MANITEX INTERNATIONAL, INC. NASDAQ: MNTX Fourth Quarter 2021 Earnings Conference Call March 8, 2022 Exhibit 99.2

Forward-Looking Statement and Non-GAAP Measures Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. NASDAQ : MNTX

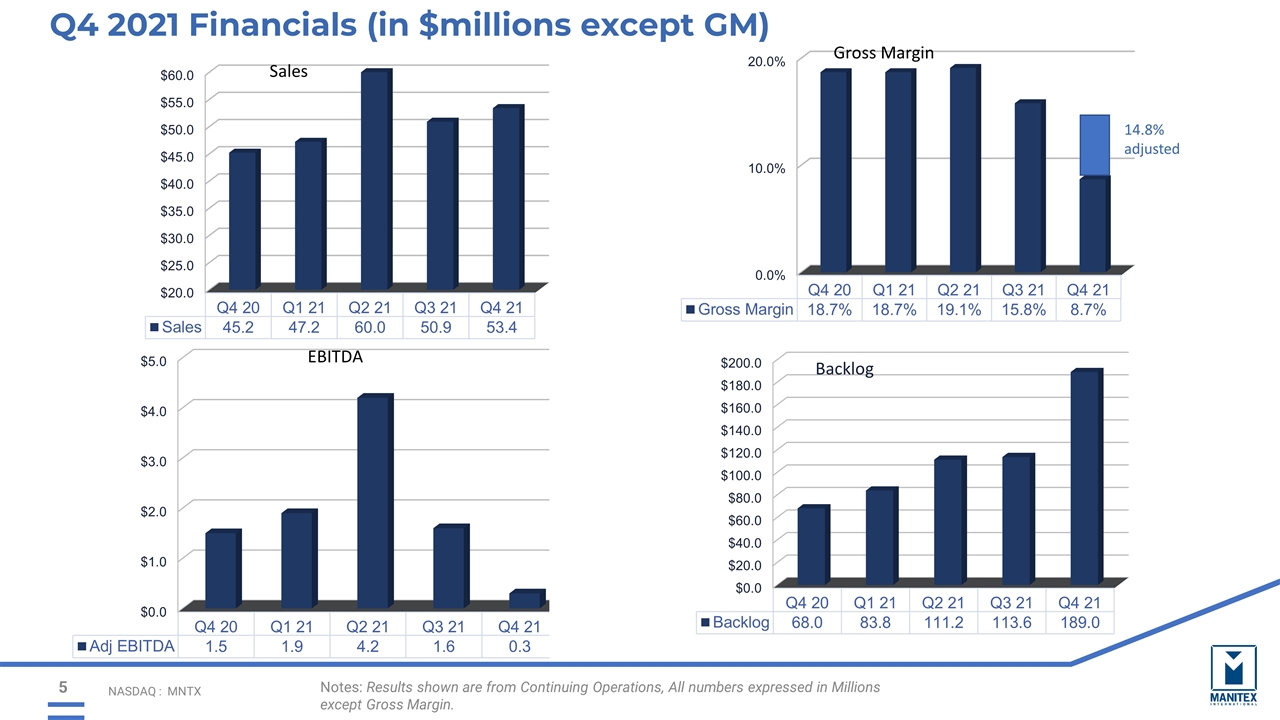

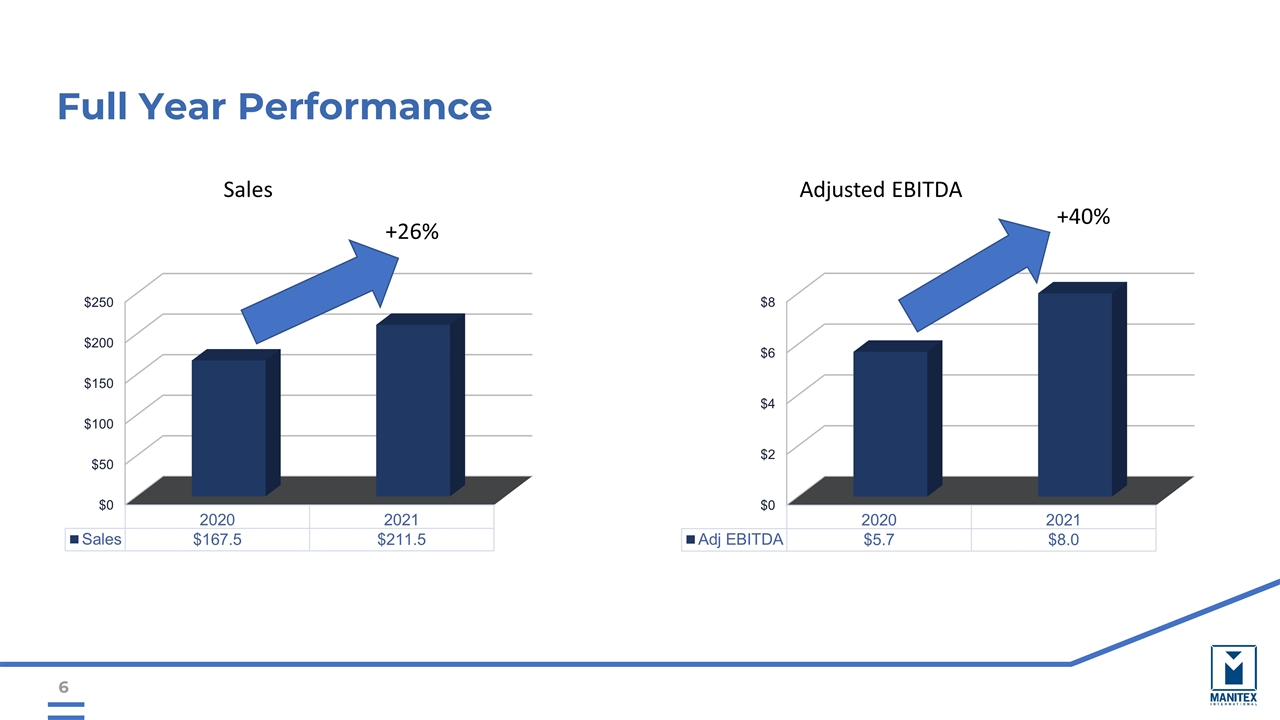

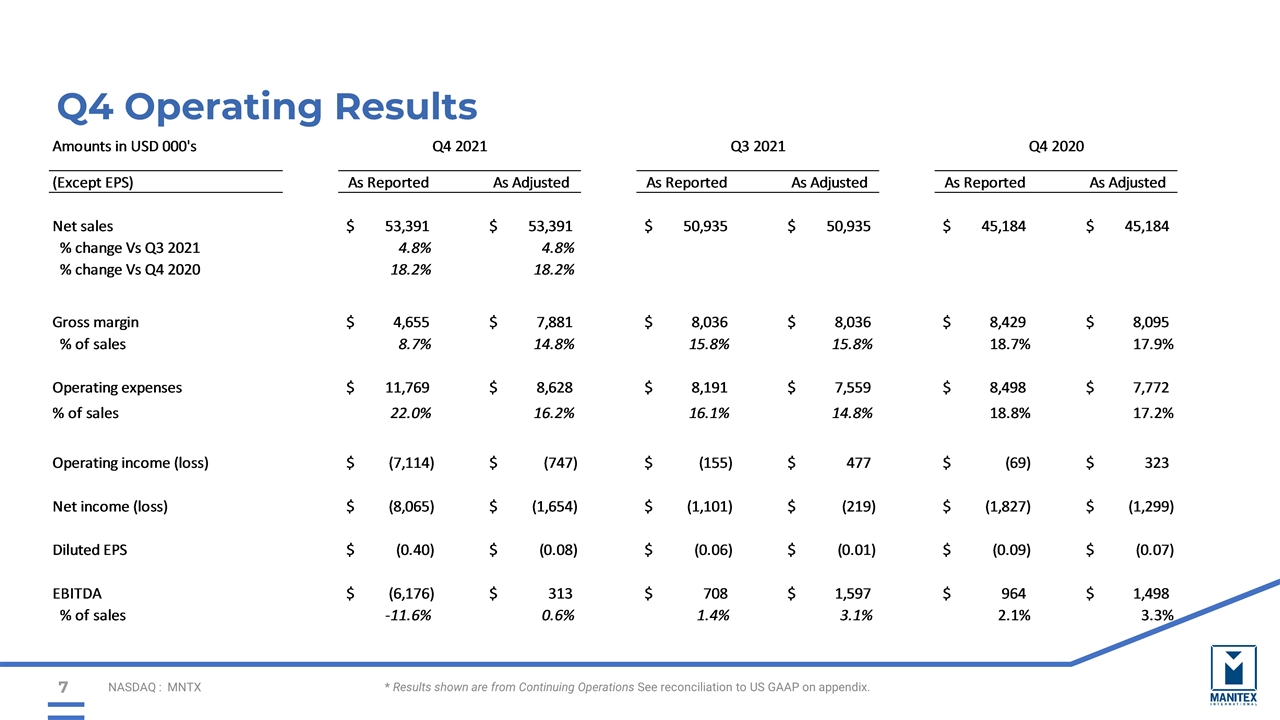

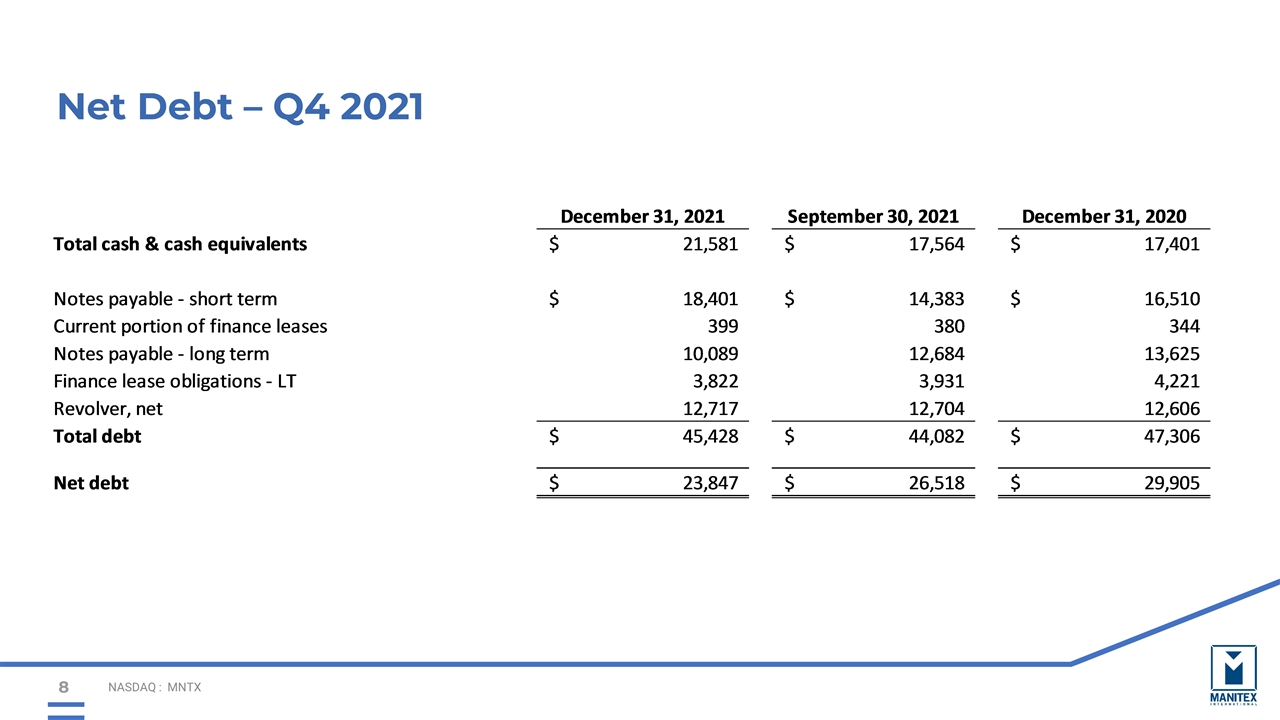

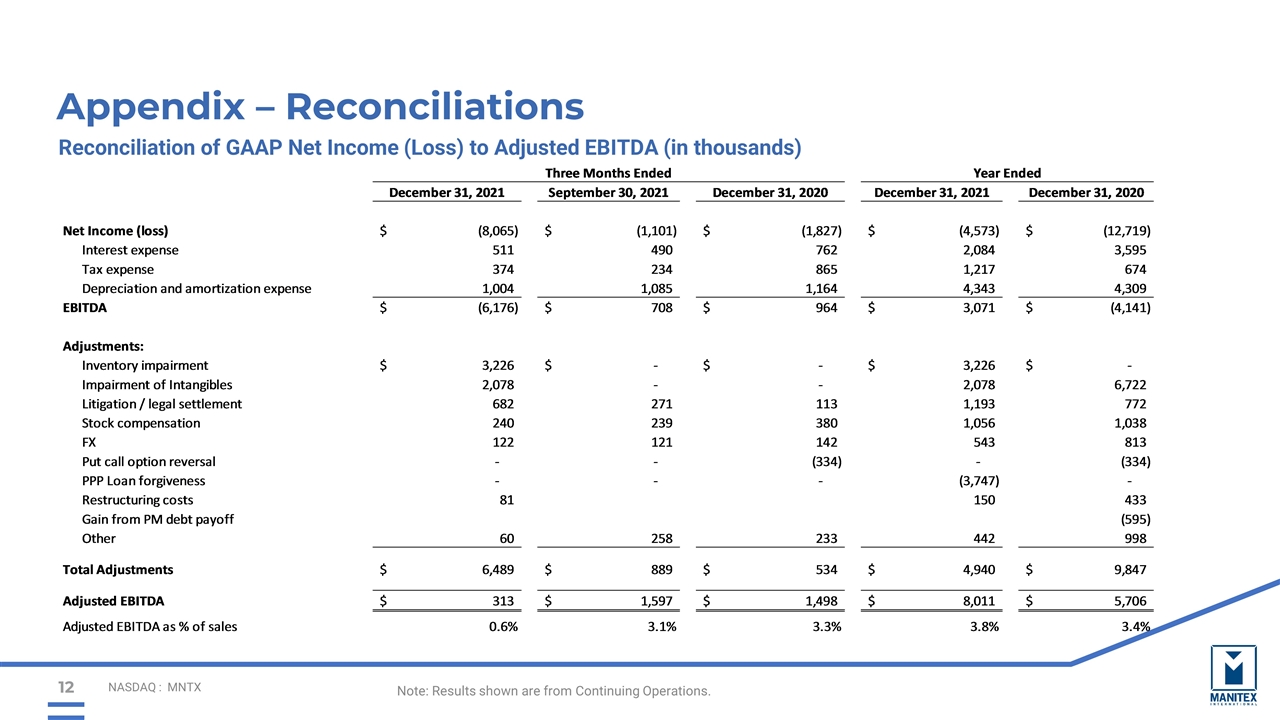

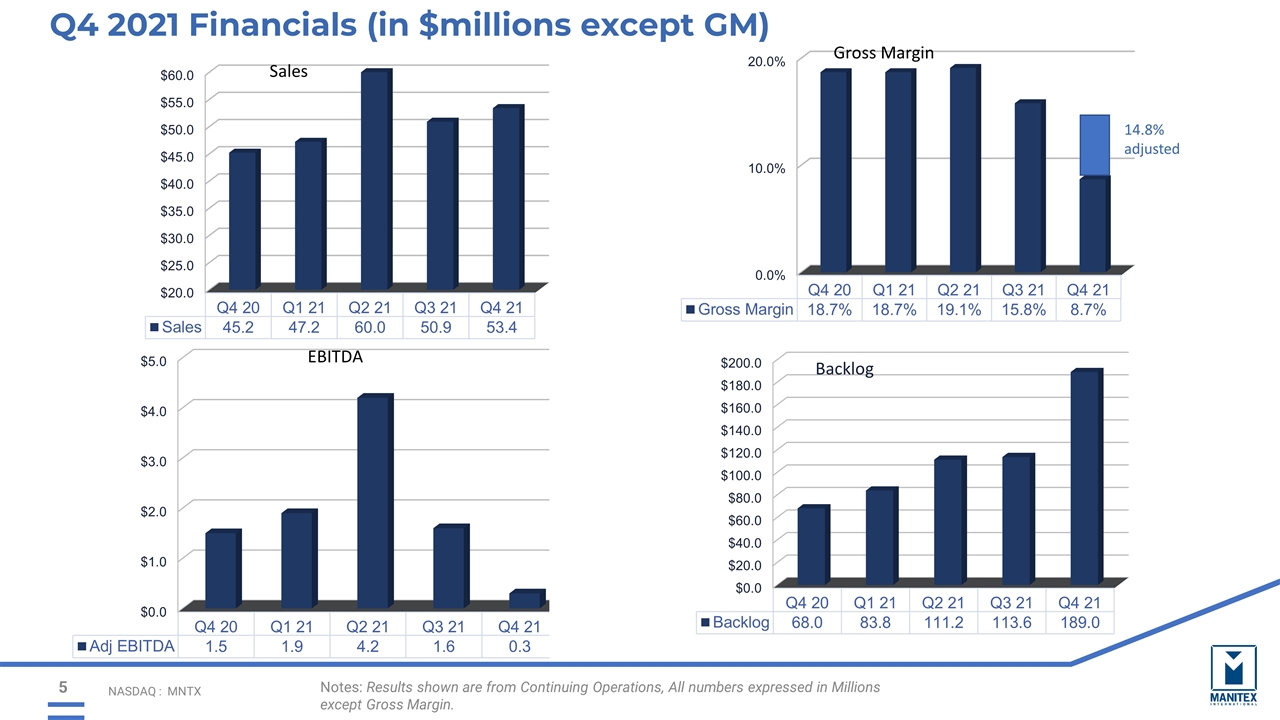

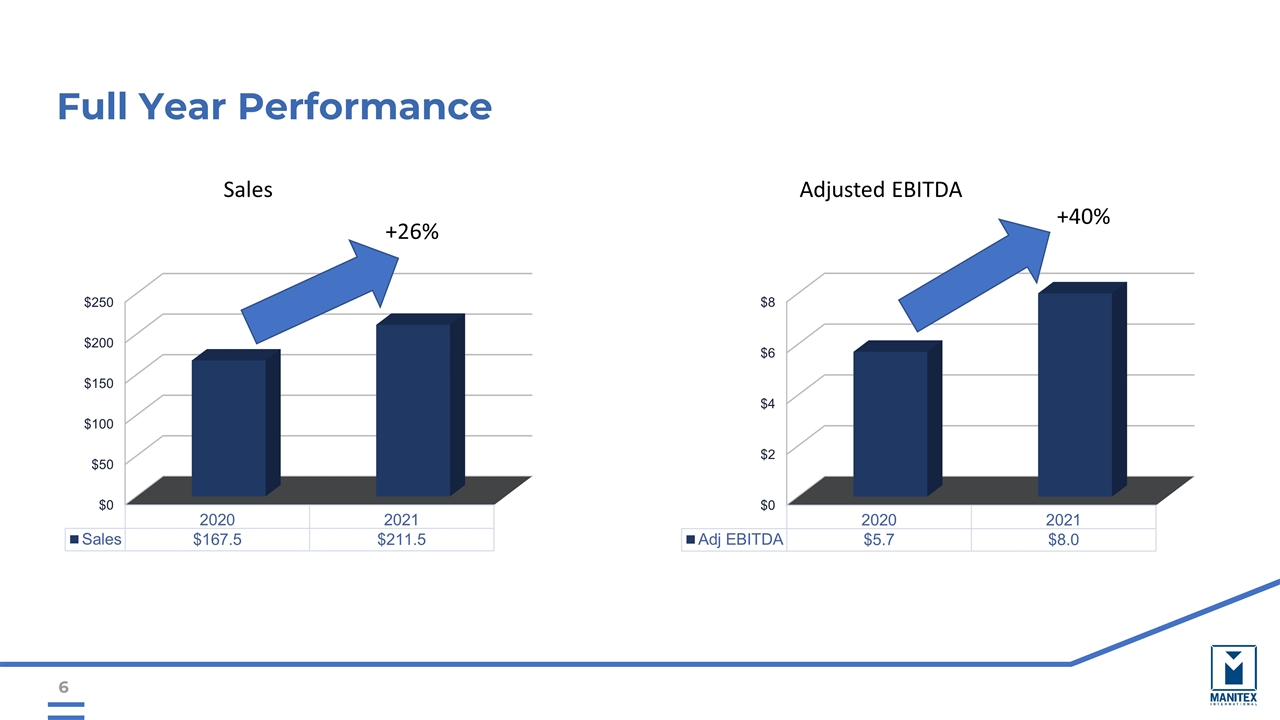

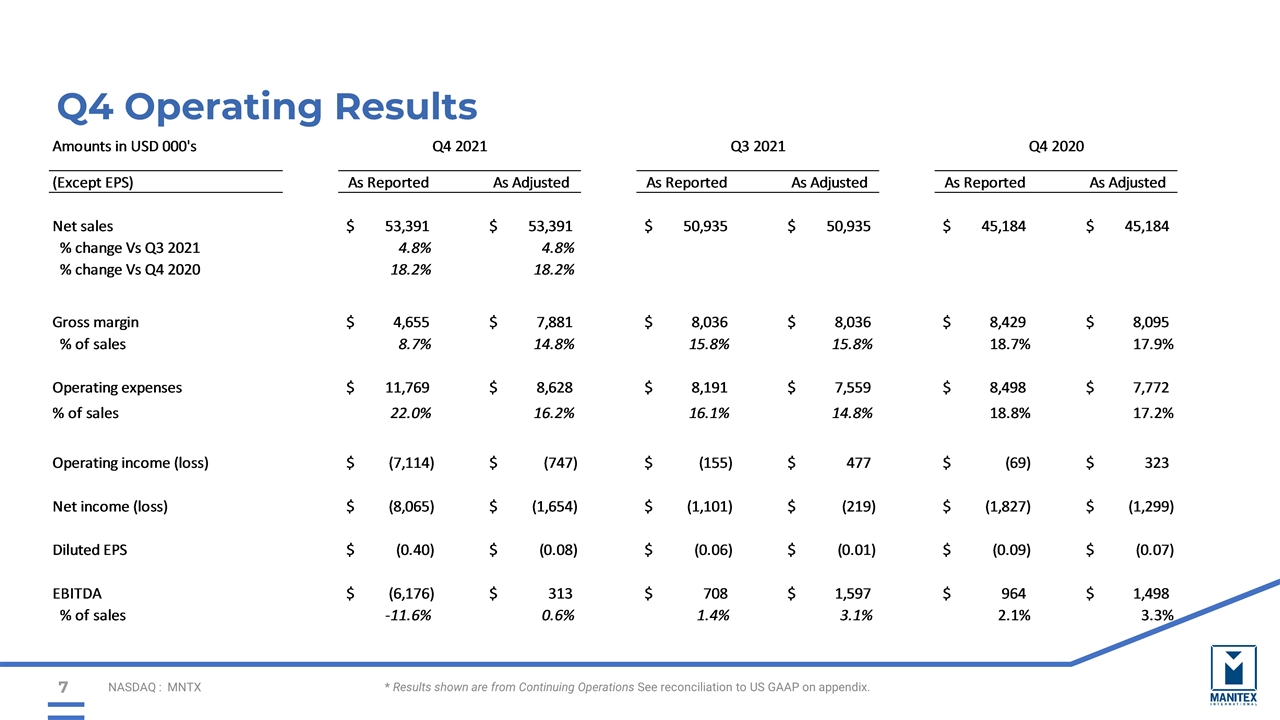

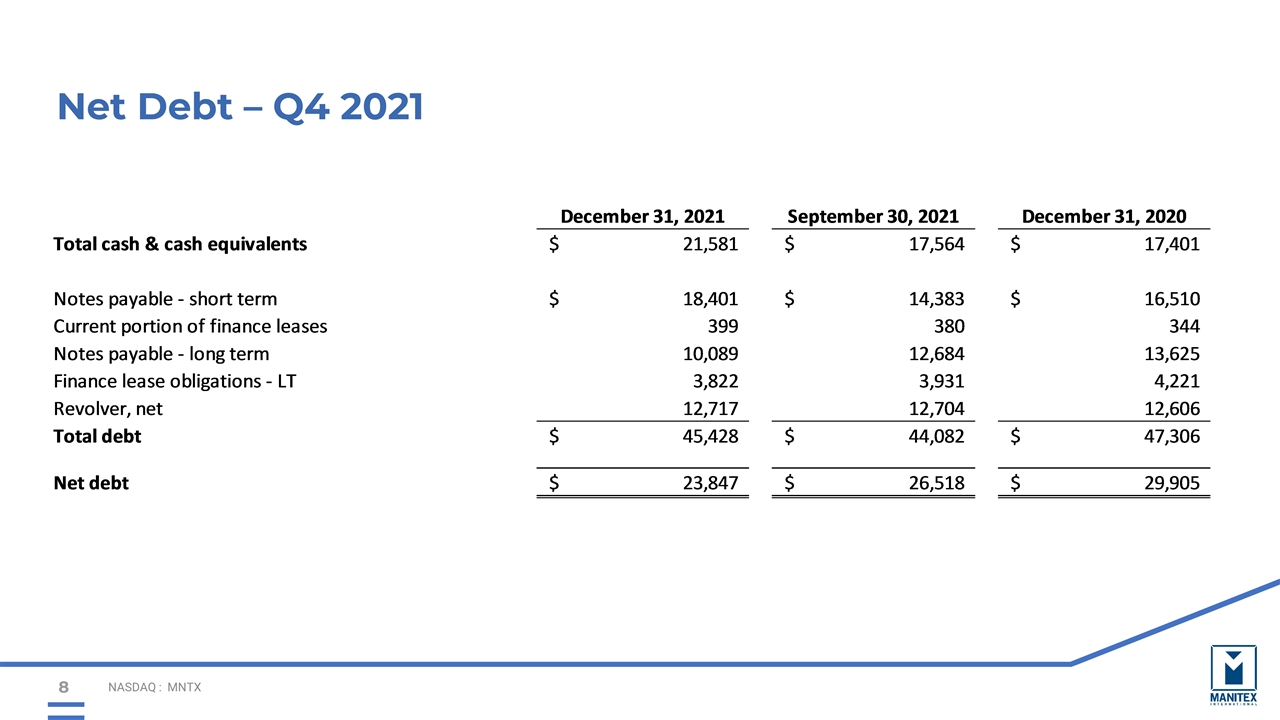

Business Update NASDAQ : MNTX Highlights Fourth quarter net sales increased 18.2% year-over-year, to $53.4 million, compared to $45.2 million in 2020 For the full year, net sales rose to $211.5 million from $167.5 million in 2020 Adjusted EBITDA was $0.3 million in the fourth quarter of fiscal 2021 versus $1.5 million in 2020 For the full year, Adjusted EBITDA rose to $8.0 million from $5.7 million in the prior-year period $189.0 million backlog – up 66% from Q3 2021 Book-to-bill ratio was 2.4:1 European business now represents 60% of total backlog North America backlog up 189% YTD Balance Sheet and Credit $23.8 million Total Net Debt Leverage ratio of 3.0 times trailing Adjusted EBITDA $37.6 million in Total Cash and Credit Availability Managing working capital while dealing with supply chain issues Operations Seeing greater stability in operations versus during the pandemic Announced closure of Winona, MN facility and expecting positive cash flow Order pipeline remains robust, representing enduring demand Supply chain constraints and higher raw material costs still an issue, being mitigated as much as possible Price increases are in effect, which should lead to gross margin expansion going forward

NASDAQ : MNTX The Takeaways – Q4 2021 and FY 2021 Performance in Q4 showed significant progress in ramping up production to meet demand, offset by continued cost/price dynamics and supply chain constraints PM Knuckle Boom Crane business delivered solid top line performance managing through supply constraints Revenue down 4% versus Q4 2020 Knuckle boom demand remains solid globally, with continued strength in Europe, North America, and Chile Expanding new distribution in the Middle East and Asia North American straight mast volumes back to pre-pandemic volumes and gaining share Good progress in revenue growth of 118% versus 2020 Strong growth in larger straight mast products for general construction and utility markets Truck Chassis deliveries continue to be a major production constraint Closure of Winona facility announced and moving boom truck production to Georgetown campus Oil & Steel Aerials global growth and market share gains continue with record 2021 revenue Revenue up 30% over Q4 2020 Secured $18M order with a major Italian utility company Successful launch and expansion into new markets with our new self-propelled spider aerial line Reorganising manufacturing footprint to improve efficiency and ramp up aerial production Valla zero-emission cranes continue to generate good demand; implementing next phase of operational and cost savings improvements Revenue up over 12% versus Q4 2020 Expanding distribution and accessing new rental customers Integrating back office functions with Oil & Steel aerials Improving production throughput and expanding supply chain

NASDAQ : MNTX Notes: Results shown are from Continuing Operations, All numbers expressed in Millions except Gross Margin. Q4 2021 Financials (in $millions except GM) Sales 14.8% adjusted

Full Year Performance SalesAdjusted EBITDA +26% +40%

Q4 Operating Results * Results shown are from Continuing Operations See reconciliation to US GAAP on appendix. NASDAQ : MNTX

Net Debt – Q4 2021 NASDAQ : MNTX

Closing Comments: NASDAQ : MNTX Record backlog of $189.0 million backlog provides visibility to higher revenue in 2022 Working through supply chain issues with increased focus on managing price realization, working capital, and product throughput Looking at further actions to reduce operational costs, tighten expense controls, and streamline production to offset sourcing pressure Active pipeline of opportunities reflects increasing demand Cash availability with leverage ratios at lowest end of historical range Remain focused on top line expansion and improving margins

APPENDIX – SUPPLEMENTAL FINANCIALS

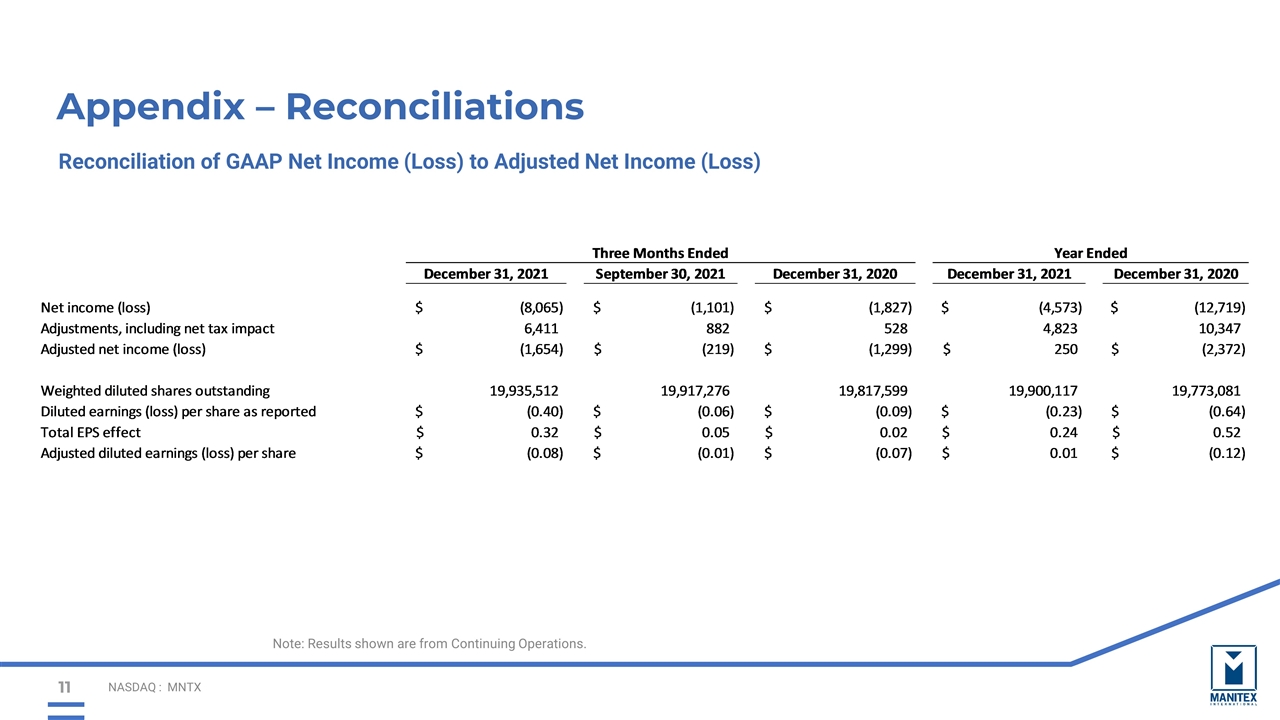

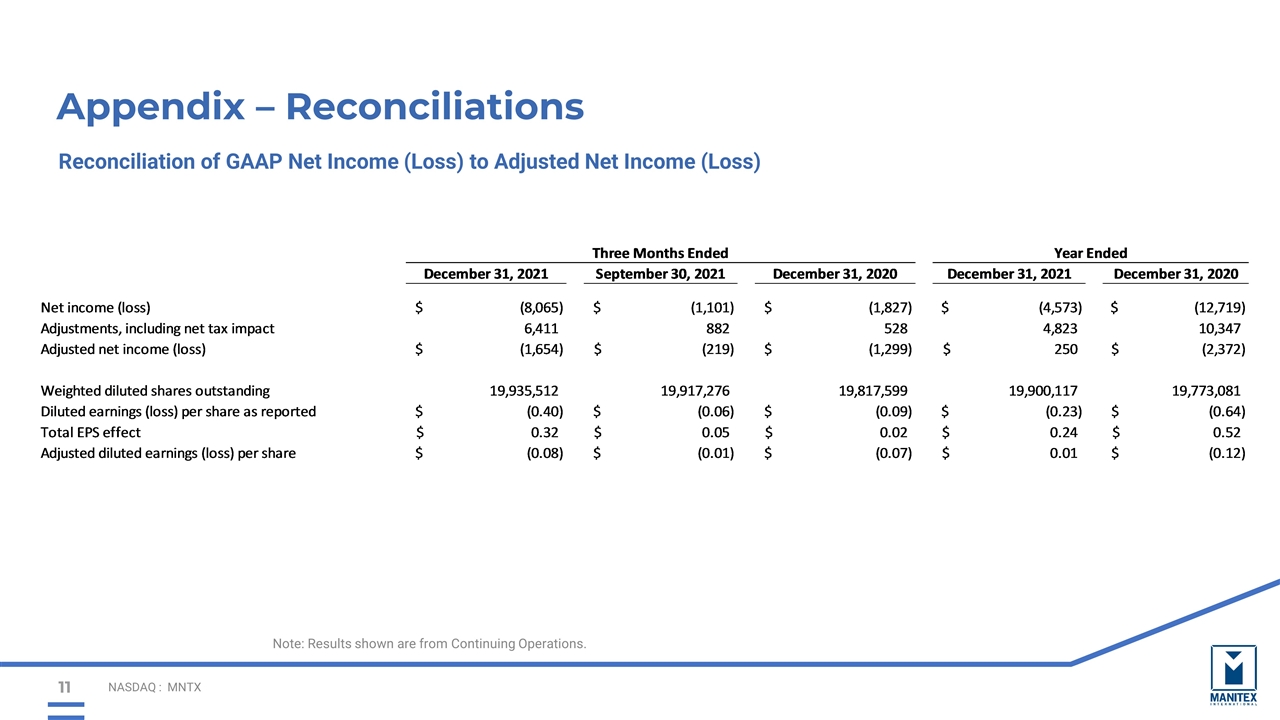

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss) Note: Results shown are from Continuing Operations.

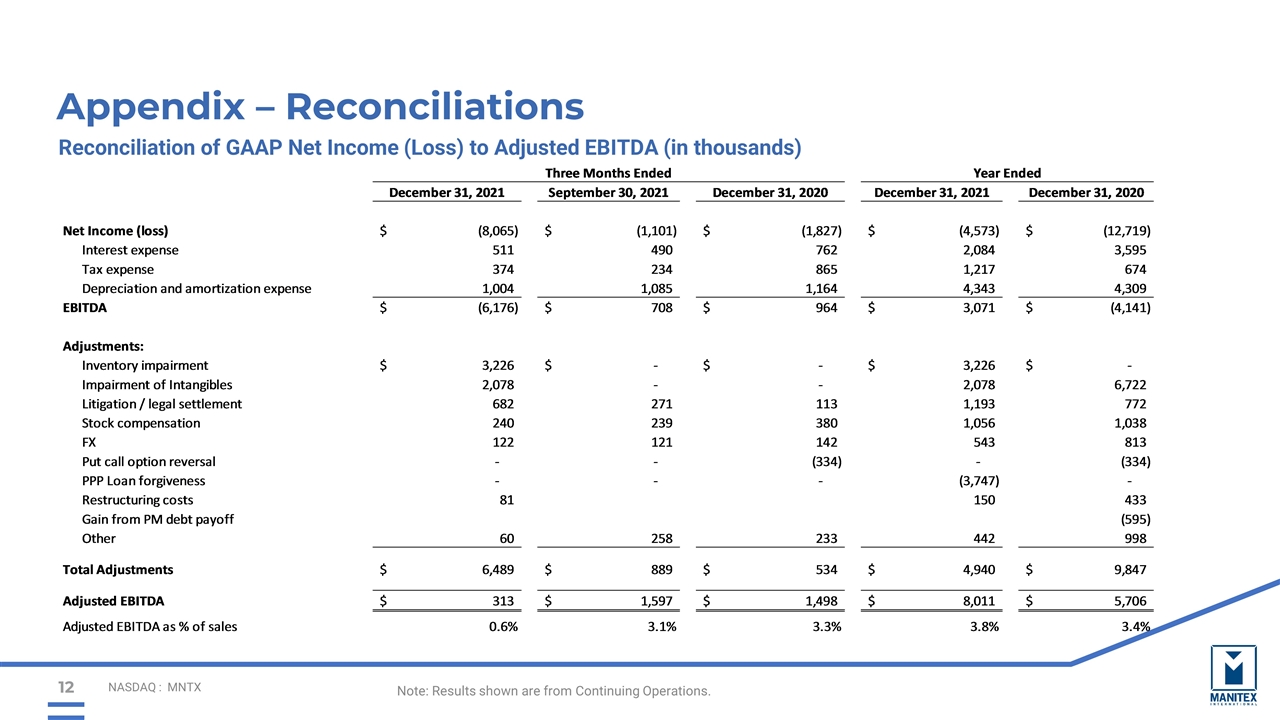

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (in thousands) Note: Results shown are from Continuing Operations.

MANITEX INTERNATIONAL, INC. NASDAQ: MNTX Fourth Quarter 2021 Earnings Conference Call March 8, 2022