UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-21656

Name of Fund: BlackRock Energy and Resources Trust (BGR)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Energy and Resources Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800)882-0052, Option 4

Date of fiscal year end: 12/31/2019

Date of reporting period: 06/30/2019

Item 1 – Report to Stockholders

JUNE 30, 2019

| | |

SEMI-ANNUAL REPORT (UNAUDITED) | |  |

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Trust (BME)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Trust (BST)

BlackRock Science and Technology Trust II (BSTZ)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Trust’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call Computershare at(800) 699-1236 to request that you continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC or its affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Enhanced Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Trust’s (BME), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Trust’s (BST), BlackRock Science and Technology Trust II (BSTZ) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions

for the Fiscal Period | | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Period | |

| | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per Common

Share | | | Net Investment Income | | | Net Realized

Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per

Common

Share | |

BGR* | | $ | 0.224815 | | | $ | — | | | $ | — | | | $ | 0.240785 | | | $ | 0.4656 | | | | 48 | % | | | — | % | | | — | % | | | 52 | % | | | 100 | % |

CII* | | | 0.118494 | | | | — | | | | 0.312165 | | | | 0.066141 | | | | 0.4968 | | | | 24 | | | | — | | | | 63 | | | | 13 | | | | 100 | |

BDJ | | | 0.121388 | | | | — | | | | 0.158812 | | | | — | | | | 0.2802 | | | | 43 | | | | — | | | | 57 | | | | — | | | | 100 | |

BOE* | | | 0.216319 | | | | — | | | | — | | | | 0.161681 | | | | 0.3780 | | | | 57 | | | | — | | | | — | | | | 43 | | | | 100 | |

BGY* | | | 0.120973 | | | | — | | | | — | | | | 0.081827 | | | | 0.2028 | | | | 60 | | | | — | | | | — | | | | 40 | | | | 100 | |

BME | | | 0.045793 | | | | 0.10126 | | | | 1.052947 | | | | — | | | | 1.2000 | | | | 4 | | | | 8 | | | | 88 | | | | — | | | | 100 | |

BCX* | | | 0.158827 | | | | — | | | | — | | | | 0.150773 | | | | 0.3096 | | | | 51 | | | | — | | | | — | | | | 49 | | | | 100 | |

BST | | | — | | | | — | | | | 0.900000 | | | | — | | | | 0.9000 | | | | — | | | | — | | | | 100 | | | | — | | | | 100 | |

BUI | | | 0.327428 | | | | — | | | | 0.398572 | | | | — | | | | 0.7260 | | | | 45 | | | | — | | | | 55 | | | | — | | | | 100 | |

| | * | Certain Trusts estimate that they have distributed more than the amount of earned income and net realized gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. | |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website athttp://www.blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis as of June 30, 2019:

| | | | |

| Exchange Symbol | | Amount Per

Common Share | |

BGR | | $ | 0.0776 | |

CII | | | 0.0828 | |

BDJ | | | 0.0467 | |

BOE | | | 0.0630 | |

BGY | | | 0.0338 | |

BME | | | 0.2000 | |

BCX | | | 0.0516 | |

BST | | | 0.1500 | |

BUI | | | 0.1210 | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Trusts to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BME’s prospectus for a more complete description of its risks.

| | |

| 2 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

The Markets in Review

Dear Shareholder,

Investment performance in the 12 months ended June 30, 2019 was a tale of two markets. The first half of the reporting period was characterized by restrictive monetary policy, deteriorating economic growth, equity market volatility, and rising fear of an imminent recession. During the second half of the reporting period, stocks and bonds rebounded sharply, as restrained inflation and weak economic growth led the U.S. Federal Reserve (the “Fed”) to stop raising interest rates, which led to broad-based optimism that stimulative monetary policy could help forestall a recession.

After the dust settled, the U.S. equity and bond markets posted mixed returns while weathering significant volatility. Less volatile U.S. large cap equities and U.S. bonds advanced, while equities at the high end of the risk spectrum — emerging markets, international developed, and U.S. small cap — posted relatively flat returns.

Fixed-income securities delivered modest positive returns with relatively low volatility. Short-term U.S. Treasury yields rose, while longer-term yields declined. This led to positive returns for U.S. Treasuries and a substantial flattening of the yield curve. Investment grade and high yield corporate bonds also posted positive returns, as the credit fundamentals in corporate markets remained relatively solid.

In the U.S. equity market, volatility spiked in late 2018, as a wide range of risks were brought to bear on markets, ranging from rising interest rates and slowing global growth to heightened trade tensions and political turmoil. These risks manifested in a broad-basedsell-off in December, leading to the worst December performance on record since 1931.

Volatility also rose in emerging markets, as the rising U.S. dollar and higher interest rates in the U.S. disrupted economic growth abroad. U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, particularly in mainland China, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe led to modest performance for European equities.

As equity performance faltered and global economic growth slowed, the Fed shifted to a more patient perspective on the economy in January 2019. In its last four meetings, the Fed left interest rates unchanged and signaled a slower pace of rate hikes in response to the global economic slowdown. Similarly, the European Central Bank signaled a continuation of accommodative monetary policy, while China committed to looser credit conditions and an increase in fiscal spending.

The outpouring of global economic stimulus led to a sharp rally in risk assets throughout the world. Hopes continued to remain high thereafter, as the current economic expansion became the longest in U.S. history. Looking ahead, markets are pricing in three interest rate cuts by the Fed over the next year, as investors anticipate a steady shift toward more stimulative monetary policy.

We expect a slowing expansion with additional room to run, as opposed to an economic recession. However, escalating trade tensions and the resulting disruptions in global supply chains have become the greatest risk to the global expansion.

We believe U.S. and emerging market equities remain relatively attractive. Within U.S. equities, companies with high-quality earnings and strong balance sheets offer the most attractive risk/rewardtrade-off. For bonds, U.S. Treasuries are likely to help buffer against volatility in risk assets, while income from other types of bonds can continue to offer steady returns.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visitblackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of June 30, 2019 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 18.54% | | 10.42% |

U.S. small cap equities

(Russell 2000® Index) | | 16.98 | | (3.31) |

International equities

(MSCI Europe, Australasia, Far East Index) | | 14.03 | | 1.08 |

Emerging market equities

(MSCI Emerging Markets Index) | | 10.58 | | 1.21 |

3-month Treasury bills

(ICE BofAML3-Month U.S. Treasury Bill Index) | | 1.24 | | 2.31 |

U.S. Treasury securities

(ICE BofAML10-Year U.S. Treasury Index) | | 7.45 | | 10.38 |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 6.11 | | 7.87 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 4.94 | | 6.39 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 9.94 | | 7.48 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | | |

| THIS PAGEISNOT PARTOF YOUR FUND REPORT | | | 3 | |

Table of Contents

Option Over-Writing Strategy

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) covered call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Distributions

Each Trust employs a plan to support a level distribution of income, capital gains and/or return of capital. The goal of the plan is to provide shareholders with consistent and predictable cash flows by setting distribution rates based on expected long-term returns of the Trust. Such distributions, under certain circumstances, may exceed a Trust’s total return performance. When total distributions exceed total return performance for the period, the difference reduces the Trust’s total assets and net asset value per share (“NAV”) and, therefore, could have the effect of increasing the Trust’s expense ratio and reducing the amount of assets the Trust has available for long term investment. In order to make these distributions, a Trust may have to sell portfolio securities at less than opportune times.

The final tax characterization of distributions is determined after the fiscal year and is reported in a Trust’s annual report to shareholders. Distributions can be characterized as ordinary income, capital gains and/or return of capital. The Trust’s taxable net investment income or net realized capital gains (“taxable income”) may not be sufficient to support the level of distributions paid. To the extent that distributions exceed the Trust’s current and accumulated earnings and profits, the excess may be treated as a non-taxable return of capital.

A return of capital distribution does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ A return of capital is a return of a portion of an investor’s original investment. A return of capital is not expected to be taxable, but it reduces a shareholder’s tax basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent disposition by the shareholder of his or her shares. It is possible that a substantial portion of the distributions paid during a calendar year may ultimately be classified as return of capital for U.S. federal income tax purposes when the final determination of the source and character of the distributions is made.

Option Over-Writing Illustrative Example

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | |

| THE BENEFITSAND RISKSOF OPTION OVER-WRITING | | | 5 | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Energy and Resources Trust |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) covered call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange (“NYSE”) | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($11.93)(a) | | 7.81% |

Current Monthly Distribution per Common Share(b) | | $0.0776 |

Current Annualized Distribution per Common Share(b) | | $0.9312 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGR(a)(b) | | | 18.71 | % | | | 13.71 | % |

Lipper Natural Resources Funds(c) | | | 20.62 | | | | 14.92 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on theex-dividend date as calculated by Lipper. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Oil prices started a strong rally from the beginning of the year through the end of April, leading to robust gains for both West Texas Intermediate and Brent crude oil for the full, semi-annual period. After a short-livedsell-off in May that was caused by concerns about weaker demand, the market quickly recovered in June as investors regained their appetite for risk. In this environment,large-cap, integrated oil companies — including the Trust’s positions in Royal Dutch Shell PLC, Exxon Mobil Corp. and BP PLC — generally performed well.

Among individual stocks, Anadarko Petroleum Corp. — which was bid for by both Occidental Petroleum Corp. and Chevron Corp. — was the leading contributor. The Trust’s investment adviser believes this may be an indication that many energy stocks are undervalued relative to the price of oil.

U.S. natural gas prices were weak during the period, reflecting strong supply growth, adverse weather conditions and weakness in the European gas market. As a result, the Trust’s position in the natural gas producer EQT Corp. was among the largest detractors from absolute performance. Other detractors of note included positions in the refining & marketing company Marathon Petroleum Corp. and the oil services company Halliburton Co.

The Trust made use of options, principally written call options on individual stocks. The option overlay strategy detracted from Trust performance in the rising market.

Describe recent portfolio activity

The investment adviser added to the Trust’s weighting in the integrated energy sector by increasing its positions in TOTAL SA and BP PLC and initiating an investment in ENI SpA. These moves were funded by decreasing the portfolio’s weighting in the exploration & production exposure (“E&P”) industry, which it achieved in part by exiting Devon Energy Corp.

Describe portfolio positioning at period end.

The investment adviser continued to focus on companies that are displaying signs of capital discipline and steady growth, as well as those that stand to benefit from growth in the emerging liquified natural gas industry. The integrated energy subsector represented the Trust’s largest allocation, followed by the E&P, distribution, refining & marketing, and oil services industries, respectively.

| | |

| 6 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Energy and Resources Trust |

As of June 30, 2019, the Trust had an options overwriting program in place whereby 33% of the underlying equities were overwritten with call options. These options were typically written at levels above prevailing market prices (estimated to be 3.8% out of the money) with an average time until expiration of 49 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

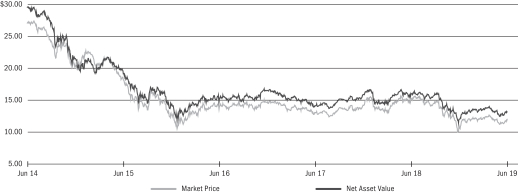

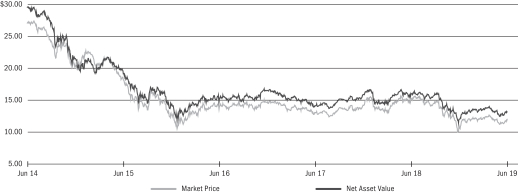

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

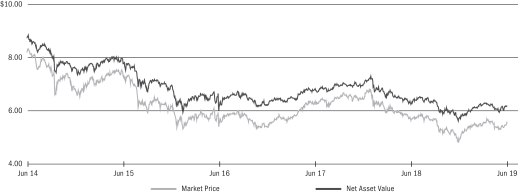

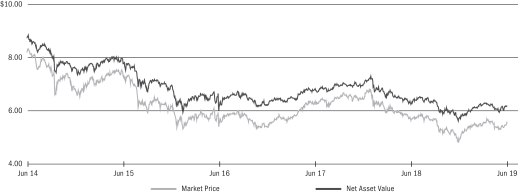

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 11.93 | | | $ | 10.45 | | | | 14.16 | % | | $ | 12.61 | | | $ | 10.21 | |

Net Asset Value | | | 13.10 | | | | 11.98 | | | | 9.35 | | | | 13.92 | | | | 11.98 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

Royal Dutch Shell PLC — ADR | | | 12 | % |

Exxon Mobil Corp. | | | 10 | |

BP PLC | | | 8 | |

TOTAL SA | | | 8 | |

ConocoPhillips | | | 4 | |

TC Energy Corp | | | 4 | |

Williams Cos., Inc. | | | 4 | |

EOG Resources, Inc. | | | 4 | |

Marathon Petroleum Corp. | | | 4 | |

Chevron Corp. | | | 4 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 06/30/19 | | | 12/31/18 | |

Oil, Gas & Consumable Fuels | | | 95 | % | | | 94 | % |

Energy Equipment & Services | | | 5 | | | | 6 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Enhanced Capital and Income Fund, Inc. |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) covered call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($15.80)(a) | | 6.29% |

Current Monthly Distribution per Common Share(b) | | $0.0828 |

Current Annualized Distribution per Common Share(b) | | $0.9936 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

CII(a)(b) | | | 15.80 | % | | | 13.05 | % |

S&P 500® Index | | | N/A | | | | 18.54 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

In the equity allocation of the Trust, the largest contributor to Trust performance for thesix-month period was stock selection within the industrials sector. Most notably, exposure to both used auto auction company KAR Auction Services, Inc. and railway Norfolk Southern Corp. added to return. An underweight allocation to as well as stock selection within utilities aided performance as well, as did positioning in the financials sector.

The largest equity allocation detractors from Trust performance for thesix-month period was stock selection within the consumer discretionary sector. In particular, positioning across specialty retail challenged performance. Positioning in health care also acted as a constraint on return, as holdings in the managed care and biotechnology segments produced weakness. Finally, positioning in the information technology (“IT”) sector weighed on results.

The Trust utilizes an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The use of options during the period slightly detracted from Trust performance.

Describe recent portfolio activity.

During thesix-month period, the Trust significantly boosted exposure to the consumer discretionary sector. Holdings within communications services and industrials were also increased. Conversely, the Trust significantly reduced its exposure to the health care sector. The Trust also reduced its exposure to utility and materials stocks.

Describe portfolio positioning at period end.

The Trust’s largest allocations were in the IT, health care and financials sectors. Relative to the benchmark, the Trust’s largest overweight positions were in the consumer discretionary, health care and communication services sectors. Conversely, the Trust’s largest relative underweights were in the real estate, utilities and technology sectors.

As of June 30, 2019, the Trust had an option overwriting program whereby 48% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at levels above prevailing market prices (estimated to be 3.9% out of the money) with maturities averaging 47 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 8 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Enhanced Capital and Income Fund, Inc. |

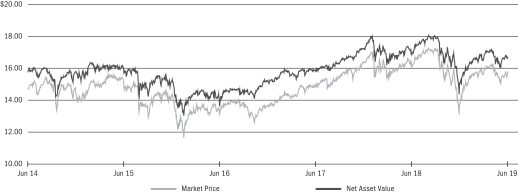

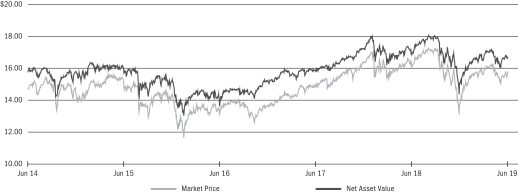

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

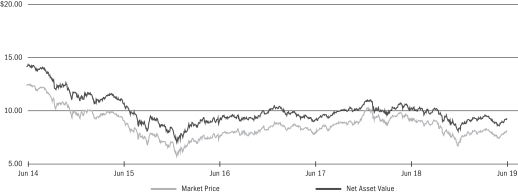

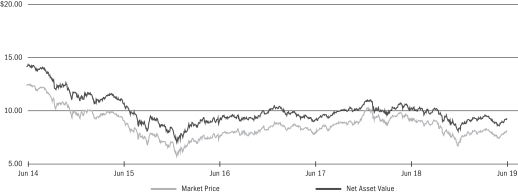

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 15.80 | | | $ | 14.08 | | | | 12.22 | % | | $ | 16.31 | | | $ | 13.92 | |

Net Asset Value | | | 16.74 | | | | 15.28 | | | | 9.55 | | | | 17.19 | | | | 14.97 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

Microsoft Corp. | | | 6 | % |

Apple, Inc. | | | 5 | |

Alphabet, Inc. | | | 5 | |

Comcast Corp. | | | 3 | |

Cisco Systems, Inc. | | | 3 | |

JPMorgan Chase & Co. | | | 3 | |

Walmart, Inc. | | | 3 | |

Pfizer, Inc. | | | 3 | |

UnitedHealth Group, Inc. | | | 3 | |

Bank of America Corp. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 06/30/19 | | | 12/31/18 | |

Information Technology | | | 20 | % | | | 20 | % |

Health Care | | | 16 | | | | 18 | |

Financials | | | 14 | | | | 15 | |

Consumer Discretionary | | | 12 | | | | 10 | |

Communication Services | | | 12 | | | | 9 | |

Industrials | | | 10 | | | | 7 | |

Consumer Staples | | | 6 | | | | 7 | |

Energy | | | 6 | | | | 6 | |

Materials | | | 3 | | | | 5 | |

Utilities | | | 1 | | | | 3 | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Enhanced Equity Dividend Trust |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by employing a strategy of writing (selling) covered call and put options. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($8.87)(a) | | 6.32% |

Current Monthly Distribution per Common Share(b) | | $0.0467 |

Current Annualized Distribution per Common Share(b) | | $0.5604 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The monthly distribution per Common Share, declared on July 1, 2019, was increased to $0.0500 per share. The current distribution rate on closing market price, current monthly distribution per Common Share and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BDJ(a)(b) | | | 17.89 | % | | | 13.44 | % |

Russell 1000® Value Index | | | N/A | | | | 16.24 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The largest contributor to Trust performance for thesix-month period was stock selection in the energy sector. In particular, selection decisions within the oil, gas & consumable fuels industry added to relative return. Within financials, stock selection and an overweight in insurance, an underweight exposure to diversified financial services, and selection among banks enhanced relative performance. Lastly, stock selection and allocation decisions within information technology (“IT”) contributed, as did selection within consumer staples.

The largest detractor from relative performance derived from a combination of stock selection and allocation decisions in the health care sector. Most notably, overweight exposure to the health care providers & services industry and an underweight to the life sciences tools & services industry detracted from relative performance. Additionally, stock selection in the utilities sector represented a headwind during the period, mainly among electric utilities. In communication services, stock selection in the diversified telecom services industry was a source of underperformance. Finally, the Trust’s cash position also weighed on performance.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy detracted slightly from returns during a period when the Trust posted a very strong absolute return.

Describe recent portfolio activity.

During thesix-month period, the Trust boosted its exposure to the financials sector. Holdings within consumer discretionary and consumer staples also were increased. The Trust reduced its exposure to the health care and utilities sectors.

Describe portfolio positioning at period end.

The Trust’s largest allocations were in the financials, health care and IT sectors. Relative to the index, the Trust’s largest overweight positions were in the IT, health care and financials sectors. Conversely, the Trust’s largest relative underweights were in the real estate, utilities and industrials sectors.

| | |

| 10 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Enhanced Equity Dividend Trust |

As of June 30, 2019, the Trust had an option overwriting program in place whereby 53% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at levels above the prevailing market prices (estimated to be 3.0% out of the money) and for maturities averaging 48 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

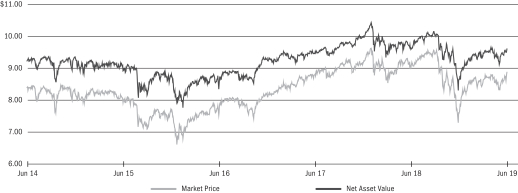

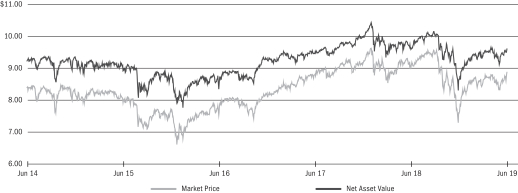

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.87 | | | $ | 7.77 | | | | 14.16 | % | | $ | 8.89 | | | $ | 7.72 | |

Net Asset Value | | | 9.60 | | | | 8.74 | | | | 9.84 | | | | 9.64 | | | | 8.64 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

Verizon Communications, Inc. | | | 5 | % |

JPMorgan Chase & Co. | | | 4 | |

Wells Fargo & Co. | | | 4 | |

Citigroup, Inc. | | | 4 | |

Bank of America Corp. | | | 3 | |

Microsoft Corp. | | | 3 | |

BP PLC | | | 3 | |

Anthem, Inc. | | | 3 | |

Medtronic PLC | | | 2 | |

Pfizer, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 06/30/19 | | | 12/31/18 | |

Financials | | | 28 | % | | | 25 | % |

Health Care | | | 18 | | | | 23 | |

Information Technology | | | 12 | | | | 12 | |

Energy | | | 9 | | | | 11 | |

Consumer Staples | | | 8 | | | | 7 | |

Communication Services | | | 7 | | | | 7 | |

Industrials | | | 7 | | | | 6 | |

Consumer Discretionary | | | 5 | | | | 3 | |

Utilities | | | 3 | | | | 4 | |

Materials | | | 3 | | | | 2 | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Enhanced Global Dividend Trust |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and by employing a strategy of writing (selling) covered call and put options. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($10.73)(a) | | 7.05% |

Current Monthly Distribution per Common Share(b) | | $0.0630 |

Current Annualized Distribution per Common Share(b) | | $0.7560 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BOE(a)(b) | | | 18.69 | % | | | 11.41 | % |

MSCI All Country World Index | | | N/A | | | | 16.23 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The Trust’s lack of exposure to the underperforming energy sector represented the top contributor to relative return during thesix-month period. Stock selection in materials also was additive, particularly within the containers and packing industry. In addition, an overweight to and stock selection within the industrials sector contributed, especially within the air freight and logistics industry. At the individual security level, the French energy management multinational Schneider Electric SE was among the largest contributors to performance based on strong first quarter sales. Technology conglomerate Cisco Systems, Inc. was another top performer in light of better than expected financial results and a raised earnings forecast. The Finnish engineering company Kone OYJ was a notable contributor as well, as investors rewarded Kone’s profit growth.

Conversely, an underweight to and stock selection within the information technology (“IT”) sector was the principal constraint on Trust performance, with positioning within the IT services industry weighing most heavily on returns. Security selection in consumer staples and overweight exposure to the sector, mainly in tobacco, also detracted, as did stock selection in consumer discretionary and financials. At the security level, the Trust’s positions in the tobacco companies Imperial Brands PLC and Altria Group, Inc. were two of the largest individual detractors from performance. Tobacco companies endured a sharpsell-off stemming from continued headlines regarding falling U.S. industry sales and increased regulatory pressure on “Next Generation” smoking products. Additionally, the Trust’s position in the biopharmaceutical firm AbbVie, Inc. detracted from relative performance as the company reported disappointing earnings.

The Trust made use of options, principally written call options on individual stocks. The Trust’s options writing strategy during the six months detracted from returns during a period when the Trust posted a very strong absolute return.

Describe recent portfolio activity.

During the period, the portfolio added exposure to the consumer discretionary sector, mainly within the leisure products and specialty retail industries. The Trust also added exposure within health care, especially the health care equipment and suppliessub-sector. Exposure to industrials was reduced as the Trust trimmed its position in Kone OYJ following a strong run of performance. Lastly, within consumer staples, the Trust sold its holdings in Japan Tobacco, Inc., modestly reducing its weighting to the sector.

| | |

| 12 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Enhanced Global Dividend Trust |

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector exposures were in consumer staples and health care, with an emphasis on the tobacco and pharmaceuticals industries, respectively. The largest underweights were to IT, financials and energy. The Trust had no exposure to the real estate, utilities or energy sectors at the end of the period. From a regional perspective, a majority of portfolio assets was invested either within the United States or Europe, with significant exposure in the United Kingdom and Switzerland.

As of June 30, 2019, the Trust had an option overwriting program in place whereby 43% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at levels above the prevailing market prices (estimated to be 2.3% out of the money) and for maturities averaging 48 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

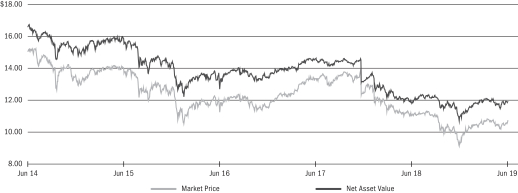

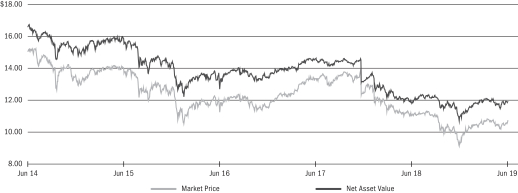

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

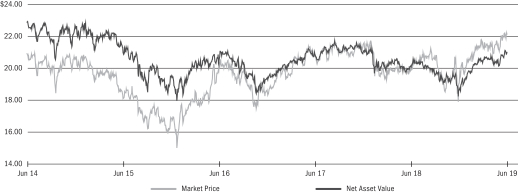

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 10.73 | | | $ | 9.37 | | | | 14.51 | % | | $ | 10.85 | | | $ | 9.30 | |

Net Asset Value | | | 11.90 | | | | 11.07 | | | | 7.50 | | | | 12.10 | | | | 10.91 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

TELUS Corp. | | | 3 | % |

Philip Morris International, Inc. | | | 3 | |

Rogers Communications, Inc., Class B | | | 3 | |

Johnson & Johnson | | | 3 | |

Genuine Parts Co. | | | 3 | |

Cisco Systems, Inc. | | | 3 | |

Amcor Ltd. | | | 3 | |

International Paper Co. | | | 3 | |

GlaxoSmithKline PLC | | | 3 | |

Coca-Cola Co. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 06/30/19 | | | 12/31/18 | |

United States | | | 44 | % | | | 43 | % |

United Kingdom | | | 16 | | | | 16 | |

Switzerland | | | 7 | | | | 6 | |

Canada | | | 6 | | | | 7 | |

Australia | | | 5 | | | | 6 | |

Netherlands | | | 3 | | | | 2 | |

Singapore | | | 3 | | | | 3 | |

France | | | 3 | | | | 4 | |

Germany | | | 3 | | | | 2 | |

Ireland | | | 2 | | | | 1 | |

Denmark | | | 2 | | | | 1 | |

Finland | | | 2 | | | | 3 | |

Sweden | | | 1 | | | | 1 | |

Taiwan | | | 1 | | | | 2 | |

India | | | 1 | | | | 1 | |

China | | | 1 | | | | 1 | |

Other | | | — | | | | 1 | (a) |

| | (a) | Other includes a 1% holding or less in Japan. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Enhanced International Dividend Trust |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and by employing a strategy of writing (selling) covered call and put options. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BGY |

Initial Offering Date | | May 30, 2007 |

Current Distribution Rate on Closing Market Price as of as of June 30, 2019 ($5.62)(a) | | 7.22% |

Current Monthly Distribution per Common Share(b) | | $0.0338 |

Current Annualized Distribution per Common Share(b) | | $0.4056 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGY(a)(b) | | | 17.05 | % | | | 11.42 | % |

MSCI All Country World Indexex-USA | | | N/A | | | | 13.60 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The largest contributions to the Trust’s relative performance during thesix-month period came from stock selection in the health care, industrials and consumer discretionary sectors. Regionally, the Trust benefited from security selection within Europeex-U.K. and Asiaex-Japan.

Conversely, security selection in information technology, financials and consumer staples detracted from relative performance. By region, holdings in Canadian- and U.K.-listed companies detracted from returns.

During the period, the Trust made use of options, principally written call options on individual stocks. The Trust’s options writing strategy during the past six months detracted slightly from Trust performance during a period when the Trust posted a strong absolute return.

Describe recent portfolio activity.

The Trust reduced its exposure to Japanese securities by exiting its position in Japan Tobacco, Inc. The Trust increased exposure to Swiss-listed companies by initiating a position in the luxury goods firm Compagnie Financière Richemont SA.

Describe portfolio positioning at period end.

At the end of the reporting period, the Fund held its largest sector overweight positions in health care, consumer staples and industrials, and its most significant underweights in financials, consumer discretionary and energy. By region, the Trust’s largest overweights were in European and North American securities, while its largest regional underweights included the emerging markets and Japan-listed securities.

As of June 30, 2019, the Trust had an option overwriting program in place whereby 44% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at levels above the prevailing market prices (estimated to be 2.2% out of the money) and for maturities averaging 50 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 14 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Enhanced International Dividend Trust |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 5.62 | | | $ | 4.98 | | | | 12.85 | % | | $ | 5.74 | | | $ | 4.94 | |

Net Asset Value | | | 6.22 | | | | 5.79 | | | | 7.43 | | | | 6.32 | | | | 5.73 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

TELUS Corp. | | | 6 | % |

Rogers Communications, Inc., Class B | | | 6 | |

Deutsche Post AG, Registered Shares | | | 5 | |

GlaxoSmithKline PLC | | | 5 | |

Imperial Brands PLC | | | 5 | |

Amcor PLC | | | 5 | |

British American Tobacco PLC | | | 5 | |

Nestle SA, Registered Shares | | | 4 | |

Novartis AG, Registered Shares | | | 4 | |

Unilever PLC | | | 4 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 06/30/19 | | | 12/31/18 | |

United Kingdom | | | 29 | % | | | 28 | % |

Canada | | | 12 | | | | 11 | |

Switzerland | | | 12 | | | | 10 | |

Australia | | | 9 | | | | 9 | |

Netherlands | | | 5 | | | | 4 | |

France | | | 5 | | | | 6 | |

Germany | | | 5 | | | | 4 | |

Singapore | | | 5 | | | | 3 | |

United States | | | 4 | | | | 5 | |

Denmark | | | 3 | | | | 2 | |

Finland | | | 3 | | | | 5 | |

Sweden | | | 2 | | | | 3 | |

China | | | 2 | | | | 3 | |

Taiwan | | | 2 | | | | 3 | |

India | | | 2 | | | | 2 | |

Japan | | | — | | | | 2 | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Health Sciences Trust |

Investment Objective

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and by employing a strategy of writing (selling) covered call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($38.89)(a) | | 6.17% |

Current Monthly Distribution per Common Share(b) | | $0.2000 |

Current Annualized Distribution per Common Share(b) | | $2.4000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BME(a)(b) | | | 10.16 | % | | | 10.12 | % |

Russell 3000® Healthcare Index | | | N/A | | | | 10.23 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s premium to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Healthcare stocks produced a strong, double-digit gain in the semiannual period, but the sector failed to keep pace with the even larger advance for the broader market. At a time of robust investor risk appetites, higher-risk and more economically sensitive stocks generally outperformed the types of stable growers typically found in the health care sector.

Consistent with the Trust’sbottom-up approach, stock selection was the primary driver of performance. While selection in the biotechnology and pharmaceuticals subsectors added value, the benefit was offset by the Trust’s somewhat weaker showing in the healthcare providers & services and medical devices & suppliessub-sectors.

At the individual company level, the Trust’s zero weightings in three outperforming stocks — Danaher Corp., Celgene Corp., and Veeva Systems, Inc. — were the largest detractors. Danaher, a medical devices & supplies firm, staged a strong rally as investors grew increasingly optimistic about the potential benefits of the company’s acquisition of GE’s biopharmaceutical business. Celgene was bid up in the first week of January following a takeover bid from the pharmaceutical firm Bristol-Myers Squibb Co., while Veeva rallied after reporting record sales growth for its clinical data management system, Veeva Vault.

A zero weighting in the biotechnology firm AbbVie, Inc. was the leading contributor to performance, as the stock declined after announcing its acquisition of the pharmaceutical firm Allergan PLC. In addition, AbbVie missed earnings expectations and lowered its guidance for 2019. An overweight position in the medical device company Masimo Corp. was also a top contributor. Masimo reported strong earnings with revenue that exceeded expectations, and raised its outlook for the full year due to robust growth in itsnon-invasive device business. Stryker Corp., which beat earnings expectations due to the solid growth of its surgical robotics technology, was another contributor of note.

The Trust made use of options, principally written call options on individual stocks. The option overlay strategy had a marginally negative impact on results in the rising market.

Describe recent portfolio activity.

The Trust increased its allocation to the medical devices & supplies subsector, while it reduced its weightings in the pharmaceuticals, biotechnology, and health care providers & services subsectors.

| | |

| 16 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Health Sciences Trust |

Describe portfolio positioning at period end.

The Trust continued to use abottom-up, fundamental investment process in an effort to construct a balanced, diversified portfolio of healthcare stocks. The portfolio continues to reflect two broad themes: innovation and value-based healthcare.

Innovation in medical technology remains a secular growth driver for the healthcare sector, as companies continue to develop new therapies or products that fulfill an unmet medical need or that represent an improvement over current treatments. This encompasses not only the biotechnology industry, but also the pharmaceuticals and medical devices & suppliessub-sectors.

With respect to value-based health care, the Trust has an above-benchmark weighting in the health care providers & services industry due to a sizable overweight in managed care stocks. The investment adviser continued to find a number of companies in this area that it believes are well positioned to reduce healthcare costs by leveraging their scale and analytical capabilities. Additionally, select holdings in the health care services industry feature business models that are benefiting from the shift to lower-cost options such as home healthcare.

As of June 30, 2019, the Trust had an options overwriting program in place whereby 30% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at levels above prevailing market prices (estimated to be 3.7% out of the money) with an average time until expiration of 45 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

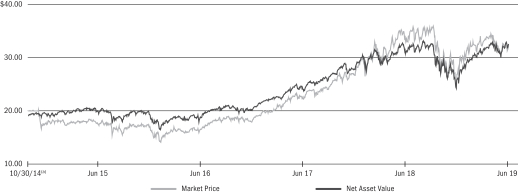

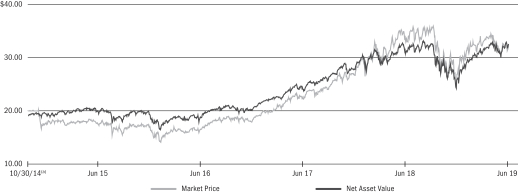

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 38.89 | | | $ | 36.45 | | | | 6.69 | % | | $ | 41.15 | | | $ | 35.75 | |

Net Asset Value | | | 38.26 | | | | 35.87 | | | | 6.66 | | | | 38.53 | | | | 34.65 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

UnitedHealth Group, Inc. | | | 8 | % |

Abbott Laboratories | | | 7 | |

Boston Scientific Corp. | | | 4 | |

Thermo Fisher Scientific, Inc. | | | 4 | |

Stryker Corp. | | | 4 | |

Medtronic PLC | | | 3 | |

Merck & Co., Inc. | | | 3 | |

Pfizer, Inc. | | | 3 | |

Eli Lilly & Co. | | | 3 | |

Anthem, Inc. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 06/30/19 | | | 12/31/18 | |

Health Care Equipment & Supplies | | | 35 | % | | | 27 | % |

Pharmaceuticals | | | 22 | | | | 25 | |

Health Care Providers & Services | | | 19 | | | | 23 | |

Biotechnology | | | 14 | | | | 18 | |

Life Sciences Tools & Services | | | 9 | | | | 5 | |

Health Care Technology | | | 1 | | | | 1 | |

Diversified Consumer Services | | | — | | | | 1 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Resources & Commodities Strategy Trust |

Investment Objective

BlackRock Resources & Commodities Strategy Trust’s (BCX) (the “Trust”) primary investment objective is to seek high current income and current gains, with a secondary objective of capital appreciation. The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources. While permitted, the Trust does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) covered call and put options.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BCX |

Initial Offering Date | | March 30, 2011 |

Current Distribution Rate on Closing Market Price as of June 30, 2019 ($8.18)(a) | | 7.57% |

Current Monthly Distribution per Common Share(b) | | $0.0516 |

Current Annualized Distribution per Common Share(b) | | $0.6192 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BCX(a)(b) | | | 20.42 | % | | | 14.27 | % |

Lipper Natural Resources Funds(c) | | | 20.62 | | | | 14.92 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on theex-dividend date as calculated by Lipper. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Oil prices stated a strong rally from the beginning of the year through the end of April, leading to robust gains for both West Texas Intermediate and Brent crude oil for the full, semiannual period. After a short-livedsell-off in May that was caused by concerns about weaker demand, the market quickly recovered in June as investors regained their appetite for risk. In this environment,large-cap, integrated oil companies — including the Trust’s positions in Royal Dutch Shell PLC and BP PLC — generally performed well.

Iron ore was the standout performer in the industrials metals space due to seasonal restocking by Chinese steel mills and a large producer’s suspension of production. The Trust’s positions in mining companies, particularly BHP Billiton Ltd and Rio Tinto PLC, finished the period among the top contributors to absolute performance.

Umicore NV was the largest individual detractor. The Trust’s investment adviser began building a position in the company in late 2018 on the belief that it would capitalize on the positive trends in the electric vehicle and battery recycling industries. The stock initially performed well, but it turned lower in April after the company issued a profit warning for both 2019 and 2020. In reducing its forward guidance, Umicore cited lower cobalt prices and weaker demand for electric vehicle cathodes in China.

The Trust’s position in the specialist ingredients producer Ingredion, Inc. also detracted from performance. The company reported fourth-quarter results that were ahead of expectations, but it lowered its outlook for 2019. Other detractors of note included positions in the nutrition company Glanbia PLC and the lithium producer Albemarle Corp.

The Trust made use of options, principally written call options on individual stocks. The option overlay strategy detracted from results in the rising market.

Describe recent portfolio activity.

The investment adviser shifted the Trust’s holdings in the diversified mining sector. It sold the Trust’s position in Glencore PLC on the belief that the company had an unfavorable commodity mix and rising environmental, social and governance risks. The proceeds were rotated into Anglo American PLC. The Trust also reduced the portfolio’s weighting in fertilizer companies by exiting CF Industries Holdings, Inc. and increased its allocation to select protein producers, including Tyson Foods, Inc.

| | |

| 18 | | 2019 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2019 (continued) | | BlackRock Resources & Commodities Strategy Trust |

Describe portfolio positioning at period end.

The mining industry represented the Trust’s largest allocation, followed by energy and agriculture, respectively.

As of June 30, 2019, the Trust had an options overwriting program in place whereby 37% of the underlying equities were overwritten with call options. The options were typically written at levels above prevailing market prices (estimated to be 3.7% out of the money) with an average time until expiration of 49 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

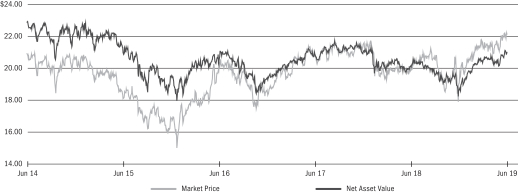

| | | 06/30/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.18 | | | $ | 7.06 | | | | 15.86 | % | | $ | 8.38 | | | $ | 6.98 | |

Net Asset Value | | | 9.28 | | | | 8.44 | | | | 9.95 | | | | 9.64 | | | | 8.31 | |

Market Price and Net Asset Value History For Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 06/30/19 | |

Royal Dutch Shell PLC — ADR | | | 6 | % |

TOTAL SA | | | 5 | |

BP PLC — ADR | | | 5 | |

BHP Group PLC | | | 5 | |

Anglo American PLC | | | 5 | |

Nutrien Ltd. | | | 5 | |

Exxon Mobil Corp. | | | 4 | |

Barrick Gold Corp. | | | 3 | |

Rio Tinto PLC — ADR | | | 3 | |

FMC Corp. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 06/30/19 | | | 12/31/18 | |

Metals & Mining | | | 37 | % | | | 38 | % |

Oil, Gas & Consumable Fuels | | | 34 | | | | 33 | |

Chemicals | | | 10 | | | | 14 | |

Food Products | | | 10 | | | | 7 | |

Containers & Packaging | | | 3 | | | | 3 | |

Electronic Equipment, Instruments & Components | | | 2 | | | | 1 | |

Specialty Retail | | | 2 | | | | — | |

Machinery | | | 1 | | | | 1 | |

Pharmaceuticals | | | 1 | | | | 1 | |

Paper & Forest Products | | | — | | | | 1 | |

Energy Equipment & Services | | | — | | | | 1 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2019 | | BlackRock Science and Technology Trust |

Investment Objective