Axos Q3 Fiscal 2022 Earnings Supplement April 28, 2022 NYSE: AX

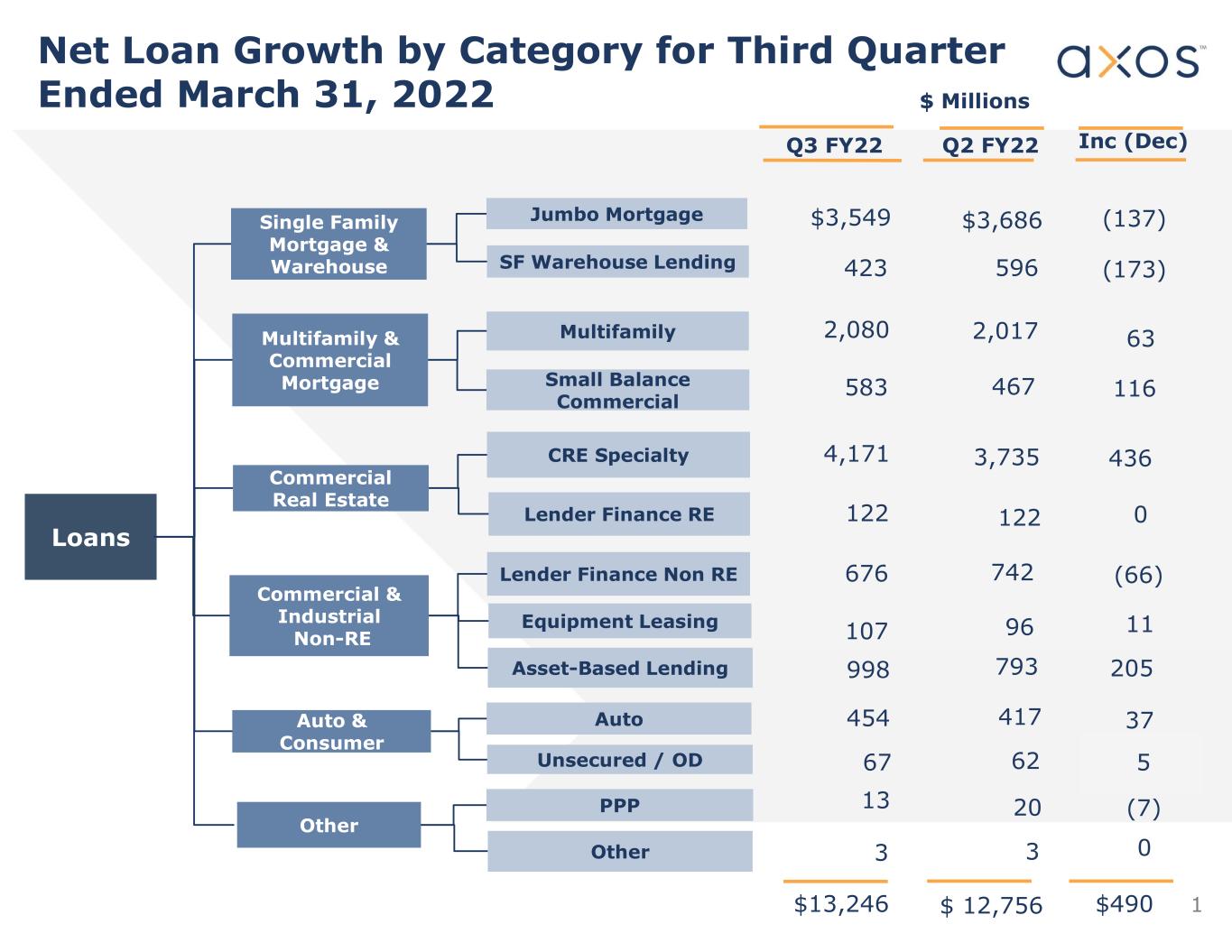

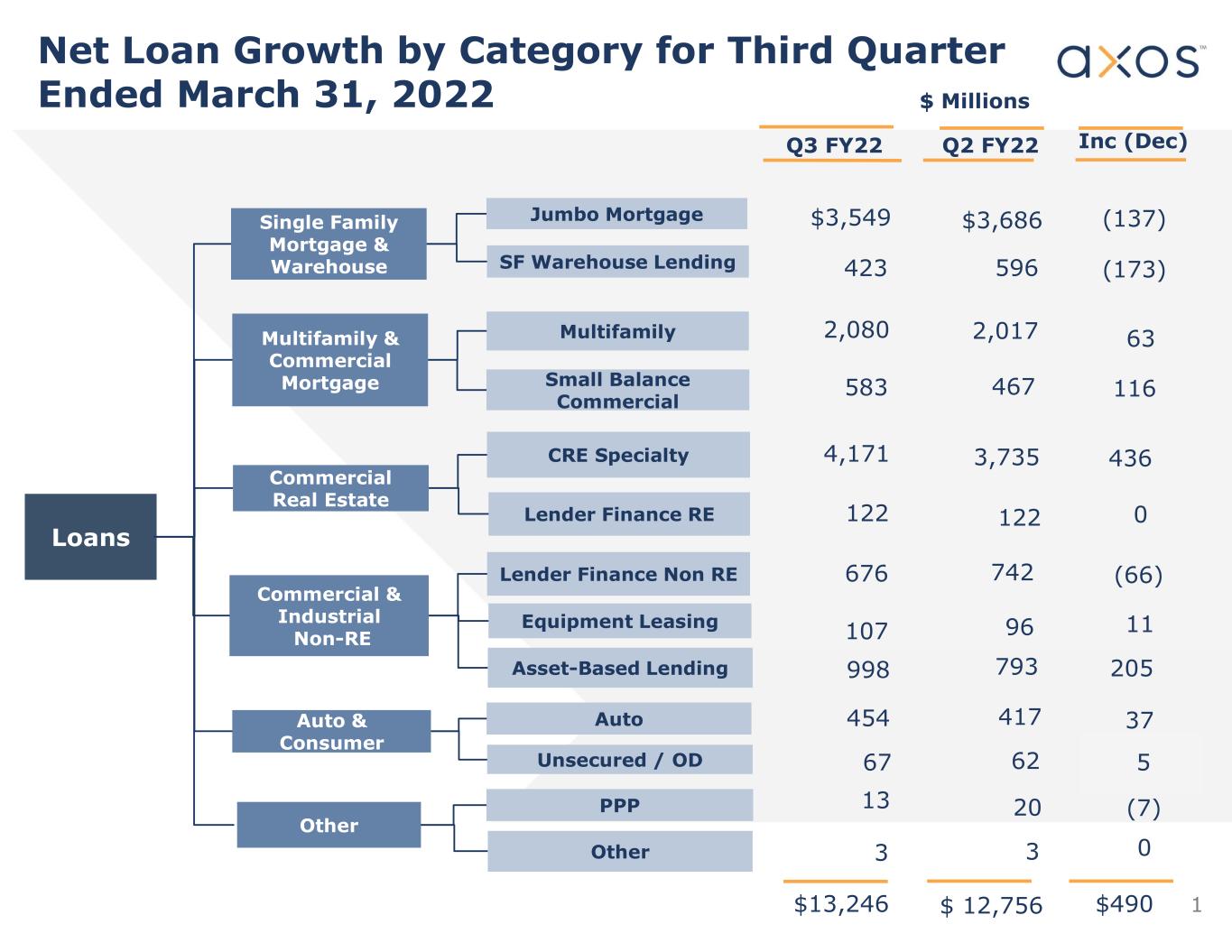

1 Net Loan Growth by Category for Third Quarter Ended March 31, 2022 Loans Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Auto & Consumer Jumbo Mortgage Multifamily Small Balance Commercial Lender Finance RE SF Warehouse Lending Asset-Based Lending Auto CRE Specialty Unsecured / OD Equipment Leasing Q3 FY22 $ Millions Other PPP Other Q2 FY22 $3,549 423 2,080 583 4,171 122 107 454 67 13 3 (137) (173) 63 116 436 0 11 37 5 0 Inc (Dec) $3,686 596 2,017 467 3,735 122 96 417 62 20 3 Commercial & Industrial Non-RE Lender Finance Non RE 676 742 (66) 998 793 205 $13,246 $ 12,756 $490 (7)

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) 2 140.5 (1.9) 0.3 4.5 143.4 8.7 9.7 120 125 130 135 140 145 150 155 Dec 31, 2021 ACL + UCL Gross Charge-offs Provisions for credit losses Gross Recoveries March 31, 2022 ACL + UCL UCLACL 1.0

3 Allowance for Credit Losses (ACL) by Loan Category as of March 31, 2022 Loans Single Family - Mortgage and Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Auto & Consumer Loan Balance $ Millions Other ACL $ $3,972.1 2,662.5 4,293.0 521.9 16.1 ACL % Commercial & Industrial Non-RE 1,780.6 $13,246.2 13.8 69.8 11.6 0.1 26.3 $21.8 $143.4 1.08% 1.63% 0.52% 0.55% 0.28% 2.22% 1.48%

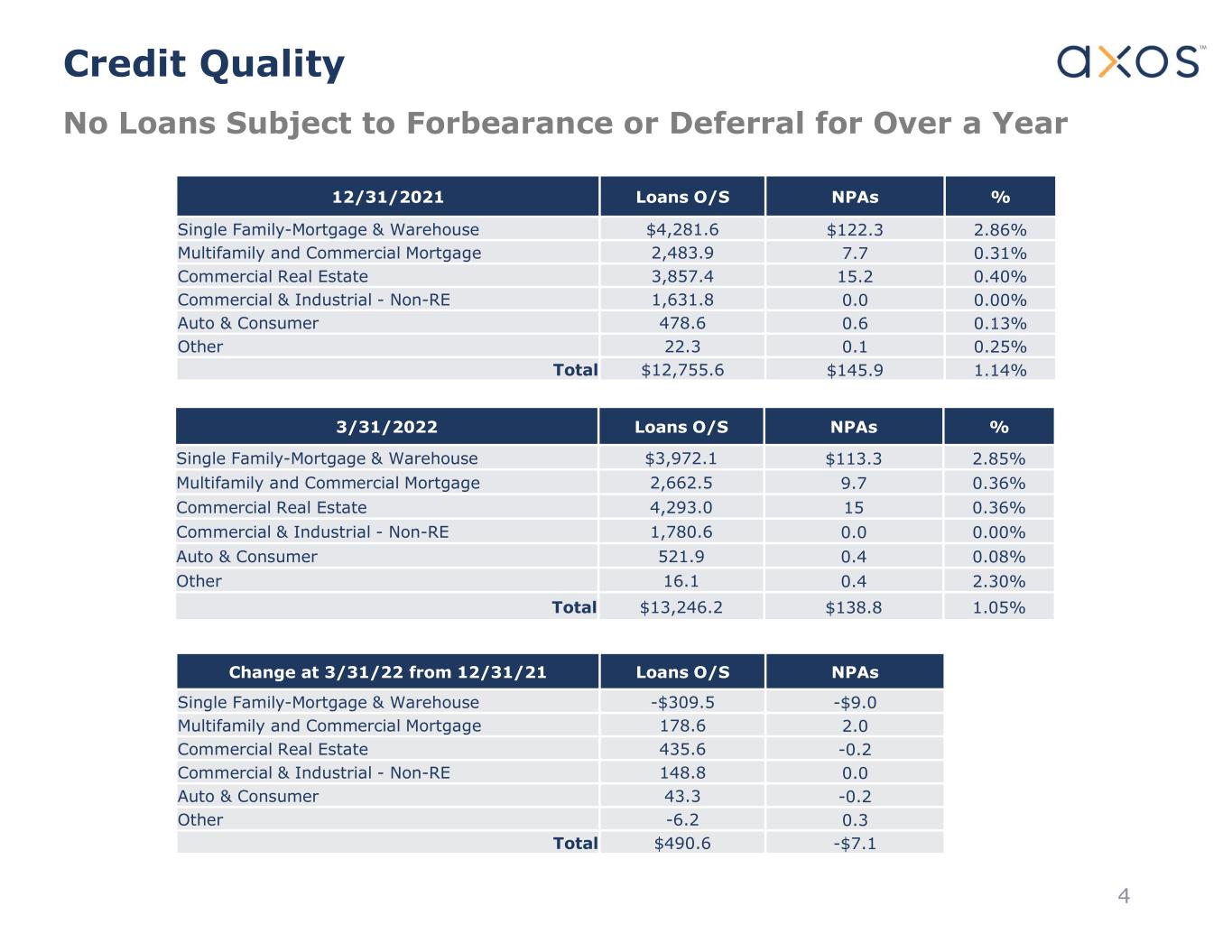

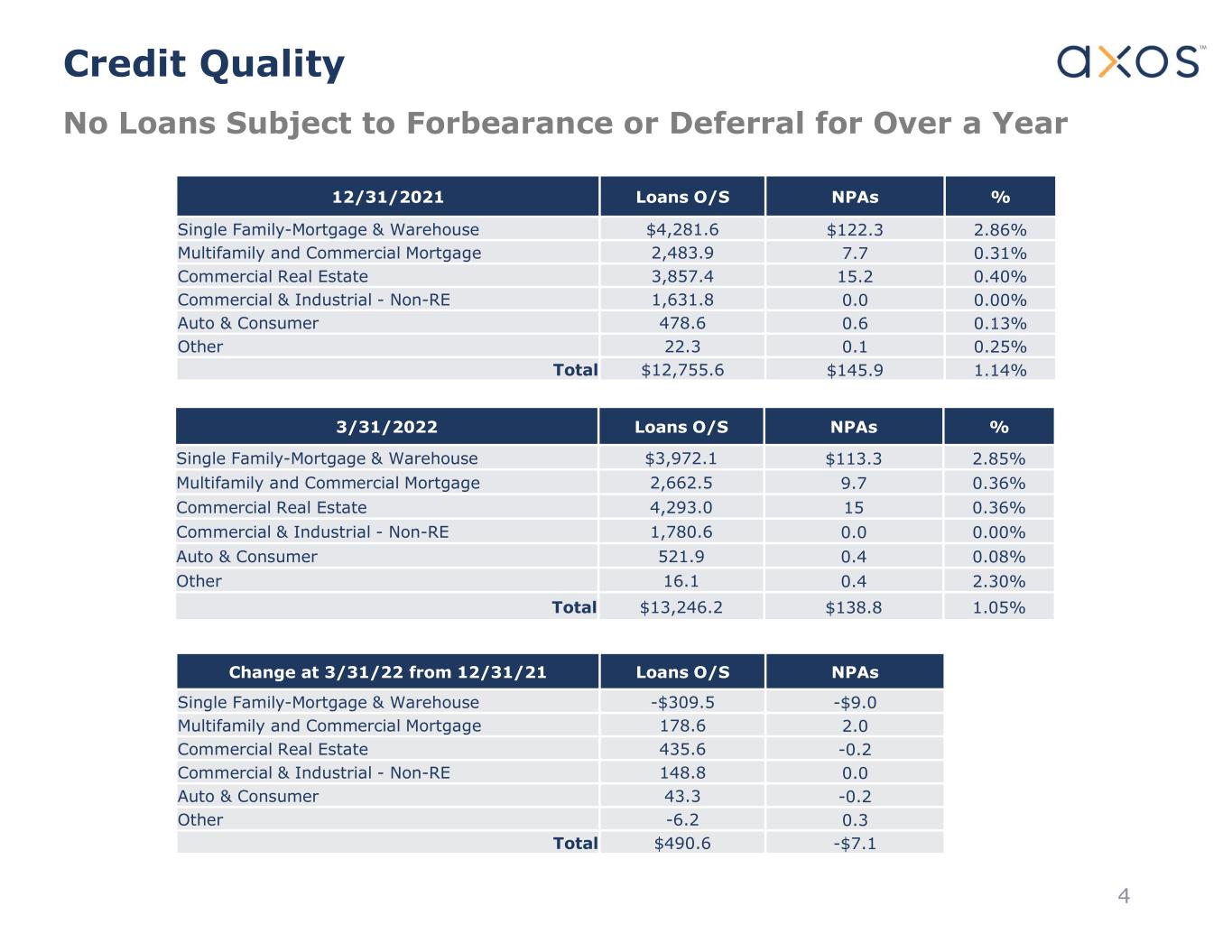

Credit Quality No Loans Subject to Forbearance or Deferral for Over a Year 4 12/31/2021 Loans O/S NPAs % Single Family-Mortgage & Warehouse $4,281.6 $122.3 2.86% Multifamily and Commercial Mortgage 2,483.9 7.7 0.31% Commercial Real Estate 3,857.4 15.2 0.40% Commercial & Industrial - Non-RE 1,631.8 0.0 0.00% Auto & Consumer 478.6 0.6 0.13% Other 22.3 0.1 0.25% Total $12,755.6 $145.9 1.14% 3/31/2022 Loans O/S NPAs % Single Family-Mortgage & Warehouse $3,972.1 $113.3 2.85% Multifamily and Commercial Mortgage 2,662.5 9.7 0.36% Commercial Real Estate 4,293.0 15 0.36% Commercial & Industrial - Non-RE 1,780.6 0.0 0.00% Auto & Consumer 521.9 0.4 0.08% Other 16.1 0.4 2.30% Total $13,246.2 $138.8 1.05% Change at 3/31/22 from 12/31/21 Loans O/S NPAs Single Family-Mortgage & Warehouse -$309.5 -$9.0 Multifamily and Commercial Mortgage 178.6 2.0 Commercial Real Estate 435.6 -0.2 Commercial & Industrial - Non-RE 148.8 0.0 Auto & Consumer 43.3 -0.2 Other -6.2 0.3 Total $490.6 -$7.1

5 Greg Garrabrants, President and CEO Derrick Walsh, EVP and CFO Andy Micheletti, EVP-Finance investors@axosfinancial.com www.axosfinancial.com Johnny Lai, SVP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information