RAND LOGISTICS, INC.

| | RAND LOGISTICS, INC 500 FIFTH AVENUE 50TH FLOOR NEW YORK, NEW YORK 10110 Telephone: (212) 644-3450 Facsimile: (212) 644-6262 |

September 3, 2014

Dear Fellow Stockholders:

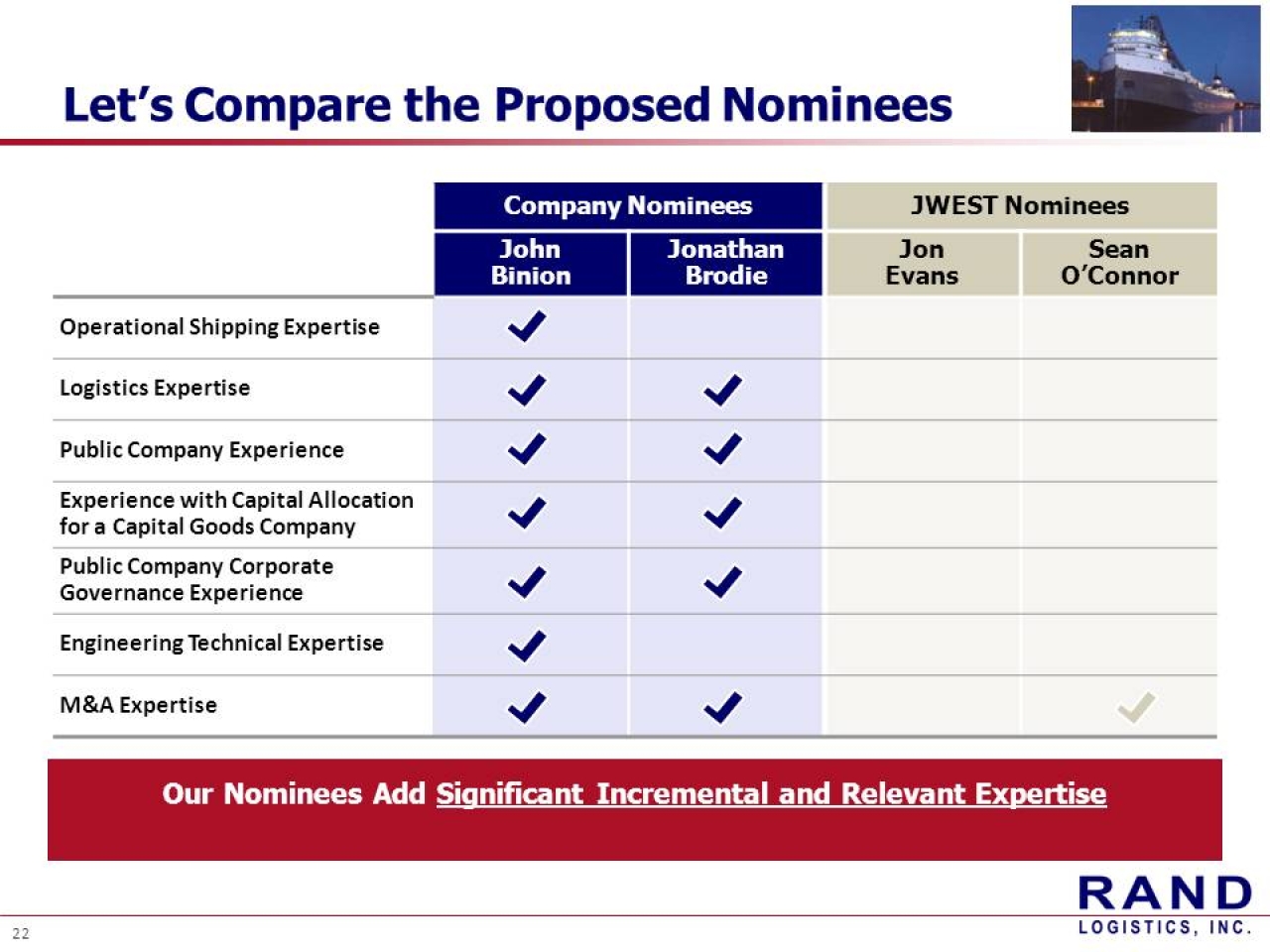

At Rand’s Annual Meeting of Stockholders on September 23, 2014, you will be asked to make an important decision regarding your Company’s future and the value of your shareholdings. A dissident stockholder of the Company has nominated two individuals – both of whom have no shipping, logistics or public company board experience – to stand for election as directors against your Board’s nominees, John Binion and Jonathan Brodie, each of whom is highly qualified and experienced in our line of business. The proponent of these nominations, JWest, LLC, a stock trading firm, makes specious arguments, at best, to support its nominations. We urge you to focus on the facts presented by your committed and professional management team and Board rather than the misdirection and speculative innuendo of a professional stock trading firm that has no experience or expertise in the maritime industry.

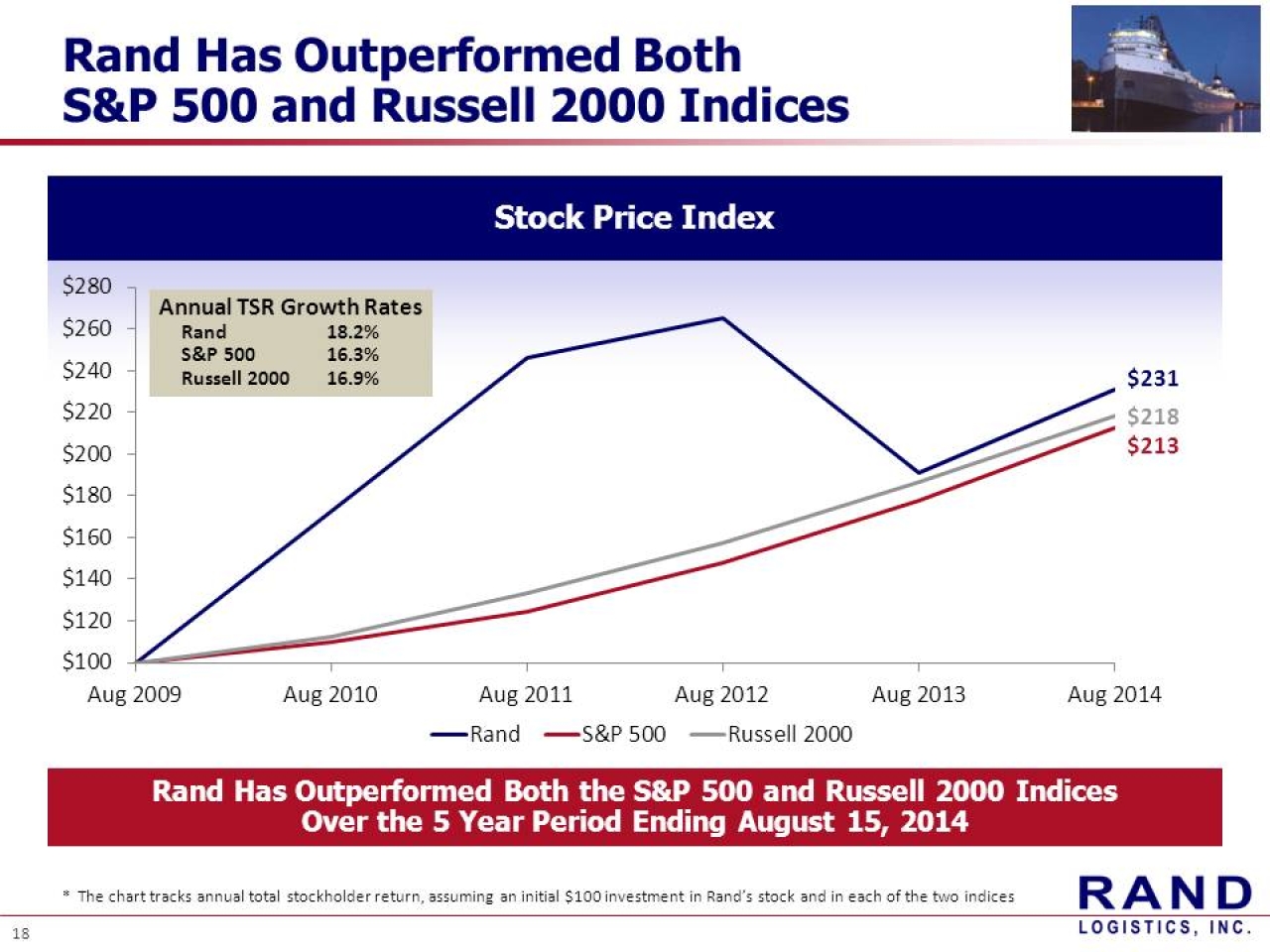

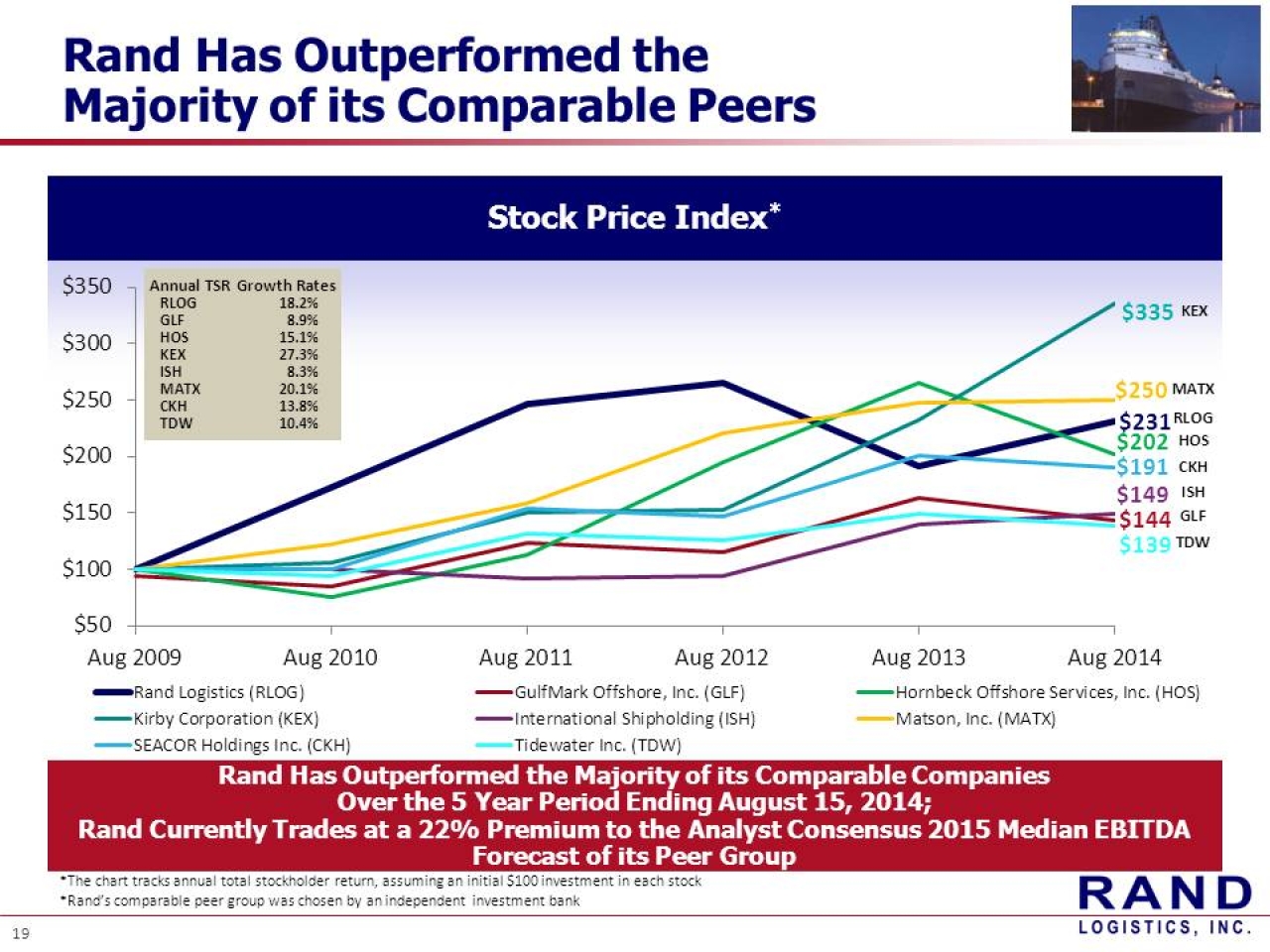

We are at a critical juncture in the growth of our Company, and a disruption in our leadership would prove an unfortunate and unnecessary hindrance to our continued success. Since our inception as a public company, our Board and management have sought to position Rand as a leading bulk freight transportation provider on the Great Lakes. We have made significant strides towards accomplishing this objective, and believe that Rand and its stockholders are positioned to enjoy the benefits of these value-creation efforts.

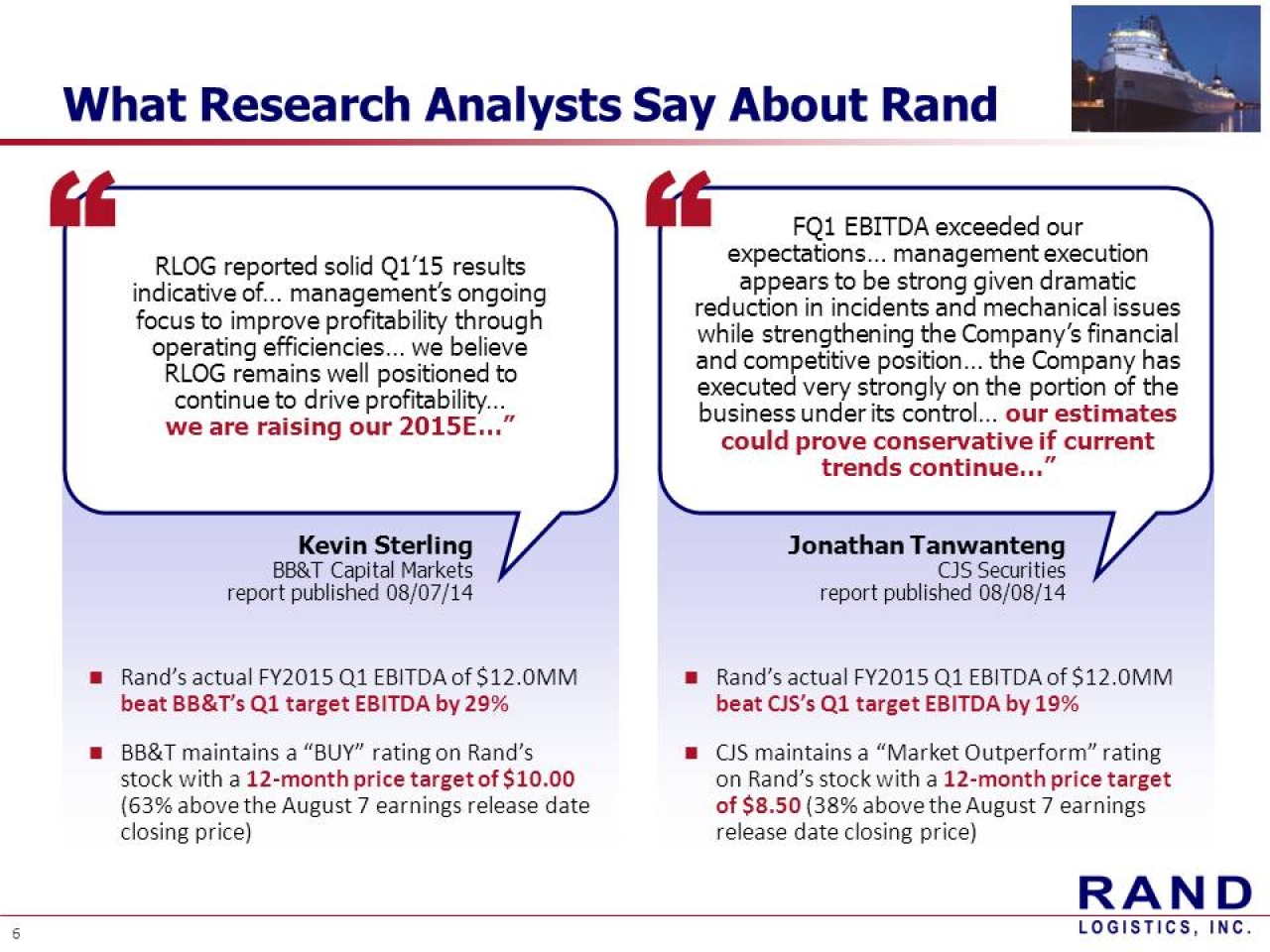

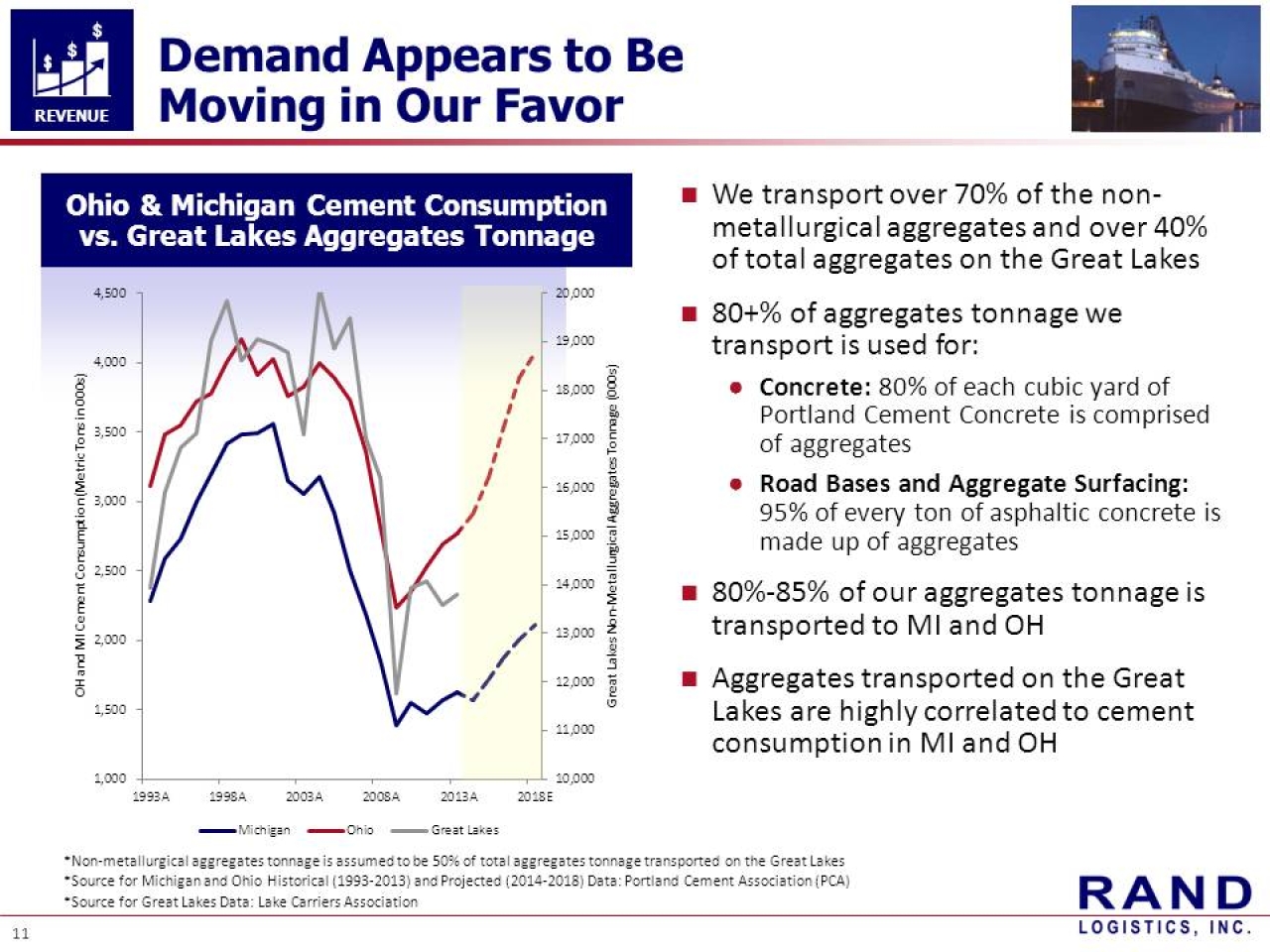

As noted by BB&T Capital Markets, an independent equity markets research firm1, the 2014 sailing season could represent an important inflection point for the Company as the Board’s profit-driving initiatives take hold and the demand environment on the Great Lakes reaches the highest level in five years. Under the stewardship of your current Board, Rand recently delivered “solid Q1’15 results”, beating BB&T’s Q1 FY2015 target EBITDA by 29%, and is “well positioned to continue to drive profitability” according the BB&T. BB&T maintained a “BUY” rating on Rand’s stock with a 12-month price target of $10.

______________________

1 BB&T report dated August 7, 2014

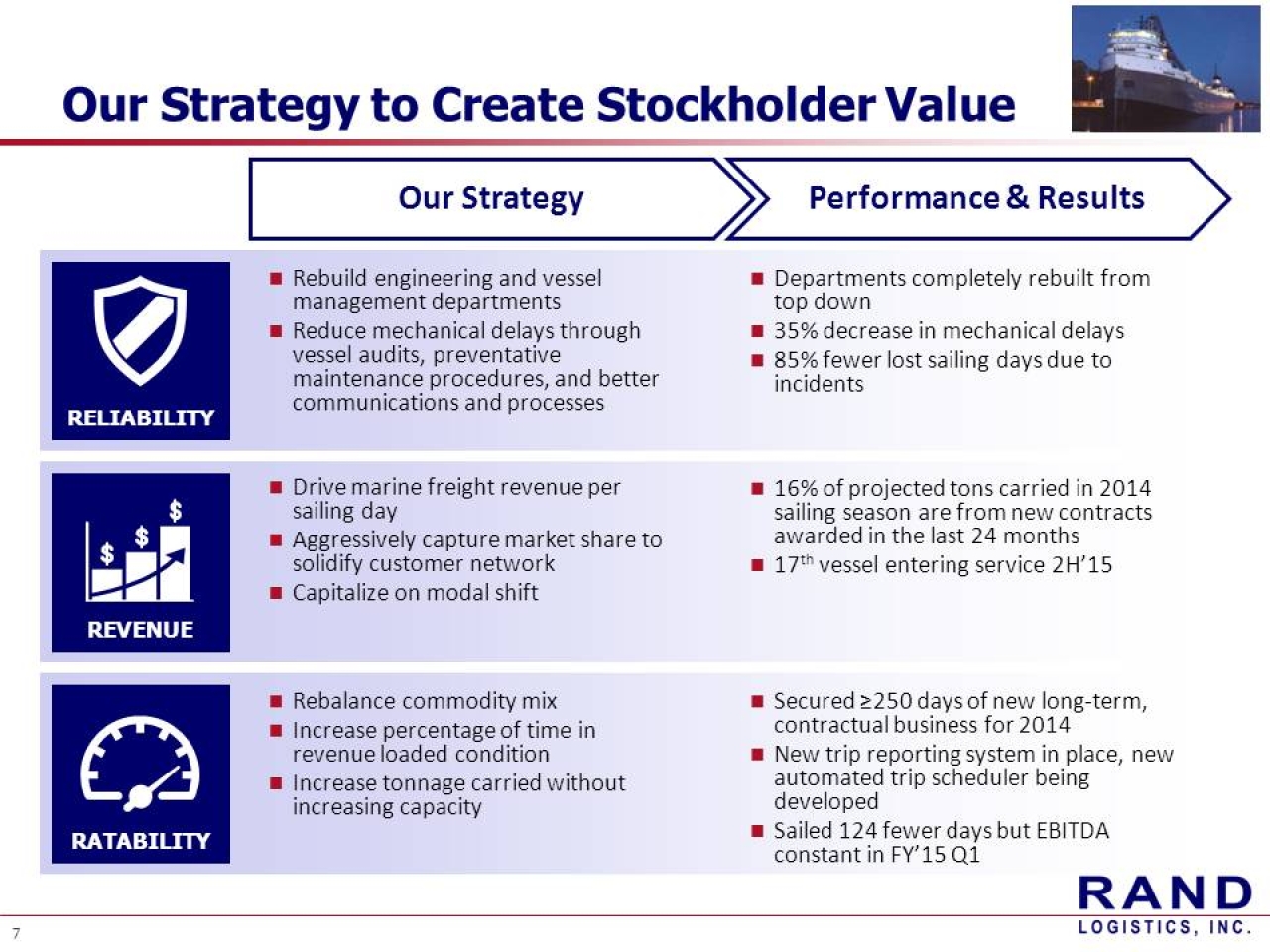

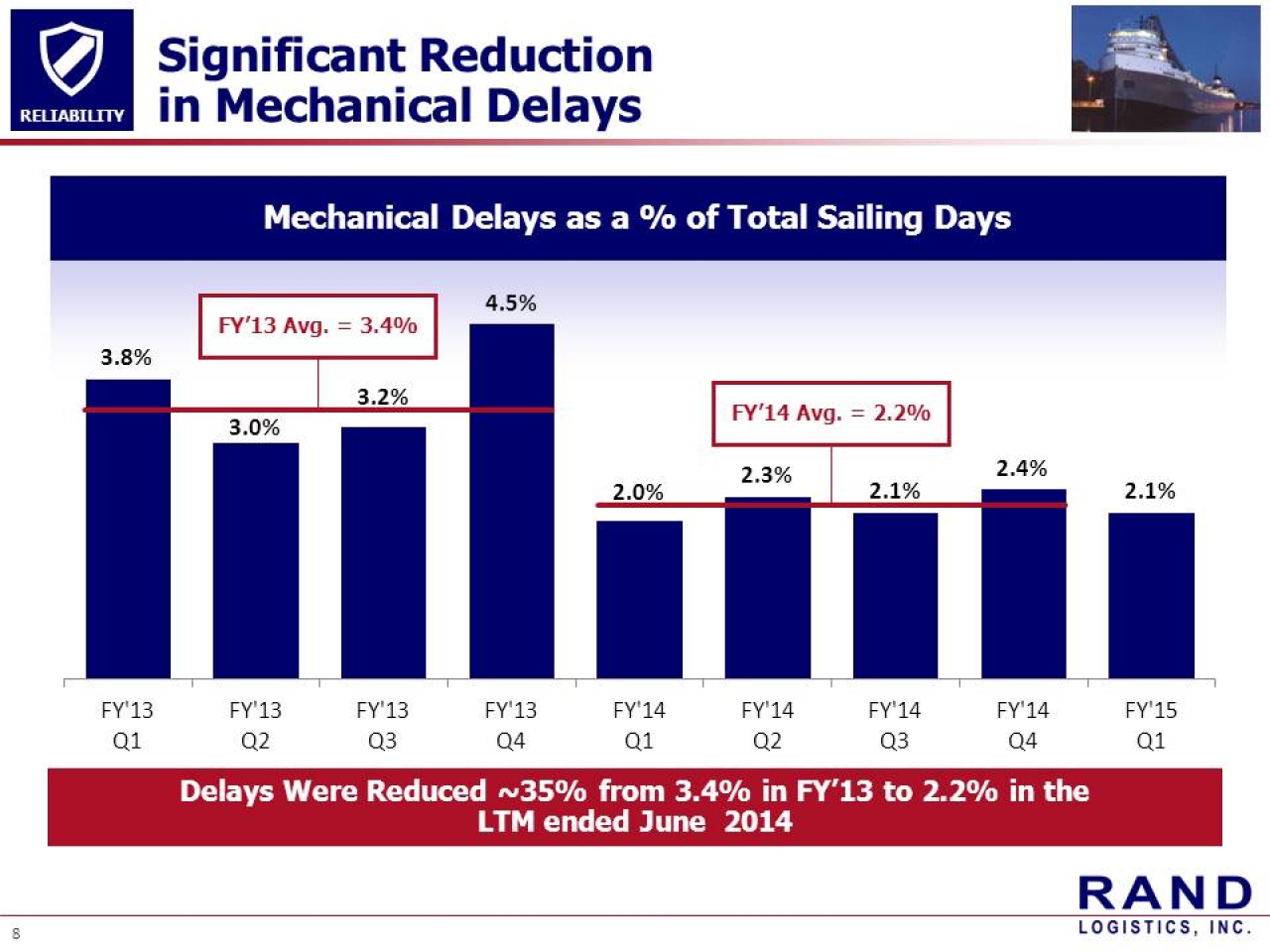

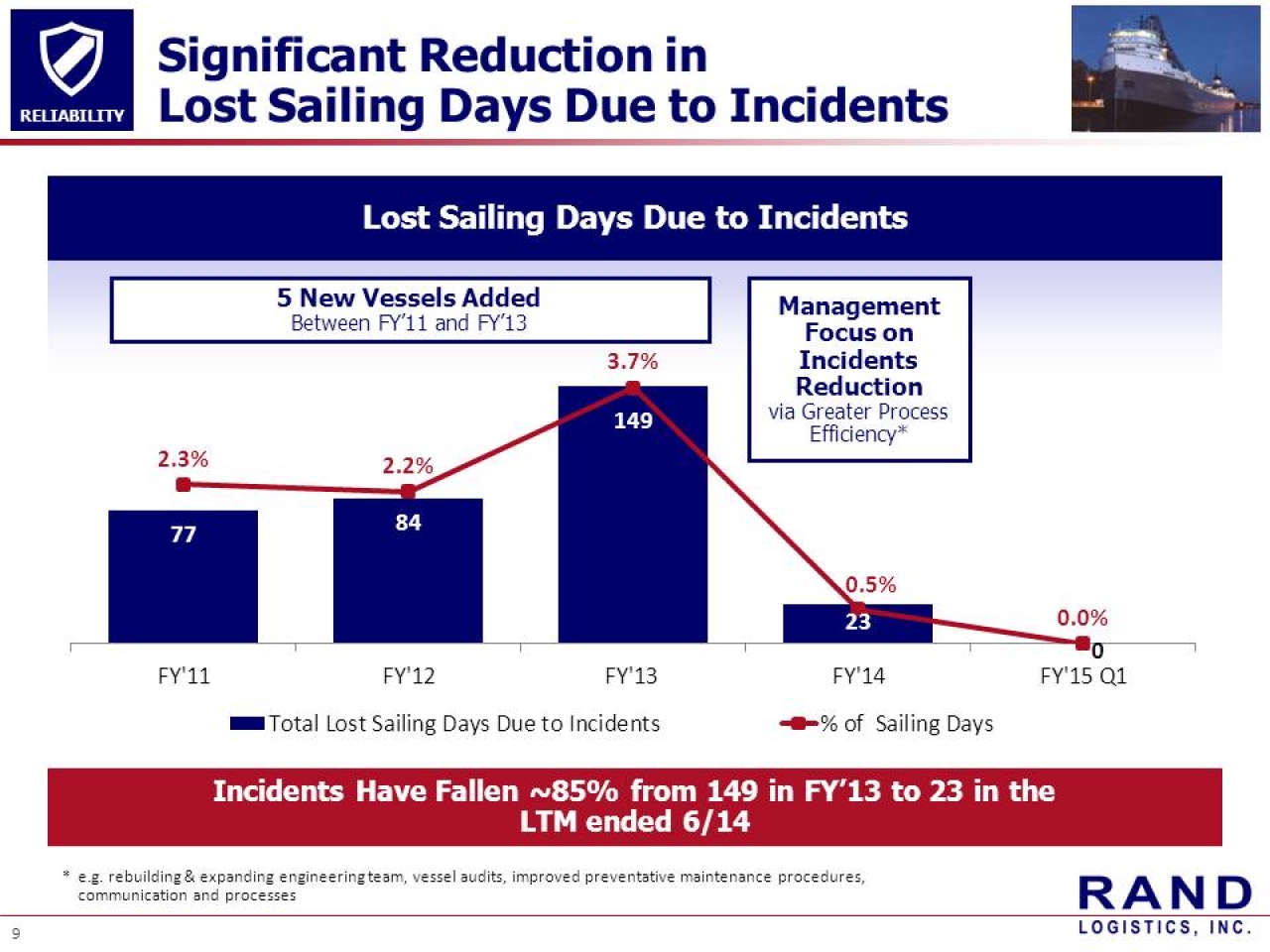

As highlighted in the attached presentation, under the guidance of our Board and management team, Rand has:

| | · | Assembled a portfolio of vessels, which cannot be duplicated at our cost basis, through a focused consolidation strategy; |

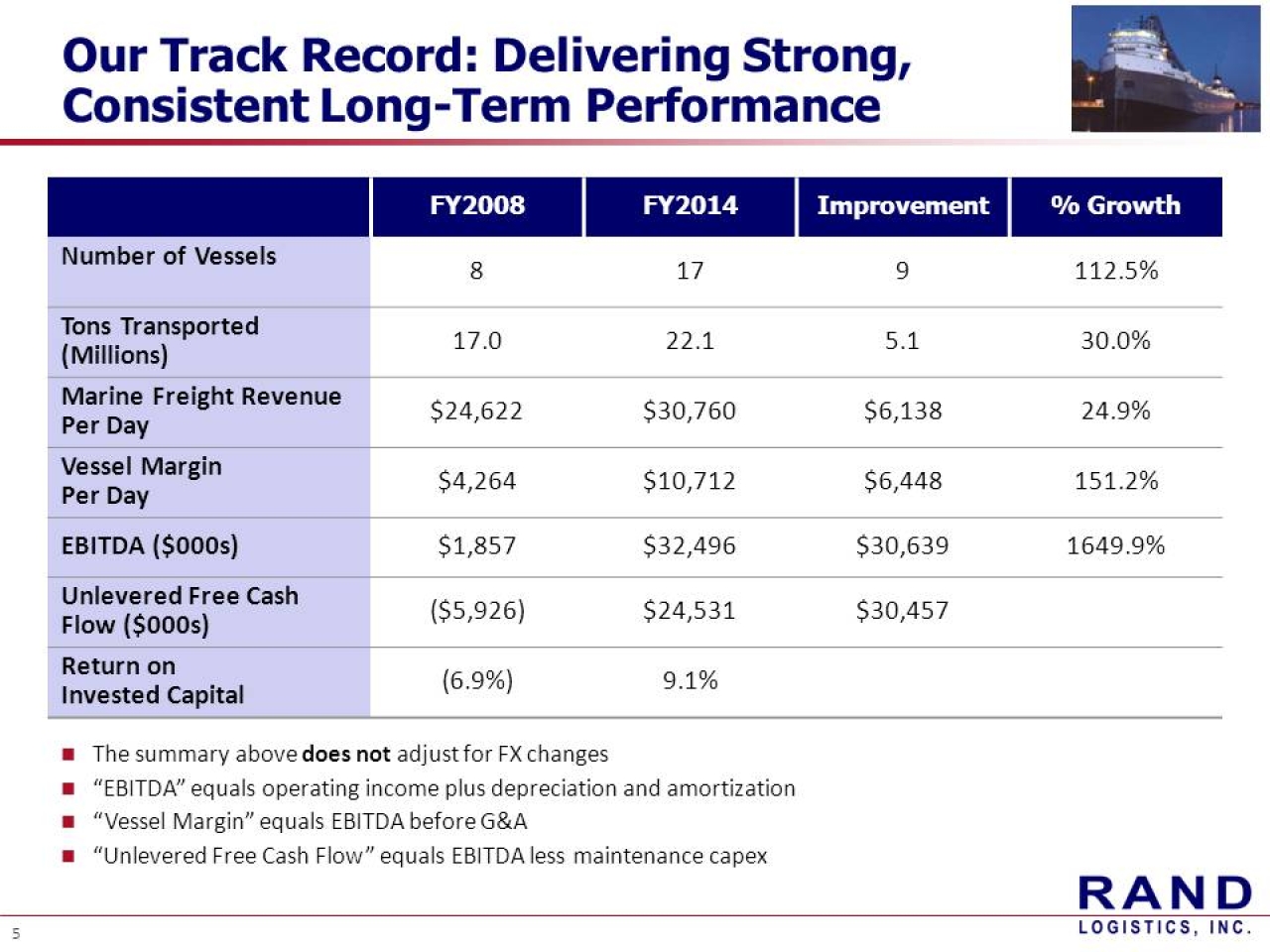

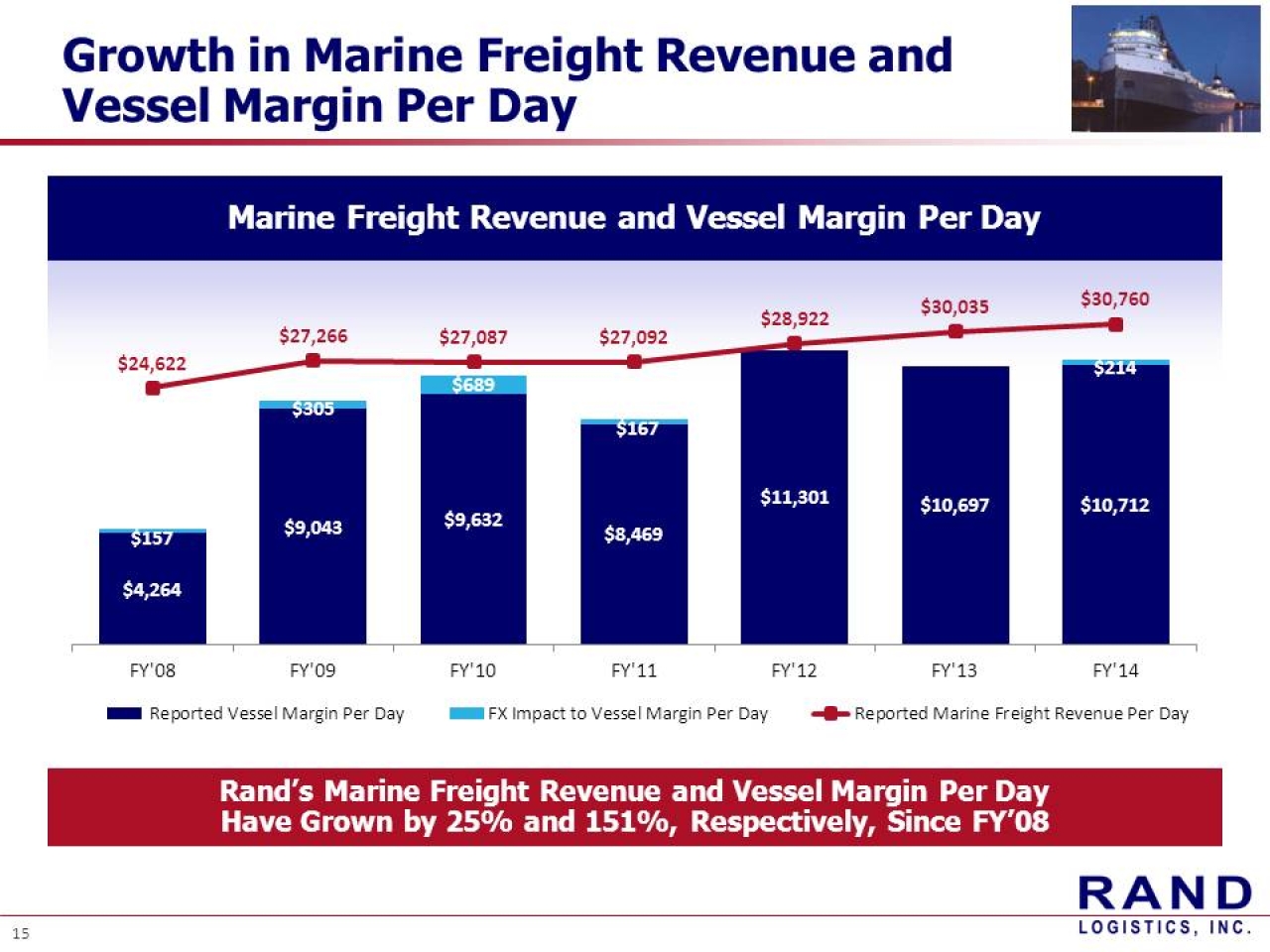

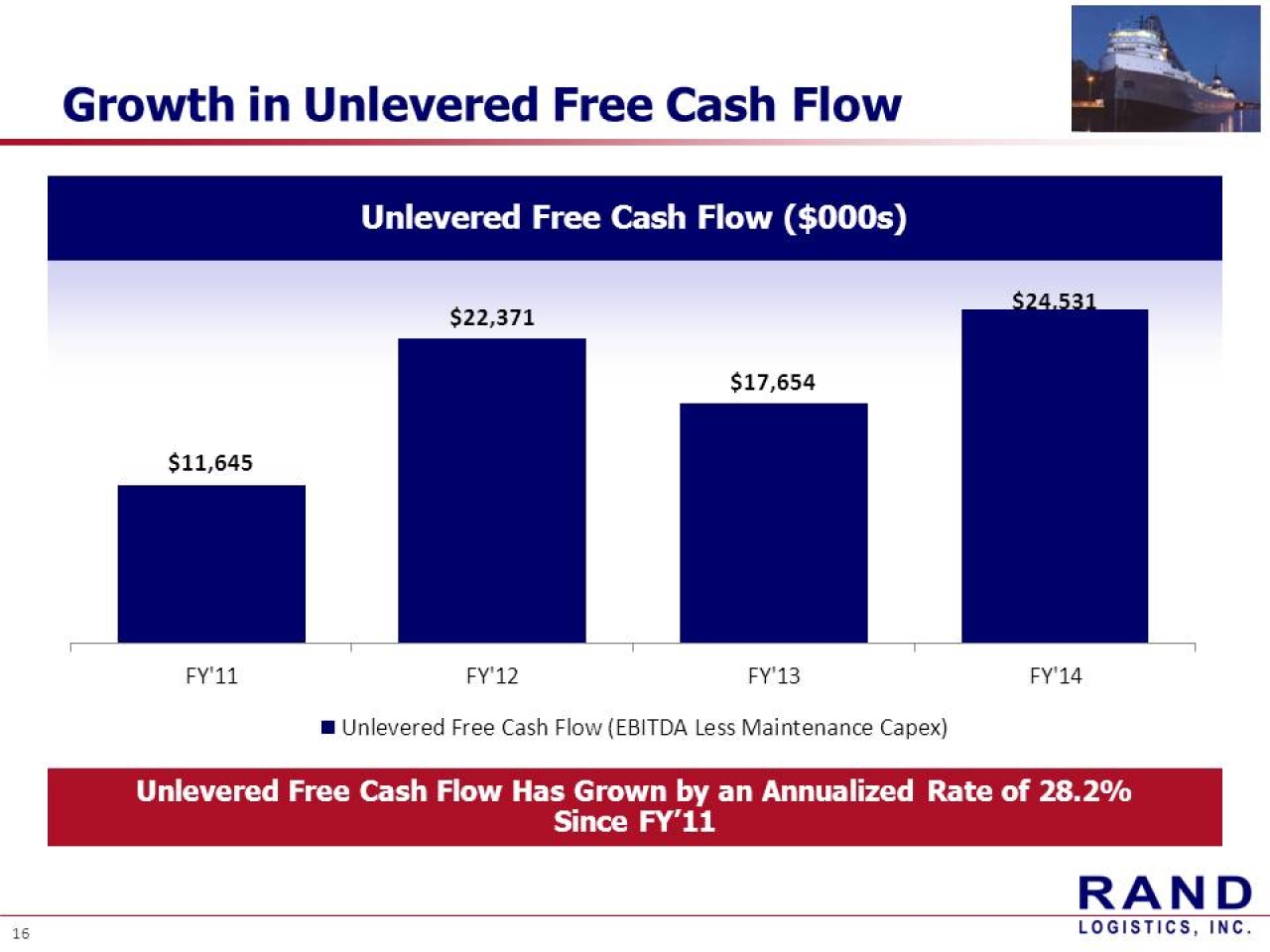

| | · | Increased EBITDA from under $2 million in fiscal 2008 to over $32 million in fiscal 2014; |

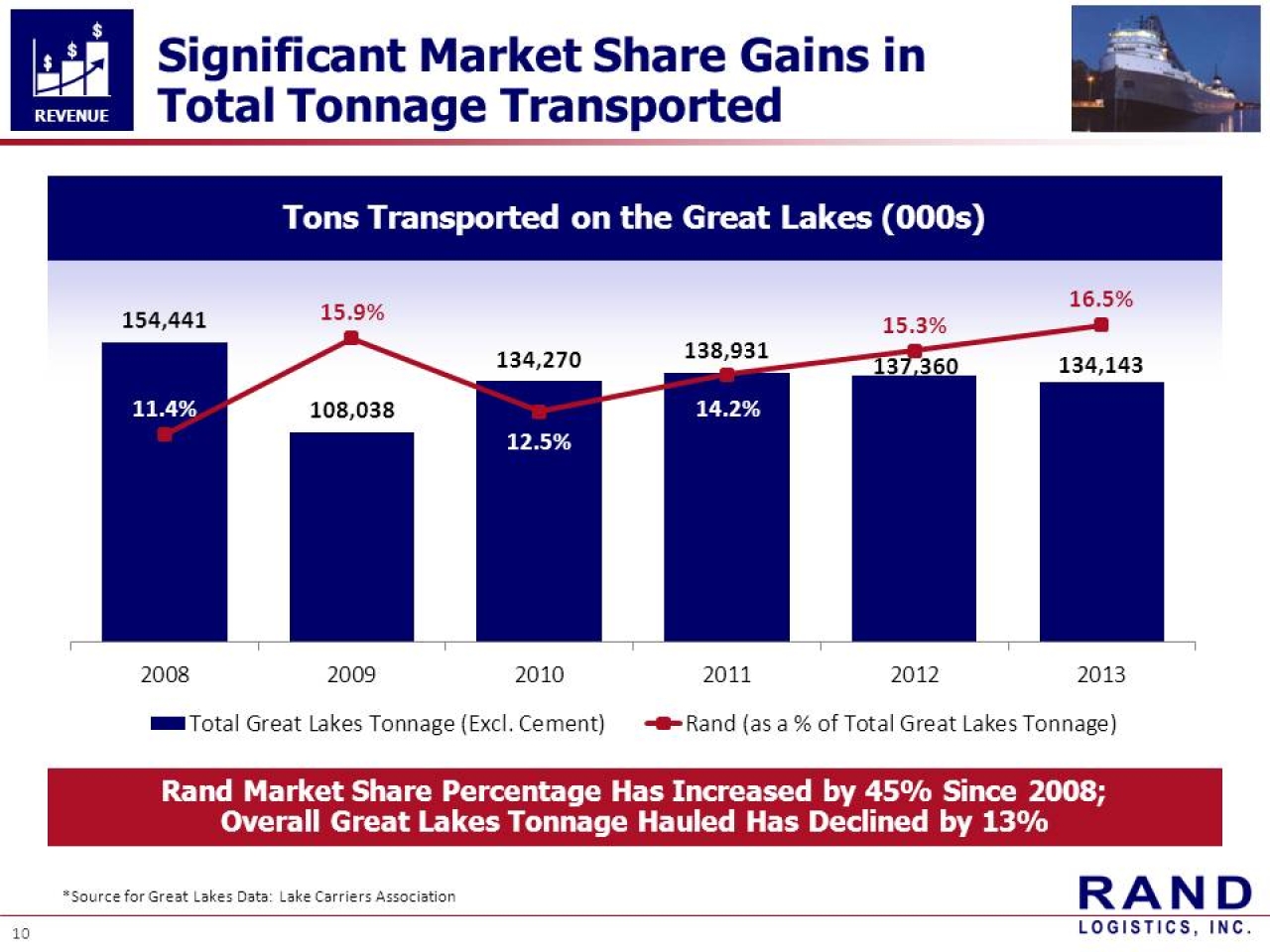

| | · | Leveraged our low-cost operating model to increase Rand’s market share percentage by 45% over the last five years despite difficult economic conditions in the Great Lakes region that resulted in total tons transported by all shippers on the Great Lakes declining by 13% over the same time period; and |

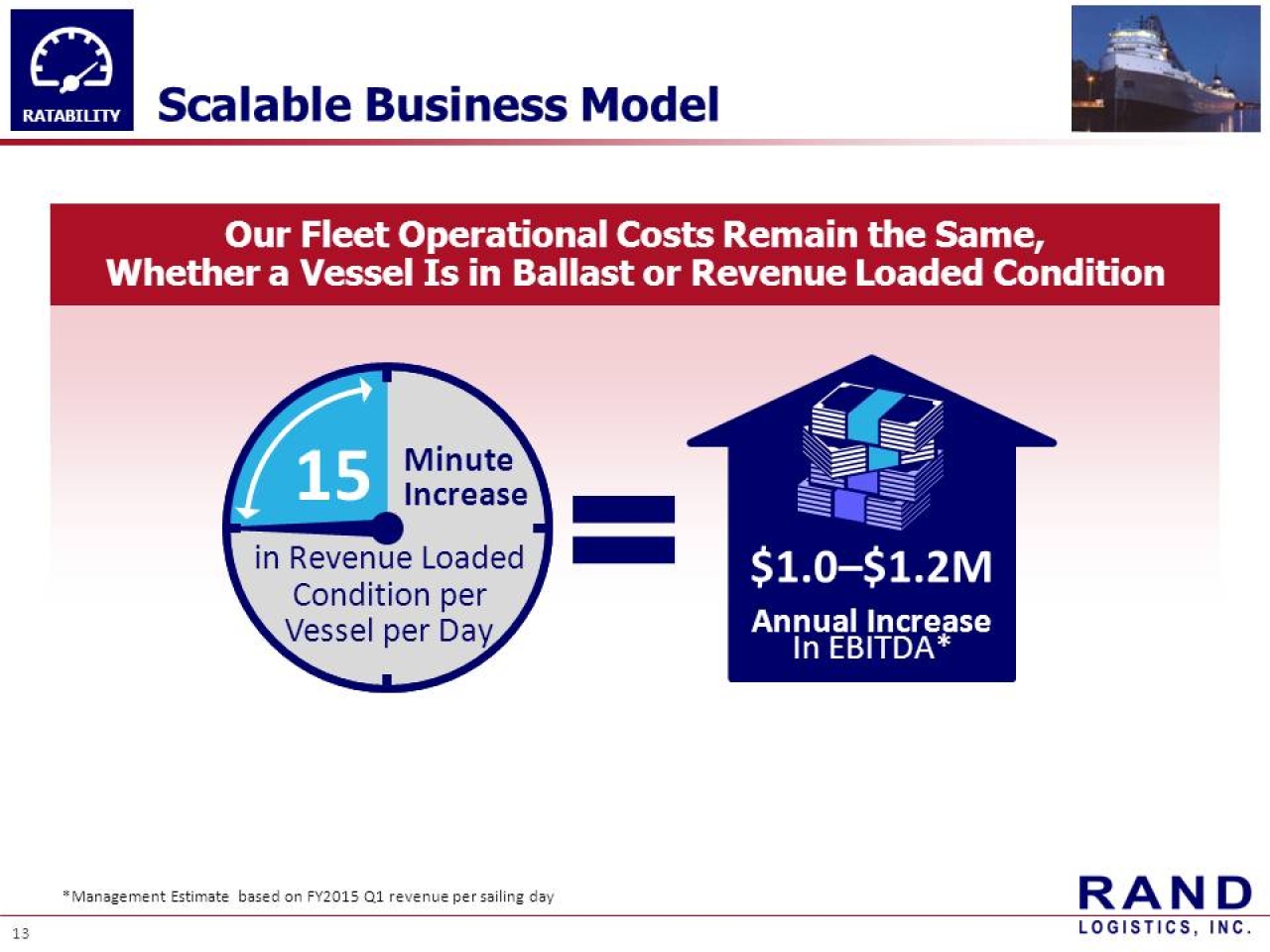

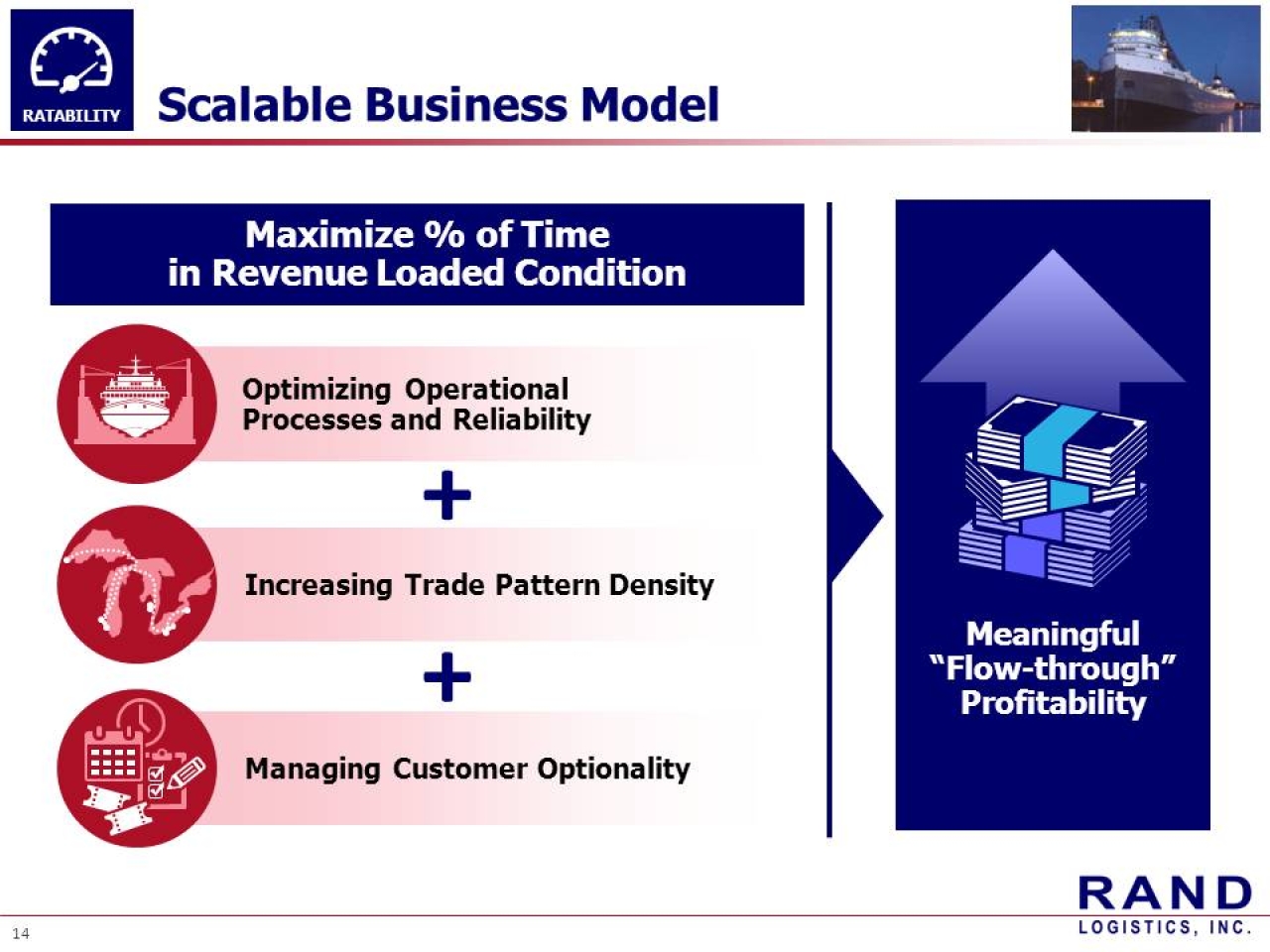

| | · | Executed a long-term strategy to capitalize on the inherent operating leverage in our business and increased vessel margin per sailing day by 2.5 times over an 8-year period. |

The growth, market positioning and operational excellence of our Company have been achieved through the thoughtful, deliberative and collaborative work of our Board of Directors and management, the members of which provide an effective mix of shipping, logistics, supplier, customer, finance, M&A, corporate governance and other public company experience.

In the context of the foregoing, and despite a JWest representative congratulating our management team on a “great first quarter,” during our last earnings call, JWest proposes to replace two of our extremely qualified and contributing directors, and then to revamp our senior management, to gain “fresh perspective” from its nominees. What real benefit JWest seeks to achieve through these actions is entirely unclear to us. What is clear, however, is that without the dedicated support of management and the continued constructive leadership of our Board, JWest’s actions will lead to a squandering of the Company’s achievements to date and a loss of the value proposition now before the Company’s stockholders.

We are confident that we have the right Board, the right management team and the right strategy to continue to drive value for our stockholders. We ask that you support our efforts and vote the WHITE proxy card FOR the Board’s nominees.

Sincerely,

The Rand Logistics Board of Directors

For additional information, please contact: