BARNES & THORNBURG llp

| http://www.btlaw.com | 171 Monroe Avenue NW |

| | Suite 1000 |

| | Grand Rapids, MI 49503 |

| | |

| | Switchboard: (616) 742-3930 |

| | Fax: (616) 742-3999 |

| | Direct Dial: (616) 742-3933 |

| |

March 10, 2009

Larry Spirgel, Assistant Director

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549-3720

| | Re: | MISCOR Group, Ltd. (“MISCOR”) | |

| | | Form 10-K (“10-K”) for the fiscal year ended December 31, 2007 | |

| | | Filed March 31, 2008 | |

| | | Form 10-Q for the quarterly period ended September 28, 2008 | |

| | | File No. 000-52380 | |

Dear Mr. Spirgel:

By letter dated November 21, 2008, your office provided comments on the above-referenced filings. Responses to those comments were submitted to you by my firm on behalf of MISCOR by letters dated December 19, 2008 and December 23, 2008, and by MISCOR directly on January 7, 2009.

By letter dated January 9, 2009, your office provided additional comments to the above-referenced filings. Responses to those comments were submitted to you by my firm on January 30, 2009.

By letter dated February 19, 2009, your office provided additional comments to the above-referenced filings. On behalf of MISCOR, we provide the following responses to those comments. For your convenience, I have reproduced you office’s comments in bold below followed by MISCOR’s responses in regular type.

* * * * *

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 2

| | 1. | We note your responses to prior comments 1 and 2. Based on our review of the report provided to your CODM, it appears that each component business listed in the consolidating income statement on page 3 is an operating segment as defined by paragraph 10 of SFAS 131. Specifically, we note that each component: a.) engages in business activities from which it earns revenues and incurs expenses, b.) has operating results that are regularly reviewed by the CODM (since he is provided with these specifically detailed reports), and c.) discrete financial information is available for each (information is presented through net income (loss) for each component). |

| | We further note throughout the CODM report that there are individual reports for each of these component businesses. These details are enough to conclude that the CODM (your CEO) allocates resources to and assesses the performance of each of these component businesses. Therefore, we believe that you should revise your analysis as if each component business is a separate operating segment. You should then determine which operating segments can be aggregated, if any and/or should be reported separately in your notes to the financial statements pursuant to the guidance in paragraphs 17-24 of SFAS 131. |

| | Further, once you complete this analysis of your operating segments, you should re-perform your analysis of your reporting units under paragraphs 30-31 of SFAS 142. |

| | You should also refer to EITF D-101 in your analysis and response. Further, you should perform your impairment testing for the fourth quarter of 2008 for each of these reporting units with allocated goodwill. |

Response: MISCOR has re-evaluated its operating and reporting segments as well as its reporting units. Under the criteria set forth in paragraphs 10, 13 and 14 of SFAS 131, MISCOR has concluded that its operating segments for 2008 are as follows: Ideal Consolidated, Inc. (“Ideal”), Martell Electric, LLC (“Martell Electric”), Magnetech Industrial Services, Inc. (“MIS”), Magnetech Power Services, LLC (“MPS”), 3D Service, Ltd. (“3D”), HK Engine Components, LLC (“HKEC”), and American Motive Power, Inc. (“AMP”). MISCOR has further concluded that, under the criteria set forth in paragraphs 17-24 of SFAS 131, these operating segments can be aggregated into three reporting segments: Industrial Services (MIS, MPS, and 3D), Construction and Engineering Services (Martell Electric and Ideal Consolidated), and Rail Services (HKEC and AMP). Finally, applying the criteria set forth in paragraphs 30-31 of SFAS 142 as well as the guidance in EITF D-101, MISCOR has concluded that each relevant operating segment is also an indivisible reporting unit for goodwill impairment testing purposes. Following is MISCOR’s analysis supporting the foregoing conclusions.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 3

I. Operating Segments

Using the criteria specified in SFAS 131, the operating segments of MISCOR can be identified as follows: Ideal, Martell Electric, MIS, MPS, 3D, HKEC and AMP. Each of these units meets the criteria specified in paragraph 10, specifically, each is a component of an enterprise:

1) that engages in business activities from which it may earn revenues and incur expenses; and

2) whose operating results are regularly reviewed by the enterprise’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance; and

3) for which discrete financial information is available.

Each unit has discrete financial information available, as evidenced by the September 2008 management report provided to MISCOR’s CODM, a copy of which was provided to the Staff supplementally by letter from me dated January 30, 2009. This management report (“MPACK”) contains summary information for the operating segments, as well as significant detail (including profit and loss) for most of the locations that make up the operating segments.

Paragraph 13 of SFAS 131 states that, in some cases, the financial information reviewed by the CODM may include reports in which business activities are presented in a variety of different ways. The MPACK demonstrates this with respect to MISCOR. Paragraph 13 states that, in such cases, “other factors may identify a single set of components as constituting an enterprises operating segments, including the nature of the business activities of each component, the existence of managers responsible for them, and information presented to the board of directors.”

The CODM relies primarily on the following schedules included in the MPACK to allocate resources and assess performance of the company (please refer to the September 2008 MPACK provided supplementally to the Staff):

1) Consolidating summary of all operating segments (Schedule “Z5-A”), which provides consolidating profit and loss information by operating segment. Schedule Z5-A is also provided to the board of directors at its regular meetings, and is the only detail provided to the board other than MISCOR’s condensed consolidated statements;

2) Consolidated summary of MIS, MPS and 3D operating segments (Schedule “M5 Mag 3D MPS Cons”);

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 4

3) Consolidated summary of Rail Group (HKEC and AMP) (Schedule “M5 HK AMP Cons”); and

4) Consolidated summary of Construction and Engineering Services Group (Martell Electric and Ideal) (Schedule “J5 Martell Ideal Cons”).

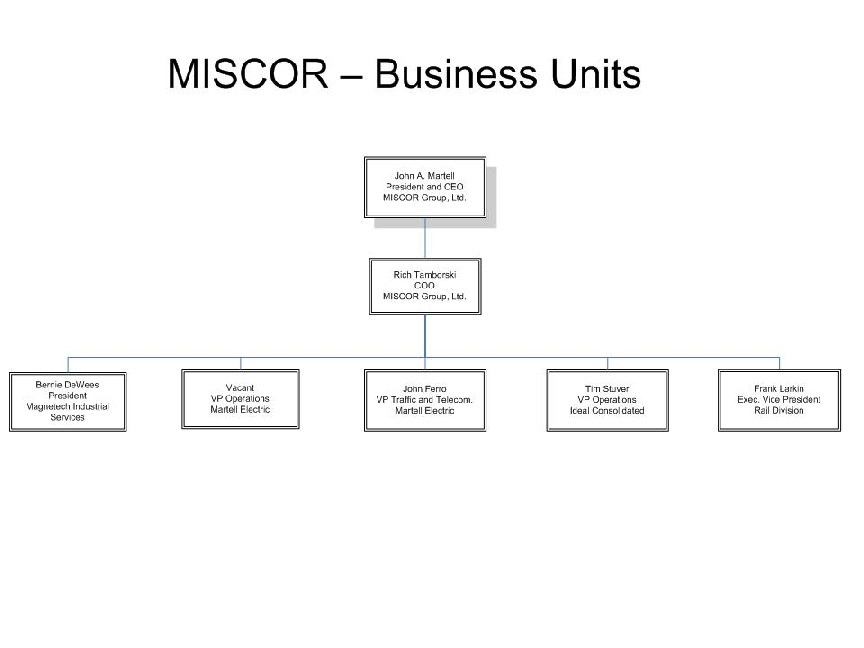

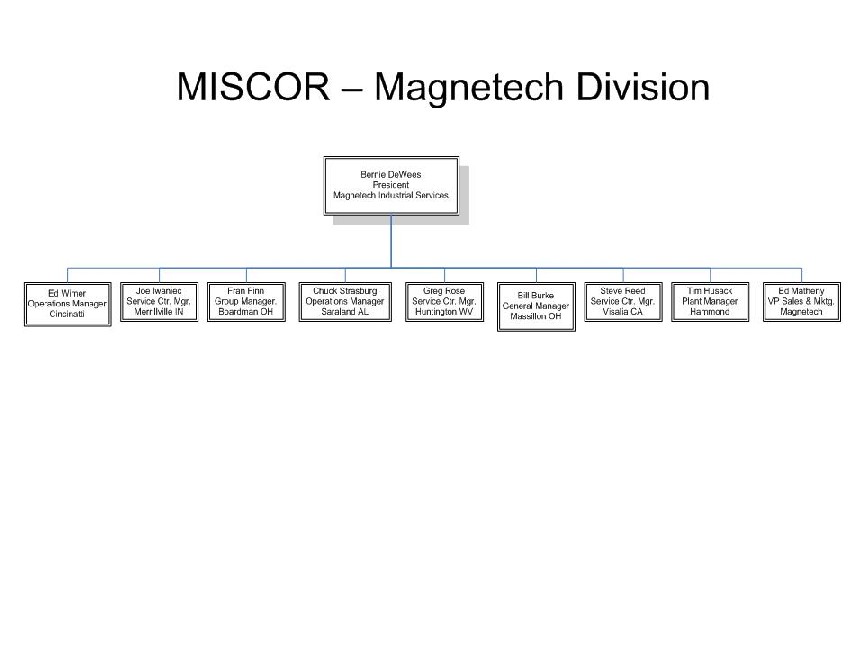

As reflected in the management charts attached hereto as Exhibit A, below the level of the CODM and the COO of MISCOR (John A. Martell and Richard A. Tamborski, respectively), there is a business manager for:

1) MIS: Bernie Dewees, President, who is responsible for the combined operations of MIS, MPS and 3D operating segments which are separately identified in item (1) of the MPACK;

2) Martell Electric: John A. Ferro – VP Traffic & Telecom, who since the January 2009 departure of VP of Operations Anthony Nicholson, has acted as interim VP of Operations in addition to his leadership of the Traffic and Telecom division of Martell Electric (see Martell on item (1) of the MPACK);

3) Ideal: Tim Stuver – VP Operations, who is responsible for the operations of Ideal (see Ideal on item (1) of the MPACK).

4) Rail Group: Frank Larkin – EVP, Rail Division, who is responsible for the combined operations of AMP and HKEC which are separately identified in item (1) from the MPACK. AMP is divided into two components: AMP New York and AMP Montreal, which are managed by two separate positions (each a VP of Operations), both of which report to Frank Larkin. HKEC is also managed by a VP of Operations, who also reports to Frank Larkin.

Based on the information received by the CODM in the MPACK report, as well as the structure of the management team, MISCOR has determined that the operating segments of the company as of December 31, 2008 are as follows:

1) MIS, with the President of MIS as its segment manager;

2) MPS, with the President of MIS as its segment manager;

3) 3D, with the President of MIS as its segment manager;

4) Martell Electric, with the VP of Operations of Martell Electric as itssegment manager;

5) Ideal, with the VP of Operations of Ideal as its segment manager;

6) HKEC, with the VP of Operations of HKEC as its segment manager; and

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 5

7) AMP, the Executive Vice President – Rail Division as its segment manager.

II. Reporting Segments – Aggregation Analysis

Based on the criteria presented in paragraph 17 of SFAS 131, MISCOR has determined that the operating segments identified above should be aggregated into three reporting segments for purposes of its periodic reporting requirements:

| · | Industrial Services (MIS, MPS, and 3D); |

| · | Construction and Engineering Services (Martell Electric and Ideal), and |

| · | Rail Services (HKEC and AMP). |

The operating segments within each of these reporting segments exhibit similar economic characteristics and are similar in each of the other areas identified in paragraph 17, as detailed below.

1) Industrial Services segment.

Operating segments MIS, MPS and 3D exhibit similar economic and other characteristics.

a) MIS, MPS and 3D share similar economic characteristics. MIS, MPS and 3D have similar cost structure at the direct, indirect and SG&A expense level. In addition, they have similar capital and fixed cost structures and exhibit similar sales and margin trends over time. All three operating segments share common resources for sales and administrative functions such as Finance and Human Resources.

b) The nature of the products and services are similar. Each company engages in the repair of electrical equipment (electric motors and generators in the case of 3D, electric motors, generators and electromagnets in the case of MIS, and electrical switches and circuit breakers in the case of MPS). MIS and 3D also engage in manufacturing and selling of new electrical industrial equipment including motors and magnets.

c) The nature of the production processes. The production processes for each operating segment primarily concentrate on the repair and rebuilding of electrical or electro-magnetic equipment. Each of the operating segments may also engage in the removal, re-installation and general trouble shooting of the components that they repair, depending on the customer’s needs.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 6

d) The type or class of customer for their products and services. The customers of MIS, 3D and MPS are all industrial operations. The industries served include, but are not limited to, the steel industry, the electric motor industry, scrap and metal processing industry, and electric utilities. Each operating segment may engage customers in any of these and other industries. In addition, from time to time the operating segments provide products or services to one or more of the other segments in order to complete the services to be provided to the customer.

e) The methods used to distribute their products or provide their services. MIS, 3D and MPS utilize a shared sales force, and distribution of products and services is directly to the customers. The few independent sales representatives represent MIS, 3D and MPS.

While not strictly relevant to 2008 reporting, it bears noting that the three legal entities that comprise the three segments (Magnetech Industrial Services, Inc.; 3D Service, Ltd.; and Magnetech Power Services, LLC) were merged into one legal entity effective January 1, 2009, with the surviving entity being Magnetech Industrial Services, Inc.

Because these three operating segments – MIS, 3D and MPS – exhibit similar economic characteristics and are similar in each of the other areas identified in paragraph 17, MISCOR believes that they are properly aggregated into one reporting unit.

2) Construction and Engineering Services segment.

Operating segments Martell Electric and Ideal Consolidated exhibit similar economic and other characteristics.

a) Martell Electric and Ideal have similar economic characteristics. Both companies have similar cost structures at the direct, indirect, and SG&A level. They have similar capital requirements and exhibit similar sales and margin trends over time. In addition, they both share common resources for their Sales and Finance functions.

b) The nature of the products and services are similar. Both companies are construction contractors that primarily provide services for building construction and maintenance.

c) The nature of the production processes. The services provided by both companies consist primarily of skilled construction labor used in both new construction and maintenance of existing facilities.

d) The type or class of customer for their products and services. Both Martell Electric and Ideal engage in work as subcontractors for new construction projects, as well as contracting directly with final customers for repair and

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 7

maintenance work. The customers of both companies primarily work with large commercial or institutional organizations.

e) The methods used to distribute their products or provide their services. Both Martell Electric and Ideal are primarily engaged in providing skilled services for construction and building maintenance. The operations are performed at the customers’ respective locations by personnel with similar skill levels, training and licensing requirements.

f) The nature of regulatory environment. Both Martell Electric and Ideal must adhere to trade licensing and training requirements with respect to the personnel employed. They also must adhere to regulations including national and local building codes.

Because these two operating segments – Martell Electric and Ideal – exhibit similar economic characteristics and are similar in each of the other areas identified in paragraph 17, MISCOR believes that they are properly aggregated into one reporting unit.

3) Rail Services segment.

Operating segments HKEC and AMP exhibit similar economic and other characteristics.

a) AMP and HKEC share similar economic characteristics. AMP and HKEC have similar cost structures at the direct expense, indirect expense and SG&A levels since they both operate in the manufacture and remanufacture of railroad products. HKEC also sold approximately $1.2 million of product to AMP in 2008 through inter-company transactions.

b) The nature of the products and services are similar. HKEC manufactures certain replacement parts (power assemblies) for large diesel engines used primarily in locomotives but also in marine and oil platform applications. AMP remanufactures and repairs locomotives and locomotive engines. As part of AMP’s overhaul process, it installs power assemblies in each locomotive engine it rebuilds. Each engine uses 16 to 20 power assemblies; the power assembly is the main wear item in the engine. HKEC is a primary supplier to AMP; for many engines, AMP installs HKEC power assemblies.

c) The nature of the production processes. Both businesses go through a labor intensive process to remanufacture locomotive parts to OEM specifications. HKEC manufactures certain components (cylinder heads, liners, and pistons) from raw materials, including parts cast at its foundry in Weston, WV. HKEC remanufactures other parts using welding techniques. All parts are machined using lathes, drill presses and similar equipment. AMP uses the same type of machines and techniques to weld and machine parts to OEM specifications.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 8

HKEC plans to use the engine test cell at AMP to work on product improvements in order to meet future EPA tiers.

d) The type or class of customer for their products and services. HKEC and AMP both sell their parts and services to domestic and international railroads for transit and freight.

e) The methods used to distribute their products or provide their services. AMP and HKEC both provide products and services directly to the final customer. AMP and HKEC utilize a shared sales force, and the few independent sales representatives represent both AMP and HKEC. Components or locomotives are received by the final customer at AMP or HKEC plant locations either by customer pick-up or common carrier.

f) The nature of the regulatory environment. Both companies receive the majority of their regulation through the EPA so there are “tier” standards to control pollution. HKEC has received AAR M-1003 quality certification (railroad specific quality program) and AMP is seeking the same certification.

Because these two operating segments – HKEC and AMP – exhibit similar economic characteristics and are similar in each of the other areas identified in paragraph 17, MISCOR believes that they are properly aggregated into one reporting unit.

Additional Aggregation Factors

In addition to meeting the paragraph 17 criteria, this aggregation into three reporting segments meets other criteria set forth in SFAS 131.

Each of the three proposed reporting segments meets the criteria specified in paragraph 18 of FAS 131, specifically, each segment meets or exceeds the 10% thresholds for paragraphs 18a, 18b and 18c, only one of which must be met in order for an operating segment to be considered a reportable segment.

Moreover, the above reporting segments encompass 100% of the revenue, which meets the requirement in paragraph 20. Financial information relating to the corporate function, which is not specifically allocable to any reporting segment will be disclosed separately under the heading “Corporate” in the MPACK report.

Based on this analysis, MISCOR proposes to report its financial results on the basis of three reporting segments – Industrial Services, Construction and Engineering Services, and Rail Services – beginning with its Annual Report on Form 10-K for the year ended December 31, 2008.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 9

III. Reporting Units

As of the fourth quarter of 2008, MISCOR had recorded goodwill in the following operating segments: MIS, as a result of the Visalia acquisition in September 2008; 3D, as a result of the acquisition of 3D in November 2007; Ideal, as a result of the acquisition of Ideal in October 2007; and AMP, as a result of the acquisition of AMP in January, 2008. Following is MISCOR’s analysis for determining the proper reporting units for testing such goodwill for impairment.

The analysis for determining the proper reporting units involves three steps:

1) Operating segments are identified using the criteria in paragraph 10 of FASB Statement No. 131; then

2) Components of operating segments are identified by isolating each unit one level below the operating segments which is itself a business and for which discrete financial information is available, and such discrete financial information is regularly reviewed by segment management; then

3) Components are examined to determine if each of them constitutes an independent reporting unit, or are properly aggregated with other economically similar components of its operating segment, based on the criteria listed in paragraph 30 of SFAS 142 and EITF D-101.

This analysis is necessary with respect to each component that has goodwill listed among its assets for the reporting period.

Operating Segments

As set forth in detail above, based on the criteria specified in paragraph 10 of SFAS 131, MISCOR has determined that there are seven operating segments of the company as of December 31, 2008:

1) MIS, with President-Magnetech Industrial Services as its segment manager;

2) MPS, with President-Magnetech Industrial Services as its segment manager;

3) 3D, with President-Magnetech Industrial Services as its segment manager;

4) Martell Electric, with VP Operations-Martell Electric as its segment manager;

5) Ideal, with VP Operations-Ideal Consolidated as its segment manager;

6) HKEC, with VP Operations-HKEC as its segment manager; and

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 10

7) AMP, with Executive Vice President – Rail Division as its segment manager.

As noted above, four of these operating segments had recorded goodwill as of the fourth quarter of 2008: MIS, 3D, Ideal and AMP. These four operating segments are the starting point for the second level of analysis.

Components of Operating Segments

The next level of analysis involves the examination of each of MISCOR’s operating segments that has recorded goodwill to determine if it contains discrete components that can be isolated based upon three criteria:

| · | Component constitutes a business. Under the guidance in EITF 98-3, one must consider whether the activities and assets of a subdivision of the component include “all the inputs and processes necessary” to conduct normal business operations. |

| · | Discrete financial information. One must consider whether there are discrete financial results for the subdivision. At this step, there need be only operating information. But the subdivision could not ultimately be a reporting unit for goodwill impairment analysis if there were no balance sheet to identify and allocate assets and liabilities of the subdivision. |

| · | Reviewed by segment management. Under SFAS 142, one must consider whether the segment manager, not the CODM, reviews the discrete financial information for the entity. If so, it is a separate component. |

Applying these criteria to the subdivisions of each of the four operating segments with recorded goodwill, MISCOR has determined that Ideal has only one component, and that the other three operating segments have smaller components:

1) MIS – This operating segment has (or had for part of 2008) eight components: MIS South Bend, MIS Hammond, MIS Boardman, MIS Huntington, MIS Indianapolis, MIS Saraland, MIS Mobile, and MIS Visalia. Each component constitutes a business, for which discrete financial information is available, and is regularly reviewed by segment management.

2) 3D – This operating segment has two components: Massillon and Cincinnati. Each component constitutes a business, for which discrete financial information is available, and is regularly reviewed by segment management.

3) AMP – This operating segment has two components: Dansville and Montreal. Both components constitute businesses, for which discrete financial information is available, and is regularly reviewed by segment management.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 11

Reporting Units

For those operating segments with recorded goodwill that have only one component, the operating segment itself is the reporting unit and there is no further analysis. This is the case for Ideal.

For the three operating segments with recorded goodwill that have more than one component (MIS, 3D and AMP), the question is whether, using the criteria presented in paragraph 17 of SFAS 131, along with the guidance given in EITF Issue D-101, the components within each of these operating segments should be aggregated into one reporting unit for the purpose of goodwill impairment testing because they have similar economic characteristics. Following is MISCOR’s analysis of each of the three operating segments.

1) MIS. The eight components of MIS will be aggregated into one reporting unit based on the applicable criteria in paragraph 17. In particular:

a) The eight components of MIS have similar economic characteristics. All of the components have similar cost structure at the direct, indirect and SG&A expense level. In addition they have similar capital and fixed cost structures and exhibit similar sales and margin trends over time. All three operating segments share common resources for sales and administrative functions such as Finance and Human Resources.

b) The nature of the products and services are similar. Each component engages in the repair of electric motors and/or electric magnets, which share similar engineering, electro-mechanical properties and construction components. The components may also engage in manufacturing and selling of new equipment.

c) The nature of the production processes. The production processes for each component primarily concentrate on the repair and rebuilding of electro-magnetic equipment. Each of the operating segments may also engage in the removal, re-installation and general trouble shooting of the components that they repair, depending on the customer’s needs.

d) The type or class of customer for their products and services. The customers of all eight components are industrial operations. The industries served include, but are not limited to: the steel industry, the electric motor industry, scrap and metal processing, and electric utilities. Each component may engage customers in any of these and other industries. In addition, from time to time the components provide products or services to one or more of the other components in order to complete the services to be provided to the customer.

e) The methods used to distribute their products or provide their services. The MIS components utilize a shared sales force, and distribution of products and services is directly to the customers.

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 12

2) AMP. The two components of AMP will be aggregated into one reporting unit based on the applicable criteria from paragraph 17. In particular:

a) AMP Dansville and AMP Montreal have similar economic characteristics. The two components have similar cost structures at the direct expense, indirect expense and SG&A levels since they both operate in the manufacture and remanufacture of locomotives.

b) The nature of the products and services are similar. The two components perform essentially the same services, specifically the repair and overhaul of locomotives for the rail industry.

c) The nature of the production processes. Both components go through a labor intensive process to remanufacture to OEM specifications, including complete truck work, engine overhauls, metal fabrications, painting, power assembly replacement and additional services.

d) The type or class of customer for their products and services. Both components focus on domestic and international railroads for transit and freight.

e) The methods used to distribute their products or provide their services. Both components repair and rebuild locomotives at their site. They contract directly with the final customer who arranges delivery to and pick up from the component’s location.

f) The nature of the regulatory environment. Both companies receive the majority of their regulation through the EPA so there are “tier” standards to control pollution.

3) 3D. The two components of 3D will be aggregated into one reporting unit based on the applicable criteria from paragraph 17. In particular:

a) 3D Cincinnati and 3D Massillon have similar economic characteristics. The two components have similar cost structures at the direct expense, indirect expense and SG&A levels. They show similar trends in sales, and share selling and administrative functions.

b) The nature of the products and services are similar. Both components engage in the repair and maintenance of electric motors and generators, although the Cincinnati location also focuses on power system services (switchgear and breakers) and the Massillon location includes some product lines (e.g., crane repair and generator rental).

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 13

c) The nature of the production processes. Both components engage in similar processes in the repair and rebuilding of various types of electric motors, generators and electrical distribution equipment. The services are performed at their plant sites and at customer locations.

d) The type or class of customer for their products and services. The customers of both components consist of industrial users of electric motors and generators.

e) The methods used to distribute their products or provide their services. Both components contract directly with the end customer. Repair, rebuild or maintenance services can be completed at the components’ locations or at the customer’s site, depending on the customer’s needs.

The result of the foregoing analysis is that each operating segment that contains goodwill as an asset either is comprised of only one component or has components that are properly aggregated into a single reporting unit under the criteria set forth in paragraph 17 of FAS 131 and the guidance in EITF D-101.

* * * * *

Larry Spirgel, Assistant Director

Securities and Exchange Commission

March 10, 2009

Page 14

We appreciate your review of the foregoing responses to your comments. Should you have additional comments or questions, please contact me at 616.742.3933.

| | Very truly yours, |

| | |

| | |

| | /s/ R. Paul Guerre |

| | |

| | R. Paul Guerre |

| cc: | John A. Martell |

| | Mary L. Hunt |

| | James M. Lewis |

| | Joseph Canataro |

| | James Kochanski |

EXHIBIT A

MANAGEMENT CHARTS