UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

| | | | | | |

x | | Preliminary proxy statement | | ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ | | Definitive proxy statement | | |

¨ | | Definitive additional materials | | |

¨ | | Soliciting material under Rule 14a-12 | | |

FOUNDATION COAL HOLDINGS, INC.

(Name of Registrant as Specified In Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

FOUNDATION COAL HOLDINGS, INC.

999 Corporate Boulevard, Suite 300

Linthicum Heights, MD 21090-2227

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

TO BE HELD May 18, 2006

To the Stockholders of Foundation Coal Holdings, Inc.:

NOTICE IS HEREBY GIVEN that Foundation Coal Holdings, Inc.’s (“Foundation” or the “Company”) 2006 Annual Meeting of Stockholders will be held at 10:00 AM on Thursday, May 18, 2006, at the BWI Marriott, 1743 West Nursery Road, Linthicum Heights, MD 21090 (the “Annual Meeting”).

At the meeting, we will ask stockholders to:

| | 1. | Elect eight directors for a term of one year; |

| | 2. | Approve Ernst & Young LLP as Foundation’s Independent Public Accountants for the fiscal year ending December 31, 2006; |

| | 3. | Approve an Amendment of the Certificate of Incorporation; and |

| | 4. | Any other matters that properly come before the meeting. |

We plan a brief business meeting focused on these items and we will attend to any other proper business that may arise.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF PROPOSALS 1, 2 AND 3. These proposals are further described in the proxy statement.

At the meeting, there will be a brief presentation on Foundation’s operations, and we will offer time for your comments and questions. Only Foundation stockholders of record at the close of business on March 30, 2006 are entitled to notice of and to vote at the meeting and any adjournment of it. For ten (10) days prior to the Annual Meeting, a list of stockholders entitled to vote will be available for inspection at Foundation’s corporate offices located at 999 Corporate Boulevard, Suite 300, Linthicum Heights, MD 21090-2227.

YOUR VOTE IS IMPORTANT. WE URGE YOU TO COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE. YOUR PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE TIME IT IS VOTED AT THE 2006 ANNUAL MEETING.

By order of the Board of Directors,

William Macaulay

Chairman of the Board of Directors

TABLE OF CONTENTS

2

PROXY STATEMENT FOR

2006 ANNUAL MEETING OF STOCKHOLDERS OF

FOUNDATION COAL HOLDINGS, INC. TO BE HELD ON

MAY 18, 2006

GENERAL INFORMATION ABOUT FOUNDATION’S ANNUAL MEETING

Foundation intends to mail this proxy statement, proxy card and Foundation’s Annual Report to Stockholders for the fiscal year ended December 31, 2005, to all stockholders entitled to vote at the Annual Meeting on or about April 14, 2006. The Annual Meeting will be held on Thursday, May 18, 2006, at 10:00 AM at the BWI Marriott, 1743 W. Nursery Road, Linthicum Heights, MD 21090. Directions to the meeting are at the back of the Proxy Statement.

Who is entitled to vote at the Annual Meeting?

Anyone who owns of record Foundation common stock as of the close of business on March 30, 2006 is entitled to one vote per share owned. There were 45,350,310 shares outstanding on that date.

Who is soliciting my proxy to vote my shares?

Foundation’s board of directors is soliciting your “proxy,” or your authorization for our representatives to vote your shares. Your proxy will be effective for the May 18, 2006 meeting and at any adjournment or continuation of that meeting.

Who is paying for and what is the cost of soliciting proxies?

Foundation is bearing the entire cost of soliciting proxies. Proxies will be solicited principally through the mail, but may also be solicited personally or by telephone, facsimile, or special letter by Foundation’s directors, officers, and regular employees for no additional compensation. To assist in the solicitation of proxies and the distribution and collection of proxy materials, Foundation has engaged Innisfree M&A Incorporated, a proxy solicitation firm, for an estimated fee of $6,500. Foundation will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to their customers or principals who are the beneficial owners of shares of common stock.

What constitutes a quorum?

For business to be conducted at the Annual Meeting, a quorum constituting a majority of the shares of Foundation common stock issued and outstanding and entitled to vote must be in attendance or represented by proxy.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and Foundation’s Certificate of Incorporation and Bylaws govern the vote on each proposal. The board of directors’ recommendation is set forth together with the description of each item in this proxy statement. In summary the board of directors’ recommendations and approval requirements are:

PROPOSAL 1. ELECTION OF DIRECTORS

The first proposal item to be voted on is the election of eight directors. The board of directors has nominated eight people as directors, each of whom is currently serving as a director of Foundation.

You may vote in favor of all the nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Assuming a quorum, each share of common stock may be voted for as many nominees

3

as there are directors to be elected. directors are elected by a plurality of the votes cast. Stockholders may not cumulate their votes. Abstentions and broker non-votes will have no effect on the outcome of the vote.

The board of directors unanimously recommends a vote FOR each director nominee.

PROPOSAL 2. APPROVAL OF INDEPENDENT ACCOUNTANTS, ERNST & YOUNG LLP

The second proposal item to be voted on is to approve Ernst & Young LLP as Foundation’s Independent Public Accountants.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the shares present in person or represented and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The board of directors unanimously recommends a vote FOR the approval of Ernst & Young LLP as Independent Public Accountants.

PROPOSAL 3. AMENDMENT OF THE CERTIFICATE OF INCORPORATION

The third proposal item to be voted on is to approve amendments to the Certificate of Incorporation in order to (a) clarify the preamble to reflect the proposed changes, (b) delete text regarding a reverse stock split that took effect on December 8, 2004 and (c) delete in Articles VI and VIII provisions regarding ownership of our common stock by our major stockholders prior to our initial public offering.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the total number of shares of common stock outstanding as of March 30, 2006. Abstentions and broker non-votes will have the same effect as votes against the proposal.

The board of directors unanimously recommends a vote FOR all four amendments to the Certificate of Incorporation.

PROPOSAL 4. OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The board of directors is not aware of any other business to be presented for a vote of the stockholders at the 2006 Annual Meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

The chairman of the Annual Meeting may refuse to allow presentation of a proposal or nominee for the board of directors if the proposal or nominee was not properly submitted. The requirements for submitting proposals and nominations for next year’s meeting are described in the section entitled “Stockholder Proposals for the 2007 Annual Meeting.”

VOTING AND PROXY PROCEDURE

What are the voting rights of holders of Foundation common stock?

Each outstanding share of Foundation stock will be entitled to one vote on each matter considered at the meeting.

4

How do I vote?

You may vote in four (4) different ways:

| | 1. | BY MAIL. Mark your voting instructions on, and sign and date, the proxy card and then return it in the postage-paid envelope provided. The board of directors recommends that you vote by proxy even if you plan on attending the meeting. If you mail your proxy card, we must receive it before the polls close at the end of the meeting. |

If we receive your signed proxy card, but you do not give voting instructions, our representatives will vote your shares FOR Proposals 1, 2 and 3. If any other matters arise during the meeting that requires a vote, the representatives will vote based on the recommendation of the board of directors, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

| | 2. | IN PERSON. You may deliver your completed proxy in person at the meeting. “Street name” or nominee account shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares. |

| | 3. | VIA TELEPHONE. If you own your shares in “street name” or in a nominee account, you may place your vote by telephone by following the instructions on the proxy card provided by your broker, bank or other holders of record. |

| | 4. | VIA INTERNET. If you own your shares in “street name” or in a nominee account, you may place your vote through the Internet by following the instructions on the proxy card provided by your broker, bank or other holders of record. |

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent or with stock brokers or other nominees. Please complete and provide your voting instructions for all proxy cards that you receive.

How do I revoke my proxy or change my voting instructions?

You may revoke your proxy or change your voting instructions in three (3) different ways:

| | 1. | WRITE TO FOUNDATION’S CORPORATE SECRETARY, GREG A. WALKER, AT 999 CORPORATE BOULEVARD, SUITE 300, LINTHICUM HEIGHTS, MD 21090-2227. |

Your letter should contain the name in which your shares are registered, your control number, the date of the proxy you wish to revoke or change, your new voting instructions, if applicable, and your signature. Mr. Walker must receive your letter before the Annual Meeting begins.

| | 2. | SUBMIT A NEW PROXY CARD BEARING A LATER DATE THAN THE ONE YOU WISH TO REVOKE. We must receive your new proxy card before the Annual Meeting begins. |

| | 3. | ATTEND THE ANNUAL MEETING AND VOTE IN PERSON AS DESCRIBED ABOVE (OR BY PERSONAL REPRESENTATIVE WITH AN APPROPRIATE PROXY). Attendance at the meeting will not by itself revoke a previously granted proxy. |

How will proxies be voted if I give my authorization?

The board of directors has selected James F. Roberts, Greg A. Walker and Edythe C. Katz, and each of them, to act as proxies with full power of substitution. With respect to the proposal regarding election of directors, stockholders may (i) vote in favor of all nominees, (ii) withhold their votes as to all nominees, or (iii) withhold their votes as to specific nominees by so indicating in the appropriate space on the enclosed proxy card. With respect to the proposal to approve the appointment of Ernst & Young LLP as the Company’s independent accountants for fiscal year 2006, stockholders may (i) vote “for”, (ii) vote “against” or (iii) abstain

5

from voting as to this matter. With respect to the proposal to approve the amendment to our Amended and Restated Certificate of Incorporation, you may (i) vote “for”, (ii) vote “against” or (iii) abstain from voting as to this matter. All properly executed proxy cards delivered by stockholders and not revoked will be voted at the Annual Meeting in accordance with the directions given. IF NO SPECIFIC INSTRUCTIONS ARE GIVEN WITH REGARD TO THE MATTERS TO BE VOTED UPON, THE SHARES REPRESENTED BY A PROPERLY EXECUTED PROXY CARD WILL BE VOTED (i) ”FOR” THE ELECTION OF ALL DIRECTOR NOMINEES, (ii) ”FOR” THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT ACCOUNTANTS AND (iii) “FOR” AMENDMENT OF THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION. Management knows of no other matters that may come before the Annual Meeting for consideration by the stockholders. However, if any other matter properly comes before the Annual Meeting, the persons named in the enclosed proxy card as proxies will vote upon such matters in accordance with the recommendation of the board of directors, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

How will votes be counted?

The inspector of elections appointed by the board of directors for the Annual Meeting will calculate affirmative votes, negative votes, abstentions, and broker non-votes. Under Delaware law, shares represented by proxies that reflect abstentions or “broker non-votes” will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

You as beneficial owner, own your shares in “street name,” if your broker or other “street” nominee is actually the record owner. Brokers or other “street” nominee have discretionary authority to vote on routine matters, regardless of whether they have received voting instructions from their clients who are the beneficial owner. Director elections and ratifying the appointment of independent accountants are each routine matters. A “broker non-vote” results on a matter when a broker or other “street” or nominee record holder returns a duly executed proxy but does not vote on non-routine matters solely because it does not have discretionary authority to vote on non-routine matters and has not received voting instructions from its client (the beneficial holder). Accordingly, no broker non-votes occur when voting on routine matters. Broker non-votes count toward a quorum. The proposal to amend our Articles of Incorporation in Proposal Three is not considered routine. The approval of Proposal Three is determined based on the vote of all shares of common stock outstanding as of March 30, 2006. Abstention on such a proposal has the same effect as a vote “against” such proposal. Broker non-votes have no effect on the vote of such proposals.

Where do I find voting results of the Annual Meeting?

Preliminary voting results will be announced at the meeting. Final voting results will be published in Foundation’s quarterly report on Form 10-Q for the second quarter of 2006. The report will be filed with the Securities and Exchange Commission (the “SEC”) on or about August 10, 2006 and you may receive a copy by contacting Foundation Investor Relations at 410-689-7632, or the SEC at 800-SEC-0330 for the location of its nearest public reference room. You may also access a copy on the Internet atwww.foundationcoal.com/investors/securities filings or through EDGAR, the SEC’s electronic data system, atwww.sec.gov.

PROPOSAL ONE

ELECTION OF DIRECTORS

The first agenda item to be voted on is the election of eight directors. The board of directors has nominated eight people as directors, each of whom is currently serving as a director of Foundation. The board of directors unanimously recommends that you vote FOR such nominees.

The board of directors consists of eight directors with each term expiring at the 2006 Annual Meeting. Each of the nominees has indicated his willingness to serve, if elected, but if any of the nominees should be unable or

6

unwilling to serve, the board of directors may either reduce its size, or designate or not designate a substitute nominee. If the board of directors designates a substitute nominee, proxies that would have been cast for the original nominee will be cast for the substitute nominee unless instructions are given to the contrary.

Nominees for Directors

William E. Macaulay(60) has been Chairman of our board of directors since 2004. Mr. Macaulay is the Chairman and Chief Executive Officer of First Reserve Corporation, a private equity firm focusing on the energy industry, which he joined in 1983. Prior to joining First Reserve Corporation, Mr. Macaulay was a co-founder of Meridien Capital Company, a private equity buyout firm. From 1972 to 1982, Mr. Macaulay was with Oppenheimer & Co., Inc., where he served as director of Corporate Finance, with responsibility for investing Oppenheimer’s capital in private equity transactions, as a General Partner and member of the Management Committee of Oppenheimer & Co., as well as President of Oppenheimer Energy Corporation. Mr. Macaulay is currently a director of the following SEC reporting companies: Dresser, Inc., Dresser-Rand Group Inc. and Weatherford International, Ltd.

William J. Crowley Jr.(60) was appointed to our board of directors in December 2004. He serves as Chairman of our audit committee and is our audit committee financial expert. Mr. Crowley is a certified public accountant and has recently served as an independent business advisor to various companies. Prior to his retirement in 2002, Mr. Crowley had a thirty-two year career with Arthur Andersen LLP, of which 16 years were in Baltimore, Maryland, most recently serving for seven years as Managing Partner of the Baltimore office. Mr. Crowley currently serves as a director and member of the audit committee of BioVeris Corporation (where he serves as chairman of the audit committee) and Provident Bankshares Corporation. He is also a board member of the Baltimore Area Council of Boy Scouts of America, Junior Achievement of Central Maryland and the Maryland Science Center.

David I. Foley(38) has been a member of our board of directors since 2004. He serves as the Chairman of the compensation committee. He is a Senior Managing Director in the Private Equity Group of The Blackstone Group L.P., an investment and advisory firm, which he joined in 1995. Mr. Foley has been involved in the execution of several of Blackstone’s investments and leads Blackstone’s investment activities in the energy industry. Prior to joining Blackstone, Mr. Foley was an employee of AEA Investors Inc. from 1991 to 1993 and a consultant with The Monitor Company from 1989 to 1991. Mr. Foley currently serves as a director of Kosmos Energy Holdings, Mega Bloks Inc., Allied Waste, Inc. and World Power Holdings GP, Ltd.

P. Michael Giftos(58) has been a member of our board of directors since 2005. Mr. Giftos also serves as a member of the board of directors of Pacer International, Inc. in which he is a member of its audit committee and chair of its governance committee. From 1985 to 2004, he served in many executive positions with CSX Corporation and its subsidiaries (“CSX”). From 2000 through 2004, Mr. Giftos served as CSX Transportation’s Executive Vice President and Chief Commercial Officer. He served as Senior Vice President and General Counsel at CSX from 1990 through 2000. From 1985 through 1989 he served as Vice President and General Counsel at CSX. Mr. Giftos received his law degree from the University of Maryland and a Bachelor of Arts in Political Science from George Washington University.

Alex T. Krueger(32) has been a member of our board of directors since 2004. Mr. Krueger is a Managing Director of First Reserve Corporation, a private equity firm focusing on the energy industry, which he joined in 1999. Prior to joining First Reserve Corporation, Mr. Krueger worked in the Energy Group of Donaldson, Lufkin & Jenrette from 1997 until 1999.

Joel Richards, III(59) has been a member of our board of directors since 2005. He serves as the Chairman of our Nominating and Corporate Governance Committee. He served as a member of the board of directors of our predecessor, RAG American Coal Holdings, Inc., from 2000 to 2003. He is currently a principal in a management consultant firm. Mr. Richards was Executive Vice President and Chief Administrative Officer with El Paso Energy Corp. from 1996 until his retirement in 2002. From 1990 through 1996 he served as Senior Vice President Human Resources and Administration at El Paso Natural Gas Company. He was Senior Vice President

7

Finance and Administration at Meridian Minerals Company, where he worked from 1985 to 1990. Prior to that, he held various management and labor relations positions at Burlington Northern, Inc., Union Carbide Corporation and Boise Cascade Corporation. Mr. Richards earned his Bachelor of Science in Political Science and Masters in Administration from Brigham Young University.

James F. Roberts(56) is our President and Chief Executive Officer and was appointed to our board of directors in 2004. Prior to his current position, Mr. Roberts had been President and Chief Executive Officer of RAG American Coal Holding, Inc. since January 1999. Mr. Roberts was President of CoalARBED International Trading from 1981 to 1999, Chief Financial Officer of Leckie Smokeless Coal Company from 1977 to 1981 and Vice President of Finance at Solar Fuel Company from 1974 to 1977. Mr. Roberts is a director of the National Mining Association, where he is also vice-chairman. In addition, Mr. Roberts is a director of the Center for Energy and Economic Development and a member of the executive committee of the National Coal Council.

Robert C. Scharp(59) has been a member of our board of directors since 2005. He currently serves as Chairman of Shell Canada’s Mining Advisory Council. He is also a member of the board of directors of Bucyrus International, Inc. He began his mining career in 1974 with Phelps Dodge where he served as a Mining Engineer. From 1975 to 1997 he held a variety of operational and management positions with the Kerr-McGee Corporation, including General Manager of the Jacobs Ranch Mine, General Manager of the Galatia Mine and Vice President Operations, Kerr-McGee Coal. Mr. Scharp served as President of Kerr-McGee Coal Corporation from 1991 until 1995 and Senior Vice President, Oil and Gas Production for Kerr-McGee from 1995 until 1997. From 1997 through 2000, Mr. Scharp served as Chief Executive Officer, Shell Coal Pty. Ltd in Brisbane, Australia and then served as the Chief Executive Officer of Anglo Coal Australia Pty. Ltd. until 2001. He joined the board of directors of Horizon Natural Resources in early 2002, and later that year became Chairman and Acting Chief Executive Officer until his departure in March 2003. That entity filed a voluntary petition for relief under Chapter 11 of the Bankruptcy code in November 2002. Mr. Scharp graduated from the Colorado School of Mines with an Engineer of Mines degree. He also attended Harvard Business School and completed the Advanced Management Program. Mr. Scharp served four years in the U.S. Army and then nineteen years in the Army National Guard retiring as a Colonel in 1993.

PROPOSAL TWO

APPROVAL OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

The second agenda item to be voted on is to approve the appointment of Ernst & Young LLP as independent public accountants for the fiscal year ending December 31, 2006.

The audit committee has recommended, and the board of directors has approved, Ernst & Young LLP to act as Foundation’s independent public accountants for the fiscal year ending December 31, 2006. The board of directors has directed that such appointment be submitted to Foundation’s stockholders for ratification at the 2006 Annual Meeting. Ernst & Young LLP were Foundation’s independent public accountants for the fiscal year ended December 31, 2005.

Stockholder ratification of the appointment of Ernst & Young LLP as Foundation’s independent public accountants is not required. The board of directors, however, is submitting the appointment to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the appointment, the board of directors will reconsider whether or not to retain Ernst & Young LLP or another firm. Even if the appointment is ratified, the board of directors, in its discretion, may direct the appointment of a different accounting firm at any time during the 2006 fiscal year if the board of directors determines that such a change would be in the best interests of Foundation and its stockholders.

Representatives of Ernst & Young LLP are expected to be present at the 2006 Annual Meeting and will have an opportunity to make a statement if they so desire. They will be available to respond to appropriate questions.

The board of directors unanimously recommends that you vote FOR this proposal.

8

Report of the Audit Committee

The audit committee of the Company’s board of directors is composed of four non-employee directors and operates under a written charter adopted by the board of directors. The committee charter is available on the Company’s web site (www.foundationcoal.com). The board of directors has determined that Messrs. Crowley, Giftos and Scharp are independent in accordance with the currently effective listing standards of the New York Stock Exchange (the “NYSE”). In addition, the board of directors has determined that William J. Crowley, Jr., as defined by SEC rules, is both independent and an audit committee financial expert.

The Company’s management is responsible for the Company’s financial reporting processes, including the system of internal controls. The independent registered public accounting firm is responsible for performing audits of the Company ‘s consolidated financial statements and for issuing opinions on the conformity of those financial statements with U.S. generally accepted accounting principles. The independent registered public accounting firm is also responsible for performing an audit of management’s assessment of the effectiveness of internal control over financial reporting and expressing an opinion on management’s report on internal control over financial reporting. The audit committee oversees the Company’s financial reporting processes on behalf of the board of directors.

In this context, the audit committee has met and held discussions with management, our internal auditors and the independent registered public accounting firm. Management represented to the audit committee that the Company’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the audit committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. Management also represented to the audit committee that it has established and maintained adequate internal controls over financial reporting and the audit committee has discussed internal controls over financial reporting with the independent registered public accounting firm. The audit committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61Communication With Audit Committees, including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by relevant professional and regulatory standards and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the firm is independent, the audit committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The audit committee discussed with the Company’s independent registered public accounting firm and our internal auditors the overall scope and plans for their respective audits. The audit committee meets with the independent registered public accounting firm at least quarterly, with and without management present, to discuss the results of their examination, their evaluations of our internal controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board of directors, and the board has approved, that the audited consolidated financial statements of the Company be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the SEC. The audit committee and the board of directors also have approved the selection of the Company’s independent registered public accounting firm.

The audit committee of the board of directors of Foundation Coal Holding, Inc.

William J. Crowley, Jr.

P. Michael Giftos

Robert C. Scharp

9

Fees of Independent Certified Public Accountants

For work performed in regard to fiscal year 2004 and 2005, Foundation paid Ernst & Young LLP the following fees for services, as categorized:

| | | | | | |

| | | Fiscal 2004 | | Fiscal 2005 |

| | | (in millions) | | (in millions) |

Audit fees(1) | | $ | 1.8 | | $ | 2.3 |

Audit-related fees(2) | | | .8 | | | .1 |

Tax fees(3) | | | — | | | — |

All other fees(4) | | | — | | | — |

| (1) | For fiscal year 2004 includes fee for audit services principally relating to the annual audit, quarterly reviews, registration statements and International Financial Reporting Standards (required by RAG Coal International AG our former parent company). For Fiscal Year 2005 includes fees for audit services relating to the annual audit, stand alone financial statements of certain subsidiaries, quarterly reviews, registration statements and the audit of management’s assessment of internal control over financial reporting and the effectiveness of internal control over financial reporting. |

| (2) | For fiscal year 2004 includes audit related fees for stand alone financial statements of subsidiaries that were sold, re-audit of year ended December 31, 2001, private placement documents and audits of employee benefits plans. For Fiscal Year 2005 includes fees for employee benefit plan audits. |

| (3) | There were no tax fees incurred. |

| (4) | There were no other fees incurred. |

Policy for Approval of Audit and Permitted Non-audit Services

All audit related services, tax services and other services were pre-approved for 2005 and 2006 by the audit committee, which concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

All audit, audit-related and tax services were pre-approved by the audit committee, which concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The audit committee’s Pre-Approval Policy provides for pre-approval of specifically described audit, audit-related and tax services by the audit committee on an annual basis, but individual engagements anticipated to exceed pre-established thresholds must be separately approved. The policy also requires specific approval by the audit committee if total fees for audit-related and tax services would exceed 10% of total fees originally pre-approved in any fiscal year. The policy authorizes the audit committee to delegate to one or more of its members pre-approval authority with respect to permitted services.

PROPOSAL THREE

AMENDMENT OF THE CERTIFICATE OF INCORPORATION

The third proposal item to be voted on is to approve amendments to the Certificate of Incorporation in order to (a) clarify the preamble to reflect the proposed changes, (b) delete text regarding a reverse stock split that took effect on December 8, 2004 and (c) delete in Articles VI and VIII provisions regarding ownership of our common stock by our major stockholders prior to our initial public offering.

Immediately prior to the consummation of our initial public offering, we approved a 1.13683:1 reverse stock split that took effect on December 8, 2004. Each of the certificates representing the shares of common stock were physically surrendered by the then existing stockholders in exchange for certificates representing the adjusted common stock. The current Certificate of Incorporation includes the provision that authorized the reverse stock split.

10

Foundation and its stockholders prior to its initial public offering entered into a stockholders agreement, which was amended and restated on October 4, 2004, to become effective upon the consummation of our initial public offering. In addition to Foundation, the parties to the stockholders agreement were First Reserve Fund IX, LP (“First Reserve”), Blackstone FCH Capital Partners IV LP, Blackstone Family Investment Partnership IV—A LP (collectively “Blackstone”) and AMCI Acquisition, LLC which was merged into AMCI Acquisition III, LLC (“AMCI”) (each a “sponsor”) and certain management stockholders. The stockholders agreement entitled Blackstone and First Reserve to designate three nominees for election to the board of directors. Blackstone and First Reserve also designated one joint nominee. Additional provisions included that if at any time, either Blackstone or First Reserve and their affiliates as a group beneficially owned less than 66 2/3% of the aggregate number of shares owned by the other, then such sponsor would be entitled only to designate two nominees for election to the board of directors, and if at any time either Blackstone or First Reserve and their affiliates as a group owned less than 33 1/3% of the aggregate number of shares owned by the other, then such sponsor would be entitled only to designate one director.

Our current Certificate of Incorporation includes a provision that relates to the rights of the sponsors to designate nominees for election to the board of directors and to take actions by written consent, as set forth in the stockholders agreement.

On September 19, 2005, Foundation closed its secondary offering and the partial exercise of the over-allotment shares in which Blackstone, First Reserve and AMCI sold an aggregate of 10,260,500 shares of the Company’s common stock. As a result, AMCI’s ownership interest in Foundation was reduced to less than five percent of our common stock. On January 24, 2006, 4,154,045 shares of our common stock were distributed by First Reserve Fund to First Reserve’s limited and other partners. An additional 4,154,045 shares of our common stock were distributed by affiliates of Blackstone to Blackstone’s limited and other partners. The 8,308,090 shares that were distributed represented all of the remaining shares of Foundation owned by First Reserve and Blackstone, respectively.

On February 18, 2006, after First Reserve and Blackstone each had divested all their stock in Foundation, or in the case of AMCI its successor reduced its stock ownership to less than five percent, the parties to the stockholders agreement entered into a termination agreement that terminated the stockholders agreement.

As a result of the further divestiture by the sponsors since our initial public offering in December 2004, our board of directors deemed it appropriate to amend and restate the Certificate of Incorporation as follows:

| | • | | Clarify the preamble to reflect the proposed changes; |

| | • | | Delete text in Article IV(A)(2) relating to the reverse stock split that took effect on December 8, 2004; |

| | • | | Amend Article VI(B) to delete the references to the voting rights of the sponsors regarding removal of board members; and |

| | • | | Amend Article VIII (A) to delete the references to rights of the sponsors as stockholders to take actions by written consent, and thus clarify that all stockholder actions must be taken at a duly called meeting and may not be effected by a consent in writing. |

Reasons for and effects of the Proposed Amendments

The reverse stock split took effect on December 8, 2004, and our stock ledger reflects the fact that the then-existing common stock was exchanged for new common stock. As described above, Blackstone, First Reserve and AMCIs ownership interest has fallen below 40%. As such, references to the rights of the sponsors until their ownership in the aggregate falls below 40% are no longer needed. The proposed amendments have no effect on the current rights of the holders of our common stock and it is the board of directors’ view that these amendments will clarify these provisions of the Certificate of Incorporation

11

In consenting to this proposal, you consent to the amendment and restatement of the Certificate of Incorporation, if this proposal is approved by a majority of shareholders eligible to vote at the Annual Meeting. A copy of the Certificate of Incorporation as proposed to be amended and restated is attached hereto as Exhibit A.

Text of the Proposed Amendments

The Company proposes to amend the Certificate of Incorporation in the preamble and in Articles IV(A)(2), VI(B) and VIII(A) as indicated in Exhibit A:

PREAMBLE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

FOUNDATION COAL HOLDINGS, INC.

Foundation Coal Holdings, Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows:

A. The name of the Corporation is Foundation Coal Holdings, Inc. The Corporation was originally incorporated under the name “FC 1 Corp.” The Corporation’s original certificate of incorporation was filed with the Secretary of State of the State of Delaware on July 19, 2004. The Corporation filed a Certificate of Amendment of the Certificate of Incorporation with the Secretary of State of the State of Delaware on August 10, 2004, filed an Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware on October 7, 2004 and filed a Second Amended and Restated Certificate of Incorporation on December 8, 2004, in each of the foregoing cases under the name “Foundation Coal Holdings, Inc.”

B. This Third Amended and Restated Certificate of Incorporation, which amends and restates the Certificate of Incorporation of the Corporation in its entirety, was duly adopted by the Board of Directors and by the stockholders in accordance with sections 103, 242, and 245 of the General Corporation Law of the State of Delaware.

C. The Third Amended and Restated Certificate of Incorporation of the Corporation (“Restated Certificate of Incorporation”) shall read in its entirety as follows:

ARTICLE IV

AUTHORIZED CAPITAL STOCK

A. The total number of shares of all classes of stock that the Corporation shall have the authority to issue is 110,000,000, which shall be divided into two classes as follows:

| | 1. | 100,000,000 shares of Common Stock, par value $0.01 per share (“Common Stock”); and |

| | 2. | 10,000,000 shares of Preferred Stock, par value $0.01 per share (the “Preferred Stock”). The Board of Directors is hereby expressly authorized, by resolution or resolutions, to provide, out of the unissued shares of Preferred Stock, for series of Preferred Stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the voting powers (if any) of the shares of such series, and the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of such series, as are not inconsistent with this Restated Certificate of Incorporation or any amendment hereto, and as may be permitted by the Delaware Code. |

12

ARTICLE VI

ELECTION AND REMOVAL OF DIRECTORS

A. Any or all of the directors (other than the directors elected by the holders of any class or classes of Preferred Stock of the Corporation, voting separately as a class or classes, as the case may be) may be removed at any time either with or without cause by the affirmative vote of at least 75% in voting power of all shares of the Corporation entitled to vote generally in the election of directors, voting as a single class.

ARTICLE VIII

CONSENT OF STOCKHOLDERS IN LIEU OF MEETING AND

SPECIAL MEETING OF STOCKHOLDERS

A. Any action required or permitted to be taken by the holders of the Common Stock of the Corporation must be effected at a duly called annual or special meeting of such holders and may not be effected by any consent in writing by such holders.

PROPOSAL FOUR

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to Foundation will be voted in accordance with the recommendation of the Board, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Stockholder proposals for the 2007 Annual Meeting

From time to time, stockholders present proposals that may be proper subjects for inclusion in the proxy statement and for consideration at an annual meeting. Under the rules of the SEC, to be included in the proxy statement for the 2007 Annual Meeting, Foundation must receive proposals no later than January 15, 2007.

Pursuant to Foundation’s bylaws, stockholders may present proposals that are proper subjects for consideration at an annual meeting. Foundation’s bylaws require all stockholders who intend to make proposals at an annual stockholders meeting to submit their proposals to Foundation no later than the close of business on the 60th day prior to nor earlier than the close of business on the 90th day prior to the anniversary date of the previous year’s annual meeting. To be eligible for consideration at the 2007 Annual Meeting, proposals that have not been submitted by the deadline for inclusion in the proxy statement must be received by Foundation between December 15, 2006 and January 15, 2007. In the event the date of the 2007 Annual Meeting is changed by more than 30 days from the date contemplated as of the date of this proxy statement, stockholder notice must be received not earlier than the close of business on the 120th day prior to the 2007 Annual Meeting nor later than the close of business on the 90th day prior to the 2007 Annual Meeting. However, if the number of directors to be elected to the board of directors is increased and there is no a public announcement by the Foundation naming all of the nominees for director or specifying the size of the increased board of directors at least 100 days prior to the anniversary of the mailing of proxy materials for the prior year’s annual meeting of stockholders, then a stockholder proposal only with respect to nominees for any new positions created by such increase must be received by the Secretary by the close of business on the 10th day following such public announcement. These provisions are intended to allow all stockholders to have an opportunity to consider business expected to be raised at the meeting.

13

CORPORATE GOVERNANCE AND RELATED MATTERS

Director Independence

In determining director independence, Foundation employs the standards set forth in the NYSE listed company manual. The independence standard in the NYSE rules requires that the director (or a member of his immediate family) is not an affiliate of or otherwise have a material relationship with Foundation and that for the last three years:

| | • | | Was not an employee of Foundation (and no immediate family member was an executive officer of Foundation). |

| | • | | Did not receive more than $100,000 per year in compensation from Foundation (other than for director and committee fees, pensions, or other deferred compensation from prior service). |

| | • | | Was not employed by or affiliated with a present or former internal or external auditor of Foundation. |

| | • | | Has not been employed as an executive officer by any company whose compensation committee includes an executive officer of Foundation. |

| | • | | Was not a current employee or executive officer (and no immediate family member was an executive officer) of another company that (in any single fiscal year) made payments to, or received payments from, Foundation for property or services in an amount that exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenue. |

Applying the NYSE independence standard, the board of directors has concluded that Messrs. Crowley, Richard, Giftos, Scharp and Foley are independent and that Messrs. Roberts and Krueger are not independent.

The Board of Directors and its Committees

The board of directors held four (4) meetings in 2005, either in person or by telephone. Each director attended at least 75% of all the board of directors and applicable committee meetings during 2005. Under Foundation’sCorporate Governance Practices and Policies, a copy of which is available atwww.foundationcoal.com or upon written request at no cost, directors are encouraged to attend stockholder meetings. Five directors attended the 2005 Annual Meeting of Stockholders. Foundation has scheduled one of its quarterly board of directors meetings on the same date as the 2006 Annual Meeting of Stockholders. In connection with each of the quarterly board of directors meetings, the non-management directors will meet in executive session without any employee directors or members of management present. If the board of directors convenes a special meeting, the non-management directors may meet in executive session if the circumstances warrant. The Chairman of the board of directors presides at each executive session of the non-management directors.

Committee Membership

| | | | | | |

NAME | | AUDIT

COMMITTEE | | COMPENSATION

COMMITTEE | | NOMINATION COMMITTEE |

Joshua H. Astrof | | X1 | | | | |

William J. Crowley | | X2 | | X3 | | X |

David I. Foley | | | | X4, 2 | | X1 |

P. Michael Giftos | | X5 | | X6 | | X5 |

Alex T. Krueger | | X7 | | X1 | | |

William E. Macaulay | | | | | | X7 |

Prakash A. Melwani | | | | X8 | | |

Joel Richards, III | | X9, 7 | | X | | X2 |

James F. Roberts | | | | | | X1 |

Robert C. Scharp | | X5 | | | | X10 |

14

| 1 | Resigned as member of committee on March 8, 2005. |

| 3 | Resigned as member of committee on October 26, 2005. |

| 4 | Appointed as member of committee on October 26, 2005. |

| 5 | Appointed as member of committee on December 7, 2005. |

| 6 | Appointed as member of committee on February 7, 2006. |

| 7 | Resigned as member of committee on December 7, 2005. |

| 8 | Resigned as a member of committee on January 27, 2006. |

| 9 | Appointed as member of committee on March 8, 2005. |

| 10 | Appointed as a member of committee on April 1, 2006. |

The standing board of directors committees and the number of meetings they held in 2005 were as follows:

| | |

Board Committee | | No. of Meetings

Held |

Audit Committee | | 7 |

Compensation Committee | | 4 |

Nominating and Corporate Governance Committee | | 5 |

Each of the audit, compensation and nominating and corporate governance committees has adopted a charter. Stockholders may obtain a copy of each charter on Foundation’s website at:

www.foundationcoal.com/investors/corporategovernance orupon written request at no cost.

The principal responsibilities and functions of the standing board of directors committees are as follows:

Audit Committee

Our audit committee currently consists of William J. Crowley, Jr., P. Michael Giftos and Robert C. Scharp. Joshua H. Astrof and Alex T. Krueger served on the audit committee until March 8, 2005 and December 7, 2005, respectively. Joel Richards, III served on the audit committee from March 8, 2005 through December 7, 2005. William J. Crowley, Jr. is our audit committee “financial expert” as such term is defined in Item 401(h) of Regulation S-K. The audit committee is responsible for (1) the hiring or termination of independent auditors and approving any non-audit work performed by such auditor, (2) approving the overall scope of the audit, (3) assisting the board in monitoring the integrity of our financial statements, the independent accountant’s qualifications and independence, the performance of the independent accountants and our internal audit function and our compliance with legal and regulatory requirements, (4) annually reviewing an independent auditors’ report describing the auditing firms’ internal quality-control procedures, any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm, (5) discussing the annual audited financial and quarterly statements with management and the independent auditor, (6) discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (7) discussing policies with respect to risk assessment and risk management, (8) meeting separately, periodically, with management, internal auditors and the independent auditor, (9) reviewing with the independent auditor any audit problems or difficulties and managements’ response, (10) setting clear hiring policies for employees or former employees of the independent auditors, (11) annually reviewing the adequacy of the audit committee’s written charter, (12) establishing procedures for the receipt and monitoring of complaints received by Foundation (including anonymous submissions by our employees) regarding accounting, internal accounting and auditing matters, (13) handling such other matters that are specifically delegated to the audit committee by the board of directors from time to time, (14) reporting regularly to the full board of directors and (15) conducting an annual evaluation of its performance.

The board of directors has concluded that all members of the audit committee are independent within the meaning of the Sarbanes-Oxley Act and the NYSE independence standard.

15

Compensation Committee

Our current compensation committee consists of David I. Foley, Joel Richards, III and P. Michael Giftos. Alex T. Krueger, William J. Crowley, Jr. and Prakash Melwani served on the compensation committee until March 8, 2005, October 26, 2005 and January 27, 2006 respectively. The compensation committee is responsible for discharging the responsibilities of the board of directors with respect to Foundation and its subsidiaries’ compensation programs including, the compensation of key employees, executives and the board of directors. The compensation committee is responsible for (1) administering Foundation’s and its subsidiaries’ long-term incentive and stock plans, (2) reviewing the overall executive compensation philosophy of Foundation and its subsidiaries and their benefit plans and programs, including employee pension plans, (3) reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer and other executive officers compensation, including annual performance targets, (4) evaluating the performance of the Chief Executive Officer and other executive officers in light of the corporate goals and objectives and, based on such evaluation, determining and approving the annual salary, bonus, equity based and other compensation and benefits, direct and indirect, of the Chief Executive Officer and other executive officers, (5) preparing recommendations and periodic reports on its activities to the board of directors, (6) preparing the annual report on executive compensation for inclusion in Foundation’s proxy statement as required by the SEC, (7) reviewing and approving employment contracts and other similar arrangements between Foundation and its executive officers, (8) approving the appointment and removal of trustees and investment managers for pension fund assets, (9) retaining consultants to advise the committee on executive compensation practices and policies, (10) handling such other matters that are specifically delegated to the compensation committee by the board of directors.

The board of directors has concluded that the members of the compensation committee are independent within the meaning of the NYSE independence standard. ..

Nominating and Corporate Governance Committee

Our current nominating and corporate governance committee consists of Joel Richards, III, William J. Crowley, Jr., P. Michael Giftos and Robert C. Scharp. James F. Roberts and David I. Foley served on the nominating and corporate governance committee until March 8, 2005. William E. Macaulay served on the nominating and corporate governance committee until December 7, 2005. The nominating and corporate governance committee is responsible for (1) developing and recommending criteria for selecting new directors, (2) screening and recommending to the board of directors individuals qualified to become executive officers, (3) overseeing evaluations of management and the board of directors, its members and committees of the board of directors, (4) periodic reviewing of the charter and composition of each committee of the board of directors (5) reviewing the adequacy of our certificate of incorporation and by-laws, (6) developing and recommending to the board of directors corporate governance practices and policies, (7) overseeing and approving the management continuity process, (8) handling such other matters that are specifically delegated to the nominating and corporate governance committee by the board of directors from time to time and (9) reporting regularly to the full board of directors.

Prospective director nominees are identified through the contacts of the Chairman of the board of directors, other directors or members of senior management. The nominating and corporate governance committee from time to time has also engaged the services of a third party for a fee to identify and evaluate prospective nominees. Once a prospective director nominee has been identified, the committee makes an initial determination through information provided to the committee and information supplemented by the committee through its own inquiries. The nominating and corporate governance committee will evaluate director nominees, including nominees that are submitted to Foundation by a Stockholder, taking into consideration certain criteria, including issues of industry knowledge and experience, the current composition of the board of directors, wisdom, integrity, actual or potential conflicts of interest, skills such as understanding of finance and marketing and educational and professional background. In addition, directors must have time available to devote to board of directors’ activities and the ability to work collegially. At all times, at least one member of the board of directors must meet the definition of “financial expert” as such term is defined in Item 401(h) of Regulation S-K and serve on Foundation’s audit committee.

16

Once the nominating and corporate governance committee has identified a prospective nominee it makes an initial evaluation through interviews and possible reference checks. Each prospective nominee is also provided with a questionnaire to complete and return to the nominating and corporate governance committee. Based on interviews, references and responses to the questionnaire, the nominating and corporate governance committee then determines whether it should extend an invitation to the prospective nominee and ultimately recommend nomination to the board of directors.

In determining whether to recommend a director for re-election, the nominating and corporate governance committee considers the director’s past attendance at meetings and participation in and contribution to the activities of the board of directors.

The board of directors has concluded that members of the nominating and corporate governance committee are independent within the meaning of the NYSE independence standard.

Code of Business Conduct and Ethics

Foundation has adopted a Code of Business Conduct and Ethics that applies to its employees, officers and directors (the “Code”). The Code also applies to our senior financial employees, including our Chief Executive Officer and Chief Financial Officer. The Code is available on Foundation’s website,

http://www.foundationcoal.com/investors/corporategovernance and upon written request at no cost.

Director Compensation

Until April 1, 2006, our director compensation policy provided that directors who are employed by Foundation, or appointed by either Blackstone or First Reserve do not receive compensation for service as a director (a “non-compensated director”). Other than non-compensated directors, each director receives an annual cash retainer of $40,000 and a fee of $1,500 for each board meeting and each committee meeting attended. The audit committee chairperson receives an additional $10,000 annual cash retainer. Committee chairpersons other than the audit committee chairperson receive an additional $2,500 annual cash retainer.

Until April 1, 2006, our director compensation policy provided that, other than non-compensated directors, each director may receive a grant of up to 4,000 shares of restricted stock upon election to the board of directors, twenty percent of the initial grant vest upon the anniversary of each December 31st, if the recipient continues to serve on the board of directors. Non-employee directors may receive an annual grant of 1,500 shares of restricted stock, one-third of the annual grant vest upon the anniversary of each December 31st, if the recipient continues to serve on the board of directors. For fiscal year 2004, Mr. Crowley received 3,000 initial shares of restricted stock, 600 of which vested on December 31, 2004 and 1,500 annual shares of restricted stock, 500 of which vests on December 31, 2006. For the fiscal year 2005, Messrs. Richards, Giftos and Scharp each received 3,000 initial shares of restricted stock, 600 of which vested for each grant on December 31, 2005. Also for the fiscal year 2005, each of Messrs. Crowley and Richards received 1,500 annual shares of restricted stock, 500 of which vests for each grant on December 31, 2006. For the fiscal year 2006, each of Messrs, Crowley, Richards, Giftos and Scharp received 1,500 annual shares of restricted stock, 500 of which vests for each grant on December 31, 2006.

17

Effective April 1, 2006, each director who is not an employee of Foundation and its subsidiaries receive compensation as follows:

| | |

Annual Retainer: | | $40,000 |

| |

Chairman of the Board of Directors: | | additional $10,000 annually |

| |

Audit Committee Chair: | | additional $10,000 annually |

| |

Other Committee Chairs: | | additional $2,500 annually |

| |

Per board of directors meeting: | | additional $1,500 |

| |

Per Committee meeting: | | additional $1,500 |

| |

Initial Equity Compensation: | | 3,000 shares of Restricted Stock (20% vest upon the anniversary of each December 31st) |

| |

Annual Equity Compensation: | | 1,500 shares of Restricted Stock (one-third vest upon the anniversary of each December 31st) |

On April 1, 2006, Mr. Foley and Mr. Krueger each received 3,000 initial shares of restricted stock, 600 of which vest on December 31, 2006.

In addition, Foundation reimburses directors for travel expenses incurred in connection with attending board of directors, committee and stockholder meetings and for other Foundation business related expenses.

Stockholder Director Nominations

In accordance with Foundation’s Amended and Restated Bylaws, any stockholder entitled to vote for the election of directors at the Annual Meeting may nominate persons for election as directors at the 2007 Annual Meeting of Stockholders only if the Secretary of Foundation receives written notice of any such nominations no earlier than December 15, 2006 and no later than January 15, 2007. Any stockholder notice of intention to nominate a director shall include:

| | • | | the name and address of the stockholder; |

| | • | | a representation that the stockholder is entitled to vote at the meeting at which directors will be elected; |

| | • | | the number of shares of Foundation that are beneficially owned by the stockholder; |

| | • | | any material interest of the stockholder; |

| | • | | information required by Regulation 14A of the Securities Exchange Act of 1934, as amended; |

| | • | | a representation that the stockholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| | • | | the following information with respect to the person nominated by the stockholder: |

| | • | | other information regarding such nominee as would be required in a proxy statement filed pursuant to applicable rules promulgated by the SEC, and |

| | • | | a description of any arrangements or understandings between the stockholder and the nominee and any other persons (including their names), pursuant to which the nomination is made; and |

| | • | | the consent of each such nominee to serve as a director if elected. |

18

Stockholder and other Interested Parties Communications with the Board of Directors

Stockholders and other interested parties may contact the board of directors as a group or an individual director by the following means:

| | Email: | board@foundationcoal.com |

| | | Attn: Corporate Secretary |

| | | Foundation Coal Holdings, Inc. |

| | | 999 Corporate Boulevard, Suite 300 |

| | | Linthicum Heights, MD 21090 |

Stockholders and other interested parties should clearly specify in each communication the name of the individual director or group of directors to whom the communication is addressed. Communications from stockholders and other interested parties will be promptly forwarded by the Secretary of Foundation to the specified director addressee. Communications addressed to the full board of directors or the group of non-management directors will be forwarded by the Secretary of Foundation to the Chairman of the board of directors. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Chairman of the audit committee and are handled in accordance with procedures established by the audit committee.

Foundation did not receive any stockholder recommendations for director nominees to be considered by the nominating and corporate governance committee for the 2006 annual Stockholders meeting.

EXECUTIVE OFFICERS

Klaus-Dieter Beck(50) is our Senior Vice President of Planning and Engineering. Prior to his current position, Mr. Beck had been Senior Vice President of Planning and Engineering of RAG American Coal Holding, Inc. since 1999. From 1998 to 1999, Mr. Beck was Vice President of Riverton Coal, Inc., and from 1996 to 1998, he was General Mine Manager of Friedrich Heinrich Mine of Ruhrkohle Bergbau AG, a subsidiary of RAG AG.

James J. Bryja(49) is our Senior Vice President, Eastern Operations. Prior to his current position, Mr. Bryja had been Senior Vice President, Eastern Operations of RAG American Coal Holding, Inc. since February 2003. From 1999 through 2001, Mr. Bryja was General Manager of Emerald Coal Resources, one of our subsidiaries, and from September 2001 to 2003, Mr. Bryja served as President of Pennsylvania Services Corporation, one of our subsidiaries. Mr. Bryja has 26 years of experience in the coal mining industry, with positions in management, engineering and production at Island Creek Corporation/Consolidation Coal Co. and U.S. Steel Mining Co. Mr. Bryja earned his Bachelor of Science in Mining Engineering from the Pennsylvania State University and his Masters Degree in Business Administration from the West Virginia University. Mr. Bryja is a registered Professional Engineer. Mr. Bryja currently serves as President of the Pittsburgh Coal Mining Institute of America. He is also a member of the Society of Mining Engineers and a member of the Pennsylvania Energy Advisory Board.

Kurt D. Kost (49) is our Senior Vice President, Western Operations and Process Management. From 1980 through 2005 Mr. Kost held various positions in engineering and operations with Foundation Coal Corporation and its predecessor and affiliated companies. Prior to his current position Mr. Kost was Vice President of Process Management for Foundation Coal Corporation since 2005. From 2001 to 2005 he was President, Foundation Coal West. He served as General Manager of RAG Coal West from 2000 to 2001 and as its General Mine Manager from 1998 to 2000. Mr. Kost is past president of the Society of Mining Engineers, Powder River Basin chapter and was an Executive Board Member of the Wyoming Mine Association. Mr. Kost earned his B.S. in Mining Engineering from the South Dakota School of Mines and has completed Harvard Business School’s—Advanced Management Program.

19

James A. Olsen(54) is our Senior Vice President of Development and Information Technology. Prior to his current position, Mr. Olsen had been Senior Vice President of Development and Information Technology of RAG American Coal Holding, Inc. since 1999. From 1993 to 1999, he worked at Cyprus Amax Coal Company as Assistant Controller and later as Vice President of Business Development. From 1975 to 1981, and from 1988 to 1990, he was employed by AMAX Inc. in several positions, including Assistant Controller and Assistant to the Treasurer. Mr. Olsen earned his Bachelor of Arts in Economics from St. Anselm College and his Masters Degree in Business Administration from Boston University.

Michael R. Peelish(44) is our Senior Vice President, Safety and Human Resources. Prior to his current position, Mr. Peelish had been Senior Vice President, Safety and Human Resources of RAG American Coal Holding, Inc. since 1999. From 1995 to 1999, Mr. Peelish was Director, Safety of Cyprus Amax Minerals Company, and from 1994 to 1995, was Manager of Regulatory Affairs and Loss Control of Cyprus Amax Coal Company. From 1989 to 1994, Mr. Peelish was a Senior Attorney at Cyprus Minerals Company, and from 1986 to 1989, was an attorney at Consolidation Coal Company. Mr. Peelish received his law degree from the West Virginia University College of Law, Cum Laude and his Bachelor of Science in Engineering of Mines from West Virginia University.

Greg A. Walker(50) is our Senior Vice President, General Counsel and Secretary. Prior to his current position, Mr. Walker had been Senior Vice President, General Counsel and Secretary of RAG American Coal Holding, Inc. since 1999. He has over 20 years of experience with legal and regulatory issues in the mining industry. He was Senior Attorney at Cyprus Amax Minerals Company from 1989 to 1999, affiliated with McGuire, Cornwell & Blakey from 1986 to 1989 and Associate Counsel at Mobil Oil Corporation from 1981 to 1986. Mr. Walker received his law degree in 1981 from the University of Florida and his Bachelor of Arts with a major in geology from the University of Pennsylvania in 1978.

Frank J. Wood(53) is our Senior Vice President and Chief Financial Officer. Prior to his current position, Mr. Wood had been Senior Vice President and Chief Financial Officer of RAG American Coal Holding, Inc. since 1999. From 1993 to 1999, he was Vice President & Controller at Cyprus Amax Coal Company, and from 1991 to 1993, he was Vice President of Administration at Cannelton Inc. From 1979 to 1991, Mr. Wood held various accounting and financial management positions at AMAX Inc.’s coal and oil and gas subsidiaries. Mr. Wood earned a Bachelor of Business Administration from the College of William and Mary and a Masters Degree in Business Administration from Indiana University.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Committee Report On Executive Compensation

The compensation committee has the responsibility for establishing all components of Foundation’s executive pay and reviewing and approving changes to Foundation’s executive compensation programs. The compensation committee also recommends or reports its decisions to the board of directors regarding all compensation payments to the CEO and the other executive officers, including base salary adjustments, annual incentives, and long-term incentive awards. The compensation committee discharges other responsibilities pertaining to Foundation such as company-wide salary adjustments and overall compensation and benefit policies and plans.

The compensation committee’s charter reflects these responsibilities, and the compensation committee conducted an assessment in December 2005 of its responsibilities including a review of its charter. The board of directors determines the compensation committee’s membership. The compensation committee meets at scheduled times during the year typically prior to board of directors meetings, however; other scheduled meetings are conducted in person or telephonically. The compensation committee chair reports on actions and

20

recommendation during the board of directors meetings. The compensation committee is supported in its work by Foundation’s human resources management. In addition, the compensation committee has the authority to engage the services of outside advisors. During 2005, the compensation committee directly engaged the services of one human resources consulting services firm and one legal firm to assist it in performing its duties under its charter.

For the fiscal year ended December 31, 2005, the compensation committee’s activity focused on the key elements of the total direct compensation program for executive officers including base salary adjustments, the annual incentive payment levels for the executive management team for 2005 performance, and the adjustment of one of the four performance target under the long-term incentive award plan. The compensation committee also approved a long-term incentive plan for other key management, excluding executive management. During 2005 and pursuant to the 2004 Stock Incentive Plan the compensation committee awarded restricted stock units to approximately 80 key managers which vest three years from the date of grant upon the achievement of performance criteria for EBITDA and free cash flow. The compensation committee received input from Foundation’s benefits committee, management and an independent compensation consultant retained by the compensation committee.

Compensation Philosophy

Foundation’s strategy is to establish executive compensation programs that retain, recruit and motivate a qualified executive management team that is needed to achieve long-term profitability of Foundation and enhance stockholder value. Foundation’s compensation program is premised upon the following beliefs:

| | (i) | Programs will establish performance targets that translate into enhanced stockholder value, |

| | (ii) | Programs will align the individual and collective performance of executive management with stockholder value, |

| | (iii) | Total compensation should encourage the achievement of individual and collective company performance targets. |

The primary components of Foundation’s executive compensation programs are base salary, annual incentive awards, and long-term equity incentive awards. The total compensation achievable should be generally competitive with the Compensation Comparison Group. This group includes Alpha Natural Resources, Arch Coal, Alliance Natural Resources, Consol Energy, James River, Massey Energy, Peabody Energy, and Westmoreland Coal.

Base Salary

Base compensation is determined by the compensation committee based upon its philosophy that executive management base salaries should be generally competitive in the marketplace. The compensation committee will continue to evaluate the base salaries of all named executive officers on a regular basis to ensure that marketplace competitiveness is maintained, taking into account each executive’s performance and contributions to Foundation, job experience, and retention value. Based on these criteria, the compensation committee accepted the recommendation of the Chief Executive Officer and approved base salary adjustments to two named executive officers during 2005. All other executives’ base salaries were adjusted based on the same increase applied to all salaried, non-represented hourly employees.

Annual Incentive Plan

Foundation’s annual incentive plan provides an opportunity for all salaried employees in Foundation to earn additional compensation for the achievement of certain individual and Foundation performance targets

21

established by management. The percentage of base salary a salaried employee can receive is predetermined under the plan. Regarding the named executive officers, the percent of base pay has been determined by the board of directors and incorporated into employment agreements while the performance targets are established by the board of directors annually.

As it relates to executive managers including the named executive officers, for calendar year 2005, Foundation’s performance targets were based on target EBITDA (as defined in the credit agreement among our subsidiary Foundation Coal Company and various parties) for the entire 2005 calendar year, pursuant to the budget. For executive managers including the named executive officers (other than the CEO, who is discussed separately below), bonuses were determined as set forth in the table below:

| | | | | | | | |

Company Performance | | Percent of

Base Salary | | Individual

Performance | | Percent of

Base Salary | | Total Percent Potential

Incentive |

125% of Target | | 83.33 | | Maximum | | 41.67 | | 125 |

100% of Target | | 33.33 | | Target | | 16.67 | | 50 |

85% of Target | | 16.67 | | Below Target | | 8.33 | | 25 |

Below 85% of Target | | 0.00 | | | | 0.00 | | 0.00 |

2005 Incentive Payments

For the fiscal year ended December 31, 2005, Foundation awarded annual incentive payments to the Chief Executive Officer and the other four named executive officers as shown in the bonus column of the Summary Compensation Table. All other eligible executive managers were paid under the same annual incentive program. The incentive payments were based in part upon Foundation exceeding the EBITDA target. For fiscal year 2005, Foundation achieved 126.4% of its EBITDA target. The individual performance targets were deemed to be met based on the performance appraisals performed by the Chief Executive Officer.

Long-Term Equity Incentives

Foundation established its 2004 Stock Incentive Plan in July 2004. The primary purpose of the plan is to offer an incentive for the achievement of superior operating results that increase the equity value of Foundation for its shareholders. The compensation committee intends that these incentive opportunities will align the interest of management with the interests of shareholders, be competitive, and be based upon actual Foundation performance.

In July 2004, the CEO and the other executive managers were eligible to participate in the long-term incentive opportunity. The equity participation was in the form of stock options issued pursuant to Foundation’s 2004 Stock Incentive Plan. Of the options granted to the executive managers, 28% percent were time options and 72% percent were performance options. The time options vest over a period of five years with the first vesting date at December 31, 2004; however, time options will immediately vest upon a change in control of Foundation (as defined in the Non-Qualified Stock Option Agreement by and between Foundation and the individual optionee). The performance options will vest on the eighth anniversary of the date of grant but the vesting may be accelerated based upon achieving predefined performance targets of EBITDA, free cash flow, EBITDA/Revenue margin, and production. Also, all performance options will immediately vest upon a change in control of Foundation (as defined in the Non-Qualified Stock Option Agreement by and between Foundation and the individual optionee).

In 2005, the compensation committee replaced the cost per ton performance target in the Non-Qualified Stock Option Agreement and the employment agreement with the EBITDA/Revenue margin performance target. The compensation committee did so to motivate management to make decisions based on the current market price for coal and its accretive impact to EBITDA due to the profit margin achieved rather than the restrictive

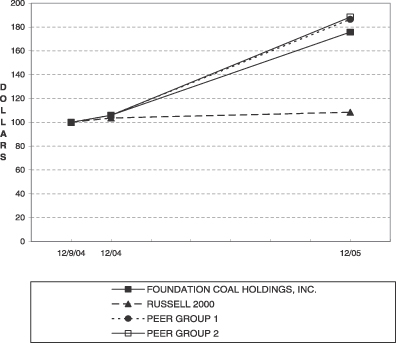

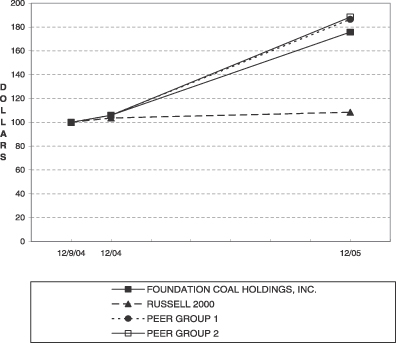

22