UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21667

Fidelity Central Investment Portfolios LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | August 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® High Income Central Fund Fidelity® High Income Central Fund true |

| | | |

This annual shareholder report contains information about Fidelity® High Income Central Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® High Income Central Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•High-yield bonds gained for the 12 months ending August 31, 2024, driven by a resilient economy and corporate profits, the perception that credit risk has fallen amid elevated coupon yields, and the Federal Reserve's likely pivot to cutting interest rates in late 2024.

•Against this backdrop, the fund's core investment in high-yield bonds increased 13.29% and contributed to performance versus the ICE BofA US High Yield Constrained Index for the fiscal year.

•By industry, security selection was the primary detractor, especially within media. Also hurting our result was security selection in retail and consumer goods. Lastly, the fund's position in cash detracted.

•The fund's non-benchmark stake in Mesquite Energy returned about -10% and was the biggest individual relative detractor. A second notable relative detractor was an overweight in Bi-Lo (-2%). An overweight in Spirit Airlines (-29%) also detracted.

•In contrast, the biggest contributor to performance versus the benchmark was security selection in telecommunications. Our choices in services and utility also boosted the fund's relative performance.

•The fund's non-benchmark stake in Jonah Energy gained 50% and was the top individual relative contributor. It was not held at period end. The second-largest relative contributor was an overweight in Community Health Systems (+29%). The company was one of the fund's largest holdings. Another notable relative contributor was timely positioning in CenturyLink (+34%).

•By quality, positioning in bonds rated BB added the most value, whereas unrated bonds hurt the most.

•Notable changes in positioning include increased exposure to the financial services industry and lower allocations to retail and energy.

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

August 31, 2014 through August 31, 2024.

Initial investment of $10,000.

Fidelity® High Income Central Fund | $10,000 | $9,842 | $10,605 | $11,623 | $12,238 | $13,044 | $13,233 | $15,213 | $14,330 | $15,315 | $17,175 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,692 | $10,586 | $11,516 | $11,893 | $12,675 | $13,134 | $14,481 | $12,970 | $13,882 | $15,613 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,113 | $10,770 | $10,915 | $10,814 | $11,903 | $12,666 | $12,778 | $11,264 | $11,219 | $12,108 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Fidelity® High Income Central Fund | 12.14% | 5.66% | 5.56% |

| ICE® BofA® US High Yield Constrained Index | 12.47% | 4.26% | 4.56% |

| Bloomberg U.S. Universal Bond Index | 7.92% | 0.34% | 1.93% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,387,537,115 | |

| Number of Holdings | 509 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 24% | |

What did the Fund invest in?

(as of August 31, 2024)

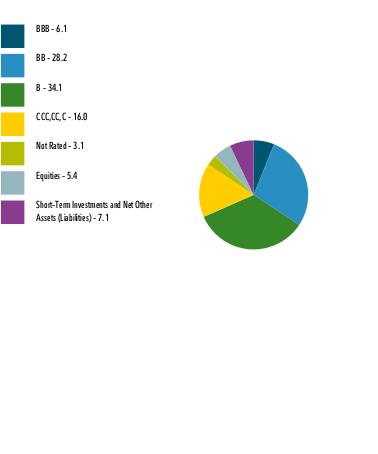

| BBB | 6.1 |

| BB | 28.2 |

| B | 34.1 |

| CCC,CC,C | 16.0 |

| Not Rated | 3.1 |

| Equities | 5.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 7.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

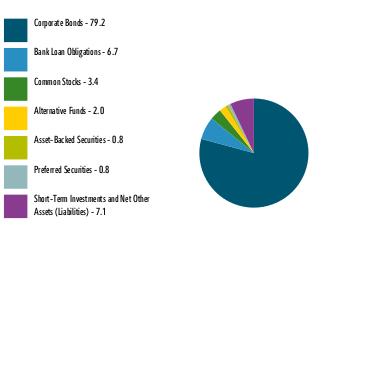

| Corporate Bonds | 79.2 |

| Bank Loan Obligations | 6.7 |

| Common Stocks | 3.4 |

| Alternative Funds | 2.0 |

| Asset-Backed Securities | 0.8 |

| Preferred Securities | 0.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 7.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

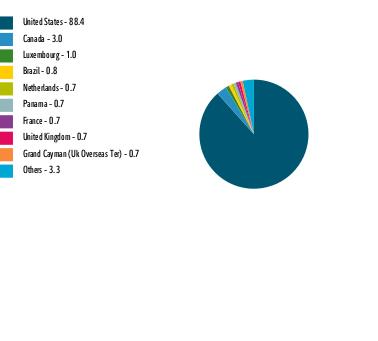

| United States | 88.4 |

| Canada | 3.0 |

| Luxembourg | 1.0 |

| Brazil | 0.8 |

| Netherlands | 0.7 |

| Panama | 0.7 |

| France | 0.7 |

| United Kingdom | 0.7 |

| Grand Cayman (Uk Overseas Ter) | 0.7 |

| Others | 3.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Private Credit Company LLC | 2.0 | |

| CHS/Community Health Systems Inc | 1.8 | |

| TransDigm Inc | 1.7 | |

| Uber Technologies Inc | 1.6 | |

| Pacific Gas and Electric Co | 1.4 | |

| Echo Global Logistics Inc | 1.4 | |

| Tenet Healthcare Corp | 1.3 | |

| Mesquite Energy Inc | 1.3 | |

| DISH Network Corp | 1.1 | |

| Cloud Software Group Inc | 1.0 | |

| | 14.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 .

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: Effective March 1, 2024, the fund's management contract was amended to remove the fee the investment adviser received from investing funds. The fund added a contractual management fee waiver during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913634.100 2062-TSRA-1024 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Specialized High Income Central Fund Fidelity® Specialized High Income Central Fund true |

| | | |

This annual shareholder report contains information about Fidelity® Specialized High Income Central Fund for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Specialized High Income Central Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•High-yield bonds gained for the 12 months ending August 31, 2024, driven by a resilient economy and corporate profits, the perception that credit risk has fallen amid elevated coupon yields, and the Federal Reserve's likely pivot to cutting interest rates in late 2024.

•Against this backdrop, the fund's core investment in high-yield bonds gained 11.71% and detracted from performance versus the ICE BofA BB US High Yield Constrained Index for the fiscal year.

•By industry, market selection was the primary detractor, especially an underweight in financial services. Also hurting our result were our choices in media and basic industry. Lastly, the fund's position in cash detracted.

•The largest individual relative detractor was an underweight in Venture Global (+14%). It was among the fund's largest holdings. The second-largest relative detractor was a non-benchmark stake in Occidental Petroleum (+7%). Another notable relative detractor was Navient (+10%).

•In contrast, the biggest contributors to performance versus the benchmark were security selection and an underweight in transportation. Picks in capital goods also boosted relative performance. Also contributing to our result were security selection and an underweight in leisure.

•The top individual relative contributor was an overweight in Ally Financial (+37%). Not owning Spirit Airlines, a benchmark component that returned about -24%, was the second-largest relative contributor. Not owning Walgreens Boots Alliance, a benchmark component that returned roughly -3%, was another notable relative contributor.

•By quality, positioning in bonds rated BB added the most value, whereas those rated BBB and above hurt the most.

•Notable changes in positioning include increased exposure to the leisure and financial services industries.

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

August 31, 2014 through August 31, 2024.

Initial investment of $10,000.

Fidelity® Specialized High Income Central Fund | $10,000 | $9,930 | $10,664 | $11,452 | $11,729 | $12,753 | $13,295 | $14,155 | $12,743 | $13,452 | $14,981 |

ICE® BofA® BB US High Yield Constrained Index | $10,000 | $9,987 | $10,961 | $11,738 | $11,899 | $13,042 | $13,870 | $14,991 | $13,429 | $14,199 | $15,880 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,113 | $10,770 | $10,915 | $10,814 | $11,903 | $12,666 | $12,778 | $11,264 | $11,219 | $12,108 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Fidelity® Specialized High Income Central Fund | 11.37% | 3.27% | 4.12% |

| ICE® BofA® BB US High Yield Constrained Index | 11.83% | 4.02% | 4.73% |

| Bloomberg U.S. Universal Bond Index | 7.92% | 0.34% | 1.93% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $241,145,314 | |

| Number of Holdings | 397 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 17% | |

What did the Fund invest in?

(as of August 31, 2024)

| BBB | 7.6 |

| BB | 61.4 |

| B | 22.0 |

| CCC,CC,C | 1.7 |

| Not Rated | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 7.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

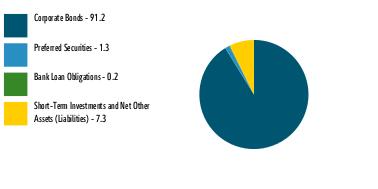

| Corporate Bonds | 91.2 |

| Preferred Securities | 1.3 |

| Bank Loan Obligations | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 7.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.9 |

| Canada | 3.4 |

| United Kingdom | 1.9 |

| Australia | 1.3 |

| Ireland | 0.8 |

| Panama | 0.6 |

| Luxembourg | 0.5 |

| Guatemala | 0.4 |

| Finland | 0.3 |

| Others | 1.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 2.0 | |

| Sirius XM Radio Inc | 1.5 | |

| Royal Caribbean Cruises Ltd | 1.5 | |

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| Hilton Domestic Operating Co Inc | 1.4 | |

| OneMain Finance Corp | 1.3 | |

| Vistra Operations Co LLC | 1.3 | |

| Venture Global Calcasieu | 1.3 | |

| Yum! Brands Inc | 1.2 | |

| | 14.3 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by October 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 .

Effective March 1, 2024, the fund's management contract was amended to remove the fee the investment adviser received from investing funds. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913633.100 1518-TSRA-1024 |

Item 2.

Code of Ethics

As of the end of the period, August 31, 2024, Fidelity Central Investment Portfolios LLC (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity High Income Central Fund and Fidelity Specialized High Income Central Fund (the “Funds”):

Services Billed by Deloitte Entities

August 31, 2024 FeesA

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity High Income Central Fund | $49,500 | $- | $9,700 | $1,200 |

Fidelity Specialized High Income Central Fund | $53,100 | $- | $9,700 | $1,300 |

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity High Income Central Fund | $49,600 | $- | $9,700 | $1,300 |

Fidelity Specialized High Income Central Fund | $53,300 | $- | $9,700 | $1,300 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by Deloitte Entities that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by Deloitte Entities

| | |

| August 31, 2024A | August 31, 2023A |

Audit-Related Fees | $200,000 | $- |

Tax Fees | $- | $- |

All Other Fees | $1,929,500 | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by Deloitte Entities for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

| | |

Billed By | August 31, 2024A | August 31, 2023A |

Deloitte Entities | $4,970,400 | $3,240,000 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by Deloitte Entities to Fund Service Providers to be compatible with maintaining the independence of Deloitte Entities in its(their) audit of the Fund(s), taking into account representations from Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity® Specialized High Income Central Fund

Annual Report

August 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Annual Report)

Fidelity® Specialized High Income Central Fund

Schedule of Investments August 31, 2024

Showing Percentage of Net Assets

| Corporate Bonds - 91.1% |

| | | Principal Amount (a) | Value ($) |

| Convertible Bonds - 0.5% | | | |

| Broadcasting - 0.4% | | | |

| DISH Network Corp. 3.375% 8/15/26 | | 1,328,000 | 826,798 |

| Homebuilders/Real Estate - 0.0% | | | |

| Meritage Homes Corp. 1.75% 5/15/28 (b) | | 10,000 | 11,010 |

| Technology - 0.1% | | | |

| Global Payments, Inc. 1.5% 3/1/31 (b) | | 324,000 | 319,950 |

TOTAL CONVERTIBLE BONDS | | | 1,157,758 |

| Nonconvertible Bonds - 90.6% | | | |

| Aerospace - 1.9% | | | |

| BWX Technologies, Inc. 4.125% 6/30/28 (b) | | 495,000 | 477,674 |

| Howmet Aerospace, Inc.: | | | |

| 5.95% 2/1/37 | | 300,000 | 325,155 |

| 6.75% 1/15/28 | | 775,000 | 825,054 |

| Kaiser Aluminum Corp. 4.625% 3/1/28 (b) | | 630,000 | 598,276 |

| Moog, Inc. 4.25% 12/15/27 (b) | | 730,000 | 703,125 |

| Rolls-Royce PLC 5.75% 10/15/27 (b) | | 635,000 | 651,060 |

| TransDigm, Inc. 6.375% 3/1/29 (b) | | 1,080,000 | 1,113,006 |

| | | | 4,693,350 |

| Air Transportation - 1.3% | | | |

| American Airlines, Inc.: | | | |

| 7.25% 2/15/28 (b)(c) | | 750,000 | 754,664 |

| 8.5% 5/15/29 (b) | | 305,000 | 317,097 |

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd. 5.5% 4/20/26 (b) | | 204,167 | 203,109 |

| Rand Parent LLC 8.5% 2/15/30 (b)(c) | | 755,000 | 755,012 |

| United Airlines, Inc. 4.375% 4/15/26 (b) | | 1,080,000 | 1,053,938 |

| | | | 3,083,820 |

| Automotive & Auto Parts - 2.5% | | | |

| Allison Transmission, Inc. 3.75% 1/30/31 (b) | | 635,000 | 577,067 |

| Dana, Inc. 4.5% 2/15/32 (c) | | 180,000 | 159,632 |

| Ford Motor Co.: | | | |

| 3.25% 2/12/32 | | 440,000 | 374,759 |

| 5.291% 12/8/46 | | 220,000 | 199,386 |

| 6.1% 8/19/32 | | 550,000 | 565,138 |

| Ford Motor Credit Co. LLC: | | | |

| 2.3% 2/10/25 | | 180,000 | 177,421 |

| 2.7% 8/10/26 | | 600,000 | 573,036 |

| 2.9% 2/10/29 | | 180,000 | 162,957 |

| 4.687% 6/9/25 | | 500,000 | 497,520 |

| 5.125% 6/16/25 | | 330,000 | 329,116 |

| LCM Investments Holdings 4.875% 5/1/29 (b) | | 80,000 | 76,208 |

| Macquarie AirFinance Holdings: | | | |

| 6.4% 3/26/29 (b) | | 70,000 | 72,850 |

| 8.125% 3/30/29 (b) | | 165,000 | 175,349 |

| 8.375% 5/1/28 (b) | | 855,000 | 905,902 |

| Phinia, Inc. 6.75% 4/15/29 (b) | | 175,000 | 179,579 |

| Thor Industries, Inc. 4% 10/15/29 (b) | | 235,000 | 214,544 |

| ZF North America Capital, Inc. 6.875% 4/14/28 (b) | | 650,000 | 671,541 |

| | | | 5,912,005 |

| Banks & Thrifts - 0.8% | | | |

| Jane Street Group LLC/JSG Finance, Inc. 4.5% 11/15/29 (b) | | 550,000 | 524,944 |

| Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc 3.625% 3/1/29 (b) | | 680,000 | 631,195 |

| UniCredit SpA: | | | |

| 5.861% 6/19/32 (b)(d) | | 83,000 | 82,813 |

| 7.296% 4/2/34 (b)(d) | | 207,000 | 217,578 |

| VFH Parent LLC / Valor Co-Issuer, Inc. 7.5% 6/15/31 (b) | | 275,000 | 285,287 |

| Western Alliance Bancorp. 3% 6/15/31 (d) | | 105,000 | 94,952 |

| | | | 1,836,769 |

| Broadcasting - 2.3% | | | |

| Nexstar Media, Inc. 5.625% 7/15/27 (b) | | 825,000 | 806,196 |

| Scripps Escrow II, Inc. 3.875% 1/15/29 (b) | | 230,000 | 148,288 |

| Sirius XM Radio, Inc.: | | | |

| 5% 8/1/27 (b) | | 2,255,000 | 2,204,277 |

| 5.5% 7/1/29 (b)(c) | | 1,420,000 | 1,382,020 |

| TEGNA, Inc.: | | | |

| 4.625% 3/15/28 | | 835,000 | 784,829 |

| 5% 9/15/29 | | 120,000 | 111,456 |

| | | | 5,437,066 |

| Building Materials - 2.7% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (b) | | 940,000 | 925,468 |

| Beacon Roofing Supply, Inc. 6.5% 8/1/30 (b) | | 190,000 | 195,114 |

| Builders FirstSource, Inc. 4.25% 2/1/32 (b) | | 980,000 | 895,374 |

| EMRLD Borrower LP / Emerald Co. 6.625% 12/15/30 (b) | | 1,410,000 | 1,443,888 |

| Knife River Holding Co. 7.75% 5/1/31 (b)(c) | | 430,000 | 455,235 |

| Smyrna Ready Mix Concrete LLC 8.875% 11/15/31 (b) | | 330,000 | 354,222 |

| Standard Industries, Inc./New Jersey 4.375% 7/15/30 (b) | | 1,240,000 | 1,159,369 |

| Summit Materials LLC/Summit Materials Finance Corp. 7.25% 1/15/31 (b) | | 1,000,000 | 1,051,250 |

| | | | 6,479,920 |

| Cable/Satellite TV - 2.4% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 2/1/31 (b) | | 100,000 | 86,771 |

| 4.5% 8/15/30 (b) | | 640,000 | 570,756 |

| 4.5% 5/1/32 | | 1,180,000 | 1,007,548 |

| 5% 2/1/28 (b) | | 2,449,000 | 2,359,858 |

| 5.125% 5/1/27 (b) | | 700,000 | 686,056 |

| CSC Holdings LLC 5.375% 2/1/28 (b) | | 100,000 | 76,889 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (b) | | 600,000 | 579,750 |

| Ziggo BV 4.875% 1/15/30 (b) | | 450,000 | 419,543 |

| | | | 5,787,171 |

| Capital Goods - 0.3% | | | |

| ESAB Corp. 6.25% 4/15/29 (b) | | 415,000 | 426,327 |

| Resideo Funding, Inc. 6.5% 7/15/32 (b)(c) | | 365,000 | 371,593 |

| | | | 797,920 |

| Chemicals - 3.7% | | | |

| Axalta Coating Systems/Dutch Holding BV 4.75% 6/15/27 (b) | | 600,000 | 590,375 |

| Methanex Corp.: | | | |

| 5.125% 10/15/27 | | 790,000 | 777,613 |

| 5.25% 12/15/29 | | 65,000 | 63,885 |

| 5.65% 12/1/44 | | 514,000 | 459,107 |

| NOVA Chemicals Corp.: | | | |

| 5% 5/1/25 (b) | | 1,000,000 | 993,956 |

| 5.25% 6/1/27 (b) | | 980,000 | 967,388 |

| Nufarm Australia Ltd. 5% 1/27/30 (b) | | 445,000 | 412,439 |

| Olin Corp.: | | | |

| 5% 2/1/30 | | 969,000 | 936,679 |

| 5.125% 9/15/27 | | 1,260,000 | 1,244,754 |

| SPCM SA 3.125% 3/15/27 (b) | | 180,000 | 168,159 |

| The Chemours Co. LLC: | | | |

| 4.625% 11/15/29 (b)(c) | | 250,000 | 219,928 |

| 5.375% 5/15/27 | | 940,000 | 913,371 |

| Tronox, Inc. 4.625% 3/15/29 (b)(c) | | 545,000 | 496,674 |

| W.R. Grace Holding LLC: | | | |

| 4.875% 6/15/27 (b) | | 615,000 | 601,407 |

| 7.375% 3/1/31 (b) | | 60,000 | 62,322 |

| | | | 8,908,057 |

| Consumer Products - 1.4% | | | |

| Kohl's Corp. 4.25% 7/17/25 | | 20,000 | 19,810 |

| Mattel, Inc.: | | | |

| 3.75% 4/1/29 (b) | | 315,000 | 299,219 |

| 6.2% 10/1/40 | | 185,000 | 187,164 |

| Newell Brands, Inc.: | | | |

| 6.625% 9/15/29 | | 1,010,000 | 1,008,448 |

| 6.875% 4/1/36 (c)(e) | | 280,000 | 266,258 |

| Prestige Brands, Inc. 3.75% 4/1/31 (b) | | 500,000 | 453,153 |

| Tempur Sealy International, Inc. 3.875% 10/15/31 (b) | | 1,185,000 | 1,042,187 |

| | | | 3,276,239 |

| Containers - 2.7% | | | |

| Ball Corp.: | | | |

| 2.875% 8/15/30 | | 1,015,000 | 897,116 |

| 3.125% 9/15/31 | | 1,835,000 | 1,604,326 |

| 6% 6/15/29 | | 450,000 | 463,031 |

| Graphic Packaging International, Inc.: | | | |

| 3.75% 2/1/30 (b) | | 480,000 | 443,946 |

| 6.375% 7/15/32 (b) | | 460,000 | 470,317 |

| OI European Group BV 4.75% 2/15/30 (b) | | 585,000 | 549,096 |

| Sealed Air Corp.: | | | |

| 5% 4/15/29 (b) | | 1,280,000 | 1,255,443 |

| 6.875% 7/15/33 (b)(c) | | 340,000 | 363,901 |

| Sealed Air Corp./Sealed Air Corp. U.S. 7.25% 2/15/31 (b)(c) | | 355,000 | 373,067 |

| | | | 6,420,243 |

| Diversified Financial Services - 5.2% | | | |

| Aercap Global Aviation Trust 6.5% 6/15/45 (b)(d) | | 250,000 | 249,218 |

| Capstone Borrower, Inc. 8% 6/15/30 (b) | | 125,000 | 131,661 |

| Cargo Aircraft Management, Inc. 4.75% 2/1/28 (b) | | 500,000 | 477,500 |

| Encore Capital Group, Inc. 9.25% 4/1/29 (b) | | 160,000 | 170,320 |

| Fortress Transportation & Infrastructure Investors LLC: | | | |

| 7% 6/15/32 (b) | | 460,000 | 481,248 |

| 7.875% 12/1/30 (b) | | 275,000 | 295,127 |

| GGAM Finance Ltd.: | | | |

| 6.875% 4/15/29 (b) | | 285,000 | 294,104 |

| 7.75% 5/15/26 (b) | | 440,000 | 451,479 |

| 8% 2/15/27 (b) | | 270,000 | 281,468 |

| Gn Bondco LLC 9.5% 10/15/31 (b)(c) | | 365,000 | 371,523 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 5.25% 5/15/27 | | 1,240,000 | 1,195,050 |

| 6.25% 5/15/26 | | 1,569,000 | 1,559,999 |

| Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. 4.25% 2/1/27 (b) | | 950,000 | 921,920 |

| LPL Holdings, Inc. 4% 3/15/29 (b) | | 710,000 | 675,478 |

| Nationstar Mortgage Holdings, Inc. 6.5% 8/1/29 (b) | | 355,000 | 357,843 |

| Navient Corp. 6.75% 6/15/26 | | 1,545,000 | 1,571,654 |

| OneMain Finance Corp.: | | | |

| 3.5% 1/15/27 | | 1,485,000 | 1,407,740 |

| 7.125% 3/15/26 | | 309,000 | 314,850 |

| 7.125% 11/15/31 | | 120,000 | 121,251 |

| 7.5% 5/15/31 | | 785,000 | 812,127 |

| 7.875% 3/15/30 | | 410,000 | 428,810 |

| | | | 12,570,370 |

| Diversified Media - 0.6% | | | |

| Advantage Sales & Marketing, Inc. 6.5% 11/15/28 (b) | | 405,000 | 379,712 |

| Lamar Media Corp. 3.625% 1/15/31 | | 1,145,000 | 1,036,809 |

| | | | 1,416,521 |

| Energy - 14.6% | | | |

| Antero Midstream Partners LP/Antero Midstream Finance Corp. 5.75% 3/1/27 (b) | | 1,545,000 | 1,538,997 |

| Apache Corp.: | | | |

| 4.25% 1/15/30 | | 124,000 | 118,389 |

| 5.1% 9/1/40 | | 341,000 | 301,592 |

| 5.25% 2/1/42 | | 515,000 | 455,666 |

| 5.35% 7/1/49 | | 85,000 | 72,514 |

| Archrock Partners LP / Archrock Partners Finance Corp. 6.625% 9/1/32 (b) | | 355,000 | 359,428 |

| Baytex Energy Corp. 7.375% 3/15/32 (b) | | 280,000 | 289,992 |

| Buckeye Partners LP 3.95% 12/1/26 | | 1,145,000 | 1,112,409 |

| California Resources Corp. 8.25% 6/15/29 (b) | | 695,000 | 716,842 |

| Chesapeake Energy Corp. 6.75% 4/15/29 (b) | | 700,000 | 710,460 |

| CNX Midstream Partners LP 4.75% 4/15/30 (b) | | 710,000 | 662,207 |

| Continental Resources, Inc. 5.75% 1/15/31 (b) | | 930,000 | 943,161 |

| CrownRock LP/CrownRock Finance, Inc. 5% 5/1/29 (b) | | 350,000 | 354,827 |

| CVR Energy, Inc. 5.75% 2/15/28 (b) | | 85,000 | 80,159 |

| DCP Midstream Operating LP: | | | |

| 5.125% 5/15/29 | | 1,650,000 | 1,677,052 |

| 5.6% 4/1/44 | | 50,000 | 49,334 |

| 6.45% 11/3/36 (b) | | 215,000 | 233,367 |

| 8.125% 8/16/30 | | 15,000 | 17,544 |

| Delek Logistics Partners LP/Delek Logistics Finance Corp. 8.625% 3/15/29 (b) | | 430,000 | 452,135 |

| Endeavor Energy Resources LP/EER Finance, Inc. 5.75% 1/30/28 (b) | | 450,000 | 457,919 |

| Energy Transfer LP: | | | |

| 5.625% 5/1/27 (b) | | 1,098,000 | 1,100,643 |

| 7.375% 2/1/31 (b) | | 185,000 | 196,964 |

| EnLink Midstream LLC 5.625% 1/15/28 (b) | | 460,000 | 468,472 |

| EnLink Midstream Partners LP: | | | |

| 5.05% 4/1/45 | | 145,000 | 127,511 |

| 5.45% 6/1/47 | | 300,000 | 278,640 |

| 5.6% 4/1/44 | | 508,000 | 480,196 |

| EQM Midstream Partners LP: | | | |

| 5.5% 7/15/28 | | 450,000 | 453,003 |

| 7.5% 6/1/27 (b) | | 355,000 | 365,850 |

| EQT Corp. 3.9% 10/1/27 | | 824,000 | 805,136 |

| Genesis Energy LP/Genesis Energy Finance Corp. 7.875% 5/15/32 | | 115,000 | 117,995 |

| Global Partners LP/GLP Finance Corp. 7% 8/1/27 | | 850,000 | 857,292 |

| Harvest Midstream I LP 7.5% 5/15/32 (b) | | 860,000 | 904,079 |

| Hess Midstream Operations LP: | | | |

| 5.125% 6/15/28 (b) | | 565,000 | 558,544 |

| 5.625% 2/15/26 (b) | | 297,000 | 296,186 |

| 6.5% 6/1/29 (b) | | 1,155,000 | 1,191,722 |

| Hilcorp Energy I LP/Hilcorp Finance Co.: | | | |

| 6.25% 11/1/28 (b) | | 190,000 | 191,001 |

| 6.25% 4/15/32 (b) | | 1,000,000 | 996,591 |

| Howard Midstream Energy Partners LLC 7.375% 7/15/32 (b) | | 235,000 | 243,287 |

| Kinetik Holdings LP: | | | |

| 5.875% 6/15/30 (b) | | 370,000 | 371,188 |

| 6.625% 12/15/28 (b) | | 395,000 | 407,001 |

| Kodiak Gas Services LLC 7.25% 2/15/29 (b) | | 320,000 | 331,402 |

| Matador Resources Co. 6.5% 4/15/32 (b) | | 385,000 | 390,731 |

| New Fortress Energy, Inc. 6.5% 9/30/26 (b)(c) | | 1,260,000 | 1,090,689 |

| Occidental Petroleum Corp. 5.55% 3/15/26 | | 830,000 | 836,831 |

| PBF Holding Co. LLC/PBF Finance Corp.: | | | |

| 6% 2/15/28 (c) | | 400,000 | 396,072 |

| 7.875% 9/15/30 (b) | | 285,000 | 296,361 |

| Permian Resources Operating LLC: | | | |

| 5.875% 7/1/29 (b) | | 95,000 | 95,000 |

| 6.25% 2/1/33 (b) | | 470,000 | 481,940 |

| 7% 1/15/32 (b) | | 630,000 | 660,877 |

| Rockies Express Pipeline LLC: | | | |

| 4.8% 5/15/30 (b) | | 545,000 | 505,911 |

| 4.95% 7/15/29 (b) | | 285,000 | 272,389 |

| 6.875% 4/15/40 (b) | | 110,000 | 106,622 |

| Seadrill Finance Ltd. 8.375% 8/1/30 (b) | | 535,000 | 564,735 |

| Southwestern Energy Co. 5.375% 2/1/29 | | 975,000 | 962,549 |

| Sunnova Energy Corp. 11.75% 10/1/28 (b) | | 160,000 | 148,557 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.5% 5/15/29 | | 645,000 | 619,268 |

| 5.875% 3/15/28 | | 105,000 | 105,102 |

| 6% 4/15/27 | | 700,000 | 701,014 |

| Superior Plus LP / Superior General Partner, Inc. 4.5% 3/15/29 (b) | | 130,000 | 121,627 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp.: | | | |

| 5.5% 1/15/28 (b) | | 125,000 | 120,609 |

| 6% 3/1/27 (b) | | 556,000 | 554,430 |

| 6% 12/31/30 (b) | | 680,000 | 648,484 |

| Talos Production, Inc. 9% 2/1/29 (b) | | 90,000 | 95,610 |

| Transocean, Inc. 8.25% 5/15/29 (b) | | 455,000 | 460,633 |

| Valaris Ltd. 8.375% 4/30/30 (b) | | 280,000 | 292,106 |

| Venture Global Calcasieu Pass LLC: | | | |

| 3.875% 8/15/29 (b) | | 220,000 | 207,985 |

| 3.875% 11/1/33 (b) | | 180,000 | 160,121 |

| 4.125% 8/15/31 (b) | | 1,210,000 | 1,121,653 |

| 6.25% 1/15/30 (b) | | 1,255,000 | 1,304,841 |

| Venture Global LNG, Inc. 8.125% 6/1/28 (b) | | 550,000 | 575,989 |

| | | | 35,245,433 |

| Environmental - 1.2% | | | |

| Clean Harbors, Inc. 6.375% 2/1/31 (b) | | 425,000 | 434,313 |

| Darling Ingredients, Inc.: | | | |

| 5.25% 4/15/27 (b) | | 635,000 | 631,700 |

| 6% 6/15/30 (b)(c) | | 110,000 | 111,346 |

| GFL Environmental, Inc. 6.75% 1/15/31 (b) | | 1,195,000 | 1,248,271 |

| Stericycle, Inc. 3.875% 1/15/29 (b) | | 460,000 | 446,666 |

| | | | 2,872,296 |

| Food & Drug Retail - 1.8% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.5% 3/15/29 (b) | | 1,880,000 | 1,741,160 |

| 4.625% 1/15/27 (b) | | 700,000 | 683,915 |

| 4.875% 2/15/30 (b) | | 500,000 | 488,681 |

| 6.5% 2/15/28 (b) | | 345,000 | 349,444 |

| Emergent BioSolutions, Inc. 3.875% 8/15/28 (b) | | 285,000 | 211,605 |

| Murphy Oil U.S.A., Inc. 3.75% 2/15/31 (b) | | 430,000 | 389,048 |

| Parkland Corp. 6.625% 8/15/32 (b) | | 595,000 | 601,232 |

| | | | 4,465,085 |

| Food/Beverage/Tobacco - 2.0% | | | |

| C&S Group Enterprises LLC 5% 12/15/28 (b) | | 350,000 | 264,391 |

| Central Garden & Pet Co. 4.125% 4/30/31 (b)(c) | | 500,000 | 453,073 |

| Lamb Weston Holdings, Inc. 4.375% 1/31/32 (b) | | 1,725,000 | 1,588,943 |

| Pilgrim's Pride Corp. 4.25% 4/15/31 | | 500,000 | 471,325 |

| Post Holdings, Inc. 5.625% 1/15/28 (b) | | 1,000,000 | 997,416 |

| U.S. Foods, Inc.: | | | |

| 4.625% 6/1/30 (b)(c) | | 785,000 | 751,392 |

| 7.25% 1/15/32 (b) | | 180,000 | 190,001 |

| | | | 4,716,541 |

| Gaming - 2.6% | | | |

| Boyd Gaming Corp. 4.75% 12/1/27 | | 650,000 | 637,824 |

| Caesars Entertainment, Inc. 4.625% 10/15/29 (b)(c) | | 700,000 | 662,136 |

| Churchill Downs, Inc. 5.75% 4/1/30 (b) | | 500,000 | 496,996 |

| Melco Resorts Finance Ltd.: | | | |

| 5.375% 12/4/29 (b) | | 265,000 | 241,576 |

| 5.75% 7/21/28 (b) | | 400,000 | 380,833 |

| MGM Resorts International 5.75% 6/15/25 | | 310,000 | 309,959 |

| Ontario Gaming GTA LP / OTG Co. issuer, Inc. 8% 8/1/30 (b) | | 95,000 | 97,916 |

| VICI Properties LP / VICI Note Co.: | | | |

| 4.25% 12/1/26 (b) | | 360,000 | 355,378 |

| 4.5% 9/1/26 (b) | | 1,292,000 | 1,280,155 |

| 4.625% 6/15/25 (b) | | 155,000 | 153,630 |

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. 5.25% 5/15/27 (b)(c) | | 1,745,000 | 1,733,394 |

| | | | 6,349,797 |

| Healthcare - 6.5% | | | |

| 180 Medical, Inc. 3.875% 10/15/29 (b)(c) | | 585,000 | 548,582 |

| Avantor Funding, Inc.: | | | |

| 3.875% 11/1/29 (b) | | 500,000 | 467,231 |

| 4.625% 7/15/28 (b) | | 605,000 | 588,767 |

| Centene Corp.: | | | |

| 2.45% 7/15/28 | | 35,000 | 32,023 |

| 2.5% 3/1/31 | | 695,000 | 590,006 |

| 3.375% 2/15/30 | | 1,000,000 | 915,655 |

| 4.25% 12/15/27 | | 710,000 | 694,167 |

| Charles River Laboratories International, Inc.: | | | |

| 3.75% 3/15/29 (b) | | 830,000 | 777,756 |

| 4.25% 5/1/28 (b) | | 75,000 | 72,316 |

| CHS/Community Health Systems, Inc. 4.75% 2/15/31 (b) | | 860,000 | 733,516 |

| DaVita, Inc. 4.625% 6/1/30 (b) | | 320,000 | 301,728 |

| Hologic, Inc.: | | | |

| 3.25% 2/15/29 (b) | | 560,000 | 517,183 |

| 4.625% 2/1/28 (b) | | 85,000 | 83,006 |

| IQVIA, Inc. 5% 5/15/27 (b) | | 1,310,000 | 1,300,528 |

| Jazz Securities DAC 4.375% 1/15/29 (b) | | 1,000,000 | 951,671 |

| Medline Borrower LP / Medline Co. 6.25% 4/1/29 (b) | | 690,000 | 711,269 |

| Molina Healthcare, Inc.: | | | |

| 3.875% 11/15/30 (b) | | 500,000 | 459,724 |

| 3.875% 5/15/32 (b) | | 740,000 | 663,950 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV: | | | |

| 4.125% 4/30/28 (b) | | 775,000 | 740,914 |

| 5.125% 4/30/31 (b) | | 525,000 | 491,685 |

| Pediatrix Medical Group, Inc. 5.375% 2/15/30 (b) | | 500,000 | 478,139 |

| Surgery Center Holdings, Inc. 7.25% 4/15/32 (b) | | 335,000 | 351,857 |

| Teleflex, Inc. 4.25% 6/1/28 (b) | | 150,000 | 144,153 |

| Tenet Healthcare Corp.: | | | |

| 4.625% 6/15/28 | | 1,970,000 | 1,925,009 |

| 5.125% 11/1/27 | | 1,245,000 | 1,234,166 |

| | | | 15,775,001 |

| Homebuilders/Real Estate - 2.3% | | | |

| Century Communities, Inc. 3.875% 8/15/29 (b) | | 215,000 | 199,196 |

| Greystar Real Estate Partners 7.75% 9/1/30 (b) | | 80,000 | 85,126 |

| HAT Holdings I LLC/HAT Holdings II LLC: | | | |

| 3.375% 6/15/26 (b) | | 730,000 | 699,307 |

| 8% 6/15/27 (b) | | 240,000 | 251,468 |

| Kennedy-Wilson, Inc. 4.75% 2/1/30 | | 355,000 | 313,265 |

| LGI Homes, Inc. 8.75% 12/15/28 (b) | | 140,000 | 149,163 |

| MPT Operating Partnership LP/MPT Finance Corp.: | | | |

| 3.5% 3/15/31 | | 600,000 | 409,832 |

| 5% 10/15/27 (c) | | 1,471,000 | 1,248,472 |

| 5.25% 8/1/26 (c) | | 205,000 | 192,833 |

| Ryan Specialty Group LLC 4.375% 2/1/30 (b) | | 265,000 | 253,877 |

| Service Properties Trust: | | | |

| 3.95% 1/15/28 | | 40,000 | 33,990 |

| 5.5% 12/15/27 | | 240,000 | 225,764 |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc. 5.75% 1/15/28 (b) | | 360,000 | 362,996 |

| TopBuild Corp. 4.125% 2/15/32 (b) | | 380,000 | 345,870 |

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC 4.75% 4/15/28 (b) | | 815,000 | 716,595 |

| | | | 5,487,754 |

| Hotels - 1.8% | | | |

| Hilton Domestic Operating Co., Inc.: | | | |

| 3.625% 2/15/32 (b) | | 565,000 | 506,428 |

| 4% 5/1/31 (b) | | 1,590,000 | 1,469,263 |

| 5.875% 4/1/29 (b) | | 1,085,000 | 1,105,692 |

| Hilton Grand Vacations Borrower Escrow LLC: | | | |

| 5% 6/1/29 (b)(c) | | 500,000 | 472,737 |

| 6.625% 1/15/32 (b) | | 50,000 | 50,603 |

| Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp. 4.875% 4/1/27 | | 211,000 | 209,867 |

| Park Intermediate Holdings LLC / PK Domestic Property LLC / PK Finance Co.-Issuer 7% 2/1/30 (b) | | 160,000 | 164,004 |

| Wyndham Hotels & Resorts, Inc. 4.375% 8/15/28 (b) | | 297,000 | 284,272 |

| | | | 4,262,866 |

| Leisure - 2.2% | | | |

| Amer Sports Co. 6.75% 2/16/31 (b)(c) | | 700,000 | 711,365 |

| Carnival Corp. 7.625% 3/1/26 (b) | | 730,000 | 737,395 |

| NCL Corp. Ltd. 8.375% 2/1/28 (b) | | 430,000 | 452,618 |

| Royal Caribbean Cruises Ltd.: | | | |

| 5.375% 7/15/27 (b) | | 160,000 | 160,273 |

| 5.5% 8/31/26 (b) | | 1,745,000 | 1,747,473 |

| 5.5% 4/1/28 (b) | | 1,345,000 | 1,355,387 |

| 6.25% 3/15/32 (b) | | 215,000 | 222,034 |

| | | | 5,386,545 |

| Metals/Mining - 2.5% | | | |

| Alcoa Nederland Holding BV 7.125% 3/15/31 (b) | | 85,000 | 89,389 |

| Arsenal AIC Parent LLC 8% 10/1/30 (b) | | 105,000 | 112,890 |

| Cleveland-Cliffs, Inc.: | | | |

| 4.875% 3/1/31 (b)(c) | | 960,000 | 881,648 |

| 6.75% 4/15/30 (b)(c) | | 370,000 | 375,118 |

| ERO Copper Corp. 6.5% 2/15/30 (b) | | 415,000 | 404,413 |

| FMG Resources August 2006 Pty Ltd. 4.5% 9/15/27 (b) | | 950,000 | 918,823 |

| Mineral Resources Ltd. 8% 11/1/27 (b) | | 1,885,000 | 1,914,644 |

| Novelis Corp. 3.875% 8/15/31 (b) | | 1,545,000 | 1,385,263 |

| | | | 6,082,188 |

| Paper - 0.2% | | | |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC: | | | |

| 3.25% 9/1/28 (b) | | 575,000 | 521,696 |

| 6% 6/15/27 (b) | | 15,000 | 14,956 |

| | | | 536,652 |

| Railroad - 0.1% | | | |

| Genesee & Wyoming, Inc. 6.25% 4/15/32 (b) | | 345,000 | 352,614 |

| Restaurants - 1.9% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc. 3.875% 1/15/28 (b) | | 1,645,000 | 1,570,873 |

| Garden SpinCo Corp. 8.625% 7/20/30 (b) | | 75,000 | 81,841 |

| Yum! Brands, Inc.: | | | |

| 3.625% 3/15/31 | | 2,380,000 | 2,184,490 |

| 4.625% 1/31/32 | | 750,000 | 710,826 |

| 5.35% 11/1/43 | | 85,000 | 82,171 |

| | | | 4,630,201 |

| Services - 5.5% | | | |

| ADT Corp.: | | | |

| 4.125% 8/1/29 (b)(c) | | 180,000 | 170,936 |

| 4.875% 7/15/32 (b) | | 175,000 | 166,353 |

| AECOM 5.125% 3/15/27 | | 1,010,000 | 1,010,957 |

| Aramark Services, Inc. 5% 2/1/28 (b)(c) | | 830,000 | 814,095 |

| ASGN, Inc. 4.625% 5/15/28 (b) | | 790,000 | 763,274 |

| Booz Allen Hamilton, Inc.: | | | |

| 3.875% 9/1/28 (b) | | 795,000 | 764,296 |

| 4% 7/1/29 (b) | | 70,000 | 67,645 |

| Brand Industrial Services, Inc. 10.375% 8/1/30 (b) | | 270,000 | 294,184 |

| CoreCivic, Inc. 8.25% 4/15/29 | | 215,000 | 226,807 |

| Fair Isaac Corp. 4% 6/15/28 (b)(c) | | 915,000 | 873,840 |

| Gartner, Inc.: | | | |

| 3.625% 6/15/29 (b) | | 100,000 | 94,413 |

| 3.75% 10/1/30 (b) | | 265,000 | 245,384 |

| 4.5% 7/1/28 (b) | | 410,000 | 402,660 |

| Iron Mountain, Inc.: | | | |

| 4.875% 9/15/27 (b) | | 250,000 | 245,466 |

| 4.875% 9/15/29 (b) | | 2,430,000 | 2,358,480 |

| Prime Securities Services Borrower LLC/Prime Finance, Inc. 3.375% 8/31/27 (b) | | 1,270,000 | 1,202,430 |

| Service Corp. International 5.125% 6/1/29 | | 1,345,000 | 1,329,133 |

| Sotheby's 7.375% 10/15/27 (b) | | 155,000 | 148,017 |

| The GEO Group, Inc. 8.625% 4/15/29 | | 260,000 | 269,717 |

| TriNet Group, Inc.: | | | |

| 3.5% 3/1/29 (b) | | 295,000 | 272,898 |

| 7.125% 8/15/31 (b) | | 180,000 | 186,678 |

| Uber Technologies, Inc. 4.5% 8/15/29 (b)(c) | | 1,395,000 | 1,368,125 |

| | | | 13,275,788 |

| Steel - 0.1% | | | |

| Commercial Metals Co. 3.875% 2/15/31 | | 375,000 | 340,173 |

| Super Retail - 3.0% | | | |

| Asbury Automotive Group, Inc.: | | | |

| 4.625% 11/15/29 (b)(c) | | 1,060,000 | 1,009,188 |

| 5% 2/15/32 (b) | | 325,000 | 306,102 |

| Bath & Body Works, Inc.: | | | |

| 6.625% 10/1/30 (b)(c) | | 1,145,000 | 1,159,304 |

| 6.875% 11/1/35 (c) | | 580,000 | 599,054 |

| EG Global Finance PLC 12% 11/30/28 (b) | | 620,000 | 676,310 |

| Gap, Inc. 3.875% 10/1/31 (b) | | 680,000 | 587,436 |

| Group 1 Automotive, Inc. 6.375% 1/15/30 (b) | | 225,000 | 228,895 |

| Hanesbrands, Inc. 4.875% 5/15/26 (b) | | 635,000 | 630,590 |

| Levi Strauss & Co. 3.5% 3/1/31 (b)(c) | | 760,000 | 685,587 |

| Nordstrom, Inc. 4.375% 4/1/30 (c) | | 650,000 | 596,922 |

| Sally Holdings LLC 6.75% 3/1/32 | | 235,000 | 239,717 |

| The William Carter Co. 5.625% 3/15/27 (b) | | 574,000 | 572,980 |

| | | | 7,292,085 |

| Technology - 6.3% | | | |

| Acuris Finance U.S. 5% 5/1/28 (b) | | 335,000 | 299,883 |

| Block, Inc.: | | | |

| 2.75% 6/1/26 (c) | | 180,000 | 172,870 |

| 6.5% 5/15/32 (b) | | 460,000 | 477,026 |

| Broadcom, Inc. 2.45% 2/15/31 (b) | | 525,000 | 458,081 |

| Central Parent, Inc./Central Merger Sub, Inc. 7.25% 6/15/29 (b) | | 220,000 | 221,097 |

| CNT PRNT/CDK GLO II/FIN 8% 6/15/29 (b) | | 350,000 | 361,372 |

| Coherent Corp. 5% 12/15/29 (b)(c) | | 690,000 | 667,219 |

| Crowdstrike Holdings, Inc. 3% 2/15/29 | | 305,000 | 279,496 |

| Elastic NV 4.125% 7/15/29 (b) | | 205,000 | 190,997 |

| Entegris, Inc.: | | | |

| 3.625% 5/1/29 (b) | | 1,000,000 | 920,717 |

| 4.375% 4/15/28 (b) | | 1,045,000 | 1,003,770 |

| Gen Digital, Inc. 5% 4/15/25 (b) | | 500,000 | 498,077 |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc.: | | | |

| 3.5% 3/1/29 (b) | | 750,000 | 697,357 |

| 5.25% 12/1/27 (b) | | 700,000 | 696,900 |

| Lightning Power LLC 7.25% 8/15/32 (b) | | 220,000 | 227,325 |

| Match Group Holdings II LLC: | | | |

| 3.625% 10/1/31 (b)(c) | | 285,000 | 253,069 |

| 4.125% 8/1/30 (b) | | 850,000 | 782,966 |

| ON Semiconductor Corp. 3.875% 9/1/28 (b) | | 310,000 | 294,612 |

| Open Text Corp.: | | | |

| 3.875% 2/15/28 (b) | | 1,375,000 | 1,303,667 |

| 3.875% 12/1/29 (b) | | 600,000 | 553,147 |

| Qorvo, Inc. 4.375% 10/15/29 | | 475,000 | 457,425 |

| Roblox Corp. 3.875% 5/1/30 (b) | | 445,000 | 409,955 |

| Seagate HDD Cayman: | | | |

| 5.75% 12/1/34 | | 300,000 | 300,171 |

| 8.25% 12/15/29 | | 1,225,000 | 1,327,802 |

| Sensata Technologies BV 4% 4/15/29 (b) | | 555,000 | 522,553 |

| Sensata Technologies, Inc. 3.75% 2/15/31 (b) | | 665,000 | 600,466 |

| TTM Technologies, Inc. 4% 3/1/29 (b) | | 680,000 | 641,756 |

| Viavi Solutions, Inc. 3.75% 10/1/29 (b) | | 360,000 | 320,305 |

| VM Consolidated, Inc. 5.5% 4/15/29 (b) | | 295,000 | 287,101 |

| | | | 15,227,182 |

| Telecommunications - 3.7% | | | |

| Altice France SA 5.125% 7/15/29 (b) | | 550,000 | 383,728 |

| C&W Senior Finance Ltd. 6.875% 9/15/27 (b) | | 1,354,000 | 1,332,957 |

| Cogent Communications Group, Inc. 7% 6/15/27 (b) | | 415,000 | 420,015 |

| Intelsat Jackson Holdings SA 6.5% 3/15/30 (b) | | 1,145,000 | 1,099,427 |

| LCPR Senior Secured Financing DAC 5.125% 7/15/29 (b) | | 770,000 | 621,847 |

| Level 3 Financing, Inc.: | | | |

| 10.5% 5/15/30 (b) | | 550,000 | 589,309 |

| 11% 11/15/29 (b) | | 131,422 | 144,079 |

| Millicom International Cellular SA 5.125% 1/15/28 (b) | | 900,000 | 870,417 |

| SBA Communications Corp.: | | | |

| 3.125% 2/1/29 | | 1,345,000 | 1,237,691 |

| 3.875% 2/15/27 | | 350,000 | 338,585 |

| ViaSat, Inc. 5.625% 9/15/25 (b) | | 360,000 | 356,413 |

| Virgin Media Secured Finance PLC 4.5% 8/15/30 (b) | | 1,845,000 | 1,629,324 |

| | | | 9,023,792 |

| Textiles/Apparel - 0.1% | | | |

| Foot Locker, Inc. 4% 10/1/29 (b) | | 95,000 | 82,701 |

| Kontoor Brands, Inc. 4.125% 11/15/29 (b) | | 60,000 | 56,500 |

| | | | 139,201 |

| Transportation Ex Air/Rail - 0.2% | | | |

| XPO, Inc.: | | | |

| 6.25% 6/1/28 (b) | | 280,000 | 285,662 |

| 7.125% 2/1/32 (b) | | 145,000 | 151,695 |

| | | | 437,357 |

| Utilities - 4.2% | | | |

| Clearway Energy Operating LLC: | | | |

| 3.75% 2/15/31 (b) | | 675,000 | 612,479 |

| 4.75% 3/15/28 (b) | | 145,000 | 140,868 |

| DPL, Inc. 4.35% 4/15/29 | | 400,000 | 373,978 |

| FirstEnergy Corp. 2.25% 9/1/30 (c) | | 1,225,000 | 1,065,799 |

| NextEra Energy Partners LP: | | | |

| 4.25% 9/15/24 (b) | | 71,000 | 70,392 |

| 7.25% 1/15/29 (b)(c) | | 395,000 | 413,553 |

| NRG Energy, Inc.: | | | |

| 5.25% 6/15/29 (b) | | 626,000 | 618,806 |

| 5.75% 1/15/28 | | 659,000 | 659,148 |

| 6.625% 1/15/27 | | 169,000 | 169,230 |

| PG&E Corp. 5% 7/1/28 | | 1,440,000 | 1,410,384 |

| TerraForm Power Operating LLC % (b) | | 809,000 | 793,684 |

| TransAlta Corp. 6.5% 3/15/40 | | 270,000 | 280,436 |

| Vertiv Group Corp. 4.125% 11/15/28 (b) | | 445,000 | 427,178 |

| Vistra Operations Co. LLC: | | | |

| 5% 7/31/27 (b) | | 1,350,000 | 1,336,224 |

| 5.5% 9/1/26 (b) | | 1,022,000 | 1,019,845 |

| 5.625% 2/15/27 (b) | | 480,000 | 479,278 |

| 7.75% 10/15/31 (b) | | 200,000 | 212,804 |

| | | | 10,084,086 |

TOTAL NONCONVERTIBLE BONDS | | | 218,602,088 |

| TOTAL CORPORATE BONDS (Cost $221,132,764) | | | 219,759,846 |

| | | | |

| Bank Loan Obligations - 0.3% |

| | | Principal Amount (a) | Value ($) |

| Broadcasting - 0.0% | | | |

| Diamond Sports Group LLC term loan 10% 8/2/27 (f) | | 44,423 | 56,639 |

| Consumer Products - 0.0% | | | |

| TripAdvisor, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 7.9967% 7/8/31 (d)(f)(g) | | 15,000 | 14,969 |

| Metals/Mining - 0.1% | | | |

| American Rock Salt Co. LLC 1LN, term loan CME Term SOFR 3 Month Index + 4.000% 9.3188% 6/4/28 (d)(f)(g) | | 258,002 | 203,305 |

| Services - 0.1% | | | |

| ABG Intermediate Holdings 2 LLC Tranche B1 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 7.9967% 12/21/28 (d)(f)(g) | | 127,400 | 127,692 |

| Utilities - 0.1% | | | |

| Brookfield WEC Holdings, Inc. Tranche B 1LN, term loan CME Term SOFR 1 Month Index + 2.750% 7.9967% 1/20/31 (d)(f)(g) | | 160,875 | 160,968 |

| TOTAL BANK LOAN OBLIGATIONS (Cost $577,198) | | | 563,573 |

| | | | |

| Preferred Securities - 1.3% |

| | | Principal Amount (a) | Value ($) |

| Air Transportation - 0.3% | | | |

| AerCap Holdings NV 5.875% 10/10/79 (d) | | 650,000 | 664,158 |

| Banks & Thrifts - 0.8% | | | |

| Ally Financial, Inc. 4.7% (d)(h) | | 1,300,000 | 1,184,276 |

| Citigroup, Inc. 7.125% (d)(h) | | 430,000 | 447,917 |

| Wells Fargo & Co. 7.625% (c)(d)(h) | | 270,000 | 294,560 |

TOTAL BANKS & THRIFTS | | | 1,926,753 |

| Diversified Financial Services - 0.2% | | | |

| Charles Schwab Corp.: | | | |

| 4% (d)(h) | | 355,000 | 312,441 |

| 5.375% (d)(h) | | 175,000 | 175,937 |

TOTAL DIVERSIFIED FINANCIAL SERVICES | | | 488,378 |

| TOTAL PREFERRED SECURITIES (Cost $3,099,712) | | | 3,079,289 |

| | | | |

| Money Market Funds - 11.1% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 5.39% (i) | | 14,468,643 | 14,471,537 |

| Fidelity Securities Lending Cash Central Fund 5.39% (i)(j) | | 12,363,301 | 12,364,537 |

| TOTAL MONEY MARKET FUNDS (Cost $26,834,136) | | | 26,836,074 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 103.8% (Cost $251,643,810) | 250,238,782 |

NET OTHER ASSETS (LIABILITIES) - (3.8)% | (9,093,468) |

| NET ASSETS - 100.0% | 241,145,314 |

| | |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $159,802,989 or 66.3% of net assets. |

| (c) | Security or a portion of the security is on loan at period end. |

| (d) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (e) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (f) | Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. |

| (g) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (h) | Security is perpetual in nature with no stated maturity date. |

| (i) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (j) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 29,184,776 | 87,594,817 | 102,308,131 | 1,366,220 | 75 | - | 14,471,537 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | - | 27,028,145 | 14,663,607 | 12,339 | - | (1) | 12,364,537 | 0.1% |

| Total | 29,184,776 | 114,622,962 | 116,971,738 | 1,378,559 | 75 | (1) | 26,836,074 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of August 31, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Corporate Bonds | 219,759,846 | - | 219,759,846 | - |

|

| Bank Loan Obligations | 563,573 | - | 563,573 | - |

|

| Preferred Securities | 3,079,289 | - | 3,079,289 | - |

|

| Money Market Funds | 26,836,074 | 26,836,074 | - | - |

| Total Investments in Securities: | 250,238,782 | 26,836,074 | 223,402,708 | - |

Financial Statements

| Statement of Assets and Liabilities |

As of August 31, 2024 |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $11,916,993) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $224,809,674) | $ | 223,402,708 | | |

Fidelity Central Funds (cost $26,834,136) | | 26,836,074 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $251,643,810) | | | $ | 250,238,782 |

| Cash | | | | 69,177 |

| Receivable for investments sold | | | | 559 |

| Interest receivable | | | | 3,199,134 |

| Distributions receivable from Fidelity Central Funds | | | | 72,698 |

Total assets | | | | 253,580,350 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 69,257 | | |

| Other payables and accrued expenses | | 1,242 | | |

| Collateral on securities loaned | | 12,364,537 | | |

| Total liabilities | | | | 12,435,036 |

| Net Assets | | | $ | 241,145,314 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 257,293,583 |

| Total accumulated earnings (loss) | | | | (16,148,269) |

| Net Assets | | | $ | 241,145,314 |

Net Asset Value, offering price and redemption price per share ($241,145,314 ÷ 2,736,607 shares) | | | $ | 88.12 |

| Statement of Operations |

| Year ended August 31, 2024 |

| Investment Income | | | | |

| Dividends | | | $ | 278,596 |

| Interest | | | | 19,051,268 |

| Income from Fidelity Central Funds (including $12,339 from security lending) | | | | 1,378,559 |

| Total income | | | | 20,708,423 |

| Expenses | | | | |

| Custodian fees and expenses | $ | 2,389 | | |

| Independent trustees' fees and expenses | | 1,736 | | |

| Miscellaneous | | 3 | | |

| Total expenses before reductions | | 4,128 | | |

| Expense reductions | | (1,292) | | |

| Total expenses after reductions | | | | 2,836 |

| Net Investment income (loss) | | | | 20,705,587 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (1,982,802) | | |

| Redemptions in-kind | | (5,913,441) | | |

| Fidelity Central Funds | | 75 | | |

| Total net realized gain (loss) | | | | (7,896,168) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 21,766,380 | | |

| Fidelity Central Funds | | (1) | | |

| Total change in net unrealized appreciation (depreciation) | | | | 21,766,379 |

| Net gain (loss) | | | | 13,870,211 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 34,575,798 |

| Statement of Changes in Net Assets |

| |

| | Year ended August 31, 2024 | | Year ended August 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 20,705,587 | $ | 18,793,308 |

| Net realized gain (loss) | | (7,896,168) | | (9,874,728) |

| Change in net unrealized appreciation (depreciation) | | 21,766,379 | | 9,704,991 |

| Net increase (decrease) in net assets resulting from operations | | 34,575,798 | | 18,623,571 |

| Distributions to shareholders | | (20,358,240) | | (18,400,365) |

| | | | | |

| Affiliated share transactions | | | | |

| Proceeds from sales of shares | | 75,000,000 | | 10,000,000 |

| Reinvestment of distributions | | 19,363,097 | | 18,400,158 |

| Cost of shares redeemed | | (228,742,015) | | (74,608) |

| | | | | |

Net increase (decrease) in net assets resulting from share transactions | | (134,378,918) | | 28,325,550 |

| Total increase (decrease) in net assets | | (120,161,360) | | 28,548,756 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 361,306,674 | | 332,757,918 |

| End of period | $ | 241,145,314 | $ | 361,306,674 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 886,194 | | 118,371 |

| Issued in reinvestment of distributions | | 227,078 | | 220,333 |

| Redeemed | | (2,687,289) | | (900) |

| Net increase (decrease) | | (1,574,017) | | 337,804 |

| | | | | |

Financial Highlights

Fidelity® Specialized High Income Central Fund |

| |

| Years ended August 31, | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 83.82 | $ | 83.76 | $ | 100.89 | $ | 100.01 | $ | 102.28 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 5.075 | | 4.570 | | 4.198 | | 4.670 | | 5.162 |

| Net realized and unrealized gain (loss) | | 4.164 | | (.039) | | (13.727) | | 1.582 | | (1.042) |

| Total from investment operations | | 9.239 | | 4.531 | | (9.529) | | 6.252 | | 4.120 |

| Distributions from net investment income | | (4.939) | | (4.471) | | (4.181) | | (4.623) | | (5.093) |

| Distributions from net realized gain | | - | | - | | (3.420) | | (.749) | | (1.297) |

| Total distributions | | (4.939) | | (4.471) | | (7.601) | | (5.372) | | (6.390) |

| Net asset value, end of period | $ | 88.12 | $ | 83.82 | $ | 83.76 | $ | 100.89 | $ | 100.01 |

Total Return C | | | | 5.56% | | (9.98)% | | 6.46% | | 4.25% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

Expenses before reductions F | | -% | | -% | | -% | | -% | | -% |

Expenses net of fee waivers, if any F | | | | -% | | -% | | -% | | -% |

Expenses net of all reductions F | | -% | | -% | | -% | | -% | | -% |

| Net investment income (loss) | | 5.93% | | 5.48% | | 4.61% | | 4.67% | | 5.20% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 241,145 | $ | 361,307 | $ | 332,758 | $ | 361,517 | $ | 531,050 |

Portfolio turnover rate G | | | | 23% | | 23% | | 55% | | 54% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount represents less than .005%.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HPortfolio turnover rate excludes securities received or delivered in-kind.

Notes to Financial Statements

For the period ended August 31, 2024

1. Organization.

Fidelity Specialized High Income Central Fund (the Fund) is a fund of Fidelity Central Investment Portfolios LLC (the LLC) and is authorized to issue an unlimited number of shares. Shares of the Fund are only offered to other investment companies and accounts managed by Fidelity Management & Research Company LLC (FMR), or its affiliates (the Investing Funds). The LLC is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware Limited Liability Company.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Directors (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing services or from brokers who make markets in such securities. Corporate bonds, bank loan obligations and preferred securities are valued by pricing services who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing services. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of August 31, 2024 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of August 31, 2024, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.