UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2007

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 001-32331

Foundation Coal Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Delaware | | 42-1638663 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

999 Corporate Boulevard, Suite 300 Linthicum Heights, Maryland | | 21090 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (410) 689-7500

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 45,207,779 shares of common stock outstanding on October 31, 2007.

TABLE OF CONTENTS

2

PART I – FINANCIAL INFORMATION

Unless the context otherwise indicates, as used in this Form 10-Q the terms “we,” “our,” “us” and similar terms refer to Foundation Coal Holdings, Inc. and its consolidated subsidiaries.

ITEM 1. FINANCIAL STATEMENTS.

Foundation Coal Holdings, Inc. and Subsidiaries

Consolidated Balance Sheets

(Dollars in thousands, except share data)

| | | | | | | | |

| | | September 30, 2007 | | | December 31, 2006 | |

| | | (Unaudited) | | | | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 69,472 | | | $ | 33,720 | |

Trade accounts receivable | | | 109,840 | | | | 119,603 | |

Inventories, net | | | 39,283 | | | | 36,771 | |

Deferred income taxes | | | 15,525 | | | | 15,525 | |

Prepaid expenses | | | 31,220 | | | | 30,790 | |

Other current assets | | | 4,906 | | | | 4,238 | |

| | | | | | | | |

Total current assets | | | 270,246 | | | | 240,647 | |

Owned surface lands | | | 35,440 | | | | 30,388 | |

Plant, equipment and mine development costs, net | | | 657,699 | | | | 626,234 | |

Owned and leased mineral rights, net | | | 947,319 | | | | 1,003,804 | |

Coal supply agreements, net | | | 23,418 | | | | 31,343 | |

Other noncurrent assets | | | 15,704 | | | | 17,164 | |

| | | | | | | | |

Total assets | | $ | 1,949,826 | | | $ | 1,949,580 | |

| | | | | | | | |

| LIABILITIES | | | | | | | | |

Current liabilities: | | | | | | | | |

Current portion of long-term debt | | $ | 12,563 | | | $ | - | |

Trade accounts payable | | | 38,117 | | | | 41,584 | |

Accrued expenses and other current liabilities | | | 177,858 | | | | 162,014 | |

| | | | | | | | |

Total current liabilities | | | 228,538 | | | | 203,598 | |

Long-term debt | | | 614,062 | | | | 626,625 | |

Deferred income taxes | | | 1,503 | | | | 8,273 | |

Coal supply agreements, net | | | 12,164 | | | | 24,223 | |

Postretirement benefits | | | 501,312 | | | | 536,628 | |

Other noncurrent liabilities | | | 263,844 | | | | 252,420 | |

| | | | | | | | |

Total liabilities | | | 1,621,423 | | | | 1,651,767 | |

| | | | | | | | |

Commitments and contingencies (Note 17) | | | | | | | | |

| | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

Common stock, $0.01 par value; 100.0 million shares authorized, 46.2 million shares issued and 45.1 million shares outstanding at September 30, 2007; 45.8 million shares issued and

45.4 million shares outstanding at December 31, 2006 | | | 462 | | | | 458 | |

Additional paid-in capital | | | 289,958 | | | | 279,436 | |

Retained earnings | | | 79,115 | | | | 63,220 | |

Accumulated other comprehensive loss | | | (5,720 | ) | | | (33,412 | ) |

Treasury stock, at cost: 1.1 million shares at September 30, 2007; 0.3 million shares at December 31, 2006 | | | (35,412 | ) | | | (11,889 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 328,403 | | | | 297,813 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,949,826 | | | $ | 1,949,580 | |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

3

Foundation Coal Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income

(Unaudited, dollars in thousands, except share and per share data)

| | | | | | | | |

| | | Three Months Ended

September 30, | |

| | | 2007 | | | 2006 | |

Revenues: | | | | | | | | |

Coal sales | | $ | 350,762 | | | $ | 347,511 | |

Other revenue | | | 8,296 | | | | 6,609 | |

| | | | | | | | |

Total revenues | | | 359,058 | | | | 354,120 | |

Costs and expenses: | | | | | | | | |

Cost of coal sales (excludes depreciation, depletion and amortization) | | | 283,079 | | | | 277,453 | |

Selling, general and administrative expenses (excludes depreciation, depletion and amortization) | | | 14,263 | | | | 11,347 | |

Accretion on asset retirement obligations | | | 2,635 | | | | 2,219 | |

Depreciation, depletion and amortization | | | 49,585 | | | | 45,170 | |

Amortization of coal supply agreements | | | (844 | ) | | | (2,309 | ) |

Employee and contract termination costs | | | 2,314 | | | | - | |

| | | | | | | | |

Income from operations | | | 8,026 | | | | 20,240 | |

Other income (expense): | | | | | | | | |

Interest expense | | | (13,389 | ) | | | (23,058 | ) |

Mark-to-market loss on interest rate swaps | | | - | | | | (112 | ) |

Interest income | | | 1,056 | | | | 958 | |

| | | | | | | | |

Loss before income tax benefit | | | (4,307 | ) | | | (1,972 | ) |

Income tax benefit | | | 6,212 | | | | 1,963 | |

| | | | | | | | |

Net income (loss) | | | 1,905 | | | | (9 | ) |

Other comprehensive income: | | | | | | | | |

Adjustments to unrecognized gains and losses and amortization of employee benefit plan costs, net of tax expense of $66 in 2007 | | | 96 | | | | - | |

Reclassification of unrealized gain on interest rate swap into interest expense | | | (370 | ) | | | 389 | |

| | | | | | | | |

Comprehensive income | | $ | 1,631 | | | $ | 380 | |

| | | | | | | | |

Basic earnings per common share | | $ | 0.04 | | | $ | - | |

Diluted earnings per common share | | $ | 0.04 | | | $ | - | |

Weighted-average shares-basic | | | 45,221,193 | | | | 45,507,284 | |

Weighted-average shares-diluted | | | 46,412,804 | | | | 46,773,741 | |

Dividends declared per share | | $ | 0.05 | | | $ | 0.05 | |

The accompanying notes are an integral part of these consolidated financial statements.

4

Foundation Coal Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income

(Unaudited, dollars in thousands, except share and per share data)

| | | | | | | | |

| | | Nine Months Ended

September 30, | |

| | | 2007 | | | 2006 | |

Revenues: | | | | | | | | |

Coal sales | | $ | 1,096,787 | | | $ | 1,094,272 | |

Other revenue | | | 25,674 | | | | 22,260 | |

| | | | | | | | |

Total revenues | | | 1,122,461 | | | | 1,116,532 | |

Costs and expenses: | | | | | | | | |

Cost of coal sales (excludes depreciation, depletion and amortization) | | | 855,160 | | | | 835,890 | |

Selling, general and administrative expenses (excludes depreciation, depletion and amortization) | | | 45,053 | | | | 38,025 | |

Accretion on asset retirement obligations | | | 7,492 | | | | 6,327 | |

Depreciation, depletion and amortization | | | 151,412 | | | | 137,678 | |

Amortization of coal supply agreements | | | (3,441 | ) | | | (11,773 | ) |

Employee and contract termination costs | | | 14,297 | | | | - | |

| | | | | | | | |

Income from operations | | | 52,488 | | | | 110,385 | |

Other income (expense): | | | | | | | | |

Interest expense | | | (39,648 | ) | | | (50,706 | ) |

Mark-to-market loss on interest rate swaps | | | - | | | | (112 | ) |

Interest income | | | 2,574 | | | | 2,184 | |

| | | | | | | | |

Income before income tax benefit (expense) | | | 15,414 | | | | 61,751 | |

Income tax benefit (expense) | | | 7,260 | | | | (8,417 | ) |

| | | | | | | | |

Net income | | | 22,674 | | | | 53,334 | |

Other comprehensive income: | | | | | | | | |

Adjustments to unrecognized gains and losses and amortization of employee benefit plan costs, net of tax expense of $19,754 in 2007 | | | 28,806 | | | | - | |

Unrealized gain on interest rate swaps, net of tax expense of $90 in 2006 | | | - | | | | 139 | |

Reclassification of unrealized gain on interest rate swap into interest expense | | | (1,114 | ) | | | 389 | |

| | | | | | | | |

Comprehensive income | | $ | 50,366 | | | $ | 53,862 | |

| | | | | | | | |

Basic earnings per common share | | $ | 0.50 | | | $ | 1.17 | |

Diluted earnings per common share | | $ | 0.49 | | | $ | 1.13 | |

Weighted-average shares-basic | | | 45,193,686 | | | | 45,654,040 | |

Weighted-average shares-diluted | | | 46,459,408 | | | | 47,103,715 | |

Dividends declared per share | | $ | 0.15 | | | $ | 0.15 | |

The accompanying notes are an integral part of these consolidated financial statements.

5

Foundation Coal Holdings, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited, dollars in thousands)

| | | | | | | | |

| | | Nine Months Ended

September 30, | |

| | | 2007 | | | 2006 | |

Operating activities: | | | | | | | | |

Net income | | $ | 22,674 | | | $ | 53,334 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Accretion on asset retirement obligations | | | 7,492 | | | | 6,327 | |

Depreciation, depletion and amortization | | | 147,971 | | | | 125,905 | |

Amortization of deferred financing costs | | | 1,382 | | | | 11,091 | |

Gain on sale of assets | | | (4,468 | ) | | | (899 | ) |

Non-cash stock compensation | | | 4,601 | | | | 2,250 | |

Non-cash mark-to-market adjustment for interest rate swaps | | | - | | | | 112 | |

Deferred income taxes | | | (26,524 | ) | | | (17,815 | ) |

Asset retirement obligations | | | (470 | ) | | | (2,020 | ) |

Other | | | (160 | ) | | | (250 | ) |

Changes in operating assets and liabilities: | | | | | | | | |

Trade accounts receivable | | | 9,788 | | | | (7,349 | ) |

Inventories, net | | | (2,406 | ) | | | 1,988 | |

Prepaid expenses and other current assets | | | (521 | ) | | | (14,467 | ) |

Other noncurrent assets | | | 37 | | | | 508 | |

Trade accounts payable | | | (3,467 | ) | | | 4,707 | |

Accrued expenses and other current liabilities | | | 3,971 | | | | (18,927 | ) |

Noncurrent liabilities | | | 14,762 | | | | 13,508 | |

| | | | | | | | |

Net cash provided by operating activities | | | 174,662 | | | | 158,003 | |

| | | | | | | | |

Investing activities: | | | | | | | | |

Purchases of property, plant and equipment | | | (120,761 | ) | | | (119,713 | ) |

Purchases of mining assets | | | - | | | | (14,630 | ) |

Proceeds from disposition of property, plant and equipment | | | 6,228 | | | | 1,704 | |

| | | | | | | | |

Net cash used in investing activities | | | (114,533 | ) | | | (132,639 | ) |

| | | | | | | | |

Financing activities: | | | | | | | | |

Payment of cash dividends | | | (6,779 | ) | | | (6,817 | ) |

Proceeds from issuance of common stock | | | 3,221 | | | | 7,479 | |

Excess tax benefit from stock-based awards | | | 2,704 | | | | 10,672 | |

Interest rate swap termination | | | - | | | | 2,259 | |

Payment of deferred financing costs | | | - | | | | (4,443 | ) |

Common stock repurchases | | | (23,424 | ) | | | (11,889 | ) |

Other | | | (99 | ) | | | - | |

| | | | | | | | |

Net cash used in financing activities | | | (24,377 | ) | | | (2,739 | ) |

| | | | | | | | |

Net increase in cash and cash equivalents | | | 35,752 | | | | 22,625 | |

Cash and cash equivalents at beginning of period | | | 33,720 | | | | 22,432 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 69,472 | | | $ | 45,057 | |

| | | | | | | | |

Supplemental cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 40,621 | | | $ | 42,142 | |

Cash paid for income taxes, net of refunds | | $ | 10,838 | | | $ | 17,210 | |

The accompanying notes are an integral part of these consolidated financial statements.

6

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited, dollars in thousands, except share data)

(1) Basis of Presentation of Consolidated Financial Statements

The accompanying interim consolidated financial statements of Foundation Coal Holdings, Inc. and Subsidiaries (the “Company”) are unaudited and prepared in accordance with the rules and regulations of the United States Securities and Exchange Commission for Form 10-Q. Such rules and regulations allow the omission of certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America as long as the statements are not misleading. In the opinion of management, these interim consolidated financial statements reflect all normal and recurring adjustments necessary for a fair presentation of the results of the periods presented. These interim consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company included in its Annual Report on Form 10-K for the twelve months ended December 31, 2006, filed March 1, 2007.

The Company’s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of the Company’s consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. The more significant areas requiring the use of management estimates and assumptions relate to coal reserves that are the basis for future cash flow estimates and units-of-production depreciation, depletion and amortization calculations; environmental and reclamation obligations; asset impairments; postemployment, postretirement and other employee benefit liabilities; valuation allowances for deferred income taxes; income tax provision calculations; reserves for contingencies and litigation; and the fair value and accounting treatment of certain financial instruments. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Accordingly, actual results may differ from these estimates. In addition, different assumptions or conditions could reasonably be expected to yield different results. The operating results for the three and nine months ended September 30, 2007 may not necessarily be indicative of the results to be expected in the fourth quarter or for the twelve months ended December 31, 2007.

(2) Recent Accounting Pronouncements

In February 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 159,The Fair Value Option for Financial Assets and Liabilities Including an amendment of FASB Statement No. 115 (“SFAS No. 159”). SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. SFAS No. 159 also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. SFAS No. 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. The Company is currently determining whether fair value accounting is preferred for any of its eligible items and has not yet determined the impact, if any, that SFAS No. 159 will have on the consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157,Fair Value Measurements (“SFAS No. 157”). This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This statement clarifies how to measure fair value as permitted under other accounting pronouncements but does not require any new fair value measurements. However, for some entities, the application of this statement will change current practice. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Company expects to adopt SFAS No. 157 on January 1, 2008 and has not yet determined the impact on the consolidated financial statements.

7

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

In September 2006, the FASB issued SFAS No. 158,Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106, and 132(R) (“SFAS No. 158”), which requires an employer to recognize the overfunded or underfunded status of a defined benefit pension and other postretirement plans (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through other comprehensive income. SFAS No. 158 requires the Company to initially recognize the funded status of a defined benefit pension and other postretirement plans and to provide the required disclosures as of the end of the fiscal year ending after December 15, 2006. Additionally, for fiscal years ending after December 15, 2008, the Company is required to measure plan assets and benefit obligations as of the date of the Company’s fiscal year-end statement of financial position rather than at an interim period. On December 31, 2006, the Company adopted the recognition and disclosure provisions of SFAS No. 158. The Company expects to early adopt the measurement date provisions on December 31, 2007.

In June 2006, the FASB issued FASB Interpretation No. (“FIN”) 48,Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109 (“FIN 48”), which clarifies the accounting for uncertainty in income taxes recognized in a company’s consolidated financial statements in accordance with SFAS No. 109,Accounting for Income Taxes. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 requires an entity to recognize the financial statement impact of a tax position when it is more-likely-than-not that the position will be sustained upon examination. If the tax position meets the more-likely-than-not recognition threshold, the tax effect is recognized at the largest amount of the benefit that is greater than fifty percent likely of being realized upon ultimate settlement. FIN 48 requires that a liability created for unrecognized tax benefits shall be presented as a liability and not combined with deferred tax liabilities or assets.

At January 1, 2007, the cumulative effect of the adoption of FIN 48 was zero. Our liability at the date of adoption for unrecognized tax benefits was $9,671. If recognized, $3,769 would affect the effective tax rate; however, the Company does not expect that these unrecognized tax benefits will significantly change this year. The Company recognizes interest and penalties accrued related to unrecognized tax benefits as a component of tax expense. The total amount of accrued interest and penalties was $163 and $270 as of January 1, 2007 and September 30, 2007, respectively.

The Company files income tax returns in the U.S. federal jurisdiction and various states. Our United States federal tax obligations have been settled through the year 2003, although certain carry forward tax attributes that were generated prior to 2002 may still be adjusted upon examination by tax authorities if they either have been or will be used in periods subsequent to 2002.

(3) Inventories

Inventories consisted of the following:

| | | | | | | | |

| | | September 30,

2007 | | | December 31,

2006 | |

Saleable coal | | $ | 15,194 | | | $ | 16,052 | |

Raw coal | | | 631 | | | | 2,199 | |

Materials and supplies | | | 28,973 | | | | 23,620 | |

| | | | | | | | |

| | | 44,798 | | | | 41,871 | |

Less materials and supplies reserve for obsolescence | | | (5,515 | ) | | | (5,100 | ) |

| | | | | | | | |

| | $ | 39,283 | | | $ | 36,771 | |

| | | | | | | | |

Saleable coal represents coal stockpiles ready for shipment to a customer. Raw coal represents coal that requires further processing prior to shipment.

8

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

(4) Prepaid Expenses

Prepaid expenses consisted of the following:

| | | | | | |

| | | September 30,

2007 | | December 31,

2006 |

Prepaid royalties | | $ | 1,140 | | $ | 1,427 |

Prepaid longwall move expenses | | | 10,215 | | | 8,628 |

Prepaid SO2 emission allowances | | | 1,775 | | | 2,052 |

Prepaid taxes | | | 6,550 | | | 6,330 |

Prepaid insurance | | | 10,442 | | | 10,796 |

Other | | | 1,098 | | | 1,557 |

| | | | | | |

| | $ | 31,220 | | $ | 30,790 |

| | | | | | |

(5) Plant, Equipment, Mine Development Costs and Owned and Leased Mineral Rights

Plant, equipment, mine development costs and owned and leased mineral rights consisted of the following:

| | | | | | | | |

| | | September 30,

2007 | | | December 31,

2006 | |

Owned surface lands and mineral rights | | | | | | | | |

Owned surface lands | | $ | 35,440 | | | $ | 30,388 | |

| | | | | | | | |

Owned and leased mineral rights | | $ | 1,255,218 | | | $ | 1,253,127 | |

Less accumulated depletion | | | (307,899 | ) | | | (249,323 | ) |

| | | | | | | | |

| | $ | 947,319 | | | $ | 1,003,804 | |

| | | | | | | | |

Plant, equipment and mine development costs | | | | | | | | |

Plant, equipment and asset retirement costs | | $ | 894,632 | | | $ | 798,159 | |

Mine development costs | | | 43,625 | | | | 27,507 | |

Internal use software | | | 35,760 | | | | 30,726 | |

Coalbed methane equipment and development costs | | | 9,991 | | | | 7,022 | |

| | | | | | | | |

| | | 984,008 | | | | 863,414 | |

| | | | | | | | |

Less accumulated depreciation and amortization: | | | | | | | | |

Plant, equipment and asset retirement costs | | | (308,699 | ) | | | (226,788 | ) |

Mine development costs | | | (6,424 | ) | | | (3,368 | ) |

Internal use software | | | (9,480 | ) | | | (5,911 | ) |

Coalbed methane equipment and development costs | | | (1,706 | ) | | | (1,113 | ) |

| | | | | | | | |

| | | (326,309 | ) | | | (237,180 | ) |

| | | | | | | | |

| | $ | 657,699 | | | $ | 626,234 | |

| | | | | | | | |

9

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

(6) Other Noncurrent Assets

Other noncurrent assets consisted of the following:

| | | | | | |

| | | September 30,

2007 | | December 31,

2006 |

Receivables from asset dispositions | | $ | 1,839 | | $ | 1,839 |

Unamortized deferred financing costs, net | | | 10,777 | | | 12,159 |

Advance mining royalties | | | 1,527 | | | 1,657 |

Other | | | 1,561 | | | 1,509 |

| | | | | | |

| | $ | 15,704 | | $ | 17,164 |

| | | | | | |

(7) Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

| | | | | | |

| | | September 30,

2007 | | December 31,

2006 |

Wages and employee benefits | | $ | 35,667 | | $ | 33,619 |

Employee termination costs | | | 444 | | | - |

Postretirement benefits other than pension | | | 22,340 | | | 21,420 |

Interest | | | 3,625 | | | 9,063 |

Royalties | | | 9,911 | | | 6,271 |

Taxes, other than income taxes | | | 36,065 | | | 35,409 |

Asset retirement obligations | | | 2,523 | | | 2,940 |

Workers’ compensation | | | 8,140 | | | 8,140 |

Deferred equipment purchase commitment | | | 17,348 | | | 4,337 |

Accrued capital expenditures | | | 8,911 | | | 10,495 |

Other | | | 32,884 | | | 30,320 |

| | | | | | |

| | $ | 177,858 | | $ | 162,014 |

| | | | | | |

(8) Other Noncurrent Liabilities

Other noncurrent liabilities consisted of the following:

| | | | | | |

| | | September 30,

2007 | | December 31,

2006 |

Postemployment benefits | | $ | 5,111 | | $ | 4,803 |

Pension benefits | | | 39,116 | | | 45,387 |

Workers’ compensation | | | 24,914 | | | 23,347 |

Minimum royalty obligations | | | 81 | | | 81 |

Black lung reserves | | | 12,446 | | | 11,305 |

Contract settlement accrual | | | 10,228 | | | 13,986 |

Asset retirement obligations | | | 144,199 | | | 122,076 |

Deferred production tax | | | 16,701 | | | 9,642 |

Deferred credits and other | | | 7,402 | | | 6,140 |

Deferred equipment purchase commitment | | | 3,646 | | | 15,653 |

| | | | | | |

| | $ | 263,844 | | $ | 252,420 |

| | | | | | |

10

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

During 2005, the Company’s Northern Appalachia business unit took delivery of one hundred new longwall shields to remedy a warranty issue associated with shields currently used in its underground mining operations. The Company entered into a purchase commitment for the shields in the amount of $21,685 and in accordance with the payment terms, periodic progress payments to the manufacturer are not scheduled to start until the fourth quarter of 2007, with scheduled completion within one year. The current portion of the deferred equipment purchase commitment liability of $17,348 is recorded inAccrued expenses and other current liabilities. See Note 7. The Company recorded a deferred equipment purchase commitment liability representing the present value of the future payments due in accordance with the terms of the purchase commitment. Interest expense is imputed and recognized in a manner consistent with the established payment terms, over which, the liability will be increased to the full value of $21,685.

(9) Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss consisted of the following:

| | | | | | | | |

| | | September 30, 2007 | | | December 31, 2006 | |

| | |

Unrealized gain on interest rate swaps | | $ | - | | | $ | 1,114 | |

Defined benefit pension, postretirement and other Company sponsored plans | | | (5,720 | ) | | | (34,526 | ) |

| | | | | | | | |

| | $ | (5,720 | ) | | $ | (33,412 | ) |

| | | | | | | | |

(10) Pension, Other Postretirement Benefit Plans and Pneumoconiosis

Actuarial liabilities related to the Company’s defined benefit pension and postretirement benefit plans were re-measured in connection with the April 2007 curtailment event which occurred with respect to the closing of the Wabash mine, as further discussed in Note 18. The curtailment gains of $5,703 were recorded inOther comprehensive income because the curtailment gains did not exceed the unrecognized net losses recorded inAccumulated other comprehensive income related to these plans.

Components of Net Periodic Pension Costs

The components of net periodic benefit costs are as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

Service cost | | $ | 1,657 | | | $ | 1,544 | | | $ | 4,898 | | | $ | 4,635 | |

Interest cost | | | 3,102 | | | | 2,766 | | | | 9,169 | | | | 8,299 | |

Expected return on plan assets | | | (3,113 | ) | | | (2,641 | ) | | | (9,203 | ) | | | (7,925 | ) |

Amortization of: | | | | | | | | | | | | | | | | |

Prior service cost | | | 138 | | | | 25 | | | | 407 | | | | 75 | |

Actuarial (gains) losses | | | (2 | ) | | | 100 | | | | (7 | ) | | | 299 | |

| | | | | | | | | | | | | | | | |

Net expense | | $ | 1,782 | | | $ | 1,794 | | | $ | 5,264 | | | $ | 5,383 | |

| | | | | | | | | | | | | | | | |

Components of Net Periodic Other Postretirement Benefit Plans Costs

The components of net periodic benefit costs are as follows:

| | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2007 | | 2006 | | 2007 | | 2006 |

Service cost | | $ | 1,930 | | $ | 2,274 | | $ | 5,850 | | $ | 6,824 |

Interest cost | | | 7,583 | | | 7,525 | | | 22,995 | | | 22,574 |

Amortization of actuarial losses | | | - | | | 25 | | | - | | | 75 |

| | | | | | | | | | | | |

Net expense | | $ | 9,513 | | $ | 9,824 | | $ | 28,845 | | $ | 29,473 |

| | | | | | | | | | | | |

11

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

The Company’s postretirement medical and life insurance plans are unfunded.

Components of Pneumoconiosis Costs

The components of net periodic benefit costs are as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

Service cost | | $ | 174 | | | $ | 176 | | | $ | 522 | | | $ | 529 | |

Interest cost | | | 341 | | | | 329 | | | | 1,021 | | | | 986 | |

Expected return on plan assets | | | (124 | ) | | | (144 | ) | | | (374 | ) | | | (431 | ) |

Amortization of actuarial losses | | | 29 | | | | 50 | | | | 87 | | | | 149 | |

| | | | | | | | | | | | | | | | |

Net expense | | $ | 420 | | | $ | 411 | | | $ | 1,256 | | | $ | 1,233 | |

| | | | | | | | | | | | | | | | |

(11) Stock-Based Compensation

On July 30, 2004, the Company’s Board of Directors adopted the Foundation Coal Holdings, Inc. 2004 Stock Incentive Plan (the “Plan”), which is designed to assist the Company in recruiting and retaining key employees, directors and consultants. The Plan, which was amended and restated December 14, 2006, permits the Company to grant its key employees, directors and consultants nonqualified stock options (“options”), stock appreciation rights, restricted stock or other stock-based awards. The shares under the Plan may be issued at an exercise price of no less than 100% of the fair market value of the Company’s common stock on the date of grant. The Plan is currently authorized for the issuance of awards for up to 5,978,483 shares of common stock. At September 30, 2007, 2,211,314 shares of common stock were available for grant under the Plan.

The Company has three types of stock-based awards: restricted stock units, restricted stock and options. Total compensation expense related to the stock-based awards recognized inSelling, general and administrative expenses for the nine months ended September 30, 2007 was $4,601, consisting of $3,170, $294 and $1,137 for restricted stock units, restricted stock and options, respectively. Compensation expense related to the stock-based awards recognized inSelling, general and administrative expenses for the nine months ended September 30, 2006 was $2,250, consisting of $1,007, $205 and $1,038 for restricted stock units, restricted stock and options, respectively.

(12) Interest Rate Swaps

On September 30, 2004, the Company entered into pay-fixed, receive-variable interest rate swap agreements on a notional amount of $85,000. The term of these swaps was for three years. Under these swaps, the Company received a variable rate of three month US dollar LIBOR and paid a fixed rate of 3.26%. Settlement of interest payments occurred quarterly. The Company was required to enter into these swaps in order to maintain at least 50% of its outstanding debt at a fixed rate as required by the Senior Secured Credit Facility. These swap agreements essentially converted $85,000 of the Company’s variable rate borrowings under the Senior Secured Credit Facility to fixed rate borrowings for a three-year period beginning September 30, 2004. The Company designated these interest rate swaps at inception as cash flow hedges of the variable interest payments due on $85,000 of its variable rate debt through September 2007 under SFAS No. 133,Accounting for Derivative Financial Instruments and Hedging Activities (“SFAS No. 133”).

In connection with the closing of the $835,000 amended and restated Senior Secured Credit Facility agreement on July 7, 2006, the Company terminated the interest rate swaps. On the date the Company made the decision to terminate the interest rate swaps, the interest rate swaps no longer qualified for cash flow hedge accounting treatment and accordingly, any change in the market value of the interest rate swaps affects net income. On July 11, 2006, the Company monetized the $2,371 derivative asset included inOther noncurrent assets on the Consolidated Balance Sheets at June 30, 2006 and recognized a $112 mark-to-market loss on the swaps. The $1,841 unrealized gain at June 30, 2006 from the change in the market value of the interest rate swaps recorded inAccumulated other comprehensive loss was amortized into income on a prorated basis over the remaining term of the original interest rate swap agreement through September 28, 2007, in accordance with SFAS No. 133 and related amendments. At December 31, 2006, the unamortized unrealized gain on the swaps was $1,114. During the three and nine months ended September 30, 2007, the Company amortized $370 and $1,114, respectively, which was recorded as an offset againstInterest expense.

12

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

(13) Asset Retirement Obligations

The Company’s mining activities are subject to various federal and state laws and regulations governing the protection of the environment. These laws and regulations are continually changing and are generally becoming more restrictive. The Company conducts its operations to protect the public health and environment and believes its operations are in material compliance with all applicable laws and regulations. The Company has made, and expects to make in the future, expenditures to comply with such laws and regulations, but cannot predict the exact amount of such future expenditures. Estimated future reclamation costs are based principally on legal and regulatory requirements.

The following table is a reconciliation of the Company’s asset retirement obligation liability from December 31, 2006 through September 30, 2007:

| | | | |

Asset retirement obligation, December 31, 2006 | | $ | 125,016 | |

Accretion expense | | | 7,492 | |

Revisions in estimated cash flows and liabilities incurred | | | 14,684 | |

Payments | | | (470 | ) |

| | | | |

Asset retirement obligation, September 30, 2007 | | $ | 146,722 | |

| | | | |

The current portions of the asset retirement obligation liabilities of $2,523 and $2,940 at September 30, 2007 and December 31, 2006, respectively, are included inAccrued expenses and other current liabilities. See Note 7. The noncurrent portion of the Company’s asset retirement obligation liabilities of $144,199 and $122,076 at September 30, 2007 and December 31, 2006, respectively, are included inOther noncurrent liabilities. See Note 8. There were no assets that were legally restricted for purposes of settling asset retirement obligations at September 30, 2007 or December 31, 2006. At September 30, 2007, regulatory obligations for asset retirements are secured by surety bonds in the amount of $260,598. These surety bonds are partially collateralized by letters of credit issued by the Company.

(14) Stockholders’ Equity and Earnings Per Share

Stockholders’ Equity

During the nine months ended September 30, 2007, the Company declared and paid cash dividends of $6,779.

During the three and nine months ended September 30, 2007, 70,000 and 420,345 options were exercised, respectively.

Earnings Per Share

The following table provides a reconciliation of weighted-average shares outstanding used in the basic and diluted earnings per share computations for the periods presented:

| | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2007 | | 2006 | | 2007 | | 2006 |

Weighted average shares outstanding-basic | | 45,221,193 | | 45,507,284 | | 45,193,686 | | 45,654,040 |

Dilutive impact of stock options | | 1,082,141 | | 1,206,587 | | 1,174,524 | | 1,392,791 |

Dilutive impact of restricted stock plans | | 109,470 | | 59,870 | | 91,198 | | 56,884 |

| | | | | | | | |

Weighted average shares outstanding-diluted | | 46,412,804 | | 46,773,741 | | 46,459,408 | | 47,103,715 |

| | | | | | | | |

Common Share Repurchases

In July 2006, the Board of Directors authorized a stock repurchase program (the “Repurchase Program”), authorizing the Company to repurchase shares of its common stock. The Company may repurchase its common stock from time to time, as determined by authorized officers of the Company, up to an aggregate amount of $100,000. During the nine months ended September 30, 2007, the Company paid $23,424 to repurchase 753,653 shares of its common stock at an average price of $31.08 per share under the Repurchase Program.

13

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

(15) Segment Information

The Company produces primarily steam coal from surface and deep mines for sale to utility and industrial customers. The Company operates in the United States with mines in three of the major coal basins. The Company has four reportable business segments: Northern Appalachia, consisting of two underground mines in southwestern Pennsylvania; Central Appalachia, consisting of seven underground mines and two surface mines in southern West Virginia; the Powder River Basin, consisting of two surface mines in Wyoming and Other. Other includes an idled underground mine in Illinois, centralized sales functions, corporate overhead, business development activities, expenses for closed mines and the elimination of intercompany transactions. The Company evaluates the performance of its segments based on income from operations.

Operating segment results for the three months ended September 30, 2007 are as follows:

| | | | | | | | | | | | | | | | | | |

| | | Powder River

Basin | | Northern

Appalachia | | Central

Appalachia | | | Other | | | Consolidated | |

Total revenues | | $ | 120,970 | | $ | 117,249 | | $ | 117,528 | | | $ | 3,311 | | | $ | 359,058 | |

Income (loss) from operations | | | 18,838 | | | 9,046 | | | 2,863 | | | | (22,721 | ) | | | 8,026 | |

Depreciation, depletion and amortization | | | 11,451 | | | 18,842 | | | 17,149 | | | | 2,143 | | | | 49,585 | |

Amortization of coal supply agreements | | | 1,128 | | | 24 | | | (2,101 | ) | | | 105 | | | | (844 | ) |

Capital expenditures | | | 14,950 | | | 21,291 | | | 7,389 | | | | 1,052 | | | | 44,682 | |

Total assets at September 30, 2007 | | $ | 506,868 | | $ | 853,535 | | $ | 439,849 | | | $ | 149,574 | | | $ | 1,949,826 | |

Operating segment results for the three months ended September 30, 2006 are as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Powder River

Basin | | Northern

Appalachia | | | Central

Appalachia | | | Other | | | Consolidated | |

Total revenues | | $ | 107,510 | | $ | 128,474 | | | $ | 105,685 | | | $ | 12,451 | | | $ | 354,120 | |

Income (loss) from operations | | | 13,244 | | | 22,000 | | | | 1,750 | | | | (16,754 | ) | | | 20,240 | |

Depreciation, depletion and amortization | | | 10,839 | | | 17,507 | | | | 14,989 | | | | 1,835 | | | | 45,170 | |

Amortization of coal supply agreements | | | 3,912 | | | (1,936 | ) | | | (4,504 | ) | | | 219 | | | | (2,309 | ) |

Capital expenditures | | | 8,681 | | | 15,676 | | | | 6,794 | | | | 13,180 | | | | 44,331 | |

Total assets at December 31, 2006 | | $ | 497,956 | | $ | 863,702 | | | $ | 469,616 | | | $ | 118,306 | | | $ | 1,949,580 | |

Operating segment results for the nine months ended September 30, 2007 are as follows:

| | | | | | | | | | | | | | | | | | |

| | | Powder River

Basin | | Northern

Appalachia | | Central

Appalachia | | | Other | | | Consolidated | |

Total revenues | | $ | 355,588 | | $ | 395,579 | | $ | 347,185 | | | $ | 24,109 | | | $ | 1,122,461 | |

Income (loss) from operations | | | 60,667 | | | 62,995 | | | 3,043 | | | | (74,217 | ) | | | 52,488 | |

Depreciation, depletion and amortization | | | 33,066 | | | 60,387 | | | 51,742 | | | | 6,217 | | | | 151,412 | |

Amortization of coal supply agreements | | | 3,130 | | | 182 | | | (6,806 | ) | | | 53 | | | | (3,441 | ) |

Capital expenditures | | | 26,089 | | | 55,637 | | | 24,343 | | | | 14,692 | | | | 120,761 | |

Total assets at September 30, 2007 | | $ | 506,868 | | $ | 853,535 | | $ | 439,849 | | | $ | 149,574 | | | $ | 1,949,826 | |

Operating segment results for the nine months ended September 30, 2006 are as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Powder River

Basin | | Northern

Appalachia | | | Central

Appalachia | | | Other | | | Consolidated | |

Total revenues | | $ | 315,474 | | $ | 418,683 | | | $ | 342,026 | | | $ | 40,349 | | | $ | 1,116,532 | |

Income (loss) from operations | | | 32,137 | | | 120,425 | | | | 15,445 | | | | (57,622 | ) | | | 110,385 | |

Depreciation, depletion and amortization | | | 31,560 | | | 56,020 | | | | 44,171 | | | | 5,927 | | | | 137,678 | |

Amortization of coal supply agreements | | | 10,659 | | | (7,068 | ) | | | (15,710 | ) | | | 346 | | | | (11,773 | ) |

Capital expenditures | | | 15,821 | | | 35,120 | | | | 40,036 | | | | 28,736 | | | | 119,713 | |

Total assets at December 31, 2006 | | $ | 497,956 | | $ | 863,702 | | | $ | 469,616 | | | $ | 118,306 | | | $ | 1,949,580 | |

14

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

(16) Other Revenue

Other revenue consisted of the following:

| | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended

September 30, |

| | | 2007 | | | 2006 | | 2007 | | | 2006 |

Royalty income | | $ | 971 | | | $ | 2,389 | | $ | 2,843 | | | $ | 3,888 |

Synfuel fees | | | 1,351 | | | | 391 | | | 4,013 | | | | 5,312 |

Coalbed methane | | | 1,337 | | | | 1,046 | | | 3,590 | | | | 3,015 |

Transloading and plant processing fees | | | 429 | | | | 680 | | | 921 | | | | 2,558 |

Gain on sale of assets | | | 1,867 | (1) | | | 514 | | | 4,468 | (1) | | | 899 |

Combined Benefit Fund refund | | | - | | | | - | | | 1,325 | | | | - |

Dry Systems Technologies equipment and filter sales | | | 888 | | | | 1,155 | | | 2,740 | | | | 3,366 |

Other | | | 1,453 | | | | 434 | | | 5,774 | | | | 3,222 |

| | | | | | | | | | | | | | |

Total other revenue | | $ | 8,296 | | | $ | 6,609 | | $ | 25,674 | | | $ | 22,260 |

| | | | | | | | | | | | | | |

(1) | Gain on sale of assets includes a $2,000 gain on a non-cash exchange of leased reserves with Boone West Development Co., a subsidiary of Massey Energy Company. |

(17) Commitments and Contingencies

General

The Company follows SFAS No. 5,Accounting for Contingencies, in determining its accruals and disclosures with respect to loss contingencies. Accordingly, estimated losses from loss contingencies and legal expenses associated with the contingency are accrued by a charge to income when information available indicates that it is probable that an asset had been impaired or a liability had been incurred and the amount of the loss can be reasonably estimated. If a loss contingency is not probable or reasonably estimable, disclosure of the loss contingency is made in the consolidated financial statements when it is at least reasonably possible that a loss will be incurred and the loss is material. Additionally, see Note 13 regarding Asset Retirement Obligations.

Guarantees

Neweagle Industries, Inc., Neweagle Coal Sales Corp., Laurel Creek Co., Inc. and Rockspring Development, Inc. (“Sellers”) are indirect wholly owned subsidiaries of the Company. The Sellers sell coal to Birchwood Power Partners, L.P. (“Birchwood”) under a Coal Supply Agreement dated July 22, 1993 (“Birchwood Contract”). Laurel Creek Co., Inc. and Rockspring Development, Inc. were parties to the Birchwood Contract since its inception, at which time those entities were not affiliated with Neweagle Industries, Inc., Neweagle Coal Sales Corp. or the Company. Effective January 31, 1994, the Birchwood Contract was assigned to Neweagle Industries, Inc. and Neweagle Coal Sales Corp. by AgipCoal Holding USA, Inc. and AgipCoal Sales USA, Inc., which at the time were affiliates of Arch Coal, Inc. Despite this assignment, Arch Coal, Inc. (“Arch”) and its affiliates have separate contractual obligations to provide coal to Birchwood if Sellers fail to perform. Pursuant to an Agreement & Release dated September 30, 1997, the Company agreed to defend, indemnify and hold harmless Arch and its subsidiaries from and against any claims arising out of any failure of Sellers to perform under the Birchwood Contract. By acknowledgement dated February 16, 2005, the Company and Arch acknowledged the continuing validity and effect of said Agreement & Release.

In the normal course of business, the Company is a party to guarantees and financial instruments with off-balance sheet risk, such as bank letters of credit, performance or surety bonds and other guarantees and indemnities related to the obligations of affiliated entities, which are not reflected in the accompanying Consolidated Balance Sheets. Management does not expect any material losses to result from these guarantees and other off-balance sheet instruments and, therefore, is of the opinion that their fair value is zero.

Contingencies

Extensive regulation of the impacts of mining on the environment and of maintaining workplace safety, and related litigation, has had or may have a significant effect on the Company’s costs of production and results of operations. Further regulations, legislation or litigation in these areas may also cause the Company’s sales or profitability to decline by increasing costs or by hindering the Company’s ability to continue mining at existing operations or to permit new operations.

15

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

Legal Proceedings

The Company is involved in various claims and other legal actions arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse effect on the Company’s consolidated financial position, consolidated results of operations or consolidated cash flows.

Letters of Credit

At September 30, 2007, the Company had $171,348 of letters of credit outstanding under its revolving credit facility.

(18) Employee and Contract Termination Costs

Employee Termination Costs

Wage agreements between three affiliates of the Company and the United Mine Workers of America (“UMWA”) expired on or shortly after March 31, 2007. Specifically, the UMWA wage agreement for Wabash Mine Holding Company (“Wabash”) expired at 11:59 p.m. on March 31, 2007 and the UMWA wage agreements with Cumberland Coal Resources, LP (“Cumberland”) and Emerald Coal Resources, LP (“Emerald”) expired at 11:59 p.m. on April 1, 2007. Negotiations between these respective subsidiaries and the UMWA commenced in early January of 2007 but intensified in late March of 2007 and continued through April 3, 2007. Emerald Coal Resources, LP and Cumberland Coal Resources, LP reiterated their willingness to sign the 2007 National Bituminous Coal Operators Association (“BCOA”) UMWA wage agreement. Wabash would not sign the BCOA agreement. The hourly workforce continued to work without a formal agreement of the parties under the terms of the expired wage agreement until 12:01 a.m. on April 4, 2007 at which time, alleging unfair labor practices by Wabash, Emerald and Cumberland, the UMWA represented hourly workforces struck the Wabash, Emerald and Cumberland mines. On the same day, Wabash announced the idling of the mine in southern Illinois. The mining operation had become economically unviable at that time as a result of a combination of factors, including aging infrastructure, softening market conditions and the prospect of a new higher cost labor contract with the UMWA.

On April 10, 2007, negotiations between the UMWA and the three subsidiaries resumed. In the early evening of April 12, 2007, it was announced that the UMWA and the three subsidiaries had reached agreement and that the workforces at Emerald and Cumberland would return to work. The Wabash mine remained closed and the effects of the idling had been negotiated with the UMWA.

During the nine months ended September 30, 2007, as a result of the Wabash mine idling, the Company recognized employee termination costs of $5,967 and $1,405 in accordance with the provisions of SFAS No. 146,Accounting for Costs Associated with Exit or Disposal Activities (“SFAS No. 146”) and the provisions of SFAS No. 112,Employers’ Accounting for Postemployment Benefits (“SFAS No. 112”), respectively. During the three months ended September 30, 2007, employee termination costs associated with one-time benefit arrangements of $617 were recognized in accordance with SFAS No. 146. Termination costs resulting from one-time benefit arrangements include medical insurance continuance costs and one-time retention pay to salaried employees. The Company also reduced its estimate of certain previously recognized employee termination costs associated with on-going benefit arrangements in accordance with SFAS No. 112 by $57. During the three and nine months ended September 30, 2007, the Company also recognized $1,754 of direct and incremental costs related to additional benefit claims for certain severed employees. These employee termination costs are recorded asEmployee and contract termination costs in the Consolidated Statements of Operations and Comprehensive Income for the three and nine months ended September 30, 2007. Wabash is included in the Company’sOther segment.

During the three and nine months ended September 30, 2007, the Company made cash payments related to employee termination costs of $2,436 and $6,928, respectively. At September 30, 2007, the Company’s liability for employee termination costs included inAccrued expenses and other current liabilities in the Consolidated Balance Sheet was $444, comprised of medical and severance benefits. See Note 7. The Company’s liability for other costs associated with severed employees included inOther noncurrent liabilities was $1,754 at September 30, 2007. See Note 8.

16

Foundation Coal Holdings, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

(Unaudited, dollars in thousands, except share data)

Contract Termination Costs

Wabash was the seller under two coal supply agreements supplied from the Wabash mine with Duke Energy Indiana, Inc. Wabash continued to ship coal under the coal supply agreements through April 3, 2007, just prior to the mine idling. Each agreement contained force majeure language excusing the seller from supplying coal in the event of a work stoppage. On April 3, 2007, Wabash and Duke Energy Indiana, Inc. executed a Termination Agreement and Mutual Release buying-out, subject to certain conditions, all obligations under their two contracts in exchange for a cash payment of $5,734 which was paid by the Company on April 5, 2007. The Company believes there will be no further obligations of Wabash under these two contracts. During the nine months ended September 30, 2007, the Company recognized $5,171 of net contract termination costs in accordance with the provisions of SFAS No. 146. The contract termination costs were recorded during the second quarter based on the date the Termination Agreement & Mutual Release was agreed-to between the parties. These contract termination costs are recorded asEmployee and contract termination costs in the Consolidated Statement of Operations and Comprehensive Income for the nine months ended September 30, 2007.

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Special Note Regarding Forward-Looking Statements

This Form 10-Q contains forward-looking statements that are not statements of historical fact and may involve a number of risks and uncertainties. These statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to our future prospects, developments and business strategies.

We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, in this Form 10-Q to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

| | • | | market demand for coal, electricity and steel; |

| | • | | future economic or capital market conditions; |

| | • | | weather conditions or catastrophic weather-related damage; |

| | • | | our ability to produce coal at existing and planned future operations; |

| | • | | the consummation of financing, acquisition or disposition transactions and the effect thereof on our business; |

| | • | | our plans and objectives for future operations and expansion or consolidation; |

| | • | | our relationships with, and other conditions affecting, our customers; |

| | • | | timing of reductions or increases in customer coal inventories; |

| | • | | long-term coal supply arrangements; |

| | • | | environmental laws, including those directly affecting our coal mining and production, and those affecting our customers’ coal usage; |

| | • | | railroad, barge, trucking and other transportation performance and costs; |

| | • | | our assumptions concerning economically recoverable coal reserve estimates; |

| | • | | employee workforce factors; |

| | • | | regulatory and court decisions; |

| | • | | future legislation and changes in regulations or governmental policies or changes in interpretations thereof; |

| | • | | changes in postretirement benefit and pension obligations; |

| | • | | our liquidity, results of operations and financial condition; |

| | • | | disruptions in delivery or changes in pricing from third party vendors of goods and services which are necessary for our operations, such as fuel, steel products, explosives and tires; |

| | • | | continuation of other revenues from fees received from synthetic fuel (“synfuel”) processors. |

You should keep in mind that any forward-looking statement made by us in this Form 10-Q or elsewhere speaks only as of the date on which we make it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements in this Form 10-Q after the date of this Form 10-Q, except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any forward-looking statement made in this Form 10-Q or elsewhere might not occur.

18

Overview

We are the fourth largest coal producer in the United States, operating a diverse group of thirteen coal mines located in Pennsylvania, West Virginia and the Powder River Basin region of Wyoming. Four of our operations are surface mines, two of our operations are underground mines using highly efficient longwall mining technology and the remaining seven operations are underground mines that utilize continuous miners. On April 4, 2007, Wabash Mine Holding Company (“Wabash”) announced the idling of the Wabash mine, an underground, continuous miner operation located in southern Illinois. The mine had become economically unviable at that time as a result of a combination of factors discussed further in “Wage Negotiations with the UMWA and Idling of the Company’s Illinois Basin Mining Operations” below.

For the three months ended September 30, 2007, we sold 18.5 million tons of coal, including 18.0 million tons that were produced and processed at our operations. For the comparable period in 2006, we sold 18.5 million tons of coal, including 18.2 million tons that were produced and processed at our operations. For the nine months ended September 30, 2007, we sold 55.5 million tons of coal, including 54.2 million tons that were produced and processed at our operations. For the comparable period in 2006, we sold 55.6 million tons of coal, including 54.0 million tons produced and processed at our operations. As of December 31, 2006, we had approximately 1.6 billion tons of proven and probable coal reserves. In addition to mining coal, we are also involved in marketing coal produced by others to supplement our own production and, through blending, provide our customers with coal qualities beyond those available from our own production. We purchased and resold approximately 0.5 million and 0.3 million tons of coal in the three months ended September 30, 2007 and 2006, respectively. For the nine months ended September 30, 2007 and 2006, we purchased and resold approximately 1.3 million and 1.6 million tons of coal, respectively.

We are primarily a supplier of steam coal to U.S. utilities for use in generating electricity. We also sell steam coal to industrial plants. Steam coal sales accounted for approximately 97% of our coal sales volume for both the three month periods ended September 30, 2007 and 2006, representing approximately 88% and 90% of our coal sales revenue in the three month periods ended September 30, 2007 and 2006, respectively. For the nine months ended September 30, 2007 and 2006, steam coal sales accounted for approximately 97% of our coal sales volume in both periods, representing approximately 90% and 91% of our coal sales revenue for the nine month periods ended September 30, 2007 and 2006, respectively. We sell metallurgical coal to steel producers where it is used to make coke for steel production. Metallurgical coal accounted for approximately 3% of our coal sales volume in both of the three month periods ended September 30, 2007 and 2006, representing approximately 12% and 10% of our coal sales revenue in the three month periods ended September 30, 2007 and 2006, respectively. Metallurgical coal accounted for approximately 3% of our coal sales volume for both of the nine month periods ended September 30, 2007 and 2006, representing approximately 10% and 9% of our coal sales revenue in both of the nine month periods ended September 30, 2007 and 2006, respectively.

While the majority of our revenues are derived from the sale of coal, we also realize revenues from coal production royalties, override royalty payments from a coal supply agreement now fulfilled by another producer, fees from the processing of our production by a synfuel facility, asset disposals, fees to transload coal through our Rivereagle facility on the Big Sandy River and revenues from the sale of coalbed methane.

Results of Operations

Three Months Ended September 30, 2007 Compared to Three Months Ended September 30, 2006

Coal sales realization per ton sold represents the average revenue realized on each ton of coal sold. It is calculated by dividing coal sales revenues by tons sold.

19

Revenues

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Increase (Decrease) |

| | | 2007 | | 2006 | | Amount | | | Percent |

| | | (Unaudited, in thousands, except per ton data) |

Coal sales | | $ | 350,762 | | $ | 347,511 | | $ | 3,251 | | | 1% |

Other revenue | | | 8,296 | | | 6,609 | | | 1,687 | | | 26% |

| | | | | | | | | | | | |

Total revenues | | $ | 359,058 | | $ | 354,120 | | $ | 4,938 | | | 1% |

| | | | | | | | | | | | |

Tons sold | | | 18,470 | | | 18,495 | | | (25 | ) | | - |

Coal sales realization per ton sold | | $ | 18.99 | | $ | 18.79 | | $ | 0.20 | | | 1% |

Coal sales revenues for the three months ended September 30, 2007 increased by $3.3 million compared to coal sales revenues for the three months ended September 30, 2006 as a result of a 1% increase in average coal sales realization per ton due to a period-over-period increase in base revenue realization. Consolidated weighted-average sales realization per ton for the third quarter of 2007 reflected a higher proportion of lower value Powder River Basin shipments compared to the same period in 2006.

Coal sales revenues in Northern Appalachia for the three months ended September 30, 2007 decreased 10% compared to coal sales revenues for the three months ended September 30, 2006 due primarily to a combination of lower coal sales volumes from lower tons shipped, lower base revenue and lower coal quality premium/penalty revenue. Coal sales revenue realization per ton sold was unchanged period-over-period. Coal sales volumes in Northern Appalachia for the three months ended September 30, 2007 decreased by 0.3 million tons (9%) period-over-period primarily as a result of decreased production and shipments from the Emerald mine due to geological challenges encountered during the quarter which hindered mining activities and slowed production.

Coal sales revenues in Central Appalachia for the three months ended September 30, 2007 increased 8% compared to coal sales revenues for the three months ended September 30, 2006. Coal sales revenue realization per ton sold increased 1% period-over-period due to higher revenues earned from purchased coal and synfuel fees and higher base revenue partially offset by lower coal quality premium/penalty revenue. Coal sales volumes in Central Appalachia increased by 0.1 million tons (7%) period-over-period reflecting increased tons that were purchased and resold and decreased shipments from all West Virginia mining operations except for the Kingston mine and from Laurel Creek’s underground mines. Production in Central Appalachia increased by 1% for the three months ended September 30, 2007 compared to the prior year period.

Coal sales revenues in the Powder River Basin for the three months ended September 30, 2007 increased by 12% compared to coal sales revenues for the three months ended September 30, 2006 as a result of a 3% increase in tons sold and higher base revenue, partially offset by lower premium/penalty revenue, resulting in a 9% increase in average coal sales realization per ton. Base revenue realization per ton increased by 16% period-over-period while coal quality premium/penalty revenue decreased 89% period-over-period. Coal sales realization per ton increased due to shipments under higher priced 2007 contracts than the comparable period in 2006. Coal sales volumes in the Powder River Basin increased by 0.3 million tons (3%) to a record quarterly shipment level of 13.3 million tons primarily due to a 12% increase in both production and shipments from the Belle Ayr mine, offset partially by 6% lower period-over-period production and shipments at the Eagle Butte mine.

Coal sales revenues in the Illinois Basin for the three months ended September 30, 2007 decreased substantially compared to the coal sales revenues for the three months ended September 30, 2006 due to the April 4, 2007 idling of the Wabash mine in southern Illinois.

Other revenues for the three months ended September 30, 2007 increased by $1.7 million (26%) compared to the three months ended September 30, 2006. The increase was due to: (a) increased gains on the sale of assets ($1.4 million); (b) higher coalbed methane sales ($0.3 million); (c) increased miscellaneous revenues ($1.0 million); (d) increased synfuel fees ($1.0 million); partially offset by (e) lower transloading and plant processing fees ($0.3 million); (f) decreased revenues from the sale of equipment and filters by Dry Systems Technologies ($0.3 million); and (g) decreased royalty revenues ($1.4 million).

20

Costs and Expenses

| | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Increase (Decrease) | |

| | | 2007 | | | 2006 | | | Amount | | Percent | |

| | | (Unaudited, in thousands) | |

Cost of coal sales (excludes depreciation, depletion and amortization) | | $ | 283,079 | | | $ | 277,453 | | | $ | 5,626 | | 2 | % |

Selling, general and administrative expenses (excludes depreciation, depletion and amortization) | | | 14,263 | | | | 11,347 | | | | 2,916 | | 26 | % |

Accretion on asset retirement obligations | | | 2,635 | | | | 2,219 | | | | 416 | | 19 | % |

Depreciation, depletion and amortization | | | 49,585 | | | | 45,170 | | | | 4,415 | | 10 | % |

Amortization of coal supply agreements | | | (844 | ) | | | (2,309 | ) | | | 1,465 | | 63 | % |

Employee and contract termination costs | | | 2,314 | | | | - | | | | 2,314 | | N/A | (1) |

| | | | | | | | | | | | | | |

Total costs and expenses | | $ | 351,032 | | | $ | 333,880 | | | $ | 17,152 | | 5 | % |

| | | | | | | | | | | | | | |

(1) | Amounts are not measurable as no such costs were incurred during the three months ended September 30, 2006. |

Cost of coal sales.Cost of coal sales increased $5.6 million for the three months ended September 30, 2007 compared to the three months ended September 30, 2006, primarily due to: (a) increases in labor and benefit costs as a result of both compensation increases and hiring of additional personnel ($5.4 million); (b) increases in royalties due to mining a higher proportion of coal subject to federal royalty ($2.6 million); (c) higher repair and maintenance, outside services and operating supply costs ($0.1 million); (d) increases in purchased coal costs as a result of higher purchased coal volumes ($7.6 million); (e) increased property, sales and production taxes ($1.5 million); (f) increased miscellaneous expenses ($0.4 million); partially offset by (g) lower longwall move expenses ($0.9 million); (h) decreased transportation and loading costs ($2.0 million); and (i) a period-over-period decrease in inventory charges to expense related to an overall higher ratio of tons produced vs. tons sold in the three months ended September 30, 2007 compared to the prior year period ($9.1 million). Cost of coal sales per ton was $15.33 for the three months ended September 30, 2007 compared to $15.00 per ton for the three months ended September 30, 2006.

Selling, general and administrative expenses.Selling, general and administrative expenses for the three months ended September 30, 2007 were $14.2 million compared to $11.3 million for the three months ended September 30, 2006. Period-over-period increases were due to: (a) higher expenses incurred for employee compensation and benefit related expenses ($2.9 million); (b) higher consulting fees primarily related to implementation activities for our enterprise software that do not qualify as capital expenditures and other miscellaneous administrative activities ($0.2 million); partially offset by (c) lower miscellaneous overhead expenses, including legal and insurance expenses ($0.2 million).

Accretion on asset retirement obligations.Accretion on asset retirement obligations is a component of accounting for asset retirement obligations under Statement of Financial Accounting Standards (“SFAS”) No. 143,Accounting for Asset Retirement Obligations (“SFAS No. 143”). Accretion represents the increase in the asset retirement liability to reflect the change in the liability for the passage of time because the initial liability is recorded at present value. Higher accretion expense in 2007 was due to increased asset retirement obligation estimates at closed mines.

Depreciation, depletion and amortization.Depreciation, depletion and amortization includes depreciation of plant and equipment, cost depletion of amounts assigned to owned and leased mineral rights, amortization of mine development costs, internal use software and leasehold improvements. Depreciation, depletion and amortization expense increased $4.4 million for the three months ended September 30, 2007 compared to the three months ended September 30, 2006, primarily due to higher depreciation and amortization. Depreciation and amortization increased by $4.5 million in the third quarter of 2007 mainly due to capital additions to plant and equipment during the twelve months ended September 30, 2007 and the depreciation of the recently placed in service enterprise resource planning (“ERP”) software, which was placed in service at the beginning of the second quarter of 2007. Cost depletion decreased by $0.1 million.

21

Coal supply agreement amortization.Application of purchase accounting in 2004 resulted in the recognition of a significant liability for below market priced coal supply agreements as well as a significant asset for above market priced coal supply agreements, both in relation to market prices at the date of acquisition of mining assets by the Company in 2004. Coal supply agreement amortization decreased $1.5 million for the three months ended September 30, 2007 compared to the three months ended September 30, 2006. Amortization of the liability for below market priced coal supply agreements during the three months ended September 30, 2007 was $3.5 million of credit to expense compared to $8.0 million of credit to expense in the comparable period of the prior year. Amortization of the asset for above market priced coal supply agreements during the three months ended September 30, 2007 was $2.7 million of expense compared to $5.7 million of expense in the comparable period of the prior year. As shipments on coal supply agreements valued in purchase accounting are completed, the period-over-period impact of the amortization on both the asset and liability balances will continue to diminish until approximately 2010 when shipments associated with these coal supply agreements are estimated to be complete.

Employee and contract termination costs.As discussed below in the section entitled “Wage Negotiations with the UMWA and Idling of the Company’s Illinois Basin Mining Operation,” the UMWA wage agreement for Wabash expired at 11:59 p.m. on March 31, 2007. The Company would not sign a new agreement for Wabash and the hourly workforce continued to work without a formal agreement of the parties under the terms of the expired wage agreement until 12:01 a.m. on April 4, 2007 at which time the UMWA represented hourly workforces struck. On the same day, Wabash announced the idling of the mine in southern Illinois. During the three months ended September 30, 2007, the Company recognized employee termination costs associated with one-time benefit arrangements of $0.6 million in accordance with the provisions of SFAS No. 146,Accounting for Costs Associated with Exit or Disposal Activities (“SFAS No. 146”). The Company also recognized employee termination costs associated with on-going benefit arrangements in accordance with the provisions of SFAS No. 112,Employers’ Accounting for Postemployment Benefits (“SFAS No. 112”) and during the three months ended September 30, 2007, the Company reduced its estimate of employee termination costs associated with such benefit arrangements by $0.1 million. Termination costs resulting from one-time benefit arrangements include medical insurance continuance costs and one-time retention pay to salaried employees. During the three months ended September 30, 2007, the Company also recognized $1.8 million of direct and incremental costs related to additional benefit claims for certain severed employees. These employee termination costs are included inEmployee and contract termination costs in the Consolidated Statement of Operations and Comprehensive Income for the three month period ended September 30, 2007.

22

Segment Analysis

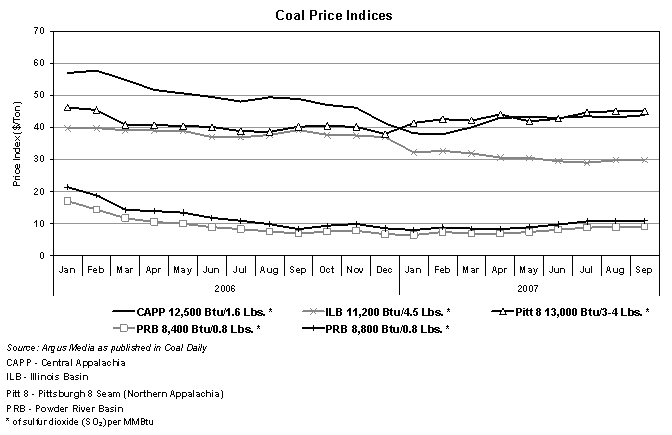

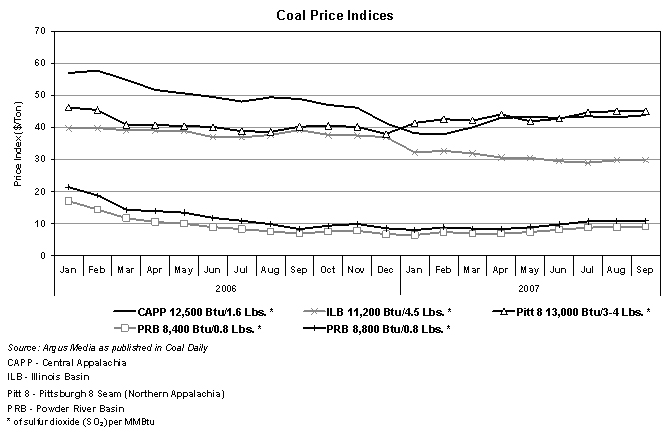

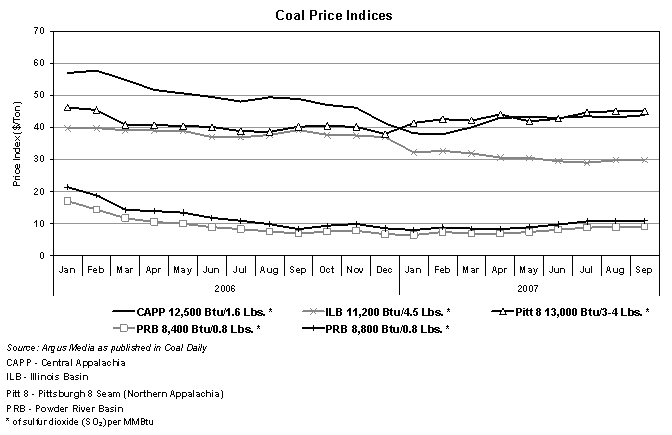

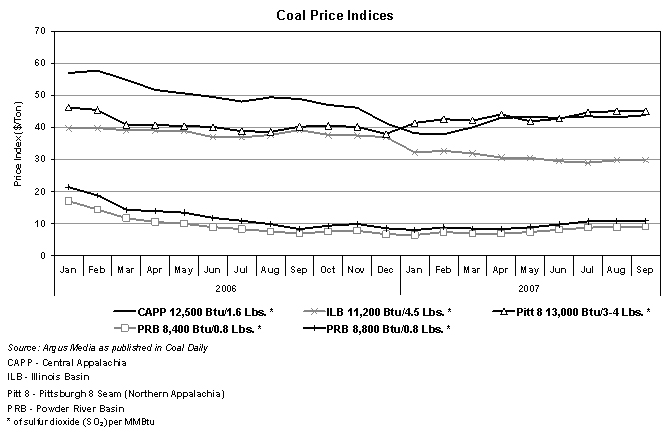

Utilizing data published by Argus Media, the following graph sets forth representative steam coal prices in various U.S. markets summarized for the monthly periods from January through September. The prices are not necessarily representative of the coal prices actually obtained by the Company. Changes in coal prices have an impact over time on the Company’s average sales realization per ton and, ultimately, its consolidated financial results.

23

| | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Increase (Decrease) | |

| | | 2007 | | 2006 | | Tons/$ | | | Percent | |

| | | (Unaudited, in thousands, except sales realization per ton) | |

Powder River Basin | | | | | | | | | | | | | |

Tons sold | | | 13,315 | | | 12,971 | | | 344 | | | 3 | % |

Average sales realization per ton | | $ | 9.05 | | $ | 8.27 | | $ | 0.78 | | | 9 | % |

Total revenues | | $ | 120,970 | | $ | 107,510 | | $ | 13,460 | | | 13 | % |

Income from operations | | $ | 18,838 | | $ | 13,244 | | $ | 5,594 | | | 42 | % |

| | | | |

Northern Appalachia | | | | | | | | | | | | | |

Tons sold | | | 2,959 | | | 3,254 | | | (295 | ) | | (9 | )% |

Average sales realization per ton | | $ | 38.86 | | $ | 39.10 | | $ | (0.24 | ) | | (1 | )% |

Total revenues | | $ | 117,249 | | $ | 128,474 | | $ | (11,225 | ) | | (9 | )% |

Income from operations | | $ | 9,046 | | $ | 22,000 | | $ | (12,954 | ) | | (59 | )% |

| | | | |

Central Appalachia | | | | | | | | | | | | | |

Tons sold | | | 2,151 | | | 2,002 | | | 149 | | | 7 | % |

Average sales realization per ton | | $ | 52.69 | | $ | 52.24 | | $ | 0.45 | | | 1 | % |

Total revenues | | $ | 117,528 | | $ | 105,685 | | $ | 11,843 | | | 11 | % |

Income from operations | | $ | 2,863 | | $ | 1,750 | | $ | 1,113 | | | 64 | % |

Powder River Basin—Income from operations increased $5.6 million period-over-period due to increased revenues of $13.5 million, partially offset by increased production costs of $7.9 million. As explained in the revenue section above, the increased revenues resulted from a 3% increase in tons sold period-over-period and a 9% increase in average sales realization per ton period-over-period. Assuming acceptable market conditions exist, we expect future increases in tons sold at the Belle Ayr mine primarily due to the expansion of its annual capacity. Production costs increased $7.9 million for the three months ended September 30, 2007 compared to the three months ended September 30, 2006, reflecting higher period-over-period cost of sales of $9.6 million, higher miscellaneous other costs of $0.5 million, partially offset by lower depreciation, depletion and amortization costs of $2.2 million.