(Amendment No. __)

LUCAS ENERGY, INC.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies: _____________________________

(2) Aggregate number of securities to which transaction applies: _____________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ________________________________

(4) Proposed maximum aggregate value of transaction: ____________________________________

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

LUCAS ENERGY, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of Lucas Energy, Inc., a Nevada corporation (the "Company"), will be held on December 16, 2011 at 10 a.m. Central Standard Time at the law offices of Dewey & LeBoeuf LLP at 1000 Main Street, Suite 2550, Houston, Texas 77002 (the "Annual Meeting" or the “Meeting”) for the purpose of considering and voting upon the following matters:

Any action may be taken on any one of the foregoing proposals at the Meeting on the date specified above or on any date or dates to which the Meeting may be adjourned. Only shareholders of record at the close of business on November 3, 2011 (the “Record Date”) are entitled to notice of and to vote in person or by proxy at the meeting. The Company has mailed notice of the Meeting to shareholders of record as of the Record Date. However, our stock transfer books will remain open subsequent to the Record Date. At least ten days prior to the Meeting, a complete list of shareholders entitled to vote will be available for inspection by any shareholder for any purpose germane to the meeting, during ordinary business hours, at the office of the Corporate Secretary at 3555 Timmons Lane, Suite 1550, Houston, Texas 77027.

As a shareholder of record, you are cordially invited to attend the meeting in person. Regardless of whether you expect to be present at the meeting, please complete, sign and date the enclosed proxy and mail it promptly in the enclosed envelope. Returning the enclosed proxy (“Proxy”) will not affect your right to vote in person if you attend the meeting.

Even though you may plan to attend the meeting in person, please execute the enclosed proxy card and mail it promptly. A return envelope is enclosed for your convenience. Should you attend the meeting in person, you may revoke your proxy and vote in person.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE REQUESTED TO PROMPTLY COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ACCOMPANYING ENVELOPE.

LUCAS ENERGY, INC.

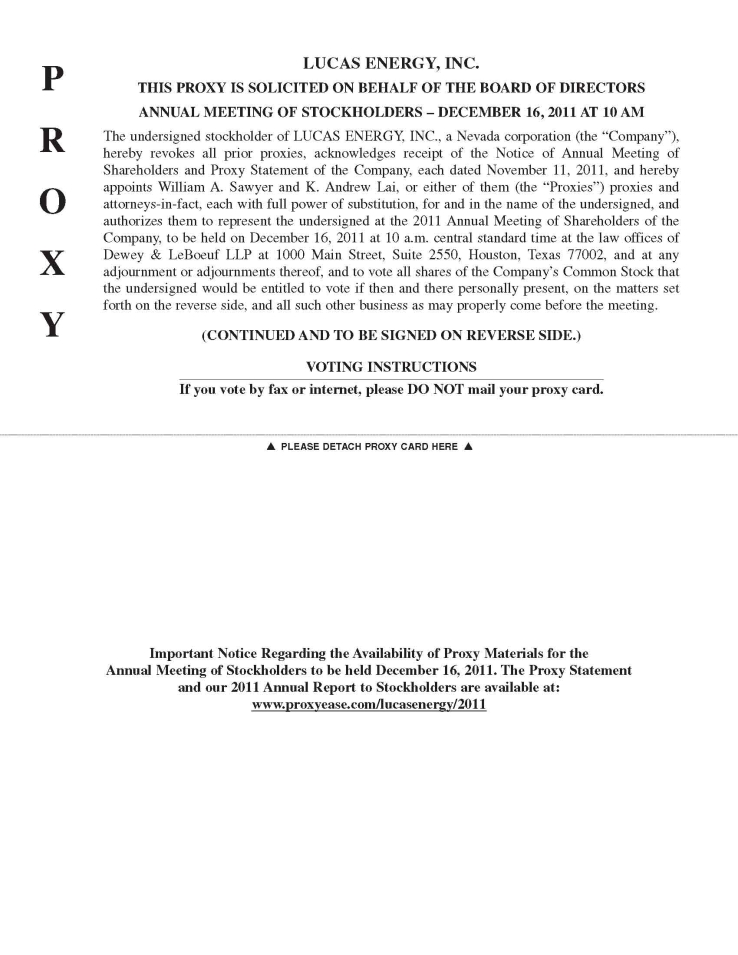

This Proxy Statement and accompanying Proxy Card are being furnished to you in connection with the solicitation on behalf of the Board of Directors of LUCAS ENERGY, INC. (the "Company" and the “Board”) of proxies for use at the Annual Meeting of Shareholders to be held on December 16, 2011 (the “Annual Meeting” or the “Meeting”), and at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders.

The Annual Meeting will be held on December 16, 2011, at the law offices of Dewey & LeBoeuf LLP at 1000 Main Street, Suite 2550, Houston, Texas 77002, at 10 a.m., Central Standard Time. The Company's telephone number is (713) 528-1881.

Shareholders of record at the close of business on November 3, 2011 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 19,535,826 shares of the Company's common stock, $0.001 par value (the "Common Stock") were outstanding. For information regarding security ownership by management and by the beneficial owners of more than 5% of the Company's Common Stock, see "Beneficial Security Ownership of Management and Certain Beneficial Owners" below.

A shareholder may revoke any proxy at any time before its exercise by delivery of a written revocation to the President of the Company or a duly executed proxy bearing a later date. Attendance at the Annual Meeting will not itself be deemed to revoke a proxy unless the shareholder gives affirmative notice at the Meeting that the shareholder intends to revoke the proxy and vote in person.

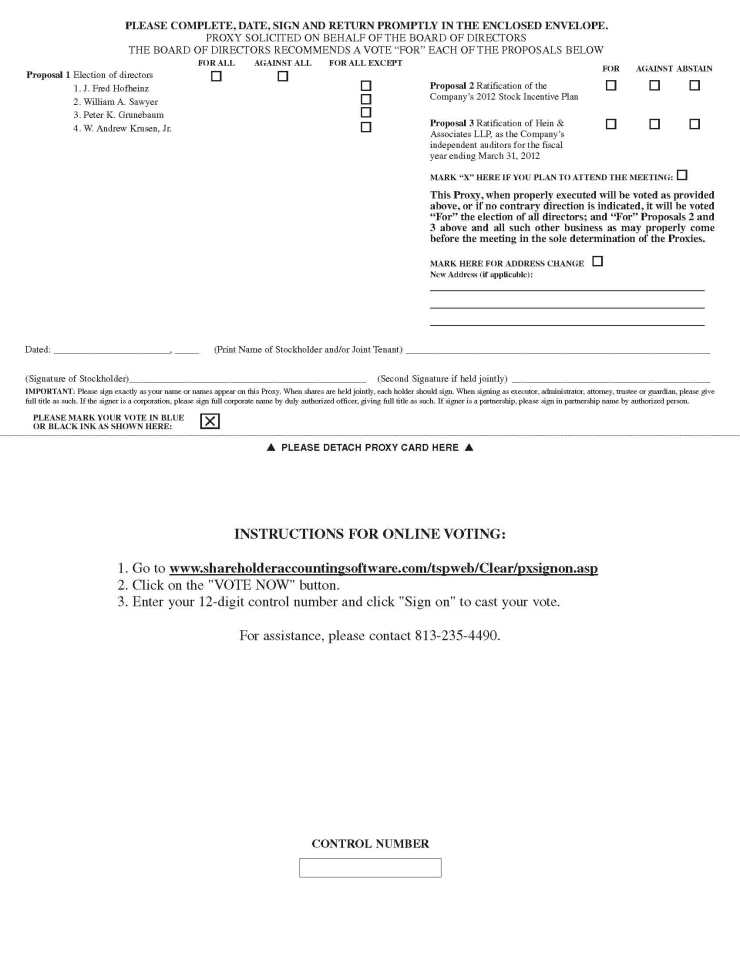

All proxies will be voted in accordance with the instructions of the shareholder. If no choice is specified, the shares will be voted: (i) FOR the election of Directors as listed in Proposal No. 1 of this proxy statement; (ii) FOR the ratification of the of the Company’s 2012 Stock Incentive Plan as listed in Proposal No. 2; and (iii) FOR the ratification of Hein & Associates LLP, as the Company’s independent auditors for the fiscal year ended March 31, 2012, as described in greater detail in proposal three.

Each shareholder is entitled to one vote for each share of Common Stock held by him, her or it on all matters presented at the Annual Meeting. There are no shares of Preferred Stock currently outstanding. Shareholders do not have the right to cumulate their votes in the election of Directors.

If on the Record Date your shares were registered in your name with the Company’s transfer agent, then you are a shareholder of record. As such, you may vote in person at the meeting or by proxy. Whether or not you plan to attend the meeting, you are encouraged to submit electronically the enclosed proxy card to ensure your vote is counted.

The cost of soliciting proxies will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company's Directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, letter or facsimile. The Company may engage a proxy solicitor to act on its behalf in soliciting proxies.

At the Annual Meeting, the presence, in person or by proxy, of shareholders holding a majority of the shares of Common Stock issued and outstanding on the Record Date shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock present in person or represented by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

If a quorum is present, the affirmative vote of the holders of a majority of the votes cast by the shareholders entitled to vote at the Annual Meeting is required to approve any proposal submitted at the Annual Meeting, other than the election of Directors, which is required to be approved by a plurality of the votes cast. Although the Company will include abstentions and broker non-votes as present or represented for purposes of establishing a quorum for the transaction of business, the Company intends to exclude abstentions and broker non-votes from the tabulation of voting results on the election of Directors or on any other issues requiring approval of a majority of the votes cast.

The following table sets forth the record beneficial ownership of Common Stock of the Company as of the Record Date for the following: (i) each person or entity who is known to the Company to beneficially own more than 5% of the outstanding shares of the Company's Common Stock; (ii) each of the Company's Directors (and nominees for election as Directors); (iii) the Company's Chief Executive Officer and each of the officers ("Named Officers") named in the Summary Compensation Table herein; and (iv) all Directors and executive officers of the Company as a group.

The number and percentage of shares beneficially owned is determined under Rule 13d-3 as promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), by the Securities and Exchange Commission ("SEC" or "Commission"), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or dispositive power and also any shares that the individual has the right to acquire within sixty days of the Record Date through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person has sole voting and dispositive power (or shares such power) with respect to the shares shown as beneficially owned.

Beneficial ownership of the common stock is determined in accordance with the rules of the SEC and includes any shares of common stock over which a person exercises sole or shared voting or investment powers, or of which a person has a right to acquire ownership at any time within 60 days of November 3, 2011. Except as otherwise indicated, and subject to applicable community property laws, the persons named in this table have sole voting and investment power with respect to all shares of common stock held by them.

* Less than one percent.

PROPOSAL NO. 1

The Company's Bylaws currently provide for a Board of Directors (the “Board”) of not less than one (1) or more than fifteen (15) members. The Company's Board currently has four (4) members. The Company's management recommends the four (4) Directors listed below for election at the Meeting. Each of the nominees has indicated his willingness to serve if elected, and each of the nominees already serves as a Director. At the Annual Meeting, shares represented by the accompanying Proxy will be voted for the election of the four (4) nominees recommended by the Company's management unless the Proxy is marked in such a manner as to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder may determine. The Company is not aware of any nominee who will be unable to, or for good cause will not, serve as a Director.

The Company’s Nominating Committee has reviewed the qualifications of the Director nominees and has recommended each of the nominees for election to the Board.

The following table and accompanying descriptions indicate the name of each nominee/Director, and certain information regarding each nominee, including their age, principal occupation or employment, and the year in which each nominee first became a Director, if such person has previously served on the Company's Board of Directors.

All Directors hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified. There are no agreements with respect to the election of Directors. We have historically compensated our Directors for service on the Board and committees thereof through the issuance of shares of common stock, stock options and nominal cash compensation for meeting fees. Additionally, we reimburse Directors for expenses incurred by them in connection with the attendance at meetings of the Board and any committee thereof (as described below). The Board appoints annually the executive officers of the Company and the executive officers serve at the discretion of the Board.

J. FRED HOFHEINZ, CHAIRMAN OF BOARD, CHAIR OF NOMINATING COMMITTEE

Mr. Hofheinz, the former Mayor of the City of Houston (1974-1978), began his business career with his late father, Roy Hofheinz, Sr., who built the Houston Astrodome. Mr. Hofheinz played a key role in the family real estate development projects surrounding the Astrodome, including an amusement park – Astroworld and four hotels. He was the senior officer of Ringling Brothers Barnum and Bailey Circus, which was owned by the Hofheinz family. In 1971, Mr. Hofheinz co-founded a closed circuit television company, Top Rank, which is now the leading professional boxing promotion firm in the nation. He has served as President of the Texas Municipal League and served on the boards of numerous other state and national organizations for municipal government elected officials. In addition to his law practice, Mr. Hofheinz also owned several direct interests in oil and gas companies. He has also dealt extensively with business interests, primarily oil and gas related, in the People’s Republic of China and in the Ukraine.

For the past five years Mr. Hofheinz has been an investor and a practicing attorney with the firm of Williams, Birnberg & Anderson LLP, in Houston, Texas. While he has numerous investments in real estate, his principal investment interest is in oil and gas. He has been actively engaged in successful exploration and production ventures, both domestic and international. He holds a PhD in economics from the University of Texas and takes an active interest in Houston’s civic and charitable affairs. He was admitted to the Texas bar in 1964, having received his preparatory education at the University of Texas, (B.A., M.A., Ph.D., 1960-1964); and his Legal education at the University of Houston, (J.D., 1964). From July 1, 2007 to February 28, 2011, Mr. Hofheinz served as a Manager of El Tex Petroleum, LLC, which Lucas entered into an acquisition transaction with during fiscal 2010 as described in greater detail under “Certain Related Party Transactions,” below.

Mr. Hofheinz has extensive experience in the oil and gas industry and the business world in general, in particular with respect to publicly listed companies. He also has extensive academic and practical knowledge of doing business in Texas and the United States. In addition, we believe Mr. Hofheinz demonstrates personal and professional integrity, ability, judgment, and effectiveness in serving the long-term interests of the Company’s shareholders. As such, we believe that Mr. Hofheinz is qualified to serve as a Director.

WILLIAM A. SAWYER, DIRECTOR, PRESIDENT AND CHIEF EXECUTIVE OFFICER

Mr. Sawyer has been a Director of the Company since April 6, 2005. Mr. Sawyer has over 30 years of diversified experience in the energy industry with firms such as: ARCO, Houston Oil & Minerals, Superior Oil (Mobil), and ERCO. Mr. Sawyer founded the petroleum consulting firm of Exploitation Engineers, Inc. and his clients included private investors, independent oil companies, banking institutions, major energy and chemical companies, and the US government. In connection with Exploitation Engineers, Mr. Sawyer evaluated and managed large projects such as a private trust that held working interests in several hundred producing and non-producing oil and gas properties. Mr. Sawyer has been an expert witness in federal court, state court, and before several state agencies in Texas and Oklahoma, and he has testified as to the fair market value of mineral interests and sub-surface storage interests. Mr. Sawyer co-founded the Company and was originally appointed Vice President of the Company on June 13, 2006. Mr. Sawyer has served as a Director of the Company and as its chief operating officer, until his appointment to President and CEO on January 22, 2009.

Mr. Sawyer has extensive experience in the oil and gas industry and the business world in general, in particular with respect to engineering management of mature oil wells, commercial, and reservoir management. He also has extensive academic and practical knowledge of doing business in Texas and the United States. In addition, we believe Mr. Sawyer demonstrates personal and professional integrity, ability, judgment, and effectiveness in serving the long-term interests of the Company’s shareholders. As a result of the above, we believe that Mr. Sawyer is qualified to serve as a Director.

PETER K. GRUNEBAUM – DIRECTOR, CHAIR OF AUDIT COMMITTEE

Mr. Grunebaum is an independent investment banker with over 40 years of experience in the energy sector with a specialty in exploration and production. Previously he was the Managing Director of Fortrend International, an investment firm headquartered in New York, New York, a position he held from 1989 until the end of 2003. From 2003 to present, Mr. Grunebaum has been an independent investment banker. Mr. Grunebaum is a graduate of Lehigh University, and in addition to being a board member of Lucas, he is also on the Board of Stonemor Partners LP. [NASDAQ: STON].

Mr. Grunebaum has extensive experience in the oil and gas industry and the business world in general, in particular with respect to founding and funding publicly listed companies such as Devon Energy. He also has extensive academic and practical knowledge of doing business in Texas and the United States. In addition, we believe Mr. Grunebaum demonstrates personal and professional integrity, ability, judgment, and effectiveness in serving the long-term interests of the Company’s shareholders. As a result of the above, we believe that Mr. Grunebaum is qualified to serve as a Director.

W. ANDREW KRUSEN, JR. – DIRECTOR, CHAIR OF THE COMPENSATION COMMITTEE

Mr. Krusen has been Chairman and Chief Executive Officer of Dominion Financial Group, Inc. since 1987. Dominion Financial is a merchant banking organization that provides investment capital to the natural resources, communications and manufacturing and distribution sectors. Mr. Krusen is currently a Director and chairman of Florida Capital Group, Inc. – a Florida bank holding company, as well as Florida Capital Bank, N.A. its wholly owned subsidiary. He also serves as a Director of publicly traded Canada Flourspar Inc., a specialty mineral concern; and Raymond James Trust Company, a subsidiary of Raymond James Financial, Inc. – and numerous privately held companies, including Beall’s Inc., Telovations, Inc., PlanSource Holdings, Inc. and Romark Laboratories, LLC. Mr. Krusen is a former member of the Young Presidents’ Organization, and he is currently a member of the World President’s Organization, Society of International Business Fellows and a Trustee of the International Tennis Hall of Fame. He is past Chairman of Tampa's Museum of Science and Industry. Mr. Krusen graduated from Princeton University in 1970. From July 1, 2007 to February 28, 2011, Mr. Krusen served as a Manager of El Tex Petroleum, LLC, which Lucas entered into an acquisition transaction with during fiscal 2010 as described in greater detail under “Certain Related Party Transactions,” below.

Mr. Krusen has extensive experience in the oil and gas industry and the business world in general, in particular with respect to founding and funding publicly listed companies. He also has extensive academic and practical knowledge of doing business in Texas and the United States. In addition, we believe Mr. Krusen demonstrates personal and professional integrity, ability, judgment, and effectiveness in serving the long-term interests of the Company’s shareholders. As a result of the above, we believe that Mr. Krusen is qualified to serve as a Director.

There are no family relationships among our Directors or executive officers.

Our Directors, executive officers and control persons have not been involved in any of the following events during the past ten years:

Board Leadership Structure

The roles of Chairman and Chief Executive Officer of the Company are currently held separately. Mr. Hofheinz serves as Chairman and Mr. Sawyer serves as CEO. The Board of Directors does not have a policy as to whether the Chairman should be an independent Director, an affiliated Director, or a member of management. Our Board believes that the Company’s current leadership structure is appropriate because it effectively allocates authority, responsibility, and oversight between management and the independent members of our Board (including Mr. Hofheinz as Chairman). It does this by giving primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while enabling the independent Directors to facilitate our Board’s independent oversight of management, promote communication between management and our Board, and support our Board’s consideration of key governance matters. The Board believes that its programs for overseeing risk, as described below, would be effective under a variety of leadership frameworks and therefore do not materially affect its choice of structure.

Risk Oversight

The Board exercises direct oversight of strategic risks to the Company. The Audit Committee reviews and assesses the Company’s processes to manage business and financial risk and financial reporting risk. It also reviews the Company’s policies for risk assessment and assesses steps management has taken to control significant risks. The Compensation Committee oversees risks relating to compensation programs and policies. In each case management periodically reports to our Board or relevant committee, which provides the relevant oversight on risk assessment and mitigation.

Vote Required

The election of the Director nominees listed above requires the affirmative vote of the holders of a plurality of the outstanding voting shares of the Company, present in person or by proxy at the Meeting. For the election of Directors, you may vote “FOR” all nominees or withhold authority to vote for all or some of the nominees. If you hold your shares through a broker, bank, trustee or other nominee and you do not instruct them on how to vote on this proposal, your broker or other nominee will not have authority to vote your shares and such non-vote will have the effect of withholding authority to vote for all of the nominees.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE DIRECTOR NOMINEES LISTED ABOVE.

PROPOSAL NO. 2

TO RATIFY THE COMPANY’S 2012 STOCK INCENTIVE PLAN

What are the stockholders being asked to approve?

On October 13, 2011, the Company's Board of Directors adopted, subject to the ratification of the shareholders, the Company's 2012 Stock Incentive Plan (the "Plan") in the form of the attached Exhibit A.

The following is a summary of the material features of the Plan:

What is the purpose of the Plan?

The Plan is intended to secure for the Company the benefits arising from ownership of the Company's common stock by the employees, officers, Directors and consultants of the Company, all of whom are and will be responsible for the Company's future growth. The Plan is designed to help attract and retain for the Company, qualified personnel for positions of exceptional responsibility, to reward employees, officers, Directors and consultants for their services to the Company and to motivate such individuals through added incentives to further contribute to the success of the Company.

Who is eligible to participate in the Plan?

The Plan will provide an opportunity for any employee, officer, Director or consultant of the Company, except for instances where their services are in connection with the offer or sale of securities in a capital-raising transaction, or they are directly or indirectly involved in the promotion or maintenance of a market for the Company's securities, subject to any other limitations provided by federal or state securities laws, to receive (i) incentive stock options (to eligible employees only); (ii) nonqualified stock options; (iii) restricted stock; (iv) stock awards; (v) shares in performance of services; or (vi) any combination of the foregoing. In making such determinations, the Board of Directors (or the Compensation Committee) may take into account the nature of the services rendered by such person, his or her present and potential future contribution to the Company's success, and such other factors as the Board of Directors (or the Compensation Committee) in its discretion shall deem relevant.

Who will administer the Plan?

The Plan shall be administered by the Board of Directors of the Company and/or the Company’s Compensation Committee. The Board (or the Compensation Committee) shall have the exclusive right to interpret and construe the Plan, to select the eligible persons who shall receive an award, and to act in all matters pertaining to the grant of an award and the determination and interpretation of the provisions of the related award agreement, including, without limitation, the determination of the number of shares subject to stock options and the option period(s) and option price(s) thereof, the number of shares of restricted stock or shares subject to stock awards or performance shares subject to an award, the vesting periods (if any) and the form, terms, conditions and duration of each award, and any amendment thereof consistent with the provisions of the Plan.

How much common stock is subject to the Plan?

Subject to adjustment in connection with the payment of a stock dividend, a stock split or subdivision or combination of the shares of common stock, or a reorganization or reclassification of the Company's common stock, the maximum aggregate number of shares of common stock which may be issued pursuant to awards under the Plan is 1,500,000 shares. Such shares of common stock shall be made available from the authorized and unissued shares of the Company.

How many securities have been granted pursuant to the Plan since its approval by the Board of Directors?

No shares of common stock, options, or other securities have been issued under the Plan since approved by the Board of Directors.

Does the Company have any present plans to grant or issue securities pursuant to the Plan?

Yes, the Company plans to issue securities under the Plan from time to time to satisfy the requirements of Mr. Sawyer’s and Mr. Lai’s employment agreements (as described in greater detail below under “Compensation of Named Executive Officers”). The Company also believes that the authorization of such Plan will provide the Company greater flexibility at such time in the future, if ever, as the Company’s Board of Directors believes it is in the best interest of the Company to grant or issue securities pursuant to the Plan.

New Plan Benefits

2012 Stock Incentive Plan

| Name and Position | Dollar Value ($) | Number of Units (3) |

| William A. Sawyer, CEO | (1) | |

| K. Andrew Lai, CFO | (2) | |

| (1) | Mr. Sawyer receives $18,750 in the form of Company common stock each quarter pursuant to the terms of his employment agreement. It is not currently known how many of such shares and what dollar value of such shares will be issued pursuant to the 2012 Stock Incentive Plan. |

| (2) | Mr. Lai receives $10,000 in the form of Company common stock each quarter pursuant to the terms of his employment agreement. It is not currently known how many of such shares and what dollar value of such shares will be issued pursuant to the 2012 Stock Incentive Plan. |

| (3) | The number of shares issuable to Mr. Sawyer and Mr. Lai pursuant to their employment agreements is not currently determinable as the number of such Units to be issued will fluctuate based on the market value of the Company’s common stock when issued by the Company, pursuant to the terms of the employment agreements. |

What will be the exercise price and expiration date of options and awards under the Plan?

The Board of Directors, in its sole discretion, shall determine the exercise price of any Options granted under the Plan which exercise price shall be set forth in the agreement evidencing the Option, provided however that at no time shall the exercise price be less than the greater of (a) the $0.001 par value per share of the Company's common stock; and (b) the market price of the Company’s common stock on the date of grant. Additionally, the Board of Directors has the sole discretion over the authorization of any stock awards.

What equitable adjustments will be made in the event of certain corporate transactions?

Upon the occurrence of:

| | (i) | the adoption of a plan of merger or consolidation of the Company with any other corporation or association as a result of which the holders of the voting capital stock of the Company as a group would receive less than 50% of the voting capital stock of the surviving or resulting corporation; |

| | (ii) | the approval by the Board of Directors of an agreement providing for the sale or transfer (other than as security for obligations of the Company) of substantially all of the assets of the Company; or |

| | (iii) | in the absence of a prior expression of approval by the Board of Directors, the acquisition of more than 20% of the Company's voting capital stock by any person within the meaning of Rule 13d-3 under the Securities Act of 1933, as amended (other than the Company or a person that directly or indirectly controls, is controlled by, or is under common control with, the Company); |

and unless otherwise provided in the award agreement with respect to a particular award, all outstanding stock options shall become immediately exercisable in full, subject to any appropriate adjustments, and shall remain exercisable for the remaining option period, regardless of any provision in the related award agreement limiting the ability to exercise such stock option or any portion thereof for any length of time. All outstanding performance shares with respect to which the applicable performance period has not been completed shall be paid out as soon as practicable; and all outstanding shares of restricted stock with respect to which the restrictions have not lapsed shall be deemed vested and all such restrictions shall be deemed lapsed and the restriction period ended.

Additionally, after the merger of one or more corporations into the Company, any merger of the Company into another corporation, any consolidation of the Company and one or more corporations, or any other corporate reorganization of any form involving the Company as a party thereto and involving any exchange, conversion, adjustment or other modification of the outstanding shares of the common stock, each participant shall, at no additional cost, be entitled, upon any exercise of such participant's stock option, to receive, in lieu of the number of shares as to which such stock option shall then be so exercised, the number and class of shares of stock or other securities or such other property to which such participant would have been entitled to pursuant to the terms of the agreement of merger or consolidation or reorganization, if at the time of such merger or consolidation or reorganization, such participant had been a holder of record of a number of shares of common stock equal to the number of shares as to which such stock option shall then be so exercised.

What happens to options upon termination of employment or other relationships?

The incentive stock options shall lapse and cease to be exercisable upon the termination of service of an employee or director as defined in the Plan, or within such period following a termination of service as shall have been determined by the Board and set forth in the related award agreement; provided, further, that such period shall not exceed the period of time ending on the date three (3) months following a termination of service. Non-incentive stock options are governed by the related award agreements.

May the Plan be modified, amended or terminated?

The Board of Directors may adopt, establish, amend and rescind such rules, regulations and procedures as it may deem appropriate for the proper administration of the Plan, make all other determinations which are, in the Board's judgment, necessary or desirable for the proper administration of the Plan, amend the Plan or a stock award as provided in Article XI of the Plan, and/or terminate or suspend the Plan as provided in Article XI.

The description of the Plan is qualified in all respects by the actual provisions of the Plan, which is attached to this Proxy Statement as Exhibit A.

Vote Required

The ratification of the Company’s 2012 Stock Incentive Plan requires the affirmative vote of the holders of a majority of the outstanding voting shares of the Company, present in person or by proxy at the Meeting. For the ratification of the Company’s 2012 Stock Incentive Plan, you may vote “FOR” or “AGAINST” or abstain from voting. If you hold your shares in your own name and abstain from voting on this matter, your abstention will have the effect of a vote “AGAINST” this proposal. If you hold your shares through a broker, bank, trustee or other nominee and you do not instruct them on how to vote on this proposal, your broker or other nominee will not have authority to vote your shares and such non-vote will have the effect of a vote “AGAINST” the ratification of the Company’s 2012 Stock Incentive Plan.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE COMPANY’S 2012 STOCK INCENTIVE PLAN.

PROPOSAL NO. 3

TO RATIFY THE APPOINTMENT OF HEIN & ASSOCIATES LLP, AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING MARCH 31, 2012.

The Board of Directors recommends that the shareholders vote for approval and ratification of the appointment of Hein & Associates LLP (“Hein”) as the Company’s independent registered accounting firm for the year ended March 31, 2012.

Effective October 27, 2011, the Audit Committee of the Company dismissed GBH CPAs, PC (“GBH”) as its registered independent accounting firm.

In connection with the audits of the two fiscal years ended March 31, 2011, and the subsequent interim period through October 27, 2011, there have been no disagreements with GBH on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of GBH would have caused GBH to make reference to the subject matter of the disagreements in connection with its reports. GBH’s audit reports on the consolidated financial statements of the Company as of and for the years ended March 31, 2011 and 2010 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles.

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred within the Company’s two most recent fiscal years and the subsequent interim period through October 27, 2011.

On October 31, 2011, the Audit Committee engaged Hein as its new independent registered accounting firm, effective as of October 31, 2011. During the two most recent fiscal years, and any subsequent interim period prior to engaging Hein, neither the Company, nor anyone on its behalf, consulted Hein regarding (i) either the application of accounting principles to a specified transaction, completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to the Company by Hein that was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of either a disagreement (as defined in paragraph 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as described in paragraph 304(a)(1)(v) of Regulation S-K).

The Company requested that GBH furnish it with a letter addressed to the Securities and Exchange Commission (“SEC”) stating whether it agrees with the above statements. A copy of GBH’s letter to the SEC is attached as an exhibit to the Company’s Form 8-K, filed with the SEC on November 2, 2011.

The Company does not anticipate a representative from Hein to be present at the Annual Meeting. In the event that a representative of Hein is present at the Annual Meeting, the representative will have the opportunity to make a statement if he/she desires to do so and the Company will allow such representative to be available to respond to appropriate questions.

Audit Fees

Our Audit Committee of the Board of Directors approves in advance the scope and cost of the engagement of an auditor before the auditor renders audit and non-audit services.

Audit Fees

The aggregate fees billed by our former independent auditors, GBH, for professional services rendered for the audit of our annual financial statements included in our Annual Reports on Form 10-K for the years ended March 31, 2011 and 2010, and for the review of quarterly financial statements included in our Quarterly Reports on Form 10-Q for the quarters ending June 30, September 30, and December 31, 2010 and 2009, were:

| | | 2011 | | | 2010 | |

| GBH CPAs, PC | | $ | 130,000 | | | $ | 102,500 | |

Audit fees incurred by the Company were pre-approved by the Audit Committee. The Company did not incur any audit fees for Hein for the years ended March 31, 2011 and 2010, as Hein was appointed as the Company’s independent registered accounting firm effective October 31, 2011.

Audit Related Fees: None.

Tax Fees: None.

All Other Fees: None.

We do not use the auditors for financial information system design and implementation. Such services, which include designing or implementing a system that aggregates source data underlying the financial statements or that generates information that is significant to our financial statements, are provided internally or by other service providers. We do not engage the auditors to provide compliance outsourcing services.

The Audit Committee of the Board of Directors has considered the nature and amount of fees billed by GBH and proposed to be billed by Hein and believes that the provision of services for activities unrelated to the audit is compatible with maintaining GBH’s and Hein’s independence.

What vote is required to ratify the appointment of Hein?

The ratification of Hein as the Company’s independent accountants for the fiscal year ended March 31, 2012 requires the affirmative vote of the holders of a majority of the outstanding voting shares of the Company, present in person or by proxy at the Meeting. For the ratification of the appointment of Hein as our independent accountants for the fiscal year ended March 31, 2012, you may vote “FOR” or “AGAINST” or abstain from voting. If you hold your shares in your own name and abstain from voting on this matter, your abstention will have the effect of a vote “AGAINST” such proposals. If you hold your shares through a broker, bank, trustee or other nominee and you do not instruct them on how to vote on this proposal, your broker or other nominee will not have authority to vote your shares and such non-vote will have the effect of a vote “AGAINST” this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION OF

THE APPOINTMENT OF HEIN AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING MARCH 31, 2012

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our Directors and officers, and the persons who beneficially own more than ten percent of our common stock, to file reports of ownership and changes in ownership with the SEC. Copies of all filed reports are required to be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act.

Based solely on the reports received by us and on the representations of the reporting persons, we believe that all required Directors, officers and greater than ten percent shareholders complied with applicable filing requirements during the fiscal year ended March 31, 2011, except that (a) J. Fred Hofheinz, William A. Sawyer, Peter K. Grunebaum and W. Andrew Krusen, Jr., each a Director of the Company, inadvertently did not timely file a Form 4 with the SEC in connection with their issuance by the Company of 12,000 shares of common stock for services rendered as a Director of the Company during the April 1, 2009 to March 31, 2010 fiscal year and the grant of options to purchase 24,000 shares of common stock to each Director for services to be rendered during the April 1, 2010 to March 31, 2011 fiscal year, which grants were approved by the stockholders of the Company effective January 10, 2011, but which reports were not filed until January 27, 2011 (Mr. Hofheinz); January 27, 2011 (Mr. Sawyer); January 28, 2011 (Mr. Grunebaum); and February 1, 2011 (Mr. Krusen); (b) William A. Sawyer inadvertently did not timely file a Form 4 with the SEC in connection with his issuance by the Company of 17,500 shares of common stock in consideration for services rendered on October 7, 2010, and an additional 17,500 shares of common stock in the event the net production of the Company averages over 10,000 barrels of oil per month for a period of six months, which report was not filed until December 6, 2010; (c) Donald L. Sytsma failed to file a Form 4 or Form 5 disclosing his receipt of 30,000 shares of the Company’s common stock as severance pay in connection with his resignation as the Chief Financial Officer of the Company on October 7, 2010; (d) K. Andrew Lai inadvertently did not timely file a Form 4 with the SEC in connection with his grant from the Board of Directors on February 18, 2011 of options to purchase 160,000 shares of the Company’s common stock in connection with his appointment as the Chief Financial Officer of the Company, which have a term of five years and an exercise price of $1.94 per share, which Form 4 was subsequently filed with the SEC on June 17, 2011; and (e) William A. Sawyer inadvertently did not timely file (i) a Form 4 with the SEC in connection with his grant from the Board of Directors on April 1, 2011 of options to purchase 200,000 shares of the Company’s common stock in connection with services rendered to the Company as the Chief Executive Officer of the Company, which have a term of five years and an exercise price of $4.05 per share, which Form 4 was subsequently filed with the SEC on June 17, 2011 and (ii) a Form 4 with the SEC in connection with his October 1, 2011 issuance of 10,061 shares of common stock, equal to one quarterly installment of $18,750 in shares, net of applicable payroll taxes, issuable to Mr. Sawyer pursuant to his Employment Agreement, which Form 4 was subsequently filed with the SEC on October 5, 2011.

CODE OF ETHICS

The Company adopted a code of ethics (“Code”) that applies to all of its Directors, officers, employees, consultants, contractors and agents of the Company. The Code of Ethics has been reviewed and approved by the Board of Directors. The Company’s Code of Ethics was filed as an exhibit to the Company’s Form 10-K dated March 31, 2009, filed with the SEC on June 29, 2009 as Exhibit 14.1. Original copies of the Code of Ethics are available, free of charge, by submitting a written request to the Company at 3555 Timmons Lane, Suite 1550, Houston, Texas 77027.

WHISTLEBLOWER PROTECTION POLICY

The Company adopted a Whistleblower Protection Policy (“Whistleblower Policy”) that applies to all of its Directors, officers, employees, consultants, contractors and agents of the Company. The Whistleblower Policy has been reviewed and approved by the Board of Directors. The Company’s Whistleblower Policy was filed as an exhibit to the Company’s Form 10-K dated March 31, 2009 filed with the SEC on June 29, 2009 as Exhibit 14.2. Original copies of the Whistleblower Policy are available, free of charge, by submitting a written request to the Company at 3555 Timmons Lane, Suite 1550, Houston, Texas 77027.

EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our executive officers.

| Name | Position | Age |

| William A. Sawyer | President and Chief Executive Officer | 62 |

| K. Andrew Lai | CFO, Treasurer, and Secretary | 47 |

WILLIAM A. SAWYER, PRESIDENT AND CHIEF EXECUTIVE OFFICER

Information regarding Mr. Sawyer is set forth in Proposal No. 1 – Election of Directors.

K. ANDREW LAI, CHIEF FINANCIAL OFFICER, TREASURER AND SECRETARY

Effective February 18, 2011, the Company appointed K. Andrew Lai, as Chief Financial Officer, Treasurer and Secretary of the Company. Mr. Lai has over 20 years of corporate and financial experience primarily in the exploration and production sector of the oil and gas energy industry, with a specialization in accounting, legal and administrative functions. From April 2010 to January 2011, Mr. Lai was an international financial consultant. From October 2008 to April 2010, Mr. Lai served as Chief Financial Officer with Far East Energy Corporation ("Far East"), based in Houston, Texas. Mr. Lai joined Far East in January 2007 and served as a member of Far East's management team until his appointment as Chief Financial Officer in October 2008. From April 1999 to January 2007, Mr. Lai held various managerial positions with EOG Resources, Inc., in Houston, Texas. From 1995 to 1999, Mr. Lai was a sole practitioner at his own certified public accountant firm. From 1987 to 1995, Mr. Lai held various positions with UMC Petroleum Corp. (which subsequently merged into Devon Energy). Mr. Lai received from the University of Houston his Bachelor of Business Administration in December 1987, his Master of Business Administration in May 1991, and his Juris Doctorate in May 2004. Mr. Lai is a Certified Public Accountant, a member of the State Bar of Texas, and a member of the American Bar Association.

[Remainder of page left intentionally blank.]

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table sets forth compensation information with respect to our chief executive officer, our two most highly compensated executive officers other than the chief executive officer who were serving as executive officers at the end of our last fiscal year, and individuals for whom disclosure would have been provided herein but for the fact they were not serving as an executive officer of the Company at the end of our last fiscal year.

| | | Fiscal | | | | | Stock | | | Option | | | All Other | | | | |

| Name and Principal Position | | Year | | Salary | | | Awards | | | Awards | | | Comp (7) | | | Total | |

| William A. Sawyer (1) | | 2011 | | $ | 168,500 | | | $ | 60,770 | | | $ | 41,140 | | | $ | 11,000 | | | $ | 281,410 | |

| President and | | 2010 | | | 162,250 | | | | 29,000 | | | | - | | | | 6,000 | | | | 197,250 | |

| Chief Executive Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| K. Andrew Lai (2) | | 2011 | | $ | 17,410 | | | $ | 5,000 | | | $ | 209,800 | | | $ | 2,270 | | | $ | 234,480 | |

| Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| John O'Keefe (3) | | 2011 | | $ | - | | | $ | - | | | $ | - | | | $ | 201,000 | | | $ | 201,000 | |

| Former Interim Chief Financial | | | | | | | | | | | | | | | | | | | | |

| Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Donald L. Sytsma (4) | | 2011 | | $ | 105,650 | | | $ | 83,090 | | | $ | - | | | $ | 7,070 | | | $ | 195,810 | |

| Former Chief Financial Officer | | 2010 | | | 120,000 | | | | 22,680 | | | | - | | | | 4,000 | | | | 146,680 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| James J. Cerna, Jr. (5) | | 2011 | | $ | - | | | $ | 167,750 | | | $ | - | | | $ | 64,730 | | | $ | 232,480 | |

| Former Chairman, President | | 2010 | | | - | | | | - | | | | - | | | | 60,330 | | | | 60,330 | |

| and Chief Executive Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Malek A. Bohsali (6) | | 2011 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Former Chief Financial Officer | | 2010 | | | - | | | | 25,000 | | | | - | | | | - | | | | 25,000 | |

(1) On October 7, 2010, the Board approved the issuance to Mr. Sawyer of 17,500 shares of common stock under the Company’s 2010 Long Term Incentive Plan (the “Plan”) and an additional 17,500 shares of common stock under the Plan in the event the net production of the Company averages over 10,000 barrels of oil per month for a period of six months. The fair value of the 17,500 shares approved on October 7, 2010, and subsequently issued, was $2.07 per share for a total stock value of $36,050. As of March 31, 2011 (and as of the date of this Proxy), the performance criterion had not been met, and none of the additional 17,500 shares had vested. Mr. Sawyer also received 12,000 shares and a grant for options to purchase 24,000 shares of common stock in consideration for serving as a Director for the year ended March 31, 2010 and in consideration for services to be rendered for the year ended March 31, 2011, respectively. The fair value of the 12,000 shares approved on October 7, 2010, and subsequently issued, was $2.07 per share for a total stock value of $24,720. The options have an exercise price of $2.07 per share and were fully vested at March 31, 2011. The options were valued using the Black-Scholes model resulting in the fair value of $41,140. During the fiscal year ended March 31, 2010, a stock award was granted to Mr. Sawyer of 50,000 shares of common stock for the Company’s joint venture partner’s commitment to and initial funding of their 70% working interest in the LEI 2009-III capital program. The fair value of shares on the date earned was $0.58 per share for a total stock award of $29,000.

(2) Effective February 18, 2011, the Company appointed K. Andrew Lai, as Chief Financial Officer, Treasurer and Secretary of the Company. On February 18, 2011, Mr. Lai received a grant of options to purchase 160,000 shares of common stock as part of his employment arrangement with the Company. The options vest 25% on each of the first four anniversary dates of the grant, have a term of five years and an exercise price of $1.94 per share. The options were valued using the Black-Scholes model resulting in the fair value of $209,800 of which $10,920 was recognized as compensation expense during the year ended March 31, 2011. Also recognized in the current year was $5,000 of Mr. Lai’s $10,000 quarterly stock award under his employment agreement.

(3) On October 7, 2010, John O’Keefe was appointed as the interim Chief Financial Officer, Treasurer and Secretary of the Company. On February 18, 2011, the Company accepted the resignation of John O’Keefe from his positions as interim Chief Financial Officer, Treasurer and Secretary of the Company. The Company employed Mr. O’Keefe under a service agreement with Tatum LLC.

(4) Mr. Sytsma was appointed Chief Financial Officer and Treasurer of the Company effective April 14, 2009 and resigned effective October 7, 2010. In addition to monthly cash compensation, Mr. Sytsma’s employment arrangement with the Company included a non-cash compensation component of 2,000 shares of common stock per month. The Company’s closing share price on the date Mr. Sytsma was appointed Chief Financial Officer was $0.56 per share. The fair value of shares earned is determined based on the closing share price on the last trading day of each month during the term of Mr. Sytsma’s employment. As severance pay in connection with Mr. Sytsma’s resignation, the Company agreed to pay Mr. Sytsma three months of salary and to issue Mr. Sytsma 30,000 restricted shares of common stock valued at $61,800.

(5) Mr. Cerna, who resigned as an officer of the Company on September 2, 2008 and as a Director of the Company on May 5, 2009, was issued 86,027 shares of common stock in November 2010 as a final part of his employment contract. The shares were issued at a fair value of $167,750.

(6) Mr. Bohsali served as Chief Financial Officer of the Company from April 10, 2007 through April 14, 2009. In July 2009, the Company issued 25,000 shares of common stock to Mr. Bohsali as part of his compensation package. The shares were issued at a fair value of $25,000.

(7) All other compensation for the year ended March 31, 2011 includes the payment of $11,000 to Mr. Sawyer as Director for attendance at four Board of Directors meetings and $2,000 paid to Mr. Sytsma as the then Chief Financial Officer, Treasurer and Secretary of the Company for the attendance at one Board meeting. Also included was $201,000 attributable to Mr. O’Keefe representing amounts paid to Tatum LLC and $54,690 attributable to Mr. Cerna representing amounts relating to his employment arrangement. Finally, all other compensation for the year ended March 31, 2011 also includes medical reimbursement payments to Mr. Lai of $2,270, Mr. Sytsma of $5,070 and Mr. Cerna of $10,040.

Compensation of Named Executive Officers

William A. Sawyer

Mr. Sawyer co-founded the Company and was originally appointed to a position with the Company on June 13, 2006. Mr. Sawyer has served as a Director and as its Chief Operating Officer, until his appointment to President and Chief Executive Officer on January 22, 2009. On March 20, 2007, the Company entered into an employment agreement with Mr. Sawyer (filed as exhibit 10.6 to the Company's Annual Report on Form 10-KSB for the year ended March 31, 2007). Mr. Sawyer’s agreement was for a period of three (3) years and provided for payment of $150,000 annually. Additionally, Mr. Sawyer’s employment agreement provided for certain payments in the event of termination of employment. Effective October 1, 2009, the Compensation Committee approved an increase to Mr. Sawyer’s base compensation to $162,000 per annum. Mr. Sawyer’s employment agreement terminated on March 20, 2010 and a new agreement was subsequently entered into effective as of April 1, 2011, as described below.

Notwithstanding the fact that Mr. Sawyer’s employment agreement terminated pursuant to its terms on March 20, 2009, Mr. Sawyer continued to serve as Chief Executive Officer of the Company, and on October 7, 2010, the Compensation Committee approved an increase in Mr. Sawyer’s annual salary to $175,000 per year (effective as of October 1, 2010), the Board approved the immediate issuance to Mr. Sawyer of 17,500 shares of common stock under the Company’s 2010 Long Term Incentive Plan (the “2010 Plan”), and an additional 17,500 shares of common stock under the 2010 Plan in the event the net production of the Company averages over 10,000 barrels of oil per month for a period of six months. As of March 31, 2011 (and as of the date of this Proxy), the performance criterion had not been met, and none of the additional 17,500 shares was vested. Mr. Sawyer also received 12,000 shares and options to purchase 24,000 shares of common stock in consideration for serving as a Director of the Company for the year ended March 31, 2010 and in consideration for services for the year ended March 31, 2011, respectively, as described in greater detail below under “Certain Related Party Transactions.”

Effective as of April 1, 2011, the Company entered into an employment agreement (the "Agreement") with Mr. Sawyer (filed as exhibit 10.22 to the Company’s Annual Report on Form 10-K for the year ended March 31, 2011). The Agreement will terminate on April 1, 2014, unless extended or earlier terminated pursuant to the terms of such Agreement. Pursuant to the Agreement, Mr. Sawyer's base salary is $250,000 per year, of which $175,000 will be payable in cash and $75,000 in shares of the Company’s common stock on a pro-rata, quarterly basis. He may also receive discretionary bonuses in an amount up to 50% of his base salary.

In conjunction with his appointment as Chief Executive Officer, Mr. Sawyer also received options to purchase up to 200,000 shares of the Company's common stock. The options vest 25% on each of the first four anniversary dates of the grant, have a term of five years and an exercise price of $4.05 per share. If Mr. Sawyer's employment is terminated without Cause (as defined in the Agreement) or for Good Reason (as defined in the Agreement), he will receive a severance payment of 100% of his annual base salary; provided that if Mr. Sawyer's employment is terminated 6 months before or within 24 months of a Change in Control (as defined in the Agreement), he will receive a severance payment of 200% of his annual base salary. If Mr. Sawyer's employment is terminated as a result of death or Disability (as defined in the Agreement), the Company will pay his base salary which would have been payable to Mr. Sawyer through the date his employment is terminated and all amounts actually earned, accrued or owing as of the date of termination. If Mr. Sawyer’s employment is terminated for Cause or Mr. Sawyer voluntarily terminates his employment, the Company will pay his base salary and all amounts actually earned, accrued or owing as of the date of termination and he will be entitled for a period of three months after termination to exercise all options granted to him under his employment agreement or otherwise to the extent vested and exercisable on the date of termination. Mr. Sawyer's Agreement contains no covenant not to compete or similar restrictions after termination.

K. Andrew Lai

Mr. Lai was appointed Chief Financial Officer, Treasurer and Secretary of the Company on February 18, 2011. Effective as of that date, the Company entered into an employment agreement (the “Lai Agreement”) with Mr. Lai (filed as exhibit 10.23 to the Company’s Annual Report on Form 10-K for the year ended March 31, 2011). The Lai Agreement will terminate on February 18, 2014, unless extended or earlier terminated. Pursuant to the Agreement, Mr. Lai's base salary is $190,000 per year, of which $150,000 will be payable in cash and $40,000 in shares of the Company’s common stock on a pro-rata, quarterly basis. He may also receive discretionary bonuses in an amount up to 50% of his base salary. In conjunction with his appointment as Chief Financial Officer, Mr. Lai also received options to purchase up to 160,000 shares of the Company's common stock. The options vest 25% on each of the first four anniversary dates of the grant, have a term of five years and an exercise price of $1.94 per share. If Mr. Lai's employment is terminated without Cause (as defined in the Lai Agreement) or for Good Reason (as defined in the Lai Agreement), he will receive a severance payment of 100% of his annual base salary; provided that if Mr. Lai's employment is terminated six months before or within 24 months of a Change in Control (as defined in the Lai Agreement), he will receive a severance payment of 200% of his annual base salary. If Mr. Lai's employment is terminated as a result of death or Disability (as defined in the Lai Agreement), the Company will pay his base salary which would have been payable to Mr. Lai through the date his employment is terminated and all amounts actually earned, accrued or owing as of the date of termination. If Mr. Lai’s employment is terminated for Cause or Mr. Lai voluntarily terminates his employment, the Company will pay his base salary and all amounts actually earned, accrued or owing as of the date of termination and he will be entitled for a period of three months after termination to exercise all options granted to him under his employment agreement or otherwise to the extent vested and exercisable on the date of termination. The Lai Agreement contains no covenant not to compete or similar restrictions after termination.

John O’Keefe

Mr. O’Keefe was appointed as the interim Chief Financial Officer, Treasurer and Secretary of the Company on October 7, 2010, and he served as the interim principal accounting and financial officer for the Company until his resignation on February 18, 2011. The Company employed Mr. O’Keefe under a service agreement with Tatum LLC.

Donald L. Sytsma

Mr. Sytsma was appointed Chief Financial Officer and Treasurer of the Company on April 14, 2009 and Secretary on or around September 30, 2009, and he served as the principal accounting and financial officer for the Company until his resignation as Chief Financial Officer, Treasurer and Secretary on October 7, 2010. Mr. Sytsma’s prior compensation arrangement with the Company provided for a salary of $11,000 per month for services as required by the Company, plus 2,000 shares of Company common stock per month. As severance pay in connection with Mr. Sytsma’s resignation on October 7, 2010, the Company agreed to pay Mr. Sytsma three months of salary and to issue Mr. Sytsma 30,000 restricted shares of common stock.

James J. Cerna, Jr.

Mr. Cerna co-founded the Company and was originally appointed a Director and Chief Executive Officer on May 19, 2006, and he was appointed as president on June 12, 2006. On September 2, 2008, Mr. Cerna transferred his duties as president and Chief Executive Officer to Mr. Sikora and continued his role as Chairman of the Board. On May 5, 2009, Mr. Cerna’s resigned as Chairman and Director. On March 20, 2007, the Company entered into an employment agreement with Mr. Cerna (filed as exhibit 10.5 to the Company's Annual Report on Form 10-KSB for the year ended March 31, 2007). Mr. Cerna's agreement was for a period of three years and provided for payment of $175,000 annually in exchange for services to the Company. The agreement also provided for certain payments in the event of termination of employment. In connection with Company initiatives to scale back costs in response to low oil prices during our 4th fiscal quarter of 2009, Mr. Cerna agreed to suspend payment of his compensation under his employment agreement. Pursuant to an agreement, effective August 1, 2009, the Company commenced remitting $7,292 per month until the remaining amount due under his employment agreement was paid. The Company agreed to issue 86,027 shares of stock to Mr. Cerna on November 24, 2010 to terminate all liabilities and payment obligations to Mr. Cerna under this agreement.

Malek A. Bohsali

Mr. Bohsali served as Chief Financial Officer of the Company from April 10, 2007 through April 14, 2009, and served as corporate secretary until his resignation effective September 30, 2009. Mr. Bohsali received compensation listed in the above compensation table.

Other resources utilized in the Company’s operations are typically contractors or sub-contractors of vendors and service providers that are not owned directly or indirectly by the Company or any officer, Director or shareholder owning greater than five percent (5%) of the Company’s outstanding shares, nor are they members of the referenced individual’s immediate family. Such sub-contracting engagement and per job payments are commonplace in the Company's business. The Company expects to continue to utilize and pay such service providers and third party contractors as necessary to operate its day-to-day field operations.

Lucas 2010 Incentive Compensation Plan

The Company shareholders approved the Lucas Energy, Inc. 2010 Plan at the annual shareholder meeting held on March 30, 2010. The 2010 Plan provides the Company with the ability to offer stock options and restricted stock to employees, consultants and contractors as performance incentives. Shares issuable under the 2010 Plan were registered on Form S-8 registration statement that was filed with the SEC on April 23, 2010. The NYSE Amex approved this listing application for the shares issuable under the 2010 Plan on May 6, 2010.

Under the Incentive Plan, 900,000 shares of the Company’s common stock are authorized for initial issuance. As of November 3, 2011, an aggregate of 22,388 shares of common stock and options were available under the 2010 Plan for future grants. The number of shares available under the 2010 Plan is reduced one for one for each share delivered pursuant to an award under the 2010 Plan. Any issued shares that become available due to expiration, forfeiture, surrender, cancellation, termination or settlement in cash of an award under the Incentive Plan may be requested and used as part of a new award under the Plan.

The 2010 Plan is administered by the Compensation Committee and/or the Board in its discretion (the “Committee”). The Committee interprets the Plan and has broad discretion to select the eligible persons to whom awards will be granted, as well as the type, size and terms and conditions of each award, including the exercise price of stock options, the number of shares subject to awards, the expiration date of awards, and the vesting schedule or other restrictions applicable to awards. The 2010 Plan allows the Company to grant the following types of awards: (1) incentive stock options, (2) non-qualified stock options, and (3) restricted shares (i.e., shares subject to such restrictions, if any, as determined by the Compensation Committee or the Board).

Outstanding Equity Awards at March 31, 2011

The following table summarizes certain information regarding unexercised stock options outstanding as of March 31, 2011 for each of the Named Officers.

| Name | Number of Securities Underlying Unexercised Stock Options Exercisable | Number of Securities Underlying Unexercised Stock Options Unexercisable | Stock Option Exercise Price | Stock Option Expiration Date |

| William A. Sawyer | 24,000 | - | $2.07 | 1/10/2016 |

| K. Andrew Lai | - | 160,000 | $1.94 | 2/18/2016 |

The Company does not currently have in place or provide retirement, disability or other benefits for its employees.

DIRECTOR COMPENSATION

The following table sets forth compensation information with respect to our Directors during our fiscal year ended March 31, 2011.

| | | Director Compensation | |

| | | Fees earned or | | | Stock | | | Option | | | | |

| Name | | paid in cash | | | awards | | | awards | | | Total | |

| Peter K. Grunebaum | | $ | 14,500 | | | $ | 24,720 | | | $ | 41,140 | | | $ | 80,360 | |

| J. Fred Hofheinz | | | 14,250 | | | | 24,720 | | | | 41,140 | | | | 80,110 | |

| W. Andrew Krusen | | | 14,750 | | | | 24,720 | | | | 41,140 | | | | 80,610 | |

Beginning with the October 7, 2010 meeting of the Board of Directors, the compensation due to each member of the Board of Directors was increased from $2,000 to $3,000 per meeting. Additionally beginning with the October 2010 meeting, the chairpersons of the various committees are paid $750 per each committee meeting and the non-chairpersons are paid $500 for each committee meeting. Non-employee directors have historically been granted shares of common stock for services provided to the Company as a director.

The Board of Directors of the Company at a meeting held October 7, 2010 (the "Grant Date"), approved the issuance of 12,000 shares of common stock to each Director for services rendered during the April 1, 2009 to March 31, 2010 fiscal year and the grant of options to purchase 24,000 shares of common stock to each Director for services to be rendered during the April 1, 2010 to March 31, 2011 fiscal year (the "Options") pursuant to the Company’s 2010. The Options have an exercise price of $2.07 per share, the mean of the highest and lowest trading prices of the Company’s common stock on the Grant Date, consistent with the terms of the Plan and vest to the Directors in tranches of 1/4th of such options per quarter (starting effective on April 1, 2010, the start of the 2011 fiscal year), with options to purchase 12,000 shares vesting as of the Grant Date, and options to purchase 6,000 shares of common stock vesting on December 31, 2010 and March 31, 2011, as long as such individuals remain as Directors. The fair value of the shares was $24,720. The Options were fully vested at March 31, 2011 and were valued using the Black-Scholes model resulting in the fair value of $41,140.

Compensation for serving as a Director for an individual that is a named executive officer is reflected in the above table on Executive Compensation.

CERTAIN RELATED PARTY TRANSACTIONS

During the past two fiscal years there have been no transactions between the Company and any officer, Director, or any shareholder owning greater than five percent (5%) of our outstanding shares, nor any member of the above referenced individual’s immediate family, except as set forth below or otherwise disclosed above under “Executive Officer Compensation”.

The Company acquired approximately 2,771 gross oil and gas lease acreage (approx. 2,078 acres net to the Company’s interest) located in Wilson County, Texas from El Tex Petroleum, LLC (“El Tex”), which acquisition was approved by the Board in September 2009. The leases have eight shut-in or plugged wellbores that the Company believes are good candidates for restoration and revitalization procedures. The leasehold, wellbore and surface equipment acquisition price totaled approximately $1.0 million and was comprised of 637,887 shares of the Company’s common stock valued at $0.77 per share, or approximately $490,000, the Company’s assumption of $500,000 in debt plus accrued interest; and the remittance of $68,000 in cash.

One Director of the Company (J. Fred Hofheinz) holds an approximate 25.2% interest in El Tex while a second Lucas Board member (W. Andrew Krusen, Jr.) holds an indirect beneficial ownership interest in El Tex of approximately 18.8% (provided that El Tex is currently in the process of distributing substantially all of its assets to its owners, including the Company’s shares, which process has not been completed to date). Pursuant to NYSE Amex exchange rules, Company shareholders were required to approve the issuance of shares of common stock to El Tex due to the Directors holding in the aggregate more than a five percent (5%) indirect interest in the assets being acquired by the Company from El Tex. Additionally, the note holder of the debt assumed by the Company, J. Fred Hofheinz, is a Director of the Company. In connection with the Company’s acquisition, the note holder agreed to convert the debt plus accrued interest due to him into shares of the Company’s common stock. Pursuant to NYSE Amex exchange rules, Company shareholders were required to approve the issuance of the shares of common stock to the Director.

At the Company’s shareholder meeting held on March 30, 2010, the shareholders approved the issuance of the shares of common stock to El Tex and the issuance of shares of common stock to the Director for the conversion of debt plus accrued interest assumed by the Company. NYSE Amex approved the listing application for the shares to be issued and on May 25, 2010, the Company issued 637,887 shares of common stock to El Tex and 683,686 shares of common stock to the Director that held the debt assumed by the Company. The shares of common stock were issued at $0.77 per share which was the fair value of the shares at the time the acquisition was agreed and effected in September 2009.

Three wells acquired by Lucas from El Tex are part of the LEI 2009-III capital program, while one well is part of the LEI 2009-II six well program.

In addition, on February 23, 2010, Lucas paid $250,000 to El Tex to acquire leases on additional properties.

In or around May 2010, the Company issued William A. Sawyer, the Company’s President and Chief Executive Officer, 50,000 shares of common stock in connection with the Company’s joint venture partner’s commitment to and initial funding of their 70% working interest in the LEI 2009-III capital program.

The Board, at a meeting held October 7, 2010 (the Grant Date), approved the issuance of 12,000 shares of common stock to each Director and the grant of options to purchase 24,000 shares of common stock to each Director as described in greater detail above under “Director Compensation”.

On October 7, 2010, the Compensation Committee approved an increase in Mr. Sawyer’s annual salary to $175,000 per year (effective as of October 1, 2010), the Board approved the immediate issuance to Mr. Sawyer of 17,500 shares of common stock under the Company’s 2010 Plan, and an additional 17,500 shares of common stock under the 2010 Plan in the event the net production of the Company averages over 10,000 barrels of oil per month for a period of six months. As of March 31, 2011, the Company's net production has not yet averaged over 10,000 barrels of oil per month for a period of six months and as such, Mr. Sawyer has not earned or been issued the additional 17,500 shares discussed above.

Donald L. Sytsma was appointed Chief Financial Officer and Treasurer of the Company on April 14, 2009 and Secretary on or around September 30, 2009, and he served as the principal accounting and financial officer for the Company until his resignation on October 7, 2010. Mr. Sytsma’s compensation arrangement provided for a salary of $11,000 per month for services as required by the Company, plus 2,000 shares of Company common stock per month. As severance pay in connection with Mr. Sytsma’s resignation on October 7, 2010, the Company agreed to pay Mr. Sytsma three months of salary and to issue Mr. Sytsma 30,000 restricted shares of common stock.

On October 7, 2010, John O’Keefe was appointed as the Chief Financial Officer, Treasurer and Secretary of the Company.

In December 2010, the Company sold an aggregate of 2,510,506 units to certain institutional investors, each consisting of (a) one share of common stock; (b) one Series B Warrant to purchase one share of common stock at an exercise price of $2.86 per share; and (c) one Series C Warrant to purchase one share of common stock at an exercise price of $2.62 per share for a combined purchase price of $2.38 per unit. An investor in the offering included Hall Phoenix Energy, LLC, who is a joint venture partner with Lucas in the Eagle Ford trend in South Texas.

On February 18, 2011, the Company accepted the resignation of John O’Keefe from his positions as Chief Financial Officer, Treasurer and Secretary of the Company. As a result of his resignation, Mr. O’Keefe no longer holds any officer position with the Company.

Also effective February 18, 2011, the Company appointed K. Andrew Lai, as Chief Financial Officer, Treasurer and Secretary of the Company and granted options to purchase 160,000 shares of the Company’s common stock to Mr. Lai. The options vest 25% on each of the first four anniversary dates of the grant, have a term of five years and an exercise price of $1.94 per share.

On April 1, 2011, the Company granted options to purchase 200,000 shares of the Company’s common stock to William A. Sawyer. The options vest 25% on each of the first four anniversary dates of the grant, have a term of five years and an exercise price of $4.05 per share.

On May 18, 2011, the Company issued K. Andrew Lai 3,861 shares of common stock valued at $2.59 per share (the closing price of the Company’s common stock on the grant date) representing $10,000 in aggregate in connection with and pursuant to the terms of his employment agreement.

On July 1, 2011, the Company issued William A. Sawyer 6,721 shares of common stock valued at $2.79 per share (the closing price of the Company’s common stock on the grant date) representing $18,750 in aggregate in connection with and pursuant to the terms of his employment agreement.

On August 18, 2011, the Company issued K. Andrew Lai 5,025 shares of common stock valued at $1.99 per share (the closing price of the Company’s common stock on the grant date) representing $10,000 in aggregate in connection with and pursuant to the terms of his employment agreement.

On October 1, 2011, the Company agreed to issue William A. Sawyer 10,061 shares of common stock which, net of applicable payroll taxes, representing an aggregate value of $18,750 (with such stock valued at $1.30 per share (the closing price of the Company’s common stock on September 30, 2011, the last trading day prior to the grant date)), in connection with and pursuant to his employment agreement.

It is our policy that any future material transactions between us and members of management or their affiliates shall be on terms no less favorable than those available from unaffiliated third parties.

DIRECTOR INDEPENDENCE

During the year ended March 31, 2011, the Board determined that a majority of the Board is independent under the definition of "independence" and in compliance with the listing standards of the NYSE Amex listing requirements. Based upon these standards, the Board has determined that all of the Directors are independent, with the exception of Mr. Sawyer, our President and Chief Executive Officer. See "Meetings and Committees of the Board of Directors" in Item 10.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

During the fiscal year that ended on March 31, 2011, the Board held four meetings. All Directors attended all meetings of the Board and all committee meetings on which the Director served during fiscal year 2011. All of the current Directors attended our fiscal year 2011 annual shareholder meeting held on January 10, 2011.

During the fiscal year that ended on March 31, 2011, the Board determined that a majority of the Board is independent under the definition of independence and in compliance with the listing standards of the NYSE Amex listing requirements. Based upon these standards, the Board has determined that all of the Directors are independent, with the exception of Mr. Sawyer, our President and Chief Executive Officer.

The Board has a standing Audit Committee, Compensation Committee, and Nominating Committee.