UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2018

Commission File Number 32297

CPFL Energy Incorporated

(Translation of Registrant's name into English)

Rodovia Engenheiro Miguel Noel Nascentes Burnier, km 2,5, parte

CEP 13088-140 - Parque São Quirino, Campinas - SP

Federative Republic of Brazil (Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_________________

.

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Table of Contents | |

Company Data | |

Capital Composition | 1 |

Individual financial statements | |

Statement of Financial Position - Assets | 2 |

Statement of Financial Position - Liabilities and Equity | 3 |

Statement of Income | 4 |

Statement of Comprehensive Income | 5 |

Statement of Cash Flows – Indirect Method | 6 |

Statement of Changes in Equity | |

01/01/2018 to 12/31/2018 | 7 |

01/01/2017 to 12/31/2017 | 8 |

Statements of Value Added | 9 |

Consolidated Interim Financial Statements | |

Statement of Financial Position - Assets | 10 |

Statement of Financial Position - Liabilities and Equity | 11 |

Statement of Income | 12 |

Statement of Comprehensive Income | 13 |

Statement of Cash Flows - Indirect Method | 14 |

Statement of Changes in Equity | |

01/01/2018 to 12/31/2018 | 15 |

01/01/2017 to 12/31/2017 | 16 |

Statements of Value Added | 17 |

Management Report | 18 |

Notes to Interim financial statements | 37 |

Reports | |

Independent Auditor’s Report - Unqualified | 124 |

Management declaration on financial statements | 128 |

Management declaration on independent auditor’s report | 129 |

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Capital Composition

Number of Shares (In units) | Closing Date 12/31/2018 |

Paid-in capital | |

Common | 1,017,914,746 |

Preferred | 0 |

Total | 1,017,914,746 |

Treasury Stock | 0 |

Common | 0 |

Preferred | 0 |

Total | 0 |

1

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Financial Position – Assets

(In thousands of Brazilian reais - R$) | | | | |

| | | | |

Code | Description | Current Year 12/31/2018 | Previous Year 12/31/2017 | Prior Year 12/31/2016 |

1 | Total assets | 10,807,954 | 9,463,648 | - |

1.01 | Current assets | 799,599 | 275,382 | - |

1.01.01 | Cash and cash equivalents | 79,364 | 6,581 | - |

1.01.06 | Taxes recoverable | 18,087 | 63,751 | - |

1.01.06.01 | Current taxes recoverable | 18,087 | 63,751 | - |

1.01.06.01.01 | Income tax and social contribution to be offset | 9,441 | 17,052 | - |

1.01.06.01.02 | Other taxes recoverable | 8,646 | 46,699 | - |

1.01.08 | Other current assets | 702,148 | 205,050 | - |

1.01.08.03 | Other | 702,148 | 205,050 | - |

1.01.08.03.01 | Other receivables | 417 | 243 | - |

1.01.08.03.04 | Dividends and interest on capital | 701,731 | 204,807 | - |

1.02 | Noncurrent assets | 10,008,355 | 9,188,266 | - |

1.02.01 | Long-term assets | 191,019 | 629,352 | - |

1.02.01.07 | Deferred taxes | 112,522 | 145,778 | - |

1.02.01.07.02 | Deferred tax assets | 112,522 | 145,778 | - |

1.02.01.09 | Receivables from related parties | 72,933 | 127,147 | - |

1.02.01.09.02 | Receivables from subsidiaries | 72,933 | 127,147 | - |

1.02.01.10 | Other noncurrent assets | 5,564 | 356,427 | - |

1.02.01.10.04 | Escrow Deposits | 703 | 665 | - |

1.02.01.10.07 | Advance for future capital increase | - | 350,000 | - |

1.02.01.10.10 | Other receivables | 4,861 | 5,762 | - |

1.02.02 | Investments | 9,816,139 | 8,557,673 | - |

1.02.02.01 | Equity interests | 9,816,139 | 8,557,673 | - |

1.02.02.01.02 | Equity interests in subsidiaries | 9,816,139 | 8,557,673 | - |

1.02.03 | Property, plant and equipment | 1,087 | 1,170 | - |

1.02.03.01 | Property, plant and equipment - in servce | 1,087 | 1,170 | - |

1.02.04 | Intangible assets | 110 | 71 | - |

1.02.04.01 | Intangible assets | 110 | 71 | - |

2

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Financial Position – Liabilities and Equity

(In thousands of Brazilian reais - R$) | | | | |

| | | | | |

Code | Description | Current Year 12/31/2018 | Previous Year 12/31/2017 | Prior Year 12/31/2016 |

2 | Total liabilities | 10,807,954 | 9,463,648 | - |

2.01 | Current liabilities | 531,380 | 303,812 | - |

2.01.02 | Trade payables | 2,854 | 1,644 | - |

2.01.02.01 | Domestic suppliers | 2,854 | 1,644 | - |

2.01.03 | Taxes payable | 13,519 | 717 | - |

2.01.03.01 | Federal taxes | 13,500 | 717 | - |

2.01.03.01.01 | Income tax and social contribution payable | 8,261 | - | - |

2.01.03.01.02 | Other taxes | 5,239 | 717 | - |

2.01.03.03 | Municipal taxes | 19 | - | - |

2.01.04 | Borrowings | - | 1,938 | - |

2.01.04.02 | Debentures | - | 1,938 | - |

2.01.04.02.02 | Interest paid on debentures | - | 1,938 | - |

2.01.05 | Other liabilities | 515,007 | 299,513 | - |

2.01.05.02 | Others | 515,007 | 299,513 | - |

2.01.05.02.01 | Dividends and interest on capital payable | 491,602 | 281,919 | - |

2.01.05.02.07 | Other payables | 23,405 | 17,594 | - |

2.02 | Noncurrent liabilities | 13,825 | 198,308 | - |

2.02.01 | Borrowings | - | 184,388 | - |

2.02.01.02 | Debentures | - | 184,388 | - |

2.02.01.02.01 | Debentures | - | 184,388 | - |

2.02.02 | Other liabilities | 13,584 | 13,320 | - |

2.02.02.02 | Others | 13,584 | 13,320 | - |

2.02.02.02.04 | Other payables | 13,584 | - | - |

2.02.04 | Provisons | 241 | 600 | - |

2.02.04.01 | Tax, social security, labor and civil provisions | 241 | 600 | - |

2.02.04.01.02 | Social security and labor provisions | - | 57 | - |

2.02.04.01.04 | Civil provisions | 241 | 543 | - |

2.03 | Equity | 10,262,749 | 8,961,528 | - |

2.03.01 | Issued capital | 5,741,284 | 5,741,284 | - |

2.03.02 | Capital reserves | 469,257 | 468,014 | - |

2.03.04 | Earnings reserves | 4,428,502 | 2,916,736 | - |

2.03.04.01 | Legal reserve | 900,992 | 798,090 | - |

2.03.04.02 | Statutory reserve | 3,527,510 | 2,118,646 | - |

2.03.08 | Other comprehensive income | (376,294) | (164,506) | - |

2.03.08.01 | Accumulated comprehensive income | (376,294) | (164,506) | - |

3

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of income

(In thousands of Brazilian reais – R$) | | |

| | | | | |

Code | Description | Current Year | Prior Year | Prior Year |

01/01/2018 to 12/31/2018 | 01/01/2017 to 12/31/2017 | 01/01/2016 to 12/31/2016 |

3.01 | Net operating revenue | 1 | 1 | - |

3.03 | Gross profit | 1 | 1 | - |

3.04 | Operating income (expenses) | 2,206,914 | 1,306,995 | - |

3.04.02 | General and administrative expenses | (43,930) | (42,771) | - |

3.04.05 | Others operating expenses | 9 | - | - |

3.04.06 | Share of profit (loss) of investees | 2,250,835 | 1,349,766 | - |

3.05 | Profit before finance income (costs) and taxes | 2,206,915 | 1,306,996 | - |

3.06 | Finance income (costs) | (27,300) | (56,471) | - |

3.06.01 | Finance income | (22,160) | 12,983 | - |

3.06.02 | Financial expenses | (5,140) | (69,454) | - |

3.07 | Profit (loss) before taxes on income | 2,179,615 | 1,250,525 | - |

3.08 | Income tax and social contribution | (121,575) | (70,775) | - |

3.08.01 | Current | (88,317) | (45,481) | - |

3.08.02 | Deferred | (33,258) | (25,294) | - |

3.09 | Profit (loss) from continuing operations | 2,058,040 | 1,179,750 | - |

3.11 | Profit (loss) for the period | 2,058,040 | 1,179,750 | - |

4

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Comprehensive Income

(In thousands of Brazilian reais – R$) | |

| | | | | |

Code | Description | Current Year | Prior Year | Prior Year |

01/01/2018 to 12/31/2018 | 01/01/2017 to 12/31/2017 | 01/01/2016 to 12/31/2016 |

4.01 | Profit for the period | 2,058,040 | 1,179,750 | - |

4.02 | Other comprehensive income | (220,817) | 96,000 | - |

4.02.01 | Comprehensive income for the period of subsidiaries | (220,817) | 96,000 | - |

4.03 | Total comprehensive income for the year | 1,837,223 | 1,275,750 | - |

5

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Cash Flows – Indirect Method

(In thousands of Brazilian reais – R$) | |

| | | | | |

Code | Description | Current year

01/01/2018 to 12/31/2018 | Previous Year

01/01/2017 to 12/31/2017 | Prior Year

01/01/2016 to

12/31/2016 |

6.01 | Cash flows from operating activities | 566,167 | 1,061,750 | - |

6.01.01 | Cash generated from operations | (68,204) | (37,443) | - |

6.01.01.01 | Profit before taxes | 2,179,615 | 1,250,525 | - |

6.01.01.02 | Depreciation and amortization | 201 | 217 | - |

6.01.01.03 | Provision for tax, civil and labor risks | (117) | 61 | - |

6.01.01.05 | Interest on debts, inflation adjusment and exchange rate changes | 2,932 | 61,520 | - |

6.01.01.07 | Equity interests in associates and joint ventures | (2,250,835) | (1,349,766) | - |

6.01.02 | Changes in assets and liabilities | 718,840 | 1,218,475 | - |

6.01.02.02 | Dividend and interest on capital received | 596,100 | 1,172,336 | - |

6.01.02.03 | Taxes recoverable | 109,719 | 65,182 | - |

6.01.02.05 | Escrow deposits | (25) | 68 | - |

6.01.02.10 | Other operating assets | 1,147 | 20,485 | - |

6.01.02.11 | Trade payables | 1,210 | (2,116) | - |

6.01.02.12 | Other taxes and social contributions | 4,541 | 263 | - |

6.01.02.16 | Tax, civil and labor risks paid | (259) | (466) | - |

6.01.02.19 | Other operating liabilities | 6,407 | (37,277) | - |

6.01.03 | Others | (84,469) | (119,282) | - |

6.01.03.01 | Interest paid on debts and debentures | (4,235) | (71,844) | - |

6.01.03.02 | Income tax and social contribution paid | (80,234) | (47,438) | - |

6.02 | Net cash generated by (used in) investing activities | (28,283) | (465,175) | - |

6.02.01 | Purchases of property, plant and equipment | (286) | (185) | - |

6.02.02 | Securities, pledges and restricted deposits | (250) | - | - |

6.02.04 | Purchases of intangible assets | (42) | (51) | - |

6.02.06 | Advances for future capital increases | (82,415) | (383,340) | - |

6.02.07 | Intragroup loans | 54,710 | (72,199) | - |

6.02.09 | Capital increase in existing investment | | (9,400) | |

6.03 | Net cash from financing activities | (465,101) | (654,966) | - |

6.03.05 | Repayment of principal of borrowings and debentures | (186,000) | (434,000) | - |

6.03.08 | Dividends and interest on capital paid | (279,101) | (220,966) | - |

6.05 | Increase (decrease) in cash and cash equivalents | 72,783 | (58,391) | - |

6.05.01 | Cash and cash equivalents at the beginning of the year | 6,581 | 64,972 | - |

6.05.02 | Cash and cash equivalents at the end of the year | 79,364 | 6,581 | - |

6

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Changes in Equity – from January 1, 2018 to December 31, 2018

(In thousands of Brazilian reais – R$) | | | | |

| | | | | | | | |

Code | Description | Issued capital | Capital reserves,

stock options and treasury stock | Earnings reserves | Retained earnings/accumulated losses | Other comprehensive income | Equity |

5.01 | Opening balances | 5,741,284 | 468,014 | 2,916,737 | - | (164,506) | 8,961,529 |

5.03 | Adjusted opening balances | 5,741,284 | 468,014 | 2,916,737 | - | (164,506) | 8,961,529 |

5.04 | Capital transactions with shareholders | - | 1,238 | - | (488,785) | - | (487,547) |

5.04.06 | Dividends | - | - | - | (488,785) | - | (488,785) |

5.04.08 | Other changes | - | 1,238 | - | - | - | 1,238 |

5.05 | Total comprehensive income | - | - | - | 1,975,433 | (186,671) | 1,788,762 |

5.05.01 | Profit for the year | - | - | - | 2,058,040 | - | 2,058,040 |

5.05.02 | Other comprehensive income | - | - | - | (82,607) | (186,671) | (269,278) |

5.05.02.03 | Equity on comprehensive income of subsidiaries | - | - | - | (82,607) | (186,671) | (269,278) |

5.06 | Internal changes in equity | - | 5 | 1,511,766 | (1,486,648) | (25,118) | 5 |

5.06.01 | Recognition of reserves | - | - | 102,902 | (102,902) | - | - |

5.06.06 | Equity on comprehensive income of subsidiaries | - | - | - | 25,118 | (25,118) | - |

5.06.07 | Changes in statutory reserve in the year | - | - | 1,408,864 | (1,408,864) | - | - |

5.06.08 | Other changes | - | 5 | - | - | - | 5 |

5.07 | Closing balances | 5,741,284 | 469,257 | 4,428,503 | - | (376,295) | 10,262,749 |

7

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Changes in Equity – from January 1, 2017 to December 31, 2017

(In thousands of Brazilian reais – R$) | | | |

| | | | | | | | |

Code | Description | Issued capital | Capital reserves, stock options and treasury stock | Earnings reserves | Retained earnings/accumulated losses | Other comprehensive income | Equity |

5.01 | Opening balances | 5,741,284 | 468,014 | 1,995,355 | - | (234,632) | 7,970,021 |

5.03 | Adjusted opening balances | 5,741,284 | 468,014 | 1,995,355 | - | (234,632) | 7,970,021 |

5.04 | Capital transactions with shareholders | - | - | (7,820) | (276,423) | - | (284,243) |

5.04.08 | Prescribed dividend | - | - | - | 3,768 | - | 3,768 |

5.04.10 | Dividend proposal approved | - | - | (7,820) | (280,191) | - | (288,011) |

5.05 | Total comprehensive income | - | - | - | 1,179,750 | 96,000 | 1,275,750 |

5.05.01 | Profit for the year | - | - | - | 1,179,750 | - | 1,179,750 |

5.05.02 | Other comprehensive income | - | - | - | - | 96,000 | 96,000 |

5.06 | Internal changes in equity | - | - | 929,201 | (903,327) | (25,874) | - |

5.06.01 | Recognition of reserves | - | - | 58,988 | (58,988) | - | - |

5.06.06 | Equity on comprehensive income of subsidiaries | - | - | - | 25,874 | (25,874) | - |

5.06.07 | Changes in statutory reserve in the year | - | - | 870,213 | (870,213) | - | - |

5.07 | Closing balances | 5,741,284 | 468,014 | 2,916,736 | - | (164,506) | 8,961,528 |

8

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Individual Financial Statements

Statement of Value Added

(In thousands of Brazilian reais – R$) | | | |

| | | | | |

Code | Description | Current Year

01/01/2018 to 12/31/2018 | Prior Year

01/01/2017 to 12/31/2017 | Prior Year

01/01/2016 to 12/31/2016 |

7.01 | Revenues | 329 | 237 | - |

7.01.01 | Sales of goods and services | 1 | 1 | - |

7.01.03 | Revenues related to construction of own assets | 328 | 236 | - |

7.02 | Inputs purchased from thrid parties | (12,857) | (10,322) | - |

7.02.02 | Materials, energy, third-party services and others | (11,127) | (8,425) | - |

7.02.04 | Others | (1,730) | (1,897) | - |

7.03 | Gross value added | (12,528) | (10,085) | - |

7.04 | Retentions | (201) | (217) | - |

7.04.01 | Depreciation, amortization and depletion | (201) | (217) | - |

7.05 | Wealth created by the Company | (12,729) | (10,302) | - |

7.06 | Wealth received in transfer | 2,268,815 | 1,391,611 | - |

7.06.01 | Share of profit (loss) of investees | 2,250,835 | 1,349,766 | - |

7.06.02 | Finance income | 17,980 | 41,845 | - |

7.07 | Total wealth for distribution | 2,256,086 | 1,381,309 | - |

7.08 | Wealth distributed | 2,256,086 | 1,381,309 | - |

7.08.01 | Personnel and charges | 27,035 | 27,248 | - |

7.08.01.01 | Salaries and wages | 10,679 | 15,690 | - |

7.08.01.02 | Benefits | 14,885 | 10,184 | - |

7.08.01.03 | FGTS (Severance Pay Fund) | 1,471 | 1,374 | - |

7.08.02 | Taxes, fees and contributions | 165,840 | 104,770 | - |

7.08.02.01 | Federal | 165,799 | 104,738 | - |

7.08.02.02 | State | 41 | 32 | - |

7.08.03 | Lenders and lessors | 5,171 | 69,541 | - |

7.08.03.01 | Interest | 5,135 | 69,311 | - |

7.08.03.02 | Rentals | 36 | 230 | - |

7.08.04 | Interest on capital | 2,058,040 | 1,179,750 | - |

7.08.04.02 | Dividend (including additional dividend proposed) | 546,274 | 250,550 | - |

7.08.04.03 | Retained earnings / Loss for the year | 1,511,766 | 929,200 | - |

9

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Financial Position – Assets

(In thousands of Brazilian reais – R$) | | | |

| | | | | |

Code | Descrição da Conta | Current Year 12/31/2018 | Previous Year 12/31/2017 | Prior Year 12/31/2016 |

1 | Total assets | 42,211,530 | 41,282,912 | - |

1.01 | Current assets | 9,402,316 | 9,581,212 | - |

1.01.01 | Cash and cash equivalents | 1,891,457 | 3,249,642 | - |

1.01.03 | Trade receivables | 4,547,951 | 4,301,283 | - |

1.01.03.01 | Consumers | 4,547,951 | 4,301,283 | - |

1.01.06 | Taxes recoverable | 411,256 | 395,046 | - |

1.01.06.01 | Current taxes recoverable | 411,256 | 395,046 | - |

1.01.06.01.01 | Income tax and social contribution to be offset | 123,739 | 88,802 | - |

1.01.06.01.02 | Other taxes recoverable | 287,517 | 306,244 | - |

1.01.07 | Prepaid expenses | 172,155 | 80,600 | - |

1.01.08 | Other current assets | 2,379,497 | 1,554,641 | - |

1.01.08.03 | Others | 2,379,497 | 1,554,641 | - |

1.01.08.03.01 | Otherns receivables | 638,850 | 843,633 | - |

1.01.08.03.02 | Derivatives | 309,484 | 444,029 | - |

1.01.08.03.04 | Dividends and interest on capital | 100,182 | 56,145 | - |

1.01.08.03.06 | Sector financial asset | 1,330,981 | 210,834 | - |

1.02 | Noncurrent assets | 32,809,214 | 31,701,700 | - |

1.02.01 | Long-term assets | 11,862,870 | 10,323,201 | - |

1.02.01.04 | Trade receivables | 752,795 | 236,539 | - |

1.02.01.04.01 | Consumers | 752,795 | 236,539 | - |

1.02.01.07 | Deferred taxes | 956,380 | 943,199 | - |

1.02.01.07.02 | Deferred tax assets | 956,380 | 943,199 | - |

1.02.01.08 | Prepaid expenses | 6,367 | 20,043 | - |

1.02.01.09 | Receivables from related parties | - | 8,612 | - |

1.02.01.09.03 | Receivables from subsidiaries | - | 8,612 | - |

1.02.01.10 | Other noncurrent assets | 10,147,328 | 9,114,808 | - |

1.02.01.10.03 | Derivatives | 347,507 | 203,901 | - |

1.02.01.10.04 | Escrow deposits | 854,374 | 839,990 | - |

1.02.01.10.05 | Income tax and social contribution to be offset | 67,966 | 61,464 | - |

1.02.01.10.06 | Other taxes recoverable | 185,725 | 171,980 | - |

1.02.01.10.08 | Sector financial asset | 7,430,149 | 6,545,668 | - |

1.02.01.10.09 | Investments at cost | 116,654 | 116,654 | - |

1.02.01.10.10 | Others receivables | 921,073 | 820,149 | - |

1.02.01.10.11 | Sector financial asset | 223,880 | 355,002 | - |

1.02.02 | Investments | 980,362 | 1,001,550 | - |

1.02.02.01 | Equity interests | 980,362 | 1,001,550 | - |

1.02.02.01.04 | Equity interests in joint ventures | 980,362 | 1,001,550 | - |

1.02.03 | Property, plant and equipment | 9,456,614 | 9,787,125 | - |

1.02.03.01 | Property, plant and equipment - in servce | 9,245,853 | 9,535,933 | - |

1.02.03.03 | Property, plant and equipment - in progress | 210,761 | 251,192 | - |

1.02.04 | Intangible assets | 10,509,368 | 10,589,824 | - |

1.02.04.01 | Intangible assets | 10,509,368 | 10,589,824 | - |

1.02.04.01.01 | Concession contract | 9,380,810 | 10,522,932 | - |

1.02.04.01.02 | Goodwill | 6,115 | 6,115 | - |

1.02.04.01.03 | Other intangible assets | 76,010 | 60,777 | - |

1.02.04.01.04 | Contractual assets in progress | 1,046,433 | - | - |

10

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Financial Position – Liabilities and Equity

(In thousands of Brazilian reais - R$) | | | |

| | | | | |

Code | Description | Current Year 12/31/2018 | Previous Year 12/31/2017 | Prior Year 12/31/2016 |

2 | Total liabilities | 42,211,530 | 41,282,912 | - |

2.01 | Current liabilities | 8,415,132 | 11,378,688 | - |

2.01.01 | Payroll and related taxes | 119,252 | 116,080 | - |

2.01.01.02 | Payroll taxes | 119,252 | 116,080 | - |

2.01.01.02.01 | Estimated payroll | 119,252 | 116,080 | - |

2.01.02 | Trade payables | 2,398,085 | 3,296,870 | - |

2.01.02.01 | Domestic suppliers | 2,398,085 | 3,296,870 | - |

2.01.03 | Taxes payable | 765,438 | 710,303 | - |

2.01.03.01 | Federal taxes | 327,658 | 300,768 | - |

2.01.03.01.01 | Income tax and social contribution | 100,450 | 81,457 | - |

2.01.03.01.02 | Other taxes | 227,208 | 219,311 | - |

2.01.03.02 | State taxes | 430,149 | 403,492 | - |

2.01.03.03 | Municipal taxes | 7,631 | 6,043 | - |

2.01.04 | Borrowings | 3,363,465 | 5,292,679 | - |

2.01.04.01 | Borrowings | 2,446,113 | 3,589,606 | - |

2.01.04.01.01 | In local currency | 876,777 | 1,258,329 | - |

2.01.04.01.02 | In foreign currency | 1,569,336 | 2,331,277 | - |

2.01.04.02 | Debentures | 917,352 | 1,703,073 | - |

2.01.05 | Other payables | 1,768,892 | 1,962,756 | - |

2.01.05.02 | Others | 1,768,892 | 1,962,756 | - |

2.01.05.02.01 | Dividends and interest on capital payable | 532,608 | 297,744 | - |

2.01.05.02.04 | Derivatives | 8,139 | 10,230 | - |

2.01.05.02.05 | Sector financial liability | - | 40,111 | - |

2.01.05.02.06 | Use of public asset | 11,570 | 10,965 | - |

2.01.05.02.07 | Other payables | 979,296 | 961,306 | - |

2.01.05.02.08 | Regulatory charges | 150,656 | 581,600 | - |

2.01.05.02.09 | Other payables | 86,623 | 60,800 | - |

2.02 | Noncurrent liabilities | 21,264,015 | 18,717,880 | - |

2.02.01 | Borrowings | 17,013,339 | 14,875,904 | - |

2.02.01.01 | Borrowings | 8,989,846 | 7,402,450 | - |

2.02.01.01.01 | In local currency | 4,927,927 | 4,884,253 | - |

2.02.01.01.02 | In foreign currency | 4,061,919 | 2,518,197 | - |

2.02.01.02 | Debentures | 8,023,493 | 7,473,454 | - |

2.02.02 | Other liabilities | 2,135,089 | 1,631,253 | - |

2.02.02.02 | Others | 2,135,089 | 1,631,253 | - |

2.02.02.02.03 | Trade payables | 333,036 | 128,438 | - |

2.02.02.02.04 | Private pension plan | 1,156,639 | 880,360 | - |

2.02.02.02.05 | Derivatives | 23,659 | 84,576 | - |

2.02.02.02.06 | Sector financial liability | 46,703 | 8,385 | - |

2.02.02.02.07 | Use of public asset | 89,965 | 83,766 | - |

2.02.02.02.08 | Other payables | 475,396 | 426,889 | - |

2.02.02.02.09 | Other taxes, fees and contributions | 9,691 | 18,839 | - |

2.02.03 | Deferred taxes | 1,136,227 | 1,249,589 | - |

2.02.03.01 | Deferred income tax and social contribution | 1,136,227 | 1,249,589 | - |

2.02.03.01.01 | Deferred income tax and social contribution | 1,126,141 | 1,239,046 | - |

2.02.03.01.02 | Others deferred taxes | 10,086 | 10,543 | - |

2.02.04 | Provisions | 979,360 | 961,134 | - |

2.02.04.01 | Tax, social security, labor and civil provisions | 979,360 | 961,134 | - |

2.02.04.01.01 | Tax provisions | 389,823 | 347,291 | - |

2.02.04.01.02 | Social security and labor provisions | 219,314 | 224,258 | - |

2.02.04.01.04 | Civil provisions | 281,304 | 291,388 | - |

2.02.04.01.05 | Others provisions | 88,919 | 98,197 | - |

2.03 | Consolidated equity | 12,532,383 | 11,186,344 | - |

2.03.01 | Issued capital | 5,741,284 | 5,741,284 | - |

2.03.02 | Capital reserves | 469,257 | 468,014 | - |

2.03.04 | Earnings reserves | 4,428,502 | 2,916,736 | - |

2.03.04.01 | Legal reserve | 900,992 | 798,090 | - |

2.03.04.02 | Statutory reserve | 3,527,510 | 2,118,646 | - |

2.03.08 | Other comprehensive income | (376,294) | (164,506) | - |

2.03.09 | Noncontrolling interests | 2,269,634 | 2,224,816 | - |

11

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of income

(In thousands of Brazilian reais – R$) | |

| | | | | |

Code | Description | Current Year | Prior Year | Prior Year |

01/01/2018 to 12/31/2018 | 01/01/2017 to 12/31/2017 | 01/01/2016 to 12/31/2016 |

3.02 | Cost of electric energy services | (22,347,258) | (21,747,273) | - |

3.02.01 | Cost of electric energy | (17,838,165) | (16,901,518) | - |

3.02.02 | Cost of operation | (2,733,754) | (2,771,145) | - |

3.02.03 | Cost of services rendered to third parties | (1,775,339) | (2,074,610) | - |

3.03 | Gross profit | 5,789,369 | 4,997,632 | - |

3.04 | Operating expenses/income | (1,746,705) | (1,663,408) | - |

3.04.01 | Selling expenses | (608,184) | (590,232) | - |

3.04.01.01 | Allowance for doubtful accounts | (169,259) | (155,097) | - |

3.04.01.02 | Others selling expenses | (438,925) | (435,135) | - |

3.04.02 | General and administrative expenses | (987,291) | (947,072) | - |

3.04.05 | Other operating expenses | (485,428) | (438,494) | - |

3.04.06 | Share of profit (loss) of investees | 334,198 | 312,390 | - |

3.05 | Profit before finance income (costs) and taxes | 4,042,664 | 3,334,224 | - |

3.06 | Finance income (costs) | (1,102,687) | (1,487,554) | - |

3.06.01 | Finance income | 762,413 | 880,314 | - |

3.06.02 | Financial expenses | (1,865,100) | (2,367,868) | - |

3.07 | Profit before taxes | 2,939,977 | 1,846,670 | - |

3.08 | Income tax and social contribution | (773,982) | (603,628) | - |

3.08.01 | Current | (805,845) | (540,618) | - |

3.08.02 | Deferred | 31,863 | (63,010) | - |

3.09 | Profit from continuing operations | 2,165,995 | 1,243,042 | - |

3.11 | Consolidated profit for the period | 2,165,995 | 1,243,042 | - |

3.11.01 | Attributable to owners of the Company | 2,058,040 | 1,179,750 | - |

3.11.02 | Attributable to noncontrolling interests | 107,955 | 63,292 | - |

3.99.01.01 | ON | 2.02 | 1.16 | - |

3.99.02.01 | ON | 2.01 | 1.16 | - |

12

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Comprehensive Income

(In thousands of Brazilian reais – R$) |

| | | | | |

Code | Description | Current Year | Prior Year | Prior Year |

01/01/2018 to 12/31/2018 | 01/01/2017 to 12/31/2017 | 01/01/2016 to 12/31/2016 |

4.02 | Other comprehensive income | (220,817) | 96,000 | - |

4.02.03 | Actuarial gains (losses), net of tax effects | (238,780) | 96,000 | - |

4.02.04 | Credit risk in mark to market of financial liabilities | 17,963 | - | - |

4.03 | Consolidated comprehensive income for the period | 1,945,178 | 1,339,042 | - |

4.03.01 | Attributable to owners of the Company | 1,837,223 | 1,275,750 | - |

4.03.02 | Attributable to noncontrolling interests | 107,955 | 63,292 | - |

13

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Cash Flows – Indirect Method

(In thousands of Brazilian reais – R$) |

| | | | | |

Code | Description | Current year

01/01/2018 to 12/31/2018 | Previous Year

01/01/2017 to 12/31/2017 | Previous Year

01/01/2016 to 12/31/2016 |

6.01 | Net cash from operating activities | 856,686 | 2,034,024 | - |

6.01.01 | Cash generated from operations | 5,919,953 | 5,506,768 | - |

6.01.01.01 | Profit before taxes | 2,939,977 | 1,846,670 | - |

6.01.01.02 | Depreciation and amortization | 1,594,064 | 1,529,052 | - |

6.01.01.03 | Provision for tax, civil and labor risks | 153,977 | 176,609 | - |

6.01.01.04 | Allowance for doubtful accounts | 169,259 | 155,097 | - |

6.01.01.05 | Interest on debts, inflation adjustment and exchange rate changes | 1,117,742 | 1,863,311 | - |

6.01.01.06 | Pension plan expense (income) | 89,909 | 113,898 | - |

6.01.01.07 | Share of profit (loss) of investees | (334,198) | (312,390) | - |

6.01.01.08 | Reversal of impairment | - | 20,437 | - |

6.01.01.09 | Loss (gain) on disposal of noncurrent assets | 216,275 | 132,195 | - |

6.01.01.10 | Deferred taxes (PIS and COFINS) | (457) | 963 | - |

6.01.01.11 | Others | (26,595) | (19,074) | - |

6.01.02 | Changes in assets and liabilities | (2,893,526) | (1,288,116) | - |

6.01.02.01 | Consumers, concessionaries and licensees | (1,006,291) | (722,406) | - |

6.01.02.02 | Dividend and interest on capital received | 311,347 | 730,178 | - |

6.01.02.03 | Taxes recoverable | 92,090 | 68,184 | - |

6.01.02.04 | Escrow deposits | 22,926 | (248,128) | - |

6.01.02.05 | Sectorial financial asset | (846,216) | (425,004) | - |

6.01.02.06 | Receivables - CDE | 59,196 | (29,354) | - |

6.01.02.07 | Concession financial assets (transmission companies) | - | (56,665) | - |

6.01.02.09 | Other operating assets | (47,836) | 91,607 | - |

6.01.02.10 | Trade payables | (848,880) | 565,945 | - |

6.01.02.11 | Other taxes and social contributions | (59,102) | (261,194) | - |

6.01.02.12 | Other taxes and social contributions | (107,668) | (79,724) | - |

6.01.02.13 | Regulatory charges | (430,944) | 215,522 | - |

6.01.02.15 | Tax, civil and labor risks paid | (215,873) | (206,788) | - |

6.01.02.16 | Sector financial liability | (64,361) | (1,089,592) | - |

6.01.02.17 | Payables - amounts provided by the CDE | 71,779 | 17,544 | - |

6.01.02.18 | Other operating liabilities | 176,307 | 141,759 | - |

6.01.03 | Others | (2,169,741) | (2,184,628) | - |

6.01.03.01 | Interest paid on debts and debentures | (1,353,339) | (1,846,453) | - |

6.01.03.02 | Income tax and social contribution paid | (816,402) | (338,175) | - |

6.02 | Net cash from investing activities | (1,850,687) | (2,509,321) | - |

6.02.01 | Purchases of property, plant and equipment | (275,986) | (685,856) | - |

6.02.02 | Securities, pledges and restricted deposits | 212,831 | (93,933) | - |

6.02.04 | Purchases of intangible assets | (16,863) | (1,884,577) | - |

6.02.07 | Sale of noncurrent assets | - | 26,807 | - |

6.02.08 | Intragroup loans | - | 36,639 | - |

6.02.10 | Capital increase in existing investee | (1,096) | 91,599 | - |

6.02.16 | Additions of contract asset – in progress | (1,769,573) | - | - |

6.03 | Net cash from financing activities | (364,185) | (2,440,057) | - |

6.03.01 | Capital increase of noncontrolling shareholder | 7,994 | (122,791) | - |

6.03.04 | Borrowings and debentures raised | 9,610,814 | 3,398,084 | - |

6.03.05 | Repayment of principal of borrowings and debentures | (10,204,257) | (5,273,261) | - |

6.03.06 | Settlement of derivatives | 543,427 | (102,641) | - |

6.03.08 | Dividend and interest on capital paid | (322,163) | (336,934) | - |

6.03.10 | Payment of business combination | - | (2,514) | - |

6.05 | Increase (decrease) in cash and cash equivalents | (1,358,186) | (2,915,354) | - |

6.05.01 | Cash and cash equivalents at the beginning of the period | 3,249,643 | 6,164,997 | - |

6.05.02 | Cash and cash equivalents at the end of the period | 1,891,457 | 3,249,643 | - |

14

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Changes in Equity – from January 1, 2018 to December 31, 2018

(In thousands of Brazilian reais – R$) | | | | | |

| | | | | | | | | | |

Code | Description | Issued capital | Capital reserves,

stock options and treasury stock | Earnings reserves | Retained earnings/accumulated losses | Other comprehensive income | Equity | Noncontrolling interests | Consolidated equity |

5.01 | Opening balances | 5,741,284 | 468,014 | 2,916,737 | - | (164,506) | 8,961,529 | 2,224,816 | 11,186,345 |

5.03 | Adjusted opening balances | 5,741,284 | 468,014 | 2,916,737 | - | (164,506) | 8,961,529 | 2,224,816 | 11,186,345 |

5.04 | Capital transactions with owners | - | 1,238 | - | (488,785) | - | (487,547) | (63,024) | (550,571) |

5.04.06 | Dividend | - | - | - | (488,785) | - | (488,785) | (68,685) | (557,470) |

5.04.08 | Other changes | - | 1,238 | - | - | - | 1,238 | 5,661 | 6,899 |

5.05 | Total comprehensive income | - | - | - | 1,975,433 | (186,671) | 1,788,762 | 107,955 | 1,896,717 |

5.05.01 | Profit for the period | - | - | - | 2,058,040 | - | 2,058,040 | 107,955 | 2,165,995 |

5.05.02 | Other comprehensive income | - | - | - | (82,607) | (186,671) | (269,278) | - | (269,278) |

5.05.02.01 | Financial instruments adjustment | - | - | - | (125,162) | 78,953 | (46,209) | - | (46,209) |

5.05.02.02 | Tax on financial instruments adjustment | - | - | - | 42,555 | (26,844) | 15,711 | - | 15,711 |

5.05.02.06 | Other comprehensive income - actuarial gains (losses) | - | - | - | - | (238,780) | (238,780) | - | (238,780) |

5.06 | Internal changes in equity | - | 5 | 1,511,766 | (1,486,648) | (25,118) | 5 | (113) | (108) |

5.06.01 | Recognition of reserves | - | - | 102,902 | (102,902) | - | - | - | - |

5.06.04 | Realization of deemed cost of property, plant and equipment | - | - | - | 38,057 | (38,057) | - | - | - |

5.06.05 | Tax effect on realization of deemed cost | - | - | - | (12,939) | 12,939 | - | - | - |

5.06.07 | Changes in statutory reserve in the year | - | - | 1,408,864 | (1,408,864) | - | - | - | - |

5.06.08 | Other changes | - | 5 | - | - | - | 5 | (113) | (108) |

5.07 | Closing balances | 5,741,284 | 469,257 | 4,428,503 | - | (376,295) | 10,262,749 | 2,269,634 | 12,532,383 |

15

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Changes in Equity – from January 1, 2017 to December 31, 2017

(In thousands of Brazilian reais – R$) |

| | | | | | | | | |

Code | Description | Paid-in capital | Capital reserves, stock options and treasury stock | Earnings reserves | Retained earnings/accumulated losses | Other comprehensive income | Equity | Noncontrolling interests | Consolidated equity |

5.01 | Opening balances | 5,741,284 | 468,014 | 1,995,355 | - | (234,632) | 7,970,021 | 2,402,647 | 10,372,668 |

5.03 | Adjusted opening balances | 5,741,284 | 468,014 | 1,995,355 | - | (234,632) | 7,970,021 | 2,402,647 | 10,372,668 |

5.04 | Capital transactions with shareholders | - | - | (7,820) | (276,423) | - | (284,243) | (241,011) | (525,254) |

5.04.01 | Capital increase | - | - | - | - | - | - | (122,791) | (122,791) |

5.04.08 | Prescribed dividends | - | - | - | 3,768 | - | 3,768 | - | 3,768 |

5.04.09 | Interim dividend | - | - | - | - | - | - | (7,226) | (7,226) |

5.04.10 | Dividend proposal approved | - | - | (7,820) | (280,191) | - | (288,011) | (110,994) | (399,005) |

5.05 | Total comprehensive income | - | - | - | 1,179,750 | 96,000 | 1,275,750 | 63,292 | 1,339,042 |

5.05.01 | Profit for the year | - | - | - | 1,179,750 | - | 1,179,750 | 63,292 | 1,243,042 |

5.05.02 | Other comprehensive income | - | - | - | - | 96,000 | 96,000 | - | 96,000 |

5.06 | Internal changes in equity | - | - | 929,201 | (903,327) | (25,874) | - | (112) | (112) |

5.06.01 | Recognition of reserves | - | - | 58,988 | (58,988) | - | - | - | - |

5.06.05 | Changes in statutory reserve in the year | - | - | 870,213 | (870,213) | - | - | - | - |

5.06.06 | Realization of deemed cost of property, plant and equipment | - | - | - | 39,202 | (39,202) | - | - | - |

5.06.07 | Tax on realization of deemed cost | - | - | - | (13,328) | 13,328 | - | - | - |

5.06.09 | Other changes in noncontrolling interests | - | - | - | - | - | - | (112) | (112) |

5.07 | Closing balances | 5,741,284 | 468,014 | 2,916,736 | - | (164,506) | 8,961,528 | 2,224,816 | 11,186,344 |

16

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Consolidated Financial Statements

Statement of Value Added

(In thousands of Brazilian reais – R$) | | | |

| | | | | |

Code | Description | Current Year

01/01/2018 to 12/31/2018 | Prior Year

01/01/2017 to 12/31/2017 | Prior Year

01/01/2016 to 12/31/2016 |

7.01 | Revenues | 42,759,621 | 40,687,927 | - |

7.01.01 | Sales of goods and services | 40,854,038 | 37,980,073 | - |

7.01.02 | Other revenues | 1,772,222 | 2,073,422 | - |

7.01.02.01 | Revenue from construction of concession infrastructure | 1,772,222 | 2,073,422 | - |

7.01.03 | Revenues related to construction of own assets | 302,620 | 789,529 | - |

7.01.04 | Allowance for doubtful debts | (169,259) | (155,097) | - |

7.02 | Inputs purchased from third parties | (23,378,560) | (23,119,553) | - |

7.02.01 | Cost of sales and services | (19,757,090) | (18,772,477) | - |

7.02.02 | Materials, energy, third-party services and others | (2,878,987) | (3,611,796) | - |

7.02.04 | Others | (742,483) | (735,280) | - |

7.03 | Gross value added | 19,381,061 | 17,568,374 | - |

7.04 | Retentions | (1,602,182) | (1,534,034) | - |

7.04.01 | Depreciation and amortization | (1,315,323) | (1,247,819) | - |

7.04.02 | Others | (286,859) | (286,215) | - |

7.04.02.01 | Amortization of concession intangible asset | (286,859) | (286,215) | - |

7.05 | Wealth created by the company | 17,778,879 | 16,034,340 | - |

7.06 | Wealth received in transfer | 1,183,083 | 1,279,056 | - |

7.06.01 | Interest in subsidiaries, associates and joint ventures | 334,198 | 312,391 | - |

7.06.02 | Financial income | 848,885 | 966,665 | - |

7.07 | Total wealth for distribution | 18,961,962 | 17,313,396 | - |

7.08 | Wealth distributed | 18,961,962 | 17,313,396 | - |

7.08.01 | Personnel and charges | 1,390,996 | 1,397,454 | - |

7.08.01.01 | Salaries and wages | 795,377 | 813,004 | - |

7.08.01.02 | Benefits | 530,120 | 516,208 | - |

7.08.01.03 | FGTS (Severance Pay Fund) | 65,499 | 68,242 | - |

7.08.02 | Taxes, fees and contributions | 13,452,580 | 12,181,755 | - |

7.08.02.01 | Federal | 7,231,289 | 6,696,508 | - |

7.08.02.02 | State | 6,195,062 | 5,460,674 | - |

7.08.02.03 | Municipal | 26,229 | 24,573 | - |

7.08.03 | Lenders and lessors | 1,952,391 | 2,491,145 | - |

7.08.03.01 | Interest | 1,879,399 | 2,418,119 | - |

7.08.03.02 | Rentals | 72,992 | 73,026 | - |

7.08.04 | Interest on capital | 2,165,995 | 1,243,042 | - |

7.08.04.02 | Dividend (including additional dividend proposed) | 581,029 | 272,294 | - |

7.08.04.03 | Retained earnings / Loss for the year | 1,584,966 | 970,748 | - |

17

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Management Report

Dear Shareholders,

In compliance with the law and the Bylaws of CPFL Energia S.A. (“CPFL Energia” or “Company”), the Management of the Company hereby submits to you the Management Report and financial statements of the Company, along with the reports of the independent auditor and fiscal council for the fiscal year ended December 31, 2018.All comparisons herein are made with consolidated figures for fiscal year 2017, except when specified otherwise.

1. Opening remarks

The CPFL group continued to be very active in 2018, promoting improvements in its operations and management, as well as following the unfolding of the political and economic scenarios of Brazil in its markets.

The 2018 results reflected the growth of energy sales in all consumption classes, our discipline in cost and expense management, as well as the drop in interest rates in Brazil.

Electricity sales to final consumers (quantity of electricity billed to final consumers) totaled 53,091 GWh, a reduction of 0.5%. Industrial and commercial classes registered reductions of 5.6% and 0.1%, respectively, reflecting the slow recovery of economy activity, while residencial class increased by 2.6%. Electricity sales to wholesaler’s, through other concessionaires, licensees and authorized reached 17,757 GWh, an increase of 8.7%.

CPFL group’s operating cash generation, measured by EBITDA, reached R$ 5,637 million in 2018 (+15.9%), reflecting the positive results of all business segments. We highlight the distribution segment, whose EBITDA reached R$ 3,004 million in 2018 (+34.5%), mainly reflecting the results coming from the conclusion of the tariff revision process (4th cycle) of CPFL Paulista, RGE Sul (both in April 2018) and RGE (in June 2018). In addition, the Company is promoting organizational reviews in order to simplify its processes and structure, aiming at greater efficiency and focus on business.

We continue working on value initiatives and in our investment plan in 2018, with financial discipline, efforts and commitment of our teams. We invested R$ 2,060 million in this period.

Among the value initiatives, it is worth mentioning the participation of CPFL Geração in the following transmission auctions: (i) in June 2018, the company won Lot 9 (Maracanaú II substation), in Ceará, and (ii) in December 2018, the company won Lots 5 (Itá substation), in Santa Catarina, and 11 (Osório 3, Porto Alegre 1 and Vila Maria substations), in Rio Grande do Sul.

We also had the creation of CPFL Soluções, which brings together services and products previously offered under the brands CPFL Brasil, CPFL Serviços and CPFL Eficiência. In this way, we have an integrated platform for interaction with customers seeking solutions for energy trading, energy efficiency, distributed generation, energy infrastructure and consulting services.

It should also be noted that CPFL promoted the merger of the distribution company RGE (“Merged Company”) into RGE Sul (“Mergee Company”). The grouping of the concessions of the two companies was carried out through the merger of the assets held by the Merged Company by the Mergee Company on December 31, 2018.

We also had the startup of the Boa Vista II SHPP (installed capacity of 29.9 MW), in November 2018, and the participation of CPFL Renováveis in the A-6 Auction of August 2018. Thecompany won with the following projects: (i) Cherobim SHPP, with 28.0 MW of installed capacity, located in Paraná state, and (ii) Gameleira Wind Complex, with 69.3 MW of installed capacity, located in Rio Grande do Norte state.

18

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Still in relation to CPFL Renováveis, we had the Mandatory Tender Offer of the company on November 26. As a result of the auction, State Grid acquired 243,771,824 common shares issued by the company, representing 48.39% of the capital stock of the company. The common shares were acquired at the price of R$ 16.85, totaling the amount of R$ 4.1 billion. State Grid and CPFL Geração (indirectly controlled by State Grid) jointly held 503,520,623 common shares issued by the company, equivalent to 99.94% of the total share capital of the company.

CPFL Energia’s capital structure and consolidated leverage remained at adequate levels. The Company’s net debt reached 3.05 times EBITDA at the end of the quarter, under the criteria to measure our financial covenants, lower than in the previous year. It is worth mentioning that the reductions in interest rates benefited the Company.

Finally, CPFL’s management remains optimistic about the advances of the Brazilian electricity sector and remains confident in its business platform, which is increasingly prepared and well positioned to face the challenges and opportunities in the country.

19

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

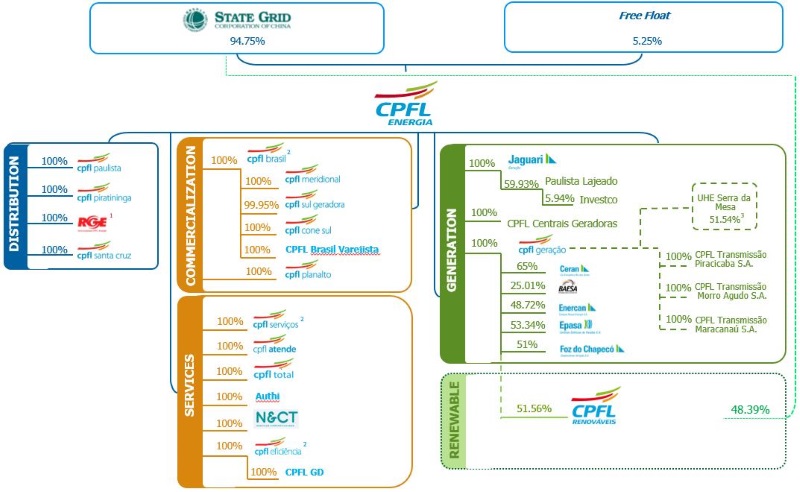

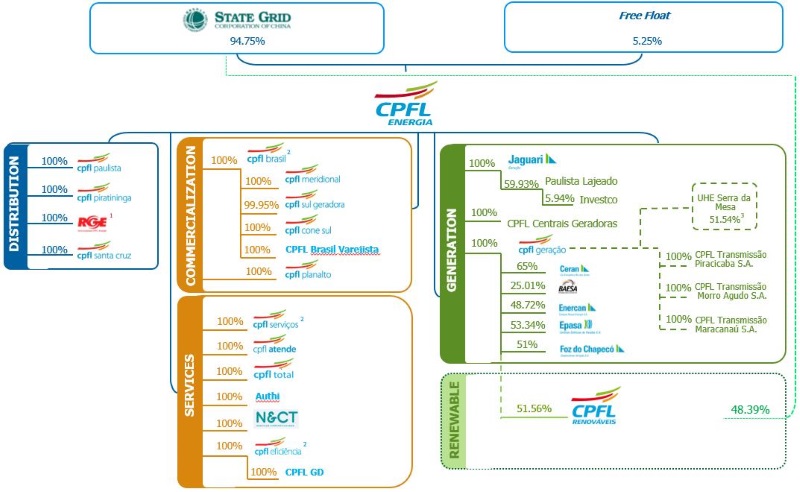

SHAREHOLDERS’ STRUCTURE (simplified)

CPFL Energia is a holding company that owns stake in other companies:

Reference date: 12/31/2018

Notes:

(1) RGE is held by CPFL Energia (89.0107%) and CPFL Brasil (10.9893% );

(2) (2) CPFL Soluções = CPFL Brasil + CPFL Serviços + CPFL Eficiência;

(3) 51.54% stake of the availability of power and energy of Serra da Mesa HPP, regarding the Power Purchase Agreement between CPFL Geração and Furnas.

2. Comments on the macroeconomic and regulatory scenario

Macroeconomic Scenario

After three years of sharp contraction between 2014 and 2016, a period marked by several political upheavals, the Brazilian economy started a slow and irregular recovery in 2017 and 2018. However, numerous allegations of corruption and the truck drivers’ strike in May 2018 put the brakes on the reforms agenda and slowed down the pace of economic recovery.

Moreover, external demand, which had been helping in the recovery of the domestic economy until early 2018, recorded a significant downturn. Some of Brazil’s main trade partners such asChina and the European Union have been registering significant economic slowdown, while Argentina, the main destination of our manufactured exports, has been facing strong economic contraction. In this scenario, Brazil’s industrial output ended last year virtually stagnant.

20

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Despite the sluggish economic recovery and the still high fiscal vulnerability, several of Brazil’s macroeconomic fundamentals improved during 2017 and 2018. The highlight was the decline in inflation and the taming of inflationary expectations. Comfortably meeting the inflation targets in a scenario where the idleness of our economy remains high, especially in the labor market, allowed the Central Bank to reduce the basic interest rate to historic lows, which helped unbind the credit market.

The year 2019 begins with more favorable expectations, as indicated by the improvement in diverse financial indicators. In fact, “Brazil risk” has been recoiling in light of expectations that the reforms, especially the pension reform, will be taken up by the new government; and the Brazilian stock market has been registering significant gains, bucking the trend of corrections seen in foreign markets.

In a stable foreign exchange scenario, inflationary expectations have remained anchored to the targets: according to forecasts by market institutions, the average increase in the IPCA rate, which serves as the benchmark for inflation targets, is around 4% for 20191, slightly below the target of 4.25% set for this year. As a result, the Central Bank is expected to maintain its monetary policy on the expansionist mode for a while longer. The average of market forecasts for the Selic interest rate at the end of this year is around 7%1 p.a.

The stimulus that the expansionist monetary policy will give the credit market, combined with the trend (albeit slow and irregular) of declining unemployment and increasing household income, should drive household consumption, which should continue its moderate acceleration during 2019. The improvement in business confidence, on the other hand, based on the expected resumption of reforms, could impart greater dynamism to the resumption of investments, which, for now, recovered a very modest part of the sharp downturn registered during the recession.

Despite the more promising expectations, the scenario for 2019 continues to face risks that cannot be ignored. The main risk continues to be political: any frustrations with the resumption of reforms would sharply increase exchange rate volatility and worsen business confidence, with impacts on consumption and investments. The external environment continues to be challenging, with the world’s leading economies cooling down.

Thus, growth projections for the Brazilian economy continue to indicate a still moderate pace of recovery. The average of forecasts made by market institutions indicate that GDP will grow from 1.1/% in 2018 as reported by IBGE to around 2.5% in 20191. Weakened external demand and fiscal adjustment measures, which weigh on government consumption and public investment, tend to limit the pace of recovery in the short term. Thus, GDP is expected to return to its level in early 2014 only in mid-2020.

REGULATORY ENVIRONMENT

The main changes in the sector regulations in 2018 in the distribution segment are outlined below:

1) The Brazilian Electricity Regulatory Agency (Aneel) amended, through Normative Resolution 820/2018, the rules for establishing the Board of Consumers of Electricity when grouping the concession areas;

1 Data from the Central Bank of Brazil’s Focus market readout on Jan. 18, 2019.

21

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

2) ANEEL amended Normative Resolution 716/2016, which deals with the procedures applicable when grouping electricity distribution concession areas subject to joint corporate control and the tariff treatment of the new concession area. The amendment was made through Normative Resolution 835/2018, aimed at adjusting the wording of the grouping agreements for concessions that did not join the new concession contract model;

3) Redraft of the Electricity Sector Accounting Manual (MCSE), approved by Normative Resolution 814/2018, in two dimensions: procedural and in principle;

4) Amendment of sub-module 2.4 of Tariff Regulation Procedures (PRORET), implemented by Normative Resolution 807/2018, which defines maintaining the current weighted average cost of capital (WACC) until December 2019, as well as advancing, from January 2020, of the public hearing process for reviewing the methodology to be applied;

5) Update of sub-modules 2.2 and 2.2A of Tariff Regulation Procedures (PRORET), approved by Normative Resolution 806/2018, establishing new efficiency levels for calculating regulatory operational costs in the tariff review processes of distributors as from 2018;

6) Update of Sub-module 6.8 of PRORET, which addresses Dynamic Pricing. The amendments were split into two stages: the first to discuss and define the ranges and triggers for activating each level of Dynamic Pricing; and the second to improve the pass-through methodology of the Centralization Account of Dynamic Pricing Funds (CCRBT). The amendments were authorized by Normative Resolutions 811/2018 and 826/2018;

7) Update of the Rules for Electricity Trading applicable to the Accounting and Settlement System (SCL), through Normative Resolution 833, for complying with Normative Resolution 824/2018, related to the Mechanism for Sale of Surplus (MVE);

8) Creation of PRORET sub-module 5.4 through Normative Resolution 837/2018, to regulate the System Service Fees (ESS) and the Reserve Energy Fees (ERR) for transferring tariff to distributors;

9) Regulation of the Energy Reserve Account (CONER) through Normative Resolution 829/2018, in order to attain the best cost/benefit ratio between collection of charges, refund of surplus in the CONER balance and the security level of the account to fulfill its obligations to pay generators contracted with reserve energy;

10)Creation of PRORET sub-module 12.6 through Normative Resolution 836/2018 to regulate the methodology for calculating the quotas of the Angra 1 and Angra 2 Generation Plants and the Itaipu Hydroelectric Plant.

11)Decree 9,642/2018, which amended Decree 7,891/2013, regarding the gradual reduction in discounts granted in the Distribution System Use Tariff and the electricity supply system, in compliance with the final report of the Plan for Structural Reduction of Expenses of the Energy Development Account (CDE) proposed by the Ministry of Mines & Energy (MME), as well as the exclusion of cumulative tariff benefits to certain consumer classes and economic activities;

22

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

ELECTRICITY TARIFFS AND PRICES

Distribution Segment

· Annual Tariff Adjustment (ATA):

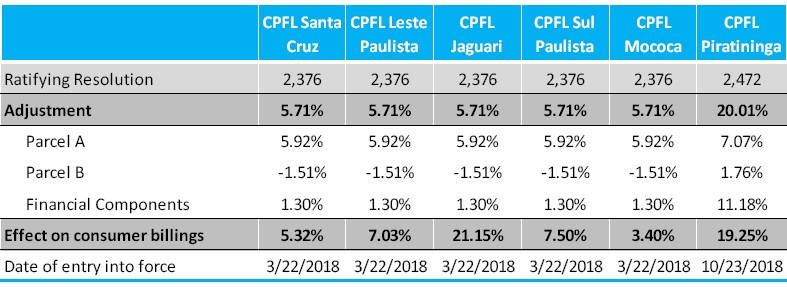

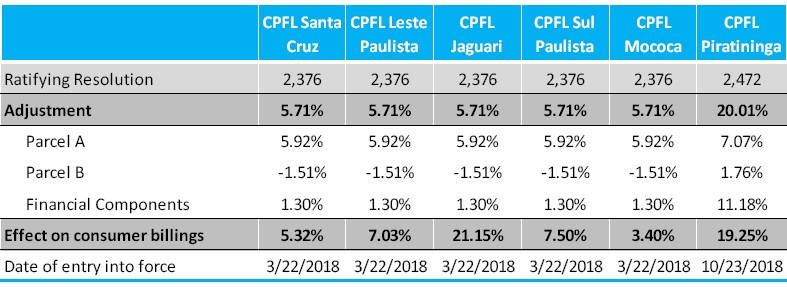

The following distribution companies had tariffs adjusted in 2018:

Considering the merger of the concessions CPFL Santa Cruz / CPFL Leste Paulista / CPFL Jaguari / CPFL Sul Paulista e CPFL Mococa in 12/31/2017, the same percentage of adjustment was considered for all the concessions, but the effect on consumer billings is different for each one of the concessions.

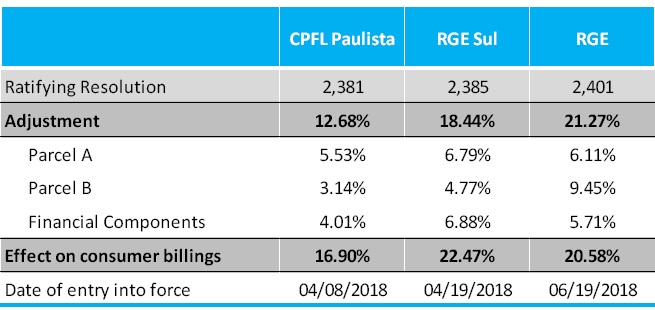

· Periodical Tariff Revision (PTR):

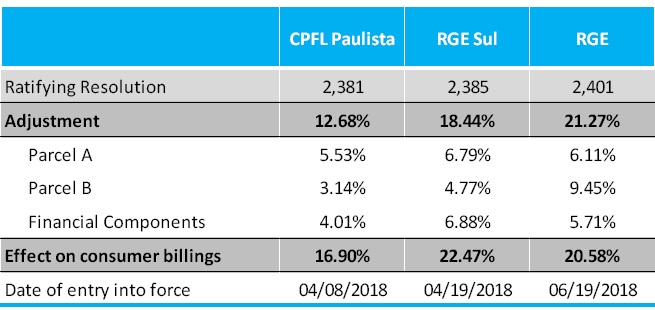

The following distribution companies went through the tariff revision process in 2018:

23

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

CPFL Paulista

On April 3, 2018, Aneel approved the results of the fourth Periodic Tariff Review of the distributor CPFL Paulista. The average impact to be perceived by consumers is 16.90% and details can be found in the table above.

RGE Sul

On April 17, 2018, Aneel approved the results of the fourth Periodic Tariff Review of the distributor RGE Sul. The average impact to be perceived by consumers is 22.47% and details can be found in the table above.

RGE

On June 19, 2018, Aneel approved the results of the fourth Periodic Tariff Review of the distributor RGE. The average impact to be perceived by consumers is 20.58% and details can be found in the table above

Generation Segment

Electricity sale contracts of generators contain specific adjustment clauses, whose main index is the average annual variation measured by the IGP-M. Contracts signed in the Regulated Contracting Environment (ACR) are indexed to the IPCA, and bilateral contracts signed by the indirect subsidiary Campos Novos Energia (Enercan) use a combination of dollar and IGP-M indexes.

3. Operating Performance

ENERGY SALES

In 2018, electricity sales to final consumers (quantity of electricity billed to final consumers) totaled 53,091 GWh, a reduction of 0.5% (285 GWh) compared to 2017.

It is noteworthy the performance of the residential segment, which accounted 37.0% of the electricity sales to final consumers:

· Residential Class: increase of 2.6%, reflecting the slow recovery of economy activity.

· Commercial Class: reduction of 0.1%, reflecting the lower sales of the distribution companies to the captive market, due to the migration of customers to the free market. This effect was partially offset by the higher sales made by the commercialization companies to free customers.

· Industrial Class: reduction of 5.6%, reflecting the lower sales of the distribution companies to the captive market, due to the migration of customers to the free market, and the lower sales made by the commercialization companies and by the assets of renewable generation (controlled by CPFL Renováveis) to free customers.

Electricity sales to wholesaler’s, through other concessionaires, licensees and authorized reached 20,631 GWh, which represented an increase of 26.3% (4.294 GWh), mainy due to the increase in sales by the commercialization companies (through bilateral contracts).

24

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

PERFORMANCE IN THE ELECTRICITY DISTRIBUTION SEGMENT

The Group maintained its strategy of encouraging the dissemination and sharing of best management and operational practices at its distributors in an effort to increase operational efficiency and improve the quality of services provided to clients.

Find below the results posted by distributors in the main indicators that measure quality and reliability of power supply. The Equivalent Duration of Interruptions (SAIDI) measures the average duration, in hours, of interruptions suffered by consumers in the year, while the SAIFI (Equivalent Frequency of Interruptions) measures the average number of interruptions suffered per consumer per year.

PERFORMANCE IN THE ELECTRICITY GENERATION SEGMENT

In 2018, the installed capacity of the Generation segment of CPFL group totaled 3,272 MW, considering its 51.56% interest in CPFL Renováveis.

On December 31, 2018, the portfolio of CPFL Renováveis totaled 2,133 MW of installed capacity in operation, comprising 40 SHPPs (453 MW), 45 wind farms (1,309 MW), 8 biomass-powered thermal power plants (370 MW) and 1 solar plant (1 MW).

In November 2018, the Boa Vista II SHPP, with 29.9 MW of installed capacity and located in the municipality of Varginha, Minas Gerais state, started operations, with more than one year of anticipation.

It is important to highlight the participation of CPFL Renováveis in the A-6 Auction of August 2018. The company won with the following projects: (i) Cherobim SHPP, with 28.0 MW of installed capacity, located in Paraná state, and (ii) Gameleira Wind Complex, with 69.3 MW of installed capacity, located in Rio Grande do Norte state. The startup of these projects is schedule to 2024.

4. Economic and Financial Performance

The Management’s comments on economic and financial performance and the operating results should be read together with the financial statements and notes to the financial statements.

Operating Revenue

Gross operating revenue was of R$ 42,626 million, representing an increase of 6.4% (R$ 2,573 million), due to the increases: (i) of 12.9% (R$ 3,324 million) in electricity sales to final consumers; (ii) of 19.7% (R$ 796 million) in other operating income; and (iii) of 68.8% (R$ 141 million) in the update of concession’s financial asset. These effects were partially offset bythe reduction of 11.3% (R$ 694 million) in the electricity sales to wholesalers, the variation of R$ 693 million in the sectoral financial assets and liabilities, from an asset of R$ 1,901 million in 2017 to an asset of R$ 1,208 million in 2018, and the reduction of 14.5% (R$ 301 million) in the revenue with construction of concession infrastructure.

25

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Deductions from operating revenue were of R$ 14,490 million, presenting an increase of 8.9% (R$ 1,181 million). Net operating revenue was of R$ 28,137 million, representing an increase of 5.2% (R$ 1,392 million).

Operating Cash Flow - EBITDA

EBITDA is a non-accounting measurement calculated by Management as the sum of income, taxes, financial income/loss, depreciation and amortization. This measurement serves as an indicator of management performance and is usually monitored by the market. Management complied with the concepts of CVM Instruction 527 of October 4, 2012, while calculating this non-accounting measurement.

Reconciliation of Net Income and EBITDA |

| | 2018 | 2017 |

Net Income | 2,165,995 | 1,243,042 |

Depreciation and Amortization | 1,594,065 | 1,529,052 |

Assets Surplus Value Amortization | 579 | 579 |

Financial Income/Loss | 1,102,687 | 1,487,554 |

Social Contribution | 213,673 | 168,728 |

Income Tax | 560,310 | 434,901 |

EBITDA | 5,637,308 | 4,863,856 |

Operating cash flow, as measured by EBITDA, reached R$ 5,637 million, an increase of 15.9% (R$ 773 million), mainly due to the increase of 5.2% (R$ 1,392 million) in net operating revenue, the reduction of 5.6% (R$ 297 million) in operating costs and expenses, including expenses with private pension fund and costs with construction of concession infrastructure, and the increase of 7.0% (R$ 22 million) in equity income. These effects were partially offset by the increase of 5.5% (R$ 937 million) in costs with energy purchase and sector charges.

Net Income

In 2018, net income reached R$ 2,166 million, an increase of 74.2% (R$ 923 million), mainly due to the increase of 15.9% (R$ 773 million) in EBITDA and the reduction of 25.9% (R$ 385 million) in net financial expenses. These effects were partially offset by the increases of R$ 170 million in Income Tax and Social Contribution and of 4.3% (R$ 65 million) in depreciation and amortization.

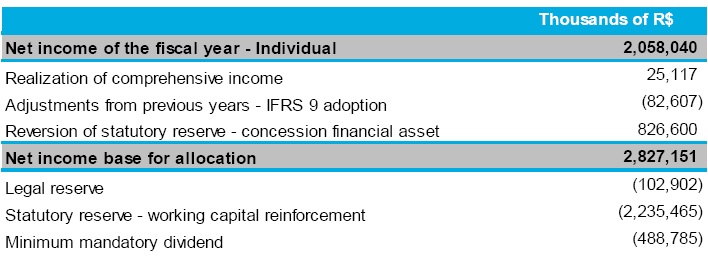

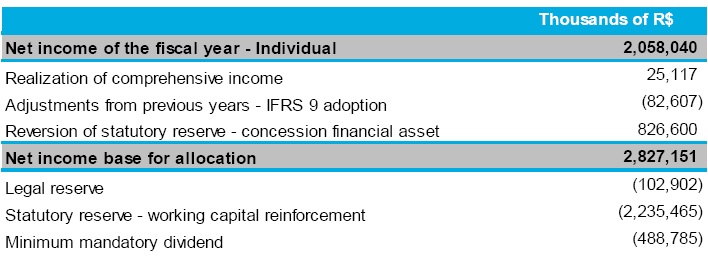

Allocation of Net Income from the Fiscal Year

The Company’s Bylaws require the distribution of at least 25% of net income adjusted according to law, as dividends to its shareholders. The proposal for allocation of net incomefrom the fiscal year is shown below:

26

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Minimum Mandatory Dividend (25%)

The Board of Directors propose the payment of R$ 489 million in dividends to holders of common shares traded on B3 S.A. – Brasil, Bolsa, Balcão (B3). This proposed amount corresponds to R$ 0.480182232 per share, related to the fiscal year of 2018.

Statutory Reserve – Working Capital Reinforcement

For this fiscal year, considering the current macro scenario with an incipient economic recovery, and also considering the uncertainties regarding hydrology, the Company’s Management is proposing the allocation of R$ 2,235 million to the statutory reserve - working capital reinforcement.

Debt

At the close of 2018, gross financial debt (including derivatives) of the Company reached R$ 19,752 million, presenting an increase of 0.7%. Cash and cash equivalents totaled R$ 1,891 million, a decrease of 41.8%. As such, net financial debt increased 9.1% to R$ 17,860 million.

5. Investments

In 2018, investments of R$ 2,062 million were made in business maintenance and expansion, of which R$ 1,770 million was destined to distribution, R$ 237 million to generation (R$ 225 million to renewable generation and R$ 12 million to conventional generation) and R$ 56 million to commercialization, services and others.In addition,we investedR$ 3 million inthetransmission segment and,according to the requirements of IFRIC 15, it wasrecorded as “Contractual Asset ofTransmission Companies” (in other credits).

CPFL Energia’s investments in 2018 include:

Distribution: investments in expansion, maintenance, improvement, automation, modernization and strengthening the electricity system to meet market growth, in operational infrastructure, customer service and research and development programs, among other areas. On December 31, 2018, our distributors had 9.6 million customers, an increase of 0.2 million customers. Our distribution network consisted of 323,979 kilometers of distribution lines (adding 5,961 kilometers of lines), including 464,627 distribution transformers (adding 6,886 transformers). Our five distribution subsidiaries had 12,564 kilometers of high voltage distribution lines of between 34.5 kV and 138 kV (adding 60 kilometers of lines). On that date,we had 548 transformer substations, from high voltage to medium voltage, for subsequent distribution (adding 01 substation), with total transformer capacity of 18,578 MVA (adding 110 MVA);

27

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Generation: in 2018, were invested R$ 237 million, of which R$ 12 million of conventional generation and R$ 225 million of renewable generation, mainly focused on the Boa Vista II SHPP, that began operations in November 2018.

6. Corporate Governance

The corporate governance model adopted by CPFL Energia and its subsidiaries is based on the principles of transparency, equity, accountability and corporate responsibility.

In 2018, CPFL completed 14 years of its IPO on the B3 and the New York Stock Exchange (NYSE). With more than 100 years of history in Brazil, the Company has its shares listed on the Novo Mercado segment of the B3 with Level III ADRs on the NYSE, both special listing segments for companies that comply with corporate governance best practices. All CPFL shares are common shares, entitling shareholders the right to vote with 100% Tag Along rights guaranteed in case of sale of shareholding control.

CPFL’s Management is composed of the Board of Directors (Board), its decision-making authority, and the Board of Executive Officers, its executive body. The Board is responsible for defining the strategic business direction of the holding company and subsidiaries, and is composed of 7 members, two of whom are independent members, whose term of office is 1 year and who are eligible for reelection.

The Charter of the Board establishes the procedures for evaluating the directors, under the leadership of the Chairman, as well as their key duties and rights.

The Board has set up three advisory committees (Management, Risks and Sustainability Processes, People Management and Related Parties), which support the Board in its decisions and monitor relevant and strategic issues, such as people and risk management, sustainability, monitoring of internal audit, analysis of transactions with related parties of shareholders pertaining to the controlling block and handling of incidents recorded through complaint hotlines and ethical conduct channels.

The Board of Executive Officers is made up of 1 Chief Executive Officer, 1 Deputy Chief Executive Officer and 8 Executive Vice Presidents, all with terms of office of two years, eligible for reelection, who are responsible for executing the strategy of CPFL Energia and its subsidiaries, as defined by the Board of Directors in line with corporate governance guidelines. To ensure alignment of governance practices, the Chief Executive Officer and the Deputy Chief Executive Officer sit on the Boards of Directors of companies that make up the CPFL group.

CPFL has a permanent Fiscal Council, consisting of 3 members and 3 alternate members, which also performs the functions of the Audit Committee, in compliance with the Sarbanes-Oxley Act (SOX) rules applicable to foreign companies listed on U.S. stock exchanges.

The guidelines and documents on corporate governance are available at the Investor Relations website http://www.cpfl.com.br/ir.

28

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

7. Capital Markets

The shares of CPFL Energia, which have a free float of 5,25% (up to December 31, 2018), are listed both on the São Paulo Stock Exchange (B3) and the New York Stock Exchange (NYSE).

In 2018, CPFL Energia shares depreciated 49.1% on the BM&FBovespa and 29.4% on the NYSE, closing the year at R$ 28.85 per share and US$ 14.80 per ADR, respectively. The average daily trading volume in 2018 was R$ 12.8 million, of which R$ 11.1 million on the BM&FBovespa and R$ 1.7 million on the NYSE, representing a decrease of 73.7% over 2017. Number of trades on the BM&FBovespa decreased 49.1%, from a daily average of 3,230 trades in 2017 to 1,645 in 2018.

8. Sustainability and Corporate Responsibility

We develop initiatives aimed at generating shared value between the company and its stakeholder groups in order to ensure competitiveness, through excellence in operations, and contribute to better economic, social and environmental conditions in the areas of influence. In line with the strategic plan of the CPFL Group, the commitments and business guidelines aim to promote sustainable development and are incorporated into the decision-making process and actions. See the highlights below.

Sustainability platform: management tool that includes performance indicators and targets related to issues that are important for the sustainability of the CPFL Group, which are defined based on its positioning and strategy for the short, medium and long terms, as well as from the perspective of its key stakeholder groups. Starting 2018, we have incorporated the United Nation Sustainable Development Goals (SDG) in the Platform as part of our implementation process.

Sustainability Committee:executive management body responsible for monitoring the Platform, evaluating and recommending the inclusion of sustainability criteria and guidelines in the decision-making process, monitoring trends and critical topics for the sustainable development of the company.

Climate Change:we maintain a strategic focus on low carbon businesses and projects that aim to combat climate change and its effects, such as the internal study on carbon pricing and structuring the group’s portfolio of low carbon products. Moreover, we work together with organizations such as the Global Compact Brazil, the Brazilian Business Council for Sustainable Development (CEBDS), World Business Council for Sustainable Development (WBCSD), Fundação Getúlio Vargas (FGV), Business Initiatives on Climate (IEC), and other business initiatives and groups.

Ethics Management and Development System (SGDE):The SGDE currently consists of seven elements, which are considered key for the operations of the holding company and its subsidiaries in the ethics management culture. These are: (i) Code of Ethical Conduct; (ii) Ethics and Business Conduct Committee (COMET); (iii) Charter of COMET; (iv) External Ethics Channel; (v) Complaints Processing Commission (CPD); (vi) Disclosure Plan; and (vii) Training. We can highlight the following initiatives carried out in 2018: a) Integrity Pills (internal communications) specifically on the guidelines of the Code of Ethical Conduct; b) On-site training on Integrity and Ethics for Sensitive Stakeholders (Legal, Regulatory, HR, Government), Electricians and CPFL Atende employees (Call Center); c) Event to celebrateInternational Anticorruption Day, which included, among others, a debate on the issue and featured the CEO of CPFL Energia at the time(Andre Dorf) and other guests: Alípio Casali (philosopher and member of the Ethics Committee), Ricardo Voltolini (consultant and author) and Marcela Varani (journalist); d) Lecture on Integrity, Compliance and Ethics by a renowned Compliance professional for CPFL Energia executives. The Ethics and Business Conduct Committee also held 11 meetings in 2018 to discuss topics related to ethics management and to analyze suggestions, queries and complaints received during the period.

29

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.

Human Resources Management: the company ended 2018 with 12,976 employees (13,008 in 2017), which represents a turnover rate of 16.25% (17.24% in 2017). The Group companies maintained their management and training programs focused on honing skills of strategic importance to the business, leadership succession, boosting productivity, as well as occupational health and safety. Average training hours per employee in 2018 stood at 55.64 (hours), higher than the average of 47 hours as per the Sextant Survey 2017 for the Energy Market and 32 hours for the General Market. In 2018, we rebranded the University which, as CPFL University, had a new positioning and the belief that “Education expands Potential” (brand essence). With this, we presented our 4 Schools to the company: Leadership, Business and Innovation, Service Excellence and Operational Excellence.

That year we also concluded the 1st Cycle of the “Flying High” and “Leader Take-off” Programs, which brought the best leadership practices to 150 managers and over 700 leaders, respectively. Another important corporate initiative was the launch of the “Expanding Horizons” Program, which extends into 2019 strengthening the actions of 35 executives of the CPFL Energia Group.

The year also saw the unification of the learning platforms, integrated with the entire CPFL Group Employee Registry (Multi HR) which brought agility, improved performance and reach of the training programs offered by the company.

Value Network: In 2018, three Value Network meetings were held.

The meetings were attended by main suppliers of materials and intensive labor services for the CPFL Group.

The first meeting was held on May 23, 2018 and featured the following lectures:

· Management, Excellence, Ethics – Marcos Bardagi (Chief Operations Officer of the National Quality Foundation - FNQ);

· Integrity Program - Helio Takashi Ito (Manager - Risks, Audit and Compliance of the CPFL group);

· Information on SUPRE – FUNCOGE (Symposium on Procurement and Logistics of Companies in the Electricity Sector).

The second meeting was held on September 25, 2018, featuring two lectures:

· Labor Reform: Current scenario – Dr. Jorge Gonzaga Matsumoto (Partner at Bichara Advogados);

· Safety at Contracted Companies - Marcos Victor Lopes (Health and Workplace Safety Manager)

The final meeting of the year, held on December 5, 2018, featured the following lectures:

· Macroeconomic Scenario - Silvio Campos Neto (Senior Economist at Tendências Consultoria)

· Challenges facing the Electricity Sector - Rafael Calaes (Strategy Manager of the CPFL Group)

· New Supplier Financial Portal - André Barbosa (Cash Management Specialist in the CPFL Group).

30

(Free Translation of the original in Portuguese)

Standard Financial Statements – DFP – Date: December 31, 2018 - CPFL Energia S.A.