,58114,24910,00013,95612,93014,56517,63510,00010,0049,0928,7869,23410,00013,21712,13313,59215,7450001293210ck0001293210:C000014684Member2023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21591 | |||||||||||||||||||

| AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC. | ||||||||||||||||||||

| (Exact name of registrant as specified in charter) | ||||||||||||||||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| JOHN PAK 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||||||||||||||||

| (Name and address of agent for service) | ||||||||||||||||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||||||||||||||||

| Date of fiscal year end: | 07-31 | |||||||||||||||||||

| Date of reporting period: | 07-31-2024 | |||||||||||||||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

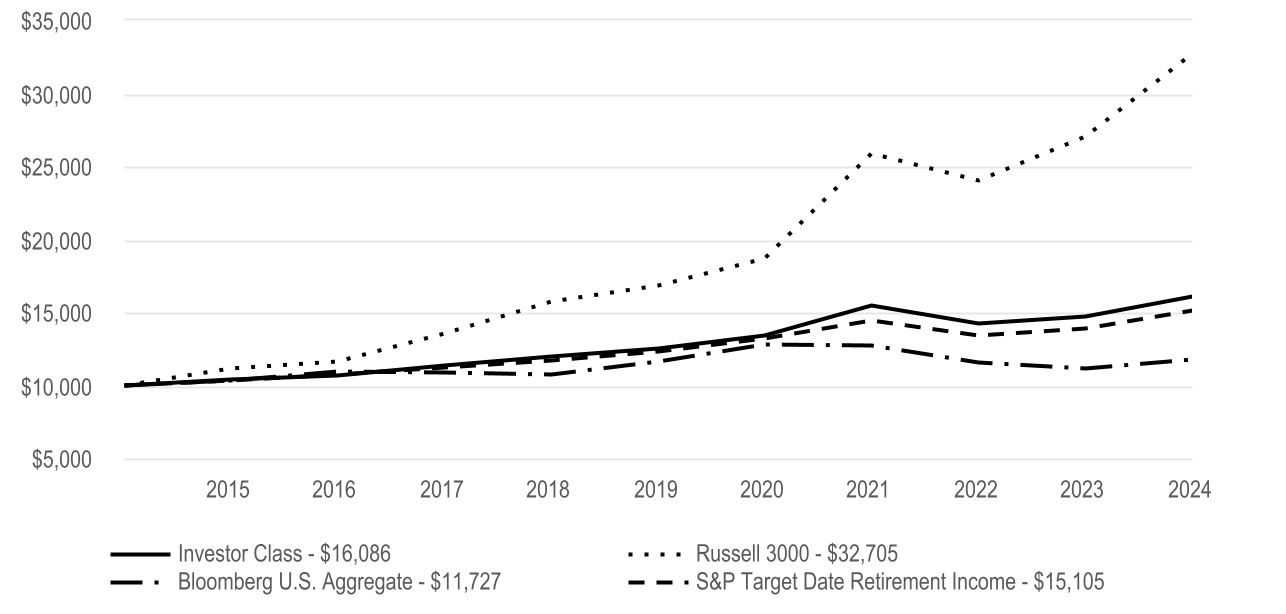

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2015 Portfolio

Investor Class (AAAFX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2015 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| Investor Class | $60 | 0.57% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2015 Portfolio Investor Class returned 9.27% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

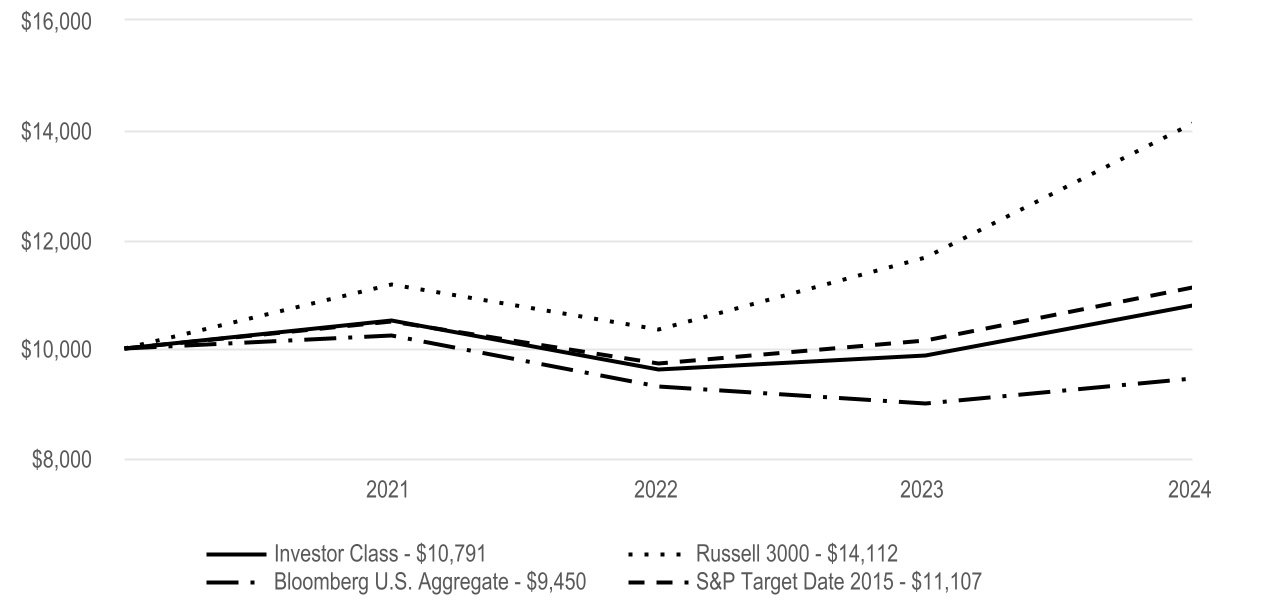

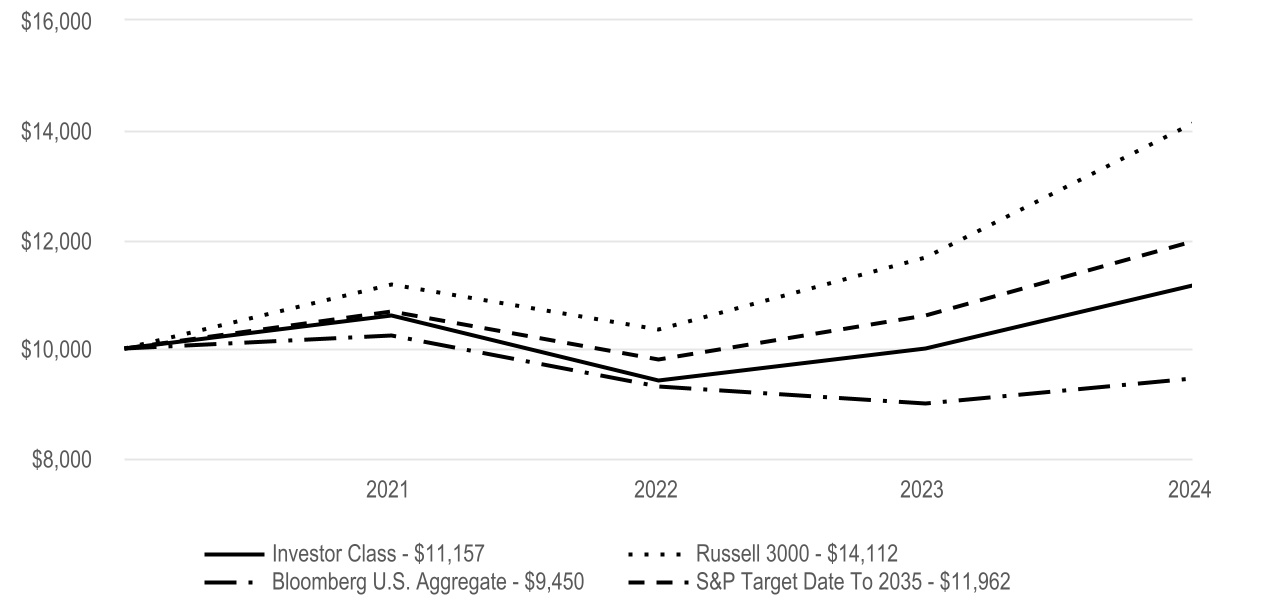

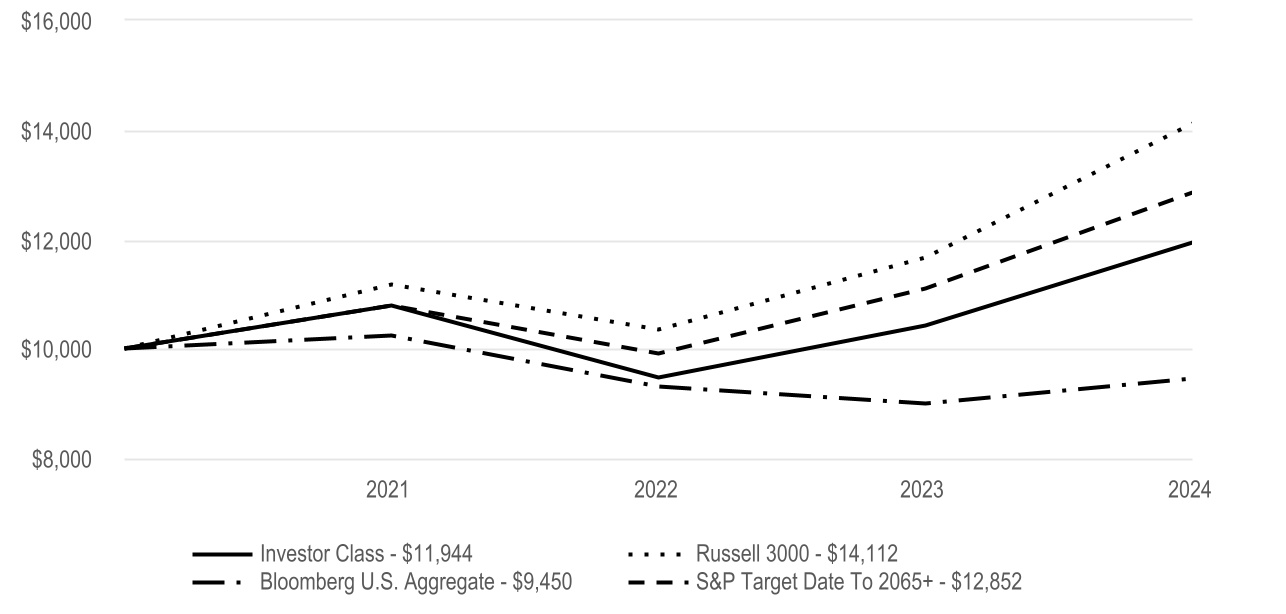

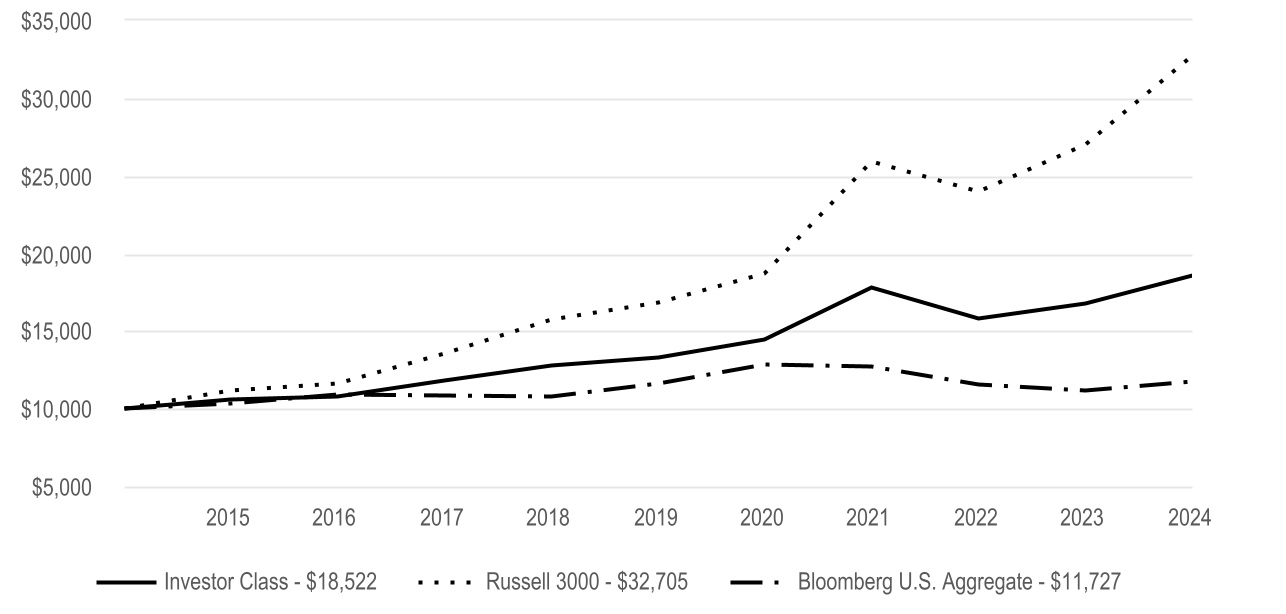

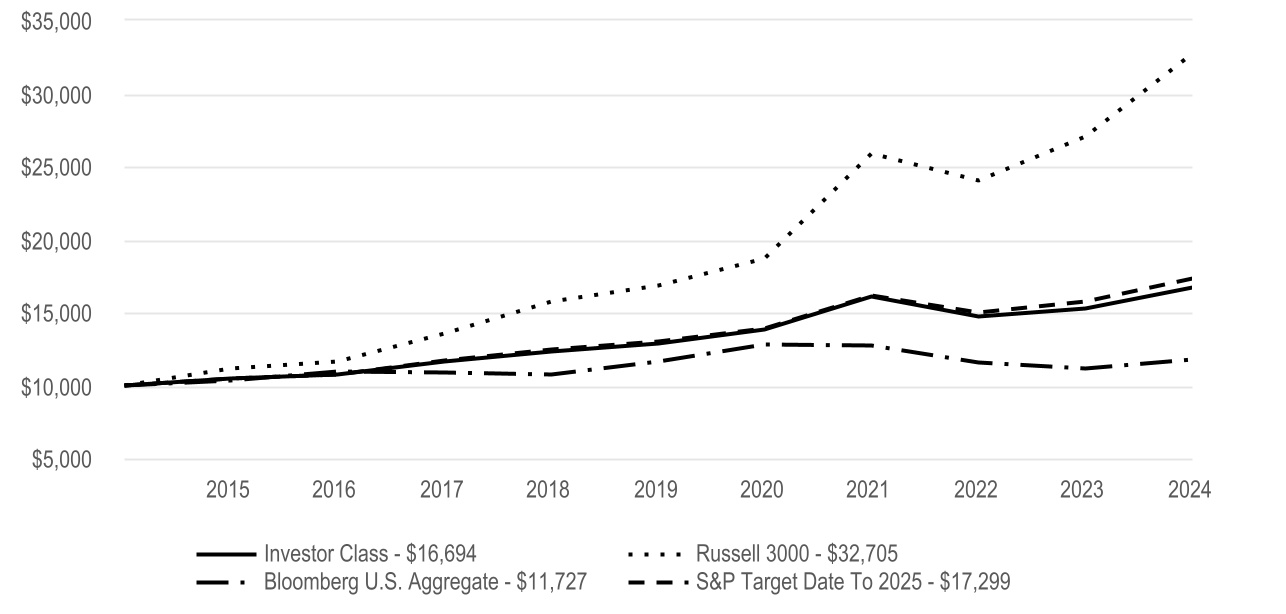

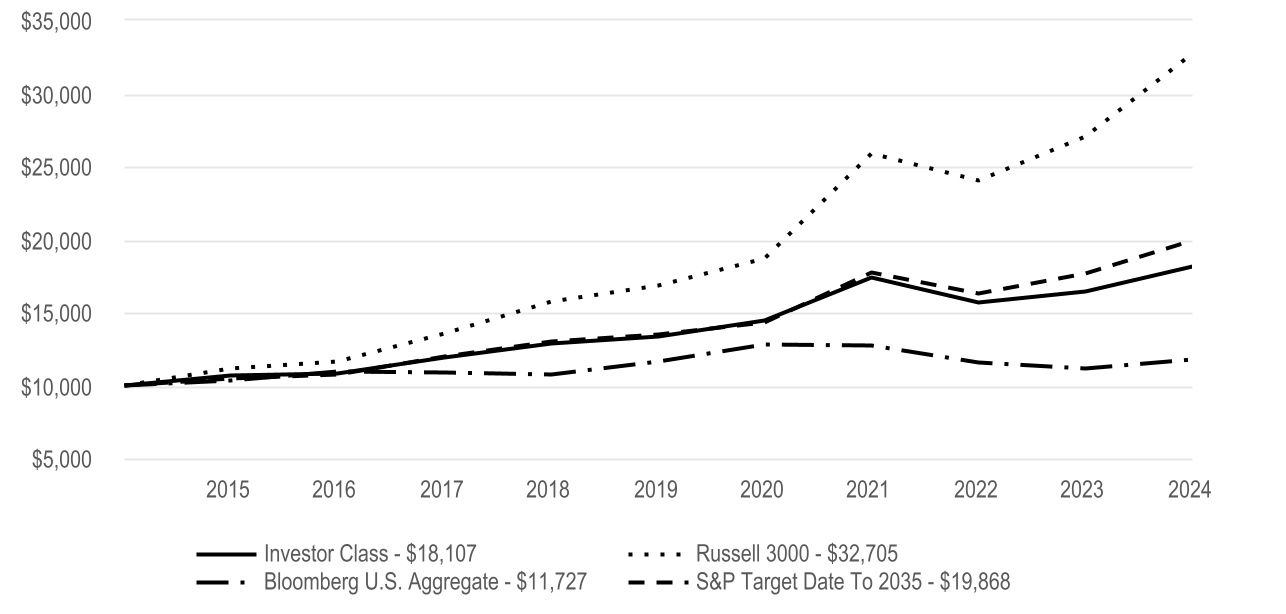

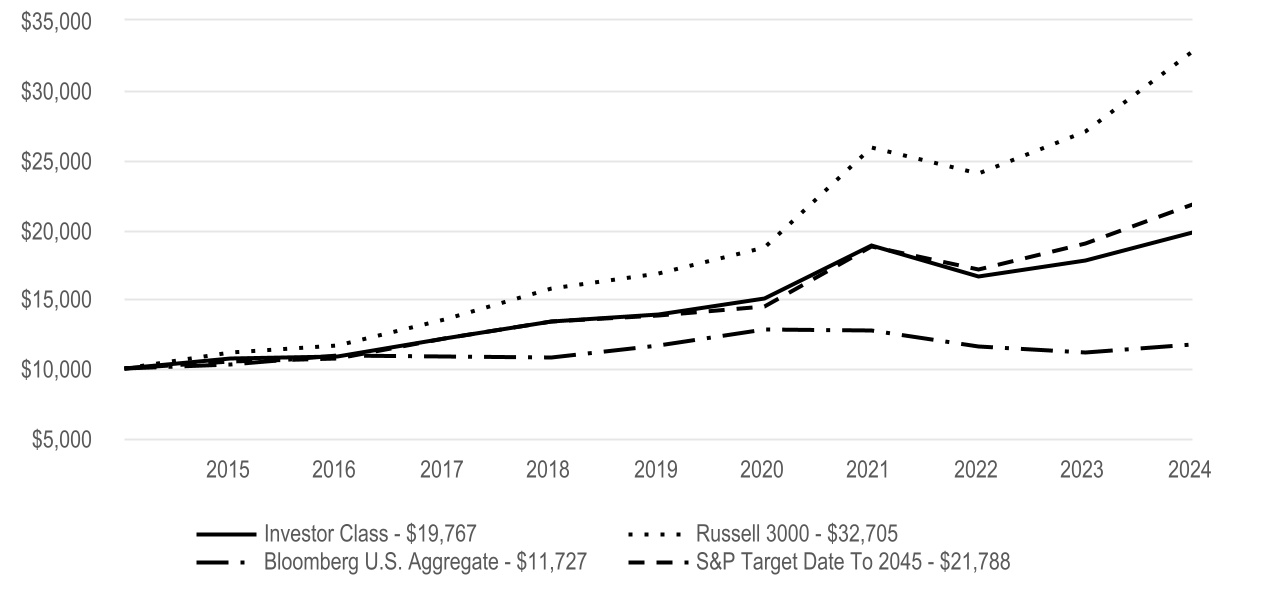

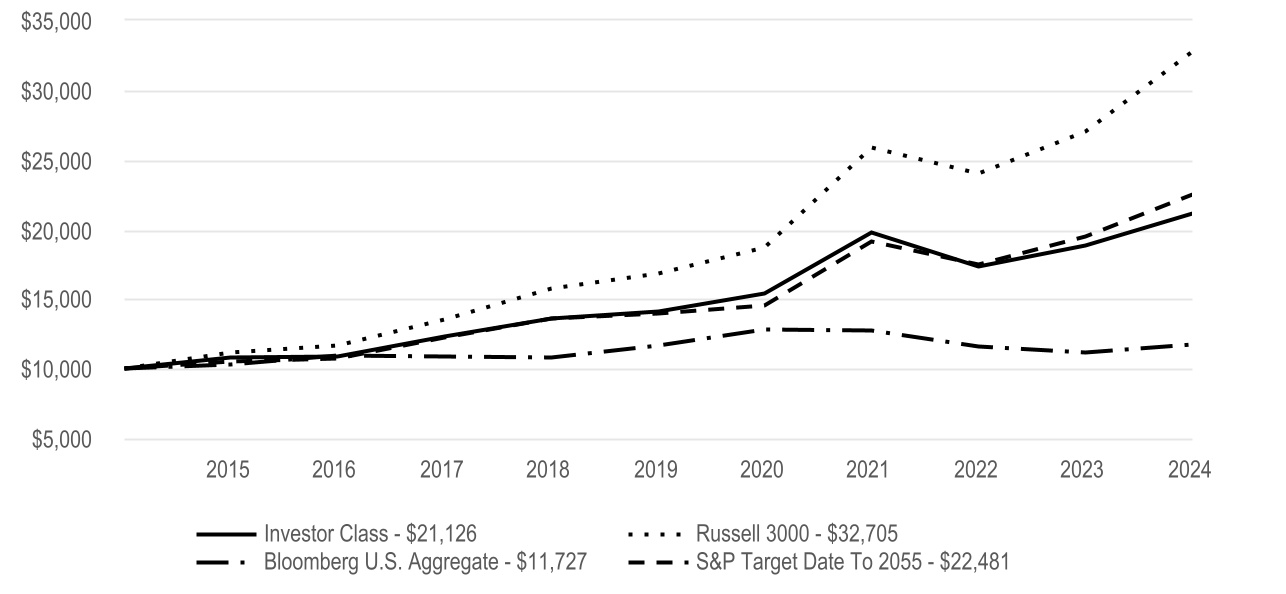

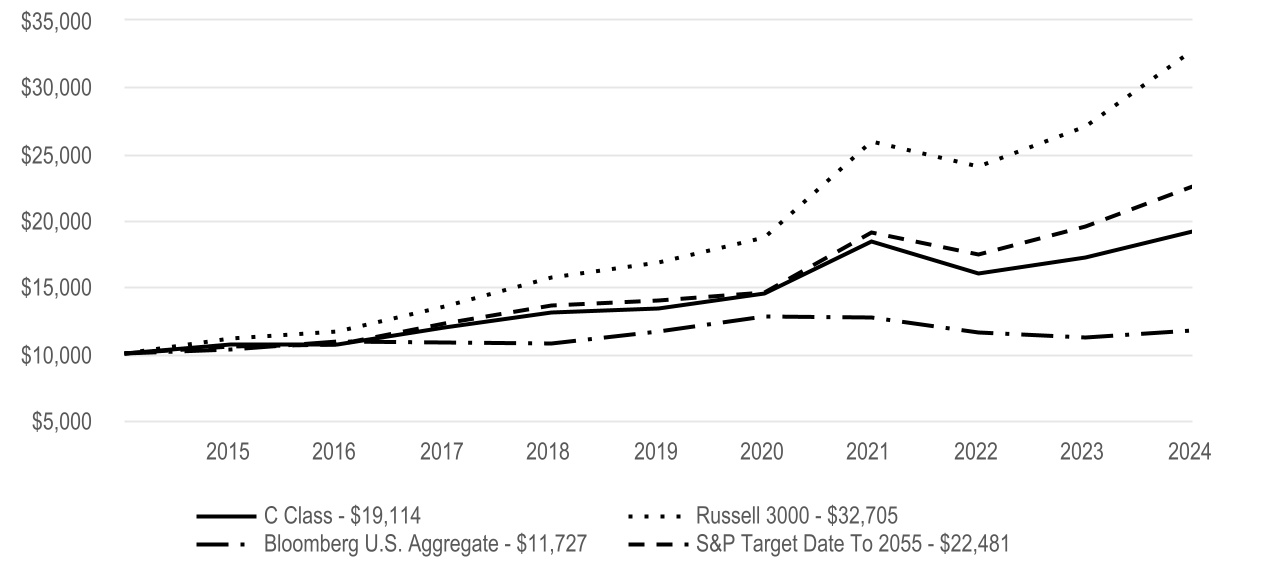

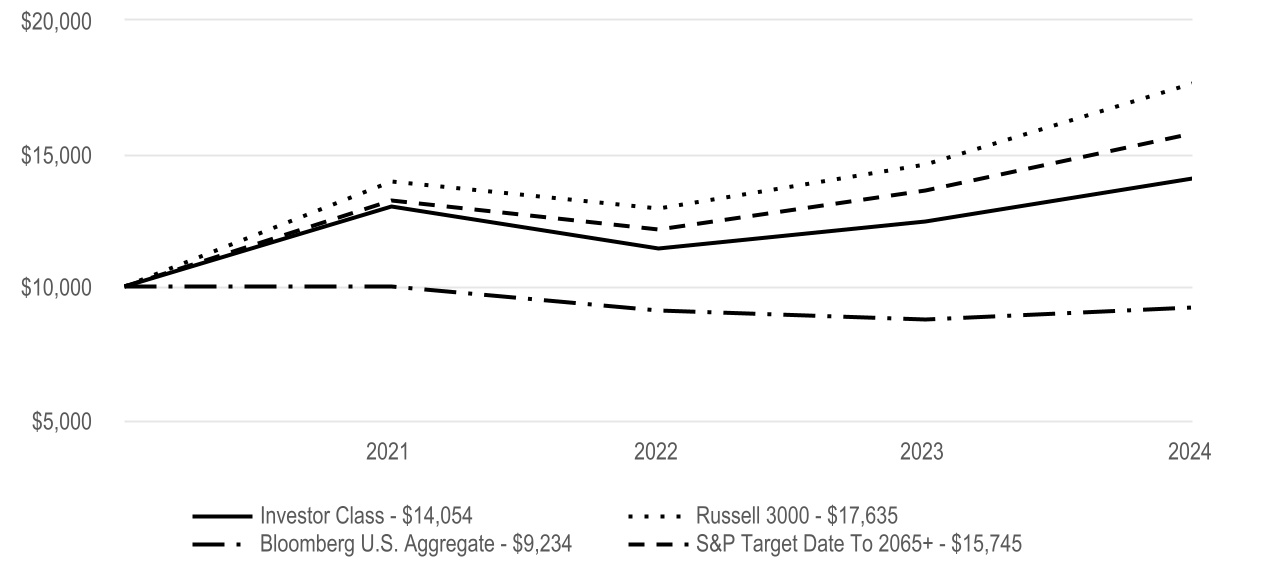

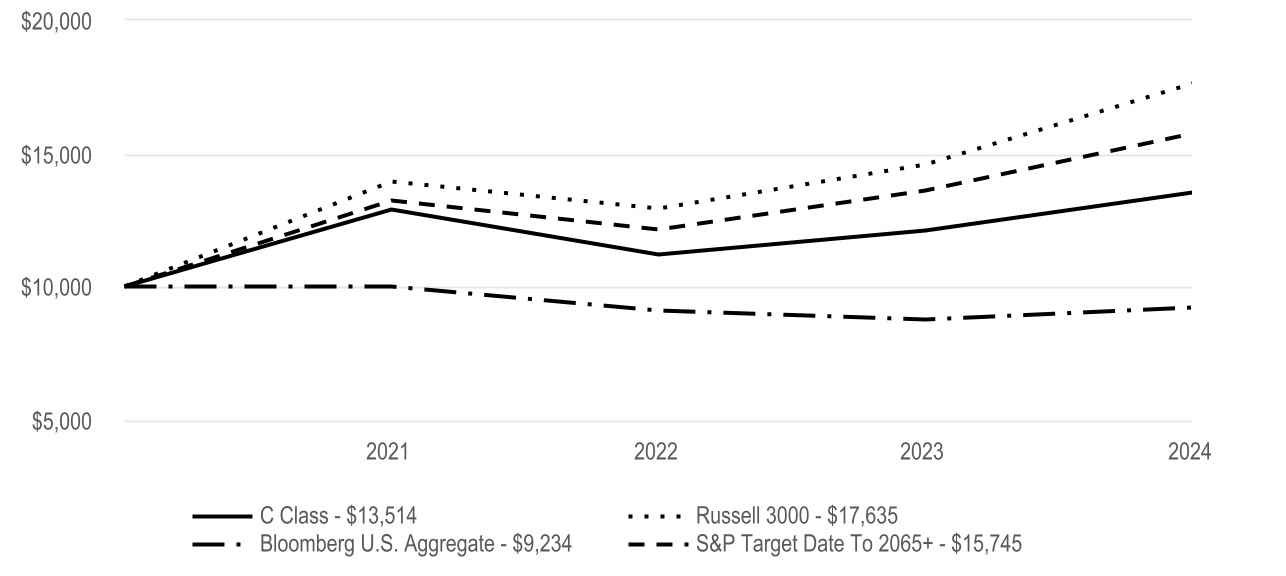

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| Investor Class | 9.27% | 2.27% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date 2015 | 9.56% | 3.14% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $3,631,927 | ||||

| Management Fees (dollars paid during the reporting period) | $12,560 | ||||

| Portfolio Turnover Rate | 37 | % | |||

| Total Number of Portfolio Holdings | 19 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J797

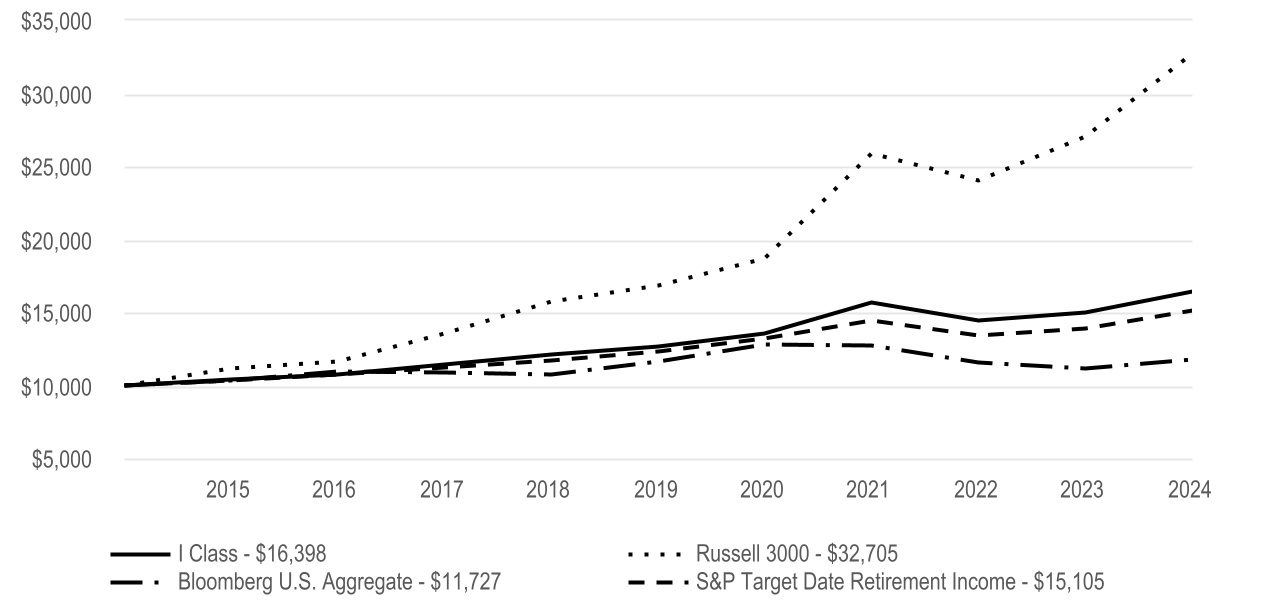

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2015 Portfolio

I Class (AAAHX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2015 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| I Class | $39 | 0.37% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2015 Portfolio I Class returned 9.49% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

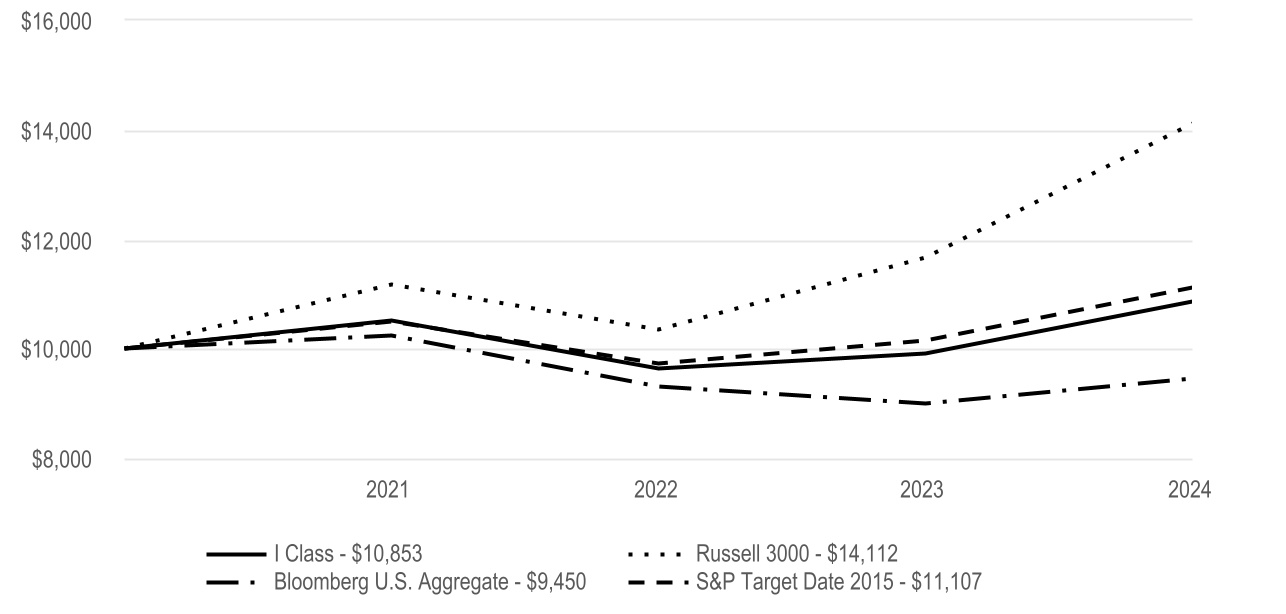

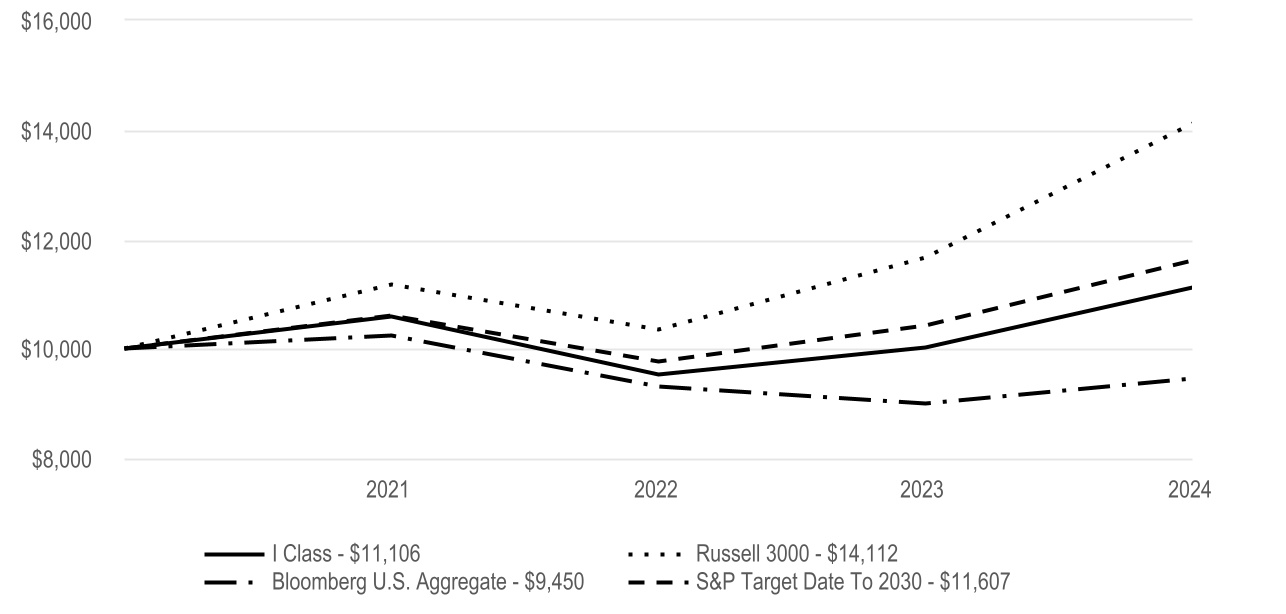

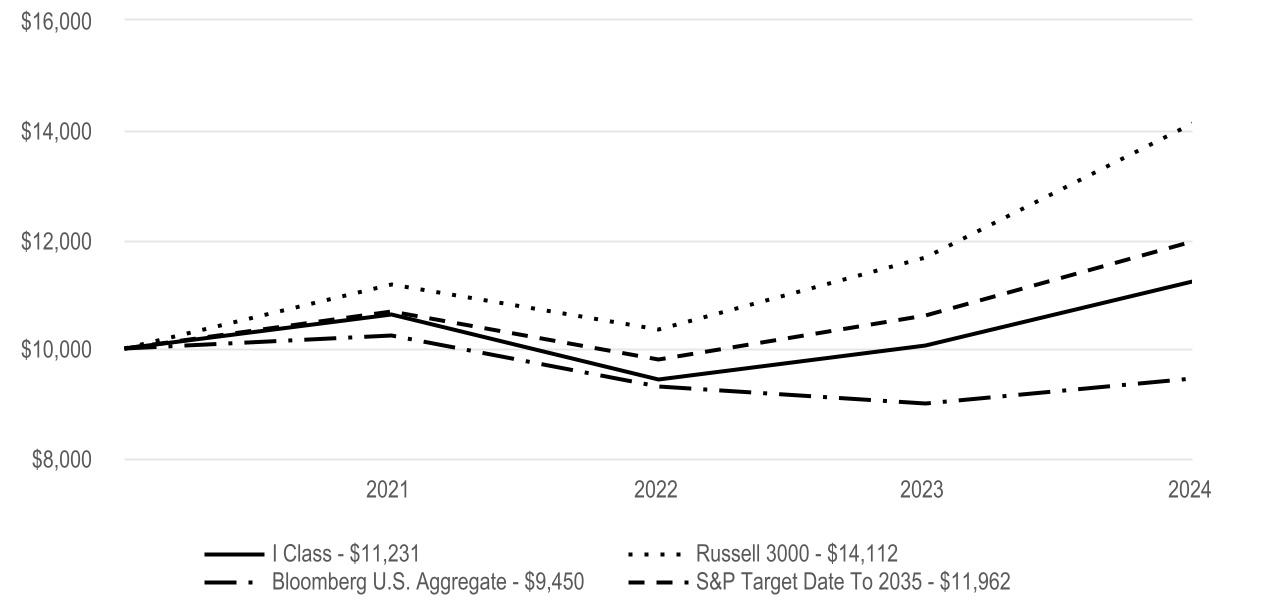

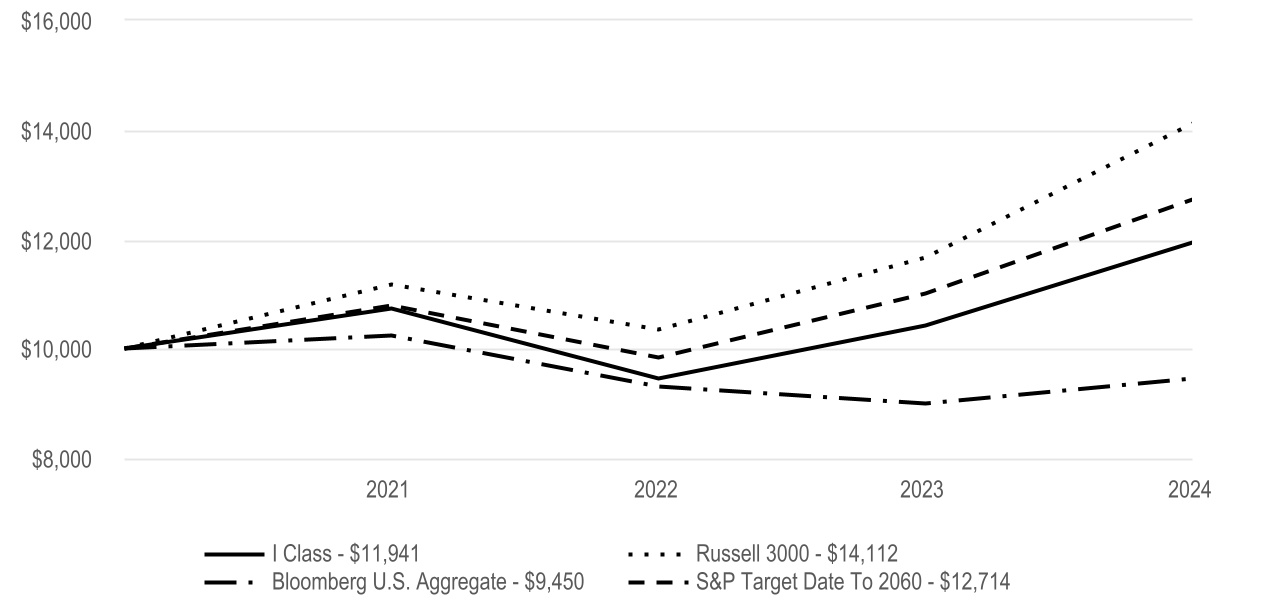

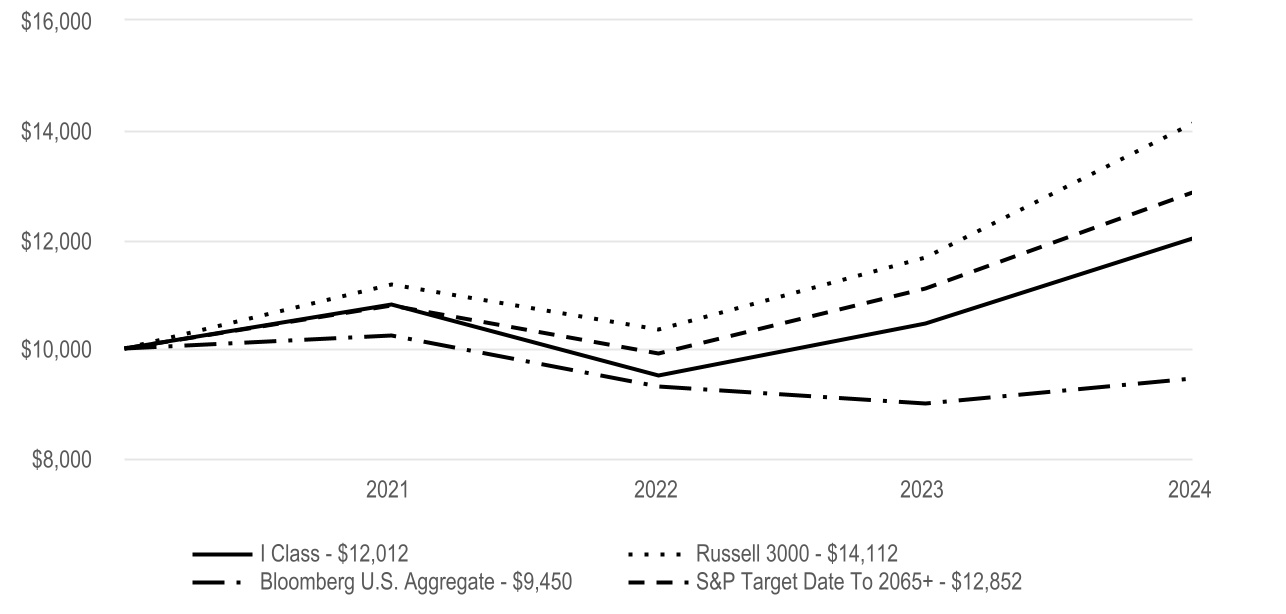

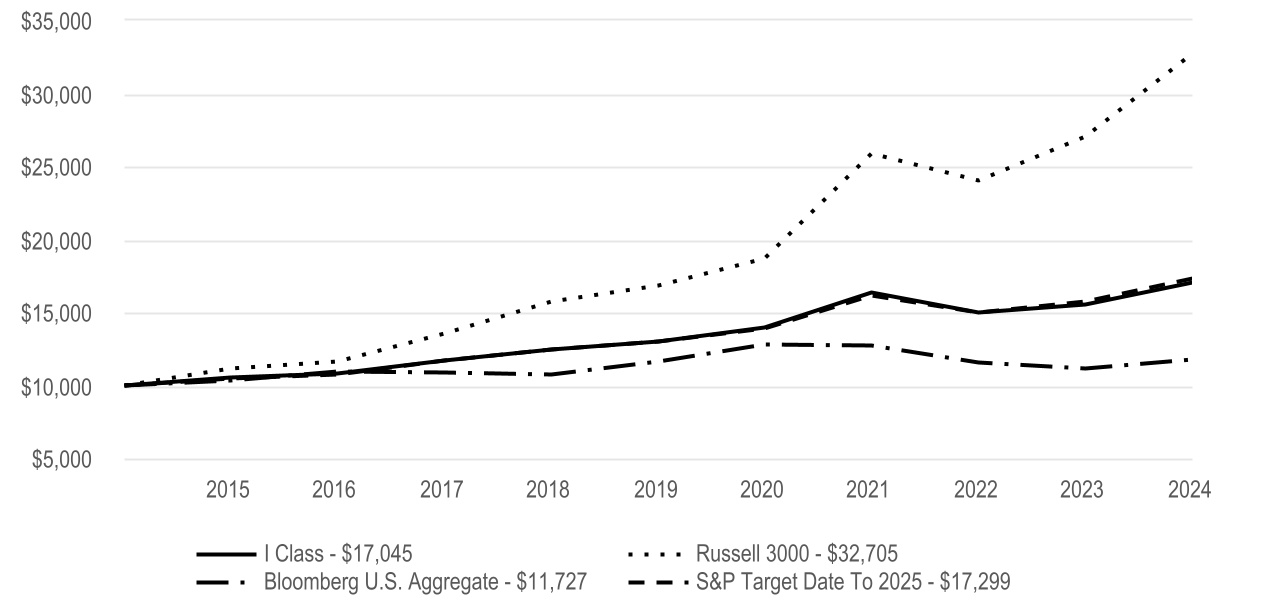

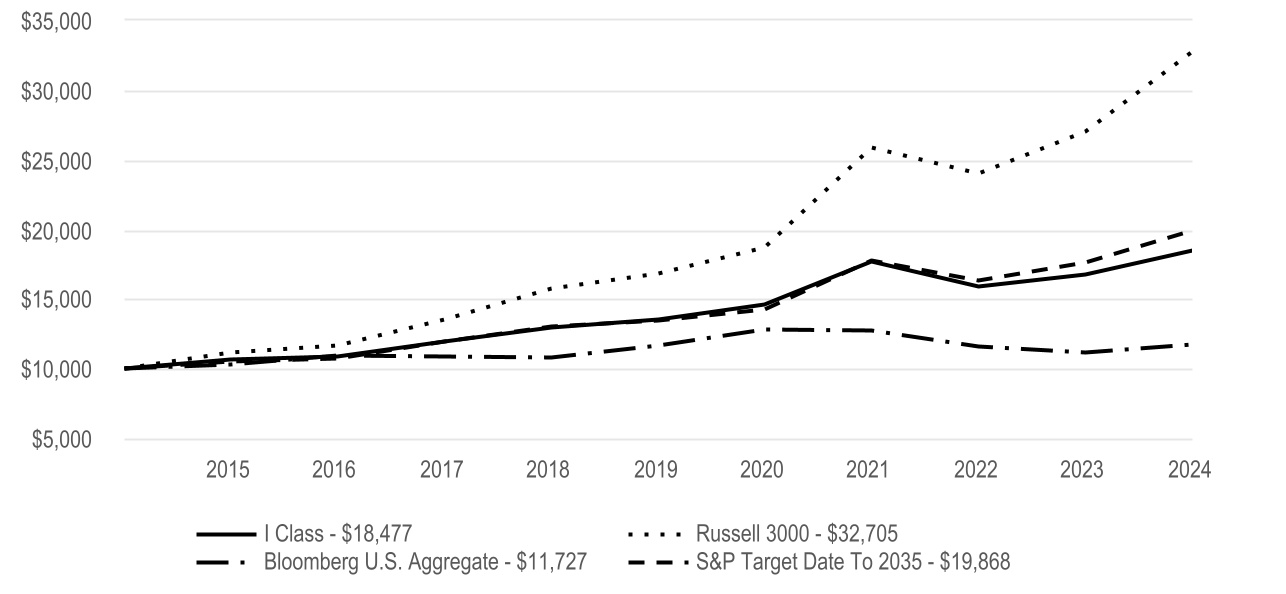

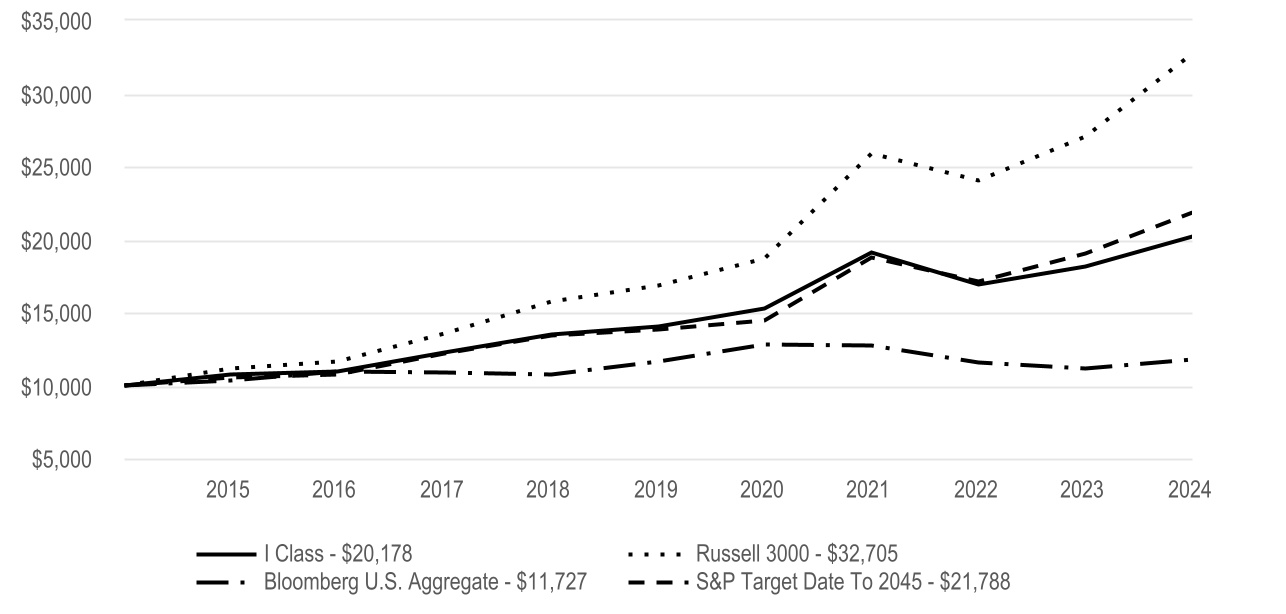

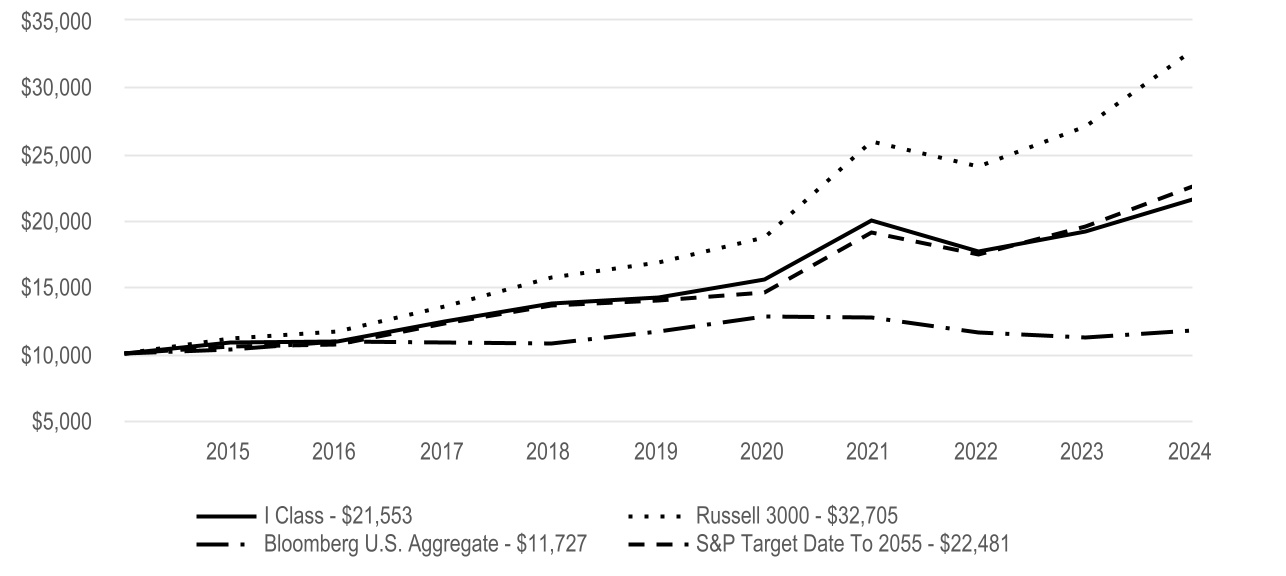

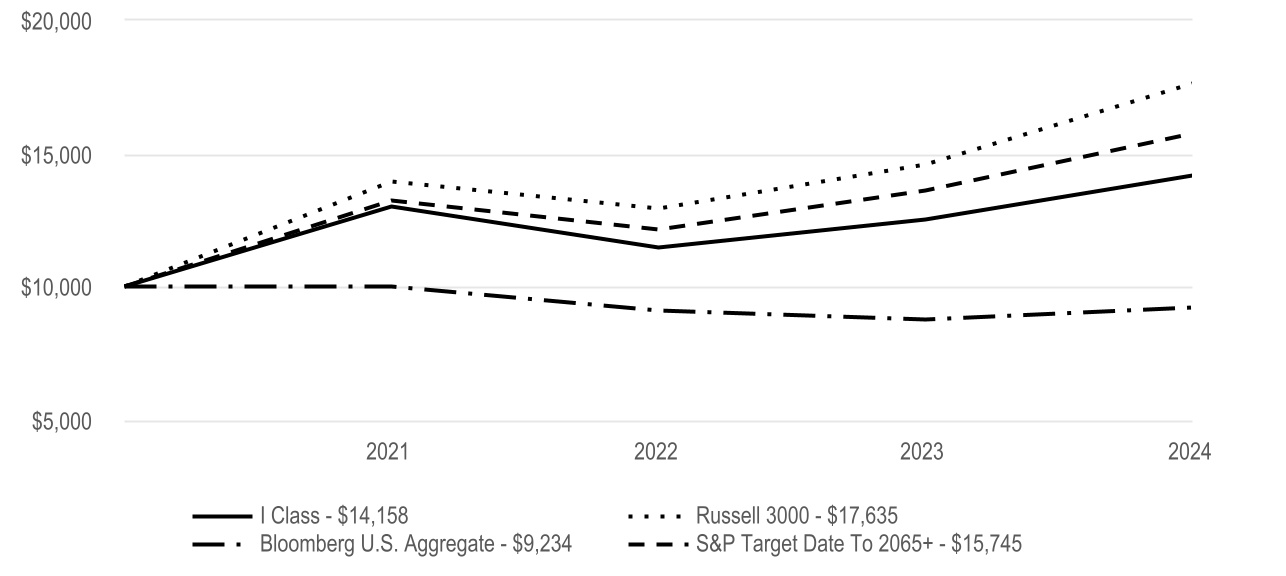

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| I Class | 9.49% | 2.44% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date 2015 | 9.56% | 3.14% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $3,631,927 | ||||

| Management Fees (dollars paid during the reporting period) | $12,560 | ||||

| Portfolio Turnover Rate | 37 | % | |||

| Total Number of Portfolio Holdings | 19 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J789

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2015 Portfolio

A Class (AAAJX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2015 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| A Class | $86 | 0.82% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2015 Portfolio A Class returned 9.01% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

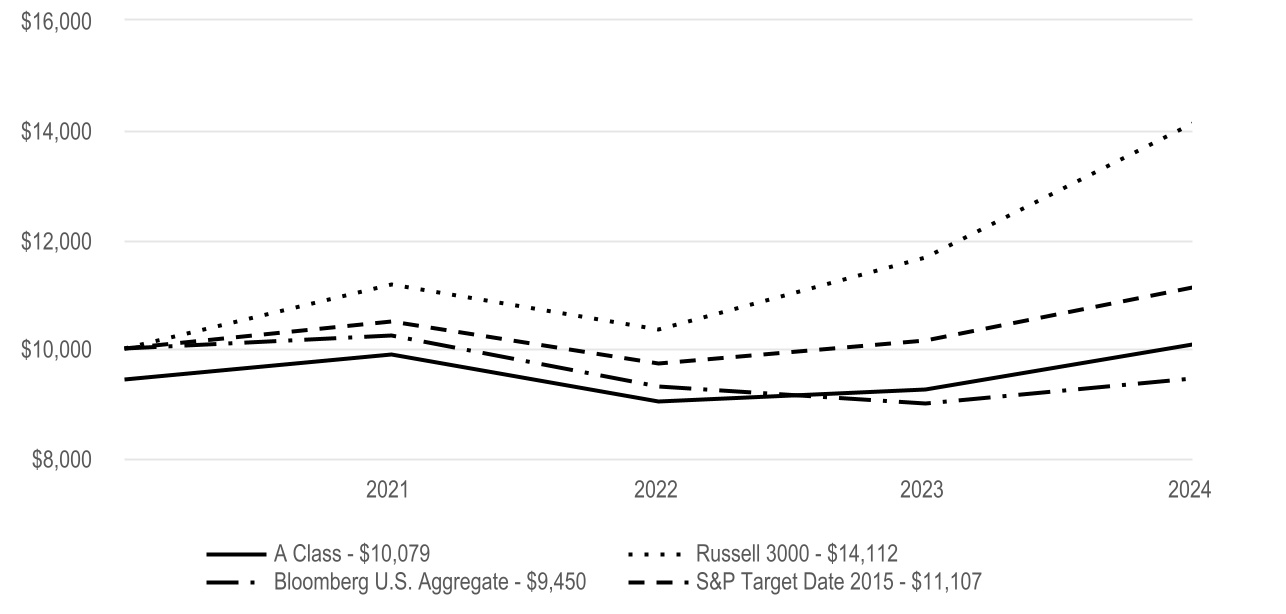

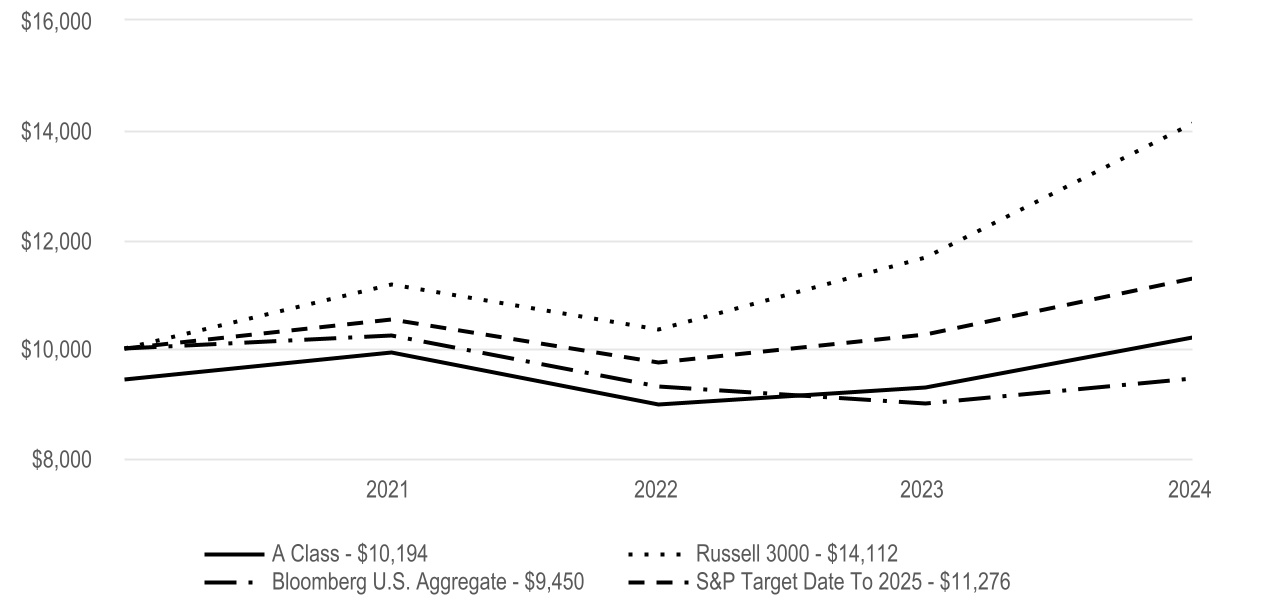

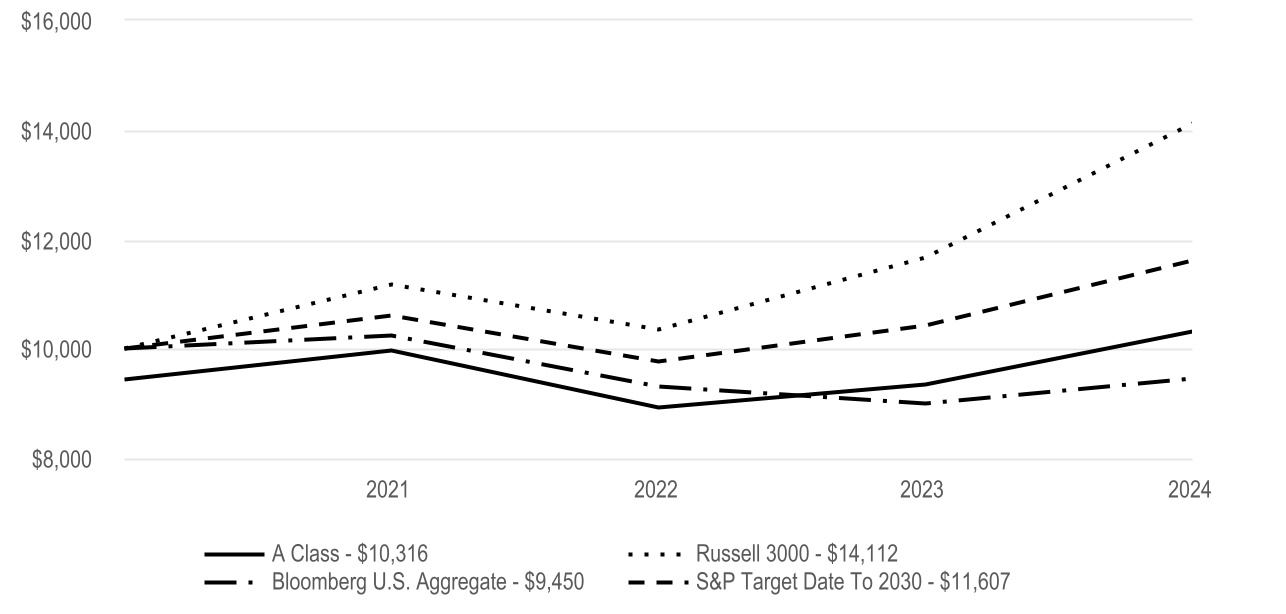

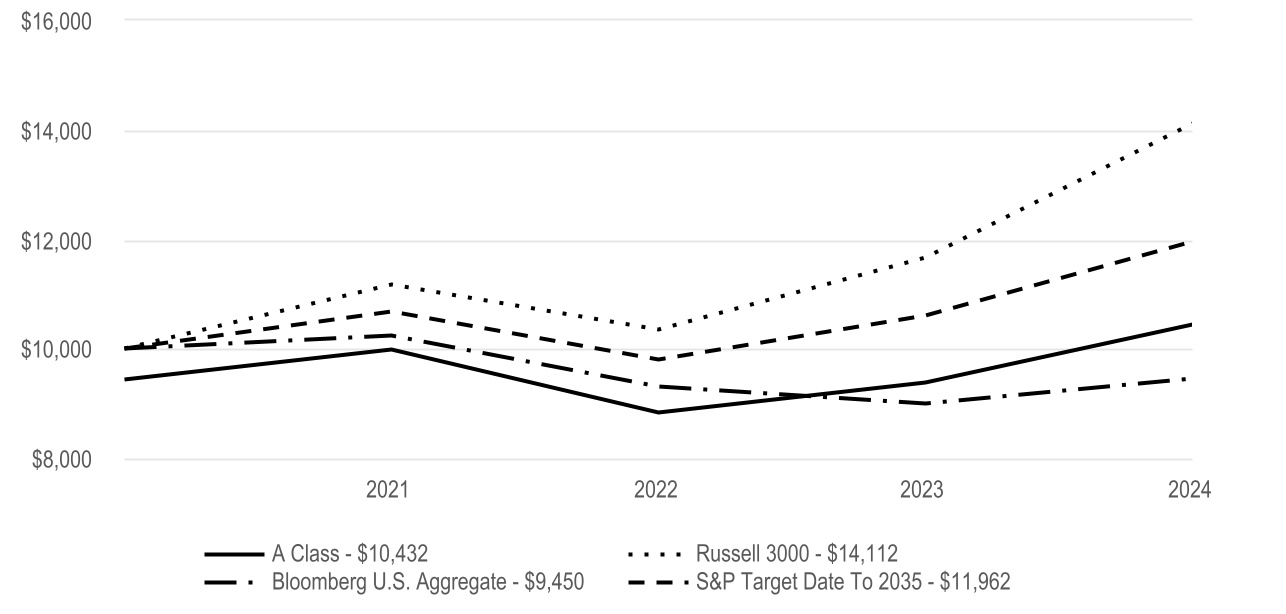

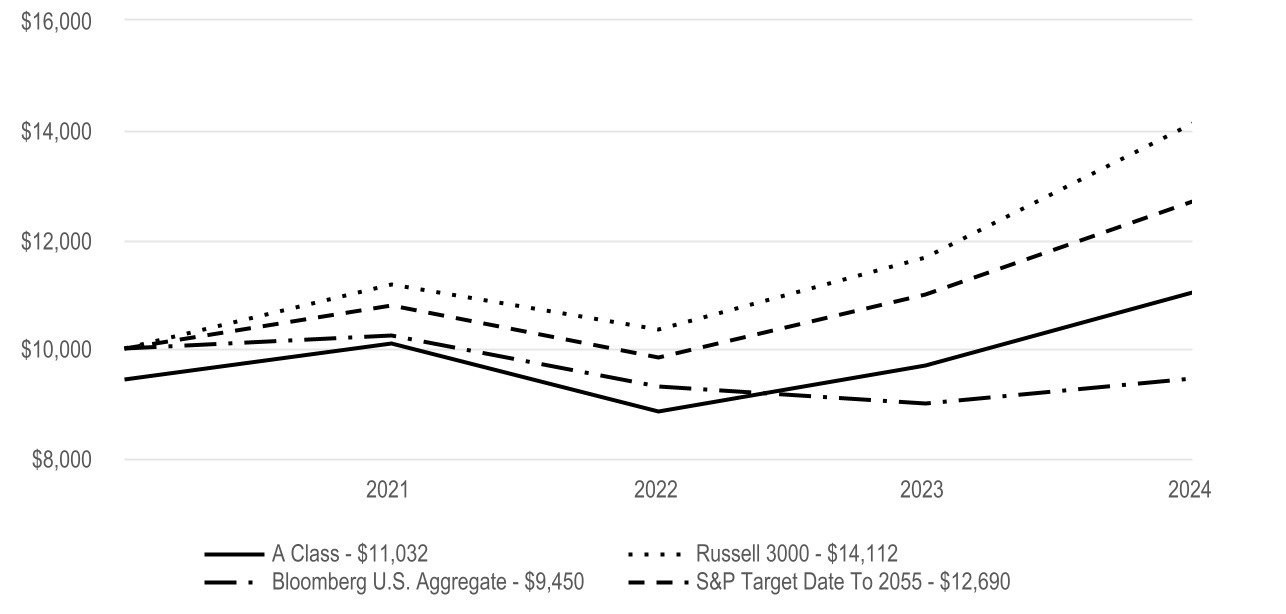

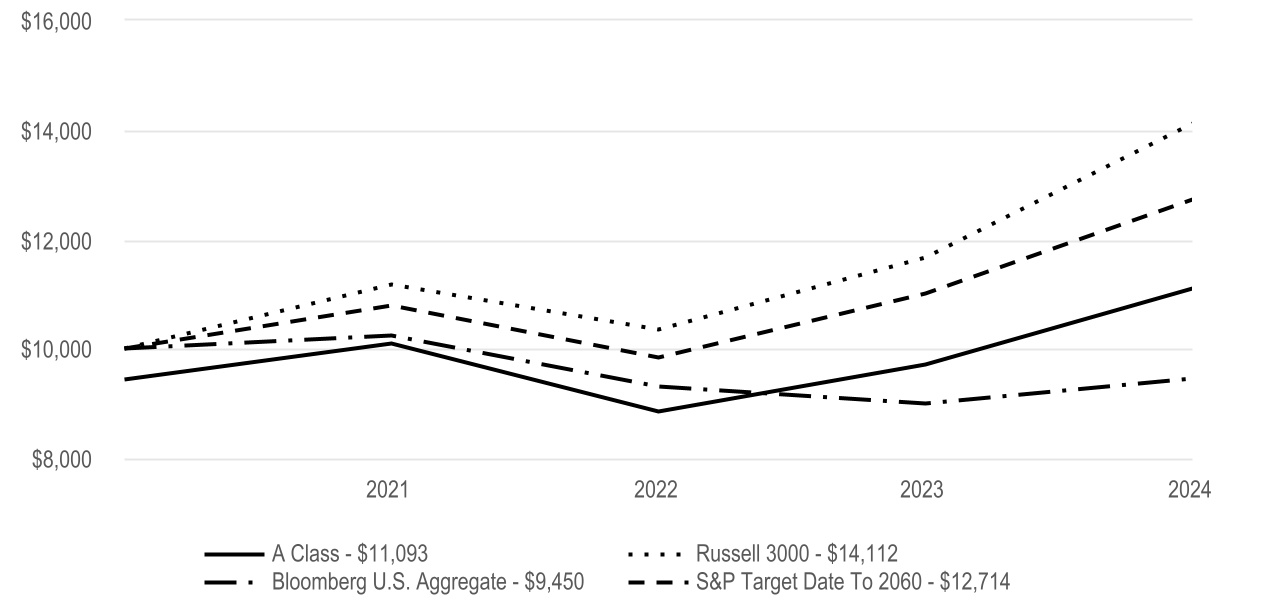

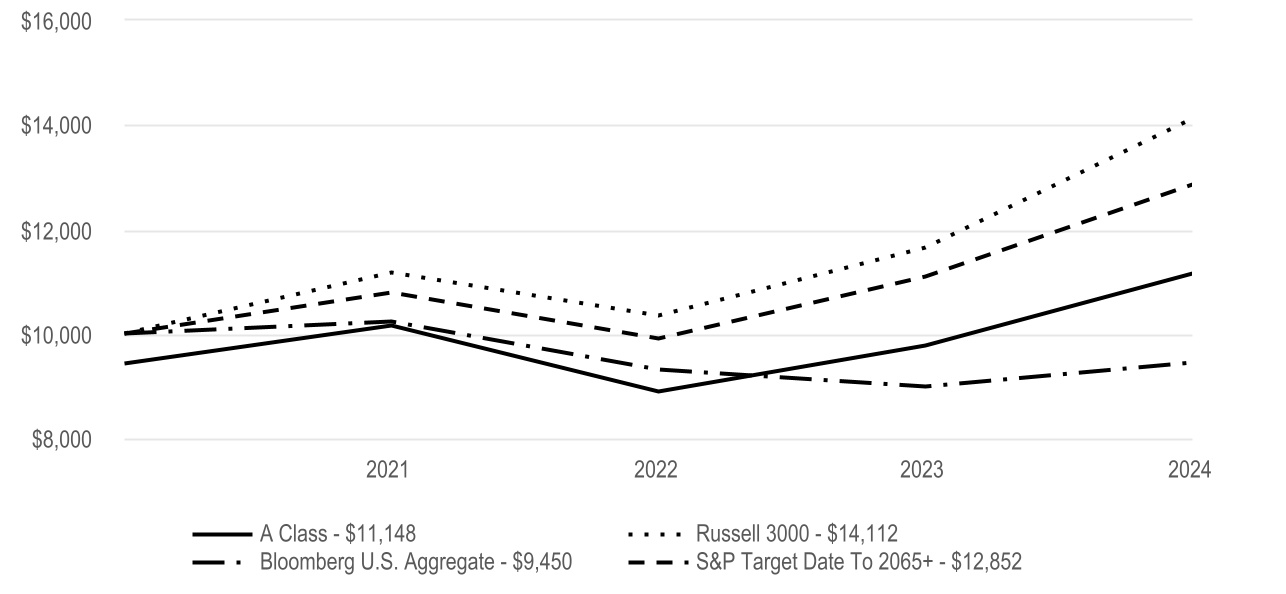

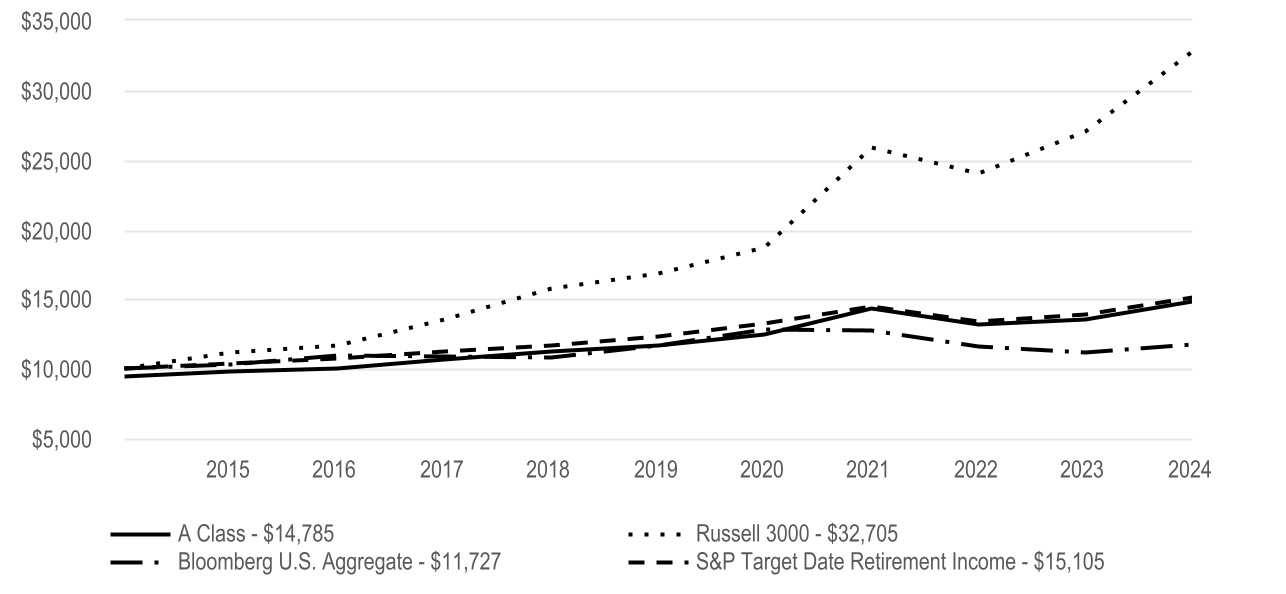

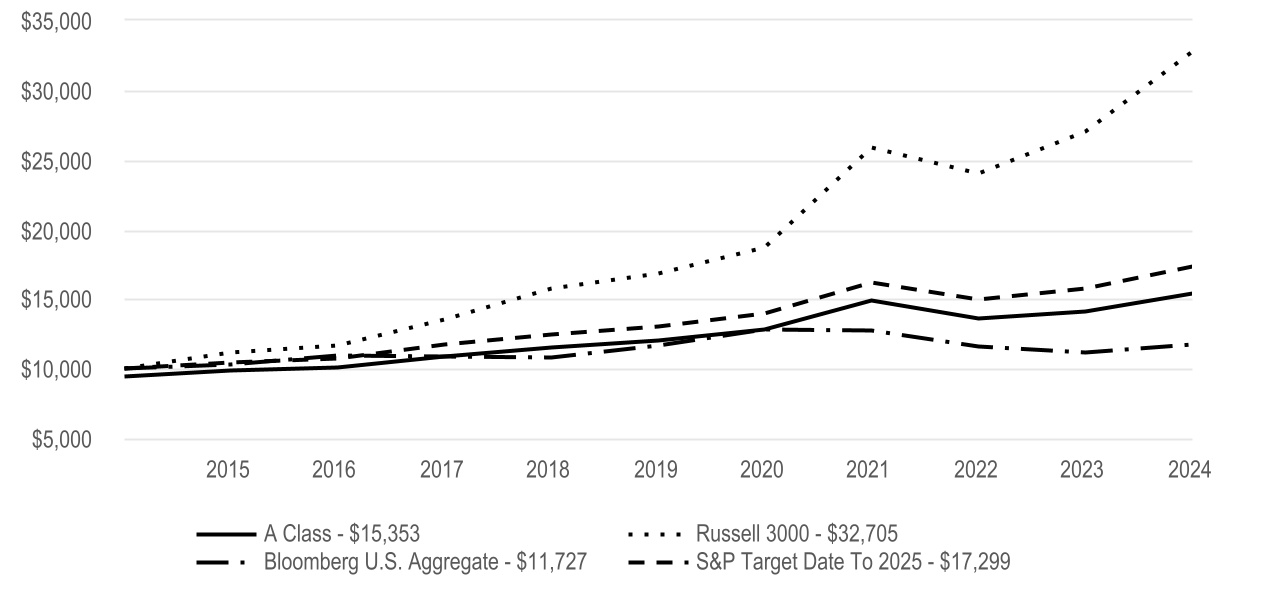

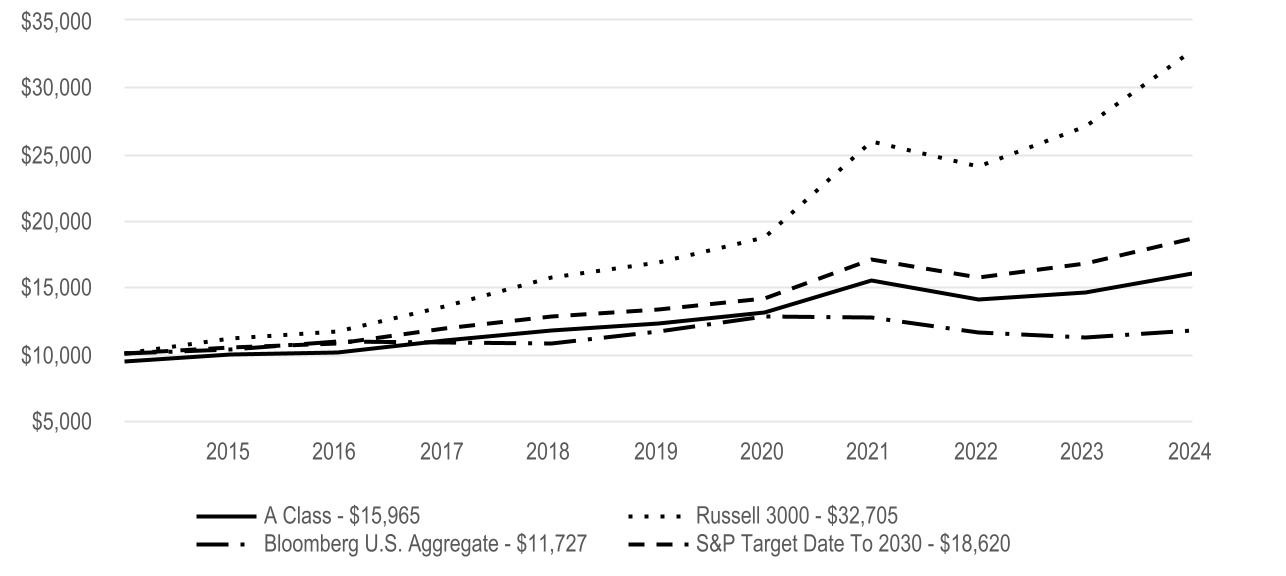

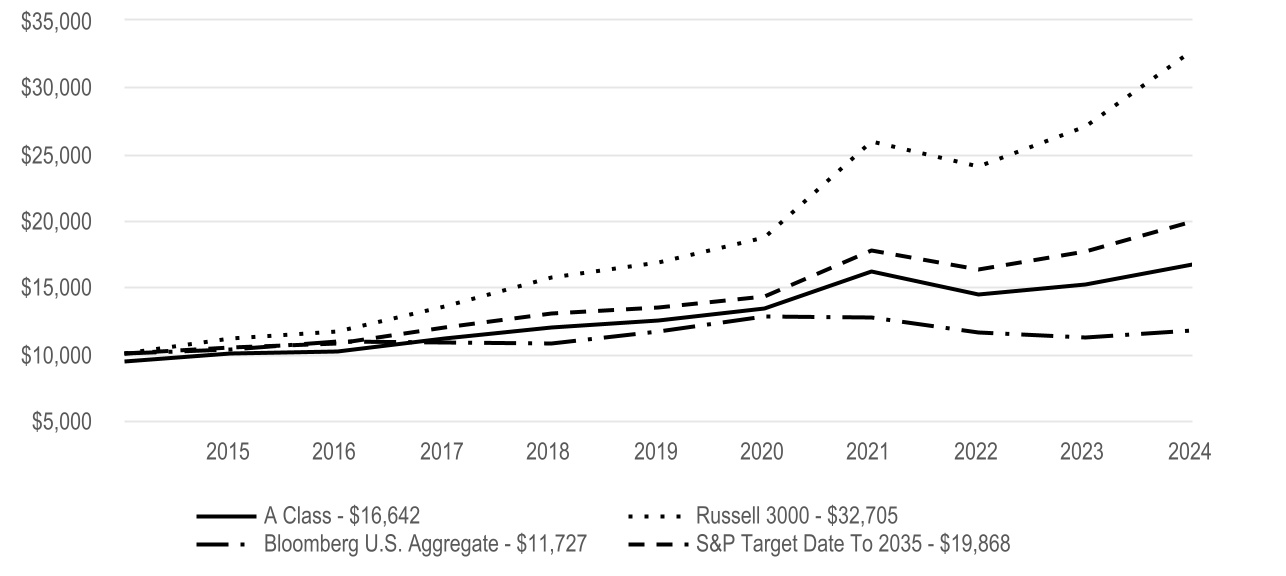

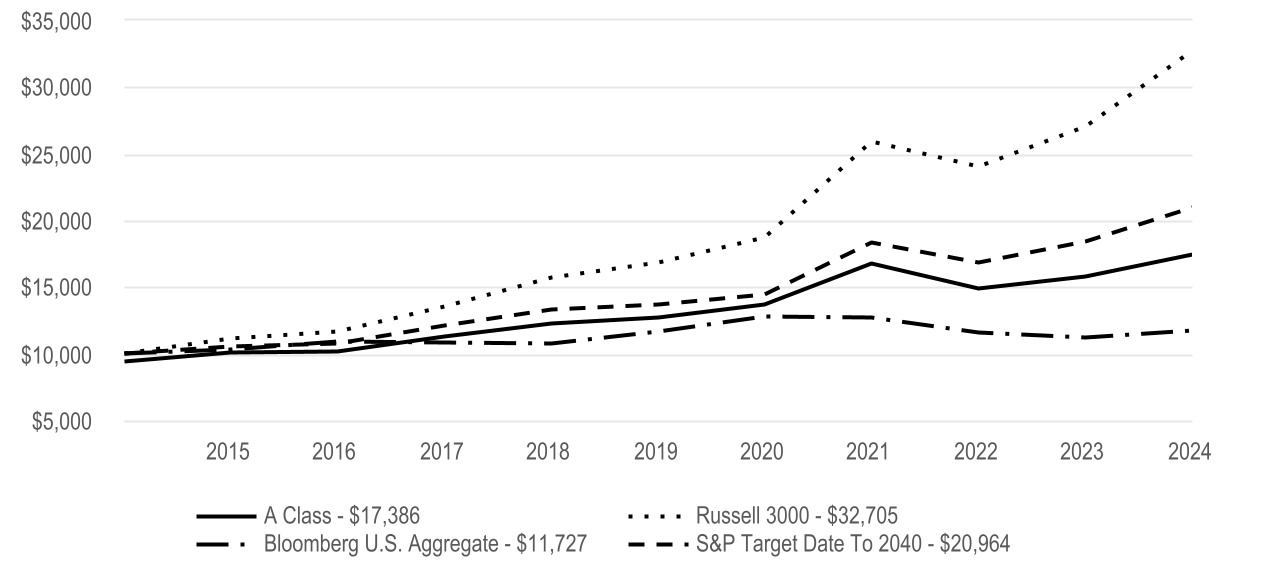

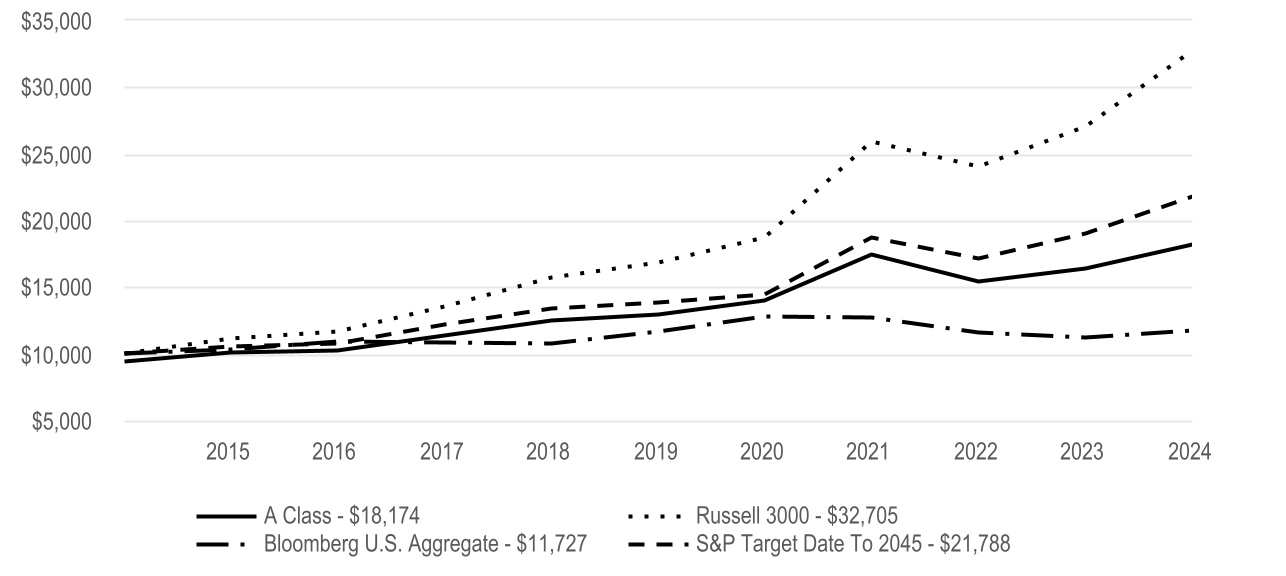

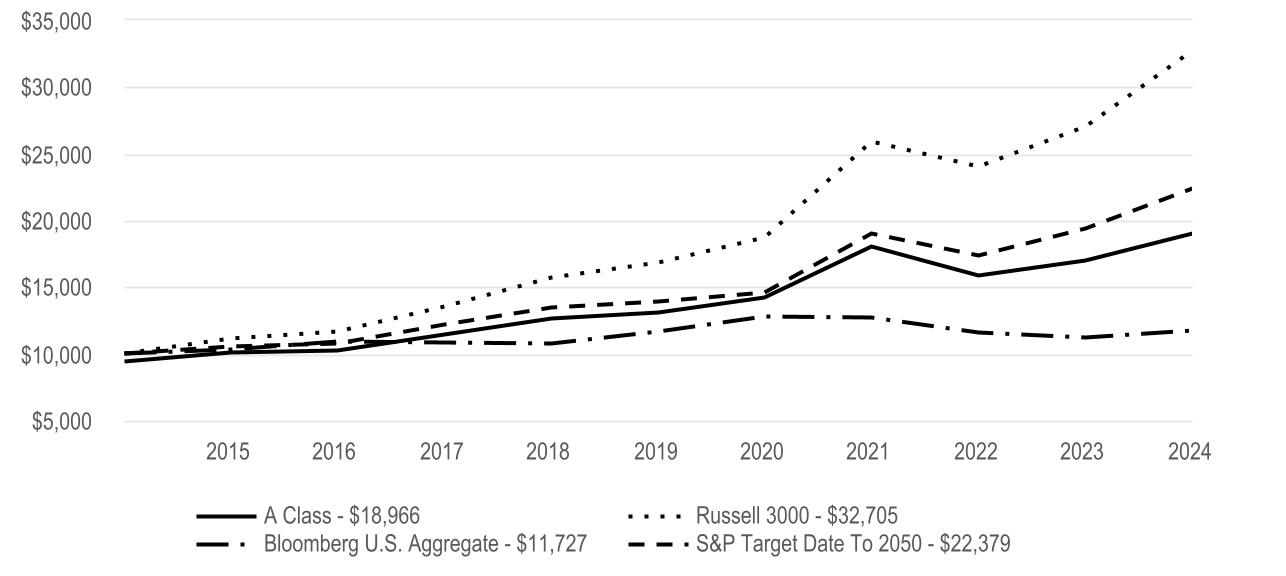

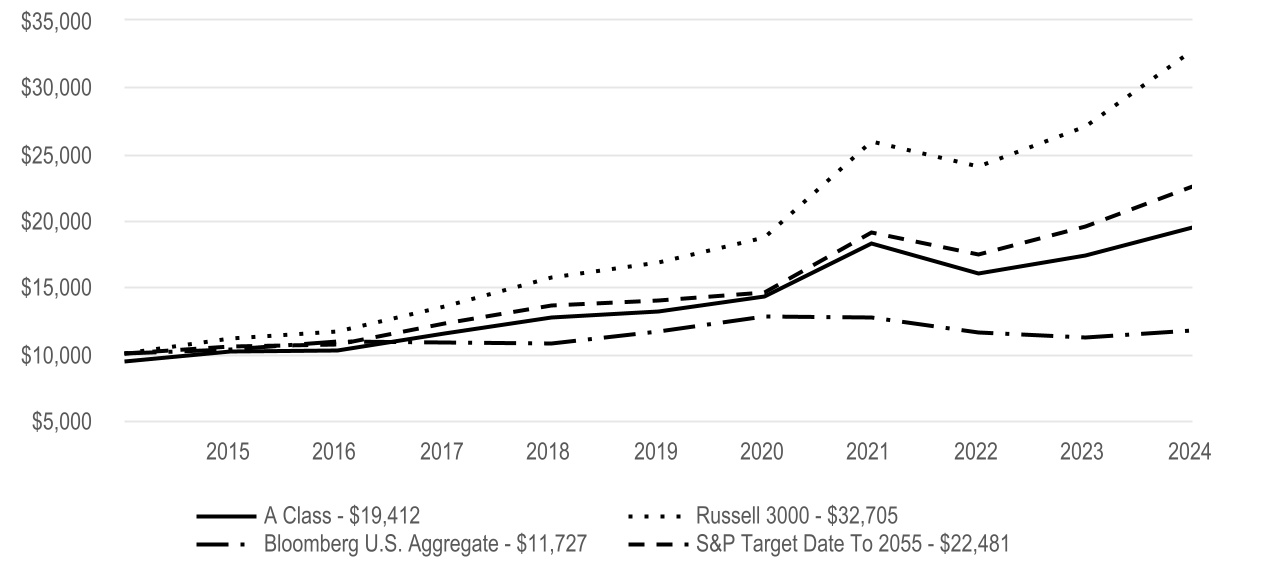

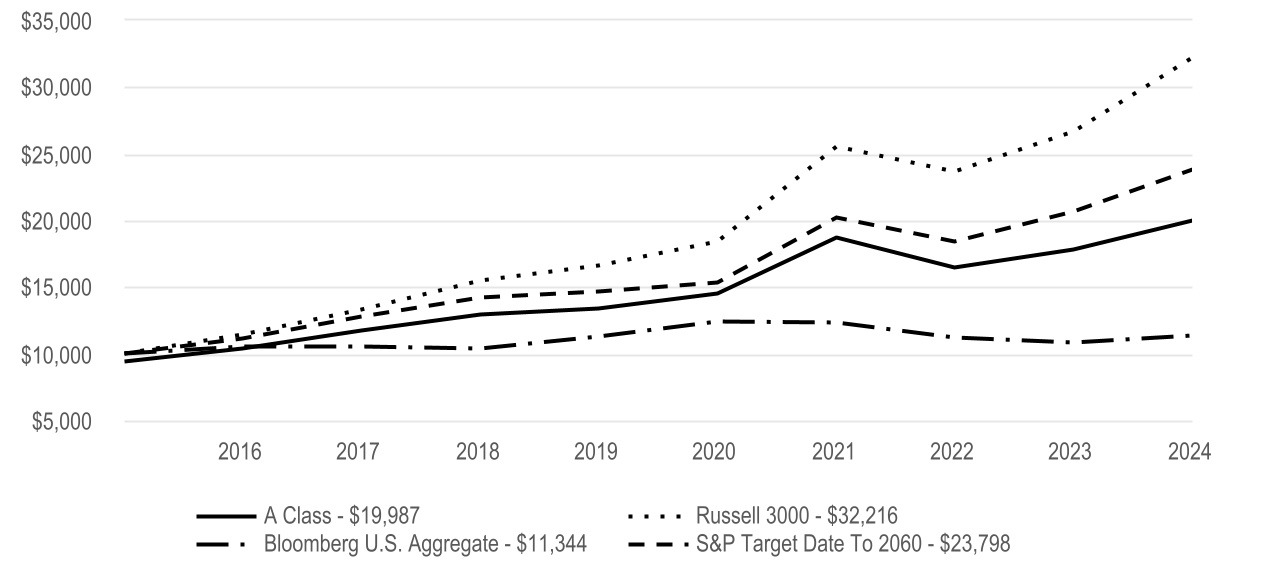

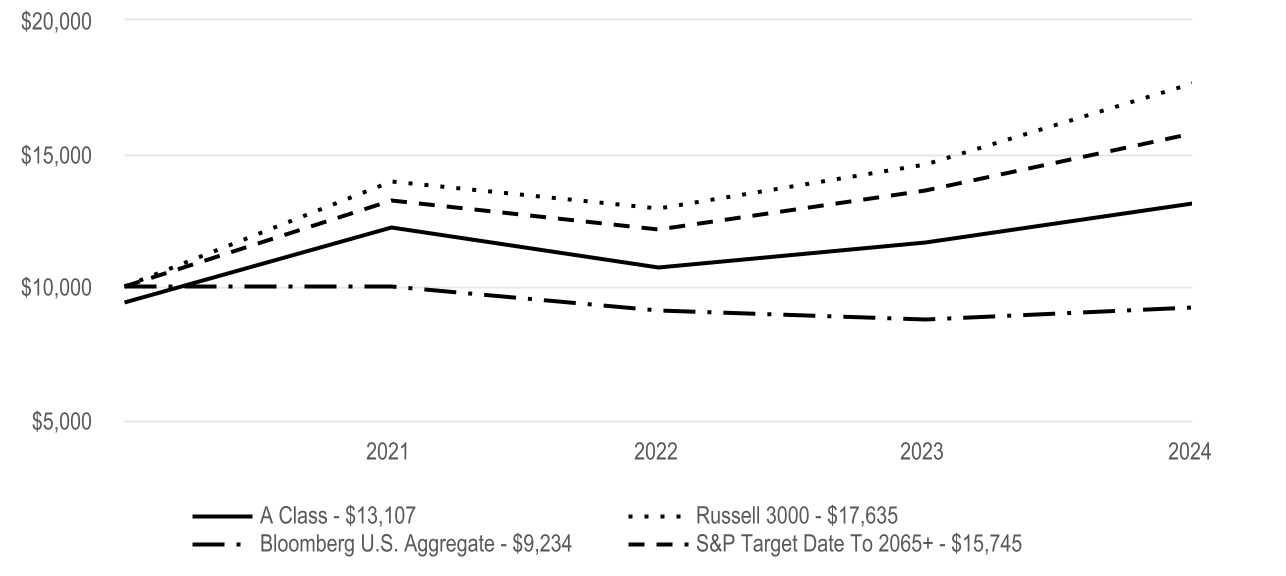

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

| The initial investment is adjusted to reflect the maximum initial sales charge. | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| A Class | 9.01% | 2.00% | 3/10/21 | |||||||||||||||||

| A Class - with sales charge | 2.74% | 0.23% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date 2015 | 9.56% | 3.14% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum contingent deferred sales charge of 1.00%. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $3,631,927 | ||||

| Management Fees (dollars paid during the reporting period) | $12,560 | ||||

| Portfolio Turnover Rate | 37 | % | |||

| Total Number of Portfolio Holdings | 19 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J771

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2015 Portfolio

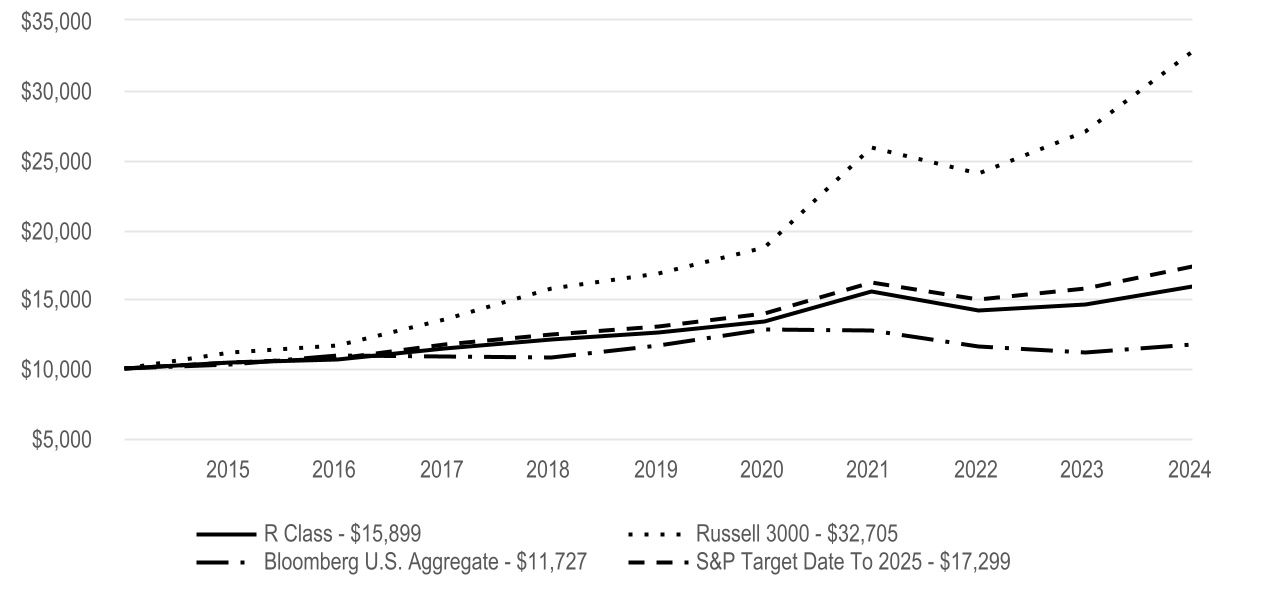

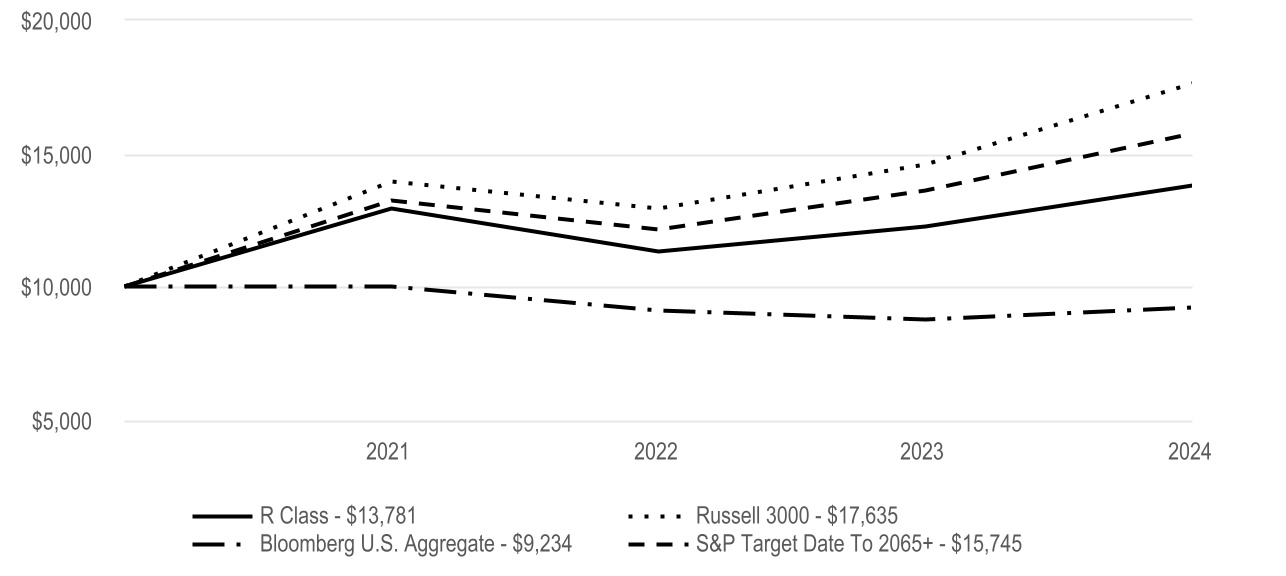

R Class (AAAKX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2015 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| R Class | $112 | 1.07% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2015 Portfolio R Class returned 8.75% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

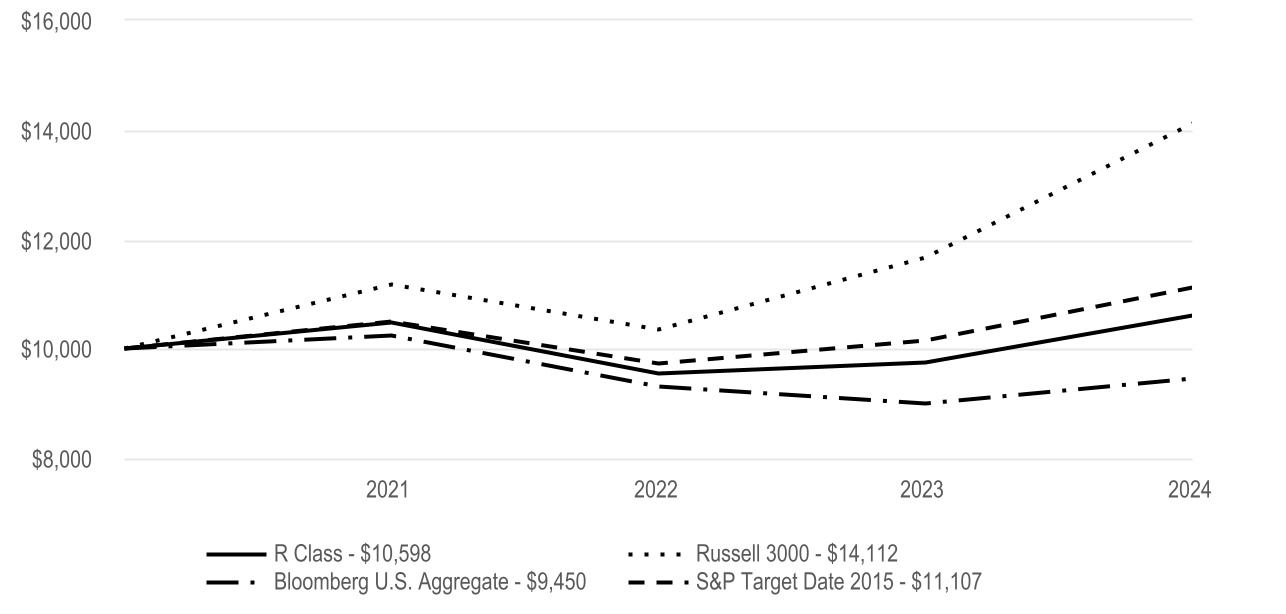

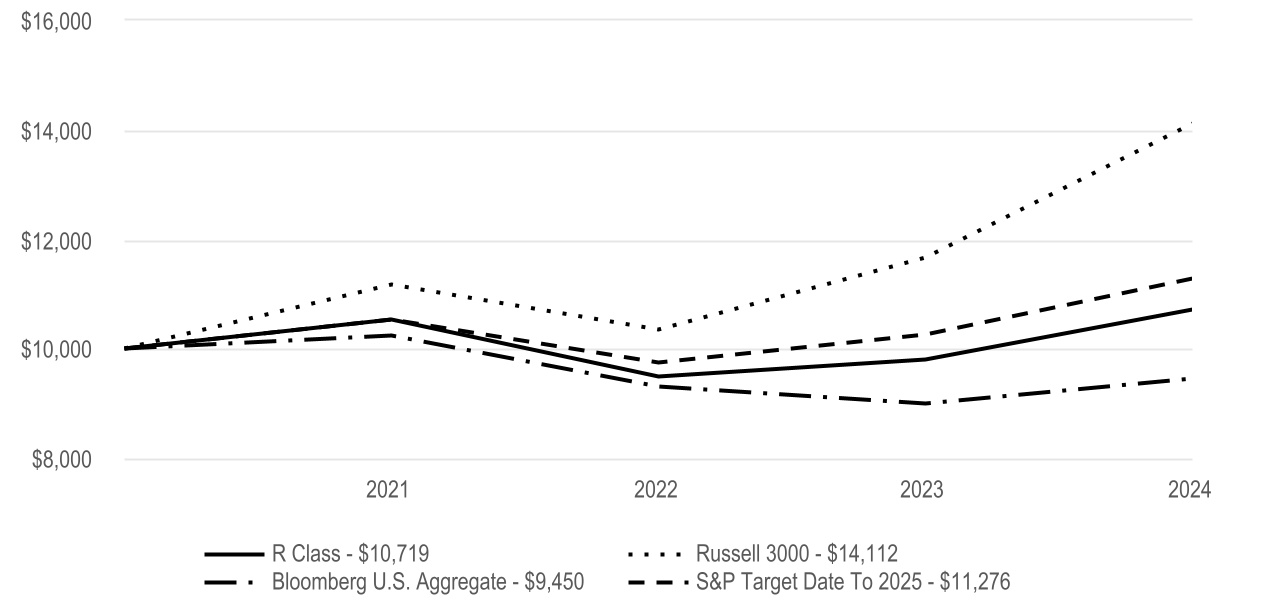

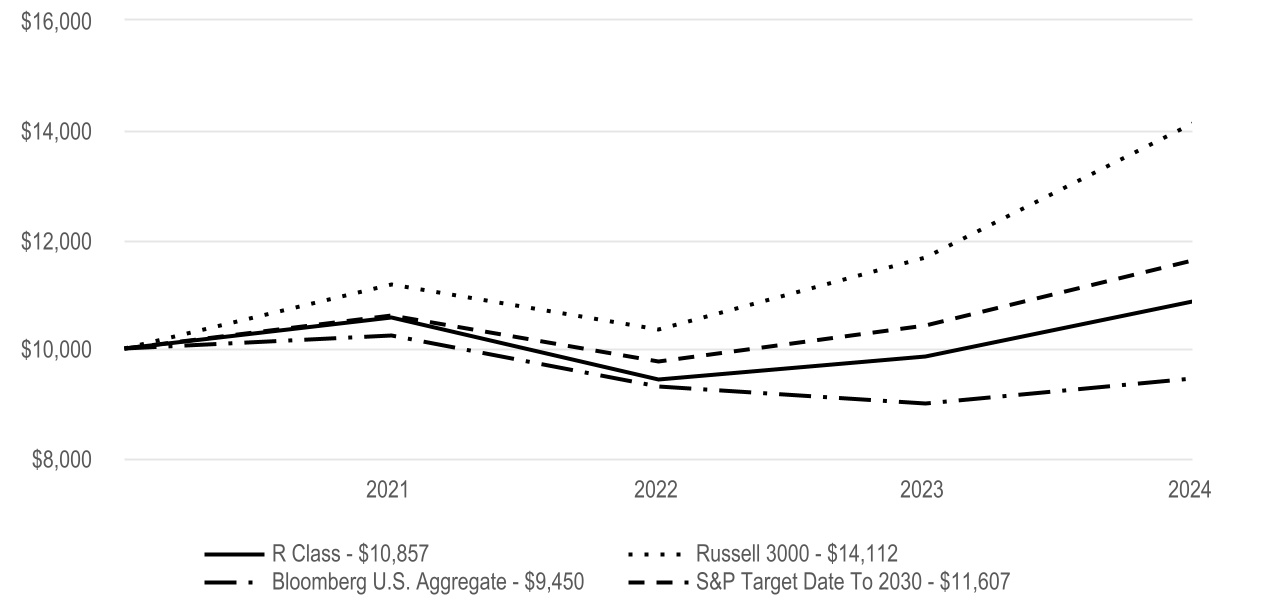

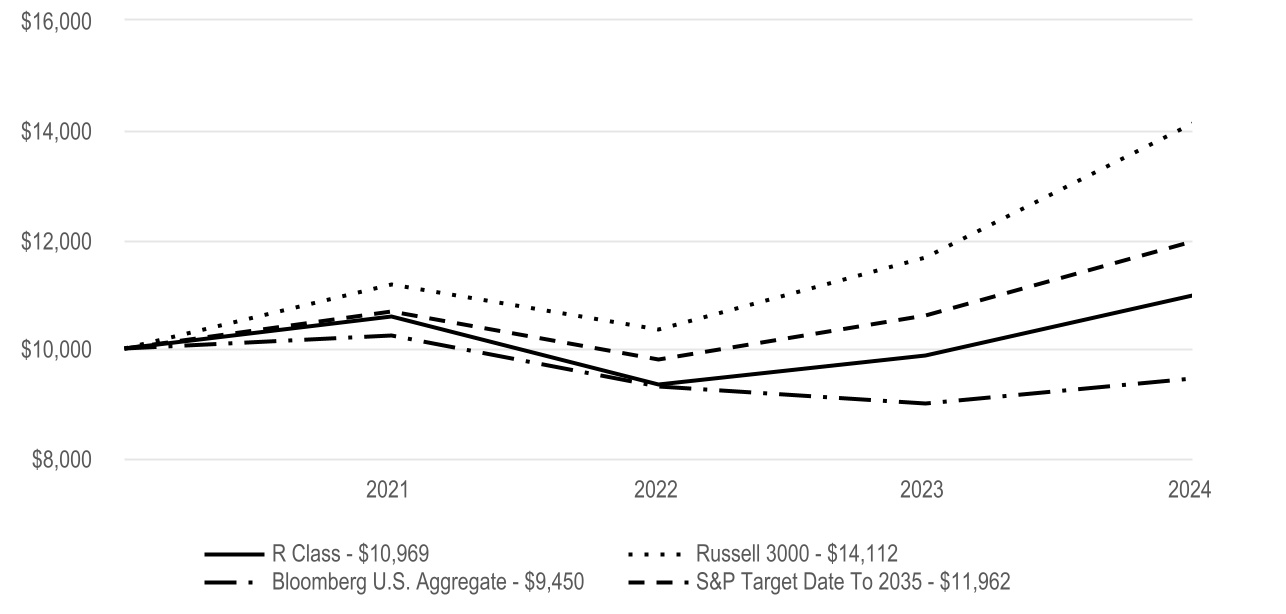

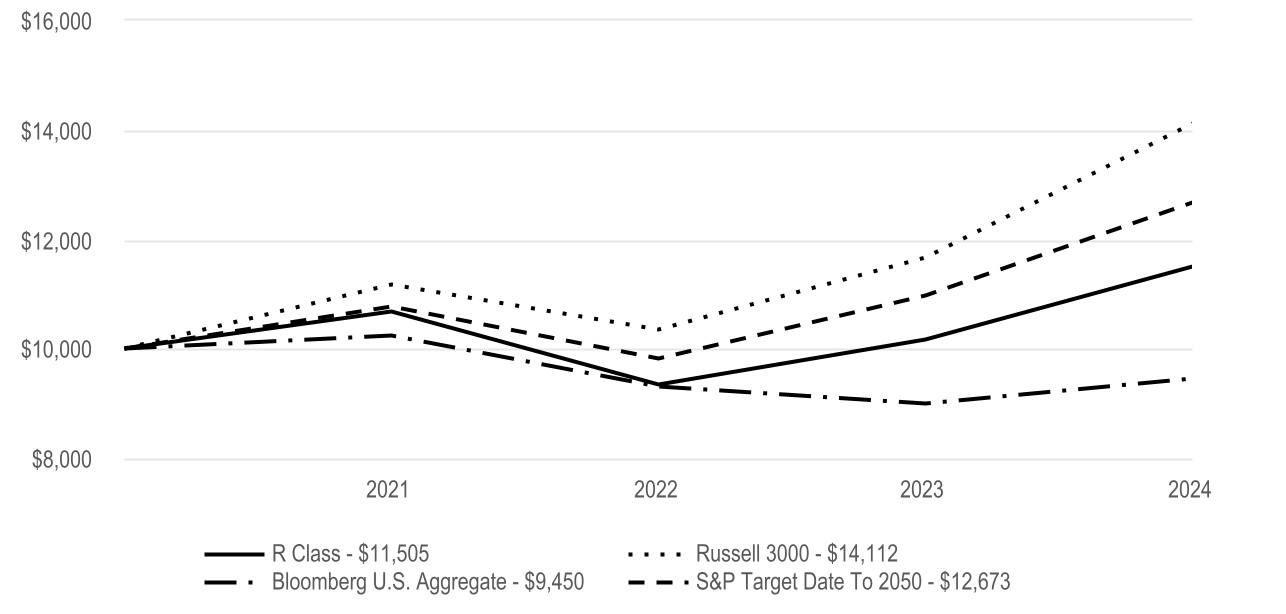

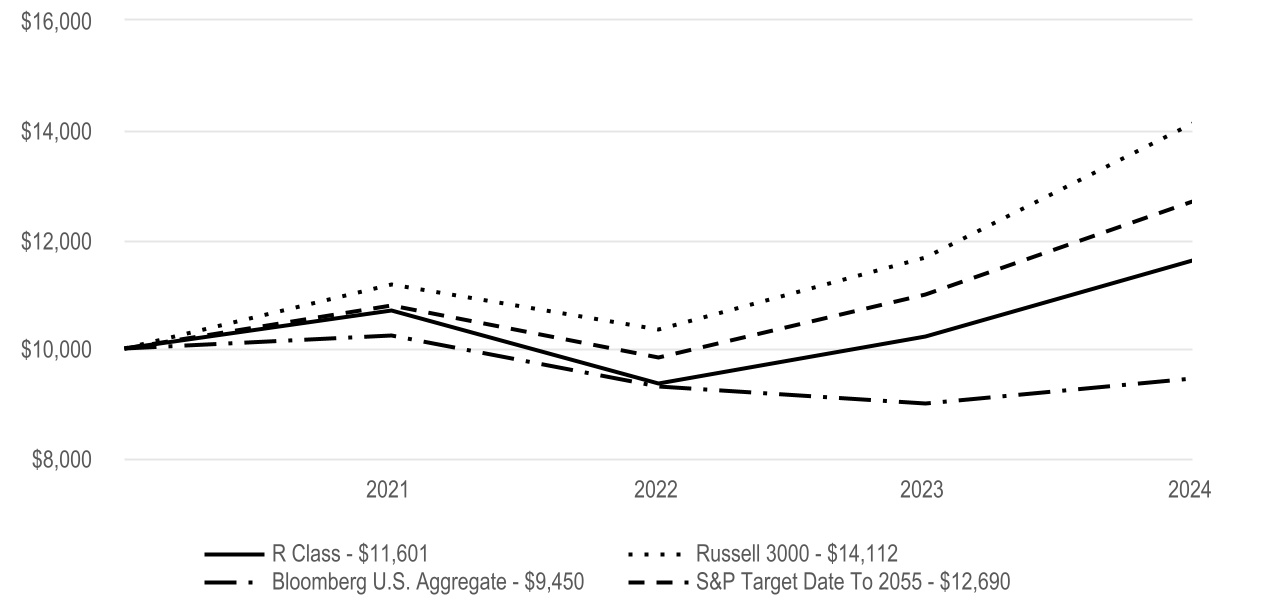

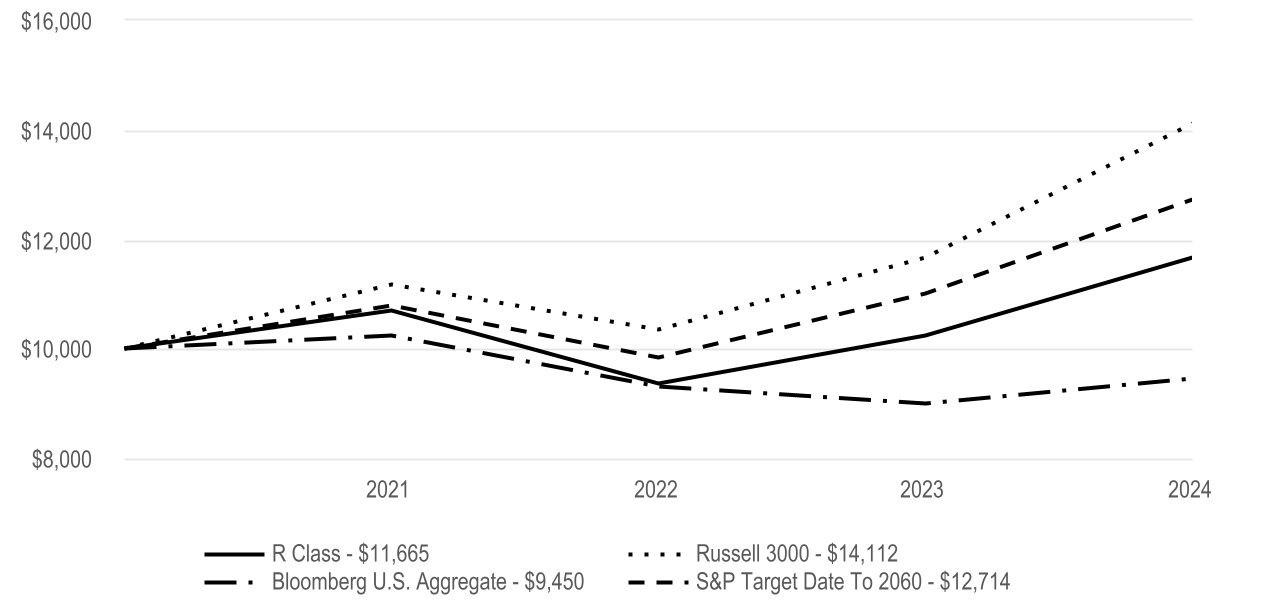

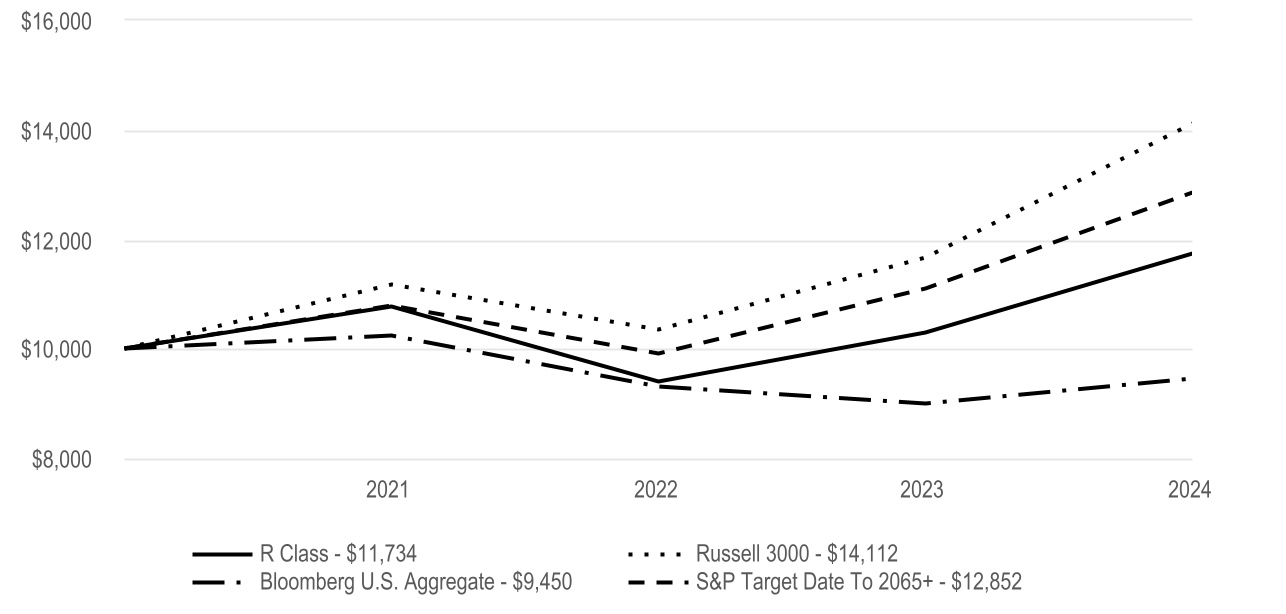

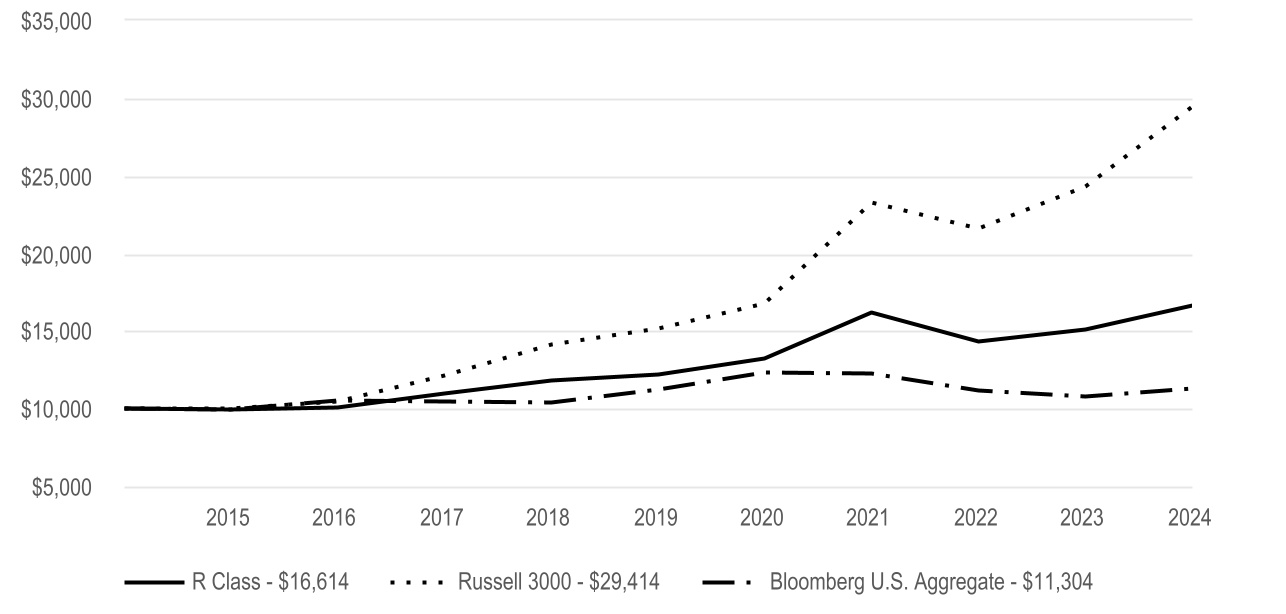

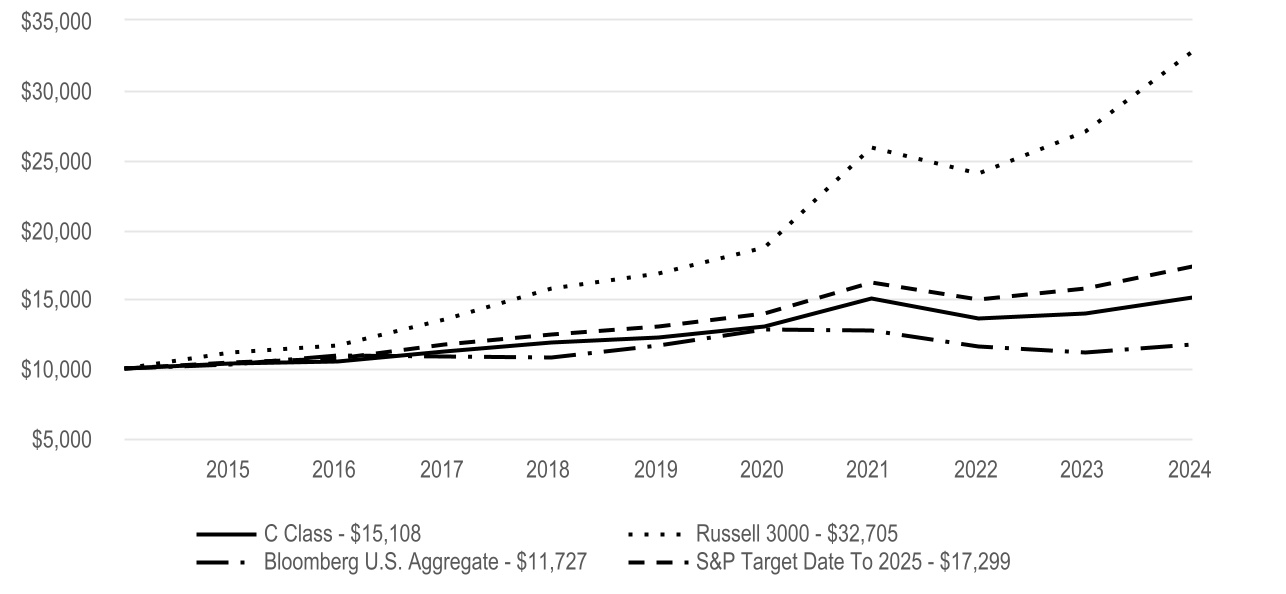

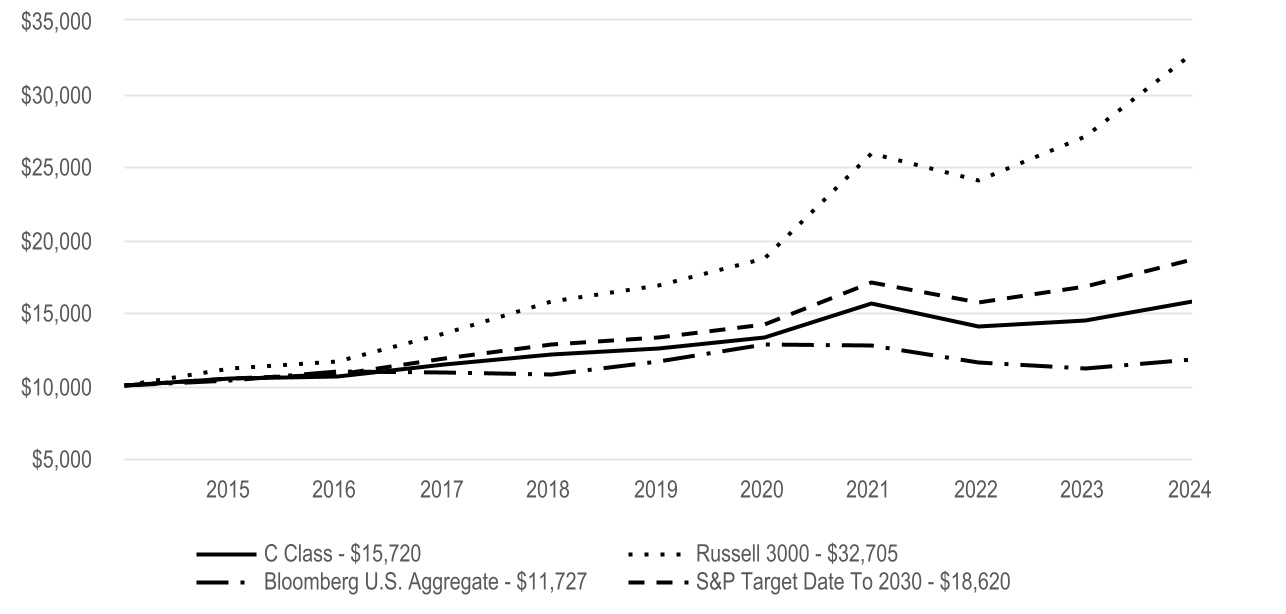

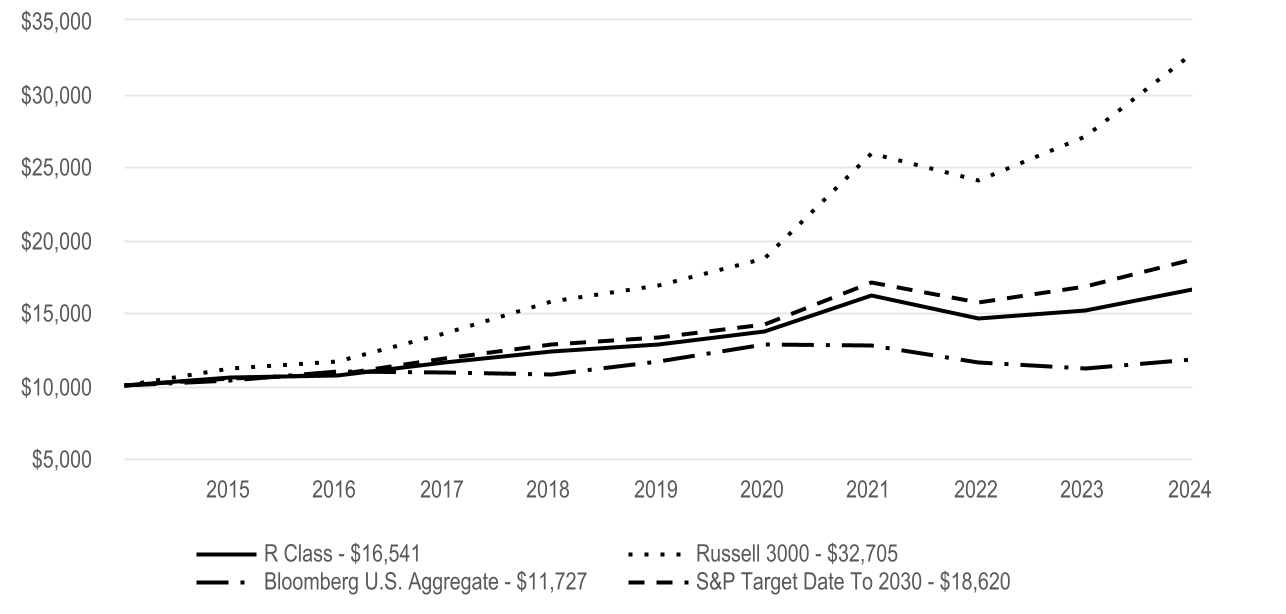

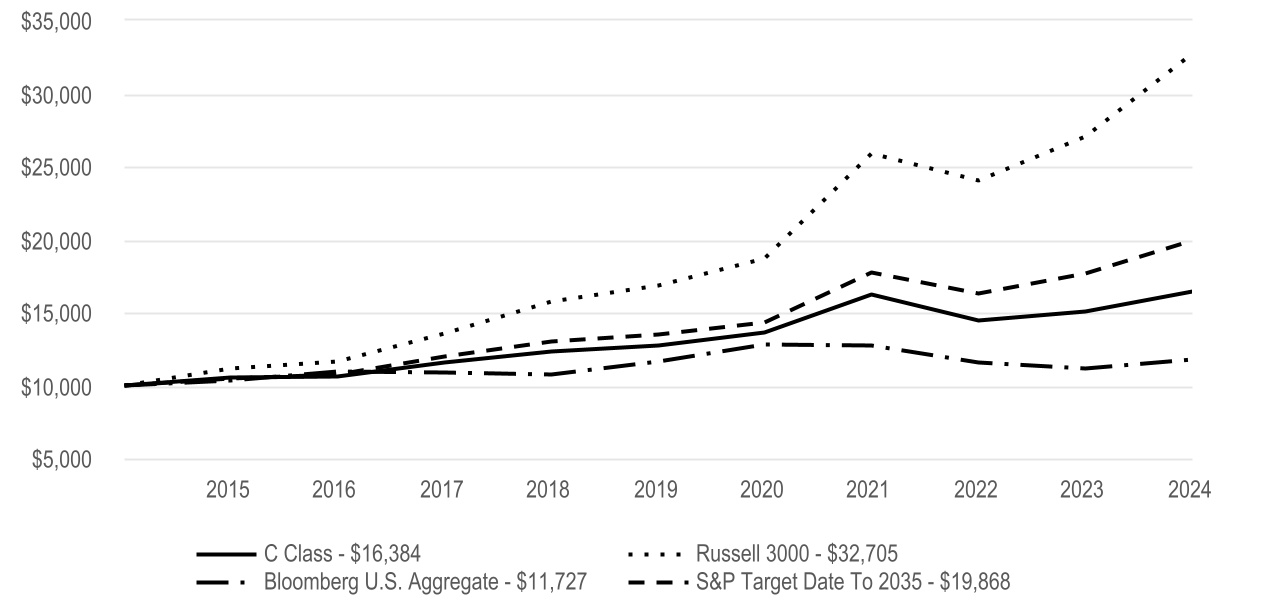

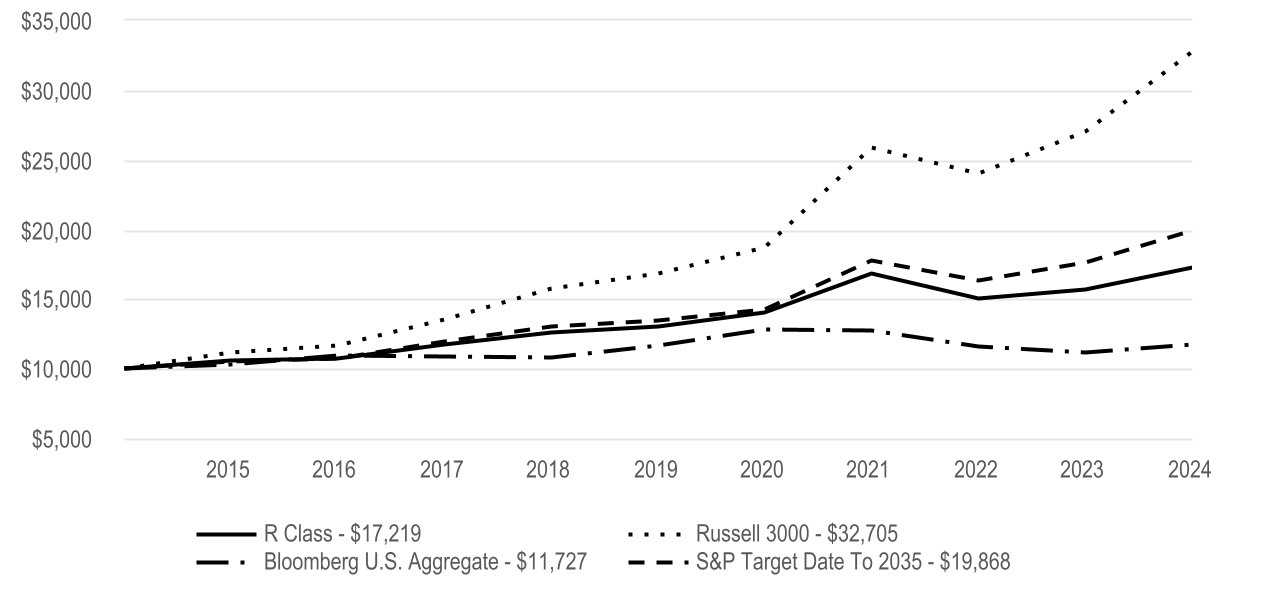

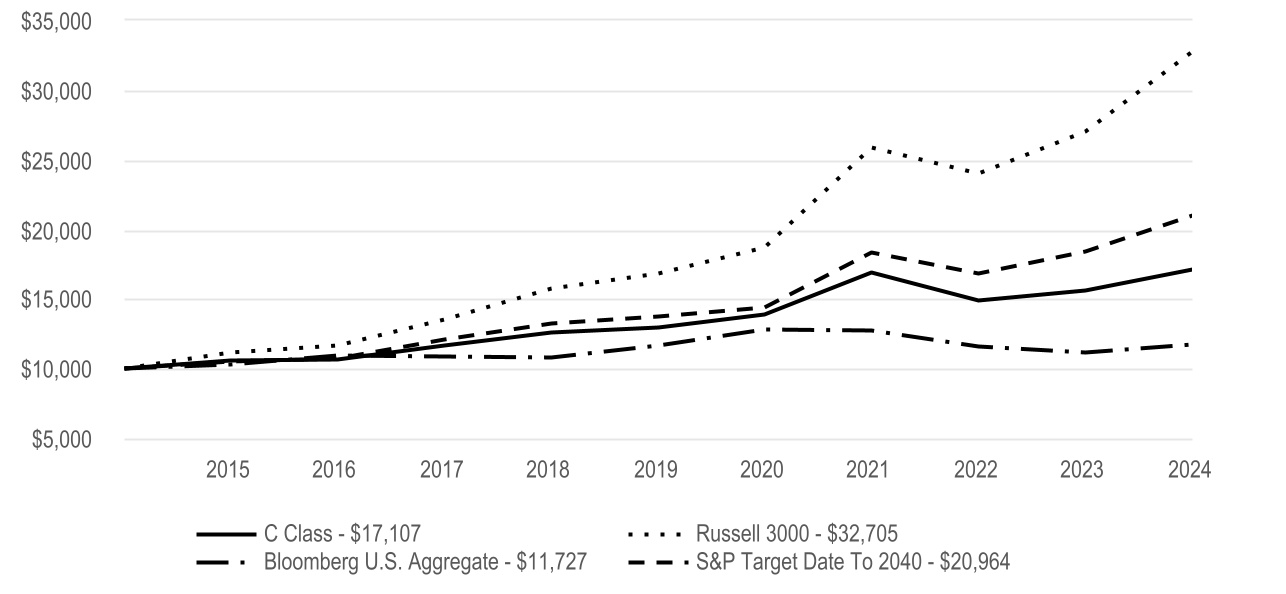

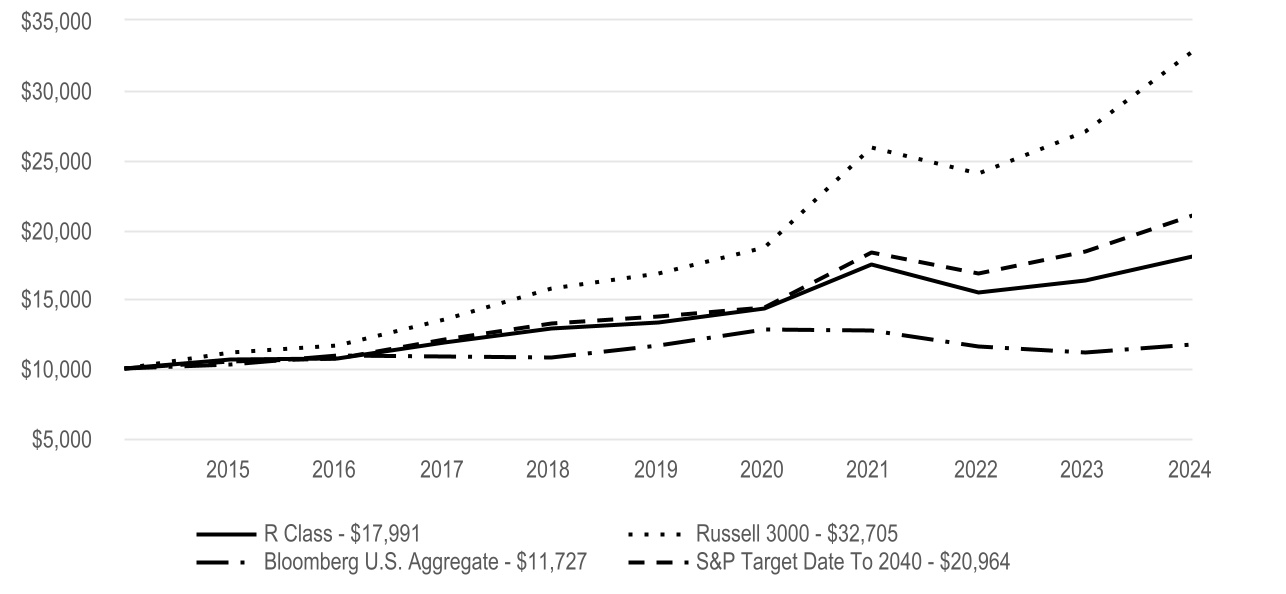

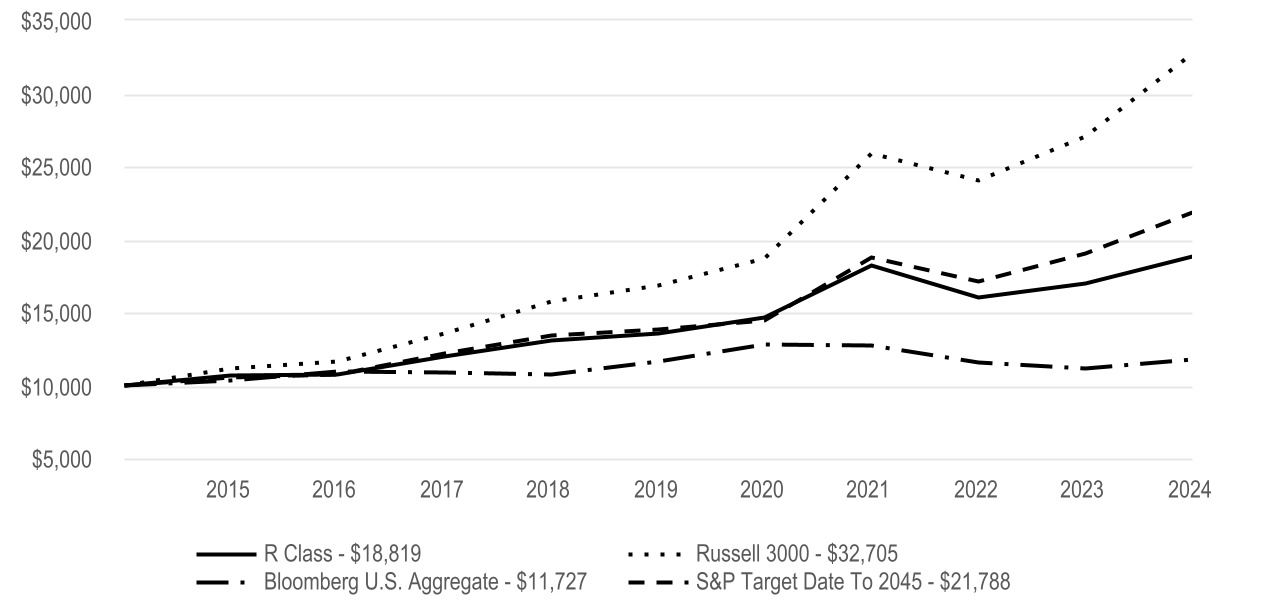

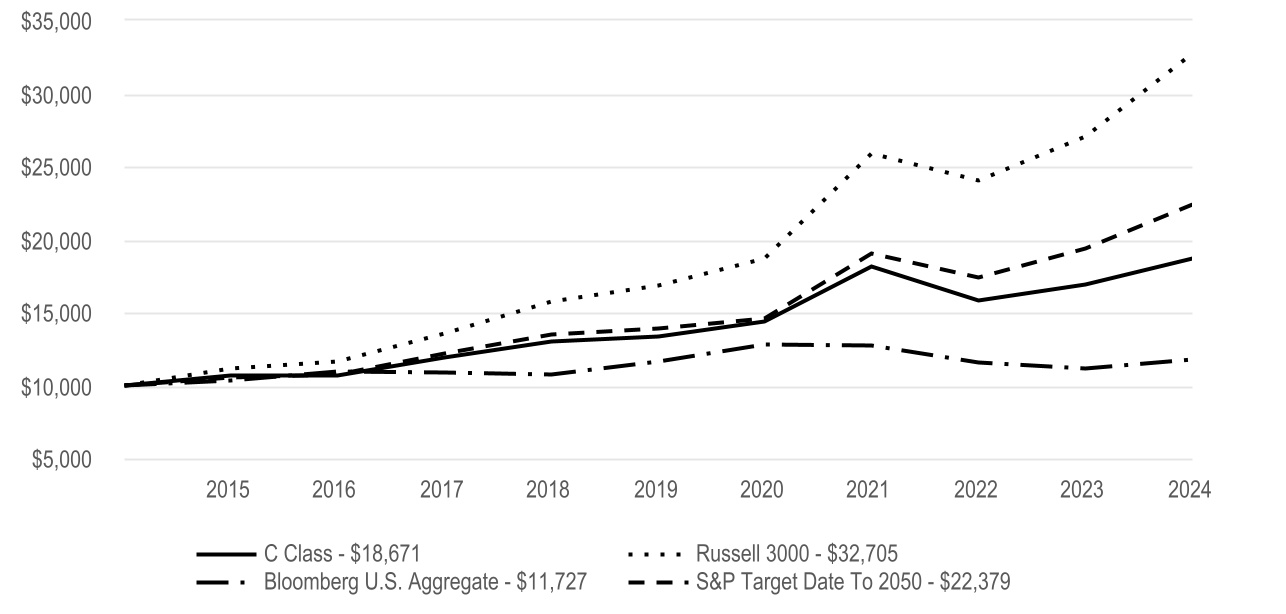

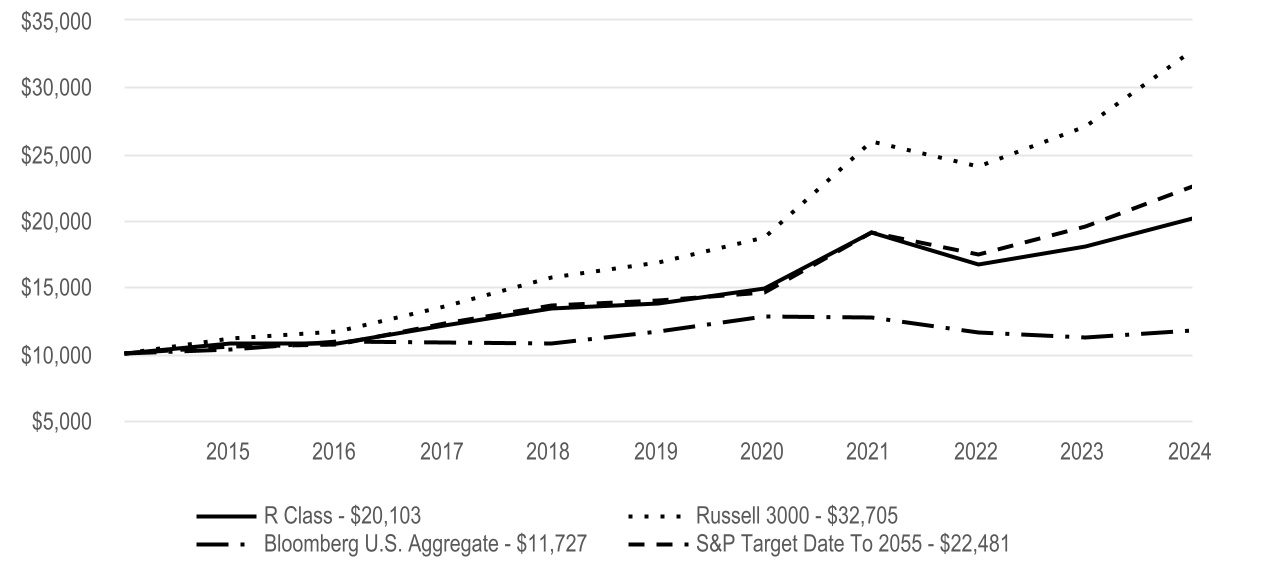

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| R Class | 8.75% | 1.73% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date 2015 | 9.56% | 3.14% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $3,631,927 | ||||

| Management Fees (dollars paid during the reporting period) | $12,560 | ||||

| Portfolio Turnover Rate | 37 | % | |||

| Total Number of Portfolio Holdings | 19 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J763

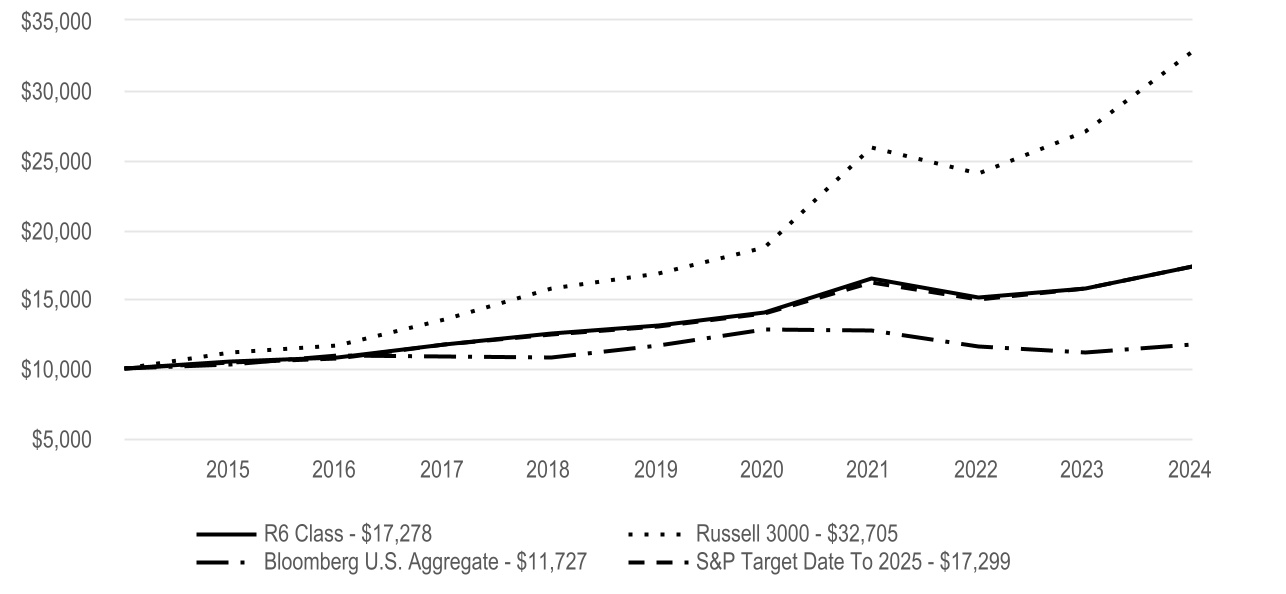

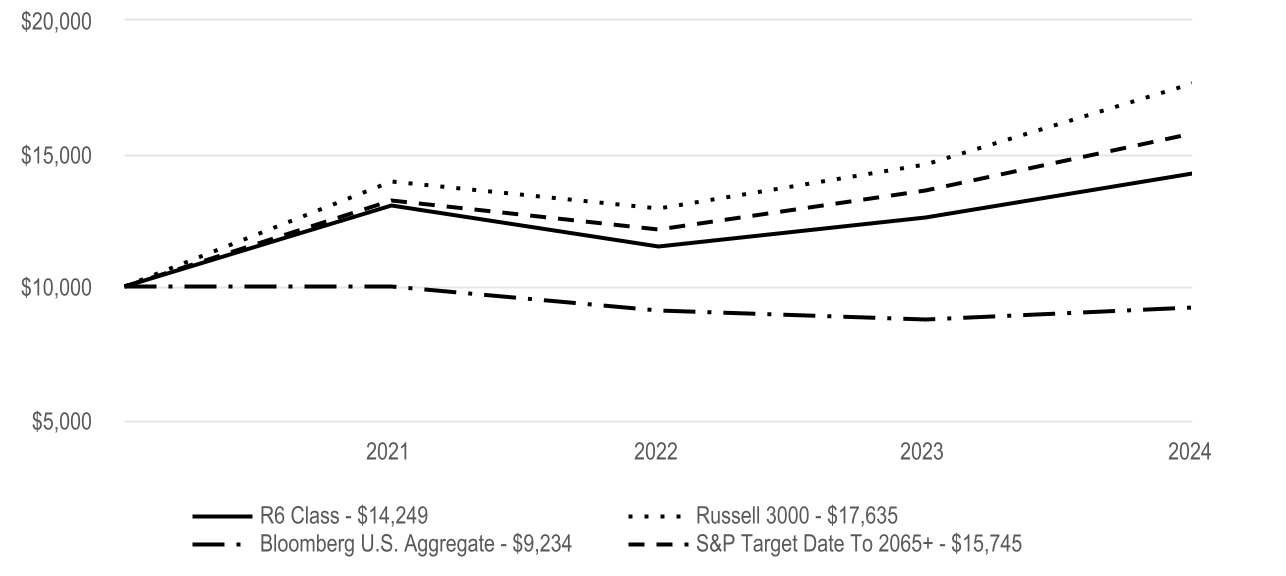

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2015 Portfolio

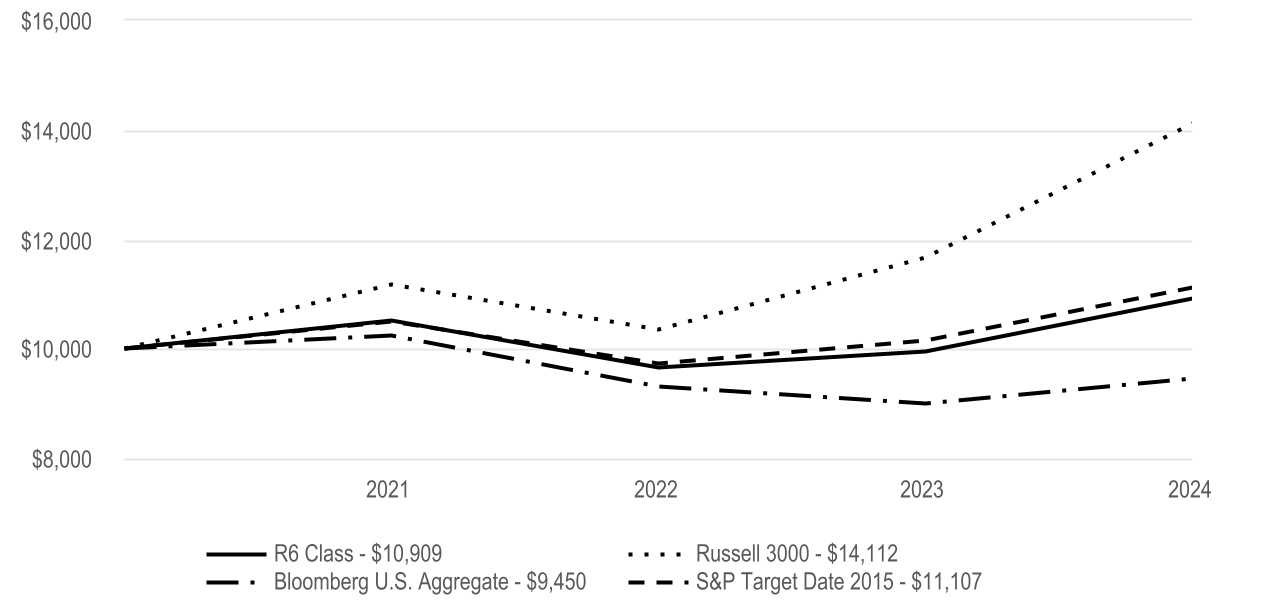

R6 Class (AAALX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2015 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| R6 Class | $23 | 0.22% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2015 Portfolio R6 Class returned 9.64% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

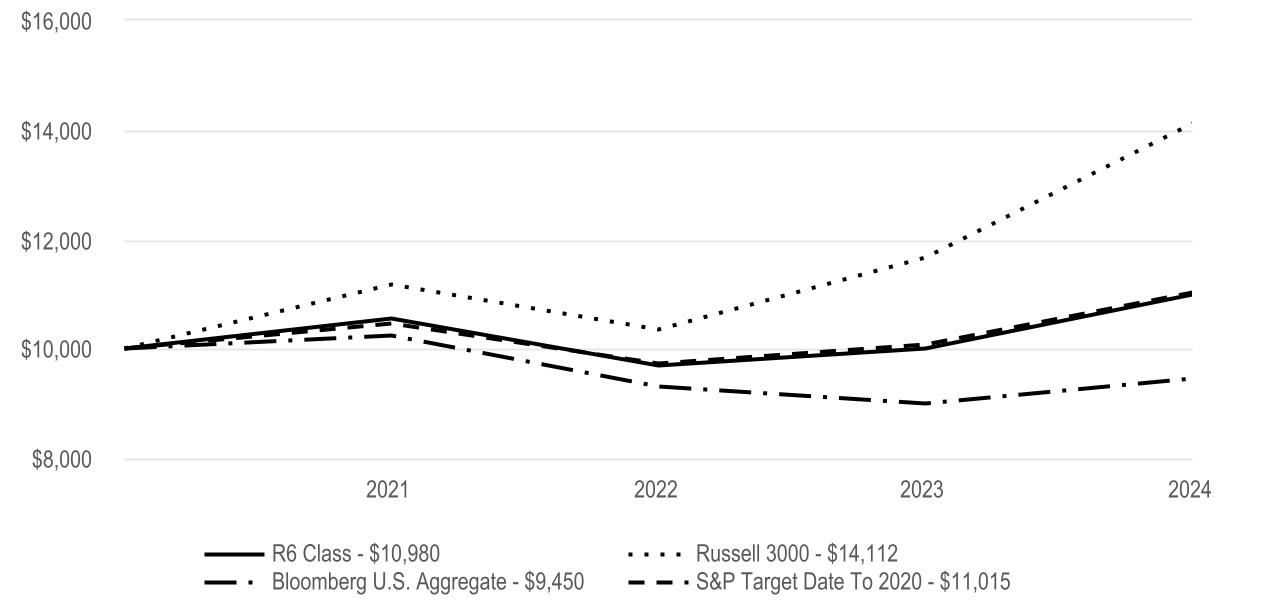

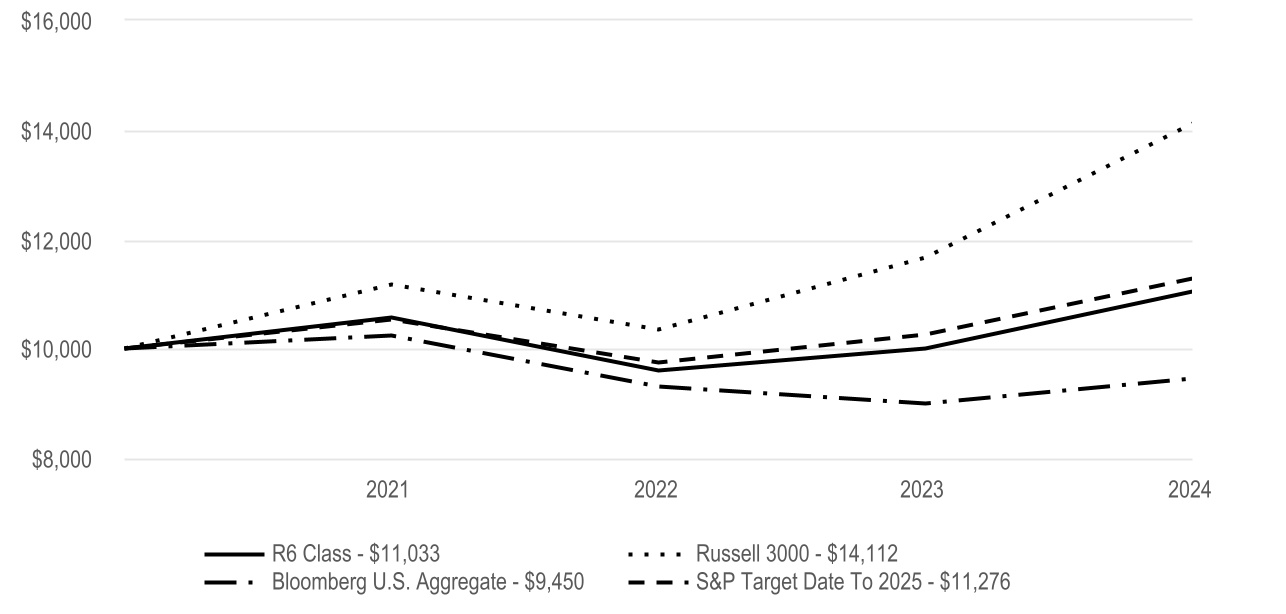

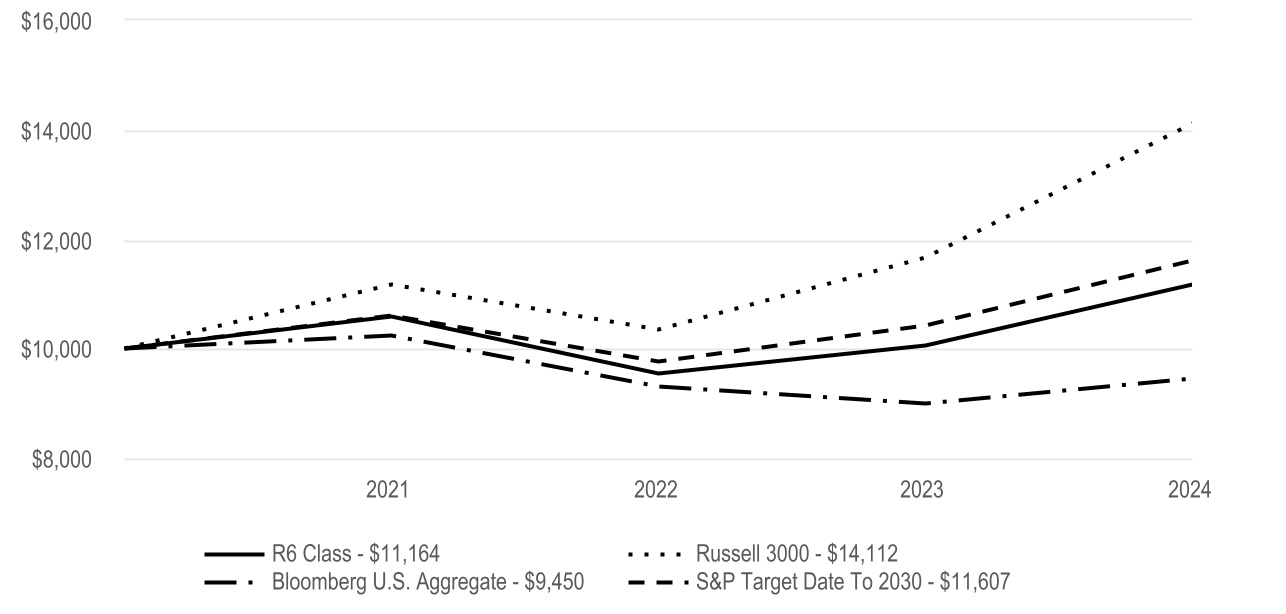

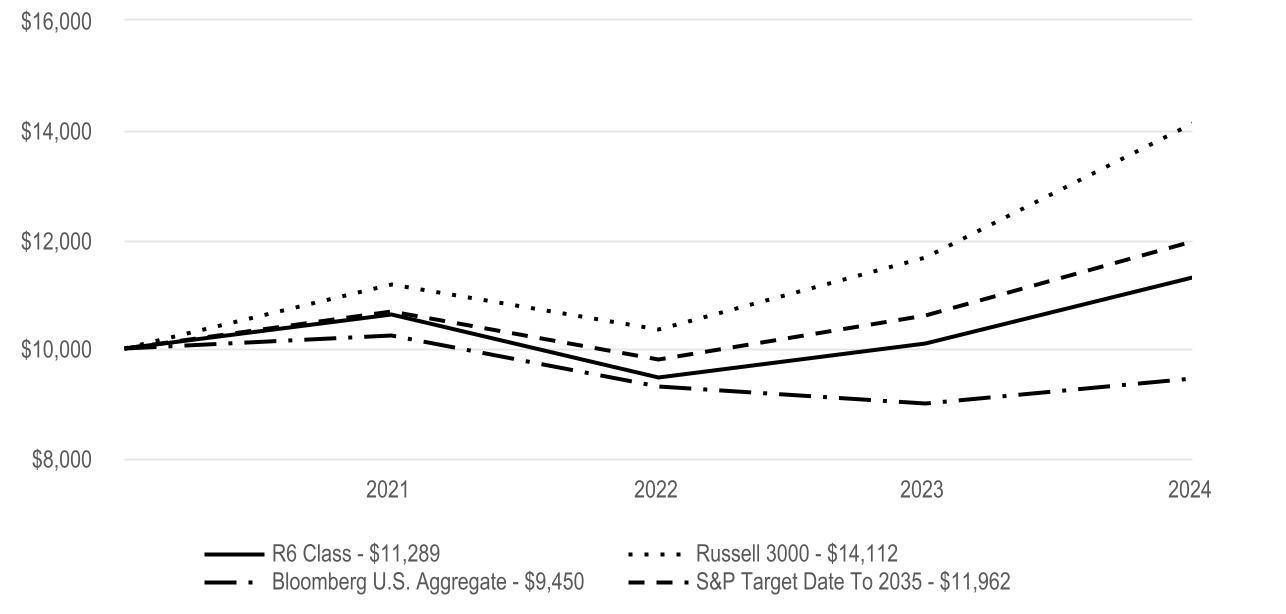

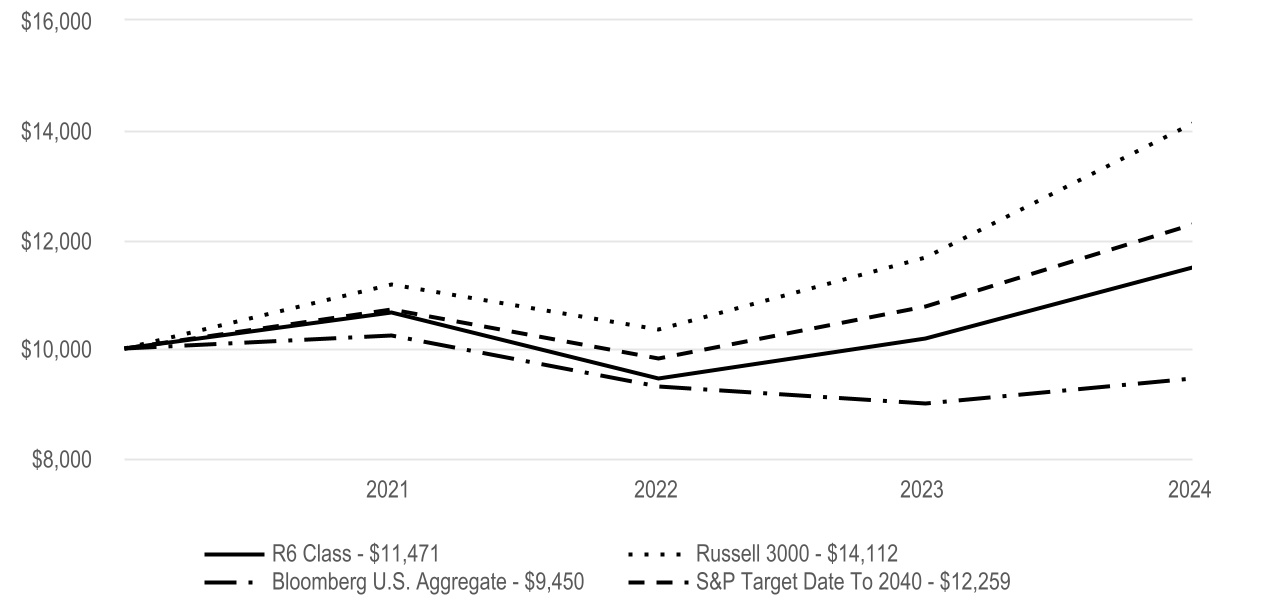

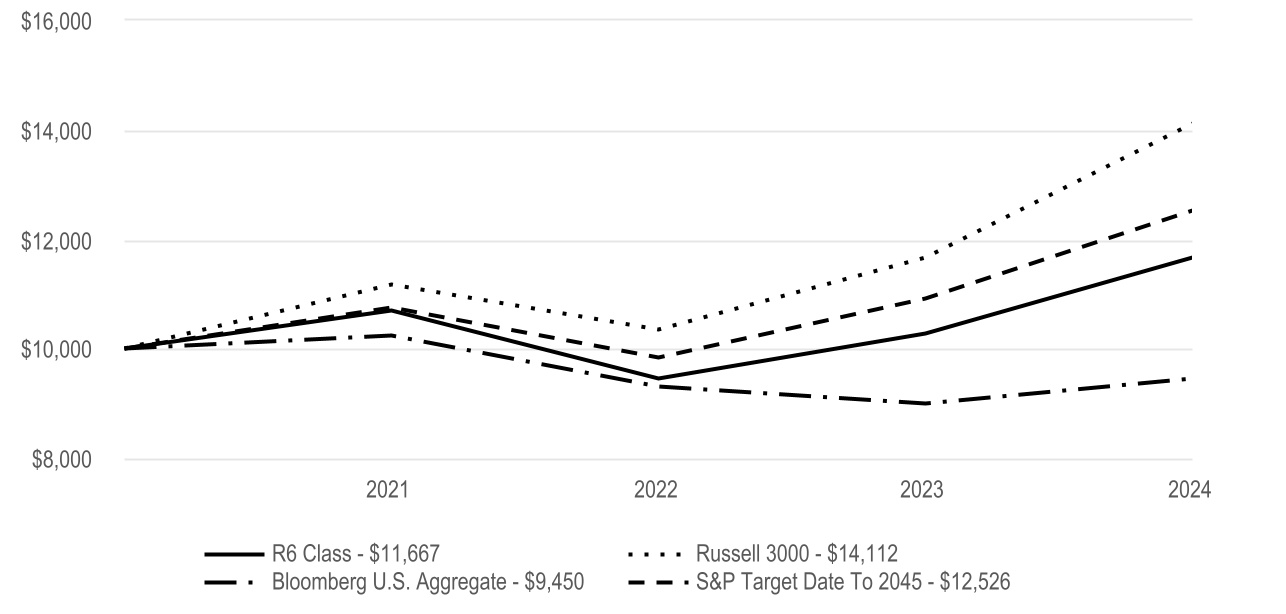

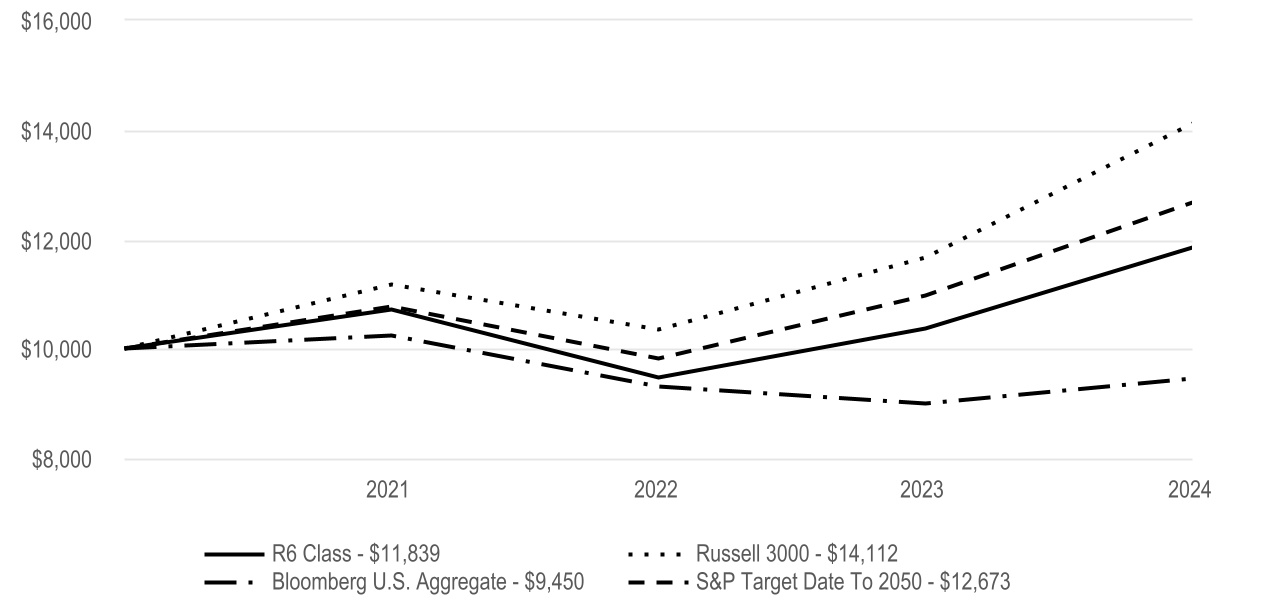

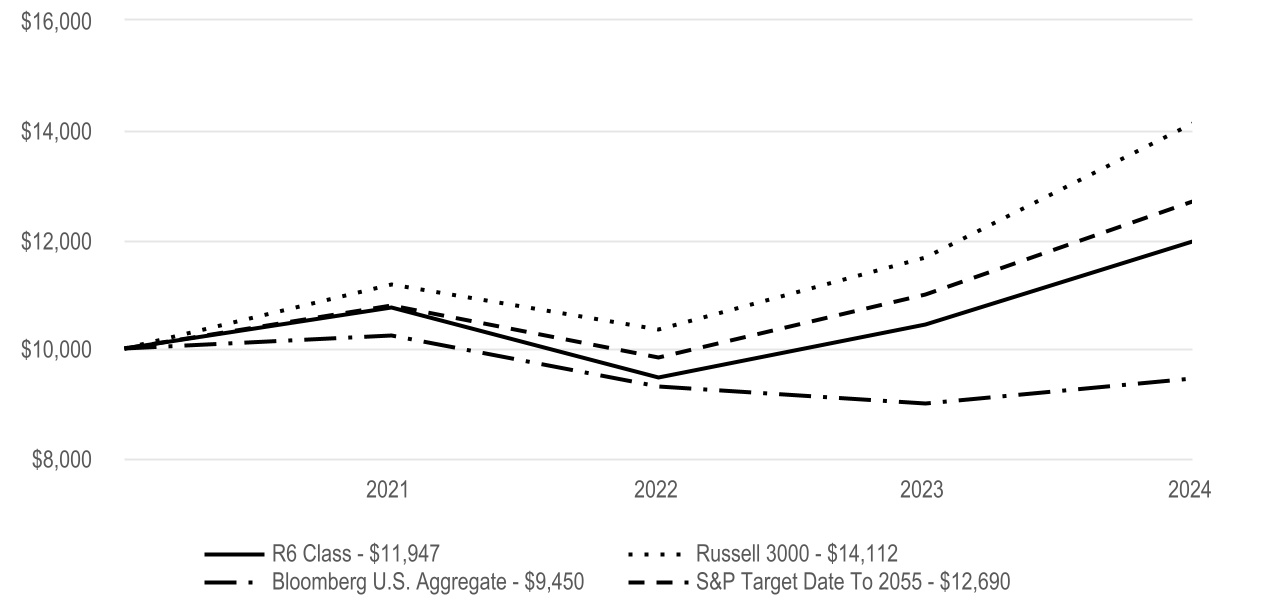

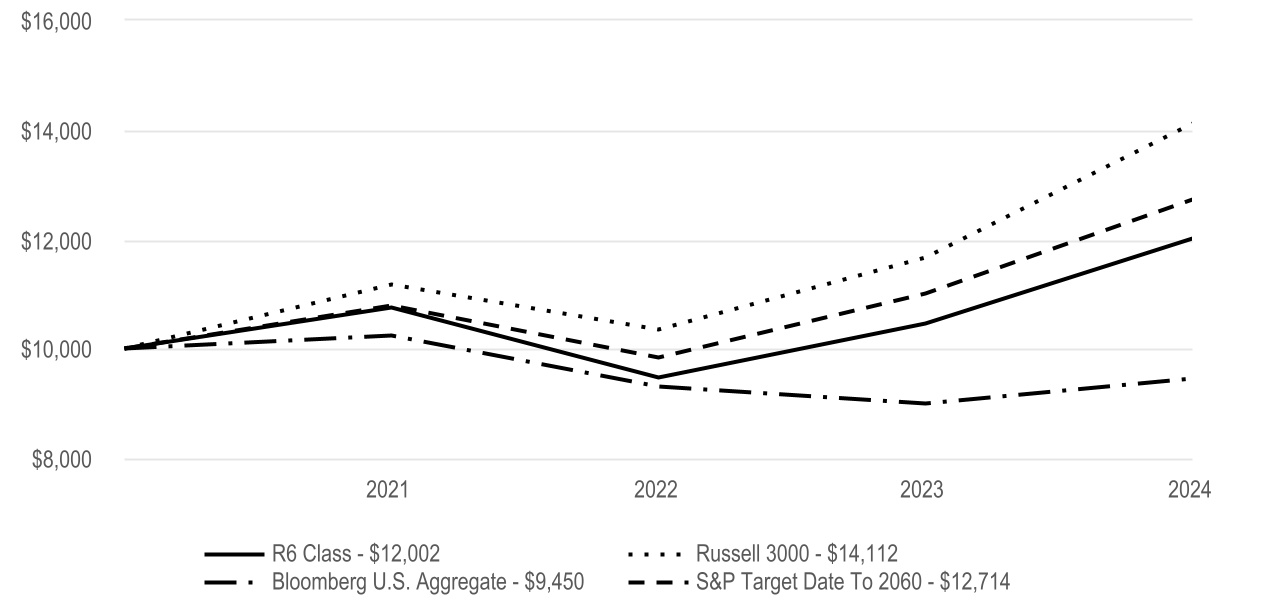

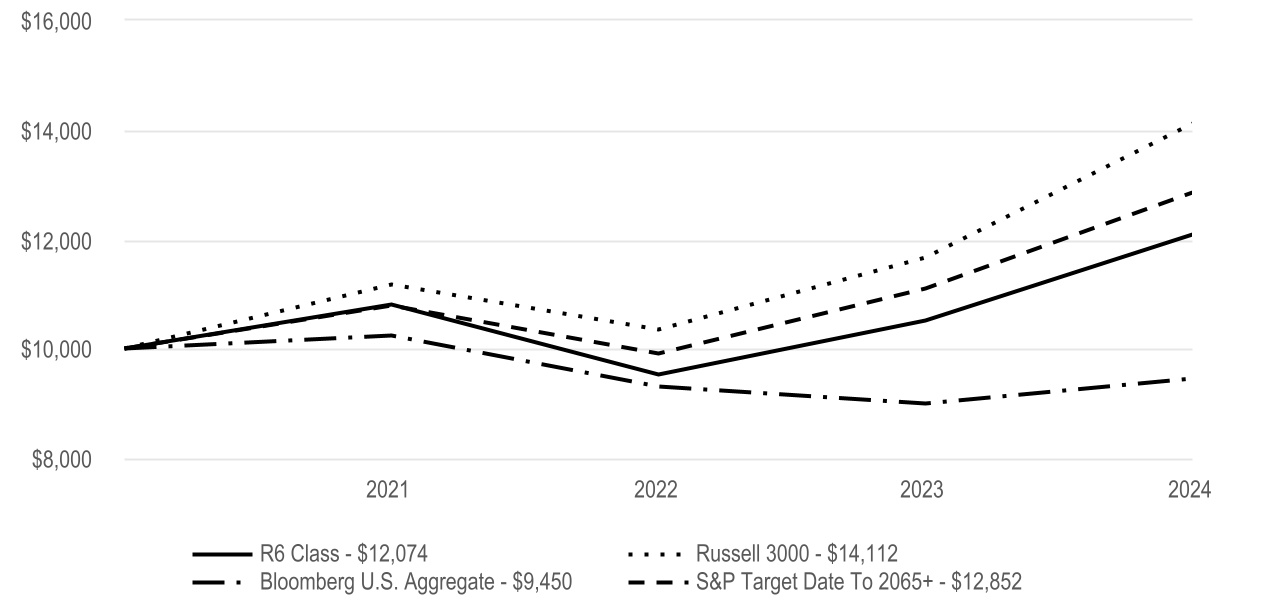

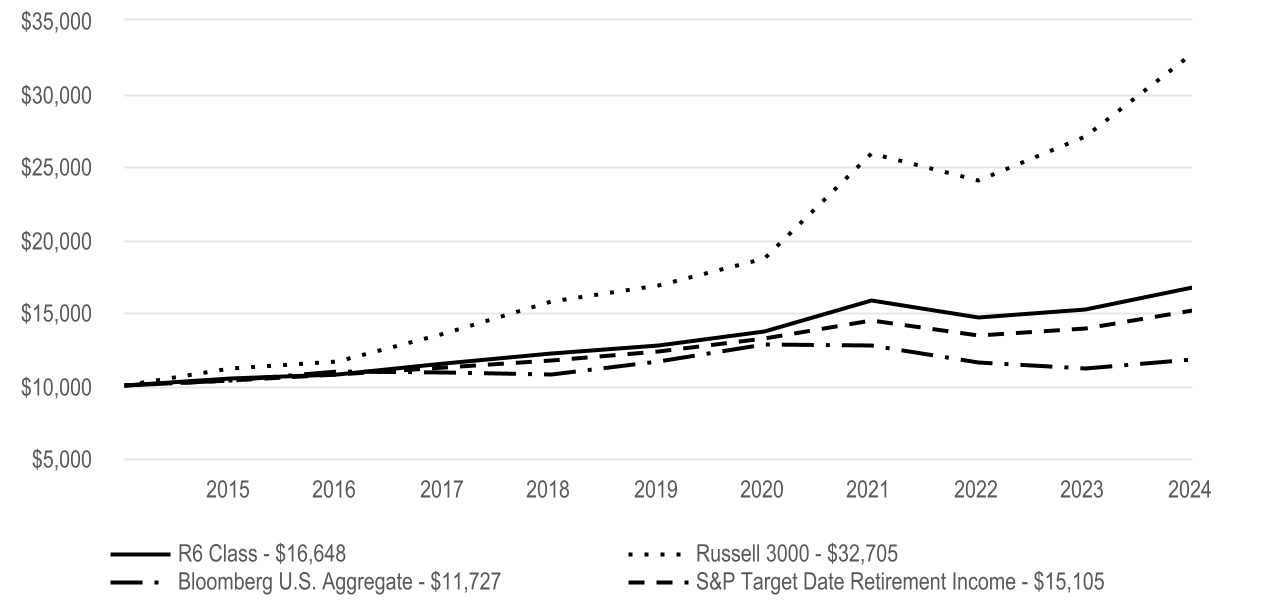

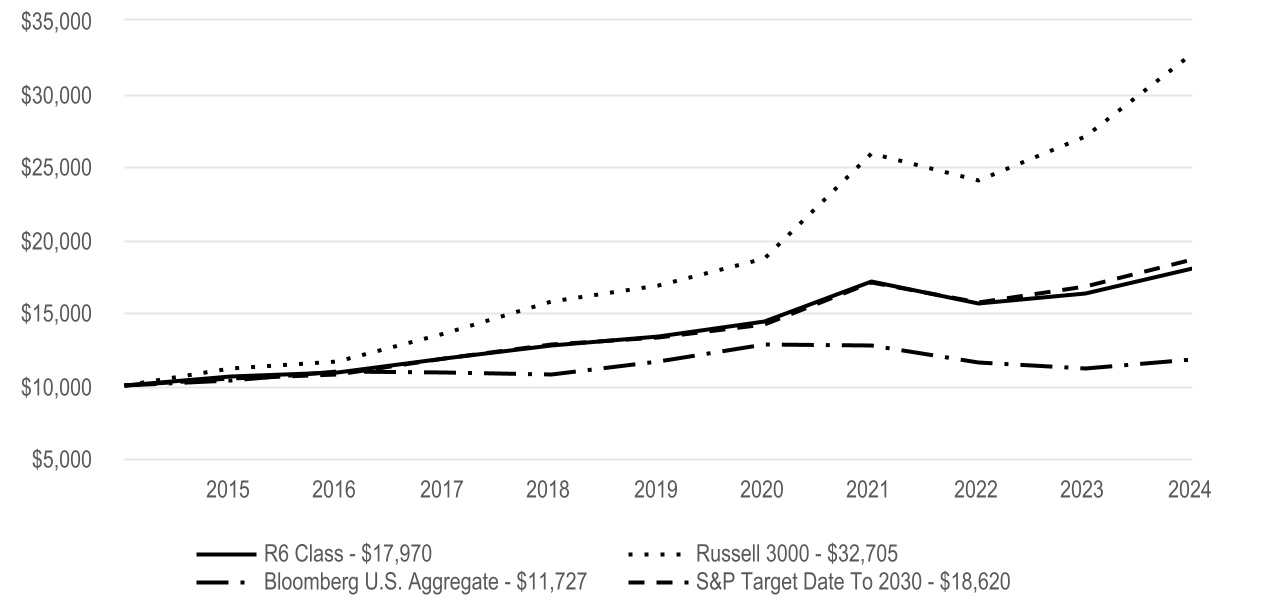

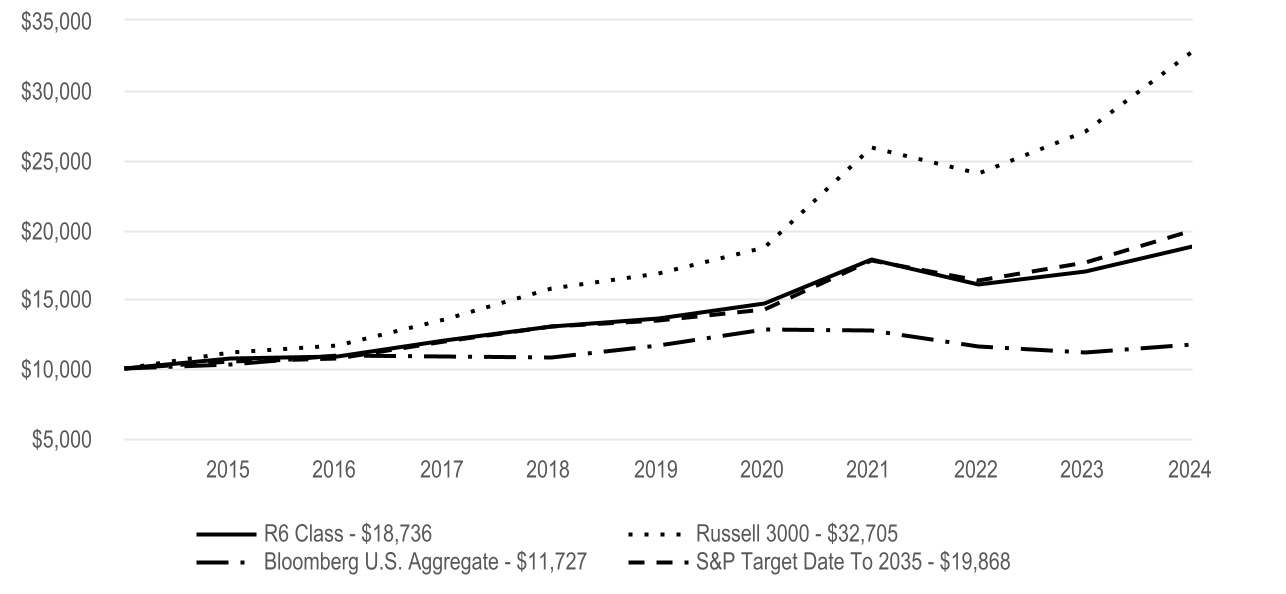

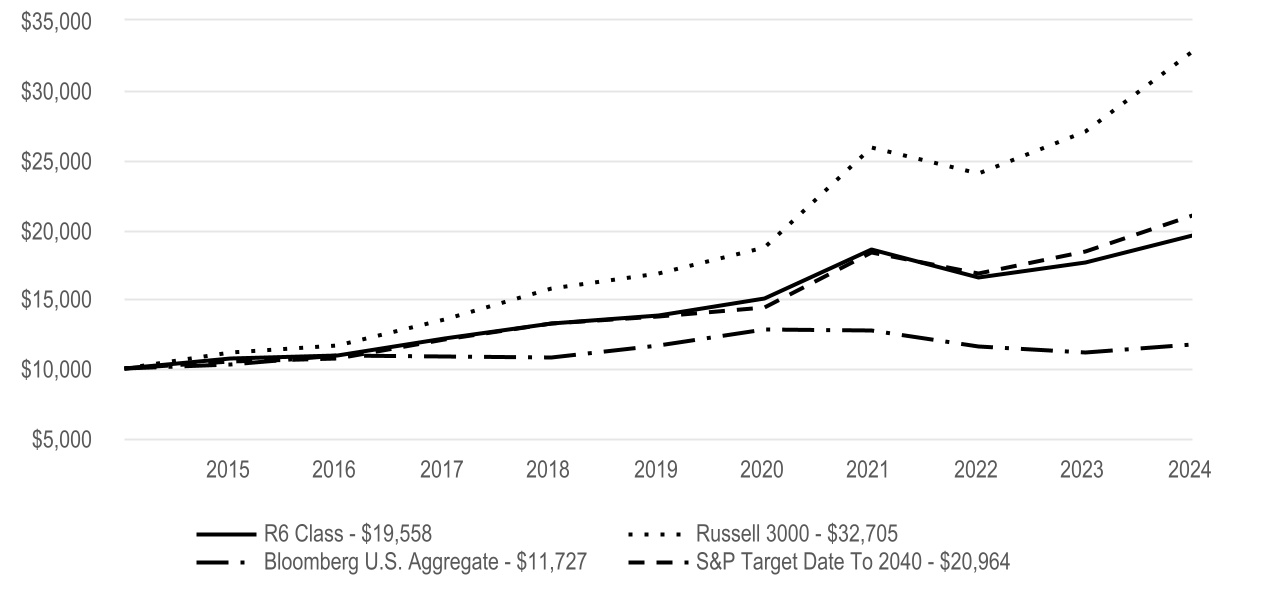

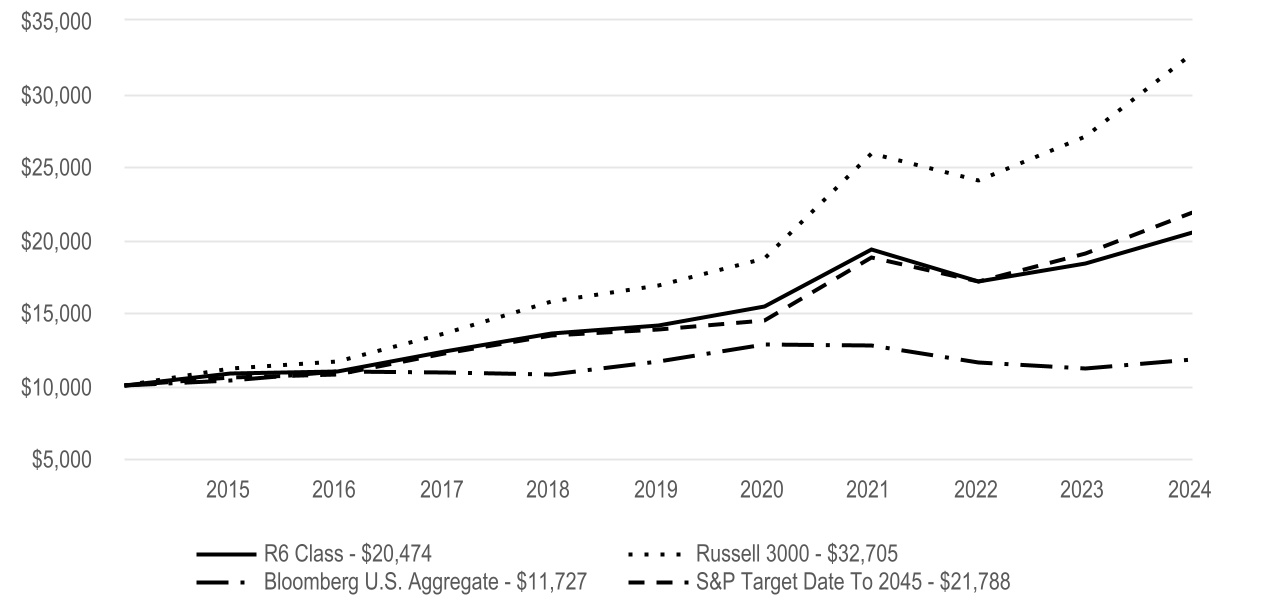

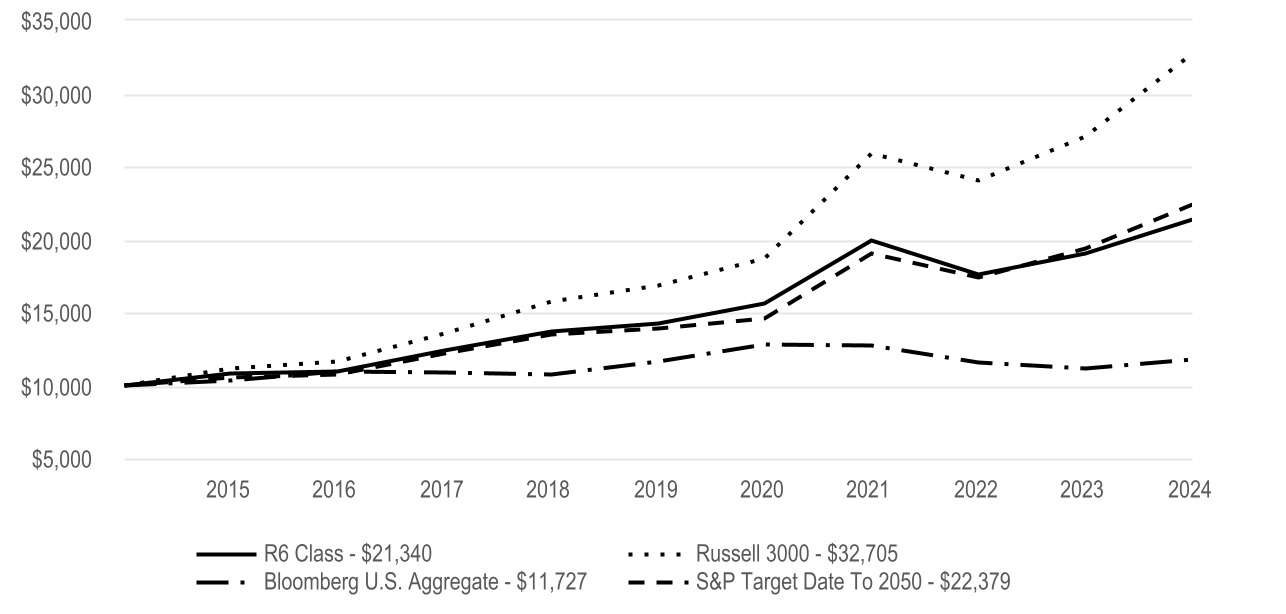

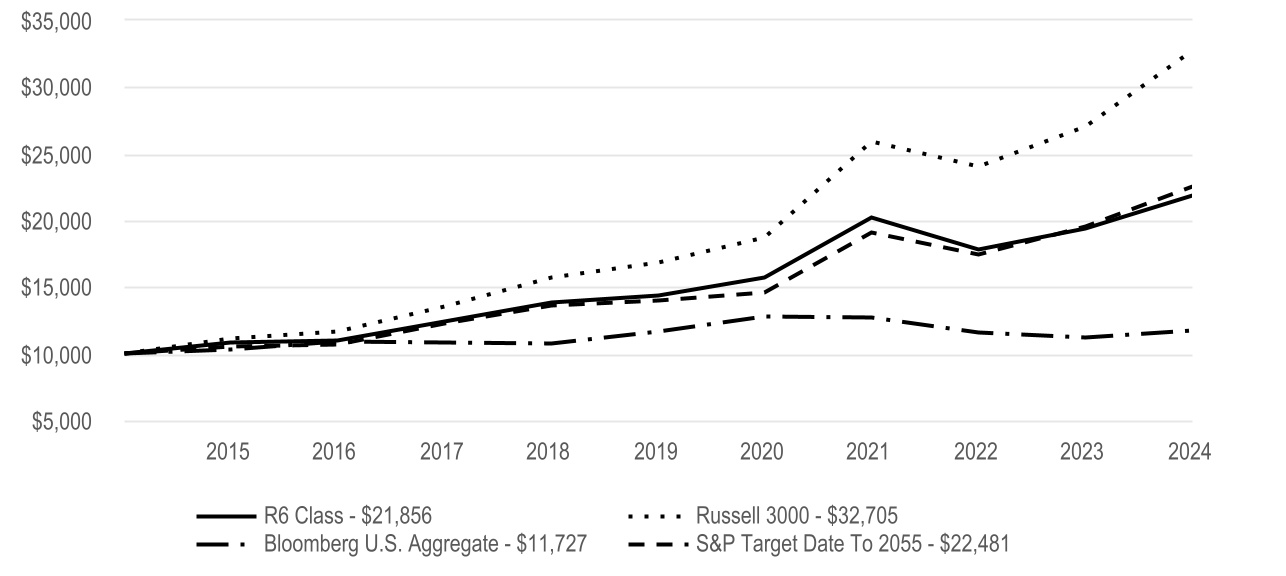

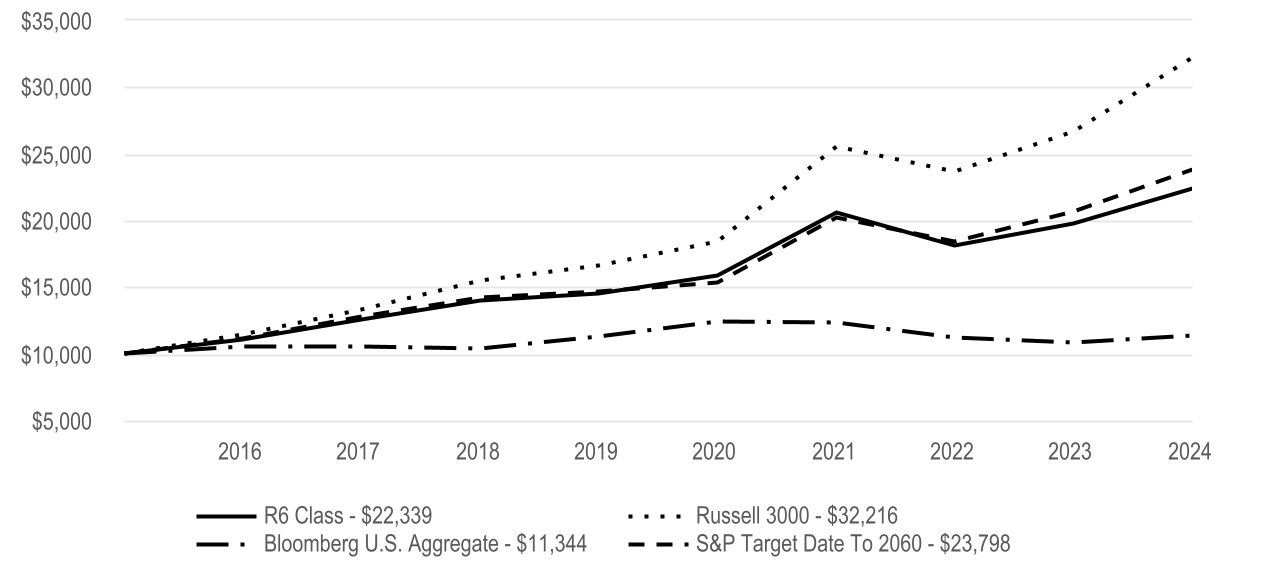

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| R6 Class | 9.64% | 2.60% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date 2015 | 9.56% | 3.14% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $3,631,927 | ||||

| Management Fees (dollars paid during the reporting period) | $12,560 | ||||

| Portfolio Turnover Rate | 37 | % | |||

| Total Number of Portfolio Holdings | 19 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J755

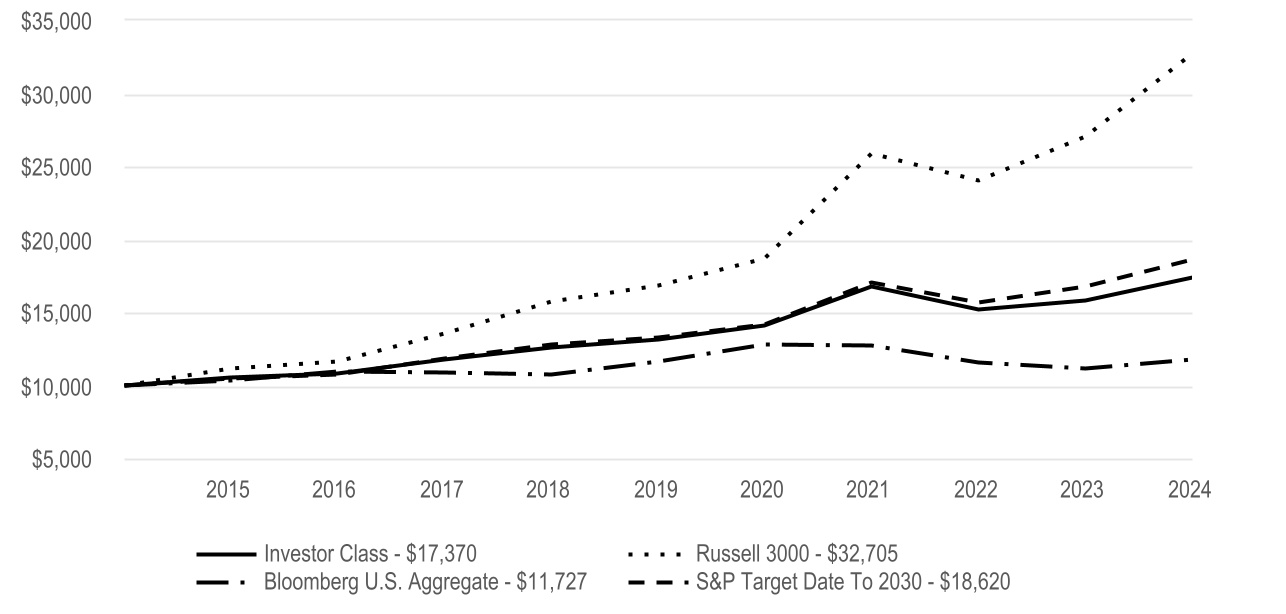

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2020 Portfolio

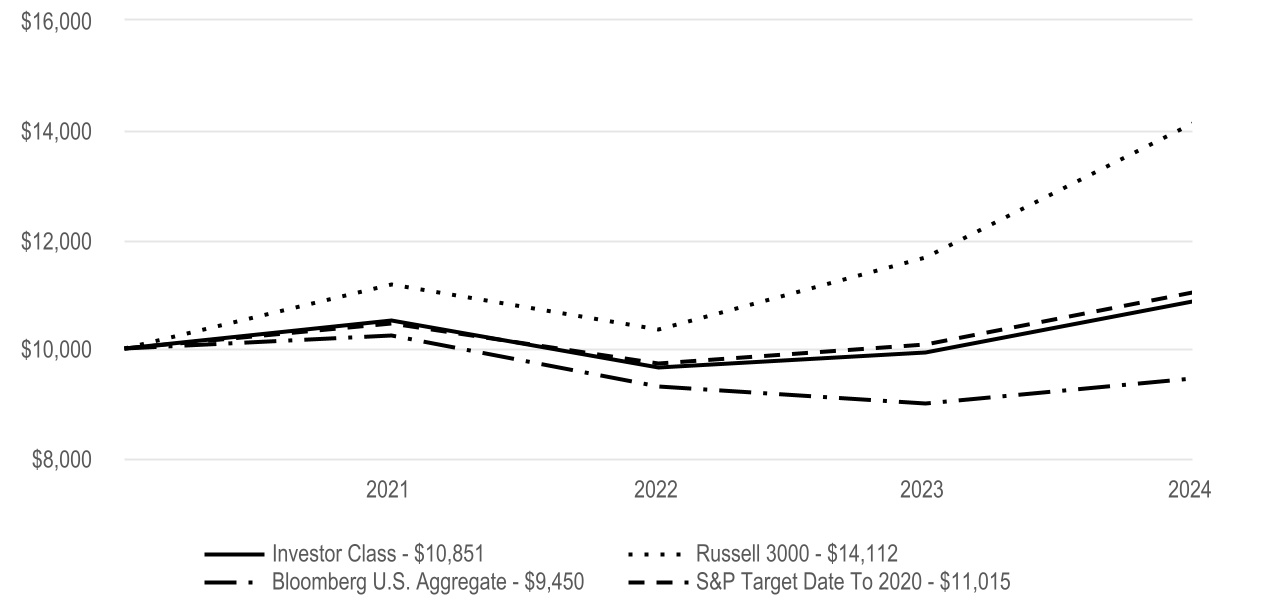

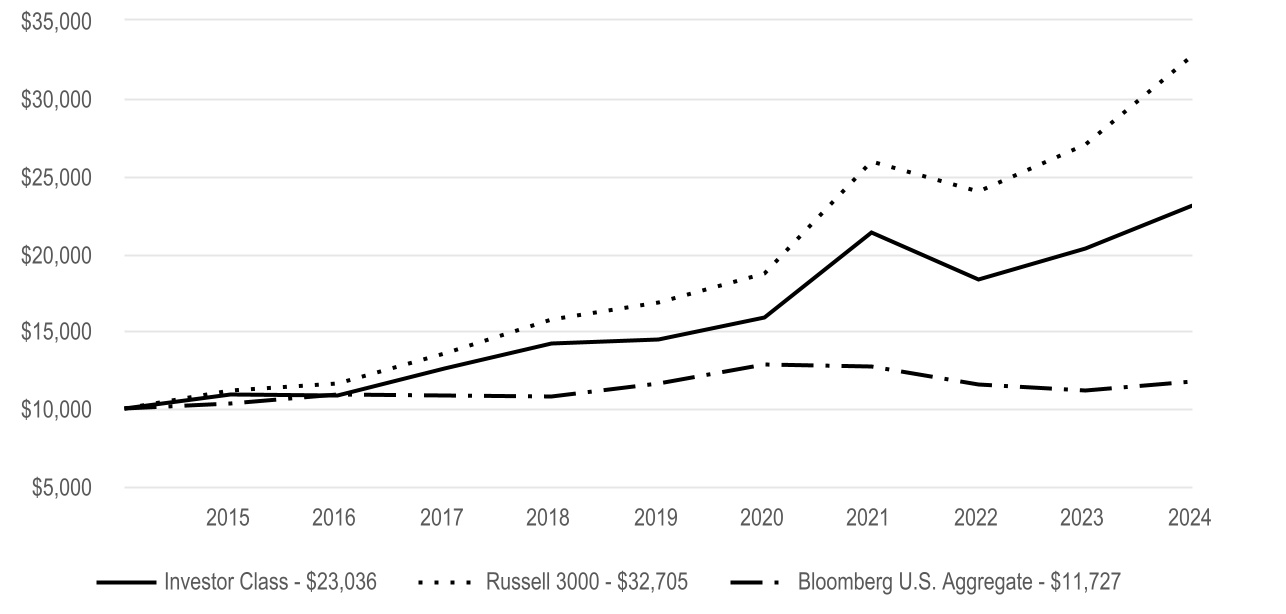

Investor Class (AAAMX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2020 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| Investor Class | $60 | 0.57% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2020 Portfolio Investor Class returned 9.37% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

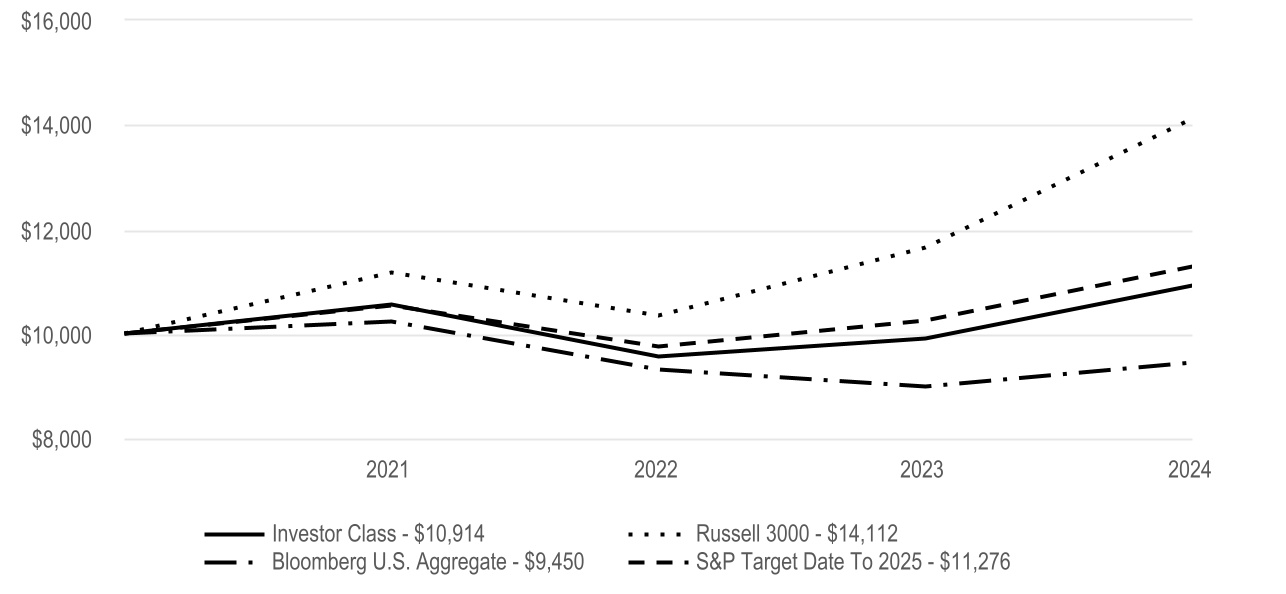

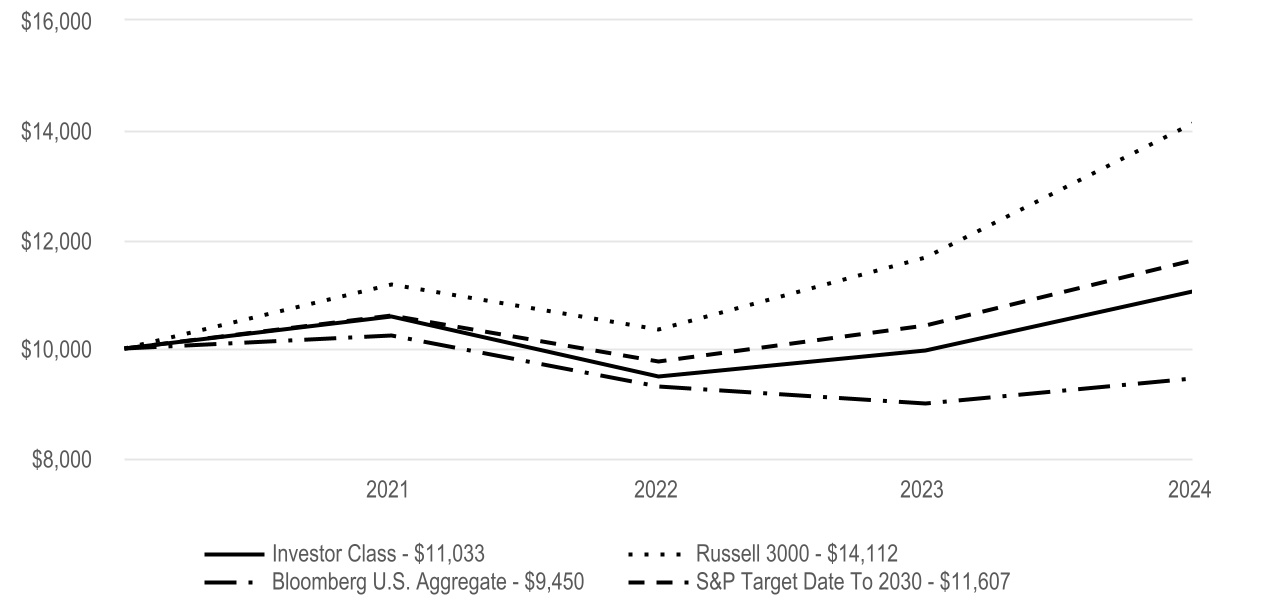

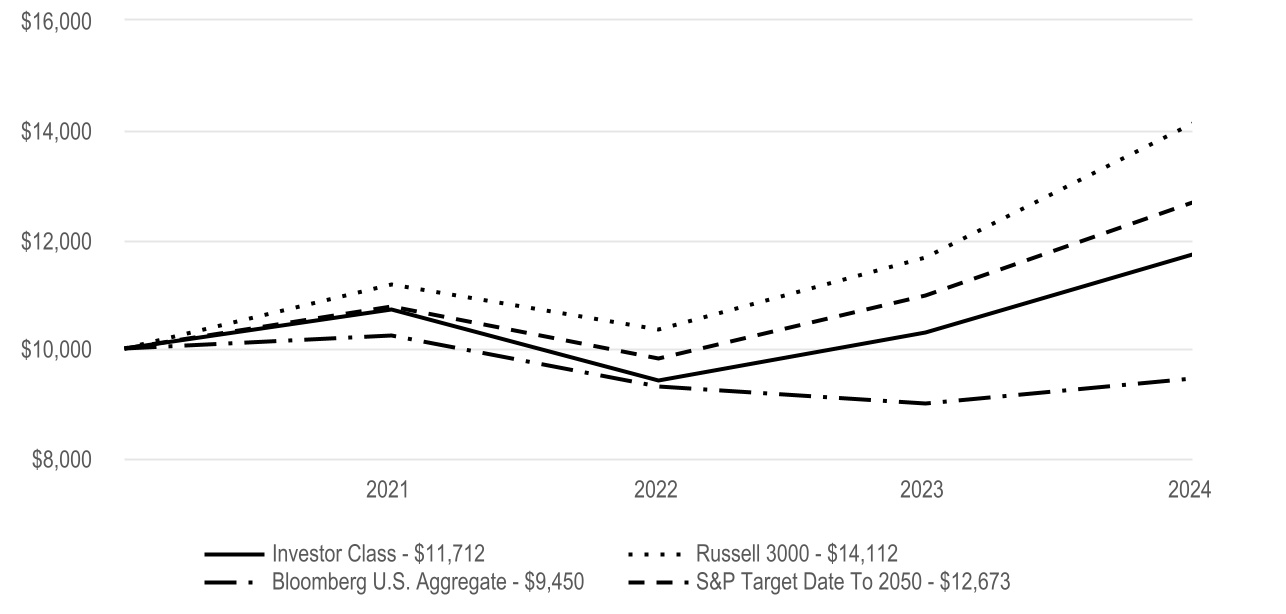

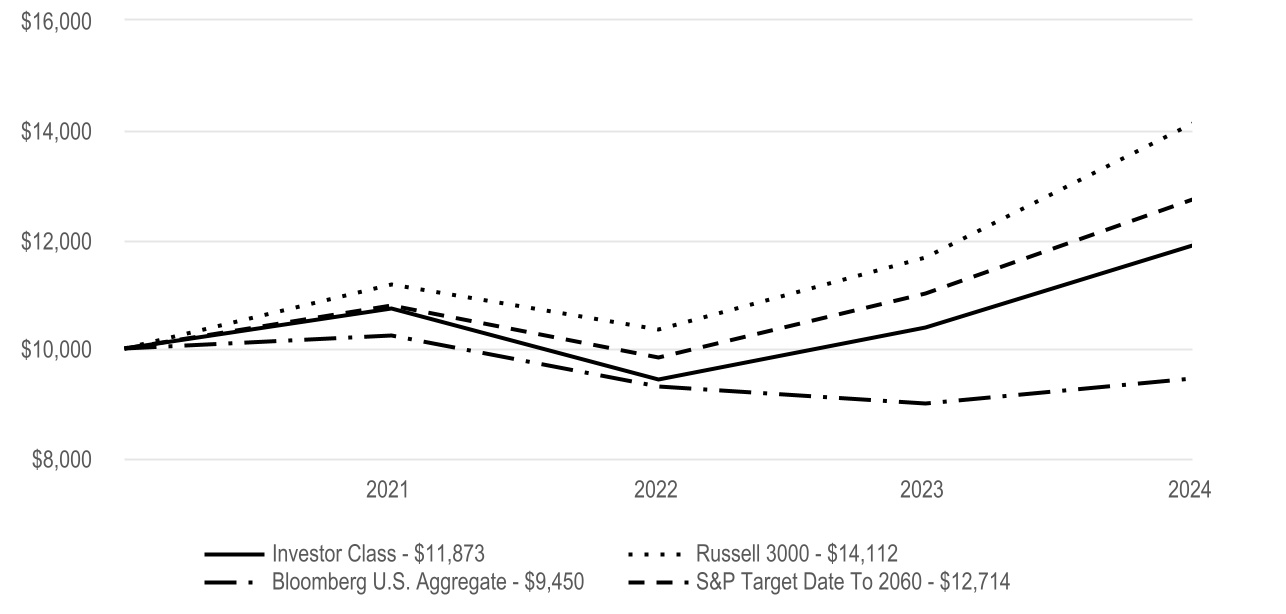

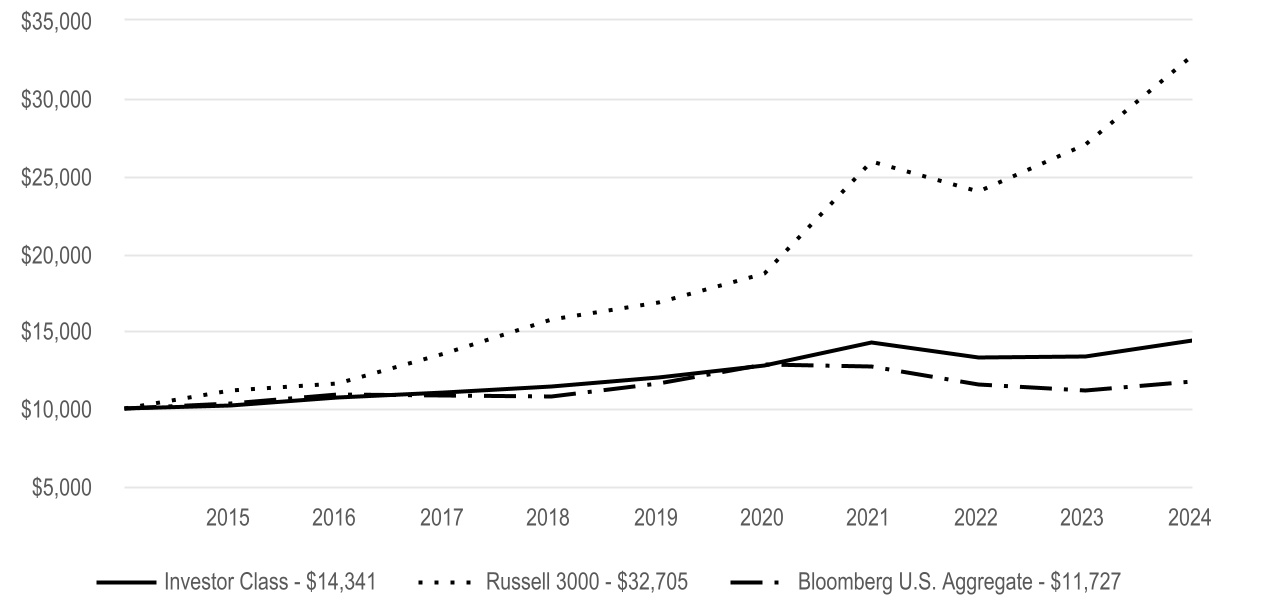

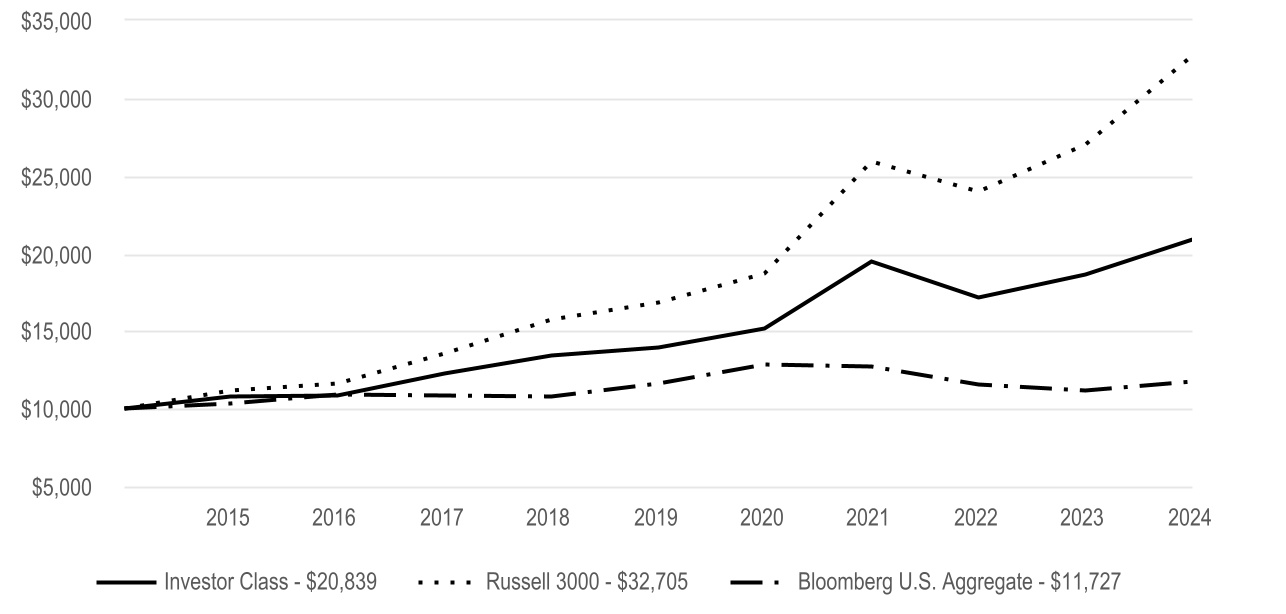

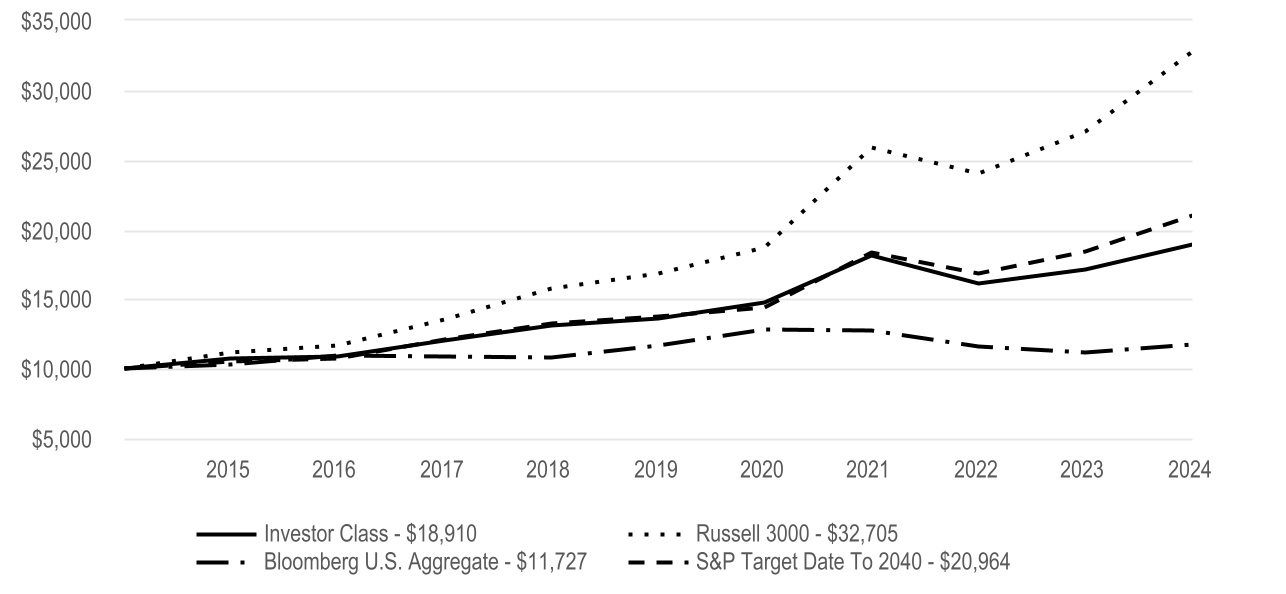

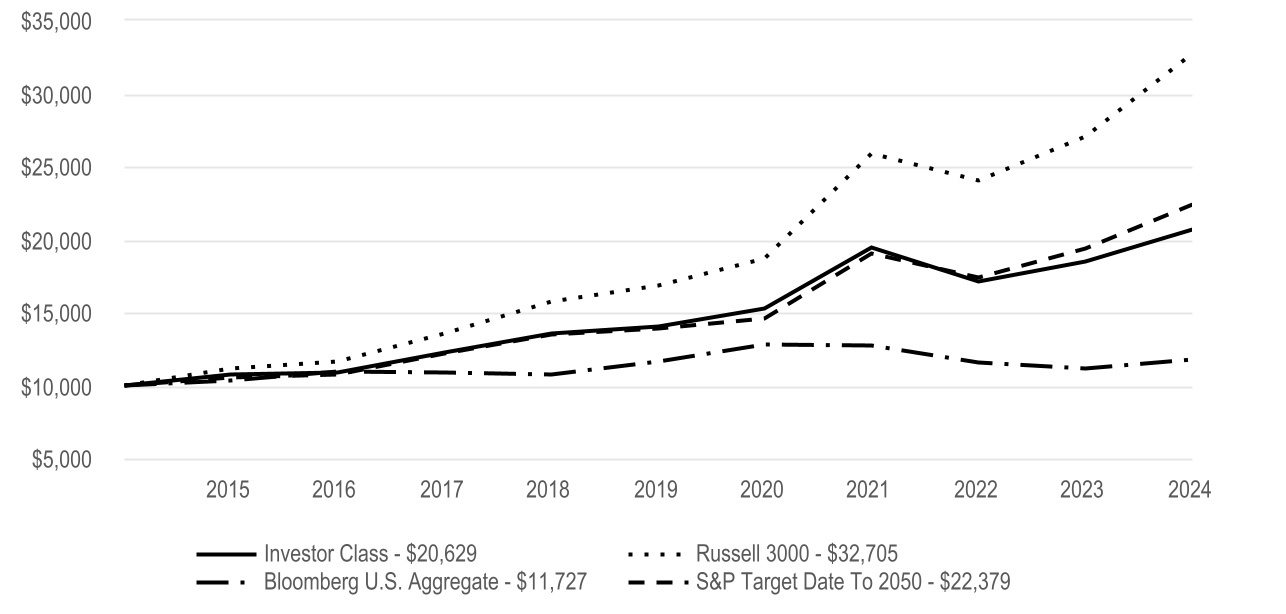

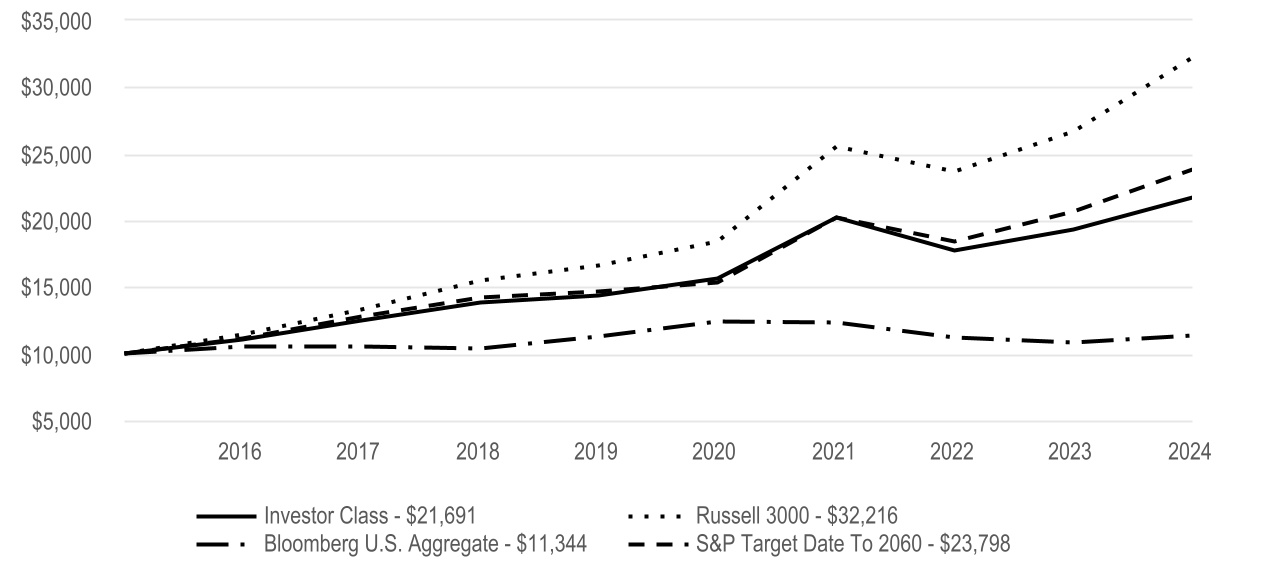

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| Investor Class | 9.37% | 2.44% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date To 2020 | 9.37% | 2.89% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $16,009,508 | ||||

| Management Fees (dollars paid during the reporting period) | $38,175 | ||||

| Portfolio Turnover Rate | 48 | % | |||

| Total Number of Portfolio Holdings | 21 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J748

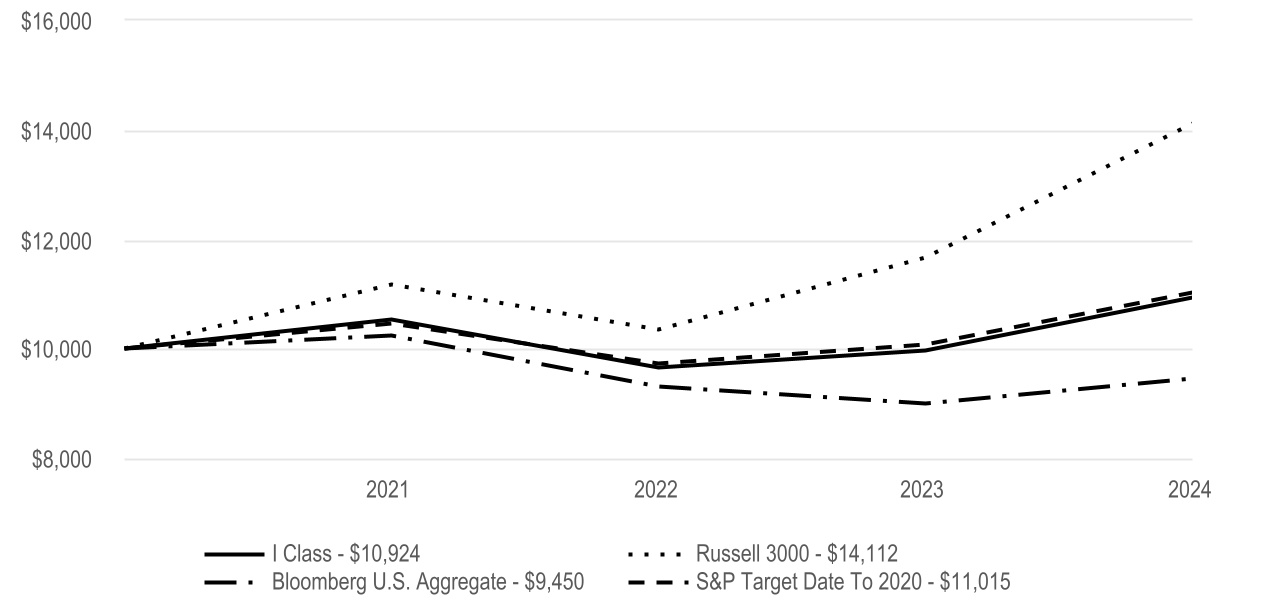

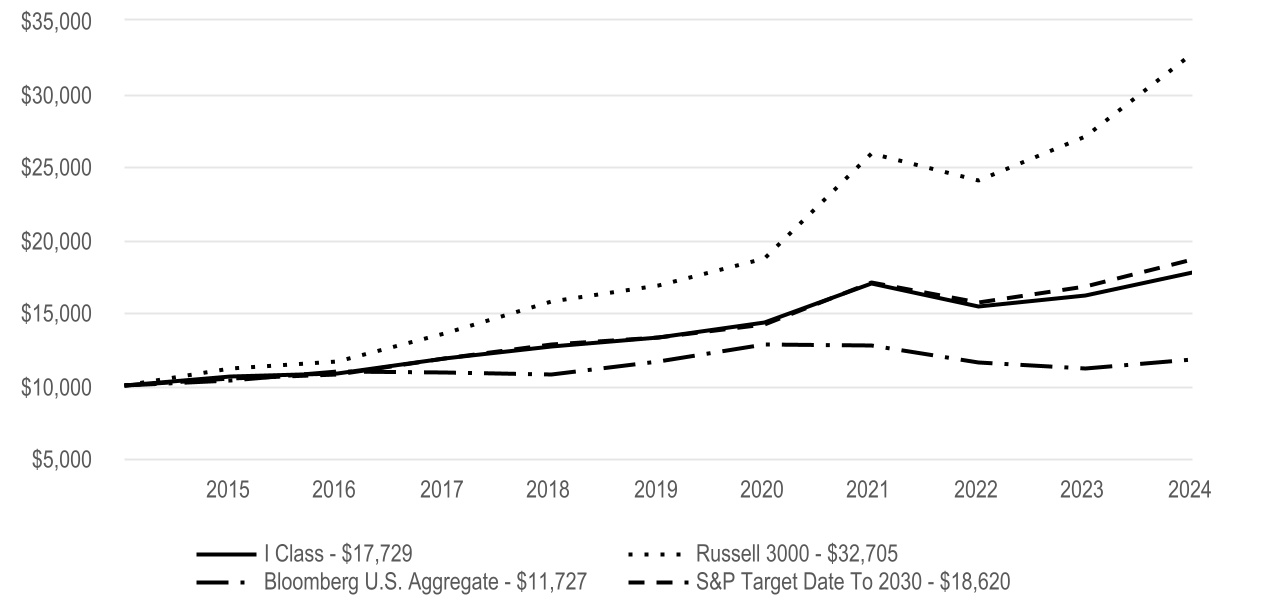

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2020 Portfolio

I Class (AAAOX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2020 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| I Class | $39 | 0.37% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2020 Portfolio I Class returned 9.70% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

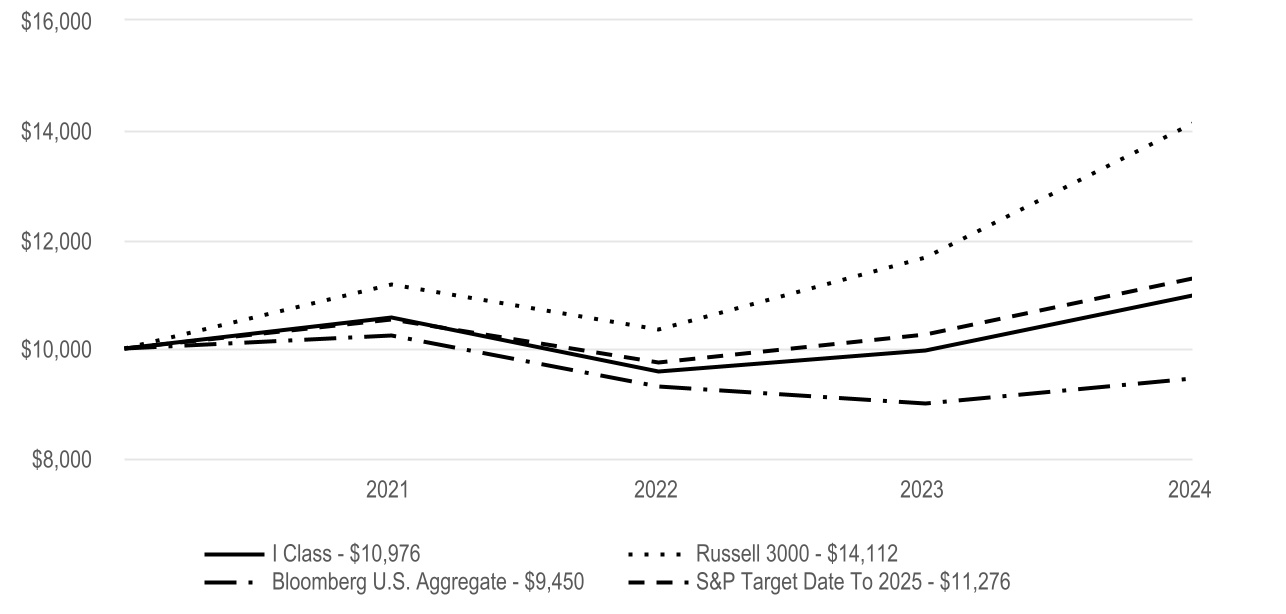

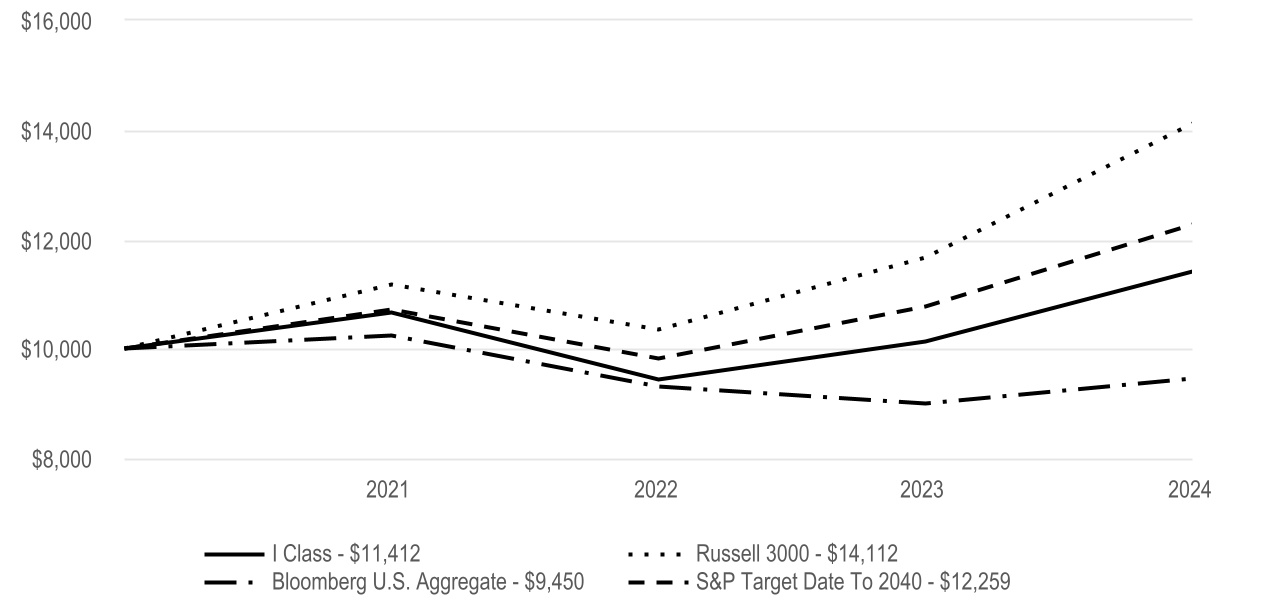

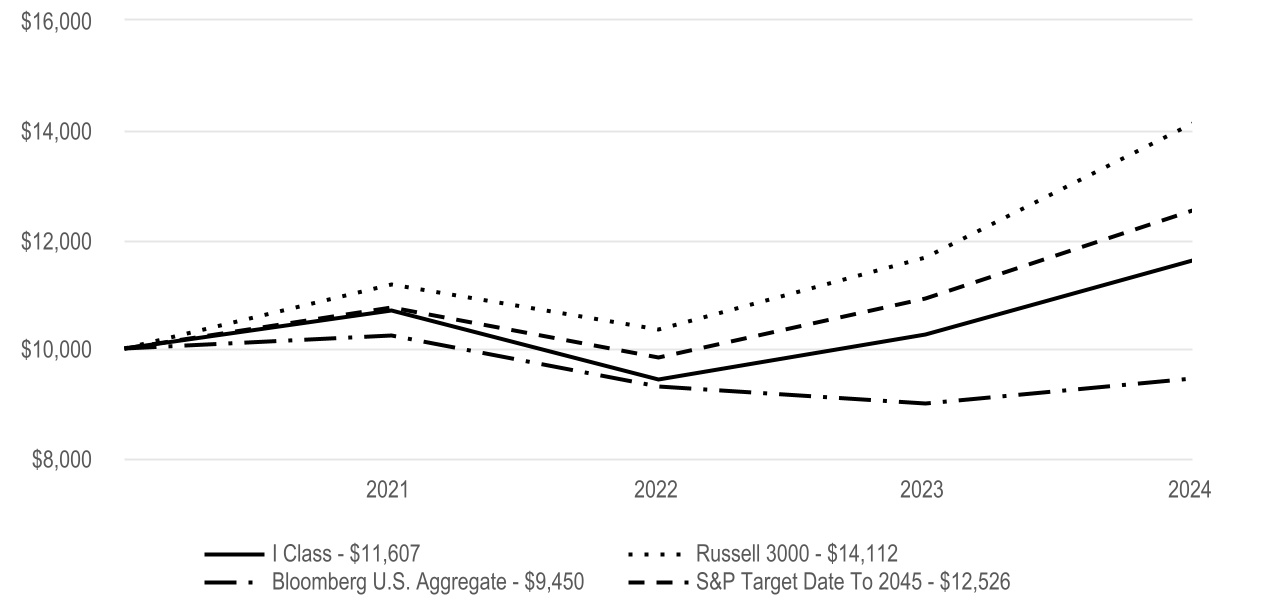

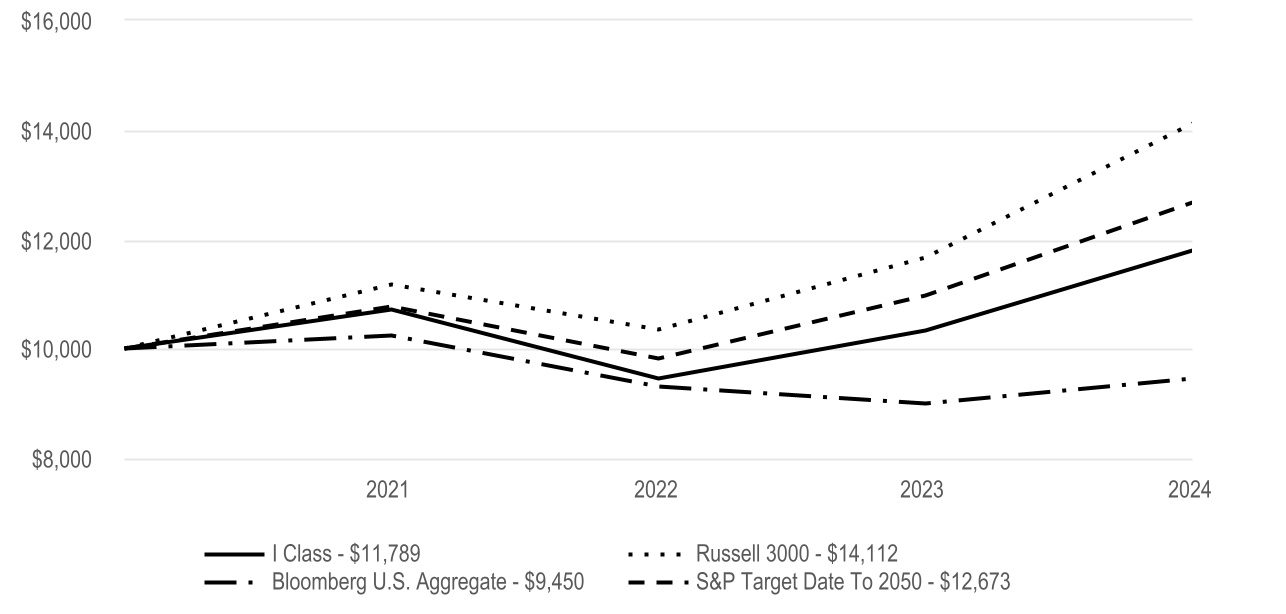

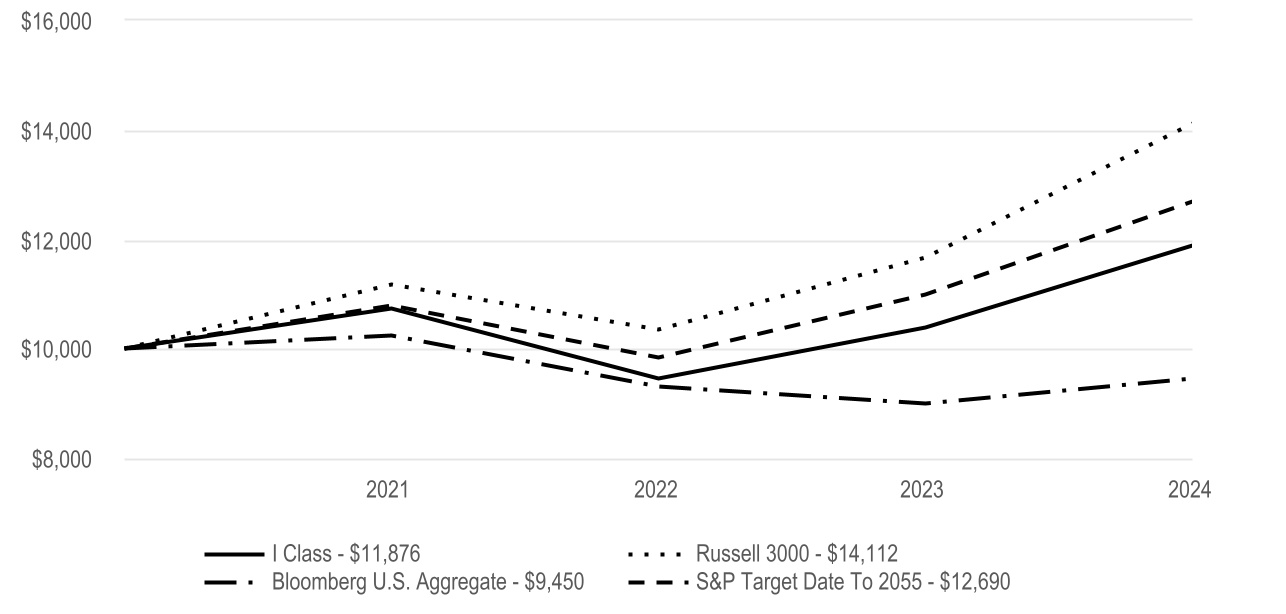

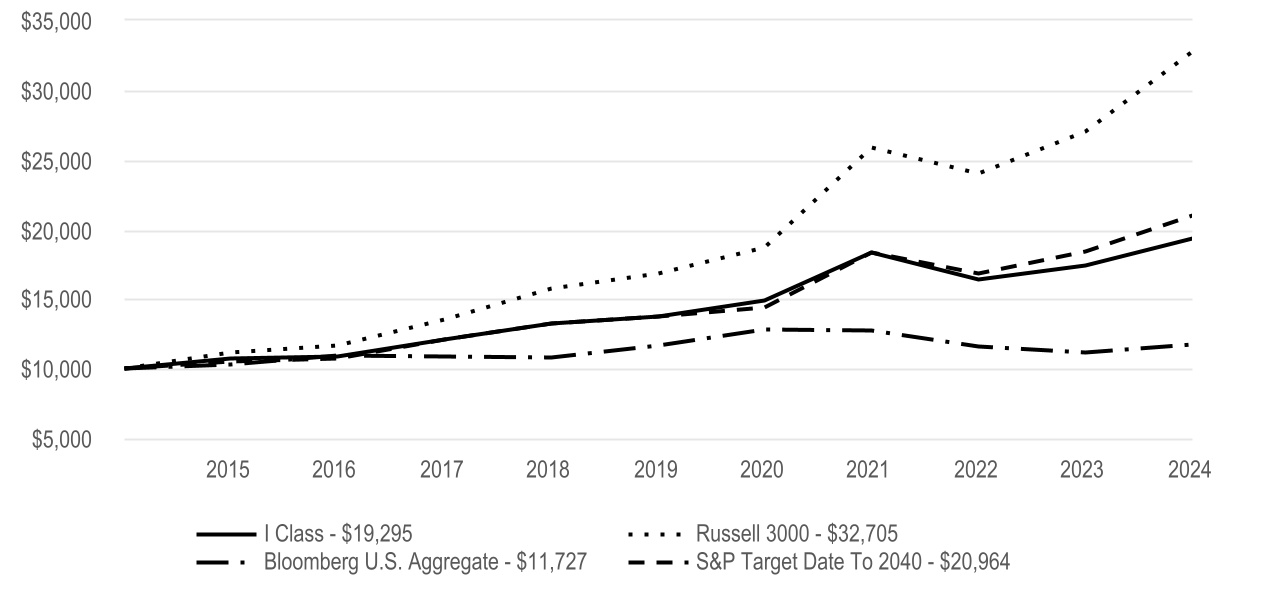

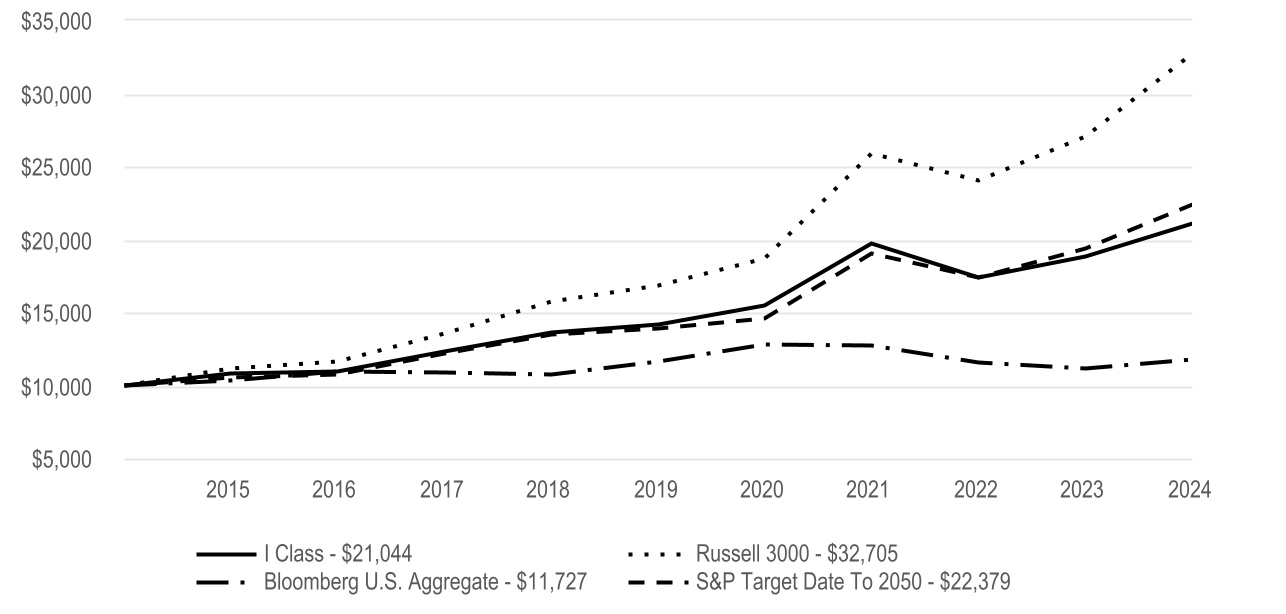

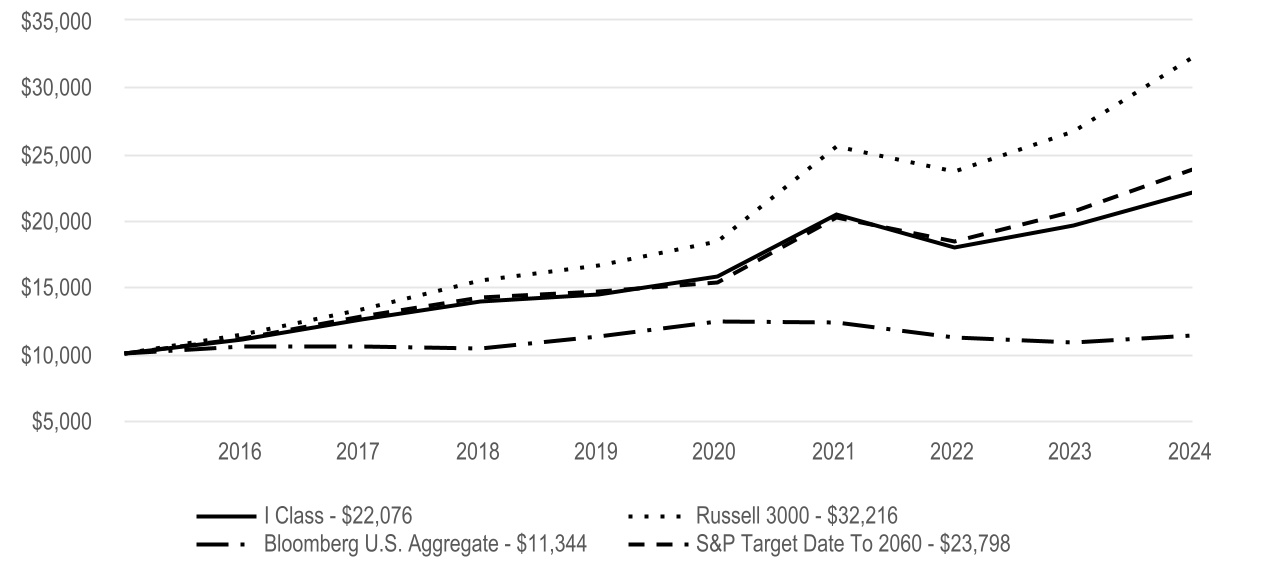

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| I Class | 9.70% | 2.64% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date To 2020 | 9.37% | 2.89% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $16,009,508 | ||||

| Management Fees (dollars paid during the reporting period) | $38,175 | ||||

| Portfolio Turnover Rate | 48 | % | |||

| Total Number of Portfolio Holdings | 21 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J730

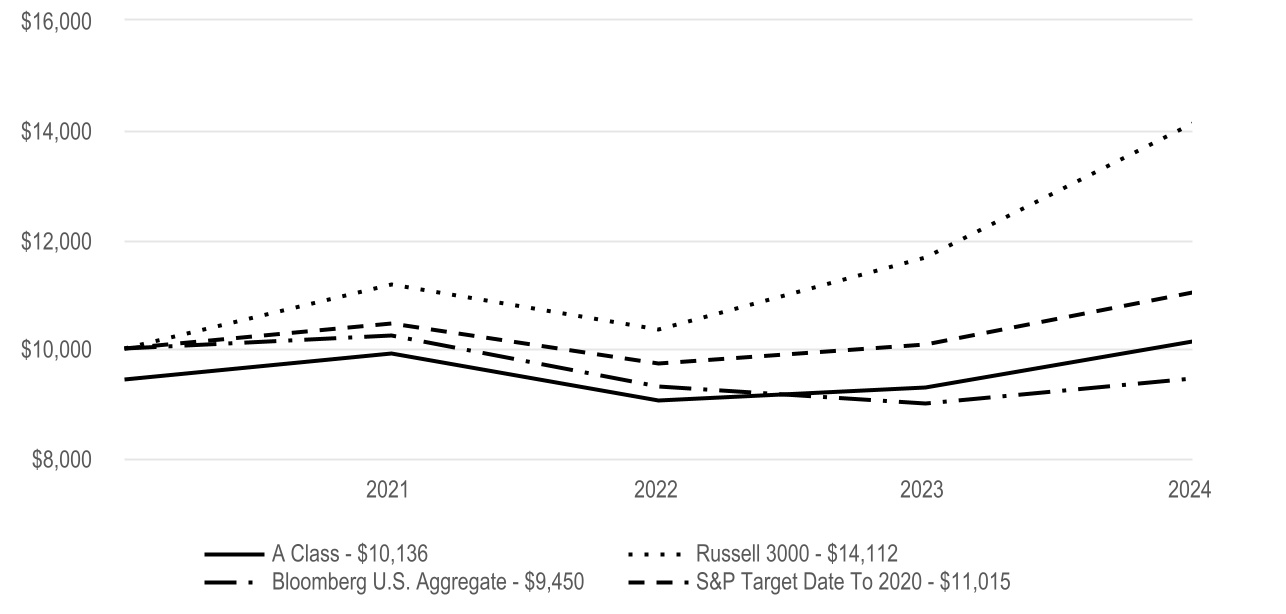

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2020 Portfolio

A Class (AABEX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2020 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| A Class | $86 | 0.82% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2020 Portfolio A Class returned 9.11% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

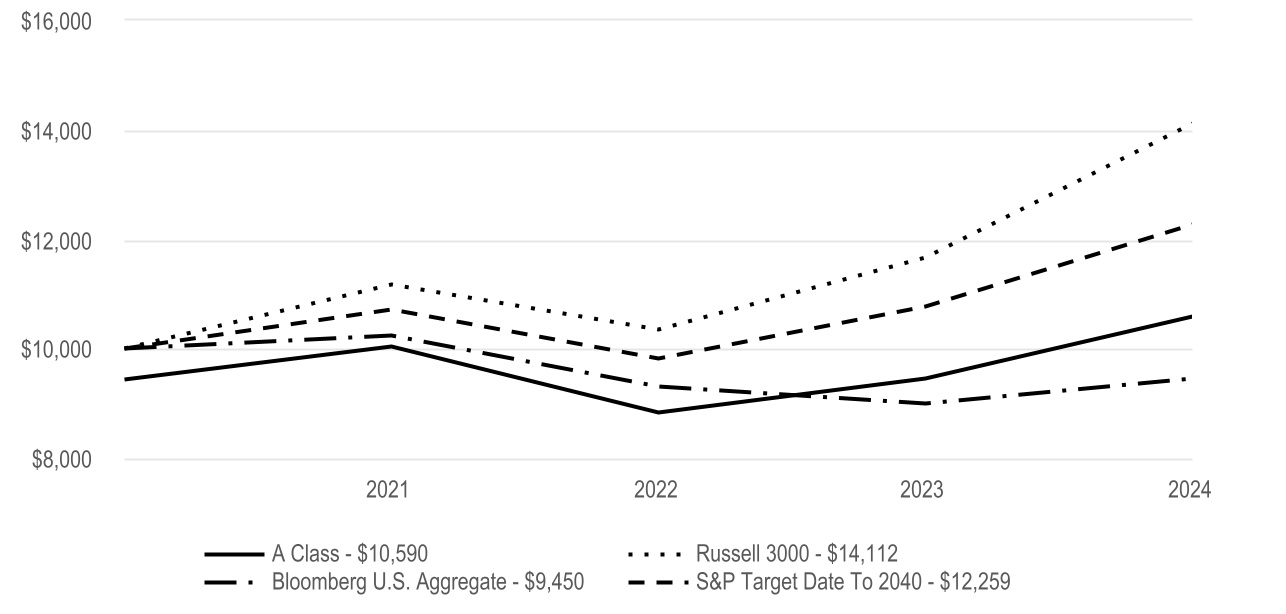

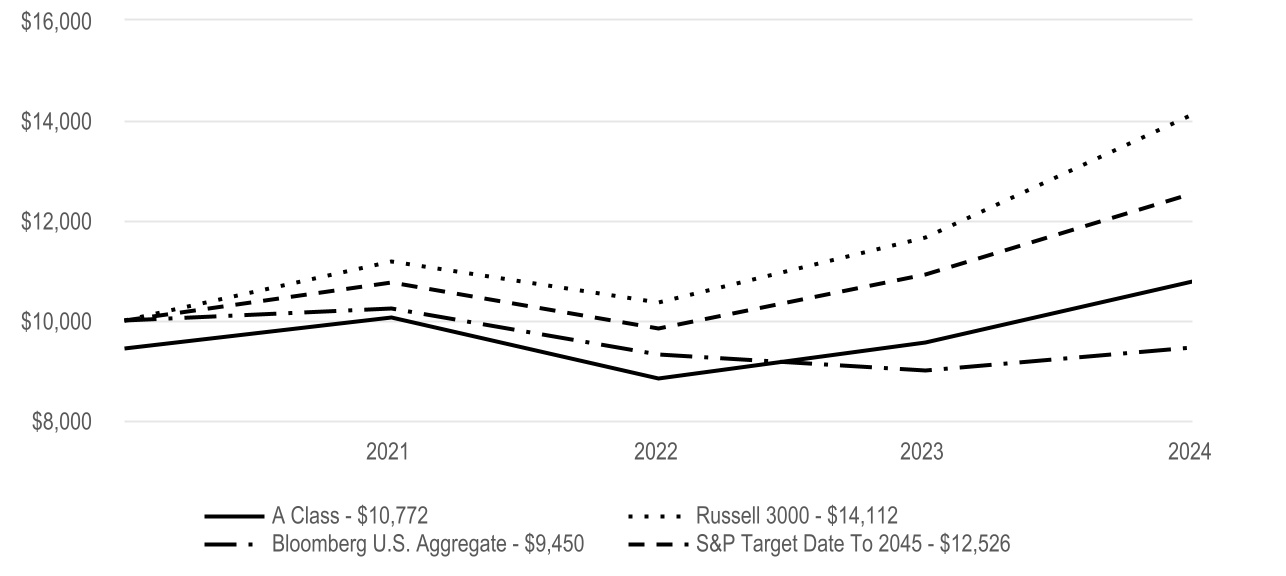

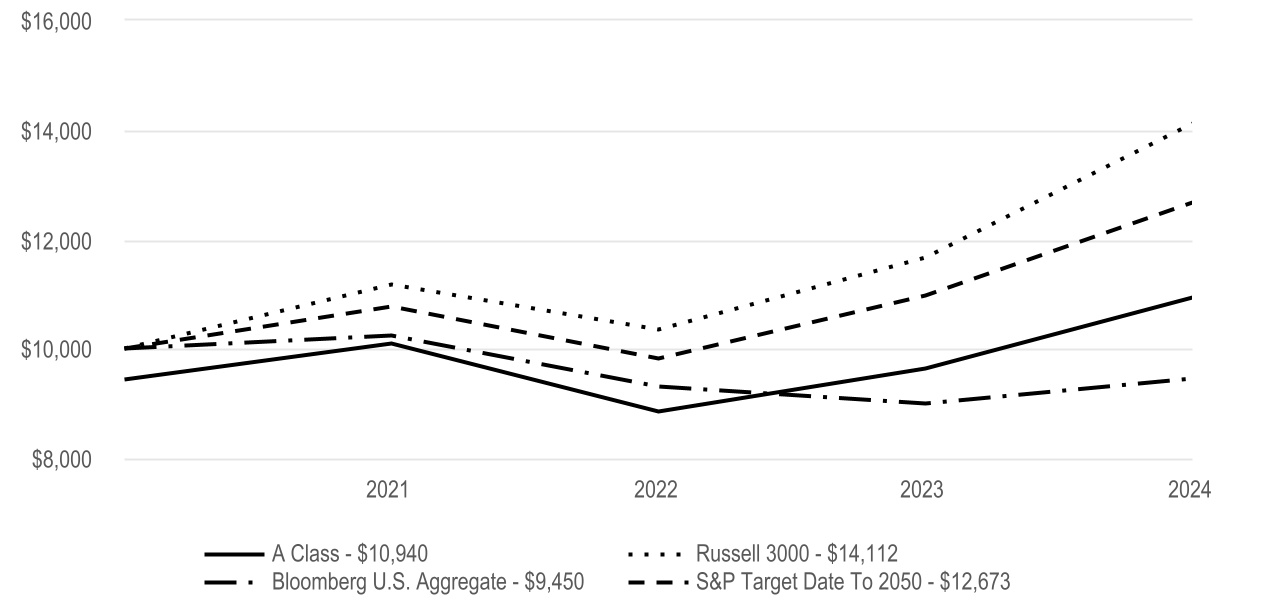

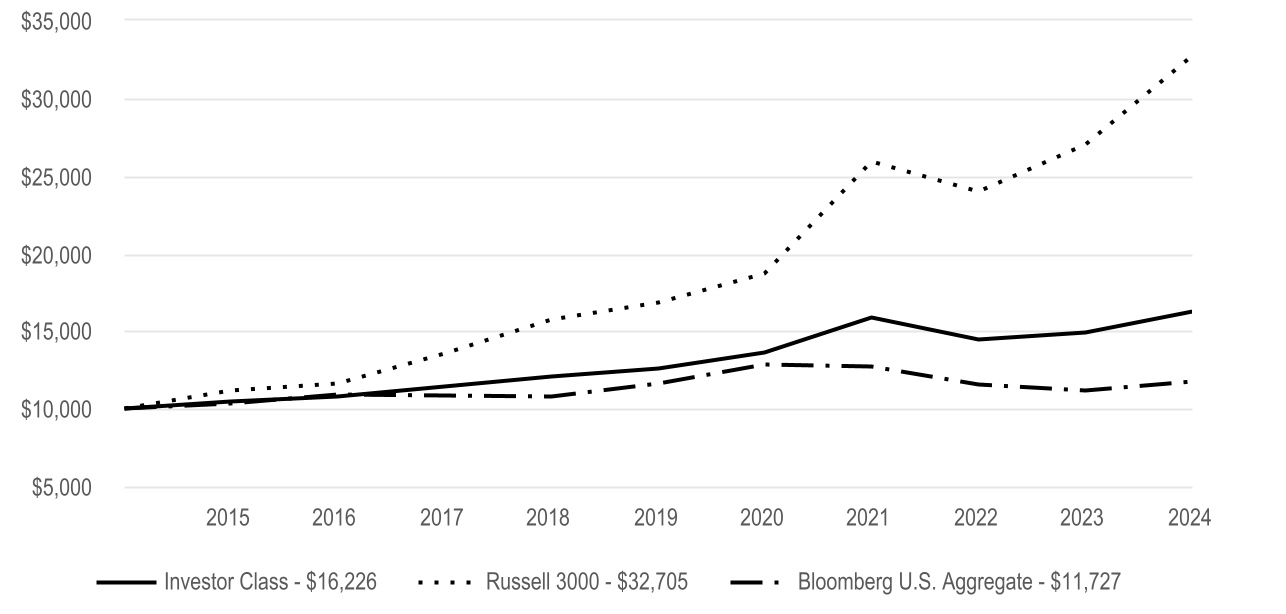

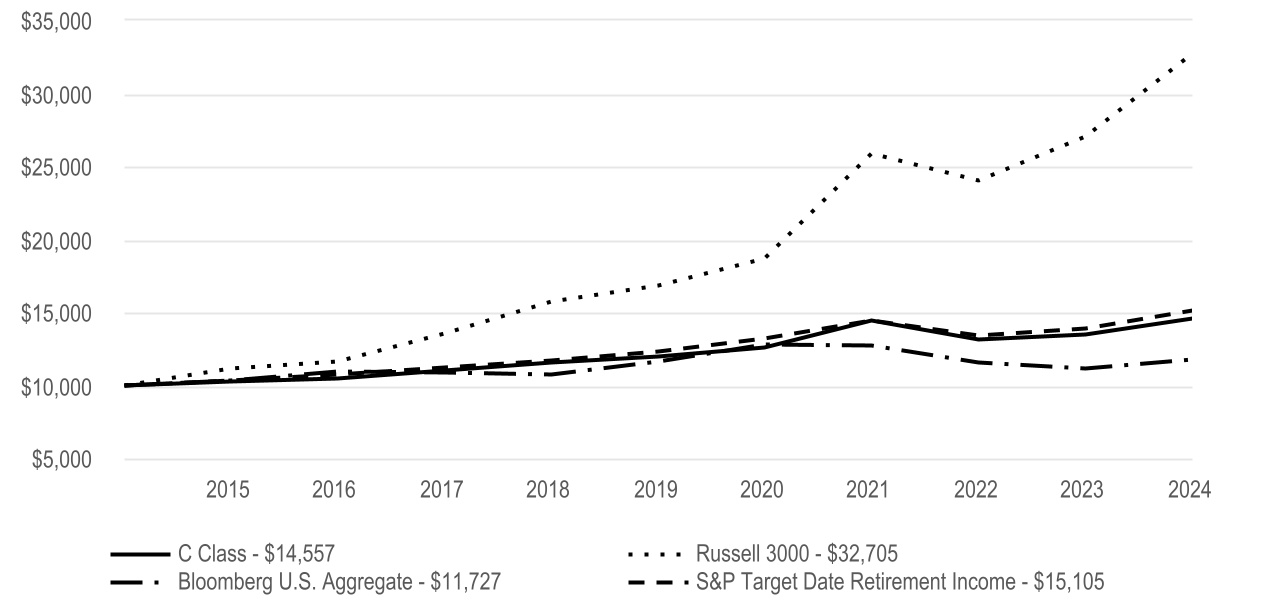

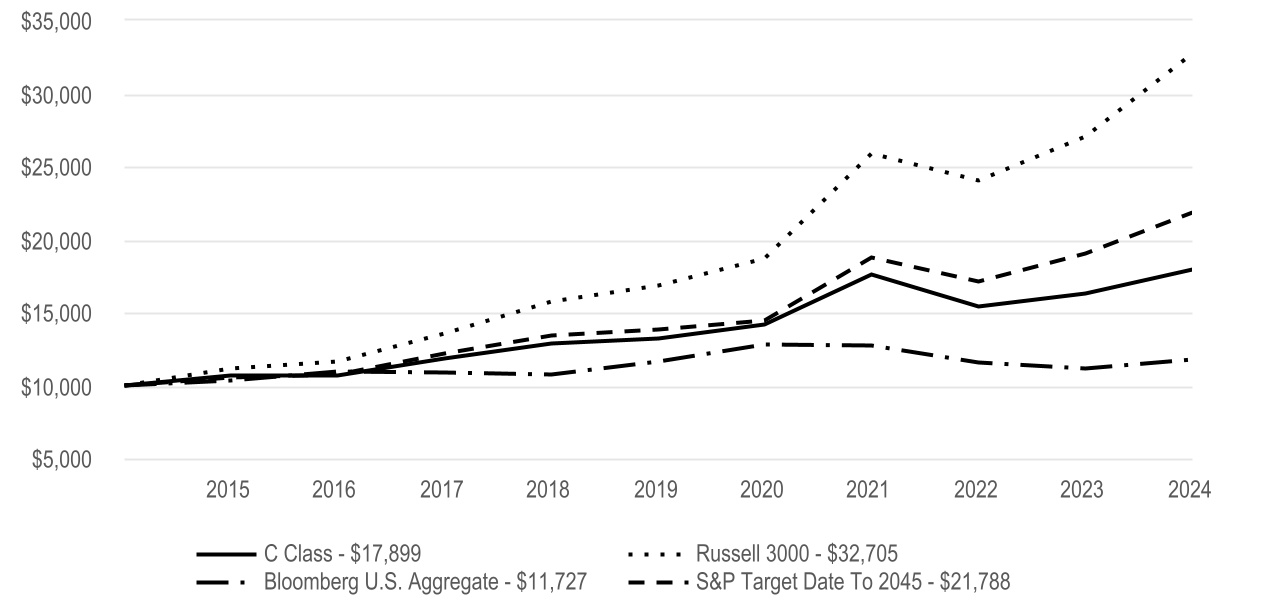

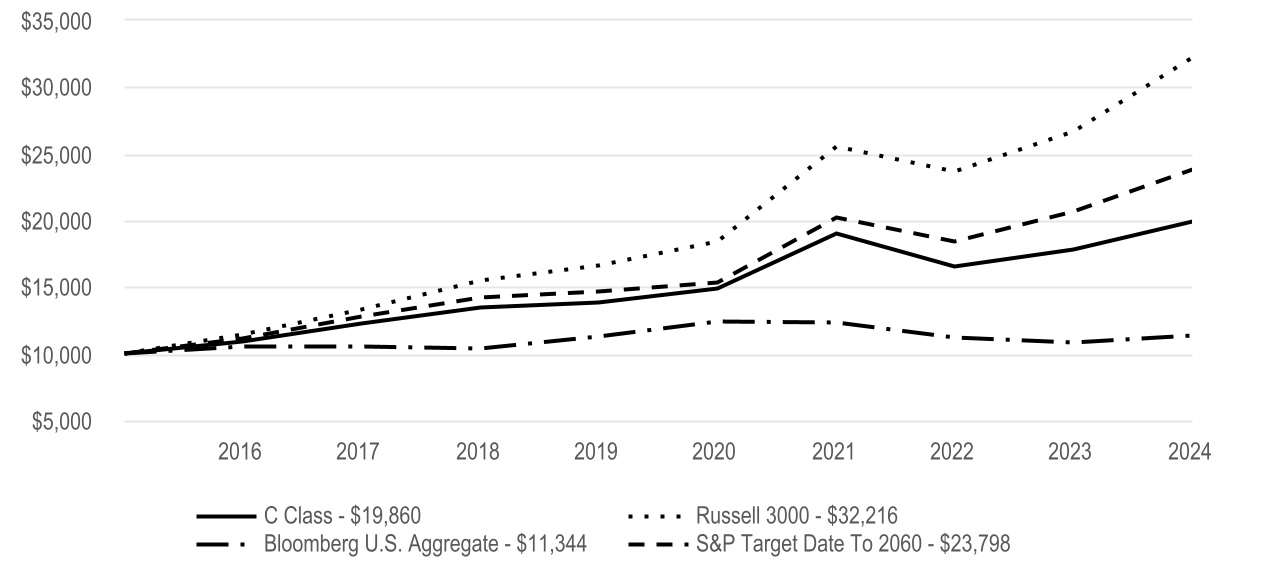

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

| The initial investment is adjusted to reflect the maximum initial sales charge. | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| A Class | 9.11% | 2.16% | 3/10/21 | |||||||||||||||||

| A Class - with sales charge | 2.84% | 0.40% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date To 2020 | 9.37% | 2.89% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum contingent deferred sales charge of 1.00%. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $16,009,508 | ||||

| Management Fees (dollars paid during the reporting period) | $38,175 | ||||

| Portfolio Turnover Rate | 48 | % | |||

| Total Number of Portfolio Holdings | 21 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Equity Funds | 29.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Fixed Income Funds | 13.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Equity Funds | 10.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets and Liabilities | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. | ||

| American Century Investment Services, Inc., Distributor | ||

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. | ||

A-2507J722

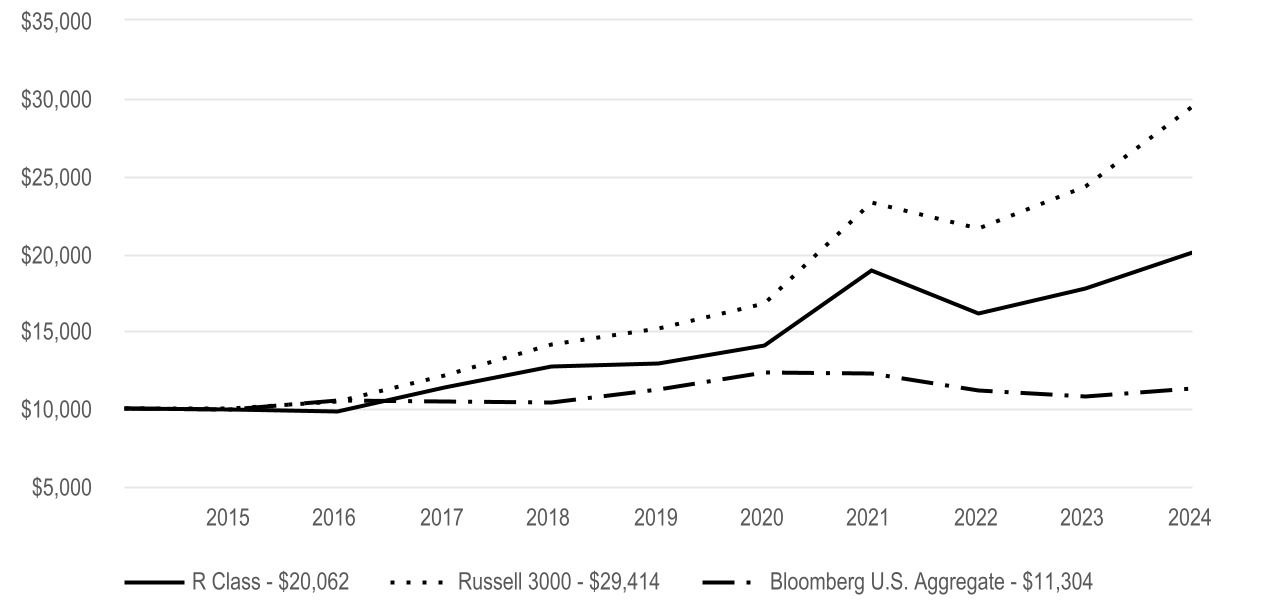

ANNUAL SHAREHOLDER REPORT

One Choice Blend+ 2020 Portfolio

R Class (AABGX) | July 31, 2024 | ||||

This annual shareholder report contains important information about One Choice Blend+ 2020 Portfolio for the period of August 1, 2023 to July 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) | ||||||||

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |||||||

| R Class | $112 | 1.07% | ||||||

| What were the key factors that affected the fund’s performance? | |||||

One Choice Blend+ 2020 Portfolio R Class returned 8.85% for the reporting period ended July 31, 2024. | |||||

| The fund seeks the highest total return consistent with its asset mix. The date in the fund name is the approximate year investors plan to retire, and the asset mix becomes more conservative as the target date approaches. See the Fund Holdings for the portfolio's asset weights. Below, we discuss the factors that affected these asset classes. | |||||

| • | Investments in domestic equities contributed to performance. Despite inflation worries and high interest rates, U.S. stocks performed well as a much-anticipated recession failed to arrive. Investors favored stocks benefiting from heavy investment in artificial intelligence-related chips and technologies. Stocks gave back some gains in July, however, amid concerns about slowing economic conditions. | ||||

| • | The portfolio's non-U.S. equity holdings rose by a smaller amount than U.S. large-cap stocks. The performance disparity can be explained by differences in actual and expected earnings growth—earnings by companies outside the U.S. fell at a faster rate in 2023 and are expected to recover more slowly in 2024 and 2025 than are those of U.S. companies, according to data provider FactSet. | ||||

| • | The portfolio's domestic fixed-income holdings contributed to performance. Bond yields were volatile amid changing perceptions of the economy and inflation. The benchmark 10-year Treasury yield started and ended the period at around 4% but went as high as 5% and as low as 3.8%. Reflecting the rally in stocks and strength in corporate earnings, corporate bonds performed well. | ||||

| • | Non-U.S. fixed-income investments produced gains. Bond prices generally rose and yields fell as manufacturing activity in several developed economies slowed, while inflation concerns eased. That allowed the European Central Bank to cut interest rates. The Bank of Japan, however, raised rates to support its currency and fight imported inflation despite signs of economic weakness. | ||||

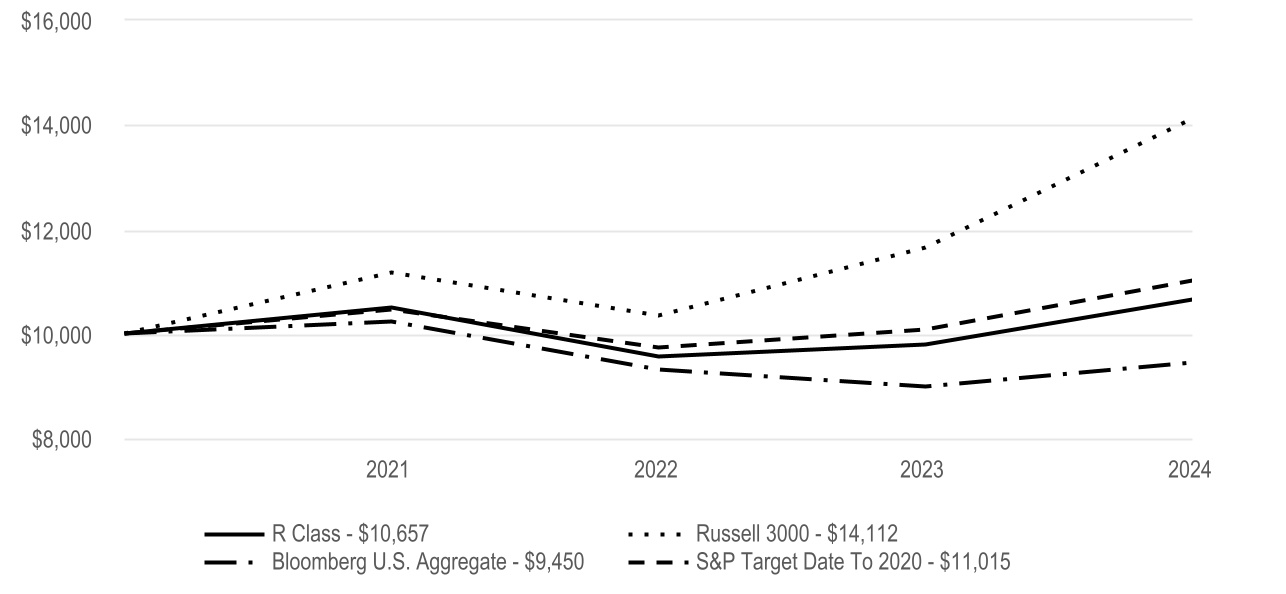

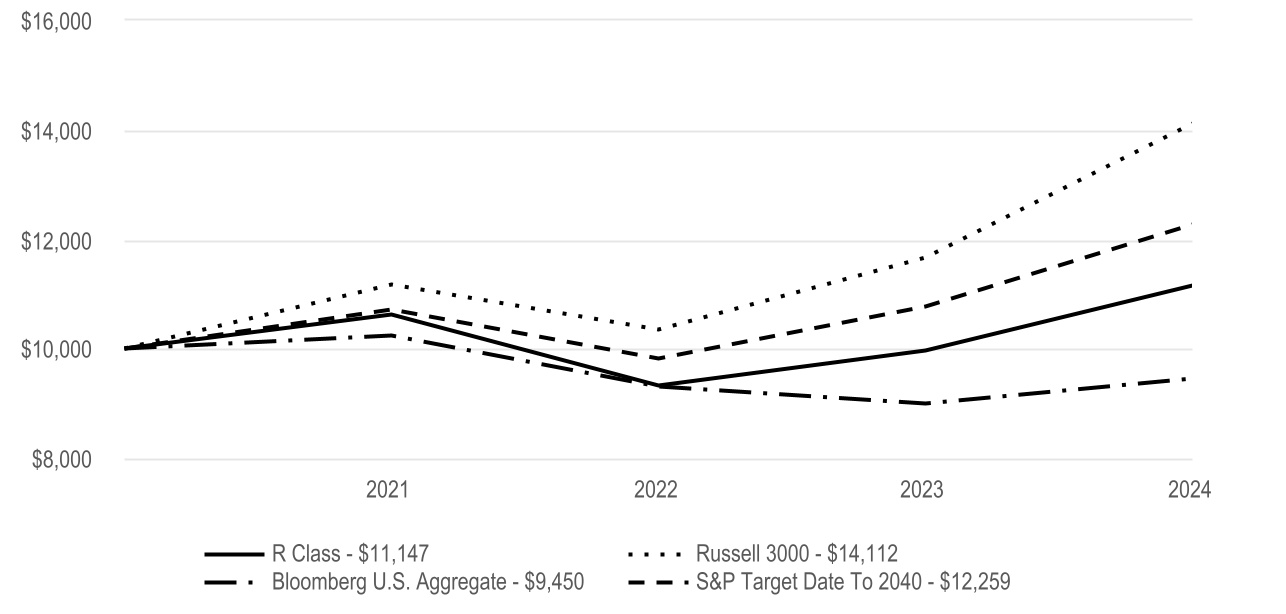

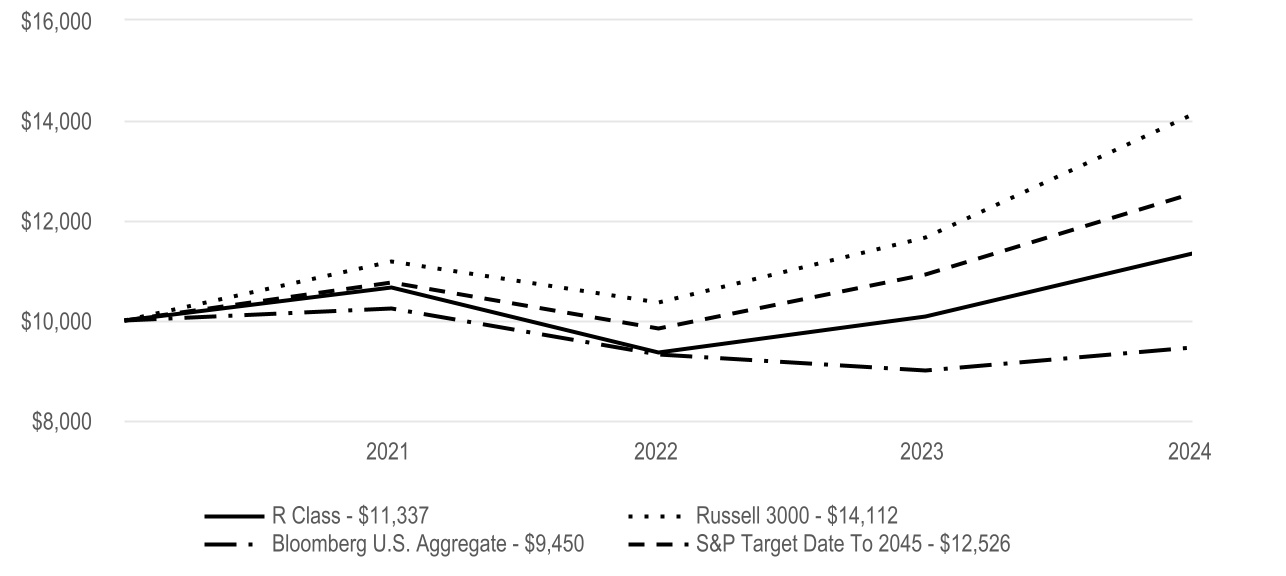

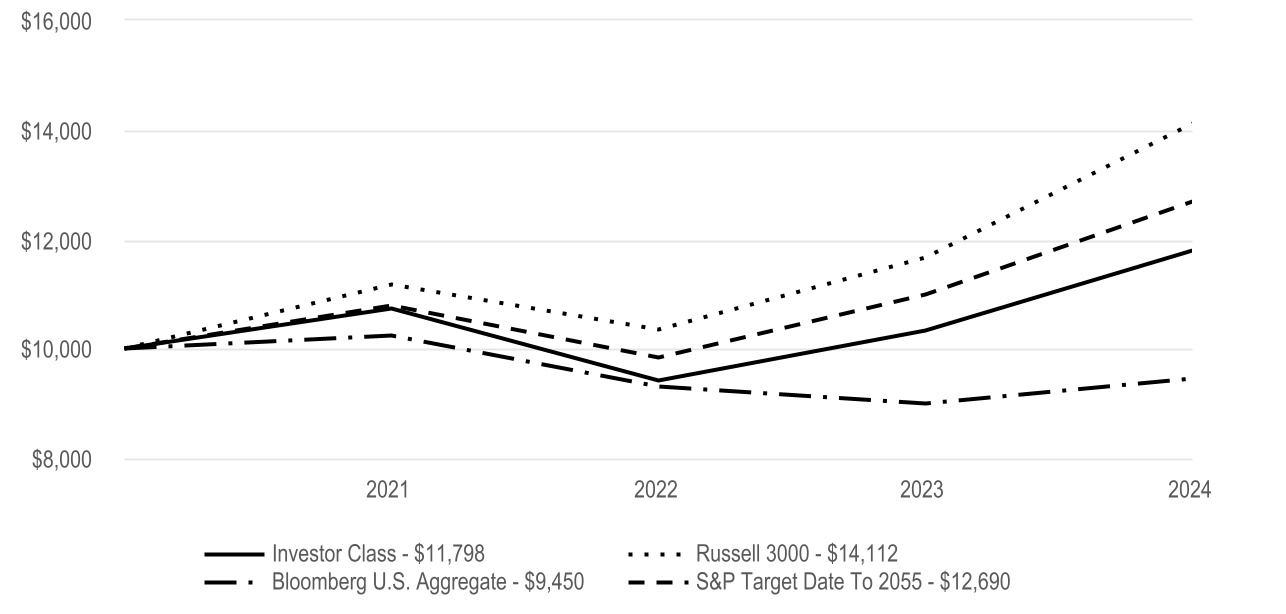

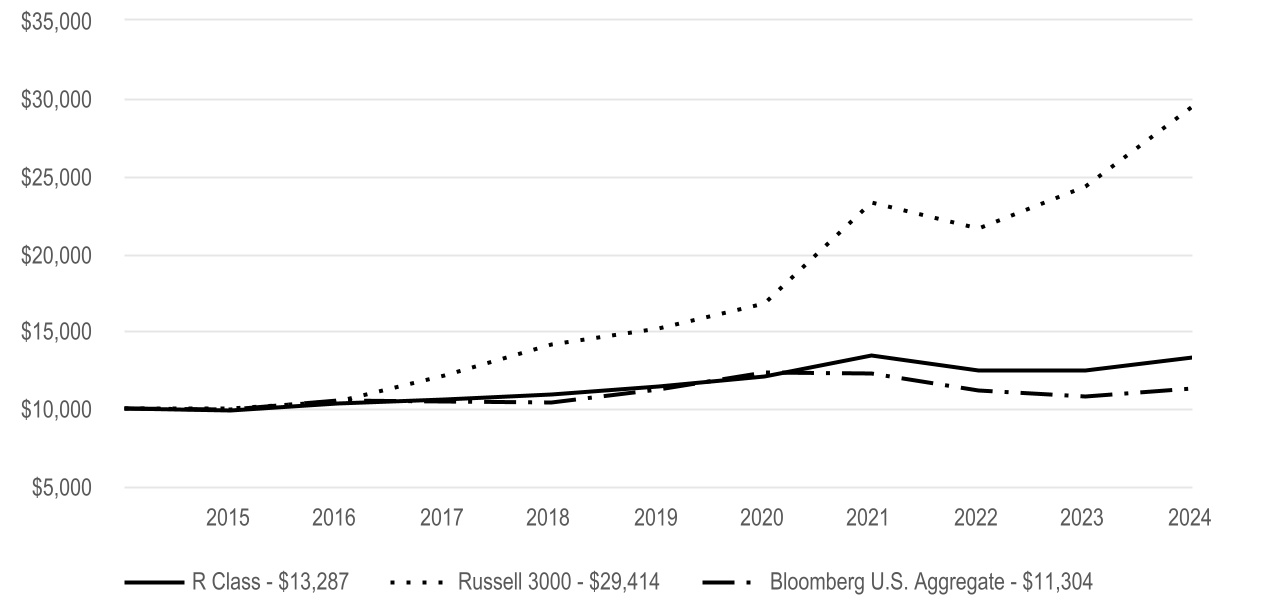

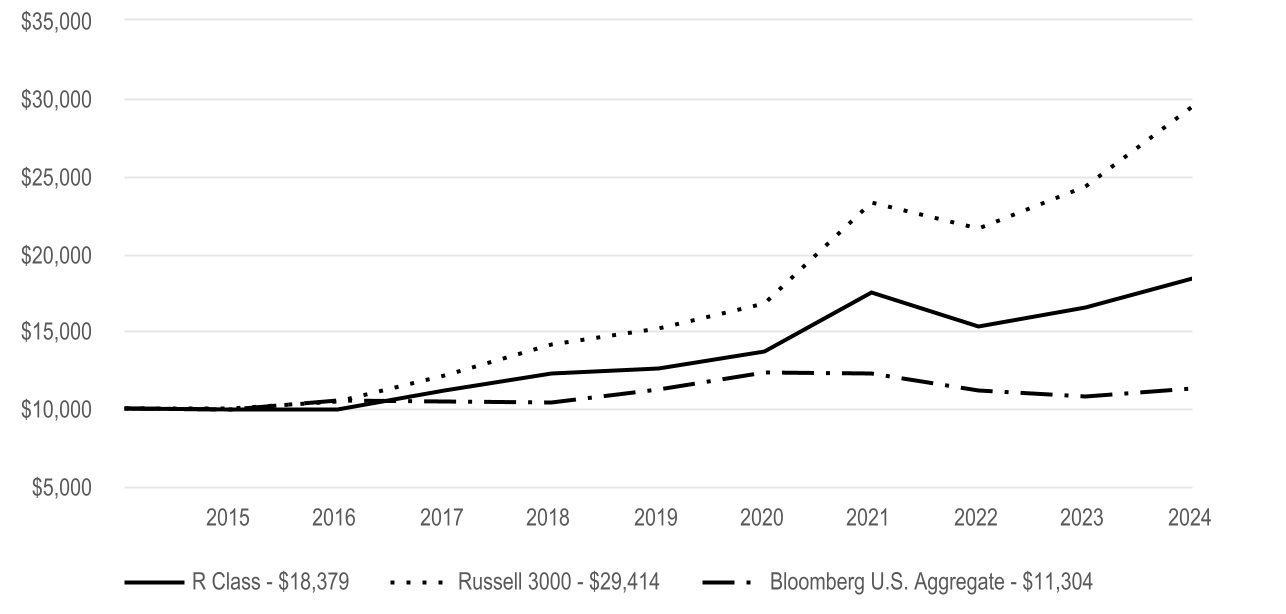

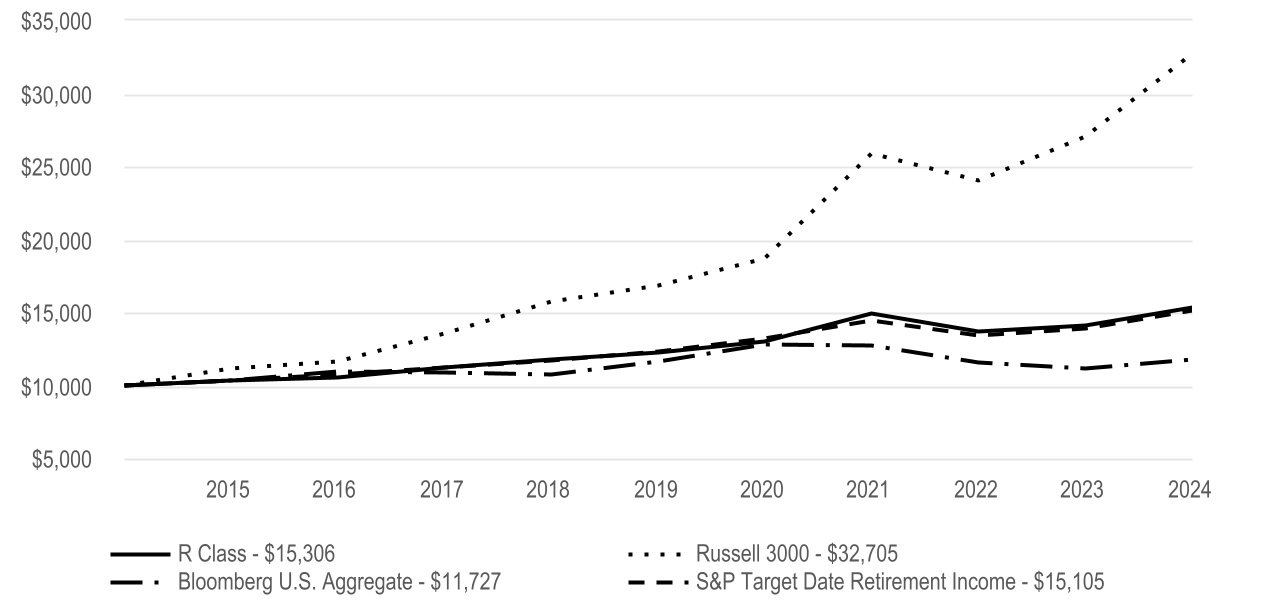

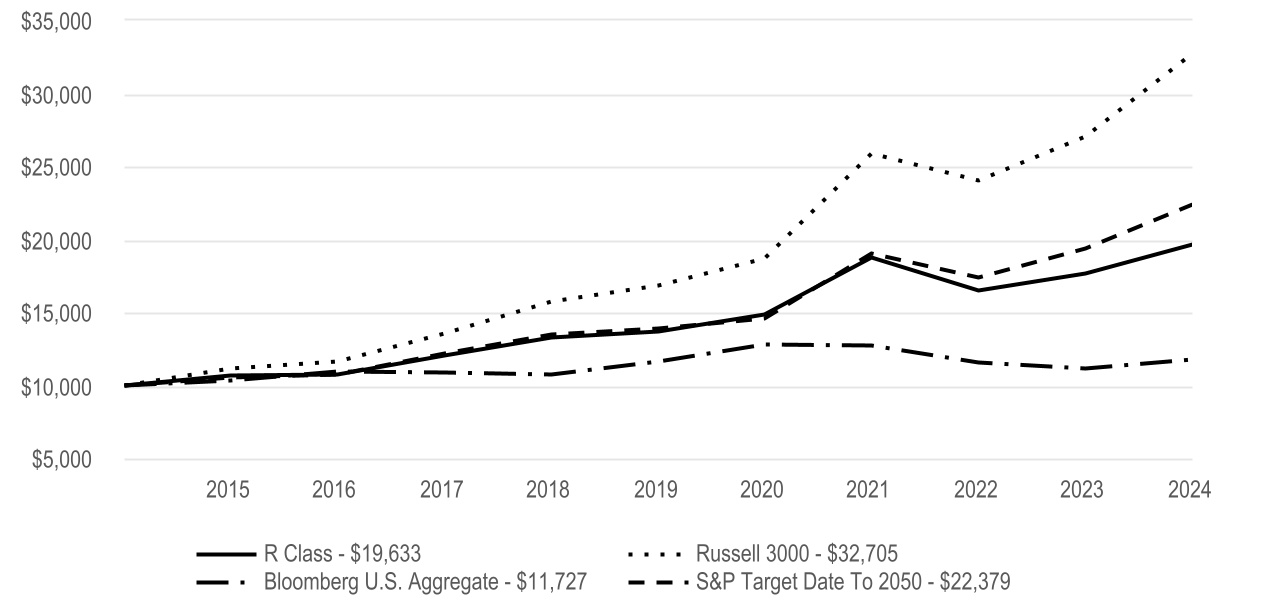

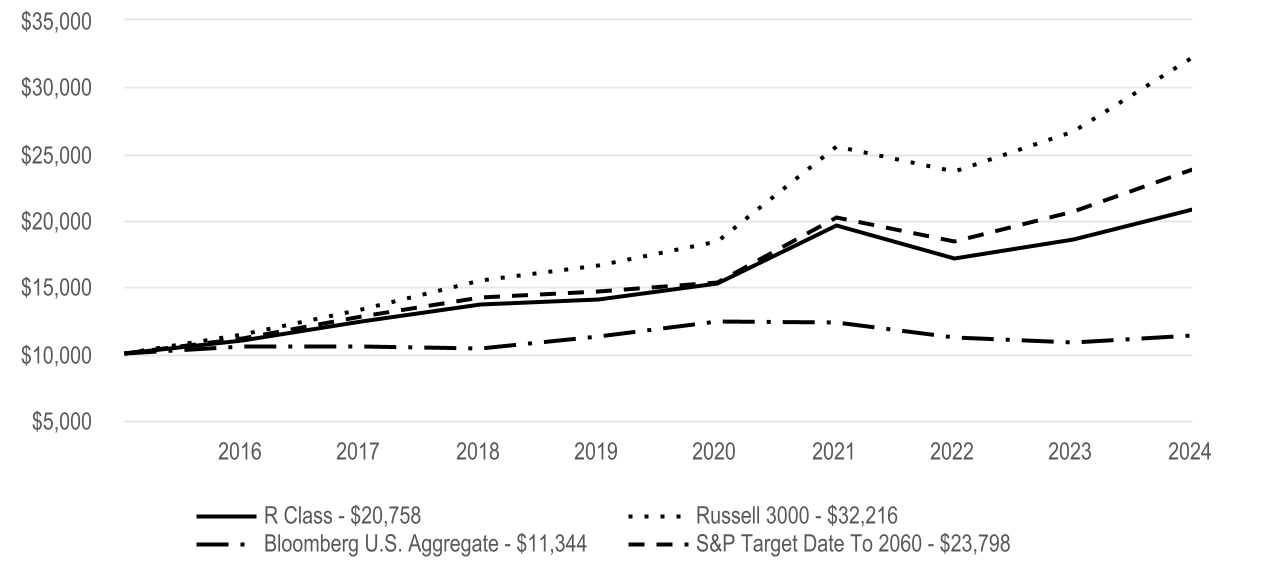

Cumulative Performance (based on an initial $10,000 investment) | ||

| March 10, 2021, through July 31, 2024 | ||

Average Annual Total Returns | ||||||||||||||||||||

| 1 Year | Since Inception | Inception Date | ||||||||||||||||||

| R Class | 8.85% | 1.89% | 3/10/21 | |||||||||||||||||

| Regulatory Index | ||||||||||||||||||||

| Russell 3000 | 21.07% | 10.68% | — | |||||||||||||||||

| Bloomberg U.S. Aggregate | 5.10% | -1.65% | — | |||||||||||||||||

| Performance Index | ||||||||||||||||||||

| S&P Target Date To 2020 | 9.37% | 2.89% | — | |||||||||||||||||

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. | |||||||||||||||||

| A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. | ||

| The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information. | ||

Fund Statistics | |||||

| Net Assets | $16,009,508 | ||||

| Management Fees (dollars paid during the reporting period) | $38,175 | ||||

| Portfolio Turnover Rate | 48 | % | |||

| Total Number of Portfolio Holdings | 21 | ||||

| Fund Holdings | ||

Types of Investments in Portfolio (as a % of net assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Domestic Fixed Income Funds | 46.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||