PROSPECTUS

(Holding company for BayVanguard Bank)

Up to 14,375,000 Shares of Common Stock

(Subject to Increase to up to 16,531,250 Shares)

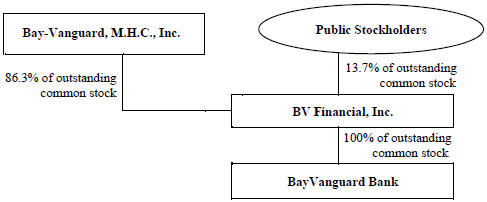

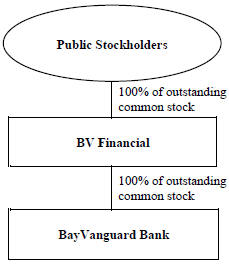

BV Financial, Inc., a Maryland corporation that we refer to as “BV Financial” throughout this prospectus, is offering shares of common stock for sale on a best efforts basis in connection with the conversion of Bay-Vanguard, M.H.C., Inc., which we refer to as “Bay-Vanguard, M.H.C.” throughout this prospectus, from the mutual holding company to the stock holding company form of organization. The shares we are offering represent the majority ownership interest in BV Financial currently owned by Bay-Vanguard, M.H.C., a Maryland-chartered mutual holding company. BV Financial’s common stock currently trades on the Pink Open Market operated by OTC Markets Group under the symbol “BVFL.” Upon completion of the conversion, we expect the shares of BV Financial common stock will trade on the Nasdaq Capital Market under the symbol “BVFL.” We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012.

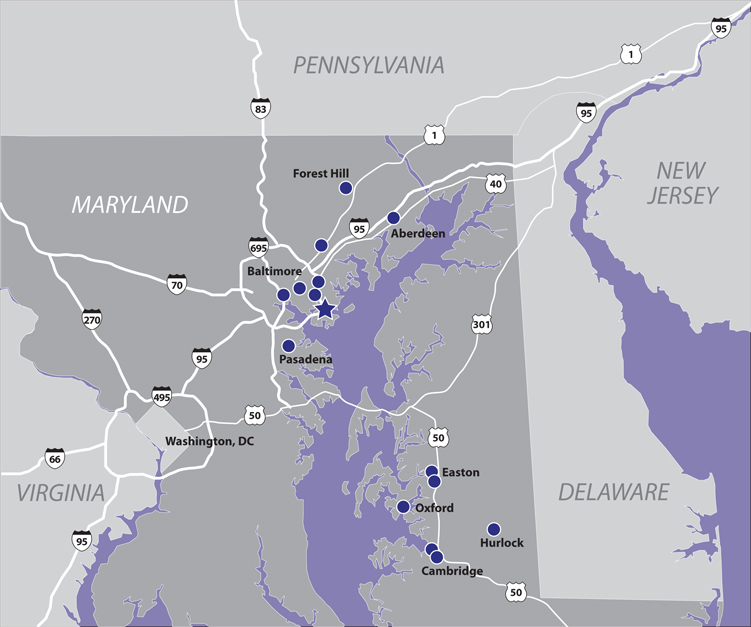

The shares of common stock are first being offered for sale in a subscription offering to eligible members of Bay-Vanguard, M.H.C. (i.e., eligible depositors of BayVanguard Bank) and to tax-qualified employee benefit plans of BayVanguard Bank. Shares not purchased in the subscription offering may be offered for sale to the general public in a community offering, with a preference given first to residents of the communities served by BayVanguard Bank. Any shares of common stock not purchased in the subscription or community offerings may be offered for sale to the public through a syndicate of broker-dealers, referred to in this prospectus as the syndicated community offering. The syndicated community offering may commence before the subscription and community offerings (including any extensions) have expired. However, no shares purchased in the subscription offering or the community offering will be issued until the completion of any syndicated community offering. We may sell up to 16,531,250 shares of common stock because of demand for the shares of common stock or changes in market conditions, without resoliciting subscribers. We must sell a minimum of 10,625,000 shares to complete the offering.

In addition to the shares we are selling in the offering, the shares of common stock of BV Financial currently owned by public stockholders will be exchanged for shares of common stock of BV Financial based on an exchange ratio that will result in existing public stockholders owning approximately the same percentage of common stock of BV Financial as they owned immediately before the completion of the conversion. We expect to issue up to 2,628,550 shares in the exchange.

The minimum purchase order is 25 shares. Generally, no individual, or individuals acting through a single qualifying account held jointly, may purchase more than 35,000 shares ($350,000) of common stock, and no person or entity, together with associates or persons acting in concert with such person or entity, may purchase more than 70,000 shares ($700,000) of common stock in all categories of the offering combined.

The subscription offering will expire at 4:30 p.m., Eastern Time, on [expiration date]. If held, the community offering may begin concurrently with, during or after the subscription offering. We may extend the expiration date of the subscription and/or community offerings without notice to you until [extension date], or longer if the Board of Governors of the Federal Reserve System, which we refer to as the “Federal Reserve Board,” approves a later date. No single extension may exceed 90 days and the offering must be completed by [final extension date]. Once submitted, orders are irrevocable unless the subscription and community offerings are terminated or extended, with regulatory approval, beyond [extension date], or the number of shares of common stock to be sold is increased to more than 16,531,250 shares or decreased to less than 10,625,000 shares. If the subscription and community offerings are extended past [extension date], all subscribers will be notified and given the opportunity to confirm, change or cancel their orders. If you do not respond to the notice of extension, we will promptly return your funds with interest or cancel your deposit account withdrawal authorization. If the number of shares to be sold in the offering is increased to more than 16,531,250 shares or decreased to less than 10,625,000 shares, we will resolicit subscribers, and all funds delivered to us to purchase shares of common stock in the subscription and community offerings will be returned promptly with interest. Funds received in the subscription and the community offerings will be held in a segregated account at BayVanguard Bank and will earn interest at [interest rate]% per annum until completion or termination of the offering.

Performance Trust Capital Partners is assisting us in selling the shares on a best efforts basis in the subscription and community offerings, and will serve as sole manager for any syndicated community offering. Performance Trust Capital Partners is not required to purchase any shares of common stock that are sold in the offering.

OFFERING SUMMARY

Price: $10.00 per Share

| | | | | | | | | | | | | | | | |

| | | Minimum | | | Midpoint | | | Maximum | | | Adjusted Maximum | |

Number of shares | | | 10,625,000 | | | | 12,500,000 | | | | 14,375,000 | | | | 16,531,250 | |

Gross offering proceeds | | $ | 106,250,000 | | | $ | 125,000,000 | | | $ | 143,750,000 | | | $ | 165,312,500 | |

Estimated offering expenses, excluding marketing agent fees and expenses (1) | | $ | 1,350,000 | | | $ | 1,350,000 | | | $ | 1,350,000 | | | $ | 1,350,000 | |

Marketing agent fees and expenses (1)(2) | | $ | 1,083,808 | | | $ | 1,237,683 | | | $ | 1,411,588 | | | $ | 1,600,014 | |

Estimated net proceeds | | $ | 103,816,193 | | | $ | 122,402,317 | | | $ | 140,988,422 | | | $ | 162,362,486 | |

Estimated net proceeds per share | | $ | 9.77 | | | $ | 9.79 | | | $ | 9.81 | | | $ | 9.82 | |

| (1) | See “The Conversion and Offering—Plan of Distribution; Marketing Agent and Underwriter Compensation” for a discussion of Performance Trust Capital Partners’ compensation for this offering and the compensation to be received by Performance Trust Capital Partners and the other broker-dealers that may participate in the syndicated community offering. |

| (2) | Includes records agent fees and expenses payable to Performance Trust Capital Partners. See “The Conversion and Offering—Records Agent Services.” |

This investment involves a degree of risk, including the possible loss of principal.

See “Risk Factors” beginning on page _.

These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Neither the Securities and Exchange Commission, the Board of Governors of the Federal Reserve System, the Office of the Commissioner of Financial Regulation for the State of Maryland, the Federal Deposit Insurance Corporation, nor any state securities regulator has approved or disapproved these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

PERFORMANCE TRUST

For assistance, contact the Stock Information Center at [stock center number].

The date of this prospectus is [Prospectus date].