Axos Q1 Fiscal 2022 Earnings Supplement NYSE: AX

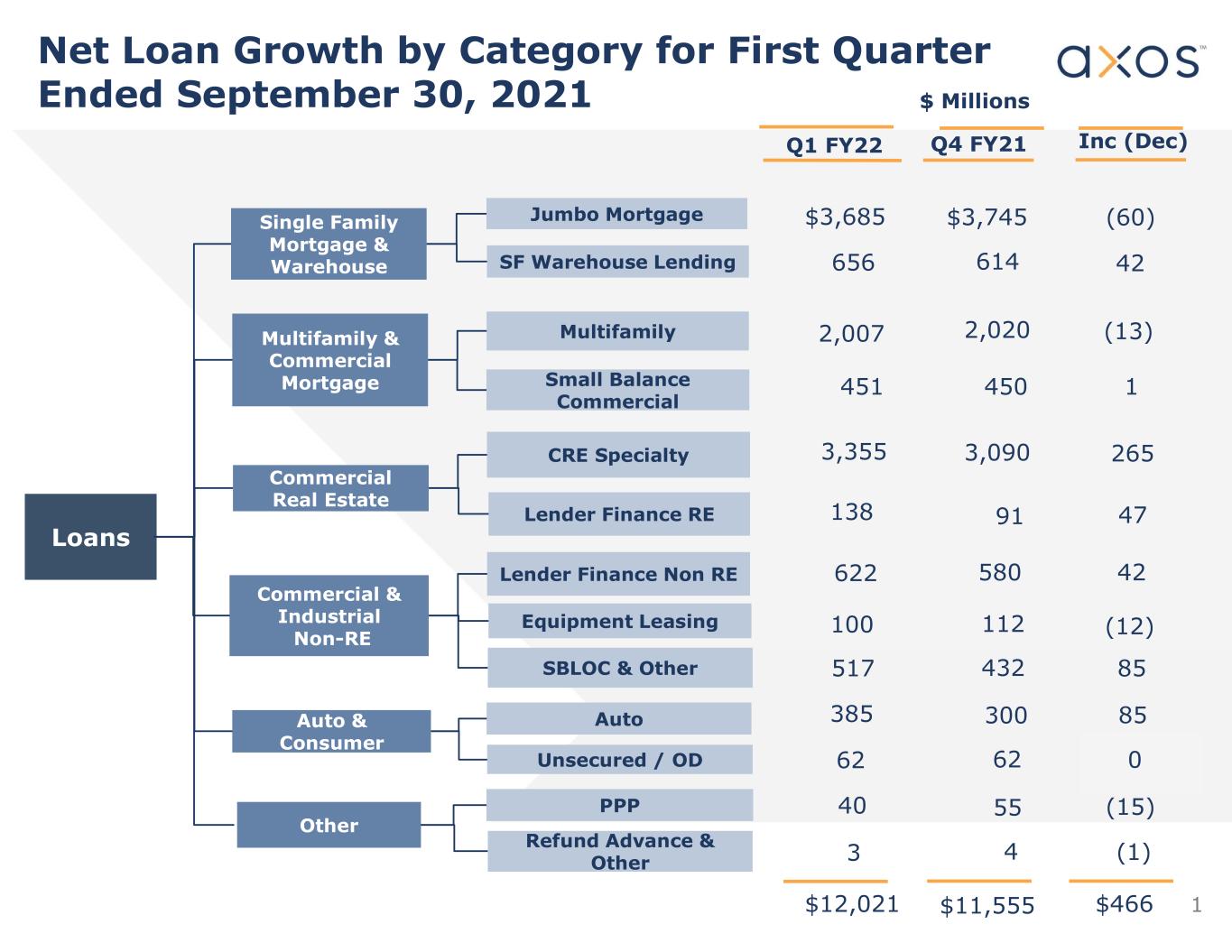

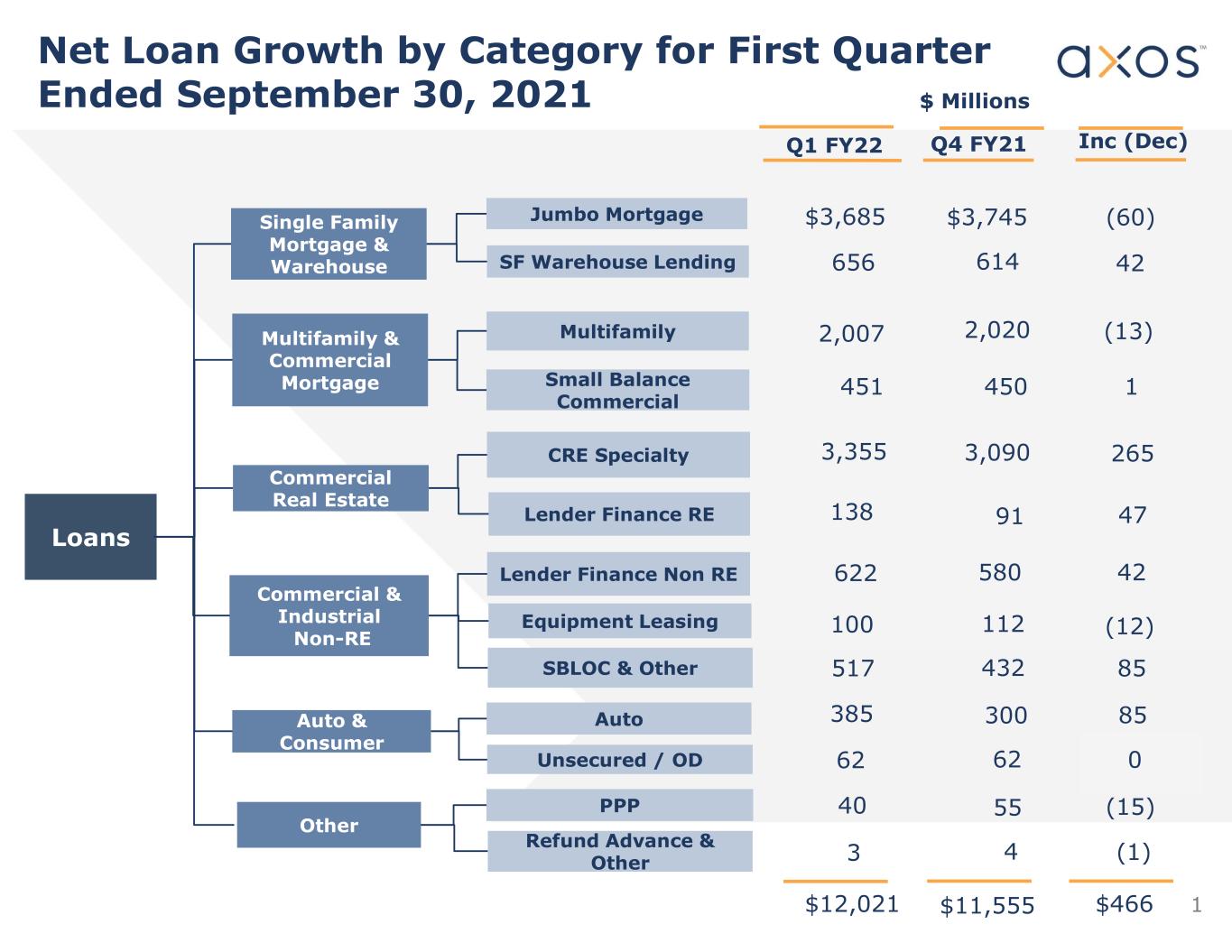

1 Net Loan Growth by Category for First Quarter Ended September 30, 2021 Loans Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Auto & Consumer Jumbo Mortgage Multifamily Small Balance Commercial Lender Finance RE SF Warehouse Lending SBLOC & Other Auto CRE Specialty Unsecured / OD Equipment Leasing Q1 FY22 $ Millions Other PPP Refund Advance & Other Q4 FY21 $3,685 656 2,007 451 3,355 138 100 385 62 40 3 (60) 42 (13) 1 265 47 (12) 85 0 (1) Inc (Dec) $3,745 614 2,020 450 3,090 91 112 300 62 55 4 Commercial & Industrial Non-RE Lender Finance Non RE 622 580 42 517 432 85 $12,021 $11,555 $466 (15)

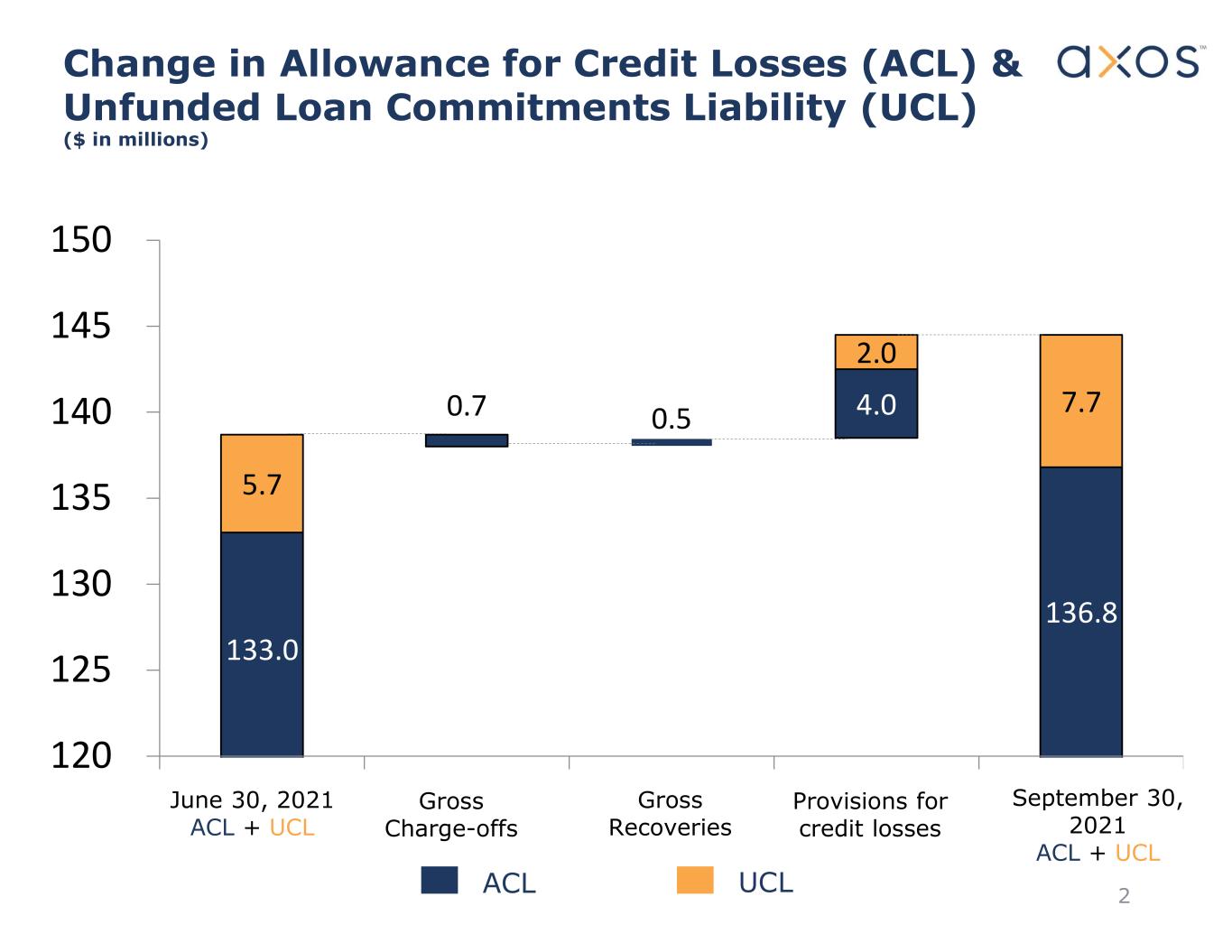

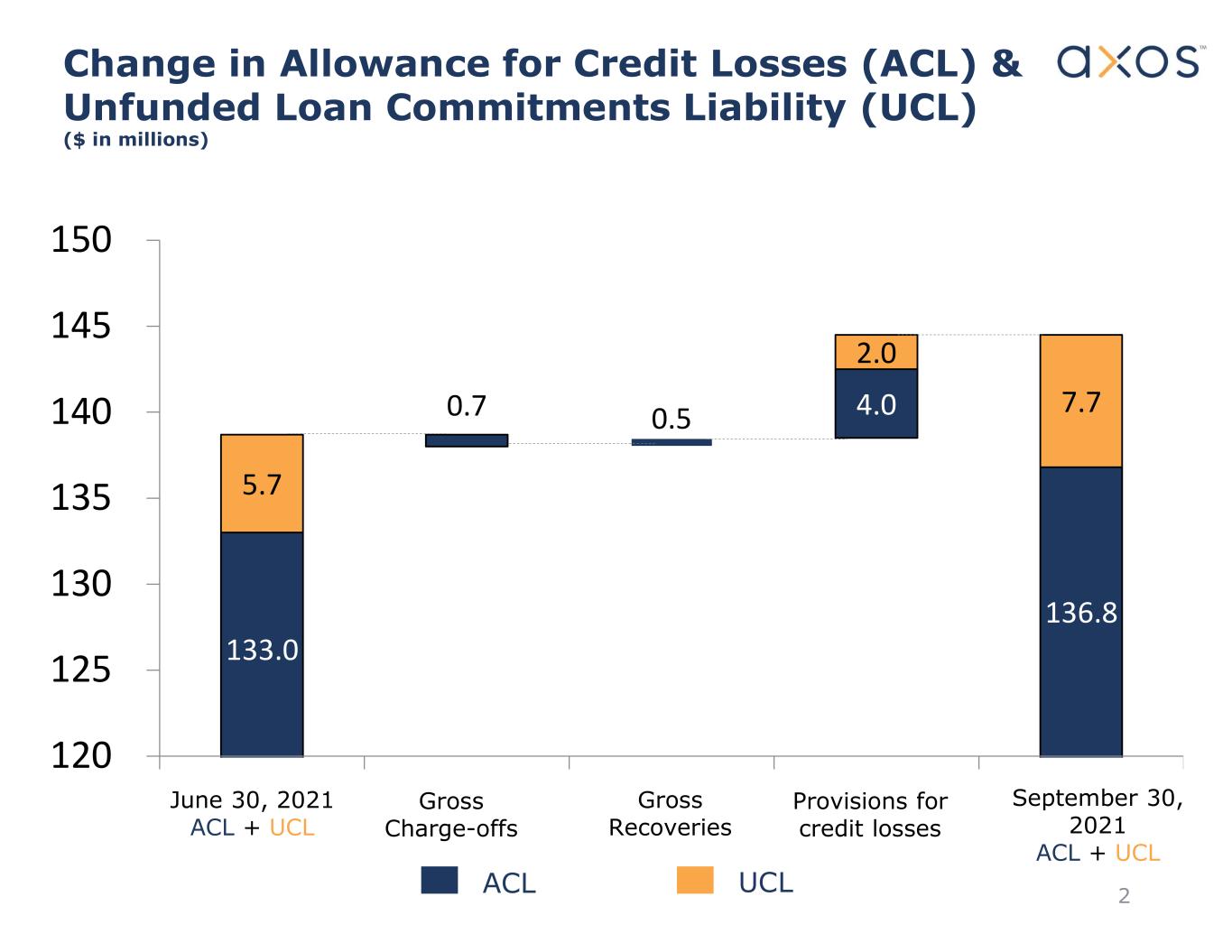

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) 2 133.0 0.7 0.5 4.0 136.8 5.7 2.0 7.7 120 125 130 135 140 145 150 June 30, 2021 ACL + UCL Gross Charge-offs Provisions for credit losses Gross Recoveries September 30, 2021 ACL + UCL UCLACL

3 Allowance for Credit Losses (ACL) by Loan Category as of September 30, 2021 Loans Single Family - Mortgage and Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Auto & Consumer Loan Balance $ Millions Other ACL $ $4,341.2 2,458.2 3,492.9 446.6 42.7 ACL % Commercial & Industrial Non-RE 1,239.4 $12,021.0 13.4 65.3 10.0 0.3 22.5 $25.3 $136.8 1.14% 1.87% 0.55% 0.58% 0.70% 2.24% 1.82%

Credit Quality No Loans in Forbearance 4 6/30/2021 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $4,359.5 $0.0 0.00% $105.7 2.42% Multifamily and Commercial Mortgage $2,470.4 $0.0 0.00% $20.4 0.83% Commercial Real Estate $3,180.4 $0.0 0.00% $15.9 0.50% Commercial & Industrial - Non-RE $1,123.9 $0.0 0.00% $2.9 0.26% Auto & Consumer $362.2 $0.0 0.00% $0.3 0.08% Other $58.3 $0.0 0.00% $0.0 0.00% Total $11,554.7 $0.0 0.00% $145.2 1.26% 9/30/2021 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $4,341.2 $0.0 0.00% $111.3 2.56% Multifamily and Commercial Mortgage $2,458.2 $0.0 0.00% $6.9 0.28% Commercial Real Estate $3,492.9 $0.0 0.00% $15.5 0.44% Commercial & Industrial - Non-RE $1,239.4 $0.0 0.00% $0.0 0.00% Auto & Consumer $446.6 $0.0 0.00% $0.4 0.09% Other $42.7 $0.0 0.00% $0.0 0.00% Total $12,021.0 $0.0 0.00% $134.1 1.12% Change at 9/30/21 from 6/30/21 Loans O/S Loans in Forbearance or Deferral NPAs Single Family-Mortgage & Warehouse -$18.3 $0.0 $5.6 Multifamily and Commercial Mortgage -$12.2 $0.0 -$13.5 Commercial Real Estate $312.5 $0.0 -$0.4 Commercial & Industrial - Non-RE $115.5 $0.0 -$2.9 Auto & Consumer $84.4 $0.0 $0.1 Other -$15.6 $0.0 $0.0 Total 466.3 $0.0 -$11.1

5 Greg Garrabrants, President and CEO Derrick Walsh, EVP and CFO Andy Micheletti, EVP-Finance investors@axosfinancial.com www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information