UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21629

SPECIAL VALUE EXPANSION FUND, LLC

(Exact Name of Registrant as Specified in Charter)

2951 28TH STREET, SUITE 1000

SANTA MONICA, CALIFORNIA 90405

(Address of Principal Executive Offices) (Zip Code)

ELIZABETH GREENWOOD, SECRETARY

SPECIAL VALUE EXPANSION FUND, LLC

2951 28TH STREET, SUITE 1000

SANTA MONICA, CALIFORNIA 90405

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (310) 566-1000

Copies to:

RICHARD T. PRINS, ESQ.

SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

FOUR TIMES SQUARE

NEW YORK, NEW YORK 10036

Date of fiscal year end: SEPTEMBER 30, 2007

Date of reporting period: SEPTEMBER 30, 2007

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL SHAREHOLDER REPORT

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

September 30, 2007

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Annual Shareholder Report

September 30, 2007

Contents

| Performance Summary | 2 |

| Portfolio Asset Allocation | 3 |

| | |

| Financial Statements | |

| | |

| Report of Independent Registered Public Accounting Firm | 4 |

| Statement of Assets and Liabilities | 5 |

| Statement of Investments | 6 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Statement of Cash Flows | 13 |

| Notes to Financial Statements | 14 |

| Schedule of Changes in Investments in Affiliates | 31 |

| | |

| Supplemental Information (Unaudited) | |

| | |

| Directors and Officers | 32 |

| Approval of Investment Management Agreement | 37 |

Special Value Expansion Fund, LLC (the “Company”) files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Company’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Company’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A free copy of the Company’s proxy voting guidelines and information regarding how the Company voted proxies relating to portfolio securities during the most recent 12-month period may be obtained without charge on the SEC’s website at http://www.sec.gov or by calling the Company’s advisor, Tennenbaum Capital Partners, LLC, at (310) 566-1000. Collect calls for this purpose are accepted.0212-0378483 12/3/2007 6:27 PM

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| | | | | | | | | |

| Performance Summary |

| | | | | | | | | |

| Inception (September 1, 2004) through September 30, 2007 |

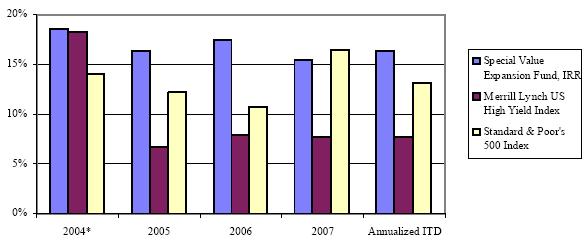

Internal Rate of Return v. Merrill Lynch US High Yield and S&P 500 Indices | | |

|

| | | | | | | | | |

| | | | | | | | | Annualized |

| | | | | 2004* | 2005 | 2006 | 2007 | Inception-to-Date |

| Special Value Expansion Fund, IRR | | 18.6% | 16.3% | 17.4% | 15.5% | 16.3% |

| Merrill Lynch US High Yield Index | | 18.3% | 6.7% | 7.9% | 7.7% | 7.7% |

| Standard & Poor's 500 Index | | 14.0% | 12.3% | 10.8% | 16.4% | 13.2% |

| | | | | | | | | |

| * Annualized period from inception (September 1, 2004) through September 30, 2004 |

| | | | | | | | | |

| | | | | | | | | |

The internal rates of return shown above represent past performance and are not a guarantee of future performance of Special Value Expansion Fund (the "Company"). Company returns are net of dividends to preferred shareholders and Company expenses, including financing costs and management and performance fees. Internal rate of return ("IRR") is the imputed annual return over an investment period and, mathematically, is the rate of return at which the discounted cash flows equal the initial outlays. The IRRs presented assume an investment in the Company at net asset value as of the period beginning date, and a liquidation of the Company at net asset value as of the period end date. IRR is reduced in earlier periods due to the equity placement and offering costs that were charged to paid-in capital and the organizational costs that were expensed in the initial operating periods of the Company.

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

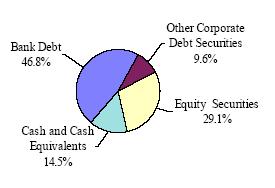

| Portfolio Asset Allocation |

| |

| September 30, 2007 |

Portfolio Holdings by Investment Type (% of Cash and Investments) | | | |

|

| |

Portfolio Holdings by Industry (% of Cash and Investments) | | | | |

| | | | | |

| Wired Telecommunications Carriers | | | | 16.3% |

| Communications Equipment Manufacturing | | | 11.5% |

| Plastics Product Manufacturing | | | | | 8.4% |

| Semiconductor and Other Electronic Component Manufacturing | 7.2% |

| Satellite Telecommunications | | | | | 6.3% |

| Motor Vehicle Parts Manufacturing | | | | 5.0% |

| Activities Related to Credit Intermediation | | | 4.6% |

| Scheduled Air Transportation | | | | | 3.4% |

| Electric Power Generation, Transmission and Distribution | | 3.4% |

| Other Amusement and Recreation Industries | | | 3.2% |

| Glass and Glass Products Manufacturing | | | | 2.9% |

| Alumina and Aluminum Production and Processing | | 2.9% |

| Data Processing, Hosting and Related Services | | | 2.5% |

| Printing and Related Activities | | | | | 2.1% |

| Depository Credit Intermediation | | | | | 1.3% |

| Offices of Real Estate Agents and Brokers | | | 0.7% |

| Basic Chemical Manufacturing | | | | | 0.4% |

| Miscellaneous | | | | | | | 3.4% |

| Cash and Cash Equivalents | | | | | 14.5% |

| | | | | | | | | |

| Total | | | | | | | | 100.0% |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

Special Value Expansion Fund, LLC

We have audited the accompanying statement of assets and liabilities of Special Value Expansion Fund, LLC (a Delaware Limited Liability Company) (the “Company”), including the statement of investments, as of September 30, 2007, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2007, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Special Value Expansion Fund, LLC at September 30, 2007, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

/s/ Ernst & Young LLP

Los Angeles, California

November 16, 2007

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Assets and Liabilities |

| |

| September 30, 2007 |

| | | | | | |

| | | | | | |

| | | Cost | | Fair Value | |

Assets | | | | | | | |

| Investments in securities of unaffiliated issuers: | | | | | | | |

| Debt securities | | $ | 290,665,172 | | $ | 291,615,134 | |

| Equity securities | | | 83,482,451 | | | 88,700,927 | |

| Total investments in securities of unaffiliated issuers | | | 374,147,623 | | | 380,316,061 | |

| | | | | | | | |

| Investments in securities of affiliates: | | | | | | | |

| Debt securities | | | 26,928,814 | | | 28,376,242 | |

| Equity securities | | | 58,603,850 | | | 76,176,194 | |

| Total investments in securities of affiliates | | | 85,532,664 | | | 104,552,436 | |

| | | | | | | | |

| Total investments | | | 459,680,287 | | | 484,868,497 | |

| | | | | | | | |

| Cash and cash equivalents | | | | | | 82,341,891 | |

| Accrued interest income on securities of unaffiliated issuers | | | | | | 5,632,904 | |

| Accrued interest income on securities of affiliates | | | | | | 1,024,410 | |

| Receivable for investment securities sold | | | | | | 1,083,200 | |

| Other receivables | | | | | | 2,140,302 | |

| Deferred debt issuance costs | | | | | | 1,523,186 | |

| Prepaid expenses and other assets | | | | | | 156,538 | |

| Total assets | | | | | | 578,770,928 | |

| | | | | | | | |

Liabilities | | | | | | | |

| Credit facility payable | | | | | | 150,000,000 | |

| Payable for investment securities purchased | | | | | | 5,824,204 | |

| Unrealized loss on derivative instruments (Note 2) | | | | | | 3,655,423 | |

| Performance fees payable | | | | | | 3,455,016 | |

| Management and advisory fees payable | | | | | | 300,000 | |

| Payable to affiliate | | | | | | 79,358 | |

| Accrued expenses and other liabilities | | | | | | 1,670,790 | |

| Total liabilities | | | | | | 164,984,791 | |

| | | | | | | | |

Preferred Stock | | | | | | | |

| Auction rate money market preferred stock (Series A and B); $50,000/share liquidation | | | |

| preference; unlimited shares authorized, 2,000 shares issued and outstanding | | | | | | 100,000,000 | |

| Accumulated dividends on auction rate money market preferred stock | | | | | | 500,934 | |

| Series S, $1,000/share liquidation preference; 1 share authorized, no shares issued | | | |

| and outstanding | | | | | | - | |

| Series Z, $500/share liquidation preference; 500 shares authorized, 312 shares | | | | | | | |

| issued and outstanding | | | | | | 156,000 | |

| Accumulated dividends on Series Z preferred stock | | | | | | - | |

| Total preferred stock | | | | | | 100,656,934 | |

| | | | | | | | |

Net assets applicable to common shareholders | | | | | $ | 313,129,203 | |

| | | | | | | | |

Composition of net assets applicable to common shareholders | | | | | | | |

| Common stock, $0.001 par value; unlimited shares authorized; 546,750.239 | | | | | | | |

| shares issued and outstanding | | | | | $ | 547 | |

| Paid-in capital in excess of par | | | | | | 295,354,714 | |

| Distributions in excess of net investment income | | | | | | (3,265,838 | ) |

| Accumulated net realized gains | | | | | | - | |

| Accumulated net unrealized appreciation | | | | | | 21,540,714 | |

| Accumulated dividends to preferred shareholders | | | | | | (500,934 | ) |

| Net assets applicable to common shareholders | | | | | $ | 313,129,203 | |

| | | | | | | | |

| Common stock, NAV per share | | | | | $ | 572.71 | |

| | | | | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Investments |

| |

| September 30, 2007 |

| |

| Showing Percentage of Total Cash and Investments of the Company |

| | | | |

| | | | | | | Percent of | |

| | | Principal | | Fair | | Cash and | |

Security | | Amount | | Value | | Investments | |

| | | | | | | | |

Debt Securities (56.41%) | | | | | | | | | | |

Bank Debt (46.86%) (1) | | | | | | | | | | |

Alumina and Aluminum Production and Processing (2.86%) | | | | | | | | | | |

Revere Industries, LLC, 2nd Lien Term Loan, LIBOR + 10%, due 6/14/11 | | | | | | | | | | |

| (Acquired 12/14/05, Amortized Cost $17,804,000) | | $ | 17,804,000 | | $ | 16,201,640 | | | 2.86 | % |

| | | | | | | | | | | |

Basic Chemical Manufacturing (0.18%) | | | | | | | | | | |

Hawkeye Renewables, LLC 2nd Lien Term Loan, LIBOR+ 7.25%, due 6/30/13 | | | | | | | | | | |

| (Acquired 7/18/06, Amortized Cost $1,157,270) | | $ | 1,186,944 | | | 1,016,816 | | | 0.18 | % |

| | | | | | | | | | | |

Communications Equipment Manufacturing (8.26%) | | | | | | | | | | |

| Dialogic Corporation, Senior Secured Note, LIBOR + 8%, due 3/28/12 | | | | | | | | | | |

| (Acquired 9/28/06, Amortized Cost $19,287,834) | | $ | 19,287,834 | | | 20,676,558 | | | 3.64 | % |

| Enterasys Network Distribution Ltd., Senior Secured Note, LIBOR + 9%, due 2/22/11 | | | | | | | | | | |

(Acquired 3/1/06, Amortized Cost $2,700,297) - (Ireland) (2) | | $ | 2,755,405 | | | 2,734,739 | | | 0.48 | % |

| Enterasys Networks, Inc., Senior Secured Note, LIBOR + 9%, due 2/22/11 | | | | | | | | | | |

(Acquired 3/1/06, Amortized Cost $11,839,763) (2) | | $ | 12,081,390 | | | 11,990,780 | | | 2.11 | % |

| Gores Ent Holdings, Inc., Senior Secured Note, LIBOR + 9.166%, due 2/22/11 | | | | | | | | | | |

(Acquired 3/1/06, Amortized Cost $10,240,323) (2) | | $ | 11,661,721 | | | 11,513,034 | | | 2.03 | % |

Total Communications Equipment Manufacturing | | | | | | 46,915,111 | | | | |

| | | | | | | | | | | |

Data Processing, Hosting and Related Services (2.53%) | | | | | | | | | | |

Terremark Worldwide, Inc., 1st Lien Term Loan, LIBOR + 3.75%, due 7/31/12 | | | | | | | | | | |

| (Acquired 8/1/07, Amortized Cost $4,139,234) | | $ | 4,139,234 | | | 4,135,095 | | | 0.73 | % |

Terremark Worldwide, Inc., 2nd Lien Term Loan, | | | | | | | | | | |

| LIBOR + 3.25% + 4.5% PIK, due 1/31/13 | | | | | | | | | | |

| (Acquired 8/1/07, Amortized Cost $10,091,531) | | $ | 10,150,811 | | | 10,226,942 | | | 1.80 | % |

Total Data Processing, Hosting and Related Services | | | | | | 14,362,037 | | | | |

| | | | | | | | | | | |

Electric Power Generation, Transmission and Distribution (0.06%) | | | | | | | | | | |

| La Paloma Generating Co. Residual Bank Debt | | | | | | | | | | |

(Acquired 2/2/05, 3/18/05, and 5/6/05, Amortized Cost $1,227,816) (4) | | $ | 13,943,926 | | | 328,891 | | | 0.06 | % |

| | | | | | | | | | | |

Offices of Real Estate Agents and Brokers (0.68%) | | | | | | | | | | |

| Realogy Corporation, Revolver, due 4/10/13 | | | | | | | | | | |

| (Acquired 6/28/07 and 7/13/07, Amortized Cost $(520,000)) | | $ | 10,000,000 | | | (830,000 | ) | | (0.15 | )% |

| Realogy Corporation, Delayed Draw B Term Loan, LIBOR + 3%, due 10/10/13 | | | | | | | | | | |

| (Acquired 7/17/07, 7/18/07, 7/19/07, 8/15/07, and 8/16/07, Amortized Cost $4,738,750) | | $ | 5,000,000 | | | 4,695,000 | | | 0.83 | % |

Total Offices of Real Estate Agents and Brokers | | | | | | 3,865,000 | | | | |

| | | | | | | | | | | |

Plastics Product Manufacturing (0.38%) | | | | | | | | | | |

| WinCup, Inc. Subordinated Promissory Note, 10% PIK, due 5/29/10 | | | | | | | | | | |

(Acquired 2/28/07, Amortized Cost $2,148,431) (2) | | $ | 2,148,431 | | | 2,137,689 | | | 0.38 | % |

| | | | | | | | | | | |

Satellite Telecommunications (6.17%) | | | | | | | | | | |

| ProtoStar Limited, Senior Secured Note, LIBOR + 9.50%, due 7/12/08 | | | | | | | | | | |

| (Acquired 7/12/07, Amortized Cost $3,111,569) | | $ | 3,111,569 | | | 3,111,569 | | | 0.54 | % |

WildBlue Communications, Inc. 1st Lien Delayed Draw Term Loan, | | | | | | | | | | |

| LIBOR + 4.0% Cash + 2.5% PIK, due 12/31/09 | | | | | | | | | | |

| (Acquired 6/6/06, Amortized Cost $15,287,474) | | $ | 15,306,386 | | | 15,243,630 | | | 2.69 | % |

WildBlue Communications, Inc. 2nd Lien Delayed Draw Term Loan, | | | | | | | | | | |

| LIBOR + 5% Cash + 4.5% PIK, due 8/15/11 | | | | | | | | | | |

| (Acquired 8/16/06, Amortized Cost $16,103,559) | | $ | 16,698,859 | | | 16,651,267 | | | 2.94 | % |

Total Satellite Telecommunications | | | | | | 35,006,466 | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Investments (Continued) |

| |

| September 30, 2007 |

| |

| Showing Percentage of Total Cash and Investments of the Company |

| | | | | | | | |

| | | | | | | Percent of | |

| | | Principal | | Fair | | Cash and | |

Security | | Amount | | Value | | Investments | |

| | | | | | | | |

Debt Securities (continued) | | | | | | | | | | |

Scheduled Air Transportation (3.42%) | | | | | | | | | | |

| Northwest Airlines, Inc. 1st Preferred Mortgage, 9.85%, due 10/15/12 | | | | | | | | | | |

| (Restated and Amended 1/18/06, Amortized Cost $10,709,684) | | $ | 10,797,547 | | $ | 11,140,370 | | | 1.96 | % |

| Northwest Airlines, Inc. 1st Preferred Mortgage, 9.85%, due 7/15/13 | | | | | | | | | | |

| (Restated and Amended 1/18/06, Amortized Cost $5,763,728) | | $ | 5,815,121 | | | 6,032,387 | | | 1.06 | % |

| Northwest Airlines, Inc. 1st Preferred Mortgage, 9.85%, due 12/15/13 | | | | | | | | | | |

| (Restated and Amended 1/18/06, Amortized Cost $2,189,866) | | $ | 2,194,482 | | | 2,276,473 | | | 0.40 | % |

Total Scheduled Air Transportation | | | | | | 19,449,230 | | | | |

| | | | | | | | | | | |

Semiconductor and Other Electronic Component Manufacturing (6.81%) | | | | | | | | | | |

| Isola USA Corporation 1st Lien Term Loan, LIBOR + 4.75%, due 12/18/12 | | | | | | | | | | |

| (Acquired 7/12/07, Amortized Cost $1,700,465) | | $ | 1,775,942 | | | 1,678,265 | | | 0.30 | % |

| Isola USA Corporation 2nd Lien Term Loan, LIBOR + 7.75%, due 12/18/13 | | | | | | | | | | |

| (Acquired 12/21/06, 4/16/07 and 5/22/07, Amortized Cost $14,661,398) | | $ | 15,133,531 | | | 14,679,525 | | | 2.59 | % |

| Vitesse Semiconductor Corporation 1st Lien Term Loan, | | | | | | | | | | |

| LIBOR + 4% Cash + 5% PIK, due 6/7/10 | | | | | | | | | | |

| (Acquired 6/7/06, Amortized Cost $17,390,896) | | $ | 17,390,896 | | | 22,260,346 | | | 3.92 | % |

Total Semiconductor and Other Electronic Component Manufacturing | | | | | | 38,618,136 | | | | |

| | | | | | | | | | | |

Wired Telecommunications Carriers (15.51%) | | | | | | | | | | |

| Casema Mezzanine Term Loan, EURIBOR + 4.5% Cash + 4.75% PIK, | | | | | | | | | | |

due 9/12/16 (Acquired 10/3/06, Amortized Cost $19,512,002) - (Netherlands) (3) | | | € 15,262,375 | | | 21,870,096 | | | 3.86 | % |

| Global Crossing Limited, Tranche B Term Loan, LIBOR + 6.25%, due 5/9/12 | | | | | | | | | | |

| (Acquired 6/4/07, Amortized Cost $6,192,023) | | $ | 6,192,023 | | | 6,130,103 | | | 1.08 | % |

| Integra Telecom, Inc. 2nd Lien Senior Secured Term Loan, | | | | | | | | | | |

| LIBOR + 7%, due 2/18/14 | | | | | | | | | | |

| (Acquired 7/31/06, Amortized Cost $12,595,236) | | $ | 13,120,038 | | | 13,251,238 | | | 2.34 | % |

| Integra Telecom, Inc. Unsecured Term Loan (Holdco), | | | | | | | | | | |

| LIBOR + 10% PIK, due 8/31/14 | | | | | | | | | | |

| (Acquired 9/05/07, Amortized Cost $14,994,329) | | $ | 14,994,329 | | | 15,294,216 | | | 2.70 | % |

| Interstate Fibernet, Inc. 1st Lien Term Loan, LIBOR + 4%, due 7/31/13 | | | | | | | | | | |

| (Acquired 8/01/07, Amortized Cost $8,070,988) | | $ | 8,299,216 | | | 8,306,129 | | | 1.46 | % |

| Interstate Fibernet, Inc. 2nd Lien Term Loan, | | | | | | | | | | |

| LIBOR + 7.5%, due 7/31/14 | | | | | | | | | | |

| (Acquired 7/31/07, Amortized Cost $8,892,017) | | $ | 8,892,017 | | | 9,047,627 | | | 1.60 | % |

| NEF Telecom Company BV 2nd Lien Term Loan, EURIBOR + 5%, due 2/16/17 | | | | | | | | | | |

(Acquired 8/29/07, Amortized Cost $1,460,354) - (Netherlands) (3) | | € | 1,067,042 | | | 1,524,633 | | | 0.27 | % |

| NEF Telecom Company BV Mezzanine Term Loan, | | | | | | | | | | |

| EURIBOR + 4.25% Cash + 5.25% PIK, due 8/16/17 | | | | | | | | | | |

(Acquired 8/29/07, Amortized Cost $11,882,155) - (Netherlands) (3) | | € | 8,678,032 | | | 12,452,139 | | | 2.20 | % |

Total Wired Telecommunications Carriers | | | | | | 87,876,181 | | | | |

| | | | | | | | | | | |

Total Bank Debt (Cost $255,372,992) | | | | | | 265,777,197 | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Investments (Continued) |

| |

| September 30, 2007 |

| |

| Showing Percentage of Total Cash and Investments of the Company |

| | | | | | | | |

| | | Principal | | | | Percent of | |

| | | Amount | | Fair | | Cash and | |

Security | | or Shares | | Value | | Investments | |

| | | | | | | | |

Other Corporate Debt Securities (9.55%) | | | | | | | | | | |

Electric Power Generation, Transmission and Distribution (0.02%) | | | | | | | | | | |

Calpine Generating Co. Secured Floating Rate Notes, LIBOR + 9%, due 4/1/11 (4) | | $ | 371,000 | | $ | 136,955 | | | 0.02 | % |

| | | | | | | | | | | |

Other Amusement and Recreation Industries (3.16%) | | | | | | | | | | |

Bally Total Fitness Holdings, Inc. Senior Subordinated Notes, 9.875%, due 10/15/07 | | $ | 19,484,000 | | | 17,925,280 | | | 3.16 | % |

| | | | | | | | | | | |

Plastics Product Manufacturing (1.64%) | | | | | | | | | | |

| Pliant Corporation Senior Secured Notes, 11.125%, due 9/1/09 | | $ | 9,200,000 | | | 8,406,500 | | | 1.48 | % |

| Radnor Holdings Senior Secured Tranche C Notes, LIBOR + 7.25%, due 9/15/09 | | | | | | | | | | |

(Acquired 4/4/06, Amortized Cost $6,811,237) (4), (5) | | $ | 6,973,000 | | | 890,173 | | | 0.16 | % |

Total Plastics Product Manufacturing | | | | | | 9,296,673 | | | | |

| | | | | | | | | | | |

Printing and Related Support Activities (2.11%) | | | | | | | | | | |

| Phoenix Color Corporation Senior Subordinated Notes, 13%, due 2/1/09 | | $ | 11,973,000 | | | 12,002,933 | | | 2.11 | % |

| | | | | | | | | | | |

Miscellaneous Securities (2.62%) (6) | | $ | 21,459,000 | | | 14,852,338 | | | 2.62 | % |

| | | | | | | | | | | |

Total Other Corporate Debt Securities (Cost $62,220,994) | | | | | | 54,214,179 | | | | |

| | | | | | | | | | | |

Total Debt Securities (Cost $317,593,986) | | | | | | 319,991,376 | | | | |

| | | | | | | | | | | |

Equity Securities (29.07%) | | | | | | | | | | |

Activities Related to Credit Intermediation (4.63%) | | | | | | | | | | |

| Online Resources Corporation Series A-1 Convertible Preferred Stock | | | | | | | | | | |

(Acquired 7/3/06, Cost $22,255,193) (4), (5) | | | 22,255,193 | | | 26,227,745 | | | 4.63 | % |

| | | | | | | | | | | |

Basic Chemical Manufacturing (0.27%) | | | | | | | | | | |

| THL Hawkeye Equity Investors, L.P. Interest | | | | | | | | | | |

(Acquired 7/25/06 Cost $2,373,887) (4), (5) | | | 2,373,887 | | | 1,531,157 | | | 0.27 | % |

| | | | | | | | | | | |

Communications Equipment Manufacturing (3.24%) | | | | | | | | | | |

| Dialogic Corporation, Class A Convertible Preferred Shares | | | | | | | | | | |

(Acquired 9/28/06, Cost $2,967,357) (4), (5) | | | 3,037,033 | | | 5,550,178 | | | 0.98 | % |

| Gores Ent Holdings, Inc. Series A Convertible Preferred Stock | | | | | | | | | | |

(Acquired 3/1/06 and 11/9/06, Cost $10,385,328) (2), (4), (5), (7) | | | 10,385.327 | | | 11,501,750 | | | 2.03 | % |

| Gores Ent Holdings, Inc. Series B Convertible Preferred Stock | | | | | | | | | | |

(Acquired 3/1/06, Cost $1,188,164) (2), (4), (5), (7) | | | 1,843.827 | | | 1,327,555 | | | 0.23 | % |

Total Communications Equipment Manufacturing | | | | | | 18,379,483 | | | | |

| | | | | | | | | | | |

Depository Credit Intermediation (1.30%) | | | | | | | | | | |

| Doral Holdings, LP | | | | | | | | | | |

(Acquired 7/12/07, Cost $4,151,971) (4), (5) | | | 4,151,971 | | | 7,346,464 | | | 1.30 | % |

| | | | | | | | | | | |

Electric Power Generation, Transmission and Distribution (3.31%) | | | | | | | | | | |

| Mach Gen, LLC Common Units | | | | | | | | | | |

(Acquired 8/17/05, 11/9/05, 12/14/05 and 12/19/05, Cost $1,198,456) (4), (5) | | | 6,846 | | | 7,445,025 | | | 1.31 | % |

| Mach Gen, LLC Warrants to Purchase Warrant Units | | | | | | | | | | |

(Acquired 8/17/05, 11/9/05, 12/14/05 and 12/19/05, Cost $336,895) (4), (5) | | | 1,831 | | | 1,007,050 | | | 0.18 | % |

Mirant Corporation, Common Stock (4) | | | 253,718 | | | 10,321,248 | | | 1.82 | % |

Total Electric Power Generation, Transmission and Distribution | | | | | | 18,773,323 | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Investments (Continued) |

| |

| September 30, 2007 |

| |

| Showing Percentage of Total Cash and Investments of the Company |

| | | | | | | | |

| | | | | | | Percent of | |

| | | | | Fair | | Cash and | |

Security | | Shares | | Value | | Investments | |

| | | | | | | | |

Equity Securities (continued) | | | | | | | | | | |

Glass and Glass Products Manufacturing (2.91%) | | | | | | | | | | |

Owens Corning, Inc. Common Stock (4) | | | 659,399 | | $ | 16,517,945 | | | 2.91 | % |

| | | | | | | | | | | |

Motor Vehicle Parts Manufacturing (4.99%) | | | | | | | | | | |

| EaglePicher Holdings Inc. Common Stock | | | | | | | | | | |

(Acquired 3/9/05, Cost $16,009,993) (2), (4), (5), (7), (8) | | | 854,400 | | | 28,295,592 | | | 4.99 | % |

| | | | | | | | | | | |

Other Amusement and Recreation Industries (0.00%) | | | | | | | | | | |

| Bally Total Fitness Holdings, Inc. Common Stock | | | | | | | | | | |

(Acquired 4/03/06, Cost $131,038) (4), (5), (9) | | | 58,239 | | | 15,069 | | | 0.00 | % |

| | | | | | | | | | | |

Plastics Product Manufacturing (6.39%) | | | | | | | | | | |

Pliant Corporation Common Stock (4) | | | 217 | | | 217 | | | 0.00 | % |

| Pliant Corporation 13% PIK Preferred Stock | | | 2,678 | | | 1,210,132 | | | 0.21 | % |

| Radnor Holdings Series A Convertible Preferred Stock | | | | | | | | | | |

(Acquired 10/27/05, Cost $7,163,929) (4), (5) | | | 7,874,163 | | | - | | | 0.00 | % |

| Radnor Holdings Common Stock | | | | | | | | | | |

(Acquired 7/31/06, Cost $60,966) (4), (5) | | | 30 | | | - | | | 0.00 | % |

| Radnor Holdings Non-Voting Common Stock | | | | | | | | | | |

(Acquired 7/31/06, Cost $628,814) (4), (5) | | | 305 | | | - | | | 0.00 | % |

| Radnor Holdings Warrants for Common Stock | | | | | | | | | | |

(Acquired 10/27/05, Cost $594) (4), (5) | | | 1 | | | - | | | 0.00 | % |

| Radnor Holdings Warrants for Non-Voting Common Stock | | | | | | | | | | |

(Acquired 10/27/05, Cost $594) (4), (5) | | | 1 | | | - | | | 0.00 | % |

| WinCup, Inc. Common Stock | | | | | | | | | | |

(Acquired 11/29/06, Cost $31,020,365) (2), (4), (5), (7) | | | 31,020,365 | | | 35,051,297 | | | 6.18 | % |

Total Plastics Product Manufacturing | | | | | | 36,261,646 | | | | |

| | | | | | | | | | | |

Satellite Telecommunications (0.09%) | | | | | | | | | | |

| WildBlue Communications, Inc. Non-Voting Warrants | | | | | | | | | | |

(Acquired 10/23/06, Cost $508,737) (4), (5) | | | 1,189,528 | | | 535,288 | | | 0.09 | % |

| | | | | | | | | | | |

Semiconductor and Other Electronic Component Manufacturing (0.38%) | | | | | | | | | | |

| TPG Hattrick Holdco, LLC Common Units | | | | | | | | | | |

(Acquired 4/21/06, Cost $1,630,062) (4), (5) | | | 969,092 | | | 2,170,766 | | | 0.38 | % |

| | | | | | | | | | | |

Wired Telecommunications Carriers (0.77%) | | | | | | | | | | |

| Integra Telecom, Inc. Warrants to Purchase Various Common and Preferred Stock | | | | | | | | | | |

(Acquired 7/31/06, Cost $382,723) (4), (5) | | | 1,144,390 | | | 1,813,855 | | | 0.32 | % |

| NEF Kamchia Co-Investment Fund, LP | | | | | | | | | | |

(Acquired 7/30/07, Cost $2,439,543) - (Cayman Islands) (3), (4), (5) | | | 1,779,000 | | | 2,538,099 | | | 0.45 | % |

Total Wired Telecommunications Carriers | | | | | | 4,351,954 | | | | |

| | | | | | | | | | | |

Miscellaneous Securities (0.79%) (6) | | | 245,238 | | | 4,470,689 | | | 0.79 | % |

| | | | | | | | | | | |

Total Equity Securities (Cost $142,086,301) | | | | | | 164,877,121 | | | | |

| | | | | | | | | | | |

Total Investments in Securities (Cost $459,680,287) | | | | | | 484,868,497 | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Investments (Continued) |

| |

| September 30, 2007 |

| | | | | |

| Showing Percentage of Total Cash and Investments of the Company |

| | | | | | | | |

| | | | | | | Percent of | |

| | | Principal | | Fair | | Cash and | |

Security | | Amount | | Value | | Investments | |

| | | | | | | | |

Cash and Cash Equivalents (14.52%) | | | | | | | |

| Citigroup Funding Commercial Paper, 5.35%, due 10/02/07 | | $ | 25,000,000 | | $ | 24,881,111 | | | 4.39 | % |

| Kitty Hawk Commercial Paper, 5.55%, due 10/15/07 | | $ | 500,000 | | | 497,842 | | | 0.09 | % |

| Ranger Commercial Paper, 5.15%, due 10/04/07 | | $ | 7,350,000 | | | 7,335,280 | | | 1.29 | % |

| Ranger Commercial Paper, 5.70%, due 10/16/07 | | $ | 5,000,000 | | | 4,974,667 | | | 0.88 | % |

| Toyota Motor Credit Corporation Commercial Paper, 4.70%, due 10/01/07 | | $ | 4,100,000 | | | 4,098,394 | | | 0.72 | % |

| UBS Finance Commercial Paper, 5.46%, due 10/25/07 | | $ | 25,000,000 | | | 24,829,375 | | | 4.38 | % |

| Union Bank of California Certificate of Deposit, 5.35%, due 11/14/07 | | $ | 5,000,000 | | | 5,000,000 | | | 0.88 | % |

| Wachovia Corporation Commercial Paper, 5.105%, due 10/25/07 | | $ | 6,500,000 | | | 6,473,296 | | | 1.14 | % |

| Wachovia Corporation Commercial Paper, 5.105%, due 10/29/07 | | $ | 2,300,000 | | | 2,289,889 | | | 0.40 | % |

| Wells Fargo Bank Overnight Repo, 4.35%, collateralized by FNMA Discount Note | | $ | 432,172 | | | 432,172 | | | 0.08 | % |

| Cash Held on Account at Various Institutions | | $ | 1,529,865 | | | 1,529,865 | | | 0.27 | % |

Total Cash and Cash Equivalents (10) | | | | | | 82,341,891 | | | | |

| | | | | | | | | | | |

Total Cash and Investments in Securities | | | | | $ | 567,210,388 | | | 100.00 | % |

| | | | | | | | | | | |

Notes to Statement of Investments |

| |

(1) | Certain investments in bank debt may be considered to be subject to contractual restrictions, and such investments are bought and sold among institutional investors in transactions not subject to registration under the Securities Act of 1933. Such transactions are generally limited to commercial lenders or accredited investors and often require approval of the agent or borrower. |

(2) | Affiliated issuers - as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of these issuers). |

(3) | Principal amount denominated in euros. Amortized cost and fair value converted from euros to U.S. dollars. |

(4) | Non-income producing security. |

(6) | Miscellaneous Securities is comprised of certain unrestricted security positions that have not previously been publicly disclosed. |

(7) | Investment is not a controlling position. |

(8) | The Company's advisor may demand registration at any time more than 180 days following the first initial public offering of common equity by the issuer. |

(9) | Registration of this issue of restricted stock may be forced by a majority of the eligible holders of the issue by written notice to the issuer once the issuer becomes eligible to use a short form registration statement on Form S-3. |

(10) | Cash and cash equivalents include $6,473,296 segregated for certain unfunded commitments. |

Aggregate purchases and aggregate sales of securities, other than Government securities, totaled $224,908,016 and $241,792,233 respectively. Aggregate purchases includes securities received as payment in kind. Aggregate sales includes principal paydowns on debt securities.

The total value of restricted securities as of September 30, 2007 was $399,024,260 or 70.35% of total cash and investments of the Company.

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statement of Operations |

| |

| For the Year Ended September 30, 2007 |

| | | | |

Investment income | | | |

| Interest income from investments in securities of unaffiliated issuers | | $ | 43,377,100 | |

| Interest income from investments in affiliates | | | 4,010,439 | |

| Accretion of market discount | | | 967,941 | |

| Accretion of original issue discount | | | 273,551 | |

| Dividend income | | | 13,533 | |

| Other income - unaffiliated issuers | | | 1,086,670 | |

| Total interest and related investment income | | | 49,729,234 | |

| | | | | |

Operating expenses | | | | |

| Performance fees (Notes 3 and 7) | | | 11,410,317 | |

| Interest expense | | | 8,340,311 | |

| Management and advisory fees | | | 3,600,000 | |

| Credit enhancement fees | | | 652,892 | |

| Legal fees, professional fees and due diligence expenses | | | 649,785 | |

| Amortization of deferred debt issuance costs | | | 296,672 | |

| Commitment fees | | | 224,131 | |

| Directors' fees | | | 191,675 | |

| Insurance expense | | | 166,839 | |

| Custody fees | | | 100,000 | |

| Other operating expenses | | | 675,032 | |

| Total expenses | | | 26,307,654 | |

| | | | | |

Net investment income | | | 23,421,580 | |

| | | | | |

Net realized and unrealized gains | | | | |

| Net realized gain from investments in securities of unaffiliated issuers | | | 32,610,387 | |

| | | | | |

| Net change in net unrealized appreciation on: | | | | |

| Investments | | | (4,740,224 | ) |

| Foreign currency | | | 7,927 | |

| Net change in unrealized appreciation | | | (4,732,297 | ) |

| Net realized and unrealized gains | | | 27,878,090 | |

| | | | | |

| Distributions to preferred shareholders | | | (5,274,424 | ) |

| Net change in reserve for distributions to preferred shareholders | | | (283,003 | ) |

| | | | | |

Net increase in net assets applicable to common shareholders | | | | |

resulting from operations | | $ | 45,742,243 | |

| | | | | |

| Special Value Expansion Fund, LLC |

| (A Delaware Limited Liability Company) |

| |

| Statements of Changes in Net Assets |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | Year Ended | | Year Ended | |

| | | September 30, 2007 | | September 30, 2006 | |

| | | | | | |

| Total common shareholder committed capital | | $ | 300,000,000 | | $ | 300,000,000 | |

| | | | | | | | |

| Net assets applicable to common shareholders, beginning of year | | $ | 314,270,127 | | $ | 138,820,731 | |

| | | | | | | | |

| Common shareholder contributions | | | - | | | 171,000,000 | |

| | | | | | | | |

| Net investment income | | | 23,421,580 | | | 19,677,928 | |

| Net realized gain on investments | | | 32,610,387 | | | 6,940,981 | |

| Net change in unrealized appreciation on investments and foreign currency | | | (4,732,297 | ) | | 10,779,157 | |

| Distributions to preferred shareholders from net investment income | | | (1,782,075 | ) | | (2,977,730 | ) |

| Distributions to preferred shareholders from net realized gains on investments | | | (3,492,349 | ) | | (704,959 | ) |

| Net change in reserve for distributions to preferred shareholders | | | (283,003 | ) | | (189,148 | ) |

| Net increase in net assets applicable to common shareholders resulting | | | | | | | |

| from operations | | | 45,742,243 | | | 33,526,229 | |

| | | | | | | | |

| Distributions to common shareholders from: | | | | | | | |

| Net investment income | | | (14,858,351 | ) | | (22,840,811 | ) |

| Net realized gains | | | (29,118,038 | ) | | (6,236,022 | ) |

| Returns of capital | | | (2,906,778 | ) | | - | |

| Total distributions to common shareholders | | | (46,883,167 | ) | | (29,076,833 | ) |

| | | | | | | | |

| Net assets applicable to common shareholders, end of year (including | | | | | | | |

| distributions in excess of net investment income of $3,265,838 and | | | | | | | |

| $10,046,992, respectively) | | $ | 313,129,203 | | $ | 314,270,127 | |

| | | | | | | | |

|

| (A Delaware Limited Liability Company) |

| |

| Statement of Cash Flows |

| |

| For the Year Ended September 30, 2007 |

| | |

Operating activities | | | | |

| Net increase in net assets applicable to common shareholders resulting from operations | | $ | 45,742,243 | |

| Adjustments to reconcile net increase in net assets applicable to common | | | | |

| shareholders resulting from operations to net cash provided by operating activities: | | | | |

| Net realized gain on investments | | | (32,610,387 | ) |

| Net change in unrealized appreciation on investments | | | 4,740,224 | |

| Distributions paid to preferred shareholders | | | 5,274,424 | |

| Increase in reserve for distributions to preferred shareholders | | | 283,003 | |

| Accretion of original issue discount | | | (273,551 | ) |

| Accretion of market discount | | | (967,941 | ) |

| Income from paid in-kind capitalization and other non-cash income | | | (9,633,954 | ) |

| Amortization of deferred debt issuance costs | | | 296,672 | |

| Changes in assets and liabilities: | | | | |

| Purchases of investment securities | | | (215,274,062 | ) |

| Proceeds from sales, maturities and paydowns of investment securities | | | 241,792,233 | |

| Decrease in accrued interest income on securities of unaffiliated issuers | | | 2,610,678 | |

| Decrease in accrued interest income on securities of affiliates | | | 753,528 | |

| Decrease in prepaid expenses and other assets | | | 157,452 | |

| Decrease in receivable for investment securities sold | | | 8,159,484 | |

| Increase in other receivables | | | (2,140,302 | ) |

| Increase in payable for securities purchased | | | 3,584,272 | |

| Decrease in performance fee payable | | | (9,329,683 | ) |

| Decrease in directors' fees payable | | | (42,500 | ) |

| Increase in payable to affiliate | | | 79,358 | |

| Increase in accrued expenses and other liabilities | | | 835,963 | |

| Net cash provided by operating activities | | | 44,037,154 | |

| | | | | |

Financing activities | | | | |

| Proceeds from draws on credit facility | | | 76,000,000 | |

| Principal repayment on credit facility | | | (6,000,000 | ) |

| Dividends to common shareholders | | | (46,883,167 | ) |

| Dividends paid to preferred shareholders | | | (5,274,424 | ) |

| Net cash provided by financing activities | | | 17,842,409 | |

| | | | | |

| Net increase in cash and cash equivalents | | | 61,879,563 | |

| Cash and cash equivalents at beginning of year | | | 20,462,328 | |

| Cash and cash equivalents at end of year | | $ | 82,341,891 | |

| | | | | |

Supplemental cash flow information | | | | |

| Interest payments | | $ | 8,302,338 | |

| | | | | |

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements

September 30, 2007

1. Organization and Nature of Operations

Special Value Expansion Fund, LLC (the “Company”), a Delaware limited liability company, is registered as a nondiversified, closed-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Company has elected to be treated as a regulated investment company (“RIC”) for U.S. federal income tax purposes. The Company will not be taxed on its income to the extent that it distributes such income each year and satisfies other applicable income tax requirements.

The Certificate of Formation of the Company was filed with the Delaware Secretary of State on August 12, 2004. Investment operations commenced and initial funding was received on September 1, 2004. The Company was formed to acquire a portfolio of investments consisting primarily of bank loans, distressed debt, stressed high yield debt, mezzanine investments and public equities. The stated objective of the Company is to generate current income as well as long-term capital appreciation using a leveraged capital structure. GMAM Investment Funds Trust II (“GMAM”) owns 99.5% of the Company’s common shares.

Tennenbaum Capital Partners, LLC (“TCP”) serves as the Investment Manager of the Company. The Company, TCP, and their members and affiliates may be considered related parties.

Company management consists of the Investment Manager and the Board of Directors. The Investment Manager directs and executes the day-to-day operations of the Company, subject to oversight from the Board of Directors, which sets the broad policies for the Company. The Board of Directors consists of three persons, two of whom are independent. If the Company has preferred shares outstanding, as it currently does, the holders of the preferred shares voting separately as a class will be entitled to elect two of the Company’s Directors. The remaining Director of the Company will be subject to election by holders of common shares and preferred shares voting together as a single class.

Company Structure

Total maximum capitalization of the Company is $600 million, consisting of $300 million of capital committed by investors to purchase the Company’s common shares, $100 million of Auction Rate Money Market Preferred Shares (“APS”), $200 million under a Senior Secured Revolving Credit Facility (the “Senior Facility”), $156,000 of Series Z Preferred Stock and $1,000 of Series S Preferred Stock (see Note 7). The contributed investor capital, APS and the amount drawn under the Senior Facility are to be used to purchase Company investments and to pay certain fees and expenses of the Company. Substantially all of these investments are included in the collateral for the Senior Facility and are available to pay certain fees and expenses of the Company incurred in connection with its organization and capitalization. At September 30, 2007, there was $150 million outstanding under the Senior Facility.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

1. Organization and Nature of Operations (continued)

Credit enhancement with respect to the APS and Senior Facility is provided by a AAA/Aaa rated monoline insurer (the “Insurer”) through surety policies issued pursuant to an insurance and indemnity agreement between the Company and the Insurer. Under the surety policies, the Insurer will guarantee payment of the liquidation preference and unpaid dividends on the APS and amounts drawn under the Senior Facility. The cost of the surety polices is 0.11% for unutilized portions of the Money Market preferred shares and the Senior Facility and 0.24% for the outstanding portions of those sources of capital.

The Company will liquidate and distribute its assets and will be dissolved at September 1, 2014, subject to up to two one-year extensions if requested by the Investment Manager and approved by a majority of the Company’s equity interests. However, the Operating Agreement will prohibit the liquidation of the Company prior to September 1, 2014 if the APS are not redeemed in full prior to such liquidation.

Investor Capital

Investors committed to purchase $300 million of the Company’s common shares over a two-year period on dates specified by the Company. As of September 30, 2007, the Company has called and received all of the common shareholder committed contributions, as follows:

| Call Date | | Share Issuance Date | | Percent of Commitment | |

| September 1, 2004 | | | September 1, 2004 | | | 20.00 | % |

| November 1, 2004 | | | November 1, 2004 | | | 10.00 | % |

| March 18, 2005 | | | May 2, 2005 | | | 3.33 | % |

| April 18, 2005 | | | May 2, 2005 | | | 6.67 | % |

| September 30, 2005 | | | November 1, 2005 | | | 3.00 | % |

| November 1, 2005 | | | December 1, 2005 | | | 12.00 | % |

| February 1, 2006 | | | March 1, 2006 | | | 10.00 | % |

| May 10, 2006 | | | June 1, 2006 | | | 15.00 | % |

| August 1, 2006 | | | September 1, 2006 | | | 20.00 | % |

Auction Rate Money Market Preferred Capital

At September 30, 2007, the Company had 2,000 shares of APS issued and outstanding with a liquidation preference of $50,000 per share (plus an amount equal to accumulated but unpaid dividends upon liquidation). The APS are redeemable at the option of the Company, subject to certain limitations. Additionally, under certain conditions, the Company may be required to either redeem certain of the APS or repay indebtedness, at the Company’s option. Such conditions would include a failure by the Company to maintain adequate collateral as required by its credit facility agreement or by the Statement of Preferences of the APS, or a failure by the Company to maintain sufficient asset coverage as required by the 1940 Act. As of September 30, 2007, the Company was in full compliance with such requirements.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

1. Organization and Nature of Operations (continued)

The auction agent receives a fee from the Company for its services in connection with auctions of APS and compensates broker-dealers at an annual rate of 0.25% of the purchase price of the shares of the APS that are issued and outstanding. The Company entered into an agreement with a major broker-dealer to underwrite initial issuances of the APS for a two-year period based on an agreed-upon drawdown schedule and subject to certain criteria.

The issuances of the APS total $100 million of the Company’s total capitalization. On November 17, 2004, the Company received $35.0 million upon issuance of 700 shares of APS. On February 2, 2006, the Company received $65.0 million upon issuance of 1,300 shares of APS.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying audited financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). In the opinion of the Investment Manager, the financial results of the Company included herein contain all adjustments necessary to present fairly the financial position of the Company as of September 30, 2007, the results of its operations and cash flows for the year then ended, and the changes in net assets for each of the two years in the period then ended. The following is a summary of the significant accounting policies of the Company.

Investment Valuation

Management values investments held by the Company at fair value based upon the principles and methods of valuation set forth in policies adopted by the Company’s Board of Directors and in conformity with the Senior Facility and Statement of Preferences for the APS.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

Investments listed on a recognized exchange, whether U.S. or foreign, are valued for financial reporting purposes as of the last business day of the reporting period using the closing price on the date of valuation.

Liquid investments not listed on a recognized exchange are valued by an approved nationally recognized security pricing service or by using either the average of the bid prices on the date of valuation, as supplied by three approved broker-dealers, or the lower of two quotes from approved broker-dealers. At September 30, 2007, all but 1.95% of the cash and investments were valued based on prices from a recognized exchange, nationally recognized third-party pricing service or an approved third-party appraisal.

Investments not listed on a recognized exchange nor priced by an approved source (“Unquoted Investments”) are valued as follows for purposes of inclusion as permitted collateral in the borrowing base of the Senior Facility:

| a) | for semi-liquid investment positions with a value of $15 million or greater but less than $30 million, the most recent quote provided by an approved investment banking firm; |

| b) | for semi-liquid investment positions with a value greater than $30 million, the most recent valuation provided by an approved third-party appraisal; and |

| c) | for illiquid investment positions with a value of $15 million or greater, the most recent valuation provided by an approved third-party appraisal. |

However, notwithstanding items (a) through (c), above, the Investment Manager may determine the market value of Unquoted Investments without obtaining a third-party quote or appraisal, up to an aggregate of 5% of the total capitalization of the Company.

Investments for which market quotations are not readily available or are determined to be unreliable are valued at fair value under guidelines adopted by the Board of Directors, with such fair valuations subject to their approval. Fair value is generally defined as the amount for which an investment could be sold in an orderly disposition over a reasonable time. Generally, to increase objectivity in valuing the Company’s assets, the Investment Manager will utilize external measures of value, such as public markets or third-party transactions, whenever possible.

The Investment Manager’s valuation is not based on long-term work-out value, immediate liquidation value, nor incremental value for potential changes that may take place in the future. The values assigned to investments that are valued by the Investment Manager are based on available information and do not necessarily represent amounts that might ultimately be realized, as these amounts depend on future circumstances and cannot reasonably be determined until the individual investments are actually liquidated. The Investment Manager generally uses three methods to fair value securities:

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

(i) Cost Method. The cost method is based on the original cost of the securities to the Company. This method is generally used in the early stages of a portfolio company’s development until significant positive or negative events occur subsequent to the date of the original investment by the Company in such company that dictate a change to another valuation method.

(ii) Private Market Method. The private market method uses actual, executed, historical transactions in a portfolio company’s securities by responsible third parties as a basis for valuation. In connection with utilizing the private market method, the Investment Manager may also use, where applicable, unconditional firm offers by responsible third parties as a basis for valuation.

(iii) Analytic Method. The analytical method is generally used by the Investment Manager to value an investment position when there is no established public or private market in the portfolio company’s securities or when the factual information available to the Investment Manager dictates that an investment should no longer be valued under either the cost or private market method. This valuation method is based on the judgment of the Investment Manager, using data available for the applicable portfolio securities.

Because of the inherent uncertainty of valuations, these estimated values may differ significantly from the values that would have been used had a ready market for such investments existed, and the differences could be material.

Investment Transactions

The Company records investment transactions on the trade date, except for private transactions that have conditions to closing, which are recorded on the closing date. The cost of investments purchased is based upon the purchase price plus those professional fees which are specifically identifiable to the investment transaction. Realized gains and losses on investments are recorded based on the specific identification method, which typically allocates the highest cost inventory to the basis of the securities sold.

Cash and Cash Equivalents

Cash consists of amounts held in accounts with brokerage firms and the custodian bank. Cash equivalents consist of highly liquid investments with an original maturity of three months or less. For purposes of reporting cash flows, cash consists of the cash held with brokerage firms and the custodian bank, and cash equivalents maturing within 90 days. Cash equivalents of $6,473,296 at September 30, 2007 were segregated at the Company’s custodian to collateralize certain unfunded commitments.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

Repurchase Agreements

In connection with transactions in repurchase agreements, it is the Company’s policy that its custodian take possession of the underlying collateral securities, for which the fair value exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. If the seller defaults, and the fair value of the collateral declines, realization of the collateral by the Company may be delayed or limited.

Investments in Restricted Securities

The Company may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold to institutional investors in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and additional expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Statement of Investments. Restricted securities, including any restricted investments in affiliates, are valued in accordance with the investment valuation policies discussed above.

Investments in Foreign Securities

The Company may invest in securities traded in foreign countries and denominated in foreign currencies. At September 30, 2007, the Company had foreign currency denominated investments with an aggregate market value of approximately 6.78% of the Company’s total cash and investments. Such positions were converted at the closing rate in effect at September 30, 2007 and reported in U.S. dollars. Purchases and sales of investment securities and income and expense items denominated in foreign currencies, when they occur, are translated into U.S. dollars on the respective dates of such transactions. As such, foreign security positions and transactions are susceptible to foreign currency as well as overall market risk. Accordingly, potential unrealized gains and losses from foreign security transactions may be affected by fluctuations in foreign exchange rates. Such fluctuations are included in the net realized and unrealized gain or loss from investments. Net unrealized foreign currency gains of $2,922,173 were included in net unrealized gains on investments at September 30, 2007.

Securities of foreign companies and foreign governments may involve special risks and considerations not typically associated with investing in U.S. companies and securities of the U.S. government. These risks include, among other things, revaluation of currencies, less reliable information about issuers, different securities transactions clearance and settlement practices, and potential future adverse political and economic developments. Moreover, securities of some foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

Derivatives

In order to mitigate the currency exchange and interest rate risks associated with the foreign currency denominated investments, the Company entered into several interest rate swaps and currency forward transactions during the year ended September 30, 2007.

The Company recognizes all derivatives as either assets or liabilities in the Statement of Assets and Liabilities. The transactions entered into are accounted for using the mark-to-market method with the resulting change in fair value recognized in earnings for the current year.

At September 30, 2007, the following derivatives were outstanding:

| | | | | | | | |

Derivative | | Notional Amount | | Fair Value | | Percent of Cash and Investments | |

| Cross Currency Basis Swaps: | | | | | | | | | | |

Pay euros, receive U.S. dollars, expiring September 13, 2016 | | $ | 18,794,861 | | $ | (2,479,443 | ) | | (0.44% | ) |

Pay euros, receive U.S. dollars, expiring May 17, 2012 | | | 13,121,097 | | | (679,907 | ) | | (0.12 | ) |

| Other | | | 663,740 | | | (306,895 | ) | | (0.05 | ) |

| Total Cross Currency Basis Swaps | | | 32,579,698 | | | (3,466,245 | ) | | (0.61 | ) |

| | | | | | | | | | | |

| Currency Forward: | | | | | | | | | | |

Sell euros, buy U.S. dollars, expiring September 15, 2009 | | | 898,821 | | | (92,795 | ) | | (0.01 | ) |

Sell euros, buy U.S. dollars, expiring February 1, 2010 | | | 1,255,091 | | | (96,383 | ) | | (0.02 | ) |

| Total Currency Forward | | | 2,153,912 | | | (189,178 | ) | | (0.03 | ) |

| | | | | | | | | | | |

| Total Derivatives | | $ | 34,733,610 | | $ | (3,655,423 | ) | | (0.64% | ) |

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

Debt Issuance Costs

Costs of $2.4 million were incurred in connection with placing the Company’s Senior Facility. These costs are being deferred and are amortized on a straight-line basis over eight years, the estimated life of the Senior Facility. The impact of utilizing the straight- line amortization method versus the effective-interest method is not expected to be material to the Company’s operations.

Equity Placement and Offering Costs

Placement costs for the Company’s APS capital were $1.0 million. Offering costs totaled $0.4 million. These costs were charged to paid-in capital.

Organization Costs

Organization costs of $0.3 million were incurred in connection with the formation of the Company and expensed to operations at the inception of the Company in 2004.

Purchase Discounts

The majority of the Company’s high yield and distressed debt securities are purchased at a considerable discount to par as a result of the underlying credit risks and financial results of the issuer and by general market factors that influence the financial markets as a whole. GAAP requires that discounts on corporate (investment grade) bonds, municipal bonds and treasury bonds be amortized using the effective-interest or constant-yield method. The process of accreting the purchase discount of a debt security to par over the holding period results in accounting entries that increase the cost basis of the investment and record a noncash income accrual to the statement of operations. The Company considers it prudent to follow GAAP guidance that requires the Investment Manager to consider the collectibility of interest when making accruals. AICPA Statement of Position 93-1 discusses financial accounting and reporting for high yield debt securities and notes for which, because of the credit risks associated with high yield and distressed debt securities, income recognition must be carefully considered and constantly evaluated for collectibility.

Accordingly, when accounting for purchase discounts, management recognizes discount accretion income when it is probable that such amounts will be collected and when such amounts can be estimated. A reclassification entry is recorded at year-end to reflect purchase discounts on all realized investments. For income tax purposes, the economic gain resulting from the sale of debt securities purchased at a discount is allocated between interest income and realized gains.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

Distributions to Common Shareholders

Distributions to common shareholders are recorded on the ex-dividend date. The amount to be paid out as a distribution is determined by the Board of Directors, which has provided the Investment Manager with criteria for such distributions, and is generally based upon estimated taxable earnings. Net realized capital gains are distributed at least annually. The Company declared distributions of $46,883,167 and $29,076,833 to common shareholders during the years ended September 30, 2007 and 2006, respectively, and has distributed $82,960,000 since inception.

Income Taxes

The Company intends to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended, pertaining to regulated investment companies and make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes. Accordingly, no provision for income taxes is required in the financial statements. As of September 30, 2007, all tax years since inception remain subject to examination by federal and state tax authorities. No such examinations are currently pending.

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States. Capital accounts within the financial statements are adjusted for permanent book and tax differences. These adjustments are primarily due to returns of capital and differing book and tax treatments for short-term realized gains and have no impact on net assets or the results of operations.

Temporary differences are attributable to differing book and tax treatments for the timing of the recognition of gains and losses on certain investment transactions and the timing of the deductibility of certain expenses, and will reverse in subsequent periods.

Cost and unrealized appreciation (depreciation) for U.S. federal income tax purposes of the investments of the Company at September 30, 2007 were as follows:

| Unrealized appreciation | | $ | 53,457,254 | |

| Unrealized depreciation | | | (31,924,467 | ) |

| Net unrealized appreciation | | $ | 21,532,787 | |

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

The tax character of distributions paid during the years ended September 30, 2007 and 2006 was as follows:

| | | | | 2007 | | 2006 | |

| Common distributions: | | | | | | | |

| Ordinary income | | | | | $ | 22,247,602 | | $ | 31,652,741 | |

| Long-term capital gains | | | | | | 21,728,787 | | | 924,092 | |

| Returns of capital | | | | | | 2,906,778 | | | - | |

| Total common distributions | | | | | $ | 46,883,167 | | $ | 32,576,833 | |

| | | | | | | | | | | |

| Preferred distributions: | | | | | | | | | | |

| Ordinary income | | | | | $ | 2,668,326 | | $ | 3,578,224 | |

| Long-term capital gains | | | | | | 2,606,098 | | | 104,465 | |

| Total preferred distributions | | | | | $ | 5,274,424 | | $ | 3,682,689 | |

There was no tax-basis undistributed ordinary income or long term capital gains at September 30, 2007.

Use of Estimates

The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although management believes these estimates and assumptions to be reasonable and accurate, actual results could differ from those estimates.

Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FIN No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FASB Statement No. 109, Accounting for Income Taxes. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 requires recognition of tax benefits that satisfy a greater than 50% probability threshold of being sustained. FIN No. 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. FIN No. 48 is effective for the Company beginning October 1, 2007. The adoption of FIN 48 is not expected to have a significant impact on the Company’s financial statements.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

2. Summary of Significant Accounting Policies (continued)

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements, which defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. This statement is effective for the Company beginning October 1, 2008. The adoption of SFAS No. 157 is not expected to have a significant impact on the Company’s financial statements.

3. Allocations and Distributions

As set forth in the Investment Management Agreement, distributions made to common shareholders and performance fees paid to the Investment Manager with respect to any accounting period are determined as follows:

| | a) | First, 100% to the common shareholders based on their respective proportionate capital contributions as of the end of such accounting period until the amount distributed to each common shareholder, together with amounts previously distributed to such shareholder, equals a 12% annual weighted-average return on undistributed capital attributable to the common shares; |

| | b) | Then, 100% to the Investment Manager as a performance fee until the cumulative amount of such fees equals 25% of all amounts previously distributed to the common shareholders pursuant to clause (a) above; and |

| | c) | All remaining amounts: (i) 80% to the common shareholders based on their proportionate capital contributions as of the end of such accounting period and (ii) 20% to the Investment Manager as performance fee. |

The timing of distributions is determined by the Board of Directors, which has provided the Investment Manager with certain criteria for such distributions. Performance fees payable to the Investment Manager are accrued in accordance with the manner used to determine distributions as specified above. At September 30, 2007, the Company’s cumulative annual return exceeded the 12% threshold, and the Investment Manager had accrued $3,455,016 in unpaid performance fees. A liability for this amount is reflected in the accompanying financial statements. During the year ended September 30, 2007, the Company paid $20,740,000 in performance fees to the Investment Manager.

The APS dividend rate is determined by auction at periodic intervals and ranged from 6.90% to 7.56% per annum as of September 30, 2007.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

3. Allocations and Distributions (continued)

The Series Z share dividend rate is fixed at 8% per annum.

4. Management Fees and Other Expenses

Pursuant to the advisory agreement, the Investment Manager is entitled to receive an annual management and advisory fee, payable monthly in arrears, equal to 0.60% of the sum of the total common shareholder commitments, APS and debt potentially issuable in respect of such common commitments, subject to reduction by the amount of the debt when no facility is outstanding and the amount of the APS when less than $1 million in liquidation value of preferred stock is outstanding. For purposes of computing the management fee, total committed capital is $600 million consisting of $300 million of capital committed by investors to purchase the Company’s common shares, $100 million of APS and $200 million of debt. In addition, the Investment Manager is entitled to a performance fee as discussed in Note 3, above.

The Company pays all expenses incurred in connection with the business of the Company, including fees and expenses of outside contracted services, such as custodian, trustee, administrative, legal, audit and tax preparation fees, costs of valuing investments, insurance costs, brokers’ and finders’ fees relating to investments, and any other transaction costs associated with the purchase and sale of investments of the Company.

5. Senior Secured Revolving Credit Facility

The Company has entered into a credit agreement with certain lenders, which provides for a senior secured revolving credit facility (“Senior Facility”). The Senior Facility is a revolving extendible credit facility pursuant to which amounts may be drawn up to $200 million. The Senior Facility matures November 17, 2012, subject to extension by the lenders at the request of the Company for one 12-month period. Amounts outstanding under the Senior Facility at September 30, 2007 totaled $150 million. As of September 30, 2007, interest payable on amounts outstanding under the Senior Facility was $140,684. For the year ended September 30, 2007, daily weighted-average debt outstanding was $141,498,630. The weighted-average interest rate on debt outstanding during the year was 5.89%. Interest payments made under the Senior Facility totaled $8,302,338 for the year ended September 30, 2007.

Advances under the Senior Facility bear interest at either (i) the Eurodollar Rate or Commercial Paper Rate plus 0.43% per annum; or (ii) the higher of (x) the “Prime Rate” plus 0.43% per annum and (y) the “Federal Funds Effective Rate,” plus 0.50% per annum. Additionally, advances under the swingline facility bear interest at either the Eurodollar Rate or Commercial Paper Rate plus 0.43% per annum.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

5. Senior Secured Revolving Credit Facility (continued)

In addition to amounts due on outstanding debt, the Senior Facility accrues commitment fees of 0.30% per annum on the Senior Facility, or $2,208 per day when the outstanding borrowings are less than $150,000,000, subject to certain ramp-up provisions.

6. Commitments, Concentration of Credit Risk and Off-Balance Sheet Risk

The Company conducts business with brokers and dealers that are primarily headquartered in New York and Los Angeles and are members of the major securities exchanges. Banking activities are conducted with a firm headquartered in the New York area.

In the normal course of business, the Company’s securities activities involve executions, settlement and financing of various securities transactions resulting in receivables from, and payables to, brokers, dealers, and the Company’s custodian. These activities may expose the Company to risk in the event such parties are unable to fulfill contractual obligations. Management does not anticipate any losses from counterparties with whom it conducts business.

7. Preferred Capital

In addition to the APS capital described in Note 1, the Company had one Series S preferred share authorized but unissued and 312 Series Z preferred shares authorized, issued and outstanding as of September 30, 2007.

Series S Preferred Share

The Company had issued, at inception, one share of its Series S preferred shares to SVOF/MM, LLC, having a liquidation preference of $1,000 plus accumulated but unpaid dividends. SVOF/MM, LLC is controlled by the Investment Manager and owned substantially entirely by the Investment Manager and certain affiliates. On May 9, 2005, the Series S preferred share was retired and assumed the status of an authorized but unissued share. Prior to retirement, the Series S preferred shareholder was entitled to receive, as dividends, the amount of the performance allocation pursuant to Note 3, above, which is now payable to the Investment Manager as a performance fee which reduces operating income as reflected in the Statement of Operations. The retirement of the Series S preferred share had no impact on any shareholder other than the Series S preferred shareholder.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

7. Preferred Capital (continued)

Series Z Preferred Shares

The Company issued 312 shares of its Series Z preferred shares, having a liquidation preference of $500 per share plus accumulated but unpaid dividends and paying dividends at an annual rate equal to 8% of liquidation preference. The Series Z preferred shares rank on par with the APS with respect to the payment of dividends and distribution of amounts on liquidation, and vote with the APS as a single class. The Series Z preferred shares are redeemable at any time at the option of the Company and may only be transferred with the consent of the Company.

8. Shareholders’ Capital

Issuances of common stock to and subscriptions of common stock by the Company’s investors for the years ended September 30, 2007 and 2006 were as follows:

| | | | | | |

| | | Year Ended September 30, 2007 | | Year Ended September 30, 2006 | |

| Number of common shares issued | | | - | | | 311,123 | |

| Less: number of common shares subscribed in prior period | | | - | | | (16,335 | ) |

| Net increase | | | - | | | 294,788 | |

| | | | | | | | |

| Gross proceeds from share issuance | | $ | - | | $ | 180,000,000 | |

| Less: proceeds from shares subscribed in prior period | | | - | | | (9,000,000 | ) |

| Net proceeds | | $ | - | | $ | 171,000,000 | |

9. Indemnifications

The Company enters into contracts that contain a variety of indemnifications. The Company’s maximum exposure under these arrangements is unknown. However, the Company expects the risk of loss to be remote.

Special Value Expansion Fund, LLC

(A Delaware Limited Liability Company)

Notes to Financial Statements (Continued)

September 30, 2007

| | | | | | | | | | |

10. Financial Highlights | | Year Ended September 30, 2007 | | Year Ended September 30, 2006 | | Year Ended September 30, 2005 | | Period from September 1, 2004 to September 30, 2004 | |

Per Common Share (1) | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 574.80 | | $ | 550.96 | | $ | 509.44 | | $ | 499.43 | |

| | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | |

| Net investment income (loss) | | | 42.84 | | | 50.20 | | | 8.43 | | | (2.65 | ) |

| Net realized and unrealized gain | | | 50.99 | | | 54.11 | | | 79.06 | | | 14.52 | |