QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the registrantý |

Filed by a party other than the registranto |

Check the appropriate box: |

o |

|

Preliminary proxy statement |

o |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive proxy statement |

o |

|

Definitive additional materials |

o |

|

Soliciting material under Rule 14a-12

|

FOUNDATION COAL HOLDINGS, INC. |

(Name of Registrant as Specified In Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

FOUNDATION COAL HOLDINGS, INC.

999 Corporate Boulevard, Suite 300

Linthicum Heights, MD 21090-2227

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

TO BE HELD May 19, 2005

To the Stockholders of Foundation Coal Holdings, Inc.:

NOTICE IS HEREBY GIVEN that Foundation Coal Holdings, Inc.'s ("Foundation") 2005 Annual Meeting of Stockholders will be held at 10:00 AM on Thursday, May 19, 2005, at the BWI Marriott, 1743 West Nursery Road, Linthicum Heights, MD 21090 (the "Annual Meeting").

At the meeting, we will ask stockholders to:

- 1.

- Elect nine Directors for a term of one year;

- 2.

- Approve Ernst & Young LLP as Foundation's Independent Public Accountants.

- 3.

- Any other matters that properly come before the meeting.

We plan a brief business meeting focused on these items and we will attend to any other proper business that may arise.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF PROPOSALS 1 AND 2. These proposals are further described in the proxy statement.

At the meeting, there will be a brief presentation on Foundation's operations, and we will offer time for your comments and questions. Only Foundation stockholders of record at the close of business on March 31, 2005 are entitled to notice of and to vote at the meeting and any adjournment of it. For ten (10) days prior to the Annual Meeting, a list of stockholders entitled to vote will be available for inspection at Foundation's corporate offices located at 999 Corporate Boulevard, Suite 300, Linthicum Heights, MD 21090-2227.

YOUR VOTE IS IMPORTANT. WE URGE YOU TO COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE. YOUR PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE TIME IT IS VOTED AT THE 2005 ANNUAL MEETING.

By order of the Board of Directors,

William Macaulay

Chairman of the Board

TABLE OF CONTENTS

| | PAGE

|

|---|

| General Information about Foundation's Annual Meeting | | 3 |

| | Who is entitled to Vote | | 3 |

| | Solicitation of Proxies | | 3 |

| | Quorum Requirements | | 3 |

| Board Recommendations and Approval Requirements | | 3 |

| | Meeting Business | | 3 |

| Voting and Proxy Procedure | | 4 |

| | Voting Rights | | 4 |

| | How to Vote | | 4 |

| | Receipt of Multiple Proxy Cards | | 5 |

| | How to Revoke or Change Your Vote | | 5 |

| | How Proxies Are Voted | | 5 |

| | How Votes Are Counted | | 6 |

| | Where to Find Voting Results | | 6 |

PROPOSAL ONE—Election of Directors |

|

6 |

| | Nominees for Directors | | 6 |

PROPOSAL TWO—Ratification of Appointment of Independent Accountants |

|

8 |

| | Audit Committee Report | | 8 |

| | Fees of Independent Accountants | | 10 |

PROPOSAL THREE—Other Matters |

|

10 |

| Stockholder Proposals for the 2006 Annual Meeting | | 10 |

CORPORATE GOVERNANCE AND RELATED MATTERS |

|

11 |

| | Director Independence | | 11 |

| | Board and Its Committees | | 11 |

| | Code of Business Conduct and Ethics | | 14 |

| | Director Compensation | | 15 |

| | Stockholder Director Nominations | | 15 |

| | Stockholder Communications with the Board | | 16 |

| Executive Officers | | 16 |

| Executive Compensation and Related Information | | 17 |

| | Compensation Committee Report on Executive Compensation | | 17 |

| | Compensation Committee Interlocks and Insider Participation | | 20 |

| | Summary Compensation Table | | 21 |

| | Employment Agreements and Termination and Change in Control Provision | | 22 |

| | Stock Options Grants | | 24 |

| | Stock Options Exercises | | 25 |

| | Equity Compensation Plan Information | | 25 |

| | Pension Plan Information | | 25 |

| Stock Ownership | | 27 |

| | Ownership by largest holders, directors and officers | | 27 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 29 |

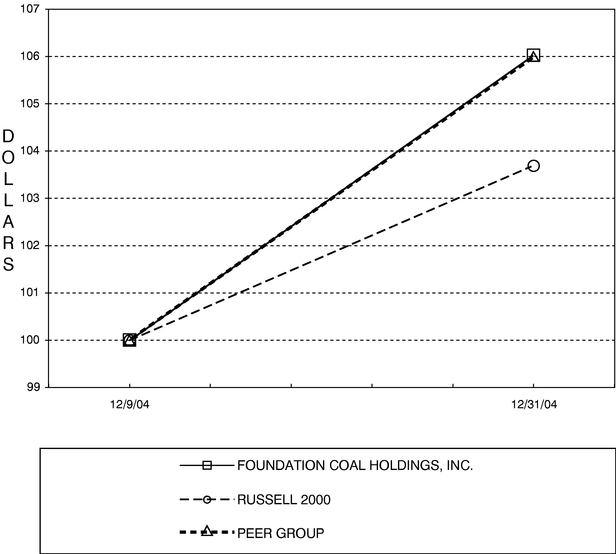

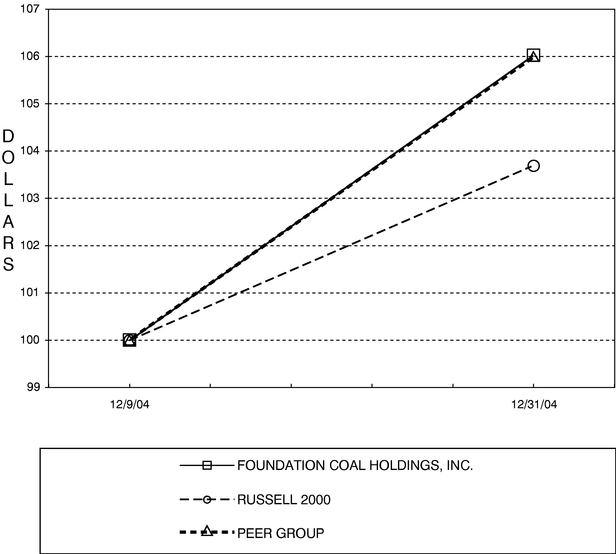

| | Stock Performance Graph | | 30 |

| Certain Relationships and Related Transactions | | 31 |

| Exhibit A Foundation Coal Holdings, Inc. Audit Committee Charter | | 35 |

| Exhibit B Foundation Coal Holdings, Inc. Audit Committee Pre-Approval Policy | | 41 |

Directions to Foundation's Annual Meeting |

|

49 |

2

PROXY STATEMENT FOR

2005 ANNUAL MEETING OF STOCKHOLDERS OF

FOUNDATION COAL HOLDINGS, INC. TO BE HELD ON

MAY 19, 2005

GENERAL INFORMATION ABOUT FOUNDATION'S ANNUAL MEETING

Foundation intends to mail this proxy statement, proxy card and Foundation's Annual Report to Stockholders for the fiscal year ended December 31, 2004, to all stockholders entitled to vote at the Annual Meeting on or about April 15, 2005. The Annual Meeting will be held on Thursday, May 19, 2005, at 10:00 AM at the BWI Marriott, 1743 W. Nursery Road, Linthicum Heights, MD 21090. Directions to the meeting are at the back of the Proxy Statement.

Who is entitled to vote at the Annual Meeting?

Anyone who owns of record Foundation common stock as of the close of business on March 31, 2005 is entitled to one vote per share owned. There were 44,627,047 shares outstanding on that date.

Who is soliciting my proxy to vote my shares?

Foundation's Board of Directors is soliciting your "proxy," or your authorization for our representatives to vote your shares. Your proxy will be effective for the May 19, 2005 meeting and at any adjournment or continuation of that meeting.

Who is paying for and what is the cost of soliciting proxies?

Foundation is bearing the entire cost of soliciting proxies. Proxies will be solicited principally through the mail, but may also be solicited personally or by telephone, facsimile, or special letter by Foundation's directors, officers, and regular employees for no additional compensation. To assist in the solicitation of proxies and the distribution and collection of proxy materials, Foundation has engaged Innisfree M&A Incorporated, a proxy solicitation firm, for an estimated fee of $6,500. Foundation will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to their customers or principals who are the beneficial owners of shares of common stock.

What constitutes a quorum?

For business to be conducted at the Annual Meeting, a quorum constituting a majority of the shares of Foundation common stock issued and outstanding and entitled to vote must be in attendance or represented by proxy.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and Foundation's Certificate of Incorporation and Bylaws govern the vote on each proposal. The Board's recommendation is set forth together with the description of each item in this proxy statement. In summary the Board's recommendations and approval requirements are:

PROPOSAL 1. ELECTION OF DIRECTORS

The first proposal item to be voted on is the election of nine Directors. The Board has nominated nine people as Directors, each of whom is currently serving as a Director of Foundation.

You may find information about these nominees, beginning on Page 6.

3

You may vote in favor of all the nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Assuming a quorum, each share of Common Stock may be voted for as many nominees as there are directors to be elected. Directors are elected by a plurality of the votes cast. Stockholders may not cumulate their votes. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends a vote FOR each director nominee.

PROPOSAL 2. APPROVAL OF INDEPENDENT ACCOUNTANTS, ERNST & YOUNG LLP

The second proposal item to be voted on is to approve Ernst & Young LLP as Foundation's Independent Public Accountants.

You may find information about this proposal beginning on Page 8.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the shares present in person or represented and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends a vote FOR the approval of Ernst & Young LLP as Independent Public Accountants.

PROPOSAL 3. OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board is not aware of any other business to be presented for a vote of the stockholders at the 2005 Annual Meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

The chairman of the Annual Meeting may refuse to allow presentation of a proposal or nominee for the Board if the proposal or nominee was not properly submitted. The requirements for submitting proposals and nominations for next year's meeting are described on Page 10.

VOTING AND PROXY PROCEDURE

What are the voting rights of holders of Foundation common stock?

Each outstanding share of Foundation stock will be entitled to one vote on each matter considered at the meeting.

How do I vote?

You may vote in three (3) different ways:

- 1.

- BY MAIL. Mark your voting instructions on, and sign and date, the proxy card and then return it in the postage-paid envelope provided. The Board recommends that you vote by proxy even if you plan on attending the meeting. If you mail your proxy card, we must receive it before the polls close at the end of the meeting.

If we receive your signed proxy card, but you do not give voting instructions, our representatives will vote your shares FOR Proposals 1 and 2. If any other matters arise during the meeting that requires a vote, the representatives will vote based on the recommendation of the Board of Directors, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

4

- 2.

- IN PERSON. You may deliver your completed proxy in person at the meeting. "Street name" or nominee account shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

- 3.

- VIA TELEPHONE. If you own your shares in "street name" or in a nominee account, you may place your vote by telephone by following the instructions on the proxy card provided by your broker, bank or other holders of record.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent or with stock brokers or other nominees. Please complete and provide your voting instructions for all proxy cards that you receive.

How do I revoke my proxy or change my voting instructions?

You may revoke your proxy or change your voting instructions in three (3) different ways:

- 1.

- WRITE TO FOUNDATION'S CORPORATE SECRETARY, GREG A. WALKER, AT 999 CORPORATE BOULEVARD, SUITE 300, LINTHICUM HEIGHTS, MD 21090-2227.

- Your letter should contain the name in which your shares are registered, your control number, the date of the proxy you wish to revoke or change, your new voting instructions, if applicable, and your signature. Mr. Walker must receive your letter before the Annual Meeting begins.

- 2.

- SUBMIT A NEW PROXY CARD BEARING A LATER DATE THAN THE ONE YOU WISH TO REVOKE. We must receive your new proxy card before the Annual Meeting begins.

- 3.

- ATTEND THE ANNUAL MEETING AND VOTE IN PERSON AS DESCRIBED ABOVE (OR BY PERSONAL REPRESENTATIVE WITH AN APPROPRIATE PROXY). Attendance at the meeting will not by itself revoke a previously granted proxy.

How will proxies be voted if I give my authorization?

The Board of Directors has selected James F. Roberts, Greg A. Walker and Edythe C. Katz, and each of them, to act as proxies with full power of substitution. With respect to the proposal regarding election of directors, stockholders may (a) vote in favor of all nominees, (b) withhold their votes as to all nominees, or (c) withhold their votes as to specific nominees by so indicating in the appropriate space on the enclosed proxy card. With respect to the proposal to approve the appointment of Ernst & Young LLP as the Company's independent accountants for fiscal year 2005, stockholders may (i) vote "for", (ii) vote "against" or (iii) abstain from voting as to each such matter. All properly executed proxy cards delivered by stockholders and not revoked will be voted at the Annual Meeting in accordance with the directions given. IF NO SPECIFIC INSTRUCTIONS ARE GIVEN WITH REGARD TO THE MATTERS TO BE VOTED UPON, THE SHARES REPRESENTED BY A PROPERLY EXECUTED PROXY CARD WILL BE VOTED (i) "FOR" THE ELECTION OF ALL DIRECTOR NOMINEES, AND (ii) "FOR" THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT ACCOUNTANTS. Management knows of no other matters that may come before the Annual Meeting for consideration by the stockholders. However, if any other matter properly comes before the Annual Meeting, the persons named in the enclosed proxy card as proxies will vote upon such matters in accordance with the recommendation of the Board, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

5

How will votes be counted?

The inspector of elections appointed by the Board for the Annual Meeting will calculate affirmative votes, negative votes, abstentions, and broker non-votes. Under Delaware law, shares represented by proxies that reflect abstentions or "broker non-votes" will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

You as beneficial owner, own your shares in "street name," if your broker or other "street" nominee is actually the record owner. Brokers or other "street" nominee have discretionary authority to vote on routine matters, regardless of whether they have received voting instructions from their clients who are the beneficial owner. Director elections and ratifying the appointment of independent accountants are each routine matters. A "broker non-vote" results on a matter when a broker or other "street" or nominee record holder returns a duly executed proxy but does not vote on non-routine matters solely because it does not have discretionary authority to vote on non-routine matters and has not received voting instructions from its client (the beneficial holder). Accordingly, no broker non-votes occur when voting on routine matters. Broker non-votes count toward a quorum. The approval of a proposal regarding a non-routine matter is determined based on the vote of all shares present in person or represented and entitled to vote on the matter. Abstention on such a proposal has the same effect as a vote "against" such proposal. Broker non-votes have no effect on the vote of such proposals.

Where do I find voting results of the Annual Meeting?

Preliminary voting results will be announced at the meeting. Final voting results will be published in Foundation's quarterly report on Form 10-Q for the second quarter of 2005. The report will be filed with the Securities and Exchange Commission (the "SEC") on or about August 15, 2005 and you may receive a copy by contacting Foundation Investor Relations at 410-689-7632, or the SEC at 800-SEC-0330 for the location of its nearest public reference room. You may also access a copy on the Internet atwww.foundationcoal.com/investors/securitiesfilings or through EDGAR, the SEC's electronic data system, atwww.sec.gov.

PROPOSAL ONE

ELECTION OF DIRECTORS

The first agenda item to be voted on is the election of nine Directors. The Board has nominated nine people as Directors, each of whom is currently serving as a Director of Foundation. The Board unanimously recommends that you vote FOR such nominees.

The Board of Directors consists of nine directors with each term expiring at the 2005 Annual Meeting. Each of the nominees has indicated his willingness to serve, if elected, but if any of the nominees should be unable or unwilling to serve, the Board may either reduce its size, or designate or not designate a substitute nominee. If the Board designates a substitute nominee, proxies that would have been cast for the original nominee will be cast for the substitute nominee unless instructions are given to the contrary.

Nominees for Directors

William E. Macaulay (59) has been Chairman of our Board of Directors since 2004 and serves as Chairman of our nominating and corporate governance committee. Mr. Macaulay is the Chairman and Chief Executive Officer of First Reserve Corporation, a private equity firm, which he joined in 1983. Mr. Macaulay serves as Chairman of Dresser-Rand Group Inc., a supplier of rotating equipment solutions to the energy industry, and Chairman of Pride International, Inc., a contract drilling and related services company. He also serves as a director of Dresser, Inc., Weatherford International, Inc., National Oilwell, Inc and Alpha Natural Resources, Inc, a coal company.

6

Prakash A. Melwani (46) has been a member of our Board of Directors since 2004 and serves as Chairman of our compensation committee. Mr. Melwani joined The Blackstone Group L.P., an investment and advisory firm, as a Senior Managing Director in its Private Equity Group in May 2003. He is also a member of the firm's Private Equity Investment Committee. Prior to joining Blackstone, Mr. Melwani was a founder, in 1988, of Vestar Capital Partners and served as its Chief Investment Officer. Prior to that, Mr. Melwani was with the management buyout group at The First Boston Corporation and with N.M. Rothschild & Sons in Hong Kong and London. He currently serves as a director of Aspen Insurance Holdings Limited, Texas Genco LLC and Kosmos Energy Holdings.

Hans J. Mende (61) has been a member of our Board of Directors since 2004. He is President and Chief Operating Officer of American Metals & Coal International, Inc. ("AMCI"), a mining and marketing company, a position he has held since he co-founded American Metal & Coal International, Inc. in 1986. Prior to founding American Metals & Coal International, Inc,, Mr. Mende was employed by the Thyssen Group, one of the largest German multinational companies with interests in steel making and general heavy industrial production, in various senior executive positions. At the time of his departure from Thyssen Group, Mr. Mende was President of its international trading company. Mr. Mende serves as Chairman of the Board of the Alpha Natural Resources, Inc., a publicly traded corporation operating in the coal business.

David I. Foley (37) has been a member of our Board of Directors since 2004. He is a principal in the Private Equity Group of The Blackstone Group L.P., an investment and advisory firm, which he joined in 1995. Mr. Foley has been involved in the execution of several of Blackstone's investments and leads Blackstone's investment activities in the energy industry. Prior to joining Blackstone, Mr. Foley was an employee of AEA Investors Inc. from 1991 to 1993 and a consultant with The Monitor Company from 1989 to 1991. Mr. Foley currently serves as a director of Premcor Inc., Mega Bloks Inc., Texas Genco LLC and Kosmos Energy Holdings.

Alex T. Krueger (30) has been a member of our Board of Directors since 2004. He joined First Reserve Corporation, a private equity firm, in 1999 and is currently a Managing Director of First Reserve Corporation focused on investment efforts in the coal and energy infrastructure sectors. Mr. Krueger also serves on the board of GP Natural Resource Partners LLC, the general partner of Natural Resource Partners LP and Alpha Natural Resources, Inc., a coal company. Prior to joining First Reserve, Mr. Krueger worked in the Energy Group of Donaldson, Lukfin & Jenrette.

Joshua H. Astrof (33) has been a member of our Board of Directors since 2004. He has been a principal in the Private Equity Group of The Blackstone Group L.P., an investment and advisory firm, since December 2001 and was an associate from 1998 to 2001. Prior to that he was an associate at Donaldson, Lufkin & Jenrette Securities Corporation, where he worked from 1993 to 1996. Mr. Astrof is a member of the Board of Directors of TRW Automotive Holdings Corp. and Utilicom Networks LLC and formerly served on the Board of Directors of Bresnan Communications Group LLC.

William J. Crowley Jr. (59) has been a member of our Board of Directors since 2004. He serves as Chairman of our audit committee. Mr. Crowley is a certified public accountant and has recently served as an independent business advisor to various companies. Prior to his retirement in 2002, Mr. Crowley had a thirty-two year career with Arthur Andersen LLP, of which 16 years were in Baltimore, Maryland, most recently serving for seven years as Managing Partner of the Baltimore office. Mr. Crowley currently serves as a director and member of the audit committee of BioVeris Corporation and Provident Bankshares Corporation. He is also a board member of the Baltimore Area Council of Boy Scouts of America, Junior Achievement of Central Maryland and the Maryland Science Center.

Joel Richards, III (58) has been a member of our Board of Directors since 2005. He served as a member of the Board of Directors of our predecessor, RAG American Coal Holdings, Inc., from 2000 to 2003. He is currently a management consultant focusing on organization restructuring and organization effectiveness. Mr. Richards was Executive Vice President and Chief Administrative Officer

7

with El Paso Energy Corp. from 1996 until his retirement in 2002. From 1990 through 1996 he served as Senior Vice President Human Resources and Administration at El Paso Natural Gas Company. He was Senior Vice President Finance and Administration at Meridian Minerals Company, where he worked from 1985 to 1990. Prior to that, he held various management and labor relation positions at Burlington Northern, Inc., STM Associates, Union Carbide Corporation and Boise Cascade Corporation. Mr. Richards earned his Bachelor of Science in Political Science and Masters in Administration from Brigham Young University.

James F. Roberts (55) is our President and Chief Executive Officer and also serves as a member of our Board of Directors. Prior to his current position, Mr. Roberts had been President and Chief Executive Officer of RAG American Coal Holding, Inc. since January 1999. Prior to joining our company, Mr. Roberts was President of CoalARBED International Trading from 1981 to 1999, Chief Financial Officer of Carbomin Coal Company from 1979 to 1981, Chief Financial Officer of Leckie Smokeless Coal Company from 1977 to 1981 and Vice President of Finance at Solar Fuel Company from 1974 to 1977. Mr. Roberts is a director of the National Mining Association, where he is also vice-chairman. In addition, Mr. Roberts is a director of the Center for Energy and Economic Development and a member of the executive committee of the National Coal Council.

PROPOSAL TWO

APPROVAL OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

The second agenda item to be voted on is to approve the appointment of Ernst & Young LLP as independent public accountants for the fiscal year ending December 31, 2005.

The audit committee has recommended, and the Board of Directors has approved, Ernst & Young LLP to act as Foundation's independent public accountants for the fiscal year ending December 31, 2005. The Board of Directors has directed that such appointment be submitted to Foundation's stockholders for ratification at the 2005 Annual Meeting. Ernst & Young LLP were Foundation's independent public accountants for the fiscal year ending December 31, 2004.

Stockholder ratification of the appointment of Ernst & Young LLP as Foundation's independent public accountants is not required. The Board, however, is submitting the appointment to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the appointment, the Board of Directors will reconsider whether or not to retain Ernst & Young LLP or another firm. Even if the appointment is ratified, the Board, in its discretion, may direct the appointment of a different accounting firm at any time during the 2005 fiscal year if the Board of Directors determines that such a change would be in the best interests of Foundation and its stockholders.

Representatives of Ernst & Young LLP are expected to be present at the 2005 Annual Meeting and will have an opportunity to make a statement if they so desire. They will be available to respond to appropriate questions.

The Board of Directors unanimously recommends that you vote FOR this proposal.

Audit Committee Report

The Audit Committee of the Company's Board of Directors is composed of three non-employee directors and operates under a written charter adopted by the Board of Directors. The committee charter is attached to this proxy statement and is available on the Company's web site (www.foundationcoal.com). The Board of Directors has determined that Messrs. Crowley and Richards are independent in accordance with the currently effective listing standards of the New York Stock Exchange. In addition, the Board of Directors has determined that William J. Crowley, as defined by SEC rules, is both independent and an audit committee financial expert.

8

The Company's management is responsible for the Company and its Predecessor's (RAG American Coal Holding, Inc.) financial reporting processes. The independent registered public accounting firm is responsible for performing audits of the Company and its Predecessor's consolidated financial statements and for issuing opinions on the conformity of those financial statements with U.S. generally accepted accounting principles. The Audit Committee oversees the Company and its Predecessor's financial reporting processes on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company and its Predecessor's consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by relevant professional and regulatory standards and has discussed with the independent registered public accounting firm the firm's independence from the Company and its management. In concluding that the firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company's independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the board has approved, that the audited consolidated financial statements of the Company and its Predecessor be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC. The Audit Committee and the Board of Directors also have approved, subject to stockholder ratification, the selection of the Company's independent registered public accounting firm.

| | | William J. Crowley,Chairman

Alex T. Krueger

Joel Richards, III |

9

Fees of Independent Certified Public Accountants

For work performed in regard to fiscal year 2004, Foundation paid Ernst & Young LLP the following fees for services, as categorized:

| | Fiscal 2004

|

|---|

| | (in millions)

|

|---|

| Audit fees(1) | | $ | 1.8 |

| Audit-related fees(2) | | | .8 |

| Tax fees(3) | | | — |

| All other fees(4) | | | — |

- (1)

- Includes fee for audit services principally relating to the annual audit, quarterly reviews, registration statements and International Financial Reporting Standards (required by RAG Coal International AG our former parent company).

- (2)

- Includes audit related fees for stand alone financial statements of subsidiaries that were sold, re-audit of year ended December 31, 2001, private placement documents and audits of employees benefits plans.

- (3)

- There were no tax fees incurred.

- (4)

- There were no other fees incurred.

The audit committee has adopted a pre-approval policy, a copy of which is attached as Exhibit B to this proxy statement. All audit related services, tax services and other services were approved for 2004 and pre-approved for 2005 by the audit committee, which concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm's independence in the conduct of its auditing functions.

PROPOSAL THREE

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to Foundation will be voted in accordance with the recommendation of the Board, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Stockholder proposals for the 2006 Annual Meeting

From time to time, stockholders present proposals that may be proper subjects for inclusion in the proxy statement and for consideration at an annual meeting. Under the rules of the SEC, to be included in the proxy statement for the 2006 Annual Meeting, Foundation must receive proposals no later than January 15, 2006.

Pursuant to Foundation's bylaws, stockholders may present proposals that are proper subjects for consideration at an annual meeting. Foundation's bylaws require all stockholders who intend to make proposals at an annual stockholders meeting to submit their proposals to Foundation no later than the close of business on the 60th day prior to nor earlier than the close of business on the 90th day prior to the anniversary date of the previous year's annual meeting. To be eligible for consideration at the 2006 Annual Meeting, proposals that have not been submitted by the deadline for inclusion in the proxy statement must be received by Foundation between December 15, 2005 and January 15, 2006. In the event the date of the 2006 Annual Meeting is changed by more than 30 days from the date contemplated as of the date of this proxy statement, stockholder notice must be received not earlier

10

than the close of business on the 120th day prior to the 2006 Annual Meeting nor later than the close of business on the 90th day prior to the 2006 Annual Meeting. However, if the number of directors to be elected to the Board of Directors is increased and there is no a public announcement by the Foundation naming all of the nominees for director or specifying the size of the increased Board of Directors at least 100 days prior to the anniversary of the mailing of proxy materials for the prior year's annual meeting of stockholders, then a stockholder proposal only with respect to nominees for any new positions created by such increase must be received by the Secretary by the close of business on the 10th day following such public announcement. These provisions are intended to allow all stockholders to have an opportunity to consider business expected to be raised at the meeting.

CORPORATE GOVERNANCE AND RELATED MATTERS

Director Independence

Foundation is currently relying upon the initial public offering phase-in exemption from the New York Stock Exchange ("NYSE") rules with respect to director independence. As a result, we will be required to have a majority of independent directors on our Board by December 9, 2005.

In determining director independence, Foundation employs the standards set forth in the NYSE listed company manual. The independence test in the NYSE rules requires that the director (or a member of his immediate family) is not an affiliate of or otherwise have a material relationship with Foundation and that for the last three years:

- •

- Was not an employee of Foundation (and no immediate family member was an executive officer of Foundation).

- •

- Did not receive more than $100,000 per year in compensation from Foundation (other than for director and committee fees, pensions, or other deferred compensation from prior service).

- •

- Was not employed by or affiliated with a present or former internal or external auditor of Foundation.

- •

- Has not been employed as an executive officer by any company whose compensation committee includes an executive officer of Foundation.

- •

- Was not an employee or executive officer (and no immediate family member was an executive officer) of another company that (in any single fiscal year) makes payments to, or receives payments from, Foundation for property or services in an amount that exceeds the greater of $1 million or 2% of such other company's consolidated gross revenue.

Applying the NYSE test, the Board has concluded that Messrs. Crowley and Richards are independent and that Mr. Roberts is not independent. The Board has not made an independence determination with respect to the remaining directors.

The Board of Directors and its Committees

The Board of Directors held three (3) meetings in 2004, either in person or by telephone. Each director attended at least 75% of all Board and applicable committee meetings during 2004, except for Mr. Macaulay who missed one Board meeting due to its impromptu nature and scheduling conflicts. Under Foundation'sCorporate Governance Practices and Policies Directors are encouraged to attend stockholder meetings. Foundation has scheduled one of its quarterly Board meetings on the same date as the 2005 Annual Meeting of Stockholders. In connection with each of the quarterly Board meetings, the non-management Directors will meet in executive session without any employee directors or members of management present. If the Board convenes a special meeting, the non-management

11

directors may meet in executive session if the circumstances warrant. The Chairman of the Board presides at each executive session of the non-management directors.

Name

| | Audit

| | Compensation

| | Nominating and

Governance

| |

|---|

| Joshua H. Astrof | | X | * | | | | |

| William J. Crowley, Jr. | | X | ** | X | | X | |

| David I. Foley | | | | | | X | * |

| Alex T. Krueger | | X | | X | * | | |

| William E. Macaulay | | | | | | X | ** |

| Prakash A. Melwani | | | | X | ** | | |

| Joel Richards, III | | X | *** | X | *** | X | *** |

| James F. Roberts | | | | | | X | * |

- *

- Resigned as member of committee on March 8, 2005.

- **

- Chairman.

- ***

- Appointed as member of committee on March 8, 2005.

The standing Board Committees and the number of meetings they held in 2004 were as follows:

- •

- Audit Committee—1

- •

- Compensation Committee—1

- •

- Nominating and Corporate Governance Committee—1

The principal responsibilities and functions of the standing Board committees are as follows:

Audit Committee

Our audit committee currently consists of William J. Crowley, Jr., Alex T. Krueger and Joel Richards, III. James F. Roberts and Joshua H. Astrof served on the audit committee until December 1, 2004 and March 8, 2005, respectively. William J. Crowley, Jr. is our audit committee "financial expert" as such term is defined in Item 401(h) of Regulation S-K. The audit committee is responsible for (1) the hiring or termination of independent auditors and approving any non-audit work performed by such auditor, (2) approving the overall scope of the audit, (3) assisting the board in monitoring the integrity of our financial statements, the independent accountant's qualifications and independence, the performance of the independent accountants and our internal audit function and our compliance with legal and regulatory requirements, (4) annually reviewing an independent auditors' report describing the auditing firms' internal quality-control procedures, any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm, (5) discussing the annual audited financial and quarterly statements with management and the independent auditor, (6) discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (7) discussing policies with respect to risk assessment and risk management, (8) meeting separately, periodically, with management, internal auditors and the independent auditor, (9) reviewing with the independent auditor any audit problems or difficulties and managements' response, (10) setting clear hiring policies for employees or former employees of the independent auditors, (11) annually reviewing the adequacy of the audit committee's written charter, (12) establishing procedures for the receipt and monitoring of complaints received by Foundation (including anonymous submissions by our employees) regarding accounting, internal accounting and auditing matters, (13) handling such other matters that are specifically delegated to the audit committee by the Board of Directors from time to time, (14) reporting regularly to the full Board of Directors and (15) conducting an annual evaluation of its performance. The audit committee has adopted a charter a copy of which is included as Exhibit A to this proxy statement.

12

As previously discussed, Foundation relies on the initial public offering phase-in exemption with respect to director independence from the New York Stock Exchange rules and the Sarbanes-Oxley Act of 2002; as a result all members serving on the audit committee must meet the requirements of the Sarbanes-Oxley Act of 2002 by December 9, 2005. Applying the test provided in the Sarbanes-Oxley Act, the Board has concluded that Messrs. Crowley and Richards are independent. The Board has not made an independence determination with respect to the remaining audit committee member. The Board has made an assessment and determined that Foundation's reliance on this phase-in exemption will not have a material adverse effect on the audit committee's ability to act independently and satisfy other applicable requirements of the Sarbanes-Oxley Act of 2002.

Compensation Committee

Our current compensation committee consists of Prakash A. Melwani, Joel Richards, III and William J. Crowley, Jr. Alex T. Krueger served on the compensation committee until March 8, 2005. The compensation committee is responsible for discharging the responsibilities of the Board of Directors with respect to Foundation and its subsidiaries' compensation programs including, the compensation of key employees, executives and the Board of Directors. The compensation committee is responsible for (1) administering Foundation's and its subsidiaries' long-term incentive and stock plans, (2) reviewing the overall executive compensation philosophy of Foundation and its subsidiaries and their benefit plans and programs, including employee pension plans, (3) reviewing and approving corporate goals and objectives relevant to CEO and other executive officers compensation, including annual performance targets, (4) evaluating the performance of the CEO and other executive officers in light of the corporate goals and objectives and, based on such evaluation, determining and approving the annual salary, bonus, equity based and other compensation and benefits, direct and indirect, of the CEO and other executive officers, (5) preparing recommendations and periodic reports on its activities to the Board of Directors, (6) preparing the annual report on executive compensation for inclusion in Foundation's proxy statement as required by the SEC, (7) reviewing and approving employment contracts and other similar arrangements between us and our executive officers, (8) approving the appointment and removal of trustees and investment managers for pension fund assets, (9) retaining consultants to advise the committee on executive compensation practices and policies, (10) handling such other matters that are specifically delegated to the compensation committee by the Board of Directors.

As discussed above, Foundation relies on the initial public offering phase-in exemption with respect to director independence from the NYSE rules; as a result all members serving on the compensation committee must meet the requirements on the NYSE by December 9, 2005. Applying the NYSE test, the Board has concluded that Messrs. Crowley and Richards are independent. The Board has not made an independence determination with respect to the remaining compensation committee member.

Nominating and Governance Committee

Our current nominating and corporate governance committee consists of William E. Macaulay, Joel Richards, III and William J. Crowley, Jr. Alex T. Krueger served on the nominating and corporate governance committee until December 1, 2004. James F. Roberts and David I. Foley served on the nominating and corporate governance committee until March 8, 2005. The nominating and corporate governance committee is responsible for (1) developing and recommending criteria for selecting new directors, (2) screening and recommending to the Board of Directors individuals qualified to become executive officers, (3) overseeing evaluations of management and the Board of Directors, its members and committees of the Board of Directors, (4) periodic reviewing of the charter and composition of each committee of the Board of Directors (5) reviewing the adequacy of our certificate of incorporation and by-laws, (6) developing and recommending to the Board of Directors corporate governance practices and policies, (7) overseeing and approving the management continuity process,

13

(8) handling such other matters that are specifically delegated to the nominating and corporate governance committee by the Board of Directors from time to time and (9) reporting regularly to the full Board of Directors.

Prospective director nominees are identified through the contacts of the Chairman of the Board, other directors or members of senior management. Once a prospective director nominee has been identified, the committee makes an initial determination through information provided to the committee and information supplemented by the committee through its own inquiries. The nominating and corporate governance committee will evaluate director nominees, including nominees that are submitted to Foundation by a Stockholder, taking into consideration certain criteria, including issues of industry knowledge and experience, the current composition of the Board of Directors, wisdom, integrity, actual or potential conflicts of interest, skills such as understanding of finance and marketing and educational and professional background. In addition, directors must have time available to devote to Board activities and the ability to work collegially. At all times, at least one member of the Board must meet the definition of "financial expert" as such term is defined in Item 401(h) of Regulation S-K and serve on Foundation's audit committee.

The nominating and corporate governance committee determined that its first priority was to identify and recruit a "financial expert." Each prospective nominee was provided with a questionnaire to complete and return to the nominating and corporate governance committee. After its initial evaluation, the nominating and corporate governance committee determined whether it should proceed by making arrangements for the nominating and corporate governance committee, as well as other members of the Board of Directors, to interview the prospective nominee. As a result, the nominating and corporate governance committee identified Mr. Crowley as its financial expert.

The nominating and corporate governance committee determined that it next needed to identify and recruit a director with a background in natural resources and energy. Ideally, the prospective nominee would have the additional expertise necessary to serve on one or more of the committees of the Board of Directors. The nominating and corporate governance committee employed the process described above and identified Mr. Richards.

Due to the fact that Foundation will phase-in independent directors, as necessary, Foundation might engage the services of a third party for a fee to identify and evaluate prospective nominees.

In determining whether to recommend a director for re-election, the nominating and corporate governance committee considers the director's past attendance at meetings and participation in and contribution to the activities of the Board of Directors.

As discussed above, Foundation relies on the initial public offering phase-in exemption with respect to director independence from the NYSE rules, as a result all members serving on the nominating and corporate governance committee must meet the requirements on the NYSE by December 9, 2005. Applying the NYSE test, the Board has concluded that Messrs. Crowley and Richards are independent and that Mr. Roberts is not independent. The Board has not made an independence determination with respect to the remaining committee member.

The nominating and corporate governance committee has adopted a charter stockholders may obtain a copy on Foundation's website at:www.foundationcoal.com/investors/corporategovernance

Code of Business Conduct and Ethics

Foundation has adopted a Code of Business Conduct and Ethics that applies to its employees, officers and directors (the "Code"). The Code also applies to our senior financial employees, including our Chief Executive Officer and Chief Financial Officer. The Code is available on Foundation's website,http://www.foundationcoal.com/investors/corporategovernance and upon written request by our stockholders at no cost.

14

Director Compensation

Directors who are employed by Foundation, or appointed by either Blackstone or First Reserve do not receive compensation for service as a director (a "non-compensated director"). Other than non-compensated directors, each Director receives an annual cash retainer of $40,000 and a fee of $1,500 for each board meeting and each committee meeting attended. The audit committee chairperson receives an additional $10,000 annual cash retainer. Committee chairpersons other than the audit committee chairperson receive an additional $2,500 annual cash retainer.

Other than non-compensated directors, each Director may receive a grant of up to 4,000 shares of restricted stock upon election to the Board of Directors, twenty percent of the initial grant vest upon the anniversary of each December 31st, if the recipient continues to serve on the Board of Directors. Non-employee directors may receive an annual grant of 1,500 shares of restricted stock, one-third of the annual grant vest upon the anniversary of each December 31st, if the recipient continues to serve on the Board of Directors. For fiscal year 2004, Mr. Crowley received 3,000 shares of restricted stock, 600 of which vested on December 31, 2004.

In addition, Foundation reimburses Directors for travel expenses incurred in connection with attending Board, committee and stockholder meetings and for other Foundation business related expenses.

Stockholder Director Nominations

In accordance with Foundation's Amended and Restated Bylaws, any stockholder entitled to vote for the election of directors at the Annual Meeting may nominate persons for election as directors at the 2006 Annual Meeting of Stockholders only if the Secretary of Foundation receives written notice of any such nominations no earlier than December 15, 2005 and no later than January 15, 2006. Any stockholder notice of intention to nominate a director shall include:

- •

- the name and address of the stockholder;

- •

- a representation that the stockholder is entitled to vote at the meeting at which directors will be elected;

- •

- the number of shares of Foundation that are beneficially owned by the stockholder;

- •

- any material interest of the stockholder;

- •

- information required by Regulation 14A of the Securities Exchange Act of 1934, as amended;

- •

- a representation that the stockholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice;

- •

- the following information with respect to the person nominated by the stockholder:

- •

- name and address;

- •

- other information regarding such nominee as would be required in a proxy statement filed pursuant to applicable rules promulgated by the SEC, and

- •

- a description of any arrangements or understandings between the stockholder and the nominee and any other persons (including their names), pursuant to which the nomination is made; and

- •

- the consent of each such nominee to serve as a director if elected.

15

Stockholder Communications with the Board

Stockholders may contact the Board of Directors as a group or an individual director by the following means:

Email: board@foundationcoal.com

Mail: Board of Directors

Attn: Corporate Secretary

Foundation Coal Holdings, Inc.

999 Corporate Boulevard, Suite 300

Linthicum Heights, MD 21090

Stockholders should clearly specify in each communication the name of the individual director or group of directors to whom the communication is addressed. Stockholder communications will be promptly forwarded by the Secretary of Foundation to the specified director addressee. Communications addressed to the full Board of Directors or the group of non-management directors will be forwarded by the Secretary of Foundation to the Chairman of the Board. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chairman of the audit committee and handled in accordance with procedures established by the audit committee.

Foundation did not receive any stockholder recommendations for director nominees to be considered by the nominating and corporate governance committee for the 2005 annual Stockholders meeting.

EXECUTIVE OFFICERS

Klaus-Dieter Beck (49) is our Senior Vice President of Planning and Engineering. Prior to his current position, Mr. Beck was Senior Vice President of Planning and Engineering of RAG American Coal Holding, Inc. since 1999. From 1998 to 1999, Mr. Beck was Vice President of Riverton Coal Production, Inc., and from 1996 to 1998, he was General Mine Manager of Friedrich Heinrich Mine of Ruhrkohle Bergbau AG, a subsidiary of RAG AG.

James J. Bryja (48) is our Senior Vice President, Eastern Operations. Prior to his current position, Mr. Bryja was Senior Vice President, Eastern Operations of RAG American Coal Holding, Inc. since February 2003. From 1999 through 2001, Mr. Bryja was General Manager of Emerald Coal Resources, one of our subsidiaries, and from September 2001 to 2003, Mr. Bryja served as President of Pennsylvania Services Corporation, one of our subsidiaries. Mr. Bryja has 24 years of experience in the coal mining industry, with positions in management, engineering and production at Island Creek Corporation/Consolidation Coal Co. and U.S. Steel Mining Co. Mr. Bryja earned his Bachelor of Science in Mining Engineering from the Pennsylvania State University and his Masters Degree in Business Administration from the West Virginia University. Mr. Bryja is a registered Professional Engineer. Mr. Bryja currently serves as First Vice President of the Pittsburgh Coal Mining Institute of America. He is also a member of the Society of Mining Engineers and a member of the Pennsylvania Energy Advisory Board.

Thomas J. Lien (62) is our Senior Vice President, Western Operations. Prior to his current position, Mr. Lien was Senior Vice President, Western Operations of RAG American Coal Holding, Inc. since 2001. From 1989 to 2001, Mr. Lien was President of RAG Coal West, Inc. Prior to that, he held various management, mining and engineering positions at AMAX Coal Company, Kaiser Steel Corporation and Kennecott Copper Corporation. Mr. Lien is a member of the Rocky Mountain Coal Mining Institute and the Society of Mining Engineers of the American Institute of Mining, Metallurgical, and Petroleum Engineers. Mr. Lien retired from Foundation effective April 1, 2005. However, Mr. Lien will continue to provide his services to Foundation as a consultant.

16

James A. Olsen (53) is our Senior Vice President of Development and Information Technology. Prior to his current position, Mr. Olsen was Senior Vice President of Development and Information Technology of RAG American Coal Holding, Inc. since 1999. From 1993 to 1999, he worked at Cyprus Amax Coal Company as Assistant Controller and later as Vice President of Business Development. From 1975 to 1981, and from 1988 to 1990, he was employed by AMAX Inc. in several positions, including Assistant Controller and Assistant to the Treasurer. Mr. Olsen earned his Bachelor of Arts in Economics from St. Anselm College and his Masters Degree in Business Administration from Boston University.

Michael R. Peelish (43) is our Senior Vice President, Safety and Human Resources. Prior to his current position, Mr. Peelish was Senior Vice President, Safety and Human Resources of RAG American Coal Holding, Inc. since 1999. From 1995 to 1999, Mr. Peelish was Director, Safety of Cyprus Amax Minerals Company, and from 1994 to 1995, was Manager of Regulatory Affairs and Loss Control of Cyprus Amax Coal Company. From 1989 to 1994, Mr. Peelish was a Senior Attorney at Cyprus Minerals Company, and from 1986 to 1989, was an attorney at Consolidation Coal Company. Mr. Peelish received his law degree from the West Virginia University College of Law and his Bachelor of Science in Engineering of Mines from West Virginia University, Cum Laude.

John R. Tellmann (54) is our Senior Vice President, Sales and Marketing. Prior to his current position, Mr. Tellmann was Senior Vice President, Sales and Marketing of RAG American Coal Holding, Inc. since 2000. From 1993 to 2000, Mr. Tellmann was President of James River Coal Sales, Inc. Prior to that, Mr. Tellmann held various management positions in sales, marketing and acquisitions at James River Coal Sales, Inc., Mapco Coal, Inc., Westmoreland Coal Company and Union Electric Company (now known as Ameren Corporation).

Greg A. Walker (49) is our Senior Vice President, General Counsel and Secretary. Prior to his current position, Mr. Walker was Senior Vice President, General Counsel and Secretary of RAG American Coal Holding, Inc. since 1999. He has over 20 years of experience with legal and regulatory issues in the mining industry. He was Senior Attorney at Cyprus Amax Minerals Company from 1989 to 1999, affiliated with McGuire, Cornwell & Blakey from 1986 to 1989 and Associate Counsel at Mobil Oil Corporation from 1981 to 1986. Mr. Walker received his law degree in 1981 from the University of Florida and his Bachelor of Arts with a major in geology from the University of Pennsylvania in 1978.

Frank J. Wood (52) is our Senior Vice President and Chief Financial Officer. Prior to his current position, Mr. Wood was Senior Vice President and Chief Financial Officer of RAG American Coal Holding, Inc. since 1999. From 1993 to 1999, he was Vice President & Controller at Cyprus Amax Coal Company, and from 1991 to 1993, he was Vice President of Administration at Cannelton Inc. From 1979 to 1991, Mr. Wood held various accounting and financial management positions at AMAX Inc.'s coal and oil and gas subsidiaries. Prior to that Mr. Wood was employed by Pricewaterhouse Coopers.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Committee Report On Executive Compensation

The compensation committee has the responsibility for reviewing and approving changes to Foundation's executive compensation programs. The compensation committee also approves all compensation payments to the CEO and the other executive officers, including base salary adjustments, annual incentives, and long-term incentive awards. The compensation committee discharges other responsibilities pertaining to Foundation such as company-wide salary adjustments and overall compensation and benefit policies and plans.

17

For the fiscal year ended December 31, 2004, the compensation committee's activity focused on the key elements of the total direct compensation program for executive officers including the annual incentive payment levels for the executive management team for 2004 performance. The compensation committee also provided parameters for developing a long-term incentive plan for other key management, excluding executive management, such as vesting criteria, type of awards, eligible participants and implementation timing. The compensation committee receives input from Foundation's benefits committee, management and an independent compensation consultant retained by the compensation committee.

Compensation Philosophy

Foundation's strategy is to establish executive compensation programs that retain, recruit and motivate a qualified executive management team that is needed to achieve long-term profitability of Foundation and enhance stockholder value. Foundation's compensation program is premised upon the following beliefs:

- (i)

- Programs will establish performance targets that translate into enhanced stockholder value,

- (ii)

- Programs will align the individual and collective performance of executive management with stockholder value,

- (iii)

- Total compensation should encourage the achievement of individual and collective company performance targets.

The primary components of Foundation's executive compensation programs are base salary, annual bonus awards, and long-term equity incentive awards. The total compensation achievable should be generally competitive with the Compensation Comparison Group. This group includes Alpha Natural Resources, Arch Coal, Alliance Natural Resources, Consol Energy, James River, Massey Energy, Peabody Energy, and Westmoreland Coal.

Base Salary

Base compensation is determined by the compensation committee based upon its philosophy that executive management base salaries should be generally competitive in the marketplace. The compensation committee will continue to evaluate the base salaries of all named executive officers on a regular basis to ensure that marketplace competitiveness is maintained, taking into account each executive's performance and contributions to Foundation, job experience, and retention value.

Annual Incentive Plan

Foundation's annual incentive plan provides an opportunity for all salaried employees in Foundation to earn additional compensation for the achievement of certain individual and Foundation performance targets established by management. The percentage of base salary a salaried employee can receive is predetermined under the plan. Regarding the named executive officers, the percent of base pay and the performance targets are established by the Board.

As it relates to executive managers including the named executive officers, for calendar year 2004, Foundation's performance targets were based (i) two-thirds on target free cash flow generated from the closing date of July 30, 2004 through December 31, 2004, pursuant to management's internal forecast as of early 2004 ("Q1 forecast") and (ii) one-third based on target EBITDA (as defined in the credit agreement among our subsidiary Foundation Coal Company and various parties) for the entire 2004 calendar year, pursuant to the Q1 forecast. For executive managers including the named executive

18

officers (other than the CEO, who is discussed separately below), bonuses were determined as set forth in the table below:

Company Performance

| | Percent of

Base Salary

| | Individual

Performance

| | Percent of

Base Salary

|

|---|

| 125% of Target | | 83.33 | | Maximum | | 41.67 |

| 100% of Target | | 33.33 | | Target | | 16.67 |

| 85% of Target | | 16.67 | | Below Target | | 8.33 |

| Below 85% of Target | | 0.00 | | | | |

2004 Incentive Payments

For the fiscal year ended December 31, 2004, Foundation awarded annual incentive payments to the CEO and the other four named executive officers as shown in the bonus column of the Summary Compensation Table. All other eligible executive managers were paid under the same annual incentive program. The incentive payments were based in part upon Foundation exceeding the free cash flow target based; however, the EBITDA target was not exceeded. The individual performance targets were deemed to be exceeded due primarily to the successful completion of several transactions by Foundation and its predecessor, including an initial public offering.

Long-Term Equity Incentives

Foundation established its 2004 Stock Incentive Plan in July 2004. The primary purpose of the plan is to offer an incentive for the achievement of superior operating results that increase the equity value of Foundation for its shareholders. The compensation committee intends that these incentive opportunities will align the interest of management with the interests of shareholders, be competitive, and be based upon actual Foundation performance.

In July 2004, the CEO and the other executive managers were eligible to participate in the long-term incentive opportunity. The equity participation was in the form of stock options issued pursuant to Foundation's 2004 Stock Incentive Plan. Of the options granted to the executive managers, twenty-eight (28) percent were time options and seventy-two (72) percent were performance options. The time options vest over a period of five years with the first vesting date at December 31, 2004; however, time options will immediately vest upon a change of control of Foundation (as defined in the Non-Qualified Stock Option Agreement by and between Foundation and the individual optionee). The performance options will vest on the eighth anniversary of the date of grant but the vesting may be accelerated based upon achieving predefined performance targets of EBITDA, free cash flow, cost per ton, and production. Also, all performance options will immediately vest upon a change of control of Foundation (as defined in the Non-Qualified Stock Option Agreement by and between Foundation and the individual optionee).

Compensation of the Chief Executive Officer

Mr. Roberts' base salary is $600,000. A review of competitive market data conducted in July 2004 supports the competitiveness of this base salary.

For the fiscal year ended December 31, 2004, Mr. Roberts' maximum annual incentive opportunity was 175% of his base salary, or $1,050,000. Mr. Roberts was awarded a target bonus payout of 75% of base salary or $450,000 under the plan. Mr. Roberts' incentive payments were based in part upon Foundation exceeding the free cash flow target; however, the EBITDA was not exceeded. His individual performance target was deemed to be exceeded as measured by the successful completion of several transactions by Foundation and its predecessor, including an initial public offering. During this time, strong operating and financial performance was maintained notwithstanding the many and varied demands placed upon Mr. Roberts.

19

Deductibility of Compensation

Under Section 162(m) of the Internal Revenue Code, Foundation is subject to the loss of the deduction for compensation in excess of $1 million paid to one or more of the executive officers named in this proxy statement. This deduction can be preserved if Foundation complies with certain conditions in the design and administration of these compensation programs.

| | | Prakash A. Melwani,Chairman

Alex T. Krueger

William J. Crowley, Jr. |

Compensation Committee Interlocks and Insider Participation

Directors Melwani, Krueger and Crowley were members of the compensation committee during 2004. None of the members of the compensation committee has ever been an officer or employee of Foundation Coal Holdings, Inc. or any of its subsidiaries.

In 2004, none of Foundation's executive officers:

- •

- served as a member of the compensation committee (or committee performing a similar function, or in the absence of such committee, the Board of Directors) of another entity, one of whose executive officers served on Foundation's compensation committee or Board of Directors; or

- •

- served as a director of another entity, one of whose executive officers served on Foundation's compensation committee.

The following tables show, for the last fiscal year, compensation information for Foundation's Chief Executive Officer and the next four most highly compensated executives. Other tables that follow provide more detail about the specific type of compensation. Each of these officers is referred to as a "named executive officer."

20

Summary Compensation Table:

| |

| | Annual Compensation

| |

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Performance

Bonus

($)

| | Other Annual

Compensation

($)

| | LTIP-Payouts*

| | All Other

Compensation

| |

|---|

James F. Roberts

President and Chief

Executive Officer | | 2004 | | $ | 571,388 | | $ | 450,000 | | $ | 1,118,550 | (a) | $ | 1,190,919 | | $ | 253,293 | (f) |

Thomas J. Lien

Senior Vice President,

Western Operations |

|

2004 |

|

$ |

224,409 |

|

$ |

90,000 |

|

$ |

60,000 |

(b) |

$ |

396,974 |

|

$ |

1,000,881 |

(g) |

Frank J. Wood

Senior Vice President and Chief Financial Officer |

|

2004 |

|

$ |

204,875 |

|

$ |

200,000 |

|

$ |

513,185 |

(c) |

$ |

396,974 |

|

$ |

201,112 |

(h) |

Greg A. Walker

Senior Vice President,

General Counsel and Secretary |

|

2004 |

|

$ |

230,406 |

|

$ |

175,000 |

|

$ |

453,185 |

(d) |

$ |

396,974 |

|

$ |

147,479 |

(i) |

John R. Tellmann

Senior Vice President,

Sales and Marketing |

|

2004 |

|

$ |

257,197 |

|

$ |

170,000 |

|

$ |

443,050 |

(e) |

$ |

396,974 |

|

$ |

77,231 |

(j) |

- *

- Upon closing of the Acquisition, Messrs. Roberts, Tellmann, Walker, Wood and Lien received payouts through RAG American Coal Holding, Inc. from grants awarded in 2002 and 2003 under RAG Coal International AG's long-term incentive plan.

- (a)

- Includes $8,000 disability insurance payment, $710,000 transaction bonus paid immediately after closing, $383,050 tax allowance and $17,500 director's fees.

- (b)

- Includes $60,000 transaction bonus paid immediately after closing of the Acquisition.

- (c)

- Includes $360,000 transaction bonus paid immediately after closing of the Acquisition and $153,185 tax allowance.

- (d)

- Includes $300,000 transaction bonus paid immediately after closing of the Acquisition and $153,185 tax allowance.

- (e)

- Includes $60,000 transaction bonus paid immediately after closing of the Acquisition and $383,050 tax allowance.

- (f)

- Includes $247,252 Supplemental Executive Retirement Plan payment and $6,041 Registrant contribution to Defined Contribution plan.

- (g)

- Includes $357,230 Supplemental Executive Retirement Plan payment, $6,700 Registrant contribution to Defined Contribution plan and $636,951 change of control agreement.

- (h)

- Includes $194,970 Supplemental Executive Retirement Plan payment and $6,142 Registrant contribution to Defined Contribution plan.

- (i)

- Includes $140,600 Supplemental Executive Retirement Plan payment and $6,879 Registrant contribution to Defined Contribution Plan.

- (j)

- Includes $71,117 Supplemental Executive Retirement Plan payment and $6,114 Registrant contribution to Defined Contribution plan.

21

Employment Agreements and Termination and Change of Control Provisions

We have entered into an employment agreement with James F. Roberts, effective July 30, 2004, to serve as President, Chief Executive Officer and member of our Board of Directors. The term of the agreement is through July 30, 2007, unless terminated earlier by us or Mr. Roberts. The employment agreement provides for an initial annual base salary of $600,000, which may be adjusted from time to time by the compensation committee. The compensation committee approved an increase in Mr. Roberts's salary of 2.5%; the increase took effect on January 1, 2005. The employment agreement also provides for an annual bonus payment based upon the achievement of certain individual and company performance targets established by the Board of Directors, in consultation with Mr. Roberts. Mr. Roberts is entitled to receive stock options under the 2004 Stock Incentive Plan, $8,000 per year for a disability insurance plan of his choice and the use of an automobile in accordance with the policies of Foundation.

If Mr. Roberts' employment is terminated by us without "cause" or if Mr. Roberts resigns for "good reason" (as such terms are defined in the employment agreement), Mr. Roberts will receive (a) the accrued but unpaid salary, bonus and reimbursements through the date of termination, (b) the target annual bonus for the year of termination, prorated to the amount of time actually employed during such year and (c) subject to Mr. Roberts' compliance with the non-compete and confidentiality provisions, the sum of his base salary and target annual bonus for the greater of (i) the remainder of his term under the employment agreement and (ii) two years, such payment to be received in bi-monthly installments during the one-year period following termination.

Under the terms of the agreement, Mr. Roberts may not disclose any confidential information concerning us, our subsidiaries or affiliates and any third party that has provided any information to us on a confidential basis. In addition, during Mr. Roberts' term of employment and (a) for a period of one year following the date Mr. Roberts ceases to be employed by us, Mr. Roberts may not compete with us or our subsidiaries, and (b) for a period of two years following the date Mr. Roberts ceases to be employed by us, Mr. Roberts may not solicit or hire our employees or employees of our subsidiaries.

Greg A. Walker, Frank J. Wood, Michael R. Peelish, Klaus-Dieter Beck, James J. Bryja, James A. Olsen and John R. Tellmann

We have entered into employment agreements effective July 30, 2004 with Greg A. Walker to serve as Senior Vice President, General Counsel and Secretary, Frank J. Wood to serve as Senior Vice President and Chief Financial Officer, Michael R. Peelish to serve as Senior Vice President, Safety and Human Resources, Klaus-Dieter Beck to serve as Senior Vice President, Planning and Engineering, James J. Bryja to serve as Senior Vice President, Eastern Operations, James A. Olsen to serve as Senior Vice President, Development and Information Technology, and John R. Tellmann to serve as Senior Vice President, Sales and Marketing (for purposes of this section, the "Executive Officers"). The term of each agreement is through July 30, 2006, unless terminated earlier by us or the Executive Officer.

The employment agreements for Mr. Walker, Mr. Wood, Mr. Peelish, Mr. Beck, Mr. Bryja, Mr. Olsen and Mr. Tellmann provide for initial annual base salaries of $230,397, $204,867, $194,361, $225,000, $229,500, $183,855 and $257,187, respectively, the base salaries may be adjusted from time to time by the compensation committee. The compensation committee approved a 2.5% increase in each of the base salaries of the Executive Officers, excluding Mr. Wood. Mr. Wood's salary was increased to $270,000. The salary increases took effect January 1, 2005. Each of these agreements provides for an annual bonus payment based upon the achievement of certain individual and company performance targets established by the Board of Directors, in consultation with the respective Executive Officer.

22

Each Executive Officer is entitled to receive stock options under the Foundation Coal Holdings, Inc. 2004 Stock Incentive Plan.

Under each of these agreements, if the Executive Officer's employment is terminated by us without "cause" or if the Executive Officer resigns for "good reason" (as such terms are defined in the employment agreement), the Executive Officer will receive (a) the accrued but unpaid salary, bonus, and reimbursements through the date of termination, (b) the target annual bonus for the year of termination, prorated for the amount of time actually employed during such year, and (c) subject to the Executive Officer's compliance with the non-compete and confidentiality provisions, the sum of his base salary and target annual bonus for the greater of (i) the remainder of his term under the employment agreement and (ii) one year, such payment to be received in bi-monthly installments during the nine-month period following termination.

Under the terms of each agreement, the Executive Officer may not disclose any confidential information concerning us, our subsidiaries or affiliates and any third party that has provided any information to us on a confidential basis. In addition, during the Executive Officer's term of employment and (a) for a period of nine months following the date the Executive Officer ceases to be employed by us, the Executive Officer may not compete with us or our subsidiaries, and (b) for a period of two years following the date the Executive Officer ceases to be employed by us, the Executive Officer may not solicit or hire our employees or employees of our subsidiaries.

We entered into an employment agreement with Thomas Lien, effective January 1, 2002, to serve as Senior Vice President, Western Operations. The agreement expired on December 31, 2004.

The employment agreement of Mr. Lien provided for an annual base salary of $220,000 and eligibility to participate in other compensations plans and policies as they may be provided by us.

A separate change of control agreement, also dated January 1, 2002, provides a payment equal to the sum of (a) two years of unadjusted base salary, (b) an amount representing the target bonus for two bonus cycles, (c) deferred compensation and (d) accrued and unpaid incentive compensation and vacation pay. Under the terms of the agreement, Mr. Lien may not disclose any confidential information concerning us, our subsidiaries or affiliates.