Axos Q1 Fiscal 2024 Earnings Supplement October 26, 2023 NYSE: AX

1 Loan Growth by Category for First Quarter Ended September 30, 2023 $ millions Inc (Dec)Q4 FY23Q1 FY24 95$3,924$4,019 45250295 )(1062,2362,130 )(14846832 1425,3465,488 )(173854681 1371,6961,833 )(9116107 ) 4418281,269 )(35476441 )(57065 )(8102 $510$16,652$17,162 Jumbo Mortgage SF Warehouse Lending Multifamily Small Balance Commercial CRE Specialty Lender Finance RE Lender Finance Non-RE Equipment Leasing Asset-Based Lending Auto Unsecured/OD Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans

CRE Specialty* Detail as of September 30, 2023 Non-Performing Loans (mm)Weighted Avg. LTVBalance (mm)Loan Type $1143%$1,804Multifamily 15371,109SFR 0411,061Hotel 039496Industrial 038456Office 043226Retail 041336Other $2641%$5,488Total <=50% > 50% to 60% >60% to 65% > 65% 81% 16% 2% 1% LTV Distribution 2 *Includes CRE Specialty loan portfolio only; see Form 10-Q for the quarterly period ended September 30, 2023 for additional details of other loan categories

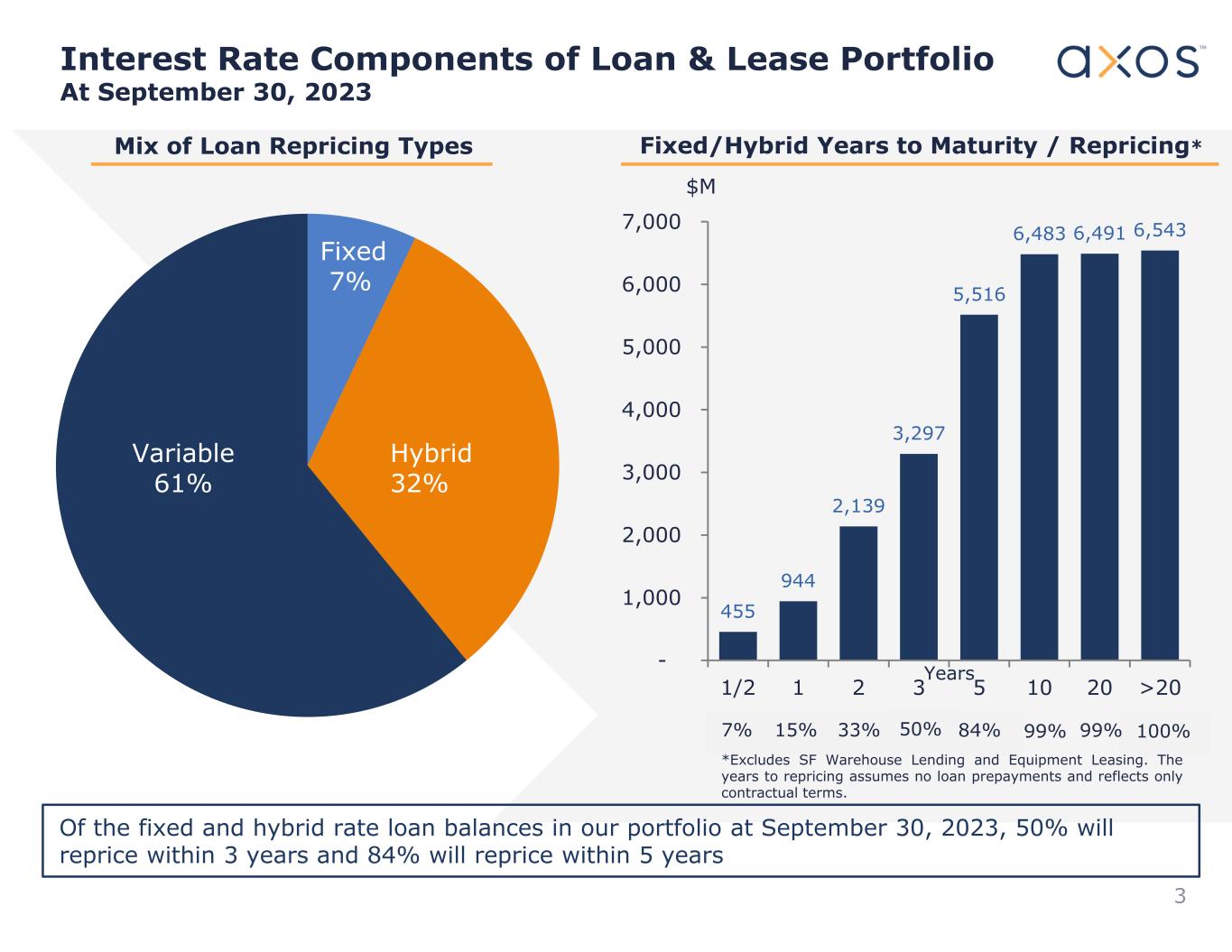

Fixed/Hybrid Years to Maturity / Repricing*Mix of Loan Repricing Types Variable 61% Hybrid 32% Fixed 7% 455 944 2,139 3,297 5,516 6,483 6,491 6,543 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 1/2 1 2 3 5 10 20 >20 Years $M 7% 15% 33% 50% 100%99%99%84% *Excludes SF Warehouse Lending and Equipment Leasing. The years to repricing assumes no loan prepayments and reflects only contractual terms. Interest Rate Components of Loan & Lease Portfolio At September 30, 2023 3 Of the fixed and hybrid rate loan balances in our portfolio at September 30, 2023, 50% will reprice within 3 years and 84% will reprice within 5 years

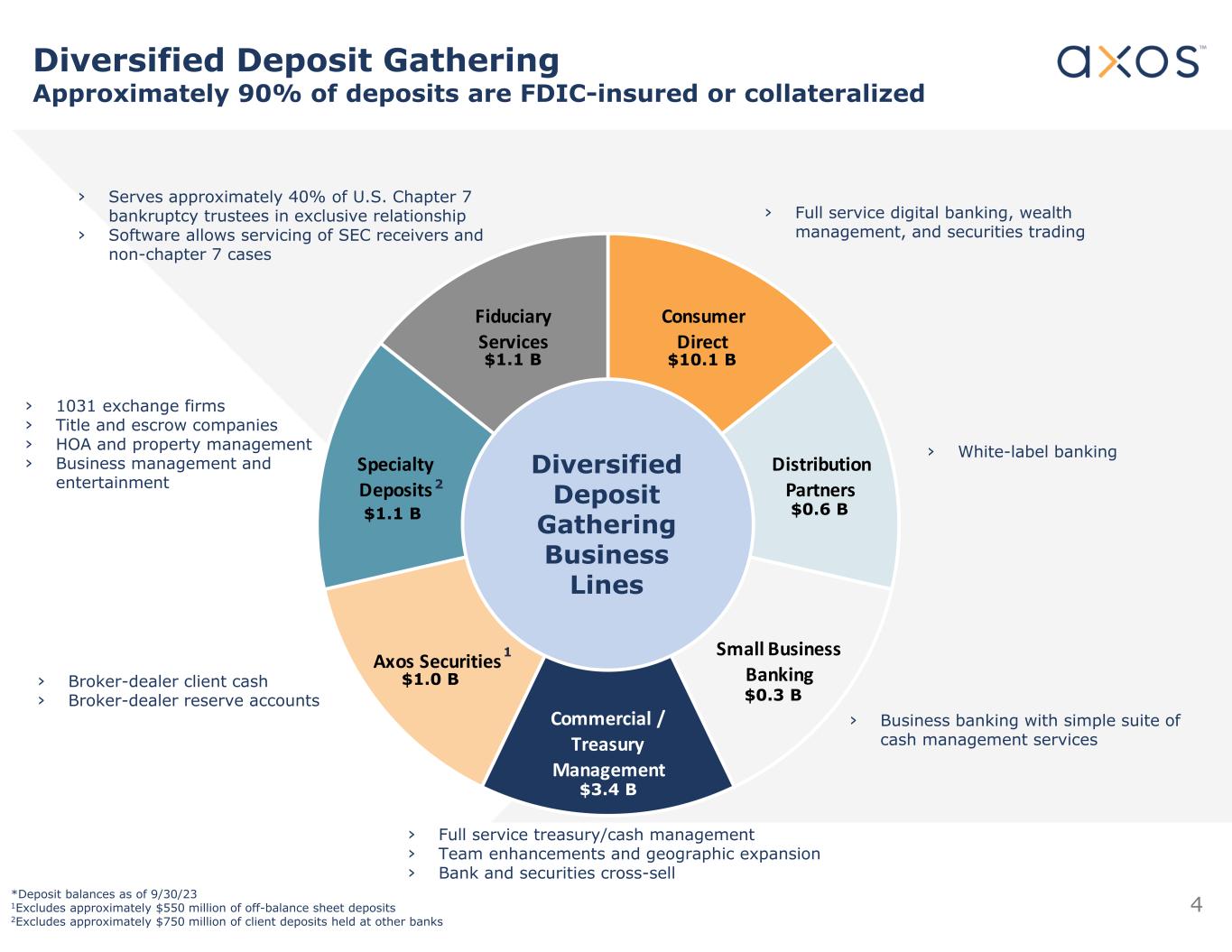

4 Consumer Direct Distribution Partners Small Business Banking Commercial / Treasury Management Axos Securities Specialty Deposits Fiduciary Services Diversified Deposit Gathering Business Lines $1.1 B $1.1 B $10.1 B $0.6 B $0.3 B $3.4 B $1.0 B Diversified Deposit Gathering Approximately 90% of deposits are FDIC-insured or collateralized *Deposit balances as of 9/30/23 1Excludes approximately $550 million of off-balance sheet deposits 2Excludes approximately $750 million of client deposits held at other banks 1 2 › Full service digital banking, wealth management, and securities trading › White-label banking › Business banking with simple suite of cash management services › Serves approximately 40% of U.S. Chapter 7 bankruptcy trustees in exclusive relationship › Software allows servicing of SEC receivers and non-chapter 7 cases › 1031 exchange firms › Title and escrow companies › HOA and property management › Business management and entertainment › Broker-dealer client cash › Broker-dealer reserve accounts › Full service treasury/cash management › Team enhancements and geographic expansion › Bank and securities cross-sell

Axos Advisor Services (AAS) Cash Sorting 5 Ending Balance* *Total ending AAS client deposit balances, both on- and off-balance sheet (895) (383) (188) (51) $(1,000) $(900) $(800) $(700) $(600) $(500) $(400) $(300) $(200) $(100) $- Q2 2023 Q3 2023 Q4 2023 Q1 2024 Pace of AAS Cash Sorting Decline Has Decelerated $1,052$1,103$1,291$1,674 (in millions)

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Reserve (UCL) ($ in millions) 166.7 2.4 0.8 5.8 170.9 10.5 11.7 130 140 150 160 170 180 190 1.2 June 30, 2023 ACL + UCL Gross Charge-offs Provisions for credit losses Gross Recoveries September 30, 2023 ACL + UCL UCLACL 6

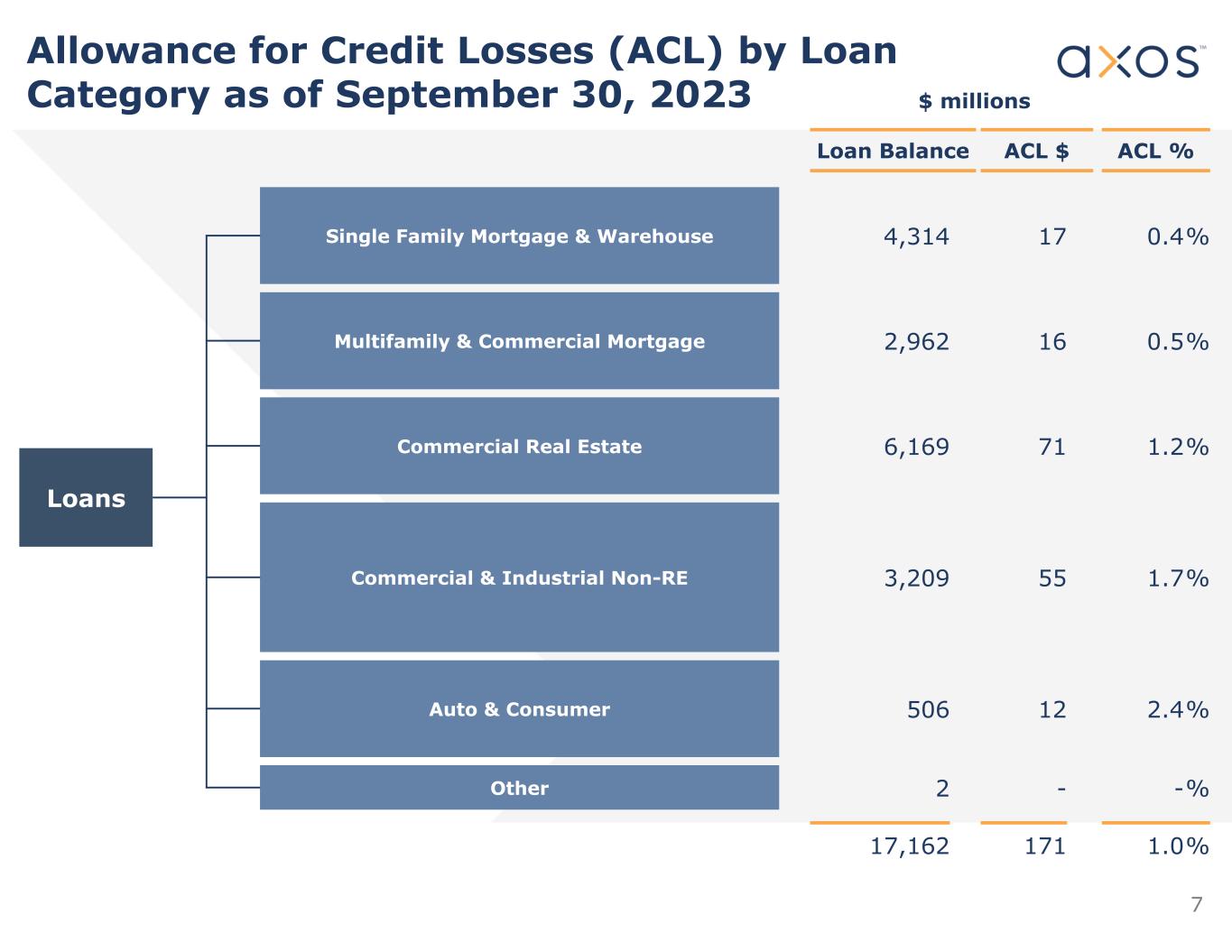

7 Allowance for Credit Losses (ACL) by Loan Category as of September 30, 2023 $ millions Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans ACL %ACL $Loan Balance %0.4174,314 %0.5162,962 %1.2716,169 %1.7553,209 %2.412506 %--2 %1.017117,162

Credit Quality ($ millions) %NPLsLoans O/S9/30/2023 0.85%$36.6$4,313.9Single Family-Mortgage & Warehouse 1.3138.82,962.0Multifamily and Commercial Mortgage 0.4226.16,168.6Commercial Real Estate 0.093.03,209.0Commercial & Industrial - Non-RE 0.472.4506.0Auto & Consumer 0.000.02.4Other 0.62%$106.9$17,161.9Total %NPLsLoans O/S6/30/2023 0.74%$30.7$4,173.8Single Family-Mortgage & Warehouse 1.1435.13,082.2Multifamily and Commercial Mortgage 0.2414.96,199.8Commercial Real Estate 0.113.02,639.7Commercial & Industrial - Non-RE 0.271.5546.3Auto & Consumer 19.612.010.2Other 0.52%$87.2$16,652.0Total %NPLsLoans O/S9/30/2022 1.64%$65.7 $4,009.8Single Family-Mortgage & Warehouse 1.2135.82,965.0Multifamily and Commercial Mortgage 0.2714.95,523.9Commercial Real Estate 0.133.02,244.3Commercial & Industrial - Non-RE 0.161.0631.3Auto & Consumer 1.000.110.0Other 0.78%$120.5$15,384.3Total 8

9

10

11

12 Greg Garrabrants, President and CEO Derrick Walsh, EVP and CFO Andy Micheletti, EVP of Finance investors@axosfinancial.com www.axosfinancial.com Johnny Lai, SVP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information