UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21666 |

|

Hatteras Master Fund, L.P. |

(Exact name of registrant as specified in charter) |

|

8540 Colonnade Center Drive, Suite 401 Raleigh, North Carolina | | 27615 |

(Address of principal executive offices) | | (Zip code) |

|

David B. Perkins 8540 Colonnade Center Drive, Suite 401 Raleigh, North Carolina 27615 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (919) 846-2324 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | March 31, 2014 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

ANNUAL REPORT

MARCH 31, 2014

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

MANAGERS DISCUSSION OF FUND PERFORMANCE

Mark W. Yusko

Finishing the fiscal year up 10.5%, The Hatteras Core Alternatives Institutional Fund, L.P. (the "Fund"), performed well ahead of industry benchmarks for the year, with the HFRX Global Hedge Fund Index and the HFRI Fund of Funds reporting returns of 4.6% and 5.9%, respectively over the same period. The Fund outperformance over industry benchmarks was due to a more focused hedge fund book as well as a mature private equity portfolio. The private portfolio returned 13.9%, and hedge funds returned 8.1% for the fiscal year, with overweight allocations to opportunistic equity and private investments which drove performance. The increasingly attractive M&A and IPO environment was the primary driver of attribution for our private strategy whereby valuations and activity acceleration towards the end of the year provided avenues for general partners ("GPs") to exit investments and realize value for investors. A year ago we stated that we were going to continue to concentrate our hedge fund positions with managers we had the most conviction with, and that strategy paid off. The Hedge Fund strategy performed well over the period and significantly outperformed its market indices mentioned above. Over the period, the standard deviation on the Fund was 3.83% (annualized) with a Sharpe ratio of 2.64 compared to the HFRX Global Hedge Fund Index which reported a standard deviation of 3.02% and a Sharpe Ratio of 1.52. With the further concentration of the hedge fund book, although the risk of the Fund was slightly above the benchmark, the higher Sharpe ratio illustrated the ability of our skilled line-up of managers to deliver additional returns associated with any excess risk. In broader

markets, global equities performed well in 2013, with muted levels of performance for the first quarter of 2014 due in part to moderate levels of GDP growth. Domestically, market performance climbed in 2013, albeit a series of hick-ups along the way caused by media rhetoric of impending duress relating to tapering of QE. Beginning in January with the Fiscal Cliff followed by the market's Taper Tantrum in May and the government shutdown in October, the potential for market volatility presented itself several times in 2013; however, markets barely faltered as the S&P 500 TR Index never fell more than 6% during 2013. Globally equity markets generally performed well in 2013, with the MSCI World Index (net) and MSCI EAFE Index (net) returning 26.7% and 22.8%, respectively for 2013. Moving into 2014 the calm waters of 2013 quickly faded away, as global equities fell hard in January with the S&P 500 TR Index, MSCI EAFE Index (net), and MSCI EM Index (net) all dropping in performance, with negative returns of 3.5%, 4.0%, and 6.5%, respectively. February exhibited a bounce back while March was mixed depending on the sector, feeding into the predictions of late that 2014 would exhibit a more volatile state than the docile market conditions of 2013. Fixed Income markets also displayed much more volatility in 2013, with the "taper talk" of the Fed pressing interest rates up in the early part of 2013. Although, the Fed changed course after the markets' negative response to an easing of QE, many fixed income strategies struggled to regain losses for the year with the Barclays US Aggregate and Barclays Long Term US Treasury down -2.0% and -12.7%, respectively as of the end of 2013.

STRATEGY COMMENTARY

Private Investments

Performance from our private investment strategy continued to do well over the year, posting returns of +13.9% for the fiscal year end at a current weight of 42.8%. With an average investment age of around 3 years for the underlying portfolio companies and a called to committed ratio of over 90% for the private investments, the current portfolio has reached a state of maturity whereby managers could be ready to exit investments. The maturity of the portfolio

coupled with an active and attractive (on a valuation basis) exit environment has caused many of our GPs to exit investments at valuations above previous published marks, thus driving both liquidity and performance for the strategy. Distributions outpaced contributions by $32M for the fiscal year — illustrating our GPs actively engaging in the value realization of underlying investments.*

* Distributions include cash distributions from private investment funds, secondary transactions and net transfers between investment strategies

ONE

With a current weight of 42.8% we are excited about the opportunities of investments in the ground working their way towards realization; however, we have chosen to prudently slow

our pace of new investments into the private strategy. As the portfolio matures, we believe the weight of the strategy could naturally move lower, through expected distributions.

Hedge Fund

Our Hedge Fund Strategy was up +8.1% during the fiscal year, outperforming the HFRX Global Hedge Fund Index and the HFRI Fund of Funds which returned 4.6% and 5.9% over the same period. Opportunistic Equity was the clear driver of performance for this strategy, with sector specialist managers in both Healthcare and Tech delivering alpha far above industry averages. Tactical Trading was the largest detractor of performance for the period due to gold exposures that took some significant losses at the beginning of the year and market volatility of our Japanese equities early in 2014. We continue to emphasize the goal of having significant exposure to our Top 20 managers to best reflect our hedge fund strategy.

As stated previously, one of the major goals for the year was to further concentrate the hedge fund portfolio, whereby we could allocate a higher percentage of assets to our favorite managers. Over the period we continued to take this concerted effort to concentrate, and ended the period with approximately 50% of assets concentrated in the top 20 managers. This concentration of the portfolio paid off big in the reflection of attribution for the strategy, with 6 of our top 10 managers providing double digit returns for the fiscal year. Looking ahead, we will continue our focus of a concentrated hedge fund book, with the philosophy to "feed our winners" in our allocation of assets.

Opportunistic Equity

Standing as our largest and best performing hedge fund strategy, Opportunistic Equity ended the year with a 34.1% weight and returned 13.8%. Attribution within the strategy was mainly a result of our higher allocation to top performing managers in the healthcare and tech sectors. With 2014 presenting a rocky start for many players in the tech and healthcare sector, the expertise of our managers shined through as they continued to deliver positive

returns into 2014. Several of our global long/short and international emerging managers also performed well for the period, specifically those with exposures to Chinese Internet plays. Commodity exposure in long/short energy detracted from returns for the period, with exposures to Russia and Japan also hurting performance at the start of 2014 due to volatility spurred by political and geopolitical events in these regions.

Enhanced Fixed Income

Enhanced Fixed Income finished the year at a 11.0% weight and posted slight losses for the year of -0.23%. Underperformance in the strategy was mostly experienced in the first part of the 2013 as fixed income strategies experienced volatility due to "tapering talks" by the Fed. The fear that the Fed would "taper" its QE program caused a lift in interest rates and blew out non-Treasury spreads in a sharp

rate movement in the beginning of 2013. When Chairman Bernanke redacted his previous statement of near-term tapering volatility calmed, however, we are still cautious of this strategy and remain underweight with current exposures evenly split between a few event driven fixed income and structured credit funds.

Absolute Return

Absolute Return performed well for the period and was up 8.9% for the year with a reduction in exposure to 5.8%. Attribution for the strategy was led by our Multi-Strategy managers that continue to deliver alpha through relative value fundamental equity. Over

the period, we reduced our exposures to this strategy by around half, shifting our allocation to more attractive opportunities in our Opportunistic Equity bucket.

Tactical Trading

Tactical Trading, which includes both Global Macro and CTA exposures, struggled for the period, returning -11.1% for the year, and sits at an underweight allocation of 4.5%. Although we have continued to reduce the weight to this strategy, minimizing losses, we are disappointed with these returns. Underperformance in the strategy resulted from early 2013 allocations to gold as well as

exposures to Japanese Equities in the first months of 2014. Negative performance in our Japanese exposures resulted primarily from the market anticipation of a consumption tax hike which finally went into effect; however, we view the market's reaction as a short-term setback and still believe Japan presents an area of opportunity over the next 12 to 24 months.

TWO

Summary

Looking ahead, we believe the portfolio is well positioned for an active and increasingly volatile environment for investors, where investors will see a greater dispersion among asset classes, strategies, and securities. The higher level of scrutiny within markets stands to illustrate the benefits of diversification, active management, and alternative investments. For the private portfolio, the heightened level of activity in IPO and M&A markets has continued in 2014, with 71 companies going public in the first quarter, an increase in exit activity of over 100% from the first quarter of 2013. As investors return to fundamentals and the taper talk discussion evolves our unique combination of private investments and hedge funds offers financial advisors the potential diversification benefits of our hedge funds and a private investment strategy uniquely positioned for potentially capturing today's exit opportunities in a robust M&A and IPO environment.

As always, we appreciate the confidence you have placed in Hatteras and your investment in the Hatteras Core Alternatives Fund. Thank you again, and if you have any questions please do not hesitate to contact us.

Mark W. Yusko

THREE

PERFORMANCE SUMMARY1 (UNAUDITED)

HATTERAS CORE ALTERNATIVES FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

| | 2014 | | | | 0.60 | % | | | 1.53 | % | | | -0.64 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1.50 | % | |

| | 2013 | | | | 1.16 | % | | | -0.03 | % | | | 0.54 | % | | | -0.39 | % | | | 0.59 | % | | | -0.53 | % | | | 0.94 | % | | | -0.50 | % | | | 1.81 | % | | | 1.88 | % | | | 1.50 | % | | | 2.94 | % | | | 10.31 | % | |

| | 2012 | | | | 1.96 | % | | | 0.89 | % | | | -0.18 | % | | | 0.07 | % | | | -0.58 | % | | | 0.01 | % | | | 0.50 | % | | | 0.74 | % | | | 0.64 | % | | | -0.04 | % | | | 0.08 | % | | | 0.94 | % | | | 5.10 | % | |

| | 2011 | | | | 0.41 | % | | | 1.09 | % | | | 0.69 | % | | | 0.83 | % | | | -0.22 | % | | | -0.79 | % | | | 0.19 | % | | | -2.37 | % | | | -3.27 | % | | | 1.02 | % | | | -0.96 | % | | | -0.56 | % | | | -3.97 | % | |

| | 2010 | | | | -0.30 | % | | | 0.06 | % | | | 1.72 | % | | | 0.94 | % | | | -2.63 | % | | | -1.13 | % | | | 0.34 | % | | | -0.11 | % | | | 2.29 | % | | | 1.30 | % | | | 0.28 | % | | | 2.31 | % | | | 5.06 | % | |

| | 2009 | | | | 0.17 | % | | | -0.43 | % | | | -0.50 | % | | | 0.49 | % | | | 3.69 | % | | | 0.79 | % | | | 2.20 | % | | | 1.20 | % | | | 2.39 | % | | | 0.11 | % | | | 0.85 | % | | | 0.95 | % | | | 12.50 | % | |

| | 2008 | | | | -2.89 | % | | | 1.86 | % | | | -2.88 | % | | | 1.57 | % | | | 2.10 | % | | | -0.48 | % | | | -2.84 | % | | | -1.53 | % | | | -8.28 | % | | | -7.54 | % | | | -4.29 | % | | | -1.01 | % | | | -23.79 | % | |

| | 2007 | | | | 0.97 | % | | | 0.67 | % | | | 1.60 | % | | | 1.86 | % | | | 2.01 | % | | | 0.78 | % | | | -0.05 | % | | | -1.85 | % | | | 1.93 | % | | | 2.71 | % | | | -1.72 | % | | | 0.92 | % | | | 10.16 | % | |

| | 2006 | | | | 2.80 | % | | | -0.20 | % | | | 1.74 | % | | | 1.10 | % | | | -1.97 | % | | | -0.75 | % | | | 0.37 | % | | | 0.76 | % | | | 0.26 | % | | | 1.60 | % | | | 2.09 | % | | | 0.93 | % | | | 8.98 | % | |

| | 2005 | | | | | | | | | | | | | | | | -1.54 | % | | | 0.26 | % | | | 1.46 | % | | | 2.16 | % | | | 0.48 | % | | | 1.39 | % | | | -1.46 | % | | | 1.35 | % | | | 1.85 | % | | | 6.04 | % | |

Returns | | Fund | | S&P 5003 | | HFRXGL3 | |

Year-to-date | | | 1.50 | % | | | 1.81 | % | | | 1.11 | % | |

| 1-Year | | | 10.11 | % | | | 21.86 | % | | | 4.63 | % | |

3-Year (annualized) | | | 3.41 | % | | | 14.66 | % | | | 0.46 | % | |

5-Year (annualized) | | | 6.12 | % | | | 21.16 | % | | | 3.82 | % | |

Annualized Since Inception | | | 2.92 | % | | | 7.50 | % | | | 1.08 | % | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | |

Cumulative Return | | | 29.56 | % | | | 91.69 | % | | | 10.15 | % | |

Standard Deviation4 | | | 6.32 | % | | | 15.29 | % | | | 6.24 | % | |

Largest Drawdown5 | | | -24.98 | % | | | -50.95 | % | | | -25.21 | % | |

Drawdown — # of months6 | | | 17 | | | | 16 | | | | 14 | | |

HATTERAS CORE ALTERNATIVES TEI FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

| | 2014 | | | | 0.59 | % | | | 1.52 | % | | | -0.65 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1.46 | % | |

| | 2013 | | | | 1.15 | % | | | -0.04 | % | | | 0.48 | % | | | -0.39 | % | | | 0.59 | % | | | 0.00 | % | | | 0.92 | % | | | -0.52 | % | | | 1.77 | % | | | 1.85 | % | | | 1.47 | % | | | 2.92 | % | | | 10.02 | % | |

| | 2012 | | | | 1.94 | % | | | 0.88 | % | | | -0.20 | % | | | 0.06 | % | | | -0.59 | % | | | 0.00 | % | | | 0.49 | % | | | 0.73 | % | | | 0.63 | % | | | -0.05 | % | | | 0.08 | % | | | 0.93 | % | | | 4.99 | % | |

| | 2011 | | | | 0.41 | % | | | 1.09 | % | | | 0.68 | % | | | 0.83 | % | | | -0.22 | % | | | -0.79 | % | | | 0.19 | % | | | -2.37 | % | | | -3.28 | % | | | 1.01 | % | | | -0.96 | % | | | -0.59 | % | | | -4.02 | % | |

| | 2010 | | | | -0.34 | % | | | 0.06 | % | | | 1.72 | % | | | 0.94 | % | | | -2.63 | % | | | -1.12 | % | | | 0.35 | % | | | -0.12 | % | | | 2.27 | % | | | 1.28 | % | | | 0.26 | % | | | 2.29 | % | | | 4.95 | % | |

| | 2009 | | | | 0.16 | % | | | -0.44 | % | | | -0.50 | % | | | 0.47 | % | | | 3.71 | % | | | 0.79 | % | | | 2.19 | % | | | 1.20 | % | | | 2.39 | % | | | 0.11 | % | | | 0.85 | % | | | 0.95 | % | | | 12.48 | % | |

| | 2008 | | | | -2.95 | % | | | 1.82 | % | | | -2.92 | % | | | 1.53 | % | | | 2.08 | % | | | -0.52 | % | | | -2.88 | % | | | -1.57 | % | | | -8.33 | % | | | -7.56 | % | | | -4.31 | % | | | -0.86 | % | | | -23.98 | % | |

| | 2007 | | | | 0.94 | % | | | 0.64 | % | | | 1.58 | % | | | 1.83 | % | | | 1.99 | % | | | 0.75 | % | | | -0.07 | % | | | -1.88 | % | | | 1.89 | % | | | 2.68 | % | | | -1.74 | % | | | 0.87 | % | | | 9.79 | % | |

| | 2006 | | | | 2.77 | % | | | -0.20 | % | | | 1.72 | % | | | 1.09 | % | | | -1.98 | % | | | -0.75 | % | | | 0.37 | % | | | 0.72 | % | | | 0.23 | % | | | 1.57 | % | | | 2.05 | % | | | 0.90 | % | | | 8.73 | % | |

| | 2005 | | | | | | | | | | | | | | | | -1.54 | % | | | 0.26 | % | | | 1.46 | % | | | 2.16 | % | | | 0.48 | % | | | 1.39 | % | | | -1.46 | % | | | 1.32 | % | | | 1.82 | % | | | 5.97 | % | |

Returns | | Fund | | S&P 5003 | | HFRXGL3 | |

Year-to-date | | | 1.46 | % | | | 1.81 | % | | | 1.11 | % | |

| 1-Year | | | 9.88 | % | | | 21.86 | % | | | 4.63 | % | |

3-Year (annualized) | | | 3.25 | % | | | 14.66 | % | | | 0.46 | % | |

5-Year (annualized) | | | 6.01 | % | | | 21.16 | % | | | 3.82 | % | |

Annualized Since Inception | | | 2.75 | % | | | 7.50 | % | | | 1.08 | % | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | |

Cumulative Return | | | 27.69 | % | | | 91.69 | % | | | 10.15 | % | |

Standard Deviation4 | | | 6.32 | % | | | 15.29 | % | | | 6.24 | % | |

Largest Drawdown5 | | | -25.23 | % | | | -50.95 | % | | | -25.21 | % | |

Drawdown — # of months6 | | | 17 | | | | 16 | | | | 14 | | |

1. Performance results and calculations after the Funds' most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor's units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee or up-front placement fees, which could be up to 2%, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Fund, L.P. are 2.38% and 7.01%, respectively. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Fund, L.P. are 2.59% and 7.22%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 4.63%. Please see the current Prospectus for detailed information regarding the expenses of the Funds.

2. Cumulative Return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above.

3. S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock's weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

4. Measurement of the investment's volatility.

5. The peak to trough decline of an investment.

6. Number of months of a peak to trough decline of an investment.

FOUR

PERFORMANCE SUMMARY1 (UNAUDITED)

HATTERAS CORE ALTERNATIVES INSTITUTIONAL FUND, L.P. (INCEPTION DATE: JANUARY 1, 2007)

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

| | 2014 | | | | 0.60 | % | | | 1.44 | % | | | -0.52 | % | | | | | | | | | | | | | | | | | | | | | 1.52 | % | |

| | 2013 | | | | 1.23 | % | | | 0.03 | % | | | 0.59 | % | | | -0.32 | % | | | 0.65 | % | | | -0.46 | % | | | 1.00 | % | | | -0.43 | % | | | 1.87 | % | | | 1.94 | % | | | 1.57 | % | | | 2.75 | % | | | 10.87 | % | |

| | 2012 | | | | 2.03 | % | | | 0.96 | % | | | -0.12 | % | | | 0.13 | % | | | -0.52 | % | | | 0.07 | % | | | 0.56 | % | | | 0.80 | % | | | 0.70 | % | | | 0.02 | % | | | 0.15 | % | | | 1.00 | % | | | 5.92 | % | |

| | 2011 | | | | 0.47 | % | | | 1.15 | % | | | 0.75 | % | | | 0.89 | % | | | -0.16 | % | | | -0.72 | % | | | 0.25 | % | | | -2.31 | % | | | -3.20 | % | | | 1.09 | % | | | -0.89 | % | | | -0.50 | % | | | -3.23 | % | |

| | 2010 | | | | -0.24 | % | | | 0.12 | % | | | 1.78 | % | | | 1.01 | % | | | -2.57 | % | | | -1.06 | % | | | 0.41 | % | | | -0.04 | % | | | 2.36 | % | | | 1.36 | % | | | 0.34 | % | | | 2.37 | % | | | 5.89 | % | |

| | 2009 | | | | 0.24 | % | | | -0.36 | % | | | -0.45 | % | | | 0.55 | % | | | 3.75 | % | | | 0.86 | % | | | 2.27 | % | | | 1.27 | % | | | 2.46 | % | | | 0.17 | % | | | 0.91 | % | | | 1.01 | % | | | 13.35 | % | |

| | 2008 | | | | -2.85 | % | | | 1.91 | % | | | -2.81 | % | | | 1.63 | % | | | 2.14 | % | | | -0.42 | % | | | -2.78 | % | | | -1.47 | % | | | -8.22 | % | | | -7.50 | % | | | -4.23 | % | | | -0.94 | % | | | -23.27 | % | |

| | 2007 | | | | 1.12 | % | | | 0.73 | % | | | 1.65 | % | | | 1.89 | % | | | 2.06 | % | | | 0.82 | % | | | 0.00 | % | | | -1.89 | % | | | 2.00 | % | | | 2.75 | % | | | -1.71 | % | | | 0.97 | % | | | 10.76 | % | |

Returns | | Fund | | S&P 5003 | | HFRXGL3 | |

Year-to-date | | | 1.52 | % | | | 1.81 | % | | | 1.11 | % | |

| 1-Year | | | 10.50 | % | | | 21.86 | % | | | 4.63 | % | |

3-Year (annualized) | | | 4.06 | % | | | 14.66 | % | | | 0.46 | % | |

5-Year (annualized) | | | 6.85 | % | | | 21.16 | % | | | 3.82 | % | |

Annualized Since Inception | | | 2.27 | % | | | 6.18 | % | | | -0.40 | % | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | |

Cumulative Return | | | 17.69 | % | | | 54.41 | % | | | -2.87 | % | |

Standard Deviation4 | | | 6.64 | % | | | 16.75 | % | | | 6.58 | % | |

Largest Drawdown5 | | | -24.29 | % | | | -50.95 | % | | | -25.21 | % | |

Drawdown — # of months6 | | | 17 | | | | 16 | | | | 14 | | |

HATTERAS CORE ALTERNATIVES TEI INSTITUTIONAL FUND, L.P. (INCEPTION DATE: FEBRUARY 1, 2007)

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

| | 2014 | | | | 0.60 | % | | | 1.43 | % | | | -0.52 | % | | | | | | | | | | | | | | | | | | | | | 1.51 | % | |

| | 2013 | | | | 1.10 | % | | | 0.03 | % | | | 0.47 | % | | | -0.29 | % | | | 0.59 | % | | | -0.43 | % | | | 0.90 | % | | | -0.41 | % | | | 1.67 | % | | | 1.73 | % | | | 1.40 | % | | | 2.71 | % | | | 9.84 | % | |

| | 2012 | | | | 2.01 | % | | | 0.94 | % | | | -0.13 | % | | | 0.13 | % | | | -0.52 | % | | | 0.07 | % | | | 0.56 | % | | | 0.80 | % | | | 0.70 | % | | | 0.02 | % | | | 0.14 | % | | | 1.00 | % | | | 5.85 | % | |

| | 2011 | | | | 0.48 | % | | | 1.16 | % | | | 0.69 | % | | | 0.81 | % | | | -0.14 | % | | | -0.65 | % | | | 0.23 | % | | | -2.24 | % | | | -3.21 | % | | | 1.07 | % | | | -0.91 | % | | | -0.51 | % | | | -3.26 | % | |

| | 2010 | | | | -0.23 | % | | | 0.13 | % | | | 1.79 | % | | | 1.01 | % | | | -2.56 | % | | | -1.06 | % | | | 0.42 | % | | | -0.05 | % | | | 2.34 | % | | | 1.35 | % | | | 0.33 | % | | | 2.36 | % | | | 5.88 | % | |

| | 2009 | | | | 0.24 | % | | | -0.36 | % | | | -0.43 | % | | | 0.54 | % | | | 3.74 | % | | | 0.85 | % | | | 2.26 | % | | | 1.27 | % | | | 2.46 | % | | | 0.18 | % | | | 0.92 | % | | | 1.02 | % | | | 13.37 | % | |

| | 2008 | | | | -2.87 | % | | | 1.87 | % | | | -2.83 | % | | | 1.59 | % | | | 2.09 | % | | | -0.44 | % | | | -2.82 | % | | | -1.50 | % | | | -8.26 | % | | | -7.51 | % | | | -4.24 | % | | | -0.91 | % | | | -23.48 | % | |

| | 2007 | | | | | | | | 0.71 | % | | | 1.62 | % | | | 1.87 | % | | | 2.03 | % | | | 0.80 | % | | | -0.04 | % | | | -1.95 | % | | | 2.01 | % | | | 2.72 | % | | | -1.76 | % | | | 0.96 | % | | | 9.23 | % | |

Returns | | Fund | | S&P 5003 | | HFRXGL3 | |

Year-to-date | | | 1.51 | % | | | 1.81 | % | | | 1.11 | % | |

| 1-Year | | | 9.74 | % | | | 21.86 | % | | | 4.63 | % | |

3-Year (annualized) | | | 3.71 | % | | | 14.66 | % | | | 0.46 | % | |

5-Year (annualized) | | | 6.62 | % | | | 21.16 | % | | | 3.82 | % | |

Annualized Since Inception | | | 1.91 | % | | | 6.03 | % | | | -0.61 | % | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | |

Cumulative Return | | | 14.53 | % | | | 52.11 | % | | | -4.31 | % | |

Standard Deviation4 | | | 6.65 | % | | | 16.84 | % | | | 6.60 | % | |

Largest Drawdown5 | | | -24.53 | % | | | -50.95 | % | | | -25.21 | % | |

Drawdown — # of months6 | | | 17 | | | | 16 | | | | 14 | | |

1. Performance results and calculations after the Funds' most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor's units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee or up-front placement fees, which could be up to 2%, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Institutional Fund, L.P. are 1.99% and 6.62%, respectively. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Institutional Fund, L.P. are 2.73% and 7.36%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 4.63%. Please see the current Prospectus for detailed information regarding the expenses of the Funds.

2. Cumulative Return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above.

3. S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock's weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

4. Measurement of the investment's volatility.

5. The peak to trough decline of an investment.

6. Number of months of a peak to trough decline of an investment.

7. Number of months to recover from a drawdown.

FIVE

PERFORMANCE SUMMARY (UNAUDITED)

ALLOCATION

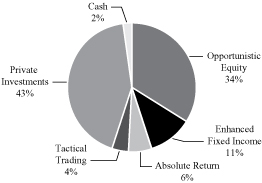

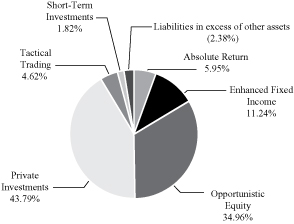

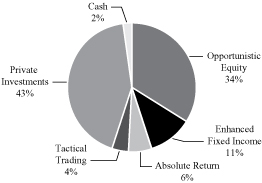

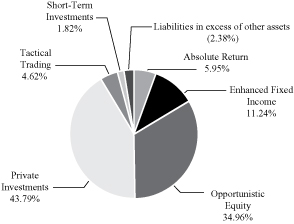

Strategies | | Target

Allocation | | Allocation

Actual* | | # of Funds | |

Opportunistic Equity (OE) | | | 30 | % | | | 34 | % | | | 27 | | |

Enhanced Fixed

Income (EFI) | | | 20 | % | | | 11 | % | | | 14 | | |

Absolute Return (AR) | | | 15 | % | | | 6 | % | | | 14 | | |

Tactical Trading (TT) | | | 10 | % | | | 4 | % | | | 6 | | |

Private Investments (PI) | | | 25 | % | | | 43 | % | | | 113 | | |

Cash | | | 0 | % | | | 2 | % | | | 0 | | |

Total | | | 100 | % | | | 100 | % | | | 174 | | |

Portfolio composition will change due to ongoing management of the Fund.

* Percentage of total investments as of March 31, 2014.

STRATEGY ALLOCATION

SIX

TOP 10 HOLDINGS (UNAUDITED)

| | Capital Balance

March 31, 2014 | | Percent of

Partners' Capital | |

Broadfin Healthcare Fund, L.P. | | $ | 51,704,609 | | | | 4.94 | % | |

Citadel Wellington, LLC (Class A) | | | 38,640,676 | | | | 3.69 | % | |

Falcon Edge Global, L.P. | | | 36,857,585 | | | | 3.52 | % | |

Teng Yue Partners Fund, L.P. | | | 33,585,270 | | | | 3.21 | % | |

Glade Brook Global Domestic Fund, L.P. | | | 31,913,484 | | | | 3.05 | % | |

Hound Partners, L.P. | | | 31,370,063 | | | | 3.00 | % | |

Tybourne Equity (US) Fund | | | 30,216,255 | | | | 2.89 | % | |

WisdomTree Japan Hedged Equity Fund | | | 28,976,814 | | | | 2.77 | % | |

Viking Global Equities, L.P. | | | 28,547,341 | | | | 2.73 | % | |

Indaba Capital Partner, L.P. | | | 28,463,801 | | | | 2.72 | % | |

Portfolio composition will change due to ongoing management of the Fund.

SEVEN

DEFINITIONS

Alpha measures excess return relative to the market; often referred to as a measurement of "manager skill".

Barclays Capital Long U.S. Treasury Index includes all publicly issued, U.S. Treasury securities that have a remaining maturity of 10 or more years, are rated investment grade, and have $250 million or more of outstanding face value.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade, U.S. dollar-denominated fixed-income securities of domestic issuers having a maturity greater than one year.

HFRI Fund of Funds Composite Index is an equal weighted index of over 650 constituent hedge fund of funds that invest over a broad range of strategies.

The HFRX Global Hedge Fund Index is index data, sourced from Hedge Funds Research, Inc., is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

MSCI EAFE (Net) Index is a total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 countries and is not available for purchase.

MSCI EM (Net) Index captures large and mid cap representation across 21 Emerging Markets (EM) countries*. With 820 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI World (Net) Index is a stock market index of 'world' stocks, and is often used as a common benchmark for 'world' or 'global' stock funds. The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI.

Standard & Poor's (S&P) 500 Index is an index of 500 stocks chosen for market size, liquidity, and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Companies included in the index are selected by the S&P Index Committee, a team of analysts and economists at Standard & Poor's. The S&P 500 is a market value weighted index — each stock's weight in the index is proportionate to its market value.

EIGHT

SAFE HARBOR AND FORWARD-LOOKING STATEMENTS DISCLOSURE

Safe Harbor Statement: This presentation shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of, the securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction. Forward-Looking Statements: This presentation contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Included among "forward-looking statements" are, among other things, statements about our future outlook on opportunities based upon current market conditions. Although the company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this discussion. Other than as required by law, the company does not assume a duty to update these forward-looking statements. Past performance is no guarantee of future results. The illustrations are not intended to predict the performance of any specific investment or security. The past performance figures do not represent performance of any Hatteras security and there can be no assurance that any Hatteras security will achieve the past returns of the illustrative examples. This is not an offering to subscribe for units in any fund and is intended for informational purposes only. An offering can only be made by delivery of the Prospectus to "qualified clients" within the meaning of U.S. securities laws.

Please carefully consider the investment objectives, risks, and charges and expenses of the Funds before investing. Please read the Prospectus carefully before investing as it contains important information on the investment objectives, composition, fees, charges and expenses, risks, suitability, and tax obligations of investing in the Funds. Copies of the Prospectus and performance data current to the most recent month-end may be obtained online at hatterasfunds.com or by contacting Hatteras at 866.388.6292. Past performance does not guarantee future results.

The Hatteras Core Alternatives Fund, L.P.; the Hatteras Core Alternatives TEI Fund, L.P; the Hatteras Core Alternatives Institutional Fund, L.P.; and the Hatteras Core Alternatives TEI Institutional Fund, L.P. (collectively referred to herein as the "Hatteras Core Alternatives Fund" or the "Fund") are Delaware limited partnerships that are registered under the Investment Company Act of 1940 (the "1940 Act"), as amended, as non-diversified, closed-end management investment companies whose

units are registered under the Securities Act of 1933, as amended. The Hatteras Core Alternatives Fund is a fund of alternative investments. As such, the Fund invests in private hedge funds and private equity investments. Hedge funds are speculative investments and are not suitable for all investors, nor do they represent a complete investment program. A hedge fund can be described generally as a private and unregistered investment pool that accepts investors' money and employs hedging and arbitrage techniques using long and short positions, leverage and derivatives, and investments in many markets.

Key Risk Factors: The Fund, through an investment in the Master Fund, will invest substantially all of its assets in underlying funds that are generally not registered as investment companies under the 1940 Act and, therefore, the Fund will not have the benefit of various protections provided under the 1940 Act with respect to an investment in those underlying funds. The Fund can be highly volatile, carry substantial fees, and involve complex tax structures. Investments in the Fund involve a high degree of risk, including loss of entire capital. The underlying funds may engage in speculative investment strategies and practices, such as the use of leverage, short sales, and derivatives transactions, which can increase the risk of investment loss. The Fund provides limited liquidity, and units in the Fund are not transferable. Liquidity will be provided only through repurchase offers made by the Fund from time to time, generally on a quarterly basis upon prior written notice. The success of the Fund is highly dependent on the financial and managerial expertise of its principals and key personnel of the Fund's investment manager. Although the investment manager for the Fund expects to receive detailed information from each underlying fund on a regular basis regarding its valuation, investment performance, and strategy, in most cases the investment managers have little or no means of independently verifying this information. The underlying funds are not required to provide transparency with respect to their respective investments. By investing in the underlying funds indirectly through the Fund, investors will be subject to a dual layer of fees, both at the Fund and underlying fund levels. Certain underlying funds will not provide final Schedule K-1s for any fiscal year before April 15th of the following year. Those funds, however, will endeavor to provide estimates of taxable income or losses with respect to their investments. Please see the Prospectus for a detailed discussion of the specific risks disclosed here and other important risks and considerations.

Securities offered through Hatteras Capital Distributors, LLC, member FINRA/SIPC. Hatteras Capital Distributors, LLC is affiliated with Hatteras Investment Partners, LLC by virtue of common control/ownership. This document is not an offering to subscribe for units of any fund and is intended for informational purposes only.

NINE

[THIS PAGE INTENTIONALLY LEFT BLANK]

HATTERAS FUNDS

Hatteras Core Alternatives Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P.

(a Delaware Limited Partnership)

Financial Statements

As of and for the year ended March 31, 2014

With Report of Independent Registered Public Accounting Firm

HATTERAS FUNDS

As of and for the year ended March 31, 2014

Hatteras Core Alternatives Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P. (a Delaware Limited Partnership)

Table of Contents

| Report of Independent Registered Accounting Firm | | | 1 | | |

| Statements of Assets, Liabilities and Partners' Capital | | | 2 | | |

| Statements of Operations | | | 3 | | |

| Statements of Changes in Partners' Capital | | | 4 | | |

| Statements of Cash Flows | | | 5 | | |

| Notes to Financial Statements | | | 6-15 | | |

| Board of Directors (Unaudited) | | | 16-17 | | |

| Fund Management (Unaudited) | | | 18 | | |

| Other Information (Unaudited) | | | 19-22 | | |

| Financial Statements of Hatteras Master Fund, L.P. | | | 23 | | |

HATTERAS FUNDS

(each a Delaware Limited Partnership)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To each Board of Directors and Partners of Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., and Hatteras Core Alternatives TEI Institutional Fund, L.P.:

We have audited the accompanying statements of assets, liabilities and partners' capital of Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., and Hatteras Core Alternatives TEI Institutional Fund, L.P. (each a Delaware Limited Partnership) (collectively the "Feeder Funds") as of March 31, 2014, and the related statements of operations and cash flows for the year then ended, and the statements of changes in partners' capital for each of the two years in the period then ended. These financial statements are the responsibility of the Feeder Funds' management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Feeder Funds are not required to have, nor were we engaged to perform, audits of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Feeder Funds' internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements referred to above present fairly, in all material respects, the financial position of each of the Feeder Funds as of March 31, 2014, the results of their operations and their cash flows for the year then ended, and the changes in their partners' capital for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 2 to the Hatteras Master Fund, L.P. financial statements, which are attached herein and should be read in conjunction with this report, the financial statements include investments valued at $1,024,053,691 (92.68% of total assets) as of March 31, 2014, whose fair value have been estimated by management in the absence of readily determinable fair values. Management's estimates are based on information provided by the underlying fund advisers.

/s/ Deloitte & Touche LLP

Philadelphia, Pennsylvania

May 30, 2014

ONE

HATTERAS FUNDS

(each a Delaware Limited Partnership)

STATEMENTS OF ASSETS, LIABILITIES AND PARTNERS' CAPITAL

March 31, 2014

| | | Hatteras

Core Alternatives

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Fund, L.P.* | | Hatteras

Core Alternatives

Institutional

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Institutional

Fund, L.P.* | |

Assets | |

Investment in Hatteras Master Fund, L.P., at

fair value | | $ | 166,947,033 | | | $ | 222,549,790 | | | $ | 179,185,802 | | | $ | 478,391,881 | | |

Cash | | | 200,000 | | | | 255,000 | | | | 200,000 | | | | 255,000 | | |

Receivable for withdrawals from Hatteras

Master Fund, L.P. | | | 8,742,352 | | | | 11,657,555 | | | | 9,401,307 | | | | 25,080,095 | | |

Investment in Hatteras Master Fund, L.P.

paid in advance | | | 100,785 | | | | — | | | | — | | | | — | | |

Prepaid assets | | | 4,360 | | | | 5,794 | | | | 4,666 | | | | 12,529 | | |

Total assets | | $ | 175,994,530 | | | $ | 234,468,139 | | | $ | 188,791,775 | | | $ | 503,739,505 | | |

Liabilities and partners' capital | |

Withdrawals payable | | $ | 8,745,446 | | | $ | 11,657,534 | | | $ | 9,401,307 | | | $ | 25,080,067 | | |

Contributions received in advance | | | 250,000 | | | | 15,000 | | | | — | | | | 50,000 | | |

Servicing fee payable | | | 123,946 | | | | 165,270 | | | | 15,672 | | | | 41,808 | | |

Professional fees payable | | | 50,500 | | | | 31,773 | | | | 50,500 | | | | 30,500 | | |

Accounting and administration fees payable | | | 22,892 | | | | 32,275 | | | | 19,375 | | | | 32,337 | | |

Printing fees payable | | | 25,000 | | | | 25,000 | | | | 25,000 | | | | 25,000 | | |

Custodian fees payable | | | 800 | | | | 1,316 | | | | 800 | | | | 1,316 | | |

Withholding tax payable | | | — | | | | 116,234 | | | | — | | | | 237,409 | | |

Other accrued expenses | | | — | | | | 5,045 | | | | — | | | | 2,885 | | |

Total liabilities | | | 9,218,584 | | | | 12,049,447 | | | | 9,512,654 | | | | 25,501,322 | | |

Partners' capital | | | 166,775,946 | | | | 222,418,692 | | | | 179,279,121 | | | | 478,238,183 | | |

Total liabilities and partners' capital | | $ | 175,994,530 | | | $ | 234,468,139 | | | $ | 188,791,775 | | | $ | 503,739,505 | | |

Components of partners' capital | |

Capital contributions (net) | | $ | 154,090,135 | | | $ | 211,201,196 | | | $ | 163,532,827 | | | $ | 409,928,697 | | |

Accumulated net investment loss | | | (15,208,146 | ) | | | (20,914,687 | ) | | | (91,582 | ) | | | (1,190,697 | ) | |

Accumulated net realized gain (loss) | | | (952,591 | ) | | | 773,091 | | | | (734,289 | ) | | | 13,038,613 | | |

Accumulated net unrealized appreciation

on investments | | | 28,846,548 | | | | 31,359,092 | | | | 16,572,165 | | | | 56,461,570 | | |

Partners' capital | | $ | 166,775,946 | | | $ | 222,418,692 | | | $ | 179,279,121 | | | $ | 478,238,183 | | |

Net asset value per unit | | $ | 102.68 | | | $ | 102.08 | | | $ | 106.86 | | | $ | 105.65 | | |

Maximum offering price per unit** | | $ | 104.74 | | | $ | 104.12 | | | $ | 106.86 | | | $ | 105.65 | | |

Number of authorized units | | | 7,500,000.00 | | | | 7,500,000.00 | | | | 7,500,000.00 | | | | 10,000,000.00 | | |

Number of outstanding units | | | 1,624,178.15 | | | | 2,178,910.44 | | | | 1,677,741.88 | | | | 4,526,662.44 | | |

* Consolidated Statement. See note 1.

** The maximum sales load for the Hatteras Core Alternatives Fund, L.P. and the Hatteras Core Alternatives TEI Fund, L.P. is 2.00%. The remaining funds are not subject to a sales load.

See notes to financial statements.

TWO

HATTERAS FUNDS

(each a Delaware Limited Partnership)

STATEMENTS OF OPERATIONS

For the year ended March 31, 2014

| | | Hatteras

Core Alternatives

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Fund, L.P.* | | Hatteras

Core Alternatives

Institutional

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Institutional

Fund, L.P.* | |

Net investment income allocated from

Hatteras Master Fund, L.P. | |

Investment income | | $ | 6,352,048 | | | $ | 8,466,554 | | | $ | 6,821,130 | | | $ | 18,217,698 | | |

Operating expenses | | | (2,342,506 | ) | | | (3,120,808 | ) | | | (2,515,179 | ) | | | (6,755,397 | ) | |

Performance allocation | | | — | | | | — | | | | (737,135 | ) | | | (5,008,658 | ) | |

Net investment income allocated from

Hatteras Master Fund, L.P. | | | 4,009,542 | | | | 5,345,746 | | | | 3,568,816 | | | | 6,453,643 | | |

Feeder Fund investment income | |

Interest | | | 63 | | | | 74 | | | | 55 | | | | 106 | | |

Total fund investment income | | | 63 | | | | 74 | | | | 55 | | | | 106 | | |

Feeder Fund expenses | |

Servicing fee | | | 1,522,054 | | | | 2,027,244 | | | | 192,089 | | | | 514,236 | | |

Accounting and administration fees | | | 133,025 | | | | 193,845 | | | | 115,107 | | | | 194,055 | | |

Insurance fees | | | 52,314 | | | | 69,554 | | | | 55,729 | | | | 149,488 | | |

Directors' fees | | | 43,125 | | | | 43,125 | | | | 43,125 | | | | 43,125 | | |

Professional fees | | | 71,858 | | | | 49,004 | | | | 67,938 | | | | 59,484 | | |

Printing fees | | | 45,614 | | | | 42,451 | | | | 47,442 | | | | 47,808 | | |

Custodian fees | | | 7,885 | | | | 11,161 | | | | 11,688 | | | | 15,717 | | |

Withholding tax | | | — | | | | 581,172 | | | | — | | | | 1,187,046 | | |

Other expenses | | | 31,731 | | | | 33,381 | | | | 32,486 | | | | 39,172 | | |

Total Feeder Fund expenses | | | 1,907,606 | | | | 3,050,937 | | | | 565,604 | | | | 2,250,131 | | |

Net investment income | | | 2,101,999 | | | | 2,294,883 | | | | 3,003,267 | | | | 4,203,618 | | |

Net realized gain and change in unrealized appreciation on

investments allocated from Hatteras Master Fund, L.P. | |

Net realized gain from investments in Adviser Funds,

securities and foreign exchange transactions | | | 4,193,753 | | | | 5,606,107 | | | | 4,517,464 | | | | 12,061,320 | | |

Net change in unrealized appreciation on investments in

Adviser Funds, securities and foreign exchange

transactions | | | 10,660,433 | | | | 14,219,601 | | | | 11,394,150 | | | | 30,822,744 | | |

Net realized gain and change in unrealized appreciation

on investments allocated from Hatteras Master

Fund, L.P. | | | 14,854,186 | | | | 19,825,708 | | | | 15,911,614 | | | | 42,884,064 | | |

Net increase in partners' capital resulting from operations | | $ | 16,956,185 | | | $ | 22,120,591 | | | $ | 18,914,881 | | | $ | 47,087,682 | | |

* Consolidated Statement. See note 1.

See notes to financial statements.

THREE

HATTERAS FUNDS

(each a Delaware Limited Partnership)

STATEMENTS OF CHANGES IN PARTNERS' CAPITAL

For the year ended March 31, 2013 and the year ended March 31, 2014

| | | Hatteras

Core Alternatives

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Fund, L.P.* | | Hatteras

Core Alternatives

Institutional

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Institutional

Fund, L.P.* | |

| | | Limited

Partners | | Limited

Partners | | Limited

Partners | | Limited

Partners | |

Partners' Capital, at March 31, 2012 | | $ | 234,880,501 | | | $ | 312,203,760 | | | $ | 236,891,562 | | | $ | 624,546,925 | | |

Capital contributions | | | 8,346,000 | | | | 10,697,277 | | | | 12,778,549 | | | | 26,609,863 | | |

Capital withdrawals | | | (66,564,692 | ) | | | (87,225,548 | ) | | | (62,321,857 | ) | | | (145,459,748 | ) | |

Repurchase fees | | | 189,352 | | | | 99,866 | | | | 190,180 | | | | 118,808 | | |

Net investment income/(loss) | | | (367,785 | ) | | | (717,489 | ) | | | 1,339,583 | | | | 2,382,329 | | |

Net realized gain from investments in Adviser Funds,

securities and foreign exchange transactions | | | 5,481,387 | | | | 7,330,608 | | | | 5,841,578 | | | | 15,628,270 | | |

Net change in unrealized appreciation on investments

in Adviser Funds, securities and foreign exchange

transactions | | | 2,989,143 | | | | 3,660,794 | | | | 2,892,592 | | | | 7,728,454 | | |

Partners' Capital, at March 31, 2013** | | $ | 184,953,906 | | | $ | 246,049,268 | | | $ | 197,612,187 | | | $ | 531,554,901 | | |

Capital contributions | | | 945,102 | | | | 2,671,050 | | | | 1,495,233 | | | | 3,553,949 | | |

Capital withdrawals | | | (36,082,341 | ) | | | (48,425,178 | ) | | | (38,743,408 | ) | | | (103,958,885 | ) | |

Withdrawal fees | | | 3,094 | | | | 2,961 | | | | 228 | | | | 536 | | |

Net investment income | | | 2,101,999 | | | | 2,294,883 | | | | 3,003,267 | | | | 4,203,618 | | |

Net realized gain from investments in Adviser Funds,

securities and foreign exchange transactions | | | 4,193,753 | | | | 5,606,107 | | | | 4,517,464 | | | | 12,061,320 | | |

Net change in unrealized appreciation on investments

in Adviser Funds, securities and foreign exchange

transactions | | | 10,660,433 | | | | 14,219,601 | | | | 11,394,150 | | | | 30,822,744 | | |

Partners' Capital, at March 31, 2014*** | | $ | 166,775,946 | | | $ | 222,418,692 | | | $ | 179,279,121 | | | $ | 478,238,183 | | |

* Consolidated Statement. See note 1.

** Including accumulated net investment loss of $17,310,145; $23,209,570; $3,094,849; and $5,394,315, respectively.

*** Including accumulated net investment loss of $15,208,146; $20,914,687; $91,582; and $1,190,697, respectively.

See notes to financial statements.

FOUR

HATTERAS FUNDS

(each a Delaware Limited Partnership)

STATEMENTS OF CASH FLOWS

For the year ended March 31, 2014

| | | Hatteras

Core Alternatives

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Fund, L.P.* | | Hatteras

Core Alternatives

Institutional

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Institutional

Fund, L.P.* | |

Cash flows from operating activities: | |

Net increase in partners' capital resulting from operations | | $ | 16,956,185 | | | $ | 22,120,591 | | | $ | 18,914,881 | | | $ | 47,087,682 | | |

Adjustments to reconcile net increase in partners' capital

resulting from operations to net cash provided by

operating activities: | |

Purchase of interests in Hatteras Master Fund, L.P. | | | (379,742 | ) | | | (1,302,726 | ) | | | (1,095,465 | ) | | | (2,796,681 | ) | |

Proceeds from withdrawals from Hatteras Master Fund, L.P. | | | 37,286,647 | | | | 50,049,324 | | | | 38,948,072 | | | | 105,214,305 | | |

Net investment income allocated from Hatteras Master

Fund, L.P. | | | (4,009,542 | ) | | | (5,345,746 | ) | | | (3,568,816 | ) | | | (6,453,643 | ) | |

Net realized gain from investments in Adviser Funds,

securities and foreign exchange transactions allocated

from Hatteras Master Fund, L.P. | | | (4,193,753 | ) | | | (5,606,107 | ) | | | (4,517,464 | ) | | | (12,061,320 | ) | |

Net change in unrealized appreciation on investments in

Adviser Funds, securities and foreign exchange transactions

allocated from Hatteras Master Fund, L.P. | | | (10,660,433 | ) | | | (14,219,601 | ) | | | (11,394,150 | ) | | | (30,822,744 | ) | |

(Increase)/Decrease in receivable for withdrawals from

Hatteras Master Fund, L.P. | | | 991,655 | | | | 1,289,973 | | | | 998,842 | | | | 2,897,248 | | |

(Increase)/Decrease in investment in Hatteras

Master Fund, L.P. paid in advance | | | 62,616 | | | | 102,229 | | | | 486,857 | | | | 439,525 | | |

(Increase)/Decrease in prepaid assets | | | 37 | | | | 55 | | | | (221 | ) | | | (802 | ) | |

Increase/(Decrease) in servicing fee payable | | | (14,050 | ) | | | (18,280 | ) | | | (1,663 | ) | | | (4,823 | ) | |

Increase/(Decrease) in accounting and administration

fees payable | | | 11,325 | | | | 16,193 | | | | 9,836 | | | | 16,189 | | |

Increase/(Decrease) in professional fees payable | | | 6,848 | | | | 6,106 | | | | 6,280 | | | | 15,990 | | |

Increase/(Decrease) in custodian fees payable | | | — | | | | (84 | ) | | | — | | | | (84 | ) | |

Increase/(Decrease) in printing fees payable | | | 15,000 | | | | 10,000 | | | | 20,000 | | | | (2,599 | ) | |

(Increase)/Decrease in withholding tax payable | | | — | | | | 116,234 | | | | — | | | | 237,409 | | |

Increase/(Decrease) in other accrued expenses | | | (5,000 | ) | | | (3,000 | ) | | | (5,000 | ) | | | (11,786 | ) | |

Net cash provided by operating activities | | | 36,067,793 | | | | 47,215,161 | | | | 38,801,989 | | | | 103,753,866 | | |

Cash flows from financing activities: | |

Capital contributions | | | 850,102 | | | | 2,347,050 | | | | 940,033 | | | | 3,051,759 | | |

Capital withdrawals, net of withdrawal fees | | | (37,067,895 | ) | | | (49,712,211 | ) | | | (39,742,022 | ) | | | (106,855,625 | ) | |

Net cash used in financing activities | | | (36,217,793 | ) | | | (47,365,161 | ) | | | (38,801,989 | ) | | | (103,803,866 | ) | |

Net change in cash | | | (150,000 | ) | | | (150,000 | ) | | | — | | | | (50,000 | ) | |

Cash at beginning of year | | | 350,000 | | | | 405,000 | | | | 200,000 | | | | 305,000 | | |

Cash at end of year | | $ | 200,000 | | | $ | 255,000 | | | $ | 200,000 | | | $ | 255,000 | | |

* Consolidated Statement. See note 1.

See notes to financial statements.

FIVE

HATTERAS FUNDS

(each a Delaware Limited Partnership)

NOTES TO FINANCIAL STATEMENTS

As of and for the year ended March 31, 2014

1. ORGANIZATION

The Hatteras Funds, each a "Feeder Fund" and collectively the "Feeder Funds" are:

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

The Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. each invest substantially all of their assets in the Hatteras Core Alternatives Offshore Fund, LDC and Hatteras Core Alternatives Offshore Institutional Fund, LDC, (collectively the "Blocker Funds"), respectively. The Blocker Funds are Cayman Islands limited duration companies with the same investment objective as the Feeder Funds. The Blocker Funds serve solely as intermediate entities through which the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. invest in Hatteras Master Fund, L.P. (the "Master Fund" and together with the Feeder Funds, the "Funds"). The Blocker Funds enable tax-exempt Limited Partners (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Limited Partners regardless of their tax-exempt status. The Hatteras Core Alternatives TEI Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Fund, LDC and the Hatteras Core Alternatives TEI Institutional Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Institutional Fund, LDC. Where these Notes to Financial Statements discuss the Feeder Funds' investment in the Master Fund, for Hatteras Core Alternatives TEI Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P., it means their investment in the Master Fund through the applicable Blocker Fund.

The Feeder Funds are organized as Delaware limited partnerships, and are registered under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, (the "1940 Act") as closed-end, non-diversified, management investment companies. The primary investment objective of the Feeder Funds is to provide capital appreciation consistent with the return characteristic of the alternative investment portfolios of larger endowments. The Feeder Funds' secondary objective is to provide capital appreciation with less volatility than that of the equity markets. To achieve their objectives, the Feeder Funds provide their investors with access to a broad range of investment strategies, asset categories and trading advisers ("Advisers") and by providing overall asset allocation services typically available on a collective basis to larger institutions, through an investment of substantially all of their assets into the Master Fund, which is registered under the 1940 Act. The Feeder Funds are co-managed by Hatteras Investment Partners, LLC ("HIP"), a Delaware limited liability company registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the "Advisers Act"), and Morgan Creek Capital Management, LLC ("MCCM," together with HIP, the "Investment Managers"), a North Carolina limited liability company registered as an investment adviser under the Advisers Act. Investors who acquire units of limited partnership interest in the Feeder Funds ("Units") are the limited partners (each, a "Limited Partner" and together, the "Limited Partners") of the Feeder Funds.

The financial statements of the Master Fund, including the schedule of investments, are included elsewhere in this report and should be read with the Feeder Funds' financial statements. The percentages of the Master Fund's beneficial limited partnership interests owned by the Feeder Funds at March 31, 2014 were:

Hatteras Core Alternatives Fund, L.P. | | | 15.94 | % | |

Hatteras Core Alternatives TEI Fund, L.P. | | | 21.25 | % | |

Hatteras Core Alternatives Institutional Fund, L.P. | | | 17.13 | % | |

Hatteras Core Alternatives TEI Institutional Fund, L.P. | | | 45.68 | % | |

Hatteras Investment Management, LLC, a Delaware limited liability company, serves as the General Partner of each of the Feeder Funds and the Master Fund (the "General Partner"). The General Partner is an affiliate of HIP. The General Partner has appointed a Board of Directors for each Feeder Fund (collectively the "Boards") and, to the fullest extent permitted by applicable law, has irrevocably delegated to the Boards its rights and powers to monitor and oversee the business affairs of the Feeder Funds, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct and operation of the Feeder Funds' business.

2. SIGNIFICANT ACCOUNTING POLICIES

These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") and are expressed in United States dollars. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Investment Valuation

The Feeder Funds do not make direct investments in securities or financial instruments, and invest substantially all of their assets in the Master Fund. The Feeder Funds record their investment in the Master Fund at fair value. Because the full amount of investment cannot be redeemed at least quarterly, each Feeder Fund's investment in the Master Fund would be considered level 3 under Accounting Standards Codification 820 — Fair Value, as described in the notes to the Master Fund's financial statements included elsewhere in this report. Valuation

SIX

HATTERAS FUNDS

(each a Delaware Limited Partnership)

NOTES TO FINANCIAL STATEMENTS (Continued)

As of and for the year ended March 31, 2014

2. SIGNIFICANT ACCOUNTING POLICIES (CONCLUDED)

a. Investment Valuation (concluded)

of securities held by the Master Fund, including the Master Fund's disclosure of investments under the three-tier hierarchy, is also discussed in the notes to the Master Fund's financial statements.

b. Allocations from the Master Fund

The Feeder Funds record their allocated portion of income, expense, realized gains and losses and unrealized appreciation and depreciation from the Master Fund.

c. Feeder Fund Level Income and Expenses

Interest income on any cash or cash equivalents held by the Feeder Funds will be recognized on an accrual basis. Expenses that are specifically attributed to the Feeder Funds are charged to each Feeder Fund. Because the Feeder Funds bear their proportionate share of the management fee of the Master Fund, the Feeder Funds pay no direct management fee to the Investment Managers. The Feeder Funds' specific expenses are recorded on an accrual basis.

d. Tax Basis Reporting

Because the Master Fund invests primarily in investment funds that are treated as partnerships for U.S. Federal tax purposes, the tax character of each of the Feeder Fund's allocated earnings is established dependent upon the tax filings of the investment vehicles operated by the Advisers ("Adviser Funds"). Accordingly, the tax basis of these allocated earnings and the related balances are not available as of the reporting date.

e. Income Taxes

For U.S. Federal income tax purposes, the Feeder Funds are treated as partnerships, and each Limited Partner in each respective Feeder Fund is treated as the owner of its proportionate share of the net assets, income, expenses, and the realized and unrealized gains (losses) of such Feeder Fund. Accordingly, no federal, state or local income taxes have been provided on profits of the Feeder Funds since the Limited Partners are individually liable for the taxes on their share of the Feeder Funds.

The Feeder Funds file tax returns as prescribed by the tax laws of the jurisdictions in which they operate. In the normal course of business, the Feeder Funds are subject to examination by federal, state, local and foreign jurisdictions, where applicable. For returns filed for the years ended December 31, 2010 through December 31, 2013, the Feeder Funds remain subject to examination by the major tax jurisdictions under the statute of limitations.

The Feeder Funds have reviewed any potential tax positions as of March 31, 2014 and have determined that they do not have a liability for any unrecognized tax benefits or expense. The Feeder Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended March 31, 2014, the Feeder Funds did not incur any material interest or penalties.

f. Cash

Cash includes amounts held in interest bearing demand deposit accounts. Such cash, at times, may exceed federally insured limits. The Feeder Funds have not experienced any losses in such accounts and do not believe they are exposed to any significant credit risk on such accounts.

g. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in Limited Partners' capital from operations during the reporting period. Actual results could differ from those estimates.

h. Consolidated Financial Statements

The asset, liability, and equity accounts of the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. are consolidated with their respective Blocker Funds as presented in the Statements of Assets, Liabilities, and Partners' Capital, Statements of Operations, Statements of Changes in Partners' Capital, and Statements of Cash Flows. All intercompany accounts and transactions have been eliminated in consolidation.

SEVEN

HATTERAS FUNDS

(each a Delaware Limited Partnership)

NOTES TO FINANCIAL STATEMENTS (Continued)

As of and for the year ended March 31, 2014

3. ALLOCATION OF LIMITED PARTNERS' CAPITAL

Net profits or net losses of the Feeder Funds for each allocation period ("Allocation Period") will be allocated among and credited to or debited against the capital accounts of the Limited Partners. Net profits or net losses will be measured as the net change in the value of the Limited Partners' capital of the Feeder Funds, including any net change in unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses during an Allocation Period, adjusted to exclude any items to be allocated among the capital accounts of the Limited Partners in accordance with the Limited Partners' respective investment percentages.

Allocation Periods generally begin on the first calendar day of each month and end at the close of business on the last day of each month.

The Feeder Funds maintain a separate capital account ("Capital Account") on their books for each Limited Partner. Each Limited Partner's Capital Account will have an opening balance equal to the Limited Partner's initial purchase of the Feeder Fund (i.e., the amount of the investment less any applicable sales load of up to 2 percent of the purchased amount), and thereafter, will be (i) increased by the amount of any additional purchases by such Limited Partner; (ii) decreased for any payments upon repurchase or sale of such Limited Partner's interest or any distributions in respect of such Limited Partner; and (iii) increased or decreased as of the close of each Allocation Period by such Limited Partner's allocable share of the net profits or net losses of the Feeder Fund.

| | | Hatteras

Core Alternatives

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Fund, L.P. | | Hatteras

Core Alternatives

Institutional

Fund, L.P. | | Hatteras

Core Alternatives

TEI

Institutional

Fund, L.P. | |

Beginning Units, April 1, 2012 | | | 2,622,166.10 | | | | 3,493,192.83 | | | | 2,569,519.62 | | | | 6,785,237.10 | | |

Purchases | | | 92,593.95 | | | | 119,103.07 | | | | 137,183.02 | | | | 288,692.00 | | |

Sales | | | (730,980.39 | ) | | | (963,327.82 | ) | | | (662,817.42 | ) | | | (1,551,702.68 | ) | |

Beginning Units, April 1, 2013 | | | 1,983,779.66 | | | | 2,648,968.08 | | | | 2,043,885.22 | | | | 5,522,226.42 | | |

Purchases | | | 9,987.39 | | | | 28,344.94 | | | | 15,316.45 | | | | 36,592.09 | | |

Sales | | | (369,588.90 | ) | | | (498,402.58 | ) | | | (381,459.79 | ) | | | (1,032,156.07 | ) | |

Ending units, March 31, 2014 | | | 1,624,178.15 | | | | 2,178,910.44 | | | | 1,677,741.88 | | | | 4,526,662.44 | | |

4. RELATED PARTY TRANSACTIONS AND OTHER

In consideration for fund services, Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P. will pay HIP (in such capacity, the "Servicing Agent") a fund servicing fee at the annual rate of 0.85%, 0.85%, 0.10% and 0.10%, respectively, of the month-end partner's capital of the applicable Feeder Fund. The respective Feeder Fund servicing fees payable to the Servicing Agent will be borne by all Limited Partners of the respective Feeder Fund on a pro-rata basis before giving effect to any repurchase of interests in the Master Fund effective as of that date, and will decrease the net profits or increase the net losses of the Master Fund that are credited to its interest holders, including each Feeder Fund.

The performance allocation is calculated at the Master Fund level, and allocated to the Feeder Funds based on each Feeder Fund's ownership interest in the Master Fund. The General Partner is allocated a performance allocation payable annually equal to 10% of the amount by which net new profits of the limited partner interests of the Master Fund exceed the non-cumulative "hurdle amount", which is calculated as of the last day of the preceding calendar year of the Master Fund at a rate equal to the yield-to-maturity of the 90 day U.S. Treasury Bill as reported by the Wall Street Journal for the last business day of the preceding calendar year (the "Performance Allocation"). The Performance Allocation is made on a "peak to peak," or "high watermark" basis, which means that the Performance Allocation is made only with respect to new net profits. If the Master Fund has a net loss in any period followed by a net profit, no Performance Allocation will be made with respect to such subsequent appreciation until such net loss has been recovered. MCCM is a non-voting member ("Member") of HIP. HIP, MCCM and the General Partner have entered into a membership agreement (the "Member Agreement"). Pursuant to the Member Agreement, the General Partner makes distributions to MCCM equal to a percentage of the Performance Allocation the General Partner receives from the Master Fund. For the year ended March 31, 2014, the General Partner of the Master Fund accrued a Performance Allocation in the amount of $5,745,793, of which $737,135 was allocated to the Hatteras Core Alternatives Institutional Fund, L.P., and $5,008,658 was allocated to the Hatteras Core Alternatives TEI Institutional Fund, L.P., which is disclosed in the Statement of Operations.

Hatteras Capital Distributors LLC ("HCD"), an affiliate of HIP, serves as the Feeder Funds' distributor. HCD receives a distribution fee from HIP equal to 0.10% on an annualized basis of the net assets of the Master Fund as of the last day of the month (before giving effect to any repurchase of interests in the Master Fund).

UMB Bank, N.A. serves as custodian of the Feeder Funds' cash balances and provides custodial services for the Feeder Funds. UMB Fund Services, Inc., serves as administrator and accounting agent to the Feeder Funds and provides certain accounting, record keeping and investor related services. The Feeder Funds pay a fee to the custodian and administrator based upon average Limited Partners' capital, subject to certain minimums.

EIGHT

HATTERAS FUNDS

(each a Delaware Limited Partnership)

NOTES TO FINANCIAL STATEMENTS (Continued)

As of and for the year ended March 31, 2014

4. RELATED PARTY TRANSACTIONS AND OTHER (CONCLUDED)

At March 31, 2014, Limited Partners who are affiliated with HIP, MCCM or the General Partner owned $597,651 (0.36% of Partners' Capital) of Hatteras Core Alternatives Fund, L.P., $1,884,816 (1.05% of Partners' Capital) of Hatteras Core Alternatives Institutional Fund, L.P., and $347,278 (0.07% of Partners' Capital) of Hatteras Core Alternatives TEI Institutional Fund, L.P.

On October 1, 2013, RCS Capital Corporation (the "Company") and Scotland Acquisition, LLC, a newly formed wholly-owned subsidiary of RCS Advisory Services, LLC, which is an operating subsidiary of the Company, entered into an asset purchase agreement with certain principals of the HIP and the General Partner (collectively the "Sellers") and David Perkins, as the Sellers' representative. The purchase will result in a change in control of HIP and, therefore, constitute an "assignment" within the meaning of the 1940 Act of i) the existing investment co-management agreement between HIP and The Master Fund, and ii) the existing investment co-management agreement among HIP, MCCM and the Master Fund. The purchase is expected to close in second quarter of 2014.

5. RISK FACTORS

An investment in the Feeder Funds involves significant risks that should be carefully considered prior to investment and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund intends to invest substantially all of its available capital in securities of private investment companies. These investments will generally be restricted securities that are subject to substantial holding periods or are not traded in public markets at all, so that the Master Fund may not be able to resell some of its Adviser Fund holdings for extended periods, which may be several years. Limited Partners should refer to the Master Fund's financial statements included in this report along with the applicable Feeder Fund's prospectus, as supplemented and corresponding statement of additional information for a more complete list of risk factors. No guarantee or representation is made that the Feeder Funds' investment objective will be met.

6. REPURCHASE OF LIMITED PARTNERS' UNITS

The Board may, from time to time and in its sole discretion, cause the Feeder Funds to repurchase Units from Limited Partners pursuant to written tenders by Limited Partners at such times and on such terms and conditions as established by the Board. In determining whether the Feeder Funds should offer to repurchase interests, the Board will consider, among other things, the recommendation of the Investment Managers. The Feeder Funds generally expect to offer to repurchase Units from Limited Partners on a quarterly basis as of March 31, June 30, September 30 and December 31 of each year. In no event will more than 20% of the Units of a Feeder Fund be repurchased per quarter. The Feeder Funds do not intend to distribute to the Limited Partners any of the Feeder Funds' income, but generally expect to reinvest substantially all income and gains allocable to the Limited Partners. A Limited Partner may, therefore, be allocated taxable income and gains and not receive any cash distribution. Units repurchased prior to the Limited Partner's one year anniversary of its initial investment may be subject to a maximum 2% repurchase fee.

7. INDEMNIFICATION

In the normal course of business, the Feeder Funds enter into contracts that provide general indemnifications. The Feeder Funds' maximum exposure under these agreements is dependent on future claims that may be made against the Feeder Funds, and therefore cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

8. FINANCIAL HIGHLIGHTS

The financial highlights are intended to help an investor understand the Feeder Funds' financial performance. The total returns in the table represent the rate that a Limited Partner would be expected to have earned or lost on an investment in each Feeder Fund.