Supplemental Investor Presentation NOVEMBER 2022 Q3 2022 Exhibit 99.2

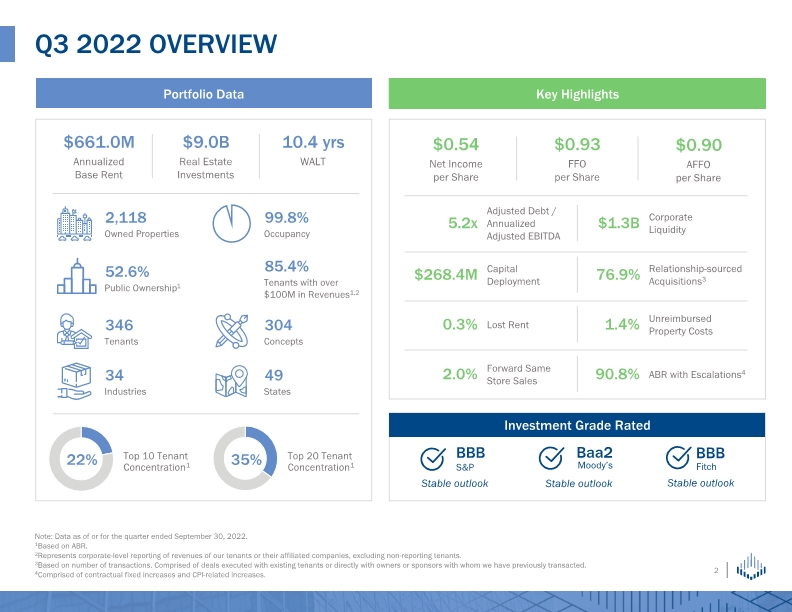

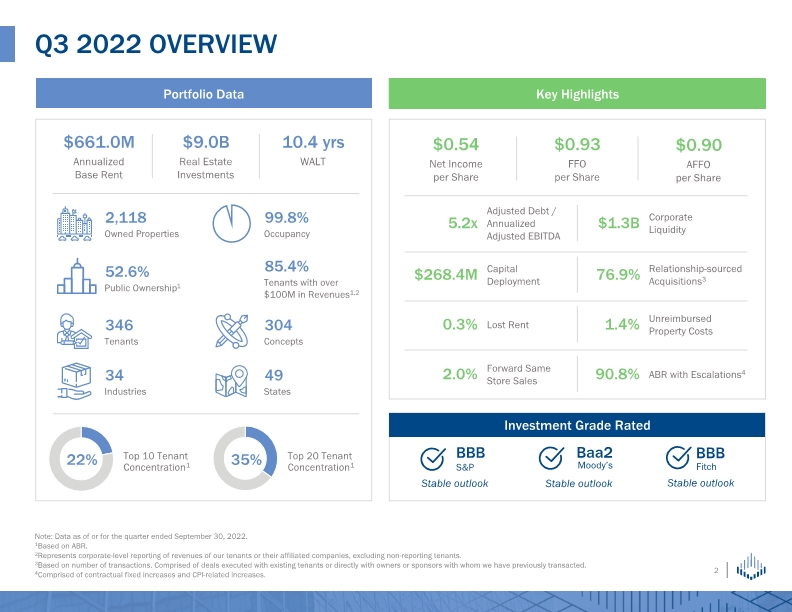

Note: Data as of or for the quarter ended September 30, 2022. 1Based on ABR. 2Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants. 3Based on number of transactions. Comprised of deals executed with existing tenants or directly with owners or sponsors with whom we have previously transacted. 4Comprised of contractual fixed increases and CPI-related increases. Q3 2022 Overview Key Highlights Portfolio Data 52.6% Public Ownership1 Investment Grade Rated Stable outlook Stable outlook Stable outlook

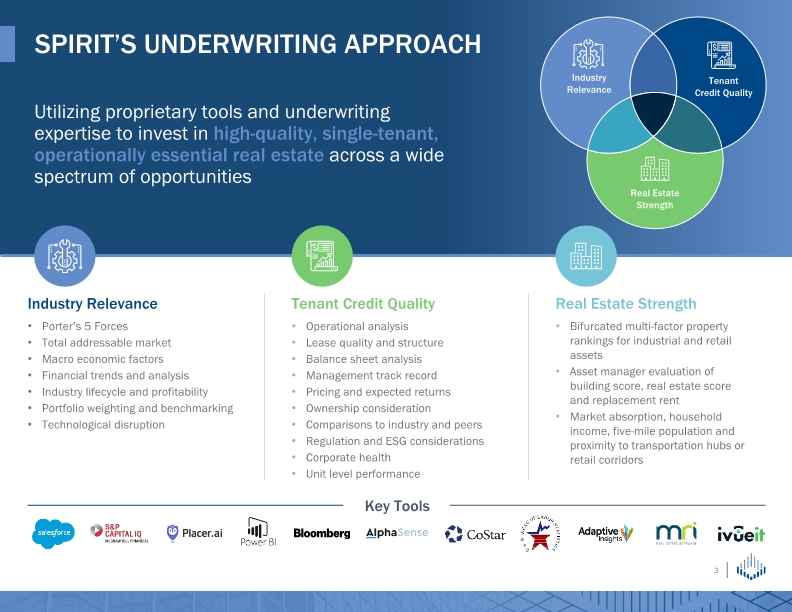

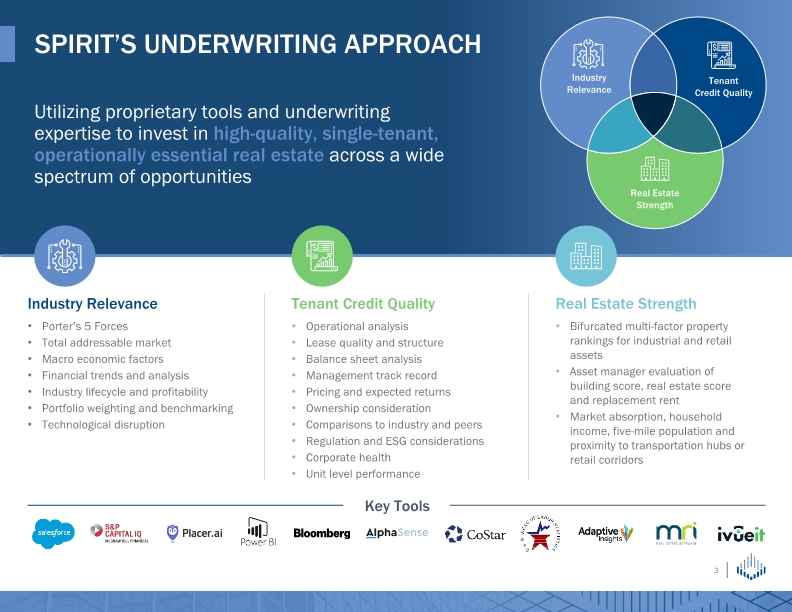

Spirit’s underwriting approach Utilizing proprietary tools and underwriting expertise to invest in high-quality, single-tenant, operationally essential real estate across a wide spectrum of opportunities Industry Relevance Porter’s 5 Forces Total addressable market Macro economic factors Financial trends and analysis Industry lifecycle and profitability Portfolio weighting and benchmarking Technological disruption Real Estate Strength Bifurcated multi-factor property rankings for industrial and retail assets Asset manager evaluation of building score, real estate score and replacement rent Market absorption, household income, five-mile population and proximity to transportation hubs or retail corridors Tenant Credit Quality Operational analysis Lease quality and structure Balance sheet analysis Management track record Pricing and expected returns Ownership consideration Comparisons to industry and peers Regulation and ESG considerations Corporate health Unit level performance

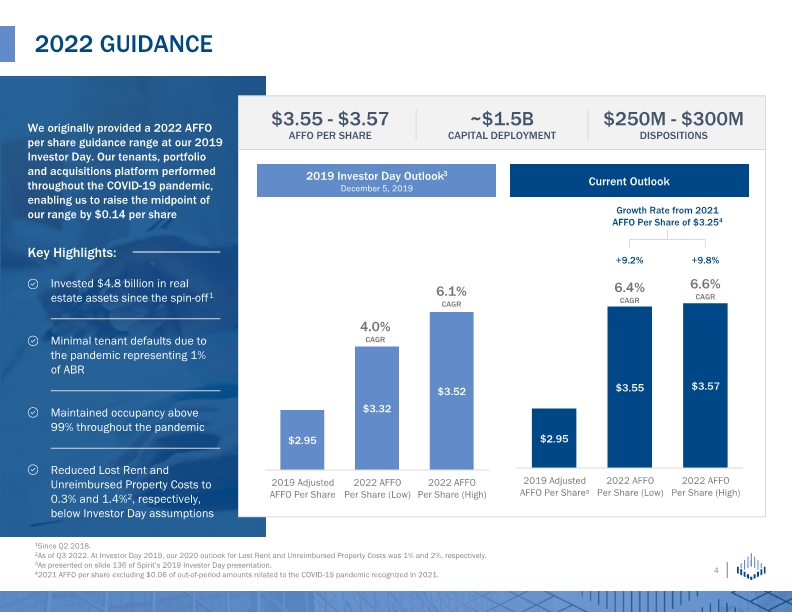

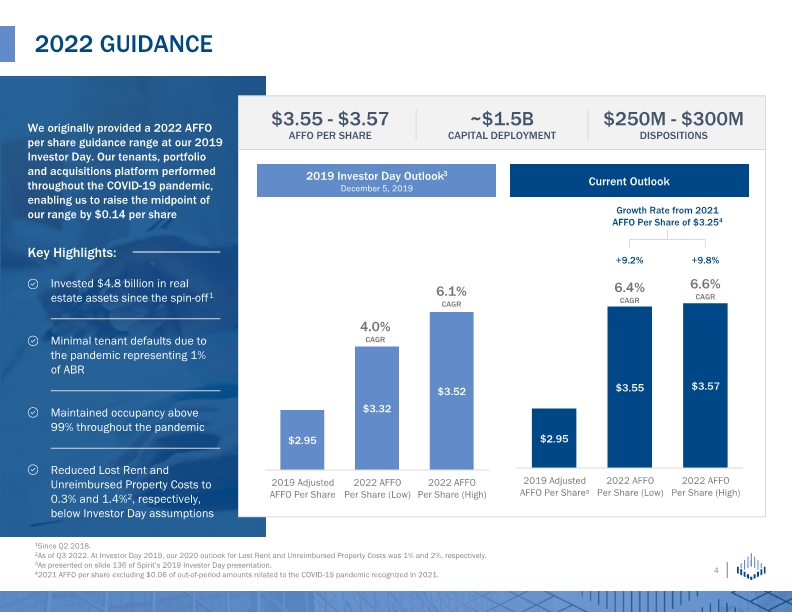

2022 guidance 1Since Q2 2018. 2As of Q3 2022. At Investor Day 2019, our 2020 outlook for Lost Rent and Unreimbursed Property Costs was 1% and 2%, respectively. 3As presented on slide 136 of Spirit’s 2019 Investor Day presentation. 42021 AFFO per share excluding $0.06 of out-of-period amounts related to the COVID-19 pandemic recognized in 2021. We originally provided a 2022 AFFO per share guidance range at our 2019 Investor Day. Our tenants, portfolio and acquisitions platform performed throughout the COVID-19 pandemic, enabling us to raise the midpoint of our range by $0.14 per share $3.55 - $3.57 AFFO PER SHARE $250M - $300M DISPOSITIONS ~$1.5B CAPITAL DEPLOYMENT 2019 Investor Day Outlook3 December 5, 2019 Current Outlook 6.1% CAGR 4.0% CAGR 6.6% CAGR 6.4% CAGR

Capital Deployment Highlights

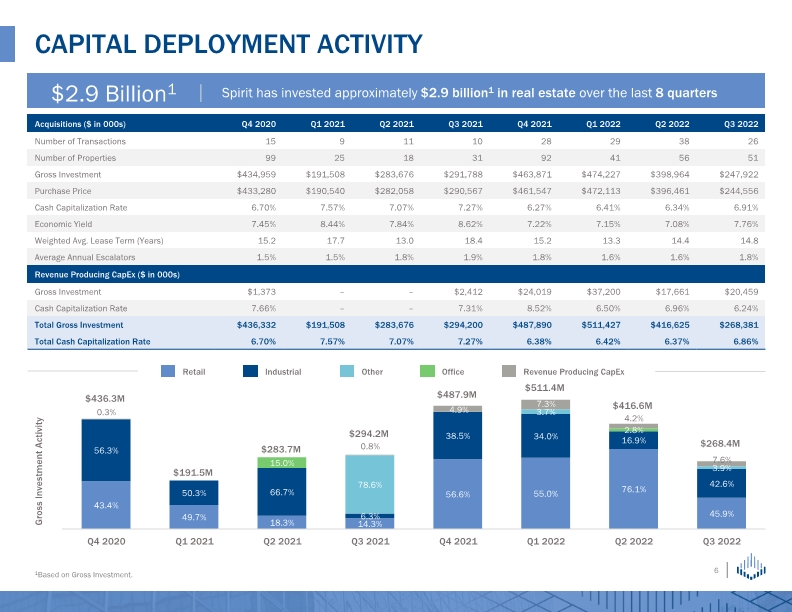

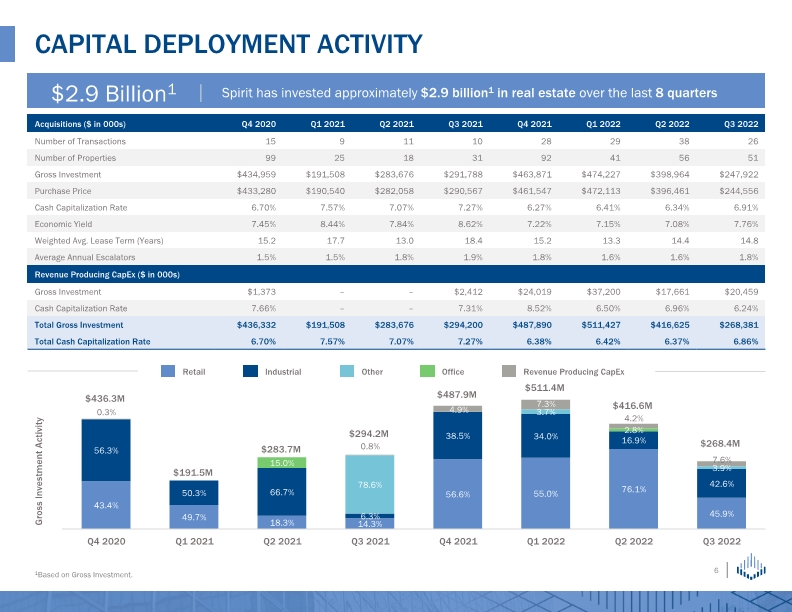

1Based on Gross Investment. Capital deployment Activity $2.9 Billion1 Spirit has invested approximately $2.9 billion1 in real estate over the last 8 quarters Gross Investment Activity $191.5M $283.7M $294.2M $436.3M $511.4M $487.9M $416.6M $268.4M

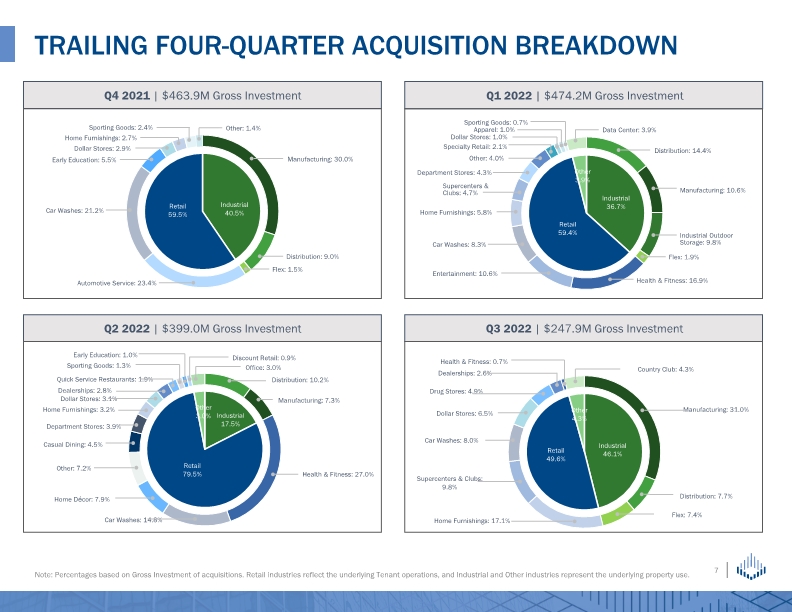

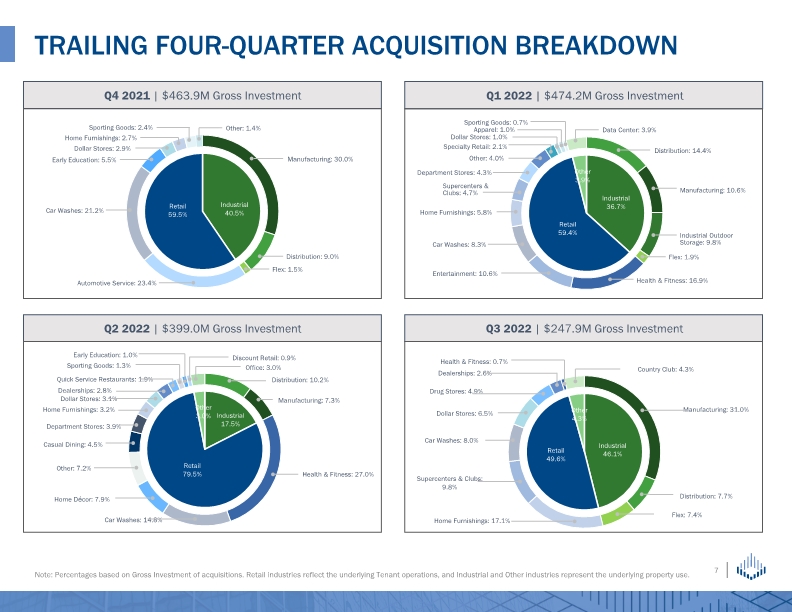

Trailing four-quarter acquisition breakdown Note: Percentages based on Gross Investment of acquisitions. Retail industries reflect the underlying Tenant operations, and Industrial and Other industries represent the underlying property use. Q2 2022 | $399.0M Gross Investment Q3 2022 | $247.9M Gross Investment Q4 2021 | $463.9M Gross Investment Q1 2022 | $474.2M Gross Investment Distribution: 14.4% Manufacturing: 10.6% Flex: 1.9% Health & Fitness: 16.9% Dollar Stores: 1.0% Apparel: 1.0% Sporting Goods: 0.7% Department Stores: 4.3% Entertainment: 10.6% Supercenters & Clubs: 4.7% Car Washes: 8.3% Home Furnishings: 5.8% Specialty Retail: 2.1% Other: 4.0% Industrial Outdoor Storage: 9.8%

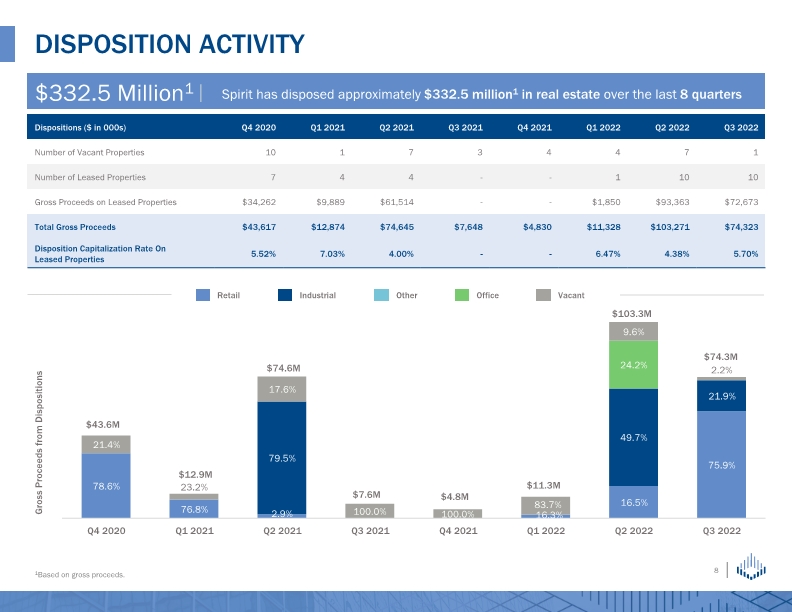

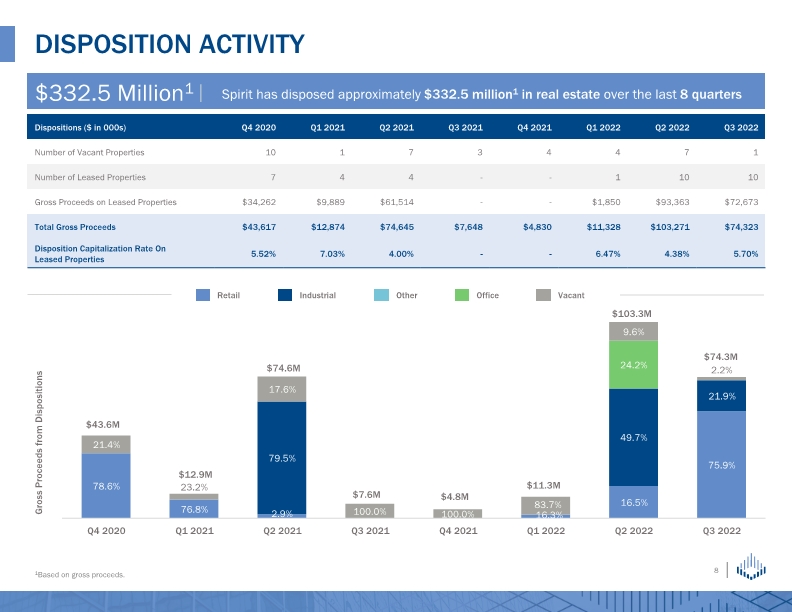

1Based on gross proceeds. DISPOSITION activity $332.5 Million1 Spirit has disposed approximately $332.5 million1 in real estate over the last 8 quarters Gross Proceeds from Dispositions $12.9M $43.6M $11.3M $43.6M $74.6M $7.6M $4.8M $103.3M $74.3M

Portfolio Composition

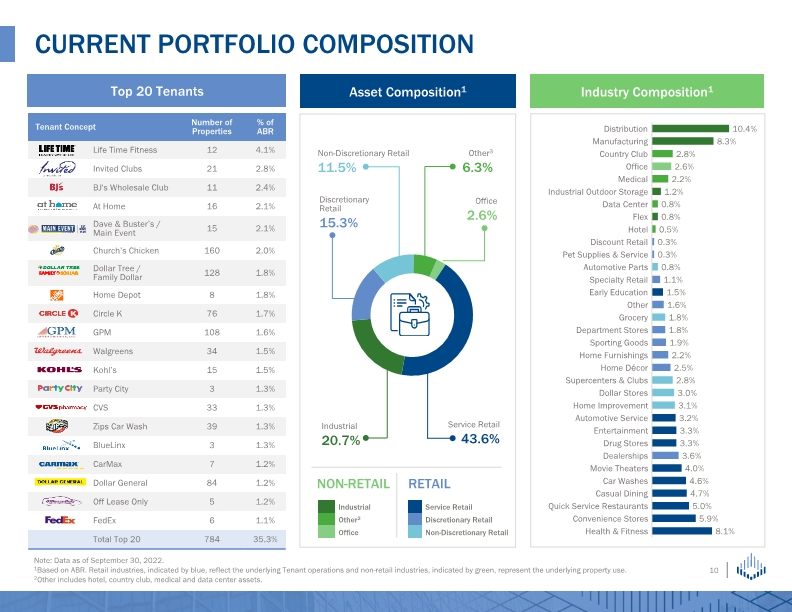

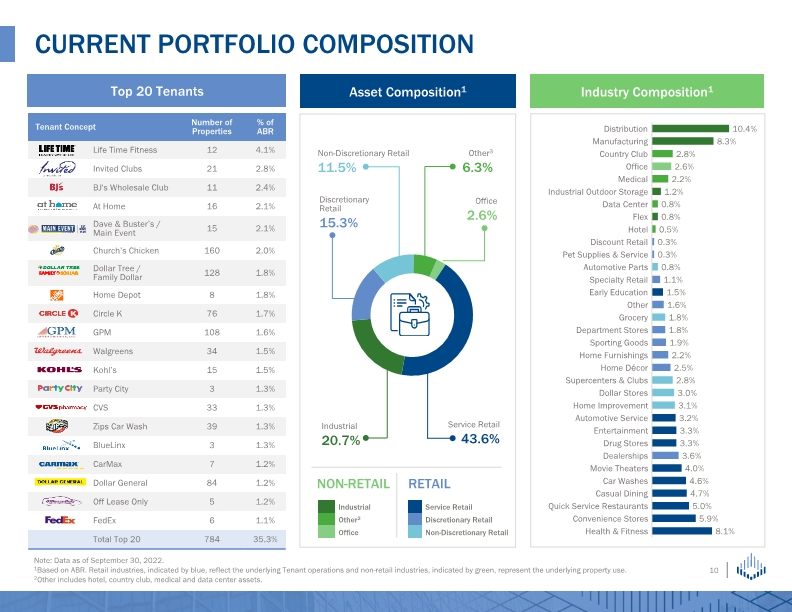

Top 20 Tenants Note: Data as of September 30, 2022. 1Based on ABR. Retail industries, indicated by blue, reflect the underlying Tenant operations and non-retail industries, indicated by green, represent the underlying property use. 2Other includes hotel, country club, medical and data center assets. Current Portfolio composition Non-Discretionary Retail 11.5% Industrial 20.7% Discretionary Retail 15.3% Other3 6.3% Office 2.6% Service Retail 43.6% NON-RETAIL RETAIL Asset Composition1 Industry Composition1

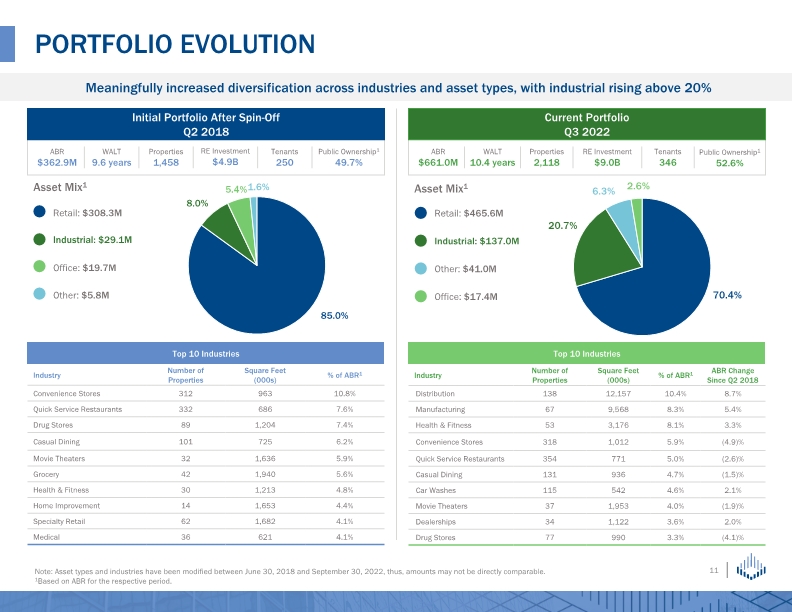

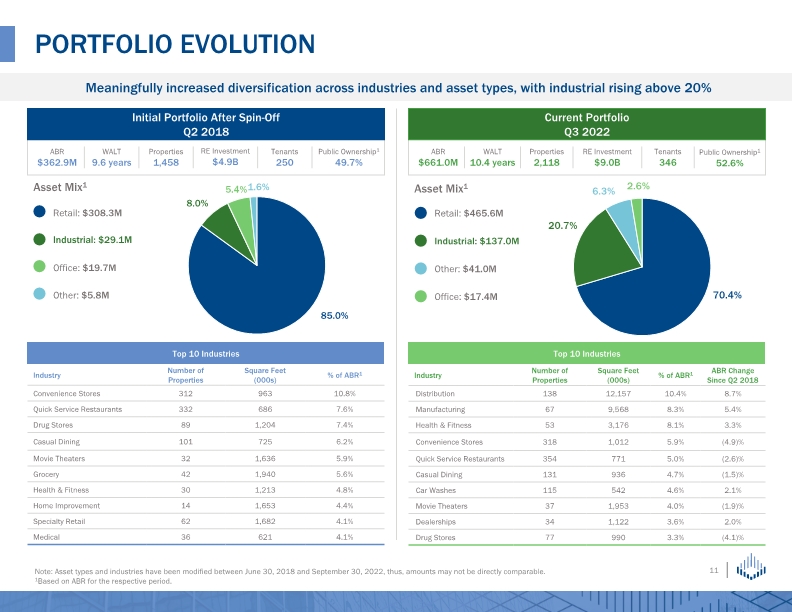

Portfolio evolution Note: Asset types and industries have been modified between June 30, 2018 and September 30, 2022, thus, amounts may not be directly comparable. 1Based on ABR for the respective period. ABR $362.9M WALT 9.6 years Initial Portfolio After Spin-Off Q2 2018 Current Portfolio Q3 2022 Properties 1,458 RE Investment $4.9B Tenants 250 ABR $661.0M WALT 10.4 years Properties 2,118 RE Investment $9.0B Tenants 346 Asset Mix1 Asset Mix1 Public Ownership1 49.7% Public Ownership1 52.6% Meaningfully increased diversification across industries and asset types, with industrial rising above 20%

Industrial portfolio highlights Note: Data as of September 30, 2022. Representative Tenants Spirit has invested $2.0B in industrial assets, of which 85% were acquired after Q2 2018

Note: Data as of September 30, 2022. Percentages are based on ABR. 1Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies. Actual ratings based on S&P or Moody’s are used. 2Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants. Portfolio Health 13

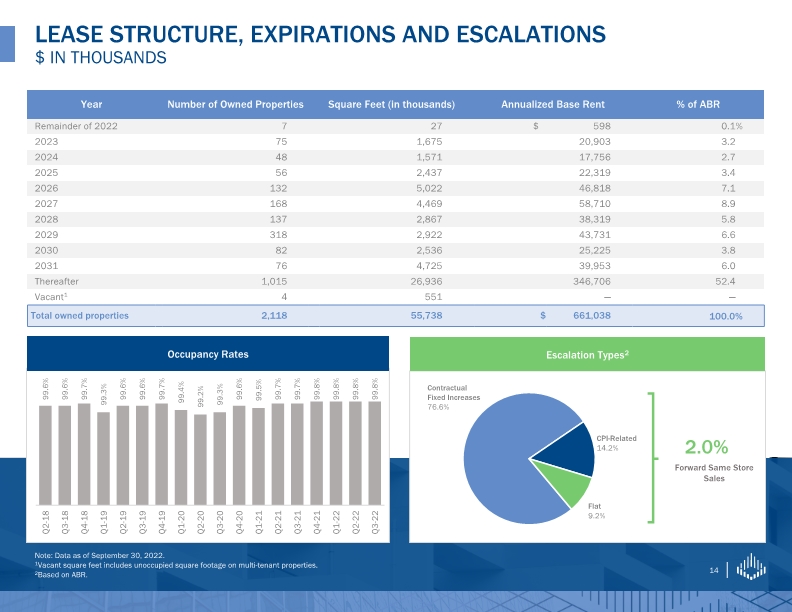

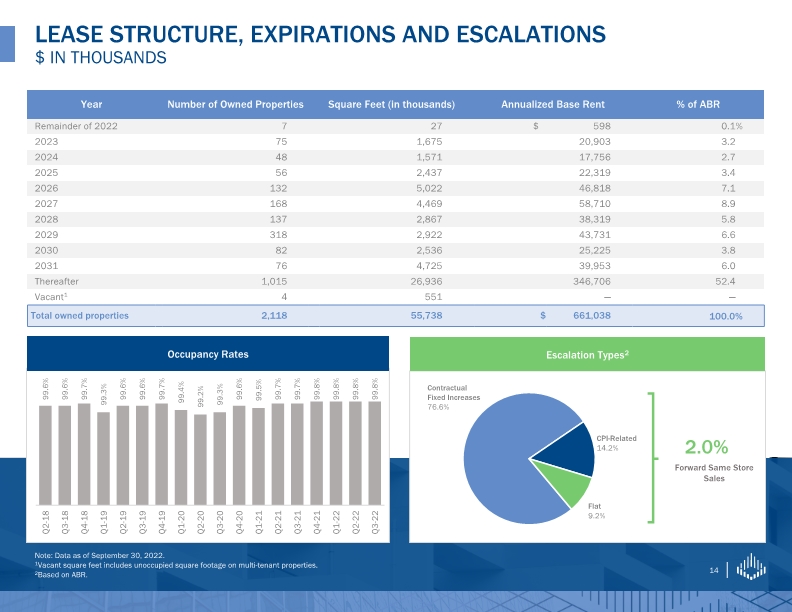

LEASE STRUCTURE, EXPIRATIONS AND ESCALATIONS $ in thousands Note: Data as of September 30, 2022. 1Vacant square feet includes unoccupied square footage on multi-tenant properties. 2Based on ABR. 14

Note: Data as of September 30, 2022. *Represent less than 0.1% of ABR. PORTFOLIO DIVERSIFICATION U.S. Virgin Islands

Financial Information and Non-GAAP Reconciliations

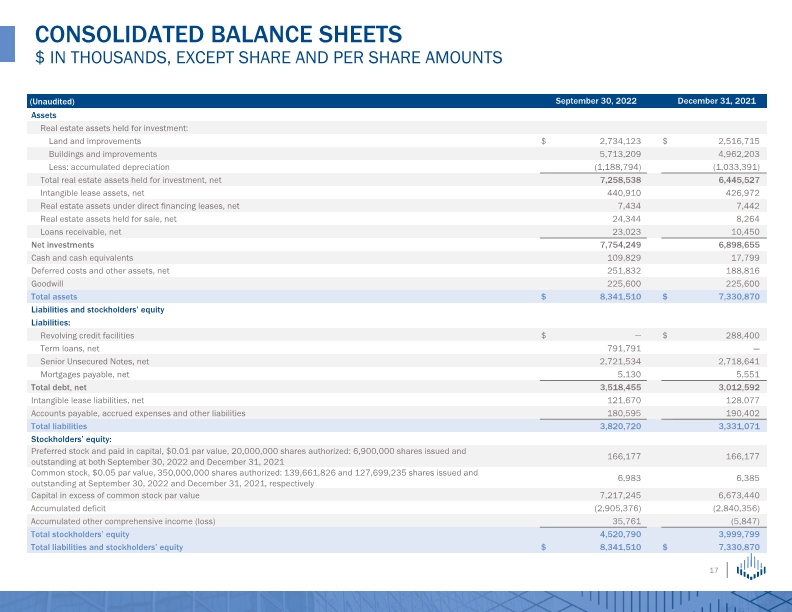

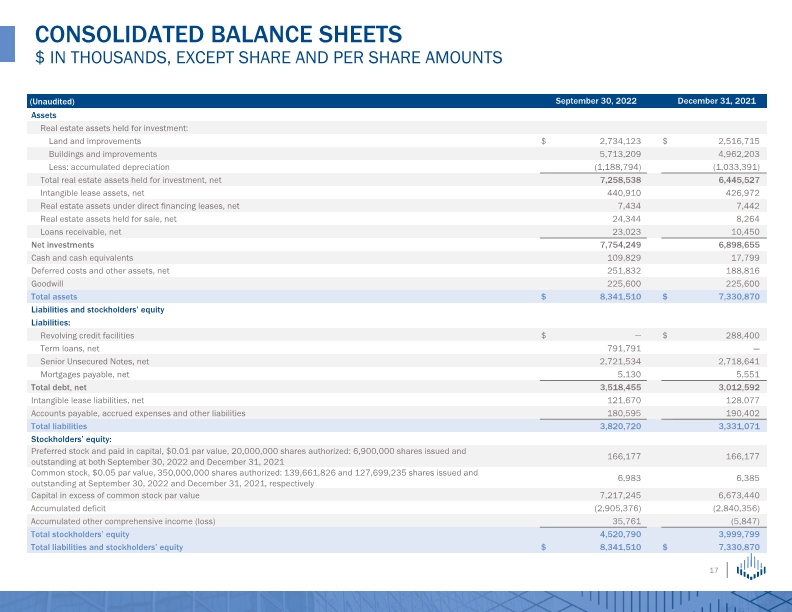

CONSOLIDATED BALANCE SHEETS $ IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS

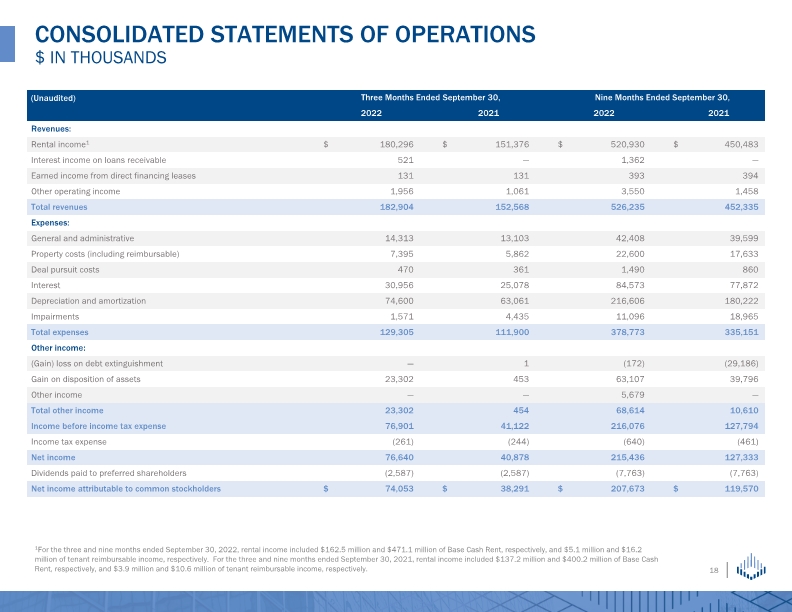

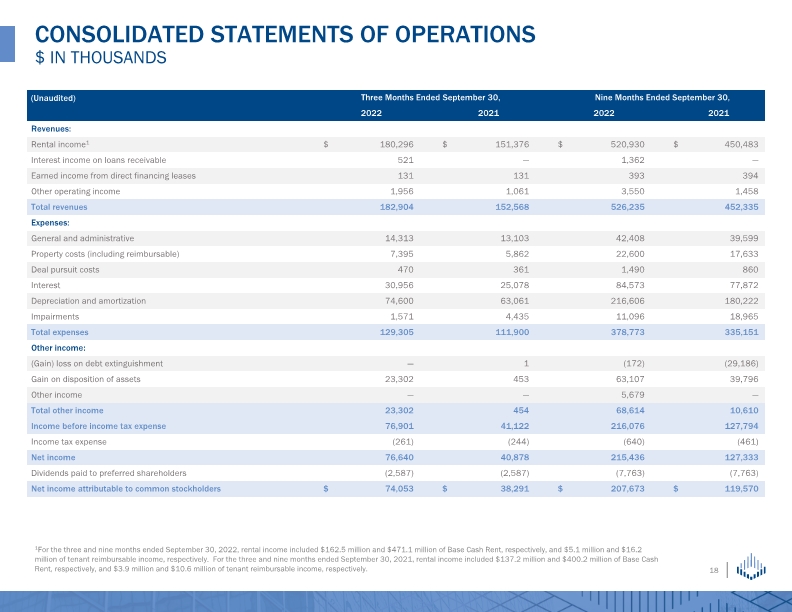

CONSOLIDATED STATEMENTS OF OPERATIONS $ IN THOUSANDS 1For the three and nine months ended September 30, 2022, rental income included $162.5 million and $471.1 million of Base Cash Rent, respectively, and $5.1 million and $16.2 million of tenant reimbursable income, respectively. For the three and nine months ended September 30, 2021, rental income included $137.2 million and $400.2 million of Base Cash Rent, respectively, and $3.9 million and $10.6 million of tenant reimbursable income, respectively.

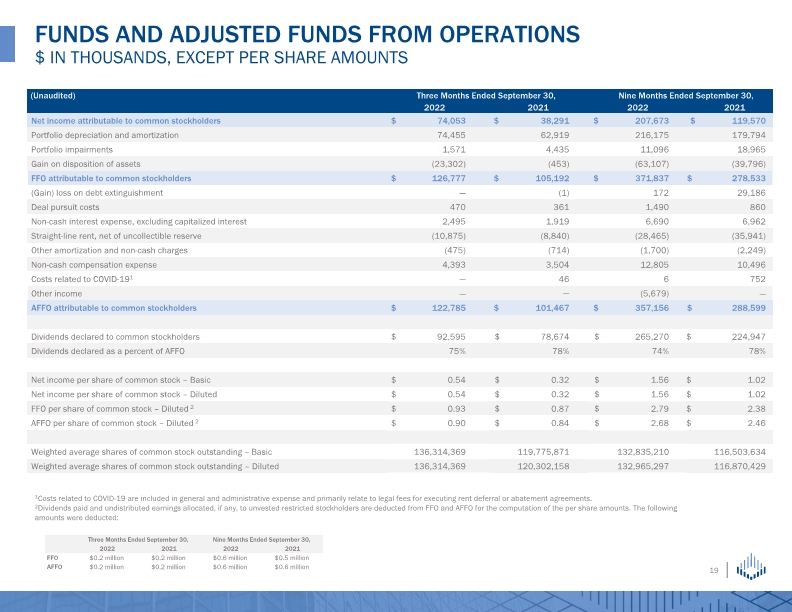

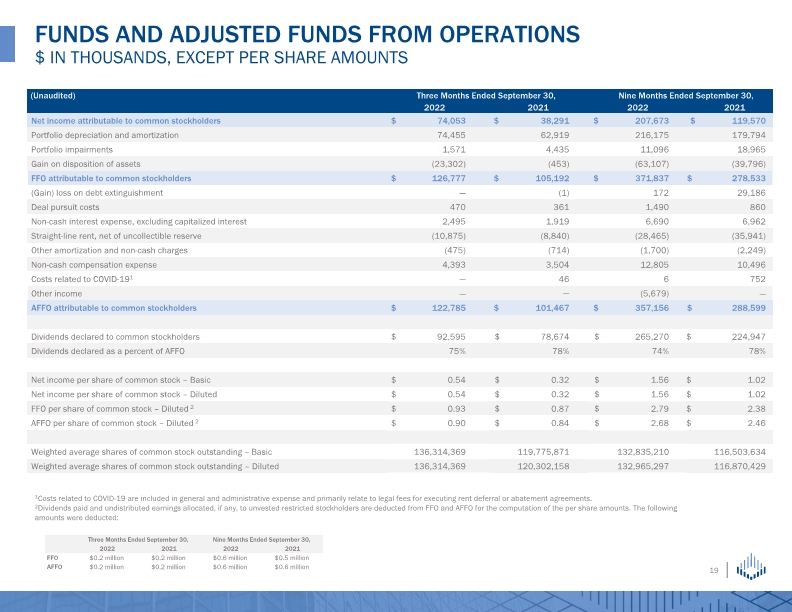

1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral or abatement agreements. 2Dividends paid and undistributed earnings allocated, if any, to unvested restricted stockholders are deducted from FFO and AFFO for the computation of the per share amounts. The following amounts were deducted: FUNDS AND ADJUSTED FUNDS FROM OPERATIONS $ IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

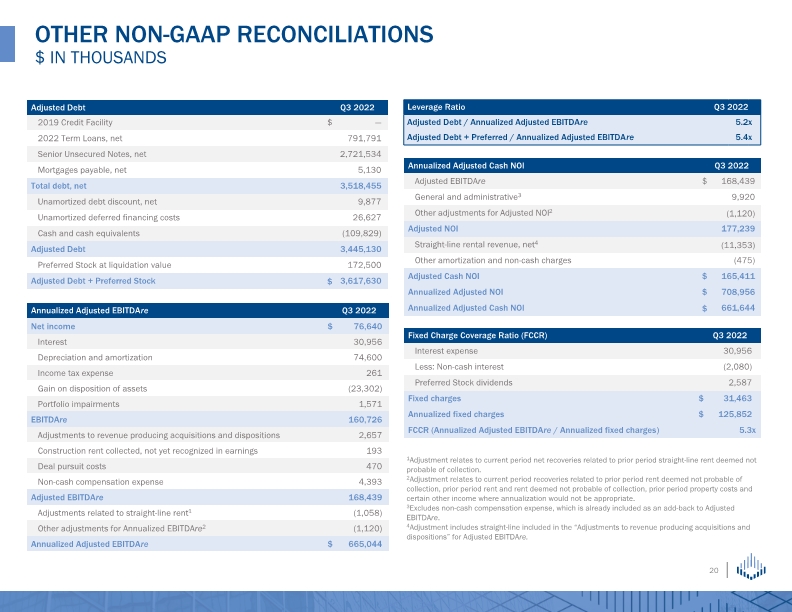

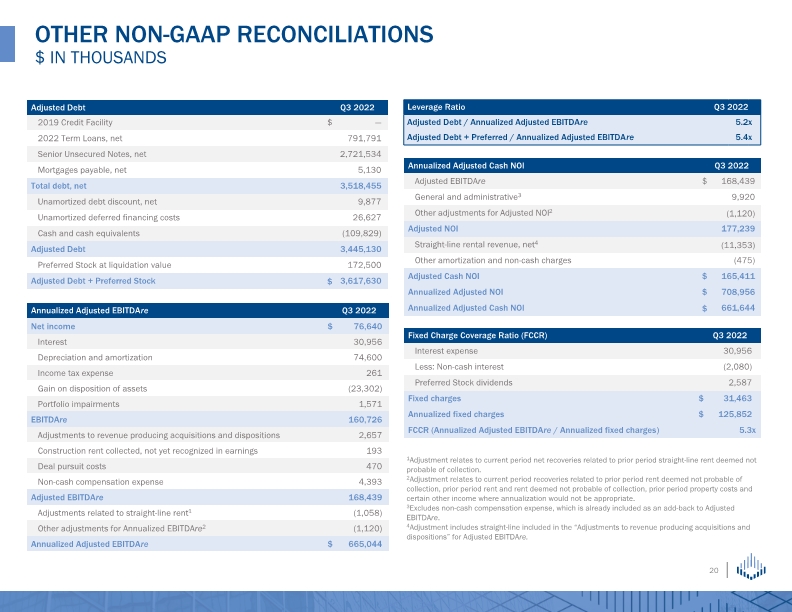

Other NON-GAAP RECONCILIATIONS $ in thousands 1Adjustment relates to current period net recoveries related to prior period straight-line rent deemed not probable of collection. 2Adjustment relates to current period recoveries related to prior period rent deemed not probable of collection, prior period rent and rent deemed not probable of collection, prior period property costs and certain other income where annualization would not be appropriate. 3Excludes non-cash compensation expense, which is already included as an add-back to Adjusted EBITDAre. 4Adjustment includes straight-line included in the “Adjustments to revenue producing acquisitions and dispositions” for Adjusted EBITDAre.

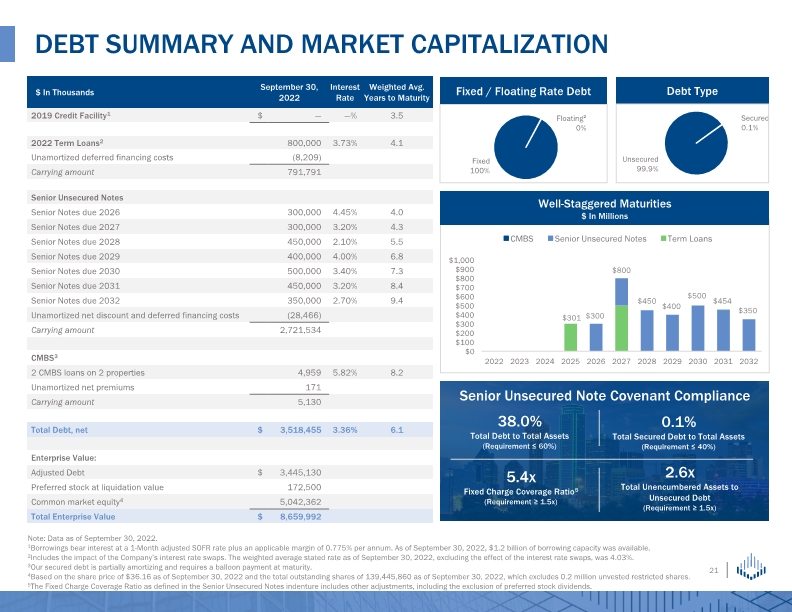

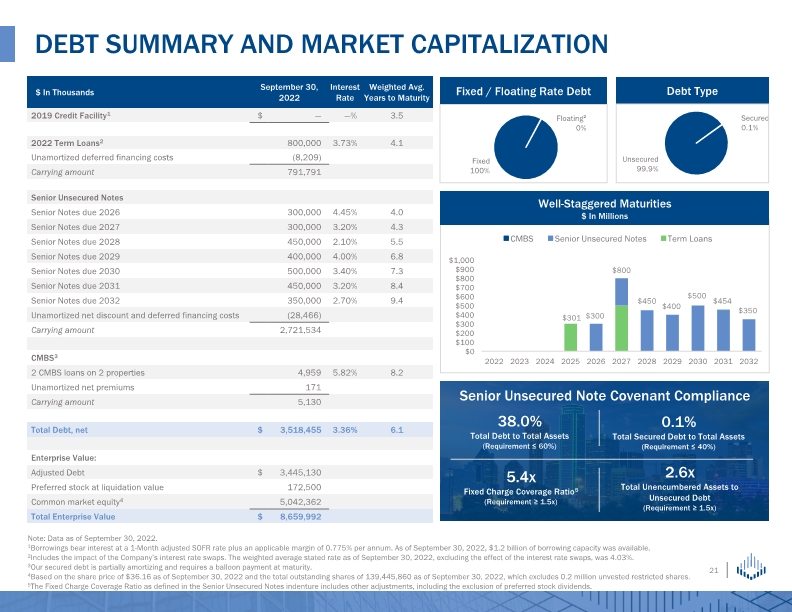

Note: Data as of September 30, 2022. 1Borrowings bear interest at a 1-Month adjusted SOFR rate plus an applicable margin of 0.775% per annum. As of September 30, 2022, $1.2 billion of borrowing capacity was available. 2Includes the impact of the Company’s interest rate swaps. The weighted average stated rate as of September 30, 2022, excluding the effect of the interest rate swaps, was 4.03%. 3Our secured debt is partially amortizing and requires a balloon payment at maturity. 4Based on the share price of $36.16 as of September 30, 2022 and the total outstanding shares of 139,445,860 as of September 30, 2022, which excludes 0.2 million unvested restricted shares. 5The Fixed Charge Coverage Ratio as defined in the Senior Unsecured Notes indenture includes other adjustments, including the exclusion of preferred stock dividends. Debt Summary and Market Capitalization Debt Type Fixed / Floating Rate Debt 38.0% Total Debt to Total Assets (Requirement ≤ 60%) Senior Unsecured Note Covenant Compliance 0.1% Total Secured Debt to Total Assets (Requirement ≤ 40%) 5.4x Fixed Charge Coverage Ratio5 (Requirement ≥ 1.5x) 2.6x Total Unencumbered Assets to Unsecured Debt (Requirement ≥ 1.5x) Well-Staggered Maturities $ In Millions

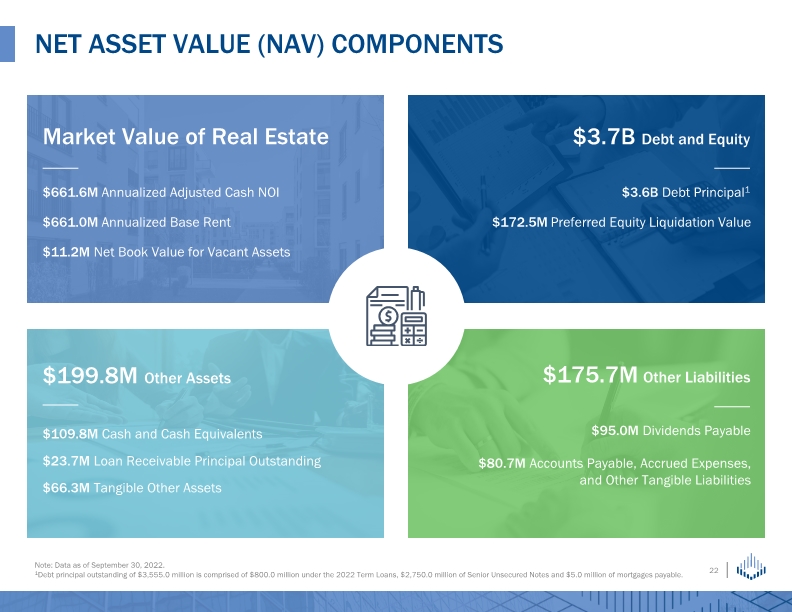

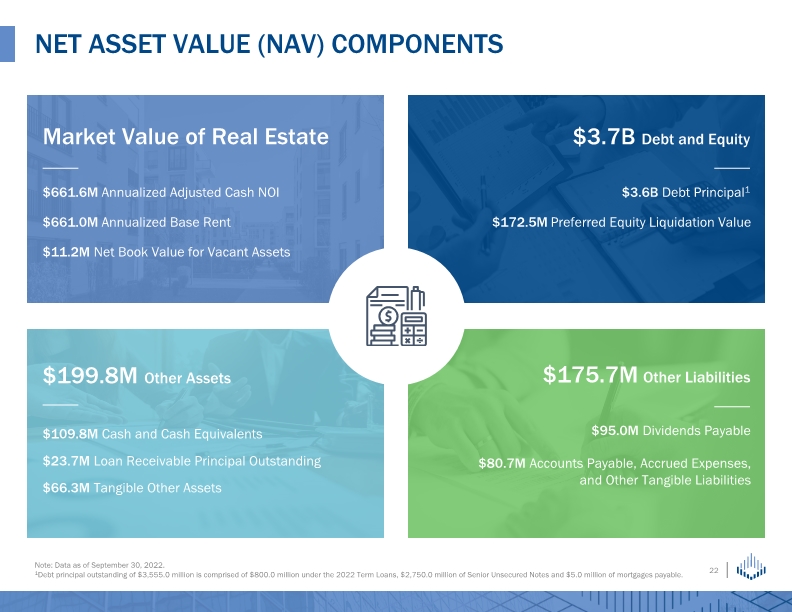

Net Asset Value (NAV) Components Note: Data as of September 30, 2022. 1Debt principal outstanding of $3,555.0 million is comprised of $800.0 million under the 2022 Term Loans, $2,750.0 million of Senior Unsecured Notes and $5.0 million of mortgages payable. Market Value of Real Estate $3.7B Debt and Equity $199.8M Other Assets $175.7M Other Liabilities $661.0M Annualized Base Rent $11.2M Net Book Value for Vacant Assets $3.6B Debt Principal1 $172.5M Preferred Equity Liquidation Value $109.8M Cash and Cash Equivalents $66.3M Tangible Other Assets $95.0M Dividends Payable $80.7M Accounts Payable, Accrued Expenses, and Other Tangible Liabilities $661.6M Annualized Adjusted Cash NOI $23.7M Loan Receivable Principal Outstanding

Appendix

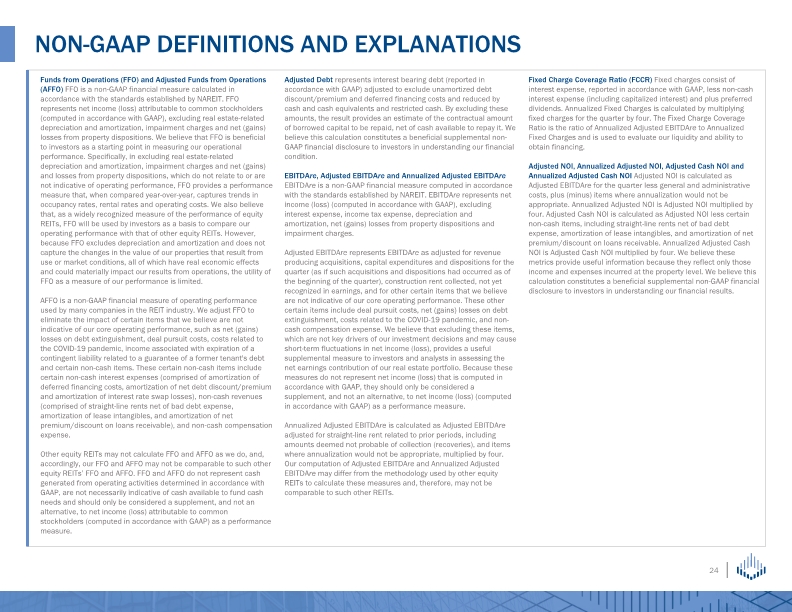

NON-GAAP DEFINITIONS AND EXPLANATIONS

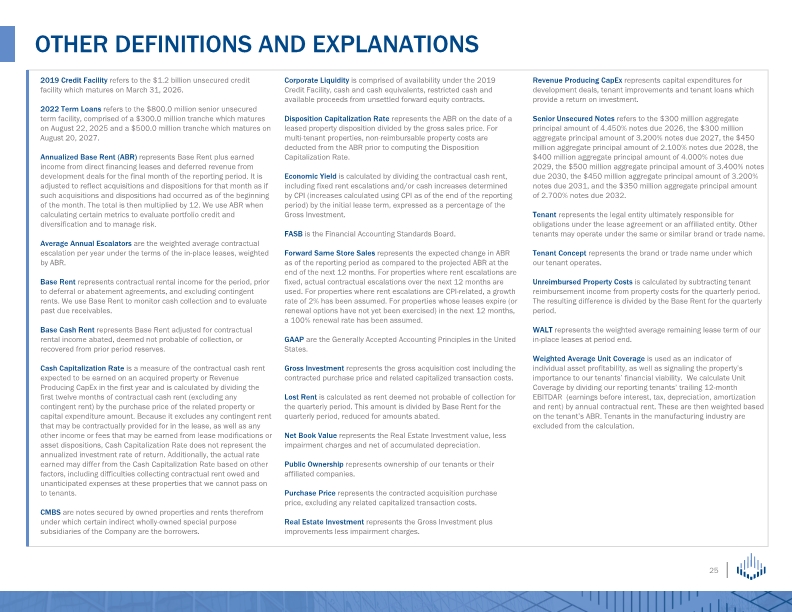

OTHER DEFINITIONS AND EXPLANATIONS

FORWARD-LOOKING STATEMENTS AND RISK FACTORS The information in this presentation should be read in conjunction with the accompanying earnings press release, as well as the Company's Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This presentation is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means of a prospectus approved for that purpose.