UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21656

Name of Fund: BlackRock Energy and Resources Trust (BGR)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Energy

and Resources Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2020

Date of reporting period: 06/30/2020

Item 1 – Report to Stockholders

| | |

| | JUNE 30, 2020 |

| | |

| |

| | 2020 Semi-Annual Report (Unaudited) |

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Trust (BME)

BlackRock Health Sciences Trust II (BMEZ)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Trust (BST)

BlackRock Science and Technology Trust II (BSTZ)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Trust’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call Computershare at (800) 699-1236 to request that you continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC or its affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Enhanced Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Trust’s (BME), BlackRock Health Sciences Trust II’s (BMEZ), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Trust’s (BST), BlackRock Science and Technology Trust II’s (BSTZ) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Fiscal Year to Date

Cumulative Distributions by Character | | | Percentage of Fiscal Year to Date

Cumulative Distributions by Character | |

| Ticker | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital (a) | | | Total Per Common

Share | | | Net Investment Income | | | Net Realized

Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per

Common

Share | |

BGR | | $ | 0.180872 | | | $ | — | | | $ | — | | | $ | 0.204328 | | | $ | 0.385200 | | | | 47 | % | | | 0 | % | | | 0 | % | | | 53 | % | | | 100 | % |

CII | | | 0.090988 | | | | — | | | | 0.434012 | | | | — | | | | 0.525000 | | | | 17 | | | | 0 | | | | 83 | | | | 0 | | | | 100 | |

BDJ | | | 0.212571 | | | | — | | | | 0.087429 | | | | — | | | | 0.300000 | | | | 71 | | | | 0 | | | | 29 | | | | 0 | | | | 100 | |

BOE | | | 0.152891 | | | | — | | | | — | | | | 0.225109 | | | | 0.378000 | | | | 40 | | | | 0 | | | | 0 | | | | 60 | | | | 100 | |

BGY | | | 0.071618 | | | | — | | | | — | | | | 0.131182 | | | | 0.202800 | | | | 35 | | | | 0 | | | | 0 | | | | 65 | | | | 100 | |

BME | | | 0.022858 | | | | — | | | | — | | | | 1.177142 | | | | 1.200000 | | | | 2 | | | | 0 | | | | 0 | | | | 98 | | | | 100 | |

BMEZ | | | — | | | | — | | | | — | | | | 0.300000 | | | | 0.300000 | | | | 0 | | | | 0 | | | | 0 | | | | 100 | | | | 100 | |

BCX | | | 0.103460 | | | | — | | | | — | | | | 0.182940 | | | | 0.286400 | | | | 36 | | | | 0 | | | | 0 | | | | 64 | | | | 100 | |

BST | | | — | | | | — | | | | — | | | | 0.993000 | | | | 0.993000 | | | | 0 | | | | 0 | | | | 0 | | | | 100 | | | | 100 | |

BSTZ | | | — | | | | — | | | | — | | | | 0.600000 | | | | 0.600000 | | | | 0 | | | | 0 | | | | 0 | | | | 100 | | | | 100 | |

| BUI | | | 0.173723 | | | | — | | | | — | | | | 0.552277 | | | | 0.726000 | | | | 24 | | | | 0 | | | | 0 | | | | 76 | | | | 100 | |

| | (a) | Certain Trusts estimate that they have distributed more than its net investment income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. | |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website at blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis as of June 30, 2020:

| | | | |

| Exchange Symbol | | Amount Per

Common Share | |

BGR | | $ | 0.0470 | |

CII | | | 0.0875 | |

BDJ | | | 0.0500 | |

BOE | | | 0.0630 | |

BGY | | | 0.0338 | |

BME | | | 0.2000 | |

BMEZ | | | 0.1000 | |

BCX | | | 0.0400 | |

BST | | | 0.1655 | |

BSTZ | | | 0.1000 | |

BUI | | | 0.1210 | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net investment income and short-term capital gains) is not earned on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Trust may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BME, BST and BUI’s prospectuses for a more complete description of each Trust’s risks.

| | |

| 2 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

The Markets in Review

Dear Shareholder,

The last 12 months have been a time of sudden change in global financial markets, as a long period of growth and positive returns was interrupted in early 2020 by the emergence and spread of the coronavirus. For the first part of the reporting period, U.S. equities and bonds both delivered impressive returns, despite fears and doubts about the economy that were ultimately laid to rest with unprecedented monetary stimulus and a sluggish yet resolute performance from the U.S. economy. But as the threat from the coronavirus became more apparent throughout February and March 2020, leading countries around the world took economically disruptive countermeasures, causing equity prices to fall sharply. While markets have since recovered some of these losses as countries around the world begin reopening, there is still significant uncertainty surrounding the course of the pandemic, and an uptick in U.S. infection rates caused concern late in the reporting period.

Returns for most securities were robust for the first part of the reporting period, as investors began to realize that the U.S. economy was maintaining the modest yet steady growth that had characterized this economic cycle. However, once stay-at-home orders and closures of non-essential businesses became widespread, many workers were laid off and unemployment claims spiked. With large portions of the global economy on hold, all types of international equities ended the 12-month reporting period with negative performance, while in the United States large-capitalization stocks, which investors saw as more resilient than smaller companies, delivered solid returns.

The performance of different types of fixed-income securities diverged substantially due to a reduced investor appetite for risk. Treasuries benefited from the risk-off environment, and posted healthy returns, as the 10-year U.S. Treasury yield (which is inversely related to bond prices) fell to an all-time low. Investment-grade corporate bonds also delivered a solid return, while high-yield corporate returns were flat due to credit concerns.

The U.S. Federal Reserve (the “Fed”) reduced interest rates three times in 2019, to support slowing economic growth. After the coronavirus outbreak, the Fed instituted two emergency rate cuts, pushing short-term interest rates close to zero. To stabilize credit markets, the Fed also announced a new bond-buying program, as did several other central banks around the world, including the European Central Bank and the Bank of Japan.

Looking ahead, while coronavirus-related disruption has clearly hindered worldwide economic growth, we believe that the global expansion is likely to continue once the impact of the outbreak subsides. Several risks remain, however, including a potential resurgence of the virus amid loosened restrictions, policy fatigue among governments already deep into deficit spending, and structural damage to the financial system from lengthy economic interruptions.

Overall, we favor a moderately positive stance toward risk, and in particular toward credit given the extraordinary central bank measures taken in recent months. This support extends beyond investment-grade corporates and into high-yield, leading to attractive opportunities throughout the credit market. We believe that both U.S. Treasuries and sustainable investments can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments. We remain neutral on equities overall while favoring European stocks, which are poised for a cyclical upside as re-openings continue.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of June 30, 2020 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | (3.08)% | | 7.51% |

U.S. small cap equities

(Russell 2000® Index) | | (12.98) | | (6.63) |

International equities

(MSCI Europe, Australasia, Far East Index) | | (11.34) | | (5.13) |

Emerging market equities

(MSCI Emerging Markets Index) | | (9.78) | | (3.39) |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | 0.60 | | 1.63 |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | 12.68 | | 14.21 |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 6.14 | | 8.74 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 1.97 | | 4.23 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | (3.83) | | 0.00 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | | |

| THIS PAGEISNOT PARTOF YOUR FUND REPORT | | | 3 | |

Table of Contents

Option Over-Writing Strategy

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Option Over-Writing Strategy Illustration

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | |

| THE BENEFITSAND RISKSOF OPTION OVER-WRITING | | | 5 | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Energy and Resources Trust (BGR) |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange (“NYSE”) | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($7.23)(a) | | 7.80% |

Current Monthly Distribution per Common Share(b) | | $0.0470 |

Current Annualized Distribution per Common Share(b) | | $0.5640 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGR(a)(b) | | | (36.19 | )% | | | (32.77 | )% |

MSCI World Energy Call Overwrite Index(c) | | | N/A | | | | (38.19 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI World Energy Call Overwrite Index incorporates an option overlay component on the MSCI World Energy Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Energy prices fell sharply in the first half of 2020, as the demand outlook was pressured by concerns about the economic impact of the coronavirus pandemic. In combination with the stock market downturn that occurred in February and March, this development led to poor returns for energy-related equities.

Consistent with this environment, the Trust produced a negative absolute return in the six-month period. While most of its holdings declined in value, its positions in more “defensive” energy companies — such as Total SA and the oil pipeline company Williams Cos. — outperformed. The Trust also benefited from not owning Occidental Petroleum Corp. and being significantly underweight Schlumberger NV, as both companies experienced sharp share price declines.

The oil refiner Marathon Petroleum Corp., which was hurt by the prospect of rising gasoline inventories, was the largest detractor from performance. The exploration and production (“E&P”) companies Kosmos Energy Ltd. and Noble Energy, Inc. also weighed on results. Shares of Kosmos slid after the company announced plans to reduce 2020 capital spending and suspend its dividend to preserve cash, while Noble lost ground due to its higher sensitivity to energy prices. An underweight in Enbridge, Inc., which outperformed thanks to progress on a proposed pipeline in the United States, was an additional detractor of note.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the six-month period.

Early in the period, the Trust held a slightly elevated cash balance. The Trust’s cash balance had no material impact to performance.

Describe recent portfolio activity

The investment adviser adopted a more defensive posture in early March given the risks to oil demand stemming from the virus. This was achieved by remaining focused on high-quality producers that the investment adviser saw as having asset bases and balance sheets strong enough to weather the near-term storm and emerge well-positioned for an eventual upturn. Later in the period, the Trust added to its positions in non-U.S. oil producers.

| | |

| 6 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Energy and Resources Trust (BGR) |

Describe portfolio positioning at period end.

The integrated energy subsector represented the Trust’s largest allocation, followed by the E&P, distribution, refining & marketing, and oil services industries, respectively.

As of June 30, 2020, the Trust had in place an option overwriting program in place whereby 34% of the underlying equities were overwritten with call options. These call options were typically written at levels above prevailing market prices (estimated to be 6.1% out of the money) with an average time until expiration of 45 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

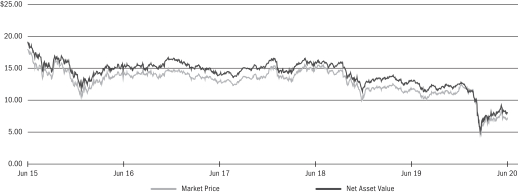

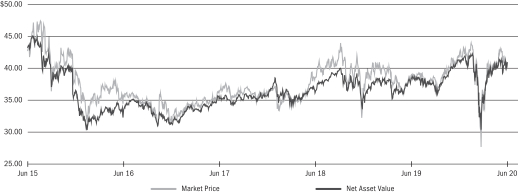

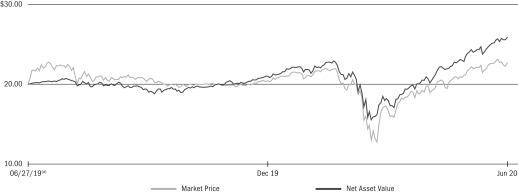

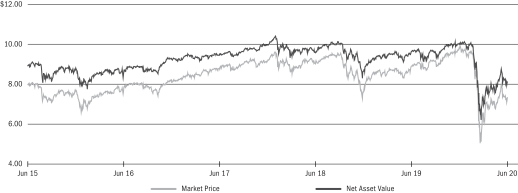

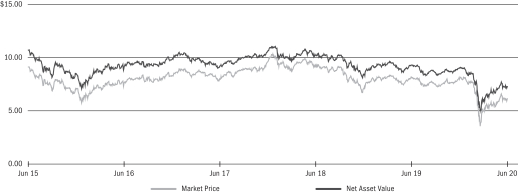

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 7.23 | | | $ | 11.88 | | | | (39.14 | )% | | $ | 12.66 | | | $ | 4.17 | |

Net Asset Value | | | 8.06 | | | | 12.57 | | | | (35.88 | ) | | | 12.82 | | | | 5.15 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Chevron Corp. | | | 14 | % |

Royal Dutch Shell PLC — ADR | | | 10 | |

TOTAL SA | | | 9 | |

BP PLC | | | 8 | |

ConocoPhillips | | | 5 | |

TC Energy Corp | | | 4 | |

Kinder Morgan, Inc. | | | 4 | |

Williams Cos., Inc. | | | 4 | |

Suncor Energy, Inc. | | | 4 | |

Pioneer Natural Resources Co. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 6/30/20 | | | 12/31/19 | |

Oil, Gas & Consumable Fuels | | | 96 | % | | | 97 | % |

Energy Equipment & Services | | | 4 | | | | 3 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Enhanced Capital and Income Fund (CII) |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($14.47)(a) | | 7.26% |

Current Monthly Distribution per Common Share(b) | | $0.0875 |

Current Annualized Distribution per Common Share(b) | | $1.0500 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

CII(a)(b) | | | (13.08 | )% | | | (7.29 | )% |

MSCI USA Call Overwrite Index(c) | | | N/A | | | | (10.36 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA Call Overwrite Index incorporates an option overlay component on the MSCI USA Index with a 55% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

In the equity allocation of the Trust, the largest contributor to relative performance was stock selection within the industrials sector. Most notably, an out-of-benchmark position in specialty contractor Quanta Services Inc. and a lack of exposure to aerospace manufacturer Boeing Co. provided strong relative returns. Underweight allocations to real estate also contributed to performance. Lastly, the Trust benefited from stock selection within the communication services sector, particularly given its overweight positions in tech giants Facebook Inc. and Alphabet Inc.

Conversely, the largest detractor from relative performance in the equity allocation of the Trust was stock selection in the information technology (“IT”) sector. Most notably, overweight positions in software developer CDK Global Inc. and IT consulting company Cognizant Technology Solutions Corp. weighed on results. Stock selection in financials also detracted, particularly due to overweight positions in U.S. Bancorp and Bank of America Corp. Also detracting from relative performance was stock selection in the energy sector, most notably through an overweight position in Marathon Oil Corp.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance during the period.

Describe recent portfolio activity.

The Trust significantly increased its exposure to the IT sector. Holdings within consumer discretionary and real estate were also increased. Conversely, the Trust significantly reduced its exposure to the financials sector. The Trust also lowered its allocation to energy and consumer staples.

Describe portfolio positioning at period end.

In the equity portion of the portfolio, the Trust’s largest allocations relative to the benchmark were in the consumer discretionary, communication services, and industrials sectors. Conversely, the Trust’s largest relative underweights were in the real estate, IT, and utilities sectors.

As of June 30, 2020, the Trust had in place an option overwriting program whereby 52% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 5.0% out of the money) with an average time until expiration of 45 days.

| | |

| 8 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Enhanced Capital and Income Fund (CII) |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

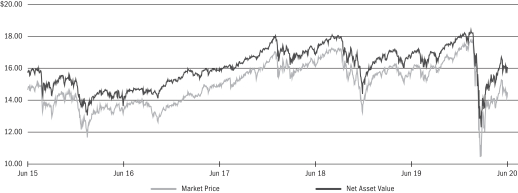

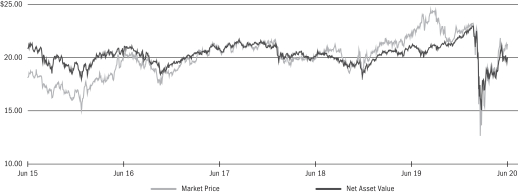

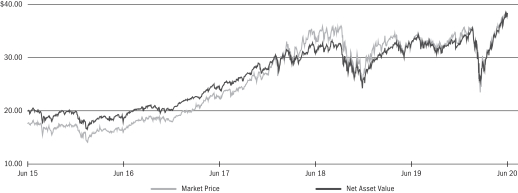

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.47 | | | $ | 17.25 | | | | (16.12 | )% | | $ | 17.86 | | | $ | 9.56 | |

Net Asset Value | | | 16.07 | | | | 17.96 | | | | (10.52 | ) | | | 18.37 | | | | 12.31 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Apple, Inc. | | | 7 | % |

Microsoft Corp. | | | 7 | |

Alphabet, Inc. | | | 5 | |

Amazon.com, Inc. | | | 5 | |

Facebook, Inc. | | | 4 | |

Visa, Inc. | | | 3 | |

UnitedHealth Group, Inc. | | | 3 | |

Comcast Corp. | | | 3 | |

Cisco Systems, Inc. | | | 2 | |

Berkshire Hathaway, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 6/30/20 | | | 12/31/19 | |

Information Technology | | | 26 | % | | | 21 | % |

Consumer Discretionary | | | 16 | | | | 12 | |

Health Care | | | 14 | | | | 14 | |

Communication Services | | | 13 | | | | 13 | |

Industrials | | | 9 | | | | 9 | |

Financials | | | 9 | | | | 13 | |

Consumer Staples | | | 5 | | | | 7 | |

Energy | | | 3 | | | | 6 | |

Materials | | | 3 | | | | 3 | |

Utilities | | | 1 | | | | 2 | |

Real Estate | | | 1 | | | | — | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($7.34)(a) | | 8.17% |

Current Monthly Distribution per Common Share(b) | | $0.0500 |

Current Annualized Distribution per Common Share(b) | | $0.6000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BDJ(a)(b) | | | (23.05 | )% | | | (15.70 | )% |

MSCI USA Value Call Overwrite Index(c) | | | N/A | | | | (22.21 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA Value Call Overwrite Index incorporates an option overlay component on the MSCI USA Value Index with a 55% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The most significant contributors to relative performance during the six-month period were stock selection and allocation decisions within the consumer discretionary sector. In particular, stock selection in the multiline retail industry proved beneficial. In addition, an underweight to the hotels, restaurants & leisure industry boosted relative return in the sector. Within information technology (“IT”), an overweight to the software industry added to performance. Other notable contributors included an overweight to health care, stock selection in the communication services sector, and an underweight to real estate.

The largest detractor from relative performance was an overweight to the financials sector. Notably, overweight exposure to banks constrained performance, as did selection among capital markets firms. Additionally, underweights to electric utilities and multi-utilities weighed on relative return. Other modest detractors included an underweight to consumer staples as well as stock selection within industrials.

The Trust utilized an options overlay strategy, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy contributed positively to performance during the six-month period.

Describe recent portfolio activity.

During the period, a combination of portfolio trading activity and market price changes resulted in increased exposure to the utilities, IT and consumer staples sectors. Conversely, the Trust’s exposures to financials, energy and industrials were reduced.

Describe portfolio positioning at period end.

The Trust’s largest allocations on an absolute basis were in the financials, health care and IT sectors. Relative to the benchmark, the Trust’s largest overweight positions were in the financials, health care and energy sectors. Conversely, the Trust’s largest relative underweights were in the real estate, industrials and consumer staples sectors.

| | |

| 10 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Enhanced Equity Dividend Trust (BDJ) |

As of June 30, 2020, the Trust had in place an option overwriting program whereby 52% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 5.6% out of the money) with an average time until expiration of 47 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

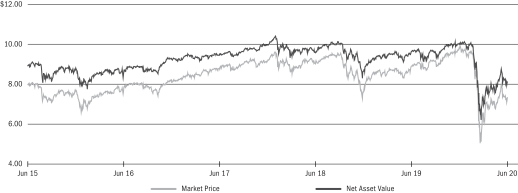

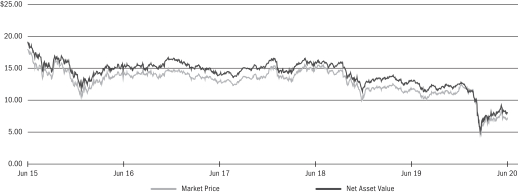

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 7.34 | | | $ | 9.92 | | | | (26.01 | )% | | $ | 9.97 | | | $ | 4.65 | |

Net Asset Value | | | 8.13 | | | | 10.03 | | | | (18.94 | ) | | | 10.13 | | | | 6.22 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Verizon Communications, Inc. | | | 4 | % |

Bank of America Corp. | | | 3 | |

Citigroup, Inc. | | | 3 | |

Anthem, Inc. | | | 3 | |

Medtronic PLC | | | 2 | |

Cognizant Technology Solutions Corp. | | | 2 | |

Altria Group, Inc. | | | 2 | |

Morgan Stanley | | | 2 | |

Unilever NV — NY Shares | | | 2 | |

Koninklijke Philips NV | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 6/30/20 | | | 12/31/19 | |

Financials | | | 27 | % | | | 29 | % |

Health Care | | | 19 | | | | 19 | |

Information Technology | | | 10 | | | | 9 | |

Energy | | | 8 | | | | 10 | |

Consumer Staples | | | 8 | | | | 7 | |

Communication Services | | | 8 | | | | 8 | |

Industrials | | | 7 | | | | 8 | |

Utilities | | | 6 | | | | 3 | |

Consumer Discretionary | | | 5 | | | | 6 | |

Materials | | | 2 | | | | 1 | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Enhanced Global Dividend Trust (BOE) |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and by employing a strategy of writing (selling) call and put options. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($9.42)(a) | | 8.03% |

Current Monthly Distribution per Common Share(b) | | $0.0630 |

Current Annualized Distribution per Common Share(b) | | $0.7560 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BOE(a)(b) | | | (10.83 | )% | | | (9.73 | )% |

MSCI ACWI Call Overwrite Index(c) | | | N/A | | | | (12.58 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Index with a 45% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The Trust’s lack of exposure to the energy sector, particularly the oil, gas and consumable fuels industry, contributed to returns during the six-month period. Stock selection within the industrials sector, most notably within machinery, also contributed to relative performance. In addition, an underweight to the real estate sector added to relative return. At the security level, the Trust’s position in the U.S. biotechnology company AbbVie, Inc. was the top individual contributor to performance. AbbVie’s shares rose after the company reported strong financial results, with sales for a number of its products exceeding market expectations. Holdings in the U.S. pharmaceutical firm Johnson & Johnson represented another top contributor as the company’s shares were boosted by a stronger-than-expected profit report. The Trust’s position in the Finnish engineering company Kone OYJ also was additive.

Stock selection within and an underweight to information technology (“IT”), particularly a lack of holdings within software, represented the largest detractor from performance. Stock selection within and an underweight to the consumer discretionary sector, especially within the internet & direct marketing retail industry, also detracted, as did stock selection within the communication services sector. At the security level, the Trust’s position in U.S.-based Darden Restaurants, Inc. was the principal detractor as social distancing measures impacted the company’s earnings. Holdings in the U.S. financial firm M&T Bank Corp. also weighed on returns as the financials sector, and banks in particular, underperformed during the period. The Trust’s position in U.S. toymaker Hasbro, Inc. also traded lower due to potential disruptions in the company’s supply chain and a disappointing earnings projection.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s options writing strategy contributed positively to performance for the six-month period..

Describe recent portfolio activity.

During the period, the Trust added exposure to the consumer staples sector, mainly within the beverages and household products industries. Exposure to the industrials sector also was added, especially within the machinery industry. Conversely, exposure to financials was reduced, especially among banks. The investment adviser also trimmed exposure to the materials sector, mostly within containers and packaging.

| | |

| 12 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Enhanced Global Dividend Trust (BOE) |

Describe portfolio positioning at period end.

At the end of the period, the Trust’s largest sector exposures were in consumer staples and health care, driven by the pharmaceuticals and beverages industries. The largest underweights were to the IT, financials and consumer discretionary sectors. The Trust had no exposure to real estate, utilities or energy at period end. Regionally, the majority of the portfolio was listed in the United States or Europe, with significant exposure in the United Kingdom and Switzerland.

As of June 30, 2020, the Trust had in place an option overwriting program whereby 43% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 3.9% out of the money) with an average time until expiration of 45 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

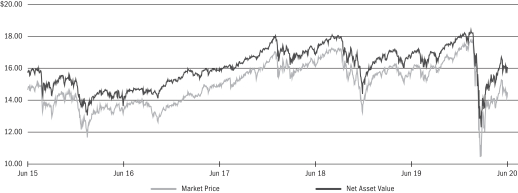

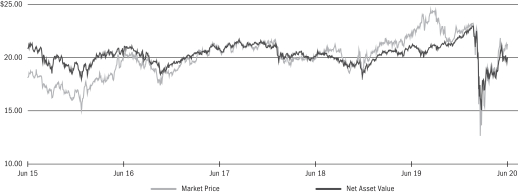

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 9.42 | | | $ | 10.99 | | | | (14.29 | )% | | $ | 11.25 | | | $ | 7.00 | |

Net Asset Value | | | 10.69 | | | | 12.32 | | | | (13.23 | ) | | | 12.41 | | | | 8.34 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Unilever PLC | | | 4 | % |

TELUS Corp. | | | 3 | |

Coca-Cola Co. | | | 3 | |

Paychex, Inc. | | | 3 | |

Sanofi SA | | | 3 | |

Novartis AG, Registered Shares | | | 3 | |

AbbVie, Inc. | | | 3 | |

Lockheed Martin Corp. | | | 3 | |

British American Tobacco PLC | | | 3 | |

Medtronic PLC | | | 3 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 6/30/20 | | | 12/31/19 | |

United States | | | 52 | % | | | 53 | % |

United Kingdom | | | 16 | | | | 13 | |

Switzerland | | | 7 | | | | 7 | |

Canada | | | 5 | | | | 7 | |

France | | | 4 | | | | 4 | |

Netherlands | | | 4 | | | | 3 | |

Australia | | | 3 | | | | 3 | |

Singapore | | | 2 | | | | 3 | |

Denmark | | | 2 | | | | 2 | |

Germany | | | 2 | | | | 2 | |

Finland | | | 1 | | | | 1 | |

Sweden | | | 1 | | | | 1 | |

Taiwan | | | 1 | | | | 1 | |

India | | | — | (a) | | | — | |

Japan | | | — | | | | — | (a) |

| | (a) | Represents less than 1% of the Trust’s total investments. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Enhanced International Dividend Trust (BGY) |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BGY |

Initial Offering Date | | May 30, 2007 |

Current Distribution Rate on Closing Market Price as of as of June 30, 2020 ($5.14)(a) | | 7.89% |

Current Monthly Distribution per Common Share(b) | | $0.0338 |

Current Annualized Distribution per Common Share(b) | | $0.4056 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGY(a)(b) | | | (9.25 | )% | | | (5.65 | )% |

MSCI ACWI ex USA Call Overwrite Index(c) | | | N/A | | | | (17.03 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI ex USA Call Overwrite Index incorporates an option overlay component on the MSCI ACWI ex USA Index with a 45% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

During the six-month period, the Trust’s lack of exposure to the energy sector, particularly the oil, gas and consumable fuels industry, contributed to returns. In addition, an underweight exposure to the financials sector, as well as an overweight to health care companies, added to relative performance. At the security level, the Trust’s position in Australian medical equipment company Ansell Ltd. was the top individual contributor to returns. Ansell’s shares were strong during the period owing to the increased usage of personal protective equipment, including medical gloves. Holdings in Danish pharmaceutical firm Novo Nordisk A/S and Finnish engineering company Kone OYJ also boosted performance.

Conversely, stock selection within and an underweight to information technology (“IT”), particularly a lack of holdings within software, represented one of the largest detractors from performance. Stock selection in the consumer discretionary and communication services sectors also weighed on returns. At the security level, a lack of exposure to Chinese gaming company Tencent Holdings Ltd. represented the largest individual detractor from relative return. Tencent performed strongly on continued momentum within technology stocks. The Trust’s position in British defense firm BAE Systems PLC also detracted as investors reacted negatively to BAE’s announcement that it would defer its dividend. A lack of exposure to Canadian e-commerce firm Shopify, Inc. also hindered relative performance.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed positively to relative performance for the six-month period.

Describe recent portfolio activity.

During the period, the Trust added exposure to the consumer staples sector, mainly within the beverages and household products industries. The portfolio also added exposure to the industrials sector, especially within the machinery industry. Exposure to financials, particularly among banks, was reduced. The investment adviser also trimmed its holdings in the materials sector, mainly within containers and packaging.

| | |

| 14 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Enhanced International Dividend Trust (BGY) |

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector exposures were in consumer staples and health care, with an emphasis on the pharmaceuticals and beverages industries, respectively. The largest underweights were to IT, financials and consumer discretionary. The Trust had no exposure to real estate, utilities or energy at the end of the period. From a regional perspective, a majority of portfolio assets was invested in Europe, with significant exposure to the United Kingdom and Switzerland.

As of June 30, 2020, the Trust had in place an option overwriting program whereby 45% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 3.0% out of the money) with an average time until expiration of 46 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

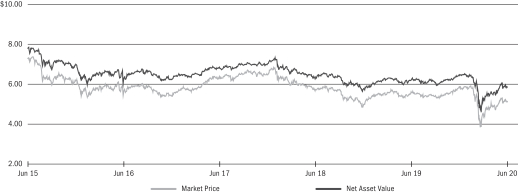

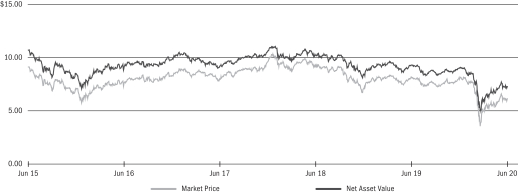

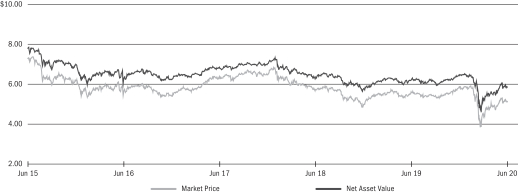

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 5.14 | | | $ | 5.89 | | | | (12.73 | )% | | $ | 5.96 | | | $ | 3.73 | |

Net Asset Value | | | 5.87 | | | | 6.47 | | | | (9.27 | ) | | | 6.52 | | | | 4.60 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Unilever PLC | | | 6 | % |

Novartis AG, Registered Shares | | | 5 | |

TELUS Corp. | | | 5 | |

Sanofi | | | 5 | |

Nestle SA, Registered Shares | | | 5 | |

British American Tobacco PLC | | | 4 | |

Heineken NV | | | 4 | |

BAE Systems PLC | | | 4 | |

Sonic Healthcare Ltd. | | | 4 | |

Koninklijke Philips NV | | | 4 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 6/30/20 | | | 12/31/19 | |

United Kingdom | | | 29 | % | | | 26 | % |

Switzerland | | | 15 | | | | 13 | |

Canada | | | 9 | | | | 13 | |

France | | | 8 | | | | 7 | |

Netherlands | | | 8 | | | | 7 | |

Australia | | | 6 | | | | 5 | |

Singapore | | | 5 | | | | 5 | |

Germany | | | 3 | | | | 5 | |

Denmark | | | 4 | | | | 3 | |

United States | | | 3 | | | | 9 | |

Finland | | | 3 | | | | 2 | |

Sweden | | | 3 | | | | 2 | |

Taiwan | | | 3 | | | | 2 | |

China | | | 1 | | | | 1 | |

India(a) | | | — | | | | — | |

| | (a) | Represents less than 1% of the Trust’s total investments. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Health Sciences Trust (BME) |

Investment Objective

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($40.78)(a) | | 5.89% |

Current Monthly Distribution per Common Share(b) | | $0.2000 |

Current Annualized Distribution per Common Share(b) | | $2.4000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BME(a)(b) | | | (1.08 | )% | | | 2.44 | % |

MSCI USA IMI Health Care Call Overwrite Index(c) | | | N/A | | | | (4.07 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA IMI Health Care Call Overwrite Index incorporates an option overlay component on the MSCI IMI Health Care Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Global health care stocks outpaced the broader equity market in the first half of 2020. The sector benefited from its steady earnings and defensive qualities, as well as the outperformance for companies expected to benefit from the development of treatments for the coronavirus.

Strong stock selection, primarily in the pharmaceuticals and biotechnology sub-sectors, was the primary driver of the Trust’s return. An overweight position in the telemedicine company Teladoc Health, Inc., which benefited from increased demand for virtual diagnostics and telemedicine services, was the top contributor to performance. An overweight in the biotechnology company Seattle Genetics, Inc. — which received approval from the Food & Drug Administration for its breast cancer drug — was the second-largest contributor. The company also presented details on its expanding pipeline and investigational therapies.

Weak stock selection in the medical devices and supplies sub-sector detracted from relative performance. Zero weightings in AbbVie, Inc. and Danaher Corp., both of which outpaced the broader category by a wide margin, were the largest detractors. Underweight positions in the pharmaceutical companies Johnson & Johnson and Eli Lilly & Co., which benefited from their efforts at developing a coronavirus vaccine and therapy, respectively, also detracted.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the six-month period.

Describe recent portfolio activity.

The Trust increased its weighting in the biotechnology industry, and it decreased its allocations to the pharmaceuticals, health care providers & services, and medical devices & supplies subsectors.

Describe portfolio positioning at period end.

As of June 30, 2020, the Trust was overweight in the medical devices & supplies, biotechnology, and health care providers & services sub-sectors, and it was underweight in pharmaceuticals.

| | |

| 16 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Health Sciences Trust (BME) |

The Trust’s investment adviser continued to identify important secular trends that underpin the health care sector, such as an aging global population and rising spending on health care in emerging market economies. This process helps form the basis for an overweight in the medical devices & supplies sub-sector, where the investment adviser continued to see strong fundamentals and growing penetration in the emerging markets.

Demographic changes across the globe, especially increased longevity, are leading to demand for the health sciences industry. This is further supported by innovation in multiple areas within health care. In drug development, for example, biotechnology and pharmaceutical companies are utilizing genomic research that allows for earlier diagnosis of disease and is facilitating the shift toward preventative care. In addition, there has been significant innovation in medical equipment, diagnostic services and biosensors.

As of June 30, 2020, the Trust had an options overwriting program in place whereby 39% of the underlying equities were overwritten with call options. These options were typically written at prices above prevailing market prices (estimated to be 6.4% out of the money) with an average time line until expiration of 49 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

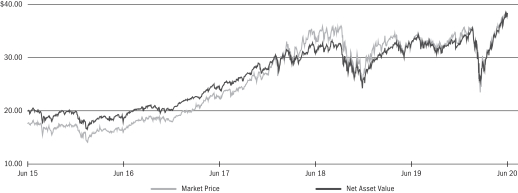

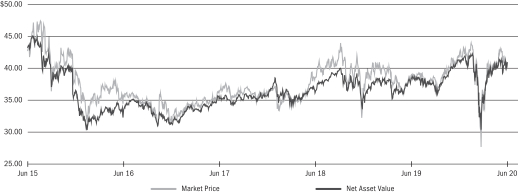

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 12/31/19 | | | Change | | | High | | | Low | |

Market Price | | $ | 40.78 | | | $ | 42.50 | | | | (4.05 | )% | | $ | 43.99 | | | $ | 27.00 | |

Net Asset Value | | | 40.93 | | | | 41.19 | | | | (0.63 | ) | | | 42.23 | | | | 30.41 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

UnitedHealth Group, Inc. | | | 7 | % |

Johnson & Johnson | | | 5 | |

Abbott Laboratories | | | 5 | |

Amgen, Inc. | | | 3 | |

Thermo Fisher Scientific, Inc. | | | 3 | |

Medtronic PLC | | | 3 | |

Boston Scientific Corp. | | | 3 | |

Eli Lilly & Co. | | | 3 | |

Vertex Pharmaceuticals, Inc. | | | 3 | |

Humana, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 6/30/20 | | | 12/31/19 | |

Health Care Equipment & Supplies | | | 28 | % | | | 30 | % |

Biotechnology | | | 23 | | | | 17 | |

Pharmaceuticals | | | 21 | | | | 23 | |

Health Care Providers & Services | | | 19 | | | | 21 | |

Life Sciences Tools & Services | | | 7 | | | | 8 | |

Health Care Technology | | | 2 | | | | 1 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Health Sciences Trust II (BMEZ) |

Investment Objective

BlackRock Health Sciences Trust II’s (BMEZ) (the “Trust”) investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. Equity derivatives in which the Trust invests include purchased and sold (written) call and put options on equity securities of companies in the health sciences group of industries.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BMEZ |

Initial Offering Date | | January 30, 2020 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($20.91)(a) | | 5.74% |

Current Monthly Distribution per Common Share(b) | | $0.1000 |

Current Annualized Distribution per Common Share(b) | | $1.2000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the period since inception (January 30, 2020) to June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BMEZ(a)(b) | | | 6.10 | % | | | 19.29 | % |

MSCI ACWI 25% Call Overwrite Index(c) | | | N/A | | | | (9.65 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust moved to a discount to NAV during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI 25% Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Index with a 25% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 18 | | 2020 BLACKROCK SEMI-ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of June 30, 2020 (continued) | | BlackRock Health Sciences Trust II (BMEZ) |

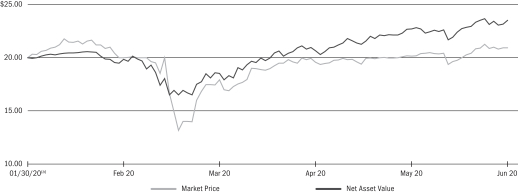

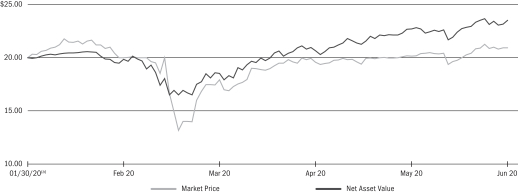

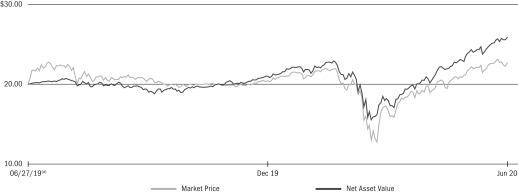

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 06/30/20 | | | 01/30/20 (a) | | | Change | | | High | | | Low | |

Market Price | | $ | 20.91 | | | $ | 20.00 | | | | 4.55 | % | | $ | 21.90 | | | $ | 12.60 | |

Net Asset Value | | | 23.51 | | | | 20.00 | | | | 17.55 | | | | 23.65 | | | | 16.49 | |

Market Price and Net Asset Value History Since Inception

| (a) | Commencement of operations. |

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 6/30/20 | |

Seattle Genetics, Inc. | | | 3 | % |

Genmab A/S | | | 3 | |

Livongo Health, Inc. | | | 3 | |

Varian Medical Systems, Inc. | | | 2 | |

Masimo Corp. | | | 2 | |

Baxter International, Inc. | | | 2 | |

Teleflex, Inc. | | | 2 | |

UCB SA | | | 2 | |

Teladoc Health, Inc. | | | 2 | |

Amedisys, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | |

| Industry | | 6/30/20 | |

Biotechnology | | | 41 | % |

Health Care Equipment & Supplies | | | 28 | |

Pharmaceuticals | | | 10 | |

Health Care Providers & Services | | | 9 | |

Life Sciences Tools & Services | | | 6 | |

Health Care Technology | | | 5 | |

Insurance | | | 1 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of June 30, 2020 | | BlackRock Resources & Commodities Strategy Trust (BCX) |

Investment Objective

BlackRock Resources & Commodities Strategy Trust’s (BCX) (the “Trust”) primary investment objective is to seek high current income and current gains, with a secondary objective of capital appreciation. The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources. While permitted, the Trust does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BCX |

Initial Offering Date | | March 30, 2011 |

Current Distribution Rate on Closing Market Price as of June 30, 2020 ($6.13)(a) | | 7.83% |

Current Monthly Distribution per Common Share(b) | | $0.0400 |

Current Annualized Distribution per Common Share(b) | | $0.4800 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2020 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BCX(a)(b) | | | (20.43 | )% | | | (15.52 | )% |

MSCI ACWI Select Liquidity Natural Resources Call Overwrite Index(c) | | | N/A | | | | (23.83 | ) |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI Select Liquidity Natural Resources Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Select Liquidity Natural Resources Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Commodity prices fell sharply in the first half of 2020, as the demand outlook was pressured by concerns about the economic impact of the coronavirus. In combination with the stock market downturn that occurred in February and March, this development led to poor returns for commodity-related equities.

Consistent with this environment, the Trust produced a negative absolute return in the six-month period. While most of its holdings lost ground, CF Industries Holdings, Inc. was among the worst performers due to the broad-based weakness in fertilizer producers. Kosmos Energy Ltd. also detracted after it announced plans to reduce 2020 capital spending and suspend its dividend to preserve cash in response to the drop in oil prices. An underweight position in Newmont Mining Corp. was among the largest detractors, as well.