UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21609 |

|

Western Asset Variable Rate Strategic Fund Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, | | NY 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq. Legg Mason & Co., LLC 300 First Stamford Place, 4th Floor Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 451-2010 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2008 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The SEMI-ANNUAL Report to Stockholders is filed herewith.

SEMI-ANNUAL REPORT / MARCH 31, 2008

Western Asset

Variable Rate

Strategic Fund Inc.

(GFY)

Managed by WESTERN ASSET

INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to maintain a high level of current income.

What’s inside

Letter from the chairman | I |

| |

Fund at a glance | 1 |

| |

Schedule of investments | 2 |

| |

Statement of assets and liabilities | 18 |

| |

Statement of operations | 19 |

| |

Statements of changes in net assets | 20 |

| |

Financial highlights | 21 |

| |

Notes to financial statements | 22 |

| |

Board approval of management and subadvisory agreements | 33 |

| |

Additional shareholder information | 39 |

| |

Dividend reinvestment plan | 40 |

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager. Western Asset Management Company (“Western Asset”) and Western Asset Management Company Limited (“Western Asset Limited”) are the Fund’s subadvisers. LMPFA, Western Asset and Western Asset Limited are wholly-owned subsidiaries of Legg Mason, Inc.

Letter from the chairman

Dear Shareholder,

The U.S. economy weakened significantly during the six-month reporting period ended March 31, 2008. Third quarter 2007 U.S. gross domestic product (“GDP”)i growth was 4.9%, its strongest showing in four years. However, continued weakness in the housing market, an ongoing credit crunch and soaring oil and food prices then took their toll on the economy. During the fourth quarter of 2007, GDP growth was 0.6%. The U.S. Commerce Department then reported that its advance estimate for first quarter 2008 GDP growth was also a tepid 0.6%. While it was once debated whether or not the U.S. would fall into a recession, it is now generally assumed that a recession is likely, and that it may have already begun. Even areas of the economy that had once been fairly resilient have begun to falter, including the job market. The U.S. Department of Labor reported that payroll employment declined in each of the first three months of 2008—the longest consecutive monthly decline since early 2003.

Ongoing issues related to the housing and subprime mortgage markets and an abrupt tightening in the credit markets prompted the Federal Reserve Board (“Fed”)ii to take aggressive and, in some cases, unprecedented actions during the reporting period. At its meeting in September 2007, the Fed reduced the federal funds rateiii from 5.25% to 4.75%. This marked the first reduction in the federal funds rate since June 2003. The Fed again lowered rates on five more occasions through the end of March 2008. Over this time, the federal funds rate fell to 2.25%. The Fed then reduced rates again on April 30, 2008, after the reporting period ended, to 2.00%. In its statement accompanying the April rate cut, the Fed stated: “Recent information indicates that economic activity remains weak. Household and business spending has been subdued and labor markets have softened further. Financial markets remain under considerable stress, and tight credit conditions and the deepening housing contraction are likely to weigh on economic growth over the next few quarters.”

In addition to lowering short-term interest rates, the Fed took several actions to improve liquidity in the credit markets. In March 2008, the Fed established a new lending program allowing brokerage firms to borrow

| Western Asset Variable Rate Strategic Fund Inc. | I |

Letter from the chairman continued

directly from its discount window. The Fed also increased the maximum term for discount window loans from 30 to 90 days. Then, in mid-March, the Fed played a major role in facilitating the purchase of Bear Stearns by JPMorgan Chase.

During the six-month reporting period, both short- and long-term Treasury yields experienced periods of volatility. This was due, in part, to mixed economic and inflation data, the fallout from the subprime mortgage market crisis and shifting expectations regarding the Fed’s monetary policy. Within the bond market, investors were initially focused on the subprime segment of the mortgage-backed market. These concerns broadened, however, to include a wide range of financial institutions and markets. As a result, other fixed-income instruments also experienced increased price volatility. This turmoil triggered several “flights to quality,” causing Treasury yields to move sharply lower (and their prices higher), while riskier segments of the market saw their yields move higher (and their prices lower).

Overall, during the six months ended March 31, 2008, two-year Treasury yields fell from 3.97% to 1.62%. Over the same time frame, 10-year Treasury yields fell from 4.59% to 3.45%. Short-term yields fell sharply in concert with the Fed’s rate cuts while longer-term yields fell less dramatically due to inflationary concerns, resulting in a steepening of the U.S. yield curveiv during the reporting period. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers U.S. Aggregate Indexv, returned 5.23%.

Increased investor risk aversion in November 2007 and again in the first quarter of 2008 caused the high-yield bond market to produce weak results over the six-month period ended March 31, 2008. During that period, the Citigroup High Yield Market Indexvi returned -4.20%. While high-yield bond prices rallied several times during the period, several flights to quality dragged down the sector, although default rates continued to be low.

Despite increased investor risk aversion, emerging markets debt generated positive results, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vii returned 3.29% over the six months ended March 31, 2008. Overall solid demand, an expanding global economy, increased domestic spending and the Fed’s numerous rate cuts supported the emerging market debt asset class.

II | Western Asset Variable Rate Strategic Fund Inc. |

Performance review

For the six months ended March 31, 2008, Western Asset Variable Rate Strategic Fund Inc. returned -7.29% based on its net asset value (“NAV”)viii and - -7.36% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Merrill Lynch Constant Maturity 3-Month LIBOR Indexix, and its former unmanaged benchmark, the Lehman Brothers U.S. Aggregate Index, returned 2.75% and 5.23%, respectively, for the same period. The Lipper Global Income Closed-End Funds Category Averagex increased 1.10% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During this six-month period, the Fund made distributions to shareholders totaling $0.57 per share, which may have included a return of capital. The performance table shows the Fund’s six-month total return based on its NAV and market price as of March 31, 2008. Past performance is no guarantee of future results.

PERFORMANCE SNAPSHOT as of March 31, 2008 (unaudited)

PRICE PER SHARE | | 6-MONTH

TOTAL RETURN† | |

$16.93 (NAV) | | -7.29% | |

$15.12 (Market Price) | | -7.36% | |

All figures represent past performance and are not a guarantee of future results.

† Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Information about your fund

Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

Looking for additional information?

The Fund is traded under the symbol “GFY” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XGFYX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites, as well as www.leggmason.com/individualinvestors.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 6:00 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Western Asset Variable Rate Strategic Fund Inc. | III |

Letter from the chairman continued

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

April 30, 2008

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objective. Your common shares at any point in time may be worth less than you invested, even after taking into account the reinvestment of Fund dividends and distributions. The Fund may invest in high-yield and foreign securities, including emerging markets, which involve risks beyond those inherent solely in higher-rated and domestic investments. High-yield bonds involve greater credit and liquidity risks than investment grade bonds. Investing in foreign securities is subject to certain risks typically not associated with domestic investing, such as currency fluctuations and changes in political conditions. These risks are magnified in emerging or developing markets. Derivatives, such as options or futures, can be illiquid and hard to value, especially in declining markets. A small investment in certain derivatives may have a potentially large impact on the Fund’s performance.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

iv | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

v | The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

vi | The Citigroup High Yield Market Index is a broad-based unmanaged index of high-yield securities. |

vii | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela. |

viii | NAV is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is at the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

ix | The Merrill Lynch Constant Maturity 3-Month LIBOR Index is based on the assumed purchase of a synthetic instrument having 3 months to maturity and with a coupon equal to the closing quote for 3-month LIBOR. That issue is sold the following day (priced at a yield equal to the current day closing 3-month LIBOR rate) and is rolled into a new 3-month instrument. The Index therefore will always have a constant maturity equal to exactly 3 months. |

x | Lipper, a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended March 31, 2008, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 15 funds in the Fund’s Lipper category. |

IV | Western Asset Variable Rate Strategic Fund Inc. |

Fund at a glance (unaudited)

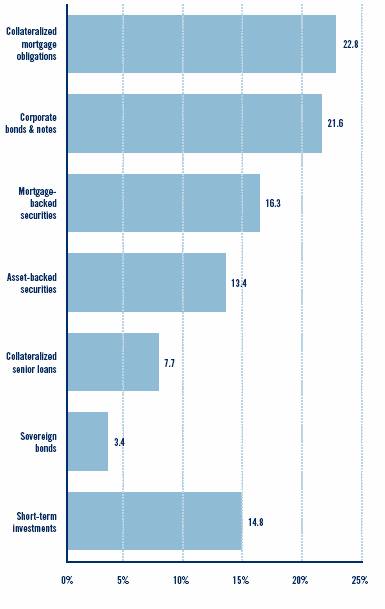

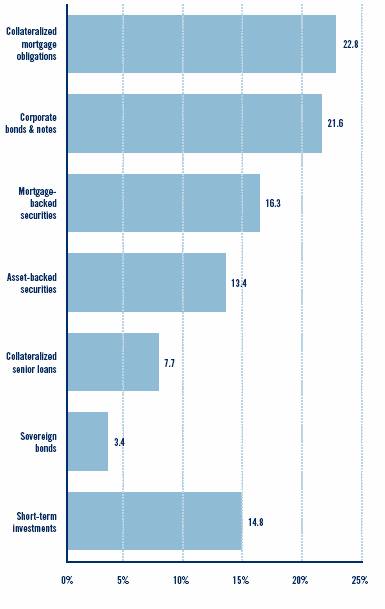

INVESTMENT BREAKDOWN (%) As a percent of total investments — March 31, 2008

| Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 1 |

Schedule of investments (unaudited)

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE AMOUNT† | | SECURITY | | VALUE | |

CORPORATE BONDS & NOTES — 23.0% | | | |

| | Aerospace & Defense — 0.3% | | | |

100,000 | | DRS Technologies Inc., Senior Subordinated Notes, 6.875% due 11/1/13 | | $ | 98,501 | |

| | Hawker Beechcraft Acquisition Co.: | | | |

10,000 | | 8.875% due 4/1/15(b) | | 10,275 | |

90,000 | | 9.750% due 4/1/17 | | 90,000 | |

250,000 | | L-3 Communications Corp., Senior Subordinated Notes, 7.625% due 6/15/12(a) | | 257,187 | |

| | Total Aerospace & Defense | | 455,963 | |

| | Airlines — 0.0% | | | |

60,000 | | DAE Aviation Holdings Inc., Senior Notes, 11.250% due 8/1/15(c) | | 59,400 | |

| | Auto Components — 0.2% | | | |

100,000 | | Keystone Automotive Operations Inc., Senior Subordinated Notes, 9.750% due 11/1/13 | | 56,500 | |

245,000 | | Visteon Corp., Senior Notes, 8.250% due 8/1/10(a) | | 201,512 | |

| | Total Auto Components | | 258,012 | |

| | Automobiles — 0.7% | | | |

| | Ford Motor Co.: | | | |

| | Debentures: | | | |

60,000 | | 8.875% due 1/15/22 | | 46,950 | |

50,000 | | 6.625% due 10/1/28 | | 30,750 | |

790,000 | | Notes, 7.450% due 7/16/31(a) | | 525,350 | |

| | General Motors Corp., Senior Debentures: | | | |

50,000 | | 8.250% due 7/15/23 | | 35,250 | |

410,000 | | 8.375% due 7/15/33(a) | | 291,100 | |

| | Total Automobiles | | 929,400 | |

| | Building Products — 0.7% | | | |

| | Associated Materials Inc.: | | | |

100,000 | | Senior Discount Notes, step bond to yield 16.276% due 3/1/14 | | 68,750 | |

100,000 | | Senior Subordinated Notes, 9.750% due 4/15/12 | | 97,500 | |

| | GTL Trade Finance Inc.: | | | |

350,000 | | 7.250% due 10/20/17(a)(c) | | 369,837 | |

389,000 | | 7.250% due 10/20/17(a)(c) | | 410,768 | |

5,000 | | Nortek Inc., Senior Subordinated Notes, 8.500% due 9/1/14 | | 3,725 | |

100,000 | | NTK Holdings Inc., Senior Discount Notes, step bond to yield 10.350% due 3/1/14 | | 49,000 | |

| | Total Building Products | | 999,580 | |

| | Chemicals — 0.1% | | | |

45,000 | | Georgia Gulf Corp., Senior Notes, 9.500% due 10/15/14 | | 34,987 | |

| | | | | | |

See Notes to Financial Statements.

2 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE AMOUNT† | | SECURITY | | VALUE | |

| | Chemicals — 0.1% continued | | | |

20,000 | | Huntsman International LLC, Senior Subordinated Notes, 7.875% due 11/15/14 | | $ | 21,300 | |

25,000 | | Methanex Corp., Senior Notes, 8.750% due 8/15/12 | | 26,938 | |

| | Total Chemicals | | 83,225 | |

| | Commercial Banks — 3.0% | | | |

770,000 | | ATF Capital BV, Senior Notes, 9.250% due 2/21/14(a)(c) | | 763,147 | |

| | HSBC Bank PLC: | | | |

60,000 | | 8.570% due 8/20/12(c)(d) | | 54,480 | |

14,936,000 | RUB | 8.900% due 12/20/10(a)(d) | | 623,372 | |

| | Medium-Term Notes: | | | |

800,000 | | 6.724% due 7/20/12(a)(c)(d) | | 661,000 | |

60,000 | | 8.320% due 8/20/12(d) | | 54,000 | |

560,000 | | HSBK Europe BV, 7.250% due 5/3/17(a)(c) | | 487,200 | |

830,000 | | ICICI Bank Ltd., Subordinated Bonds, 6.375% due 4/30/22(a)(c)(d) | | 723,133 | |

7,212,500 | RUB | JPMorgan Chase Bank, 9.500% due 2/11/11(a)(c) | | 298,719 | |

250,000 | | TuranAlem Finance BV, Bonds, 5.269% due 1/22/09(a)(c)(d) | | 234,263 | |

390,000 | | VTB Capital SA, 4.812% due 11/2/09(c)(d) | | 381,225 | |

| | Total Commercial Banks | | 4,280,539 | |

| | Commercial Services & Supplies — 0.4% | | | |

100,000 | | Allied Security Escrow Corp., Senior Subordinated Notes, 11.375% due 7/15/11 | | 86,500 | |

90,000 | | DynCorp International LLC/DIV Capital Corp., Senior Subordinated Notes, 9.500% due 2/15/13 | | 92,025 | |

125,000 | | Interface Inc., Senior Notes, 10.375% due 2/1/10(a) | | 131,250 | |

110,000 | | Rental Services Corp., Senior Notes, 9.500% due 12/1/14 | | 92,400 | |

120,000 | | US Investigations Services Inc., Senior Notes, 10.500% due 11/1/15(c) | | 98,400 | |

| | Total Commercial Services & Supplies | | 500,575 | |

| | Construction & Engineering — 0.4% | | | |

570,000 | | Odebrecht Finance Ltd., 7.500% due 10/18/17(a)(c) | | 591,375 | |

| | Consumer Finance — 4.2% | | | |

| | Ford Motor Credit Co.: | | | |

| | Notes: | | | |

115,000 | | 6.625% due 6/16/08(a) | | 113,706 | |

3,000,000 | | 5.828% due 1/15/10(a)(d) | | 2,510,199 | |

220,000 | | Senior Notes, 9.875% due 8/10/11(a) | | 196,319 | |

| | General Motors Acceptance Corp.: | | | |

50,000 | | Bonds, 8.000% due 11/1/31 | | 35,911 | |

| | Notes: | | | |

25,000 | | 7.250% due 3/2/11 | | 19,696 | |

| | | | | | |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 3 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Consumer Finance — 4.2% continued | | | |

4,000,000 | | 5.276% due 12/1/14(a)(d) | | $ | 2,676,052 | |

500,000 | | 6.750% due 12/1/14(a) | | 354,283 | |

| | Total Consumer Finance | | 5,906,166 | |

| | Containers & Packaging — 0.2% | | | |

| | Graham Packaging Co. Inc.: | | | |

75,000 | | 8.500% due 10/15/12 | | 67,875 | |

30,000 | | Senior Subordinated Notes, 9.875% due 10/15/14 | | 25,350 | |

190,000 | | Graphic Packaging International Corp., Senior Subordinated Notes, 9.500% due 8/15/13(a) | | 183,350 | |

| | Total Containers & Packaging | | 276,575 | |

| | Diversified Consumer Services — 0.1% | | | |

| | Education Management LLC/Education Management Finance Corp.: | | | |

90,000 | | Senior Notes, 8.750% due 6/1/14 | | 76,500 | |

35,000 | | Senior Subordinated Notes, 10.250% due 6/1/16 | | 28,000 | |

30,000 | | Service Corp. International, Senior Notes,

7.625% due 10/1/18 | | 30,300 | |

| | Total Diversified Consumer Services | | 134,800 | |

| | Diversified Financial Services — 1.2% | | | |

80,000 | | Basell AF SCA, Senior Secured Subordinated Second Priority Notes, 8.375% due 8/15/15(c) | | 58,800 | |

100,000 | | CCM Merger Inc., Notes, 8.000% due 8/1/13(c) | | 84,500 | |

250,000 | | Chukchansi Economic Development Authority, Senior Notes, 8.238% due 11/15/12(a)(c)(d) | | 217,500 | |

80,000 | | Leucadia National Corp., Senior Notes, 8.125% due 9/15/15 | | 80,800 | |

300,000 | | Merna Reinsurance Ltd., Subordinated Notes, 4.446% due 7/7/10(a)(c)(d) | | 273,690 | |

840,000 | | TNK-BP Finance SA, 6.875% due 7/18/11(a)(c) | | 820,050 | |

20,000 | | Vanguard Health Holdings Co. I LLC, Senior Discount Notes, step bond to yield 10.072% due 10/1/15 | | 15,400 | |

125,000 | | Vanguard Health Holdings Co. II LLC, Senior Subordinated Notes, 9.000% due 10/1/14(a) | | 120,937 | |

| | Total Diversified Financial Services | | 1,671,677 | |

| | Diversified Telecommunication Services — 1.1% | | | |

467,000 | | Axtel SAB de CV, Senior Notes, 7.625% due 2/1/17(a)(c) | | 470,502 | |

45,000 | | Cincinnati Bell Telephone Co., Senior Debentures, 6.300% due 12/1/28 | | 36,225 | |

135,000 | | Citizens Communications Co., Senior Notes, 7.875% due 1/15/27(a) | | 116,438 | |

25,000 | | Hawaiian Telcom Communications Inc., Senior Subordinated Notes, 12.500% due 5/1/15 | | 9,125 | |

225,000 | | Intelsat Bermuda Ltd., Senior Notes, 11.250% due 6/15/16(a) | | 229,219 | |

| | | | | | |

See Notes to Financial Statements.

4 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE AMOUNT† | | SECURITY | | VALUE | |

| | Diversified Telecommunication Services — 1.1% continued | | | |

40,000 | | Level 3 Financing Inc., Senior Notes, 9.250% due 11/1/14 | | $ | 32,900 | |

250,000 | | Qwest Corp., Notes, 6.050% due 6/15/13(a)(d) | | 226,250 | |

| | Virgin Media Finance PLC, Senior Notes: | | | |

100,000 | | 8.750% due 4/15/14 | | 90,250 | |

130,000 | | 9.125% due 8/15/16(a) | | 117,000 | |

190,000 | | Windstream Corp., Senior Notes, 8.625% due 8/1/16(a) | | 187,625 | |

| | Total Diversified Telecommunication Services | | 1,515,534 | |

| | Electric Utilities — 0.8% | | | |

1,022,000 | | EEB International Ltd., Senior Bonds, 8.750% due 10/31/14(a)(c) | | 1,057,770 | |

10,000 | | Orion Power Holdings Inc., Senior Notes, 12.000% due 5/1/10 | | 10,975 | |

| | Total Electric Utilities | | 1,068,745 | |

| | Energy Equipment& Services — 0.1% | | | |

155,000 | | Complete Production Services Inc., Senior Notes, 8.000% due 12/15/16(a) | | 149,575 | |

20,000 | | Pride International Inc., Senior Notes, 7.375% due 7/15/14 | | 20,900 | |

| | Total Energy Equipment& Services | | 170,475 | |

| | Food& Staples Retailing — 0.4% | | | |

467,789 | | CVS Corp., Pass-through Certificates, 6.117% due 1/10/13(a)(c) | | 496,254 | |

| | Gas Utilities — 0.0% | | | |

45,000 | | Suburban Propane Partners LP/Suburban Energy Finance Corp., Senior Notes, 6.875% due 12/15/13 | | 44,100 | |

| | Health Care Equipment& Supplies — 0.0% | | | |

15,000 | | Advanced Medical Optics Inc., 7.500% due 5/1/17 | | 12,975 | |

| | Health Care Providers& Services — 0.5% | | | |

60,000 | | Community Health Systems Inc., Senior Notes, 8.875% due 7/15/15 | | 60,525 | |

| | HCA Inc.: | | | |

195,000 | | Notes, 6.375% due 1/15/15(a) | | 165,994 | |

100,000 | | Senior Secured Notes, 9.625% due 11/15/16(a)(b) | | 104,000 | |

275,000 | | Tenet Healthcare Corp., Senior Notes, 9.875% due 7/1/14(a) | | 267,437 | |

10,000 | | Universal Hospital Services Inc., 8.500% due 6/1/15(b) | | 10,050 | |

36,877 | | US Oncology Holdings Inc., Senior Notes, 7.949% due 3/15/12(b)(d) | | 28,580 | |

| | Total Health Care Providers& Services | | 636,586 | |

| | Hotels, Restaurants& Leisure — 0.6% | | | |

35,000 | | Buffets Inc., Senior Notes, 12.500% due 11/1/14(e) | | 1,225 | |

234,000 | | Choctaw Resort Development Enterprise, Senior Notes, 7.250% due 11/15/19(a)(c) | | 204,750 | |

| | | | | | |

See Notes to Financial Statements.

| Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 5 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE AMOUNT† | | SECURITY | | VALUE | |

| | Hotels, Restaurants& Leisure — 0.6% continued | | | |

85,000 | | Herbst Gaming Inc., Senior Subordinated Notes, 7.000% due 11/15/14(e) | | $ | 15,937 | |

70,000 | | Inn of the Mountain Gods Resort& Casino, Senior Notes, 12.000% due 11/15/10 | | 68,250 | |

260,000 | | MGM MIRAGE Inc., Senior Notes, 7.625% due 1/15/17(a) | | 237,900 | |

200,000 | | Mohegan Tribal Gaming Authority, Senior Subordinated Notes, 6.875% due 2/15/15(a) | | 162,000 | |

25,000 | | Sbarro Inc., Senior Notes, 10.375% due 2/1/15 | | 20,875 | |

| | Snoqualmie Entertainment Authority, Senior Secured Notes: | | | |

10,000 | | 6.936% due 2/1/14(c)(d) | | 8,200 | |

5,000 | | 9.125% due 2/1/15(c) | | 4,300 | |

| | Station Casinos Inc.: | | | |

155,000 | | Senior Notes, 7.750% due 8/15/16(a) | | 125,550 | |

15,000 | | Senior Subordinated Notes, 6.875% due 3/1/16 | | 8,813 | |

| | Total Hotels, Restaurants& Leisure | | 857,800 | |

| | Household Durables — 0.2% | | | |

45,000 | | Norcraft Cos. LP/Norcraft Finance Corp., Senior Subordinated Notes, 9.000% due 11/1/11 | | 45,563 | |

220,000 | | Norcraft Holdings LP/Norcraft Capital Corp., Senior Discount Notes, step bond to yield 9.979% due 9/1/12(a) | | 193,600 | |

| | Total Household Durables | | 239,163 | |

| | Independent Power Producers& Energy Traders — 1.4% | | | |

40,000 | | AES China Generating Co., Ltd., 8.250% due 6/26/10 | | 37,779 | |

| | AES Corp., Senior Notes: | | | |

375,000 | | 9.375% due 9/15/10(a) | | 398,437 | |

25,000 | | 8.875% due 2/15/11 | | 26,313 | |

120,000 | | Dynegy Holdings Inc., Senior Notes, 7.750% due 6/1/19(a) | | 112,800 | |

| | Edison Mission Energy, Senior Notes: | | | |

80,000 | | 7.750% due 6/15/16 | | 82,800 | |

30,000 | | 7.200% due 5/15/19 | | 29,775 | |

30,000 | | 7.625% due 5/15/27 | | 28,350 | |

820,000 | | Energy Future Holdings, Senior Notes, 11.250% due 11/1/17(a)(b)(c) | | 815,900 | |

130,000 | | Mirant North America LLC, Senior Notes, 7.375% due 12/31/13(a) | | 131,950 | |

| | NRG Energy Inc., Senior Notes: | | | |

75,000 | | 7.250% due 2/1/14 | | 74,250 | |

310,000 | | 7.375% due 2/1/16(a) | | 304,575 | |

| | Total Independent Power Producers& Energy Traders | | 2,042,929 | |

| | IT Services — 0.2% | | | |

50,000 | | Ceridian Corp., Senior Notes, 12.250% due 11/15/15(b)(c) | | 41,875 | |

| | | | | | |

See Notes to Financial Statements.

6 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | IT Services — 0.2% continued | | | |

| | SunGard Data Systems Inc.: | | | |

50,000 | | Senior Notes, 9.125% due 8/15/13 | | $ | 50,750 | |

175,000 | | Senior Subordinated Notes, 10.250% due 8/15/15(a) | | 176,750 | |

| | Total IT Services | | 269,375 | |

| | Machinery — 0.0% | | | |

10,000 | | Terex Corp., Senior Subordinated Notes, 7.375% due 1/15/14 | | 9,950 | |

| | Media — 1.1% | | | |

60,000 | | Affinion Group Inc., Senior Notes, 10.125% due 10/15/13 | | 59,925 | |

557,000 | | CCH I LLC/CCH Capital Corp., Senior Secured Notes, 11.000% due 10/1/15(a) | | 389,900 | |

10,000 | | Charter Communications Holdings LLC/Charter Communications Holdings Capital Corp., Senior Discount Notes, 11.750% due 5/15/11 | | 6,063 | |

100,000 | | Charter Communications Inc., 10.875% due 9/15/14(c) | | 99,000 | |

30,000 | | CMP Susquehanna Corp., 9.875% due 5/15/14 | | 20,850 | |

| | CSC Holdings Inc.: | | | |

75,000 | | Senior Debentures, 8.125% due 8/15/09 | | 75,937 | |

250,000 | | Senior Notes, 8.125% due 7/15/09(a) | | 253,125 | |

375,000 | | EchoStar DBS Corp., Senior Notes, 6.625% due 10/1/14(a) | | 342,187 | |

105,000 | | Idearc Inc., Senior Notes, 8.000% due 11/15/16 | | 68,513 | |

| | R.H. Donnelley Corp.: | | | |

80,000 | | Senior Discount Notes, 6.875% due 1/15/13 | | 49,200 | |

240,000 | | Senior Notes, 8.875% due 10/15/17(a)(c) | | 151,200 | |

50,000 | | Sun Media Corp., 7.625% due 2/15/13 | | 47,500 | |

40,000 | | TL Acquisitions Inc., Senior Notes, 10.500% due 1/15/15(c) | | 34,600 | |

| | Total Media | | 1,598,000 | |

| | Metals & Mining — 0.8% | | | |

300,000 | | Freeport-McMoRan Copper & Gold Inc., Senior Notes, 8.375% due 4/1/17(a) | | 319,125 | |

150,000 | | Metals USA Inc., Senior Secured Notes, 11.125% due 12/1/15(a) | | 147,750 | |

80,000 | | Noranda Aluminum Holding Corp., Senior Notes, 10.488% due 11/15/14(b)(c)(d) | | 59,200 | |

25,000 | | Novelis Inc., Senior Notes, 7.250% due 2/15/15 | | 22,250 | |

125,000 | | Ryerson Inc., Senior Secured Notes, 12.000% due 11/1/15(a)(c) | | 118,750 | |

95,000 | | Steel Dynamics Inc., 6.750% due 4/1/15 | | 93,575 | |

50,000 | | Tube City IMS Corp., Senior Subordinated Notes, 9.750% due 2/1/15 | | 44,250 | |

| | Vale Overseas Ltd., Notes: | | | |

128,000 | | 6.250% due 1/23/17(a) | | 127,792 | |

201,000 | | 6.875% due 11/21/36(a) | | 197,124 | |

| | Total Metals & Mining | | 1,129,816 | |

| | | | | | |

See Notes to Financial Statements.

| Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 7 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Multiline Retail — 0.1% | | | |

115,000 | | Dollar General Corp., 11.875% due 7/15/17(b) | | $ | 101,200 | |

60,000 | | Neiman Marcus Group Inc., Senior Subordinated Notes, 10.375% due 10/15/15 | | 60,300 | |

| | Total Multiline Retail | | 161,500 | |

| | Office Electronics — 0.1% | | | |

120,000 | | Xerox Corp., Senior Notes, 6.750% due 2/1/17(a) | | 126,885 | |

| | Oil, Gas & Consumable Fuels — 2.1% | | | |

170,000 | | Belden & Blake Corp., Secured Notes, 8.750% due 7/15/12(a) | | 171,275 | |

70,000 | | Chesapeake Energy Corp., Senior Notes, 6.375% due 6/15/15 | | 68,250 | |

210,000 | | Compagnie Generale de Geophysique SA, Senior Notes, 7.500% due 5/15/15(a) | | 214,200 | |

| | El Paso Corp., Medium-Term Notes: | | | |

375,000 | | 7.375% due 12/15/12(a) | | 380,610 | |

300,000 | | 7.750% due 1/15/32(a) | | 309,611 | |

| | Enterprise Products Operating LP: | | | |

120,000 | | 7.034% due 1/15/68 | | 102,034 | |

80,000 | | Junior Subordinated Notes, 8.375% due 8/1/66 | | 77,983 | |

60,000 | | EXCO Resources Inc., Senior Notes, 7.250% due 1/15/11 | | 58,650 | |

| | Gazprom, Loan Participation Notes: | | | |

190,000 | | 6.212% due 11/22/16(c) | | 176,225 | |

210,000 | | 6.510% due 3/7/22(c) | | 187,688 | |

30,000 | | International Coal Group Inc., Senior Notes, 10.250% due 7/15/14 | | 28,875 | |

330,000 | | LUKOIL International Finance BV, 6.356% due 6/7/17(a)(c) | | 307,725 | |

55,000 | | OPTI Canada Inc., 8.250% due 12/15/14 | | 54,725 | |

75,000 | | Peabody Energy Corp., 6.875% due 3/15/13 | | 76,500 | |

45,000 | | SemGroup LP, Senior Notes, 8.750% due 11/15/15(c) | | 41,400 | |

140,000 | | Stone Energy Corp., Senior Subordinated Notes, 8.250% due 12/15/11(a) | | 139,300 | |

20,000 | | W&T Offshore Inc., Senior Notes, 8.250% due 6/15/14(c) | | 18,650 | |

500,000 | | Williams Cos. Inc., Notes, 8.750% due 3/15/32(a) | | 580,000 | |

| | Total Oil, Gas & Consumable Fuels | | 2,993,701 | |

| | Paper & Forest Products — 0.3% | | | |

| | Abitibi-Consolidated Co. of Canada: | | | |

190,000 | | 13.750% due 4/1/11(c) | | 195,225 | |

10,000 | | Senior Notes, 7.750% due 6/15/11 | | 5,450 | |

| | Abitibi-Consolidated Inc.: | | | |

20,000 | | Debentures, 7.400% due 4/1/18 | | 8,900 | |

80,000 | | Notes, 8.550% due 8/1/10 | | 46,400 | |

| | | | | | |

See Notes to Financial Statements.

8 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Paper & Forest Products — 0.3% continued | | | |

| | Appleton Papers Inc.: | | | |

100,000 | | Senior Notes, 8.125% due 6/15/11 | | $ | 96,750 | |

125,000 | | Senior Subordinated Notes, 9.750% due 6/15/14(a) | | 119,062 | |

20,000 | | NewPage Corp., Senior Secured Notes, 9.489% due 5/1/12(d) | | 19,900 | |

| | Total Paper & Forest Products | | 491,687 | |

| | Pharmaceuticals — 0.0% | | | |

145,000 | | Leiner Health Products Inc., Senior Subordinated Notes, 11.000% due 6/1/12(e)(f) | | 544 | |

| | Real Estate Investment Trusts (REITs) — 0.2% | | | |

5,000 | | Forest City Enterprises Inc., Senior Notes, 7.625% due 6/1/15 | | 4,775 | |

425,000 | | iStar Financial Inc., Senior Notes, 5.150% due 3/1/12(a) | | 314,761 | |

30,000 | | Ventas Realty LP/Ventas Capital Corp., Senior Notes, 6.750% due 4/1/17 | | 29,475 | |

| | Total Real Estate Investment Trusts (REITs) | | 349,011 | |

| | Real Estate Management & Development — 0.1% | | | |

15,000 | | Ashton Woods USA LLC/Ashton Woods Finance Co., Senior Subordinated Notes, 9.500% due 10/1/15 | | 8,100 | |

190,000 | | Realogy Corp., 12.375% due 4/15/15 | | 85,500 | |

| | Total Real Estate Management & Development | | 93,600 | |

| | Road & Rail — 0.2% | | | |

360,000 | | Hertz Corp., Senior Subordinated Notes, 10.500% due 1/1/16(a) | | 338,850 | |

| | Software — 0.0% | | | |

30,000 | | Activant Solutions Inc., Senior Subordinated Notes, 9.500% due 5/1/16 | | 25,350 | |

| | Specialty Retail — 0.1% | | | |

80,000 | | Blockbuster Inc., Senior Subordinated Notes, 9.000% due 9/1/12 | | 65,600 | |

40,000 | | Michaels Stores Inc., 11.375% due 11/1/16 | | 31,600 | |

| | Total Specialty Retail | | 97,200 | |

| | Textiles, Apparel & Luxury Goods — 0.0% | | | |

25,000 | | Oxford Industries Inc., Senior Notes, 8.875% due 6/1/11 | | 23,875 | |

50,000 | | Simmons Co., Senior Discount Notes, step bond to yield 9.995% due 12/15/14 | | 32,500 | |

| | Total Textiles, Apparel & Luxury Goods | | 56,375 | |

| | Tobacco — 0.0% | | | |

| | Alliance One International Inc., Senior Notes: | | | |

10,000 | | 8.500% due 5/15/12 | | 9,450 | |

40,000 | | 11.000% due 5/15/12 | | 40,800 | |

| | Total Tobacco | | 50,250 | |

| | | | | | |

See Notes to Financial Statements.

| Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 9 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Trading Companies & Distributors — 0.1% | | | |

50,000 | | Ashtead Capital Inc., Notes, 9.000% due 8/15/16(c) | | $ | 40,750 | |

130,000 | | H&E Equipment Services Inc., Senior Notes, 8.375% due 7/15/16(a) | | 107,900 | |

| | Total Trading Companies & Distributors | | 148,650 | |

| | Transportation Infrastructure — 0.1% | | | |

210,000 | | Saint Acquisition Corp., Senior Secured Notes, 10.815% due 5/15/15(c)(d) | | 84,525 | |

| | Wireless Telecommunication Services — 0.9% | | | |

10,000 | | MetroPCS Wireless Inc., Senior Notes, 9.250% due 11/1/14 | | 9,250 | |

| | Rural Cellular Corp.: | | | |

100,000 | | Senior Notes, 9.875% due 2/1/10(a) | | 103,250 | |

20,000 | | Senior Subordinated Notes, 6.076% due 6/1/13(d) | | 20,100 | |

731,000 | | True Move Co., Ltd., 10.750% due 12/16/13(a)(c) | | 690,795 | |

380,000 | | UBS Luxembourg SA for OJSC Vimpel Communications, Loan Participation Notes, 8.250% due 5/23/16(c) | | 375,250 | |

| | Total Wireless Telecommunication Services | | 1,198,645 | |

| | TOTAL CORPORATE BONDS & NOTES

(Cost — $36,373,136) | | 32,455,762 | |

ASSET-BACKED SECURITIES — 14.3% | | | |

| | Automobiles — 0.4% | | | |

630,000 | | AmeriCredit Automobile Receivables Trust, 3.110% due 5/7/12(a)(d) | | 596,383 | |

| | Home Equity — 13.9% | | | |

350,000 | | Asset Backed Funding Certificates, 2.909% due 1/25/35(a)(d) | | 312,715 | |

405,375 | | Asset Backed Securities Corp., 2.759% due 6/25/35(a)(d) | | 400,709 | |

338,947 | | Bravo Mortgage Asset Trust, 2.729% due 7/25/36(a)(c)(d) | | 333,387 | |

| | Countrywide Asset-Backed Certificates: | | | |

744,021 | | 3.599% due 8/25/47(a)(c)(d) | | 719,681 | |

814,174 | | 3.499% due 10/25/47(a)(d) | | 669,126 | |

451,497 | | EMC Mortgage Loan Trust, 3.149% due 3/25/31(a)(c)(d) | | 372,620 | |

2,000,000 | | GMAC Mortgage Corp. Loan Trust, 2.669% due 12/25/36(a)(d) | | 1,994,677 | |

1,232,774 | | Greenpoint Home Equity Loan Trust, 3.378% due 8/15/30(a)(d) | | 1,011,725 | |

410,000 | | GSAMP Trust, 4.199% due 11/25/34(a)(d) | | 290,372 | |

1,002,165 | | Home Equity Mortgage Trust, 2.759% due 7/25/36(a)(d) | | 614,843 | |

410,000 | | IXIS Real Estate Capital Trust, 2.939% due 2/25/36(a)(d) | | 397,396 | |

492,846 | | JP Morgan Mortgage Acquisition Corp., 2.859% due 7/25/35(a)(d) | | 480,847 | |

2,731,845 | | Lehman XS Trust, 4.660% due 7/25/35(a)(d) | | 1,937,150 | |

| | Long Beach Mortgage Loan Trust: | | | |

219,940 | | 2.739% due 11/25/35(a)(d) | | 215,875 | |

300,000 | | 2.839% due 1/25/46(a)(d) | | 265,315 | |

| | | | | | |

See Notes to Financial Statements.

10 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Home Equity — 13.9% continued | | | |

338,848 | | MASTR Second Lien Trust, 2.869% due 9/25/35(a)(d) | | $ | 327,710 | |

| | Morgan Stanley ABS Capital I: | | | |

1,100,000 | | 2.969% due 2/25/37(a)(d) | | 331,674 | |

1,000,000 | | 3.019% due 2/25/37(a)(d) | | 246,150 | |

800,000 | | 3.149% due 2/25/37(a)(d) | | 168,082 | |

500,000 | | 3.599% due 2/25/37(d) | | 86,651 | |

700,000 | | 3.799% due 2/25/37(a)(d) | | 111,558 | |

946,229 | | Morgan Stanley Mortgage Loan Trust, 2.719% due 10/25/36(a)(d) | | 936,126 | |

250,601 | | Option One Mortgage Loan Trust, 2.999% due 2/25/35(a)(d) | | 229,832 | |

| | RAAC Series: | | | |

1,300,823 | | 2.889% due 1/25/46(a)(c)(d) | | 1,184,173 | |

1,200,000 | | 3.399% due 10/25/46(a)(c)(d) | | 240,000 | |

760,949 | | 2.869% due 5/25/36(a)(c)(d) | | 674,758 | |

659,568 | | 2.849% due 2/25/37(a)(c)(d) | | 589,989 | |

627,621 | | 3.799% due 9/25/47(a)(d) | | 502,097 | |

204,425 | | Renaissance Home Equity Loan Trust, 3.039% due 8/25/33(a)(d) | | 191,441 | |

141,776 | | Renaissance Net Interest Margin Trust, 8.353% due 6/25/37(c) | | 70,888 | |

| | SACO I Trust: | | | |

429,872 | | 2.949% due 9/25/35(a)(d) | | 350,047 | |

1,215,386 | | 2.769% due 3/25/36(a)(d) | | 610,918 | |

1,213,393 | | 2.829% due 4/25/36(a)(d) | | 676,597 | |

107,070 | | Sail Net Interest Margin Notes, 5.500% due 3/27/34(c) | | 12 | |

| | Structured Asset Investment Loan Trust: | | | |

810,000 | | 3.899% due 10/25/34(a)(d) | | 638,512 | |

39,548 | | 2.829% due 2/25/35(c)(d) | | 39,122 | |

| | Structured Asset Securities Corp.: | | | |

1,177,328 | | 2.869% due 5/25/31(a)(c)(d) | | 1,073,386 | |

290,000 | | 2.779% due 5/25/47(a)(d) | | 208,936 | |

500,000 | | Washington Mutual Asset-Backed Certificates, 3.649% due 5/25/47(d) | | 82,521 | |

| | Total Home Equity | | 19,587,618 | |

| | TOTAL ASSET-BACKED SECURITIES

(Cost — $28,486,827) | | 20,184,001 | |

COLLATERALIZED MORTGAGE OBLIGATIONS — 24.4% | | | |

497,362 | | Adjustable Rate Mortgage Trust, 2.869% due 2/25/36(a)(d) | | 321,576 | |

| | American Home Mortgage Investment Trust: | | | |

410,000 | | 3.399% due 11/25/45(a)(d) | | 149,340 | |

659,288 | | 5.350% due 11/25/45(a)(d) | | 560,968 | |

| | | | | | |

See Notes to Financial Statements.

| Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 11 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Banc of America Funding Corp.: | | | |

1,091,326 | | 6.000% due 5/20/33(a) | | $ | 1,097,878 | |

969,240 | | 5.663% due 6/20/35(a)(d) | | 749,735 | |

1,156,094 | | Countrywide Alternative Loan Trust, 2.766% due 7/20/35(a)(d) | | 897,420 | |

1,742,700 | | Countrywide Home Loans, 5.310% due 2/20/36(a)(d) | | 1,658,079 | |

| | Downey Savings & Loan Association Mortgage Loan Trust: | | | |

1,301,441 | | 2.889% due 8/19/45(a)(d) | | 1,012,287 | |

628,437 | | 5.246% due 3/19/46(a)(d) | | 488,806 | |

628,437 | | 5.246% due 3/19/47(a)(d) | | 338,472 | |

| | Federal Home Loan Mortgage Corp. (FHLMC): | | | |

| | PAC IO: | | | |

4,689,493 | | 5.000% due 1/15/19(f) | | 510,431 | |

5,273,150 | | 5.000% due 5/15/23(f) | | 865,869 | |

2,897,077 | | 5.000% due 5/15/23(f) | | 25,177 | |

5,907,835 | | 5.000% due 1/15/24(f) | | 237,356 | |

4,234,623 | | 5.000% due 5/15/24(f) | | 104,747 | |

8,750,022 | | 5.000% due 7/15/26(f) | | 503,593 | |

| | PAC-1 IO: | | | |

52,713 | | 5.000% due 8/15/19 | | 16 | |

5,604,845 | | 5.000% due 3/15/22(f) | | 885,213 | |

| | Federal National Mortgage Association (FNMA) STRIP, IO: | | | |

4,406,270 | | 5.500% due 7/1/18(d)(f) | | 624,224 | |

13,068,051 | | 5.000% due 7/1/33(f) | | 2,873,531 | |

411,554 | | Harborview Mortgage Loan Trust, 2.909% due 1/19/35(a)(d) | | 360,451 | |

| | Indymac Index Mortgage Loan Trust: | | | |

576,861 | | 3.029% due 9/25/34(a)(d) | | 531,050 | |

159,564 | | 2.999% due 11/25/34(a)(d) | | 144,136 | |

175,417 | | 2.989% due 12/25/34(a)(d) | | 158,462 | |

1,107,745 | | 5.387% due 10/25/35(a)(d) | | 866,319 | |

680,706 | | Lehman XS Trust, 2.899% due 11/25/35(a)(d) | | 536,640 | |

261,721 | | Long Beach Mortgage Loan Trust, 3.424% due 9/25/31(a)(d) | | 174,104 | |

1,391,292 | | Luminent Mortgage Trust, 2.799% due 2/25/46(a)(d) | | 1,055,957 | |

| | MASTR ARM Trust: | | | |

388,019 | | 5.037% due 12/25/33(a)(d) | | 373,326 | |

1,024,333 | | 5.322% due 12/25/46(a)(d) | | 757,566 | |

1,673,069 | | Morgan Stanley Mortgage Loan Trust, 5.469% due 5/25/36(a)(d) | | 1,347,221 | |

707,198 | | Residential Accredit Loans Inc., 2.879% due 12/25/45(a)(d) | | 553,760 | |

1,333,198 | | Structured Adjustable Rate Mortgage Loan Trust, 2.969% due 7/25/34(a)(d) | | 1,320,220 | |

| | | | | | |

See Notes to Financial Statements.

12 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Structured Asset Mortgage Investments Inc.: | | | |

1,421,489 | | 2.829% due 2/25/36(a)(d) | | $ | 1,077,765 | |

685,467 | | 2.809% due 4/25/36(a)(d) | | 519,978 | |

| | Structured Asset Securities Corp.: | | | |

449,176 | | 3.699% due 2/25/28(a)(d) | | 397,140 | |

181,813 | | 3.599% due 3/25/28(a)(d) | | 155,016 | |

498,700 | | 3.539% due 8/25/28(a)(d) | | 433,729 | |

6,284,090 | | 6.339% due 6/25/35(a)(c)(d) | | 6,570,412 | |

580,165 | | Thornburg Mortgage Securities Trust, 2.869% due 10/25/45(a)(d) | | 573,232 | |

| | WaMu Mortgage Pass-Through Certificates: | | | |

375,077 | | 5.667% due 3/25/37(a)(d) | | 355,301 | |

875,344 | | 2.959% due 7/25/45(a)(d) | | 609,461 | |

436,816 | | Washington Mutual Alternative Mortgage Pass-Through Certificates, 5.266% due 4/25/46(a)(d) | | 339,010 | |

1,243,315 | | Wells Fargo Mortgage Backed Securities Trust, 4.614% due 1/25/35(a)(d) | | 1,251,993 | |

| | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost — $36,953,452) | | 34,366,967 | |

COLLATERALIZED SENIOR LOANS — 8.2% | | | |

| | Distributors — 0.5% | | | |

987,500 | | Keystone Auto Industry Inc., Term Loan B, 8.636% due 10/30/09(c)(d) | | 780,125 | |

| | Diversified Financial Services — 0.3% | | | |

497,500 | | Chrysler Financial, Term Loan B, 9.360% due 8/3/12(c)(d) | | 413,824 | |

| | Diversified Telecommunication Services — 0.7% | | | |

992,405 | | Cablevision Systems Corp., Term Loan B, 6.875% due 3/30/13(c)(d) | | 929,902 | |

| | Electric Utilities — 0.6% | | | |

995,000 | | TXU Corp., Term Loan B, 6.579% due 10/10/14(c)(d) | | 908,503 | |

| | Energy Equipment & Services — 0.7% | | | |

1,000,000 | | SandRidge Energy, Term Loan, 8.854% due 4/1/14(c)(d) | | 935,000 | |

| | Health Care Providers & Services — 1.2% | | | |

992,462 | | HCA Inc., Term Loan B, 7.448% due 11/1/13(c)(d) | | 914,217 | |

974,254 | | Health Management Association, Term Loan B, 6.948% due 1/16/14(c)(d) | | 848,667 | |

| | Total Health Care Providers & Services | | 1,762,884 | |

| | Hotels, Restaurants & Leisure — 0.2% | | | |

750,000 | | BLB Worldwide Holdings Inc., Term Loan, 9.720% due 8/15/12(d) | | 300,000 | |

| | Independent Power Producers & Energy Traders — 0.6% | | | |

850,028 | | NRG Energy Inc., Term Loan, 6.948% due 2/1/13(c)(d) | | 797,491 | |

| | | | | | |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | | 13 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

| | Media — 1.2% | | | |

997,500 | | Charter Communications Operating LLC, First Lien, 5.260% due 3/5/14(c)(d) | | $ | 845,174 | |

992,462 | | Idearc Inc., Term Loan B, 7.200% due 11/1/14(c)(d) | | 798,560 | |

| | Total Media | | 1,643,734 | |

| | Multiline Retail — 0.3% | | | |

500,000 | | Neiman Marcus Group Inc., Term Loan B, 7.448% due 3/13/13(c)(d) | | 463,798 | |

| | Oil, Gas & Consumable Fuels — 0.6% | | | |

| | Ashmore Energy International: | | | |

47,569 | | Synthetic Revolving Credit Facility, 5.098% due 3/30/14(c)(d) | | 41,385 | |

350,797 | | Term Loan, 8.360% due 3/30/14(c)(d) | | 305,193 | |

| | Targa Resources Inc., Term Loans: | | | |

342,935 | | 7.525% due 10/28/12(c)(d) | | 324,932 | |

193,548 | | Tranche A, 7.168% due 10/28/12(c)(d) | | 183,387 | |

| | Total Oil, Gas & Consumable Fuels | | 854,897 | |

| | Trading Companies & Distributors — 1.3% | | | |

1,060,200 | | Penhall International Corp., Term Loan, 12.393% due 4/1/12(c)(d) | | 837,558 | |

1,000,000 | | Transdigm Inc. Term B, 7.200% due 6/23/13(c)(d) | | 940,833 | |

| | Total Trading Companies & Distributors | | 1,778,391 | |

| | TOTAL COLLATERALIZED SENIOR LOANS

(Cost — $13,307,760) | | 11,568,549 | |

MORTGAGE-BACKED SECURITIES — 17.5% | | | |

| | FHLMC — 3.7% | | | |

| | Federal Home Loan Mortgage Corp. (FHLMC): | | | |

1,081,500 | | 4.937% due 10/1/37(a)(d) | | 1,100,330 | |

3,538,553 | | 5.984% due 7/1/36(a)(d) | | 3,560,104 | |

471,222 | | Gold, 7.000% due 6/1/17(a) | | 494,531 | |

| | TOTAL FHLMC | | 5,154,965 | |

| | FNMA — 13.8% | | | |

| | Federal National Mortgage Association (FNMA): | | | |

2,846,588 | | 5.500% due 1/1/14-4/1/35(a) | | 2,883,965 | |

1,287,161 | | 7.000% due 10/1/18-6/1/32(a) | | 1,373,363 | |

4,112,750 | | 6.000% due 5/1/33-11/1/37(a) | | 4,235,134 | |

7,700,000 | | 5.000% due 4/14/38(g) | | 7,621,799 | |

3,300,000 | | 5.500% due 4/14/38(g) | | 3,331,452 | |

| | TOTAL FNMA | | 19,445,713 | |

| | TOTAL MORTGAGE-BACKED SECURITIES

(Cost — $24,446,720) | | 24,600,678 | |

| | | | | | |

See Notes to Financial Statements.

14 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

SOVEREIGN BONDS — 3.6% | | | |

| | Argentina — 0.6% | | | |

| | Republic of Argentina Bonds: | | | |

251,642 | ARS | 2.000% due 1/3/10(d) | | $ | 175,918 | |

657,000 | | 7.000% due 9/12/13 | | 539,342 | |

| | GDP Linked Securities: | | | |

275,000 | EUR | 1.262% due 12/15/35(d) | | 43,461 | |

270,000 | | 1.318% due 12/15/35(d) | | 32,940 | |

50,385 | ARS | 1.383% due 12/15/35(d) | | 1,566 | |

| | Total Argentina | | 793,227 | |

| | Ecuador — 0.2% | | | |

325,000 | | Republic of Ecuador, 10.000% due 8/15/30(c) | | 316,063 | |

| | El Salvador — 0.2% | | | |

| | Republic of El Salvador: | | | |

132,000 | | 7.750% due 1/24/23(c) | | 146,520 | |

59,000 | | 8.250% due 4/10/32(c) | | 67,113 | |

| | Total El Salvador | | 213,633 | |

| | Mexico — 0.5% | | | |

695,000 | | United Mexican States, Medium-Term Notes, 6.750% due 9/27/34 | | 775,828 | |

| | Panama — 0.7% | | | |

| | Republic of Panama: | | | |

521,000 | | 9.375% due 4/1/29 | | 690,325 | |

260,000 | | 6.700% due 1/26/36 | | 265,525 | |

| | Total Panama | | 955,850 | |

| | Russia — 0.8% | | | |

655,000 | | Russian Federation, 12.750% due 6/24/28(c) | | 1,183,094 | |

| | Venezuela — 0.6% | | | |

| | Bolivarian Republic of Venezuela: | | | |

24,000 | | 8.500% due 10/8/14 | | 22,380 | |

232,000 | | 5.750% due 2/26/16 | | 182,120 | |

| | Collective Action Securities: | | | |

105,000 | | 9.375% due 1/13/34 | | 97,387 | |

500,000 | | Notes, 10.750% due 9/19/13 | | 516,250 | |

| | Total Venezuela | | 818,137 | |

| | TOTAL SOVEREIGN BONDS

(Cost — $4,906,911) | | 5,055,833 | |

| | | | | | |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | | 15 |

Schedule of investments (unaudited) continued

March 31, 2008

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

SHARES | | SECURITY | | VALUE | |

PREFERRED STOCKS — 0.0% | | | |

CONSUMER DISCRETIONARY — 0.0% | | | |

| | Automobiles — 0.0% | | | |

100 | | Ford Motor Co., Series F, 7.550% | | $ | 1,517 | |

FINANCIALS — 0.0% | | | |

| | Diversified Financial Services — 0.0% | | | |

600 | | Preferred Plus, Trust Series FRD-1, 7.400% | | 8,670 | |

1,700 | | Saturns, Series F 2003-5, 8.125% | | 24,310 | |

| | TOTAL FINANCIALS | | 32,980 | |

| | TOTAL PREFERRED STOCKS

(Cost — $42,106) | | 34,497 | |

| | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $144,516,912) | | 128,266,287 | |

| | | | | | |

FACE

AMOUNT† | | | | | |

SHORT-TERM INVESTMENTS — 15.8% | | | |

| | U.S. Government Agency — 0.7% | | | |

970,000 | | Federal National Mortgage Association (FNMA), Discount Notes, 1.691% - 2.050% due 12/15/08(h)(i) (Cost — $957,369) | | 956,409 | |

| | Repurchase Agreement — 15.1% | | | |

21,265,000 | | Morgan Stanley tri-party repurchase agreement

dated 3/31/08, 2.250% due 4/1/08; Proceeds at

maturity — $21,266,329; (Fully collateralized by U.S.

government agency obligation, 6.000% due 4/18/36;

Market value — $22,242,938) (Cost — $21,265,000)(a) | | 21,265,000 | |

| | TOTAL SHORT-TERM INVESTMENTS

(Cost — $22,222,369) | | 22,221,409 | |

| | TOTAL INVESTMENTS — 106.8%

(Cost — $166,739,281#) | | 150,487,696 | |

| | Liabilities in Excess of Other Assets — (6.8)% | | (9,568,643 | ) |

| | TOTAL NET ASSETS — 100.0% | | $140,919,053 | |

† | | Face amount denominated in U.S. dollars, unless otherwise noted. |

(a) | | All or a portion of this security is segregated for open futures contracts, written options, swap contracts, foreign currency contracts, mortgage dollar rolls and securities traded on a to-be-announced (“TBA”) basis. |

(b) | | Payment-in-kind security for which part of the income earned may be paid as additional principal. |

(c) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

(d) | | Variable rate security. Interest rate disclosed is that which is in effect at March 31, 2008. |

(e) | | Security is currently in default. |

(f) | | Illiquid security. |

(g) | | This security is traded on a TBA basis (See Note 1). |

(h) | | Rate shown represents yield-to-maturity. |

(i) | | All or a portion of this security is held at the broker as collateral for open futures contracts. |

# | | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

16 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

WESTERN ASSET VARIABLE RATE STRATEGIC FUND INC.

Abbreviations used in this schedule:

ARM | | – Adjustable Rate Mortgage |

ARS | | – Argentine Peso |

EUR | | – Euro |

GDP | | – Gross Domestic Product |

IO | | – Interest Only |

MASTR | | – Mortgage Asset Securitization Transactions Inc. |

OJSC | | – Open Joint Stock Company |

PAC | | – Planned Amortization Class |

RUB | | – Russian Ruble |

STRIP | | – Separate Trading of Registered Interest and Principal |

SCHEDULE OF OPTIONS WRITTEN (unaudited)

CONTRACTS | | SECURITY | | EXPIRATION DATE | | STRIKE PRICE | | VALUE | | |

16 | | Eurodollar Futures, Put | | 3/16/09 | | $ 97.50 | | | $11,300 | | |

46 | | U.S. Treasury Notes 10

Year Futures, Put | | 5/23/08 | | 110.50 | | | 2,156 | | |

| | TOTAL OPTIONS WRITTEN (Premiums Received — $42,315) | | $13,456 | | |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | | 17 |

Statement of assets and liabilities (unaudited)

March 31, 2008

ASSETS: | | | |

Investments, at value (Cost — $145,474,281) | | $ | 129,222,696 | |

Repurchase agreement, at value (Cost — $21,265,000) | | 21,265,000 | |

Foreign currency, at value (Cost — $22,100) | | 22,480 | |

Cash | | 23,128 | |

Deposits with brokers for open futures contracts | | 1,800,000 | |

Interest receivable | | 1,456,446 | |

Interest receivable for open swap contracts | | 394,561 | |

Receivable for securities sold | | 256,834 | |

Receivable for open forward currency contracts | | 44,082 | |

Prepaid expenses | | 22,171 | |

Total Assets | | 154,507,398 | |

LIABILITIES: | | | |

Payable for securities purchased | | 11,000,884 | |

Swap contracts, at value (premium paid $163,980) | | 2,008,000 | |

Interest payable for open swap contracts | | 374,499 | |

Investment management fee payable | | 97,525 | |

Directors’ fees payable | | 16,372 | |

Options written, at value (premium received $42,315) | | 13,456 | |

Payable to broker — variation margin on open futures contracts | | 9,938 | |

Accrued expenses | | 67,671 | |

Total Liabilities | | 13,588,345 | |

TOTAL NET ASSETS | | $ | 140,919,053 | |

NET ASSETS: | | | |

Par value ($0.001 par value; 8,323,434 shares issued and outstanding; 100,000,000 shares authorized) | | $ | 8,323 | |

Paid-in capital in excess of par value | | 158,195,188 | |

Over distributed net investment income | | (1,040,407 | ) |

Accumulated net realized gain on investments, futures contracts, options written, swap contracts and foreign currency transactions | | 1,296,323 | |

Net unrealized depreciation on investments, futures contracts, options written, swap contracts and foreign currencies | | (17,540,374 | ) |

TOTAL NET ASSETS | | $ | 140,919,053 | |

Shares Outstanding | | 8,323,434 | |

Net Asset Value | | $16.93 | |

See Notes to Financial Statements.

18 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended March 31, 2008

INVESTMENT INCOME: | | | |

Interest | | $ | 5,032,153 | |

Dividends | | 2,376 | |

Total Investment Income | | 5,034,529 | |

EXPENSES: | | | |

Investment management fee (Note 2) | | 619,104 | |

Audit and tax | | 31,519 | |

Shareholder reports | | 28,720 | |

Directors’ fees | | 12,019 | |

Transfer agent fees | | 7,965 | |

Stock exchange listing fees | | 6,608 | |

Legal fees | | 1,916 | |

Insurance | | 1,402 | |

Custody fees | | 1,313 | |

Miscellaneous expenses | | 3,714 | |

Total Expenses | | 714,280 | |

NET INVESTMENT INCOME | | 4,320,249 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FUTURES CONTRACTS, OPTIONS WRITTEN, SWAP CONTRACTS AND FOREIGN CURRENCY TRANSACTIONS (NOTES 1 AND 3): | | | |

Net Realized Gain From: | | | |

Investment transactions | | 697,319 | |

Futures contracts | | 1,103,777 | |

Options written | | 42,610 | |

Swap contracts | | 97,508 | |

Foreign currency transactions | | 30,922 | |

Net Realized Gain | | 1,972,136 | |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | (15,377,969 | ) |

Futures contracts | | 429,088 | |

Options written | | 28,859 | |

Swap contracts | | (2,608,150 | ) |

Foreign currencies | | 33,486 | |

Change in Net Unrealized Appreciation/Depreciation | | (17,494,686 | ) |

Increase From Payment by Affiliate (Note 2) | | 349 | |

Net Loss on Investments, Futures Contracts, Options Written, Swap Contracts and Foreign Currency Transactions | | (15,522,201 | ) |

DECREASE IN NET ASSETS FROM OPERATIONS | | $(11,201,952 | ) |

| | | | |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 19 |

Statements of changes in net assets

FOR THE SIX MONTHS ENDED MARCH 31, 2008 (unaudited)

AND THE YEAR ENDED SEPTEMBER 30, 2007 | | 2008 | | 2007 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 4,320,249 | | $ | 8,910,387 | |

Net realized gain | | 1,972,136 | | 162,848 | |

Change in net unrealized appreciation/depreciation | | (17,494,686 | ) | (3,925,043 | ) |

Increase from payment by affiliate | | 349 | | — | |

Increase (Decrease) in Net Assets from Operations | | (11,201,952 | ) | 5,148,192 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (4,744,357 | ) | (10,862,490 | ) |

Net realized gains | | — | | (1,204,824 | ) |

Decrease in Net Assets from Distributions to Shareholders | | (4,744,357 | ) | (12,067,314 | ) |

DECREASE IN NET ASSETS | | (15,946,309 | ) | (6,919,122 | ) |

NET ASSETS: | | | | | |

Beginning of period | | 156,865,362 | | 163,784,484 | |

End of period* | | $ | 140,919,053 | | $ | 156,865,362 | |

* Includes over distributed net investment income of: | | $(1,040,407 | ) | $(616,299 | ) |

See Notes to Financial Statements.

20 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

Financial highlights

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH YEAR ENDED SEPTEMBER 30,

UNLESS OTHERWISE NOTED:

| | 20081,2 | | 20072 | | 20062 | | 20053 | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $18.85 | | $19.68 | | $19.47 | | $19.06 | 4 |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | |

Net investment income | | 0.52 | | 1.07 | | 1.04 | | 0.86 | |

Net realized and unrealized gain (loss) | | (1.87 | ) | (0.45 | ) | 0.36 | | 0.45 | |

Total income (loss) from operations | | (1.35 | ) | 0.62 | | 1.40 | | 1.31 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | |

Net investment income | | (0.57 | ) | (1.31 | ) | (1.07 | ) | (0.85 | ) |

Net realized gains | | — | | (0.14 | ) | (0.12 | ) | — | |

Return of capital | | — | | — | | — | | (0.05 | ) |

Total distributions | | (0.57 | ) | (1.45 | ) | (1.19 | ) | (0.90 | ) |

NET ASSET VALUE, END OF PERIOD | | $16.93 | | $18.85 | | $19.68 | | $19.47 | |

MARKET PRICE, END OF PERIOD | | $15.12 | | $16.91 | | $17.36 | | $17.16 | |

Total return, based on NAV5,6 | | (7.29 | )%7 | 3.21 | % | 7.45 | % | 7.06 | % |

Total return, based on Market Price6 | | (7.36 | )%7 | 5.75 | % | 8.46 | % | (9.82 | )% |

NET ASSETS, END OF PERIOD (000s) | | $140,919 | | $156,865 | | $163,784 | | $162,066 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | |

Gross expenses | | 0.95 | %8 | 0.97 | %9 | 2.35 | % | 1.65 | %8 |

Gross expenses, excluding interest expense | | 0.95 | 8 | 0.97 | 9 | 1.16 | | 1.07 | 8 |

Net expenses | | 0.95 | 8 | 0.97 | 9,10 | 2.34 | 10 | 1.65 | 8 |

Net expenses, excluding interest expense | | 0.95 | 8 | 0.97 | 9,10 | 1.16 | 10 | 1.07 | 8 |

Net investment income | | 5.75 | 8 | 5.53 | | 5.35 | | 4.94 | 8 |

PORTFOLIO TURNOVER RATE | | 35 | %11 | 160 | %11 | 27 | % | 46 | % |

1 | | For the six months ended March 31, 2008 (unaudited). |

2 | | Per share amounts have been calculated using the average shares method. |

3 | | For the period October 26, 2004 (inception date) to September 30, 2005. |

4 | | Initial public offering price of $20.00 per share less offering costs and sales load totaling $0.94 per share. |

5 | | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

6 | | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

7 | | The investment manager fully reimbursed the Fund for losses incurred resulting from an investment transaction error. Without this reimbursement, total return would not have changed. |

8 | | Annualized. |

9 | | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would have both have been 0.97%. |

10 | | Reflects fee waivers and/or expense reimbursements. |

11 | | Excluding mortgage dollar roll transactions. If mortgage dollar roll transactions had been included, the portfolio turnover rate would have been 107% for the six months ended March 31, 2008 and 197% for the year ended September 30, 2007. |

See Notes to Financial Statements.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 21 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Variable Rate Strategic Fund Inc. (the “Fund”) was incorporated in Maryland on August 3, 2004 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, (the “1940 Act”). The Board of Directors authorized 100 million shares of $0.001 par value common stock. The Fund’s primary investment objective is to maintain a high level of current income.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. Debt securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. Equity securities for which market quotations are available are valued at the last sale price or official closing price on the primary market or exchange on which they trade. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market, and are valued at the mean between the bid and asked prices as of the close of business of that market. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

(b) Repurchase agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Financial futures contracts. The Fund may enter into financial futures contracts typically to hedge a portion of the portfolio. Upon entering into a financial futures contract, the Fund is required to deposit cash or securities as

22 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

initial margin, equal to a certain percentage of the contract amount (initial margin deposit). Additional securities are also segregated up to the current market value of the financial futures contracts. Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying financial instruments. For foreign denominated futures, variation margins are not settled daily. The Fund recognizes an unrealized gain or loss equal to the fluctuation in the value. When the financial futures contracts are closed, a realized gain or loss is recognized equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund’s basis in the contracts.

The risks associated with entering into financial futures contracts include the possibility that a change in the value of the contract may not correlate with the changes in the value of the underlying financial instruments. In addition, investing in financial futures contracts involves the risk that the Fund could lose more than the initial margin deposit and subsequent payments required for a futures transaction. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(d) Forward foreign currency contracts. The Fund may enter into a forward foreign currency contract to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of a foreign currency denominated portfolio transaction. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is closed, through either delivery or offset by entering into another forward foreign currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(e) Swap contracts. Swaps involve the exchange by the Fund with another party of the respective amounts payable with respect to a notional principal amount related to one or more indices. The Fund may enter into these transactions to preserve a return or spread on a particular investment or portion of its assets, as a duration management technique, or to protect against any increase in the price of securities the Fund anticipates purchasing at a later date. The Fund may also use these transactions for speculative purposes, such as to obtain the price performance of a security without actually purchasing the security in circumstances where, for example, the subject security is illiquid, is unavailable for direct investment or available only on less attractive terms.

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 23 |

Notes to financial statements (unaudited) continued

Swaps are marked-to-market daily based upon quotations from market makers and the change in value, if any, is recorded as an unrealized gain or loss in the Statement of Operations. Net receipts or payments of interest are recorded as realized gains or losses, respectively.

Swaps have risks associated with them, including possible default by the counterparty to the transaction, illiquidity and, where swaps are used as hedges, the risk that the use of a swap could result in losses greater than if the swap had not been employed.

(f) Credit default swaps. The Fund may enter into credit default swap (“CDS”) contracts for investment purposes, to manage its credit risk or to add leverage. CDS agreements involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a third party, typically corporate issuers or sovereign issuers of an emerging country, on a specified obligation. The Fund may use a CDS to provide a measure of protection against defaults of the issuers (i.e., to reduce risk where a Fund has exposure to the sovereign issuer) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. As a seller of protection, the Fund generally receives an upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will pay to the buyer of the protection an amount up to the notional value of the swap, and in certain instances take delivery of the security. As the seller, the Fund would effectively add leverage to its portfolio because, in addition to its total net assets, the Fund would be subject to investment exposure on the notional amount of the swap. As a buyer of protection, the Fund generally receives an amount up to the notional value of the swap if a credit event occurs.

Payments received or made at the beginning of the measurement period are reflected as such on the Statement of Assets and Liabilities. These upfront payments are recorded as realized gain or loss on the Statement of Operations upon termination or maturity of the swap. A liquidation payment received or made at the termination of the swap is recorded as realized gain or loss on the Statement of Operations. Net periodic payments received or paid by the Fund are recorded as realized gain or loss on the Statement of Operations.

Entering into a CDS agreement involves, to varying degrees, elements of credit, market and documentation risk in excess of the related amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreement may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreement and that there will be unfavorable changes in net interest rates.

(g) Stripped securities. The Fund invests in “Stripped Securities,” a term used collectively for stripped fixed income securities. Stripped securities can be principal only securities (“PO”), which are debt obligations that have been

24 | Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report |

stripped of unmatured interest coupons or, interest only securities (“IO”), which are unmatured interest coupons that have been stripped from debt obligations. As is the case with all securities, the market value of Stripped Securities will fluctuate in response to changes in economic conditions, interest rates and the market’s perception of the securities. However, fluctuations in response to interest rates may be greater in Stripped Securities than for debt obligations of comparable maturities that pay interest currently. The amount of fluctuation increases with a longer period of maturity.

The yield to maturity on IO’s is sensitive to the rate of principal repayments (including prepayments) on the related underlying debt obligation and principal payments may have a material effect on yield to maturity. If the underlying debt obligation experiences greater than anticipated prepayments of principal, the Fund may not fully recoup its initial investment in IO’s.

(h) Mortgage dollar rolls. The Fund may enter into dollar rolls in which the Fund sells mortgage-backed securities for delivery in the current month, realizing a gain or loss, and simultaneously contracts to repurchase substantially similar (same type, coupon and maturity) securities to settle on a specified future date. During the roll period, the Fund forgoes interest paid on the securities. The Fund is compensated by the interest earned on the cash proceeds of the initial sale and by the lower repurchase price at the specified future date. The Fund maintains a segregated account, the dollar value of which is at least equal to its obligations with respect to dollar rolls.

The Fund executes its mortgage dollar rolls entirely in the to-be-announced (“TBA”) market, where the Fund makes a forward commitment to purchase a security and, instead of accepting delivery, the position is offset by a sale of the security with a simultaneous agreement to repurchase at a future date.

The risk of entering into a mortgage dollar roll is that the market value of the securities the Fund is obligated to repurchase under the agreement may decline below the repurchase price. In the event the buyer of securities under a mortgage dollar roll files for bankruptcy or becomes insolvent, the Fund’s use of proceeds of the dollar roll may be restricted pending a determination by the other party, or its trustee or receiver, whether to enforce the Fund’s obligation to repurchase the securities.

(i) Written options. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked-to-market daily to reflect the current market value of the option written. If the option expires, the Fund realizes a gain from investments equal to the amount of the premium received. When a written call option is exercised, the difference between the premium received plus the option exercise price and the Fund’s basis in the underlying security (in the case of a covered written call option), or the cost to purchase the underlying security (in the case of an uncovered written call option), including brokerage commission, is treated as a realized gain or loss. When a written put option is exercised, the amount of the premium received is added to the cost of the security purchased by the Fund

Western Asset Variable Rate Strategic Fund Inc. 2008 Semi-Annual Report | 25 |