MANITEX INTERNATIONAL, INC. NASDAQ: MNTX First Quarter 2021 Earnings Conference Call May 6, 2021 Exhibit 99.2

Forward-Looking Statement and Non-GAAP Measures Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. NASDAQ : MNTX

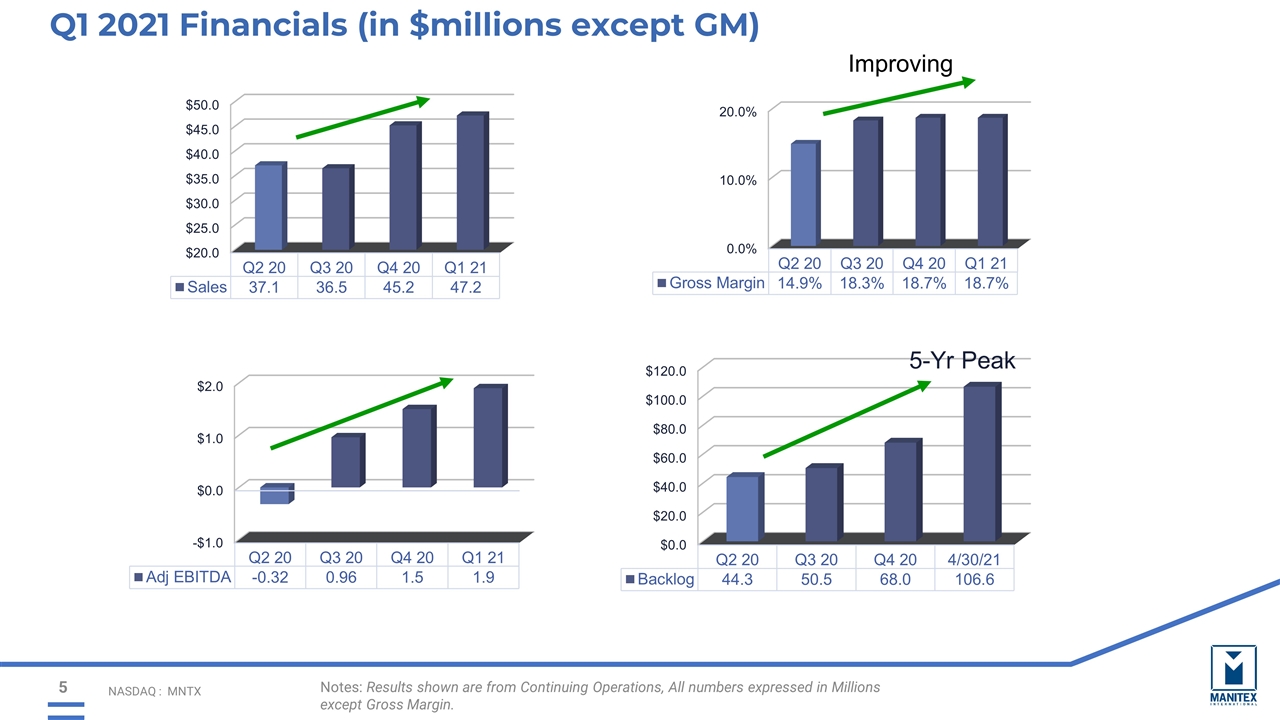

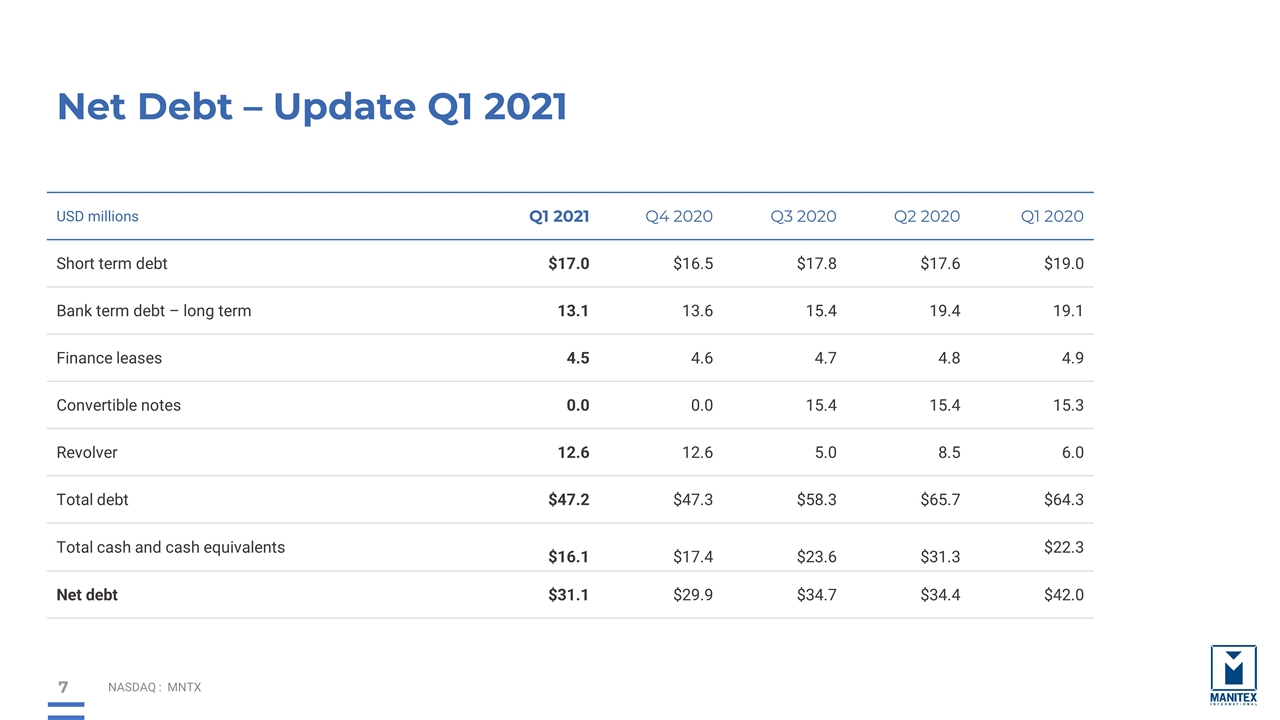

Business Update NASDAQ : MNTX Highlights Revenue growth of 4% in Q1 2021 vs Q4 2020 Third consecutive quarter of EBITDA margin expansion Strong increase in demand with production ramping up to pre-pandemic levels Backlog of $107 million is at 5-year high; order rate remains strong PM Group backlog continues to grow globally Manitex backlog steady improvement in North America Valla zero-emission industrial cranes remain strong and gaining market share Balance Sheet and Credit $31 million Total Net Debt $28 million in Total Cash and Credit Availability Improved Operating Cash Flow at PM Group Operations Continued focus on COVID-19 health and safety protocols All facilities currently operational and ramping up to meet higher demand Supply chain constraints remain challenging and higher input costs being managed daily with our suppliers Disciplined pricing and discount structures implemented with our dealers and customers

The Takeaways – Q1 2021 Performance in Q1 was consistent throughout our global portfolio: North American straight mast sales drove a significant portion of sequential revenue growth Straight mast market recovery starting to take hold Dealer network ordering products with expected improvement demand MAC products continue improve share and backlog PM Group performance contributing to higher consolidated Adjusted EBITDA and global growth Global knuckle boom market steadily growing Gaining share in most European markets as demand improves Developing new dealers and end markets such as utility, waste management, tree care and special rail applications Oil & Steel Aerials global growth and market share gains continue Rental customers regaining confidence as market improves European market driving growth Valla zero-emission cranes ramping up to meet higher demand Started delivery to a major European rental customer Launching new products to increase share growth NASDAQ : MNTX

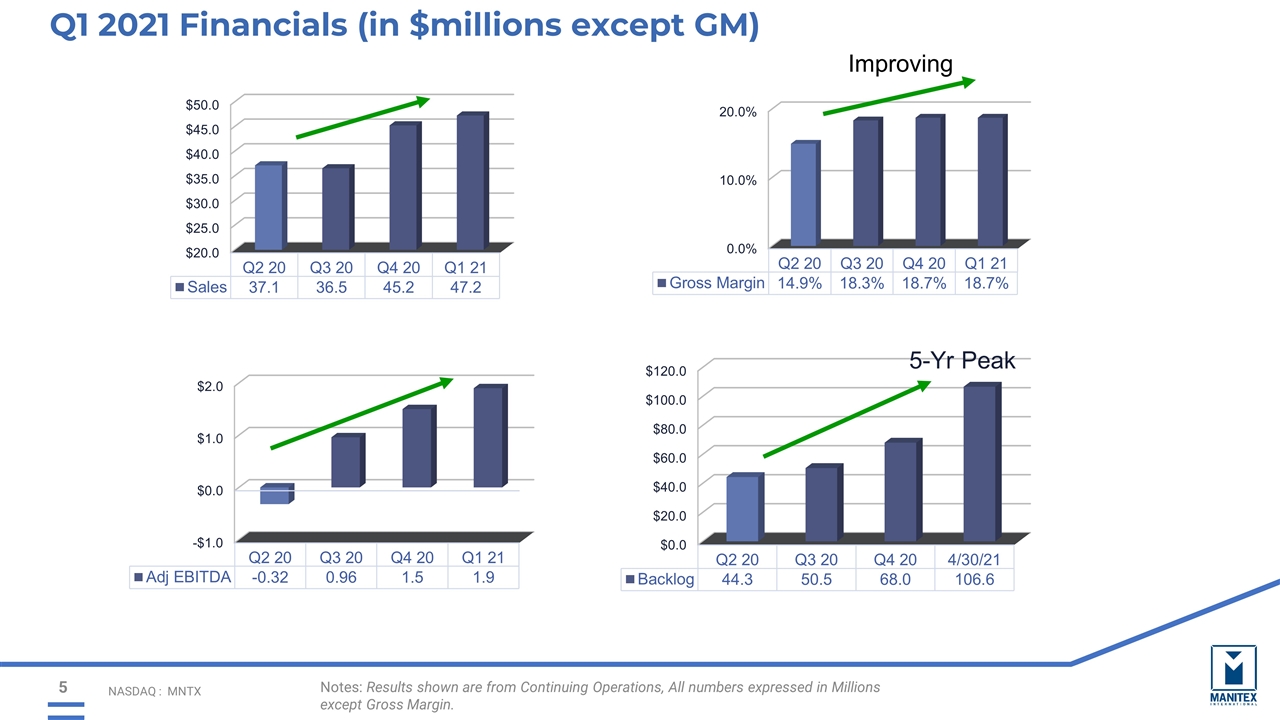

NASDAQ : MNTX Notes: Results shown are from Continuing Operations, All numbers expressed in Millions except Gross Margin. Q1 2021 Financials (in $millions except GM) Improving

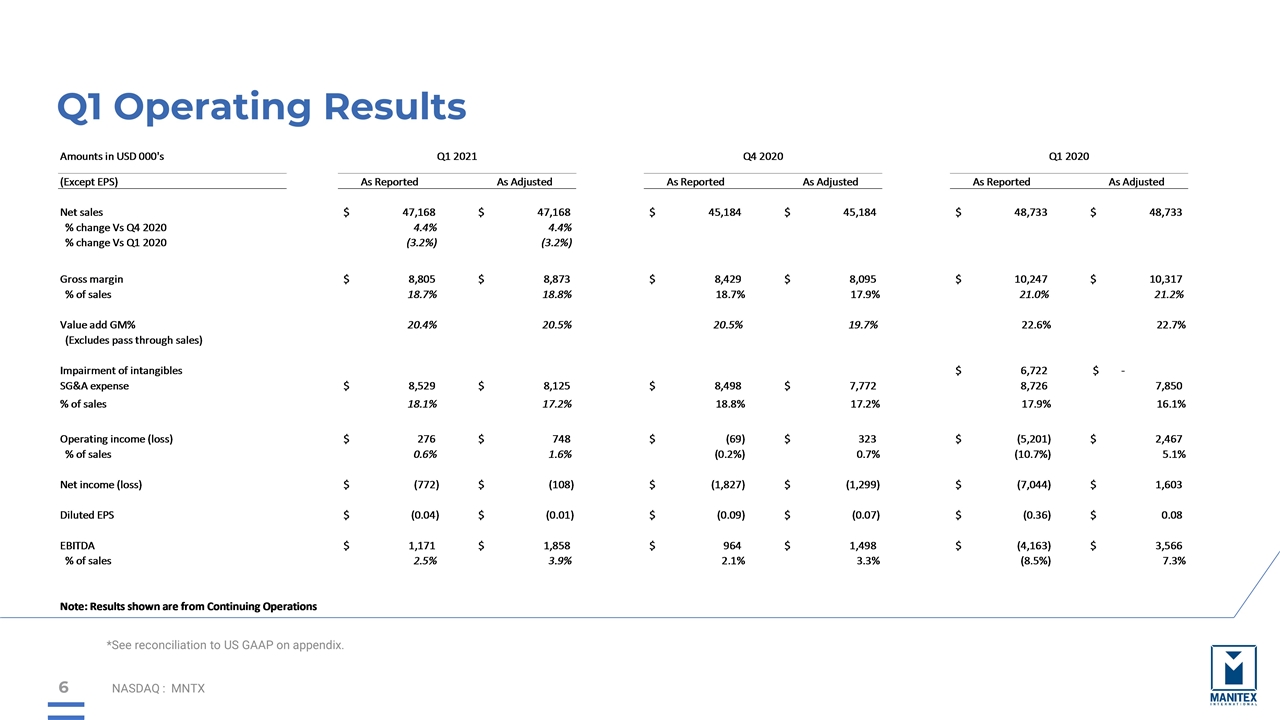

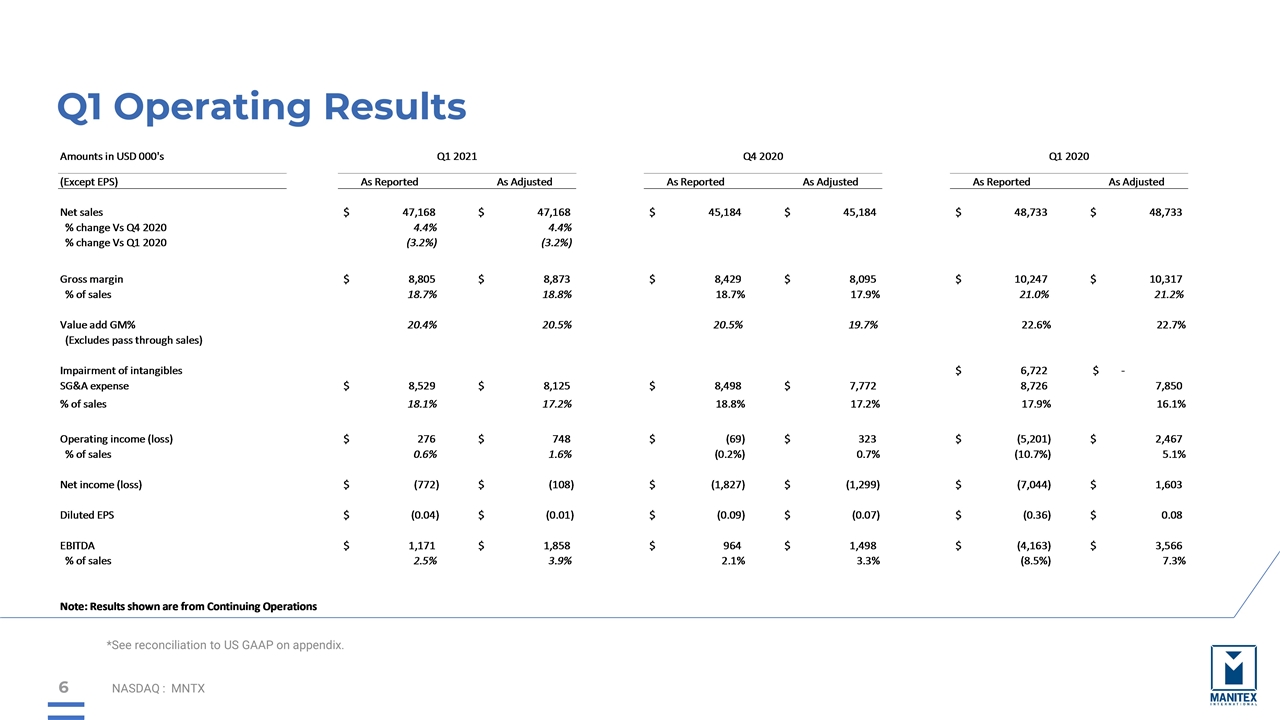

Q1 Operating Results NASDAQ : MNTX *See reconciliation to US GAAP on appendix.

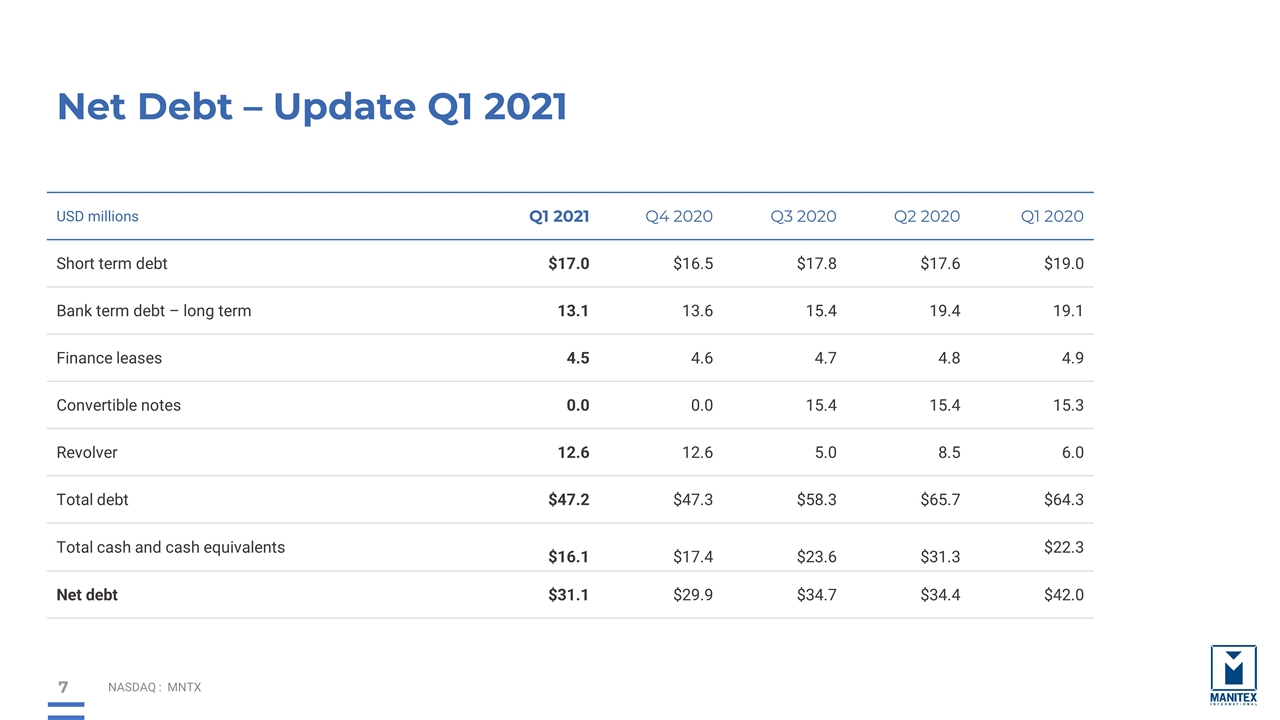

Net Debt – Update Q1 2021 NASDAQ : MNTX USD millions Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 Short term debt $17.0 $16.5 $17.8 $17.6 $19.0 Bank term debt – long term 13.1 13.6 15.4 19.4 19.1 Finance leases 4.5 4.6 4.7 4.8 4.9 Convertible notes 0.0 0.0 15.4 15.4 15.3 Revolver 12.6 12.6 5.0 8.5 6.0 Total debt $47.2 $47.3 $58.3 $65.7 $64.3 Total cash and cash equivalents $16.1 $17.4 $23.6 $31.3 $22.3 Net debt $31.1 $29.9 $34.7 $34.4 $42.0

Q2 2021 Outlook NASDAQ : MNTX Prioritize the safety of our team for duration of COVID-19 and beyond $100 million-plus backlog provides visibility to higher revenues and improved EBITDA throughout 2021 Production levels at pre-pandemic highs Continue to manage supply constraints and input costs Starting to see benefits on Manitex’s global portfolio of products We remain focused on cash generation and Adjusted EBITDA margin target of 10%

APPENDIX_- SUPPLEMENTAL FINANCIALS

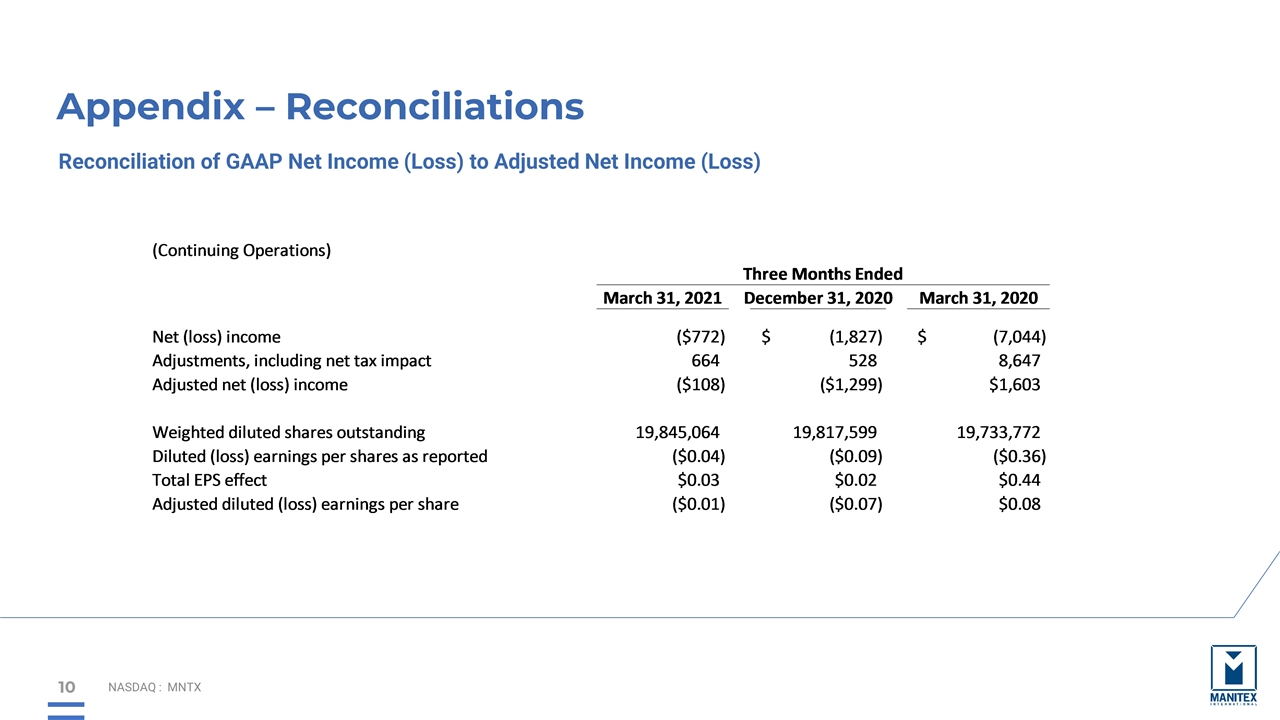

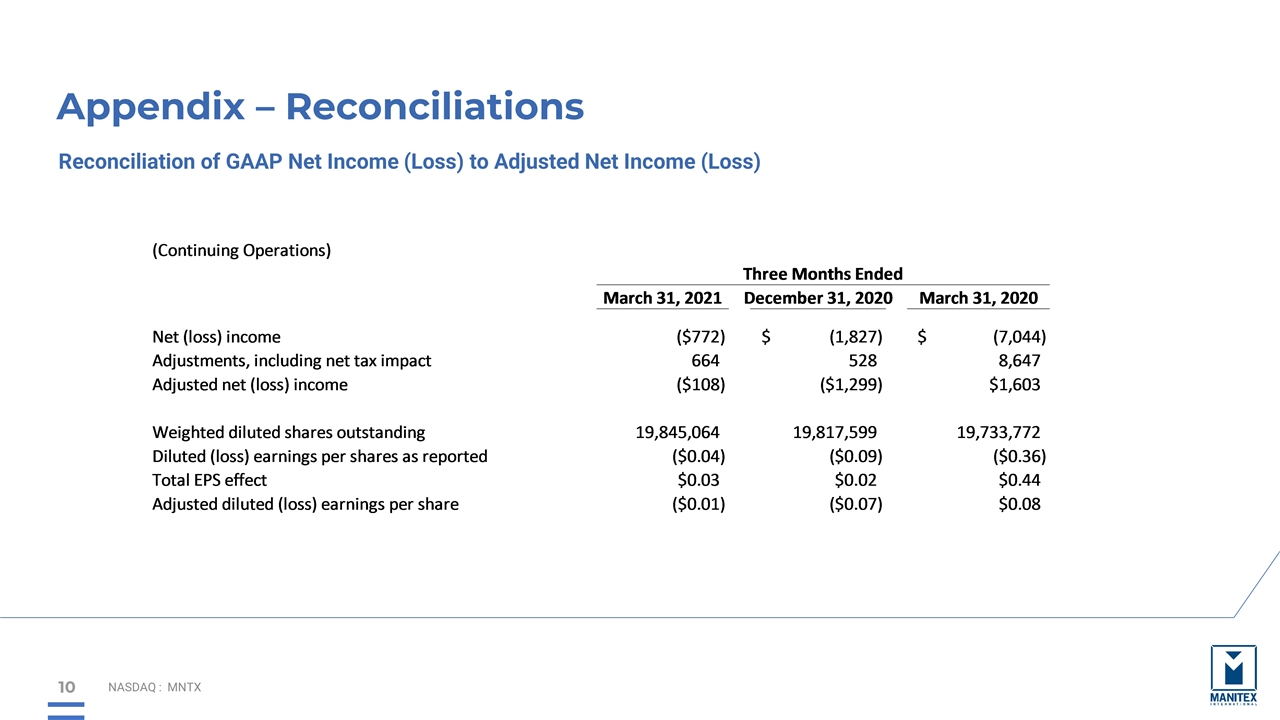

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss)

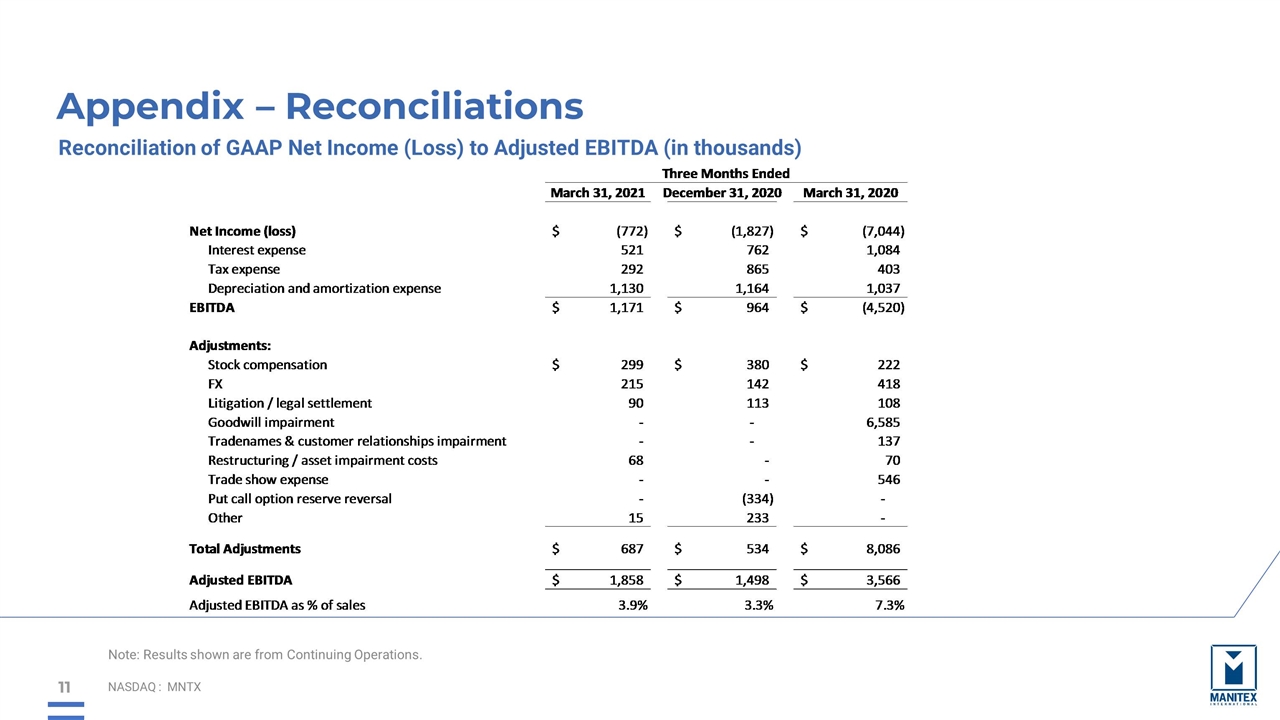

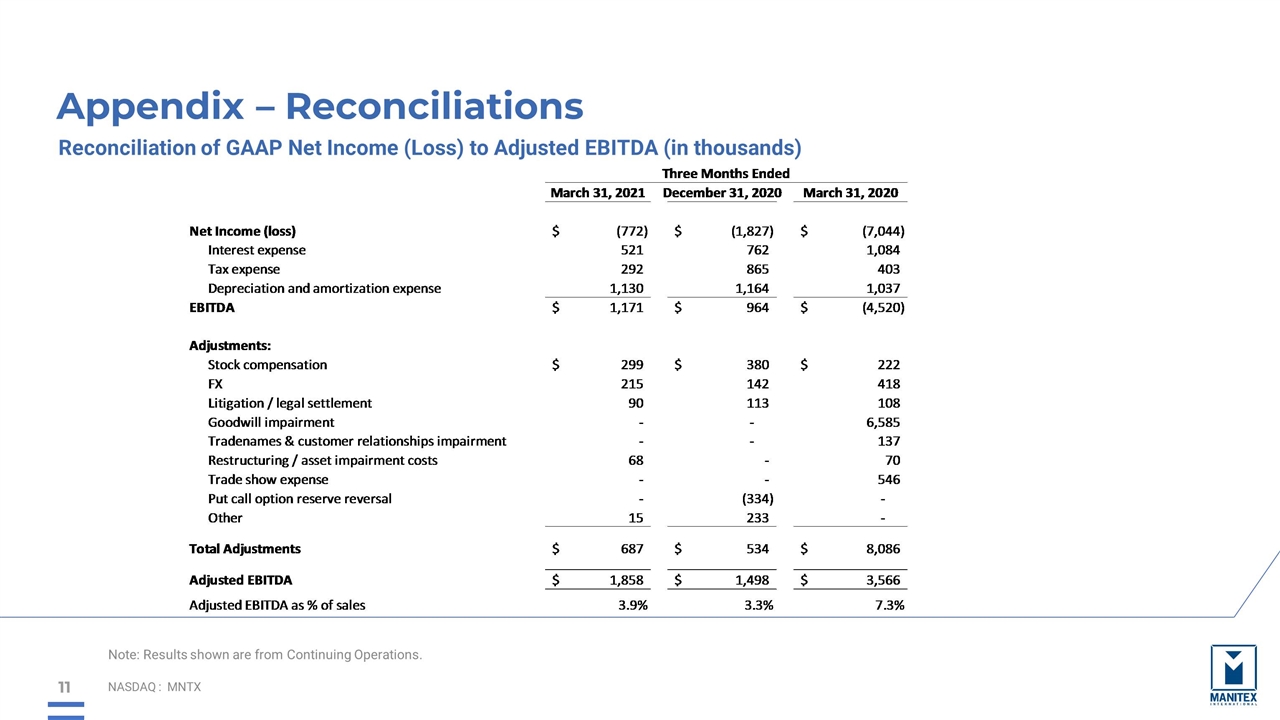

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (in thousands) Note: Results shown are from Continuing Operations.

Steve Filipov, CEO Manitex International 708-237-2054 Peter Seltzberg, IR Darrow Associates, Inc. 516-419-9915 MANITEX INTERNATIONAL, INC. NASDAQ: MNTX First Quarter 2021 Earnings Conference Call May 6, 2021