Moreover, a significant decline in general economic conditions caused by inflation, recession, acts of terrorism, civil unrest, an outbreak of hostilities or other international or domestic calamities, an epidemic or pandemic, unemployment or other factors beyond our control could further impact these local economic conditions and could further negatively affect the financial results of our banking operations. In addition, deflationary pressures, while possibly lowering our operating costs, could have a significant negative effect on our borrowers, especially our business borrowers, and the values of underlying collateral securing loans, which could negatively affect our financial performance.

We have a high concentration of loans secured by real estate in our market area. Adverse economic conditions, both generally and in our market area, could adversely affect our financial condition and results of operations.

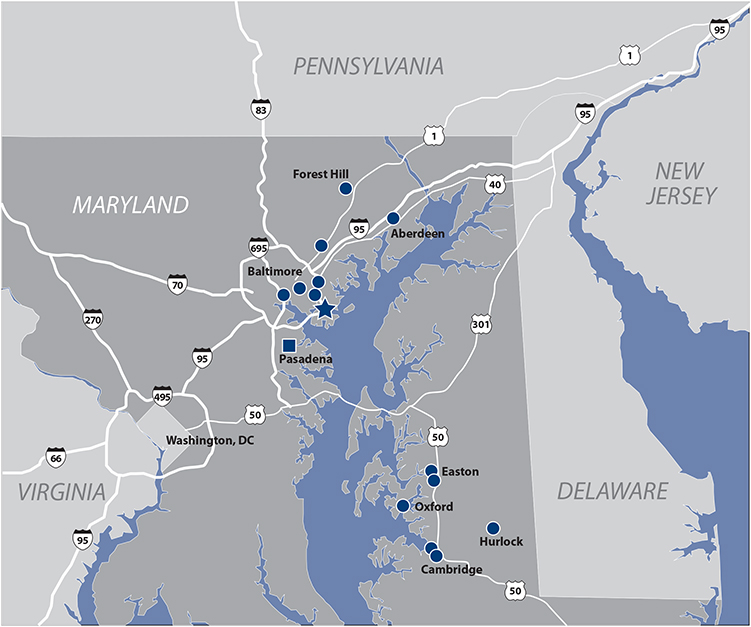

Most of our loans are inside of our market area and, as a result, we have a greater risk of loan defaults and losses in the event of a further economic downturn in our market area, as adverse economic conditions may have a negative effect on the ability of our borrowers to make timely payments of their loans. A return of recessionary conditions and/or negative developments in the domestic and international credit markets may significantly affect the markets in which we do business, the value of our loans, investments, and collateral securing our loans, and our ongoing operations, costs and profitability. Any of these negative events may result in higher-than-expected loan delinquencies, increase our levels of non-performing and classified assets, and reduce demand for our products and services, which may cause us to incur losses and may adversely affect our capital, liquidity and financial condition. According to published data, our market area has not experienced any material declines in real estate values during the last year or any material increase in the number of foreclosure proceedings.

Recent bank industry events involving financial institution failures may adversely affect our business and the market price of our common stock.

Recent developments and events in the financial services industry, including the failures of Silicon Valley Bank, Signature Bank and First Republic Bank and the voluntary liquidation of Silvergate Bank, have resulted in decreased confidence in banks among depositors, other counterparties and investors, as well as significant disruption, volatility and reduced valuations of equity and other securities of banks in the capital markets. These events have occurred against the backdrop of a rapidly rising interest rate environment which, among other things, has resulted in unrealized losses in longer duration securities and loans held by banks, more competition for bank deposits and may increase the risk of a potential recession. These events and developments could materially and adversely impact our business or financial condition, including through potential liquidity pressures, reduced net interest margins, and potential increased credit losses. These recent events and developments have, and could continue to, adversely impact the market price and volatility of our common stock. These recent events may also result in changes to laws or regulations governing banks and bank holding companies or result in the impositions of restrictions through supervisory or enforcement activities, including higher capital requirements, which could have a material impact on our businesses. The cost of resolving the recent failures may prompt the FDIC to increase its premiums above the recently increased levels or to issue additional special assessments.

Lawmakers’ failure to address the federal debt ceiling in a timely manner, downgrades of the U.S. credit rating and uncertain credit and financial market conditions may affect the stability of securities issued or guaranteed by the federal government, which may affect the valuation or liquidity of our investment securities portfolio and increase future borrowing costs.

As a result of uncertain political, credit and financial market conditions, including the potential consequences of the federal government defaulting on its obligations for a period of time due to federal debt ceiling limitations or other unresolved political issues, investments in financial instruments issued or guaranteed by the federal government pose credit default and liquidity risks. Given that future deterioration in the U.S. credit and financial markets is a possibility, no assurance can be made that losses or significant deterioration in the fair value of our U.S. government issued or guaranteed investments will not occur. Downgrades to the U.S. credit rating could affect the stability of securities issued or guaranteed by the federal government and the valuation or liquidity of our portfolio of such investment securities, and could result in our counterparties requiring additional collateral for our borrowings. Further, unless and until U.S. political, credit and financial market conditions have been sufficiently resolved or stabilized, it may increase our future borrowing costs.

Risks Related to Our Funding

Our inability to generate core deposits may cause us to rely more heavily on wholesale funding strategies for funding and liquidity needs, which could have an adverse effect on our net interest margin and profitability.

We must maintain sufficient funds to respond to the needs of depositors and borrowers. Deposits have traditionally been our primary source of funds for use in lending and investment activities. We also receive funds from loan repayments, investment maturities and income on other interest-earning assets. While we emphasize generating transaction accounts, we cannot guarantee if and when this will occur. Further, the considerable competition for deposits in our market area also has made, and may continue to make, it difficult for us to obtain reasonably priced deposits. Moreover, deposit balances can decrease if customers perceive alternative investments as providing a better risk/return tradeoff. If we are not able to increase our lower-cost transactional deposits at a level necessary to fund our asset growth or deposit outflows, we may be forced seek other sources of funds, including other certificates of deposit, Federal Home Loan Bank advances, brokered deposits and lines of credit to meet the borrowing and deposit withdrawal requirements of our customers, which may be more expensive and have an adverse effect on our net interest margin and profitability. In this regard, total deposits decreased $17.6 million, or 2.6%, to $667.0 million at March 31, 2023 from $684.6 million at December 31, 2022. The decrease in deposits has led BV Financial to rely more heavily on Federal Home Loan Bank advances in recent periods to fund loan growth and to maintain on-balance sheet liquidity. This has resulted in an increase from no Federal Home Loan Bank advances at December 31, 2021 to $12.0 million at December 31, 2022 and $37.5 million at March 31, 2023 and a corresponding increase in borrowing expense to $288,000 for the three months ended March 31, 2023 as compared to $11,000 for the year ended December 31, 2022.

Risks Related to Laws and Regulations

Changes in laws and regulations and the cost of regulatory compliance with new laws and regulations may adversely affect our operations and/or increase our costs of operations.

BayVanguard Bank is subject to extensive regulation, supervision and examination by the OCFR and the FDIC, and BV Financial is subject to extensive regulation, supervision and examination by the Federal Reserve Board. Such regulation and supervision govern the activities in which an institution and its holding company may engage and are intended primarily for the protection of the federal deposit insurance fund and the depositors of BayVanguard Bank, rather than for our stockholders. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on our operations, the classification of our assets and determination of the adequacy of the level of our allowance for credit losses. These regulations, along with existing tax, accounting, securities, insurance and monetary laws, rules, standards, policies, and interpretations, control the methods by which financial institutions conduct business, implement strategic initiatives and tax compliance, and govern financial reporting and disclosures. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material impact on our operations.

Non-compliance with the USA PATRIOT Act, Bank Secrecy Act, or other laws and regulations could result in fines or sanctions.

The USA PATRIOT and Bank Secrecy Acts require financial institutions to develop programs to prevent financial institutions from being used for money laundering and terrorist activities. If such activities are suspected, financial institutions are obligated to file suspicious activity reports with the U.S. Treasury’s Office of Financial Crimes Enforcement Network. These rules require financial institutions to establish procedures for identifying and verifying the identity of customers seeking to open new financial accounts. Failure to comply with these regulations could result in fines or sanctions, including restrictions on pursuing acquisitions or establishing new branches. The policies and procedures we have adopted that are designed to assist in compliance with these laws and regulations may not be effective in preventing violations of these laws and regulations. Furthermore, these rules and regulations continue to evolve and expand.

18