| BARNES & THORNBURG llp | |

| http://www.btlaw.com | 171 Monroe Avenue NW |

| | Suite 1000 |

| | Grand Rapids, MI 49503 |

| | |

| | Switchboard: (616) 742-3930 |

| | Fax: (616) 742-3999 |

| | Direct Dial: (616) 742-3933 |

| |

FOIA Confidential Treatment Request by MISCOR Group, Ltd. pursuant to Rule 83, 17 C.F.R. 200.83, with respect to information provided supplementally to the Securities and Exchange Commission, Division of Corporate Finance, in partial response to Comment 2.

January 30, 2009

Larry Spirgel, Assistant Director

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549-3720

| | Re: | MISCOR Group, Ltd. (“MISCOR”) |

| | | Form 10-K (“10-K”) for the fiscal year ended December 31, 2007 |

| | | Filed March 31, 2008 |

| | | Form 10-Q for the quarterly period ended September 28, 2008 |

| | | File No. 000-52380 |

Dear Mr. Spirgel:

By letter dated November 21, 2008, your office provided comments on the above-referenced filings. Responses to those comments were submitted to you by my firm on behalf of MISCOR by letters dated December 19, 2008 and December 23, 2008, and by MISCOR directly on January 7, 2009.

By letter dated January 9, 2009, your office provided additional comments to the above-referenced filings. On behalf of MISCOR, we provide the following responses to those comments. For your convenience, I have reproduced you office’s comments and requests for information in bold below followed by MISCOR’s responses in regular type.

To protect confidential and sensitive business and financial information, MISCOR has provided the information constituting Exhibit B hereto, in partial response to your Comment 2, as a supplemental submission under Rule 12b-4 under the Securities Exchange Act of 1934, as amended, which submission requests that the information be returned to MISCOR in accordance with Rule 12b-4 after you have completed your review and further requests confidential treatment of the information under Rule 83, 17 C.F.R. 200.83.

* * * * *

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 2

Form 10-K for the fiscal year ended December 31, 2007

Note A – Summary of Significant Accounting Policies

| | 1. | We note your response to prior comment 1. In your critical accounting policies, you should revise to provide more details of your goodwill impairment policy by: |

| | · | Disclosing how you determine the fair value of your reporting units. |

| | | Providing a quantitative description of the material assumptions used in determining that fair value and a sensitivity analysis of those assumptions based upon reasonably likely changes. |

Please provide us with your proposed disclosures.

Response: MISCOR recorded goodwill in conjunction with the acquisitions of Ideal Consolidated, Inc. (“IDEAL”) in October, 2007 and 3-D Service, Ltd. (“3-D”) in November, 2007. Prior to these acquisitions, there was no goodwill on MISCOR’s consolidated balance sheet. In accordance with SFAS 142, paragraphs 26 and 28, MISCOR is required to test the carrying amount of its reporting units’ goodwill for impairment at least annually. Due to the fact that the above acquisitions closed during the fourth quarter of fiscal 2007, MISCOR did not test goodwill for impairment as of and for the year ended December 31, 2007. For the nine months ended September 28, 2008, MISCOR did not perform the goodwill impairment tests on an interim basis as there were no triggering events that indicated that the fair value of the reporting units had fallen below the reporting units’ carrying amount. MISCOR elected to conduct its fiscal 2008 annual goodwill impairment tests in the fourth quarter of 2008. MISCOR has engaged a third party valuation specialist to assist management in determining the fair value of MISCOR’s reporting units and these analyses are still in progress.

Upon completion of its goodwill impairment testing, MISCOR will disclose in its critical accounting policies how it determined the fair value of its reporting units. In addition, the disclosure will include a quantitative description of the material assumptions used in determining the fair value of its reporting units and a sensitivity analysis of those assumptions based upon reasonably likely changes. MISCOR will provide you with its proposed disclosures upon completion of its goodwill impairment analyses.

Note O – Segment Information, page 62

| | 2. | We note your response to prior comment 5. You disclose that your chief operating decision maker does not review the results of your business groups because separate financial statements are not prepared for each of the three groups. However, in your response to prior comment 2, you disclose that Magnetech Industrial Services, Inc. (MIS) is a separate and distinct business for which discrete financial information is available. Further the response to this |

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 3

comment states that MIS is not aggregated with other components in the RRM segment as it does not have similar economic characteristics with the other components. Please explain and reconcile the differences in these two responses. Also, as previously requested, please provide us with the reports that are provided to your chief operating decision maker to make decisions about resources to be allocated to the segments and assess their performance.

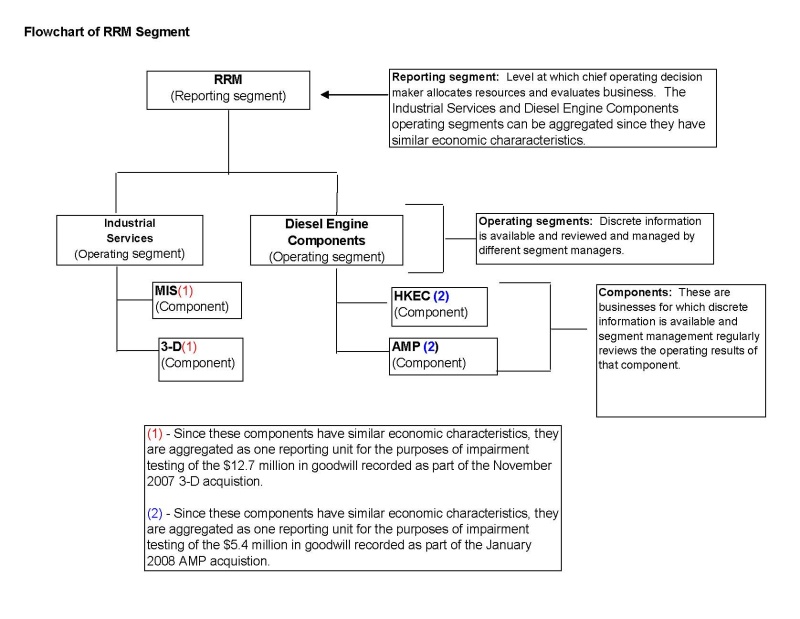

Response: As noted in our letter dated December 19, 2008, MISCOR has two reporting segments: the repair, remanufacturing and manufacturing (“RRM”) segment; and the construction and engineering services segment. In order to clarify the RRM reporting segment structure, we have included a flowchart of the RRM reporting segment attached hereto as Exhibit A and have provided an expanded discussion of the RRM reporting segment below.

The RRM reporting segment is comprised of two operating segments, the Industrial Services Segment and the Diesel Engine Components segment, which are managed by different segment managers. MISCOR has determined that these two operating segments meet the aggregation criteria to be considered one reporting segment as set forth in SFAS No. 131, paragraph 17, as both operating segments clearly exhibit similar economic characteristics. The operating segments share assets, mainly a common sales force, and also have certain common customers in the rail and steel industry. Additionally, MISCOR’s Chief Executive Officer receives financial data for these two operating segments on a combined basis and evaluates performance and makes resource allocation decisions as if these operating segments were combined.

The Industrial Services operating segment provides maintenance and repair services for both alternating current and direct current electric motors for a broad range of industries including steel, railroad, marine, petrochemical, pulp and paper, wind energy, mining, automotive and power generation. Additionally, this operating segment repairs and manufactures industrial lifting magnets. For the purposes of goodwill impairment testing, this operating segment has two components, Magnetech Industrial Services, Inc. (“MIS”) and 3-D Service, Ltd. (“3-D”), for which discrete financial is available and the operating results of these components are regularly reviewed by segment management. MISCOR indicated in response to your prior Comment #2 that MIS is not aggregated with other components in the RRM segment; however, after further analysis and review, MISCOR has determined to aggregate MIS and 3-D into one reporting unit under SFAS No. 142, paragraph 30, because they provide similar products and services and share many of the same customers. Accordingly, for goodwill impairment testing purposes, the $12.7 million of goodwill recorded as part of the November 2007 acquisition of 3-D will be tested in the reporting unit which reflects both the MIS and 3-D components.

The Diesel Engine Components operating segment provides maintenance and repair services for locomotives and diesel engines and manufacturers and remanufactures power assemblies, engine parts and other components related to diesel engines. For the purposes of

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 4

goodwill impairment testing, this operating segment has two components, HK Engine Components LLC (“HKEC”) and American Motive Power, Inc. (“AMP”), for which discrete financial is available and segment management regularly reviews the operating results of these components. However, these two components have similar economic characteristics and thus are aggregated into one reporting unit as directed under SFAS No. 142, paragraph 30. For goodwill impairment testing purposes, the $5.4 million of goodwill recorded as part of the January 2008 acquisition of AMP will be tested in the reporting unit which reflects both the HKEC and AMP components.

As it relates to production facilities, MISCOR has organized its RRM reporting segment into three primary business groups: the Motor Group; the Magnet Group; and the Rail Services Group. Separate financial statements are not prepared for each business group. As discussed below, while separate financial information is prepared for MIS, its facilities serve all three business groups and therefore its financial information is not representative of any single group.

MIS’s seven production facilities provide products and services for all three business groups. 3-D’s two production facilities provide products and services for the Motors Group. HKEC’s two production facilities provide products and services only for the Rail Group. This is summarized in the following diagram:

| | | | | | Business Groups | |

| | Legal Entity | | Facility | | Motors | | Magnets | | Rail | |

| | MIS | | South Bend, IN | | X | | | | X | |

| | | | Hammond, IN | | X | | X | | | |

| | | | Indianapolis, IN | | X | | | | | |

| | | | Boardman, OH | | | | X | | | |

| | | | Huntington, WV | | X | | | | X | |

| | | | Saraland, AL | | X | | | | | |

| | | | Mobile, AL | | | | X | | | |

| | | | | | | | | | | |

| | 3-D | | Massillon, OH | | X | | | | | |

| | | | Cincinnati, OH | | X | | | | | |

| | | | | | | | | | | |

| | HKEC | | Hagerstown, MD | | | | | | X | |

| | | | Weston, WV | | | | | | X | |

Note: The above table does not include the fiscal 2008 AMP acquisition.

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 5

While MIS is part of the RRM segment, its operations straddle, but do not constitute all of the three business groups within that segment. Each of the other subsidiary corporations in the segment serves one of three business groups. Further, because each business group is served by two of the three subsidiaries comprising the RRM segment, the separate financial information of each subsidiary does not reflect the financial condition or operating results of a single business group within the segment.

MISCOR has also re-examined the components within its construction and engineering services reporting segment in order to determine if the components should be aggregated for the purpose of determining reporting units for goodwill impairment purposes. MISCOR indicated in response to your prior Comment #2 that IDEAL is not aggregated with other components in the construction and engineering services segment; however, after further review and analysis, MISCOR has determined to aggregate the IDEAL and Martell Electric, LLC components into one reporting unit under SFAS No. 142, paragraph 30, because both components have similar economic characteristics. Accordingly, for goodwill impairment testing purposes, the $0.6 million of goodwill recorded as part of the October 2007 acquisition of IDEAL will be tested in the reporting unit which reflects both the IDEAL and Martell Electric components.

John A. Martell, MISCOR’s President and Chief Executive Officer, is the chief operating decision maker (“CODM”). The CODM considers a variety of financial and operating information to evaluate performance and allocate resources to MISCOR’s operating segments. Such financial and operating information provided to the CODM and certain other members of MISCOR’s management for the interim period ending September 28, 2008 is attached hereto as Exhibit B. To protect confidential and sensitive business and financial information, MISCOR is sending the materials constituting Exhibit B to you as a supplemental submission under Rule 12b-4 under the Securities Exchange Act of 1934, as amended, and therefore MISCOR respectfully requests that you return Exhibit B to MISCOR, Attention: General Counsel, 1125 South Walnut Street, South Bend, Indiana 46619 after you complete your review.

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 6

Rule 83 MISCOR Group, Ltd. Confidential Treatment Request No. 1

Because of the confidential and sensitive nature of the information constituting Exhibit B, if you determine not to return the information constituting Exhibit B, MISCOR requests confidential treatment of Exhibit B pursuant to Rule 83, 17. C.F.R. 200.83, which request is designated as MISCOR Group, Ltd. Confidential Treatment Request No. 1.

If any person (including any government employee who is not a member of the Staff of the Securities and Exchange Commission “SEC”)) requests an opportunity to inspect or copy any information constituting Exhibit B, MISCOR requests that (i) you promptly notify MISCOR’s General Counsel of such request by writing to MISCOR Group, Ltd., Attention: General Counsel, 1125 South Walnut Street, South Bend, Indiana 46619, or by facsimile at (574) 232-7648, or by calling 573-234-8131; (ii) you furnish to the General Counsel a copy of all written material pertaining to such request (including but not limited to the request itself and any determination by the SEC Staff with respect to such request); and (iii) you provide to the General Counsel sufficient advance notice of any intended release so that MISCOR, if it deems necessary or appropriate, may pursue any available remedies. If the SEC is not satisfied that the information for which MISCOR requests confidential treatment is exempt from disclosure, MISCOR requests an opportunity to be heard on its claim of exemption.

The foregoing request also applies to any reports, summaries, analyses, letters or memoranda arising out of, in anticipation of or in connection with the SEC’s examination or inspection of memoranda, notes, transcripts or writings of any kind that are made by or at the direction of any employee of the SEC (or any other governmental agency authorized to do so) and which incorporate, include or relate to any of the matters (i) contained in the information for which MISCOR requests confidential treatment or any materials submitted by MISCOR to the SEC (or any other governmental agency) or (ii) referred to in any conference, meeting or telephone conversation between (a) counsel for MISCOR and (b) employees of the SEC (or any other governmental agency).

* * * * *

Larry Spirgel, Assistant Director

Division of Corporate Finance

U.S. Securities and Exchange Commission

January 30, 2009

Page 7

We appreciate your review of the foregoing responses to your comments. Should you have additional comments or questions, please contact me at 616.742.3933.

| | Very truly yours, |

| | |

| | |

| | /s/ R. Paul Guerre |

| | |

| | R. Paul Guerre |

| cc: | John A. Martell |

| | Richard J. Mullin |

| | James M. Lewis |

| | Joseph Canataro |

| | James Kochanski |

EXHIBIT A

Rule 83 MISCOR Group, Ltd. Confidential Treatment Request No. 1

EXHIBIT B

Information Provided Supplementally

To protect confidential and sensitive business and financial information, MISCOR has provided the information constituting Exhibit B as a supplemental submission under Rule 12b-4 under the Securities Exchange Act of 1934, as amended, which submission requests that the information be returned to MISCOR in accordance with Rule 12b-4 after the Staff of the Securities and Exchange Commission has completed its review and further requests (i) confidential treatment of the information under Rule 83, 17 C.F.R. 200.83, which request is designated as MISCOR Group, Ltd. Confidential Treatment Request No. 1, and (ii) that the Securities and Exchange Commission provide timely notice to MISCOR Group, Ltd., Attention: General Counsel, 1125 South Walnut Street, South Bend, Indiana 46619, or by facsimile at (574) 232-7648, or by calling 573-234-8131, before disclosing any information constituting Exhibit B.