Ecotality, Inc

6821 E Thomas Road

Scottsdale, AZ 85251

US Securities and Exchange Commission

Division of Corporation Finance

Attn: Kevin Kuhar, Accountant

100 F Street NE

Washington, DC 20549-7010

| RE: | Ecotality Inc. Form 10K for the Fiscal-Year ended December 31, 2008 Filed April 16, 2009 File No. 000-50983 |

Dear Mr. James

We are in receipt of your comment letter dated September 29, 2009 regarding our 2008 10K and have responded to your inquiries and included disclosure enhancements per your recommendations to be incorporated in future filings. The notes below are keyed to your comments.

Form 10-K for the Fiscal Year ended December 31, 2008

Note 4 – Acquisitions and Goodwill, page F-10

| 1.) | Your response to prior comment 4 indicates that you recorded a goodwill impairment charge for the entire amount of goodwill recorded from the Minit-Charger acquitision during the year-ended December 31, 2007 and subsequently, your recorded the post-closing true up payment of $390,174 from Edison as other income during the year-ended December 31, 2008….Please tell us how you considered the guidance in paragraph 46 of SFAS 141 in accounting for the true-up payment and in coluding that recognition of the payment of other income was appropriate. |

Response:

At the time of the true up payment the guidance in paragraph 46 of SFAS 141 was considered with respect to the remaining book value of the assets acquired in the Minit-Charger acquisition. The remaining book value of the acquired assets was approximately $180K at the time of the true up payment and a full allocation requiring considerable effort would have resulted in an immaterial adjustment to our financials (<2% of total assets/income). For this reason a full allocation was not undertaken and the adjustment was booked in full as “other income” and was fully disclosed.

Note 6 – Note payable, page F-14

| 2.) | We note your response to prior comment 5. To help us better understand your conclusions, please address the following: Bullet 1: Your response indicated that “the Debentures do not appear to have floating conversion terms”. Please describe to us in detail the conversion terms of each of the debentures and represent to us in a definitive statement whether you have concluded the debentures include any adjustable conversion terms. |

Response to Bullet 1:

Our debentures have fixed conversion terms which are stated as follows (The below “sections” are referenced in our Original Issue Discount 8% Secured Convertible Debenture Documents issued in November and December 2007):

Section 4. b) “The conversion price in effect on any Conversion Date shall be equal to $0.30, subject to adjustment herin.” The “subject to adjustment” refers to a clause in Section 5. b) Subsequent Equity Sales which calls for a reset of the conversion price in the event that the Company issues equity at a price lower than the conversion price stated in the debentures. Since it was not the company’s intention to issue new equity at price lower than market or in a scenario where the market price was less than the exercise price of the debenture warrants, in our view the conversion price was essentially fixed. Our assessment concluded the possible scenario of an adjustment limited to a decision to issue new equity did not fit the definition of a “floating conversion term”. According to our research a “floating” term would normally be associated with an automatic dynamic reset based on an outside uncontrollable variable (such as interest rate or stock price).

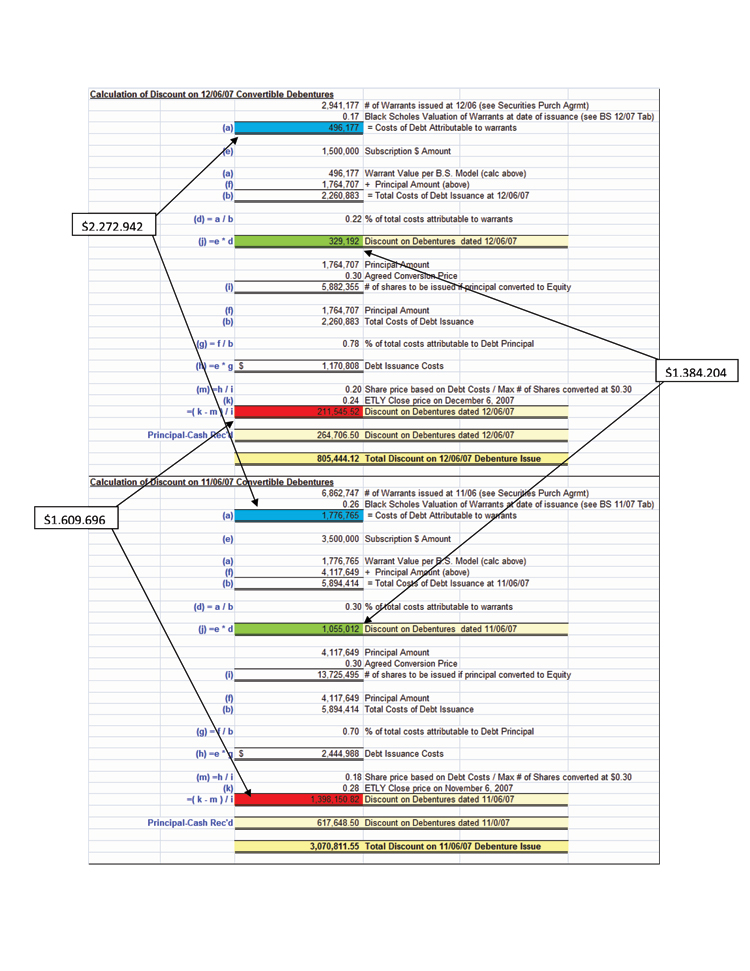

Bullet 2: Please provide detailed calculation of the $1,609,696 beneficial conversion feature recorded wth appropriate references to the conversion price, the “effective conversion price” and the grant date trading value of your common stock.

Bullet 3: Please reconcile for us the debt disscount related to the warrant of $1,384,204 as discussed in your response with the $2,272,942 fair value of the warrant noted on page F-14.

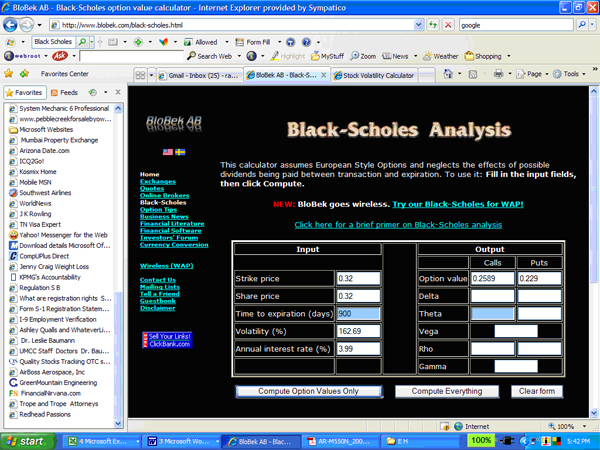

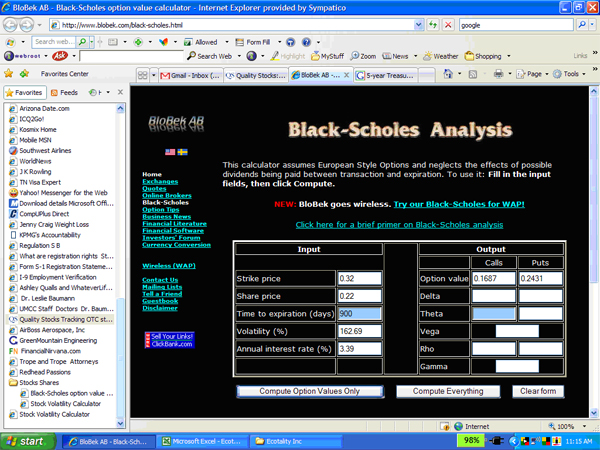

RESPONSE TO BULLETS 2 & 3: Below please find detailed calculations for all above noted figures. The Black Scholes used to determine warrant valuation are also provided.

Black Scholes valuation for November 6, 2007

Black Scholes December 2007

| 3.) | We note from your response to prior comment 6 that you are amortizing the additional costs of the troubled debt restructurings over the wiaver period in a “straight line manner” Please note that paragraph 470-60-35-5 of FASB Accounting Standards Codification (SFAS15) requireds interest to be recognized using the interest method. Please confirm, if true, that the amortization method you used is not materially different than the interest method as detailed in paragraphs 835-30-35-2 to 35-4 of FASB Accounting Standards Codification. Confirm that you will use the interest method in future period and revise your policy to so indicate. |

| | |

| | RESPONSE: As the principal did not change over the waiver period, our application of straight line amortization was not materially different from the results that would have been obtained using the interest method (in compliance with 835-30-35-4 of the FASB Codification Standards). We will be sure to use the interest method as applicable in future periods and to revise our policy to so indicate. Form 10-Q for the Fiscal-Quarter ended June 30, 2009 Note 6 – Notes payable, page 14 Impact of the May 2009 Waiver Provision on the Financial Statements, Page 18 4. We see that as a result of the make whole provision of the May 2009 waiver, you have recorded the value of additional warrants to be issued to maintin the required 80% equity position as a contra equity account valued as a percentage of your market capitalization. Please address the following: |

| | · | Tell us how you dtermined that the market capilization model you utilized to fair value the warrants was appropriate. Describe how this model properly reflected the fair value of the warrants issued. For expample, we see that you utilzed the Black-Scholes model to fair value other warrant issuance, please tell us whether you considered using the Black-Scholes model to fair value the transaction and discuss your conclusions. |

RESPONSE TO BULLET #1

As per our previous filings we first calculated the fair value of the warrants using the Black-Scholes model. The result was a fair market value of $54 million for the issuance of the new warrants. Since the reality of the transaction was an allocation of 80% of the value of our company, and our total market cap on the waiver date of May 15th was $18 million, booking a $54 million contra-equity amount to reflect the 80% allocation was determined to be unreasonable. We then recalculated on a mark to market basis using our market cap and fully diluted shares at the waiver date as a basis for valuation. This yielded a value of $10 million for the new warrants. We felt strongly this was a conservative and fair representation of the fair value the warrants represented.

See our calculation for the warrant values based on market cap below:

| | · | Discuss your conclusion on whether the contingent obligation to issue additional warrants represented a derivative that should be bifurcated and recorded at fair value under Topic 815 of the FASB Accounting Standards Codification. Please tell us your reaons for concluding that equity classifcation of the warrants was appropriate. |

RESPONSE TO BULLET #2

Following the May 15, 2009 waiver date, the contingent obligation to issue additional warrants per the 80% allocation requirement would only be triggered if the company issued new equity. In that case, we would have to recalculate the fully diluted number of shares including the new issuance, and “true up” the debenture holders to 80% of that figure through the issuance of additional warrants.

It was not the intention of the company to issue additional equity while still subject to the terms of this waiver since it would not make sense for a new investor to put in money if their equity would be immediately diluted to that degree. This provision was designed to give the debenture holders an 80% interest in the company in return for the May waiver, with later reductions (no provisions for increase) in this allocation subject to milestones specified in the waiver documents. A true up based on this 80% allocation after the initial warrant issuance on the date of the May 15, 2009 was not anticipated or forseeable. For this reason, we booked the value of the warrants issued in May, and we did not account for this provision as a derivative.

As the settlement of the May waiver provisions resulted in an issuance of equity intruments we accounted for the obligation through a contra-equity account.

In summary, we believe our 2008 10K and 2009 June 30, 10Q filing included all required disclosures.

We acknowledge that the Company is responsible for the adequacy and accuracy of the disclosure in this filing; that the staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing’ and that the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under federal securities laws of the United States.

Sincerely,

Barry Baer

Chief Financial Officer

Ecotality, Inc.