FILED PURSUANT TO RULE 424(B)(3)

REGISTRATION NO. 333-120847

Prospectus |

|

|

Up to 48,000,000 shares offered to the public |

200,000 shares minimum |

Minimum purchase: 200 shares ($2,000) in most states |

Behringer Harvard Opportunity REIT I, Inc. is a Maryland corporation that intends to qualify as a real estate investment trust. The company has been formed primarily to invest in and operate commercial real estate. In particular, we focus on acquiring properties with significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning or those located in markets with higher volatility, lower barriers to entry and high growth potential. We may acquire office, industrial, retail, hospitality, multi-family and other real properties, including existing or newly constructed properties or properties under development or construction. Further, we may invest in real estate related securities, including securities issued by other real estate companies, either for investment or in change of control transactions completed on a negotiated basis or otherwise. We also may invest in collateralized mortgage-backed securities, mortgage, bridge or mezzanine loans and Section 1031 tenant-in-common interests, or in entities that make investments similar to the foregoing. We plan to be opportunistic in our investments.

We are offering and selling to the public a maximum of 40,000,000 shares and a minimum of 200,000 shares of our common stock for $10.00 per share. We also are offering up to 8,000,000 shares of common stock to be issued pursuant to our distribution reinvestment plan for $9.50 per share.

The Offering:

| | Price

to Public | | Selling

Commissions | | Dealer

Manager Fee | | Net Proceeds

(Before Expenses) | |

Primary Offering | | | | | | | | | |

Per Share | | $ | 10.00 | | $ | 0.70 | | $ | 0.20 | | $ | 9.10 | |

Total Minimum | | $ | 2,000,000 | | $ | 140,000 | | $ | 40,000 | | $ | 1,820,000 | |

Total Maximum | | $ | 400,000,000 | | $ | 28,000,000 | | $ | 8,000,000 | | $ | 364,000,000 | |

Distribution Reinvestment Plan | | | | | | | | | |

Per Share | | $ | 9.50 | | $ | 0.095 | | $ | — | | $ | 9.405 | |

Total Minimum | | $ | — | | $ | — | | $ | — | | $ | — | |

Total Maximum | | $ | 76,000,000 | | $ | 760,000 | | $ | — | | $ | 75,240,000 | |

The shares will be offered to investors on a best efforts basis. Selling commissions will be reduced to $0.095 per share and no dealer manager fees will be paid with respect to shares sold pursuant to our distribution reinvestment plan. We expect that if the maximum offering amount is raised, at least 90.6% of the gross proceeds of this offering (89% in a minimum offering) will be used for investment in real estate, loans and other investments, paying the expenses incurred in making such investments, and for initial working capital reserves for real estate investments. We expect to use approximately 87.1% of the gross proceeds if the maximum offering amount is raised (85.6% in a minimum offering) to make investments in real estate properties, loans and other investments, and to use approximately 3.5% of the gross proceeds if the maximum offering amount is raised (3.4% in a minimum offering), assuming no debt financing, for payment of fees and expenses related to the selection and acquisition of our investments and for initial working capital reserves for real estate investments. This offering will terminate on or before September 20, 2007 (unless extended with respect to the shares offered under our distribution reinvestment plan or as otherwise permitted under applicable law).

Investing in our common stock involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 29. The most significant risks relating to your investment include the following:

• No public market currently exists for our shares of common stock. Our shares cannot be readily sold, and if you are able to sell your shares, you would likely have to sell them at a substantial discount. If the shares are not listed for trading on an exchange or included for quotation on the Nasdaq National Market System by the sixth anniversary of the termination of this offering, we intend to liquidate our assets and distribute the proceeds unless such date is extended by our board of directors including a majority of our independent directors.

• We have no operating history nor established financing sources. With the exception of the 12600 Whitewater property described herein, we do not currently own any properties, and, with the exception of the Ferncroft property described herein, we have not identified any other properties to acquire with proceeds from this offering.

• If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of properties and the value of your investment may fluctuate more widely with the performance of specific investments.

• We will rely on Behringer Harvard Opportunity Advisors I LP, our advisor, to select properties and other investments and conduct our operations.

• We are obligated to pay substantial fees to our advisor and its affiliates, some of which are payable based upon factors other than the quality of services provided to us. Our advisor and its affiliates will face conflicts of interest, such as competing demands upon their time, their involvement with other entities and the allocation of opportunities among affiliated entities and us.

• We also have issued to an affiliate of our advisor 1,000 shares of our non-participating, non-voting, convertible stock at a purchase price of $1.00 per share. Pursuant to its terms, the convertible stock will convert into shares of our common stock upon certain events. The interests of our stockholders will be diluted upon such conversion.

• We may incur substantial debt, which could hinder our ability to make distributions to our stockholders or could decrease the value of your investment in the event that income on, or the value of, the property securing such debt falls.

• Our investment strategy may cause us to lose our REIT status, or to own and sell properties through taxable REIT subsidiaries, each of which would diminish the return to our stockholders.

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

No one is authorized to make any statement about this offering different from those that appear in this prospectus. The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence that may flow from an investment in this offering is not permitted.

Behringer Harvard Opportunity REIT I, Inc. is not a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940 and is not subject to regulation thereunder.

The dealer manager of this offering, Behringer Securities LP, is our affiliate. The dealer manager is not required to sell any specific number of shares or dollar amount of our common stock but will use its best efforts to sell the shares offered hereby.

The date of this prospectus is June 1, 2006

SUITABILITY STANDARDS

General

An investment in our common stock involves significant risk and is only suitable for persons who have adequate financial means, desire a relatively long-term investment and who will not need immediate liquidity from their investment. Persons who meet this standard and seek to diversify their personal portfolios with a finite-life, real estate-based investment, preserve capital, receive current income, obtain the benefits of potential capital appreciation over the anticipated life of the fund, and who are able to hold their investment for a time period consistent with our liquidity plans are most likely to benefit from an investment in our company. On the other hand, we caution persons who require immediate liquidity or guaranteed income, or who seek a short-term investment, not to consider an investment in our common stock as meeting these needs.

In order to purchase shares in this offering, you must:

• meet the applicable financial suitability standards as described below; and

• purchase at least the minimum number of shares as described below.

We have established suitability standards for initial stockholders and subsequent purchasers of shares from our stockholders. These suitability standards require that a purchaser of shares have, excluding the value of a purchaser’s home, furnishings and automobiles, either:

• a net worth of at least $150,000; or

• a gross annual income of at least $45,000 and a net worth of at least $45,000.

The minimum purchase is 200 shares ($2,000), except in certain states as described below. You may not transfer fewer shares than the minimum purchase requirement. In addition, you may not transfer, fractionalize or subdivide your shares so as to retain less than the number of shares required for the minimum purchase. In order to satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate IRAs, provided that each such contribution is made in increments of $100. You should note that an investment in shares of our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code.

After you have purchased the minimum investment, or have satisfied the minimum purchase requirements of Behringer Harvard REIT I, Behringer Harvard Short-Term Opportunity Fund I, Behringer Harvard Mid-Term Value Enhancement Fund I or any other Behringer Harvard public real estate program, any additional purchase must be in increments of at least 2.5 shares ($25), except for (1) purchases of shares pursuant to our distribution reinvestment plan or reinvestment plans of other Behringer Harvard public real estate programs, which may be in lesser amounts, and (2) purchases made by Minnesota and Oregon residents in other Behringer Harvard public real estate programs, who must still satisfy the minimum purchase requirements established by each program.

Several states have established suitability requirements that are more stringent than the standards that we have established and described above. Shares will be sold only to investors in these states who meet the special suitability standards set forth below:

• Arizona, Iowa, Kansas, Massachusetts, Michigan and Tennessee - Investors must have either (1) a net worth of at least $225,000 or (2) gross annual income of $60,000 and a net worth of at least $60,000.

• California – Investors must have either (1) a net worth of at least $225,000 or (2) gross annual income of $60,000 and a net worth of at least $60,000; provided, however, that such special suitability standards shall not be applicable to an individual (or a husband and wife) who, including the proposed purchase, has not purchased more than $2,500 worth of securities issued or proposed to be issued by us within the twelve months preceding the proposed sale.

• New Jersey – Investors must have either (1) a net worth of at least $225,000 or (2) annual taxable income of $60,000 and a net worth of at least $60,000.

• Maine – Investors must have either (1) a net worth of at least $200,000 or (2) gross annual income of $50,000 and a net worth of at least $50,000.

• Ohio – Investors must have either (1) a net worth of at least $250,000 or (2) gross annual income of $70,000 and a net worth of at least $70,000. In addition, investors must have a liquid net worth of at least ten times their investment in the shares of us and our affiliates.

• Kansas and Pennsylvania - In addition to our standard suitability requirements, investors must have a liquid net worth of at least ten times their investment in our shares.

In all states listed above, net worth is to be determined excluding the value of a purchaser’s home, furnishings and automobiles.

1

Because the minimum offering of our common stock is less than $47,600,000, Pennsylvania investors are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of our subscription proceeds.

On April 11, 2006, the Pennsylvania Securities Commission approved our registration to offer and sell our shares in Pennsylvania contingent upon our undertaking to amend Article XIII of our charter. See the “Description of Shares – Provisions of Maryland law and of Our Charter and Bylaws” section of this prospectus and our definitive proxy statement, as filed with the Securities and Exchange Commission on April 28, 2006, for a more detailed discussion of this amendment to our charter.

In the case of sales to fiduciary accounts, these suitability standards must be met by one of the following: (1) the fiduciary account, (2) the person who directly or indirectly supplied the funds for the purchase of the shares or (3) the beneficiary of the account. These suitability standards are intended to help ensure that, given the long-term nature of an investment in our shares, our investment objectives and the relative illiquidity of our shares, shares of our common stock are an appropriate investment for those of you who become investors.

Each participating broker-dealer, authorized representative or any other person selling shares on our behalf are required to:

• make every reasonable effort to determine that the purchase of shares is a suitable and appropriate investment for each investor based on information provided by such investor to the broker-dealer, including such investor’s age, investment objectives, investment experience, income, net worth, financial situation and other investments held by such investor; and

• maintain records for at least six years of the information used to determine that an investment in the shares is suitable and appropriate for each investor.

In making this determination, your participating broker-dealer, authorized representative or other person selling shares on our behalf will consider, based on a review of the information provided by you, whether you:

• meet the minimum income and net worth standards established in your state;

• can reasonably benefit from an investment in our common stock based on your overall investment objectives and portfolio structure;

• are able to bear the economic risk of the investment based on your overall financial situation; and

• have an apparent understanding of:

o the fundamental risks of an investment in our common stock;

o the risk that you may lose your entire investment;

o the lack of liquidity of our common stock;

o the restrictions on transferability of our common stock;

o the background and qualifications of our advisor; and

o the tax consequences of an investment in our common stock.

Restrictions Imposed by the PATRIOT Act and Related Acts

The shares of common stock offered hereby may not be offered, sold, transferred or delivered, directly or indirectly, to any “unacceptable investor.” “Unacceptable investor” means any person who is a:

• person or entity who is a “designated national,” “specially designated national,” “specially designated terrorist,” “specially designated global terrorist,” “foreign terrorist organization,” or “blocked person” within the definitions set forth in the Foreign Assets Control Regulations of the U.S. Treasury Department;

• person acting on behalf of, or any entity owned or controlled by, any government against whom the U.S. maintains economic sanctions or embargoes under the Regulations of the U.S. Treasury Department;

• person or entity who is within the scope of Executive Order 13224-Blocking Property and Prohibiting Transactions with Persons who Commit, Threaten to Commit, or Support Terrorism, effective September 24, 2001;

• person or entity subject to additional restrictions imposed by the following statutes or regulations and executive orders issued thereunder: the Trading with the Enemy Act, the Iraq Sanctions Act, the National Emergencies Act, the Antiterrorism and Effective Death Penalty Act of 1996, the International Emergency Economic Powers Act, the United Nations Participation Act, the International Security and Development Cooperation Act, the Nuclear Proliferation Prevent Act of 1994, the Foreign Narcotics Kingpin Designation Act, the Iran and Libya Sanctions Act of 1996, the Cuban Democracy Act, the Cuban Liberty and Democratic Solidarity Act and the Foreign Operations, Export Financing and

2

Related Programs Appropriations Act or any other law of similar import as to any non-U.S. country, as each such act or law has been or may be amended, adjusted, modified or reviewed from time to time; or

• person or entity designated or blocked, associated or involved in terrorism, or subject to restrictions under laws, regulations, or executive orders as may apply in the future similar to those set forth above.

3

PROSPECTUS SUMMARY

This prospectus summary highlights selected information contained elsewhere in this prospectus. See also the “Questions and Answers About this Offering” section immediately following this summary. This section and the “Questions and Answers About this Offering” section do not contain all of the information that is important to your decision whether to invest in our common stock. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements.

Behringer Harvard Opportunity REIT I, Inc.

Behringer Harvard Opportunity REIT I, Inc. is a Maryland corporation formed in November 2004 that intends to qualify as a real estate investment trust (REIT) under federal tax law. We intend to acquire and operate commercial real estate. In particular, we focus on acquiring properties with significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning or those located in markets with higher volatility, lower barriers to entry and high growth potential. We may acquire office, industrial, retail, hospitality, multi-family and other real properties, including existing or newly constructed properties or properties under development or construction. Further, we may invest in real estate related securities, including securities issued by other real estate companies, either for investment or in change of control transactions completed on a negotiated basis or otherwise. We also may invest in collateralized mortgage-backed securities, mortgage, bridge or mezzanine loans and Section 1031 tenant-in-common interests (including those previously issued by programs sponsored by Behringer Harvard Holdings, LLC (referred to herein as Behringer Harvard Holdings) or its affiliates), or in entities that make investments similar to the foregoing. Although our sole investment to date has been located in the United States, we also may invest in real estate assets located outside the United States. Our investment strategy is designed to provide investors with a geographically diversified portfolio of real estate assets. We plan to be opportunistic in our investments. Our office is located at 15601 Dallas Parkway, Suite 600, Addison, Texas 75001. Our toll free telephone number is (866) 655-1605. We sometimes refer to Behringer Harvard Opportunity REIT I, Inc. as Behringer Harvard Opportunity REIT I in this prospectus.

Our Advisor

Our advisor is Behringer Harvard Opportunity Advisors I LP (Behringer Harvard Opportunity Advisors I), a Texas limited partnership formed in November 2004, which is responsible for managing our affairs on a day-to-day basis and for identifying and making acquisitions and investments on our behalf.

Our Management

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. Our board of directors, including a majority of our independent directors, must approve each investment proposed by our advisor, as well as certain other matters set forth in our charter. Prior to the commencement of this offering, we will have three members on our board of directors. Two of the directors will be independent of our advisor and have responsibility for reviewing its performance. Our directors are elected annually by the stockholders. Although we have executive officers who will manage our operations, we do not have any paid employees. Except with respect to stock options that may be granted to our executive officers, only our non-employee directors are compensated for their services to us.

Our REIT Status

As a REIT, we generally will not be subject to federal income tax on income that we distribute to our stockholders. Under the Internal Revenue Code of 1986, as amended (Internal Revenue Code), REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute at least 90% of their taxable income, excluding income from operations or sales through taxable REIT subsidiaries. If we fail to qualify for taxation as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

Terms of the Offering

We are offering up to 40,000,000 shares of our common stock to the public at $10.00 per share. We are also offering up to 8,000,000 shares pursuant to our distribution reinvestment plan at a price of $9.50 per share. We

4

will offer shares of our common stock until the earlier of September 20, 2007, or the date we sell all $476,000,000 worth of shares in this offering; provided, however, that the amount of shares registered pursuant to this offering is the amount which, as of the date of this prospectus, we reasonably expect to be offered and sold within two years from the date of this prospectus, and to the extent permitted by applicable law, we may extend this offering for an additional year; provided, further, that notwithstanding the foregoing, we may elect to extend the offering period up to the sixth anniversary of the termination of this offering solely for the shares reserved for issuance pursuant to our distribution reinvestment plan if all such shares are not sold prior to the termination date. We may terminate this offering at any time prior to such termination date. This offering must be registered, or exempt from registration, in every state in which we offer or sell shares. Generally, such registrations are for a period of one year. Therefore, we may have to stop selling shares in any state in which the registration is not renewed annually. Having sold the initial 200,000 shares, subscription proceeds shall be paid directly to us. The proceeds will be held until investors are admitted as stockholders. Subscriptions will be effective only upon our acceptance and countersigning of the subscription agreement, and we reserve the right to reject any subscription in whole or in part, notwithstanding our deposit of the subscription proceeds. We intend to accept or reject subscriptions and admit new stockholders at least monthly, but may do so on a more frequent basis. If we reject your subscription, we will return your subscription funds, plus interest, if such funds have been held for more than 35 days, within ten days after the date of such rejection.

We have issued to Behringer Harvard Holdings, an affiliate of our advisor, 1,000 shares of our non-participating, non-voting, convertible stock. The convertible stock is non-voting, is not entitled to any distributions and is a separate class of stock from the common stock to be issued in this offering. Any reference in this prospectus to our “common stock” means the class of common stock offered hereby. Any reference in this prospectus to our “convertible stock” means the class of non-participating, non-voting, convertible stock previously issued to Behringer Harvard Holdings.

Certain Summary Risk Factors

An investment in our common stock is subject to significant risks that are described in more detail in the “Risk Factors” and “Conflicts of Interest” sections of this prospectus. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives and, therefore, you may lose some or all of your investment. The following is a summary of the risks that we believe are most relevant to an investment in shares of our common stock:

• There is no public trading market for the shares, and we cannot assure you that one will ever develop. Until the shares are publicly traded, you will have difficulty selling your shares, and even if you are able to sell your shares, you will likely have to sell them at a substantial discount.

• We have no operating history nor established financing sources.

• This is a “blind pool” offering because, with the exception of the 12600 Whitewater property described herein, we do not currently own any properties, and with the exception of the Ferncroft property described herein, we have not identified any other properties to acquire with proceeds from this offering. You will not have the opportunity to evaluate our investments prior to our making them. You must rely totally upon our advisor’s ability to select our investments.

• The number of properties that we will acquire and the diversification of our investments will be reduced to the extent that we sell less than all of the 40,000,000 shares. If we do not sell substantially more than the minimum offering amount, we may buy only one property and the value of your investment may fluctuate more widely with the performance of specific investments. There is a greater risk that you will lose money in your investment if we cannot diversify our portfolio of investments by geographic location and property type.

• Our ability to achieve our investment objectives and to make distributions depends on the performance of our advisor for the day-to-day management of our business and the selection of our real estate properties, loans and other investments.

• Our opportunistic property acquisition strategy may involve the acquisition of properties in markets that are depressed or overbuilt, have low barriers to entry and higher volatility in real estate lease rates and sale prices. As a result of our investment in these types of markets, we will face increased risks relating to changes in local market conditions and increased competition for similar properties in the same market, as well as increased risks that these markets will not recover and the value of our properties in these markets will not increase, or will decrease, over time. Our intended approach to

5

acquiring and operating income-producing properties involves more risk than comparable real estate programs that have a targeted holding period for investments longer than ours, utilize leverage to a lesser degree and/or employ more conservative investment strategies.

• Until proceeds from this offering are invested and generating operating cash flow sufficient to make distributions to our stockholders, we intend to pay all or a substantial portion of our distributions from the proceeds of this offering or from borrowings in anticipation of future cash flow, which may reduce the amount of capital we ultimately invest in properties, and negatively impact the value of your investment.

• We will pay significant fees to our advisor and its affiliates, some of which are payable based upon factors other than the quality of services provided to us.

• Our advisor and its affiliates will face various conflicts of interest resulting from their activities with affiliated entities, such as conflicts related to allocating the purchase and leasing of properties between us and other Behringer Harvard sponsored programs, conflicts related to any joint ventures, tenant-in-common investments or other co-ownership arrangements between us and any such other programs and conflicts arising from time demands placed on our advisor and its executive officers in serving other Behringer Harvard sponsored programs.

• We have issued to an affiliate of our advisor 1,000 shares of our convertible stock at a purchase price of $1.00 per share. Pursuant to its terms, the convertible stock will convert into shares of common stock upon the full return of our stockholders’ invested capital plus a 10% cumulative, non-compounded, annual return or the listing of our common stock for trading on a national securities exchange or for quotation on the Nasdaq National Market System. The interests of our stockholders will be diluted upon conversion of the convertible stock into shares of common stock. The terms of the convertible stock provide that, generally, the holder of such shares will receive shares of common stock with a value equal to the sum of (1) 15% of the excess of our enterprise value over the aggregate of the capital invested by our stockholders and (2) a 10% cumulative, non-compounded, annual return on such capital. Thus, it is impossible to quantify at this time the extent of the dilution to existing stockholders upon such conversion.

• We may incur substantial debt. Loans we obtain will be secured by some of our properties, which will put those properties at risk of forfeiture if we are unable to pay our debts and could hinder our ability to make distributions to our stockholders in the event income on such properties, or their value, falls.

• To ensure that we continue to qualify as a REIT, our charter contains certain protective provisions, including a provision that prohibits any stockholder from owning more than 9.8% of our outstanding common stock during any time that we are qualified as a REIT. However, our charter also allows our board to waive compliance with certain of these protective provisions, which may have the effect of jeopardizing our REIT status. Furthermore, this limitation does not apply to the holder of our convertible stock or shares of common stock issued upon conversion of our convertible stock.

• We may not qualify or remain qualified as a REIT for federal income tax purposes, which would subject us to the payment of tax on our income at corporate rates and reduce the amount of funds available for payment of distributions to our stockholders.

• Our opportunistic investment strategy may result in a finding by the Internal Revenue Service that we have engaged in one or more “prohibited transactions” under provisions of the Internal Revenue Code related to dispositions of properties deemed to be inventory or otherwise held for sale in the ordinary course of our business. This could cause all of the gain we realize from any such sale to be payable as a tax to the Internal Revenue Service, with none of such gain available for distribution to our stockholders. Further, if we hold and sell one or more properties through taxable REIT subsidiaries, our return to stockholders would be diminished because the gain from any such sale would be subject to a corporate-level tax, thereby reducing the net proceeds from such sale available for distribution to our stockholders. Moreover, if the ownership and sale of one of more of our properties by a taxable REIT subsidiary causes the value of our taxable REIT subsidiaries to exceed 20% of the value of all of our assets at the end of any calendar quarter, we may lose our status as a REIT.

• Real estate investments are subject to general downturns in the industry as well as downturns in specific geographic areas. We cannot predict what the occupancy level will be in a particular building or that any tenant or mortgage or other real estate-related loan borrower will remain solvent. We also

6

cannot predict the future value of our properties. Accordingly, we cannot guarantee that you will receive cash distributions or appreciation of your investment.

• You will not have preemptive rights as a stockholder, so any shares we issue in the future may dilute your interest in us.

• We may invest some or all of the offering proceeds to acquire vacant land on which a building will be constructed in the future. Additionally, we may acquire property for redevelopment. These types of investments involve risks relating to the construction company’s ability to control construction costs, failure to perform, or failure to build or redevelop in conformity with plan specifications and timetables. We will be subject to potential cost overruns and time delays for properties under construction or redevelopment. Increased costs of newly constructed or redeveloped properties may reduce our returns to you, while construction delays may delay our ability to distribute cash to you.

• The vote of stockholders owning at least a majority of our shares will bind all of the stockholders as to certain matters such as the election of directors and an amendment of our charter.

• If we do not list our common stock for trading on a national securities exchange (the New York Stock Exchange or the American Stock Exchange) or for quotation on the Nasdaq National Market System by the sixth anniversary of the termination of this offering, unless such date is extended by a majority of our board of directors and a majority of our independent directors, our charter provides that we must begin to sell all of our properties and distribute the net proceeds to our stockholders.

• Each of our executive officers, including Robert M. Behringer, who also serves as the chairman of our board of directors, also serve as officers of our advisor, our property manager, our dealer manager and other affiliated entities, including the advisor(s) to and general partners of other Behringer Harvard sponsored real estate programs, and as a result they will face conflicts of interest relating from their duties to these other entities.

Description of Properties to be Acquired, Investments and Borrowing

As of the date of this prospectus, with the exception of the 12600 Whitewater and Ferncroft properties described in the “Investment Objectives and Criteria – Real Property Investments” section of this prospectus, we have neither acquired nor contracted to acquire any investments, nor have we identified any assets in which there is currently a reasonable probability that we will invest. We will use an opportunistic investment strategy in which we will seek to invest in properties that we believe may be repositioned or redeveloped so that they will reach an optimum value within six years after the termination of this offering. We may acquire properties with lower tenant quality or low occupancy rates and reposition them by seeking to improve the property, tenant quality and occupancy rates and thereby increase lease revenues and overall property value. Further, we may invest in properties that we believe present an opportunity for enhanced future value because all or a portion of the tenant leases expire within a short period after the date of acquisition and we intend to renew leases or replace existing tenants at the properties for improved tenant quality. We may invest in a wide variety of commercial properties, including, without limitation, office buildings, shopping centers, business and industrial parks, manufacturing facilities, apartment buildings, warehouses and distribution facilities, and motel and hotel properties. We may purchase properties that have been constructed and have operating histories, are newly constructed, are under development or construction, or are not yet developed. Additionally, as a property reaches what we believe to be its optimum value, we will consider disposing of the property and may do so for the purpose of either distributing the net sale proceeds to our stockholders or investing the proceeds in other properties that we believe may produce a higher overall future return to our investors. We anticipate that such dispositions typically would occur during the period from three to six years after the termination of this offering. However, we may consider investing in properties with a different anticipated holding period in the event such properties provide an opportunity for an attractive overall return. We may also acquire properties in markets that are depressed or overbuilt with the anticipation that, within our anticipated holding period, the markets will recover and favorably impact the value of these properties. Many of the markets where we will acquire properties may have low barriers to entry and higher volatility in real estate lease rates and sale prices. In addition, we may acquire interests in other entities with similar real property investments or investment strategies. As a result of our flexibility to invest in a variety of types of commercial properties rather than in specific limited property types, our intent to target properties with significant possibilities for near-term capital appreciation, and our use of a higher degree of leverage, we believe that we will have the opportunity to provide a rate of return superior to real estate programs that invest in a limited range of property types, have a longer anticipated holding period, utilize leverage to a lesser degree and/or employ more conservative investment strategies.

7

All directly owned real estate properties may be acquired, developed and operated by us alone or jointly with another party. We are likely to enter into one or more joint ventures, tenant-in-common investments or other co-ownership arrangements for the acquisition, development or improvement of properties with third parties or certain of our affiliates, including other present and future REITs and real estate limited partnerships sponsored by affiliates of our advisor. We may also serve as lender to these joint ventures, tenant-in-common investments or other joint venture arrangements or other Behringer Harvard sponsored programs.

Our board of directors has adopted a policy that we will limit our aggregate borrowings to approximately 75% of the aggregate value of our assets as of the date of any borrowing, unless substantial justification exists that borrowing a greater amount is in our best interests and a majority of our independent directors approve the greater borrowing. Our policy limitation does not apply to individual properties and only will apply once we have ceased raising capital under this or any subsequent offering. As a result, it can be expected that, with respect to the acquisition of one or more of our properties, we may incur indebtedness of more than 75% of the asset value of the property acquired, and that our debt levels likely will be higher until we have completed our capital raising offerings and invested most of our capital. However, our advisor’s and its affiliates’ experience with prior real estate programs with similar opportunistic investment strategies has been that lenders’ preferences will be to make loans of closer to 60% to 65% of the asset value of a property of the type targeted by us until such time as the property has been successfully repositioned or redeveloped. In that event, we expect to borrow up to the maximum amount available from our lenders. Our board of directors must review our aggregate borrowings at least quarterly. We have not established any financing sources at this time. See the “Investment Objectives and Criteria – Borrowing Policies” section of this prospectus for a more detailed discussion of our borrowing policies.

Estimated Use of Proceeds of this Offering

We expect that if the maximum offering amount is raised, at least 90.6% of the gross proceeds of this offering (89% in a minimum offering) will be used for investment in real estate, loans and other investments, paying the expenses incurred in making such investments, and for initial working capital reserves for real estate investments. We expect to use approximately 87.1% of the gross proceeds if the maximum offering amount is raised (85.6% in a minimum offering) to make investments in real estate and real estate related assets and to use approximately 3.5% of the gross proceeds if the maximum offering amount is raised (3.4% in a minimum offering), assuming no debt financing, for payment of fees and expenses related to the selection and acquisition of our investments and for initial working capital reserves for real estate investments. The remaining proceeds will be used to pay acquisition and advisory fees to our advisor in connection with its work in identifying, reviewing, and evaluating investments in properties, the purchase, development or construction of such properties, and the making of or investing in loans or other investments related to real estate.

Investment Objectives

Our overall investment objectives, in their relative order of importance, are:

• to realize growth in the value of our investments to enhance the value received upon our ultimate sale of such investments or the listing of our shares for trading on a national securities exchange or for quotation on the Nasdaq National Market System;

• to preserve, protect and return (through our ultimate sale of our investments or the listing of our shares for trading on a national securities exchange or for quotation on the Nasdaq National Market System) your capital contribution;

• to grow net cash from operations such that more cash is available for distributions to you; and

• to provide you with a return of your investment by beginning the process of liquidation and distribution within three to six years after the termination of this offering or by listing the shares for trading on a national securities exchange or for quotation on the Nasdaq National Market System. If we do not liquidate or obtain listing or quotation of the shares by the sixth anniversary of the termination of this offering, we will make an orderly disposition of our assets and distribute the cash to you unless a majority of the board of directors and a majority of the independent directors extends such date.

We may only change these investment objectives upon a majority vote of the stockholders. See the “Investment Objectives and Criteria” section of this prospectus for a more complete description of our business and objectives.

8

Distribution Policy

In order to qualify as a REIT, we are required to distribute 90% of our annual taxable income to our stockholders. After we begin making distributions to our stockholders, we intend to coordinate our distribution declaration dates with our new investor admission dates so that thereafter, our investors will be entitled to be paid distributions immediately upon their purchase of shares. However, we will not pay any distributions until after we have commenced real estate operations, which did not occur until after we sold the initial 200,000 shares of common stock in this offering and released the proceeds of those sales from escrow. Because of this, investors who invest in us at the beginning of this offering may realize a lower rate of return than later investors. Further, because we have not identified any probable investments, other than our purchase of the 12600 Whitewater property described herein, there can be no assurances as to when we will begin to generate sufficient cash flow and to make distributions. We expect to have little, if any, cash flow from operations available for distribution until we make substantial investments in properties. Therefore we anticipate paying all or a significant portion of initial distributions from the proceeds of this offering or from borrowings until such time as we have sufficient cash flow from operations to fund the payment of distributions. Additionally, our taxable income may exceed available cash even after we begin receiving cash flow from operations. As a result, we may need to borrow funds in order to make required distributions.

Once we begin making distributions, we intend to make them on a monthly basis to our stockholders. Our board of directors will determine the amount of each distribution. Although currently we anticipate paying all or a substantial portion of our initial distributions from available capital in anticipation of future cash flow, the amount of each distribution generally will be based upon such factors as the amount of distributable funds, capital available or anticipated to be available from our properties, real estate securities, loans and other investments, current and projected cash requirements, tax considerations and other factors. Distributions in any period may constitute a return of capital.

Conflicts of Interest

Our advisor and its and our executive officers will experience conflicts of interest in connection with the management of our business affairs, including the following:

• Our advisor and its officers and directors will have to allocate their time between us and the other Behringer Harvard sponsored programs and activities in which they are involved;

• Our advisor and the advisors and general partners of our affiliated programs must determine which Behringer Harvard sponsored program or other entity should purchase any particular property, make or purchase any particular mortgage loan or mortgage loan participation or make any other investment, or enter into a joint venture, tenant-in-common investment, or other co-ownership arrangements for the acquisition, development or improvement of specific properties. Our advisor’s affiliates are the advisors or general partners of other Behringer Harvard sponsored real estate programs. The executive officers of our advisor also are the executive officers of these affiliates, and these entities are under common ownership.

• Our advisor may compete with other Behringer Harvard sponsored programs and properties owned by officers and directors of our advisor, including programs for which our advisor’s affiliates serve as advisor, for the same tenants in negotiating leases, making or investing in mortgage, bridge or mezzanine loans or in selling similar properties at the same time; and

• Our advisor and its affiliates will receive fees in connection with transactions involving the purchase, management and sale of our investments regardless of the quality of the services provided to us.

• We have issued 1,000 shares of our convertible stock to Behringer Harvard Holdings, an affiliate of our advisor, for an aggregate purchase price of $1,000. Robert Behringer, our President, Chief Executive Officer and Chairman of the Board, owns approximately 55% of the limited liability company interests of Behringer Harvard Holdings. Under limited circumstances, these shares of convertible stock may be converted into shares of our common stock, thereby resulting in dilution of our stockholders’ interest in us. The terms of the convertible stock provide that, generally, the holder of such shares will receive shares of common stock with a value equal to 15% of the excess of our enterprise value over the sum of the capital invested by the stockholders and a 10% cumulative, non-compounded, annual return on such capital. We believe that the convertible stock provides an incentive for our advisor to increase the overall return to our investors. The shares of convertible stock will be converted into shares of common stock if:

9

o the holders of our common stock have received aggregate distributions equal to the sum of the capital invested by such stockholders and a 10% cumulative, non-compounded, annual return through the date of conversion;

o shares of our common stock are listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System; or

o the advisory agreement expires without renewal or is terminated, other than due to a material breach by our advisor, and at the time of or subsequent to such termination the holders of our common stock have received aggregate distributions equal to the sum of the capital invested by such stockholders and a 10% cumulative, non-compounded, annual return on such capital contributions through the date of conversion.

See the “Conflicts of Interest” section of this prospectus for a detailed discussion of the various conflicts of interest relating to your investment, as well as the procedures that we have established to resolve or mitigate a number of these potential conflicts.

10

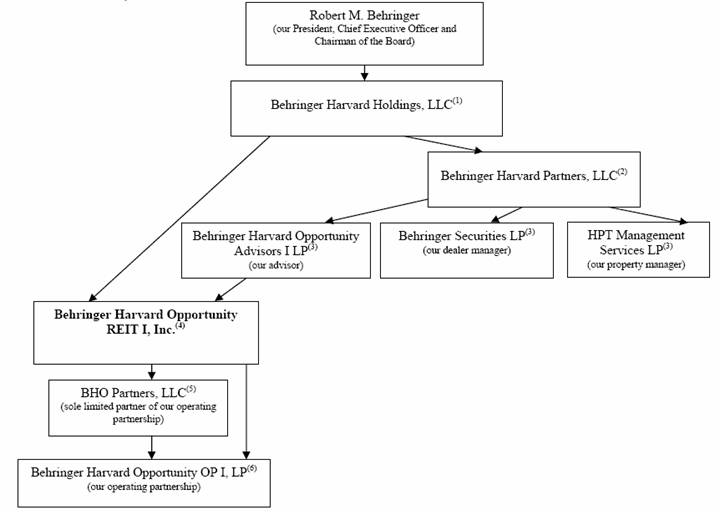

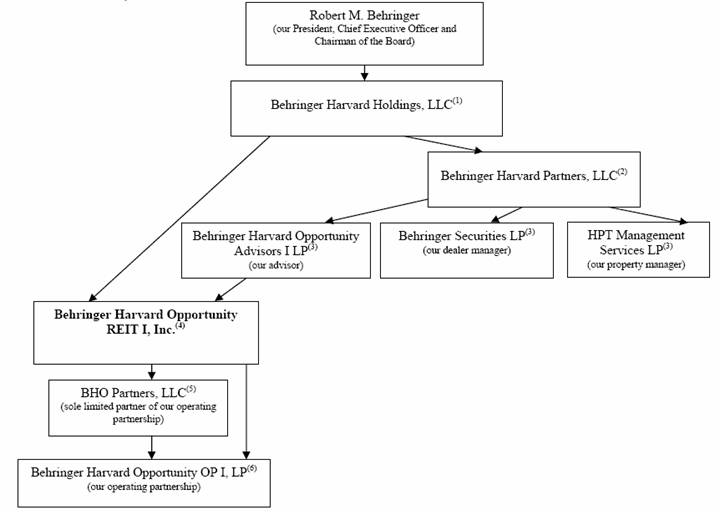

The following chart shows the ownership structure of the various Behringer Harvard entities that are affiliated with us. The address of the executive offices of each of the listed Behringer Harvard entities is 15601 Dallas Parkway, Suite 600, Addison, Texas 75001.

(1) Robert Behringer, our President, Chief Executive Officer and Chairman of the Board, owns approximately 55% of the economic limited liability company interests of Behringer Harvard Holdings and 100% of the voting interests. The remaining interests are owned by persons not affiliated with Mr. Behringer.

(2) Behringer Harvard Holdings owns 100% of the limited liability company interests of Behringer Harvard Partners, LLC (Behringer Harvard Partners).

(3) Behringer Harvard Partners is the 99.9% owner and the sole limited partner of each of Behringer Harvard Opportunity Advisors I, our advisor, Behringer Securities LP (Behringer Securities), our dealer manager, and HPT Management Services LP (HPT Management), our affiliated property management company. Harvard Property Trust, LLC, a wholly owned subsidiary of Behringer Harvard Holdings, is the owner of the remaining 0.1% and the sole general partner of each of Behringer Harvard Opportunity Advisors I and Behringer Securities. IMS, LLC, another wholly owned subsidiary of Behringer Harvard Holdings, is the owner of the remaining 0.1% interest and the sole general partner of HPT Management.

(4) Behringer Harvard Holdings currently owns 21,739 of our issued and outstanding shares of common stock and all 1,000 of our issued and outstanding shares of convertible stock. The convertible stock is convertible into common shares in certain circumstances. However, the actual number of shares of common stock issuable upon conversion of the convertible stock is indeterminable at this time. Upon completion of this offering, the 21,739 shares of common stock currently owned by Behringer Harvard Holdings will represent 9.8% of our outstanding common stock if we sell the minimum offering of 200,000 shares and less than 0.1% if we sell the maximum of 48,000,000 shares in this offering.

(5) We own 100% of the limited liability company interests of BHO Partners, LLC (BHO Partners).

(6) BHO Partners currently is the sole limited partner and the 99.9% owner of Behringer Harvard Opportunity OP I, LP (Behringer Harvard Opportunity OP I), our operating partnership. We are the sole general partner and owner of the remaining 0.1% of Behringer Harvard Opportunity OP I.

11

Prior Offering Summary

In addition to our REIT, Mr. Behringer, our founder, Chief Executive Officer and Chief Investment Officer, has recently sponsored the following programs through Behringer Harvard Holdings: one publicly offered REIT, Behringer Harvard REIT I, Inc. (Behringer Harvard REIT I); two publicly offered real estate limited partnerships, Behringer Harvard Short-Term Opportunity Fund I LP (Behringer Harvard Short-Term Fund I) and Behringer Harvard Mid-Term Value Enhancement Fund I LP (Behringer Harvard Mid-Term Fund I); nine private offerings of tenant-in-common interests; and two private real estate limited partnerships, Behringer Harvard Strategic Opportunity Fund I LP (Behringer Harvard Strategic Opportunity Fund I) and Behringer Harvard Strategic Opportunity Fund II LP (Behringer Harvard Strategic Opportunity Fund II). Over the last 15 years, Mr. Behringer has sponsored an additional 29 privately offered real estate programs, consisting of 28 single-asset, real estate limited partnerships and a private REIT, Harvard Property Trust, Inc. As of December 31, 2005, approximately 26,000 investors had invested an aggregate of approximately $1.1 billion in the foregoing real estate programs. The “Prior Performance Summary” section of this prospectus contains a discussion of the programs sponsored by Mr. Behringer from January 1, 1995. Certain statistical data relating to such programs with investment objectives similar to ours also is provided in the “Prior Performance Tables” included as Exhibit A to this prospectus. The prior performance of the programs previously sponsored by Mr. Behringer is not necessarily indicative of the results that we will achieve. Therefore, you should not assume that you will experience returns, if any, comparable to those experienced by investors in such prior real estate programs.

Compensation to Our Advisor and Its Affiliates

Our advisor and its affiliates will receive compensation and fees for services relating to this offering and the investment, management and disposition of our assets. The most significant items of compensation are summarized in the following table:

Type of Compensation | | | Form of Compensation | | | Estimated $Amount

for Maximum Offering

(48,000,000 shares -

$476,000,000) |

Offering Stage |

Sales Commissions | | | Up to 7% of gross offering proceeds; limited to 1% for sales under our distribution reinvestment plan. | | | $28,760,000 |

Dealer Manager Fee | | | Up to 2% of gross offering proceeds; no dealer manager fee will be paid with respect to sales under our distribution reinvestment plan. | | | $8,000,000 |

Organization and Offering Expenses | | | Up to 2% of gross offering proceeds; no organization and offering expenses will be paid with respect to sales under our distribution reinvestment plan. | | | $8,000,000 |

Acquisition and Development Stage |

Acquisition and Advisory Fees | | | 2.5% of the contract purchase price of each asset for the acquisition, development, construction or improvement of real property or the amount of funds advanced by us in respect of a loan or other investment. | | | $10,366,346 (1) |

Acquisition Expenses | | | Up to 0.5% of the contract purchase price of each property or the amount of funds advanced in respect of a loan. | | | $2,073,269 (1) |

Debt Financing Fee | | | 1% of the amount available under any debt made available to us. It is anticipated that our advisor will pay some or all of the fees to third parties with whom it subcontracts to coordinate financing for us. | | | Not determinable at this time |

(1) Assumes no financing is used to acquire properties or other investments. However, it is our intent to leverage our investments with debt. Therefore, actual amounts are dependent upon the value of our assets as financed and cannot be determined at the present time.

12

Type of Compensation | | | Form of Compensation | | | Estimated $Amount

for Maximum Offering

(48,000,000 shares -

$476,000,000) |

Development Fee | | | We will pay a development fee in an amount that is usual and customary for comparable services rendered to similar projects in the geographic market of the project; provided, however, we will not pay a development fee to an affiliate of our advisor if our advisor or any of its affiliates elects to receive an acquisition and advisory fee based on the cost of such development. | | | Not determinable at this time. |

Operational Stage |

Property Management and Leasing Fees | | | Property management fees equal to 4.5% of gross revenues of the properties managed by HPT Management. It is anticipated that HPT Management will pay some or all of these fees to third parties with whom it subcontracts to perform property management or leasing services. In the event that we contract directly with a non-affiliated third-party property manager in respect of a property, we will pay HPT Management an oversight fee equal to 1% of gross revenues of the property managed. In no event will we pay both a property management fee and an oversight fee to HPT Management with respect to any particular property. In addition, separate leasing fees may be paid in an amount equal to the fee customarily charged by others rendering similar services in the same geographic area. Furthermore, other third-party charges, including fees and expenses of third-party accountants, will be reimbursed. | | | Not determinable at this time. |

Asset Management Fee | | | Monthly fee of one-twelfth of 0.75% of our aggregate assets value as of the last day of the preceding month. | | | Not determinable at this time. |

Subordinated Disposition Fee | | | If our advisor provides a substantial amount of services, as determined by our independent directors, in connection with the sale of assets, it will receive (subject to satisfaction of the condition set forth below) a subordinated disposition fee equal to (1) in the case of the sale of real property, the lesser of: (A) one-half of the aggregate brokerage commission paid (including the subordinated disposition fee) or, if none is paid, the amount that customarily would be paid, or (B) 3% of the sales price of each property sold, and (2) in the case of the sale of any asset other than real property, 3% of the sales price of such assets, upon satisfaction of the condition that the investors have first received distributions equal to the sum of the aggregate capital contributions by investors plus a 10% cumulative, non-compounded, annual return on such capital contributions. Subordinated disposition fees relative to asset sales made prior to the satisfaction of the above condition will be a contingent liability of the company, which will be earned and paid at such time as the above condition has been satisfied, if ever. | | | Not determinable at this time. |

13

Type of Compensation | | | Form of Compensation | | | Estimated $Amount

for Maximum Offering

(48,000,000 shares -

$476,000,000) |

Subordinated Participation in Net Sale Proceeds (payable only if our shares are not listed on an exchange) | | | 15% of remaining amounts of net sale proceeds after investors have received distributions equal to the sum of the aggregate capital contributions by investors plus a 10% cumulative, non-compounded, annual return on such capital contributions. Any such fees relative to asset sales made prior to the satisfaction of the above condition will be a contingent liability of the company, which shall be earned and paid at such time as the above condition has been satisfied, if ever. The subordinated participation in net sale proceeds will be reduced or eliminated upon conversion of our convertible stock. | | | Not determinable at this time. |

Subordinated Incentive Listing Fee (payable only if our shares are listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System) | | | Up to 15% of the amount, if any, by which (1) the market value of our outstanding shares plus distributions paid to our investors prior to listing exceeds (2) the sum of the aggregate capital contributions by investors plus a 10% cumulative, non-compounded, annual return on such capital contributions. The subordinated incentive listing fee will be paid in the form of an interest bearing promissory note that will be repaid using the net sales proceeds from each sale of property after the listing of our shares. The subordinated incentive listing fee will be reduced by or eliminated upon conversion of our convertible stock. | | | Not determinable at this time. |

Subordinated Performance Fee (payable upon termination of the advisory agreement only if the Subordinated Incentive Listing Fee is not paid) | | | Upon termination of the advisory agreement between us and our advisor, other than termination by us because of a material breach of the advisory agreement by the advisor, a performance fee of up to 15% of the amount, if any, by which (1) the sum of our actual value as a going concern (based on the actual value of our assets less our liabilities) at the time of such termination, plus total distributions paid to our stockholders through the termination date exceeds (2) the sum of the aggregate capital contributions by investors plus a 10% cumulative, non-compounded, annual return on such capital contributions. The subordinated performance fee will be paid in the form of an interest bearing promissory note that will be repaid using the net sales proceeds from each sale of property made after the date of termination. No subordinated performance fee will be paid if we have already paid or become obligated to pay our advisor a subordinated incentive listing fee. The subordinated performance fee will be reduced or eliminated upon the determination of the number of shares of common stock issuable upon conversion of our convertible stock. | | | Not determinable at this time. |

There are many additional conditions and restrictions on the amount of compensation our advisor and its affiliates may receive. There are also some smaller items of compensation and expense reimbursements that our advisor may receive. For a more detailed explanation of the fees and expenses payable to our advisor and its affiliates, see the “Estimated Use of Proceeds” section of this prospectus and the “Management – Management Compensation” section of this prospectus.

14

Listing

Unless we liquidate earlier, we anticipate causing our shares of common stock to be listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System, or liquidating our real estate portfolio on or before the sixth anniversary of the termination of this offering. Depending upon then prevailing market conditions, it is our management’s intention to consider beginning the process of liquidation within three to six years after the termination of this offering. If we do not liquidate, our management intends to begin the process of causing our shares of common stock to be listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System prior to the sixth anniversary of the termination of this offering. In the event we do not obtain such listing prior to the sixth anniversary of the termination of this offering, unless a majority of our board of directors and a majority of our independent directors extend such date, our charter requires us to begin the sale of our properties and liquidation of our assets.

Distribution Reinvestment Plan

You may participate in our distribution reinvestment plan pursuant to which you may have the distributions you receive reinvested in shares of our common stock. Regardless of whether you participate in our distribution reinvestment plan, you will be taxed on your distributions to the extent they constitute taxable income, and participation in our distribution reinvestment plan would mean that you will have to rely solely on sources other than distributions from which to pay such taxes. As a result, you may have a tax liability without receiving cash distributions to pay such liability. We may terminate the distribution reinvestment plan in our discretion at any time upon ten days’ notice to plan participants. See the “Summary of Distribution Reinvestment and Automatic Purchase Plans” section of this prospectus for further explanation of our distribution reinvestment plan, a complete copy of which is attached as Exhibit C to this prospectus.

Share Redemption Program

On October 5, 2005, the SEC granted us exemptive relief from rules restricting issuer purchases during distributions with respect to our share redemption program. Accordingly, on February 17, 2006, our board of directors adopted our share redemption program, which permits you to sell your shares back to us after you have held them for a least one year, subject to the significant conditions and limitations described below. The per share redemption price will equal:

• prior to the time we begin having appraisals performed by an independent third party, the amount by which (a) the lesser of (1) 90% of the average price per share the original purchaser or purchasers of your shares paid to us for all of your shares (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like with respect to our common stock) or (2) 90% of the offering price of shares in our most recent offering exceeds (b) the aggregate amount of net sale proceeds per share, if any, distributed to investors prior to the redemption date as a result of the sale of one or more of our properties; or

• after we begin obtaining appraisals performed by an independent third party, the lesser of (1) 100% of the average price per share the original purchaser or purchasers of your shares paid for all of your shares (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like with respect to our common stock) or (2) 90% of the net asset value per share, as determined by the most recent appraisal.

In the discretion of our board of directors, we may also waive the one-year holding requirement and redeem shares due to other involuntary exigent circumstances surrounding the stockholder, such as bankruptcy, or due to a mandatory distribution requirement under a stockholder’s IRA, provided that your redemption request is made within 180 days of the event giving rise to such exigent circumstance.

Subject to the limitations described in this prospectus and provided that your redemption request is made within 180 days of the event giving rise to the special circumstances described in this prospectus, we will waive the one-year holding requirement and redeem shares (1) upon the request of the estate, heir or beneficiary of a deceased stockholder; or (2) upon the disability of the stockholder or such stockholder’s need for long-term care, provided that the condition causing such disability or need for long-term care was not pre-existing on the date that such stockholder became a stockholder. The purchase price per share for shares redeemed upon the death or disability of the stockholder or upon such stockholder’s need for long-term care, until we begin having appraisals performed by an independent third-party, will be the amount by which (a) the average price per share that the stockholder actually paid for the shares (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like with

15

respect to our common stock) exceeds (b) the aggregate amount of net sale proceeds per share, if any, distributed to investors prior to the redemption date as a result of the sale of one or more of our properties. The purchase price per share for shares redeemed upon the death of a stockholder or upon the disability of a stockholder or such stockholder’s need for long-term care after we begin obtaining appraisals performed by an independent third-party will be the net asset value per share as determined by the most recent appraisal.

We will not redeem in excess of 5% of the weighted average number of shares outstanding during the twelve-month period immediately prior the date of redemption. In addition, the cash available for redemption generally will be limited to any proceeds from our distribution reinvestment plan plus 1% of the operating cash flow from the previous fiscal year.

In general, you may present to us fewer than all of your shares for redemption, except that you must present for redemption at least 25% of your shares. However, provided that your redemption request is made within 180 days of the event giving rise to the special circumstances described in this sentence, where redemption is being requested:

• on behalf of a deceased stockholder;

• by a stockholder that is disabled or in need of long-term care;

• by a stockholder due to other involuntary exigent circumstances, such as bankruptcy; or

• by a stockholder due to a mandatory distribution under such stockholder’s IRA,

a minimum of 10% of the stockholder’s shares may be presented for redemption; provided, however, that any future redemption request by such stockholder must present for redemption at least 25% of such stockholder’s remaining shares. In the case of stockholders who undertake a series of partial redemptions, appropriate adjustments in the purchase price for the redeemed shares will be made so that the blended price per share for all redeemed shares is reflective of the original price per share of all shares purchased by such stockholder through the dates of each redemption.

In order to participate in our share redemption program, you must have, and will be required to certify to us that you, acquired the shares to be redeemed by either (1) a purchase directly from us or (2) a transfer from the original subscriber by way of a bona fide gift not for value to, or for the benefit of, a member of the subscriber’s immediate or extended family or through a transfer to a custodian, trustee or other fiduciary for the account of the subscriber or his immediate or extended family in connection with an estate planning transaction, including by bequest or inheritance upon death or by operation of law.

Our board of directors reserves the right to reject any request for redemption of shares or to terminate, suspend or amend the share redemption program at any time. You will have no right to request redemption of your shares after the shares are listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System. See “Description of Shares - Share Redemption Program” for further explanation of the share redemption program.

Behringer Harvard Opportunity OP I

We generally intend to own our investments through Behringer Harvard Opportunity OP I, LP (Behringer Harvard Opportunity OP I) or subsidiaries thereof, or other operating partnerships. We may, however, own investments directly or through entities other than Behringer Harvard Opportunity OP I if limited partners of Behringer Harvard Opportunity OP I that are not affiliated with us and who hold more than 50% of the limited partnership units held by all limited partners not affiliated with us approve the ownership of a property through another entity. We are the sole general partner of Behringer Harvard Opportunity OP I. BHO Partners, LLC, our subsidiary, is currently the only limited partner of Behringer Harvard Opportunity OP I. Our ownership of properties in Behringer Harvard Opportunity OP I is referred to as an “UPREIT,” which stands for Umbrella Partnership Real Estate Investment Trust. We use this structure because a sale of property directly to the REIT is generally a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may transfer the property to the UPREIT in exchange for limited partnership units in the UPREIT and defer taxation of gain until the seller later exchanges his UPREIT units on a one-for-one basis for REIT shares. Using an UPREIT structure may allow us to acquire desired properties from persons who may not otherwise sell their properties because of unfavorable tax results. At present, we have no plans to acquire any specific properties in exchange for units of Behringer Harvard Opportunity OP I. The holders of

16

units in Behringer Harvard Opportunity OP I may have their units exchanged for cash or shares of our common stock under certain circumstances described in the section of this prospectus captioned “The Operating Partnership Agreement.”

ERISA Considerations

The section of this prospectus entitled “Investment by Tax-Exempt Entities and ERISA Considerations” describes the effect the purchase of shares will have on individual retirement accounts (IRAs) and retirement plans subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA), and/or the Internal Revenue Code. ERISA is a federal law that regulates the operation of certain tax-advantaged retirement plans. Any retirement plan trustee or individual considering purchasing shares for a retirement plan or an IRA should read carefully the section of this prospectus captioned “Investment by Tax-Exempt Entities and ERISA Considerations.”

Description of Common Stock

General

Our board of directors has authorized the issuance of shares of our common stock without certificates. Instead, your investment will be recorded on our books only. We expect that, until our common stock is listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System, we will not issue shares in certificated form. We maintain a stock ledger that contains the name and address of each stockholder and the number of shares that the stockholder holds. If you wish to transfer your shares, you are required to send an executed transfer form to us, along with a fee to cover reasonable transfer costs, in an amount as determined by our board of directors. We will provide the required form to you upon request or make it available on our web site.

Stockholder Voting Rights and Limitations

We will hold annual meetings of our stockholders for the purpose of electing our directors or conducting other business matters that may be properly presented at such meetings. We may also call a special meeting of stockholders from time to time for the purpose of conducting certain matters. You are entitled to one vote for each share of common stock you own at any of these meetings. The holder of the convertible stock is generally not entitled to vote such shares on matters presented to stockholders.

Restriction on Share Ownership

Our charter contains a restriction on ownership of our shares that generally prevents any one person from owning more than 9.8% of our outstanding common stock unless otherwise excepted by our board of directors or charter. These restrictions are designed to enable us to comply with share accumulation restrictions imposed on REITs by the Internal Revenue Code. For a more complete description of the shares, including restrictions on the ownership of shares, please see the “Description of Shares” section of this prospectus.

17

Other Behringer Harvard Programs

Affiliates of our advisor are currently sponsoring a registered public offering on behalf of Behringer Harvard REIT I, which is expected to terminate on or before February 11, 2007. As such, we will be engaged in the public offering of common stock at the same time as Behringer Harvard REIT I. The following table summarizes some of the most important features of this offering and Behringer Harvard REIT I’s public offering.

| | | BEHRINGER HARVARD

OPPORTUNITY REIT I | | | BEHRINGER

HARVARD REIT I |

Entity Type | | | Real estate investment trust. | | | Real estate investment trust. |

Offering Size | | | $400,000,000 to the public plus $76,000,000 for the distribution reinvestment plan; minimum offering of $2,000,000. | | | $800,000,000 to the public plus $152,000,000 for distribution reinvestment plan; no minimum offering. |

Minimum Investment | | | $2,000 (some states may vary). | | | $2,000 (some states may vary). |

Targeted Fund Term | | | Approximately three to six years from the termination of this offering. | | | Approximately eight to twelve years from the termination of its initial offering. |

Investment Objectives (listed by order of importance) | | | • To realize growth in the value of our investments to enhance the value received upon our ultimate sale of such investments or the listing of our shares for trading on a national securities exchange or for quotation on the Nasdaq National Market System. • To preserve, protect and return (through our ultimate sale of our investments or the listing of our shares for trading on a national securities exchange or for quotation on the Nasdaq National Market System) your capital contribution. • To grow net cash from operations such that more cash is available for distributions to you. • To provide you with a return of your investment by either (1) making an orderly disposition of investments and distributing the net proceeds from such sales to you or (2) by causing the shares to be listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System. If we do not liquidate or obtain listing of the shares by the sixth anniversary of the termination of this offering, we will make an orderly disposition of our investments and distribute the net cash to you unless a majority of the board of directors and a majority of the independent directors extends such date. | | | • To preserve, protect and return capital contributions. • To maximize distributable cash to investors. • To realize growth in the value of investments upon the ultimate sale of investments. • By 2017, either (1) to cause the shares to be listed for trading on a national securities exchange or for quotation on the Nasdaq National Market System or (2) to make an orderly disposition of assets and distribute the cash to investors, unless a majority of the board of directors and a majority of the independent directors approve otherwise. |

Targeted Real Property Assets | | | • To employ an opportunistic and flexible approach to investing in properties with significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning or those located in markets with higher volatility, lower barriers to entry and high growth potential. • To invest in any type of commercial property investment. | | | • To employ an investment approach targeting markets and submarkets where barriers to entry are judged to be high. • To invest principally in institutional quality office properties that have premier business addresses, desirable locations, personalized amenities, high quality construction and highly creditworthy commercial tenants. Also may acquire institutional quality industrial, retail, hospitality, multi-family and other real properties. |

18

| | | BEHRINGER HARVARD

OPPORTUNITY REIT I | | | BEHRINGER

HARVARD REIT I |