MANITEX INTERNATIONAL, INC. NASDAQ: MNTX Fourth Quarter Earnings Conference Call March 11, 2021 Exhibit 99.2

Forward-Looking Statement and Non-GAAP Measures Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. NASDAQ : MNTX

Business Update NASDAQ : MNTX Highlights 24% revenue growth in Q4 vs Q3 and expected to continue into 2021 Operating Income increased in Q4 vs Q3 and expected to continue into 2021 Backlog of $82.2 million at 3-year high with orders remaining strong through March 2021 PM Group backlog growth is driving sales Valla zero-emission industrial cranes at record backlog and gaining market share Continuing to launch new and innovative products for the construction and utility industries \Balance Sheet and Credit $30 million Total Net Debt $29 million in Total Cash and Credit Availability Facilities Continuing stringent COVID-19 protocols with effective mitigation and following all health and safety guidelines All facilities currently operational Ramping up production globally to meet backlog demand

The Takeaways – Q4 and FY 2020 Performance in Q4 was again led by PM global business PM Backlog representing over 50% consolidated total backlog PM Group Adjusted EBITDA trending higher Oil & Steel Aerials sales being driven by new product launches Valla zero-emission cranes backlog at record level, now exceeding $5M North American market conditions remains pressured: Implemented restructuring plan to save an annualized $4.5M Seeing modest recovery in unit orders for straight mast MAC products 50% higher for full year Manitex remains the market leader and well-positioned for economic recovery in boom trucks Greater than 35% market share of 2020 industry orders Began shipments of our first utility-specific boom truck Launched a 65-ton boom truck \ NASDAQ : MNTX

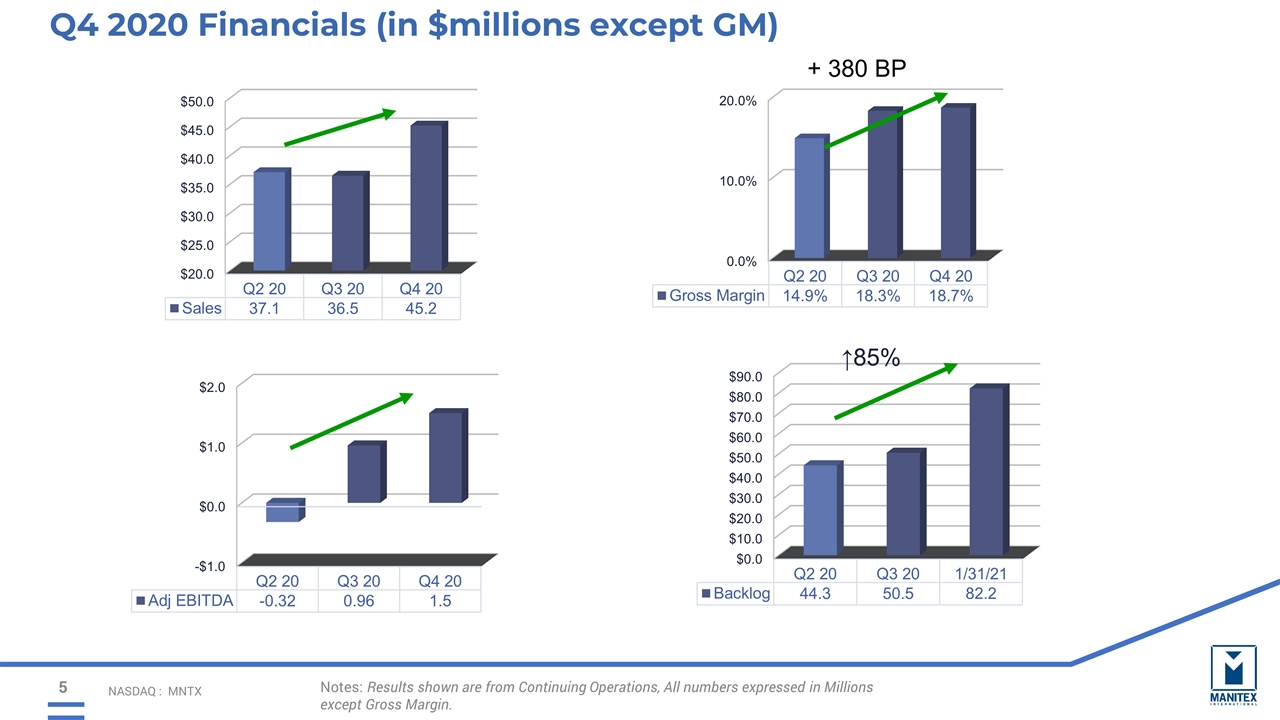

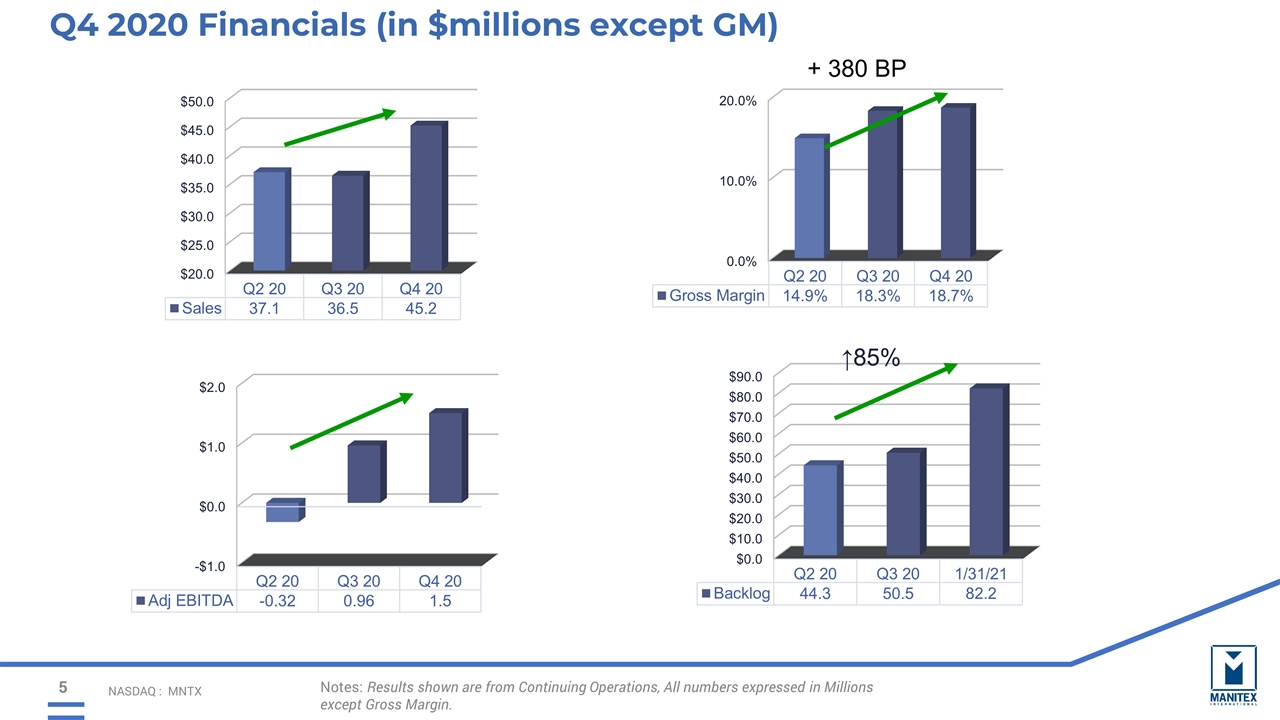

NASDAQ : MNTX Notes: Results shown are from Continuing Operations, All numbers expressed in Millions except Gross Margin. Q4 2020 Financials (in $millions except GM) + 380 BP

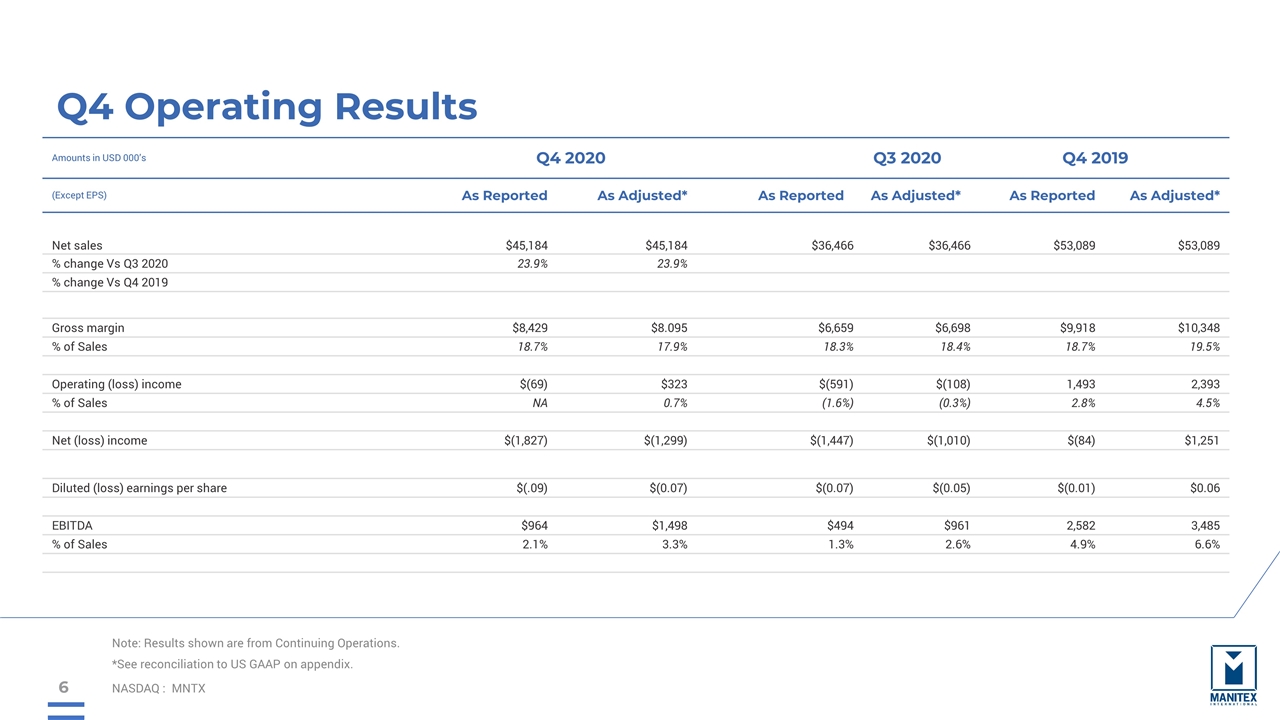

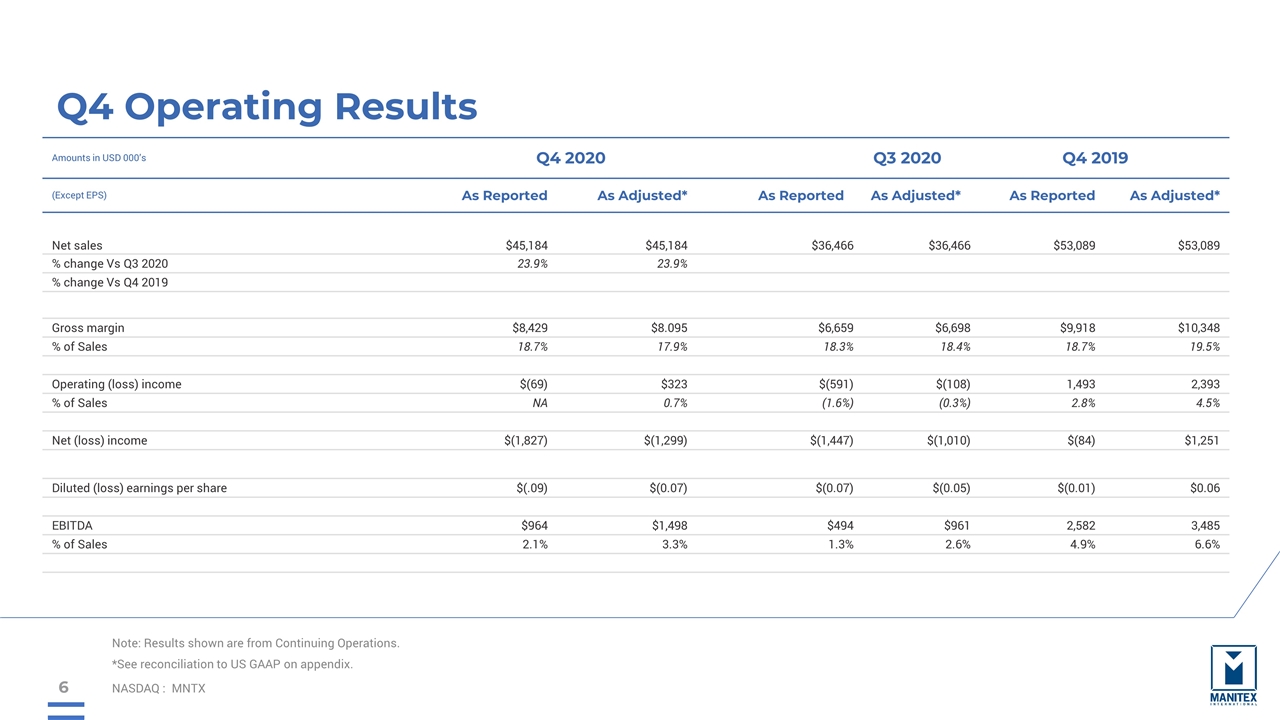

Q4 Operating Results NASDAQ : MNTX Amounts in USD 000’s Q4 2020 Q3 2020 Q4 2019 (Except EPS) As Reported As Adjusted* As Reported As Adjusted* As Reported As Adjusted* Net sales $45,184 $45,184 $36,466 $36,466 $53,089 $53,089 % change Vs Q3 2020 23.9% 23.9% % change Vs Q4 2019 Gross margin $8,429 $8.095 $6,659 $6,698 $9,918 $10,348 % of Sales 18.7% 17.9% 18.3% 18.4% 18.7% 19.5% Operating (loss) income $(69) $323 $(591) $(108) 1,493 2,393 % of Sales NA 0.7% (1.6%) (0.3%) 2.8% 4.5% Net (loss) income $(1,827) $(1,299) $(1,447) $(1,010) $(84) $1,251 Diluted (loss) earnings per share $(.09) $(0.07) $(0.07) $(0.05) $(0.01) $0.06 EBITDA $964 $1,498 $494 $961 2,582 3,485 % of Sales 2.1% 3.3% 1.3% 2.6% 4.9% 6.6% Note: Results shown are from Continuing Operations. *See reconciliation to US GAAP on appendix.

Net Debt – Update Q4 2020 NASDAQ : MNTX USD millions Q4 2020 Q3 2020 Q2 2020 Q1 2020 Q4 2019 Short term debt $16.5 $17.8 $17.6 $19.0 $18.2 Bank term debt – long term 13.6 15.4 19.4 19.1 19.4 Finance leases 4.6 4.7 4.8 4.9 5.1 Convertible notes 0.0 15.4 15.4 15.3 22.1 Revolver 12.6 5.0 8.5 6.0 - Total debt $47.3 $58.3 $65.7 $64.3 $64.8 Total cash $17.4 $23.6 $31.3 $22.3 $23.6 Net debt $29.9 $34.7 $34.4 $42.0 $41.2

Q1 2021 Outlook NASDAQ : MNTX Prioritize the safety of our team for duration of COVID-19 and beyond Launching new products in aerials, electric cranes, and higher capacity boom trucks Gradual ramping of production to meet backlog globally, should lead to consistent improvements at top and bottom lines Q1 2021 revenues expected to show modest sequential growth Focus on cash generation and Adjusted EBITDA margin target of 10%

APPENDIX_- SUPPLEMENTAL FINANCIALS

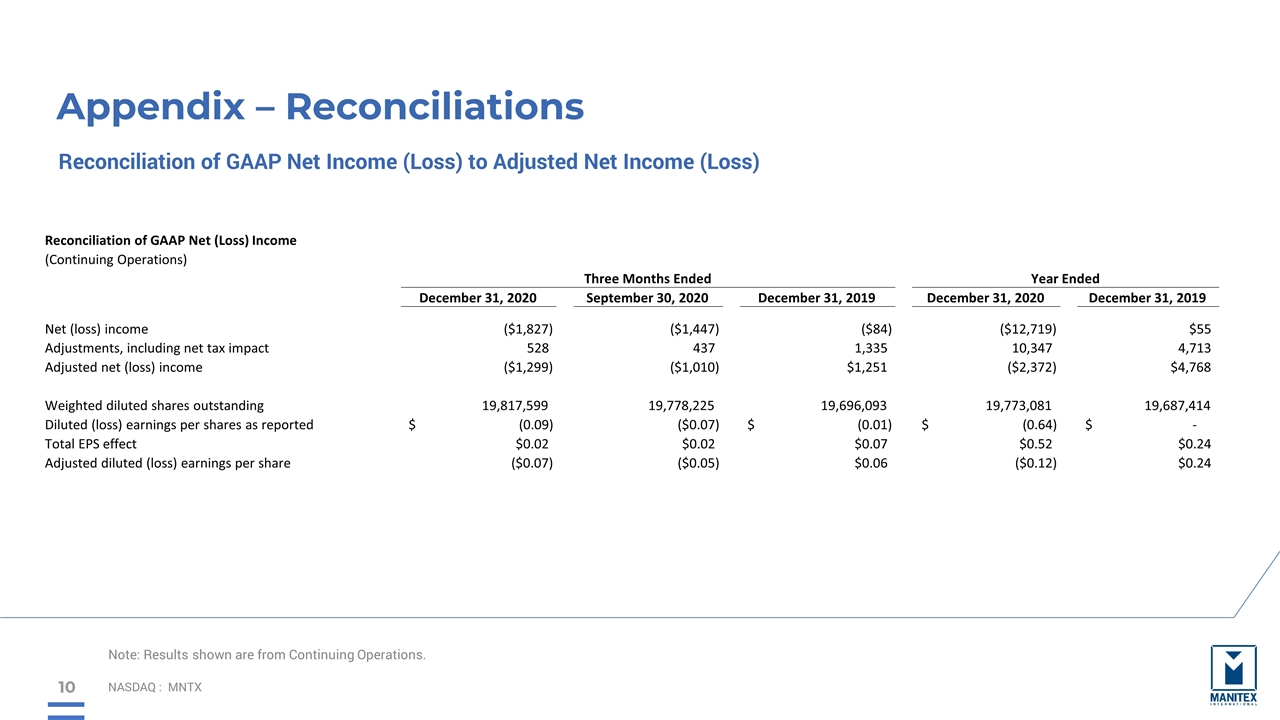

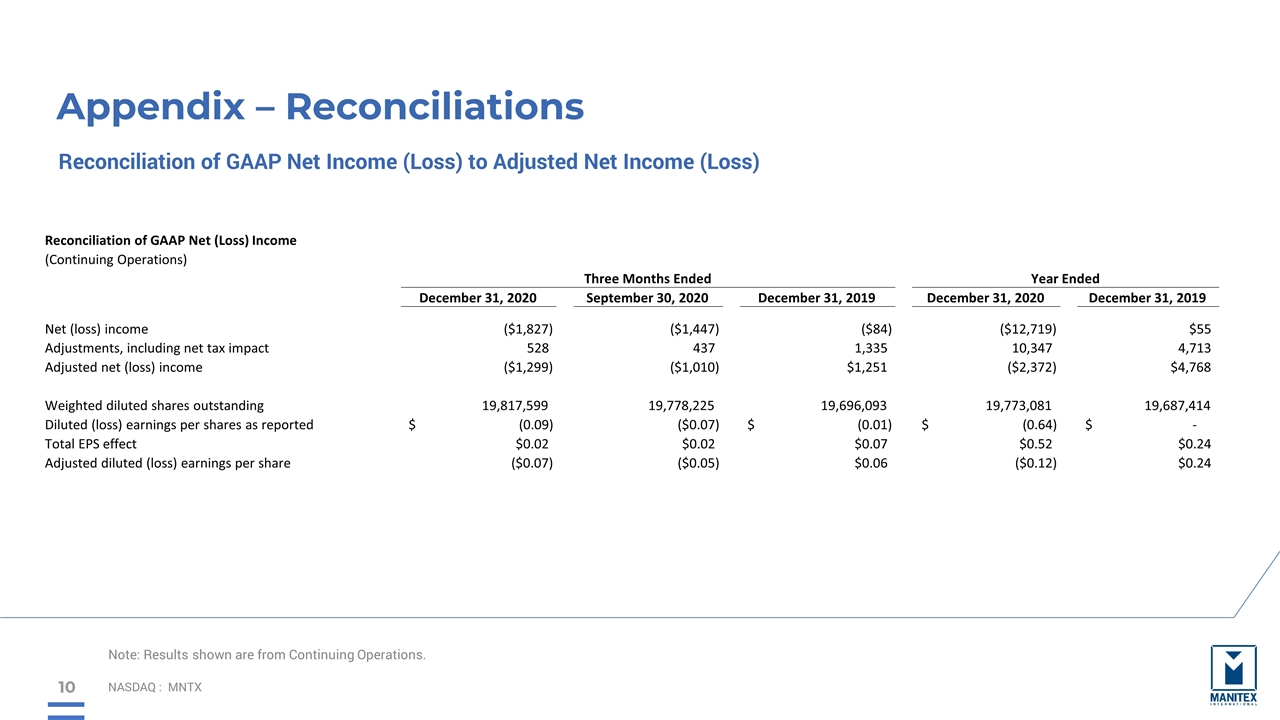

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss) Note: Results shown are from Continuing Operations. Reconciliation of GAAP Net (Loss) Income (Continuing Operations) December 31, 2020 September 30, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Net (loss) income ($1,827) ($1,447) ($84) ($12,719) $55 Adjustments, including net tax impact 528 437 1,335 10,347 4,713 Adjusted net (loss) income ($1,299) ($1,010) $1,251 ($2,372) $4,768 Weighted diluted shares outstanding 19,817,599 19,778,225 19,696,093 19,773,081 19,687,414 Diluted (loss) earnings per shares as reported (0.09) $ ($0.07) (0.01) $ (0.64) $ - $ Total EPS effect $0.02 $0.02 $0.07 $0.52 $0.24 Adjusted diluted (loss) earnings per share ($0.07) ($0.05) $0.06 ($0.12) $0.24 Three Months Ended Year Ended

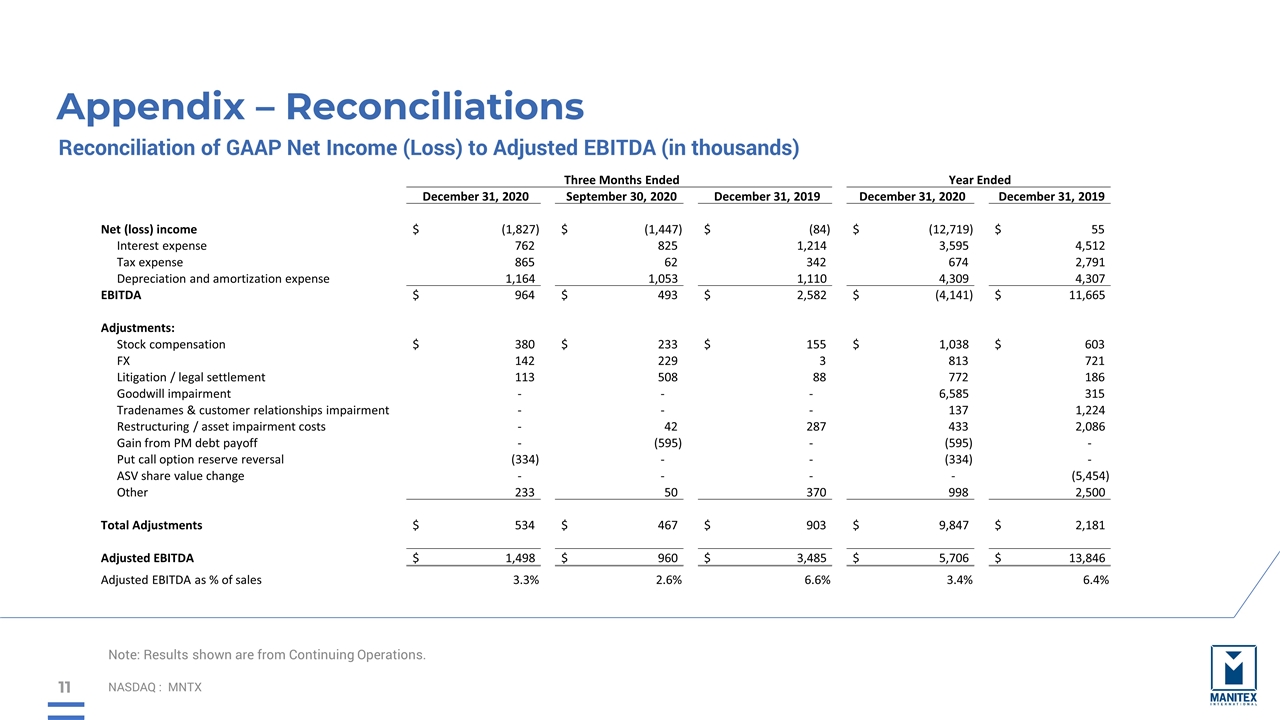

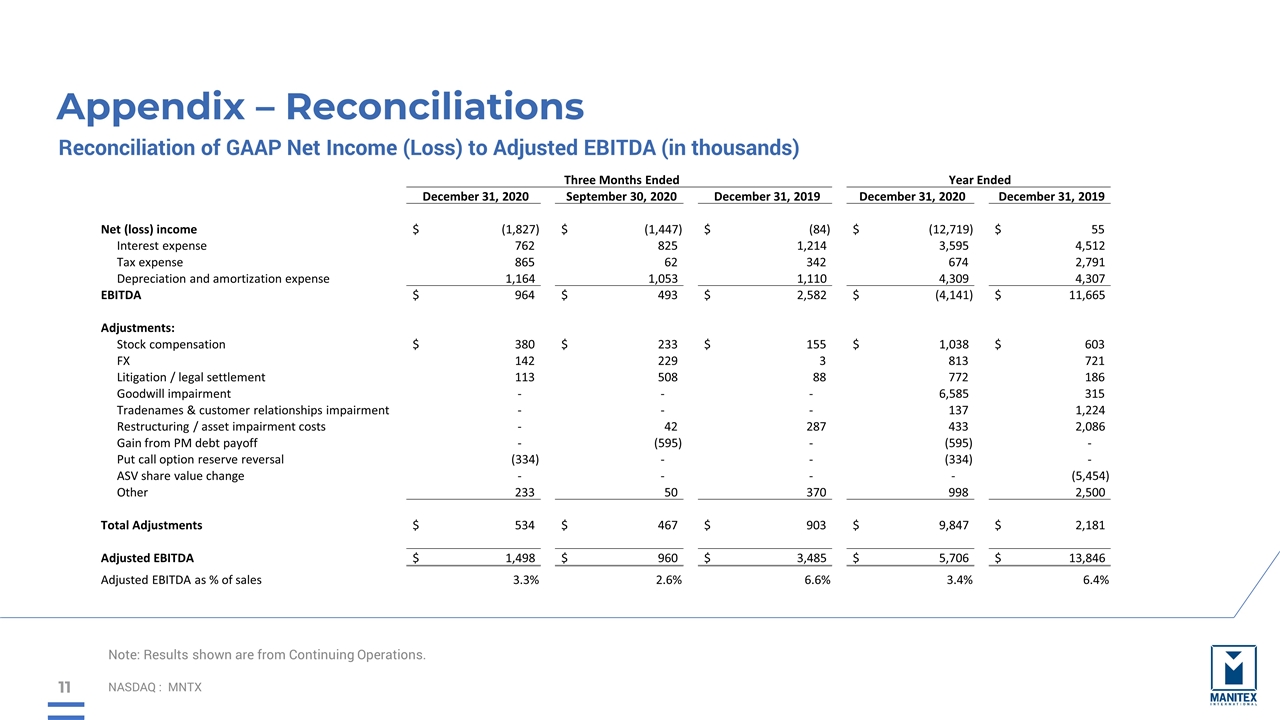

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (in thousands) Note: Results shown are from Continuing Operations. December 31, 2020 September 30, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Net (loss) income (1,827) $ (1,447) $ (84) $ (12,719) $ 55 $ Interest expense 762 825 1,214 3,595 4,512 Tax expense 865 62 342 674 2,791 Depreciation and amortization expense 1,164 1,053 1,110 4,309 4,307 EBITDA 964 $ 493 $ 2,582 $ (4,141) $ 11,665 $ Adjustments: Stock compensation 380 $ 233 $ 155 $ 1,038 $ 603 $ FX 142 229 3 813 721 Litigation / legal settlement 113 508 88 772 186 Goodwill impairment - - - 6,585 315 Tradenames & customer relationships impairment - - - 137 1,224 Restructuring / asset impairment costs - 42 287 433 2,086 Gain from PM debt payoff - (595) - (595) - Put call option reserve reversal (334) - - (334) - ASV share value change - - - - (5,454) Other 233 50 370 998 2,500 Total Adjustments 534 $ 467 $ 903 $ 9,847 $ 2,181 $ Adjusted EBITDA 1,498 $ 960 $ 3,485 $ 5,706 $ 13,846 $ Adjusted EBITDA as % of sales 3.3% 2.6% 6.6% 3.4% 6.4% Three Months Ended Year Ended

Steve Filipov, CEO Manitex International 708-237-2054 Peter Seltzberg, IR Darrow Associates, Inc. 516-419-9915 MANITEX INTERNATIONAL, INC. NASDAQ: MNTX Fourth Quarter Earnings Conference Call March 11, 2021