Ecotality, Inc

6821 E Thomas Road

Scottsdale, AZ 85251

US Securities and Exchange Commission

Division of Corporation Finance

Attn: Martin James, Senior Assistant Chief Accountant

100 F Street NE

Washington, DC 20549-7010

RE: Ecotality Inc.

Form 10K for the Fiscal-Year ended December 31, 2008

Filed April 16, 2009

File No. 000-50983

Dear Mr. James

We are in receipt of your comment letter dated August 6, 2009 regarding our 2008 10K and have responded to your inquiries and included disclosure enhancements per your recommendations to be incorporated in future filings. The notes below are keyed to your comments.

Form 10-K for the Fiscal Year ended December 31, 2008

Consolidated Balance Sheets, page F-2

| | 1. | We note that you present unamortized stock issued for services as contra equity accounts. On Page F-17, you disclose that the amounts relate to common stock and options issued to employees, including your CEO. In light of the transitional guidance provided in Section 718 of the FASB Accounting Standards Codification (SFAS 123R), which would have required you to eliminate any unearned or deferred compensation relating to earlier awards to employees upon adopting the standard, please tell us how you concluded that your presentation is appropriate. Please refer to the authoritative accounting literature which supports your presentation. |

RESPONSE:

According to guidance provided by FAS 123R (#200 of the summary section) “… the costs of employee services are recognized over the periods in which employees are required to render service to earn the right to the benefit.” Accordingly, the equity award to our CEO which was referred to on Page F-17 related to a two year employment agreement which extended from October 2007 – October 2009. The options in question were granted on November 1, 2007 and were amortized over the respective service period of 24 months (Oct-’07 to Oct ’09) in a straight line manner. The $117,208 in unamortized costs for services presented as contra equity at December 31, 2008 was the last 10 months of amortization to be completed at the end of the service period to which the award related.

After further review, we could see that while the service period to which the award was attached extended through October 2009, the options themselves technically vested on November 1, 2008. While we felt comfortable that we were within compliance based on our understanding of the guidance at December 31, 2008 (above), we have now taken a more conservative approach taking into further consideration the guidance in FAS 123R (#198 of the summary section) “…The right to exercise an option has been earned by the date the option becomes vested.” which would suggest that in this case, the amount in unamortized costs at the end of 2008, while not material to our overall results, could have been expensed in full by November 1, 2008 at the vesting date. As of our June 30, 2009 10Q report, this award has been fully expensed.

Note 3 – Summary of Significant Accounting Policies, page F-6

Impariment of long-lived assets and intangible assets, page F-7

| | 2. | We note your policy for the impairment of long-lived assets and intangible assets discloses that you regularly review property, equipment and intangibles and other long-lived assets for possible impairment, but does not discuss your accounting policy for the testing of goodwill for impairment. Paragraph 350-20-35-28 of the FASB Accounting Standards Codification requires that goodwill be tested for impairment on an annual basis and between annual tests in certain circumstances. The impairment test for goodwill is a two step test as described in paragraphs 350-20-35-4 to 35-13 and based on your current disclosure, it is not possible to determine how you assess and measure goodwill for impairment under this two-step test. Please tell us and revise future filing to describe in appropriate detail, how your goodwill accounting policies comply with the aforementioned guidance and also the results of yor most recent goodwill impairment testing. |

RESPONSE:

In compliance with the guidance in FASB Accounting Standards Codification 350-20-35-28 we annually test goodwill in the fourth quarter of our fiscal year and perform additional testing whenever an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. When testing goodwill for impairment we engage in the two step process for recognition and measurement of an impairment loss. Our first step compares the fair value of the reporting unit with its carrying amount, including goodwill. If the carrying amount of the reporting unit exceeds it fair value, we perform the second step of the impairment test to compare the implied fair value of reporting unit goodwill with the carrying amount of that goodwill. If the carrying amount exceeds the implied fair value, we recognize impairment in an amount equal to the excess.

Our most recent annual testing took place in the fourth quarter of our fiscal year ended December 31, 2008 using the two-step process from paragraph 19-22 of SFAS 142. At that time the only remaining goodwill on our balance sheet related to our acquisition of our Etec subsidiary. We performed the first test comparing the fair value of the reporting unit with its carrying amount including goodwill. As the fair value we calculated exceeded the carrying amount, the second step was not performed.

We will modify our disclosures as noted above in future reporting to more clearly explain our goodwill testing procedures and where appropriate, the corresponding results as they relate to these tests.

Recent Accounting Pronouncements, page F-10

| | 3. | The last sentence of the section appears to indicate that you followed the guidance provided in SFAS 141R in accounting for all your acquisitions consummated in 2007. As we note that SFAS 141R is to be applied prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning after December 15, 2008, please confirm that you accounted for the acquisitions you consummated during the fiscal year ended December 31,2007 using the guidance provided in SFAS 141. As applicable revise future filings to clarify. |

RESPONSE:

The sentence you refer to will be modifed in our next filing for the period ended September 30, 2009 to read: The Company followed the guidance provided in SFAS 141 for all acquisitions that occurred in 2007.

Note 4 – Acquisitions and Goodwill, page F-10

| | 4. | We see that during the fiscal year ended December 31, 2007 you completed the acquisitions of four companies. For each of the acquisitions, please tell us and in future filings revise the note to disclose the following: |

Bullet # 1 How the initial cost of the acquired entity was established and how that amount was recorded in the financial statements. Please reference the fair value of securities or quoted market prices. Refer to paragraphs 20-23 of SFAS 141.

Bullet # 2 How you accounted for any contingent consideration, including guarantees of future securities prices, in accordance with paragraphs 25-31 of SFAS 141. Please include a discussion of the timing when the contingent consideration was intitally recognized and when the contingencies were resolved and how those amounts were recorded in the financial statements.

Bullet # 3 How you assessed the goodwill recorded from each acquisition for possible impairment at December 31, 2007 in accordance with paragraphs 35-1 to 35-19 of Section 350 20 of the FASB Accounting Standards Codification (paragraphs 19-22 of SFAS 142). Explain how “the lack of proven future cash flows generated by the assets acquired” impacted your assessment and your conclusion that goodwill was impaired by that date.

RESPONSE:

All acquisitions in 2007 were accounted for under the purchase accounting method pursuant to SFAS 141. In compliance with paragraph 20-23 of SFAS 141 the initial cost was established through the cash payment made for each acquired entity in addition to the fair value of marketable securities (specifically Ecotality common stock) distributed as consideration. To the extent there were contingent liabilities, the fair value of these liabilities was recognized and disclosed at the time of the purchase.

#1 Acquisition of Fuel Cell Store – highlighted sections are our proposed enhancements to previous disclosure, all other text already appeared on page F-10 of our 2008 10K:

How the intial cost was established: “ The fair value of the transaction was $539,000. The company paid $350,000 in cash and issued 300,000 shares of common stock, which was valued at $189,000 based on the closing market price of $0.63 on the date of the agreement, June 11, 2007.”

How the amount was recorded in the financial statements: “ The aggregate purchase price was allocated to the assets acquired on their preliminary estimated fair values at the date of the acquisition. The preliminary estimate of tihe excess of purchase price over the fair value of net tangible assets acquired and liabilities assumed was allocated to goodwill. In accordance with U.S. generally accepted accounting principles, we have up to twelve months from closing of the acquisition to finalize the valuation. The following table summarizes the preliminary estimate of fair value of assets as part of the acquisition with ECOtality Stores, Inc.:”

| | | 2007 | |

| Tangible assets acquired, net of liabilities assumed | | $ | 212,218 | |

| Goodwill | | | 326,782 | |

| | | $ | 539,000 | |

How goodwill was assessed at the end of 2007 and how the “lack of future cash flows” impacted your assessment and conclusion that goodwill was impaired at that date.

Goodwill was assessed for possible impairment during the quarter ended June 30, 2007 using the two-step process from paragraph 19-22 of SFAS 142. It was determined that the fair value of the reporting unit, based on our calculations using discounted future cash flows generated by the assets acquired, was less than the carrying amount including Goodwill. In the second step we allocated the fair value of the reporting unit to all of the assets and liabilities of that unit. The excess of the fair value over the amounts assigned to its assets and liabilities was the value of the Goodwill and subsequently was impaired in full. Goodwill impairment recorded that time was $326,782. Our calculation using discounted future cash flows to derive fair value as discussed here was what we have previously referred to as “lack of future cash flows”.

# 2 Acquisition of Innergy Power Corporation — unless otherwise noted, all disclosures below appear on page F-11 of our 2008 10K

How the initial cost was established: “The Company issued 3,000,000 shares of the Company’s common stock for the acquisition. The Company guaranteed to the sellers that the shares would be worth $1 each ($3,000,000) during the 30-day period commencing 11 months from the closing date. If the shares were not worth $3,000,000, the company would be required to either (a) issue additional shares such that the total shares are worth $3,000,000 at that time or, (b) pay cash to the seller such that the aggregate value of the 3,000,000 shares plus the cash given would equal $3,000,000.

How the amount was recorded in the financial statements: “The aggregate purchase price was allocated to the assets acquired and liabilities assumed on their preliminary estimated fair values at the date of the acquisition. The preliminary estimate of the excess of purchase price over the fair value of net tangible assets acquired was allocated to identifiable intangible assets and goodwill. In accordance with U.S. generally accepted accounting principles, we have up to twelve months from closing of the acquisition to finalize the valuation. The purchase price allocation is preliminary, pending finalization of our valuation of certain liabilities assumed. The following table summarizes the preliminary estimate of fair value of assets as part of the acquisition of Innergy Power Corporation: "

| | | 2007 | |

| Tangible assets acquired, net of liabilities assumed | | $ | 505,435 | |

| Goodwill | | 2,494,565 | |

| | | $ | 3,000,000 | |

When the contingent consideration was initially recognized: Per our 2007 10K page F-11: “The fair value of the 3,000,000 shares of common stock given, based on the closing price of the Company’s common stock on December 31, 2007 was $555,000. The Contingent liability was the difference between stock given already ($555,000) and the $3,000,000 guarantee. A liability for the balance of $2,445,000 has been recorded as a current liability for purchase price on the consolidated balance sheet as of December 31, 2007.” The liability was marked to market at the end of each reporting period with the liability being the difference between the $3,000,000 guarantee and the value of the shares already given at the market value at the end of the period.

How it was resolved and recorded: Per our 2008 10K page F-11: “The purchase price obligation was settled in full on October 17, 2008 with the issuance of shares of Ecotality’s $0.001 par value common stock.”

How goodwill was assessed at the end of 2007 and how the “lack of future cash flows” impacted your assessment and conclusion that goodwill was impaired at that date.

Goodwill was assessed for possible impairment during the quarter ended December 31, 2007 using the two-step process from paragraph 19-22 of SFAS 142. It was determined that the fair value of the reporting unit, based on our calculations using discounted future cash flows generated by the assets acquired, was less than the carrying amount including Goodwill. In the second step we allocated the fair value of the reporting unit to all of the assets and liabilities of that unit. The excess of the fair value over the amounts assigned to its assets and liabilities was the value of the Goodwill and subsequently was impaired in full. Goodwill impairment recorded at that time was $2,494,565. Our calculation using discounted future cash flows to derive fair value as discussed here was what we have previously referred to as “lack of future cash flows”.

# 3 Acquisition of eTec: highlighted sections are our proposed enhancements to previous disclosure, all other text already appeared on page F-11 of our 2008 10K:

How the initial cost was established: “The fair market value of the transaction was $5,037,193. The Company paid $2,500,000 in cash, issued a $500,000 note payable, and issued 6,500,000 shares of the company’s common stock for the acquisition, which was valued at $1,820,000 based on the closing market price of $0.28 on the date of the agreement. The total value of the transaction also includes $217,193 in direct acquisition costs.

How the initial amount was recorded in the financial statements: “The aggregate purchase price has been allocated to the assets acquired and liabilities assumed on their preliminary estimated fair values at the date of the acquisition. The preliminary estimate of the excess of purchase price over the fair value of net tangible assets acquired has been allocated to goodwill. In accordance with U.S. generally accepted accounting principles, we have up to twelve months from closing of the acquisition to finalize the valuation. The purchase price allocation is preliminary, pending finalization of our valuation of certain liabilities assumed. The following table summarizes the preliminary estimate of fair value of assets as part of the acquisition with eTec.”

| | | 2007 | |

| Tangible assets acquired, net of liabilities assumed | | $ | 1,941,315 | |

| Goodwill | | | 3,095,878 | |

| | | $ | 5,037,193 | |

How the 2008 revised amount was recorded in the financial statements: This Goodwill was adjusted in August 2008 as follows: per our 2008 10-K page F-11 “Included in the purchase agreement was a Net Working Capital Adjustment which called for an adjustment to the purchase price to be made via a post-Closing payment from the Sellers to the Buyers or the Buyers to the Seller to the extent that the actual Net Working Capital as of the Closing Date was more or less than the agreed Net Working Capital Target. A reconciliation of actual vs. target net working capital was presented by the Sellers in August 2008 and a True Up Payment of $400,000 from the Buyers to the Sellers was agreed to in full satisfaction of this purchase agreement requirement. The resulting note payable represents an adjustment of the purchase price, and as such has been recorded as an increase to Goodwill of $400,000.”

| | | 2007 | |

| Tangible assets acquired, net of liabilities assumed | | $ | 1,941,315 | |

| Goodwill | | | 3,495,878 | |

| | | $ | 5,437,193 | |

When contingent consideration was initially recognized, how it was resolved and recorded: The $500,000 note was initially payable in monthly installments of $50,000 beginning December of 2007. Payment of the balance of the note payable remaining at December 31, 2008 was $235,253 and payment of this amount has been deferred by the Sellers until October 2009.

How goodwill was assessed at the end of 2007 and how the “lack of future cash flows” impacted your assessment and conclusion that goodwill was impaired at that date.

Goodwill was assessed in the quarter ended December 31, 2007 using the two-step process from paragraph 19-22 of SFAS 142. We performed the first test comparing the fair value of the reporting unti with its carrying amount including goodwill. As the fair value we calculated exceeded the carrying amount, the second step was not performed.

#4 Acquisition of Minit-Charger – highlighted sections are our proposed enhancements to previous disclosure, all other text already appeared on page F-12 of our 2008 10K:

How the initial cost was established: “The fair market value of the transaction was $3,000,000. The company paid $1,000,000 in cash and issued 2,000,000 shares of the company’s common stock for the acquisition. The company guaranteed to the sellers that the shares would be worth $1 each ($2,000,000) by the tenth day following the first anniversary date of the transaction. If the shares are not worth $2,000,000, the company would be required to either issue additional shares such that the total shares are worth $2,000,000 at that time or pay cash to the seller so that the aggregate value of the 2,000,000 shares plus the cash given would equal $2,000,000.”

How the initial amount was recorded in the financial statements: “The aggregate purchase price was allocated to the assets acquired and liabilities assumed on their preliminary estimated fair values at the date of the acquisition. The preliminary estimate of the excess of purchase price over the fair value of net tangible assets acquired was allocated to identifiable intangible assets and goodwill. In accordance with U.S. generally accepted accounting principles, we have up to twelve months from closing of the acquisition to finalize the valuation. The purchase price allocation is preliminary, pending finalization of our valuation of certain liabilities assumed. The following table summarizes the preliminary estimate of fair value of assets as part of the acquisition with Minit-Charger:”

| | | 2007 | |

| Tangible assets acquired, net of liabilities assumed | | $ | 1,719,934 | |

| Goodwill | | 1,280,066 | |

| | | $ | 3,000,000 | |

When contingent consideration was initially recognized, how it was resolved and recorded: per our 2008 10K Page F-12: “The fair value of the common stock given, based on the closing price of the Company’s common stock on December 31, 2007, was $370,000. The contingent liability was the difference between the $2,000,000 guarantee and the fair value of the stock already given. A liability for the balance of $1,630,000 based on the December 31 closing price was recorded as a current liability for purchase price on the consolidated balance sheet as of December 31, 2007. The liability was marked to market at the end of each reporting period with the liability being the difference between the $2,000,000 guarantee and the value of the shares already given at the market value at the end of the period. This liability has been adjusted to reflect the actual obligation due of $1,880,000 on the December 31, 2008 balance sheet. This obligation totals the $2,000,000 remaining purchase price obligation multiplied by $0.94 (the difference between $1.00 and the VWAP of $0.06 for the thirty days prior to the true up date of December 15, 2008).

Included in the purchase agreement with Edison was a Net Working Capital Adjustment which called for an adjustment to the purchase price to be made via a post-Closing payment from the Sellers to the Buyers or the Buyers to the Seller to the extent that the actual Net Working Capital as of the Closing Date was more or less than the agreed Net Working Capital Target. A reconciliation of actual vs. target net working capital was presented to the Sellers in April 2008. Based on this reconciliation and additional documentation and updates from both parties a true up payment of $390,174 was received in December 2008 in full satisfaction of this obligation. This True Up represents an adjustment of the purchase price. As all goodwill associated with the Minit-Charger acquisition was impaired and written down to $0 in year ended December 31, 2007, the $390,174 has been recorded as other income in our eTec business segment for the year ended December 31, 2008.”

per our 03/31/2009 10Q Page 13: “This liability was reduced to $0 for the March 31, 2009 balance sheet as the purchase price obligation was settled in full on January 30, 2009 with the issuance of 31,333,333 shares of Ecotality’s $0.001 par value common stock with a market value on the day of the issuance of $.06 per share.”

How goodwill was assessed at the end of 2007 and how the “lack of future cash flows” impacted your assessment and conclusion that goodwill was impaired at that date.

Goodwill was assessed for possible impairment during the quarter ended December 30, 2007 using the two-step process from paragraph 19-22 of SFAS 142. It was determined that the fair value of the reporting unit, based on our calculations using discounted future cash flows generated by the assets acquired, was less than the carrying amount including Goodwill. In the second step we allocated the fair value of the reporting unit to all of the assets and liabilities of that unit. The excess of the fair value over the amounts assigned to its assets and liabilities was the value of the Goodwill and subsequently was impaired in full. Goodwill impairment recorded that time was $1,280,066. Our calculation using discounted future cash flows to derive fair value as discussed here was what we have previously referred to as “lack of future cash flows”.

Note 6 – Notes payable, page F-14

| | 5. | We see that in November and December 2007, you issued 8% Secured Convertible Debentures along with detachable warrants to purchase common shares. You disclose that you allocated the gross proceeds of the $5.0 million between the notes payable and the warrants and recorded a discount to the 8% Secured Convertible Debenture of $3.9 million. |

Bullet #1 Please describe to us the method you used to allocate the gross proceeds to the notes payable and the warrants.

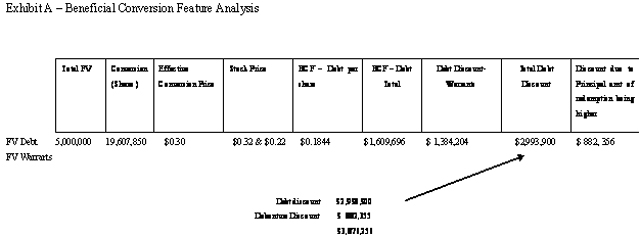

RESPONSE: Per EITF 98-5 and 00-27, the proceeds received should be allocated between the convertible instrument and the warrants based on their respective fair values. We estimated the fair value of the November 6th and December 6th debentures to be its face value, and fair value of the warrants based on a Black Scholes calculation assuming exercise price of $0.32, grant date stock price of $0.32 and $0.22 respectively (first available close price post transaction), volatility 162.69%, risk free rate 3.99 and 3.39% respectively, expected life 5 years. (Note: Although the maturity date is 5 years per the warrant agreement, SAB 107 states that in the absence of historical evidence of exercise, the estimated exercise date should be calculated as the contractual life divided by 2, or in this case, 5 yrs/2, or 900 days.)

Bullet #2 Tell us how you considered the guidance in paragraphs 470-20-25-2 to 25-4 and 815-15-25-51 of the FASB Accounting Standards Codification in concluding that the Convertible Debenture agreements did not include any beneficial conversion features or embedded derivatives that were required to be bifurcated and accounted for separately.

RESPONSE: In accordance with the guidance established in paragraph 12 of FASB Statement No. 133 (“SFAS 133”), Accounting for Derivative Instruments and Hedging Activities, it may be necessary to remove the conversion option from the debt host and account for it separately as a derivative if the conversion option meets certain criteria. The conversion option of the Debentures meets all three criteria of paragraph 12: (1) the conversion feature is not clearly and closely related to the debt host component, (2) the convertible debt instrument is not accounted for at fair value, and (3) the embedded conversion option meets the definition of a derivative in paragraph 6 of SFAS 133 conversion option. If the Debentures are considered “conventional,” the Company would need to consider only the settlement alternatives (i.e. who controls the settlement and whether the settlement will be in shares or cash) to determine whether the embedded conversion option Paragraphs 11(a) and 12(c) of SFAS 133, however, specify that if the embedded conversion option is indexed to the reporting entity’s own stock and would be classified in stockholders’ equity if it were a freestanding derivative, the conversion option would be excluded from the scope of SFAS 133 and thus, needn’t be separated from the debt host and accounted for separately. To assess whether or not the conversion option would be classified as stockholders’ equity if it were freestanding, EITF Issue No. 00-19 (“EITF 00-19”), Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company's Own Stock provides the relevant guidance. In assessing whether or not the conversion option would be classified as equity or a liability if it were freestanding, it is critical that the issuer determine whether or not the convertible debt is considered “conventional.” EITF 00-19 defines conventional convertible debt as debt whereby the holder will, at the issuer’s option, receive a fixed amount of shares or the equivalent amount of cash as proceeds when he exercises the convertible debt should be classified as equity. If the convertible debt is not “conventional,” the issuer must consider all aspects of EITF 00-19 (i.e. paragraphs 12-32), to determine the appropriate classification (i.e. debt or equity) for the conversion option.

The following two considerations were taken into account to determine whether the Debentures are a “conventional” security:

| | 1. | Does the company have the ability to satisfy the conversion option in shares or cash or any combination of the two? For an instrument to be considered “conventional” under EITF 00-19, the instrument must be settled entirely in a fixed number of shares or entirely in cash. A feature that allows the issuer to satisfy the obligation through any combination of cash and shares would result in the securities being considered “non-conventional”. |

Based on the terms of the Notes, the conversion option can be settled in stock only, no combination. Criteria met.

| | 2. | Does the convertible debt have floating conversion terms or fixed-formula conversions? Both of these provisions may result in a variable number of shares being issued upon conversion, in which case the convertible debt would not be conventional under EITF 00-19. This could occur if accrued unpaid interest were included in the conversion formula such that the interest would convert into shares. |

Based on the terms of the Debentures, the Debentures do not appear to have floating conversion terms or fixed-formula conversions. Criteria met.

As the Debentures appear to be a “conventional” security, paragraphs 12-32 of EITF 00-19 do not need to be considered to determine the appropriate classification for the conversion option. In accordance with paragraph 8 of EITF 00-19, a security that physical settlement or net-share settlement in its own shares would initially be classified as equity (the criteria set forth in paragraphs 12-32 of EITF do not need to be considered). The Debentures provide the Company with a choice of physical settlement or net-share settlement and the conversion option would be initially classified as equity. Accordingly, paragraphs 11(a) and 12(c) of SFAS 133 exclude the conversion option from the scope of SFAS 133 and thus, needn’t be separated from the debt host and accounted for separately.

With respect to the detachable warrants, the holder has the option of physical settlement or net-share settlement. The number of shares available for issuance under the warrant agreement is fixed. As such, the detachable warrants are not in the scope of SFAS 150 and should be evaluated under EITF 00-19. Per EITF 00-19, paragraph 9, “Contracts that require that the company deliver shares as part of a physical settlement or a net-share settlement should be initially measured at fair value and reported in permanent equity. Subsequent changes in fair value should not be recognized as long as the contracts continue to be classified as equity.”

The Company entered into a registration rights agreement with the Debenture holders. In October 2006, the FASB issued a proposed FASB Staff Position (FSP) EITF 00-19-b, "Accounting for Registration Payment Arrangements." The proposed FSP specifies that the contingent obligation to make future payments or otherwise transfer consideration under registration payment arrangement, whether issued as a separate agreement or included as a provision of a financial instrument or other agreement, should be separately recognized and measured in accordance with FAS 5, "Accounting for Contingencies." For existing registration payment arrangements, the proposed FSP's effective date is for financial statements issued for fiscal years beginning after December 15, 2006. Based on existing accounting literature and the proposed FSP, equity classification of the warrants is appropriate in accordance with EITF 00-19.

Bullet #3 Tell us how you calculated the discount and tell us the method you are using to amortize the amount.

The total debt discount (Beneficial Conversion Feature (BCF) plus warrants) is limited to the actual cash received of $5,000,000.

Based on this, the effective conversion price of the debentures was computed as the allocated proceeds / the # of shares into which the debt is convertible. From this, a BCF was computed based on the difference between the effective conversion price and the trading price on the grant date and the total BCF is equal to the per share BCF x number of shares into which the debt is convertible. The BCF, along with the proceeds allocated to the warrants, are treated as a debt discount that is expensed over the period from inception to the maturity date in accordance with paragraph 6 of EITF 00-27.

The discount is being amortized straight line over the life of the debentures based on the below calculations:

| Date of Issue | | Total Discount | | | # Days | | | Amort per Day | |

| Nov 6 '07 | | | 3,070,811.55 | | | | 912 | | | | 3,367 | |

| Dec 6 '07 | | | 805,444.12 | | | | 912 | | | | 883 | |

| | | | | | | | | | | | | |

| Amoritzation of Discount | |

| | 6. | We note that you amended your Convertible Debenture agreements on August 28, 2008. March 3, 2009 and May 15, 2009. As part of the amendments, you modified the terms of the agreements, including, but not limited to, increasing the outstanding principle balance on the notes, deferring the principle and interest payments and modifying the conversion and warrant exercise prices. Please summarize for us in appropriate detail your conclusions as to whether each of these amendments resulted in a modification or an extinguishment of your debt instruments. Provide an analysis, using the guidance in paragraphs 470-50-40-6 to 40-16 of the FASB Accounting Standards Codification (EITF 96-19) to explain your conclusion and address of how the modification of each of the terms impacted your analysis. |

RESPONSE:

We reviewed the guidance in paragraphs 470-50-40-6 to 40-16 and based on our analysis they did not apply as all amendments to our debt were made in a troubled debt situation which is specifically excluded from this guidance in 470 50 40 10. Based on our assessment of the guidance in 470 60 15 which states the troubled debt restructuring guidance in subtopic 470 applies if the creditor for economic or legal reasons related to the debtor’s financial difficulties grants a concession (in our case additional time to pay) that it would not otherwise consider, we determined these amendments should be accounted for as troubled debt restructurings as per 470 60 35 5 and 10. Our consideration of these provisions is noted below. We have noted only the provisions that would have a financial impact for purposes of this discussion.

For our August 28, 2008 amendment for our first troubled debt restructuring

| · | we reset the debt conversion rate from $0.30 to $.15, |

| · | agreed to make whole provision obligating us to issue additional warrants in the future, |

| · | added accrued unpaid interest oustanding + a 20% penalty on the unpaid interest to our principal balance. |

In assessing this amendment we noted:

| · | 470 60 35 2 did not apply as no assets were transferred |

| · | 470 60 35 3 did not apply as no equity interest was offered to settle the existing payable. The warrants were agreed to in exchange for allowing additional time to pay in addition to, not in satisfaction of any of the existing payable balance. |

| · | 470 60 35 5 did apply as we did modify the terms of the payable through our change to the conversion feature, and the shift of accrued interest and penalties to principal. |

| · | 470 60 35 10 also applied as we added a contingent liability to issue warrants subject to a future true up. |

470 60 35 5 calls for the effects of the restructuring to be accounted for prospectively from the time of restructuring. In future periods, which we defined as the periods to which the restructuring applied, we amortized the additional costs related to the make whole provisions and penalties in a straight line manner over the waiver period.

470 60 35 10 calls for the recognition of the contingent liability which we addressed in our accounting for 470 60 35 5 above.

For our March 3, 2009 amendment for our second troubled debt restructuring

| · | We reset the warrant exercise prices for our debenture warrants to $.06. |

In assessing this amendment we noted:

| · | 470 60 35 2 did not apply as no assets were transferred |

| · | 470 60 35 3 did not apply as no equity interest was offered to settle the existing payable. |

| · | 470 60 35 5 did apply as we did modify the terms of the payable through our change to the conversion feature, and the shift of accrued interest and penalties to principal. |

470 60 35 5 calls for the effects of the restructuring to be accounted for prospectively from the time of restructuring. In future periods, which we defined as the periods to which the restructuring applied, we amortized the additional costs related to the warrant reset in a straight line manner over the waiver period.

For our May 15, 2009 amendment for our third troubled debt restructuring

| · | agreed to make whole provisions relating to 80% ownership for our debenture holders obligating us to issue additional warrants. |

| · | modified debenture warrant exercise prices from $0.06 to $0.01 |

In assessing this amendment we noted:

| · | 470 60 35 2 did not apply as no assets were transferred |

| · | 470 60 35 3 did not apply as no equity interest was offered to settle the existing payable. The warrants were agreed to in exchange for allowing additional time to pay in addition to, not in satisfaction of any of the existing payable balance. |

| · | 470 60 35 5 did apply as we did modify the terms of the payable through our change to the conversion feature, and the shift of accrued interest and penalties to principal. |

| · | 470 60 35 10 also applied as we added a contingent liability to issue warrants subject to a future true up. |

470 60 35 5 calls for the effects of the restructuring to be accounted for prospectively from the time of restructuring. In future periods, which we defined as the periods to which the restructuring applied, we amortized the additional costs related to the obligations to issue new warrants that the reset in exercise price of existing warrants in a straight line manner over the waiver period.

470 60 35 10 calls for the recognition of the contingent liability which we addressed in our accounting for 470 60 35 5 above.

Exhibit 31

| | 7. | We note that you replaced the word “registrant” with “small business issuer” in paragraphs 3,4(a), 4(c), 4(d), 5(a) and 5(b) of the certifications. In future filings, please revise the certifications to present them in the exact form as set forth in Item 601(b)(31) of Regulation S-K with no modifications. Please note this comment also applied to your Form 10Q for the interim period ended March 31, 2009. |

RESPONSE:

We have revised the certifications to present them in the exact form as set forth in Item 601(b) (31) of Reg S-K as reflected in our 10Q for the quarter ended June 30, 2009 and filed on August 14, 2009. We will present in this manner in all future filings.

Exhibit 32

| | 8. | We note that your Section 906 certification furnished in accordance with Item 601(b)(32) of Regulation S-K improperly refers to the annual report on Form 10-KSB although your annual report was filed on Form 10-K. In future filing, please ensure the Section 906 certifications refer to the correct form. |

RESPONSE:

We have revised our section 906 certification in accordance with Item 601 (b)(32) of Regulation S-K as reflected in our 10Q for the quarter ended June 30, 2009 and filed on August 14, 2009. We will present in this manner in all future filings

In summary, we believe our 2008 10K filing included all required disclosures. We agree these disclosures could be further enhanced as noted in your inquiries and recommendations—and plan to incorporate your input in future filings as noted here throughout.

We acknowledge that the Company is responsible for the adequacy and accuracy of the disclosure in this filing; that the staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing’ and that the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under federal securities laws of the United States.

Sincerely,

Barry Baer

Chief Financial Officer

Ecotality, Inc.