UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number811-21686

Oppenheimer Portfolio Series

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code:(303)768-3200

Date of fiscal year end:January 31

Date of reporting period:1/31/2019

Item 1. Reports to Stockholders.

Important Updates

On October 18, 2018, Massachusetts Mutual Life Insurance Company, an indirect corporate parent of OppenheimerFunds, Inc. and its subsidiaries OFI Global Asset Management, Inc., OFI SteelPath, Inc. and OFI Advisors, LLC, announced that it has entered into an agreement whereby Invesco Ltd., a global investment management company, will acquire OppenheimerFunds, Inc. As of the date of this report, the transaction is expected to close in the second quarter of 2019, pending necessary regulatory and other third-party approvals. This is subject to change. See the Notes to Financial Statements for more information.

Update to Shareholder Report Document Delivery

Beginning January 1, 2021, OppenheimerFunds will send a notice, either by mail or email, each time your fund’s updated report is available on our website (oppenheimerfunds.com). Investors who are not enrolled in electronic delivery by January 1, 2021 will receive the notice in the mail. Enrolling in electronic delivery will enable you to receive a direct link to your full shareholder report the moment it becomes available, and limit the amount of mail you receive. All investors who prefer to receive shareholder reports in paper may, at any time, choose that option.

How do you update your delivery preferences?

If you own these shares through a financial intermediary, you may contact your financial intermediary.

If your accounts are held through OppenheimerFunds and you receive statements, confirms, and other documents directly from us, you can enroll in our eDocs DirectSM service atoppenheimerfunds.com or by calling us. Once you’re enrolled, you’ll begin to receive email notifications of updated documents when they become available. If you have any questions, feel free to call us at1.800.225.5677.

Table of Contents

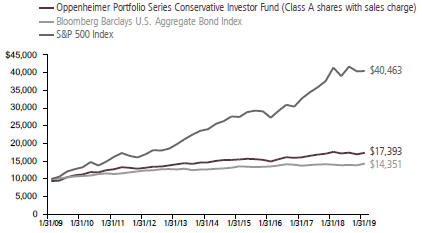

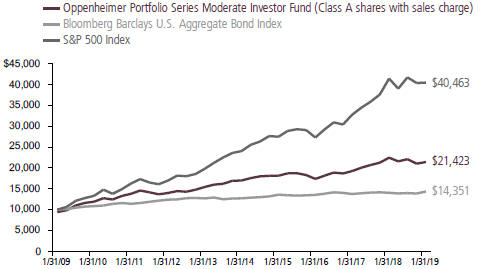

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 1/31/19

| | | | | | | | |

| | | Class A Shares of the Fund | | | | |

| | | Without Sales Charge | | With Sales Charge | | Bloomberg Barclays

U.S. Aggregate Bond

Index | | S&P 500 Index |

1-Year | | -1.49% | | -7.16% | | 2.25% | | -2.31% |

|

5-Year | | 3.43 | | 2.21 | | 2.44 | | 10.96 |

|

10-Year | | 6.32 | | 5.69 | | 3.68 | | 15.00 |

|

Performance data quoted represents past performance, which does not guarantee future results.The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recentmonth-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

3 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Fund Performance Discussion1

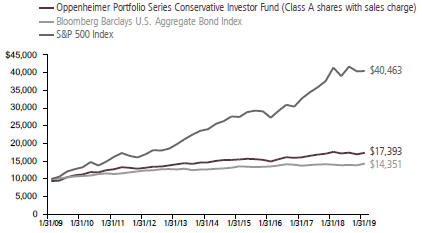

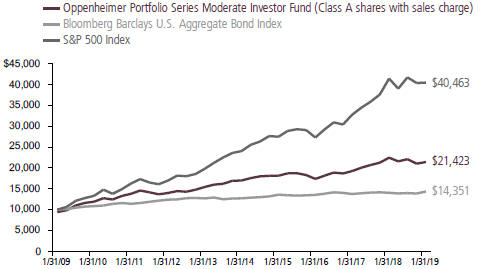

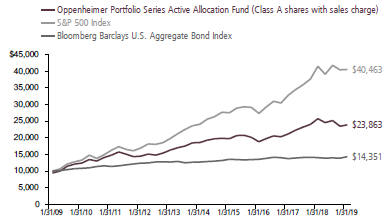

During theone-year period ended January 31, 2019, the Fund’s Class A shares (without sales charge) returned-1.49%. For theone-year period ended January 31, 2019, the Fund underperformed the Bloomberg Barclays U.S. Aggregate Bond Index’s 2.25% return and outperformed the S&P 500 Index’s-2.31% return.

MARKET OVERVIEW

Markets were volatile in 2018 and hit a wall in the last quarter of the year, before picking up again in January 2019. Several shocks negatively affected market sentiment. The U.S. Federal Reserve (Fed) once again decided to hike interest rates, as was nearly universally expected, but the post-meeting conference was more hawkish than expected. Markets were expecting a clear message that the Fed might consider a pause in any future rate increases, but that was not initially

communicated. Equity markets sold off, bonds rallied, and the U.S. dollar weakened. The sell-offs were sizable, which led some to think a recession might be imminent. It was not just the Fed making headlines, some key economic data were also weaker in December. In the U.S., regional surveys from the Fed and Institute for Supply Management (ISM) sentiment surveys decreased markedly, along with acool-off in housing. Politics were once again a factor because there was little clarity

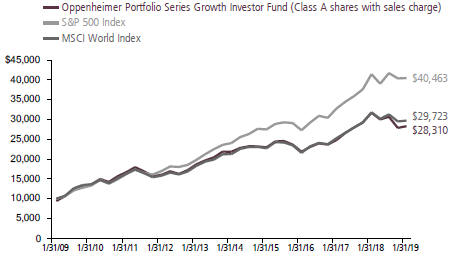

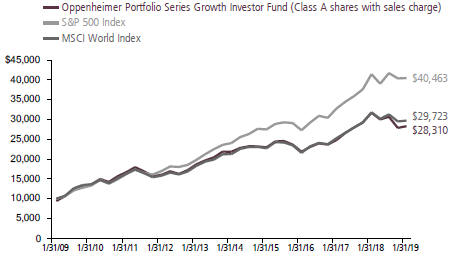

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

1. The Fund is invested in Class I shares of all underlying funds discussed in this Fund Performance Discussion.

4 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

from the Trump Administration about the policies for tariffs on Chinese imports, and the U.S. Government shutdown did not help in an environment where the appetite for risk declined. Risk markets rallied in January 2019. The strong gains were driven by a shift in the statements from the Fed, which signaled a more dovish tone on future interest rate rises.

Despite rallying in January 2019, equities generally declined for theone-year period ended January 31, 2019. U.S. equities outperformed their international counterparts, with the S&P 500 returning-2.31%, the MSCI ACWI returning-7.48%, and emerging markets falling the most with a-14.24% return for the MSCI Emerging Markets Index. Growth stocks continued to outperform value stocks this reporting period. Fixed income fared better than equities in a volatile environment, with the Bloomberg Barclays U.S. Aggregate Bond Index returning 2.25% and the Bloomberg Barclays Global Aggregate Bond Index, Hedged returning 3.58%.

FUND REVIEW

In a period where U.S. fixed income produced positive returns and outperformed equities, the Fund’s exposure to both Oppenheimer Total Return Bond Fund and Oppenheimer Limited-Term Government Fund benefited performance. The Fund’s allocation to Oppenheimer International Bond Fund detracted slightly from performance as a result of asell-off in emerging markets fixed income.

The Fund’s equity exposure detracted from performance. Top detractors from performance in this area included Oppenheimer Value Fund, Oppenheimer Capital Appreciation Fund, Oppenheimer International Growth Fund, and Oppenheimer International Equity Fund. As mentioned earlier, value stocks underperformed this reporting period, which impacted Oppenheimer Value Fund’s performance. Oppenheimer Capital Appreciation Fund, which typically invests inlarge-cap U.S. growth stocks, fared better than Oppenheimer Value Fund as growth outperformed; however, Oppenheimer Capital Appreciation Fund experienced declines and negatively impacted performance as it remained a top holding for most of the reporting period. We significantly trimmed our exposure to Oppenheimer Capital Appreciation Fund over the closing months of the reporting period. With international stocks underperforming U.S. stocks this period, the Fund’s allocation to Oppenheimer International Growth Fund and Oppenheimer International Equity Fund detracted from performance this reporting period. Oppenheimer Developing Markets Fund also detracted from absolute results as emerging market equities had a difficult reporting period.

Oppenheimer Global Fund and Oppenheimer Emerging Markets Innovators Fund were underlying equity funds that contributed positively to performance this period. We initiated positions in these underlying funds over the second half of the reporting period.

5 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

POST-PERIOD UPDATE

Effective February 1, 2019, we implemented changes to the Fund, which we believe will meaningfully enhance our investment capabilities and flexibility to manage the strategy in line with client expectations. The investment universe of the Fund has been expanded across OppenheimerFunds’ products, including additional mutual funds, ETFs andclosed-end funds, which will offer us additional component parts and greater investment flexibility to seek to achieve the

| | |

| |

Jeffrey Bennett Portfolio Manager |

| | |

Fund’s investment objective. In addition, the Fund will permit derivative usage for cash and duration management. To better reflect the changes to the Fund, including an increase in international exposure, the Fund changed its benchmarks from the Bloomberg Barclays U.S. Aggregate Bond Index and S&P 500 Index to the Bloomberg Barclays Global Aggregate Bond Index, Hedged, MSCI ACWI, and a blended benchmark that consists of 20% MSCI ACWI and 80% Bloomberg Barclays Global Aggregate Bond Index, Hedged.

6 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Top Holdings and Allocations

ASSET CLASS ALLOCATION

| | |

Domestic Fixed Income Funds | | 47.2% |

Foreign Fixed Income Fund | | 24.6 |

Foreign Equity Funds | | 14.2 |

Alternative Funds | | 8.0 |

Domestic Equity Funds | | 6.0 |

Money Market Fund | | —* |

| * | Represents a value of less than 0.05%. |

Portfolio holdings and allocations are subject to change. Percentages are as of January 31, 2019, and are based on the total market value of investments.

TOP TEN HOLDINGS

| | |

| Oppenheimer Total Return Bond Fund, Cl. I | | 24.7% |

| Oppenheimer International Bond Fund, Cl. I | | 24.6 |

| Oppenheimer Master Loan Fund, LLC | | 9.7 |

| Oppenheimer Limited-Term Government Fund, Cl. I | | 8.3 |

| Oppenheimer Global Fund, Cl. I | | 6.2 |

| Oppenheimer Master Inflation Protected Securities Fund, LLC | | 4.4 |

| Oppenheimer Master Event-Linked Bond Fund, LLC | | 3.3 |

| Oppenheimer Value Fund, Cl. I | | 2.7 |

| Oppenheimer Fundamental Alternatives Fund, Cl. I | | 1.9 |

| Oppenheimer International Equity Fund, Cl. I | | 1.9 |

Portfolio holdings and allocations are subject to change. Percentages are as of January 31, 2019, and are based on net assets.

For more current Fund holdings, please visit oppenheimerfunds.com.

7 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 1/31/19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | | | | 1-Year | | | | | | 5-Year | | | | | | 10-Year | | | | |

Class A (OACIX) | | | 4/5/05 | | | | | | | | -1.49 | % | | | | | | | 3.43 | % | | | | | | | 6.32 | % | | | | |

Class C (OCCIX) | | | 4/5/05 | | | | | | | | -2.30 | | | | | | | | 2.67 | | | | | | | | 5.51 | | | | | |

Class R (ONCIX) | | | 4/5/05 | | | | | | | | -1.73 | | | | | | | | 3.18 | | | | | | | | 6.03 | | | | | |

Class Y (OYCIX) | | | 4/5/05 | | | | | | | | -1.31 | | | | | | | | 3.67 | | | | | | | | 6.60 | | | | | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 1/31/19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | | | | 1-Year | | | | | | 5-Year | | | | | | 10-Year | | | | |

Class A (OACIX) | | | 4/5/05 | | | | | | | | -7.16 | % | | | | | | | 2.21 | % | | | | | | | 5.69 | % | | | | |

Class C (OCCIX) | | | 4/5/05 | | | | | | | | -3.27 | | | | | | | | 2.67 | | | | | | | | 5.51 | | | | | |

Class R (ONCIX) | | | 4/5/05 | | | | | | | | -1.73 | | | | | | | | 3.18 | | | | | | | | 6.03 | | | | | |

Class Y (OYCIX) | | | 4/5/05 | | | | | | | | -1.31 | | | | | | | | 3.67 | | | | | | | | 6.60 | | | | | |

Performance data quoted represents past performance, which does not guarantee future results.The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recentmonth-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75% and for Class C shares, the contingent deferred sales charge of 1% for the1-year period. There is no sales charge for Class R and Class Y shares. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

The Fund’s performance is compared to the performance of the S&P 500 Index and the Bloomberg Barclays U.S. Aggregate Bond Index. The S&P 500 Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the U.S. economy. The Bloomberg Barclays U.S. Aggregate Bond Index is an index of U.S.-dollar-denominated, investment-grade U.S. corporate government and mortgage-backed securities. The indices areunmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising theindices. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio manager(s) and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on January 31, 2019, and are

8 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

9 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire6-month period ended January 31, 2019.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended January 31, 2019” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such asfront-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

| | | | | | | | | | | | |

| Actual | | Beginning Account Value August 1, 2018 | | | | Ending Account Value January 31, 2019 | | | | Expenses Paid During 6 Months Ended January 31, 2019 | | |

Class A | | $ 1,000.00 | | | | $ 997.40 | | | | $ 2.17 | | |

Class C | | 1,000.00 | | | | 993.60 | | | | 5.95 | | |

Class R | | 1,000.00 | | | | 996.10 | | | | 3.43 | | |

Class Y | | 1,000.00 | | | | 998.30 | | | | 0.96 | | |

Hypothetical (5% return before expenses) | | | | | | | | | | | | |

Class A | | 1,000.00 | | | | 1,023.04 | | | | 2.19 | | |

Class C | | 1,000.00 | | | | 1,019.26 | | | | 6.02 | | |

Class R | | 1,000.00 | | | | 1,021.78 | | | | 3.47 | | |

Class Y | | 1,000.00 | | | | 1,024.25 | | | | 0.97 | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the6-month period ended January 31, 2019 are as follows:

| | | | | | | | |

| Class | | Expense Ratios | | | | |

Class A | | | 0.43 | % | | | | |

Class C | | | 1.18 | | | | | |

Class R | | | 0.68 | | | | | |

Class Y | | | 0.19 | | | | | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

11 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENT OF INVESTMENTSJanuary 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| |

Investment Companies—99.8%1 | |

Alternative Funds—8.0% | | | | | | | | |

Oppenheimer Fundamental Alternatives Fund, Cl. I | | | 409,938 | | | $ | 11,006,849 | |

| |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | 1,226,899 | | | | 19,003,204 | |

| |

Oppenheimer Real Estate Fund, Cl. I | | | 396,960 | | | | 9,943,844 | |

| |

Oppenheimer SteelPath MLP Select 40 Fund, Cl. I | | | 737,093 | | | | 5,771,438 | |

| | | | | | | | |

| | | | | | | 45,725,335 | |

| |

Domestic Equity Funds—6.0% | | | | | | | | |

Oppenheimer Capital Appreciation Fund, Cl. I | | | 118,471 | | | | 7,262,243 | |

| |

Oppenheimer Discovery Mid Cap Growth Fund, Cl. I | | | 272,484 | | | | 5,801,191 | |

| |

Oppenheimer Main Street Small Cap Fund, Cl. I | | | 411,452 | | | | 5,776,785 | |

| |

Oppenheimer Value Fund, Cl. I | | | 489,329 | | | | 15,702,572 | |

| | | | | | | | |

| | | | | | | 34,542,791 | |

| |

Domestic Fixed Income Funds—47.1% | | | | | | | | |

Oppenheimer Limited-Term Government Fund, Cl. I | | | 10,961,760 | | | | 47,464,421 | |

| |

Oppenheimer Master Inflation Protected Securities Fund, LLC | | | 2,087,517 | | | | 25,343,831 | |

| |

Oppenheimer Master Loan Fund, LLC | | | 3,228,487 | | | | 55,546,345 | |

| |

Oppenheimer Total Return Bond Fund, Cl. I | | | 21,263,843 | | | | 141,404,555 | |

| | | | | | | | |

| | | | | | | 269,759,152 | |

| |

Foreign Equity Funds—14.1% | | | | | | | | |

Oppenheimer Developing Markets Fund, Cl. I | | | 220,108 | | | | 8,978,195 | |

| |

Oppenheimer Emerging Markets Innovators Fund, Cl. I2 | | | 302,160 | | | | 2,940,020 | |

| |

Oppenheimer Global Fund, Cl. I | | | 436,351 | | | | 35,654,209 | |

| |

Oppenheimer International Equity Fund, Cl. I | | | 558,975 | | | | 10,704,379 | |

| |

Oppenheimer International Growth Fund, Cl. I | | | 237,334 | | | | 8,812,219 | |

| |

Oppenheimer InternationalSmall-Mid Co. Fund, Cl. I | | | 81,208 | | | | 3,529,302 | |

| |

Oppenheimer Macquarie Global Infrastructure Fund, Cl. I | | | 960,524 | | | | 10,277,607 | |

| | | | | | | | |

| | | | | | | 80,895,931 | |

| |

Foreign Fixed Income Fund—24.6% | | | | | | | | |

Oppenheimer International Bond Fund, Cl. I | | | 25,266,341 | | | | 140,480,858 | |

| |

Money Market Fund—0.0% | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E, 2.35%3 | | | 109,421 | | | | 109,421 | |

| |

Total Investments, at Value(Cost $576,057,187) | | | 99.8% | | | | 571,513,488 | |

| |

Net Other Assets (Liabilities) | | | 0.2 | | | | 904,858 | |

| | | | |

Net Assets | | | 100.0% | | | $ | 572,418,346 | |

| | | | |

Footnotes to Statement of Investments

1. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares January 31, 2018 | | | Gross Additions | | | Gross Reductions | | | Shares January 31, 2019 | |

| |

Investment Companies Alternative Funds | | | | | | | | | | | | | | | | |

Oppenheimer Fundamental Alternatives Fund, Cl. I | | | 485,515 | | | | 481,301 | | | | 556,878 | | | | 409,938 | |

Oppenheimer Global Multi Strategies Fund, Cl. I | | | 1,155,713 | | | | 630 | | | | 1,156,343 | | | | — | |

12 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | | | | | |

| | | Shares January 31, 2018 | | | Gross Additions | | | Gross Reductions | | | Shares January 31, 2019 | |

| |

Oppenheimer Gold & Special Minerals Fund, Cl. I | | | 610,836 | | | | 332,724 | | | | 943,560 | | | | — | |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | — | | | | 1,333,591 | | | | 106,692 | | | | 1,226,899 | |

Oppenheimer Real Estate Fund, Cl. I | | | 793,943 | | | | 138,525 | | | | 535,508 | | | | 396,960 | |

Oppenheimer SteelPath MLP Select 40 Fund, Cl. I | | | — | | | | 754,134 | | | | 17,041 | | | | 737,093 | |

Domestic Equity Funds | | | | | | | | | | | | | | | | |

Oppenheimer Capital Appreciation Fund, Cl. I | | | 1,068,074 | | | | 14,985 | | | | 964,588 | | | | 118,471 | |

Oppenheimer Discovery Mid Cap Growth Fund, Cl. I | | | — | | | | 278,698 | | | | 6,214 | | | | 272,484 | |

Oppenheimer Main Street Mid Cap Fund, Cl. I | | | 423,476 | | | | 14,562 | | | | 438,038 | | | | — | |

Oppenheimer Main Street Small Cap Fund, Cl. I | | | 735,252 | | | | 42,352 | | | | 366,152 | | | | 411,452 | |

Oppenheimer Value Fund, Cl. I | | | 1,833,645 | | | | 130,696 | | | | 1,475,012 | | | | 489,329 | |

Domestic Fixed Income Funds | | | | | | | | | | | | | | | | |

Oppenheimer Limited-Term Government Fund, Cl. I | | | 15,119,183 | | | | 2,410,202 | | | | 6,567,625 | | | | 10,961,760 | |

Oppenheimer Master Inflation Protected Securities Fund, LLC | | | 3,517,926 | | | | 428,318 | | | | 1,858,727 | | | | 2,087,517 | |

Oppenheimer Master Loan Fund, LLC | | | 1,883,024 | | | | 1,799,112 | | | | 453,649 | | | | 3,228,487 | |

Oppenheimer Total Return Bond Fund, Cl. I | | | 22,817,338 | | | | 2,382,324 | | | | 3,935,819 | | | | 21,263,843 | |

Foreign Equity Funds | | | | | | | | | | | | | | | | |

Oppenheimer Developing Markets Fund, Cl. I | | | 110,827 | | | | 125,572 | | | | 16,291 | | | | 220,108 | |

Oppenheimer Emerging Markets Innovators Fund, Cl. I | | | — | | | | 309,283 | | | | 7,123 | | | | 302,160 | |

Oppenheimer Global Fund, Cl. I | | | — | | | | 446,072 | | | | 9,721 | | | | 436,351 | |

Oppenheimer International Equity Fund, Cl. I | | | 490,134 | | | | 161,928 | | | | 93,087 | | | | 558,975 | |

Oppenheimer International Growth Fund, Cl. I | | | 274,637 | | | | 18,527 | | | | 55,830 | | | | 237,334 | |

Oppenheimer International Small- Mid Co. Fund, Cl. I | | | 81,335 | | | | 9,362 | | | | 9,489 | | | | 81,208 | |

Oppenheimer Macquarie Global Infrastructure Fund, Cl. I | | | — | | | | 982,846 | | | | 22,322 | | | | 960,524 | |

Foreign Fixed Income Funds | | | | | | | | | | | | | | | | |

Oppenheimer International Bond Fund, Cl. I | | | 11,588,336 | | | | 15,517,801 | | | | 1,839,796 | | | | 25,266,341 | |

Money Market Funds | | | | | | | | | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E | | | 199,526 | | | | 23,235,699 | | | | 23,325,804 | | | | 109,421 | |

13 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENT OF INVESTMENTSContinued

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | | | | | |

| | | Value | | | Income | | | Realized Gain (Loss) | | | Change in Unrealized Gain (Loss) | |

| |

Investment Companies Alternative Funds | | | | | | | | | | | | | | | | |

Oppenheimer Fundamental Alternatives Fund, Cl. I | | $ | 11,006,849 | | | $ | 232,183 | | | $ | 244,476 | | | $ | (563,979) | |

Oppenheimer Global Multi Strategies Fund, Cl. I | | | — | | | | — | | | | (4,129,984) | | | | 3,647,259 | |

Oppenheimer Gold & Special Minerals Fund, Cl. I | | | — | | | | — | | | | (6,574,418) | | | | 5,113,070 | |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | 19,003,204 | | | | 1,022,004a | | | | (387,983) | a | | | (577,411) | a |

Oppenheimer Real Estate Fund, Cl. Ib | | | 9,943,844 | | | | 271,192 | | | | 2,386,123 | | | | (1,983,599) | |

Oppenheimer SteelPath MLP Select 40 Fund, Cl. I | | | 5,771,438 | | | | 84,750 | | | | (1,383) | | | | (72,903) | |

Domestic Equity Funds | | | | | | | | | | | | | | | | |

Oppenheimer Capital Appreciation Fund, Cl. Ic | | | 7,262,243 | | | | 15,791 | | | | 13,423,448 | | | | (16,447,286) | |

Oppenheimer Discovery Mid Cap Growth Fund, Cl. Id | | | 5,801,191 | | | | — | | | | (2,853) | | | | (233,423) | |

Oppenheimer Main Street Mid Cap Fund, Cl. Ie | | | — | | | | 11,475 | | | | 1,044,056 | | | | (1,888,269) | |

Oppenheimer Main Street Small Cap Fund, Cl. If | | | 5,776,785 | | | | 25,130 | | | | 899,295 | | | | (1,524,320) | |

Oppenheimer Value Fund, Cl. Ig | | | 15,702,572 | | | | 889,988 | | | | 18,823,207 | | | | (27,553,054) | |

Domestic Fixed Income Funds | | | | | | | | | | | | | | | | |

Oppenheimer Limited-Term Government Fund, Cl. I | | | 47,464,421 | | | | 1,627,174 | | | | (1,070,864) | | | | 675,628 | |

Oppenheimer Master Inflation Protected Securities Fund, LLC | | | 25,343,831 | | | | 1,133,707h | | | | (570,925) | h | | | (506,407) | h |

Oppenheimer Master Loan Fund, LLC | | | 55,546,345 | | | | 2,354,999i | | | | 209,597i | | | | (2,238,688) | i |

Oppenheimer Total Return Bond Fund, Cl. I | | | 141,404,555 | | | | 5,353,779 | | | | (613,667) | | | | (2,562,704) | |

Foreign Equity Funds | | | | | | | | | | | | | | | | |

Oppenheimer Developing Markets Fund, Cl. I | | | 8,978,195 | | | | 53,832 | | | | 184,544 | | | | (500,698) | |

Oppenheimer Emerging Markets Innovators Fund, Cl. I | | | 2,940,020 | | | | — | | | | 339 | | | | 125,303 | |

Oppenheimer Global Fund, Cl. Ij | | | 35,654,209 | | | | 201,962 | | | | (20,848) | | | | (1,424,464) | |

Oppenheimer International Equity Fund, Cl. I | | | 10,704,379 | | | | 155,178 | | | | 613,023 | | | | (2,513,682) | |

Oppenheimer International Growth Fund, Cl. I | | | 8,812,219 | | | | 132,750 | | | | 833,500 | | | | (3,075,027) | |

Oppenheimer International Small-Mid Co. Fund, Cl. Ik | | | 3,529,302 | | | | 35,700 | | | | 278,199 | | | | (934,565) | |

Oppenheimer Macquarie Global Infrastructure Fund, Cl. Il | | | 10,277,607 | | | | 48,314 | | | | 341 | | | | 336,368 | |

Foreign Fixed Income Funds | | | | | | | | | | | | | | | | |

Oppenheimer International Bond Fund, Cl. I | | | 140,480,858 | | | | 2,663,885 | | | | 261,479 | | | | (2,367,935) | |

14 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | | | | | | | |

| | | Value | | | Income | | | Realized Gain (Loss) | | | Change in Unrealized Gain (Loss) | |

| |

Money Market Funds | | | | | | | | | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E | | $ | 109,421 | | | $ | 92,936 | | | $ | — | | | $ | — | |

| | | | |

Total | | $ | 571,513,488 | | | $ | 16,406,729 | | | $ | 25,828,702 | | | $ | (57,070,786) | |

| | | | |

a. Represents the amount allocated to the Fund from Oppenheimer Event-Linked Bond Fund, LLC.

b. This fund distributed realized gains of $245,461.

c. This fund distributed realized gains of $511,524.

d. This fund distributed realized gains of $290,744.

e. This fund distributed realized gains of $288,026.

f. This fund distributed realized gains of $455,317.

g. This fund distributed realized gains of $2,908,020.

h. Represents the amount allocated to the Fund from Oppenheimer Master Inflation Protected Securities Fund, LLC.

i. Represents the amount allocated to the Fund from Oppenheimer Master Loan Fund, LLC.

j. This fund distributed realized gains of $2,256,961.

k. This fund distributed realized gains of $310,730.

l. This fund distributed realized gains of $34,454.

2.Non-income producing security.

3. Rate shown is the7-day yield at period end.

See accompanying Notes to Financial Statements.

15 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENT OF ASSETS AND LIABILITIESJanuary 31, 2019

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments—affiliated companies (cost $576,057,187) | | $ | 571,513,488 | |

Cash | | | 1,035,179 | |

Receivables and other assets: | | | | |

Dividends | | | 1,153,224 | |

Investments sold | | | 462,417 | |

Shares of beneficial interest sold | | | 183,668 | |

Other | | | 24,454 | |

| | | | |

Total assets | | | 574,372,430 | |

Liabilities | | | | |

Payables and other liabilities: | | | | |

Investments purchased | | | 1,177,404 | |

Shares of beneficial interest redeemed | | | 593,151 | |

Distribution and service plan fees | | | 118,022 | |

Trustees’ compensation | | | 32,302 | |

Shareholder communications | | | 6,339 | |

Other | | | 26,866 | |

| | | | |

Total liabilities | | | 1,954,084 | |

Net Assets | | $ | 572,418,346 | |

| | | | |

| | | | |

Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 61,652 | |

Additionalpaid-in capital | | | 602,620,990 | |

Total accumulated loss | | | (30,264,296) | |

| | | | |

Net Assets | | $ | 572,418,346 | |

| | | | |

| | | | |

Net Asset Value Per Share | | | | |

Class A Shares: | | | | |

| |

| Net asset value and redemption price per share (based on net assets of $396,318,269 and 42,569,816 shares of beneficial interest outstanding) | | | $9.31 | |

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | | $9.88 | |

| |

Class C Shares: | | | | |

| |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $125,385,307 and 13,625,568 shares of beneficial interest outstanding) | | | $9.20 | |

| |

Class R Shares: | | | | |

| |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $44,044,202 and 4,742,315 shares of beneficial interest outstanding) | | | $9.29 | |

| |

Class Y Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $6,670,568 and 713,922 shares of beneficial interest outstanding) | | | $9.34 | |

See accompanying Notes to Financial Statements.

16 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENT OF

OPERATIONSFor the Year EndedJanuary 31, 2019

| | | | |

Allocation of Income and Expenses from Master Funds1 | | | | |

Net investment income allocated from Oppenheimer Master Event-Linked Bond Fund, LLC: | | | | |

Interest | | $ | 1,014,534 | |

Dividends | | | 7,470 | |

Net expenses | | | (60,035) | |

| | | | |

Net investment income allocated from Oppenheimer Master Event-Linked Bond Fund, LLC | | | 961,969 | |

| |

Net investment income allocated from Oppenheimer Master Inflation Protected Securities Fund, LLC: | | | | |

Interest | | | 1,128,321 | |

Dividends | | | 5,386 | |

Net expenses | | | (184,721) | |

| | | | |

Net investment income allocated from Oppenheimer Master Inflation Protected Securities Fund, LLC | | | 948,986 | |

| |

Net investment income allocated from Oppenheimer Master Loan Fund, LLC: | | | | |

Interest | | | 2,306,755 | |

Dividends | | | 48,244 | |

Net expenses | | | (155,288) | |

| | | | |

Net investment income allocated from Oppenheimer Master Loan Fund, LLC | | | 2,199,711 | |

| | | | |

Total allocation of net investment income from master funds | | | 4,110,666 | |

| | | | |

Investment Income | | | | |

Dividends from affiliated companies | | | 11,896,019 | |

| |

Interest | | | 13,824 | |

| | | | |

Total investment income | | | 11,909,843 | |

| | | | |

Expenses | | | | |

Distribution and service plan fees: | | | | |

Class A | | | 1,004,210 | |

Class B2 | | | 2,955 | |

Class C | | | 1,289,932 | |

Class R | | | 210,629 | |

| |

Transfer and shareholder servicing agent fees: | | | | |

Class A | | | 807,233 | |

Class B2 | | | 578 | |

Class C | | | 253,007 | |

Class R | | | 83,741 | |

Class Y | | | 11,492 | |

| |

Shareholder communications: | | | | |

Class A | | | 17,994 | |

Class B2 | | | 49 | |

Class C | | | 5,654 | |

Class R | | | 1,590 | |

Class Y | | | 225 | |

| |

Trustees’ compensation | | | 8,432 | |

| |

Custodian fees and expenses | | | 4,080 | |

| |

Other | | | 54,733 | |

| | | | |

Total expenses | | | 3,756,534 | |

17 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENT OF

OPERATIONSContinued

| | | | |

|

| |

Expenses (Continued) | | | | |

Less waivers and reimbursements of expenses | | $ | (592,849) | |

| | | | |

Net expenses | | | 3,163,685 | |

|

| |

Net Investment Income | | | 12,856,824 | |

|

| |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain on: | | | | |

Investment transactions in affiliated companies | | | 26,578,013 | |

Distributions received from affiliate companies | | | 7,301,237 | |

| |

Net realized gain (loss) allocated from: | | | | |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | (387,983) | |

Oppenheimer Master Inflation Protected Securities Fund, LLC | | | (570,925) | |

Oppenheimer Master Loan Fund, LLC | | | 209,597 | |

| | | | |

Net realized gain | | | 33,129,939 | |

| |

Net change in unrealized appreciation/(depreciation) on investment transactions | | | (53,748,280) | |

| |

Net change in unrealized appreciation/(depreciation) allocated from: | | | | |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | (577,411) | |

Oppenheimer Master Inflation Protected Securities Fund, LLC | | | (506,407) | |

Oppenheimer Master Loan Fund, LLC | | | (2,238,688) | |

| | | | |

Net change in unrealized appreciation/(depreciation) | | | (57,070,786) | |

|

| |

Net Decrease in Net Assets Resulting from Operations | | $ | (11,084,023) | |

| | | | |

1. The Fund invests in certain affiliated mutual funds that expect to be treated as partnerships for tax purposes. See Note 4 of the accompanying Notes.

2. Effective June 1, 2018, all Class B shares converted to Class A shares.

See accompanying Notes to Financial Statements.

18 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

January 31, 2019 | | Year Ended

January 31, 20181 | |

Operations | | | | | | | | |

Net investment income | | $ | 12,856,824 | | | $ | 10,404,475 | |

| |

Net realized gain | | | 33,129,939 | | | | 22,131,340 | |

| |

Net change in unrealized appreciation/(depreciation) | | | (57,070,786 | ) | | | 24,046,534 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (11,084,023 | ) | | | 56,582,349 | |

Dividends and/or Distributions to Shareholders | | | | | | | | |

Dividends and distributions declared: | | | | | | | | |

Class A | | | (8,685,727 | ) | | | (9,351,733) | |

Class B2 | | | — | | | | (5,347) | |

Class C | | | (1,802,991 | ) | | | (1,929,785) | |

Class R | | | (845,052 | ) | | | (861,904) | |

Class Y | | | (156,417 | ) | | | (153,200) | |

| | | | |

Total dividends and distributions declared | | | (11,490,187 | ) | | | (12,301,969) | |

Beneficial Interest Transactions | | | | | | | | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

Class A | | | (33,682,311 | ) | | | (13,651,741) | |

Class B2 | | | (1,830,823 | ) | | | (5,059,405) | |

Class C | | | (8,930,783 | ) | | | (17,926,869) | |

Class R | | | 52,916 | | | | (162,889) | |

Class Y | | | 687,591 | | | | 522,312 | |

| | | | |

Total beneficial interest transactions | | | (43,703,410 | ) | | | (36,278,592) | |

Net Assets | | | | | | | | |

Total increase (decrease) | | | (66,277,620 | ) | | | 8,001,788 | |

| |

Beginning of period | | | 638,695,966 | | | | 630,694,178 | |

| | | | |

End of period | | $ | 572,418,346 | | | $ | 638,695,966 | |

| | | | |

1. Prior period amounts have been conformed to current year presentation. See Notes to Financial Statements, Note

2– New Accounting Pronouncements for further details.

2. Effective June 1, 2018, all Class B shares converted to Class A shares.

See accompanying Notes to Financial Statements.

19 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Class A | | Year Ended

January 31,

2019 | | | Year Ended

January 31,

2018 | | | Year Ended

January 31,

2017 | | | Year Ended

January 29,

20161 | | | Year Ended

January 30,

20151 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $9.67 | | | | $9.02 | | | | $8.54 | | | | $9.07 | | | | $8.74 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.22 | | | | 0.17 | | | | 0.20 | | | | 0.15 | | | | 0.17 | |

| Net realized and unrealized gain (loss) | | | (0.37) | | | | 0.69 | | | | 0.47 | | | | (0.48) | | | | 0.31 | |

| | | | |

| Total from investment operations | | | (0.15) | | | | 0.86 | | | | 0.67 | | | | (0.33) | | | | 0.48 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.21) | | | | (0.21) | | | | (0.19) | | | | (0.20) | | | | (0.15) | |

| |

| Net asset value, end of period | | | $9.31 | | | | $9.67 | | | | $9.02 | | | | $8.54 | | | | $9.07 | |

| | | | |

|

| |

Total Return, at Net Asset Value3 | | | (1.49)% | | | | 9.53% | | | | 7.92% | | | | (3.68)% | | | | 5.54% | |

|

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $396,318 | | | | $445,732 | | | | $428,722 | | | | $381,636 | | | | $377,253 | |

| |

| Average net assets (in thousands) | | | $413,824 | | | | $440,897 | | | | $413,080 | | | | $385,849 | | | | $356,752 | |

| |

| Ratios to average net assets:4,5 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.35% | | | | 1.82% | | | | 2.22% | | | | 1.70% | | | | 1.84% | |

| Expenses excluding specific expenses listed below | | | 0.52% | | | | 0.53% | | | | 0.54% | | | | 0.54% | | | | 0.53% | |

| Interest and fees from borrowings | | | 0.00% | | | | 0.00% | | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 0.52% | | | | 0.53% | | | | 0.54% | | | | 0.54% | | | | 0.53% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.42% | | | | 0.42% | | | | 0.44% | | | | 0.44% | | | | 0.43% | |

| |

| Portfolio turnover rate | | | 45% | | | | 7% | | | | 9% | | | | 10% | | | | 14% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from the master funds.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | | | | | |

Year Ended January 31, 2019 | | | 1.00 | % |

Year Ended January 31, 2018 | | | 1.06 | % |

Year Ended January 31, 2017 | | | 1.08 | % |

Year Ended January 29, 2016 | | | 1.07 | % |

Year Ended January 30, 2015 | | | 1.06 | % |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

| | | | | | | | | | | | | | | | | | | | |

| Class C | | Year Ended

January 31,

2019 | | | Year Ended

January 31,

2018 | | | Year Ended

January 31,

2017 | | | Year Ended

January 29,

20161 | | | Year Ended

January 30,

20151 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $9.56 | | | | $8.92 | | | | $8.43 | | | | $8.96 | | | | $8.63 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.15 | | | | 0.10 | | | | 0.13 | | | | 0.08 | | | | 0.10 | |

| Net realized and unrealized gain (loss) | | | (0.38) | | | | 0.67 | | | | 0.48 | | | | (0.48) | | | | 0.32 | |

| | | | |

| Total from investment operations | | | (0.23) | | | | 0.77 | | | | 0.61 | | | | (0.40) | | | | 0.42 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.13) | | | | (0.13) | | | | (0.12) | | | | (0.13) | | | | (0.09) | |

| |

| Net asset value, end of period | | | $9.20 | | | | $9.56 | | | | $8.92 | | | | $8.43 | | | | $8.96 | |

| | | | |

|

| |

Total Return, at Net Asset Value3 | | | (2.30)% | | | | 8.69% | | | | 7.28% | | | | (4.48)% | | | | 4.83% | |

|

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $125,385 | | | | $139,290 | | | | $147,359 | | | | $150,838 | | | | $163,041 | |

| |

| Average net assets (in thousands) | | | $129,705 | | | | $141,175 | | | | $153,128 | | | | $159,469 | | | | $160,307 | |

| |

| Ratios to average net assets:4,5 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.60% | | | | 1.06% | | | | 1.47% | | | | 0.95% | | | | 1.08% | |

| Expenses excluding specific expenses listed below | | | 1.27% | | | | 1.28% | | | | 1.29% | | | | 1.29% | | | | 1.28% | |

| Interest and fees from borrowings | | | 0.00% | | | | 0.00% | | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 1.27% | | | | 1.28% | | | | 1.29% | | | | 1.29% | | | | 1.28% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.17% | | | | 1.17% | | | | 1.19% | | | | 1.19% | | | | 1.18% | |

| |

| Portfolio turnover rate | | | 45% | | | | 7% | | | | 9% | | | | 10% | | | | 14% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from the master funds.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | | | | | |

Year Ended January 31, 2019 | | | 1.75 | % |

Year Ended January 31, 2018 | | | 1.81 | % |

Year Ended January 31, 2017 | | | 1.83 | % |

Year Ended January 29, 2016 | | | 1.82 | % |

Year Ended January 30, 2015 | | | 1.81 | % |

See accompanying Notes to Financial Statements.

21 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

FINANCIAL HIGHLIGHTSContinued

| | | | | | | | | | | | | | | | | | | | |

| Class R | | Year Ended

January 31,

2019 | | | Year Ended

January 31,

2018 | | | Year Ended

January 31,

2017 | | | Year Ended

January 29,

20161 | | | Year Ended

January 30,

20151 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $9.65 | | | | $9.01 | | | | $8.53 | | | | $9.05 | | | | $8.72 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.20 | | | | 0.15 | | | | 0.18 | | | | 0.13 | | | | 0.14 | |

| Net realized and unrealized gain (loss) | | | (0.37) | | | | 0.67 | | | | 0.47 | | | | (0.48) | | | | 0.32 | |

| | | | |

| Total from investment operations | | | (0.17) | | | | 0.82 | | | | 0.65 | | | | (0.35) | | | | 0.46 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.19) | | | | (0.18) | | | | (0.17) | | | | (0.17) | | | | (0.13) | |

| |

| Net asset value, end of period | | | $9.29 | | | | $9.65 | | | | $9.01 | | | | $8.53 | | | | $9.05 | |

| | | | |

|

| |

Total Return, at Net Asset Value3 | | | (1.73)% | | | | 9.18% | | | | 7.71% | | | | (3.89)% | | | | 5.28% | |

|

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $44,044 | | | | $45,605 | | | | $42,716 | | | | $35,442 | | | | $42,872 | |

| |

| Average net assets (in thousands) | | | $42,940 | | | | $44,190 | | | | $38,675 | | | | $39,789 | | | | $43,215 | |

| |

| Ratios to average net assets:4,5 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.10% | | | | 1.59% | | | | 1.99% | | | | 1.44% | | | | 1.58% | |

| Expenses excluding specific expenses listed below | | | 0.77% | | | | 0.77% | | | | 0.79% | | | | 0.79% | | | | 0.78% | |

| Interest and fees from borrowings | | | 0.00% | | | | 0.00% | | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 0.77% | | | | 0.77% | | | | 0.79% | | | | 0.79% | | | | 0.78% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.67% | | | | 0.66% | | | | 0.69% | | | | 0.69% | | | | 0.68% | |

| |

| Portfolio turnover rate | | | 45% | | | | 7% | | | | 9% | | | | 10% | | | | 14% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from the master funds.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | | | | | |

Year Ended January 31, 2019 | | | 1.25 | % |

Year Ended January 31, 2018 | | | 1.30 | % |

Year Ended January 31, 2017 | | | 1.33 | % |

Year Ended January 29, 2016 | | | 1.32 | % |

Year Ended January 30, 2015 | | | 1.31 | % |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

| | | | | | | | | | | | | | | | | | | | |

| Class Y | | Year Ended

January 31,

2019 | | | Year Ended

January 31,

2018 | | | Year Ended

January 31,

2017 | | | Year Ended

January 29,

20161 | | | Year Ended

January 30,

20151 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $9.71 | | | | $9.06 | | | | $8.57 | | | | $9.10 | | | | $8.77 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | | 0.24 | | | | 0.20 | | | | 0.23 | | | | 0.17 | | | | 0.20 | |

| Net realized and unrealized gain (loss) | | | (0.38) | | | | 0.68 | | | | 0.47 | | | | (0.49) | | | | 0.31 | |

| | | | |

| Total from investment operations | | | (0.14) | | | | 0.88 | | | | 0.70 | | | | (0.32) | | | | 0.51 | |

| |

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.23) | | | | (0.23) | | | | (0.21) | | | | (0.21) | | | | (0.18) | |

| |

| Net asset value, end of period | | | $9.34 | | | | $9.71 | | | | $9.06 | | | | $8.57 | | | | $9.10 | |

| | | | |

|

| |

Total Return, at Net Asset Value3 | | | (1.31)% | | | | 9.78% | | | | 8.27% | | | | (3.54)% | | | | 5.85% | |

|

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $6,671 | | | | $6,195 | | | | $5,280 | | | | $5,078 | | | | $6,947 | |

| |

| Average net assets (in thousands) | | | $5,897 | | | | $5,831 | | | | $5,067 | | | | $7,659 | | | | $4,601 | |

| |

| Ratios to average net assets:4,5 | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.59% | | | | 2.14% | | | | 2.52% | | | | 1.93% | | | | 2.22% | |

| Expenses excluding specific expenses listed below | | | 0.28% | | | | 0.28% | | | | 0.29% | | | | 0.29% | | | | 0.28% | |

| Interest and fees from borrowings | | | 0.00% | | | | 0.00% | | | | 0.00%6 | | | | 0.00%6 | | | | 0.00% | |

| | | | |

| Total expenses7 | | | 0.28% | | | | 0.28% | | | | 0.29% | | | | 0.29% | | | | 0.28% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.18% | | | | 0.17% | | | | 0.19% | | | | 0.19% | | | | 0.18% | |

| |

| Portfolio turnover rate | | | 45% | | | | 7% | | | | 9% | | | | 10% | | | | 14% | |

1. Represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Includes the Fund’s share of the allocated expenses and/or net investment income from the master funds.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | | | | | |

Year Ended January 31, 2019 | | | 0.76 | % |

Year Ended January 31, 2018 | | | 0.81 | % |

Year Ended January 31, 2017 | | | 0.83 | % |

Year Ended January 29, 2016 | | | 0.82 | % |

Year Ended January 30, 2015 | | | 0.81 | % |

See accompanying Notes to Financial Statements.

23 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

NOTES TO FINANCIAL STATEMENTSJanuary 31, 2019

1. Organization

Oppenheimer Portfolio Series (the “Trust”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as a diversifiedopen-end management investment company. Conservative Investor Fund (the “Fund”) is a series of the Trust whose investment objective is to seek total return. The Fund normally invests in a diversified portfolio of Oppenheimer mutual funds (individually, an “Underlying Fund” and collectively, the “Underlying Funds”). The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the“Sub-Adviser”). The Manager has entered into asub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class R and Class Y shares, and previously offered Class B shares for new purchase through June 29, 2012. Subsequent to that date, no new purchases of Class B shares were permitted. Reinvestment of dividend and/or capital gain distributions and exchanges of Class B shares into and from other Oppenheimer funds were permitted through May 31, 2018. Effective June 1, 2018 (the “Conversion Date”), all Class B shares converted to Class A shares. Class A shares are sold at their offering price, which is normally net asset value plus afront-end sales charge. Class C and Class R shares are sold, and Class B shares were sold, without afront-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class Y shares are sold to certain institutional investors or intermediaries without either afront-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and R shares have, and Class B shares had, separate distribution and/or service plans under which they pay, and Class B shares paid, fees. Class Y shares do not pay such fees. Previously issued Class B shares automatically converted to Class A shares 72 months after the date of purchase.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation.All investments in securities are recorded at their estimated fair value, as described in Note 3.

Allocation of Income, Expenses, Gains and Losses.Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that

24 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

2. Significant Accounting Policies (Continued)

class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on theex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as determined necessary by the Manager.

Investment Income.Dividend distributions received from the Underlying Funds are recorded on theex-dividend date. Upon receipt of notification from an Underlying Fund, and subsequent to theex-dividend date, some of the dividend income originally recorded by the Fund may be reclassified as a tax return of capital by reducing the cost basis of the Underlying Fund and/or increasing the realized gain on sales of investments in the Underlying Fund.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdraft at a rate equal to the Prime Rate plus 0.35%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications.The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes.The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended January 31, 2019, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

25 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

NOTES TO FINANCIAL STATEMENTSContinued

2. Significant Accounting Policies (Continued)

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| | | | | | |

Undistributed

Net Investment

Income | | Undistributed Long-Term Gain | | Accumulated Loss Carryforward1,2,3 | | Net Unrealized Depreciation Based on cost of Securities and Other Investments for Federal Income Tax Purposes |

$4,377,014 | | $— | | $— | | $34,609,986 |

1.During the reporting period, the Fund utilized $26,273,805 of capital loss carryforward to offset capital gains realized in that fiscal year.

2.During the previous reporting period, the Fund utilized $17,263,769 of capital loss carryforward to offset capital gains realized in that fiscal year.

3.During the reporting period, $3,593,366 of unused capital loss carryforward expired.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for the reporting period. Net assets of the Fund were unaffected by the reclassifications.

| | | | |

Reduction

toPaid-in Capital | | Reduction to Accumulated Net Loss | |

$3,593,366 | | | $3,593,366 | |

The tax character of distributions paid during the reporting periods:

| | | | | | | | |

| | | Year Ended January 31, 2019 | | | Year Ended January 31, 2018 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 11,490,187 | | | $ | 12,301,969 | |

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized

26 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

2. Significant Accounting Policies (Continued)

gain or loss.

| | | | |

Federal tax cost of securities | | $ | 606,123,474 | |

| | | | |

Gross unrealized appreciation | | $ | 9,089,587 | |

Gross unrealized depreciation | | | (43,699,573) | |

| | | | |

Net unrealized depreciation | | $ | (34,609,986) | |

| | | | |

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements. In March 2017, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”), ASU2017-08. This provides guidance related to the amortization period for certain purchased callable debt securities held at a premium. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Manager has evaluated the impacts of these changes on the financial statements and there are no material impacts.

During August 2018, the Securities and Exchange Commission (the “SEC”) issued Final Rule ReleaseNo. 33-10532 (the “Rule”), Disclosure Update and Simplification. The rule amends certain financial statement disclosure requirements to conform to U.S. GAAP. The amendments to Rule6-04.17 of RegulationS-X (balance sheet) remove the requirement to separately state the book basis components of net assets: undistributed (over-distribution of) net investment income (“UNII”), accumulated undistributed net realized gains (losses), and net unrealized appreciation (depreciation) at the balance sheet date. Instead, consistent with U.S. GAAP, funds will be required to disclose total distributable earnings. The amendments to Rule6-09 of RegulationS-X (statement of changes in net assets) remove the requirement to separately state the sources of distributions paid. Instead, consistent with U.S. GAAP, funds will be required to disclose the total amount of distributions paid, except that any tax return of capital must be separately disclosed. The amendments also remove the requirement to parenthetically state the book basis amount of UNII on the statement of changes in net assets. The requirements of the Rule were effective November 5, 2018, and the Fund’s Statement of Assets and Liabilities and Statement of Changes in Net Assets for the current reporting period have been modified accordingly. In addition, certain amounts within the Fund’s Statement of Changes in Net Assets for the prior fiscal period have been modified to conform to the Rule.

3. Securities Valuation

The Fund calculates the net asset value of its shares based upon the net asset value of the applicable investment companies. For each investment company, the net asset value per share for a class of shares is determined as of 4:00 P.M. Eastern Time, on each day the New York Stock Exchange (the “Exchange” or “NYSE”) is open for trading, except in the case of

27 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

NOTES TO FINANCIAL STATEMENTSContinued

3. Securities Valuation (Continued)

a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange. This is calculated by dividing the value of the investment company’s net assets attributable to that class by the number of outstanding shares of that class on that day.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated theday-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a fair valuation for any security for which market quotations are not readily available. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at least quarterly or more frequently, if necessary.

Valuations Methods and Inputs

To determine their net asset values, the Underlying Funds’ assets are valued primarily on the basis of current market quotations as generally supplied by third party portfolio pricing services or by dealers. Such market quotations are typically based on unadjusted quoted prices in active markets for identical securities or other observable market inputs.

Securities for which market quotations are not readily available, or when a significant event has occurred that would materially affect the value of the security, are fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those Underlying Funds.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs may be used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated

28 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

3. Securities Valuation (Continued)

with investing in those securities.

The Fund classifies each of its investments in investment companies which are publicly offered as Level 1. Investment companies that are not publicly offered, if any, are measured using net asset value and are classified as Level 2 in the fair value hierarchy. The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Level 1—

Unadjusted

Quoted Prices | | | | | | Level 2—

Other Significant

Observable Inputs | | | | | | Level 3—

Significant

Unobservable

Inputs | | | | | | Value | |

Assets Table | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments, at Value: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | $ | 471,620,108 | | | $ | | | | | 99,893,380 | | | $ | | | | | — | | | $ | | | | | 571,513,488 | |

| | | | | | | | | | |

Total Assets | | | | | | | | $ | 471,620,108 | | | $ | | | | | 99,893,380 | | | $ | | | | | — | | | $ | | | | | 571,513,488 | |

| | | | | | | | | | |

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

For the reporting period, there were no transfers between levels.

4. Investments and Risks

Risks of Investing in the Underlying Funds.The Fund invests in other mutual funds advised by the Manager. The Underlying Funds are registeredopen-end management investment companies under the 1940 Act, as amended. The Manager is the investment adviser of, and theSub-Adviser provides investment and related advisory services to, the Underlying Funds. The Fund’s Investments in Underlying Funds are included in the Statement of Investments. Shares of Underlying Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Underlying Funds’ expenses, including their management fee.

Each of the Underlying Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Underlying Fund than in another, the Fund will have greater exposure to the risks of that Underlying Fund.

Investment in Oppenheimer Institutional Government Money Market Fund.The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Government Money Market Fund (“IGMMF”) to seek current income while preserving liquidity or for defensive purposes. IGMMF is a registeredopen-end management investment company, regulated as a money market fund under the 1940 Act, as amended. The Manager is the investment adviser of IGMMF, and theSub-Adviser provides investment and related advisory services to IGMMF. When applicable, the Fund’s investment in IGMMF is included in

29 OPPENHEIMER PORTFOLIO SERIES CONSERVATIVE INVESTOR FUND

NOTES TO FINANCIAL STATEMENTSContinued

4. Investments and Risks (Continued)

the Statement of Investments. Shares of IGMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IGMMF’s Class E expenses, including its management fee.

Investment in Oppenheimer Master Funds.Certain Underlying Funds in which the Fund invests are mutual funds registered under the 1940 Act, as amended, that expect to be treated as partnerships for tax purposes, specifically Oppenheimer Master Loan Fund, LLC (“Master Loan”), Oppenheimer Master Event-Linked Bond Fund, LLC (“Master Event-Linked Bond”) and Oppenheimer Master Inflation Protected Securities Fund, LLC (“Master Inflation Protected Securities”) (the “Master Funds”). Each Master Fund has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Master Fund than in another, the Fund will have greater exposure to the risks of that Master Fund.