Q1 2022 Investor Presentation may 2022 Exhibit 99.3

Underwriting value Forecast, Implied Growth and Opportunity Portfolio and Balance Sheet Strength Rigorous underwriting platform, high-quality diversified portfolio and well capitalized balance sheet delivering strong earnings growth Underwriting Methodology, Tools and Outcomes

Underwriting Methodology, Tools & Outcomes

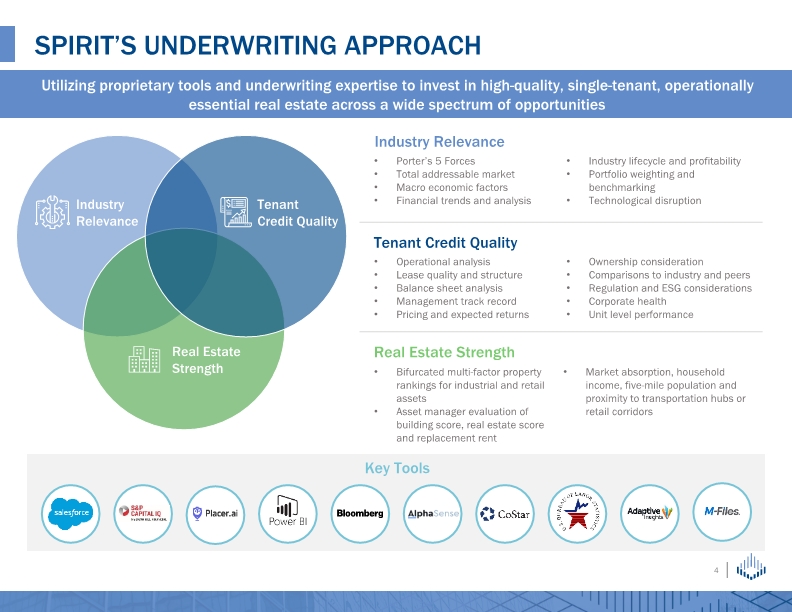

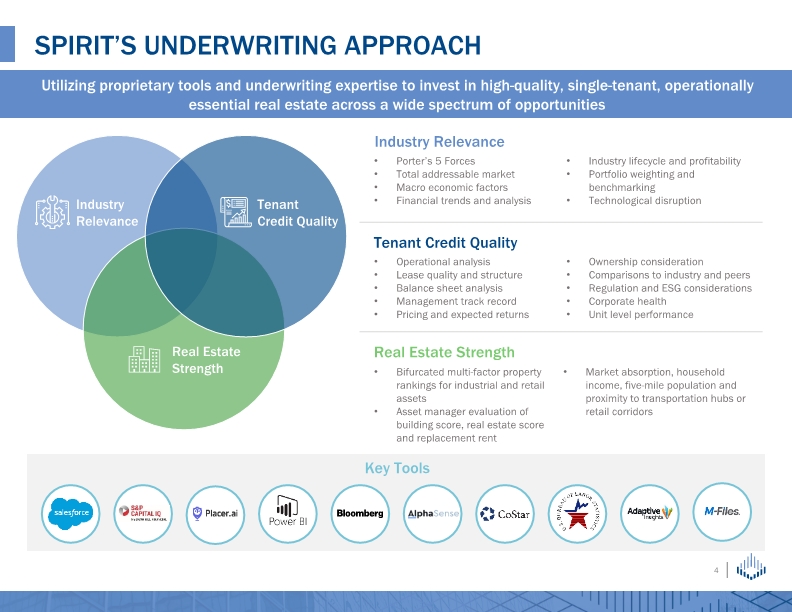

Spirit’s underwriting approach Utilizing proprietary tools and underwriting expertise to invest in high-quality, single-tenant, operationally essential real estate across a wide spectrum of opportunities Key Tools Porter’s 5 Forces Total addressable market Macro economic factors Financial trends and analysis Industry lifecycle and profitability Portfolio weighting and benchmarking Technological disruption Industry Relevance Operational analysis Lease quality and structure Balance sheet analysis Management track record Pricing and expected returns Ownership consideration Comparisons to industry and peers Regulation and ESG considerations Corporate health Unit level performance Tenant Credit Quality Bifurcated multi-factor property rankings for industrial and retail assets Asset manager evaluation of building score, real estate score and replacement rent Market absorption, household income, five-mile population and proximity to transportation hubs or retail corridors Real Estate Strength

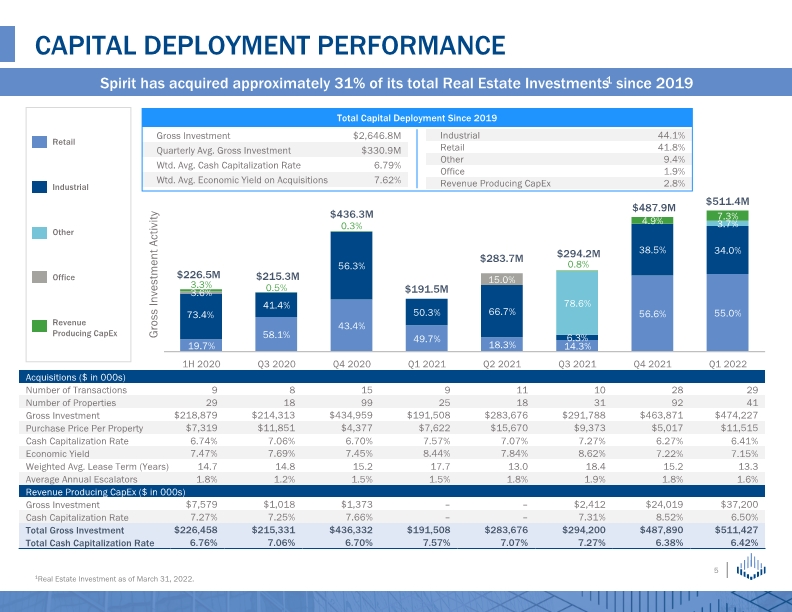

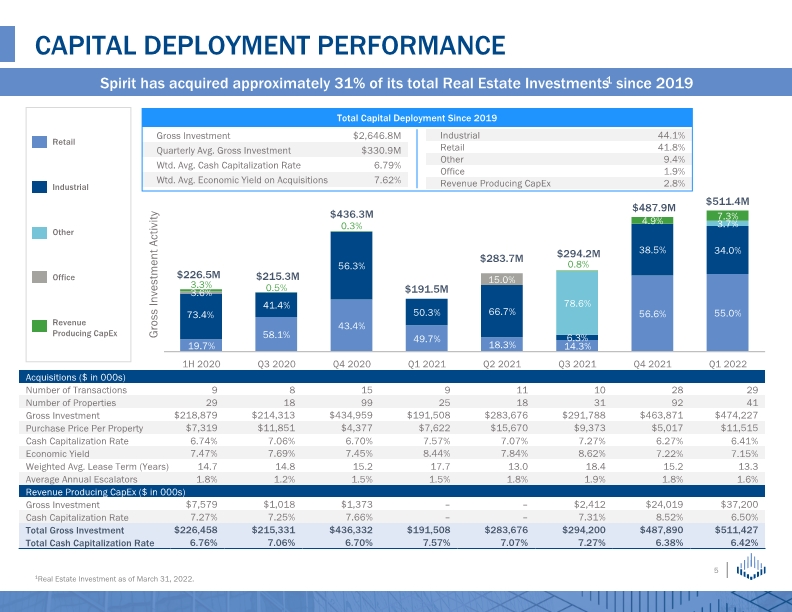

Capital deployment performance Gross Investment Activity Total Capital Deployment Since 2019 Spirit has acquired approximately 31% of its total Real Estate Investments1 since 2019 15.0% 1Real Estate Investment as of March 31, 2022. $226.5M $215.3M $436.3M $191.5M $283.7M $294.2M $487.9M $511.4M

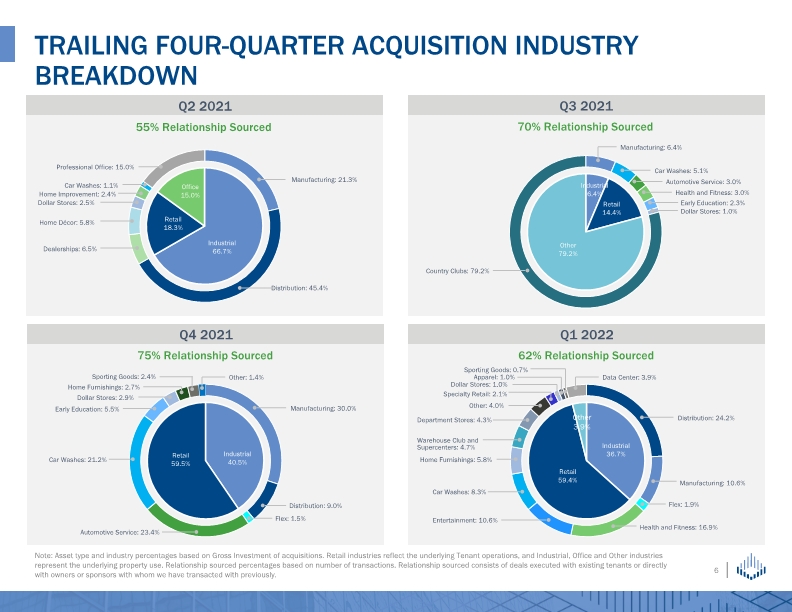

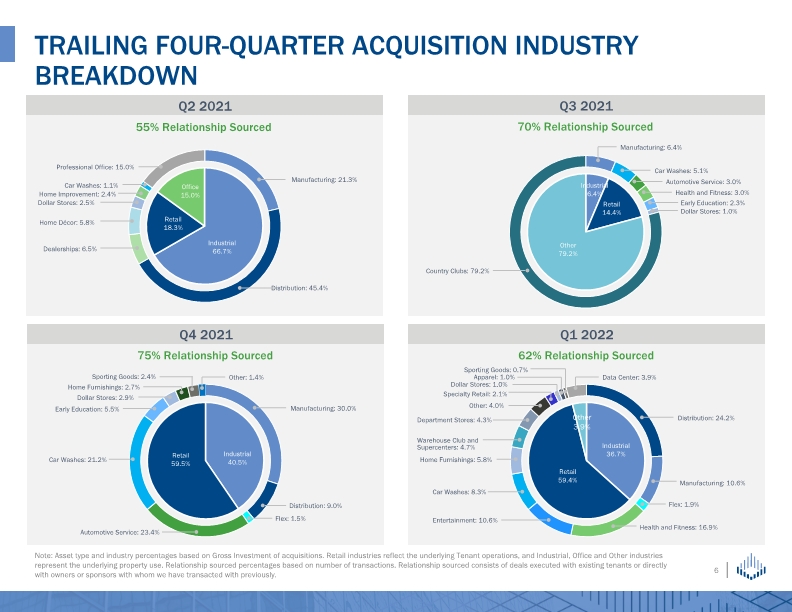

Trailing four-quarter acquisition industry breakdown Manufacturing: 21.3% Dealerships: 6.5% Home Décor: 5.8% Dollar Stores: 2.5% Home Improvement: 2.4% Car Washes: 1.1% Professional Office: 15.0% Distribution: 45.4% Manufacturing: 6.4% Car Washes: 5.1% Automotive Service: 3.0% Health and Fitness: 3.0% Early Education: 2.3% Country Clubs: 79.2% Dollar Stores: 1.0% Q2 2021 Q3 2021 Q1 2022 62% Relationship Sourced 70% Relationship Sourced 55% Relationship Sourced Manufacturing: 30.0% Distribution: 9.0% Automotive Service: 23.4% Car Washes: 21.2% Early Education: 5.5% Dollar Stores: 2.9% Home Furnishings: 2.7% Sporting Goods: 2.4% Other: 1.4% Q4 2021 Flex: 1.5% 75% Relationship Sourced Distribution: 24.2% Manufacturing: 10.6% Entertainment: 10.6% Warehouse Club and Supercenters: 4.7% Department Stores: 4.3% Specialty Retail: 2.1% Dollar Stores: 1.0% Data Center: 3.9% Flex: 1.9% Health and Fitness: 16.9% Car Washes: 8.3% Home Furnishings: 5.8% Other: 4.0% Apparel: 1.0% Sporting Goods: 0.7% Note: Asset type and industry percentages based on Gross Investment of acquisitions. Retail industries reflect the underlying Tenant operations, and Industrial, Office and Other industries represent the underlying property use. Relationship sourced percentages based on number of transactions. Relationship sourced consists of deals executed with existing tenants or directly with owners or sponsors with whom we have transacted with previously.

Forecast, Implied Growth & Opportunity

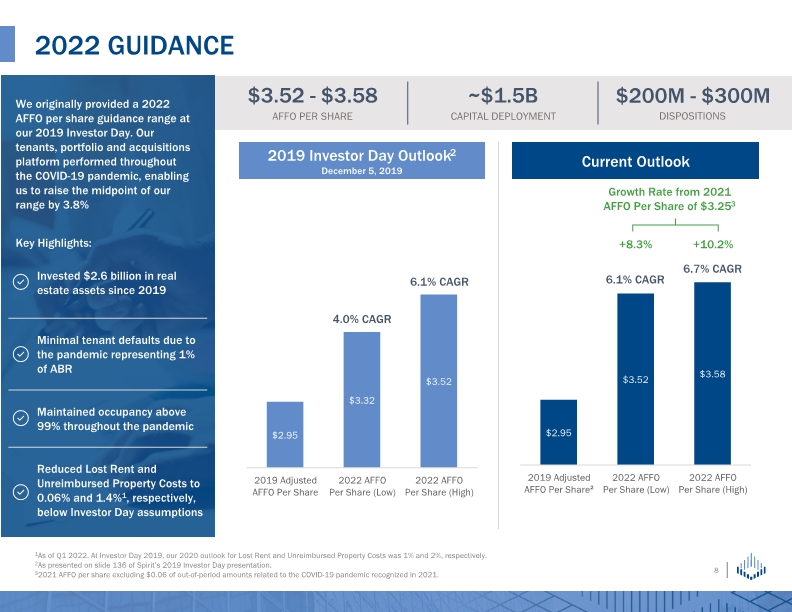

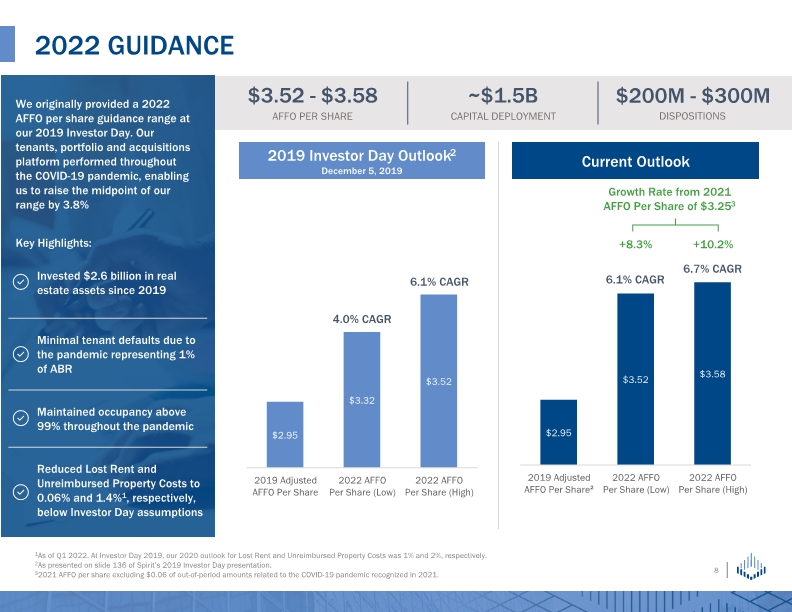

2022 guidance 1As of Q1 2022. At Investor Day 2019, our 2020 outlook for Lost Rent and Unreimbursed Property Costs was 1% and 2%, respectively. 2As presented on slide 136 of Spirit’s 2019 Investor Day presentation. 32021 AFFO per share excluding $0.06 of out-of-period amounts related to the COVID-19 pandemic recognized in 2021. 4.0% CAGR 6.1% CAGR 6.1% CAGR 6.7% CAGR 2019 Investor Day Outlook2 December 5, 2019 Current Outlook We originally provided a 2022 AFFO per share guidance range at our 2019 Investor Day. Our tenants, portfolio and acquisitions platform performed throughout the COVID-19 pandemic, enabling us to raise the midpoint of our range by 3.8% Key Highlights: +8.3% +10.2% Growth Rate from 2021 AFFO Per Share of $3.253

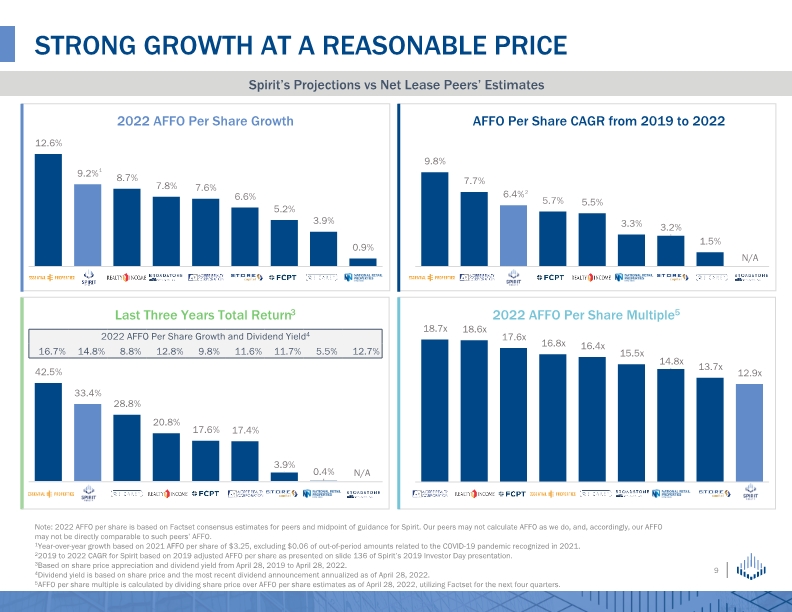

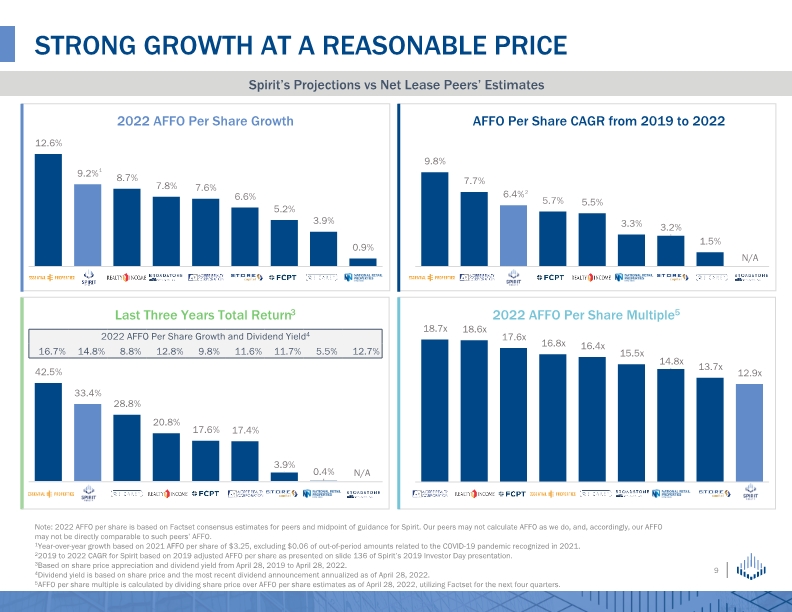

Strong growth at a reasonable price Note: 2022 AFFO per share is based on Factset consensus estimates for peers and midpoint of guidance for Spirit. Our peers may not calculate AFFO as we do, and, accordingly, our AFFO may not be directly comparable to such peers’ AFFO. 1Year-over-year growth based on 2021 AFFO per share of $3.25, excluding $0.06 of out-of-period amounts related to the COVID-19 pandemic recognized in 2021. 22019 to 2022 CAGR for Spirit based on 2019 adjusted AFFO per share as presented on slide 136 of Spirit’s 2019 Investor Day presentation. 3Based on share price appreciation and dividend yield from April 28, 2019 to April 28, 2022. 4Dividend yield is based on share price and the most recent dividend announcement annualized as of April 28, 2022. 5AFFO per share multiple is calculated by dividing share price over AFFO per share estimates as of April 28, 2022, utilizing Factset for the next four quarters. Spirit’s Projections vs Net Lease Peers’ Estimates 2022 AFFO Per Share Growth AFFO Per Share CAGR from 2019 to 2022 N/A Last Three Years Total Return3 2022 AFFO Per Share Multiple5 1 N/A 2

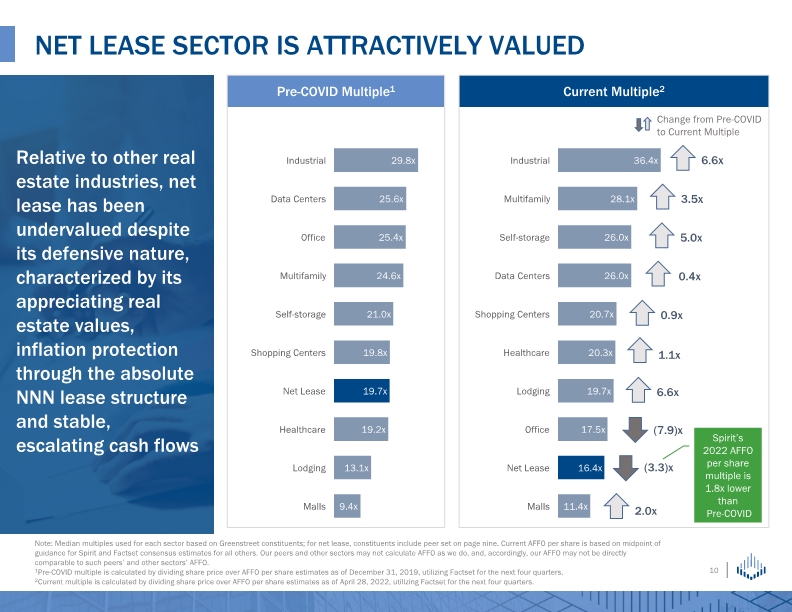

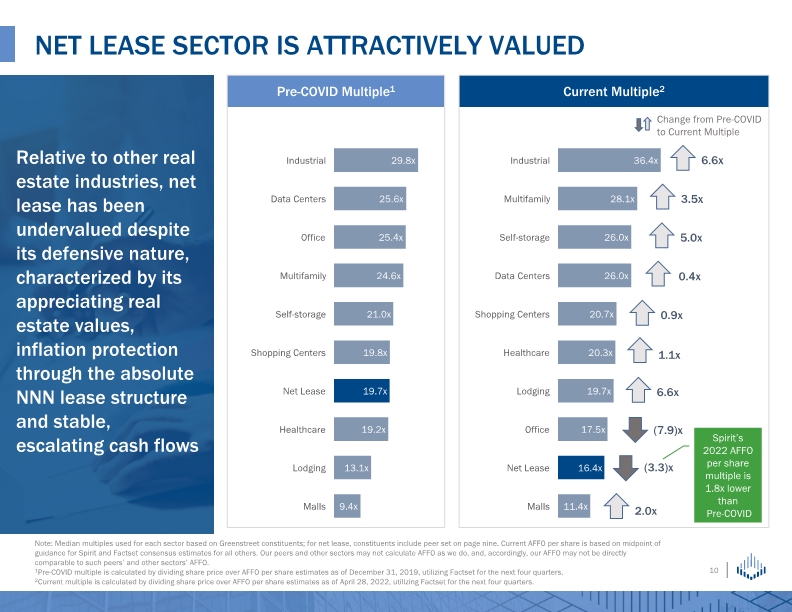

Net lease sector is attractively valued Note: Median multiples used for each sector based on Greenstreet constituents; for net lease, constituents include peer set on page nine. Current AFFO per share is based on midpoint of guidance for Spirit and Factset consensus estimates for all others. Our peers and other sectors may not calculate AFFO as we do, and, accordingly, our AFFO may not be directly comparable to such peers’ and other sectors’ AFFO. 1Pre-COVID multiple is calculated by dividing share price over AFFO per share estimates as of December 31, 2019, utilizing Factset for the next four quarters. 2Current multiple is calculated by dividing share price over AFFO per share estimates as of April 28, 2022, utilizing Factset for the next four quarters. Pre-COVID Multiple1 Current Multiple2 0.4x Relative to other real estate industries, net lease has been undervalued despite its defensive nature, characterized by its appreciating real estate values, inflation protection through the absolute NNN lease structure and stable, escalating cash flows Spirit’s 2022 AFFO per share multiple is 1.8x lower than Pre-COVID

Portfolio & Balance Sheet Strength

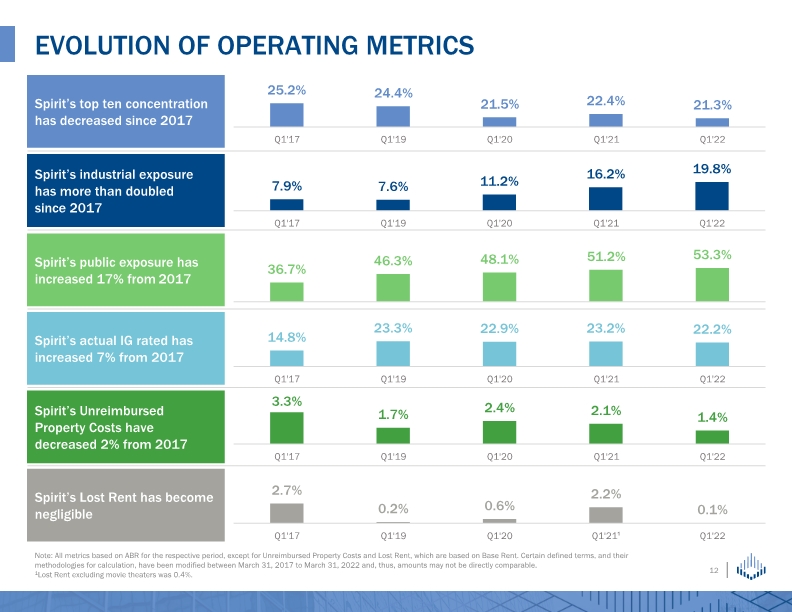

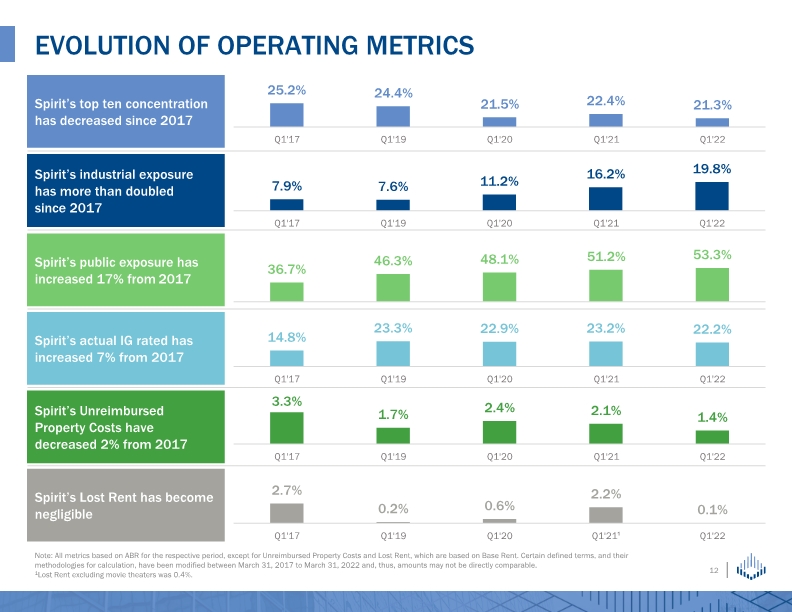

Evolution of operating metrics Note: All metrics based on ABR for the respective period, except for Unreimbursed Property Costs and Lost Rent, which are based on Base Rent. Certain defined terms, and their methodologies for calculation, have been modified between March 31, 2017 to March 31, 2022 and, thus, amounts may not be directly comparable. 1Lost Rent excluding movie theaters was 0.4%. Spirit’s industrial exposure has more than doubled since 2017 Spirit’s actual IG rated has increased 7% from 2017 Spirit’s Unreimbursed Property Costs have decreased 2% from 2017 Spirit’s Lost Rent has become negligible

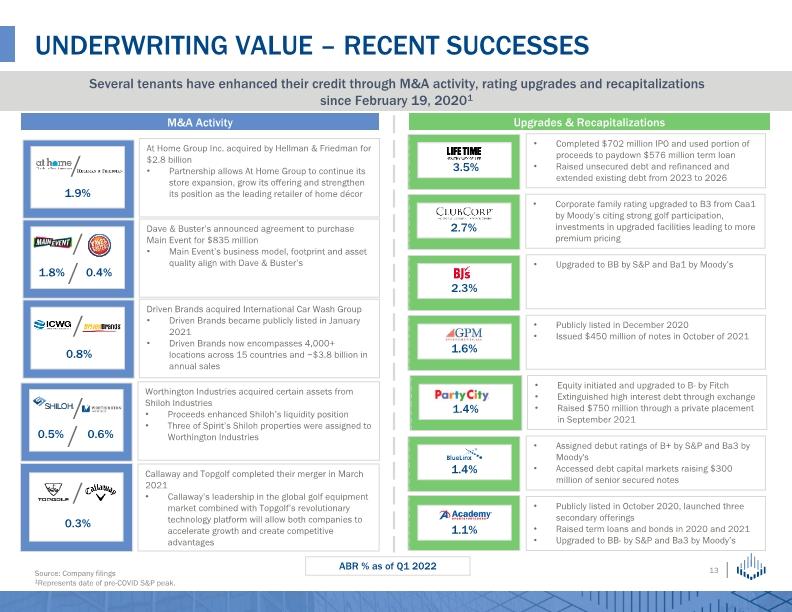

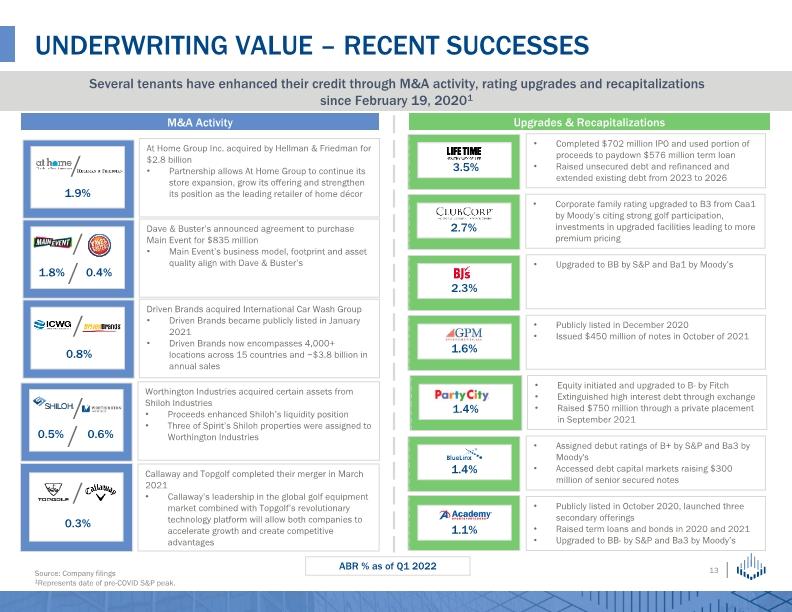

Underwriting value – recent successes Source: Company filings 1Represents date of pre-COVID S&P peak. Several tenants have enhanced their credit through M&A activity, rating upgrades and recapitalizations since February 19, 20201 M&A Activity Upgrades & Recapitalizations Driven Brands acquired International Car Wash Group Driven Brands became publicly listed in January 2021 Driven Brands now encompasses 4,000+ locations across 15 countries and ~$3.8 billion in annual sales 0.5% Worthington Industries acquired certain assets from Shiloh Industries Proceeds enhanced Shiloh’s liquidity position Three of Spirit’s Shiloh properties were assigned to Worthington Industries Callaway and Topgolf completed their merger in March 2021 Callaway’s leadership in the global golf equipment market combined with Topgolf’s revolutionary technology platform will allow both companies to accelerate growth and create competitive advantages Completed $702 million IPO and used portion of proceeds to paydown $576 million term loan Raised unsecured debt and refinanced and extended existing debt from 2023 to 2026 Publicly listed in October 2020, launched three secondary offerings Raised term loans and bonds in 2020 and 2021 Upgraded to BB- by S&P and Ba3 by Moody’s Assigned debut ratings of B+ by S&P and Ba3 by Moody's Accessed debt capital markets raising $300 million of senior secured notes Publicly listed in December 2020 Issued $450 million of notes in October of 2021 / / / Upgraded to BB by S&P and Ba1 by Moody’s Corporate family rating upgraded to B3 from Caa1 by Moody’s citing strong golf participation, investments in upgraded facilities leading to more premium pricing Equity initiated and upgraded to B- by Fitch Extinguished high interest debt through exchange Raised $750 million through a private placement in September 2021 / 0.6%

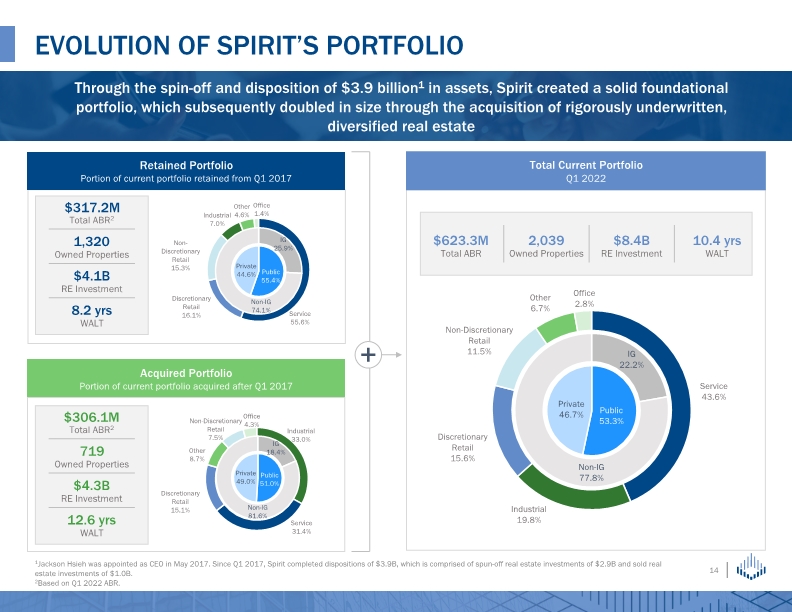

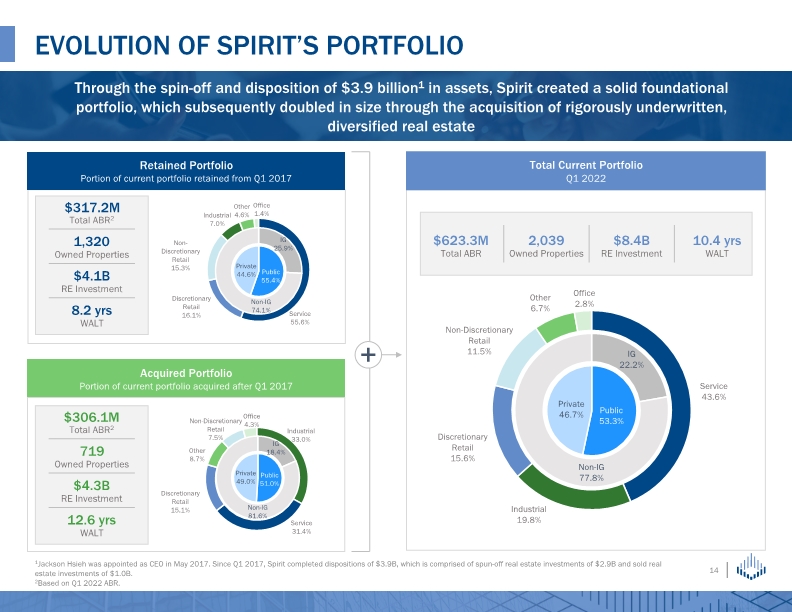

Evolution of spirit’s portfolio 1Jackson Hsieh was appointed as CEO in May 2017. Since Q1 2017, Spirit completed dispositions of $3.9B, which is comprised of spun-off real estate investments of $2.9B and sold real estate investments of $1.0B. 2Based on Q1 2022 ABR. $8.4B RE Investment 10.4 yrs WALT $623.3M Total ABR 2,039 Owned Properties Retained Portfolio Portion of current portfolio retained from Q1 2017 Acquired Portfolio Portion of current portfolio acquired after Q1 2017 Total Current Portfolio Q1 2022

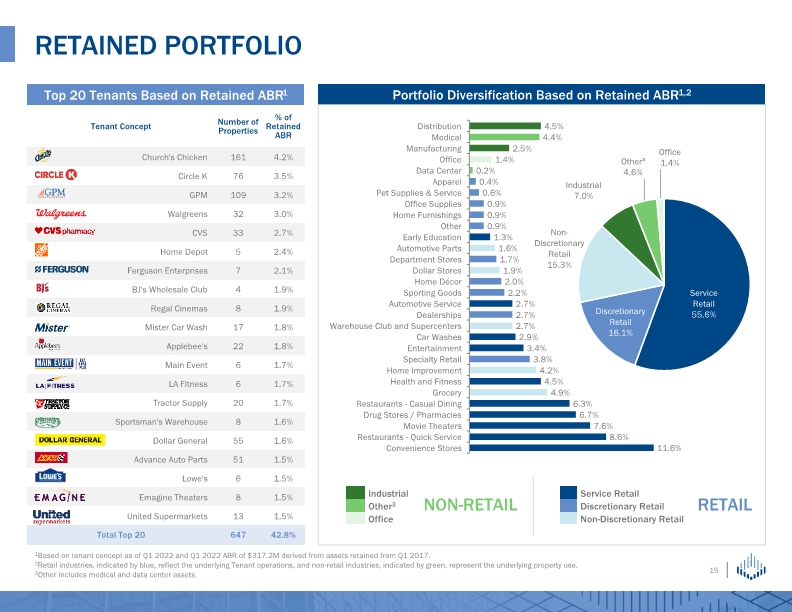

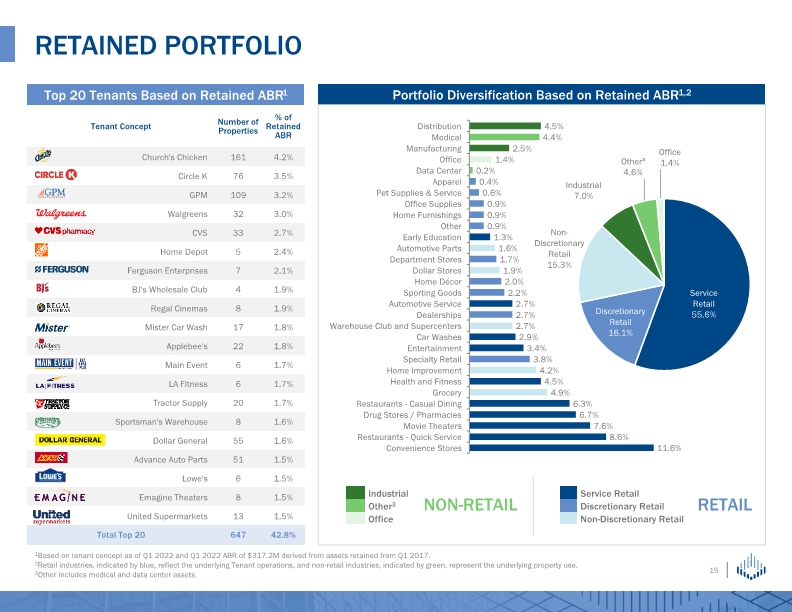

Retained portfolio Top 20 Tenants Based on Retained ABR1 Portfolio Diversification Based on Retained ABR1,2 1Based on tenant concept as of Q1 2022 and Q1 2022 ABR of $317.2M derived from assets retained from Q1 2017. 2Retail industries, indicated by blue, reflect the underlying Tenant operations, and non-retail industries, indicated by green, represent the underlying property use. 3Other includes medical and data center assets. NON-RETAIL RETAIL

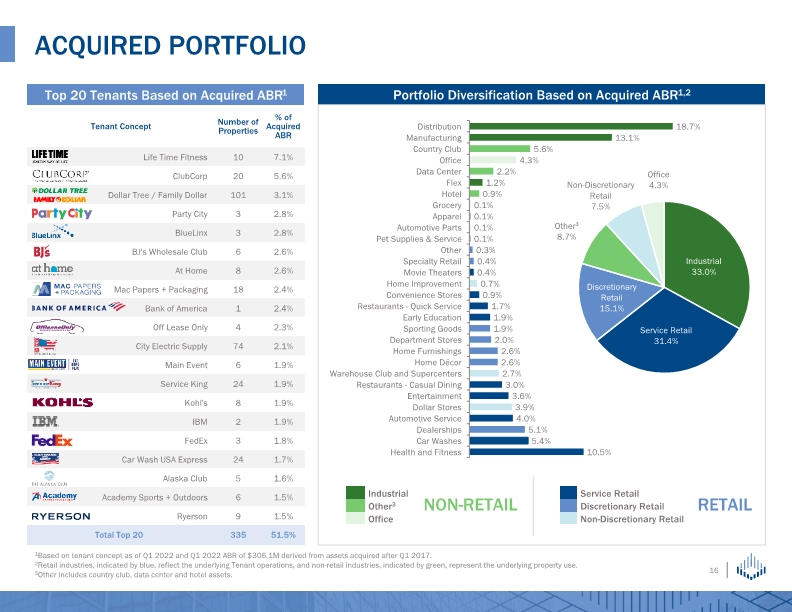

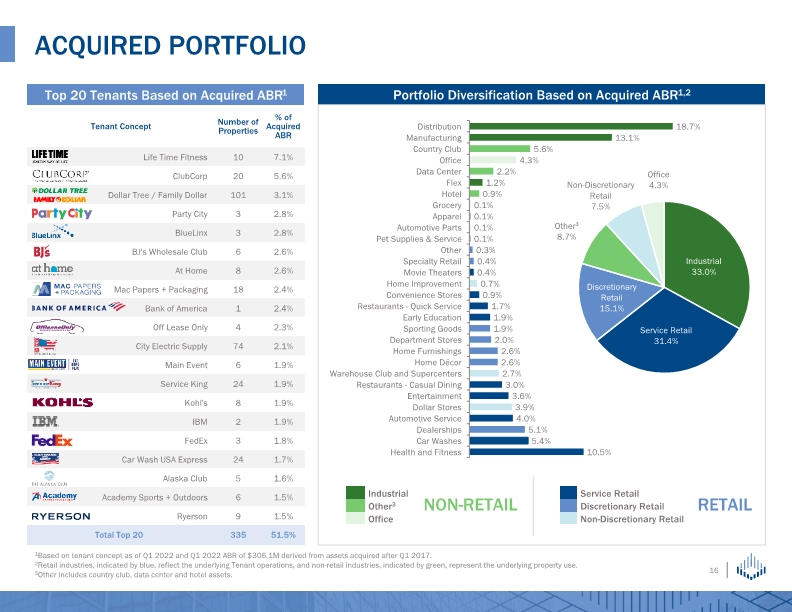

1Based on tenant concept as of Q1 2022 and Q1 2022 ABR of $306.1M derived from assets acquired after Q1 2017. 2Retail industries, indicated by blue, reflect the underlying Tenant operations, and non-retail industries, indicated by green, represent the underlying property use. 3Other includes country club, data center and hotel assets. Top 20 Tenants Based on Acquired ABR1 Portfolio Diversification Based on Acquired ABR1,2 Acquired portfolio NON-RETAIL RETAIL

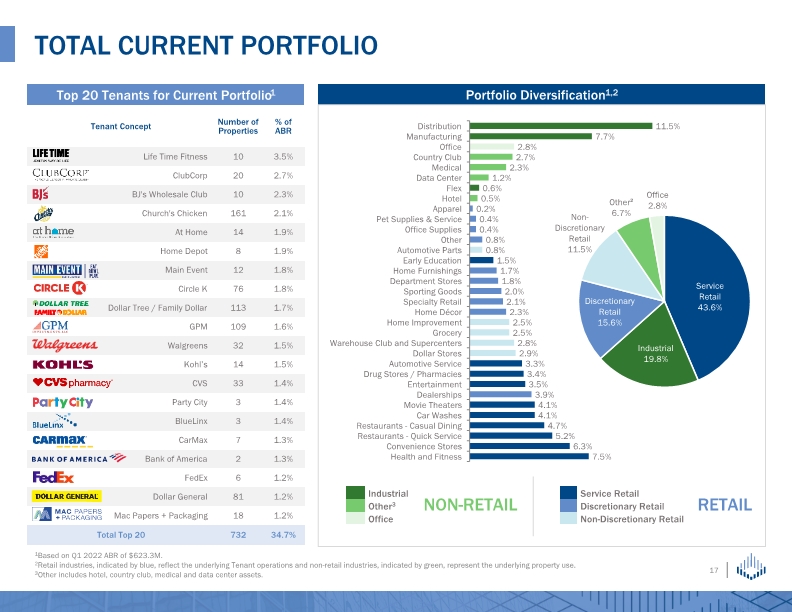

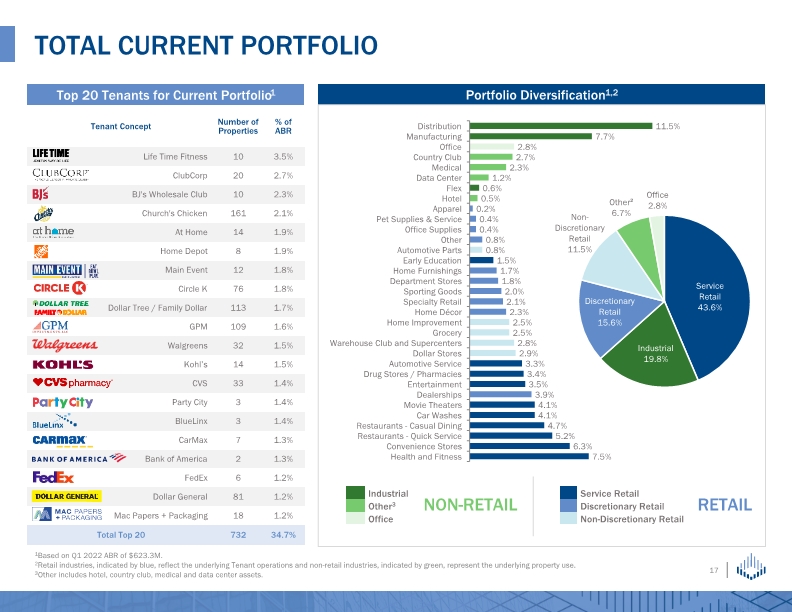

Total Current Portfolio 1Based on Q1 2022 ABR of $623.3M. 2Retail industries, indicated by blue, reflect the underlying Tenant operations and non-retail industries, indicated by green, represent the underlying property use. 3Other includes hotel, country club, medical and data center assets. Portfolio Diversification1,2 NON-RETAIL RETAIL Top 20 Tenants for Current Portfolio1

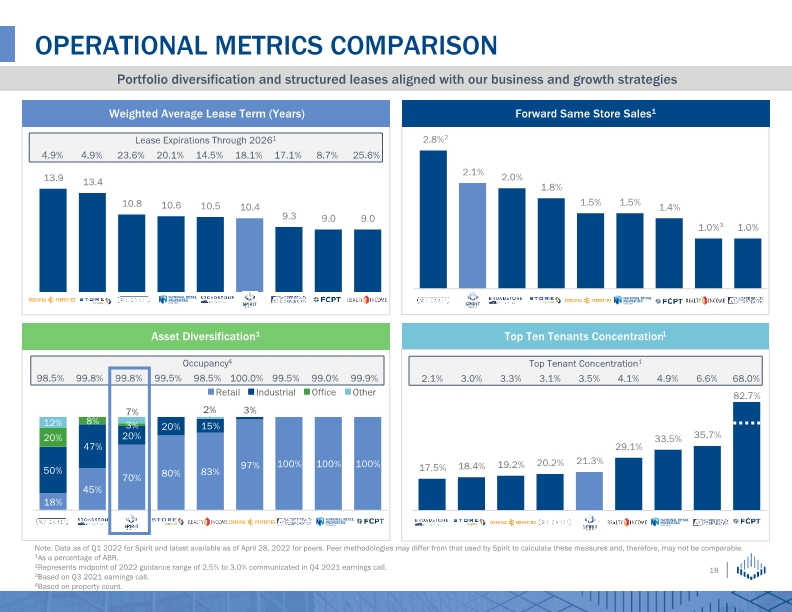

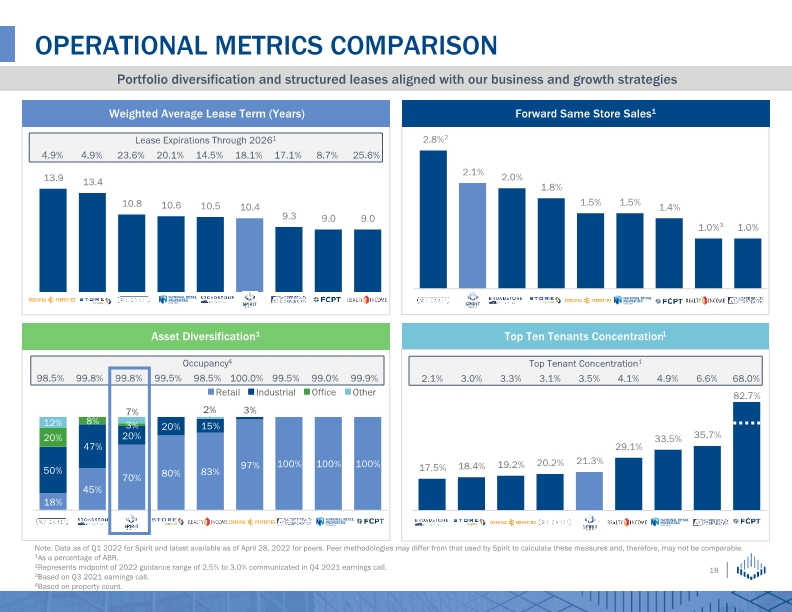

Operational Metrics Comparison Note: Data as of Q1 2022 for Spirit and latest available as of April 28, 2022 for peers. Peer methodologies may differ from that used by Spirit to calculate these measures and, therefore, may not be comparable. 1As a percentage of ABR. 2Represents midpoint of 2022 guidance range of 2.5% to 3.0% communicated in Q4 2021 earnings call. 3Based on Q3 2021 earnings call. 4Based on property count. 82.7% Portfolio diversification and structured leases aligned with our business and growth strategies Weighted Average Lease Term (Years) Asset Diversification1 Forward Same Store Sales1 Top Ten Tenants Concentration1 2 3

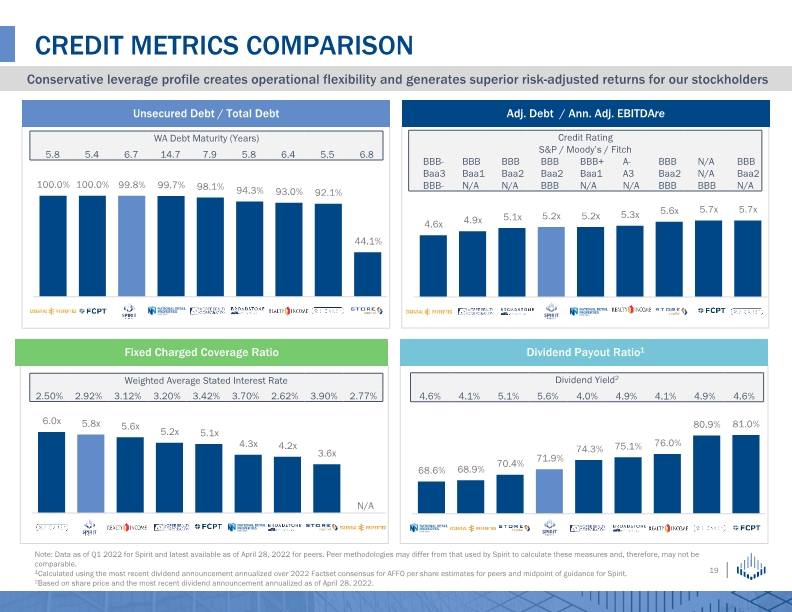

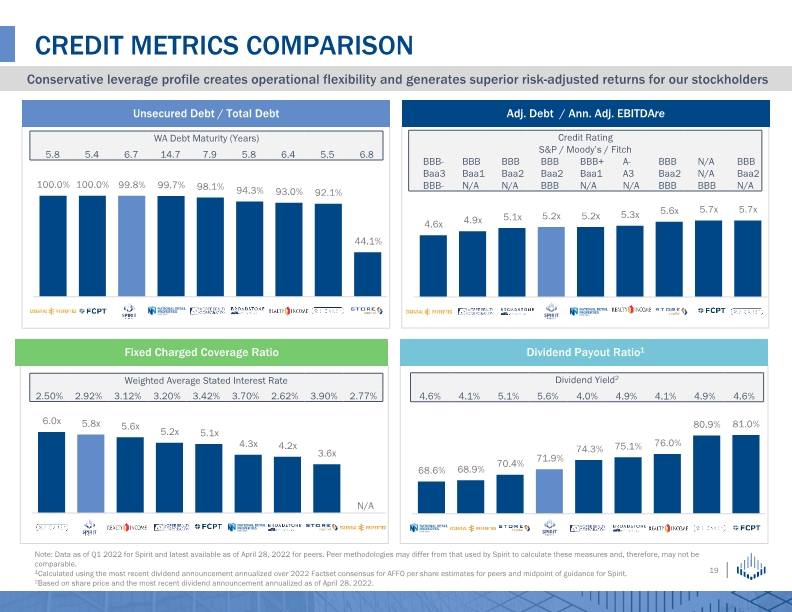

Credit metrics comparison Note: Data as of Q1 2022 for Spirit and latest available as of April 28, 2022 for peers. Peer methodologies may differ from that used by Spirit to calculate these measures and, therefore, may not be comparable. 1Calculated using the most recent dividend announcement annualized over 2022 Factset consensus for AFFO per share estimates for peers and midpoint of guidance for Spirit. 2Based on share price and the most recent dividend announcement annualized as of April 28, 2022. Conservative leverage profile creates operational flexibility and generates superior risk-adjusted returns for our stockholders Unsecured Debt / Total Debt Fixed Charged Coverage Ratio Adj. Debt / Ann. Adj. EBITDAre N/A Dividend Payout Ratio1

Q1 Earnings Highlights

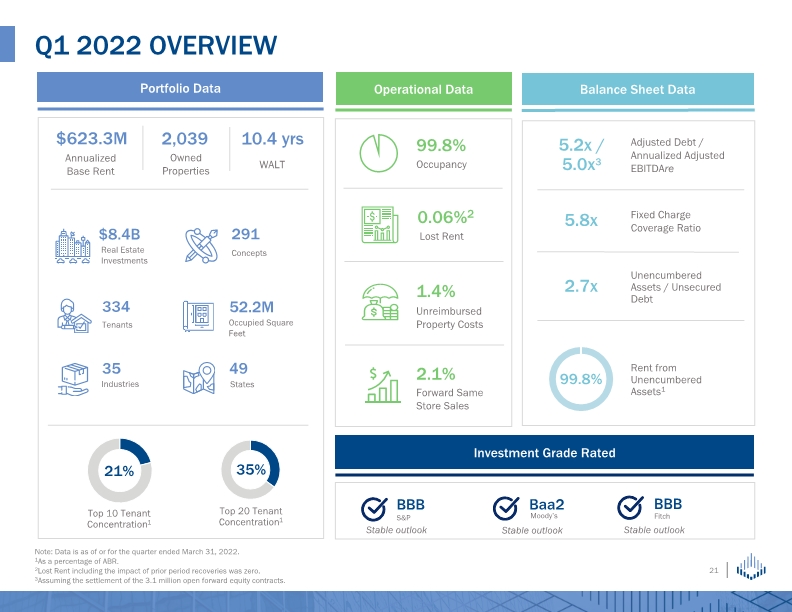

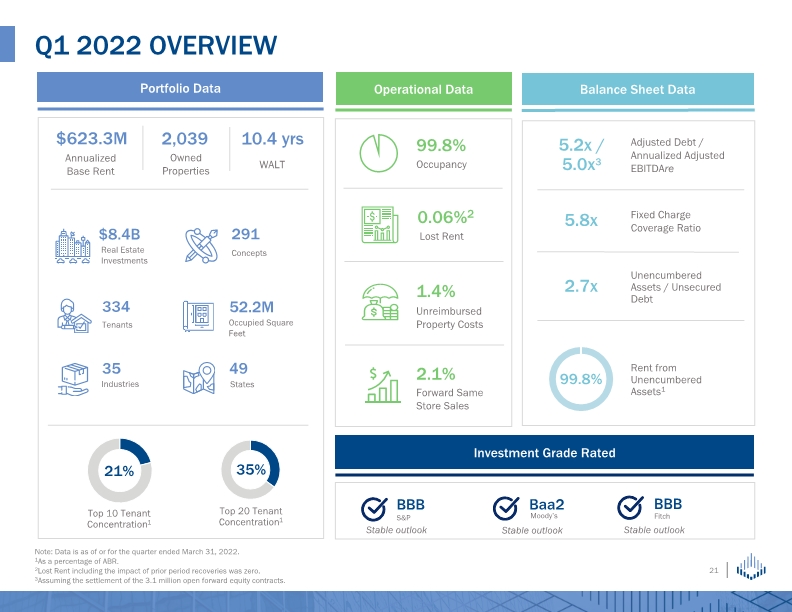

Q1 2022 Overview Portfolio Data Operational Data Balance Sheet Data $623.3M 35% Top 10 Tenant Concentration1 21% Investment Grade Rated Baa2 Moody’s Annualized Base Rent Top 20 Tenant Concentration1 5.2x / 5.0x3 Adjusted Debt / Annualized Adjusted EBITDAre 5.8x Fixed Charge Coverage Ratio Concepts 291 10.4 yrs WALT 99.8% Rent from Unencumbered Assets1 Unencumbered Assets / Unsecured Debt 2.7x Note: Data is as of or for the quarter ended March 31, 2022. 1As a percentage of ABR. 2Lost Rent including the impact of prior period recoveries was zero. 3Assuming the settlement of the 3.1 million open forward equity contracts. 2.1% Forward Same Store Sales 99.8% Occupancy 1.4% Unreimbursed Property Costs 0.06%2 Lost Rent Stable outlook Stable outlook Stable outlook

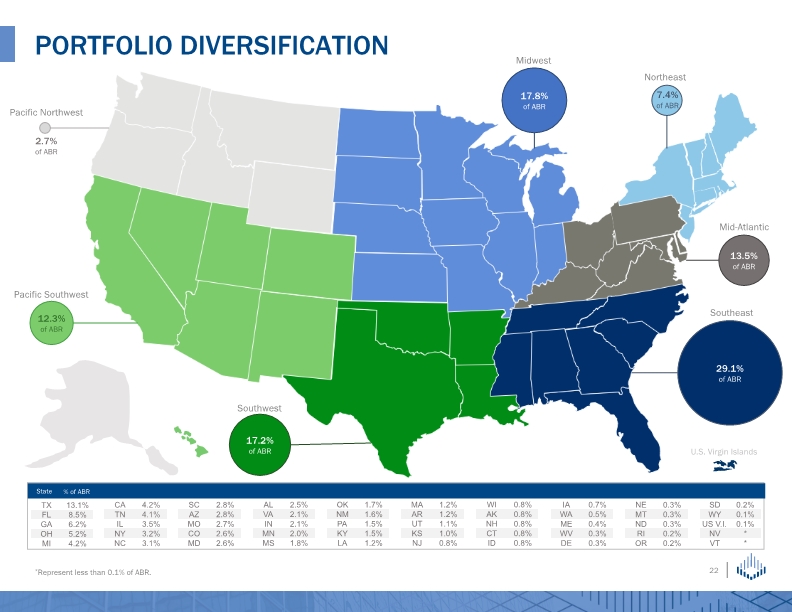

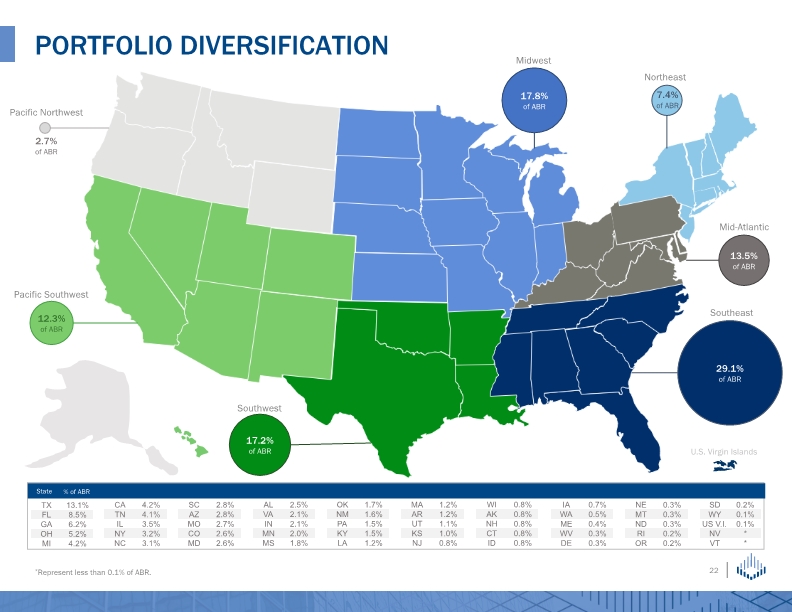

29.1% of ABR PORTFOLIO DIVERSIFICATION *Represent less than 0.1% of ABR. % of ABR State Southeast Mid-Atlantic Pacific Southwest Pacific Northwest Southwest Midwest Northeast 17.8% of ABR 13.5% of ABR 12.3% of ABR 17.2% of ABR U.S. Virgin Islands 2.7% of ABR 7.4% of ABR

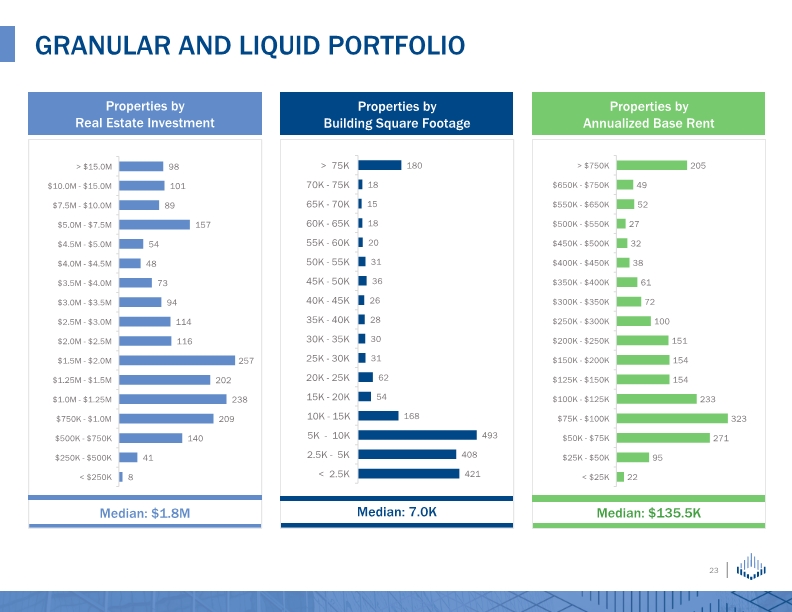

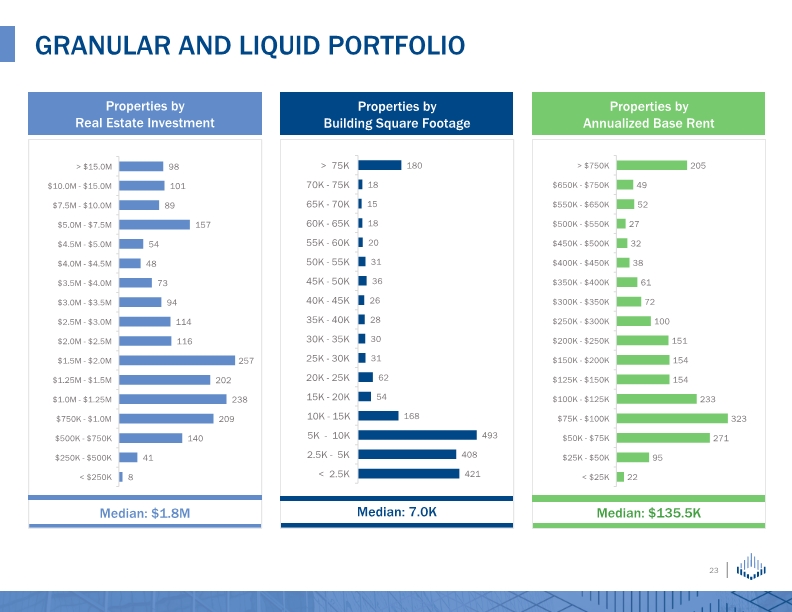

Granular and Liquid Portfolio

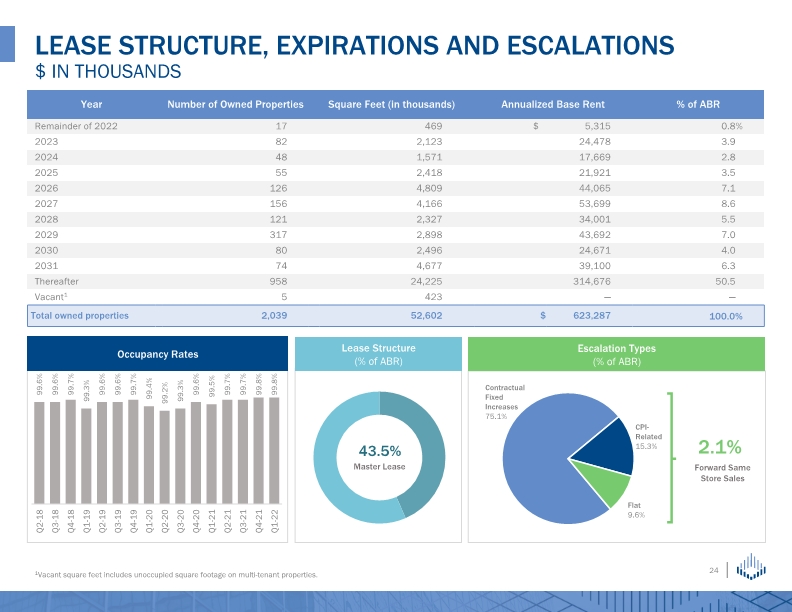

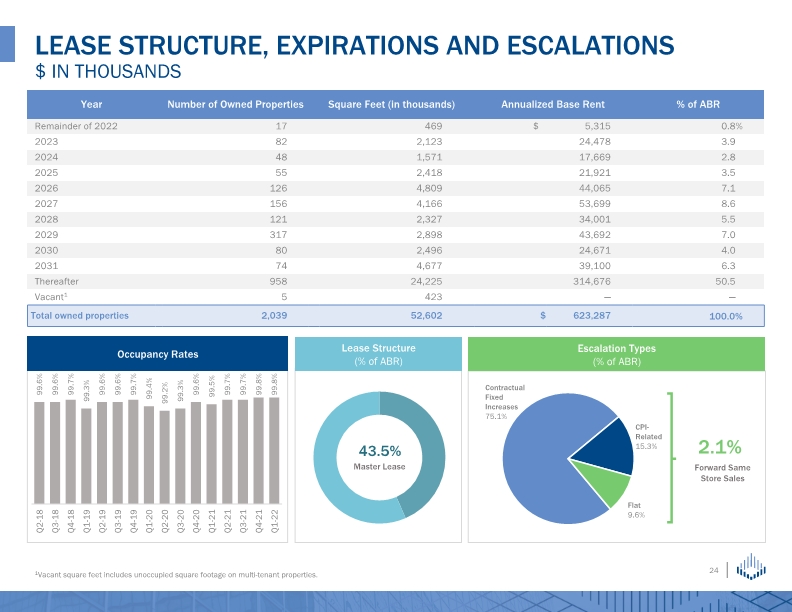

LEASE STRUCTURE, EXPIRATIONS AND ESCALATIONS $ in thousands 2.1% Forward Same Store Sales Occupancy Rates Lease Structure (% of ABR) 43.5% Master Lease Escalation Types (% of ABR) 1Vacant square feet includes unoccupied square footage on multi-tenant properties.

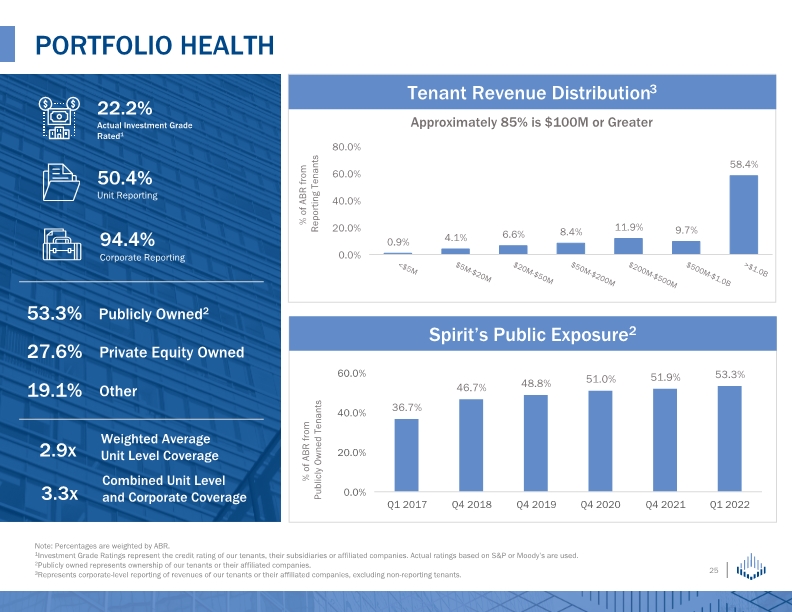

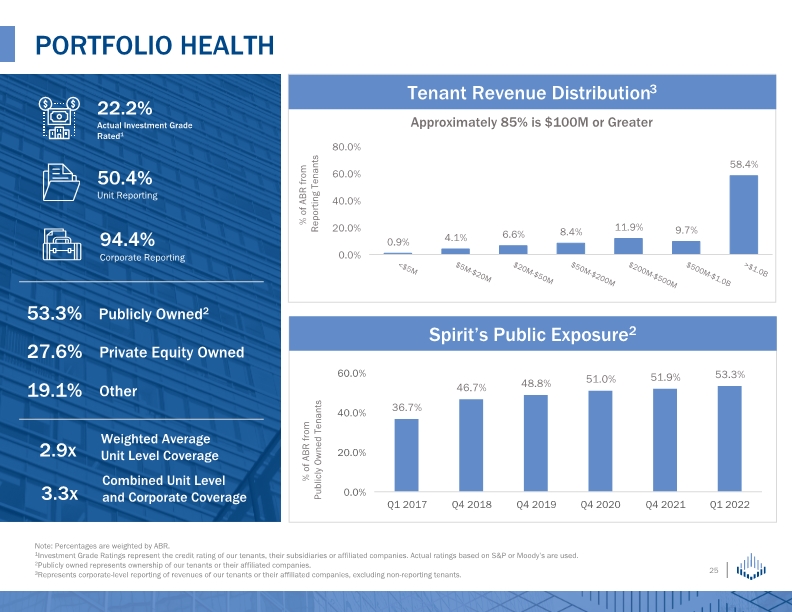

Portfolio Health % of ABR from Reporting Tenants Note: Percentages are weighted by ABR. 1Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies. Actual ratings based on S&P or Moody’s are used. 2Publicly owned represents ownership of our tenants or their affiliated companies. 3Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants. Tenant Revenue Distribution3 Approximately 85% is $100M or Greater Spirit’s Public Exposure2 % of ABR from Publicly Owned Tenants

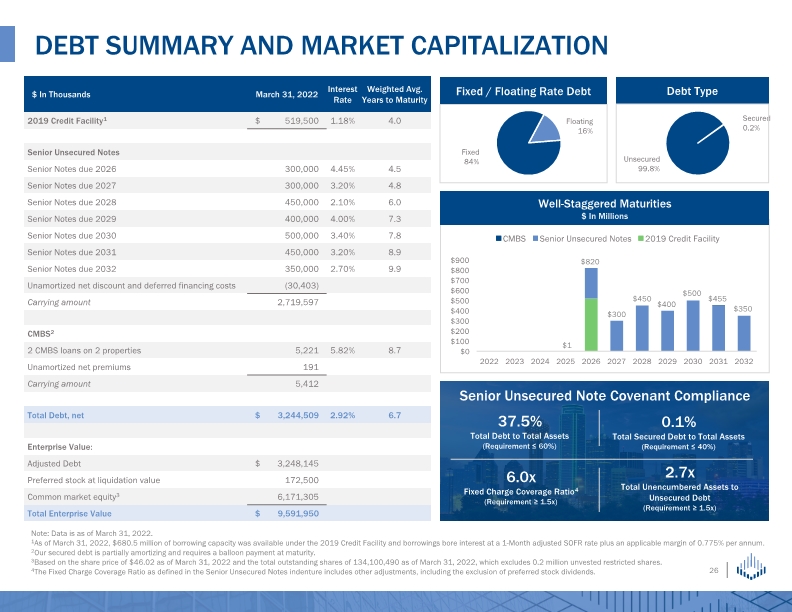

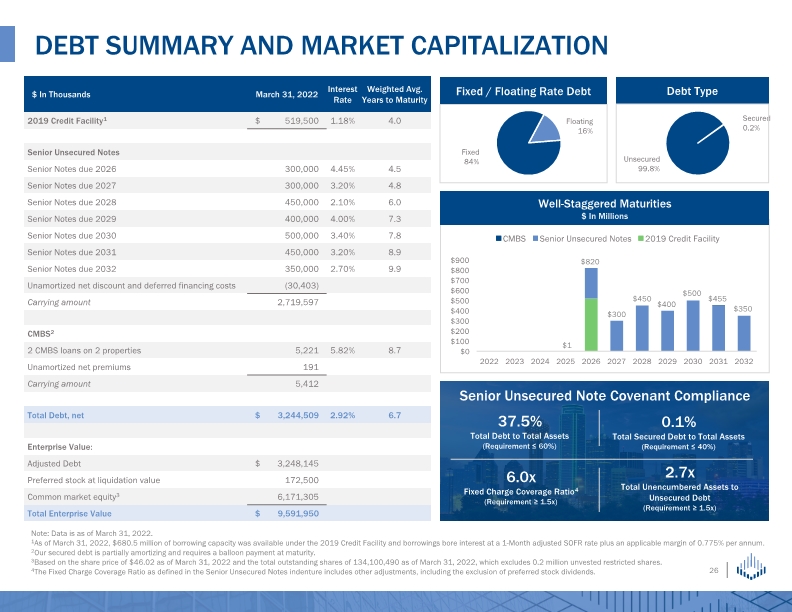

Debt Summary and Market Capitalization Note: Data is as of March 31, 2022. 1As of March 31, 2022, $680.5 million of borrowing capacity was available under the 2019 Credit Facility and borrowings bore interest at a 1-Month adjusted SOFR rate plus an applicable margin of 0.775% per annum. 2Our secured debt is partially amortizing and requires a balloon payment at maturity. 3Based on the share price of $46.02 as of March 31, 2022 and the total outstanding shares of 134,100,490 as of March 31, 2022, which excludes 0.2 million unvested restricted shares. 4The Fixed Charge Coverage Ratio as defined in the Senior Unsecured Notes indenture includes other adjustments, including the exclusion of preferred stock dividends. Debt Type Fixed / Floating Rate Debt 37.5% Total Debt to Total Assets (Requirement ≤ 60%) Senior Unsecured Note Covenant Compliance 0.1% Total Secured Debt to Total Assets (Requirement ≤ 40%) 6.0x Fixed Charge Coverage Ratio4 (Requirement ≥ 1.5x) 2.7x Total Unencumbered Assets to Unsecured Debt (Requirement ≥ 1.5x) Well-Staggered Maturities $ In Millions

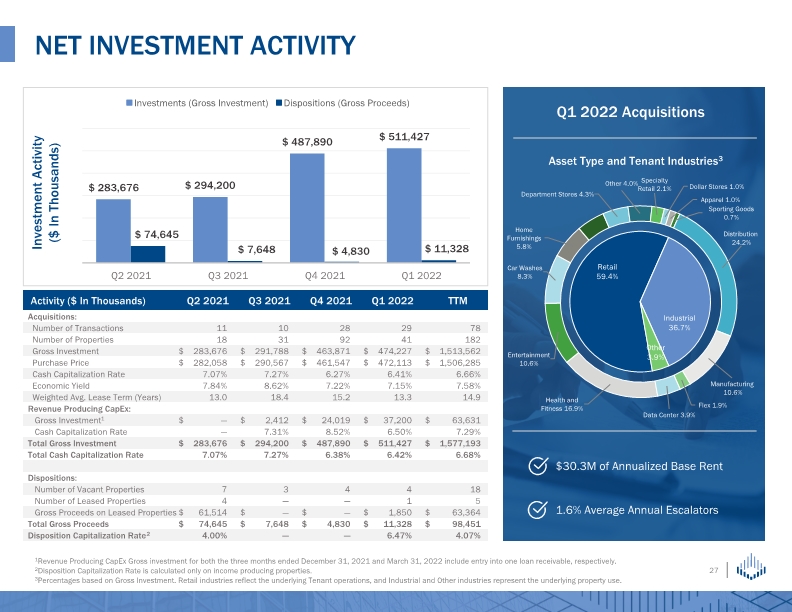

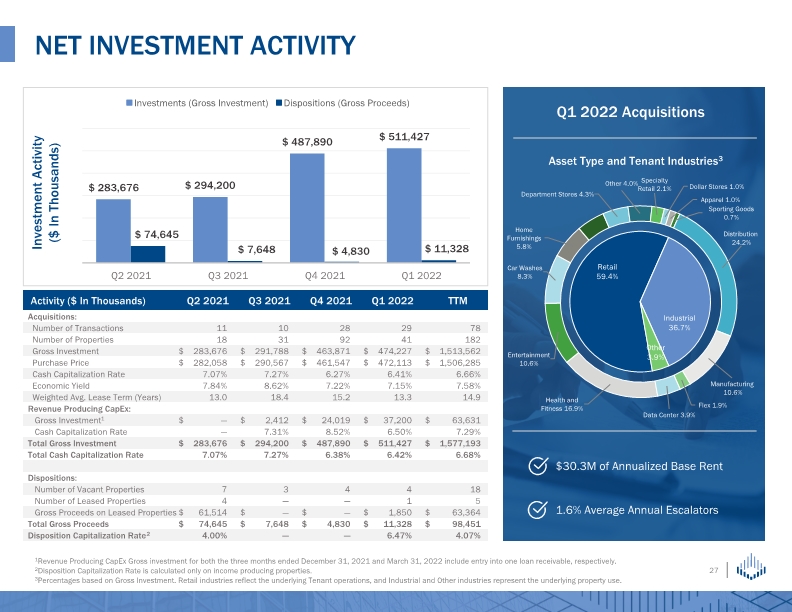

NET INVESTMENT ACTIVITY Asset Type and Tenant Industries3 1Revenue Producing CapEx Gross investment for both the three months ended December 31, 2021 and March 31, 2022 include entry into one loan receivable, respectively. 2Disposition Capitalization Rate is calculated only on income producing properties. 3Percentages based on Gross Investment. Retail industries reflect the underlying Tenant operations, and Industrial and Other industries represent the underlying property use.

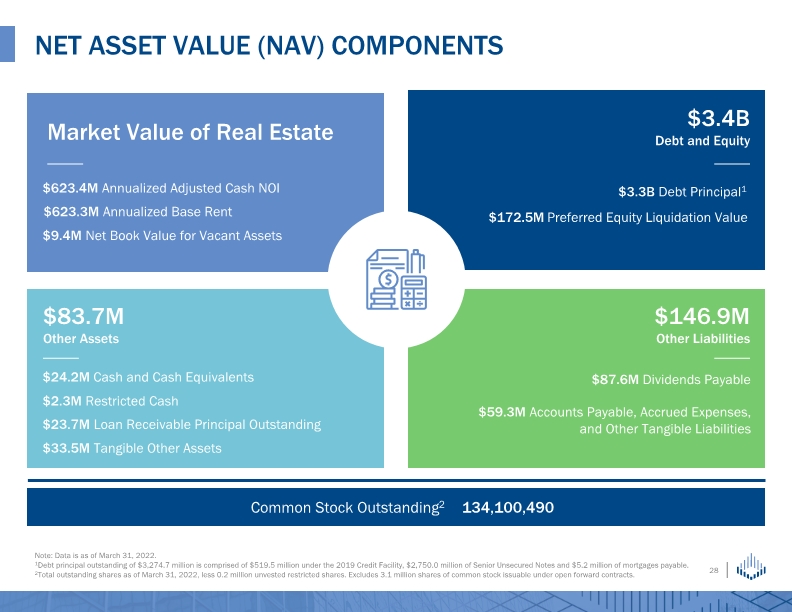

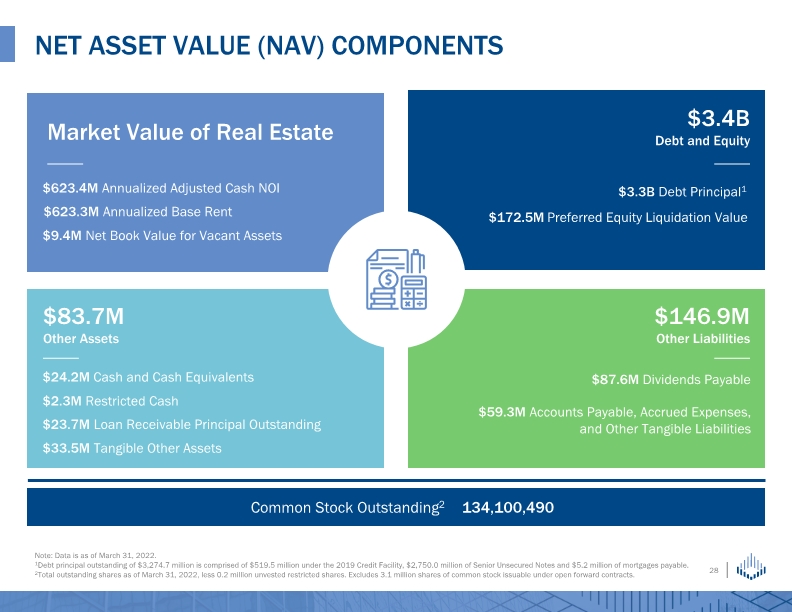

Net Asset Value (NAV) Components Market Value of Real Estate $3.4B Debt and Equity $83.7M Other Assets $146.9M Other Liabilities $623.3M Annualized Base Rent $9.4M Net Book Value for Vacant Assets $3.3B Debt Principal1 $172.5M Preferred Equity Liquidation Value $24.2M Cash and Cash Equivalents $33.5M Tangible Other Assets $87.6M Dividends Payable $59.3M Accounts Payable, Accrued Expenses, and Other Tangible Liabilities $623.4M Annualized Adjusted Cash NOI Note: Data is as of March 31, 2022. 1Debt principal outstanding of $3,274.7 million is comprised of $519.5 million under the 2019 Credit Facility, $2,750.0 million of Senior Unsecured Notes and $5.2 million of mortgages payable. 2Total outstanding shares as of March 31, 2022, less 0.2 million unvested restricted shares. Excludes 3.1 million shares of common stock issuable under open forward contracts. $23.7M Loan Receivable Principal Outstanding $2.3M Restricted Cash

Commitment to Environmental, Social & Governance

Announced intent to publish first ESG Report aligned with SASB and TCFD Frameworks (Published March 21, 2022) Key esg successes in 2021 Overall Updates Formed an internal Task Force and hired a third-party ESG consultant, HXE Partners, to assist with ESG initiatives Developed a multi-year road-map to define ESG priorities and execute initiatives Conducted an in-depth internal gap analysis to understand ESG opportunities

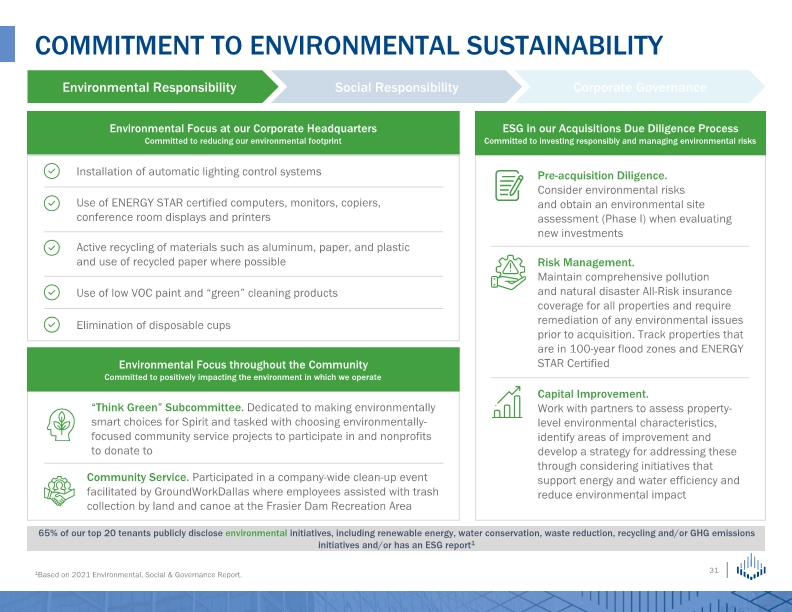

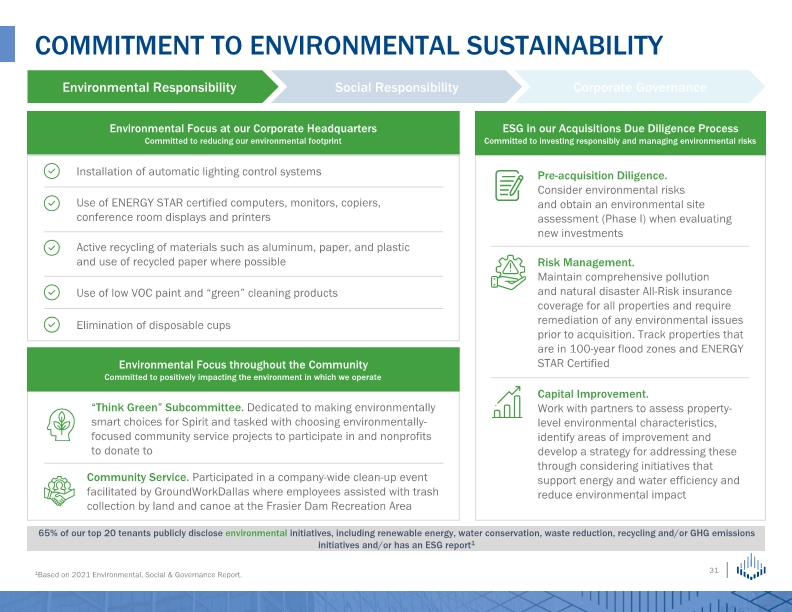

Commitment to Environmental Sustainability Environmental Responsibility Social Responsibility Corporate Governance Environmental Focus throughout the Community Committed to positively impacting the environment in which we operate Environmental Focus at our Corporate Headquarters Committed to reducing our environmental footprint “Think Green” Subcommittee. Dedicated to making environmentally smart choices for Spirit and tasked with choosing environmentally-focused community service projects to participate in and nonprofits to donate to Community Service. Participated in a company-wide clean-up event facilitated by GroundWorkDallas where employees assisted with trash collection by land and canoe at the Frasier Dam Recreation Area ESG in our Acquisitions Due Diligence Process Committed to investing responsibly and managing environmental risks Capital Improvement. Work with partners to assess property-level environmental characteristics, identify areas of improvement and develop a strategy for addressing these through considering initiatives that support energy and water efficiency and reduce environmental impact Risk Management. Maintain comprehensive pollution and natural disaster All-Risk insurance coverage for all properties and require remediation of any environmental issues prior to acquisition. Track properties that are in 100-year flood zones and ENERGY STAR Certified Pre-acquisition Diligence. Consider environmental risks and obtain an environmental site assessment (Phase I) when evaluating new investments 65% of our top 20 tenants publicly disclose environmental initiatives, including renewable energy, water conservation, waste reduction, recycling and/or GHG emissions initiatives and/or has an ESG report1 1Based on 2021 Environmental, Social & Governance Report.

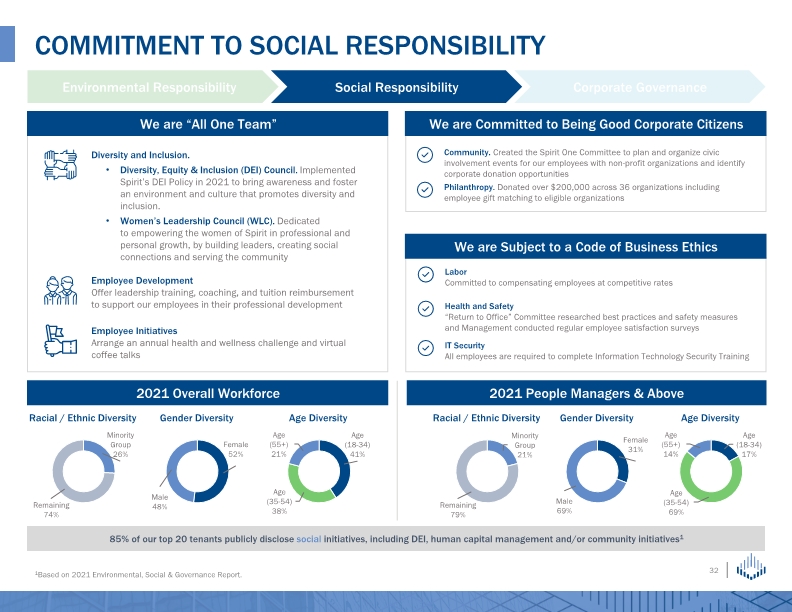

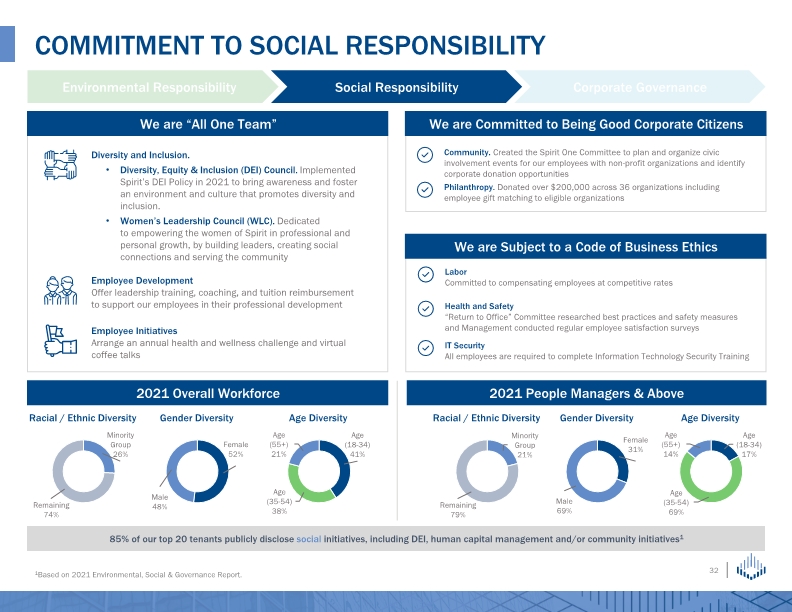

Commitment to social responsibility Racial / Ethnic Diversity Racial / Ethnic Diversity Gender Diversity Gender Diversity Age Diversity Age Diversity We are “All One Team” 2021 Overall Workforce 2021 People Managers & Above We are Committed to Being Good Corporate Citizens Environmental Responsibility Social Responsibility Corporate Governance Diversity and Inclusion. Diversity, Equity & Inclusion (DEI) Council. Implemented Spirit’s DEI Policy in 2021 to bring awareness and foster an environment and culture that promotes diversity and inclusion. Women’s Leadership Council (WLC). Dedicated to empowering the women of Spirit in professional and personal growth, by building leaders, creating social connections and serving the community We are Subject to a Code of Business Ethics 85% of our top 20 tenants publicly disclose social initiatives, including DEI, human capital management and/or community initiatives1 1Based on 2021 Environmental, Social & Governance Report.

Commitment to strong governance practice Environmental Responsibility Social Responsibility Corporate Governance Our Board maintains a diversity of perspectives that support the oversight of the Company’s ongoing strategic objectives Leading board practices 9 of 10 are independent Committee chair rotation Opted out of MUTA 40% are women Independent Chairman of the Board 50% shareholder threshold to amend bylaws Majority voting standard No poison pill Third party annual board evaluations Minimum stock ownership requirements Conduct annual CEO performance reviews Clawback policy All committees are independent Anti-hedging/pledging policy Annual elections for all directors Plurality voting standard in contested elections 70% of our top 20 tenants publicly disclose governance initiatives, including board oversight and/or responsible company policies1 1Based on 2021 Environmental, Social & Governance Report.

Financial Presentation and Non-GAAP Reconciliations

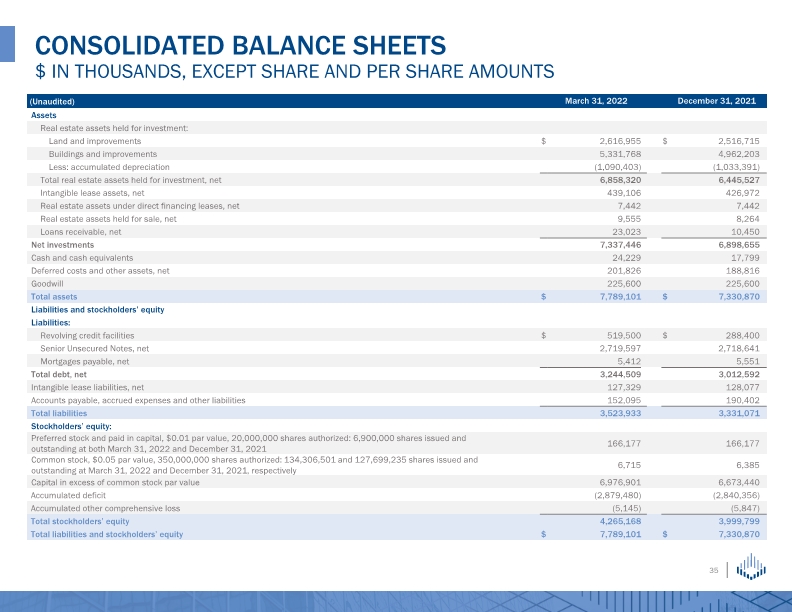

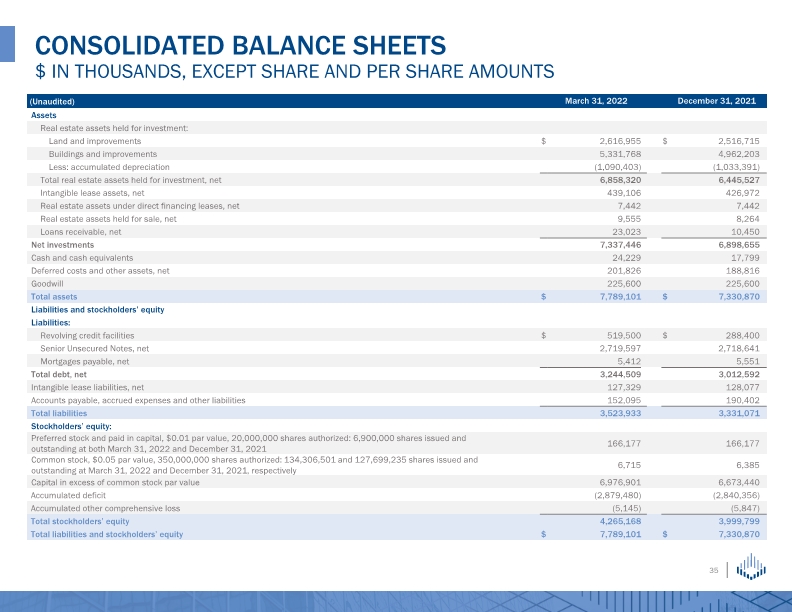

CONSOLIDATED BALANCE SHEETS $ IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS

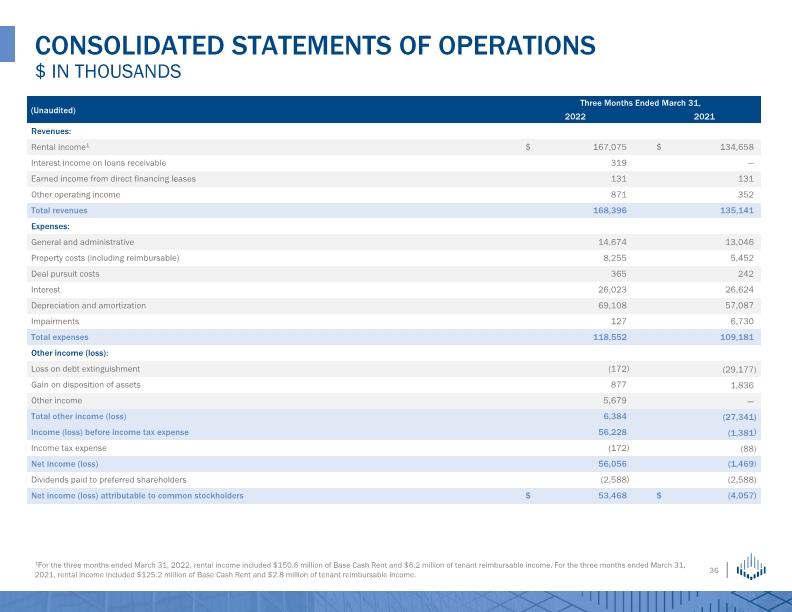

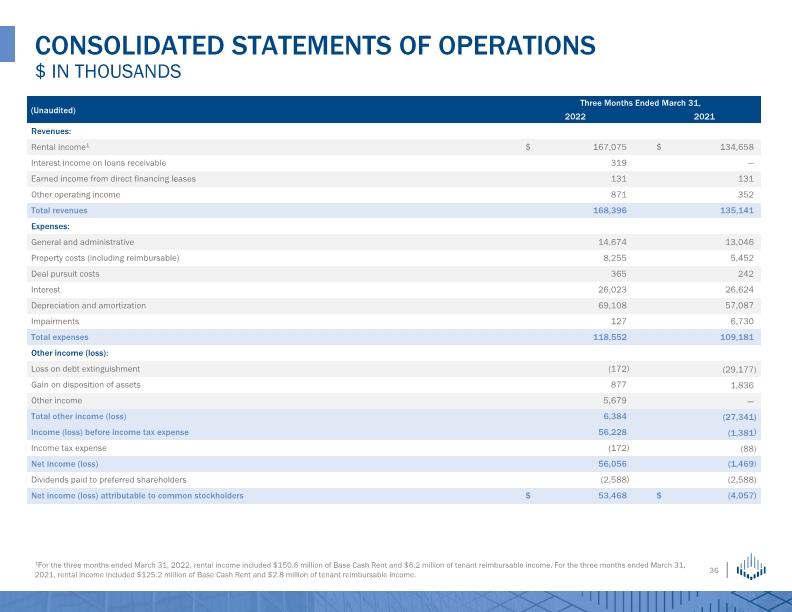

CONSOLIDATED STATEMENTS OF OPERATIONS $ IN THOUSANDS 1For the three months ended March 31, 2022, rental income included $150.6 million of Base Cash Rent and $6.2 million of tenant reimbursable income. For the three months ended March 31, 2021, rental income included $125.2 million of Base Cash Rent and $2.8 million of tenant reimbursable income.

1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral or abatement agreements. 2Dividends paid and undistributed earnings allocated, if any, to unvested restricted stockholders are deducted from FFO and AFFO for the computation of the per share amounts. The following amounts were deducted: 3Weighted average shares of common stock for non-GAAP measures for the three months ended March 31, 2021 includes unvested market-based awards, which are anti-dilutive for earnings per share but dilutive for the non-GAAP calculations. FUNDS AND ADJUSTED FUNDS FROM OPERATIONS $ IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

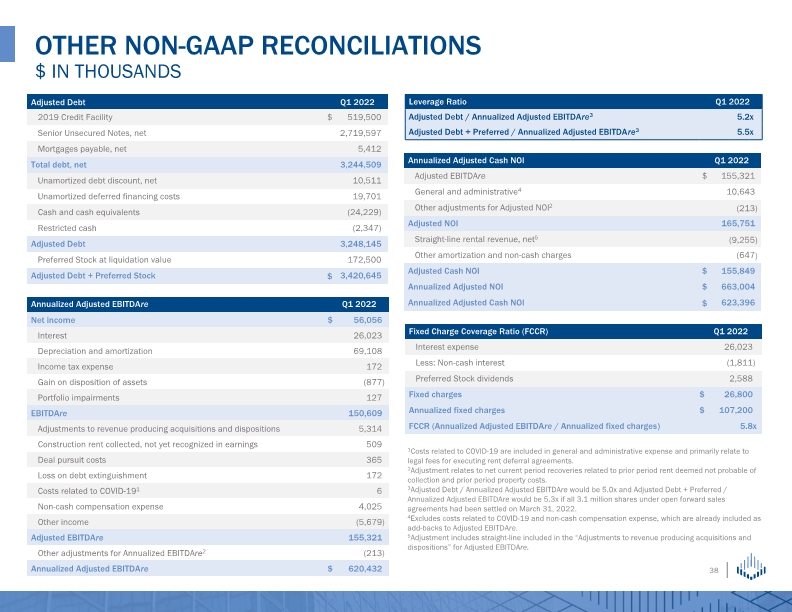

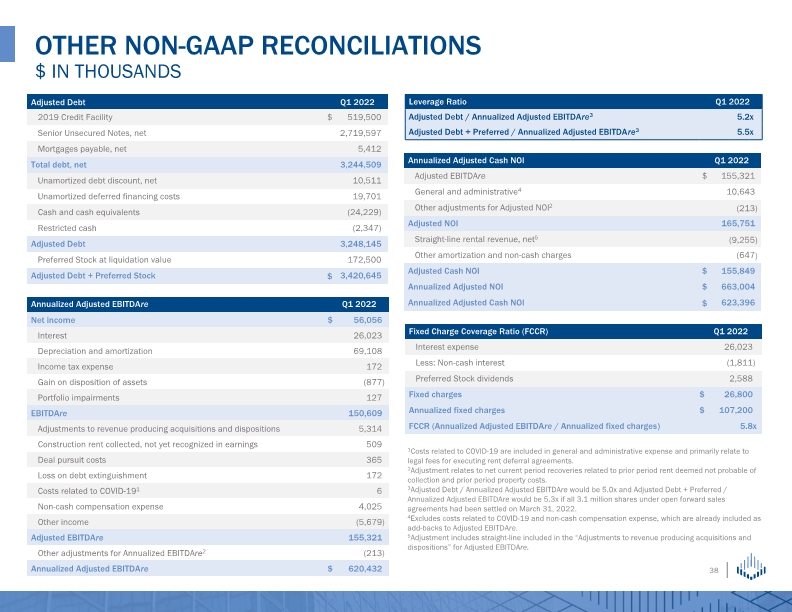

Other NON-GAAP RECONCILIATIONS $ in thousands 1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral agreements. 2Adjustment relates to net current period recoveries related to prior period rent deemed not probable of collection and prior period property costs. 3Adjusted Debt / Annualized Adjusted EBITDAre would be 5.0x and Adjusted Debt + Preferred / Annualized Adjusted EBITDAre would be 5.3x if all 3.1 million shares under open forward sales agreements had been settled on March 31, 2022. 4Excludes costs related to COVID-19 and non-cash compensation expense, which are already included as add-backs to Adjusted EBITDAre. 5Adjustment includes straight-line included in the “Adjustments to revenue producing acquisitions and dispositions” for Adjusted EBITDAre.

Appendix

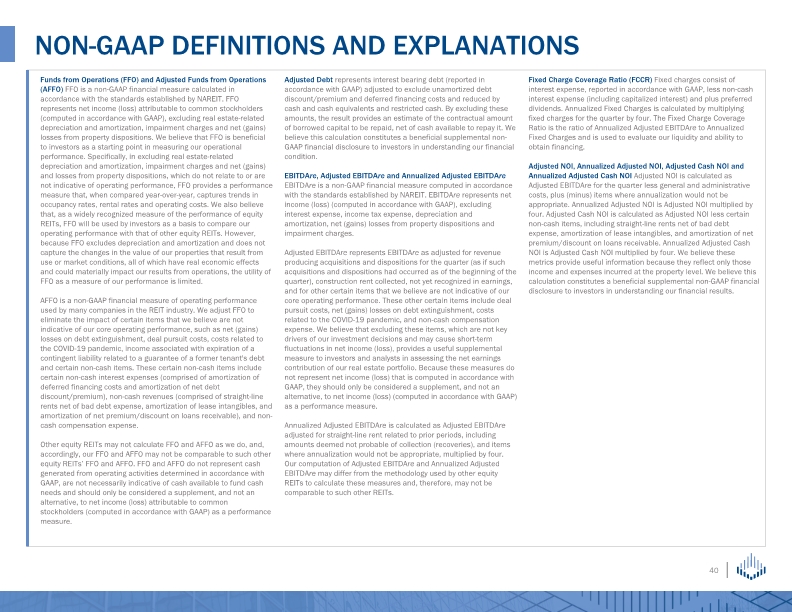

NON-GAAP DEFINITIONS AND EXPLANATIONS

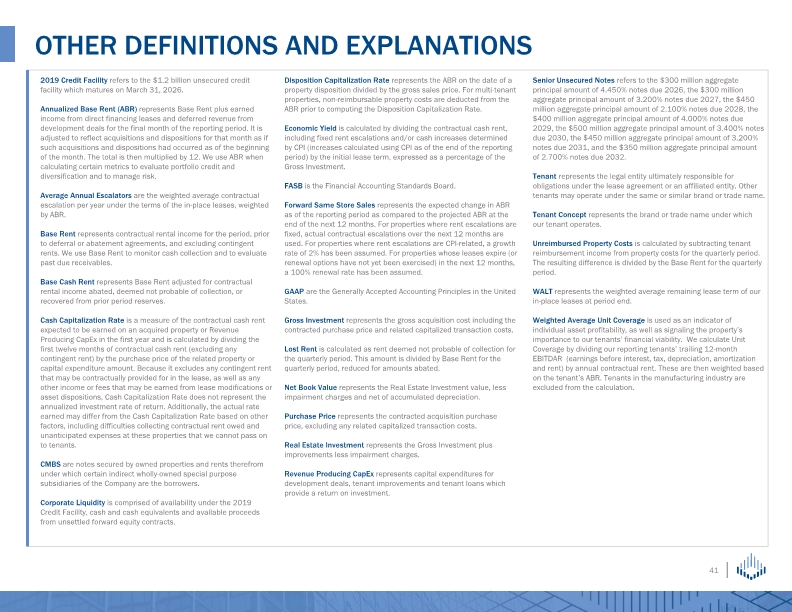

OTHER DEFINITIONS AND EXPLANATIONS

FORWARD-LOOKING STATEMENTS AND RISK FACTORS The information in this presentation should be read in conjunction with the accompanying earnings press release, as well as the Company's Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This presentation is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means of a prospectus approved for that purpose. This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act, as amended, Section 21E of the Exchange Act, as amended, the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words and phrases such as “preliminary,” “expect,” “plan,” “will,” “estimate,” “project,” “intend,” “believe,” “guidance,” “approximately,” “anticipate,” “may,” “should,” “seek,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate to historical matters but are meant to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management. These forward-looking statements are subject to known and unknown risks and uncertainties that you should not rely on as predictions of future events. Forward-looking statements depend on assumptions, data and/or methods which may be incorrect or imprecise, and Spirit may not be able to realize them. Spirit does not guarantee that the events described will happen as described (or that they will happen at all). The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: industry and economic conditions; volatility and uncertainty in the financial markets, including potential fluctuations in the Consumer Price Index; Spirit's success in implementing its business strategy and its ability to identify, underwrite, finance, consummate, integrate and manage diversifying acquisitions or investments; the financial performance of Spirit's retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers; Spirit's ability to diversify its tenant base; the nature and extent of future competition; increases in Spirit's costs of borrowing as a result of changes in interest rates and other factors; Spirit's ability to access debt and equity capital markets; Spirit's ability to pay down, refinance, restructure and/or extend its indebtedness as it becomes due; Spirit's ability and willingness to renew its leases upon expiration and to reposition its properties on the same or better terms upon expiration in the event such properties are not renewed by tenants or Spirit exercises its rights to replace existing tenants upon default; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect Spirit or its major tenants; Spirit's ability to manage its expanded operations; Spirit's ability and willingness to maintain its qualification as a REIT under the Internal Revenue Code of 1986, as amended; the impact on Spirit’s business and those of its tenants from epidemics, pandemics or other outbreaks of illness, disease or virus (such as the strain of coronavirus known as COVID-19); and other risks inherent in the real estate business, including tenant defaults, potential liability relating to environmental matters, illiquidity of real estate investments and potential damages from natural disasters discussed in Spirit's most recent filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on forward-looking statements which are based on information that was available, and speak only, as of the date on which they were made. While forward-looking statements reflect Spirit's good faith beliefs, they are not guarantees of future performance. Spirit expressly disclaims any responsibility to update or revise forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published.