UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 1-32383

BLUELINX HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 77-0627356 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 4300 Wildwood Parkway, Atlanta, Georgia | | 30339 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

770-953-7000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of July 2, 2011 was $26,336,336, based on the closing price on the New York Stock Exchange of $2.24 per share on July 1, 2011.

As of February 24, 2012, the registrant had 63,726,094 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of BlueLinx Holdings Inc.’s Definitive Proxy Statement on Schedule 14A for its Annual Meeting of Stockholders, to be held on May 17, 2012, are incorporated by reference into Part III hereof.

BLUELINX HOLDINGS INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2011

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “anticipate,” “believe,” “could,” “expect,” “estimate,” “intend,” “may,” “project,” “plan,” “should,” “will be,” “will likely continue,” “will likely result” or words or phrases of similar meaning. You should read statements containing these words carefully, because they discuss our future expectations, contain projections of our future results or state other “forward-looking” information.

Forward-looking statements are based on estimates and assumptions made by us that, although believed by us to be reasonable, involve inherent risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy or actual results to differ materially from those contained in forward-looking statements. Factors you should consider that could cause these differences include, among other things:

| | • | | changes in the prices, supply and/or demand for products which we distribute, especially as a result of conditions in the residential housing market; |

| | • | | the acceptance by our customers of our privately branded products; |

| | • | | inventory levels of new and existing homes for sale; |

| | • | | general economic and business conditions in the United States; |

| | • | | the financial condition and credit worthiness of our customers; |

| | • | | the activities of competitors; |

| | • | | changes in significant operating expenses; |

| | • | | risk of losses associated with accidents; |

| | • | | exposure to product liability claims; |

| | • | | changes in the availability of capital and interest rates; |

| | • | | immigration patterns and job and household formation; |

| | • | | our ability to identify acquisition opportunities and effectively and cost-efficiently integrate acquisitions; |

| | • | | adverse weather patterns or conditions; |

| | • | | acts of war or terrorist activities, including cyber intrusion; |

| | • | | variations in the performance of the financial markets, including the credit markets; and |

| | • | | the risk factors discussed under Item 1A. Risk Factors and elsewhere in this Form 10-K. |

Forward-looking statements speak only as of the date of this Form 10-K. Except as required under federal securities laws and the rules and regulations of the SEC, we do not have any intention, and do not undertake, to update any forward-looking statements to reflect events or circumstances arising after the date of this Form 10-K, whether as a result of new information, future events or otherwise. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements included in this Form 10-K or that may be made elsewhere from time to time by or on behalf of us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

3

PART I

As used herein, unless the context otherwise requires, “BlueLinx,” the “Company,” “we,” “us” and “our” refer to BlueLinx Holdings Inc. and its subsidiaries. BlueLinx Corporation is the wholly-owned operating subsidiary of BlueLinx Holdings Inc. and is referred to herein as the “operating company” when necessary. Reference to “fiscal 2011” refers to the 52-week period ended December 31, 2011. Reference to “fiscal 2010” refers to the 52-week period ended January 1, 2011. Reference to “fiscal 2009” refers to the 52-week period ended January 2, 2010.

ITEM 1. BUSINESS.

Company Overview

BlueLinx Holdings Inc., operating through our wholly-owned subsidiary, BlueLinx Corporation, is a leading distributor of building products in the United States. We operate in all of the major metropolitan areas in the United States and, as of December 31, 2011, we distributed approximately 10,000 products from over 750 suppliers to service more than 11,500 customers nationwide, including dealers, industrial manufacturers, manufactured housing producers and home improvement retailers. We operate our distribution business from sales centers in Atlanta and Denver, and our network of approximately 55 distribution centers.

We distribute products in two principal categories: structural products and specialty products. Structural products, which represented approximately 39%, 46% and 44% of our fiscal 2011, fiscal 2010, and fiscal 2009 gross sales, respectively, include plywood, oriented strand board (“OSB”), rebar and remesh, lumber and other wood products primarily used for structural support, walls and flooring in construction projects. Specialty products, which represented approximately 61%, 54% and 56% of our fiscal 2011, fiscal 2010, and fiscal 2009 gross sales, respectively, include roofing, insulation, specialty panels, moulding, engineered wood products, vinyl products (used primarily in siding), outdoor living and metal products (excluding rebar and remesh).

Our customers include building materials dealers, industrial users of building products, manufactured housing builders and home improvement centers. We purchase products from over 750 vendors and serve as a national distributor for a number of our suppliers. We distribute products through our owned and leased fleet of over 550 trucks and over 950 trailers, as well as by common carrier.

Our principal executive offices are located at 4300 Wildwood Parkway, Atlanta, Georgia 30339 and our telephone number is (770) 953-7000. Our filings with the U.S. Securities and Exchange Commission, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports, are accessible free of charge at our official website, www.BlueLinxCo.com. We have adopted a Code of Ethics within the meaning of Item 406(b) of Regulation S-K. This Code of Ethics applies to our principal executive officer, principal financial officer and principal accounting officer. This Code of Ethics, our board committee charters and our corporate governance guidelines are publicly available without charge at www.BlueLinxCo.com or without charge upon request by writing to BlueLinx Holdings Inc., Attn: Corporate Secretary, 4300 Wildwood Parkway, Atlanta, Georgia 30339. If we make substantial amendments to our Code of Ethics or grant any waiver, including any implicit waiver, we will disclose the nature of such amendment or waiver on our website or in a report on Form 8-K. The reference to our website does not constitute incorporation by reference of the information contained at the site, and our website is not considered part of this filing.

History

We were created on March 8, 2004 as a Georgia corporation named ABP Distribution Holdings Inc. (“ABP”). ABP was owned by Cerberus Capital Management, L.P. (Cerberus Capital Management, L.P. and its subsidiaries are referred to herein as “Cerberus”), a private, New York-based investment firm, and members of our management team. Prior to May 7, 2004, certain of our assets were owned by the distribution division (the “Division”) of Georgia-Pacific Corporation (“Georgia-Pacific” or “G-P”). The Division commenced operations in 1954 with 13 warehouses primarily used as an outlet for G-P’s plywood. On May 7, 2004, G-P sold the assets of the Division to ABP. ABP subsequently merged into BlueLinx Holdings Inc. On December 17, 2004, we consummated an initial public offering of our common stock.

4

Products and Services

As of December 31, 2011, we distributed approximately 10,000 different structural and specialty products to approximately 11,500 customers nationwide. Our structural products are primarily used for structural support, walls, flooring and roofing in construction projects. Additional end-uses of our structural products include outdoor decks, sheathing, crates and boxes. Our specialty products include engineered lumber, roofing, insulation, metal products (excluding rebar and remesh), vinyl products (used primarily in siding), moulding, outdoor living and particle board. In some cases, these products are branded by us.

We also provide a wide range of value-added services and solutions to our customers and vendors including:

| | • | | providing “less-than-truckload” delivery services; |

| | • | | pre-negotiated program pricing plans; |

| | • | | automated order processing through an electronic data interchange, or EDI, that provides a direct link between us and our customers; |

| | • | | inter-modal distribution services, including railcar unloading and cargo reloading onto customers’ trucks; and |

| | • | | back-haul services, when otherwise empty trucks are returning from customer deliveries. |

Distribution Channels

We sell products through three main distribution channels:

Warehouse Sales

Warehouse sales are delivered from our warehouses to dealers, home improvement centers and industrial users. We deliver products primarily using our fleet of over 550 trucks and over 950 trailers, but also occasionally use common carriers for peak load flexibility. We operate in all of the major metropolitan areas in the United States through our network of approximately 55 distribution centers. Our warehouses have approximately ten million square feet of space under roof plus significant outdoor storage space. Warehouse sales accounted for approximately 66% of our fiscal 2011 and fiscal 2010 gross sales.

Reload Sales

Reload sales are similar to warehouse sales but are shipped from third-party warehouses where we store owned product in order to expand our geographic reach. This channel is employed primarily to service strategic customers that would be uneconomical to service from our warehouses and to distribute large volumes of imported products such as metal or hardwood plywood from port facilities. Reload sales accounted for approximately 13% and 11% of our gross sales in fiscal 2011 and fiscal 2010, respectively.

Direct Sales

Direct sales are shipped from the manufacturer to the customer without our taking physical inventory possession. This channel requires the lowest amount of committed capital and fixed costs. Direct sales accounted for approximately 21% and 23% of our fiscal 2011 and fiscal 2010 gross sales, respectively.

5

Customers

As of December 31, 2011, our customer base included approximately 11,500 customers across multiple market segments and various end-use markets, including the following types of customers:

| | • | | building materials dealers; |

| | • | | industrial users of building products; |

| | • | | manufactured housing builders; and |

| | • | | home improvement centers. |

In fiscal 2011, Lowes Companies, Inc. (and its affiliated companies) was our largest customer, accounting for approximately 10.4% of total sales. Although not anticipated in the near term, the loss of this customer could negatively impact our business.

Sales and Marketing

Our sales efforts are directed primarily through our sales force of 436 sales representatives, of which 237 are primarily located at our two sales centers in Denver and Atlanta. Within these sales centers, our sales representatives interact with our customers over the telephone. The remaining 199 sales representatives are located throughout the country and are responsible for maintaining a local dialogue with our customers, including making frequent, in-person visits.

Our sales force is separated between industrial/dealer sales and home improvement center sales. Industrial/dealer sales are managed by regional vice-presidents with sales teams organized by geographical customer regions. The majority of industrial/dealer orders are processed by telephone and are facilitated by our centralized database of customer preferences and purchasing history. We also have dedicated cross-functional customer support teams focused on strategic growth with the home improvement centers.

Suppliers

As of December 31, 2011, our vendor base included over 750 suppliers of both structural and specialty building products. In some cases, these products are branded. We have supply contracts in place with many of our vendors. Terms for these agreements frequently include prompt payment discounts, freight allowances and occasionally include volume discounts, growth incentives, marketing allowances, and consigned inventory.

On April 27, 2009, we entered into a Termination and Modification Agreement (“Modification Agreement”) related to our Master Purchase, Supply and Distribution Agreement (the “Supply Agreement”) with G-P. The Modification Agreement effectively terminated the existing Supply Agreement with respect to our distribution of G-P plywood, OSB and lumber.

G-P agreed to pay us $18.8 million in exchange for our agreement to terminate the Supply Agreement one year earlier than May 7, 2010, the termination date previously agreed upon. Under the terms of the Modification Agreement, we received four quarterly cash payments of $4.7 million, which began on May 1, 2009 and ended on February 1, 2010. As a result of the termination, we recognized a net gain of $17.8 million in fiscal 2009 as a reduction to operating expense. The gain was net of a $1.0 million write-off of an intangible asset associated with the Supply Agreement.

On February 12, 2012, our three-year purchase agreement with G-P for engineered lumber expired in accordance with its terms. We continue to distribute a variety of G-P building products, but no longer are contractually obligated to make minimum purchases of products from G-P or to purchase certain products exclusively from G-P.

Competition

The U.S. building products distribution market is a highly fragmented market, served by a small number of multi-regional distributors, several regionally focused distributors and a large number of independent local distributors. Local and regional distributors tend to be closely held and often specialize in a limited number of segments, such as the roofing segment, in

6

which they offer a broader selection of products. Some of our multi-regional competitors are part of larger companies and therefore have access to greater financial and other resources than we do. We compete on the basis of breadth of product offering, consistent availability of product, product price and quality, reputation, service and distribution facility location.

Our two largest competitors are Weyerhaeuser Company and Boise Cascade LLC. Most major markets are served by at least one of these distributors.

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors. These seasonal factors are common in the building products distribution industry. The first and fourth quarters are typically our slowest quarters due to the impact of poor weather on the construction market. Our second and third quarters are typically our strongest quarters, reflecting a substantial increase in construction due to more favorable weather conditions. Our working capital generally peaks in the third quarter, related to the building season. During fiscal year 2011 we experienced significant business disruption, in excess of normal seasonal fluctuations, due to the record snow fall in the Northeast in the winter months.

Trademarks

As of December 31, 2011, we had 41 U.S. trademark applications and registrations, one issued U.S. patent and one Canadian trademark registration. Depending on the jurisdiction, trademarks are valid as long as they are in use and/or their registrations are properly maintained and they have not become generic. Registrations of trademarks generally can be renewed indefinitely as long as the trademarks are in use. Our patent expires in September 2013. We do not believe our business is dependent on any one of our trademarks or on our patent.

Employees

As of December 31, 2011 we employed approximately 1,860 persons on a full-time basis. Approximately 30% of our employees were represented by various labor unions. As of December 31, 2011, we had 42 collective bargaining agreements, of which 5, covering approximately 80 total employees, are up for renewal in fiscal 2012. Of the five collective bargaining agreements expiring in fiscal 2012, one will expire in each of the first three quarters of fiscal 2012 and two will expire in the fourth quarter of fiscal 2012. Two additional collective bargaining agreements, which cover approximately 80 total employees will expire on December 31, 2013. Five collective bargaining agreements, covering approximately 50 employees, renewed in 2011. We consider our relationship with our employees generally to be good.

Executive Officers

The following table contains the name, age and position with our Company of each of our executive officers as of December 31, 2011.

| | September 30, | | September 30, |

Name | | Age | | Position |

George R. Judd | | 50 | | President and Chief Executive Officer |

H. Douglas Goforth | | 48 | | Chief Financial Officer and Treasurer |

Dean A. Adelman | | 46 | | Chief Administrative Officer |

Ned M. Bassil | | 46 | | Chief Supply Chain Officer |

George R. Juddhas served as our Chief Executive Officer since November 2008 and as our President since May 2004. Prior to that time, he worked for G-P in a variety of positions managing both inside and outside sales, national accounts and most recently as Vice President of Sales and Eastern Operations from 2002-2004. From 2000 until 2002, Mr. Judd worked as Vice President of the North and Midwest regions of the Distribution Division. He served as Vice President of the Southeast region from 1999 to 2000. He graduated from Western Connecticut State University in 1984 with a Bachelor’s degree in Marketing.

H. Douglas Goforthhas served as our Senior Vice President, Chief Financial Officer and Treasurer since February 2008. From November 2006 until February 2008, Mr. Goforth served as Vice President and Corporate Controller for Armor Holdings Inc. which was acquired by BAE Systems in July 2007. Previously he served as Corporate Controller for BlueLinx from May 2004 until October 2006, where he played a key role in our 2004 IPO. From 2002 until 2004 he served as

7

Controller for the Distribution Division of G-P. Mr. Goforth has 25 years of combined accounting, finance, treasury, acquisition and management experience with leading distribution and manufacturing companies including Mitsubishi Wireless Communications, Inc., Yamaha Motor Manufacturing, Inc. and Ingersoll-Rand. .Mr. Goforth is a North Carolina State Board Certified Public Accountant and earned a Bachelor of Science in Accounting from Mars Hill College in North Carolina.

Dean A. Adelmanhas served as our Chief Administrative Officer since May 2008 and as our Vice President, Human Resources since October 2005. Prior to that time, he served as Vice President Human Resources, Staff Development & Training for Corrections Corporation of America. Previously, Mr. Adelman served as Vice President Human Resources for Arby’s Inc. (formerly RTM Restaurant Group) from 1998 to 2002. From 1991 to 1998, Mr. Adelman served as senior counsel for G-P. Mr. Adelman received his Masters of Business Administration from the Kellogg School of Management at Northwestern University, a Juris Doctor degree from the University of Georgia School of Law, and a Bachelor of Arts degree from the University of Georgia.

Ned M.Bassil has served as our Senior Vice President, Chief Supply Chain Officer since December 2011. Prior to that, Mr. Bassil was a Senior Partner at Bahou Heritage a boutique firm providing large industrial clients with customized advisory services, from 2009 to 2011 and from 2006 to 2007. Mr. Bassil held the role of Group CEO at Azadea Holdings from 2008 to 2009, overseeing operations at over 350 retail outlets in 12 countries in Europe, the Middle East, & Africa, in the areas of Fashion, Food & Beverage, and Home Furnishings, in addition to Real Estate development activities. Mr. Bassil also held a number of senior management roles such as VP Global Operations, Senior VP Operations and Director of Operational Excellence, at Black & Decker from 2004 to 2005, Philips Electronics from 1998 to 2004 and Allied Signal (Honeywell) from 1996 to 1998 in the durable consumer goods, consumer electronics and lighting, and automotive industries, respectively. Mr. Bassil received his Masters of Business Administration from the Wharton School at the University of Pennsylvania, a Masters in Engineering from Youngstown State University, and a Bachelor of Science in Electrical Engineering from Youngstown State University. He is fluent in 4 languages and his experience has spanned the Americas, Europe, Asia, and the Middle East.

Environmental and Other Governmental Regulations

Our operations are subject to various federal, state, provincial and local laws, rules and regulations. We are subject to environmental laws, rules and regulations that limit discharges into the environment, establish standards for the handling, generation, emission, release, discharge, treatment, storage and disposal of hazardous materials, substances and wastes, and require cleanup of contaminated soil and groundwater. These laws, ordinances and regulations are complex, change frequently and have tended to become more stringent over time. Many of them provide for substantial fines and penalties, orders (including orders to cease operations) and criminal sanctions for violations. They may also impose liability for property damage and personal injury stemming from the presence of, or exposure to, hazardous substances. In addition, certain of our operations require us to obtain, maintain compliance with, and periodically renew permits.

Certain of these laws, including the Comprehensive Environmental Response, Compensation, and Liability Act, may require the investigation and cleanup of an entity’s or its predecessor’s current or former properties, even if the associated contamination was caused by the operations of a third party. These laws also may require the investigation and cleanup of third-party sites at which an entity or its predecessor sent hazardous wastes for disposal, notwithstanding that the original disposal activity accorded with all applicable requirements. Liability under such laws may be imposed jointly and severally, and regardless of fault.

G-P has agreed to indemnify us against any claim arising from environmental conditions that existed prior to May 7, 2004 in connection with the properties acquired when G-P sold the assets of the Division to us (see “History” above). In addition, we carry environmental insurance. While we do not expect to incur significant costs to BlueLinx arising from environmental conditions, there can be no assurance that all such costs will be covered by indemnification or insurance.

We are also subject to the requirements of the U.S. Department of Labor Occupational Safety and Health Administration, or OSHA. In order to maintain compliance with applicable OSHA requirements, we have established uniform safety and compliance procedures for our operations and implemented measures to prevent workplace injuries.

8

The U.S. Department of Transportation, or DOT, regulates our operations in domestic interstate commerce. We are subject to safety requirements governing interstate operations prescribed by the DOT. Vehicle dimensions and driver hours of service also remain subject to both federal and state regulation.

We incur and will continue to incur costs to comply with the requirements of environmental, health and safety and transportation laws, ordinances and regulations. We anticipate that these requirements could become more stringent in the future, and we cannot assure you that compliance costs will not be material.

ITEM 1A. RISK FACTORS.

In addition to the other information contained in this Form 10-K, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition, or results of operations could be materially adversely affected by any of these risks. Additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Our industry is highly cyclical, and prolonged periods of weak demand or excess supply may reduce our net sales and/or margins, which may reduce our net income or cause us to incur losses.

The building products distribution industry is subject to cyclical market pressures. Prices of building products are determined by overall supply and demand in the market for building products. Market prices of building products historically have been volatile and cyclical and we have limited ability to control the timing and amount of pricing changes for building products. Demand for building products is driven mainly by factors outside of our control, such as general economic and political conditions, interest rates, availability of mortgage financing, the construction, repair and remodeling and industrial markets, weather and population growth. The supply of building products fluctuates based on available manufacturing capacity, and excess capacity in the industry can result in significant declines in market prices for those products. To the extent that prices and volumes experience a sustained or sharp decline, our net sales and margins likely would decline as well. Because we have substantial fixed costs, a decrease in sales and margin generally may have a significant adverse impact on our financial condition, operating results and cash flows. Our results in some periods have been affected by market volatility, including a reduction in gross profits due to a decline in the resale value of our structural products inventory. All of these factors make it difficult to forecast our operating results.

Our industry is dependant on the homebuilding industry which is suffering from a prolonged significant downturn, and any further downturn or sustained continuation of the current downturn will continue to materially affect our business, liquidity and operating results.

Our sales depend heavily on the strength of national and local new residential construction and home improvement and remodeling markets. The strength of these markets depends on new housing starts and residential renovation projects, which are a function of many factors beyond our control. Some of these factors include general economic conditions, employment levels, job and household formation, interest rates, housing prices, tax policy, availability of mortgage financing, prices of commodity wood and steel products, immigration patterns, regional demographics and consumer confidence. The downturn in the residential construction market is in its sixth consecutive year and it is one of the most severe housing downturns in United States history. Along with high unemployment, tighter lending standards and general economic uncertainty, there is an oversupply of unsold homes on the market and the pool of qualified home buyers has declined significantly. Moreover, the government’s legislative and administrative measures aimed at restoring liquidity to the credit markets and providing relief to homeowners facing foreclosure have had limited results. In 2009, the government provided eligible home buyers a tax credit that was extended until April 30, 2010. As a result of the home buyers’ tax credit, the residential construction market improved during the first and second quarters of fiscal 2010, but experienced a decline in the third and fourth quarters of fiscal 2010 following expiration of the credits. While the residential construction market experienced marginal improvement in fiscal 2011, it is unclear if and to what extent the residential construction market will improve during fiscal 2012.

Our results of operations have been adversely affected by the severe downturn in new housing activity in the United States and we expect the severe downturn in new housing activity to continue to adversely affect our operating results in 2012. A prolonged continuation of the current downturn and any future downturns in the markets that we serve or in the economy generally will have a material adverse effect on our operating results, liquidity and financial condition. Reduced levels of construction activity may result in continued intense price competition among building materials suppliers, which may adversely affect our gross margins. We cannot provide assurance that our responses to the downturn or the government’s attempts to address the difficulties in the economy will be successful.

9

A significant portion of our sales are on credit to our customers. Material changes in their credit worthiness or our inability to forecast deterioration in their credit position could have a material adverse effect on our operating results, cash flow and liquidity.

The majority of our sales are on account where we provide credit to our customers. Continued market disruptions could cause additional economic downturns, which may lead to lower demand for our products and increased incidence of customers’ inability to pay their accounts. Bankruptcies by our customers may cause us to incur bad debt expense at levels higher than historically experienced. In fiscal 2011, approximately 0.1% in bad debt expense to total net sales was incurred related to credit sales. Our customers are generally susceptible to the same economic business risks as we are. Furthermore, we may not necessarily be aware of any deterioration in their financial position. If our customers’ financial position becomes impaired, it could have a significant impact on our bad debt exposure and could have a material adverse effect on our operating results, cash flow and liquidity. In addition, certain of our suppliers potentially may be impacted as well, causing disruption or delay of product availability. These events would adversely impact our results of operations, cash flows and financial position.

Our cash flows and capital resources may be insufficient to make required payments on our substantial indebtedness and future indebtedness or to maintain our required level of excess liquidity.

We have a substantial amount of debt. As of December 31, 2011, we had outstanding borrowings of $93.4 million and excess availability of $115.7 million under the terms of our U.S. revolving credit facility (the “U.S. revolving credit facility”), outstanding borrowing of $1.1 million and excess availability of $2.6 million under our Canadian revolving credit facility and outstanding letters of credit totaling $2.7 million. We also have a mortgage loan in the amount of $243.3 million.

Our substantial debt could have important consequences to you. For example, it could:

| | • | | make it difficult for us to satisfy our debt obligations; |

| | • | | make us more vulnerable to general adverse economic and industry conditions; |

| | • | | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and other general corporate requirements as our excess liquidity likely will decrease while our industry and our Company begins its recovery from the historic housing market downturn; |

| | • | | expose us to interest rate fluctuations because the interest rate on the debt under our U.S. revolving credit facility is variable; |

| | • | | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow for operations and other purposes; |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| | • | | place us at a competitive disadvantage compared to competitors that may have proportionately less debt. |

In addition, our ability to make scheduled payments or refinance our obligations depends on our successful financial and operating performance, cash flows and capital resources, which in turn depend upon prevailing economic conditions and certain financial, business and other factors, many of which are beyond our control. These factors include, among others:

| | • | | economic and demand factors affecting the building products distribution industry; |

10

| | • | | increased operating costs; |

| | • | | competitive conditions; and |

| | • | | other operating difficulties. |

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell material assets or operations, obtain additional capital or restructure our debt. Obtaining additional capital or restructuring our debt could be accomplished in part through new or additional borrowings or placements of debt or equity securities. There is no assurance that we could obtain additional capital or restructure our debt on terms acceptable to us or at all. In the event that we are required to dispose of material assets or operations to meet our debt service and other obligations, the value realized on such assets or operations will depend on market conditions and the availability of buyers. Accordingly, any such sale may not, among other things, be for a sufficient dollar amount. Our obligations under the revolving credit facilities are secured by a first priority security interest in all of our operating company’s inventories, receivables and proceeds from those items. In addition, our mortgage loan is secured by the majority of our real property. The foregoing encumbrances may limit our ability to dispose of material assets or operations. We also may not be able to restructure our indebtedness on favorable economic terms, if at all. We may incur substantial additional indebtedness in the future, including under the revolving credit facilities. Our incurrence of additional indebtedness would intensify the risks described above.

The instruments governing our indebtedness contain various covenants limiting the discretion of our management in operating our business, including requiring us to maintain a minimum level of excess liquidity.

Our revolving credit facilities and mortgage loan contain various restrictive covenants and restrictions, including financial covenants customary for asset-based loans that limit our management’s discretion in operating our business. In particular, these instruments limit our ability to, among other things:

| | • | | make investments, including capital expenditures; |

| | • | | sell or acquire assets outside the ordinary course of business; |

| | • | | engage in transactions with affiliates; and |

| | • | | make fundamental business changes. |

Under our U.S. revolving credit facility, we are required to maintain a fixed charge coverage ratio of 1.1 to 1.0 in the event our excess availability falls below the greater of $30 million or the amount equal to 15% of the lesser of the borrowing base or $400 million. If we fail to maintain this minimum excess availability, the U.S. revolving credit facility requires us to (i) maintain certain financial ratios, which we would not meet with current operating results, and (ii) limit our capital expenditures. If we fail to comply with the restrictions in the U.S. revolving credit facility, the Canadian revolving credit facility, the mortgage loan documents or any other current or future financing agreements, a default may allow the creditors under the relevant instruments to accelerate the related debt and to exercise their remedies under these agreements, which will typically include the right to declare the principal amount of that debt, together with accrued and unpaid interest and other related amounts, immediately due and payable, to exercise any remedies the creditors may have to foreclose on assets that are subject to liens securing that debt and to terminate any commitments they had made to supply further funds.

11

We are dependent upon a single supplier, G-P, for a significant percentage of our products.

Although we have been working to diversify our supplier base, we are still dependent on G-P for a significant percentage of our products. Purchases from G-P accounted for approximately 11% and 12% of our purchases during fiscal 2011 and fiscal 2010, respectively. On February 12, 2012, our three-year purchase agreement with G-P for engineered lumber expired in accordance with its terms. As of that date, we operate without a supply agreement for any of the products that we purchase from G-P. As a result, our purchases from G-P are subject to greater volatility with respect to sales terms, including volume and pricing, than when we had a long-term supply agreement in place. In addition, if we are unable to agree on supply arrangements for these products or if G-P otherwise discontinues sales of product to us, we could experience a product shortage unless and until we obtain a replacement supplier or suppliers. We may not be able to obtain replacement products on favorable economic terms. An inability to replace products on favorable economic terms could adversely impact our net sales and our costs, which in turn could impact our gross profit, net income and cash flows.

Product shortages, loss of key suppliers, and our dependence on third-party suppliers and manufacturers could affect our financial health.

Our ability to offer a wide variety of products to our customers is dependent upon our ability to obtain adequate product supply from manufacturers and other suppliers. Generally, our products are obtainable from various sources and in sufficient quantities. However, the loss of, or a substantial decrease in the availability of, products from our suppliers or the loss of key supplier arrangements could adversely impact our financial condition, operating results, and cash flows.

Although in many instances we have agreements with our suppliers, these agreements are generally terminable by either party on limited notice. Failure by our suppliers to continue to supply us with products on commercially reasonable terms, or at all, could put pressure on our gross margins or have a material adverse effect on our financial condition, operating results, and cash flows.

Our industry is highly fragmented and competitive. If we are unable to compete effectively, our net sales and operating results will be reduced.

The building products distribution industry is highly fragmented and competitive and the barriers to entry for local competitors are relatively low. Competitive factors in our industry include pricing and availability of product, service and delivery capabilities, ability to assist with problem-solving, customer relationships, geographic coverage and breadth of product offerings. Also, financial stability is important to suppliers and customers in choosing distributors for their products and affects the favorability of the terms on which we are able to obtain our products from our suppliers and sell our products to our customers.

Some of our competitors are part of larger companies and therefore have access to greater financial and other resources than us. In addition, certain product manufacturers sell and distribute their products directly to customers. Additional manufacturers of products distributed by us may elect to sell and distribute directly to end-users in the future or enter into exclusive supply arrangements with other distributors. Finally, we may not be able to maintain our costs at a level sufficiently low for us to compete effectively. If we are unable to compete effectively, our net sales and net income will be reduced.

Integrating acquisitions may be time-consuming and create costs that could reduce our operating results and cash flows.

We may elect to selectively pursue acquisitions. Any integration process may be complex and time consuming, may be disruptive to the business and may cause an interruption of, or a distraction of management’s attention from, the business as a result of a number of obstacles, including but not limited to:

| | • | | the loss of key customers of the acquired company; |

| | • | | the incurrence of unexpected expenses and working capital requirements; |

| | • | | a failure of our due diligence process to identify significant issues or contingencies; |

| | • | | difficulties assimilating the operations and personnel of the acquired company; |

12

| | • | | difficulties effectively integrating the acquired technologies with our current technologies; |

| | • | | our inability to retain key personnel of acquired entities; |

| | • | | failure to maintain the quality of customer service; |

| | • | | our inability to achieve the financial and strategic goals for the acquired and combined businesses; and |

| | • | | difficulty in maintaining internal controls, procedures and policies. |

Any of the foregoing obstacles, or a combination of them, could increase selling, general and administrative expenses in absolute terms and/or as a percentage of net sales, which could in turn negatively impact our operating results and cash flows.

We may not be able to consummate acquisitions in the future on terms acceptable to us, or at all. In addition, future acquisitions are accompanied by the risk that the obligations and liabilities of an acquired company may not be adequately reflected in the historical financial statements of that company and the risk that those historical financial statements may be based on assumptions which are incorrect or inconsistent with our assumptions or approach to accounting policies. Any of these material obligations, liabilities or incorrect or inconsistent assumptions could adversely impact our results of operations.

A significant percentage of our employees are unionized. Wage increases or work stoppages by our unionized employees may reduce our results of operations.

As of December 31, 2011, approximately 30% of our employees were represented by various labor unions. As of December 31, 2011, we had 42 collective bargaining agreements, of which 5, covering approximately 80 total employees, are up for renewal in fiscal 2012. Two additional collective bargaining agreements, which cover approximately 80 total employees, will expire on December 31, 2012. Although we have historically had good relations with our unionized employees and expect to renew the collective bargaining agreements that will expire in 2012, no assurances can be provided that we will be able to reach a timely agreement as to the renewal of the agreements and their expiration or continued expired status, as applicable, could result in a work stoppage. In addition, we may become subject to material cost increases, or additional work rules imposed by agreements with labor unions. The foregoing could increase our selling, general and administrative expenses in absolute terms and/or as a percentage of net sales. In addition, work stoppages or other labor disturbances may occur in the future, which could adversely impact our net sales and/or selling, general and administrative expenses. All of these factors could negatively impact our operating results and cash flows.

Increases in the cost of employee benefits, such as pension and other postretirement benefits, could impact our financial results and cash flow.

Unfavorable changes in the cost of our pension retirement benefits and current employees’ medical benefits could materially impact our financial results and cash flow. We sponsor several defined benefit pension plans covering substantially all of our hourly employees. Our estimates of the amount and timing of our future funding obligations for our defined benefit pension plans are based upon various assumptions. These assumptions include, but are not limited to, the discount rate, projected return on plan assets, compensation increase rates, mortality rates, retirement patterns, and turnover rates. In addition, the amount and timing of our pension funding obligations can be influenced by funding requirements that are established by the Employee Retirement Income and Security Act of 1974 (ERISA), the Pension Protection Act, Congressional Acts, or other governing bodies. During fiscal 2010 and 2011, we met our required contribution to our defined benefit pension plans. As of December 31, 2011, the net unfunded status of our benefit plan was $35.5 million. The Company’s required cash contribution to the pension plan in 2012 is approximately $4.1 million. This contribution is comprised of approximately $1.2 million related to our 2011 minimum required contribution and approximately $2.9 million related to our 2012 minimum required contribution. The Company’s minimum required contribution for plan year 2012 is $5.4 million. The Company will fund the $1.2 million related to its 2011 minimum required contribution with cash in 2012. However, in an effort to preserve additional cash for operations, we intend to seek a waiver from the Internal Revenue Service (the “IRS”) for our 2012 minimum required contribution. If we are granted the requested waiver, our contributions for 2012 will be deferred and amortized over the following five years, increasing our future minimum required contributions. No assurances can be provided, however, that any such waiver request will be granted.

13

We participate in various multi-employer pension plans in the United States. The majority of these plans are underfunded. If, in the future, we choose to withdraw from these plans, we likely would need to record a withdrawal liability, which may be material to our financial results.

The payment of dividends has been suspended, and resumption is dependant on business conditions, among other factors. Further, the instruments governing our indebtedness contain various covenants that may limit our ability to pay dividends.

We suspended the payment of dividends on our common stock for an indefinite period of time on December 5, 2007. Resumption of the payment of dividends will depend on, among other things, business conditions in the housing industry, our results of operations, cash requirements, financial condition, contractual restrictions, provisions of applicable law and other factors that our board of directors may deem relevant. Accordingly, we may not be able to resume the payment of dividends at the same quarterly rate in the future, if at all.

Federal and state transportation regulations could impose substantial costs on us which would reduce our net income.

We use our own fleet of over 550 trucks and over 950 trailers to service customers throughout the United States. The U.S. Department of Transportation, or DOT, regulates our operations in domestic interstate commerce. We are subject to safety requirements governing interstate operations prescribed by the DOT. Vehicle dimensions and driver hours of service also remain subject to both federal and state regulation. More restrictive limitations on vehicle weight and size, trailer length and configuration, or driver hours of service would increase our costs, which, if we are unable to pass these cost increases on to our customers, will increase our selling, general and administrative expenses and reduce our operating results.

Environmental laws impose risks and costs on us.

Our operations are subject to federal, state, provincial and local laws, rules and regulations governing the protection of the environment, including, but not limited to, those regulating discharges into the air and water, the use, handling and disposal of hazardous or toxic substances, the management of wastes, the cleanup of contamination and the control of noise and odors. We have made, and will continue to make, expenditures to comply with these requirements. While we believe, based upon current information, that we are in substantial compliance with all applicable environmental laws, rules and regulations, we could be subject to potentially significant fines or penalties for any failure to comply. Moreover, under certain environmental laws, a current or previous owner or operator of real property, and parties that generate or transport hazardous substances that are disposed of at that real property, may be held liable for the cost to investigate or clean up such real property and for related damages to natural resources. We may be subject to liability, including liability for investigation and cleanup costs, if contamination is discovered at one of our current or former warehouse facilities, or at a landfill or other location where we have disposed of, or arranged for the disposal of, wastes. G-P has agreed to indemnify us against any claim arising from environmental conditions that existed prior to May 7, 2004 in connection with the properties we acquired when we purchased the assets of the Division from G-P. We also carry environmental insurance. However, any remediation costs either not related to conditions existing prior to May 7, 2004 or on properties acquired after May 7, 2004 may not be covered by indemnification. In addition, certain remediation costs may not be covered by insurance. We could also be subject to claims brought pursuant to applicable laws, rules or regulations for property damage or personal injury resulting from the environmental impact of our operations. Increasingly stringent environmental requirements, more aggressive enforcement actions, the discovery of unknown conditions or the bringing of future claims may cause our expenditures for environmental matters to increase, and we may incur material costs associated with these matters.

Failure to comply with governmental laws and regulations could harm our business.

Our business is subject to regulation by various federal, state, local and foreign governmental agencies, including agencies responsible for monitoring and enforcing employment and labor laws, workplace safety, product safety, environmental laws, consumer protection laws, anti-bribery laws, import/export controls, federal securities laws and tax laws and regulations. Noncompliance with applicable regulations or requirements could subject us to investigations, sanctions, mandatory product recalls, enforcement actions, disgorgement of profits, fines, damages, civil and criminal penalties or injunctions. If any governmental sanctions are imposed, or if we do not prevail in any possible civil or criminal litigation, our business,

14

operating results and financial condition could be materially adversely affected. In addition, responding to any action will likely result in a significant diversion of management’s attention and resources and an increase in professional fees. Enforcement actions and sanctions could harm our business, operating results and financial condition.

Affiliates of Cerberus control us and may have conflicts of interest with other stockholders in the future.

Cerberus, which we refer to as the controlling stockholder, beneficially owned approximately 54% of our common stock as of December 31, 2011. As a result, the controlling stockholder will continue to be able to control the election of our directors, determine our corporate and management policies and determine, without the consent of our other stockholders, the outcome of any corporate transaction or other matter submitted to our stockholders for approval, including potential mergers or acquisitions, asset sales and other significant corporate transactions. This concentrated ownership position limits other stockholders’ ability to influence corporate matters and, as a result, we may take actions that some of our stockholders do not view as beneficial.

The controlling stockholder is controlled by Cerberus Capital Management. Four of our eight directors are, or recently were, employees of or advisors to Cerberus Capital management. The controlling stockholder also has sufficient voting power to amend our organizational documents. The interests of the controlling stockholder may not coincide with the interests of other holders of our common stock. Additionally, the controlling stockholder is in the business of making investments in companies and may, from time to time, acquire and hold interests in businesses that compete directly or indirectly with us. The controlling stockholder may also pursue, for its own account, acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. So long as the controlling stockholder continues to own a significant amount of the outstanding shares of our common stock, it will continue to be able to strongly influence or effectively control our decisions, including potential mergers or acquisitions, asset sales and other significant corporate transactions. In addition, because we are a controlled company within the meaning of the New York Stock Exchange rules, we are exempt from the NYSE requirements that our board be composed of a majority of independent directors, that our compensation committee be composed entirely of independent directors, and that we maintain a nominating/corporate governance committee composed entirely of independent directors.

Even if Cerberus no longer controls us in the future, certain provisions of our charter documents and agreements and Delaware law could discourage, delay or prevent a merger or acquisition at a premium price.

Our Amended and Restated Certificate of Incorporation and Bylaws contain provisions that:

| | • | | permit us to issue, without any further vote or action by the stockholders, up to 30 million shares of preferred stock in one or more series and, with respect to each series, to fix the number of shares constituting the series and the designation of the series, the voting powers (if any) of the shares of such series, and the preferences and other special rights, if any, and any qualifications, limitations or restrictions, of the shares of the series; and |

| | • | | limit the stockholders’ ability to call special meetings. |

These provisions may discourage, delay or prevent a merger or acquisition at a premium price.

In addition, we are subject to Section 203 of the General Corporation Law of the State of Delaware, or the DGCL, which also imposes certain restrictions on mergers and other business combinations between us and any holder of 15% or more of our common stock. Further, certain of our incentive plans provide for vesting of stock options and/or payments to be made to our employees in connection with a change of control, which could discourage, delay or prevent a merger or acquisition at a premium price.

We may incur substantial costs relating to G-P’s product liability related claims.

G-P is a defendant in suits brought in various courts around the nation by plaintiffs who allege that they have suffered personal injury as a result of exposure to products containing asbestos. These suits allege a variety of lung and other diseases based on alleged exposure to products previously manufactured by G-P. Although the terms of the asset purchase agreement provide that G-P will indemnify us against all obligations and liabilities arising out of, relating to or otherwise in any way in

15

respect of any product liability claims (including, without limitation, claims, obligations or liabilities relating to the presence or alleged presence of asbestos-containing materials) with respect to products purchased, sold, marketed, stored, delivered, distributed or transported by G-P and its affiliates, including the Division prior to the acquisition, it could be possible that circumstances may arise under which asbestos-related claims against G-P could cause us to incur substantial costs.

For example, in the event that G-P is financially unable to respond to an asbestos product liability claim, plaintiffs’ lawyers may, in order to obtain recovery, attempt to sue us, in our capacity as owner of assets sold by G-P, despite the fact that the assets sold to us did not contain asbestos. Asbestos litigation has, over the years, proved unpredictable, as the aggressive and well-financed asbestos plaintiffs’ bar has been creative, and often successful, in bringing claims based on novel legal theories and on expansive interpretations of existing legal theories. These claims have included claims against companies that did not manufacture asbestos products. As a result of these factors, a number of companies have been held liable for amounts far in excess of their perceived exposure. Although we believe, based on our understanding of the law as currently interpreted, that we should not be held liable for any of G-P’s asbestos-related claims, and, to the contrary, that we would prevail on summary judgment on any such claims, there is nevertheless a possibility that new theories could be developed, or that the application of existing theories could be expanded, in a manner that would result in liability for us. Any such liability ultimately could be borne by us if G-P is unable to fulfill its indemnity obligation under the asset purchase agreement with us.

We are subject to cybersecurity risks and may incur increasing costs in an effort to minimize those risks.

Our business employs systems and a website that allow for the secure storage and transmission of customers’ proprietary information. Security breaches could expose us to a risk of loss or misuse of this information, litigation and potential liability. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber attacks. Any compromise of our security could result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, and a loss of confidence in our security measures, which could harm our business. As cyber attacks become more sophisticated generally, we may be required to incur significant costs to strengthen our systems from outside intrusions and/or obtain insurance coverage related to the threat of such attacks.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

We own 53 warehouse facilities and lease 2 additional warehouse facilities. The total square footage under roof at our owned and leased warehouses is approximately 10 million square feet. Our Denver sales center and 52 of our owned warehouse facilities secure our mortgage loan.

Our corporate headquarters located at 4300 Wildwood Parkway, Atlanta, Georgia 30339 is approximately 150,000 square feet. During the fourth quarter of fiscal 2007, as part of a restructuring effort, we vacated approximately 100,000 square feet of our corporate headquarters space in the building located at 4100 Wildwood Parkway, Atlanta, Georgia 30339. During the third quarter of fiscal 2011, we entered into an amendment to our corporate headquarters lease in Atlanta, Georgia related to the unoccupied 4100 building. This amendment released us from our obligations with respect to this unoccupied space as of January 31, 2012, in exchange for a $5.0 million space remittance fee. In addition, we are obligated to pay $1.2 million on or before December 31, 2013 to be used for tenant improvements. The provisions relating to the occupied 4300 building remain unchanged. Under the existing provisions, the current term of the lease ends on January 31, 2019. The amendment resulted in a reduction of our restructuring reserve of approximately $2.0 million, with the credit recorded in “Selling, general, and administrative” expenses in the Consolidated Statements of Operations.

The following table summarizes our real estate facilities including their inside square footage:

| | | September 30, | | | | September 30, | | | | September 30, | |

Facility Type | | Number | | | Owned

Facilities (ft(2)) | | | Leased

Facilities (ft(2)) | |

Office Space(1) | | | 3 | | | | 68,721 | | | | 251,885 | |

Warehouses | | | 55 | | | | 9,585,733 | | | | 320,675 | |

| | | | | | | | | | | | |

TOTAL | | | 58 | | | | 9,654,454 | | | | 572,560 | |

| | | | | | | | | | | | |

| (1) | Includes corporate headquarters in Atlanta, the Denver Sales Center and a call center in Vancouver. |

16

We also store materials outdoors, such as lumber and rebar, at all of our warehouse locations, which increases their distribution and storage capacity. We believe that substantially all of our property and equipment is in good condition, subject to normal wear and tear. We believe that our facilities have sufficient capacity to meet current and projected distribution needs.

ITEM 3. LEGAL PROCEEDINGS.

BlueLinx, its directors, and Cerberus ABP Investor LLC (“CAI”) were named as defendants in the following putative shareholder class actions filed in the Superior Courts of Fulton and Cobb Counties, Georgia, the United States District Court for the Northern District of Georgia, the Chancery Court for the State of Delaware, and the Supreme Court of the State of New York in connection with the proposed tender offer announced by CAI on July 21, 2010 and commenced by CAI on August 2, 2010:Habiniak, et al. v. Cohen, et al., Fulton County Superior Court, Georgia, filed July 23, 2010, voluntarily dismissed August 11, 2010;Hindermann, et al. v. BlueLinx Holdings Inc.,et al., Cobb County Superior Court, Georgia, filed July 27, 2010, dismissed December 14, 2010;Markich, et al v. BlueLinx Holdings Inc., et al., Cobb County Superior Court, Georgia, filed July 30, 2010, dismissed December 14, 2010;Jerszynski v. BlueLinx Holdings Inc., et al., Cobb County Superior Court, Georgia, filed August 3, 2010, dismissed December 14, 2010;Winter v. Cerberus ABP Investor LLC, Cobb County Superior Court, Georgia, filed August 4, 2010, dismissed December 14, 2010;Stadium Capital Qualified Partners, LP, et al. v. Cerberus ABP Investor LLC, etc al., Delaware Chancery Court, filed August 10, 2010, voluntarily dismissed October 20, 2010;Habiniak, et al. v. Cohen, et al., Delaware Chancery Court, filed August 13, 2010, voluntarily dismissed February 10, 2011;Lang et al v. Cohen, et al., Delaware Chancery Court, filed August 13, 2010;Kajaria, et al. v. Cohen, et al.,U.S. District Court, Northern District of Georgia, filed September 30, 2010, motion for fees filed on June 16, 2011, opposition filed on June 30, 2011; andCentonze, et al. v. Judd, et al., Supreme Court of New York, New York County, filed on October 4, 2010. Certain of the complaints also named Cerberus Capital Management L.P. as a defendant. The complaints sought to enjoin the proposed tender offer, alleging that the Company’s directors and CAI breached their fiduciary duties by, among other things, failing to make certain disclosures and maximize the value to be received by our stockholders. The complaints also asserted claims of aiding and abetting breach of fiduciary duty. In addition to an order enjoining the transaction, the complaints variously sought, among other things: additional disclosures regarding the proposed transaction; imposition of a constructive trust in favor of plaintiffs for any improper benefits received by defendants; rescission of the transaction, if consummated, or an award to plaintiffs of rescissory damages; and attorneys’ fees and expenses. As a result of the expiration of the tender offer, all of these matters have been voluntarily dismissed and did not have a material effect on our financial statements.

We are, and from time to time may be, a party to routine legal proceedings incidental to the operation of our business. The outcome of any pending or threatened proceedings is not expected to have a material adverse effect on our financial condition, operating results or cash flows, based on our current understanding of the relevant facts. We establish reserves for pending or threatened proceedings when the costs associated with such proceedings become probable and can be reasonably estimated.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

17

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our equity securities consist of one class of common stock. The common stock began trading on December 16, 2004. The common stock is traded on the New York Stock Exchange under the symbol “BXC”. The following table sets forth, for the periods indicated, the range of the high and low sales prices for the common stock as quoted on the New York Stock Exchange:

| | | September 30, | | | | September 30, | |

| | | High | | | Low | |

Fiscal Year Ended December 31, 2011 | | | | | | | | |

First Quarter | | $ | 3.90 | | | $ | 3.41 | |

Second Quarter | | $ | 4.35 | | | $ | 2.23 | |

Third Quarter | | $ | 2.40 | | | $ | 1.39 | |

Fourth Quarter | | $ | 1.90 | | | $ | 1.25 | |

Fiscal Year Ended January 1, 2011 | | | | | | | | |

First Quarter | | $ | 4.11 | | | $ | 2.51 | |

Second Quarter | | $ | 6.32 | | | $ | 2.30 | |

Third Quarter | | $ | 4.10 | | | $ | 2.24 | |

Fourth Quarter | | $ | 4.00 | | | $ | 2.94 | |

As of February 24, 2012, there were 55 registered stockholders, and, as of that date we estimate there were approximately 2,200 beneficial owners holding our common stock in nominee or “street” name.

In December 2007, we suspended the payment of dividends on our common stock for an indefinite period of time. Resumption of the payment of dividends will depend on, among other things, business conditions in the housing industry, our results of operations, cash requirements, financial condition, contractual restrictions, provisions of applicable law and other factors that our board of directors may deem relevant. See “Item 8. Financial Statements and Supplementary Data, Note 10. Revolving Credit Facilities” for additional information regarding limitations on the ability of BlueLinx Corporation to transfer funds to its parent, BlueLinx Holdings Inc., which could impact our ability to pay dividends to our stockholders. Accordingly, we may not be able to resume the payment of dividends at the same quarterly rate in the future, if at all.

18

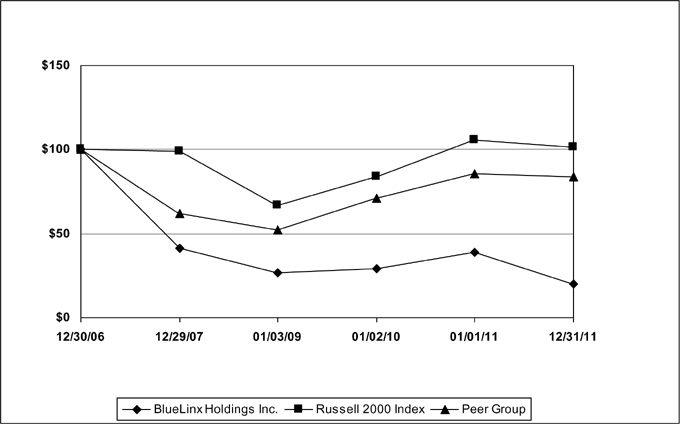

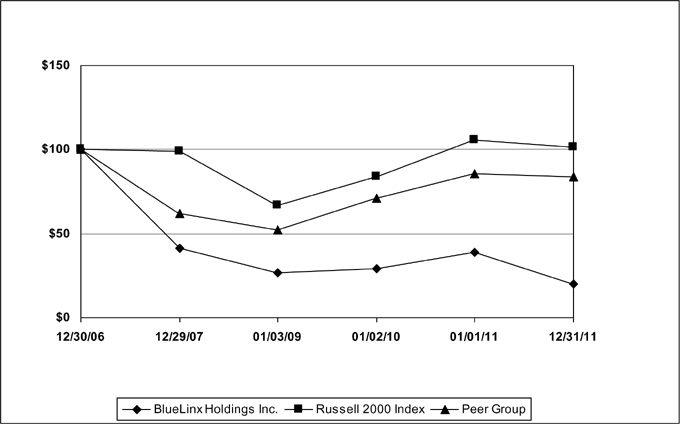

Performance Graph

The chart below compares the quarterly percentage change in the cumulative total stockholder return on our common stock with the cumulative total return on the Russell 2000 Index and a peer group index for the period commencing December 30, 2006 and ending December 31, 2011, assuming an investment of $100 and the reinvestment of any dividends.

Our peer group index was selected by us and is comprised of reporting companies with lines of business and product offerings that are comparable to ours and which we believe most accurately represent our business. Our peer group consists of the following companies: Beacon Roofing Supply Inc., Builders Firstsource, Building Materials HLDG CP (through January 4, 2010), Huttig Building Products Inc., Interline Brands Inc., Universal Forest Products Inc. and Watsco Inc.

Comparison of Cumulative Total Return

Cumulative Total Return

Years Ending

| | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | |

| | | Base Period | | | | | | | | | | | | | | | | |

Company Name/Index | | 12/30/06 | | | 12/29/07 | | | 01/03/09 | | | 01/02/10 | | | 01/01/11 | | | 12/31/11 | |

BlueLinx Holdings Inc. | | | 100 | | | | 41.52 | | | | 26.52 | | | | 29.27 | | | | 38.67 | | | | 19.97 | |

Russell 2000 Index | | | 100 | | | | 99.17 | | | | 66.50 | | | | 83.51 | | | | 105.93 | | | | 101.51 | |

Peer Group | | | 100 | | | | 61.69 | | | | 52.50 | | | | 70.86 | | | | 85.76 | | | | 83.51 | |

19

ITEM 6. SELECTED FINANCIAL DATA.

The following table sets forth certain historical financial data of our Company. The selected financial data for the fiscal years ended December 31, 2011, January 1, 2011, January 2, 2010, January 3, 2009 and December 29, 2007 have been derived from our audited financial statements included elsewhere in this Annual Report on Form 10-K or from prior financial statements. The following information should be read in conjunction with our financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | |

| | | Year Ended

December 31,

2011 | | | Year Ended

January 1,

2011 | | | Year Ended

January 2,

2010 | | | Year Ended

January 3,

2009 | | | Year Ended

December 29,

2007 | |

| | | (In thousands, except per share data) | |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,755,431 | | | $ | 1,804,418 | | | $ | 1,646,108 | | | $ | 2,779,699 | | | $ | 3,833,910 | |

Cost of sales | | | 1,545,282 | | | | 1,593,745 | | | | 1,452,947 | | | | 2,464,766 | | | | 3,441,964 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 210,149 | | | | 210,673 | | | | 193,161 | | | | 314,933 | | | | 391,946 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 207,857 | | | | 221,185 | | | | 210,214 | | | | 303,403 | | | | 372,754 | |

Net gain from terminating the Georgia-Pacific supply agreement | | | — | | | | — | | | | (17,772 | ) | | | — | | | | — | |

| | | | | |

Depreciation and amortization | | | 10,562 | | | | 13,365 | | | | 16,984 | | | | 20,519 | | | | 20,924 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 218,419 | | | | 234,550 | | | | 209,426 | | | | 323,922 | | | | 393,678 | |

| | | | | | | | | | | | | | | | | | | | |

Operating loss | | | (8,270 | ) | | | (23,877 | ) | | | (16,265 | ) | | | (8,989 | ) | | | (1,732 | ) |

Non-operating expenses (income): | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | 30,510 | | | | 33,788 | | | | 32,456 | | | | 38,547 | | | | 43,660 | |

Changes associated with the ineffective interest rate swap | | | (1,676 | ) | | | (4,603 | ) | | | 6,252 | | | | — | | | | — | |

Write-off of debt issue costs | | | — | | | | 183 | | | | 1,407 | | | | — | | | | — | |

Other expense (income), net | | | 501 | | | | 587 | | | | 519 | | | | 601 | | | | (370 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss before provision for (benefit from) income taxes | | | (37,605 | ) | | | (53,832 | ) | | | (56,899 | ) | | | (48,137 | ) | | | (45,022 | ) |

Provision for (benefit from) income taxes | | | 962 | | | | (589 | ) | | | 4,564 | | | | (16,434 | ) | | | (17,077 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (38,567 | ) | | $ | (53,243 | ) | | $ | (61,463 | ) | | $ | (31,703 | ) | | $ | (27,945 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic weighted average number of common shares outstanding | | | 43,187 | | | | 30,688 | | | | 31,017 | | | | 31,083 | | | | 30,848 | |

Basic net loss per share applicable to common stock | | $ | (0.89 | ) | | $ | (1.73 | ) | | $ | (1.98 | ) | | $ | (1.02 | ) | | $ | (0.91 | ) |

Diluted weighted average number of common shares outstanding | | | 43,187 | | | | 30,688 | | | | 31,017 | | | | 31,083 | | | | 30,848 | |

Diluted net loss per share applicable to common stock | | $ | (0.89 | ) | | $ | (1.73 | ) | | $ | (1.98 | ) | | $ | (1.02 | ) | | $ | (0.91 | ) |

Dividends declared per share of common stock | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 0.50 | |

| | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | |

| | | Year Ended

December 31,

2011 | | | Year Ended

January 1,

2011 | | | Year Ended

January 2,

2010 | | | Year Ended

January 3,

2009 | | | Year Ended

December 29,

2007 | |

| | | (In thousands, except per share data) | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | $ | 7,222 | | | $ | 4,092 | | | $ | 1,815 | | | $ | 4,919 | | | $ | 13,141 | |

EBITDA(1) | | | 1,790 | | | | (11,099 | ) | | | 200 | | | | 10,929 | | | | 19,562 | |

Net cash (used in) provided by operating activities | | | (49,643 | ) | | | (29,909 | ) | | | (19,853 | ) | | | 190,390 | | | | 79,842 | |

Net cash provided by (used in) investing activities | | | 11,133 | | | | (3,381 | ) | | | 12,636 | | | | 985 | | | | (9,070 | ) |

Net cash provided by (used in) financing activities | | | 29,111 | | | | 18,130 | | | $ | (113,679 | ) | | $ | (56,781 | ) | | $ | (82,055 | ) |

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 4,898 | | | $ | 14,927 | | | $ | 29,457 | | | $ | 150,353 | | | $ | 15,759 | |

Working capital | | | 233,414 | | | | 236,168 | | | | 247,722 | | | | 320,527 | | | | 448,731 | |

Total assets | | | 503,915 | | | | 525,019 | | | | 546,846 | | | | 729,178 | | | | 883,436 | |

Total debt(2) | | | 337,741 | | | | 382,869 | | | | 341,669 | | | | 444,870 | | | | 478,535 | |

Stockholders’ equity | | | 8,374 | | | | 991 | | | $ | 50,820 | | | $ | 102,852 | | | $ | 154,823 | |

20