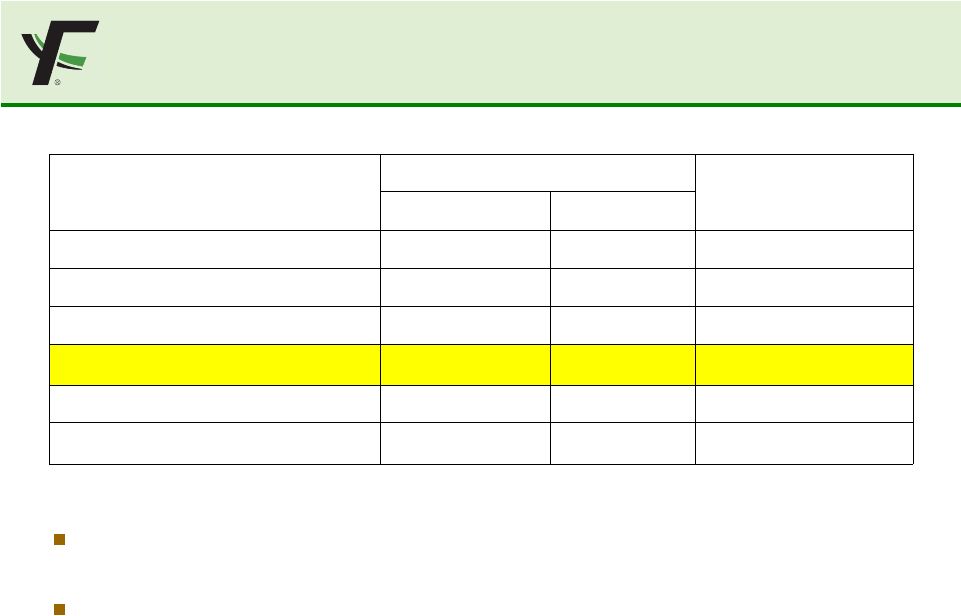

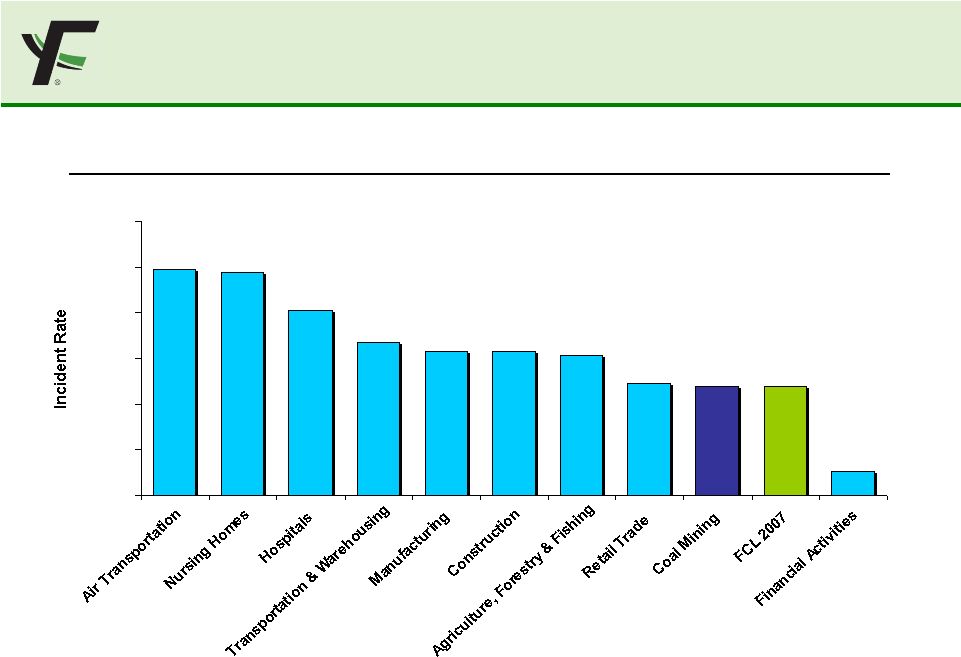

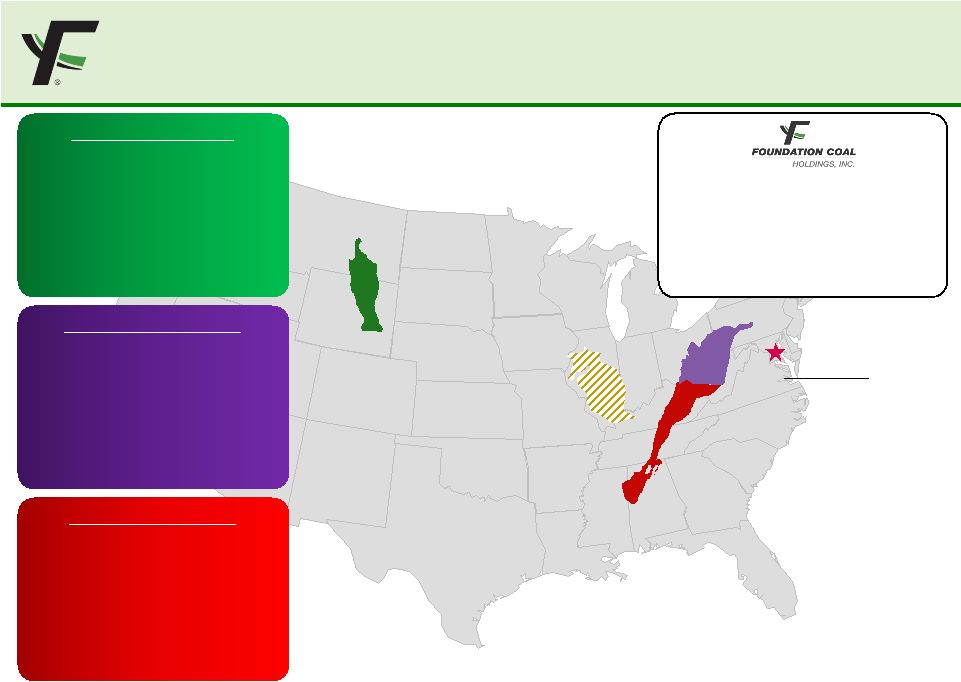

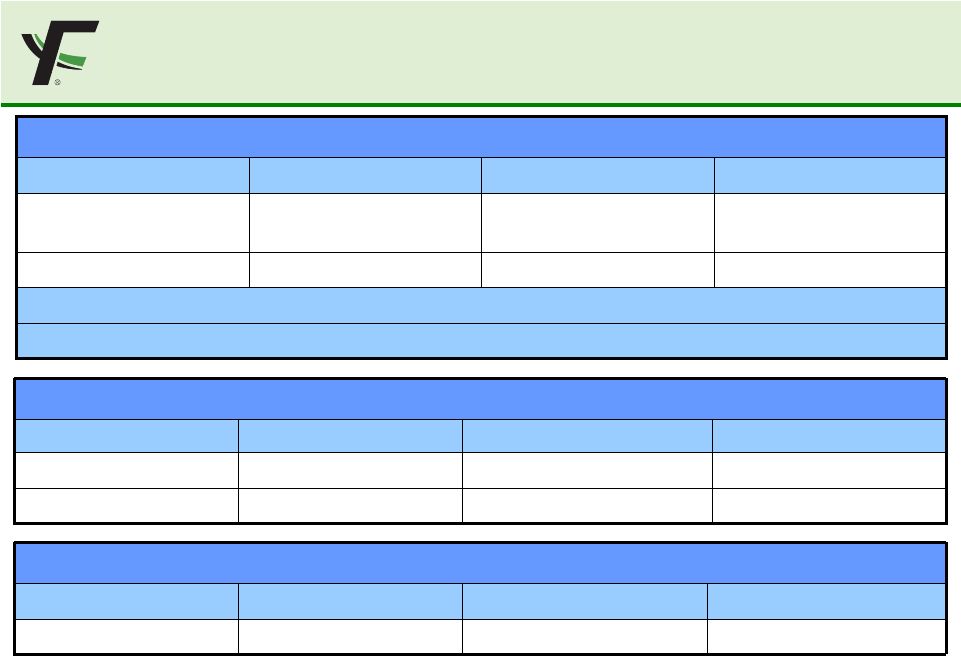

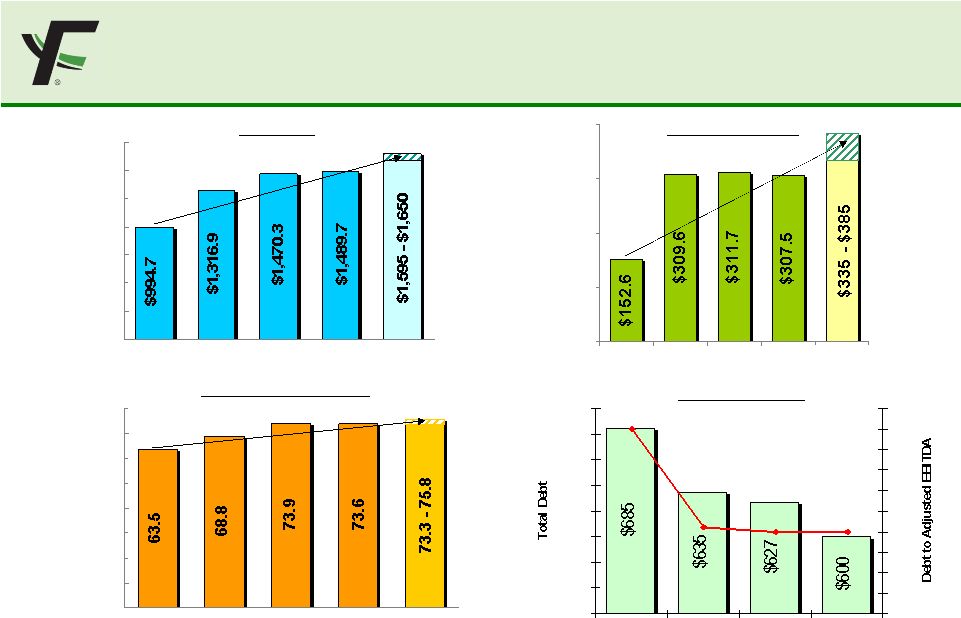

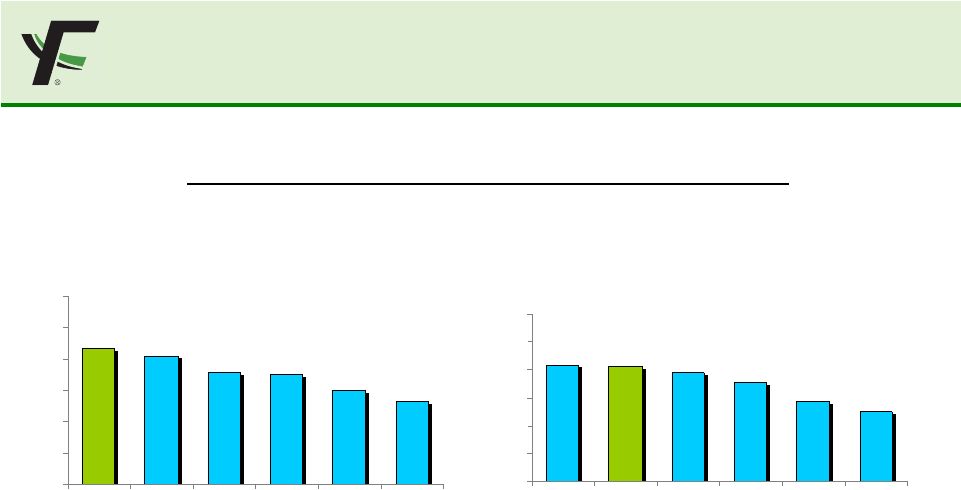

20 SUMMARY OF INVESTMENT HIGHLIGHTS Excellent Industry Position Among the largest producers – fourth by volume Nationally diversified – only producer with a major presence in NAPP & PRB Strong Financial Performance Consistent out-performance: leading adjusted EBITDA margins 2007 adjusted EBITDA in-line with beginning-of-year guidance Low 2.0x debt/Adjusted EBITDA ratio provides significant financial flexibility Current Strategy Continuing to execute our successful marketing strategy--leveraging our significant 2009 & 2010 unpriced positions Delivering future growth by: Expanding production in 2008 in the high margin NAPP region Growing organic production approximately 20% near-term, with opportunities for increased met production and export Selectively pursuing growth through acquisition Managing our costs to maintain our position as a low-cost provider Attractive Valuation* 2009 EV/EBITDA of 6.0x for FCL versus 8.0x for other companies producing greater than 50 million tons per year * Calculated using FirstCall consensus 2009 EBITDA estimates and enterprise values based on April 2, 2008 closing prices. |