UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2019

Commission File Number 32297

CPFL Energy Incorporated

(Translation of Registrant's name into English)

Rodovia Engenheiro Miguel Noel Nascentes Burnier, km 2,5, parte

CEP 13088-140 - Parque São Quirino, Campinas - SP

Federative Republic of Brazil (Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_________________

.

Campinas, March 28, 2019 – CPFL Energia S.A. (B3: CPFE3 and NYSE: CPL), announces its4Q18/2018 results.The financial and operational information herein, unless otherwise indicated, is presented on a consolidated basis and is in accordance with the applicable legislation. Comparisons are relative to 4Q17/2017, unless otherwise stated.

CPFL ENERGIA ANNOUNCES ITS 2018 RESULTS

Indicators (R$ Million) | 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Sales within the Concession Area - GWh | 17,026 | 16,827 | 1.2% | 67,213 | 65,576 | 2.5% |

Captive Market | 11,512 | 11,464 | 0.4% | 45,589 | 45,358 | 0.5% |

Free Client | 5,513 | 5,363 | 2.8% | 21,624 | 20,218 | 7.0% |

Gross Operating Revenue | 10,314 | 11,093 | -7.0% | 42,626 | 40,053 | 6.4% |

Net Operating Revenue | 6,686 | 7,460 | -10.4% | 28,137 | 26,745 | 5.2% |

EBITDA(1) | 1,354 | 1,366 | -0.9% | 5,637 | 4,864 | 15.9% |

Net Income | 670 | 498 | 34.7% | 2,166 | 1,243 | 74.2% |

Investments(2) | 693 | 694 | -0.1% | 2,066 | 2,617 | -21.0% |

Notes:

(1) EBITDA is calculated from the sum of net income, taxes, financial result, depreciation/amortization, as CVM Instruction no. 527/12. See the calculation in item 4.6 of this report;

(2) Includes investments related to the transmission segment; according to the requirements of IFRIC 15, it was recorded as “Contractual Asset of Transmission Companies” (in other credits). Does not include special obligations.

2018 HIGHLIGHTS

• Increase of2.5% in sales within the concession area, highlighting the growths of the residential (+2.6%) and industrial (+2.6%) classes;

• Growth of15.9% in EBITDAand of74.2% in Net Income;

• Net debt ofR$ 16.3 billionand leverage of3.05x Net Debt/EBITDA;

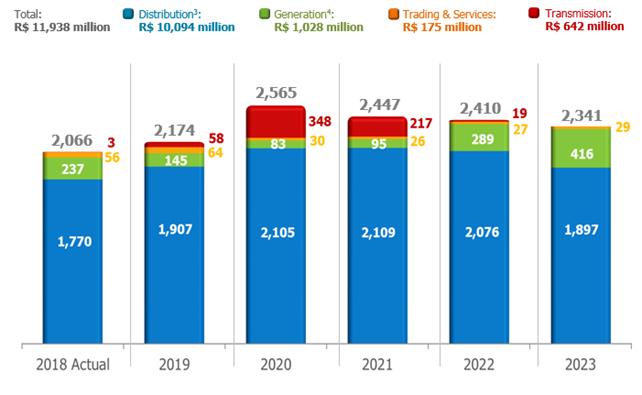

• Investments ofR$ 693 millionin4Q18and ofR$ 2,066 millionin2018;

• Tariff Revisions: CPFL Paulista andRGE Sul, in Apr/18, andRGE, in Jun/18;

• Grouping of the concessions of the distribution companiesRGEandRGE Sul;

• CPFL Renováveis: (i) winning projects in the A-6 Auction (Aug-18) -Cherobim SHPP (28.0 MW) andGameleira Wind Complex (69.3 MW); and (ii) anticipation of commercial start-up ofBoa Vista II SHPP (29.9 MW), in Nov-18;

• Transmission Auctions: CPFL Geraçãowon one lot in Jun-18 (CE - Investment estimated by ANEEL: R$ 102 MM) and two lots in Dec-18 (SC - Invest.: R$ 366 MM and RS - Invest.: R$ 349 MM);

• CPFL Renováveis’ Mandatory Tender Offer: auction occurred on Nov 26, 2018; State Grid (directly and indirectly) now holds 99.94% of the shares.

| 4Q18/2018 Results | March 28, 2019 |

INDEX

| |

| 1) MESSAGE FROM THE CEO | 4 |

| |

| 2) ENERGY SALES | 6 |

| 2.1) Sales within the Distributors Concession Area | 6 |

| 2.1.1) Sales by Segment Concession Area | 7 |

| 2.1.2) Sales to the Captive Market | 8 |

| 2.1.3) Free Clients | 8 |

| 2.2) Generation Installed Capacity | 9 |

| |

| 3) INFORMATION ON INTEREST IN COMPANIES AND CRITERIA OF FINANCIAL STATEMENTS | |

| CONSOLIDATION | 10 |

| 3.1) Consolidation of CPFL Renováveis Financial Statements | 12 |

| 3.2) Consolidation of RGE Sul Financial Statements | 12 |

| 3.3) Economic-Financial Performance Presentation | 12 |

| 3.4) Consolidation of Transmission Companies | 12 |

| |

| 4) ECONOMIC-FINANCIAL PERFORMANCE | 13 |

| 4.1) Opening of economic-financial performance by business segment | 13 |

| 4.2) Sectoral Financial Assets and Liabilities | 14 |

| 4.3) Operating Revenue | 14 |

| 4.4) Cost of Electric Energy | 15 |

| 4.5) Operating Costs and Expenses | 17 |

| 4.6) EBITDA | 19 |

| 4.7) Financial Result | 20 |

| 4.8) Net Income | 22 |

| |

| 5) INDEBTEDNESS | 23 |

| 5.1) Debt (IFRS) | 23 |

| 5.1.1) Debt Amortization Schedule in IFRS (Dec-18) | 24 |

| 5.2) Debt in Financial Covenants Criteria | 25 |

| 5.2.1) Indexation and Debt Cost in Financial Covenants Criteria | 25 |

| 5.2.2) Net Debt in Financial Covenants Criteria and Leverage | 26 |

| |

| 6) INVESTMENTS | 26 |

| 6.1) Actual Investments | 26 |

| 6.2) Investments Forecasts | 27 |

| |

| 7) ALLOCATION OF RESULTS | 28 |

| |

| 8) STOCK MARKETS | 28 |

| 8.1) Stock Performance | 28 |

| 8.2) Daily Average Volume | 29 |

| |

| 9) CORPORATE GOVERNANCE | 30 |

| |

| 10) SHAREHOLDERS STRUCTURE | 31 |

| 10.1) CPFL Renováveis Tender Offer | 31 |

| 10.2) Merger of RGE and RGE Sul distribution companies | 31 |

| |

| 11) PERFORMANCE OF THE BUSINESS SEGMENTS | 33 |

| 11.1) Distribution Segment | 33 |

| 11.1.1) Economic-Financial Performance | 33 |

| 11.1.1.1) Sectoral Financial Assets and Liabilities | 33 |

| 11.1.1.2) Operating Revenue | 34 |

| 11.1.1.3) Cost of Electric Energy | 36 |

| 4Q18/2018 Results | March 28, 2019 |

| |

| 11.1.1.4) Operating Costs and Expenses | 37 |

| 11.1.1.5) EBITDA | 39 |

| 11.1.1.6) Financial Result | 40 |

| 11.1.1.7) Net Income | 42 |

| 11.1.2) Tariff Events | 42 |

| 11.1.3) Operating Performance of Distribution | 44 |

| 11.2) Commercialization and Services Segments | 45 |

| 11.2.1) Commercialization Segment | 45 |

| 11.2.2) Services Segment | 46 |

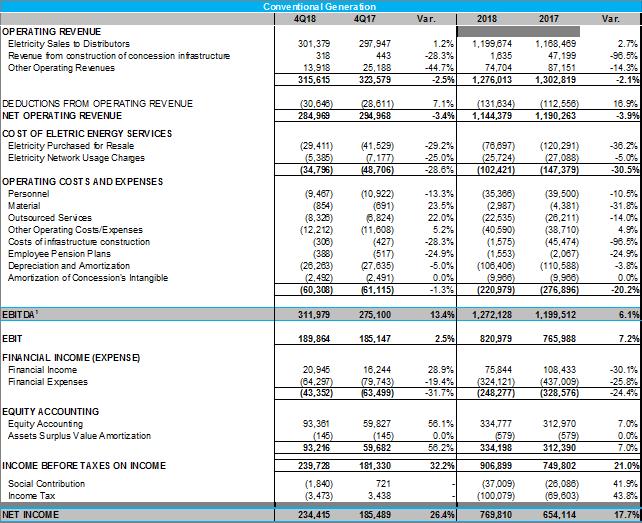

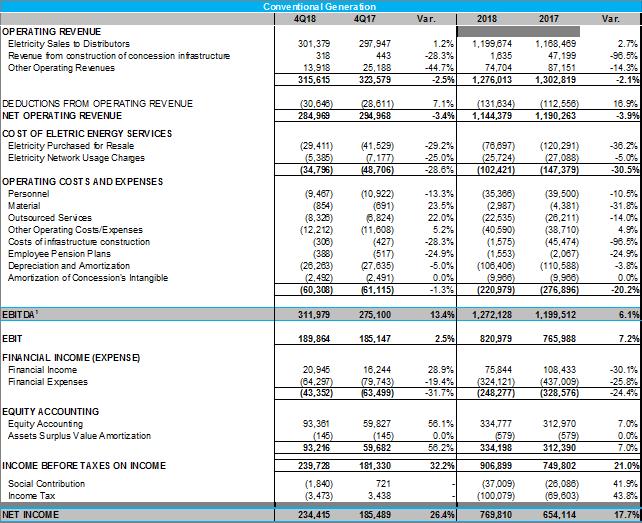

| 11.3) Conventional Generation Segment | 47 |

| 11.3.1) Economic-Financial Performance | 47 |

| 11.3.1.1) Operating Revenue | 47 |

| 11.3.1.2) Cost of Electric Power | 48 |

| 11.3.1.3) Operating Costs and Expenses | 48 |

| 11.3.1.4) Equity Income | 50 |

| 11.3.1.5) EBITDA | 51 |

| 11.3.1.6) Financial Result | 51 |

| 11.3.1.7) Net Income | 53 |

| 11.4) CPFL Renováveis | 53 |

| 11.4.1) Economic-Financial Performance | 53 |

| 11.4.1.1) Operating Revenue | 53 |

| 11.4.1.2) Cost of Electric Power | 54 |

| 11.4.1.3) Operating Costs and Expenses | 55 |

| 11.4.1.4) EBITDA | 56 |

| 11.4.1.5) Financial Result | 56 |

| 11.4.1.6) Net Income | 57 |

| 11.4.2) Status of Generation Projects 100% Participation | 57 |

| |

| 12) ATTACHMENTS | 59 |

| 12.1) Statement of Assets CPFL Energia | 59 |

| 12.2) Statement of Liabilities CPFL Energia | 60 |

| 12.3) Income Statement CPFL Energia | 61 |

| 12.4) Cash Flow CPFL Energia | 62 |

| 12.5) Income Statement Conventional Generation Segment | 63 |

| 12.6) Income Statement CPFL Renováveis | 64 |

| 12.7) Income Statement Distribution Segment | 65 |

| 12.8) Economic-Financial Performance by Distributor | 66 |

| 12.9) Sales within the Concession Area by Distributor (In GWh) | 67 |

| 12.10) Sales to the Captive Market by Distributor (in GWh) | 68 |

| 12.11) Reconciliation of Net Debt/EBITDA Pro Forma ratio of CPFL Energia for purposes of financial | |

| covenants calculation | 69 |

| 4Q18/2018 Results | March 28, 2019 |

1) MESSAGE FROM THE CEO

The CPFL group continued to be very active in 2018, promoting improvements in its operations and management, as well as following the unfolding of the political and economic scenarios of Brazil in its markets.

The 2018 results reflected the growth of energy sales in all consumption classes, our discipline in cost and expense management, as well as the drop in interest rates in Brazil.

The distribution segment had an increase in energy sales (+2.5%) in 2018. Residential, industrial and commercial classes registered market variations of 2.6%, 2.8% and 1.2%, respectively, reflecting the slow recovery of economy activity.

CPFL group’s operating cash generation, measured by EBITDA, reached R$ 5,643 million in 2018 (+15.9%), reflecting the positive results of all business segments. We highlight the distribution segment, whose EBITDA reached R$ 3,004 million in 2018 (+34.5%), mainly reflecting the results coming from the conclusion of the tariff revision process (4th cycle) of CPFL Paulista, RGE Sul (both in April 2018) and RGE (in June 2018). In addition, the Company is promoting organizational reviews in order to simplify its processes and structure, aiming at greater efficiency and focus on business.

We continue working on value initiatives and in our investment plan in 2018, with financial discipline, efforts and commitment of our teams. We invested R$ 2,066 million in this period.

Among the value initiatives, it is worth mentioning the participation of CPFL Geração in the following transmission auctions: (i) in June 2018, the company won Lot 9 (Maracanaú II substation), in Ceará, and (ii) in December 2018, the company won Lots 5 (Itá substation), in Santa Catarina, and 11 (Osório 3, Porto Alegre 1 and Vila Maria substations), in Rio Grande do Sul.

We also had the creation of CPFL Soluções, which brings together services and products previously offered under the brands CPFL Brasil, CPFL Serviços and CPFL Eficiência. In this way, we have an integrated platform for interaction with customers seeking solutions for energy trading, energy efficiency, distributed generation, energy infrastructure and consulting services.

It should also be noted that CPFL promoted the merger of the distribution company RGE (“Merged Company”) into RGE Sul (“Mergee Company”). The grouping of the concessions of the two companies was carried out through the merger of the assets held by the Merged Company by the Mergee Company on December 31, 2018.

We also had the startup of the Boa Vista II SHPP (installed capacity of 29.9 MW), in November 2018, and the participation of CPFL Renováveis in the A-6 Auction of August 2018. The company won with the following projects: (i) Cherobim SHPP, with 28.0 MW of installed capacity, located in Paraná state, and (ii) Gameleira Wind Complex, with 69.3 MW of installed capacity, located in Rio Grande do Norte state.

Still in relation to CPFL Renováveis, we had the Mandatory Tender Offer of the company on November 26. As a result of the auction, State Grid acquired 243,771,824 common shares issued by the company, representing 48.39% of the capital stock of the company. The common shares were acquired at the price of R$ 16.85, totaling the amount of R$ 4.1 billion. State Grid and CPFL Geração (indirectly controlled by State Grid) jointly held 503,520,623 common shares issued by the company, equivalent to 99.94% of the total share capital of the company.

CPFL Energia’s capital structure and consolidated leverage remained at adequate levels. The Company’s net debt reached 3.05 times EBITDA at the end of the quarter, under the criteria to measure our financial covenants, lower than in the previous year. It is worth mentioning that the reductions in interest rates benefited the Company.

| 4Q18/2018 Results | March 28, 2019 |

Finally, CPFL’s management remains optimistic about the advances of the Brazilian electricity sector and remains confident in its business platform, which is increasingly prepared and well positioned to face the challenges and opportunities in the country.

Gustavo Estrella

CEO of CPFL Energia

| 4Q18/2018 Results | March 28, 2019 |

2) ENERGY SALES

2.1) Sales within the Distributors’ Concession Area

Sales within the Concession Area - GWh |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Captive Market | 11,512 | 11,464 | 0.4% | 45,589 | 45,358 | 0.5% |

Free Client | 5,513 | 5,363 | 2.8% | 21,624 | 20,218 | 7.0% |

Total | 17,026 | 16,827 | 1.2% | 67,213 | 65,576 | 2.5% |

In 4Q18, sales within the concession area, achieved by the distribution segment, totaled 17,026 GWh, an increase of 1.2%. Sales to the captive market totaled 11,512 GWh in 4Q18, an increase of 0.4%. The quantity of energy, in GWh, which corresponds to the consumption of free clients in the concession area of group’s distributors, billed through the Tariff for the Usage of the Distribution System (TUSD), reached 5,513 GWh in 4Q18, an increase of 2.8%.

In 2018, sales within the concession area totaled 67,213 GWh, an increase of 2.5%. Sales to the captive market totaled 45,589 GWh in 2018, an increase of 0.5%. The quantity of energy billed through TUSD reached 21,624 GWh in 2018, an increase of 7.0%.

Sales within the Concession Area - GWh |

| 4Q18 | 4Q17 | Var. | Part. | 2018 | 2017 | Var. | Part. |

Residential | 4,970 | 4,866 | 2.2% | 29.2% | 19,618 | 19,122 | 2.6% | 29.2% |

Industrial | 6,371 | 6,316 | 0.9% | 37.4% | 25,023 | 24,346 | 2.8% | 37.2% |

Commercial | 2,841 | 2,820 | 0.7% | 16.7% | 11,048 | 10,921 | 1.2% | 16.4% |

Others | 2,844 | 2,826 | 0.6% | 16.7% | 11,524 | 11,187 | 3.0% | 17.1% |

Total | 17,026 | 16,827 | 1.2% | 100.0% | 67,213 | 65,576 | 2.5% | 100.0% |

Note: The tables with sales within the concession area by distributor are attached to this report in item 12.9.

Noteworthy in 4Q18, in the concession area:

· Residential and commercial classes (29.2% and 16.7% of total sales, respectively): increases of 2.2% and 0.7%, respectively. Highlights for RGE (+4.3%) and CPFL Santa Cruz (+2.2%). In New RGE, the effect of the temperature contributed to the growth of consumption.

· Industrial class (37.4% of total sales): increase of 0.9%. Highlight for the growths in CPFL Santa Cruz (+12.5%) and RGE (+3.2%).

Noteworthy in 2018, in the concession area:

· Residential and commercial classes (29.2% and 16.4% of total sales, respectively): increases 2.6% and 1.2%, respectively. One-off effects of temperature increased consumption in some months of the year, contributing to the growth of sales in 2018.

· Industrial class (37.2% of total sales):increase of 2.8%. Highlight for the growths in CPFL Piratininga (+4.0%), RGE (+3.1%) and CPFL Santa Cruz (+7.6%). This positive result come from the performance of the main industrial activities in the concession area of CPFL Energia (chemicals, automotive vehicles, coke and derived petroleum products and metallurgy).

| 4Q18/2018 Results | March 28, 2019 |

2.1.1) Sales by Segment – Concession Area

Note: in parentheses, the variation in percentage points from 4Q17/2017 to 4Q18/2018.

| 4Q18/2018 Results | March 28, 2019 |

2.1.2) Sales to the Captive Market

Sales to the Captive Market - GWh |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Residential | 4,970 | 4,866 | 2.2% | 19,618 | 19,122 | 2.6% |

Industrial | 1,561 | 1,618 | -3.5% | 6,151 | 6,557 | -6.2% |

Commercial | 2,217 | 2,244 | -1.2% | 8,630 | 8,828 | -2.2% |

Others | 2,763 | 2,736 | 1.0% | 11,190 | 10,852 | 3.1% |

Total | 11,512 | 11,464 | 0.4% | 45,589 | 45,358 | 0.5% |

Note: The tables with captive market sales by distributor are attached to this report in item 12.10.

Sales to the captive market totaled 11,512 GWh in 4Q18, an increase of 0.4% (48 GWh), mainly due to the performance of the residential class (+2.2%); the performance of industrial (-3.5%) and commercial (-1.2%) classes, reflects the migration of customers to the free market.

In 2018, sales to the captive market totaled 45,589 GWh, an increase of 0.5% (231 GWh), mainly due to the performance of the residential class (+2.6%); the performance of industrial (-6.2%) and commercial (-2.2%) classes, also reflects the migration of customers to the free market.

2.1.3) Free Clients

Free Client - GWh |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Industrial | 4,809 | 4,698 | 2.4% | 18,872 | 17,789 | 6.1% |

Commercial | 624 | 576 | 8.3% | 2,418 | 2,093 | 15.5% |

Others | 80 | 90 | -10.4% | 334 | 335 | -0.4% |

Total | 5,513 | 5,363 | 2.8% | 21,624 | 20,218 | 7.0% |

Free Client by Distributor - GWh |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

CPFL Paulista | 2,593 | 2,554 | 1.5% | 10,027 | 9,504 | 5.5% |

CPFL Piratininga | 1,548 | 1,535 | 0.8% | 6,255 | 5,809 | 7.7% |

New RGE | 1,205 | 1,133 | 6.3% | 4,724 | 4,396 | 7.5% |

CPFL Santa Cruz | 168 | 141 | 18.8% | 619 | 509 | 21.5% |

Total | 5,513 | 5,363 | 2.8% | 21,624 | 20,218 | 7.0% |

| 4Q18/2018 Results | March 28, 2019 |

2.2) Generation Installed Capacity

In 4Q18, the Generation installed capacity of CPFL Energia group, considering the proportional stake in each project, is of 3,272 MW.

Note: Take into account CPFL Energia’s 51.56% stake in CPFL Renováveis.

| 4Q18/2018 Results | March 28, 2019 |

3) INFORMATION ON INTEREST IN COMPANIES AND CRITERIA OF FINANCIAL STATEMENTS CONSOLIDATION

The interests directly or indirectly held by CPFL Energia in its subsidiaries and jointly-owned entities are described below. Except for: (i) the jointly-owned entities ENERCAN, BAESA, Foz do Chapecó and EPASA, that, as from January 1, 2013 are no longer proportionally consolidated in the Company’s financial statements, being their assets, liabilities and results accounted for using the equity method of accounting, and (ii) the investment in Investco S.A. recorded at cost by the subsidiary Paulista Lajeado, the other units are fully consolidated.

As of December 31, 2018 and 2017, the participation of non-controlling interests stated in the consolidated statements refers to the third-party interests in the subsidiaries CERAN, Paulista Lajeado and CPFL Renováveis.

Since November 1st, 2016 CPFL Energia is considering the full consolidation of RGE Sul.

Energy distribution | Company Type | Equity Interest | Location (State) | Number of municipalities | Approximate number of consumers

(in thousands) | Concession term | End of the concession |

Companhia Paulista de Força e Luz ("CPFL Paulista") | Publicly-quoted corporation | Direct

100% | Countryside of São Paulo | 234 | 4,496 | 30 years | November 2027 |

Companhia Piratininga de Força e Luz ("CPFL Piratininga") | Publicly-quoted corporation | Direct

100% | Countryside and seaside of São Paulo | 27 | 1,756 | 30 years | October 2028 |

RGE Sul Distribuidora de Energia S.A. ("RGE") (a) | Publicly-quoted corporation | Direct and Indirect

100% | Countryside of Rio Grande do Sul | 381 | 2,871 | 30 years | November 2027 |

Companhia Jaguari de Energia ("CPFL Santa Cruz") (b) | Private corporation | Direct

100% | Countryside of São Paulo, Paraná and Minas Gerais | 45 | 457 | 30 years | July 2045 |

Energy generation (conventional and renewable sources) | Company Type | Equity Interest | Location (State) | Number of plants / type of energy | Installed capacity |

Total | CPFL participation |

CPFL Geração de Energia S.A. ("CPFL Geração") | Publicly-quoted corporation | Direct

100% | São Paulo and Goiás | 3 Hydroelectric (c) | 1,295 | 678 |

CERAN - Companhia Energética Rio das Antas ("CERAN") | Private corporation | Indirect

65% | Rio Grande do Sul | 3 Hydroelectric | 360 | 234 |

Foz do Chapecó Energia S.A. ("Foz do Chapecó") | Private corporation | Indirect

51% (d) | Santa Catarina and

Rio Grande do Sul | 1 Hydroelectric | 855 | 436 |

Campos Novos Energia S.A. ("ENERCAN") | Private corporation | Indirect

48.72% | Santa Catarina | 1 Hydroelectric | 880 | 429 |

BAESA - Energética Barra Grande S.A. ("BAESA") | Publicly-quoted corporation | Indirect

25.01% | Santa Catarina and

Rio Grande do Sul | 1 Hydroelectric | 690 | 173 |

Centrais Elétricas da Paraíba S.A. ("EPASA") | Private corporation | Indirect

53.34% | Paraíba | 2 Thermoelectric | 342 | 182 |

Paulista Lajeado Energia S.A. ("Paulista Lajeado") | Private corporation | Indirect

59.93% (e) | Tocantins | 1 Hydroelectric | 903 | 38 |

CPFL Energias Renováveis S.A. ("CPFL Renováveis") | Publicly-quoted corporation | Indirect

51.56% | See chapter 11.4.2 | See chapter 11.4.2 | See chapter 11.4.2 | See chapter 11.4.2 |

CPFL Centrais Geradoras Ltda. ("CPFL Centrais Geradoras") | Limited company | Direct

100% | São Paulo and Minas Gerais | 6 MHPPs | 4 | 4 |

Transmission | Company Type | Core activity | Equity Interest |

CPFL Transmissão Piracicaba S.A. ("CPFL Piracicaba") | Private corporation | Electric energy transmission services | Indirect 100% |

CPFL Transmissão Morro Agudo S.A. ("CPFL Morro Agudo") | Private corporation | Electric energy transmission services | Indirect 100% |

CPFL Transmissão Maracanaú S.A. ("CPFL Maracanaú") | Privately-held corporation | Electric energy transmission services | Indirect 100% |

Notes:

(a) On December 31, 2018, was approved the grouping of the concessions of the distribution companies RGE Sul Distribuidora de Energia S.A. (“RGE Sul”) and Rio Grande Energia S.A. (“RGE”), considering RGE Sul as the Merging Company and RGE as the Merged Company;

(b) On December 31, 2017, was approved the merger of the subsidiaries Companhia Luz e Força Santa Cruz, Companhia Leste Paulista de Energia, Companhia Sul Paulista de Energia and Companhia Luz e Força de Mococa into Companhia Jaguari de Energia, whose fancy name became "CPFL Santa Cruz”;

(c) CPFL Geração holds 51.54% of the assured power and power of the Serra da Mesa HPP, whose concession belongs to Furnas. The Cariobinha HPP and the Carioba TPP projects are deactivated pending the position of the Ministry of Mines and Energy on the anticipated closure of its concession and are not included in the table;

(d) The joint venture Chapecoense fully consolidates the interim financial statements of its direct subsidiary, Foz de Chapecó;

(e) Paulista Lajeado has a 7% participation in the installed power of Investco S.A. (5.94% share of its capital).

| 4Q18/2018 Results | March 28, 2019 |

Energy commercialization | Company Type | Core activity | Equity Interest |

CPFL Comercialização Brasil S.A. ("CPFL Brasil") | Private corporation | Energy commercialization | Direct

100% |

Clion Assessoria e Comercialização de Energia Elétrica Ltda. ("CPFL Meridional") | Limited company | Commercialization and provision of energy services | Indirect

100% |

CPFL Comercialização Cone Sul S.A. ("CPFL Cone Sul") | Private corporation | Energy commercialization | Indirect

100% |

CPFL Planalto Ltda. ("CPFL Planalto") | Limited company | Energy commercialization | Direct

100% |

CPFL Brasil Varejista S.A. ("CPFL Brasil Varejista") | Private corporation | Energy commercialization | Indirect

100% |

Services | Company Type | Core activity | Equity Interest |

CPFL Serviços, Equipamentos, Industria e Comércio S.A. ("CPFL Serviços") | Private corporation | Manufacturing, commercialization, rental and maintenance of electro-mechanical equipment and service provision | Direct

100% |

NECT Serviços Administrativos Ltda. ("Nect") | Limited company | Provision of administrative services | Direct

100% |

CPFL Atende Centro de Contatos e Atendimento Ltda. ("CPFL Atende") | Limited company | Provision of telephone answering services | Direct

100% |

CPFL Total Serviços Administrativos Ltda. ("CPFL Total") | Limited company | Billing and collection services | Direct

100% |

CPFL Eficiência Energética S.A. ("CPFL Eficiência") | Private corporation | Management in Energy Efficiency | Direct

100% |

TI Nect Serviços de Informática Ltda. ("Authi") | Limited company | IT services | Direct

100% |

CPFL GD S.A. ("CPFL GD") | Private corporation | Electric energy generation services | Indirect

100% |

Others | Company Type | Core activity | Equity Interest |

CPFL Jaguari de Geração de Energia Ltda. ("Jaguari Geração") | Limited company | Venture capital company | Direct

100% |

Chapecoense Geração S.A. ("Chapecoense") | Private corporation | Venture capital company | Indirect

51% |

Sul Geradora Participações S.A. ("Sul Geradora") | Private corporation | Venture capital company | Indirect

99.95% |

CPFL Telecom S.A. ("CPFL Telecom") | Private corporation | Telecommunication services | Direct

100% |

| 4Q18/2018 Results | March 28, 2019 |

3.1) Consolidation of CPFL Renováveis Financial Statements

On December 31, 2018, CPFL Energia indirectly held 51.56% of CPFL Renováveis, through its subsidiary CPFL Geração. CPFL Renováveis has been fully consolidated (100%, line by line), in CPFL Energia’s financial statements since August 1, 2011, and the interest held by the non-controlling shareholders has been mentioned bellow the net income line (in the Financial Statements), as “Non-Controlling Shareholders’ Interest”, and in the Shareholders Equity (in the Balance Sheet) in the line with the same name.

3.2) Consolidation of RGE Sul Financial Statements

On December 31, 2018, CPFL Energia held the following stake in the capital stock of RGE Sul: 89,0107%, directly, and 10,9893%, indirectly, through CPFL Brasil. RGE Sul has been fully consolidated (100%, line by line), in CPFL Energia’s financial statements since November 1st, 2016.

3.3) Economic-Financial Performance Presentation

In accordance with U.S. SEC (Securities and Exchange Commission) guidelines and pursuant to items 100(a) and (b) of Regulation G, with the disclosure of 4Q16/2016 results, in order to avoid the disclosure of non-GAAP measures, we no longer disclose the economic-financial performance considering the proportional consolidation of the generation projects and the adjustment of the numbers for non-recurring items, focusing the disclosure in the IFRS criterion. Only in chapter 5, of Indebtedness, we continue presenting the information in the financial covenants criterion, considering that the proper reconciliation with the numbers in the IFRS criterion are presented in item 12.11 of this report.

3.4) Consolidation of Transmission Companies

As of 4Q17, the subsidiaries CPFL Transmissão Piracicaba and CPFL Transmissão Morro Agudo are consolidated in the financial statements of the segment "Conventional Generation".

| 4Q18/2018 Results | March 28, 2019 |

4) ECONOMIC-FINANCIAL PERFORMANCE

Consolidated Income Statement - CPFL ENERGIA (R$ Million) |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Gross Operating Revenue | 10,314 | 11,093 | -7.0% | 42,626 | 40,053 | 6.4% |

Net Operating Revenue | 6,686 | 7,460 | -10.4% | 28,137 | 26,745 | 5.2% |

Cost of Electric Power | (3,885) | (4,696) | -17.3% | (17,838) | (16,902) | 5.5% |

Operating Costs & Expenses | (1,943) | (1,844) | 5.4% | (6,590) | (6,822) | -3.4% |

EBIT | 858 | 920 | -6.7% | 3,708 | 3,022 | 22.7% |

EBITDA1 | 1,354 | 1,366 | -0.9% | 5,637 | 4,864 | 15.9% |

Financial Income (Expense) | (271) | (290) | -6.7% | (1,103) | (1,488) | -25.9% |

Income Before Taxes | 681 | 689 | -1.3% | 2,940 | 1,847 | 59.2% |

Net Income | 670 | 498 | 34.7% | 2,166 | 1,243 | 74.2% |

Note: (1) EBITDA is calculated from the sum of net income, taxes, financial result and depreciation/amortization, according to CVM Instruction no. 527/12. See the calculation in item 4.6 of this report.

4.1) Opening of economic-financial performance by business segment

Income Statement by business segment - CPFL Energia (R$ million) |

| | Distribution | | Conventional Generation | | Renewable Generation | | Commerciali-zation | | Services | | Others | | Eliminations | | Total |

4Q18 |

Net operating revenue | | 5,160 | | 285 | | 516 | | 963 | | 153 | | - | | (391) | | �� 6,686 |

Operating costs and expenses | | (4,434) | | (66) | | (218) | | (948) | | (137) | | (13) | | 391 | | (5,426) |

Depreciation e amortization | | (196) | | (29) | | (155) | | (1) | | (6) | | (16) | | - | | (402) |

Income from electric energy service | | 530 | | 190 | | 143 | | 14 | | 10 | | (29) | | - | | 858 |

Equity accounting | | - | | 93 | | - | | - | | - | | - | | - | | 93 |

EBITDA | | 726 | | 312 | | 298 | | 14 | | 16 | | (13) | | - | | 1,354 |

Financial result | | (61) | | (43) | | (129) | | 0 | | 1 | | (38) | | - | | (271) |

Income (loss) before taxes | | 469 | | 240 | | 14 | | 14 | | 11 | | (67) | | - | | 681 |

Income tax and social contribution | | 42 | | (5) | | 93 | | (4) | | (14) | | (122) | | - | | (10) |

Net income (loss) | | 511 | | 234 | | 107 | | 10 | | (3) | | (189) | | - | | 670 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

4Q17 |

Net operating revenue | | 5,750 | | 295 | | 591 | | 1,044 | | 140 | | 0 | | (360) | | 7,460 |

Operating costs and expenses | | (5,082) | | (80) | | (237) | | (991) | | (113) | | (11) | | 360 | | (6,153) |

Depreciation e amortization | | (179) | | (30) | | (155) | | (1) | | (5) | | (16) | | - | | (387) |

Income from electric energy service | | 489 | | 185 | | 199 | | 53 | | 21 | | (27) | | - | | 920 |

Equity accounting | | - | | 60 | | - | | - | | - | | - | | - | | 60 |

EBITDA | | 668 | | 275 | | 354 | | 53 | | 27 | | (11) | | 0 | | 1,366 |

Financial result | | (88) | | (63) | | (124) | | (8) | | 2 | | (9) | | (0) | | (290) |

Income (loss) before taxes | | 401 | | 181 | | 75 | | 45 | | 23 | | (36) | | - | | 689 |

Income tax and social contribution | | (64) | | 4 | | (24) | | (15) | | (6) | | (87) | | - | | (192) |

Net income (loss) | | 337 | | 185 | | 51 | | 29 | | 17 | | (123) | | - | | 498 |

| | | | | | | | | | | | | | | | | |

Variation |

Net operating revenue | | -10.2% | | -3.4% | | -12.7% | | -7.8% | | 9.7% | | -100.0% | | 8.6% | | -10.4% |

Operating costs and expenses | | -12.7% | | -16.7% | | -8.1% | | -4.3% | | 21.4% | | 20.4% | | 8.6% | | -11.8% |

Depreciation e amortization | | 9.5% | | -4.6% | | -0.2% | | -14.5% | | 6.0% | | 0.0% | | - | | 4.0% |

Income from electric energy service | | 8.5% | | 2.5% | | -28.0% | | -73.7% | | -51.7% | | 8.4% | | - | | -6.7% |

Equity accounting | | - | | 56.2% | | - | | - | | - | | - | | - | | 56.2% |

EBITDA | | 8.7% | | 13.4% | | -15.8% | | -73.0% | | -40.0% | | 20.4% | | -100.0% | | -0.9% |

Financial result | | -30.5% | | -31.7% | | 4.7% | | - | | -73.8% | | 312.7% | | -100.0% | | -6.7% |

Income (loss) before taxes | | 16.9% | | 32.2% | | -81.6% | | -68.4% | | -53.6% | | 85.7% | | - | | -1.3% |

Income tax and social contribution | | - | | - | | - | | -74.0% | | 128.9% | | 41.3% | | - | | -94.5% |

Net income (loss) | | 51.8% | | 26.4% | | 108.4% | | -65.5% | | - | | 54.3% | | - | | 34.7% |

Note: an analysis of the economic-financial performance by business segment is presented in chapter 11.

| 4Q18/2018 Results | March 28, 2019 |

Income Statement by business segment - CPFL Energia (R$ million) |

| | Distribution | | Conventional Generation | | Renewable Generation | | Commerciali-zation | | Services | | Others | | Eliminations | | Total |

2018 |

Net operating revenue | | 22,467 | | 1,144 | | 1,936 | | 3,496 | | 533 | | - | | (1,441) | | 28,137 |

Operating costs and expenses | | (19,463) | | (207) | | (728) | | (3,400) | | (438) | | (39) | | 1,441 | | (22,834) |

Depreciation e amortization | | (767) | | (116) | | (623) | | (2) | | (23) | | (63) | | - | | (1,594) |

Income from electric energy service | | 2,237 | | 821 | | 586 | | 94 | | 73 | | (102) | | - | | 3,708 |

Equity accounting | | - | | 334 | | - | | - | | - | | - | | - | | 334 |

EBITDA | | 3,004 | | 1,272 | | 1,209 | | 96 | | 95 | | (39) | | - | | 5,637 |

Financial result | | (310) | | (248) | | (504) | | (13) | | (0) | | (27) | | - | | (1,103) |

Income (loss) before taxes | | 1,928 | | 907 | | 82 | | 81 | | 72 | | (129) | | - | | 2,940 |

Income tax and social contribution | | (495) | | (137) | | 37 | | (28) | | (30) | | (122) | | - | | (774) |

Net income (loss) | | 1,432 | | 770 | | 119 | | 53 | | 43 | | (251) | | - | | 2,166 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

2017 |

Net operating revenue | | 21,077 | | 1,190 | | 1,959 | | 3,414 | | 486 | | 1 | | (1,382) | | 26,745 |

Operating costs and expenses | | (18,842) | | (304) | | (737) | | (3,243) | | (398) | | (51) | | 1,382 | | (22,194) |

Depreciation e amortization | | (704) | | (121) | | (617) | | (3) | | (20) | | (65) | | - | | (1,529) |

Income from electric energy service | | 1,531 | | 766 | | 605 | | 168 | | 68 | | (115) | | - | | 3,022 |

Equity accounting | | - | | 312 | | - | | - | | - | | - | | - | | 312 |

EBITDA | | 2,234 | | 1,200 | | 1,222 | | 171 | | 87 | | (50) | | - | | 4,864 |

Financial result | | (566) | | (329) | | (511) | | (33) | | 4 | | (53) | | - | | (1,488) |

Income (loss) before taxes | | 964 | | 750 | | 94 | | 135 | | 72 | | (168) | | - | | 1,847 |

Income tax and social contribution | | (300) | | (96) | | (74) | | (45) | | (17) | | (73) | | - | | (604) |

Net income (loss) | | 665 | | 654 | | 20 | | 90 | | 55 | | (241) | | - | | 1,243 |

| | | | | | | | | | | | | | | | | |

Variation |

Net operating revenue | | 6.6% | | -3.9% | | -1.2% | | 2.4% | | 9.7% | | -100.0% | | 4.2% | | 5.2% |

Operating costs and expenses | | 3.3% | | -31.8% | | -1.3% | | 4.8% | | 9.9% | | -23.1% | | 4.2% | | 2.9% |

Depreciation e amortization | | 9.0% | | -3.5% | | 1.0% | | -23.2% | | 14.0% | | -3.3% | | - | | 4.3% |

Income from electric energy service | | 46.2% | | 7.2% | | -3.1% | | -43.9% | | 7.4% | | -11.0% | | - | | 22.7% |

Equity accounting | | - | | 7.0% | | - | | - | | - | | - | | - | | 7.0% |

EBITDA | | 34.5% | | 6.1% | | -1.1% | | -43.5% | | 8.9% | | -21.1% | | - | | 15.9% |

Financial result | | -45.3% | | -24.4% | | -1.3% | | -60.4% | | - | | -48.6% | | - | | -25.9% |

Income (loss) before taxes | | 99.9% | | 21.0% | | -13.1% | | -39.9% | | 0.8% | | -22.9% | | - | | 59.2% |

Income tax and social contribution | | 65.3% | | 43.3% | | - | | -37.2% | | 73.8% | | 67.0% | | - | | 28.2% |

Net income (loss) | | 115.5% | | 17.7% | | 504.2% | | -41.2% | | -21.7% | | 4.3% | | - | | 74.2% |

Note: an analysis of the economic-financial performance by business segment is presented in chapter 11.

4.2) Sectoral Financial Assets and Liabilities

In 4Q18, it was accounted the totalsectoral financial liabilities in the amount of R$ 735 million, compared to the totalsectoral financial assets in the amount of R$ 852 million in 4Q17, a variation of R$ 1,586 million. In 2018, it was accounted the totalsectoral financial assets in the amount of R$ 1,208 million, compared to the totalsectoral financial assets in the amount of R$ 1,901 million in 2017, a reduction of 36.5% (R$ 693 million).

On December 31, 2018, the balance of these sectoral financial assets and liabilities was positive in R$ 1,508 million, compared to a positive balance of R$ 2,207 million on September 30, 2018 and a positive balance of R$ 517 million on December 31, 2017.

As established by the applicable regulation, any sectoral financial assets or liabilities shall be included in the tariffs of the distributors in their respective annual tariff events.

4.3) Operating Revenue

In 4Q18, gross operating revenue reached R$ 10,314 million, representing a reduction of 7.0% (R$ 780 million). Deductions from the gross operating revenue was of R$ 3,627 million in 4Q18, representing a reduction of 0.2% (R$ 7 million). Net operating revenue reached R$ 6,686 million in 4Q18, registering a reduction of 10.4% (R$ 773 million).

The main factors that affected the net operating revenue were:

· Reduction of revenues in the Distribution segment, in the amount of R$ 589 million (for more details, see item 11.1.1.2);

| 4Q18/2018 Results | March 28, 2019 |

· Reduction of revenues in the Commercialization segment, in the amount of R$ 81 million;

· Reduction of revenues in the Renewable Generation segment, in the amount of R$ 75 million;

· Reduction of R$ 31 million, due to eliminations;

· Reduction of revenues in the Conventional Generation segment, in the amount of R$ 10 million;

Partially offset by:

· Increase of revenues in the Services segment, in the amount of R$ 14 million.

In 2018, gross operating revenue reached R$ 42,626 million, representing an increase of 6.4% (R$ 2,573 million). Deductions from the gross operating revenue was of R$ 14,490 million in 2018, representing an increase of 8.9% (R$ 1,181 million). Net operating revenue reached R$ 28,137 million in 2018, registering an increase of 5.2% (R$ 1,392 million).

The main factors that affected the net operating revenue were:

· Increase of revenues in the Distribution segment, in the amount of R$ 1,391 million (for more details, see item 11.1.1.2);

· Increase of revenues in the Commercialization segment, in the amount of R$ 82 million;

· Increase of revenues in the Services segment, in the amount of R$ 47 million;

Partially offset by:

· Reduction of R$ 59 million, due to eliminations;

· Reduction of revenues in the Conventional Generation segment, in the amount of R$ 46 million;

· Reduction of revenues in the Renewable Generation segment, in the amount of R$ 23 million;

· Reduction of revenues in Others, in the amount of R$ 1 million.

4.4) Cost of Electric Energy

Cost of Electric Energy (R$ Million) |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Cost of Electric Power Purchased for Resale | | | | | | |

Energy from Itaipu Binacional | 643 | 587 | 9.6% | 2,668 | 2,351 | 13.5% |

PROINFA | 81 | 77 | 5.0% | 331 | 293 | 12.8% |

Energy Purchased through Auction in the Regulated Environment, Bilateral Contracts and Energy Purchased in the Spot Market | 2,893 | 4,071 | -28.9% | 13,970 | 14,536 | -3.9% |

PIS and COFINS Tax Credit | (317) | (428) | -26.1% | (1,503) | (1,563) | -3.8% |

Total | 3,300 | 4,306 | -23.4% | 15,466 | 15,617 | -1.0% |

| | | | | | | |

Charges for the Use of the Transmission and Distribution System | | | | | | |

Basic Network Charges | 485 | 554 | -12.5% | 2,115 | 1,542 | 37.2% |

Itaipu Transmission Charges | 68 | 63 | 7.5% | 266 | 160 | 66.5% |

Connection Charges | 47 | 32 | 46.7% | 163 | 123 | 32.9% |

Charges for the Use of the Distribution System | 14 | 10 | 43.5% | 49 | 39 | 23.7% |

System Service Usage Charges - ESS | 32 | (229) | - | (106) | (453) | -76.6% |

Reserve Energy Charges - EER | (0) | (0) | -48.6% | 135 | (0) | - |

PIS and COFINS Tax Credit | (60) | (39) | 54.9% | (249) | (126) | 97.6% |

Total | 585 | 390 | 49.9% | 2,372 | 1,284 | 84.7% |

| | | | | | | |

Cost of Electric Energy | 3,885 | 4,696 | -17.3% | 17,838 | 16,902 | 5.5% |

In 4Q18, the cost of electric energy, comprising the purchase of electricity for resale and charges for the use of the distribution and transmission system, amounted to R$ 3,885 million, registering areduction of 17.3% (R$ 811 million).

| 4Q18/2018 Results | March 28, 2019 |

The factors that explain these variations follow below:

· The cost of electric power purchased for resale reached R$ 3,300 million in 4Q18, a reduction of 23.4% (R$ 1,006 million), due to the following factors:

(i) Reduction of 28.9% (R$ 1,178 million) in the cost of energy purchased through auction in the regulated environment, bilateral contracts and energy purchased in the spot market, due to the reductions of 28.2% in the average purchase price (R$ 181.72/MWh in 4Q18 vs. R$ 253.02/MWh in 4Q17) and of 1.1% (170 GWh) in the volume of purchased energy;

Partially offset by:

(ii) Reduction of 26.1% (R$ 112 million) in PIS and COFINS tax credits (cost reducer), generated from the energy purchase;

(iii) Increase of 9.6% (R$ 56 million) in the cost of energy from Itaipu, due to the increase of 16.1% in the average purchase price (R$ 229.13/MWh in 4Q18 vs. R$ 197.38/MWh in 4Q17), partially offset by the reduction of 5.6% (167 GWh) in the volume of purchased energy;

(iv) Increase of 5.0% (R$ 4 million) in the amount of PROINFA cost, due to the increase of 6.1% in the average purchase price (R$ 264.09/MWh in 4Q18 vs. R$ 248.90/MWh in 4Q17), partially offset by the reduction of 1.0% (3 GWh) in the volume of purchased energy;

· Charges for the use of the transmission and distribution system reached R$ 585 million in 4Q18, an increase of 49.9% (R$ 195 million), due to the following factors:

(i) Variation of R$ 261 million in the System Service Usage Charges – ESS, from a revenue of R$ 229 million in 4Q17 to an expense of R$ 32 million in 4Q18;

(ii) Increase of 46.7% (R$ 15 million) in charges for connection;

(iii) Increase of 7.5% (R$ 5 million) in Itaipu transmission charges;

(iv) Increase of 43.5% (R$ 4 million) in charges for usage of the distribution system;

Partially offset by:

(v) Reduction of 12.5% (R$ 69 million) in the basic network charges;

(vi) Increase of 54.9% (R$ 21 million) in PIS and COFINS tax credits (cost reducer), generated from the charges.

In 2018, the cost of electric energy, comprising the purchase of electricity for resale and charges for the use of the distribution and transmission system, amounted to R$ 17,838 million, registering an increase of 5.5% (R$ 937 million).

The factors that explain these variations follow below:

· The cost of electric power purchased for resale reached R$ 15,466 million in 2018, a reduction of 1.0% (R$ 151 million), due to the following factors:

(i) Reduction of 3.9% (R$ 566 million) in the cost of energy purchased through auction in the regulated environment, bilateral contracts and energy purchased in the spot market, due to the reduction of 5.5% (3,592 GWh) in the volume of purchased energy, partially offset by the increase of 1.7% in the average purchase price (R$ 227.30/MWh in 2018 vs. R$ 223.45/MWh in 2017);

| 4Q18/2018 Results | March 28, 2019 |

Partially offset by:

(ii) Increase of 13.5% (R$ 317 million) in the cost of energy from Itaipu, due to the increase of 20.3% in the average purchase price (R$ 240.03/MWh in 2018 vs. R$ 199.58/MWh in 2017), partially offset by the reduction of 5.6% (662 GWh) in the volume of purchased energy;

(iii) Reduction of 3.8% (R$ 60 million) in PIS and COFINS tax credits (cost reducer), generated from the energy purchase;

(iv) Increase of 12.8% (R$ 37 million) in the amount of PROINFA cost, due to the increase of 15.9% in the average purchase price (R$ 297.52/MWh in 2018 vs. R$ 256.69/MWh in 2017), partially offset by the reduction of 2.7% (31 GWh) in the volume of purchased energy.

· Charges for the use of the transmission and distribution system reached R$ 2,372 million in 2018, an increase of 84.7% (R$ 1,088 million), due to the following factors:

(i) Increase of 37.2% (R$ 573 million) in the basic network charges;

(ii) Reduction of 76.6% (R$ 347 million) in the System Service Usage Charges – ESS (cost reducer), from a revenue of R$ 453 million in 2017 to a revenue of R$ 106 million in 2018;

(iii) Expense of R$ 135 million in 2018, related to Reserve Energy Charges – EER;

(iv) Increase of 66.5% (R$ 106 million) in Itaipu transmission charges;

(v) Increase of 32.9% (R$ 40 million) in charges for connection;

(vi) Increase of 23.7% (R$ 9 million) in charges for usage of the distribution system;

Partially offset by:

(vii) Increase of 97.6% (R$ 123 million) in PIS and COFINS tax credits (cost reducer), generated from the charges.

4.5) Operating Costs and Expenses

Operating costs and expenses reached R$ 1,943 million in 4Q18, compared to R$ 1,844 million in 4Q17, an increase of 5.4% (R$ 100 million). In 2018, operating costs and expenses reached R$ 6,590 million, compared to R$ 6,822 million in 2017, a reduction of 3.4% (R$ 232 million).

The factors that explain these variations follow below:

PMSO

| 4Q18/2018 Results | March 28, 2019 |

Reported PMSO (R$ million) |

| 4Q18 | 4Q17 | Variation | 2018 | 2017 | Variação |

| R$ MM | % | R$ MM | % |

Reported PMSO | | | | | | | | |

Personnel | (380) | (379) | (1) | 0.4% | (1,414) | (1,377) | (37) | 2.7% |

Material | (70) | (68) | (2) | 3.1% | (258) | (250) | (8) | 3.2% |

Outsourced Services | (193) | (179) | (14) | 8.0% | (692) | (727) | 35 | -4.9% |

Other Operating Costs/Expenses | (306) | (210) | (96) | 45.8% | (770) | (753) | (17) | 2.2% |

Allowance for doubtful accounts | (56) | (36) | (19) | 53.3% | (169) | (155) | (14) | 9.1% |

Legal and judicial expenses | (74) | (66) | (8) | 11.6% | (187) | (188) | 2 | -0.9% |

Others | (177) | (107) | (69) | 64.4% | (414) | (409) | (4) | 1.1% |

Total Reported PMSO | (950) | (836) | (114) | 13.6% | (3,134) | (3,107) | (27) | 0.9% |

The PMSO item reached R$ 950 million in 4Q18, compared to R$ 836 million in 4Q17, an increase of 13.6% (R$ 114 million), due to the following factors:

(i) Personnel - increase of 0.4% (R$ 1 million), mainly due to the collective bargaining agreement – wages and benefits;

(ii) Material - increase of 3.1% (R$ 2 million), mainly due to the increase in thereplacement of material to the maintenance of lines and grid;

(iii) Outsourced services - increase of 8.0% (R$ 14 million), mainly due to the increases inmaintenance services in lines, network and substations and in outsourced services;

(iv) Other operational costs/expenses-increase of 45.8% (R$ 96 million), mainly due to:

ü Increase of 278.8% (R$ 91 million) of loss on disposal, retirement and other noncurrent assets;

ü Increase of 53.3% (R$ 19 million) in allowance for doubtful account;

ü Increase of 11.6% (R$ 8 million) in legal and judicial expenses;

Partially offset by:

ü Compensation for non-compliance with technical indicators (R$ 16 million), which from January 2018 onwards was classified under Other Revenues;

ü Other effects (R$ 6 million).

In 2018, the PMSO item reached R$ 3,134 million, compared to R$ 3,107 million in 2017, an increase of 0.9% (R$ 27 million), due to the following factors:

(i) Personnel - increase of 2.7% (R$ 37 million), mainly due to the collective bargaining agreement – wages and benefits;

(ii) Material - increase of 3.2% (R$ 8 million), mainly due to the increase in thereplacement of material to the maintenance of lines and grid;

(iii) Outsourced services - reduction of 4.9% (R$ 35 million), mainly due to the reductionsin other outsourced services and in maintenance in machinery and equipment;

(iv) Other operational costs/expenses - increase of 2.2% (R$ 17 million), mainly due to:

| 4Q18/2018 Results | March 28, 2019 |

ü Increase of 59.5% (R$ 79 million) of loss on disposal, retirement and other noncurrent assets;

ü Increase of 9.1% (R$ 14 million) in allowance for doubtful account;

Partially offset by:

ü Compensation for non-compliance with technical indicators (R$ 50 million), which from January 2018 onwards was classified under Other Revenues;

ü Provision for impairment (R$ 20 million);

ü Reduction of 0.9% (R$ 2 million) in legal and judicial expenses;

ü Other effects (R$ 4 million).

Other operating costs and expenses

Other operating costs and expenses reached R$ 994 million in 4Q18, compared to R$ 1,008 million in 4Q17, registering a reduction of 1.4% (R$ 14 million), due to the following factors:

· Reduction of 4.0% (R$ 24 million) inCosts of Building the Infrastructure item;

· Reduction of 21.0% (R$ 6 million) inPrivate Pension Fund item, due to the registration of the impacts of the 2018 actuarial report;

Partially offset by:

· Increase of 4.3% (R$ 14 million) inDepreciation and Amortization item;

· Increase of 2.9% (R$ 2 million) inAmortization of Intangible of Concession Asset item.

In 2018, other operating costs and expenses reached R$ 3,456 million, compared to R$ 3,715 million in 2017, registering a reduction of 7.0% (R$ 259 million), due to the following factors:

· Reduction of 14.5% (R$ 300 million) inCosts of Building the Infrastructure item;

· Reduction of 21.1% (R$ 24 million) inPrivate Pension Fund item, due to the registration of the impacts of the 2018 actuarial report;

Partially offset by:

· Increase of 5.2% (R$ 64 million) inDepreciation and Amortization item;

· Increase of 0.2% (R$ 1 million) inAmortization of Intangible of Concession Asset item.

4.6) EBITDA

In 4Q18,EBITDA reached R$ 1,354 million, compared to R$ 1,366 million in 4Q17, registering a reduction of 0.9% (R$ 12 million). In 2018,EBITDA reached R$ 5,637 million, compared to R$ 4,864 million in 2017, registering an increase of 15.9% (R$ 773 million).

EBITDA is calculated according to CVM Instruction no. 527/12 and showed in the table below:

| 4Q18/2018 Results | March 28, 2019 |

EBITDA and Net Income conciliation (R$ million) |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Net Income | 670 | 498 | 34.7% | 2,166 | 1,243 | 74.2% |

De preciation and Amortization | 403 | 387 | | 1,595 | 1,530 | |

Financial Result | 271 | 290 | | 1,103 | 1,488 | |

Income Tax / Social Contribution | 10 | 192 | | 774 | 604 | |

EBITDA | 1,354 | 1,366 | -0.9% | 5,637 | 4,864 | 15.9% |

4.7) Financial Result

|

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Revenues | | | | | | |

Income from Financial Investments | 47 | 74 | -35.9% | 223 | 457 | -51.3% |

Additions and Late Payment Fines | 73 | 62 | 18.6% | 276 | 265 | 4.1% |

Fiscal Credits Update | 2 | 5 | -53.0% | 15 | 20 | -24.5% |

Judicial Deposits Update | 9 | 10 | -3.7% | 37 | 50 | -24.6% |

Monetary and Foreign Exchange Updates | 19 | 11 | 78.7% | 70 | 61 | 15.1% |

Discount on Purchase of ICMS Credit | 9 | 7 | 28.9% | 34 | 16 | 106.1% |

Sectoral Financial Assets Update | 36 | - | - | 80 | - | - |

PIS and COFINS - over Other Financial Revenues | (12) | (11) | 5.3% | (46) | (48) | -4.4% |

PIS and COFINS over Interest on Own Capital | (39) | (26) | 50.1% | (39) | (28) | 41.6% |

Others | 39 | 41 | -5.9% | 113 | 87 | 29.0% |

Total | 184 | 171 | 7.1% | 762 | 880 | -13.4% |

| | | | | | | |

Expenses | | | | | | |

Debt Charges | (326) | (340) | -4.1% | (1,329) | (1,661) | -20.0% |

Monetary and Foreign Exchange Updates | (69) | (104) | -33.4% | (368) | (540) | -31.8% |

(-) Capitalized Interest | 8 | 8 | -0.1% | 29 | 51 | -43.4% |

Sectoral Financial Liabilities Update | - | (2) | -100.0% | - | (82) | -100.0% |

Use of Public Asset | (4) | (3) | 20.1% | (18) | (8) | 120.7% |

Others | (63) | (21) | 198.6% | (179) | (127) | 41.1% |

Total | (454) | (461) | -1.5% | (1,865) | (2,368) | -21.2% |

| | | | | | | |

Financial Result | (271) | (290) | -6.7% | (1,103) | (1,488) | -25.9% |

In 4Q18,net financial expense was of R$ 271 million, a reduction of 6.7% (R$ 19 million) compared to the net financial expense of R$ 290 million reported in 4Q17.

The items explaining these variations in Financial Result are as follows:

· Financial Revenues: increase of 7.1% (R$ 12 million), from R$ 171 million in 4Q17 to R$ 184 million in 4Q18, mainly due to the following factors:

(i) Sectoral financial assets update in 4Q18, in the amount of R$ 36 million;

(ii) Increase of 18.6% (R$ 11 million) inadditions and late payment fines;

(iii) Increase of 78.7% (R$ 9 million) in themonetary and foreign exchange updates, due to the increases: (a) of R$ 12 million in revenues from fines, interest and monetary adjustment relating to installment payments made by consumers, and (b) of R$ 4 million in other monetary and foreign exchange updates; partially offset by the reductions (c) of R$ 6 million in the update of the balance of tariff subsidies, as determined by ANEEL,and (d) of R$ 1 million in gains with the zero-cost collar derivative1;

| 4Q18/2018 Results | March 28, 2019 |

(iv) Increase of 28.9% (R$ 2 million) indiscount on the acquisition of ICMS credit;

Partially offset by:

(v) Reduction of 35.9% (R$ 26 million) in theincome from financial investments, due to the reductions in the CDI interbank rate and in the average balance of investments;

(vi) Increase of 50.1% (R$ 13 million) inPIS and COFINS over Interest on Own Capital (revenue reducer);

(vii) Reduction of 53.0% (R$ 3 million) infiscal credits update;

(viii) Reduction of 5.9% (R$ 2 million) inother financial revenues;

(ix) Increase of 5.3% (R$ 1 million) inPIS and COFINS over Other Financial Revenue (revenue reducer).

· Financial Expenses: reduction of 1.5% (R$ 7 million), from R$ 461 million in 4Q17 to R$ 454 million in 4Q18, mainly due to the following factors:

(i) Reduction of 33.4% (R$ 35 million) in themonetary and foreign exchange updates, due to: (a) the mark-to-market positive effect for financial operations under Law 4,131 – non-cash effect (R$ 21 million), (b) the effect of Itaipu’s exchange variation (R$ 13 million), and (c) the reduction of debt charges in foreign currency, with swap to CDI interbank rate (R$ 1 million);

(ii) Reduction of 4.1% (R$ 14 million) ofdebt charges in local currency, due to the reduction in the CDI interbank rate;

(iii) Sectoral financial liabilities update in 4Q17, in the amount of R$ 2 million (expense reducer);

Partially offset by:

(iv) Increase of 198.6% (R$ 42 million) inother financial expenses;

(v) Increase of 20.1% (R$ 1 million) in thefinancial expenses with the Use of Public Asset (UBP).

In 2018,net financial expense was of R$ 1,103 million, a reduction of 25.9% (R$ 385 million) compared to the net financial expense of R$ 1,488 million reported in 2017.

The items explaining these variations in Financial Result are as follows:

· Financial Revenues: reduction of 13.4% (R$ 118 million), from R$ 880 million in 2017 to R$ 762 million in 2018, mainly due to the following factors:

(i) Reduction of 51.3% (R$ 234 million) in theincome from financial investments, due to the reductions in the CDI interbank rate and in the average balance of investments;

(ii) Reduction of 24.6% (R$ 12 million) injudicial deposits update;

(iii) Increase of 41.6% (R$ 12 million) inPIS and COFINS over Interest on Own Capital (revenue reducer);

1In 2015, subsidiary CPFL Geração contracted US$ denominated put and call options, involving the same financial institution as counterpart, and which on a combined basis are characterized as an operation usually known as zero-cost collar. The contracting of this operation does not involve any kind of speculation, inasmuch as it is aimed at minimizing any negative impacts on future revenues of the joint venture ENERCAN, which has electric energy sale agreements with annual restatement of part of the tariff based on the variation in the US$. In addition, according to Management’s view, the scenario was favorable for contracting this type of financial instrument, considering the high volatility implicit in dollar options and the fact that there was no initial cost for same.

| 4Q18/2018 Results | March 28, 2019 |

(iv) Reduction of 24.5% (R$ 5 million) infiscal credits update;

Partially offset by:

(v) Sectoral financial assets update in 2018, in the amount of R$ 80 million;

(vi) Increase of 29.0% (R$ 25 million) inother financial revenues;

(vii) Increase of 106.1% (R$ 17 million) indiscount on the acquisition of ICMS credit;

(viii) Increase of 4.1% (R$ 11 million) inadditions and late payment fines;

(ix) Increase of 15.1% (R$ 9 million) in themonetary and foreign exchange updates, due to: (a) the increase of R$ 38 million in revenues from fines, interest and monetary adjustment relating to installment payments made by consumers; partially offset by the reductions (b) of R$ 20 million in the gains with the zero-cost collar derivative, (c) of R$ 5 million in other monetary and foreign exchange updates, and (d) of R$ 4 million in the update of the balance of tariff subsidies, as determined by ANEEL;;

(x) Reduction of 4.4% (R$ 2 million) inPIS and COFINS over Other Financial Revenue (revenue reducer).

· Financial Expenses: reduction of 21.2% (R$ 503 million), from R$ 2,368 million in 2017 to R$ 1,865 million in 2018, mainly due to the following factors:

(i) Reduction of 20.0% (R$ 332 million) ofdebt charges in local currency, due to the reduction in the CDI interbank rate;

(ii) Reduction of 31.8% (R$ 172 million) in themonetary and foreign exchange updates, due to: (a) the reduction of debt charges in foreign currency, with swap to CDI interbank rate (R$ 145 million), (b) the mark-to-market positive effect for financial operations under Law 4,131 – non-cash effect (R$ 19 million), and (c) the effect of Itaipu’s exchange variation (R$ 7 million);

(iii) Sectoral financial liabilities update in 2017, in the amount of R$ 82 million;

Partially offset by:

(iv) Increase of 41.1% (R$ 52 million) inother financial expenses;

(v) Reduction of 43.4% (R$ 22 million) incapitalized interest (expense reducer);

(vi) Increase of 120.7% (R$ 10 million) in thefinancial expenses with the Use of Public Asset (UBP).

4.8) Net Income

Net incomewas of R$ 670 million in 4Q18, registering an increase of 34.7% (R$ 173 million) if compared to the net income of R$ 498 million observed in 4Q17. In 2018,net income was of R$ 2,166 million, registering an increase of 74.2% (R$ 923 million) if compared to the net income of R$ 1,243 million observed in 2017.

| 4Q18/2018 Results | March 28, 2019 |

5) INDEBTEDNESS

5.1) Debt (IFRS)

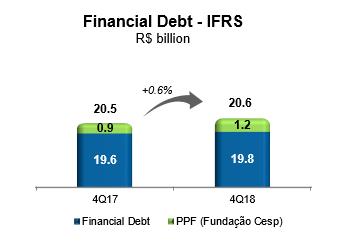

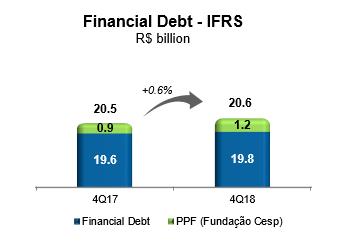

|

Note includes the mark-to-market (MTM) effect and borrowing costs. | |

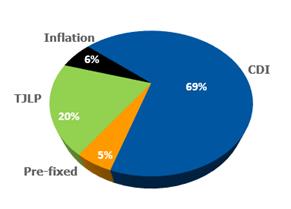

| Indexation after Hedge – 4Q17 vs. 4Q18 4Q17

| |

| 4Q18

| |

Note: for debt linked to foreign currency (25.6% of total in 4Q18), swap operations are contracted, aiming the protection ofthe foreign exchange and the rate linked to the contract.

| 4Q18/2018 Results | March 28, 2019 |

Net Debt in IFRS

IFRS | R$ Million | 4Q18 | 4Q17 | Var. % |

Financial Debt (including hedge) | (19,752) | (19,615) | 0.7% |

(+) Available Funds | 1,891 | 3,250 | -41.8% |

(=) Net Debt | (17,860) | (16,366) | 9.1% |

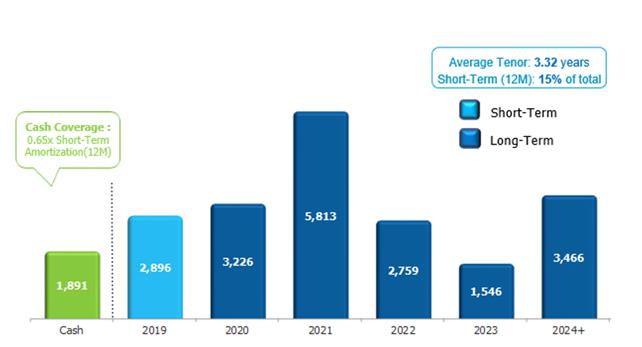

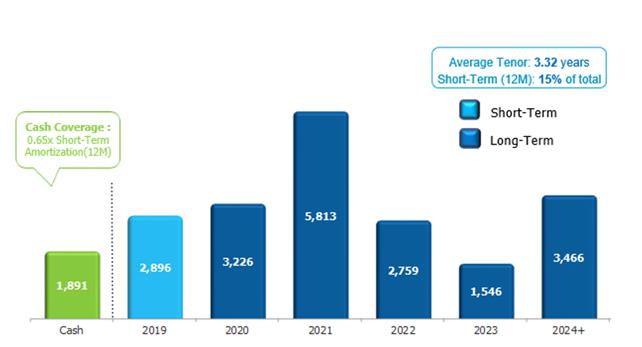

5.1.1) Debt Amortization Schedule in IFRS (Dec-18)

CPFL Energia has a large market access to liquidity sources through diversified funding alternatives, either through local market financing lines such as debenture issues, BNDES and other development banks, or through financing lines in the foreign market. This access to credit for the CPFL group is currently strengthened by the support of its shareholding structure, as State Grid gives greater robustness to CPFL group in financial market.

Notes:

1) Considers only the principal of the debt of R$ 19,706 million. In order to reach the value of debt in IFRS, of R$ 19,752 million, should be included charges and the mark-to-market (MTM) effect and cost with funding;

2) Short-term (January 2019 – December 2019) = R$ 2,896 million.

The cash position at the end of 4Q18 had a coverage ratio of0.65x the amortizations of the next 12 months, enough to honor all amortization commitments until the beginning of 2019. The average amortization term, calculated from this schedule, is of3.32 years.

| 4Q18/2018 Results | March 28, 2019 |

Gross Debt Cost1 in IFRS criteria

Note: (1) as of 2Q17, CPFL Energia started to calculate its debt average cost considering the end of the period, to better reflect the variations on interest rates.

5.2) Debt in Financial Covenants Criteria

5.2.1) Indexation and Debt Cost in Financial Covenants Criteria

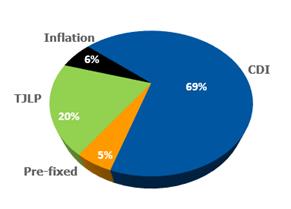

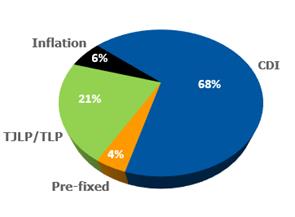

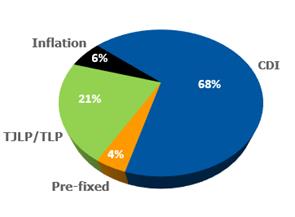

Indexation1 After Hedge2 in Financial Covenants Criteria – 4Q17 vs. 4Q18

4Q17

4Q18

1) Considering proportional consolidation of CPFL Renováveis, CERAN, ENERCAN, Foz do Chapecó and EPASA;

2) For debt linked to foreign currency (28.3% of total), swap operations are contracted, aiming the protection of the foreign exchange and the rate linked to the contract.

| 4Q18/2018 Results | March 28, 2019 |

5.2.2) Net Debt in Financial Covenants Criteria and Leverage

In 4Q18 Proforma Net Debt totaledR$ 16,274 million, an increase of12.3% compared to net debt position at the end of 4Q17, in the amount ofR$ 14,490 million.

Covenant Criteria (*) - R$ Million | 4Q18 | 4Q17 | Var. |

Financial Debt (including hedge)1 | (17,868) | (17,385) | 2.8% |

(+) Available Funds | 1,593 | 2,895 | -45.0% |

(=) Net Debt | (16,274) | (14,490) | 12.3% |

EBITDA Proforma2 | 5,343 | 4,531 | 17.9% |

Net Debt / EBITDA | 3.05 | 3.20 | -4.75% |

1) Considering proportional consolidation of CPFL Renováveis, CERAN, ENERCAN, Foz do Chapecó and EPASA;

2) Proforma EBITDA in the financial covenants criteria: adjusted according to equivalent participation of CPFL Energia in each of its subsidiaries, with the inclusion of regulatory assets and liabilities and the historical EBITDA of newly acquired projects.

In line with the criteria for calculation of financial covenants of loan agreements with financial institutions, net debt is adjusted according to the equivalent stake of CPFL Energia in each of its subsidiaries. Also, include in the calculation of Proforma EBITDA the effects of historic EBITDA of newly acquired projects. Considering that the Proforma Net Debt totaledR$ 16,274 million and Proforma EBITDA in the last 12 months reachedR$ 5,343 million, the ratio Proforma Net Debt / EBITDA at the end of 4Q18 reached3.05x.

6) INVESTMENTS

6.1) Actual Investments

Investments (R$ Million) |

Segment | 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Distribution | 617 | 618 | -0.2% | 1,770 | 1,883 | -6.0% |

Generation - Conventional | 6 | 6 | -0.8% | 12 | 9 | 28.4% |

Generation - Renewable | 51 | 55 | -7.5% | 225 | 621 | -63.7% |

Commercialization | 1 | 1 | -4.5% | 3 | 3 | 0.0% |

Services and Others1 | 18 | 13 | 32.9% | 53 | 55 | -3.2% |

Subtotal | 693 | 694 | -0.1% | 2,062 | 2,570 | -19.8% |

Transmission | 1 | 0 | 87.1% | 3 | 46 | -92.5% |

Total | 693 | 694 | -0.1% | 2,066 | 2,617 | -21.0% |

Note:

1) Others – basically refer to assets and transactions that are not related to the listed segments.

In 4Q18, investments were R$ 693 million, a reduction of 0.1% compared to 4Q17. In 2018, the investments were R$ 2,066 million, a reduction of 21.0%. Investments related to the transmission segment, according to IFRIC 15, are recorded as “Contractual Asset of Transmission Companies” (in other credits).

| 4Q18/2018 Results | March 28, 2019 |

We highlight investments made by CPFL Energia in each segment:

(i) Distribution:

a. Expansion and strengthening of the electric system;

b. Electricity system maintenance and improvements;

c. Operational infrastructure;

d. Upgrade of management and operational support systems;

e. Customer help services;

f. Research and development programs;

(ii) Generation:

a. Boa Vista II SHPP.

6.2) Investments Forecasts

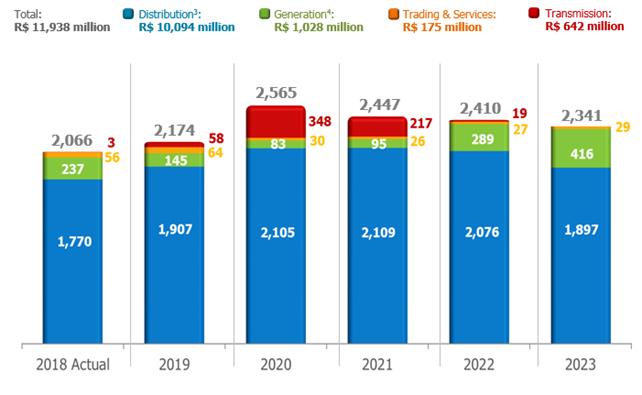

On November 30, 2018, CPFL Energia’s Board of Directors approved Board of Executive Officers’ proposal for 2019 Annual Budget and 2020/2023 Multiannual Plan for the Company, which was previously discussed by the Budget and Corporate Finance Commission.

Investments Forecasts (R$ million)1

Notes:

1) Constant currency;

2) Investment Plan released in 4Q18/2018 Earnings Release, from March 2019;

3) Disregard investments in Special Obligations (among other items financed by consumers);

4) Conventional + Renewable.

| 4Q18/2018 Results | March 28, 2019 |

7) ALLOCATION OF RESULTS

The Company’s Bylaws require the distribution of at least 25% of net income adjusted according to law, as dividends to its shareholders. The proposal for allocation of net income from the fiscal year is shown below:

Minimum Mandatory Dividend (25%)

The Board of Directors propose the payment of R$ 489 million in dividends to holders of common shares traded on B3 S.A. – Brasil, Bolsa, Balcão (B3). This proposed amount corresponds to R$ 0.480182232 per share, related to the fiscal year of 2018.

Statutory Reserve – Working Capital Reinforcement

For this fiscal year, considering the current macro scenario with an incipient economic recovery, and also considering the uncertainties regarding hydrology, the Company’s Management is proposing the allocation of R$ 2.235 million to the statutory reserve - working capital reinforcement.

8) STOCK MARKETS

8.1) Stock Performance

CPFL Energia is listed on both the B3 (Novo Mercado) and the New York Stock Exchange (NYSE) (ADR Level III), segments with the highest levels of corporate governance.

B3 | NYSE |

Date | CPFE3 (R$) | IEE | IBOV | Date | CPL (US$) | DJBr20 | Dow Jones |

12/31/2018 | R$ 28.85 | 49,266 | 87,887 | 12/31/2018 | $ 14.80 | 22,007 | 23,327 |

09/30/2018 | R$ 23.87 | 39,351 | 79,342 | 09/30/2018 | $ 11.82 | 19,406 | 26,458 |

12/31/2017 | R$ 19.35 | 39,732 | 76,402 | 12/31/2017 | $ 11.50 | 22,690 | 24,719 |

QoQ | 20.9% | 25.2% | 10.8% | QoQ | 25.2% | 13.4% | -11.8% |

YoY | 49.1% | 24.0% | 15.0% | YoY | 28.7% | -3.0% | -5.6% |

On December 31, 2018, CPFL Energia’s shares closed at R$ 28.85 per share on the B3 and US$14.80 per ADR on the NYSE, an appreciation in the quarter of 20.9% and 25.2%, respectively. Considering the variation in the last 12 months, the shares and ADRs presented an appreciation of 49.1% on the B3 and of 28.7% on the NYSE.

| 4Q18/2018 Results | March 28, 2019 |

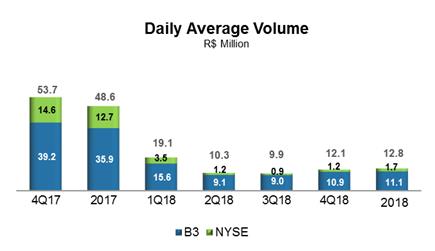

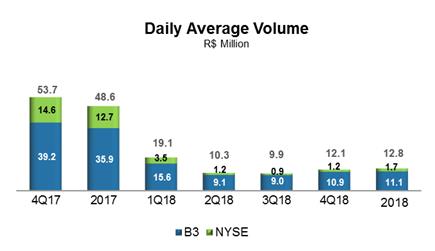

8.2) Daily Average Volume

The daily trading volume in 4Q18 averaged R$ 12.1 million, of which R$ 10.9 million on the B3 and R$ 1.2 million on the NYSE, representing a reduction of 77.5% in relation to 4Q17. The number of trades on the B3 decreased by 61.8%.

Note: Considers the sum of the average daily volume on the B3 and NYSE.

| 4Q18/2018 Results | March 28, 2019 |

9) CORPORATE GOVERNANCE

The corporate governance model adopted by CPFL Energia and its subsidiaries is based on the principles of transparency, equity, accountability and corporate responsibility.

In 2018, CPFL marked 14 years since being listed on the B3 and the New York Stock Exchange (“NYSE”). With more than 100 years of history in Brazil, the Company’s shares are listed on theNovo MercadoSpecial Listing Segment of the B3 with Level III ADRs, a special segment for companies that comply with corporate governance best practices. All CPFL shares are common shares, entitling all shareholders the right to vote with 100% Tag Along rights guaranteed in case of sale of shareholding control.

CPFL’s Management is composed of the Board of Directors (“Board”), its decision-making authority, and the Board of Executive Officers, its executive body. The Board is responsible for defining the strategic business direction of the holding company and subsidiaries, and is composed of 7 members (of which 2 independent members), with terms of one year, eligible for reelection.

The Bylaws of the Board establishes the procedures for evaluating the directors, under the leadership of the Chairman, their main duties and rights.

The Board set up three advisory committees (Management Processes, Risks and Sustainability, People Management and Related Parties), which support the Board in its decisions and monitor relevant and strategic themes, such as people and risk management, sustainability, the surveillance of internal audits and analysis of transactions with Parties Related to controlling shareholders and handling of incidents recorded through complaint hotlines and ethical conduct channels.

The Board of Executive Officers is made up of 1 Chief Executive Officer, 1 Deputy Chief of Executive Officer and 7 Vice Presidents, with terms of two years, eligible for reelection, responsible for executing the strategy of CPFL Energia and its subsidiaries as defined by the Board of Directors in line with corporate governance guidelines. To ensure alignment of governance practices, Executive Officers sit on the Boards of Directors of companies that make up the CPFL group and nominate their respective executive officers.

CPFL has a permanent Fiscal Council, made up of 3 members, that also exercises the duties of the Audit Committee, in line with Sarbanes-Oxley law (SOX) rulings applicable to foreign companies listed on U.S. stock exchanges.

The guidelines and documents on corporate governance are available at the Investor Relations website http://www.cpfl.com.br/ir.

| 4Q18/2018 Results | March 28, 2019 |

10) SHAREHOLDERS STRUCTURE

CPFL Energia is a holding company that owns stake in other companies. State Grid Corporation of China (SGCC) controls CPFL Energia through its subsidiaries State Grid International Development Co., Ltd, State Grid International Development Limited (SGID), International Grid Holdings Limited, State Grid Brazil Power Participações S.A. (SGBP) and ESC Energia S.A.:

Reference date: 12/31/2018

Notes:

(1) RGE Sul is held by CPFL Energia (89.0107%) and CPFL Brasil (10.9893%).

(2) CPFL Soluções = CPFL Brasil + CPFL Serviços + CPFL Eficiência;

(3) 51.54% stake of the availability of power and energy of Serra da Mesa HPP, regarding the Power Purchase Agreement between CPFL Geração and Furnas;

10.1) CPFL Renováveis’ Tender Offer

CPFL Renováveis’ Mandatory Tender Offer occurred on November 26, 2018. According to the Material Fact and the Announcement to the Market released on November 26 and 30, 2018, respectively, as a result of the auction, State Grid acquired 243,771,824 common shares issued by the company, representing 48.39% of the capital stock of the company. The common shares were acquired at the price of R$ 16.85, totaling the amount of R$ 4.1 billion. State Grid and CPFL Geração (indirectly controlled by State Grid) jointly held 503,520,623 common shares issued by the company, equivalent to 99.94% of the total share capital of the company.

10.2) Merger of RGE and RGE Sul distribution companies

In December 2018, CPFL promoted the merger of the distribution company Rio Grande Energia S.A. (“RGE” or “Merged Company”) into RGE Sul Distribuidora de Energia S.A. (“RGE Sul” or“Merging Company”). On December 04, 2018, by means of Authorizing Resolution No. 7,499, the grouping of the concessions of the two companies was approved by the National Electric Energy Regulatory Agency (ANEEL), through the incorporation of the assets held by the Merged Company by the Merging Company on December 31, 2018.

| 4Q18/2018 Results | March 28, 2019 |

As a result of the grouping, RGE Sul (“New RGE”) became responsible for the electric power supply of 381 municipalities, located in the State of Rio Grande do Sul, meeting the demand of 2.9 million clients.

| 4Q18/2018 Results | March 28, 2019 |

11) PERFORMANCE OF THE BUSINESS SEGMENTS

11.1) Distribution Segment

11.1.1) Economic-Financial Performance

Consolidated Income Statement - Distribution (R$ Million) |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Gross Operating Revenue | 8,613 | 9,197 | -6.4% | 36,310 | 33,768 | 7.5% |

Net Operating Revenue | 5,160 | 5,750 | -10.2% | 22,467 | 21,077 | 6.6% |

Cost of Electric Power | (3,104) | (3,767) | -17.6% | (15,022) | (14,147) | 6.2% |

Operating Costs & Expenses | (1,526) | (1,494) | 2.1% | (5,208) | (5,399) | -3.5% |

EBIT | 530 | 489 | 8.5% | 2,237 | 1,531 | 46.2% |

EBITDA(1) | 726 | 668 | 8.7% | 3,004 | 2,234 | 34.5% |

Financial Income (Expense) | (61) | (87) | -30.4% | (310) | (566) | -45.3% |

Income Before Taxes | 469 | 401 | 16.9% | 1,928 | 964 | 99.9% |

Net Income | 511 | 337 | 51.8% | 1,432 | 665 | 115.4% |

Note:

(1) EBITDA (IFRS) is calculated from the sum of net income, taxes, financial result and depreciation/amortization, as CVM Instruction no. 527/12.

11.1.1.1) Sectoral Financial Assets and Liabilities

In 4Q18, totalsectoral financial liabilities accounted for R$ 735 million, a variation of R$ 1,586 million if compared to 4Q17, whensectoral financial assets amounted to R$ 852 million. In 2018, totalsectoral financial assets accounted for R$ 1,208 million, a reduction of 36.5% (R$ 693 million) if compared to 2017, whensectoral financial assets amounted to R$ 1,901 million.

On December 31, 2018, the balance of sectoral financial assets and liabilities was positive in R$ 1,508 million, compared to a positive balance of R$ 2,207 million on September 30, 2018 and a positive balance of R$ 517 million on December 31, 2017.

As established by the applicable regulation, any sectoral financial assets or liabilities shall be included in the tariffs of the distributors in their respective annual tariff events.

| 4Q18/2018 Results | March 28, 2019 |

11.1.1.2) Operating Revenue

Operating Revenue (R$ Million) |

| 4Q18 | 4Q17 | Var. | 2018 | 2017 | Var. |

Gross Operating Revenue | | | | | | |

Revenue with Energy Sales (Captive + TUSD) | 8,245 | 7,020 | 17.4% | 30,203 | 26,174 | 15.4% |

Short-term Electric Energy | 13 | 193 | -93.3% | 781 | 1,723 | -54.7% |

Revenue from Building the Infrastructure of the Concession | 568 | 592 | -4.0% | 1,771 | 2,026 | -12.6% |

Sectoral Financial Assets and Liabilities | (735) | 852 | - | 1,208 | 1,901 | -36.5% |

CDE Resources - Low-income and Other Tariff Subsidies | 375 | 347 | 7.9% | 1,536 | 1,419 | 8.3% |

Adjustments to the Concession's Financial Asset | 43 | 113 | -62.3% | 345 | 204 | 68.8% |

Other Revenues and Income | 104 | 79 | 31.1% | 467 | 321 | 45.3% |

Total | 8,613 | 9,197 | -6.4% | 36,310 | 33,768 | 7.5% |

| | | | | | | |

Deductions from the Gross Operating Revenue | | | | | | |

ICMS Tax | (1,647) | (1,405) | 17.2% | (6,090) | (5,362) | 13.6% |

PIS and COFINS Taxes | (743) | (767) | -3.1% | (3,179) | (2,889) | 10.0% |

CDE Sector Charge | (1,187) | (787) | 50.9% | (4,016) | (3,186) | 26.1% |

R&D and Energy Efficiency Program | (45) | (51) | -10.0% | (203) | (188) | 8.1% |

PROINFA | (40) | (39) | 3.1% | (152) | (167) | -9.0% |

Tariff Flags and Others | 216 | (395) | - | (179) | (878) | -79.7% |

Others | (7) | (5) | 26.6% | (24) | (21) | 15.6% |

Total | (3,452) | (3,447) | 0.1% | (13,843) | (12,692) | 9.1% |

| | | | | | | |

Net Operating Revenue | 5,160 | 5,750 | -10.2% | 22,467 | 21,077 | 6.6% |

In 4Q18, gross operating revenue amounted to R$ 8,613 million, a reduction of 6.4% (R$ 584 million), due to the following factors:

· Variation of R$ 1,586 million in the Sectoral Financial Assets/Liabilities, from a sectoral financial asset of R$ 852 million in 4Q17 to a sectoral financial liability of R$ 735 million in 4Q18;

· Reduction of 93.3% (R$ 181 million) in Short-term Electric Energy;

· Reduction of 62.3% (R$ 70 million) in the adjustments to the Concession´s Financial Asset;

· Reduction of 4.0% (R$ 24 million) in revenue from building the infrastructure of the concession;

Partially offset by:

· Increase of 17.4% (R$ 1,224 million) in the revenue with energy sales (captive + free clients), due to: (i) the positive average tariff adjustment in the distribution companies for the period between 4Q17 and 4Q18 (highlight for the average increases of 16.90% in CPFL Paulista and 22.47% in RGE Sul, in April 2018, of 20.58% in RGE, in June 2018, and of 19.25% in CPFL Piratininga, in October 2018); and (ii) the increase of 1.2% in the sales volume within the concession area;

· Increase of 7.9% (R$ 28 million) in tariff subsidies (CDE resources);

· Increase of 31.1% (R$ 25 million) in Other Revenues and Income.

Deductions from the gross operating revenue were R$ 3,452 million in 4Q18, representing an increase of 0.1% (R$ 5 million), due to the following factors:

· Increase of 50.9% (R$ 400 million) in the CDE sector charge;

· Increase of 17.2% (R$ 242 million) in ICMS tax;

· Increase of 3.1% (R$ 1 million) in the PROINFA;

· Increase of 26.6% (R$ 1 million) in other deductions from the gross operating revenue;

Partially offset by the following factor:

| 4Q18/2018 Results | March 28, 2019 |

· Variation of R$ 611 million in tariff flags approved by the CCEE, from an expense of R$ 395 million in 4Q17 to a revenue of R$ 216 million in 4Q18;

· Reduction of 3.1% (R$ 24 million) in PIS and COFINS taxes;

· Reduction of 10.0% (R$ 5 million) in the R&D and Energy Efficiency Program.

Net operating revenue reached R$ 5,160 million in 4Q18, representing a reduction of 10.2% (R$ 589 million).

In 2018, gross operating revenue amounted to R$ 36,310 million, an increase of 7.5% (R$ 2,542 million), due to the following factors:

· Increase of 15.4% (R$ 4,029 million) in the revenue with energy sales (captive + free clients), due to: (i) the positive average tariff adjustment in the distribution companies for the period between 2017 and 2018; and (ii) the increase of 2.5% in the sales volume within the concession area;

· Increase of 45.3% (R$ 146 million) in Other Revenues and Income;