| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-21598) |

| | |

| Exact name of registrant as specified in charter: | Putnam RetirementReady Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2019 |

| | |

| Date of reporting period: | August 1, 2018 — January 31, 2019 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

RetirementReady®

Funds

| | | |

| Putnam RetirementReady 2060 Fund | Putnam RetirementReady 2035 Fund | | |

| Putnam RetirementReady 2055 Fund | Putnam RetirementReady 2030 Fund | | |

| Putnam RetirementReady 2050 Fund | Putnam RetirementReady 2025 Fund | | |

| Putnam RetirementReady 2045 Fund | Putnam RetirementReady 2020 Fund | | |

| Putnam RetirementReady 2040 Fund | Putnam Retirement Income Fund Lifestyle 1 | | |

Semiannual report

1|31|19

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

Message from the Trustees

March 19, 2019

Dear Fellow Shareholder:

Investors around the world faced challenging conditions in 2018, with increased volatility and turbulence, and generally more losses than gains for stocks at the end of the year. At the same time, investors who have owned either stocks or bonds for three years or more may still be in positive territory. Historically, periods of market weakness are often followed by recovery and rebounds, and we have already seen evidence of this in the early months of 2019.

If there is any lesson to be learned from these constantly changing markets, it is the importance of positioning your investment portfolio for your long-term goals. We believe that one way is to diversify across different asset classes and investment strategies.

We also believe your mutual fund investment offers a number of advantages, including constant monitoring by experienced investment professionals who maintain a long-term perspective. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions.

Another key strategy, in our view, is seeking the counsel of a financial advisor. For over 80 years, Putnam has recognized the importance of professional investment advice. Your financial advisor can help in many ways, including defining and planning for goals such as retirement, evaluating the level of risk appropriate for you, and reviewing your investments on a regular basis and making adjustments as necessary.

As always, your fund’s Board of Trustees remains committed to protecting the interests of Putnam shareholders like you, and we thank you for investing with Putnam.

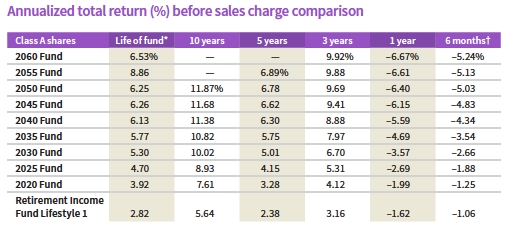

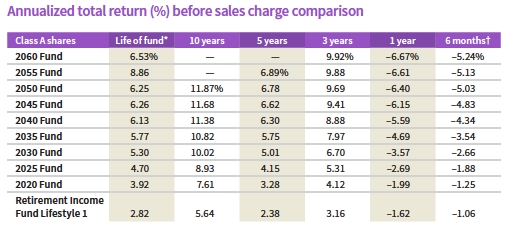

Performance history as of 1/31/19

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares.Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the table above do not reflect a sales charge of 4.00% for Retirement Income Fund Lifestyle 1 and 5.75% for all other funds; had they, returns would have been lower. See below and pages 8–17 for additional performance information. For a portion of the periods, the funds had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

*With the exception of Putnam RetirementReady 2050 Fund, 2055 Fund, and 2060 Fund (inceptions: 5/2/05, 11/30/10, and 11/30/15, respectively), the inception date of the class A shares of the RetirementReady Funds is 11/1/04.

†Returns for the six-month period are not annualized, but cumulative.

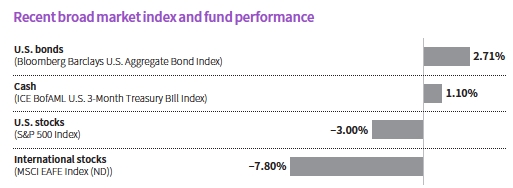

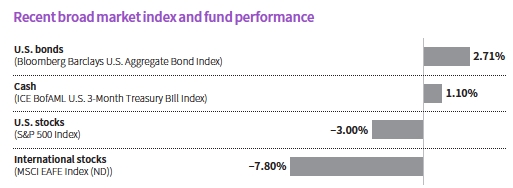

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/19. See above and pages 8–17 for additional fund performance information. Index descriptions can be found on pages 23–24.

Please describe the investment environment during the six-month reporting period.

Investors faced an array of heightened concerns worldwide during the six-month reporting period. A difficult fourth quarter brought volatility and annual losses for many major indexes. Among the issues that contributed to the downturn were geopolitical instability, uncertainty about the Federal Reserve’s monetary policy, a slowing Chinese economy, and the U.S.– China trade dispute. The U.S. economy remained strong, but interest rates and market volatility increased. Buoyed by government spending and tax cuts, the U.S. economy grew at a 3.5% annual rate in the third quarter of 2018. Unemployment has touched multi-decade lows, inflation remains anchored, and the likelihood of a recession remains low, in our view. Still, we believe the outlook for global economic growth has eased over the past few months because of protectionist tariffs, rising interest rates, and weakness in many emerging markets, including China.

January 2019 brought some reprieve and global markets gained value. The Fed unanimously agreed to keep the federal funds rate, which influences the cost of mortgages, credit cards,

and other borrowing, at a range of 2.25% to 2.50% at their January 2019 meeting. Fed Chair Jerome Powell also said that the case for raising rates has “weakened somewhat.” A strong January 2019 helped the broad S&P 500 Index trim losses for the six-month period. The S&P 500 declined 3.00%; and international stocks, as measured by the MSCI EAFE Index [ND], dropped 7.80%. Across the Atlantic, the European Central Bank [ECB] ended its bond-buying program in December 2018. The ECB also left benchmark interest rates unchanged at its January 2019 meeting.

How did the funds perform during the reporting period?

Putnam RetirementReady funds posted negative returns during the six-month reporting period. The results largely reflected the difficult investment environment. The majority of risk assets declined in value, and only a few segments of the fixed-income market finished the period in positive territory.

The funds with greater allocations to stocks had lower returns compared with shorter-dated funds that had more exposure to fixed-income and absolute return strategies. The high allocation to stocks is for investors who are decades from retiring. The shorter-dated funds have proportionately higher exposure to bonds and other fixed-income securities than to equities. Bloomberg Barclays U.S. Aggregate Bond Index gained 2.71% during the period.

What strategies contributed to or detracted from performance during the reporting period?

Our dynamic allocation decisions, particularly in equities and commodities, were detractors from performance. We increased our equity holdings in the fourth quarter of 2018, anticipating a market bounce that did not materialize by year-end. The commodities sector also struggled during the dramatic sell-off in crude oil prices. This occurred when the U.S. government granted waivers from sanctions to some of the biggest buyers of oil exports from Iran.

Our active implementation decisions and security selections detracted from performance. Our quantitative strategies in U.S. large-cap and international developed equity markets worked against results during the period. The quantitative strategies guide stock selection based on our team’s analysis of equity market history to identify characteristics in stocks with excess risk-adjusted returns. Despite what we believe is a clear long-term relationship between these factors and positive stock performance, our strategies underperformed.

Our absolute return strategies produced mixed results. Each fund has an allocation to the Putnam Multi-Asset Absolute Return Fund, which declined in value, and to the Putnam Fixed Income Absolute Return Fund, which gained in value. However, both funds helped to reduce volatility and improve diversification.

What is your outlook for the coming months?

Looking ahead, we believe the key risks weighing on equity markets may subside. We believe a resolution of the U.S.–China tariff conflict, even if limited in scope, is quite possible. In China, we believe more aggressive stimulus measures could improve the outlook for both the Chinese economy and global markets. And in the wake of the sell-off in the fourth quarter of 2018, we see more attractive valuations for companies with strong fundamental prospects.

We also believe that economic growth in the United States is likely to slow in 2019. Fed Chair Powell said in January 2019 that low inflation would allow the Fed to be “patient” in deciding whether to continue raising interest rates.At the same time, we expect bond yields to continue to drift higher in 2019 as interest-rate

normalization continues in the United States and globally.

We maintain a positive outlook for equities, inflation (commodities), and credit risks. The portfolios have an overweight position in U.S. equities and commodities. We are also slightly overweight in high-yield credit and slightly underweight in interest-rate-sensitive fixed-income assets. We believe U.S. stock valuations are now more appealing, and companies may return to buying back their own shares.In terms of credit, we recently upgraded our position due to positive indications from our quantitative model. Also, we believe corporate credit fundamentals are improving because of strong company earnings.

Thank you, Jason, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the funds for the entire period. Portfolio composition is subject to review in accordance with each fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk. Statements in the Q&A concerning each fund’s performance or portfolio composition relative to those of each fund’s Lipper peer group may reference information produced by Lipper Inc. or through a third party.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which isderivedfrom an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use currency forward contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates. In other examples, the managers may use options and futures contracts to hedge against a variety of risks by establishing a combination of long and short exposures to specific equity markets or sectors.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

Composition of the funds’

underlying investments

Historically, each Putnam RetirementReady® Fund invests, to varying degrees, in a variety of Putnam mutual funds. This section describes the goals and strategies of each of the underlying Putnam funds as of January 31, 2019. For more information, please see the funds’ prospectus.

Putnam Fixed Income Absolute Return Fund and Putnam Multi-Asset Absolute Return Fund

Each fund pursues an “absolute return” strategy that seeks to earn a positive total return over a reasonable period of time regardless of market conditions or general market direction. Putnam Fixed Income Absolute Return Fund invests in a broadly diversified portfolio reflecting uncorrelated fixed-income strategies. Putnam Multi-Asset Absolute Return Fund combines two independent investment strategies: a beta strategy, which provides broad exposure to investment markets, and an alpha strategy, which seeks returns from active trading. Actual allocations of both funds will vary.

Putnam Dynamic Asset Allocation Equity Fund

The fund’s portfolio invests mainly in common stocks (growth or value stocks or both) of large and midsize companies worldwide and is designed for investors seeking long-term growth. The fund typically allocates approximately 75% of its assets to investments in U.S. companies and 25% of its assets to international companies, but allocations may vary. The Portfolio Managers can adjust allocations based on market conditions.

Putnam Dynamic Asset Allocation Growth Fund

The fund’s portfolio invests mainly in equity securities (growth or value stocks or both) of U.S. and international companies of any size and is designed for investors seeking capital appreciation with moderate risk. The fund’s strategic equity weighting is 80% (the range is 65% to 95%), with the balance invested in a range of fixed-income investments. The Portfolio Managers can adjust allocations based on market conditions.

Putnam Dynamic Asset Allocation Balanced Fund

The fund’s portfolio is diversified across stocks and bonds in global markets and is designed for investors seeking total return. The fund’s strategic equity allocation is 60% (the range is 45% to 75%), with the balance invested in bonds and money market instruments. The Portfolio Managers can adjust the allocations based on market conditions.

Putnam Dynamic Asset Allocation Conservative Fund

The fund’s globally diversified portfolio emphasizes bonds over stocks and is designed for investors who want to protect the value of their investment while receiving regular income and protection against inflation. The strategic fixed-income allocation is 70% (with a range of 55% to 85%), with the balance invested in stocks and money market instruments. The Portfolio Managers can adjust allocations based on market conditions.

Putnam Government Money Market Fund

The fund seeks as high a rate of current income as Putnam Management believes is consistent

with preservation of capital and maintenance of liquidity. The fund invests at least 99.5% of its total assets in cash, U.S. government securities, and repurchase agreements that are fully collateralized by U.S. government securities or cash.

You can lose money by investing in the funds. Although the funds seek to preserve the value of your investment at $1.00 pershare, it cannot guarantee it will do so. An investment in the funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Each fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Each RetirementReady Fund has a different target date indicating when each fund’s investors expect to retire and begin withdrawing assets from their account, typically at retirement. The funds are generally weighted more heavily toward more aggressive, higher-risk investments when the target date of the fund is far off, and more conservative, lower-risk investments when the target date of the fund is near. The principal value of the funds is not guaranteed at any time, including the target date.

| | | | | | | | | | |

| Allocations by fundas of 1/31/19 | | | | | | | | | |

| |

| Underlying Putnam Fund | Putnam

Retirement

Ready

2060 Fund | Putnam

Retirement

Ready

2055 Fund | Putnam

Retirement

Ready

2050 Fund | Putnam

Retirement

Ready

2045 Fund | Putnam

Retirement

Ready

2040 Fund | Putnam

Retirement

Ready

2035 Fund | Putnam

Retirement

Ready

2030 Fund | Putnam

Retirement

Ready

2025 Fund | Putnam

Retirement

Ready

2020 Fund | Putnam

Retirement

Income

Fund

Lifestyle 1 |

| Putnam Dynamic Asset Allocation | | | | | | | | | | |

| Equity Fund | 73.7% | 66.1% | 49.2% | 28.5% | 7.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| Putnam Dynamic Asset Allocation | | | | | | | | | | |

| Growth Fund | 16.0% | 23.4% | 39.5% | 58.6% | 68.5% | 45.9% | 11.9% | 0.0% | 0.0% | 0.0% |

| Putnam Dynamic Asset Allocation | | | | | | | | | | |

| Balanced Fund | 0.0% | 0.0% | 0.0% | 0.0% | 5.7% | 27.8% | 50.1% | 36.8% | 9.6% | 0.0% |

| Putnam Dynamic Asset Allocation | | | | | | | | | | |

| Conservative Fund | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.0% | 15.3% | 30.1% | 34.3% |

| Putnam Multi-Asset Absolute | | | | | | | | | | |

| Return Fund | 9.4% | 9.4% | 9.4% | 10.0% | 13.4% | 17.4% | 21.6% | 26.7% | 30.0% | 30.2% |

| Putnam Fixed Income Absolute | | | | | | | | | | |

| Return Fund | 0.6% | 0.9% | 1.5% | 2.4% | 3.0% | 5.9% | 10.5% | 15.8% | 24.9% | 29.7% |

| Putnam Government Money | | | | | | | | | | |

| Market Fund | 0.4% | 0.4% | 0.4% | 0.6% | 1.9% | 3.0% | 4.1% | 5.2% | 5.8% | 5.8% |

Percentages are based on net assets as of 1/31/19. Portfolio composition may vary over time. Due to rounding, percentages may not equal 100%. Summary information may differ from the portfolio schedule included in the financial statements due to the exclusion of as-of trades.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2019, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the funds’ current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

Fund performanceTotal return for periods ended 1/31/19

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2060 Fund* | | | | | | | | | | | |

| Life of fund | 22.19% | 15.16% | 19.29% | 16.29% | 19.24% | 19.24% | 20.26% | 16.05% | 21.21% | 23.38% | 23.18% |

| Annual average | 6.53 | 4.56 | 5.73 | 4.88 | 5.71 | 5.71 | 6.00 | 4.81 | 6.26 | 6.86 | 6.81 |

| 3 years | 32.82 | 25.18 | 29.89 | 26.89 | 29.84 | 29.84 | 30.92 | 26.34 | 31.93 | 34.09 | 33.88 |

| Annual average | 9.92 | 7.77 | 9.11 | 8.26 | 9.09 | 9.09 | 9.40 | 8.11 | 9.68 | 10.27 | 10.21 |

| 1 year | –6.67 | –12.04 | –7.39 | –11.74 | –7.40 | –8.27 | –7.14 | –10.39 | –6.92 | –6.36 | –6.37 |

| 6 months | –5.24 | –10.69 | –5.64 | –10.07 | –5.65 | –6.53 | –5.47 | –8.78 | –5.33 | –5.08 | –5.02 |

| 2055 Fund† | | | | | | | | | | | |

| Life of fund | 99.96% | 88.46% | 88.30% | 88.30% | 87.94% | 87.94% | 91.85% | 85.14% | 95.97% | 104.79% | 104.04% |

| Annual average | 8.86 | 8.07 | 8.06 | 8.06 | 8.03 | 8.03 | 8.31 | 7.83 | 8.59 | 9.17 | 9.12 |

| 5 years | 39.54 | 31.52 | 34.37 | 32.53 | 34.23 | 34.23 | 35.97 | 31.21 | 37.79 | 41.74 | 41.22 |

| Annual average | 6.89 | 5.63 | 6.09 | 5.79 | 6.06 | 6.06 | 6.34 | 5.58 | 6.62 | 7.23 | 7.15 |

| 3 years | 32.67 | 25.04 | 29.68 | 26.68 | 29.54 | 29.54 | 30.54 | 25.97 | 31.69 | 34.09 | 33.59 |

| Annual average | 9.88 | 7.73 | 9.05 | 8.20 | 9.01 | 9.01 | 9.29 | 8.00 | 9.61 | 10.27 | 10.14 |

| 1 year | –6.61 | –11.98 | –7.31 | –11.38 | –7.38 | –8.19 | –7.12 | –10.37 | –6.83 | –6.24 | –6.41 |

| 6 months | –5.13 | –10.58 | –5.53 | –9.67 | –5.57 | –6.39 | –5.42 | –8.73 | –5.27 | –4.98 | –5.08 |

| 2050 Fund‡ | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 6.25% | 5.79% | 5.79% | 5.79% | 5.67% | 5.67% | 5.72% | 5.44% | 5.98% | 6.53% | 6.51% |

| 10 years | 207.03 | 189.38 | 189.07 | 189.07 | 184.84 | 184.84 | 192.11 | 181.89 | 199.48 | 215.52 | 214.87 |

| Annual average | 11.87 | 11.21 | 11.20 | 11.20 | 11.04 | 11.04 | 11.32 | 10.92 | 11.59 | 12.18 | 12.15 |

| 5 years | 38.84 | 30.86 | 33.77 | 31.77 | 33.73 | 33.73 | 35.42 | 30.68 | 37.10 | 40.91 | 40.62 |

| Annual average | 6.78 | 5.53 | 5.99 | 5.67 | 5.99 | 5.99 | 6.25 | 5.50 | 6.51 | 7.10 | 7.06 |

| 3 years | 31.98 | 24.39 | 29.11 | 26.11 | 29.01 | 29.01 | 30.02 | 25.47 | 31.00 | 33.27 | 32.99 |

| Annual average | 9.69 | 7.55 | 8.89 | 8.04 | 8.86 | 8.86 | 9.15 | 7.86 | 9.42 | 10.05 | 9.97 |

| 1 year | –6.40 | –11.78 | –7.05 | –11.12 | –7.14 | –7.95 | –6.85 | –10.11 | –6.63 | –6.08 | –6.17 |

| 6 months | –5.03 | –10.49 | –5.30 | –9.44 | –5.37 | –6.20 | –5.23 | –8.54 | –5.11 | –4.85 | –4.85 |

Fund performanceTotal return for periods ended 1/31/19cont.

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2045 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 6.26% | 5.82% | 5.82% | 5.82% | 5.71% | 5.71% | 5.74% | 5.47% | 6.00% | 6.55% | 6.53% |

| 10 years | 201.70 | 184.35 | 184.21 | 184.21 | 179.99 | 179.99 | 186.99 | 176.95 | 194.28 | 210.18 | 209.26 |

| Annual average | 11.68 | 11.02 | 11.01 | 11.01 | 10.84 | 10.84 | 11.12 | 10.72 | 11.40 | 11.99 | 11.95 |

| 5 years | 37.80 | 29.88 | 32.67 | 30.67 | 32.71 | 32.71 | 34.36 | 29.66 | 36.07 | 39.89 | 39.47 |

| Annual average | 6.62 | 5.37 | 5.82 | 5.50 | 5.82 | 5.82 | 6.09 | 5.33 | 6.35 | 6.94 | 6.88 |

| 3 years | 30.98 | 23.45 | 28.07 | 25.07 | 28.11 | 28.11 | 29.04 | 24.53 | 30.03 | 32.31 | 31.92 |

| Annual average | 9.41 | 7.27 | 8.60 | 7.74 | 8.61 | 8.61 | 8.87 | 7.59 | 9.15 | 9.78 | 9.67 |

| 1 year | –6.15 | –11.55 | –6.88 | –10.90 | –6.85 | –7.65 | –6.62 | –9.89 | –6.38 | –5.84 | –5.96 |

| 6 months | –4.83 | –10.30 | –5.20 | –9.30 | –5.17 | –5.98 | –5.05 | –8.37 | –4.94 | –4.67 | –4.73 |

| 2040 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 6.13% | 5.69% | 5.69% | 5.69% | 5.58% | 5.58% | 5.60% | 5.34% | 5.88% | 6.42% | 6.40% |

| 10 years | 193.81 | 176.92 | 176.73 | 176.73 | 172.58 | 172.58 | 179.40 | 169.62 | 186.70 | 201.90 | 201.16 |

| Annual average | 11.38 | 10.72 | 10.71 | 10.71 | 10.55 | 10.55 | 10.82 | 10.43 | 11.11 | 11.68 | 11.66 |

| 5 years | 35.73 | 27.92 | 30.69 | 28.69 | 30.74 | 30.74 | 32.36 | 27.73 | 34.11 | 37.76 | 37.42 |

| Annual average | 6.30 | 5.05 | 5.50 | 5.17 | 5.51 | 5.51 | 5.77 | 5.02 | 6.05 | 6.62 | 6.56 |

| 3 years | 29.07 | 21.65 | 26.22 | 23.22 | 26.18 | 26.18 | 27.14 | 22.69 | 28.13 | 30.33 | 30.02 |

| Annual average | 8.88 | 6.75 | 8.07 | 7.21 | 8.06 | 8.06 | 8.33 | 7.05 | 8.61 | 9.23 | 9.14 |

| 1 year | –5.59 | –11.02 | –6.32 | –10.51 | –6.29 | –7.13 | –6.05 | –9.34 | –5.80 | –5.26 | –5.36 |

| 6 months | –4.34 | –9.84 | –4.67 | –8.94 | –4.71 | –5.56 | –4.55 | –7.90 | –4.41 | –4.14 | –4.21 |

| 2035 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.77% | 5.33% | 5.33% | 5.33% | 5.22% | 5.22% | 5.24% | 4.98% | 5.50% | 6.06% | 6.03% |

| 10 years | 179.36 | 163.30 | 163.10 | 163.10 | 159.14 | 159.14 | 165.72 | 156.42 | 172.50 | 187.17 | 186.38 |

| Annual average | 10.82 | 10.17 | 10.16 | 10.16 | 9.99 | 9.99 | 10.27 | 9.87 | 10.54 | 11.13 | 11.10 |

| 5 years | 32.25 | 24.65 | 27.38 | 25.38 | 27.36 | 27.36 | 28.96 | 24.45 | 30.56 | 34.21 | 33.84 |

| Annual average | 5.75 | 4.50 | 4.96 | 4.63 | 4.96 | 4.96 | 5.22 | 4.47 | 5.48 | 6.06 | 6.00 |

| 3 years | 25.85 | 18.61 | 23.02 | 20.02 | 23.04 | 23.04 | 23.95 | 19.61 | 24.89 | 27.12 | 26.77 |

| Annual average | 7.97 | 5.86 | 7.15 | 6.27 | 7.15 | 7.15 | 7.42 | 6.15 | 7.69 | 8.33 | 8.23 |

| 1 year | –4.69 | –10.17 | –5.39 | –9.67 | –5.39 | –6.25 | –5.16 | –8.48 | –4.92 | –4.33 | –4.47 |

| 6 months | –3.54 | –9.09 | –3.89 | –8.23 | –3.93 | –4.80 | –3.80 | –7.17 | –3.68 | –3.39 | –3.46 |

| 2030 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.30% | 4.87% | 4.86% | 4.86% | 4.75% | 4.75% | 4.78% | 4.51% | 5.04% | 5.58% | 5.56% |

| 10 years | 159.91 | 144.96 | 144.83 | 144.83 | 141.26 | 141.26 | 147.28 | 138.62 | 153.64 | 167.15 | 166.54 |

| Annual average | 10.02 | 9.37 | 9.37 | 9.37 | 9.21 | 9.21 | 9.48 | 9.09 | 9.75 | 10.33 | 10.30 |

| 5 years | 27.71 | 20.37 | 23.07 | 21.07 | 23.09 | 23.09 | 24.62 | 20.26 | 26.18 | 29.60 | 29.30 |

| Annual average | 5.01 | 3.78 | 4.24 | 3.90 | 4.24 | 4.24 | 4.50 | 3.76 | 4.76 | 5.32 | 5.27 |

| 3 years | 21.49 | 14.50 | 18.85 | 15.85 | 18.87 | 18.87 | 19.72 | 15.53 | 20.67 | 22.70 | 22.41 |

| Annual average | 6.70 | 4.62 | 5.93 | 5.03 | 5.93 | 5.93 | 6.18 | 4.93 | 6.46 | 7.06 | 6.97 |

| 1 year | –3.57 | –9.12 | –4.27 | –8.70 | –4.28 | –5.17 | –4.03 | –7.39 | –3.81 | –3.25 | –3.36 |

| 6 months | –2.66 | –8.26 | –3.05 | –7.54 | –3.02 | –3.91 | –2.92 | –6.32 | –2.76 | –2.49 | –2.56 |

Fund performanceTotal return for periods ended 1/31/19cont.

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2025 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 4.70% | 4.26% | 4.26% | 4.26% | 4.15% | 4.15% | 4.17% | 3.91% | 4.44% | 4.98% | 4.96% |

| 10 years | 135.13 | 121.61 | 121.38 | 121.38 | 118.19 | 118.19 | 123.64 | 115.81 | 129.41 | 141.78 | 141.10 |

| Annual average | 8.93 | 8.28 | 8.27 | 8.27 | 8.11 | 8.11 | 8.38 | 8.00 | 8.66 | 9.23 | 9.20 |

| 5 years | 22.54 | 15.49 | 18.02 | 16.02 | 17.99 | 17.99 | 19.54 | 15.36 | 21.01 | 24.40 | 24.05 |

| Annual average | 4.15 | 2.92 | 3.37 | 3.02 | 3.36 | 3.36 | 3.63 | 2.90 | 3.89 | 4.46 | 4.40 |

| 3 years | 16.79 | 10.08 | 14.18 | 11.18 | 14.17 | 14.17 | 15.05 | 11.02 | 15.96 | 17.98 | 17.65 |

| Annual average | 5.31 | 3.25 | 4.52 | 3.59 | 4.52 | 4.52 | 4.78 | 3.55 | 5.06 | 5.67 | 5.57 |

| 1 year | –2.69 | –8.28 | –3.43 | –7.94 | –3.41 | –4.32 | –3.15 | –6.54 | –2.89 | –2.31 | –2.43 |

| 6 months | –1.88 | –7.52 | –2.30 | –6.87 | –2.28 | –3.19 | –2.13 | –5.55 | –1.99 | –1.68 | –1.75 |

| 2020 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 3.92% | 3.49% | 3.48% | 3.48% | 3.38% | 3.38% | 3.40% | 3.14% | 3.67% | 4.19% | 4.18% |

| 10 years | 108.28 | 96.30 | 96.13 | 96.13 | 93.36 | 93.36 | 98.10 | 91.16 | 103.13 | 113.95 | 113.63 |

| Annual average | 7.61 | 6.98 | 6.97 | 6.97 | 6.82 | 6.82 | 7.07 | 6.69 | 7.34 | 7.90 | 7.89 |

| 5 years | 17.49 | 10.73 | 13.17 | 11.17 | 13.19 | 13.19 | 14.58 | 10.57 | 16.03 | 19.19 | 19.02 |

| Annual average | 3.28 | 2.06 | 2.50 | 2.14 | 2.51 | 2.51 | 2.76 | 2.03 | 3.02 | 3.57 | 3.54 |

| 3 years | 12.89 | 6.40 | 10.39 | 7.39 | 10.41 | 10.41 | 11.22 | 7.32 | 12.05 | 13.97 | 13.79 |

| Annual average | 4.12 | 2.09 | 3.35 | 2.41 | 3.36 | 3.36 | 3.61 | 2.38 | 3.87 | 4.45 | 4.40 |

| 1 year | –1.99 | –7.63 | –2.70 | –7.34 | –2.64 | –3.57 | –2.44 | –5.86 | –2.21 | –1.66 | –1.70 |

| 6 months | –1.25 | –6.92 | –1.62 | –6.31 | –1.60 | –2.54 | –1.48 | –4.93 | –1.38 | –1.08 | –1.12 |

| Retirement | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | |

| Lifestyle 1 | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 2.82% | 2.52% | 2.38% | 2.38% | 2.28% | 2.28% | 2.44% | 2.20% | 2.56% | 3.09% | 3.07% |

| 10 years | 73.15 | 66.23 | 63.12 | 63.12 | 60.64 | 60.64 | 67.86 | 62.40 | 68.84 | 77.89 | 77.50 |

| Annual average | 5.64 | 5.21 | 5.01 | 5.01 | 4.85 | 4.85 | 5.32 | 4.97 | 5.38 | 5.93 | 5.91 |

| 5 years | 12.46 | 7.96 | 8.33 | 6.37 | 8.32 | 8.32 | 11.08 | 7.47 | 11.05 | 14.08 | 13.83 |

| Annual average | 2.38 | 1.54 | 1.61 | 1.24 | 1.61 | 1.61 | 2.12 | 1.45 | 2.12 | 2.67 | 2.62 |

| 3 years | 9.77 | 5.38 | 7.35 | 4.35 | 7.35 | 7.35 | 8.92 | 5.38 | 8.95 | 10.79 | 10.55 |

| Annual average | 3.16 | 1.76 | 2.39 | 1.43 | 2.39 | 2.39 | 2.89 | 1.76 | 2.90 | 3.47 | 3.40 |

| 1 year | –1.62 | –5.55 | –2.35 | –7.12 | –2.33 | –3.28 | –1.88 | –5.07 | –1.88 | –1.29 | –1.37 |

| 6 months | –1.06 | –5.01 | –1.41 | –6.23 | –1.38 | –2.34 | –1.18 | –4.40 | –1.19 | –0.89 | –0.93 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. The maximum sales charges for Retirement Income Fund Lifestyle 1 class A and M shares are 4.00% and 3.25%, respectively. Class B share returns after the contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R6 and Y shares have no initial sales charge or CDSC. Performance for class R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R6 shares; had it, returns would have been higher.

For a portion of the periods, these funds had expense limitations, without which returns would have been lower.

For the funds with eight years of performance, class B share performance reflects conversion to class A shares after eight years.

|

| 10 RetirementReady® Funds |

For the funds with 10 years of performance, class C share performance reflects conversion to class A shares after 10 years.

* The inception date of Putnam RetirementReady 2060 Fund is 11/30/15, for all share classes except class R6, which is 9/1/16.

†The inception date of Putnam RetirementReady 2055 Fund is 11/30/10, for all share classes except class R6, which is 9/1/16.

‡The inception date of Putnam RetirementReady 2050 Fund is 5/2/05, for all share classes except class R6, which is 9/1/16.

Comparative index returnsFor periods ended 1/31/19

| | |

| | | Bloomberg Barclays |

| | S&P 500 Index | U.S. Aggregate Bond Index |

| Annual average | | |

| (life of fund) (since 11/1/04)* | 8.55% | 3.85% |

| Annual average | | |

| (life of fund) (since 5/2/05)† | 8.61 | 3.92 |

| Life of fund | 171.65 | 24.67 |

| Annual average (since 11/30/10)‡ | 13.02 | 2.74 |

| Life of fund | 38.65 | 7.08 |

| Annual average (since 11/30/15)** | 10.87 | 2.18 |

| 10 years | 304.63 | 43.51 |

| Annual average | 15.00 | 3.68 |

| 5 years | 68.19 | 12.79 |

| Annual average | 10.96 | 2.44 |

| 3 years | 48.23 | 5.97 |

| Annual average | 14.02 | 1.95 |

| 1 year | –2.31 | 2.25 |

| 6 months | –3.00 | 2.71 |

Index results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

*Inception date of all Putnam RetirementReady Funds with the exception of the 2050, 2055, and 2060 Fund.

†Inception date of Putnam RetirementReady 2050 Fund.

‡Inception date of Putnam RetirementReady 2055 Fund.

**Inception date of Putnam RetirementReady 2060 Fund.

Fund price and distribution informationFor the six-month period ended 1/31/19

| | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| 2060 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.337 | $0.268 | $0.252 | $0.220 | $0.291 | $0.350 | $0.340 |

| Capital gains | | | | | | | | | |

| Long-term gains | 0.316 | 0.316 | 0.316 | 0.316 | 0.316 | 0.316 | 0.316 |

| Short-term gains | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 |

| Total | $0.693 | $0.624 | $0.608 | $0.576 | $0.647 | $0.706 | $0.696 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $11.70 | $12.41 | $11.66 | $11.60 | $11.68 | $12.10 | $11.69 | $11.77 | $11.74 |

| 1/31/19 | 10.34 | 10.97 | 10.33 | 10.29 | 10.42 | 10.80 | 10.37 | 10.41 | 10.40 |

|

| RetirementReady® Funds 11 |

Fund price and distribution informationFor the six-month period ended 1/31/19cont.

| | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| 2055 Fund | | | | | | | | | |

| Number | | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.309 | $0.215 | $0.228 | $0.268 | $0.184 | $0.356 | $0.338 |

| Capital gains | | | | | | | | | |

| Long-term gains | 1.134 | 1.134 | 1.134 | 1.134 | 1.134 | 1.134 | 1.134 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $1.443 | $1.349 | $1.362 | $1.402 | $1.318 | $1.490 | $1.472 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $12.57 | $13.34 | $12.45 | $12.28 | $12.56 | $13.02 | $12.52 | $12.71 | $12.68 |

| 1/31/19 | 10.37 | 11.00 | 10.31 | 10.13 | 10.37 | 10.75 | 10.44 | 10.47 | 10.45 |

| 2050 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.513 | $0.357 | $0.372 | $0.431 | $0.473 | $0.585 | $0.530 |

| Capital gains | | | | | | | | | |

| Long-term gains | 1.882 | 1.882 | 1.882 | 1.882 | 1.882 | 1.882 | 1.882 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $2.395 | $2.239 | $2.254 | $2.313 | $2.355 | $2.467 | $2.412 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $20.52 | $21.77 | $20.19 | $20.02 | $20.68 | $21.43 | $20.27 | $20.70 | $20.66 |

| 1/31/19 | 16.91 | 17.94 | 16.71 | 16.52 | 17.11 | 17.73 | 16.70 | 17.04 | 17.06 |

| 2045 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.690 | $0.532 | $0.566 | $0.583 | $0.573 | $0.767 | $0.738 |

| Capital gains | | | | | | | | | |

| Long-term gains | 1.941 | 1.941 | 1.941 | 1.941 | 1.941 | 1.941 | 1.941 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $2.631 | $2.473 | $2.507 | $2.524 | $2.514 | $2.708 | $2.679 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $22.67 | $24.05 | $20.50 | $20.52 | $22.01 | $22.81 | $23.32 | $27.44 | $27.38 |

| 1/31/19 | 18.75 | 19.89 | 16.78 | 16.77 | 18.19 | 18.85 | 19.47 | 23.25 | 23.21 |

| 2040 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.641 | $0.460 | 0.485 | $0.532 | $0.421 | $0.716 | $0.674 |

| Capital gains | | | | | | | | | |

| Long-term gains | 1.621 | 1.621 | 1.621 | 1.621 | 1.621 | 1.621 | 1.621 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $2.262 | $2.081 | $2.106 | $2.153 | $2.042 | $2.337 | $2.295 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $24.24 | $25.72 | $22.20 | $21.88 | $22.59 | $23.41 | $25.09 | $28.73 | $28.68 |

| 1/31/19 | 20.77 | 22.04 | 18.94 | 18.60 | 19.26 | 19.96 | 21.80 | 25.04 | 25.02 |

| |

| 12 RetirementReady® Funds |

Fund price and distribution informationFor the six-month period ended 1/31/19cont.

| | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| 2035 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.773 | $0.599 | $0.624 | $0.617 | $0.660 | $0.851 | $0.825 |

| Capital gains | | | | | | | | | |

| Long-term gains | 1.335 | 1.335 | 1.335 | 1.335 | 1.335 | 1.335 | 1.335 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $2.108 | $1.934 | $1.959 | $1.952 | $1.995 | $2.186 | $2.160 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $24.08 | $25.55 | $22.07 | $21.96 | $23.14 | $23.98 | $23.16 | $28.35 | $28.30 |

| 1/31/19 | 20.99 | 22.27 | 19.16 | 19.02 | 20.19 | 20.92 | 20.19 | 25.07 | 25.03 |

| 2030 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.707 | $0.513 | $0.532 | $0.610 | $0.592 | $0.783 | $0.756 |

| Capital gains | | | | | | | | | |

| Long-term gains | 0.989 | 0.989 | 0.989 | 0.989 | 0.989 | 0.989 | 0.989 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $1.696 | $1.502 | $1.521 | $1.599 | $1.581 | $1.772 | $1.745 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $23.22 | $24.64 | $22.02 | $21.94 | $22.55 | $23.37 | $22.02 | $26.78 | $26.74 |

| 1/31/19 | 20.82 | 22.09 | 19.77 | 19.68 | 20.21 | 20.94 | 19.75 | 24.25 | 24.22 |

| 2025 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.795 | $0.615 | $0.658 | $0.671 | $0.646 | $0.874 | $0.849 |

| Capital gains | | | | | | | | | |

| Long-term gains | 0.682 | 0.682 | 0.682 | 0.682 | 0.682 | 0.682 | 0.682 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $1.477 | $1.297 | $1.340 | $1.353 | $1.328 | $1.556 | $1.531 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $22.91 | $24.31 | $21.32 | $21.26 | $21.68 | $22.47 | $21.44 | $23.11 | $23.06 |

| 1/31/19 | 20.94 | 22.22 | 19.48 | 19.38 | 19.81 | 20.53 | 19.63 | 21.10 | 21.06 |

| 2020 Fund | | | | | | | | | |

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Income | $0.633 | $0.478 | $0.490 | $0.506 | $0.569 | $0.696 | $0.687 |

| Capital gains | | | | | | | | | |

| Long-term gains | 0.330 | 0.330 | 0.330 | 0.330 | 0.330 | 0.330 | 0.330 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $0.963 | $0.808 | $0.820 | $0.836 | $0.899 | $1.026 | $1.017 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $19.63 | $20.83 | $18.89 | $18.87 | $19.31 | $20.01 | $18.90 | $22.15 | $22.13 |

| 1/31/19 | 18.39 | 19.51 | 17.75 | 17.72 | 18.16 | 18.82 | 17.71 | 20.85 | 20.83 |

|

| RetirementReady® Funds 13 |

Fund price and distribution informationFor the six-month period ended 1/31/19cont.

| | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Retirement Income | | | | | | | | | |

| Fund Lifestyle 1 | | | | | | | | | |

| Number | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Income | $0.378 | $0.313 | $0.317 | $0.355 | $0.355 | $0.407 | $0.400 |

| Capital gains | | | | | | | | | |

| Long-term gains | 0.025 | 0.025 | 0.025 | 0.025 | 0.025 | 0.025 | 0.025 |

| Short-term gains | — | — | — | — | — | — | — |

| Total | $0.403 | $0.338 | $0.342 | $0.380 | $0.380 | $0.432 | $0.425 |

| | Before | After | Net | Net | Before | After | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value |

| 7/31/18 | $17.62 | $18.35 | $17.20 | $17.24 | $17.67 | $18.26 | $17.61 | $17.68 | $17.68 |

| 1/31/19 | 17.02 | 17.73 | 16.61 | 16.65 | 17.07 | 17.64 | 17.01 | 17.08 | 17.08 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase.After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares for all funds except Retirement Income Fund Lifestyle 1, for which the rates are 4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarterTotal return for periods ended 12/31/18

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2060 Fund* | | | | | | | | | | | |

| Life of fund | 13.33% | 6.81% | 10.74% | 7.86% | 10.66% | 10.66% | 11.60% | 7.70% | 12.44% | 14.38% | 14.18% |

| Annual average | 4.14 | 2.16 | 3.36 | 2.49 | 3.34 | 3.34 | 3.62 | 2.43 | 3.88 | 4.45 | 4.40 |

| 3 years | 16.21 | 9.53 | 13.63 | 10.63 | 13.55 | 13.55 | 14.49 | 10.48 | 15.33 | 17.26 | 17.06 |

| Annual average | 5.13 | 3.08 | 4.35 | 3.42 | 4.33 | 4.33 | 4.61 | 3.38 | 4.87 | 5.45 | 5.39 |

| 1 year | –9.80 | –14.98 | –10.48 | –14.68 | –10.50 | –11.34 | –10.20 | –13.34 | –10.02 | –9.55 | –9.57 |

| 6 months | –9.48 | –14.69 | –9.85 | –14.08 | –9.87 | –10.71 | –9.73 | –12.89 | –9.62 | –9.40 | –9.41 |

| 2055 Fund† | | | | | | | | | | | |

| Life of fund | 85.50% | 74.83% | 74.68% | 74.68% | 74.58% | 74.58% | 78.16% | 71.93% | 81.89% | 89.93% | 89.39% |

| Annual average | 7.94 | 7.16 | 7.14 | 7.14 | 7.14 | 7.14 | 7.41 | 6.93 | 7.68 | 8.26 | 8.22 |

| 5 years | 26.08 | 18.83 | 21.50 | 19.83 | 21.41 | 21.41 | 22.98 | 18.68 | 24.56 | 28.05 | 27.69 |

| Annual average | 4.74 | 3.51 | 3.97 | 3.68 | 3.96 | 3.96 | 4.22 | 3.48 | 4.49 | 5.07 | 5.01 |

| 3 years | 16.03 | 9.36 | 13.46 | 10.62 | 13.45 | 13.45 | 14.30 | 10.30 | 15.22 | 17.28 | 16.95 |

| Annual average | 5.08 | 3.03 | 4.30 | 3.42 | 4.30 | 4.30 | 4.56 | 3.32 | 4.83 | 5.46 | 5.36 |

| 1 year | –9.76 | –14.95 | –10.42 | –14.34 | –10.46 | –11.24 | –10.24 | –13.38 | –9.99 | –9.46 | –9.54 |

| 6 months | –9.39 | –14.60 | –9.75 | –13.71 | –9.78 | –10.57 | –9.65 | –12.81 | –9.55 | –9.24 | –9.32 |

| |

| 14 RetirementReady® Funds |

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/18cont.

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2050 Fund‡ | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.72% | 5.26% | 5.26% | 5.26% | 5.14% | 5.14% | 5.19% | 4.91% | 5.45% | 6.00% | 5.98% |

| 10 years | 163.22 | 148.08 | 147.76 | 147.76 | 144.22 | 144.22 | 150.44 | 141.67 | 156.80 | 170.52 | 169.81 |

| Annual average | 10.16 | 9.51 | 9.50 | 9.50 | 9.34 | 9.34 | 9.62 | 9.23 | 9.89 | 10.46 | 10.43 |

| 5 years | 25.67 | 18.44 | 21.02 | 19.10 | 21.01 | 21.01 | 22.57 | 18.28 | 24.17 | 27.54 | 27.21 |

| Annual average | 4.68 | 3.44 | 3.89 | 3.56 | 3.89 | 3.89 | 4.15 | 3.41 | 4.42 | 4.99 | 4.93 |

| 3 years | 15.77 | 9.12 | 13.24 | 10.39 | 13.28 | 13.28 | 14.10 | 10.10 | 14.97 | 17.00 | 16.70 |

| Annual average | 5.00 | 2.95 | 4.23 | 3.35 | 4.24 | 4.24 | 4.49 | 3.26 | 4.76 | 5.37 | 5.28 |

| 1 year | –9.61 | –14.81 | –10.26 | –14.18 | –10.27 | –11.05 | –10.06 | –13.21 | –9.81 | –9.29 | –9.37 |

| 6 months | –9.29 | –14.51 | –9.62 | –13.57 | –9.63 | –10.41 | –9.52 | –12.69 | –9.40 | –9.15 | –9.19 |

| 2045 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.77% | 5.33% | 5.32% | 5.32% | 5.21% | 5.21% | 5.24% | 4.98% | 5.51% | 6.05% | 6.03% |

| 10 years | 159.87 | 144.93 | 144.76 | 144.76 | 141.15 | 141.15 | 147.21 | 138.56 | 153.48 | 167.15 | 166.45 |

| Annual average | 10.02 | 9.37 | 9.36 | 9.36 | 9.20 | 9.20 | 9.47 | 9.08 | 9.75 | 10.33 | 10.30 |

| 5 years | 25.14 | 17.94 | 20.55 | 18.68 | 20.52 | 20.52 | 22.09 | 17.82 | 23.63 | 27.09 | 26.76 |

| Annual average | 4.59 | 3.36 | 3.81 | 3.48 | 3.80 | 3.80 | 4.07 | 3.33 | 4.33 | 4.91 | 4.86 |

| 3 years | 15.55 | 8.91 | 12.94 | 10.13 | 12.98 | 12.98 | 13.89 | 9.90 | 14.70 | 16.77 | 16.46 |

| Annual average | 4.94 | 2.89 | 4.14 | 3.27 | 4.15 | 4.15 | 4.43 | 3.20 | 4.68 | 5.30 | 5.21 |

| 1 year | –9.34 | –14.55 | –10.02 | –13.90 | –9.99 | –10.77 | –9.76 | –12.92 | –9.53 | –9.01 | –9.09 |

| 6 months | –9.09 | –14.32 | –9.44 | –13.35 | –9.41 | –10.19 | –9.30 | –12.47 | –9.17 | –8.91 | –8.96 |

| 2040 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.67% | 5.23% | 5.22% | 5.22% | 5.12% | 5.12% | 5.14% | 4.88% | 5.41% | 5.95% | 5.93% |

| 10 years | 155.70 | 141.00 | 140.82 | 140.82 | 137.17 | 137.17 | 143.05 | 134.55 | 149.39 | 162.65 | 162.11 |

| Annual average | 9.84 | 9.19 | 9.19 | 9.19 | 9.02 | 9.02 | 9.29 | 8.90 | 9.57 | 10.14 | 10.12 |

| 5 years | 24.01 | 16.88 | 19.47 | 17.54 | 19.42 | 19.42 | 20.93 | 16.69 | 22.46 | 25.80 | 25.54 |

| Annual average | 4.40 | 3.17 | 3.62 | 3.29 | 3.61 | 3.61 | 3.87 | 3.14 | 4.14 | 4.70 | 4.65 |

| 3 years | 14.84 | 8.24 | 12.32 | 9.43 | 12.32 | 12.32 | 13.10 | 9.14 | 13.99 | 15.97 | 15.73 |

| Annual average | 4.72 | 2.67 | 3.95 | 3.05 | 3.95 | 3.95 | 4.19 | 2.96 | 4.46 | 5.06 | 4.99 |

| 1 year | –8.78 | –14.03 | –9.46 | –13.51 | –9.44 | –10.25 | –9.25 | –12.43 | –9.00 | –8.47 | –8.56 |

| 6 months | –8.47 | –13.74 | –8.79 | –12.87 | –8.80 | –9.62 | –8.72 | –11.91 | –8.59 | –8.34 | –8.36 |

| 2035 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 5.37% | 4.93% | 4.92% | 4.92% | 4.81% | 4.81% | 4.84% | 4.58% | 5.10% | 5.65% | 5.63% |

| 10 years | 146.01 | 131.87 | 131.73 | 131.73 | 128.24 | 128.24 | 134.07 | 125.88 | 139.92 | 152.86 | 152.25 |

| Annual average | 9.42 | 8.77 | 8.77 | 8.77 | 8.60 | 8.60 | 8.88 | 8.49 | 9.15 | 9.72 | 9.69 |

| 5 years | 22.06 | 15.04 | 17.59 | 15.64 | 17.60 | 17.60 | 19.09 | 14.92 | 20.55 | 23.91 | 23.61 |

| Annual average | 4.07 | 2.84 | 3.29 | 2.95 | 3.29 | 3.29 | 3.56 | 2.82 | 3.81 | 4.38 | 4.33 |

| 3 years | 13.52 | 7.00 | 11.02 | 8.10 | 11.03 | 11.03 | 11.89 | 7.97 | 12.68 | 14.70 | 14.42 |

| Annual average | 4.32 | 2.28 | 3.55 | 2.63 | 3.55 | 3.55 | 3.82 | 2.59 | 4.06 | 4.68 | 4.59 |

| 1 year | –7.80 | –13.10 | –8.45 | –12.58 | –8.47 | –9.29 | –8.21 | –11.42 | –8.03 | –7.47 | –7.54 |

| 6 months | –7.37 | –12.70 | –7.73 | –11.90 | –7.70 | –8.54 | –7.61 | –10.84 | –7.50 | –7.21 | –7.24 |

|

| RetirementReady® Funds 15 |

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/18cont.

| | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (9/1/16) | (11/1/04) |

| | Before | After | | | | | Before | After | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value |

| 2030 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 4.96% | 4.53% | 4.52% | 4.52% | 4.41% | 4.41% | 4.44% | 4.17% | 4.70% | 5.24% | 5.22% |

| 10 years | 132.55 | 119.18 | 118.98 | 118.98 | 115.75 | 115.75 | 121.16 | 113.42 | 126.83 | 138.88 | 138.42 |

| Annual average | 8.81 | 8.16 | 8.15 | 8.15 | 7.99 | 7.99 | 8.26 | 7.88 | 8.54 | 9.10 | 9.08 |

| 5 years | 19.60 | 12.72 | 15.22 | 13.22 | 15.22 | 15.22 | 16.60 | 12.52 | 18.12 | 21.30 | 21.07 |

| Annual average | 3.64 | 2.42 | 2.87 | 2.51 | 2.87 | 2.87 | 3.12 | 2.39 | 3.39 | 3.94 | 3.90 |

| 3 years | 11.61 | 5.19 | 9.17 | 6.21 | 9.15 | 9.15 | 9.93 | 6.09 | 10.83 | 12.69 | 12.47 |

| Annual average | 3.73 | 1.70 | 2.97 | 2.03 | 2.96 | 2.96 | 3.21 | 1.99 | 3.49 | 4.06 | 4.00 |

| 1 year | –6.50 | –11.87 | –7.16 | –11.46 | –7.19 | –8.05 | –6.97 | –10.23 | –6.73 | –6.19 | –6.26 |

| 6 months | –6.01 | –11.41 | –6.35 | –10.69 | –6.33 | –7.20 | –6.26 | –9.54 | –6.12 | –5.83 | –5.87 |

| 2025 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 4.42% | 3.99% | 3.98% | 3.98% | 3.87% | 3.87% | 3.90% | 3.64% | 4.16% | 4.70% | 4.68% |

| 10 years | 114.14 | 101.83 | 101.60 | 101.60 | 98.62 | 98.62 | 103.59 | 96.47 | 108.79 | 120.02 | 119.50 |

| Annual average | 7.91 | 7.27 | 7.26 | 7.26 | 7.10 | 7.10 | 7.37 | 6.99 | 7.64 | 8.20 | 8.18 |

| 5 years | 16.27 | 9.59 | 12.03 | 10.03 | 12.03 | 12.03 | 13.44 | 9.47 | 14.83 | 18.02 | 17.74 |

| Annual average | 3.06 | 1.85 | 2.30 | 1.93 | 2.30 | 2.30 | 2.55 | 1.83 | 2.80 | 3.37 | 3.32 |

| 3 years | 9.15 | 2.88 | 6.69 | 3.77 | 6.71 | 6.71 | 7.51 | 3.74 | 8.35 | 10.25 | 9.99 |

| Annual average | 2.96 | 0.95 | 2.18 | 1.24 | 2.19 | 2.19 | 2.44 | 1.23 | 2.71 | 3.31 | 3.23 |

| 1 year | –5.45 | –10.88 | –6.16 | –10.55 | –6.16 | –7.04 | –5.94 | –9.23 | –5.71 | –5.11 | –5.23 |

| 6 months | –4.82 | –10.29 | –5.18 | –9.61 | –5.18 | –6.07 | –5.07 | –8.39 | –4.96 | –4.65 | –4.69 |

| 2020 Fund | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 3.70% | 3.27% | 3.26% | 3.26% | 3.16% | 3.16% | 3.19% | 2.93% | 3.45% | 3.98% | 3.96% |

| 10 years | 94.11 | 82.95 | 82.90 | 82.90 | 80.15 | 80.15 | 84.66 | 78.19 | 89.38 | 99.45 | 99.04 |

| Annual average | 6.86 | 6.23 | 6.22 | 6.22 | 6.06 | 6.06 | 6.33 | 5.95 | 6.59 | 7.15 | 7.13 |

| 5 years | 12.89 | 6.40 | 8.77 | 6.78 | 8.79 | 8.79 | 10.16 | 6.31 | 11.51 | 14.55 | 14.32 |

| Annual average | 2.46 | 1.25 | 1.70 | 1.32 | 1.70 | 1.70 | 1.95 | 1.23 | 2.20 | 2.75 | 2.71 |

| 3 years | 7.04 | 0.88 | 4.65 | 1.71 | 4.66 | 4.66 | 5.43 | 1.74 | 6.27 | 8.07 | 7.85 |

| Annual average | 2.29 | 0.29 | 1.53 | 0.57 | 1.53 | 1.53 | 1.78 | 0.58 | 2.05 | 2.62 | 2.55 |

| 1 year | –4.52 | –10.01 | –5.23 | –9.75 | –5.17 | –6.08 | –4.97 | –8.30 | –4.71 | –4.13 | –4.27 |

| 6 months | –3.83 | –9.36 | –4.22 | –8.79 | –4.16 | –5.07 | –4.03 | –7.39 | –3.95 | –3.61 | –3.70 |

| Retirement | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | |

| Lifestyle 1 | | | | | | | | | | | |

| Annual average | | | | | | | | | | | |

| (life of fund) | 2.62% | 2.32% | 2.18% | 2.18% | 2.08% | 2.08% | 2.24% | 2.00% | 2.36% | 2.89% | 2.87% |

| 10 years | 66.18 | 59.53 | 56.48 | 56.48 | 54.19 | 54.19 | 61.09 | 55.85 | 62.05 | 70.73 | 70.37 |

| Annual average | 5.21 | 4.78 | 4.58 | 4.58 | 4.43 | 4.43 | 4.88 | 4.54 | 4.95 | 5.50 | 5.47 |

| 5 years | 8.97 | 4.62 | 4.92 | 3.02 | 4.99 | 4.99 | 7.64 | 4.14 | 7.61 | 10.55 | 10.31 |

| Annual average | 1.73 | 0.91 | 0.97 | 0.60 | 0.98 | 0.98 | 1.48 | 0.82 | 1.48 | 2.03 | 1.98 |

| 3 years | 4.97 | 0.77 | 2.59 | –0.34 | 2.65 | 2.65 | 4.17 | 0.78 | 4.19 | 5.95 | 5.73 |

| Annual average | 1.63 | 0.26 | 0.85 | –0.11 | 0.88 | 0.88 | 1.37 | 0.26 | 1.38 | 1.95 | 1.87 |

| 1 year | –4.13 | –7.96 | –4.87 | –9.52 | –4.84 | –5.77 | –4.31 | –7.42 | –4.38 | –3.79 | –3.87 |

| 6 months | –3.53 | –7.39 | –3.93 | –8.63 | –3.89 | –4.83 | –3.65 | –6.78 | –3.66 | –3.36 | –3.40 |

| |

| 16 RetirementReady® Funds |

*The inception date of Putnam RetirementReady 2060 Fund is 11/30/15, for all share classes except class R6, which incepted on 9/1/16.

†The inception date of Putnam RetirementReady 2055 Fund is 11/30/10, for all share classes except class R6, which incepted on 9/1/16.

‡The inception date of Putnam RetirementReady 2050 Fund is 5/2/05, for all share classes except class R6, which incepted on 9/1/16.

See the discussion following the fund performance tables on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Putnam RetirementReady 2060 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18* | 1.04% | 1.79% | 1.79% | 1.54% | 1.29% | 0.69% | 0.79% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 17.10% | 17.85% | 17.85% | 17.60% | 17.35% | 16.75% | 16.85% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.38% | 1.13% | 1.13% | 0.88% | 0.63% | 0.05% | 0.13% |

| Putnam RetirementReady 2055 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18**† | 1.08% | 1.83% | 1.83% | 1.58% | 1.33% | 0.69% | 0.83% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18† | 1.57% | 2.32% | 2.32% | 2.07% | 1.82% | 1.18% | 1.32% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.42% | 1.17% | 1.17% | 0.92% | 0.67% | 0.05% | 0.17% |

| Putnam RetirementReady 2050 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18** | 1.05% | 1.80% | 1.80% | 1.55% | 1.30% | 0.69% | 0.80% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 1.24% | 1.99% | 1.99% | 1.74% | 1.49% | 0.88% | 0.99% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.39% | 1.14% | 1.14% | 0.89% | 0.64% | 0.05% | 0.14% |

| Putnam RetirementReady 2045 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18** | 1.07% | 1.82% | 1.82% | 1.57% | 1.32% | 0.70% | 0.82% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 1.25% | 2.00% | 2.00% | 1.75% | 1.50% | 0.88% | 1.00% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.40% | 1.15% | 1.15% | 0.90% | 0.65% | 0.05% | 0.15% |

| Putnam RetirementReady 2040 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18**† | 1.03% | 1.78% | 1.78% | 1.53% | 1.28% | 0.69% | 0.78% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18† | 1.12% | 1.87% | 1.87% | 1.62% | 1.37% | 0.78% | 0.87% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.38% | 1.13% | 1.13% | 0.88% | 0.63% | 0.05% | 0.13% |

|

| RetirementReady® Funds 17 |

Expense ratioscont.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Putnam RetirementReady 2035 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18** | 1.03% | 1.78% | 1.78% | 1.53% | 1.28% | 0.67% | 0.78% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 1.14% | 1.89% | 1.89% | 1.64% | 1.39% | 0.78% | 0.89% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.40% | 1.15% | 1.15% | 0.90% | 0.65% | 0.05% | 0.15% |

| Putnam RetirementReady 2030 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18** | 0.98% | 1.73% | 1.73% | 1.48% | 1.23% | 0.64% | 0.73% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 1.06% | 1.81% | 1.81% | 1.56% | 1.31% | 0.72% | 0.81% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.38% | 1.13% | 1.13% | 0.88% | 0.63% | 0.05% | 0.13% |

| Putnam RetirementReady 2025 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18** | 0.99% | 1.74% | 1.74% | 1.49% | 1.24% | 0.63% | 0.74% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18 | 1.10% | 1.85% | 1.85% | 1.60% | 1.35% | 0.74% | 0.85% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.40% | 1.15% | 1.15% | 0.90% | 0.65% | 0.05% | 0.15% |

| Putnam RetirementReady 2020 Fund | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18**† | 0.96% | 1.71% | 1.71% | 1.46% | 1.21% | 0.63% | 0.71% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18† | 1.04% | 1.79% | 1.79% | 1.54% | 1.29% | 0.71% | 0.79% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.38% | 1.13% | 1.13% | 0.88% | 0.63% | 0.05% | 0.13% |

| Putnam Retirement Income Fund | | | | | | | |

| Lifestyle 1 | | | | | | | |

| Net expenses for the fiscal year ended 7/31/18**† | 0.97% | 1.72% | 1.72% | 1.22% | 1.22% | 0.63% | 0.72% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 7/31/18† | 1.10% | 1.85% | 1.85% | 1.35% | 1.35% | 0.76% | 0.85% |

| Annualized expense ratio for the six-month | | | | | | | |

| period ended 1/31/19# | 0.38% | 1.13% | 1.13% | 0.63% | 0.63% | 0.05% | 0.13% |

Fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and differs from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

Prospectus expense information also includes the impact of acquired fund fees and expense in which each fund invests (see table below), which are not included in financial highlights or annualized expense ratios.

| | | | |

| Putnam RetirementReady 2060 Fund | 0.64% | | | |

| Putnam RetirementReady 2055 Fund | 0.64% | | | |

| Putnam RetirementReady 2050 Fund | 0.64% | | | |

| Putnam RetirementReady 2045 Fund | 0.65% | | | |

| Putnam RetirementReady 2040 Fund | 0.64% | | | |

| Putnam RetirementReady 2035 Fund | 0.62% | | | |

| Putnam RetirementReady 2030 Fund | 0.59% | | | |

| Putnam RetirementReady 2025 Fund | 0.58% | | | |

| Putnam RetirementReady 2020 Fund | 0.58% | | | |

| Putnam Retirement Income Fund Lifestyle 1 | 0.58% | | | |

*Reflects Putnam Management’s decision to contractually limit certain fund expenses through 11/30/28.

**Reflects Putnam Management’s decision to contractually limit certain fund expenses through 11/30/19.

†Restated to reflect current fees.

#Excludes the expense ratio of the underlying Putnam mutual funds.

|

| 18 RetirementReady® Funds |

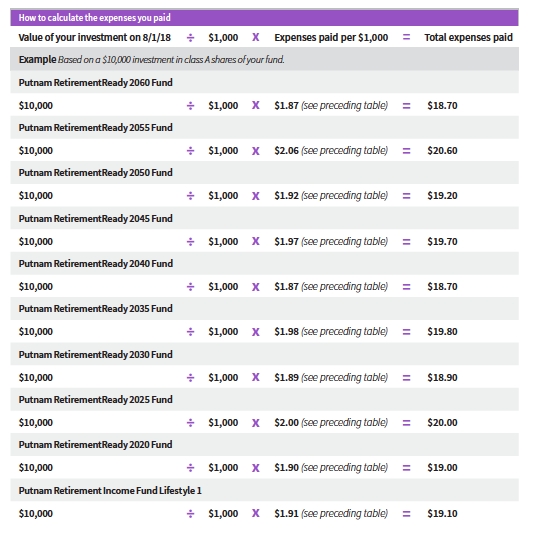

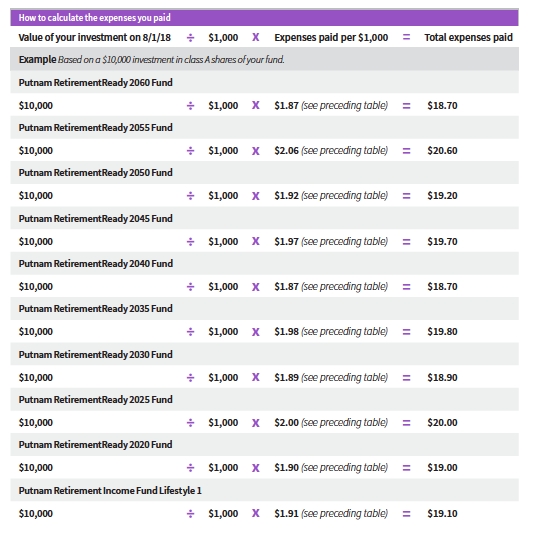

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each fund from 8/1/18 to 1/31/19. It also shows how much a $1,000 investment would be worth at the close of the period, assumingactual returnsand expenses.

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Putnam RetirementReady | | | | | | | |

| 2060 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.87 | $5.54 | $5.54 | $4.31 | $3.09 | $0.25 | $0.64 |

| Ending value (after expenses) | $947.60 | $943.60 | $943.50 | $945.30 | $946.70 | $949.20 | $949.80 |

| Putnam RetirementReady | | | | | | | |

| 2055 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.06 | $5.74 | $5.73 | $4.51 | $3.29 | $0.25 | $0.84 |

| Ending value (after expenses) | $948.70 | $944.70 | $944.30 | $945.80 | $947.30 | $950.20 | $949.20 |

| Putnam RetirementReady | | | | | | | |

| 2050 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.92 | $5.59 | $5.59 | $4.37 | $3.14 | $0.25 | $0.69 |

| Ending value (after expenses) | $949.70 | $947.00 | $946.30 | $947.70 | $948.90 | $951.50 | $951.50 |

| Putnam RetirementReady | | | | | | | |

| 2045 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.97 | $5.65 | $5.65 | $4.42 | $3.20 | $0.25 | $0.74 |

| Ending value (after expenses) | $951.70 | $948.00 | $948.30 | $949.50 | $950.60 | $953.30 | $952.70 |

| Putnam RetirementReady | | | | | | | |

| 2040 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.87 | $5.56 | $5.56 | $4.34 | $3.11 | $0.25 | $0.64 |

| Ending value (after expenses) | $956.60 | $953.30 | $952.90 | $954.50 | $955.90 | $958.60 | $957.90 |

| Putnam RetirementReady | | | | | | | |

| 2035 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.98 | $5.68 | $5.68 | $4.45 | $3.22 | $0.25 | $0.74 |

| Ending value (after expenses) | $964.60 | $961.10 | $960.70 | $962.00 | $963.20 | $966.10 | $965.40 |

| Putnam RetirementReady | | | | | | | |

| 2030 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.89 | $5.61 | $5.61 | $4.37 | $3.13 | $0.25 | $0.65 |

| Ending value (after expenses) | $973.40 | $969.50 | $969.80 | $970.80 | $972.40 | $975.10 | $974.40 |

| Putnam RetirementReady | | | | | | | |

| 2025 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.00 | $5.73 | $5.73 | $4.49 | $3.24 | $0.25 | $0.75 |

| Ending value (after expenses) | $981.20 | $977.00 | $977.20 | $978.70 | $980.10 | $983.20 | $982.50 |

| Putnam RetirementReady | | | | | | | |

| 2020 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.90 | $5.65 | $5.65 | $4.40 | $3.15 | $0.25 | $0.65 |

| Ending value (after expenses) | $987.50 | $983.80 | $984.00 | $985.20 | $986.20 | $989.20 | $988.80 |

| Putnam Retirement Income | | | | | | | |

| Fund Lifestyle 1 | | | | | | | |

| Expenses paid per $1,000*† | $1.91 | $5.66 | $5.66 | $3.16 | $3.16 | $0.25 | $0.65 |

| Ending value (after expenses) | $989.40 | $985.90 | $986.20 | $988.20 | $988.10 | $991.10 | $990.70 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

|

| RetirementReady® Funds 19 |

Estimate the expenses you paid

To estimate the expenses you paid for the six months ended 1/31/19, use the following calculation method. To find the value of your investment on 8/1/18, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming ahypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in each of the RetirementReady Funds with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| |

| 20 RetirementReady® Funds |

| | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R6 | Class Y |

| Putnam RetirementReady | | | | | | | |

| 2060 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.94 | $5.75 | $5.75 | $4.48 | $3.21 | $0.26 | $0.66 |

| Ending value (after expenses) | $1,023.29 | $1,019.51 | $1,019.51 | $1,020.77 | $1,022.03 | $1,024.95 | $1,024.55 |

| Putnam RetirementReady | | | | | | | |

| 2055 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.14 | $5.96 | $5.96 | $4.69 | $3.41 | $0.26 | $0.87 |

| Ending value (after expenses) | $1,023.09 | $1,019.31 | $1,019.31 | $1,020.57 | $1,021.83 | $1,024.95 | $1,024.35 |

| Putnam RetirementReady | | | | | | | |

| 2050 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.99 | $5.80 | $5.80 | $4.53 | $3.26 | $0.26 | $0.71 |

| Ending value (after expenses) | $1,023.24 | $1,019.46 | $1,019.46 | $1,020.72 | $1,021.98 | $1,024.95 | $1,024.50 |

| Putnam RetirementReady | | | | | | | |

| 2045 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.04 | $5.85 | $5.85 | $4.58 | $3.31 | $0.26 | $0.77 |

| Ending value (after expenses) | $1,023.19 | $1,019.41 | $1,019.41 | $1,020.67 | $1,021.93 | $1,024.95 | $1,024.45 |

| Putnam RetirementReady | | | | | | | |

| 2040 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.94 | $5.75 | $5.75 | $4.48 | $3.21 | $0.26 | $0.66 |

| Ending value (after expenses) | $1,023.29 | $1,019.51 | $1,019.51 | $1,020.77 | $1,022.03 | $1,024.95 | $1,024.55 |

| Putnam RetirementReady | | | | | | | |

| 2035 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.04 | $5.85 | $5.85 | $4.58 | $3.31 | $0.26 | $0.77 |

| Ending value (after expenses) | $1,023.19 | $1,019.41 | $1,019.41 | $1,020.67 | $1,021.93 | $1,024.95 | $1,024.45 |

| Putnam RetirementReady | | | | | | | |

| 2030 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.94 | $5.75 | $5.75 | $4.48 | $3.21 | $0.26 | $0.66 |

| Ending value (after expenses) | $1,023.29 | $1,019.51 | $1,019.51 | $1,020.77 | $1,022.03 | $1,024.95 | $1,024.55 |

| Putnam RetirementReady | | | | | | | |

| 2025 Fund | | | | | | | |

| Expenses paid per $1,000*† | $2.04 | $5.85 | $5.85 | $4.58 | $3.31 | $0.26 | $0.77 |

| Ending value (after expenses) | $1,023.19 | $1,019.41 | $1,019.41 | $1,020.67 | $1,021.93 | $1,024.95 | $1,024.45 |

| Putnam RetirementReady | | | | | | | |

| 2020 Fund | | | | | | | |

| Expenses paid per $1,000*† | $1.94 | $5.75 | $5.75 | $4.48 | $3.21 | $0.26 | $0.66 |

| Ending value (after expenses) | $1,023.29 | $1,019.51 | $1,019.51 | $1,020.77 | $1,022.03 | $1,024.95 | $1,024.55 |

| Putnam Retirement Income | | | | | | | |

| Fund Lifestyle 1 | | | | | | | |

| Expenses paid per $1,000*† | $1.94 | $5.75 | $5.75 | $3.21 | $3.21 | $0.26 | $0.66 |

| Ending value (after expenses) | $1,023.29 | $1,019.51 | $1,019.51 | $1,022.03 | $1,022.03 | $1,024.95 | $1,024.55 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/19. The expense ratio may differ for each share class.

†Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

|

| RetirementReady® Funds 21 |

Consider these risks before investing

Our allocation of assets among permitted asset categories may hurt performance. Stock and bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, changing market perceptions (including, in the case of bonds, perceptions about the risk of default and expectations about monetary policy or interest rates), changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may lead to increased volatility and reduced liquidity in the funds’ portfolio holdings. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Default risk is generally higher for non-qualified mortgages. Interest-rate risk is greater for longer-term bonds, and credit risk is greater for below-investment-grade bonds. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk and the risk that they may increase in value less when interest rates decline and decline in value more when interest rates rise. International investing involves currency, economic, and political risks. Emerging-market securities carry illiquidity and volatility risks. Active trading strategies may lose money or not earn a return sufficient to cover trading and other costs. REITs are subject to the risk of economic downturns that have an adverse impact on real estate markets. Commodity-linked notes are subject to the same risks as commodities, such as weather, disease, political, tax and other regulatory developments, and other factors affecting the value of commodities. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Efforts to produce lower volatility returns may not be successful and may make it more difficult at times for the funds to achieve their targeted returns. In addition, under certain market conditions, the funds may accept greater volatility than would typically be the case, in order to seek their targeted returns. If the quantitative models or data that are used in managing an underlying fund prove to be incorrect or incomplete, investment decisions made in reliance on the models or data may not produce the desired results and the fund may realize losses. There is no guarantee that the funds will provide adequate income at and through an investor’s retirement. You can lose money by investing in the funds.

For the portion invested in Putnam Government Money Market Fund, these risks also apply:

You can lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. The values of money market investments usually rise and fall in response to changes in interest rates. Changes in the financial condition of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect a security’s or instrument’s credit quality or value.

Certain securities in which the fund may invest, including securities issued by certain U.S. government agencies and U.S. government sponsored enterprises, are not guaranteed by the U.S. government or supported by the full faith and credit of the United States. Mortgage-backed securities are subject to prepayment risk and the risk that they may increase in value less when interest rates decline and decline in value more when interest rates rise.

The principal value of each fund is not guaranteed at any time, including at the target date.

| |

| 22 RetirementReady® Funds |

Terms and definitions

Important terms