Axos Q4 2021 Earnings Supplement July 29, 2021 NYSE: AX

Safe Harbor 1 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, projected consummation of pending acquisitions, including the acquisition of E*TRADE Advisor Services, estimates of capital expenditures, plans for future operations, products or services, the effects of the COVID-19 pandemic, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2020 and our last earnings press release. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. or achievements expressed or implied by such forward-

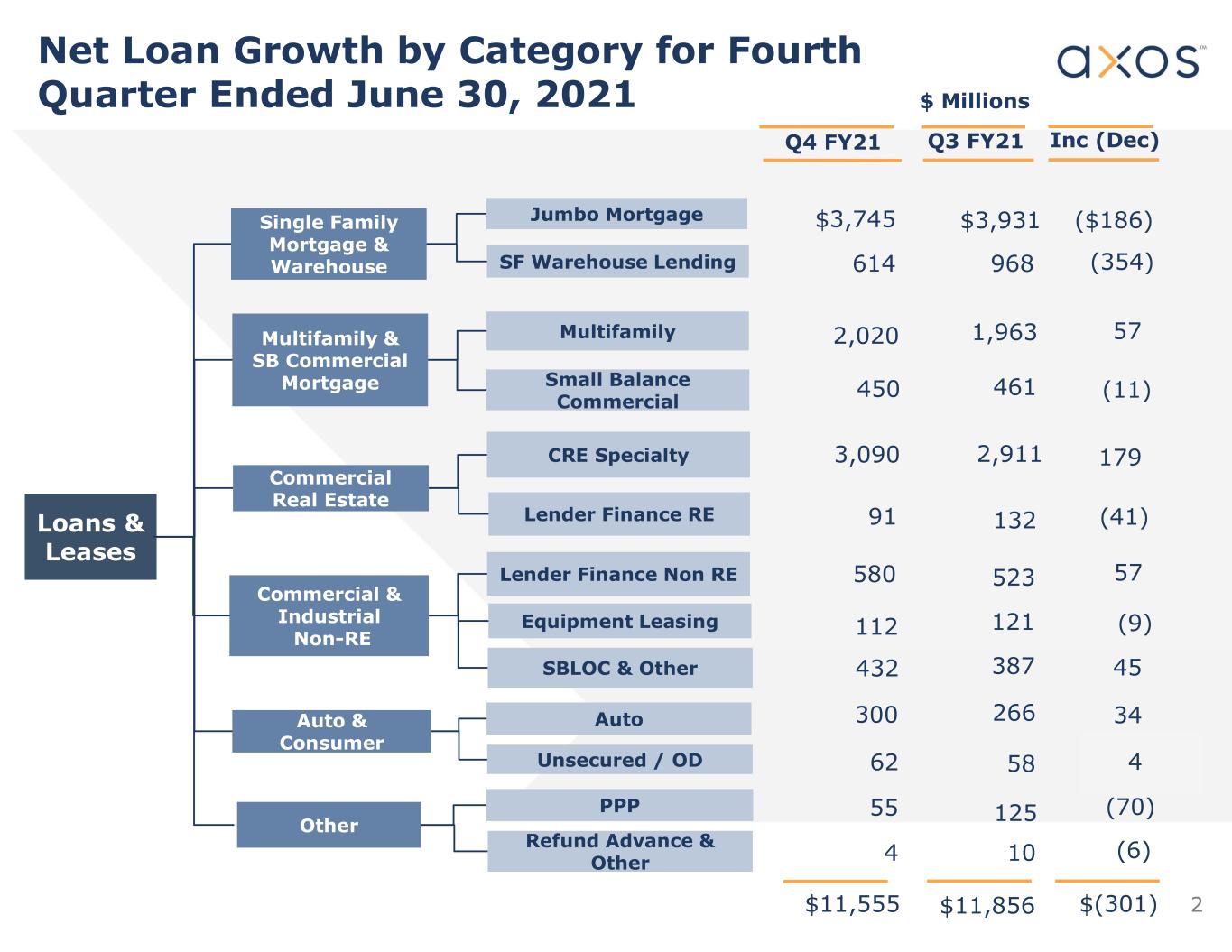

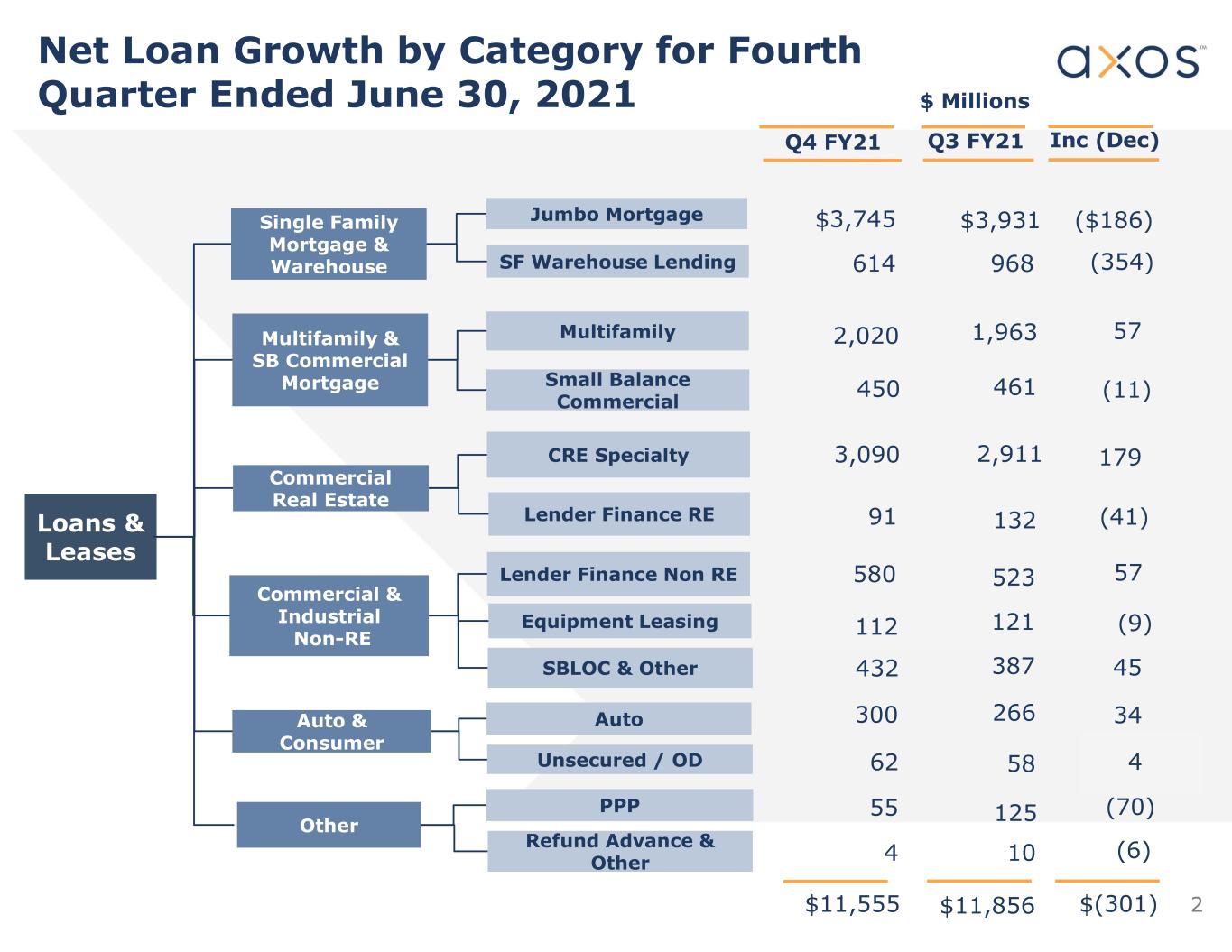

2 Net Loan Growth by Category for Fourth Quarter Ended June 30, 2021 Loans & Leases Single Family Mortgage & Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Jumbo Mortgage Multifamily Small Balance Commercial Lender Finance RE SF Warehouse Lending SBLOC & Other Auto CRE Specialty Unsecured / OD Equipment Leasing Q4 FY21 $ Millions Other PPP Refund Advance & Other Q3 FY21 $3,745 614 2,020 450 3,090 91 112 300 62 55 4 ($186) (354) 57 (11) 179 (41) (9) 34 4 (6) Inc (Dec) $3,931 968 1,963 461 2,911 132 121 266 58 125 10 Commercial & Industrial Non-RE Lender Finance Non RE 580 523 57 432 387 45 $11,555 $11,856 $(301) (70)

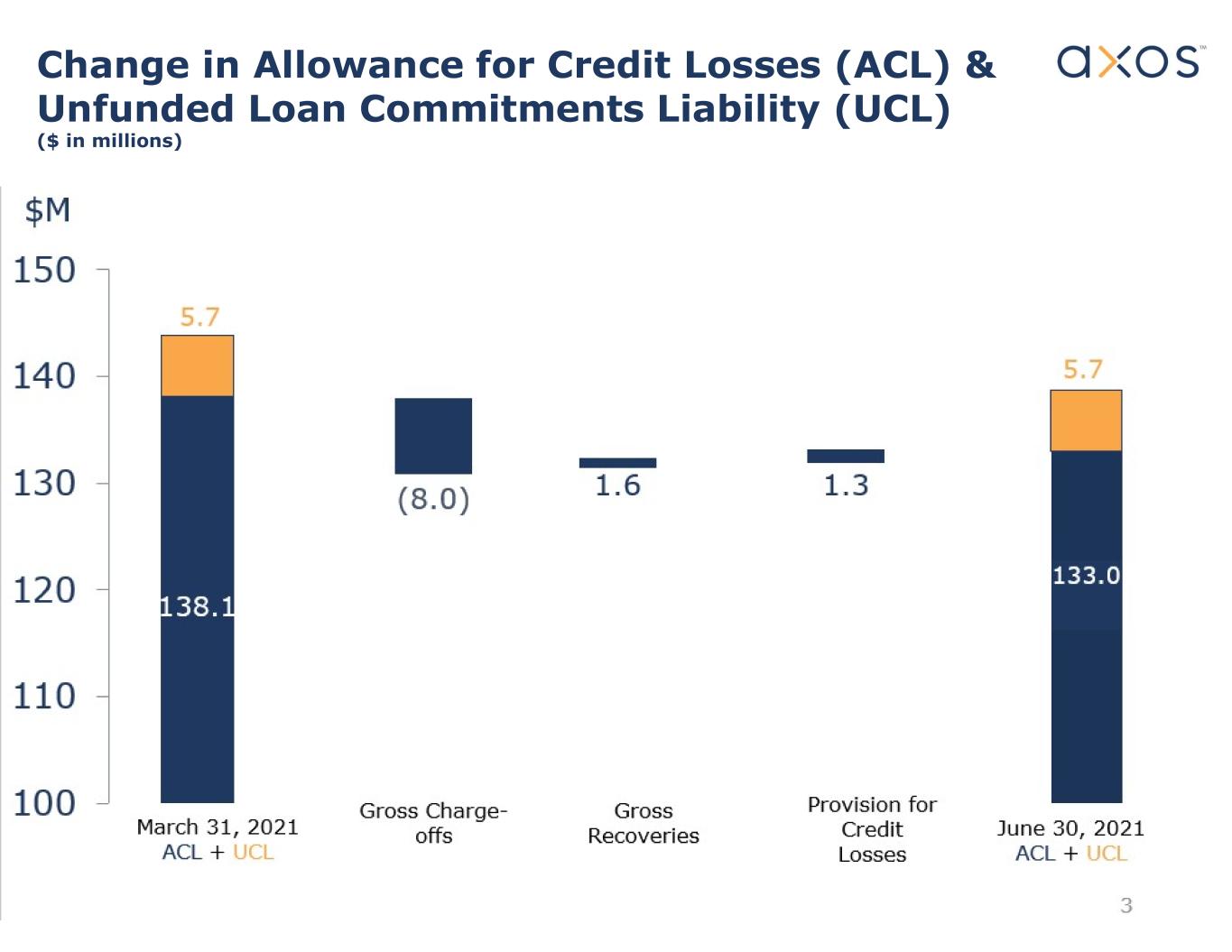

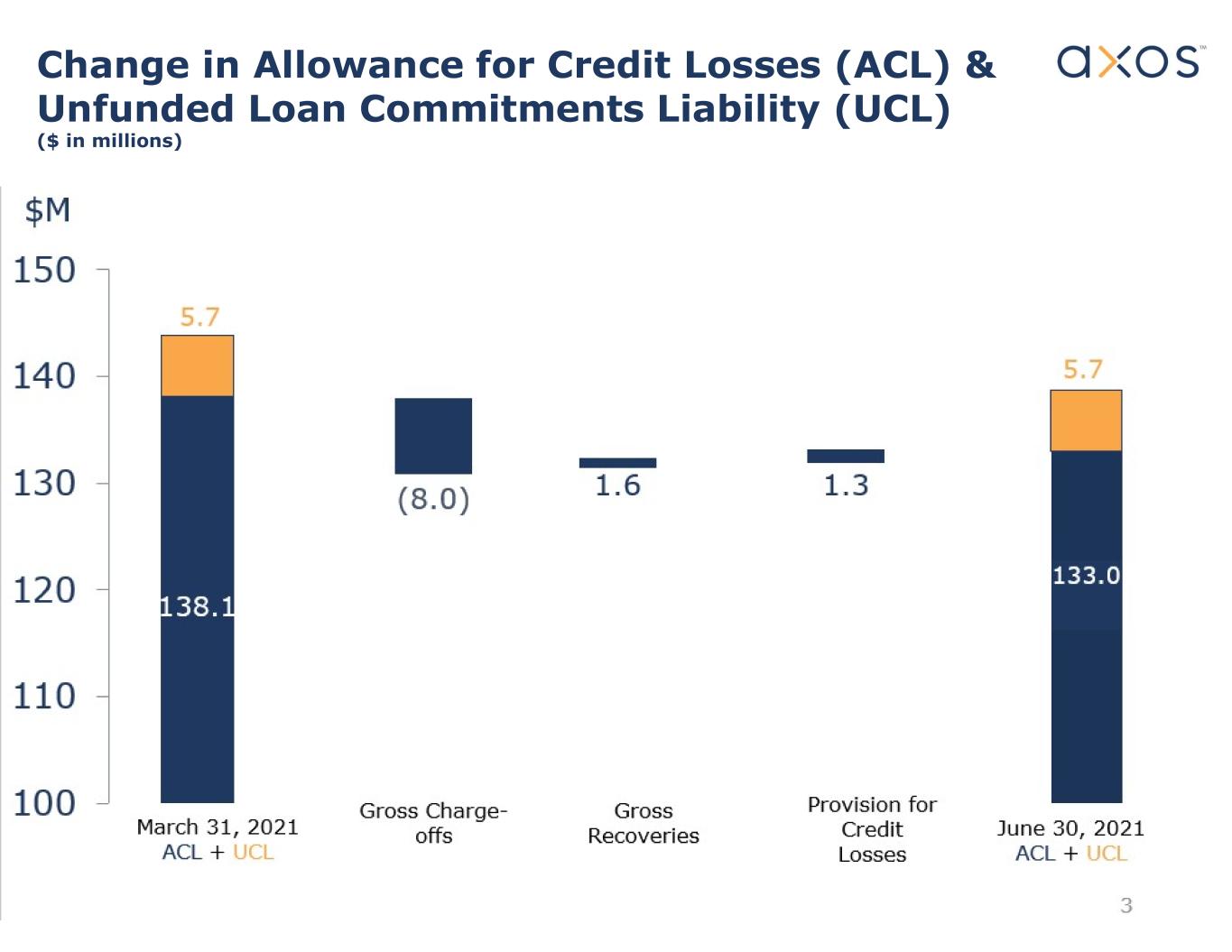

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) 3

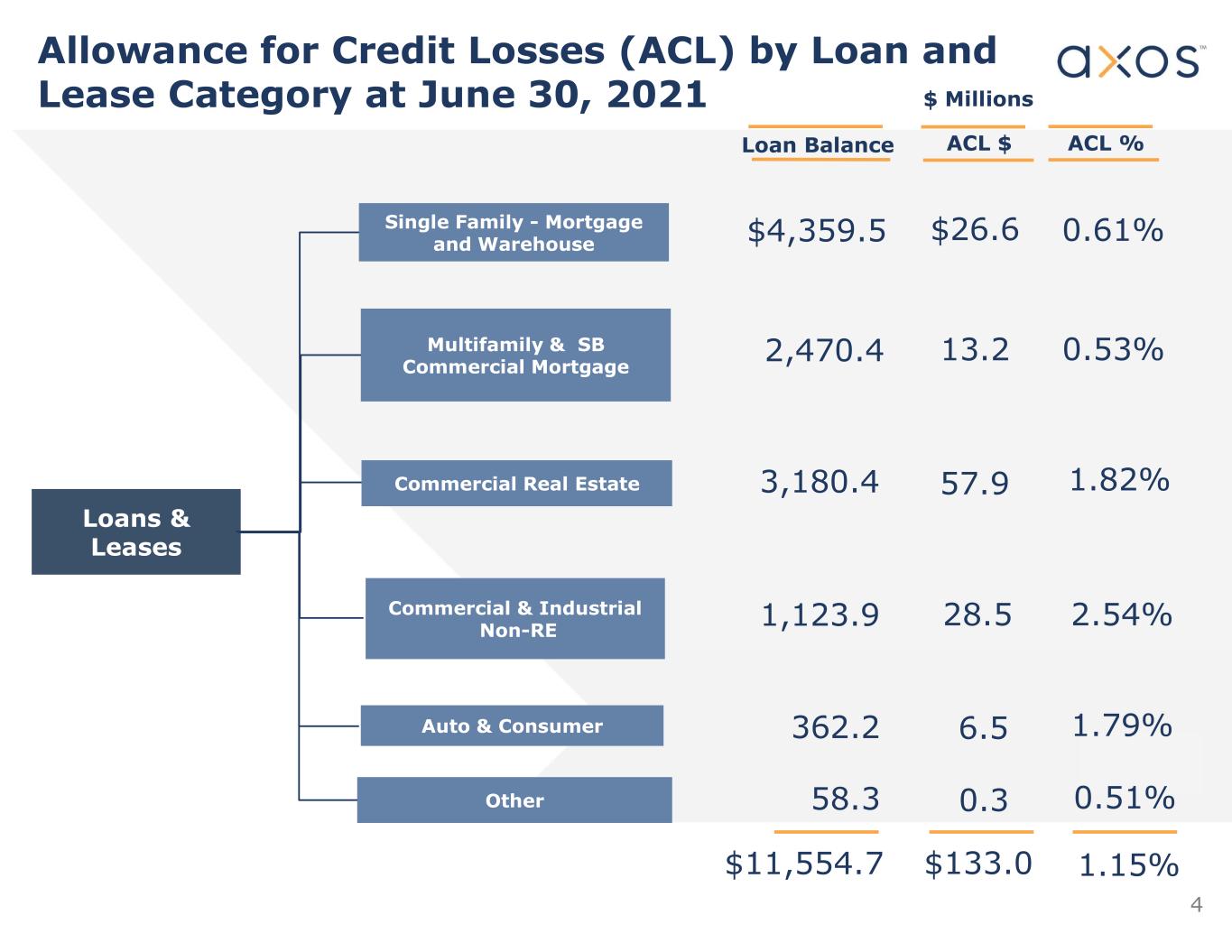

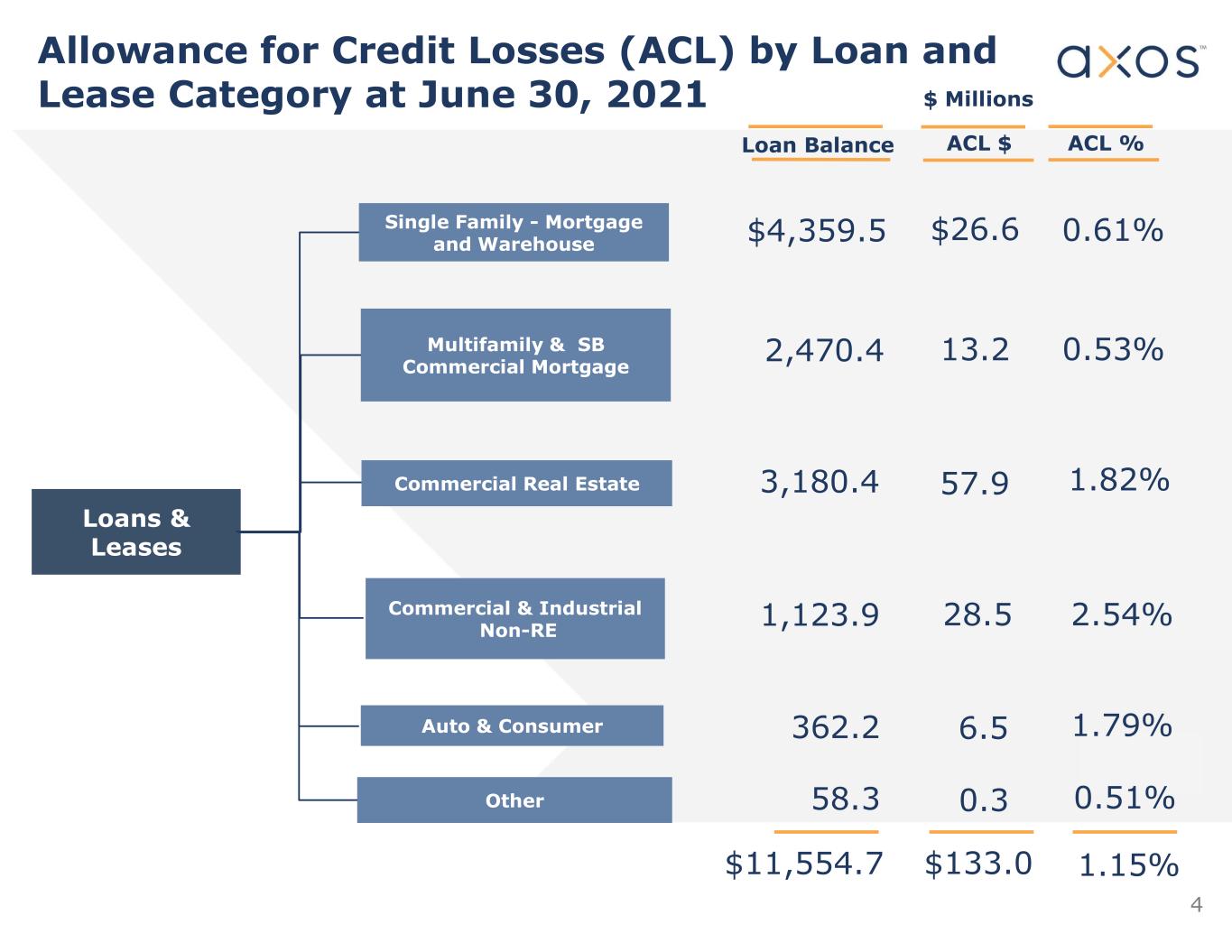

4 Allowance for Credit Losses (ACL) by Loan and Lease Category at June 30, 2021 Loans & Leases Single Family - Mortgage and Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Loan Balance $ Millions Other ACL $ $4,359.5 2,470.4 3,180.4 362.2 58.3 ACL % Commercial & Industrial Non-RE 1,123.9 $11,554.7 13.2 57.9 6.5 0.3 28.5 $26.6 $133.0 1.15% 1.82% 0.53% 0.61% 0.51% 1.79% 2.54%

Credit Quality No Loans in Forbearance 5 3/31/2021 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $4,899.2 $0.0 0.00% $85.0 1.74% Multifamily and Commercial Mortgage $2,424.2 $0.0 0.00% $30.8 1.27% Commercial Real Estate $3,042.9 $0.0 0.00% $16.4 0.54% Commercial & Industrial - Non-RE $1,030.9 $0.0 0.00% $3.0 0.29% Auto & Consumer $323.6 $0.0 0.00% $0.4 0.12% Other $135.7 $0.0 0.00% $0.0 0.00% Total $11,856.5 $0.0 0.00% $135.6 1.14% 6/30/2021 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $4,359.5 $0.0 0.00% $105.7 2.42% Multifamily and Commercial Mortgage $2,470.4 $0.0 0.00% $20.4 0.83% Commercial Real Estate $3,180.4 $0.0 0.00% $15.8 0.50% Commercial & Industrial - Non-RE $1,123.9 $0.0 0.00% $2.9 0.26% Auto & Consumer $362.2 $0.0 0.00% $0.3 0.08% Other $58.3 $0.0 0.00% $0.0 0.00% Total $11,554.7 $0.0 0.00% $145.1 1.26% Change from 3/31/21 to 6/30/21 Loans O/S Loans in Forbearance or Deferral NPAs Single Family-Mortgage & Warehouse -$539.7 $0.0 $20.7 Multifamily and Commercial Mortgage $46.2 $0.0 -$10.4 Commercial Real Estate $137.5 $0.0 -$0.6 Commercial & Industrial - Non-RE $93.0 $0.0 -$0.1 Auto & Consumer $38.6 $0.0 -$0.1 Other -$77.4 $0.0 $0.0 Total -$301.8 $0.0 $9.5

6 Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO investors@axosfinancial.com www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information