eNett International (Jersey) Limited Company Number 103203 Unaudited Interim Condensed Consolidated Financial Statements for the period ended - 30 September 2020 Exhibit 99.4

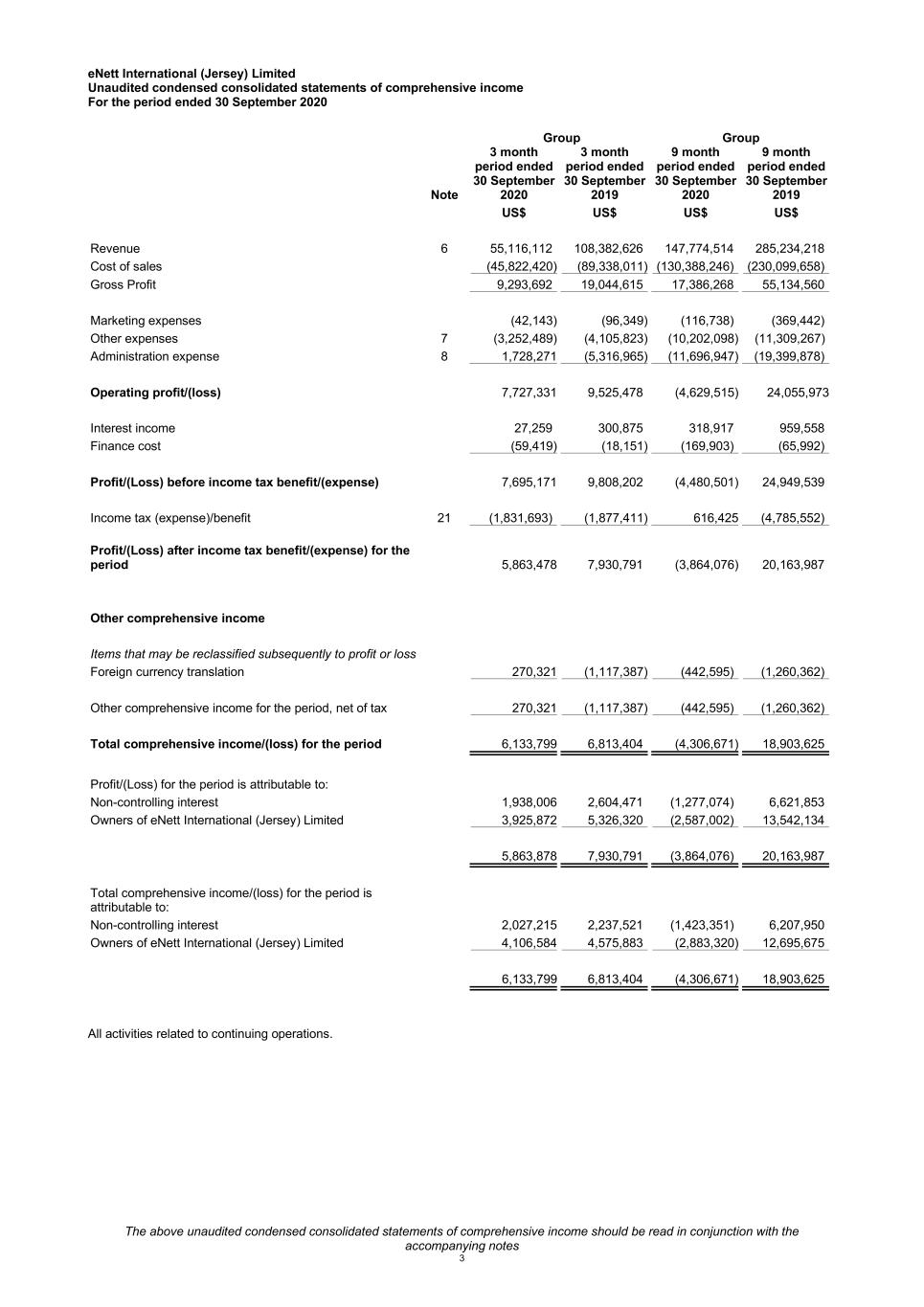

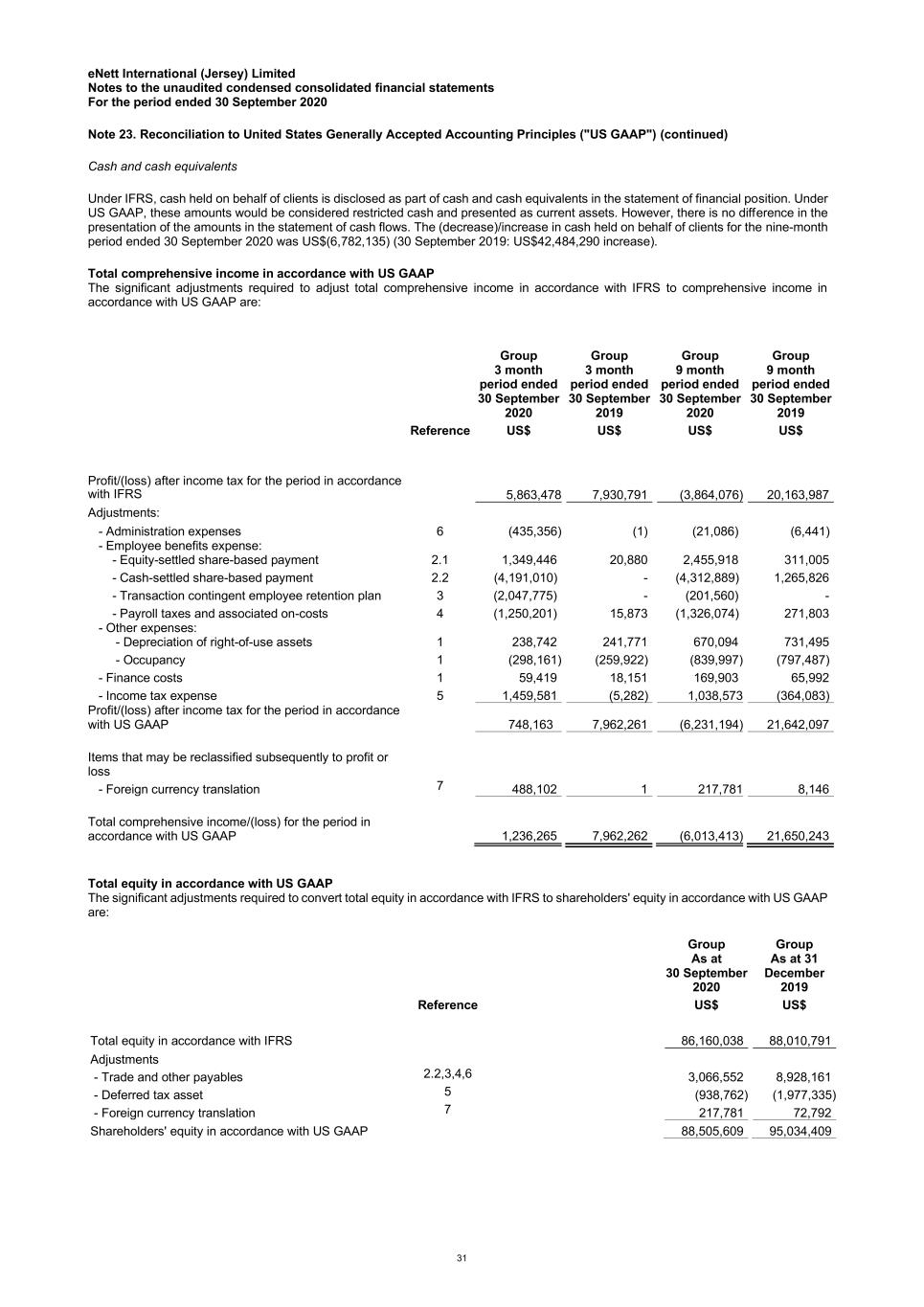

eNett International (Jersey) Limited Unaudited condensed consolidated statements of comprehensive income For the period ended 30 September 2020 Group Group Note 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ The above unaudited condensed consolidated statements of comprehensive income should be read in conjunction with the accompanying notes 3 Revenue 6 55,116,112 108,382,626 147,774,514 285,234,218 Cost of sales (45,822,420) (89,338,011) (130,388,246) (230,099,658) Gross Profit 9,293,692 19,044,615 17,386,268 55,134,560 Marketing expenses (42,143) (96,349) (116,738) (369,442) Other expenses 7 (3,252,489) (4,105,823) (10,202,098) (11,309,267)- Administration expense 8 1,728,271 (5,316,965) (11,696,947) (19,399,878) Operating profit/(loss) 7,727,331 9,525,478 (4,629,515) 24,055,973 Interest income 27,259 300,875 318,917 959,558 Finance cost (59,419) (18,151) (169,903) (65,992) Profit/(Loss) before income tax benefit/(expense) 7,695,171 9,808,202 (4,480,501) 24,949,539 Income tax (expense)/benefit 21 (1,831,693) (1,877,411) 616,425 (4,785,552) Profit/(Loss) after income tax benefit/(expense) for the period 5,863,478 7,930,791 (3,864,076) 20,163,987 Other comprehensive income Items that may be reclassified subsequently to profit or loss Foreign currency translation 270,321 (1,117,387) (442,595) (1,260,362) Other comprehensive income for the period, net of tax 270,321 (1,117,387) (442,595) (1,260,362) Total comprehensive income/(loss) for the period 6,133,799 6,813,404 (4,306,671) 18,903,625 Profit/(Loss) for the period is attributable to: Non-controlling interest 1,938,006 2,604,471 (1,277,074) 6,621,853 Owners of eNett International (Jersey) Limited 3,925,872 5,326,320 (2,587,002) 13,542,134 5,863,878 7,930,791 (3,864,076) 20,163,987 Total comprehensive income/(loss) for the period is attributable to: Non-controlling interest 2,027,215 2,237,521 (1,423,351) 6,207,950 Owners of eNett International (Jersey) Limited 4,106,584 4,575,883 (2,883,320) 12,695,675 6,133,799 6,813,404 (4,306,671) 18,903,625 All activities related to continuing operations.

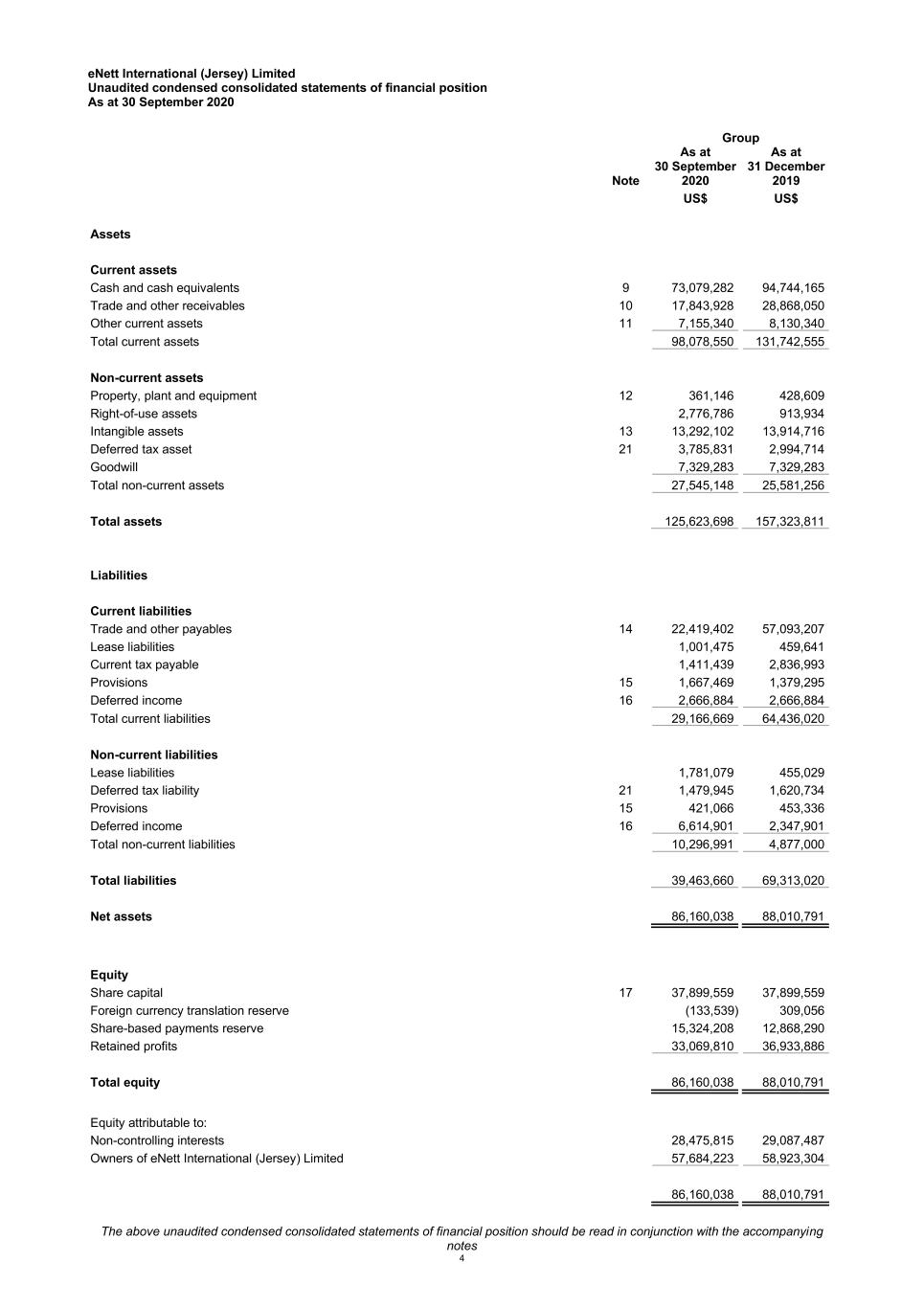

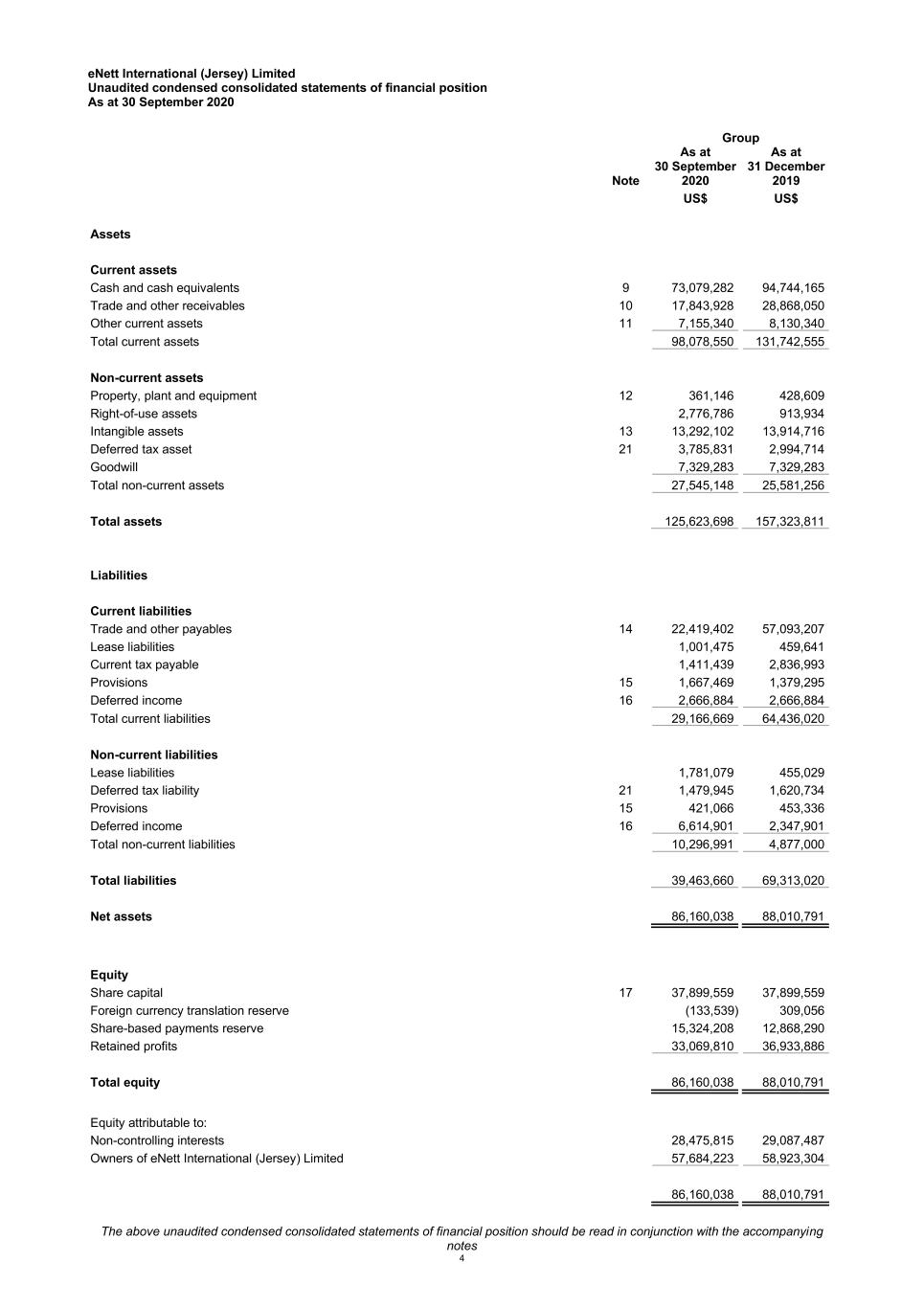

eNett International (Jersey) Limited Unaudited condensed consolidated statements of financial position As at 30 September 2020 Group Note As at 30 September 2020 As at 31 December 2019 US$ US$ The above unaudited condensed consolidated statements of financial position should be read in conjunction with the accompanying notes 4 Assets Current assets Cash and cash equivalents 9 73,079,282 94,744,165 Trade and other receivables 10 17,843,928 28,868,050 Other current assets 11 7,155,340 8,130,340 Total current assets 98,078,550 131,742,555 Non-current assets Property, plant and equipment 12 361,146 428,609 Right-of-use assets 2,776,786 913,934 Intangible assets 13 13,292,102 13,914,716 Deferred tax asset 21 3,785,831 2,994,714 Goodwill 7,329,283 7,329,283 Total non-current assets 27,545,148 25,581,256 Total assets 125,623,698 157,323,811 Liabilities Current liabilities Trade and other payables 14 22,419,402 57,093,207 Lease liabilities 1,001,475 459,641 Current tax payable 1,411,439 2,836,993 Provisions 15 1,667,469 1,379,295 Deferred income 16 2,666,884 2,666,884 Total current liabilities 29,166,669 64,436,020 Non-current liabilities Lease liabilities 1,781,079 455,029 Deferred tax liability 21 1,479,945 1,620,734 Provisions 15 421,066 453,336 Deferred income 16 6,614,901 2,347,901 Total non-current liabilities 10,296,991 4,877,000 Total liabilities 39,463,660 69,313,020 Net assets 86,160,038 88,010,791 Equity Share capital 17 37,899,559 37,899,559 Foreign currency translation reserve (133,539) 309,056 Share-based payments reserve 15,324,208 12,868,290 Retained profits 33,069,810 36,933,886 Total equity 86,160,038 88,010,791 Equity attributable to: Non-controlling interests 28,475,815 29,087,487 Owners of eNett International (Jersey) Limited 57,684,223 58,923,304 86,160,038 88,010,791

eNett International (Jersey) Limited Unaudited condensed consolidated statements of financial position As at 30 September 2020 The above unaudited condensed consolidated statements of financial position should be read in conjunction with the accompanying notes 5 The financial statements of eNett International (Jersey) Limited (registered number 103203) were approved and signed on behalf of the Board of Directors: ___________________________ ___________________________ Anthony Hynes Adam Olding Director Director 15 January 2021

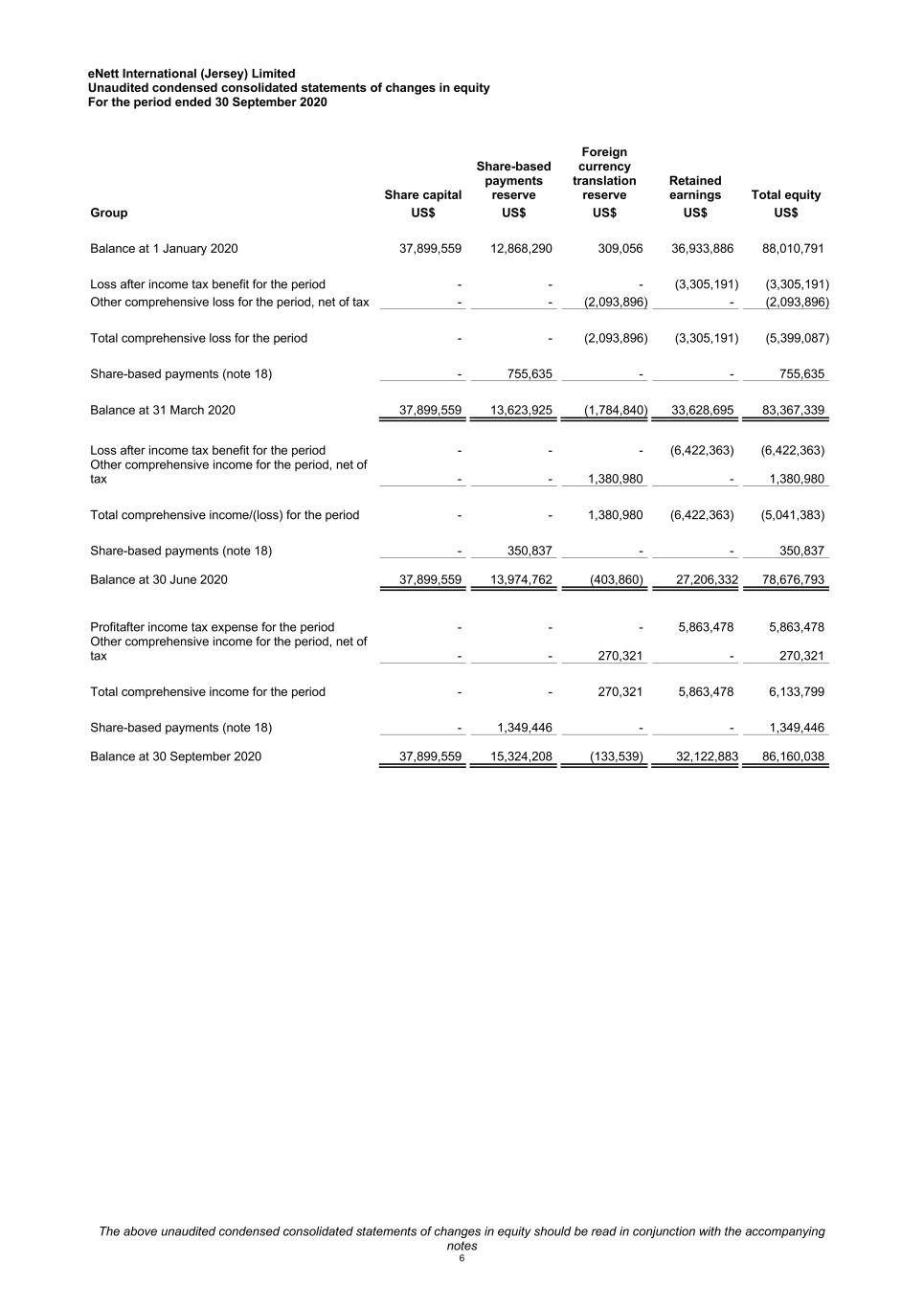

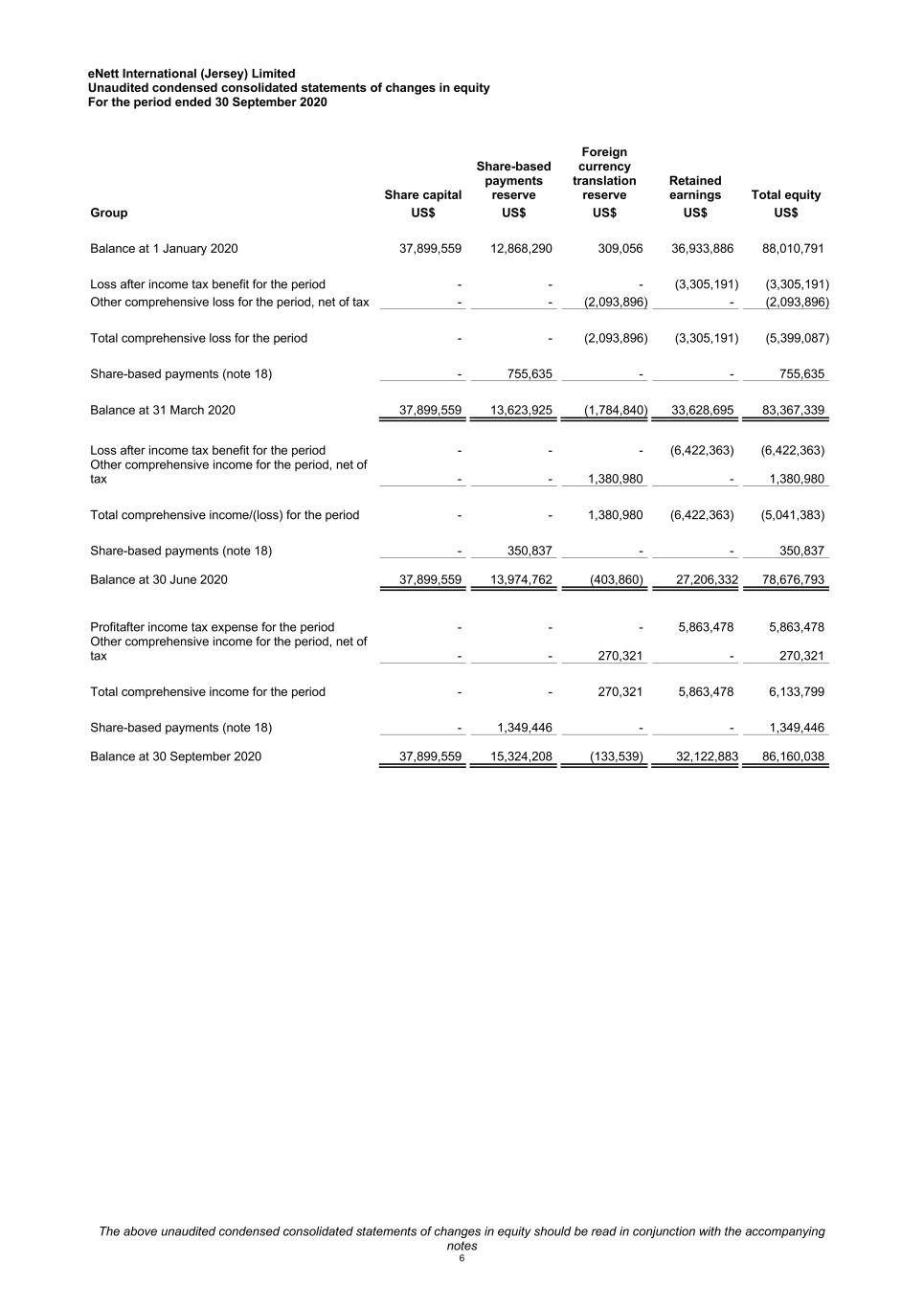

eNett International (Jersey) Limited Unaudited condensed consolidated statements of changes in equity For the period ended 30 September 2020 The above unaudited condensed consolidated statements of changes in equity should be read in conjunction with the accompanying notes 6 Total equity Share capital Share-based payments reserve Foreign currency translation reserve Retained earnings Group US$ US$ US$ US$ US$ Balance at 1 January 2020 37,899,559 12,868,290 309,056 36,933,886 88,010,791 Loss after income tax benefit for the period - - - (3,305,191) (3,305,191) Other comprehensive loss for the period, net of tax - - (2,093,896) - (2,093,896) Total comprehensive loss for the period - - (2,093,896) (3,305,191) (5,399,087) Share-based payments (note 18) - 755,635 - - 755,635 Balance at 31 March 2020 37,899,559 13,623,925 (1,784,840) 33,628,695 83,367,339 Loss after income tax benefit for the period - - - (6,422,363) (6,422,363) Other comprehensive income for the period, net of tax - - 1,380,980 - 1,380,980 Total comprehensive income/(loss) for the period - - 1,380,980 (6,422,363) (5,041,383) Share-based payments (note 18) - 350,837 - - 350,837 Balance at 30 June 2020 37,899,559 13,974,762 (403,860) 27,206,332 78,676,793 Profitafter income tax expense for the period - - - 5,863,478 5,863,478 Other comprehensive income for the period, net of tax - - 270,321 - 270,321 Total comprehensive income for the period - - 270,321 5,863,478 6,133,799 Share-based payments (note 18) - 1,349,446 - - 1,349,446 Balance at 30 September 2020 37,899,559 15,324,208 (133,539) 32,122,883 86,160,038

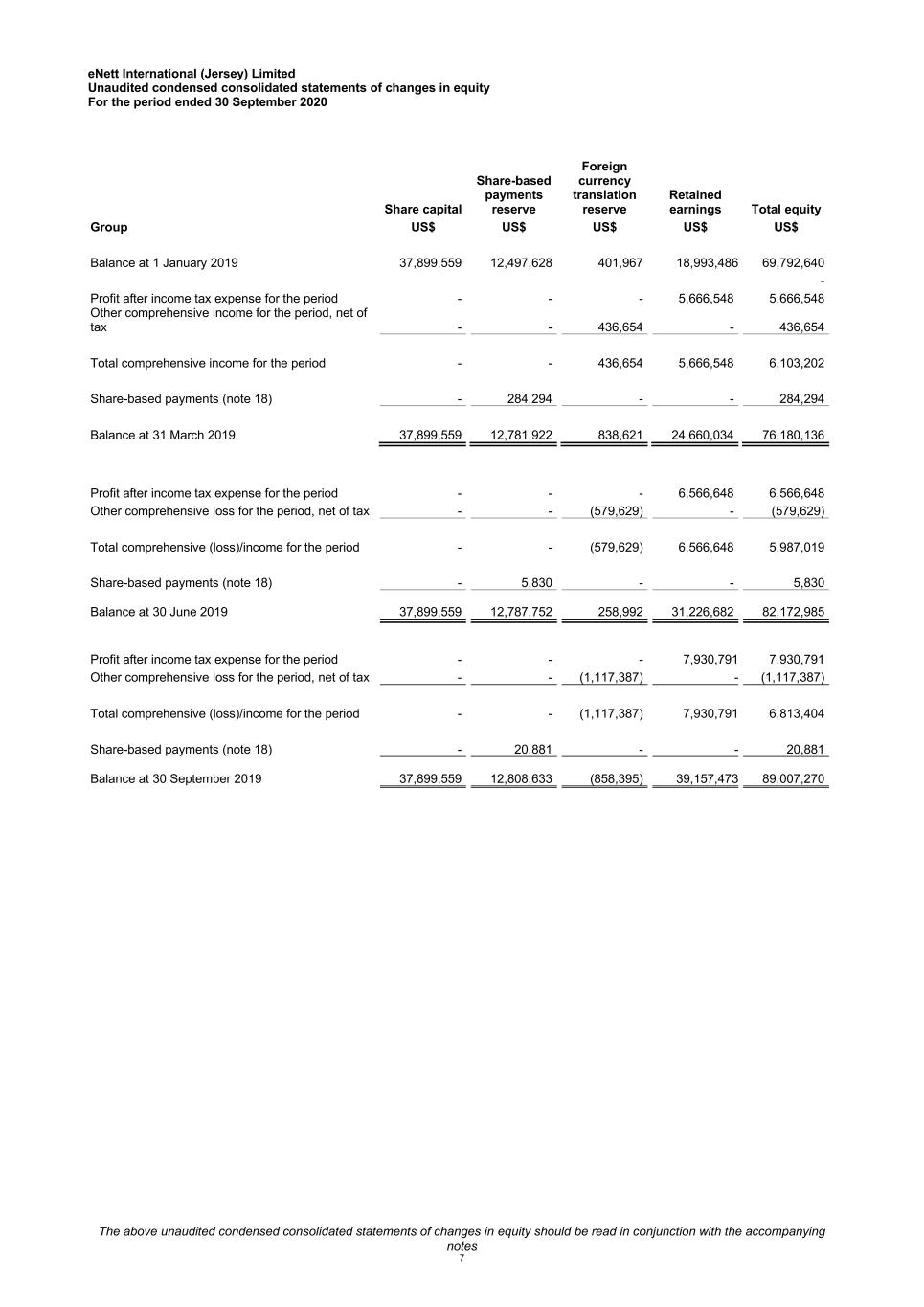

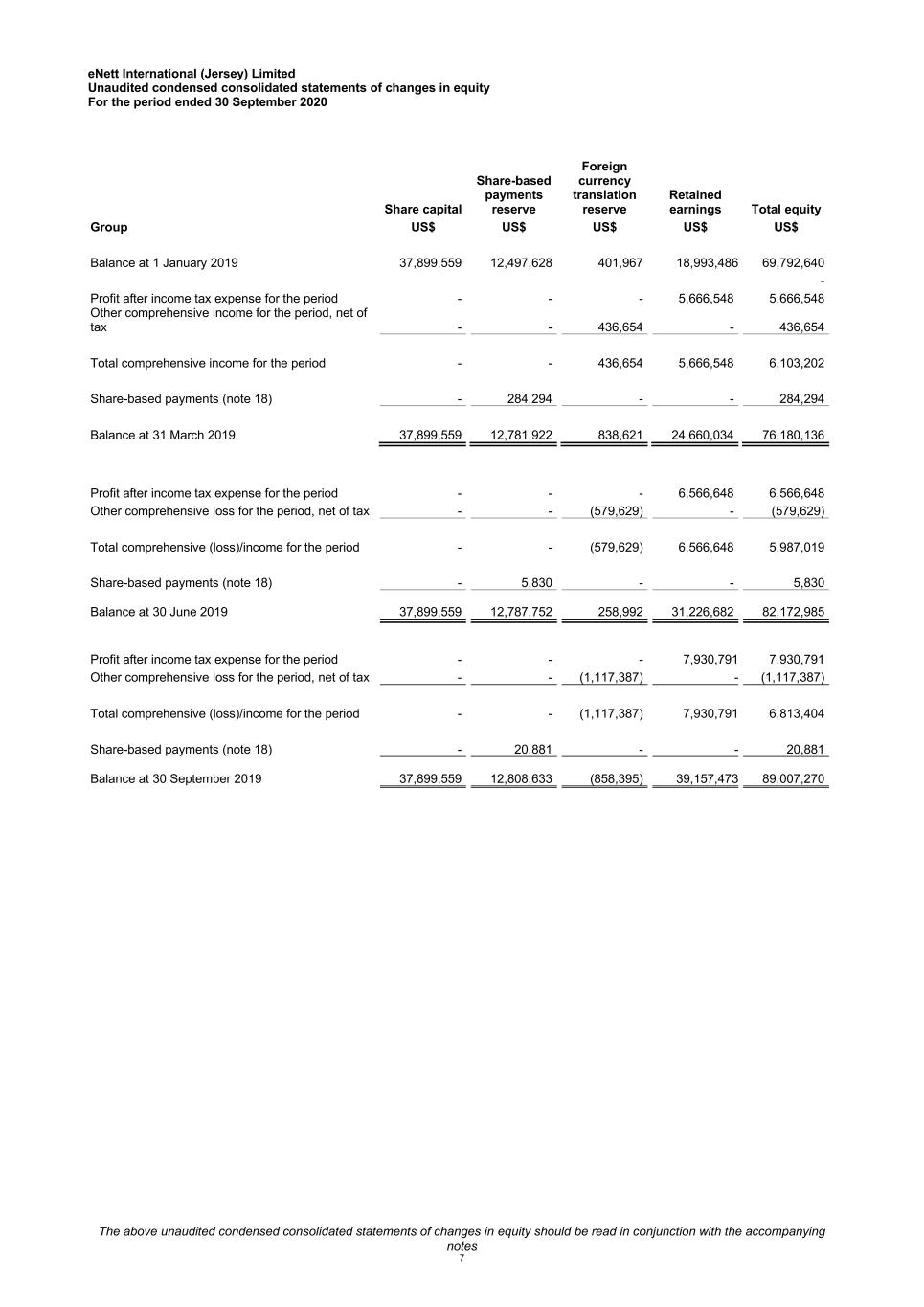

eNett International (Jersey) Limited Unaudited condensed consolidated statements of changes in equity For the period ended 30 September 2020 The above unaudited condensed consolidated statements of changes in equity should be read in conjunction with the accompanying notes 7 Total equity Share capital Share-based payments reserve Foreign currency translation reserve Retained earnings Group US$ US$ US$ US$ US$ Balance at 1 January 2019 37,899,559 12,497,628 401,967 18,993,486 69,792,640 - Profit after income tax expense for the period - - - 5,666,548 5,666,548 Other comprehensive income for the period, net of tax - - 436,654 - 436,654 Total comprehensive income for the period - - 436,654 5,666,548 6,103,202 Share-based payments (note 18) - 284,294 - - 284,294 Balance at 31 March 2019 37,899,559 12,781,922 838,621 24,660,034 76,180,136 Profit after income tax expense for the period - - - 6,566,648 6,566,648 Other comprehensive loss for the period, net of tax - - (579,629) - (579,629) Total comprehensive (loss)/income for the period - - (579,629) 6,566,648 5,987,019 Share-based payments (note 18) - 5,830 - - 5,830 Balance at 30 June 2019 37,899,559 12,787,752 258,992 31,226,682 82,172,985 Profit after income tax expense for the period - - - 7,930,791 7,930,791 Other comprehensive loss for the period, net of tax - - (1,117,387) - (1,117,387) Total comprehensive (loss)/income for the period - - (1,117,387) 7,930,791 6,813,404 Share-based payments (note 18) - 20,881 - - 20,881 Balance at 30 September 2019 37,899,559 12,808,633 (858,395) 39,157,473 89,007,270

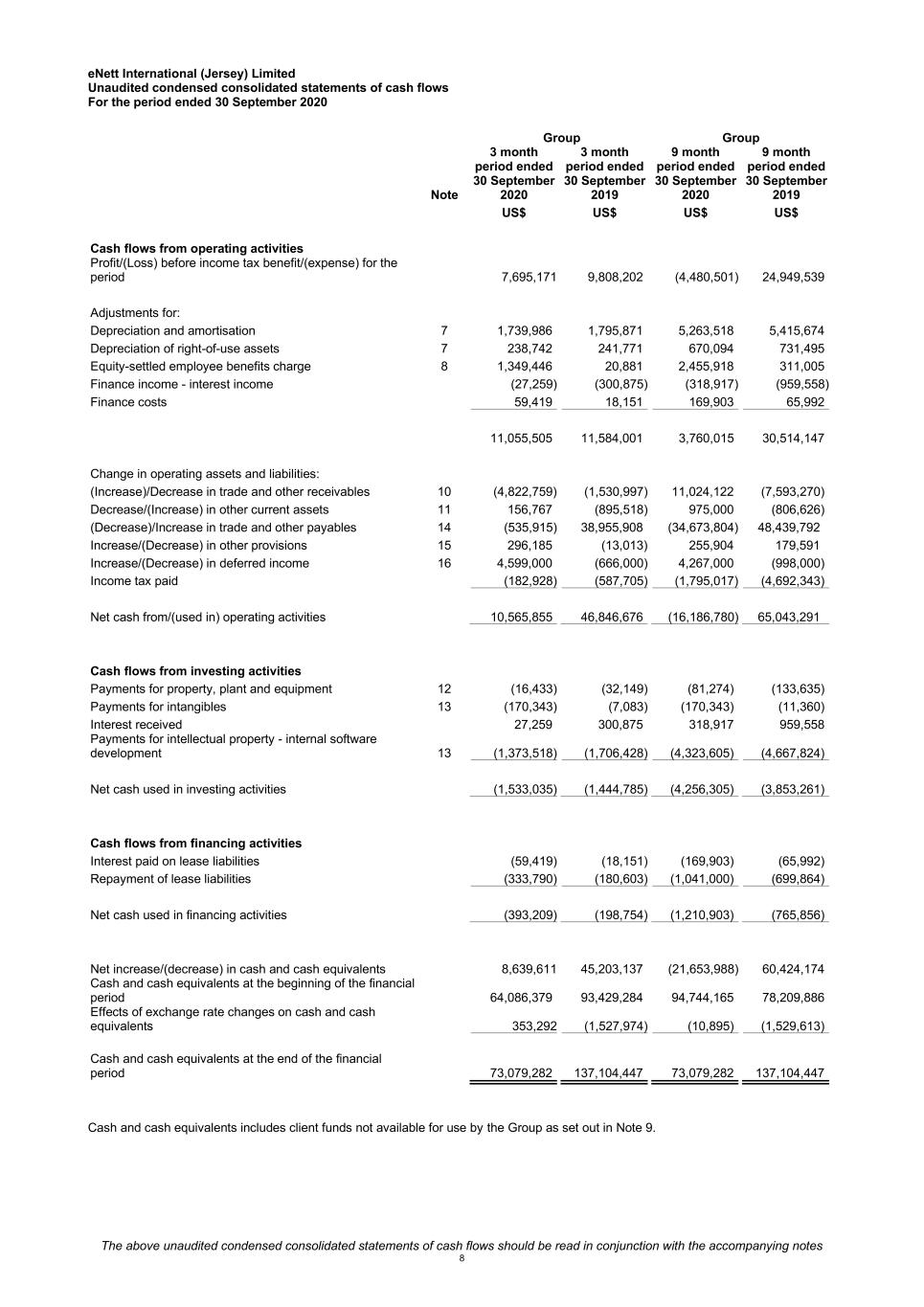

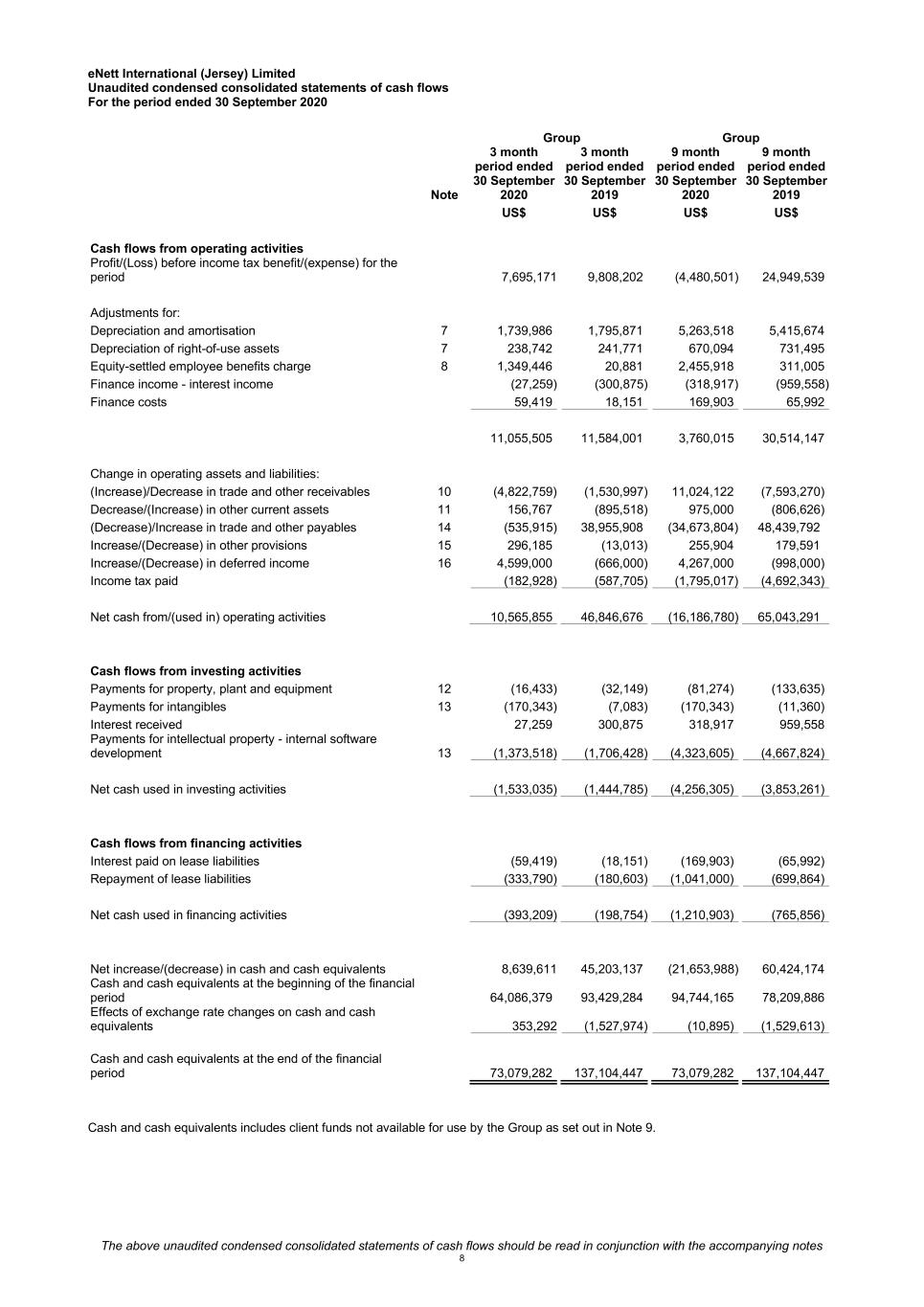

eNett International (Jersey) Limited Unaudited condensed consolidated statements of cash flows For the period ended 30 September 2020 Group Group Note 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ The above unaudited condensed consolidated statements of cash flows should be read in conjunction with the accompanying notes 8 Cash flows from operating activities Profit/(Loss) before income tax benefit/(expense) for the period 7,695,171 9,808,202 (4,480,501) 24,949,539 Adjustments for: Depreciation and amortisation 7 1,739,986 1,795,871 5,263,518 5,415,674 Depreciation of right-of-use assets 7 238,742 241,771 670,094 731,495 Equity-settled employee benefits charge 8 1,349,446 20,881 2,455,918 311,005 Finance income - interest income (27,259) (300,875) (318,917) (959,558) Finance costs 59,419 18,151 169,903 65,992 11,055,505 11,584,001 3,760,015 30,514,147 Change in operating assets and liabilities: (Increase)/Decrease in trade and other receivables 10 (4,822,759) (1,530,997) 11,024,122 (7,593,270) Decrease/(Increase) in other current assets 11 156,767 (895,518) 975,000 (806,626) (Decrease)/Increase in trade and other payables 14 (535,915) 38,955,908 (34,673,804) 48,439,792 Increase/(Decrease) in other provisions 15 296,185 (13,013) 255,904 179,591 Increase/(Decrease) in deferred income 16 4,599,000 (666,000) 4,267,000 (998,000) Income tax paid (182,928) (587,705) (1,795,017) (4,692,343) Net cash from/(used in) operating activities 10,565,855 46,846,676 (16,186,780) 65,043,291 Cash flows from investing activities Payments for property, plant and equipment 12 (16,433) (32,149) (81,274) (133,635) Payments for intangibles 13 (170,343) (7,083) (170,343) (11,360) Interest received 27,259 300,875 318,917 959,558 Payments for intellectual property - internal software development 13 (1,373,518) (1,706,428) (4,323,605) (4,667,824) Net cash used in investing activities (1,533,035) (1,444,785) (4,256,305) (3,853,261) Cash flows from financing activities Interest paid on lease liabilities (59,419) (18,151) (169,903) (65,992) Repayment of lease liabilities (333,790) (180,603) (1,041,000) (699,864) Net cash used in financing activities (393,209) (198,754) (1,210,903) (765,856) Net increase/(decrease) in cash and cash equivalents 8,639,611 45,203,137 (21,653,988) 60,424,174 Cash and cash equivalents at the beginning of the financial period 64,086,379 93,429,284 94,744,165 78,209,886 Effects of exchange rate changes on cash and cash equivalents 353,292 (1,527,974) (10,895) (1,529,613) Cash and cash equivalents at the end of the financial period 73,079,282 137,104,447 73,079,282 137,104,447 Cash and cash equivalents includes client funds not available for use by the Group as set out in Note 9.

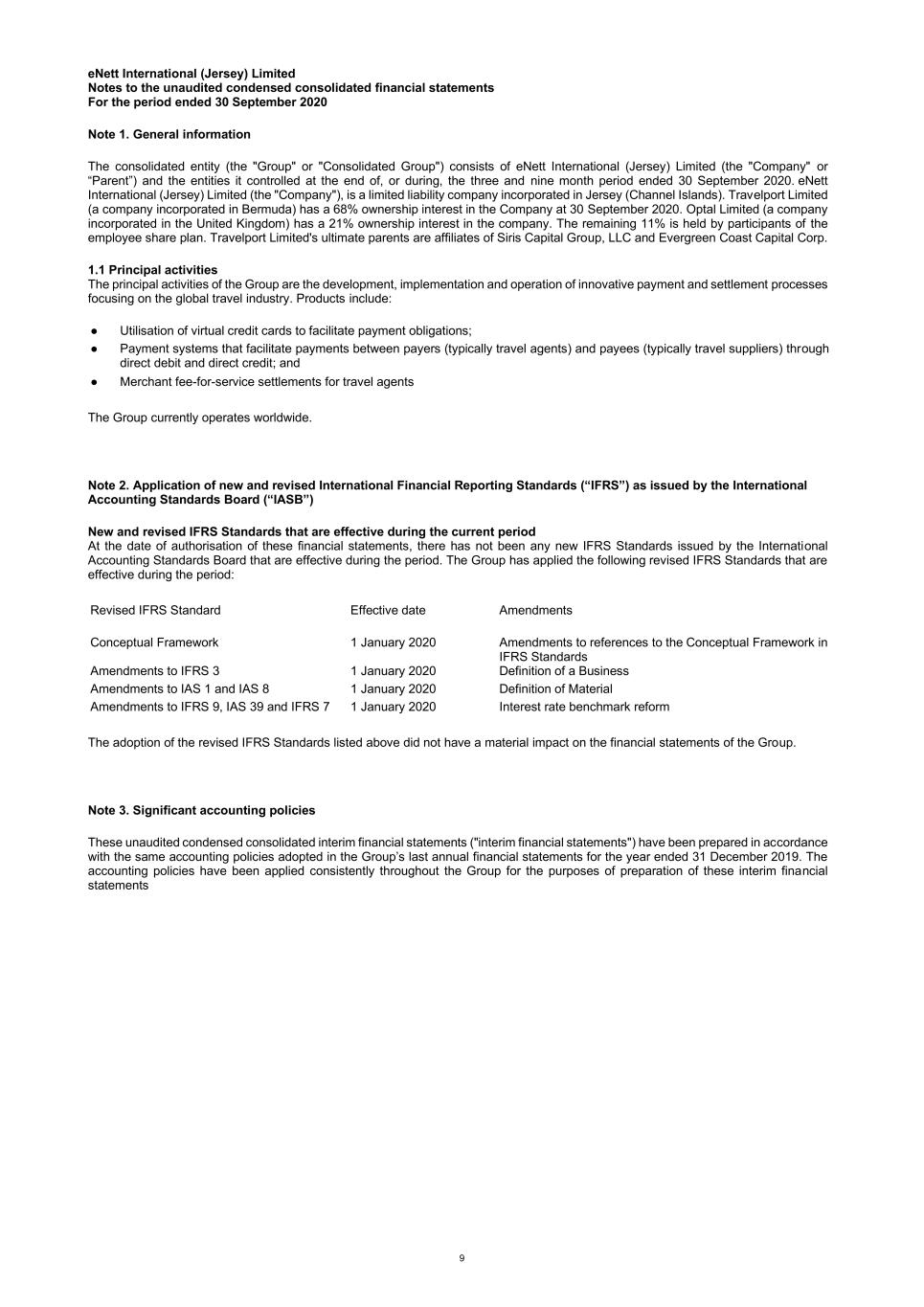

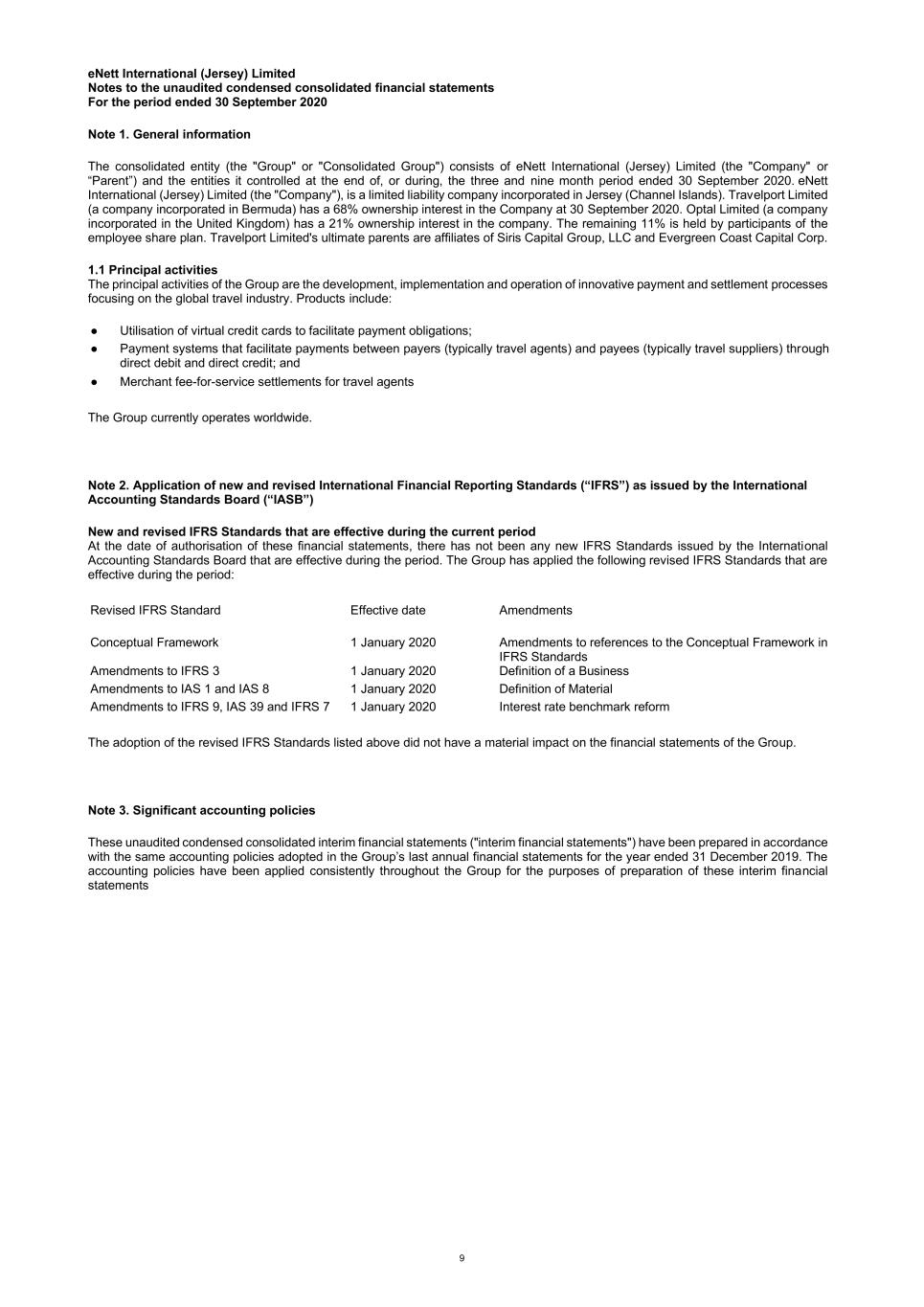

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 9 Note 1. General information The consolidated entity (the "Group" or "Consolidated Group") consists of eNett International (Jersey) Limited (the "Company" or “Parent”) and the entities it controlled at the end of, or during, the three and nine month period ended 30 September 2020. eNett International (Jersey) Limited (the "Company"), is a limited liability company incorporated in Jersey (Channel Islands). Travelport Limited (a company incorporated in Bermuda) has a 68% ownership interest in the Company at 30 September 2020. Optal Limited (a company incorporated in the United Kingdom) has a 21% ownership interest in the company. The remaining 11% is held by participants of the employee share plan. Travelport Limited's ultimate parents are affiliates of Siris Capital Group, LLC and Evergreen Coast Capital Corp. 1.1 Principal activities The principal activities of the Group are the development, implementation and operation of innovative payment and settlement processes focusing on the global travel industry. Products include: ● Utilisation of virtual credit cards to facilitate payment obligations; ● Payment systems that facilitate payments between payers (typically travel agents) and payees (typically travel suppliers) through direct debit and direct credit; and ● Merchant fee-for-service settlements for travel agents The Group currently operates worldwide. Note 2. Application of new and revised International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) New and revised IFRS Standards that are effective during the current period At the date of authorisation of these financial statements, there has not been any new IFRS Standards issued by the International Accounting Standards Board that are effective during the period. The Group has applied the following revised IFRS Standards that are effective during the period: Revised IFRS Standard Effective date Amendments Conceptual Framework 1 January 2020 Amendments to references to the Conceptual Framework in IFRS Standards Amendments to IFRS 3 1 January 2020 Definition of a Business Amendments to IAS 1 and IAS 8 1 January 2020 Definition of Material Amendments to IFRS 9, IAS 39 and IFRS 7 1 January 2020 Interest rate benchmark reform The adoption of the revised IFRS Standards listed above did not have a material impact on the financial statements of the Group. Note 3. Significant accounting policies These unaudited condensed consolidated interim financial statements ("interim financial statements") have been prepared in accordance with the same accounting policies adopted in the Group’s last annual financial statements for the year ended 31 December 2019. The accounting policies have been applied consistently throughout the Group for the purposes of preparation of these interim financial statements

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 3. Significant accounting policies (continued) 10 3.1 Basis of preparation The interim financial statements for the three month reporting period ended 30 September 2020 (the “quarter”) and the nine month reporting period ended 30 September 2020 (the “nine month period”) have been prepared in accordance with International Accounting Standard 34 - Interim Financial Reporting as issued by the IASB and are presented in United States Dollars (US$), which is also the functional currency of the Company. As set out in note 5, the outbreak of the novel strain of COVID-19 Coronavirus (the "Coronavirus") has had a significant adverse impact on global travel, leisure and airline booking volumes since March 2020. This has had a significant impact on the volume of customer transactions and associated revenue from our virtual card product; and we expect this to continue until restrictions on travel are eased, airlines can safely return to normal operating conditions, and travellers have an increased confidence to resume travel. The directors have reviewed the expected cash flows and projected income and expenditure to 31 December 2021. The directors have also considered the current economic climate, alongside expected and current trading conditions encompassing different scenarios whereby revenues have significantly reduced in order to determine whether the Group can continue to operate in an unfavourable or challenging business environment over that period. Based on their review, the current cash position, and an assessment of the ability and intention of WEX Inc. to provide continuing support if and as necessary (which includes having a letter of support in place); the directors believe that the Group has access to adequate financial resources to continue in operational existence for at least 12 months from the date of signing these financial statements. For this reason, the directors have continued to adopt the going concern basis in preparing these unaudited condensed interim financial statements. The interim financial statements do not include all the notes of the type normally included in an annual financial report. Accordingly, this report is to be read in conjunction with the annual report for the year ended 31 December 2019. Note 4. Critical accounting judgements, estimates and assumptions In application of the Group’s accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates. The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods. 4.1 Critical judgements in applying accounting policies Probability and timing of a liquidity event At each reporting date, the Group assesses the probability of a liquidity event occurring, based on the current expected circumstances and conditions. The probability percentage impacts the share-based payments expense recognised in the relevant period (where there is a non-market vesting condition for the occurrence of a liquidity event attached to the instrument), and the amount of any transaction contingent employee retention plan expenses. Given the definitive agreement to acquire all the issued shares in the Company and the subsequent closing of the Transaction on 15 December 2020 as outlined in note 5 ‘Significant events and transactions’, as at 30 September 2020 , the Group assessment of the likelihood of a future liquidity event occurring of 90% probable is considered appropriate, given the ongoing litigation and subsequent negotiations (31 December 2019: 90%). The Directors have made no other critical judgements, apart from those involving estimations, in the process of applying the Group’s accounting policies that may have made a significant effect on the amounts recognised in the financial statements. Note 5. Significant events and transactions The Coronavirus outbreak During the first two months of the nine-month period, the volume of customer transactions and associated revenue from our virtual card product was higher against the previous comparable period and we continued to see growth in our product offerings, especially with our key customers. However, the Coronavirus progressively spread to multiple countries and continents throughout the world during the period causing a global pandemic which in turn lead to significant restrictions on global travel and reductions in leisure and airline booking volumes with countries closing their borders and imposing prolonged quarantines and other travel restrictions. The impact of the Coronavirus caused a significant decrease in the volume of customer transactions and associated revenue from our virtual card product, with the largest declines seen during the months of March and April 2020. A steady recovery towards historical revenues is expected as and when individual countries ease restrictions on domestic and international travel, and we anticipate the easing of such restrictions to be largely consistent with the relevant success by countries in containing the spread of the virus outbreak. Whilst some recovery impact from the easing of certain regional restrictions has already been seen, with some domestic and a low-level of international flights recommencing; the recovery impact remains volatile as individual countries continue to release, adjust, or reimpose restrictions on domestic and international travel.

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 5. Significant events and transactions (continued) 11 As a result of the Coronavirus pandemic, the financial impact has been significant for our business, as it has been for many industries and in particular the travel payments industry in which we operate. However, the Group has significant financial resources, low financial asset risk, and is well prepared to ensure the continued operations of its product offerings during this time, whilst ensuring its workforce are protected as much as possible and are fully able to work effectively whilst remotely away from its usual operational sites. Furthermore, the Group has mitigated operational costs through a number of initiatives such as the reduction of labour costs, travel expenditure and other operating expenses, whilst also ensuring local government financial support schemes are utilised to assist the business and its workforce. The Group has also reviewed whether there are potential factors to warrant an expected credit loss on its trade and other receivables, particularly within the virtual card payment processing. As outlined within note 10 'Trade and other receivables', the Group considers the risk of credit losses to be low, primarily due to trade receivables primarily continuing to be part of the Mastercard global settlement program and other relevant agreements. However, as of September 30, 2020 the Group had a number of trade receivables from virtual card customers in certain currencies as a result of the increased level of transactional refunds and customer chargebacks processed due to the higher than normal level of travel booking cancellations resulting from the Coronavirus. This credit loss risk is substantially mitigated through bank guarantees, corporate guarantees, and/or the ability to recover from subsequent rebate payments and client fund balances held. Furthermore, goodwill is assessed for impairment annually and the impact of reduced travel volumes due to the Coronavirus pandemic may be an indicator of impairment, given the unknown duration of the Coronavirus pandemic. At the end of the previous year, there was significant headroom in estimated discounted future cash-flows above the carrying value as determined, and the Group has re-assessed the carrying value of goodwill and has not identified any impairment as at 30 September 2020. Definitive agreement to acquire all the issued shares in the Company On 24 January 2020, the Board of Directors unanimously approved entry into a definitive agreement (the “Purchase Agreement”) w ith WEX Inc ("WEX") for the acquisition of all the issued shares in the Company (the "Transaction"). The Transaction also includes the acquisition of Optal Limited and its subsidiaries ("Optal"). Optal is a non-majority shareholder of the Company and the primary issuer of the Group's virtual credit card products. Pursuant to the terms of the Purchase Agreement, WEX will acquire the Group and Optal for a total consideration of approximately US$1.7 billion, comprising approximately US$1.275 billion in cash and approximately two million shares of WEX common stock. The WEX common stock issued in connection with the transaction is valued at approximately US$425 million, based on WEX’s volume-weighted average price over the 30 trading days prior to signing the definitive agreement. On 7 May 2020, WEX reported that it had concluded that the Coronavirus pandemic and conditions arising in connection with it have had, and continue to have, a material adverse effect on the businesses of the Company and Optal, and that because of this material adverse effect, WEX had advised the Company and Optal that it is not required to close the Transaction pursuant to the terms of the Purchase Agreement. Also, on 7 May 2020, Travelport Limited, the Company and Optal issued a statement rejecting WEX’s attempt to walk away from the Purchase Agreement and stating that they intend to vigorously enforce their contractual rights and to hold WEX to its promises under the Purchase Agreement. On 11 May 2020, Travelport Limited and Optal each filed claims in the UK commercial court seeking a declaratory judgment that no material adverse effect has occurred within the meaning of the Purchase Agreement and requesting an order for specific performance under the terms of the Purchase Agreement to obligate WEX to proceed with closing of the Transaction. On 12 October 2020, the Commercial Court, Queen’s Bench Division of the High Court of Justice of England and Wales published its ruling on certain preliminary issues relating to the complaint filed against WEX by shareholders of eNett and Optal. The Court’s decision on one of the identified preliminary issues, was that there is no Travel Payments Industry, and the shareholders of eNett and Optal have submitted a request to the Court of Appeal for permission to appeal that issue. The Court’s decision on one of the other identified preliminary issues was that changes in law or regulation cannot be relied upon to establish that a Material Adverse Effect has occurred. WEX has submitted a request to the Court of Appeal for permission to appeal that issue. While the Court has ruled on certain preliminary issues, it has yet to make a ruling on the ultimate issue, whether the effect of the pandemic constitutes a “Material Adverse Effect”, as defined in the Purchase Agreement. WEX bears the burden of proof on this issue, which remains to be decided at trial. At trial, WEX will not be permitted to rely on any impact on travel that occurred in connection with changes in law or regulation. On 15 December 2020, following a period of negotiation, WEX completed the Transaction and an amended Purchase Agreement was executed by all parties. WEX paid a total consideration of US$577.5 million for both the Company and Optal, which was funded from cash on hand. Additionally, contemporaneously with the completion of the Transaction, WEX and the former shareholders of the Company and Optal have agreed to a full and final settlement of the litigation pending in the English courts relating to the Purchase Agreement. As a result, WEX Inc. (a company registered with the U.S. Security and Exchange Commission and incorporated in the state of Delaware in the United States of America) acquired A Class shares from Travelport Limited and C Class shares from various third parties to become the ultimate parent with 100% controlling interest in the Company. Refer to ‘Note 22 – Events after the reporting period’ for further details.

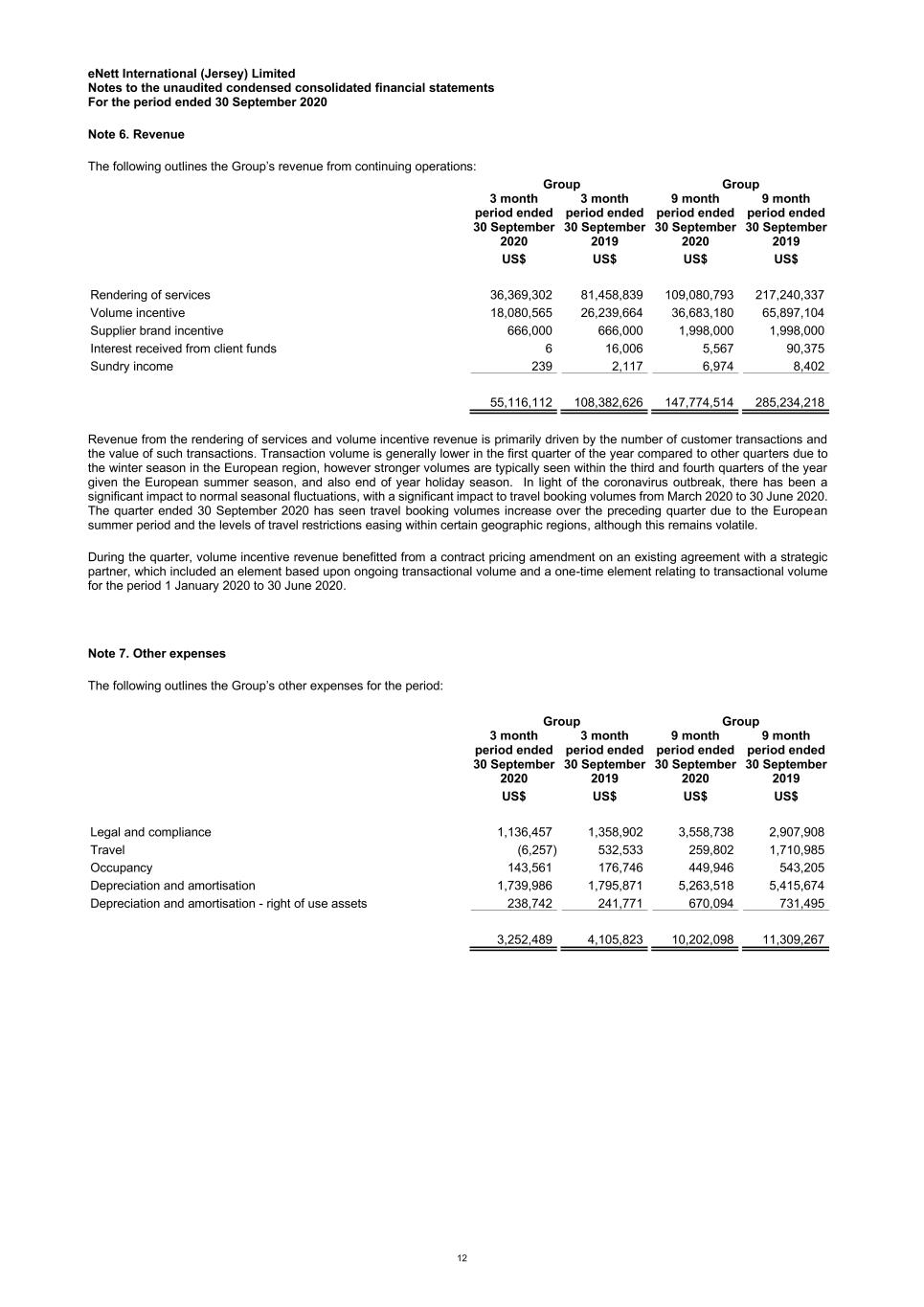

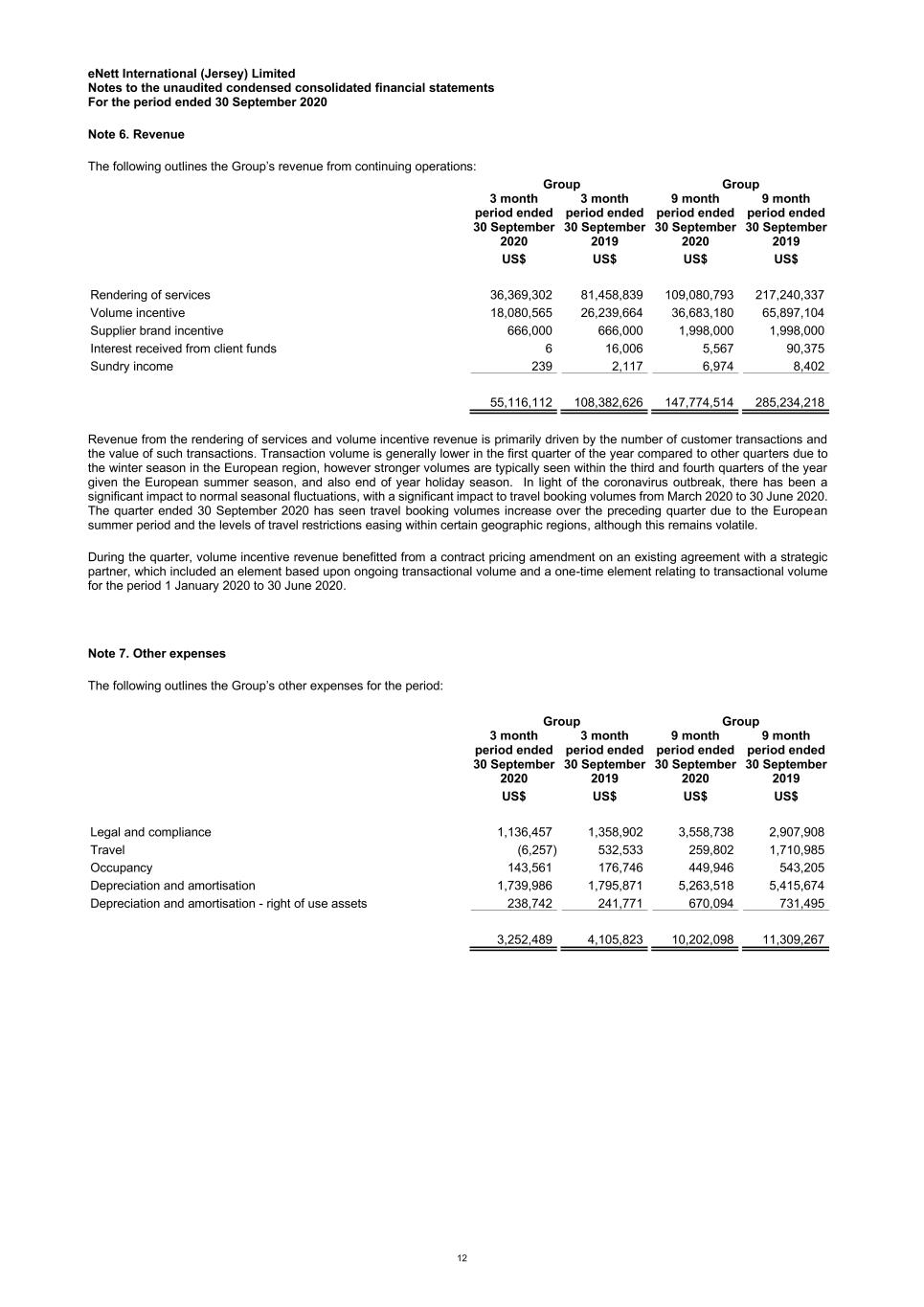

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 12 Note 6. Revenue The following outlines the Group’s revenue from continuing operations: Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Rendering of services 36,369,302 81,458,839 109,080,793 217,240,337 Volume incentive 18,080,565 26,239,664 36,683,180 65,897,104 Supplier brand incentive 666,000 666,000 1,998,000 1,998,000 Interest received from client funds 6 16,006 5,567 90,375 Sundry income 239 2,117 6,974 8,402 55,116,112 108,382,626 147,774,514 285,234,218 Revenue from the rendering of services and volume incentive revenue is primarily driven by the number of customer transactions and the value of such transactions. Transaction volume is generally lower in the first quarter of the year compared to other quarters due to the winter season in the European region, however stronger volumes are typically seen within the third and fourth quarters of the year given the European summer season, and also end of year holiday season. In light of the coronavirus outbreak, there has been a significant impact to normal seasonal fluctuations, with a significant impact to travel booking volumes from March 2020 to 30 June 2020. The quarter ended 30 September 2020 has seen travel booking volumes increase over the preceding quarter due to the European summer period and the levels of travel restrictions easing within certain geographic regions, although this remains volatile. During the quarter, volume incentive revenue benefitted from a contract pricing amendment on an existing agreement with a strategic partner, which included an element based upon ongoing transactional volume and a one-time element relating to transactional volume for the period 1 January 2020 to 30 June 2020. Note 7. Other expenses The following outlines the Group’s other expenses for the period: Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Legal and compliance 1,136,457 1,358,902 3,558,738 2,907,908 Travel (6,257) 532,533 259,802 1,710,985 Occupancy 143,561 176,746 449,946 543,205 Depreciation and amortisation 1,739,986 1,795,871 5,263,518 5,415,674 Depreciation and amortisation - right of use assets 238,742 241,771 670,094 731,495 3,252,489 4,105,823 10,202,098 11,309,267

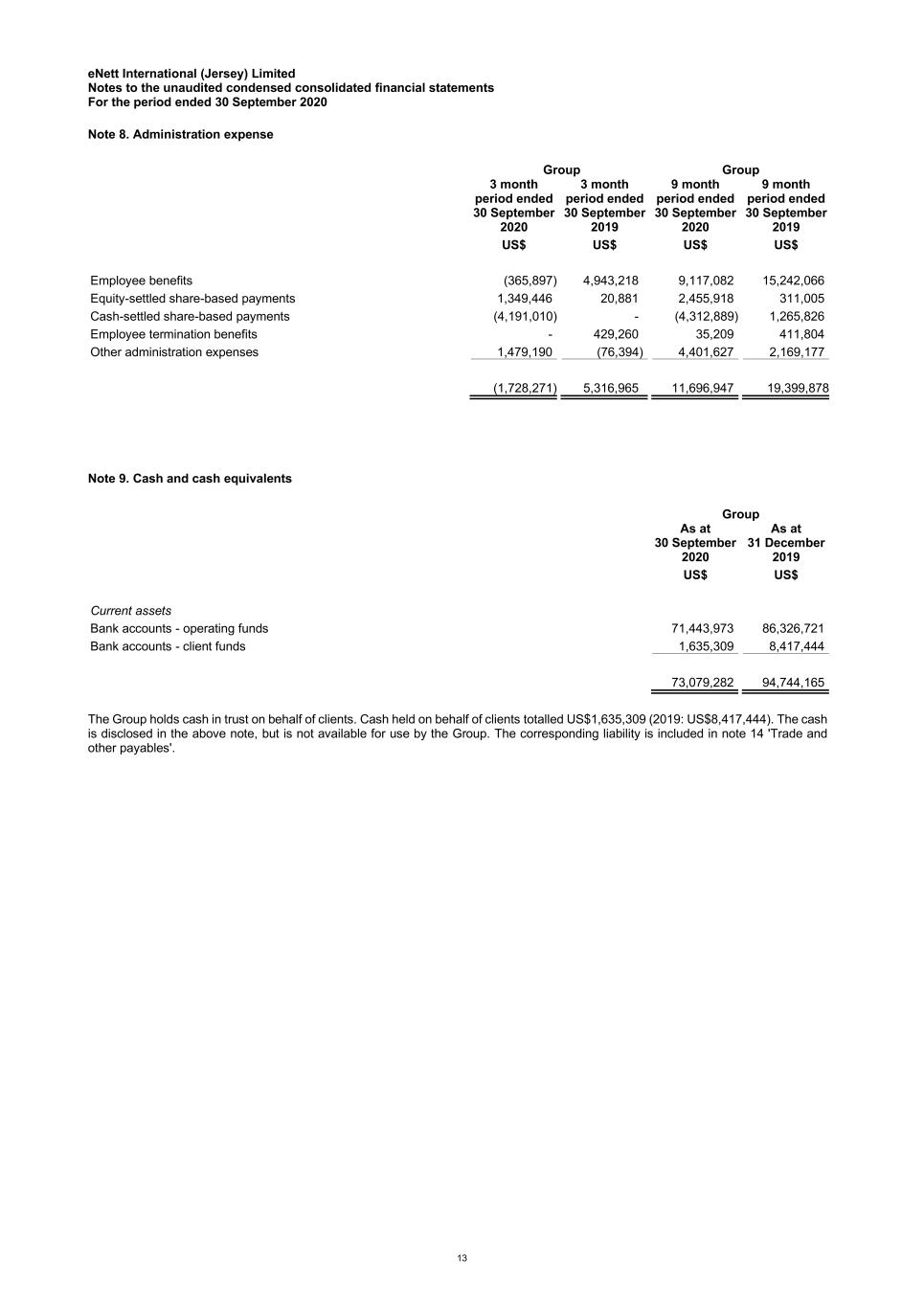

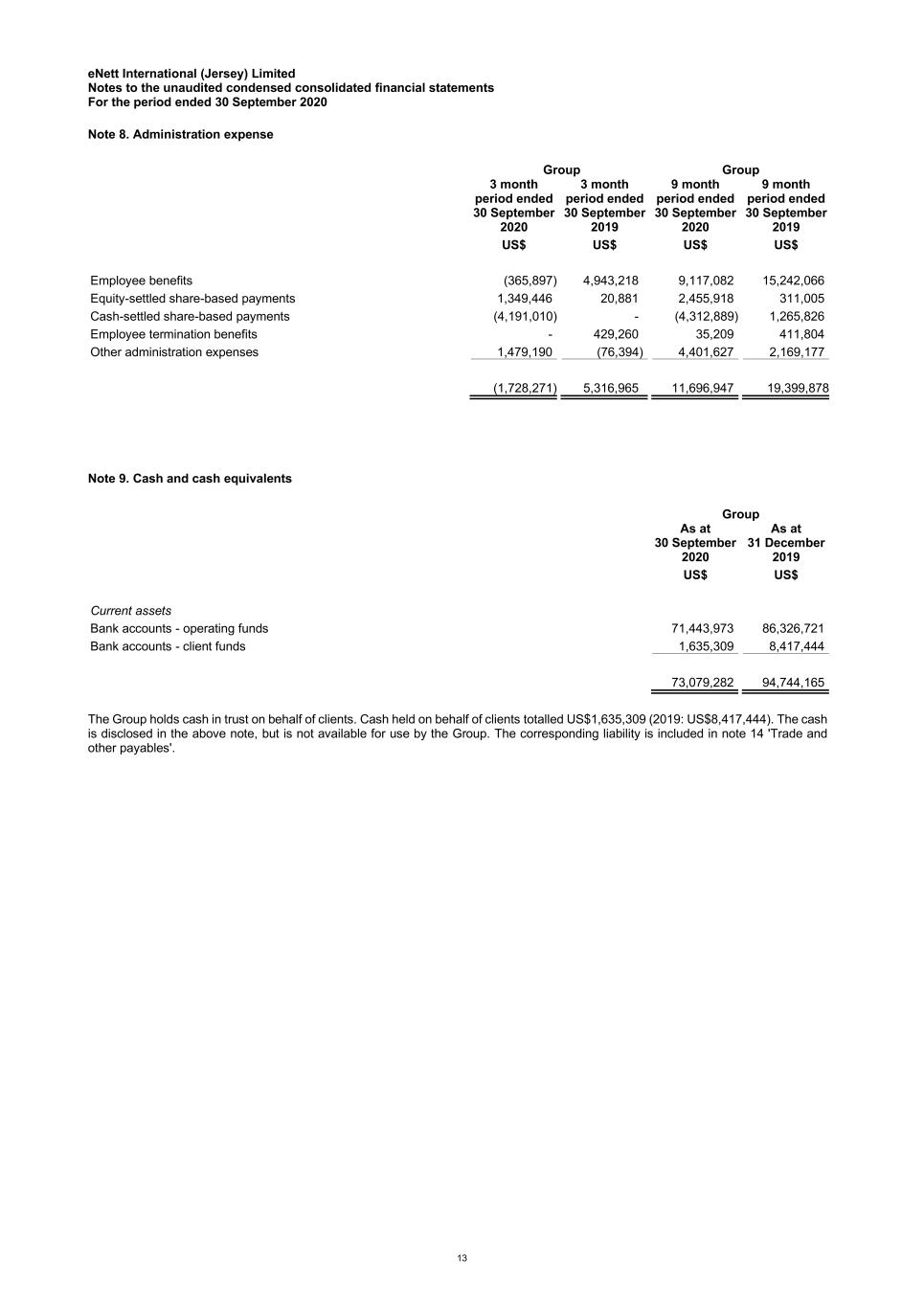

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 13 Note 8. Administration expense Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Employee benefits (365,897) 4,943,218 9,117,082 15,242,066 Equity-settled share-based payments 1,349,446 20,881 2,455,918 311,005 Cash-settled share-based payments (4,191,010) - (4,312,889) 1,265,826 Employee termination benefits - 429,260 35,209 411,804 Other administration expenses 1,479,190 (76,394) 4,401,627 2,169,177 (1,728,271) 5,316,965 11,696,947 19,399,878 Note 9. Cash and cash equivalents Group As at 30 September 2020 As at 31 December 2019 US$ US$ Current assets Bank accounts - operating funds 71,443,973 86,326,721 Bank accounts - client funds 1,635,309 8,417,444 73,079,282 94,744,165 The Group holds cash in trust on behalf of clients. Cash held on behalf of clients totalled US$1,635,309 (2019: US$8,417,444). The cash is disclosed in the above note, but is not available for use by the Group. The corresponding liability is included in note 14 'Trade and other payables'.

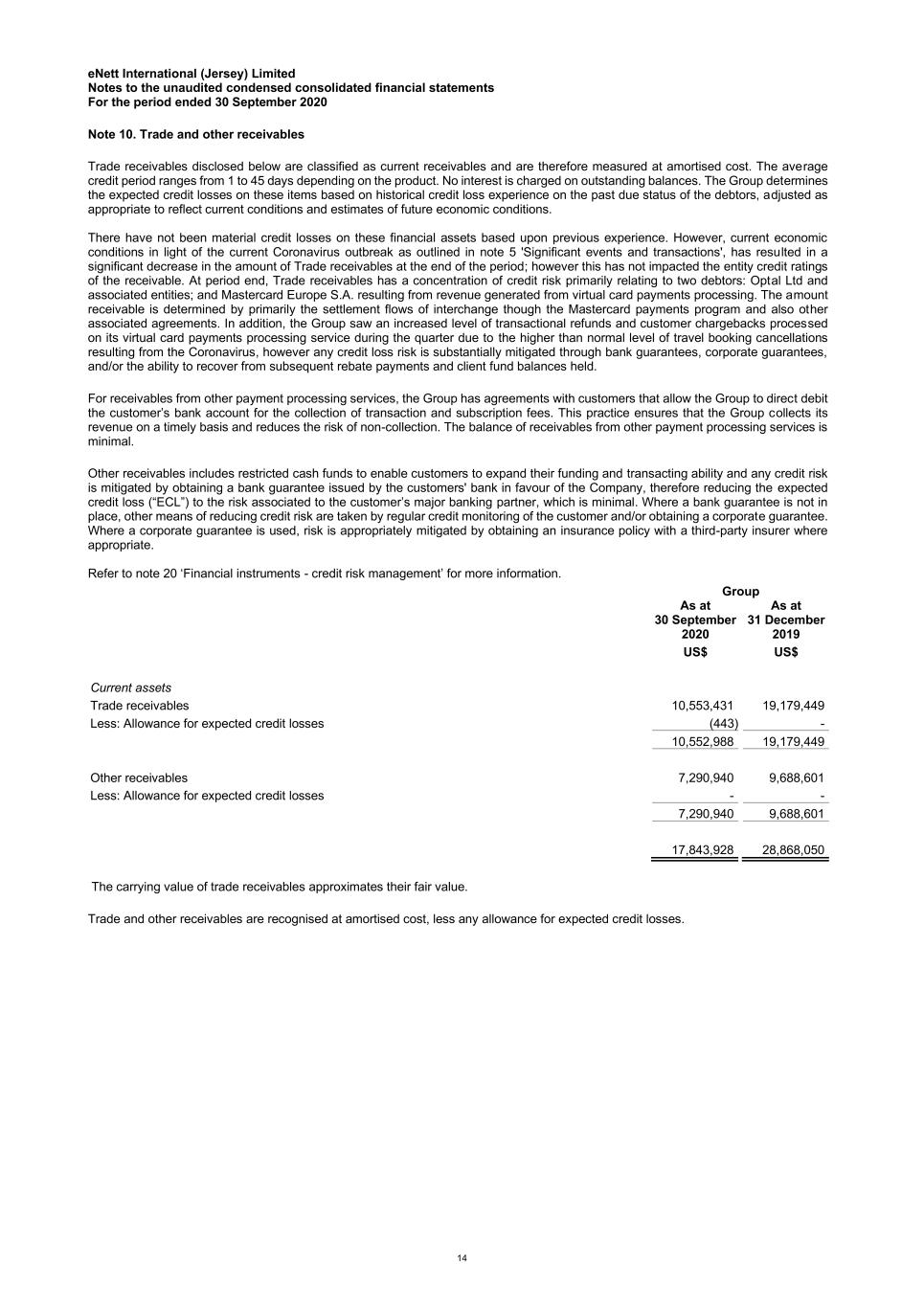

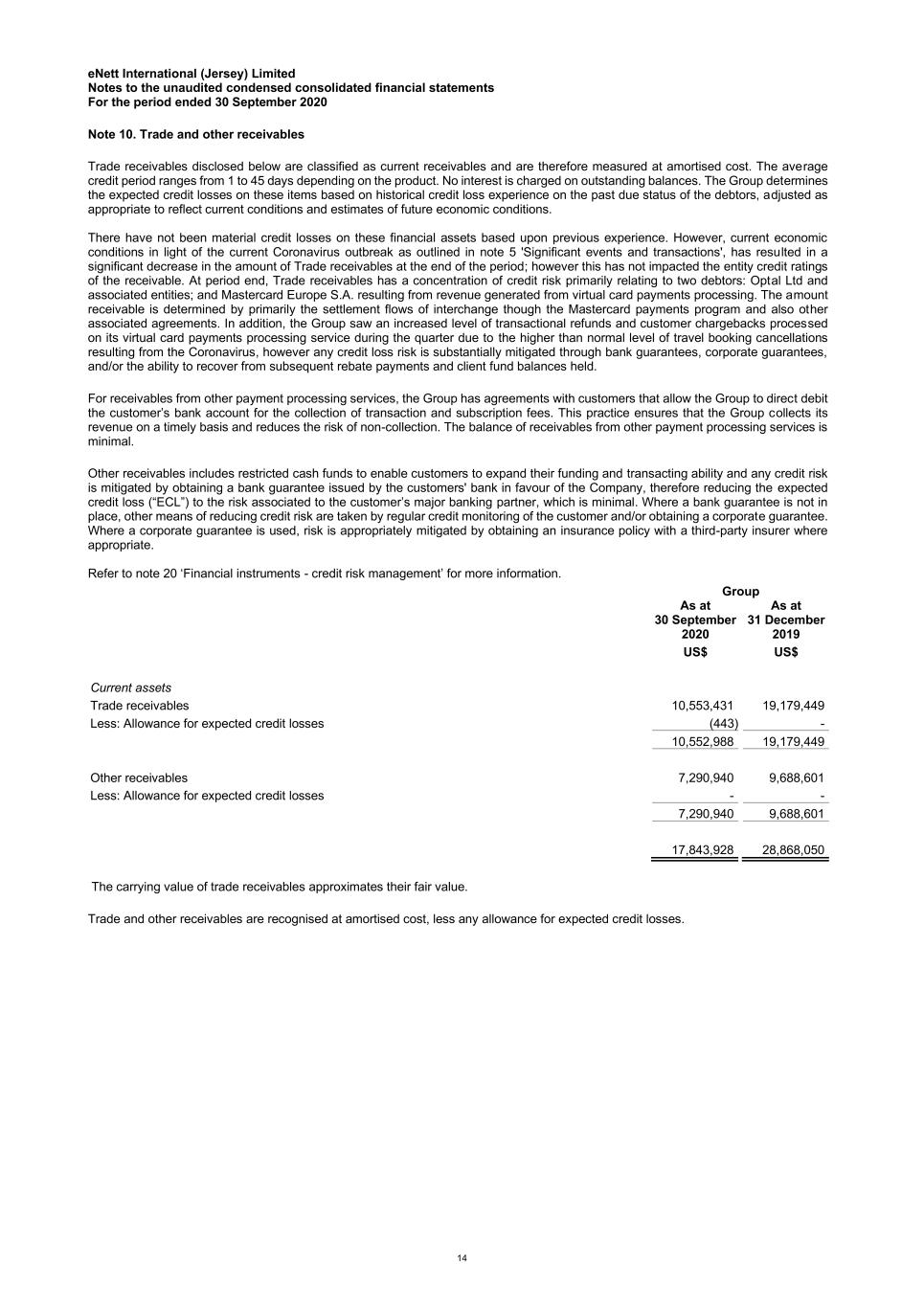

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 14 Note 10. Trade and other receivables Trade receivables disclosed below are classified as current receivables and are therefore measured at amortised cost. The average credit period ranges from 1 to 45 days depending on the product. No interest is charged on outstanding balances. The Group determines the expected credit losses on these items based on historical credit loss experience on the past due status of the debtors, adjusted as appropriate to reflect current conditions and estimates of future economic conditions. There have not been material credit losses on these financial assets based upon previous experience. However, current economic conditions in light of the current Coronavirus outbreak as outlined in note 5 'Significant events and transactions', has resulted in a significant decrease in the amount of Trade receivables at the end of the period; however this has not impacted the entity credit ratings of the receivable. At period end, Trade receivables has a concentration of credit risk primarily relating to two debtors: Optal Ltd and associated entities; and Mastercard Europe S.A. resulting from revenue generated from virtual card payments processing. The amount receivable is determined by primarily the settlement flows of interchange though the Mastercard payments program and also other associated agreements. In addition, the Group saw an increased level of transactional refunds and customer chargebacks processed on its virtual card payments processing service during the quarter due to the higher than normal level of travel booking cancellations resulting from the Coronavirus, however any credit loss risk is substantially mitigated through bank guarantees, corporate guarantees, and/or the ability to recover from subsequent rebate payments and client fund balances held. For receivables from other payment processing services, the Group has agreements with customers that allow the Group to direct debit the customer’s bank account for the collection of transaction and subscription fees. This practice ensures that the Group collects its revenue on a timely basis and reduces the risk of non-collection. The balance of receivables from other payment processing services is minimal. Other receivables includes restricted cash funds to enable customers to expand their funding and transacting ability and any credit risk is mitigated by obtaining a bank guarantee issued by the customers' bank in favour of the Company, therefore reducing the expected credit loss (“ECL”) to the risk associated to the customer’s major banking partner, which is minimal. Where a bank guarantee is not in place, other means of reducing credit risk are taken by regular credit monitoring of the customer and/or obtaining a corporate guarantee. Where a corporate guarantee is used, risk is appropriately mitigated by obtaining an insurance policy with a third-party insurer where appropriate. Refer to note 20 ‘Financial instruments - credit risk management’ for more information. Group As at 30 September 2020 As at 31 December 2019 US$ US$ Current assets Trade receivables 10,553,431 19,179,449 Less: Allowance for expected credit losses (443) - 10,552,988 19,179,449 Other receivables 7,290,940 9,688,601 Less: Allowance for expected credit losses - - 7,290,940 9,688,601 17,843,928 28,868,050 The carrying value of trade receivables approximates their fair value. Trade and other receivables are recognised at amortised cost, less any allowance for expected credit losses.

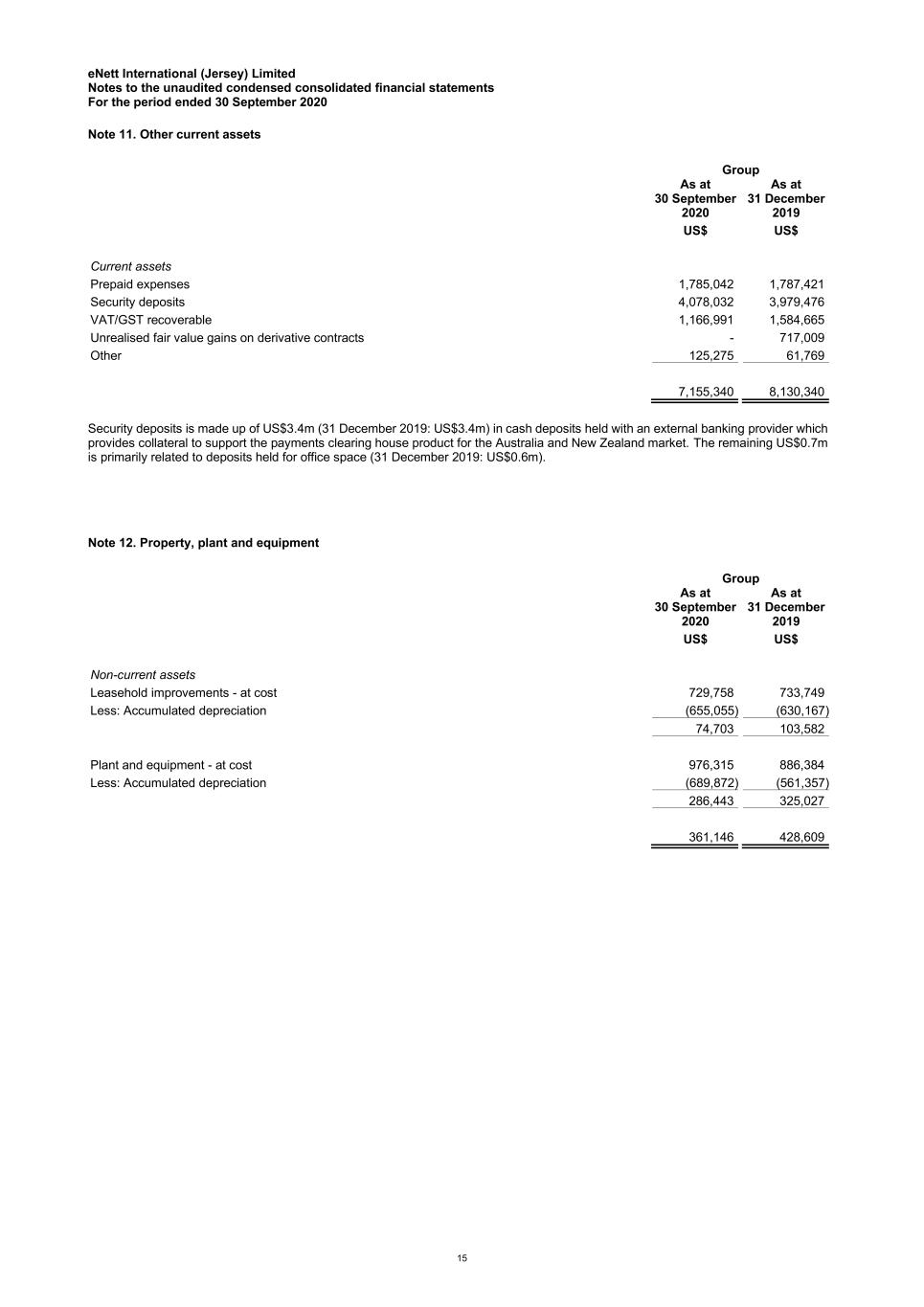

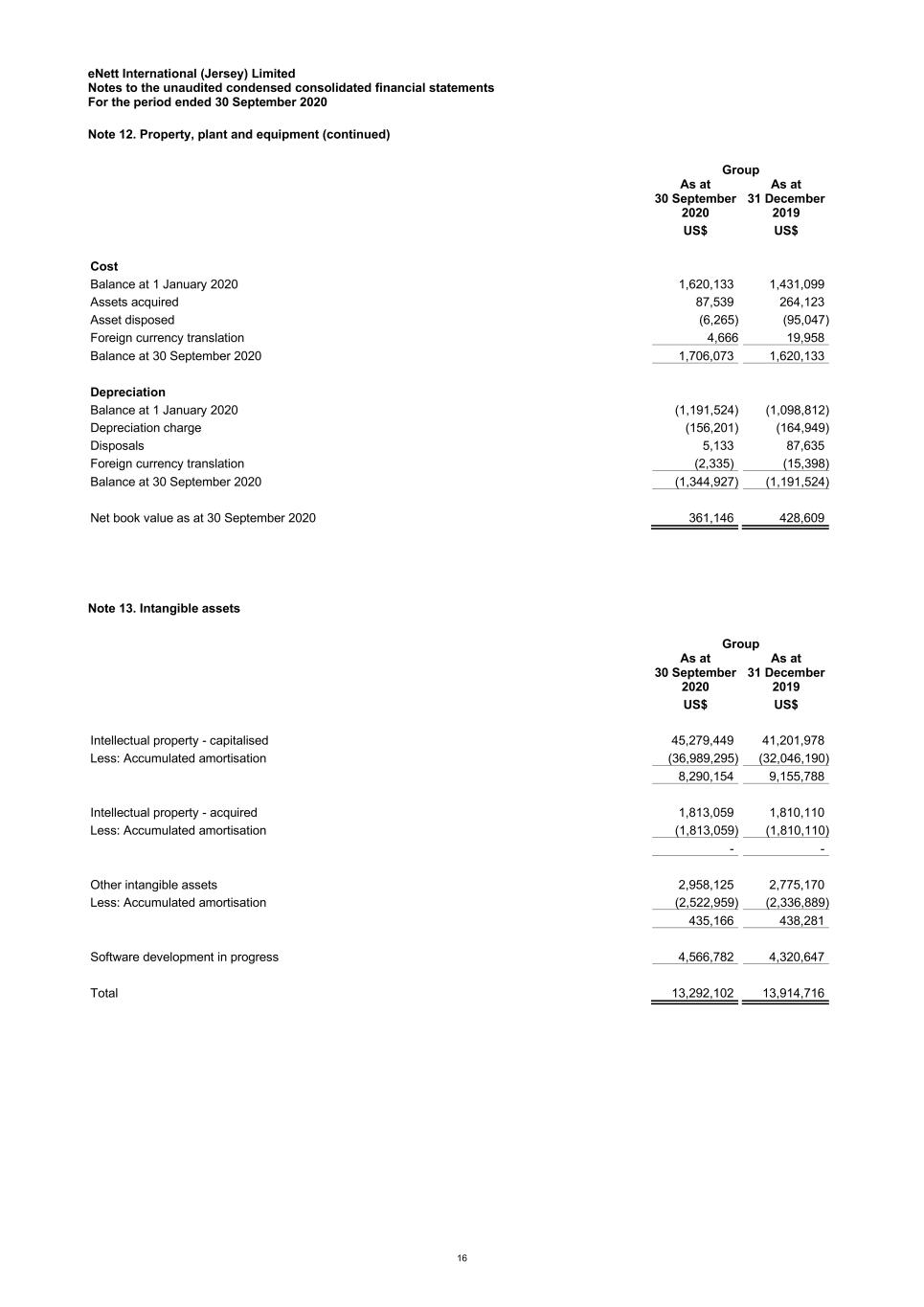

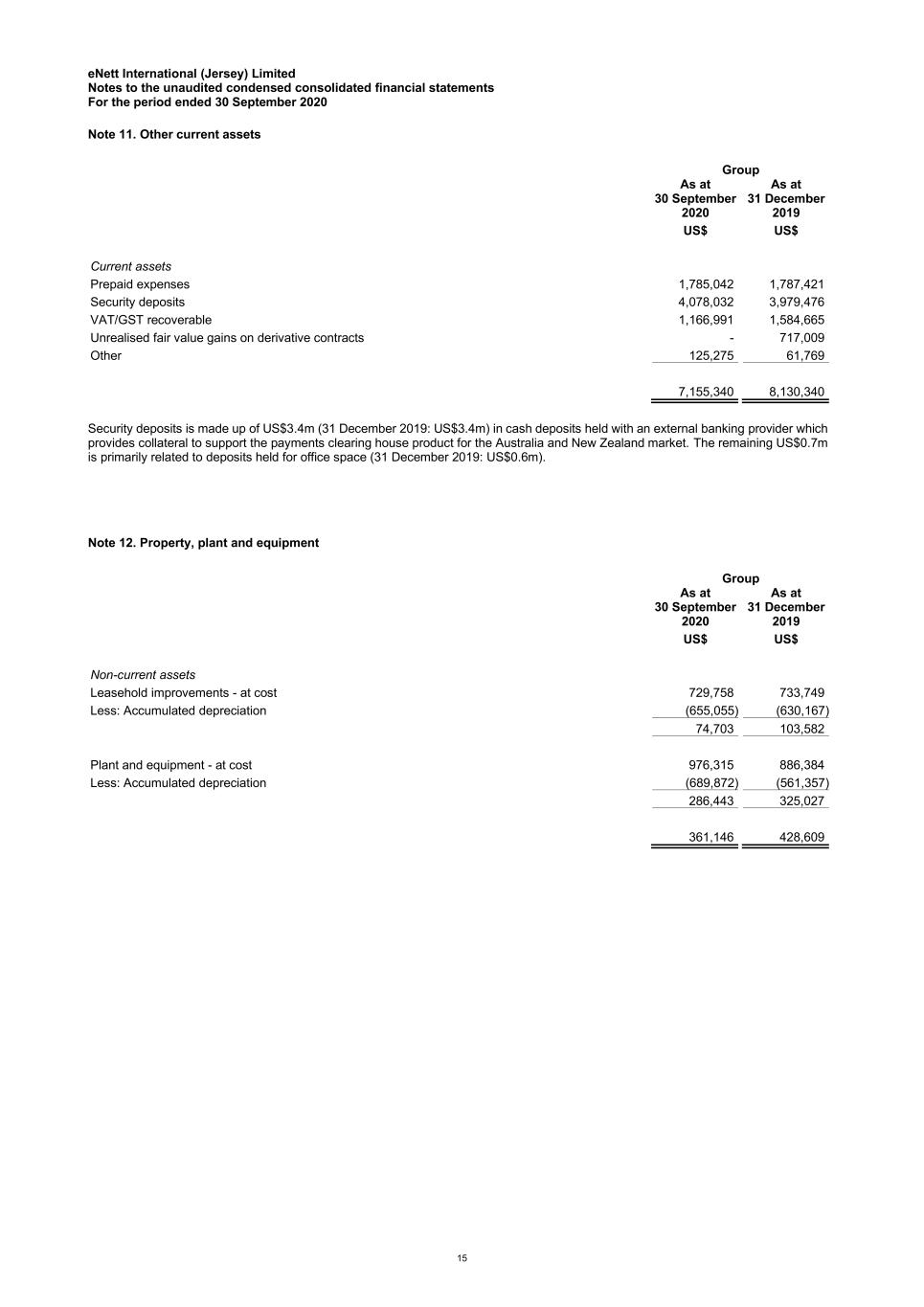

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 15 Note 11. Other current assets Group As at 30 September 2020 As at 31 December 2019 US$ US$ Current assets Prepaid expenses 1,785,042 1,787,421 Security deposits 4,078,032 3,979,476 VAT/GST recoverable 1,166,991 1,584,665 Unrealised fair value gains on derivative contracts - 717,009 Other 125,275 61,769 7,155,340 8,130,340 Security deposits is made up of US$3.4m (31 December 2019: US$3.4m) in cash deposits held with an external banking provider which provides collateral to support the payments clearing house product for the Australia and New Zealand market. The remaining US$0.7m is primarily related to deposits held for office space (31 December 2019: US$0.6m). Note 12. Property, plant and equipment Group As at 30 September 2020 As at 31 December 2019 US$ US$ Non-current assets Leasehold improvements - at cost 729,758 733,749 Less: Accumulated depreciation (655,055) (630,167) 74,703 103,582 Plant and equipment - at cost 976,315 886,384 Less: Accumulated depreciation (689,872) (561,357) 286,443 325,027 361,146 428,609

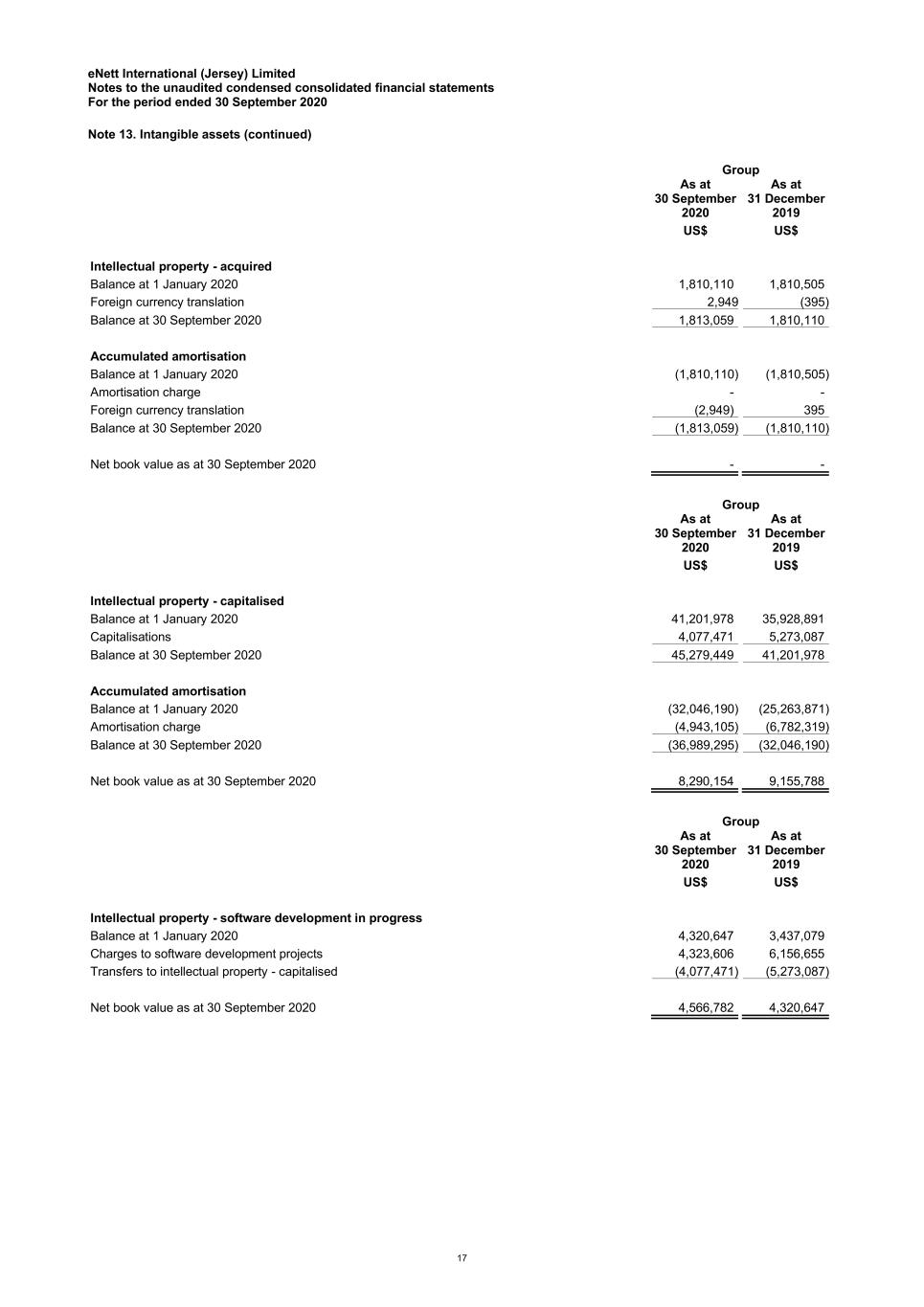

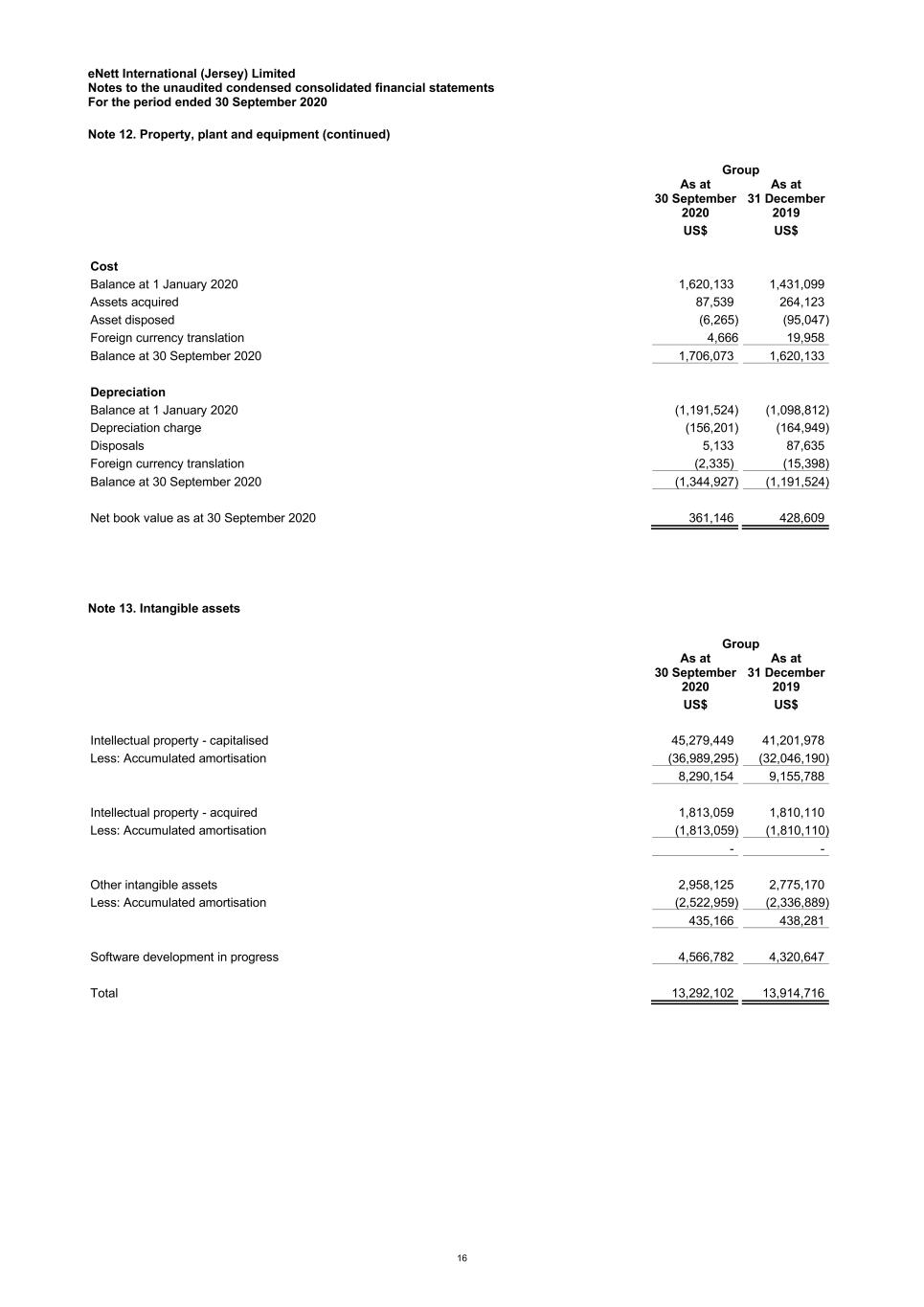

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 12. Property, plant and equipment (continued) 16 Group As at 30 September 2020 As at 31 December 2019 US$ US$ Cost Balance at 1 January 2020 1,620,133 1,431,099 Assets acquired 87,539 264,123 Asset disposed (6,265) (95,047) Foreign currency translation 4,666 19,958 Balance at 30 September 2020 1,706,073 1,620,133 Depreciation Balance at 1 January 2020 (1,191,524) (1,098,812) Depreciation charge (156,201) (164,949) Disposals 5,133 87,635 Foreign currency translation (2,335) (15,398) Balance at 30 September 2020 (1,344,927) (1,191,524) Net book value as at 30 September 2020 361,146 428,609 Note 13. Intangible assets Group As at 30 September 2020 As at 31 December 2019 US$ US$ Intellectual property - capitalised 45,279,449 41,201,978 Less: Accumulated amortisation (36,989,295) (32,046,190) 8,290,154 9,155,788 Intellectual property - acquired 1,813,059 1,810,110 Less: Accumulated amortisation (1,813,059) (1,810,110) - - Other intangible assets 2,958,125 2,775,170 Less: Accumulated amortisation (2,522,959) (2,336,889) 435,166 438,281 Software development in progress 4,566,782 4,320,647 Total 13,292,102 13,914,716

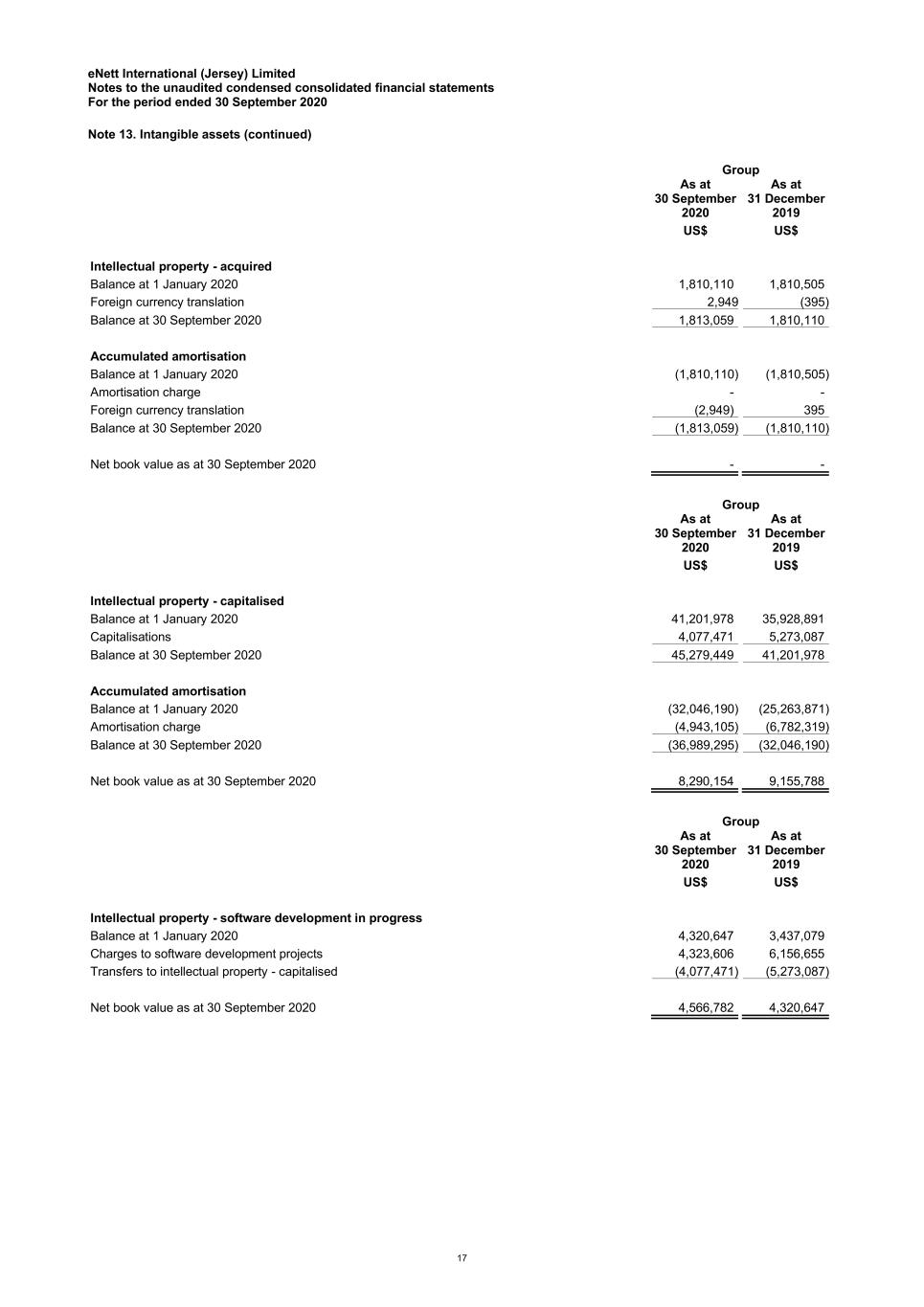

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 13. Intangible assets (continued) 17 Group As at 30 September 2020 As at 31 December 2019 US$ US$ Intellectual property - acquired Balance at 1 January 2020 1,810,110 1,810,505 Foreign currency translation 2,949 (395) Balance at 30 September 2020 1,813,059 1,810,110 Accumulated amortisation Balance at 1 January 2020 (1,810,110) (1,810,505) Amortisation charge - - Foreign currency translation (2,949) 395 Balance at 30 September 2020 (1,813,059) (1,810,110) Net book value as at 30 September 2020 - - Group As at 30 September 2020 As at 31 December 2019 US$ US$ Intellectual property - capitalised Balance at 1 January 2020 41,201,978 35,928,891 Capitalisations 4,077,471 5,273,087 Balance at 30 September 2020 45,279,449 41,201,978 Accumulated amortisation Balance at 1 January 2020 (32,046,190) (25,263,871) Amortisation charge (4,943,105) (6,782,319) Balance at 30 September 2020 (36,989,295) (32,046,190) Net book value as at 30 September 2020 8,290,154 9,155,788 Group As at 30 September 2020 As at 31 December 2019 US$ US$ Intellectual property - software development in progress Balance at 1 January 2020 4,320,647 3,437,079 Charges to software development projects 4,323,606 6,156,655 Transfers to intellectual property - capitalised (4,077,471) (5,273,087) Net book value as at 30 September 2020 4,566,782 4,320,647

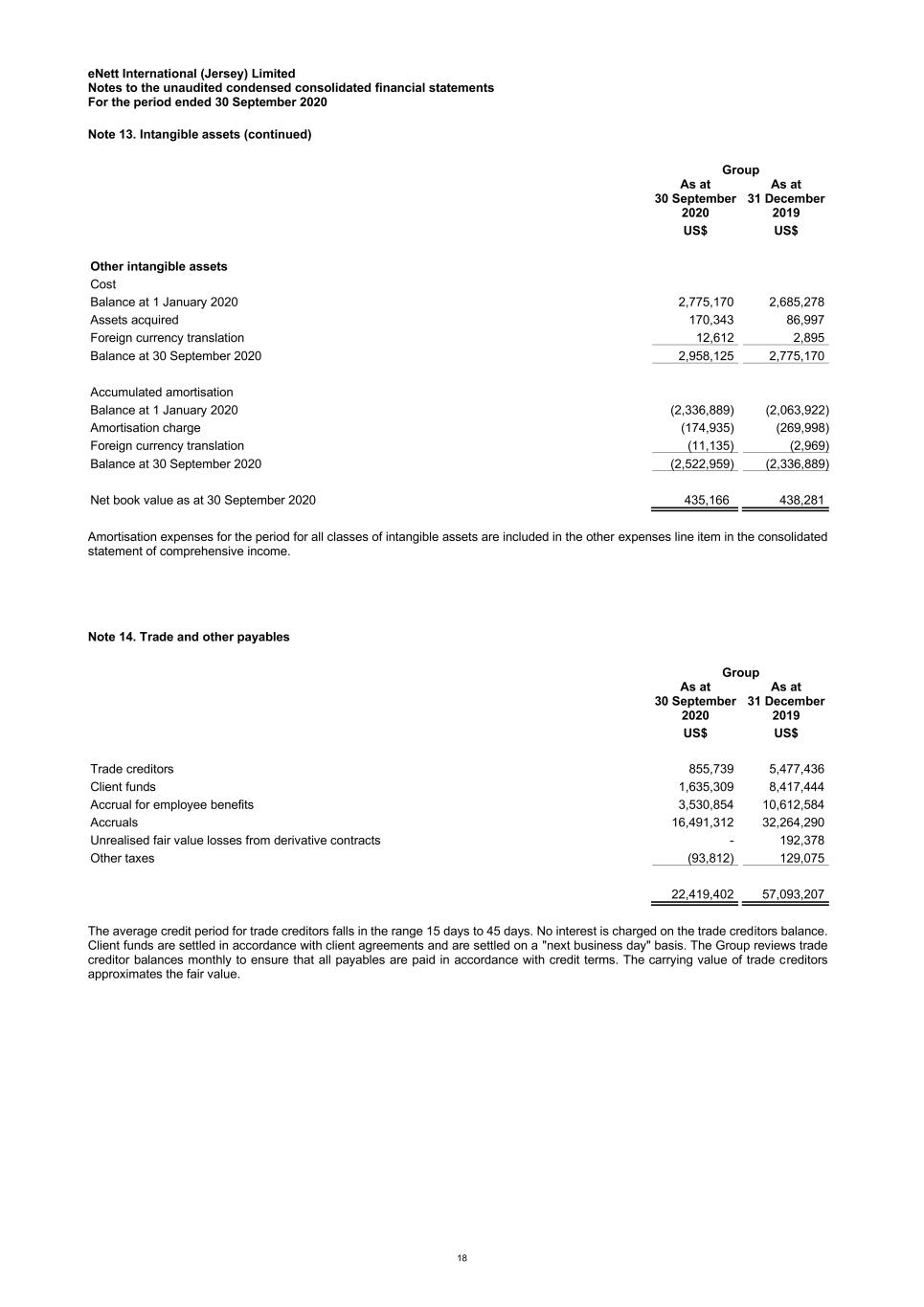

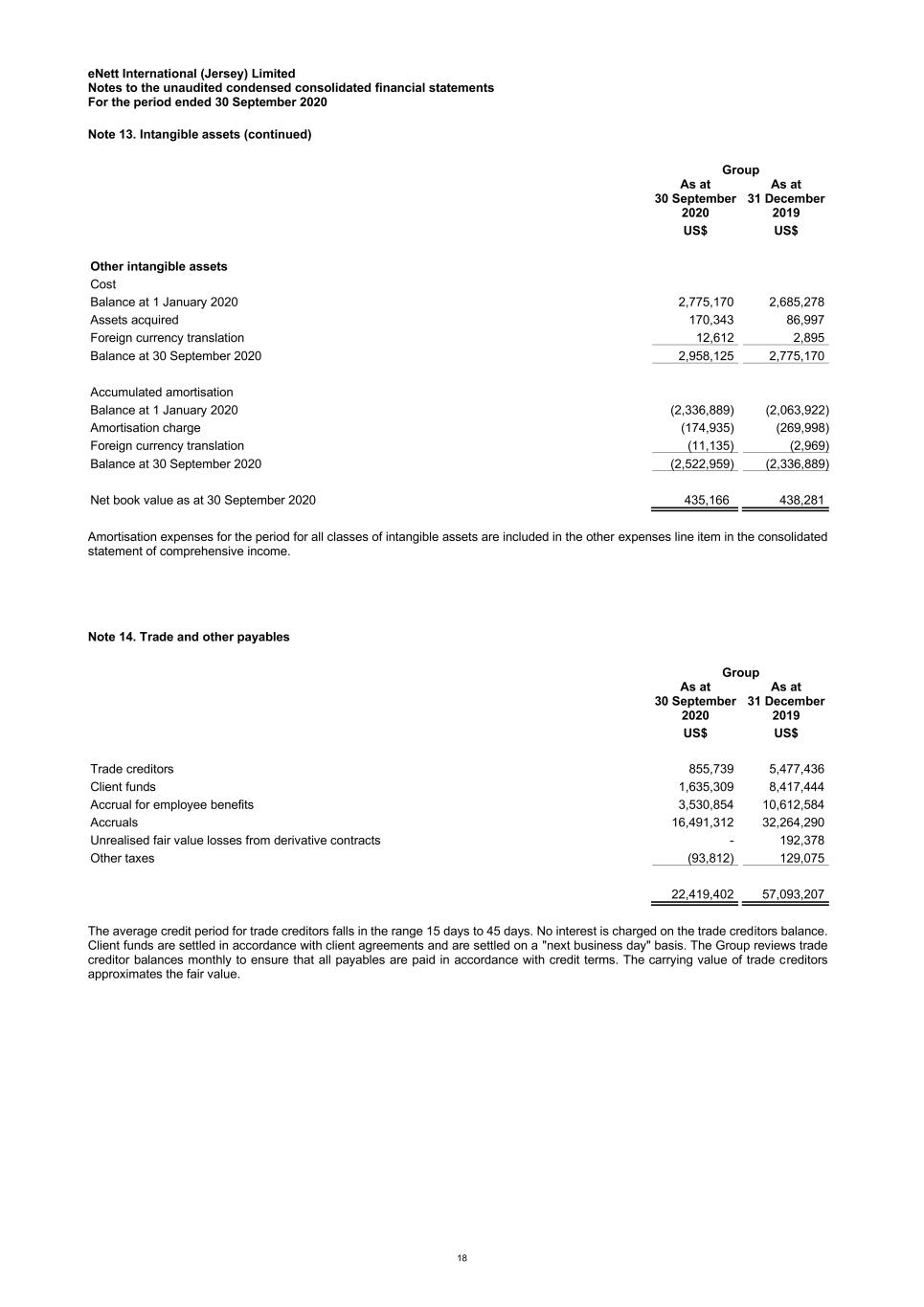

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 13. Intangible assets (continued) 18 Group As at 30 September 2020 As at 31 December 2019 US$ US$ Other intangible assets Cost Balance at 1 January 2020 2,775,170 2,685,278 Assets acquired 170,343 86,997 Foreign currency translation 12,612 2,895 Balance at 30 September 2020 2,958,125 2,775,170 Accumulated amortisation Balance at 1 January 2020 (2,336,889) (2,063,922) Amortisation charge (174,935) (269,998) Foreign currency translation (11,135) (2,969) Balance at 30 September 2020 (2,522,959) (2,336,889) Net book value as at 30 September 2020 435,166 438,281 Amortisation expenses for the period for all classes of intangible assets are included in the other expenses line item in the consolidated statement of comprehensive income. Note 14. Trade and other payables Group As at 30 September 2020 As at 31 December 2019 US$ US$ Trade creditors 855,739 5,477,436 Client funds 1,635,309 8,417,444 Accrual for employee benefits 3,530,854 10,612,584 Accruals 16,491,312 32,264,290 Unrealised fair value losses from derivative contracts - 192,378 Other taxes (93,812) 129,075 22,419,402 57,093,207 The average credit period for trade creditors falls in the range 15 days to 45 days. No interest is charged on the trade creditors balance. Client funds are settled in accordance with client agreements and are settled on a "next business day" basis. The Group reviews trade creditor balances monthly to ensure that all payables are paid in accordance with credit terms. The carrying value of trade creditors approximates the fair value.

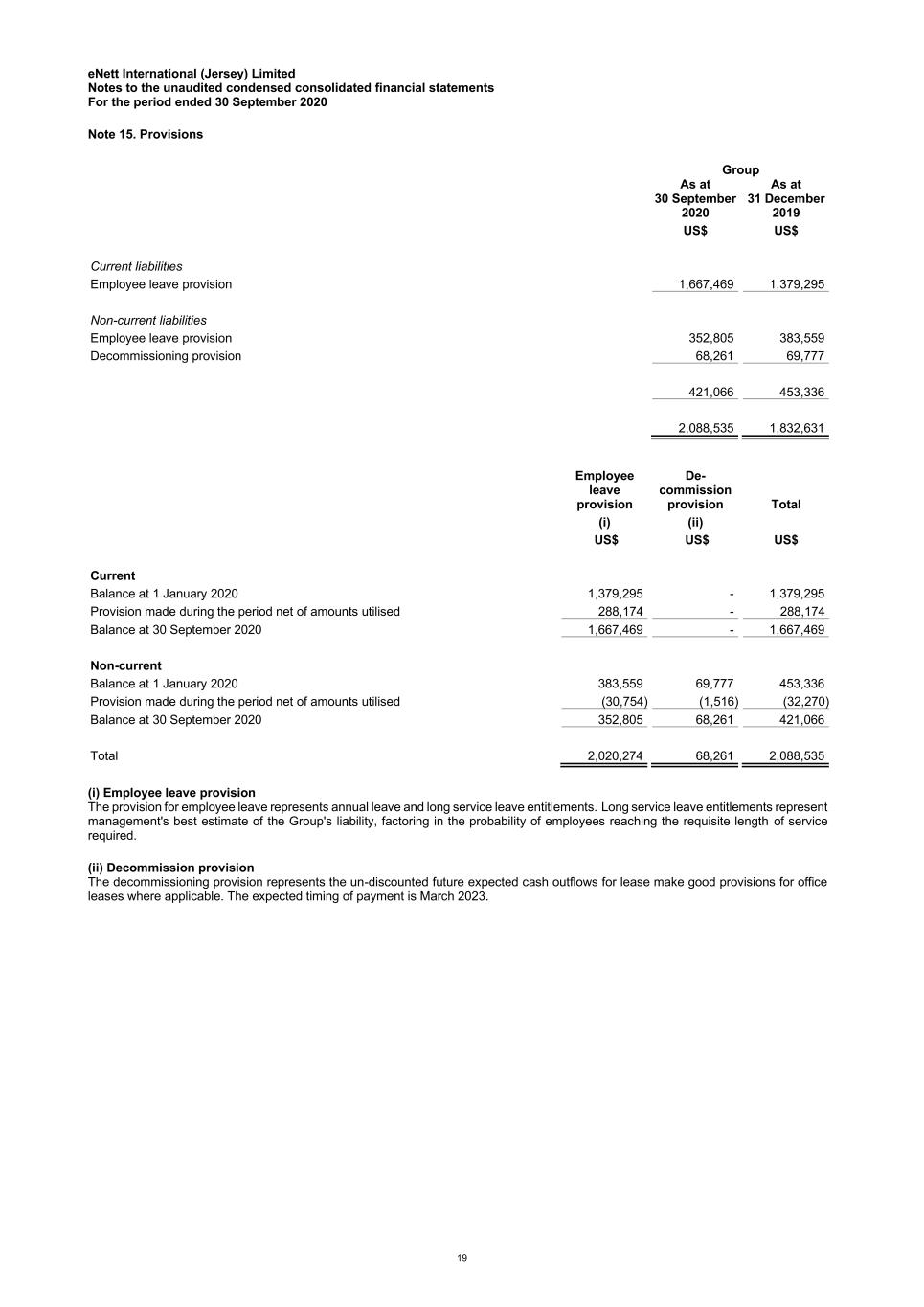

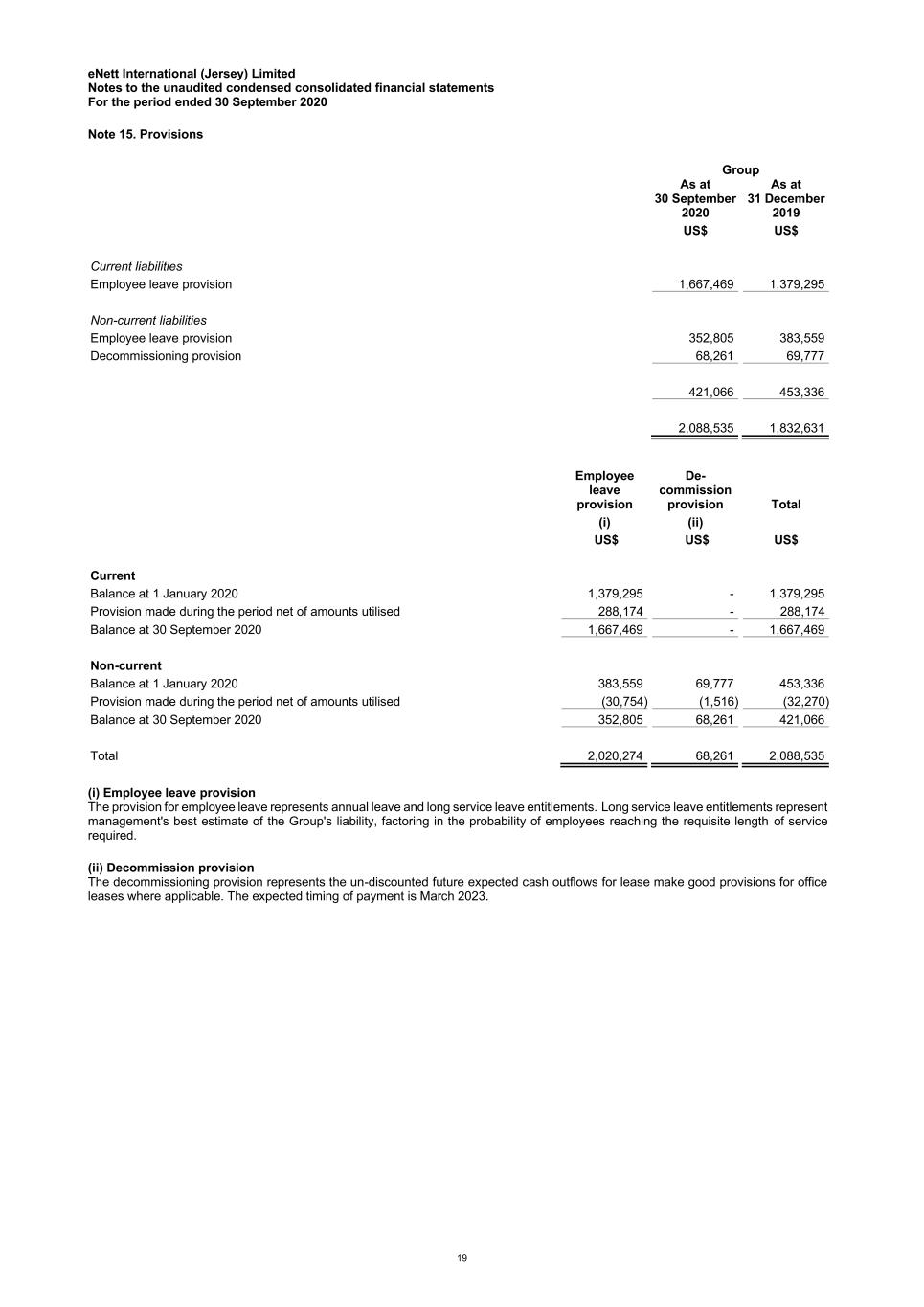

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 19 Note 15. Provisions Group As at 30 September 2020 As at 31 December 2019 US$ US$ Current liabilities Employee leave provision 1,667,469 1,379,295 Non-current liabilities Employee leave provision 352,805 383,559 Decommissioning provision 68,261 69,777 421,066 453,336 2,088,535 1,832,631 Employee leave provision De- commission provision Total (i) (ii) US$ US$ US$ Current Balance at 1 January 2020 1,379,295 - 1,379,295 Provision made during the period net of amounts utilised 288,174 - 288,174- Balance at 30 September 2020 1,667,469 - 1,667,469 Non-current Balance at 1 January 2020 383,559 69,777 453,336 Provision made during the period net of amounts utilised (30,754) (1,516) (32,270) Balance at 30 September 2020 352,805 68,261 421,066 Total 2,020,274 68,261 2,088,535 (i) Employee leave provision The provision for employee leave represents annual leave and long service leave entitlements. Long service leave entitlements represent management's best estimate of the Group's liability, factoring in the probability of employees reaching the requisite length of service required. (ii) Decommission provision The decommissioning provision represents the un-discounted future expected cash outflows for lease make good provisions for office leases where applicable. The expected timing of payment is March 2023.

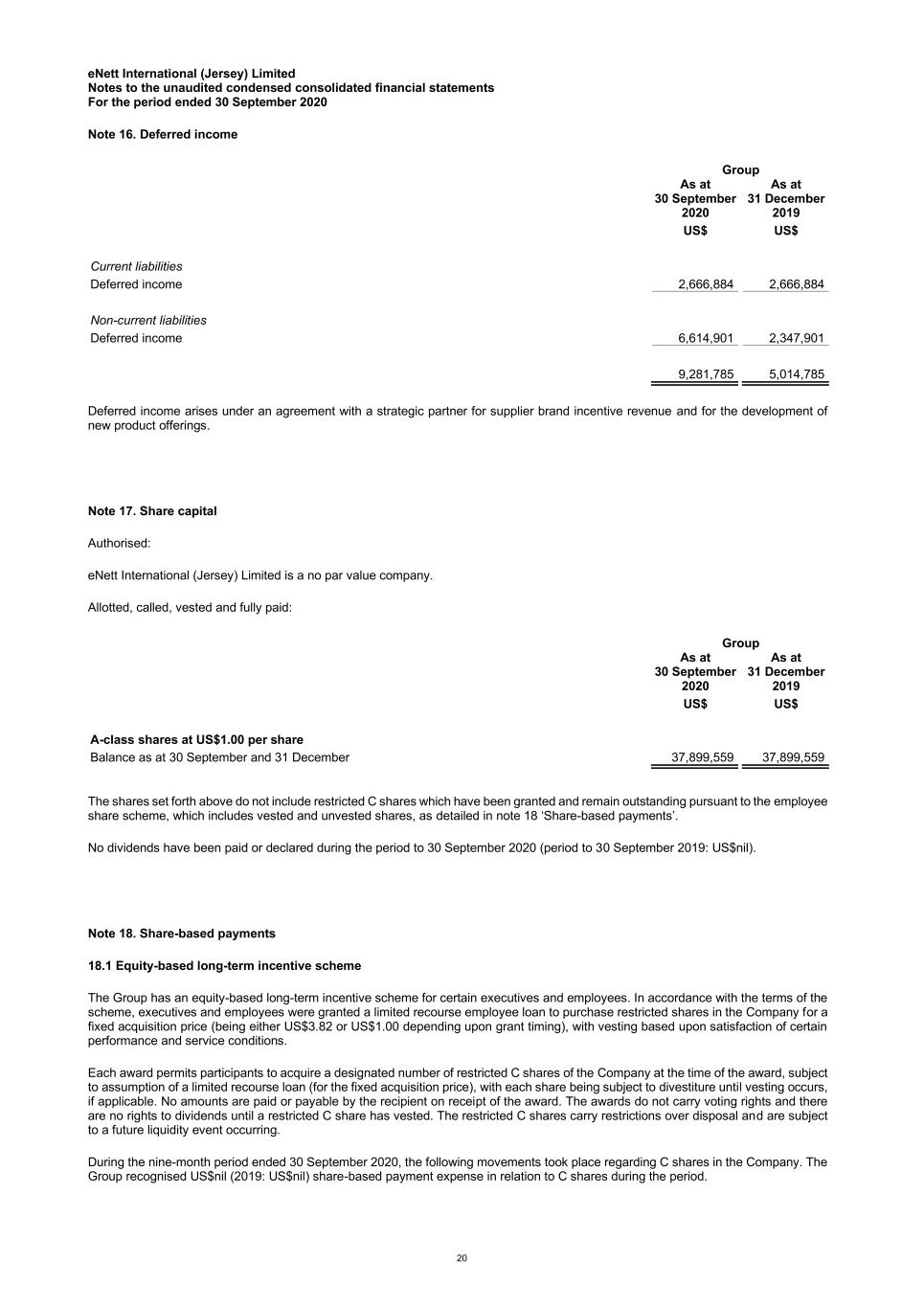

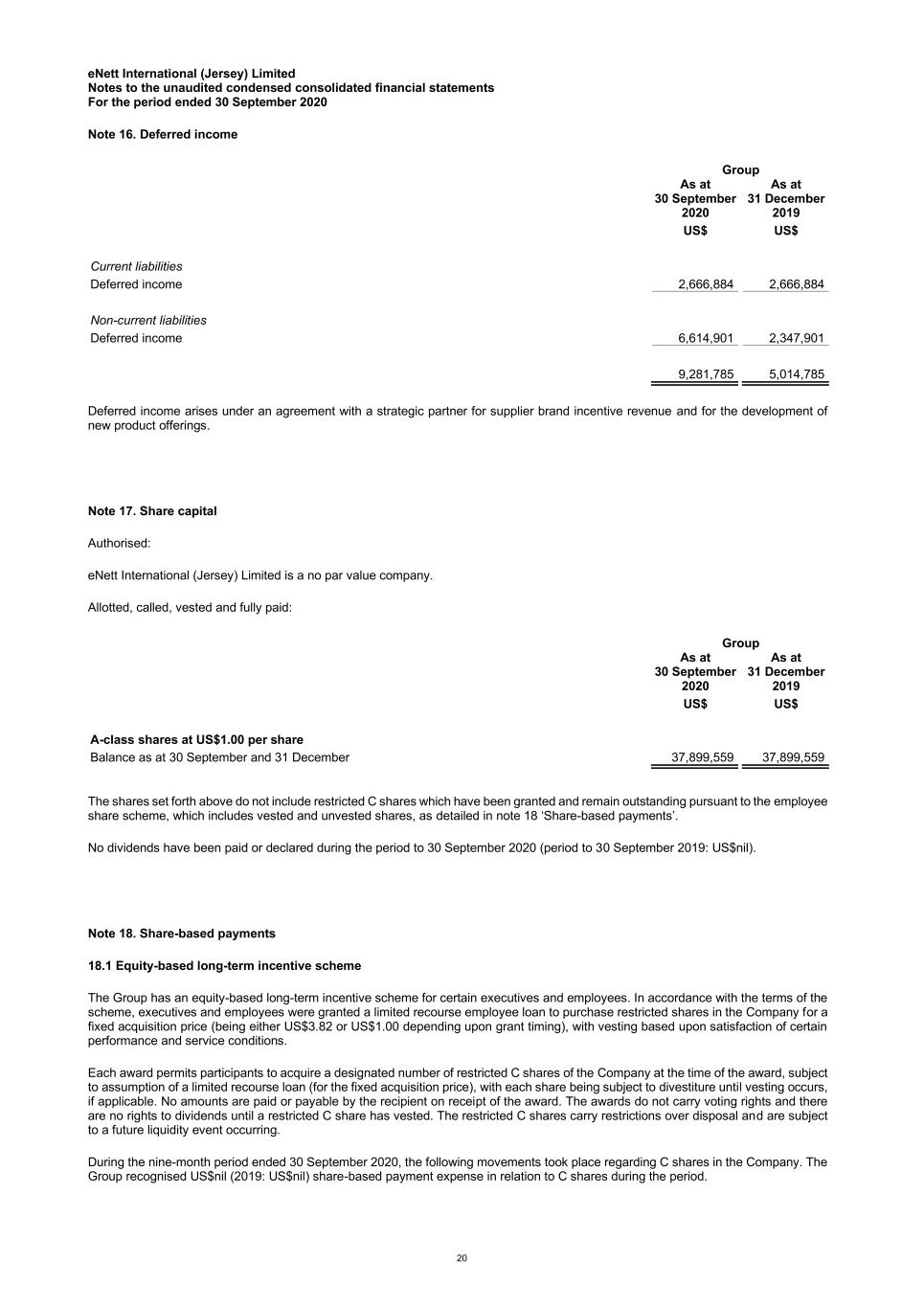

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 20 Note 16. Deferred income Group As at 30 September 2020 As at 31 December 2019 US$ US$ Current liabilities Deferred income 2,666,884 2,666,884 Non-current liabilities Deferred income 6,614,901 2,347,901 9,281,785 5,014,785 Deferred income arises under an agreement with a strategic partner for supplier brand incentive revenue and for the development of new product offerings. Note 17. Share capital Authorised: eNett International (Jersey) Limited is a no par value company. Allotted, called, vested and fully paid: Group As at 30 September 2020 As at 31 December 2019 US$ US$ A-class shares at US$1.00 per share Balance as at 30 September and 31 December 37,899,559 37,899,559 The shares set forth above do not include restricted C shares which have been granted and remain outstanding pursuant to the employee share scheme, which includes vested and unvested shares, as detailed in note 18 ‘Share-based payments’. No dividends have been paid or declared during the period to 30 September 2020 (period to 30 September 2019: US$nil). Note 18. Share-based payments 18.1 Equity-based long-term incentive scheme The Group has an equity-based long-term incentive scheme for certain executives and employees. In accordance with the terms of the scheme, executives and employees were granted a limited recourse employee loan to purchase restricted shares in the Company for a fixed acquisition price (being either US$3.82 or US$1.00 depending upon grant timing), with vesting based upon satisfaction of certain performance and service conditions. Each award permits participants to acquire a designated number of restricted C shares of the Company at the time of the award, subject to assumption of a limited recourse loan (for the fixed acquisition price), with each share being subject to divestiture until vesting occurs, if applicable. No amounts are paid or payable by the recipient on receipt of the award. The awards do not carry voting rights and there are no rights to dividends until a restricted C share has vested. The restricted C shares carry restrictions over disposal and are subject to a future liquidity event occurring. During the nine-month period ended 30 September 2020, the following movements took place regarding C shares in the Company. The Group recognised US$nil (2019: US$nil) share-based payment expense in relation to C shares during the period.

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 18. Share-based payments (continued) 21 Equity-settled awards Number of awards granted but unvested Number of awards vested Total of awards Weighted average exercise price Balance at 1 January 2020 - 3,955,330 3,955,330 US$1.25 Granted during the period - - - US$0.00 Forfeited during the period - - - US$0.00 Vested during the period - - - US$1.00 Exercised during the period - - - US$0.00 Expired during the period - - - US$0.00 Balance at 30 September 2020 - 3,955,330 3,955,330 US$1.25 Balance at 30 September 2020 which are disposable and unrestricted - - - US$1.25 As of 30 September 2020, 3,955,330 million restricted C shares have been granted and are fully vested. Additionally, the Board of Directors of the Company has approved for grant approximately 0.3 million of further restricted C shares which are available for grants in future years, which may also be utilised for options in restricted D shares or other cash or equity based share appreciation rights plans. 18.2 Cash-settled share appreciation rights plan The Group has a share appreciation rights plan for employees. Rights are redeemable into cash at a price equal to the estimated fair value of the Company's shares on the date of grant. The number of awards granted is calculated in accordance with the performance- based formula approved by the shareholders of the Company. For Series 1, the vesting period was 19 months and subject to a value target in the Company’s valuation. For Series 2, the vesting period was up to 32.5 months and subject to annual vesting of 25% on each of 31 March 2015 and 31 March 2016 and 50% on 31 March 2017, based upon the performance of the Group's results for the preceding financial year, being 2014, 2015 and 2016, respectively. Rights are forfeited if the employee leaves the Group before the rights vest. Exercise of the relevant award is conditional upon a qualifying liquidity event. Note the number of units granted is adjusted based upon the probability of achievement of non-market conditions at each grant date. The following cash-settled share-based payment arrangements were in existence during the current reporting period: Series Grant date Vesting date Number granted Fair value of liability as at 30 September 2020 Series 1 31/05/2013 31/12/2014 228,963 1,704,790 Series 2 10/07/2014 01/04/2017 104,586 513,277 333,549 2,218,667 The cost of cash-settled transactions is initially, and at each reporting date until settled, determined by applying the Black-Scholes option pricing model, taking into consideration the terms and conditions on which the award was granted. The cumulative charge to profit or loss until settlement of the liability is calculated as follows: ● During the vesting period the liability at each reporting date is the fair value of the award, factoring the probability of a liquidity event which is a non-vesting condition, multiplied by the expired portion of the vesting period. ● From the end of the vesting period until settlement of the award, the liability is the full fair value of the liability at the reporting date. All changes in the liability are recognised in profit or loss. The inputs into the Black-Scholes model used to value the cash-settled liability at the end of the period are outlined below: Inputs into Black-Scholes model Series 1 Series 2 Grant date share price US$1.00 US$3.82 Exercise price US$1.00 US$3.82 Expected annualised volatility 39.24% 39.24% Expected life 2.5 months 2.5 months Risk-free interest rate 0.04% 0.04% Expected dividend yield 0% 0%

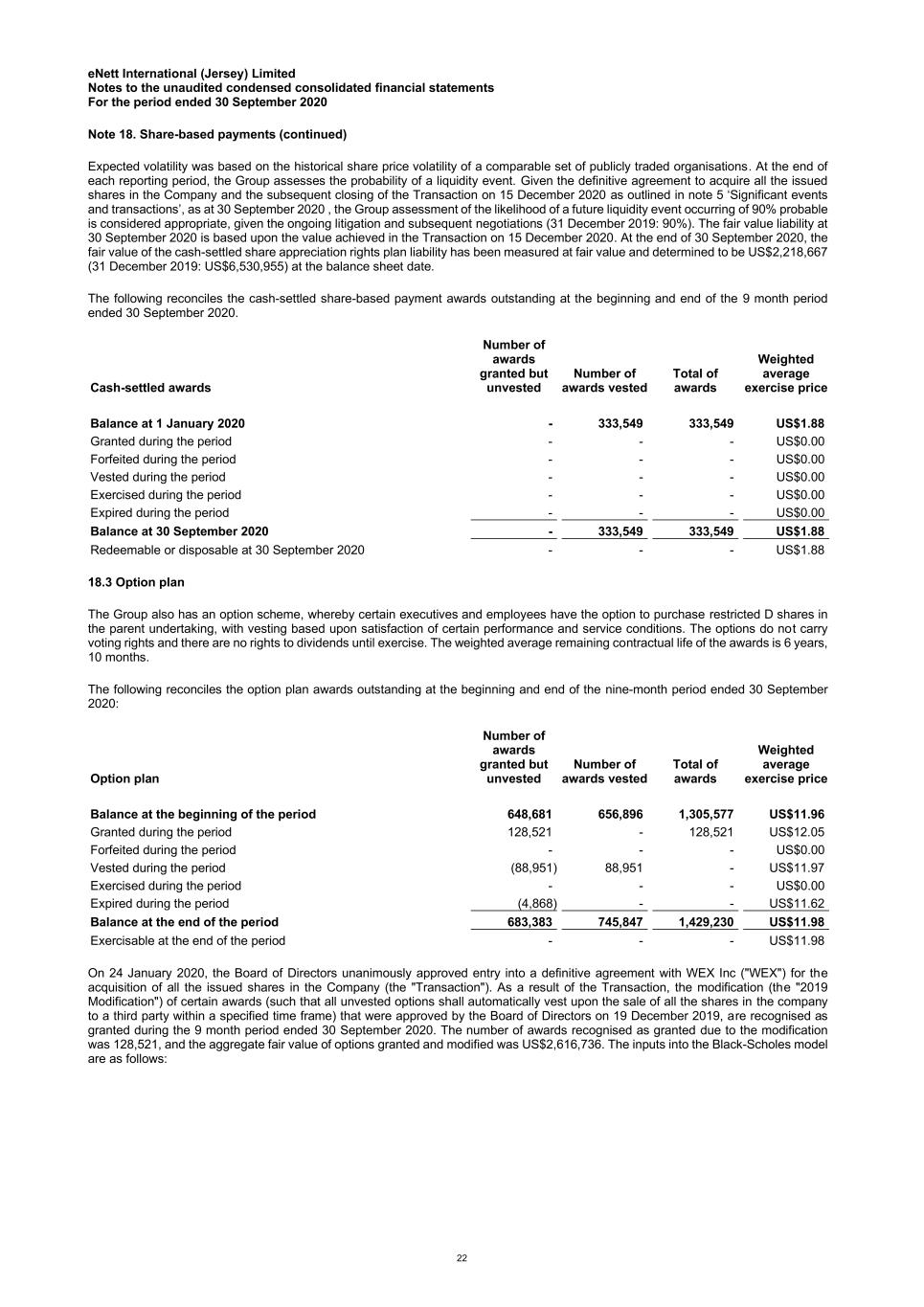

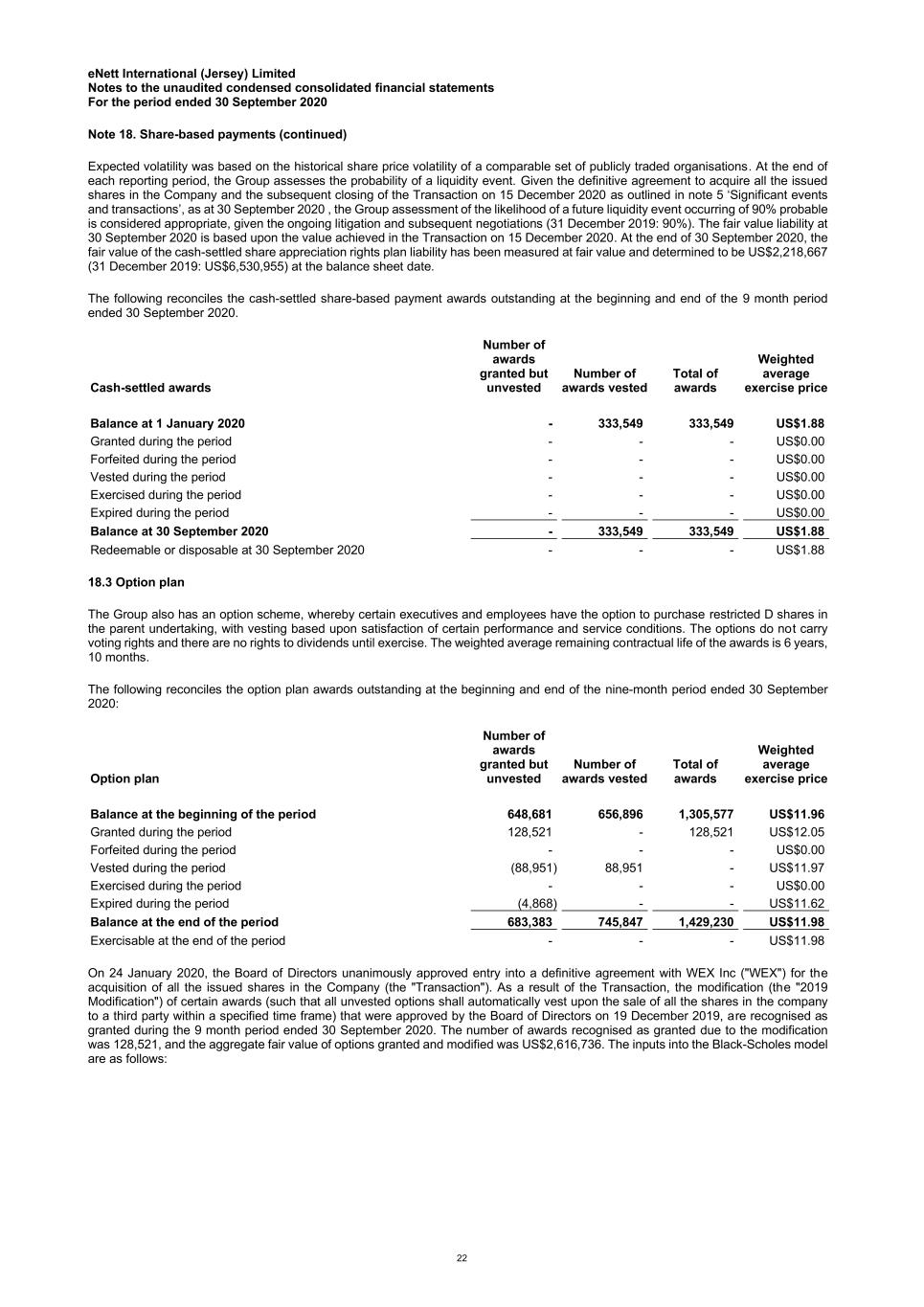

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 18. Share-based payments (continued) 22 Expected volatility was based on the historical share price volatility of a comparable set of publicly traded organisations. At the end of each reporting period, the Group assesses the probability of a liquidity event. Given the definitive agreement to acquire all the issued shares in the Company and the subsequent closing of the Transaction on 15 December 2020 as outlined in note 5 ‘Significant events and transactions’, as at 30 September 2020 , the Group assessment of the likelihood of a future liquidity event occurring of 90% probable is considered appropriate, given the ongoing litigation and subsequent negotiations (31 December 2019: 90%). The fair value liability at 30 September 2020 is based upon the value achieved in the Transaction on 15 December 2020. At the end of 30 September 2020, the fair value of the cash-settled share appreciation rights plan liability has been measured at fair value and determined to be US$2,218,667 (31 December 2019: US$6,530,955) at the balance sheet date. The following reconciles the cash-settled share-based payment awards outstanding at the beginning and end of the 9 month period ended 30 September 2020. Cash-settled awards Number of awards granted but unvested Number of awards vested Total of awards Weighted average exercise price Balance at 1 January 2020 - 333,549 333,549 US$1.88 Granted during the period - - - US$0.00 Forfeited during the period - - - US$0.00 Vested during the period - - - US$0.00 Exercised during the period - - - US$0.00 Expired during the period - - - US$0.00 Balance at 30 September 2020 - 333,549 333,549 US$1.88 Redeemable or disposable at 30 September 2020 - - - US$1.88 18.3 Option plan The Group also has an option scheme, whereby certain executives and employees have the option to purchase restricted D shares in the parent undertaking, with vesting based upon satisfaction of certain performance and service conditions. The options do not carry voting rights and there are no rights to dividends until exercise. The weighted average remaining contractual life of the awards is 6 years, 10 months. The following reconciles the option plan awards outstanding at the beginning and end of the nine-month period ended 30 September 2020: Option plan Number of awards granted but unvested Number of awards vested Total of awards Weighted average exercise price Balance at the beginning of the period 648,681 656,896 1,305,577 US$11.96 Granted during the period 128,521 - 128,521 US$12.05 Forfeited during the period - - - US$0.00 Vested during the period (88,951) 88,951 - US$11.97 Exercised during the period - - - US$0.00 Expired during the period (4,868) - - US$11.62 Balance at the end of the period 683,383 745,847 1,429,230 US$11.98 Exercisable at the end of the period - - - US$11.98 On 24 January 2020, the Board of Directors unanimously approved entry into a definitive agreement with WEX Inc ("WEX") for the acquisition of all the issued shares in the Company (the "Transaction"). As a result of the Transaction, the modification (the "2019 Modification") of certain awards (such that all unvested options shall automatically vest upon the sale of all the shares in the company to a third party within a specified time frame) that were approved by the Board of Directors on 19 December 2019, are recognised as granted during the 9 month period ended 30 September 2020. The number of awards recognised as granted due to the modification was 128,521, and the aggregate fair value of options granted and modified was US$2,616,736. The inputs into the Black-Scholes model are as follows:

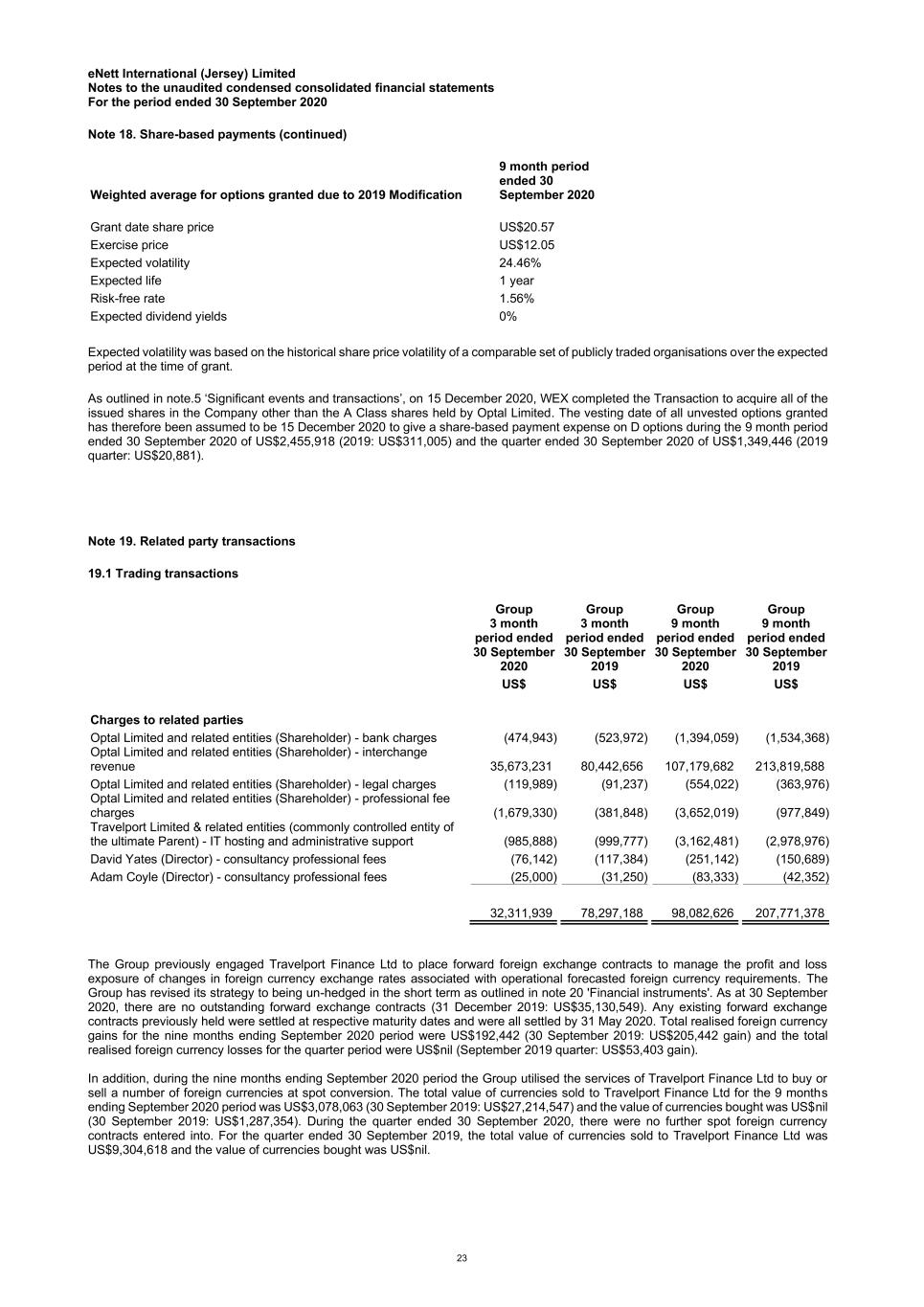

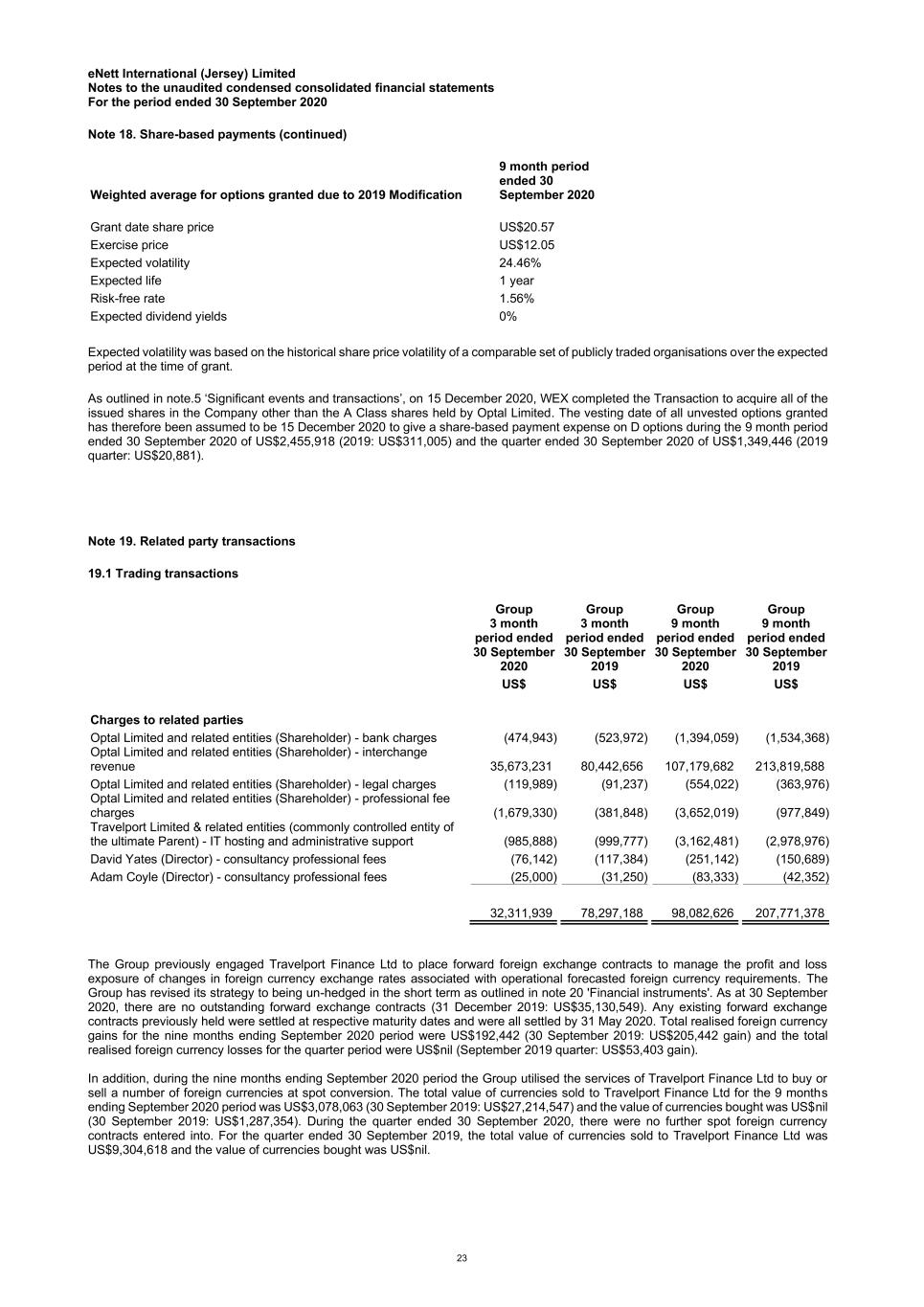

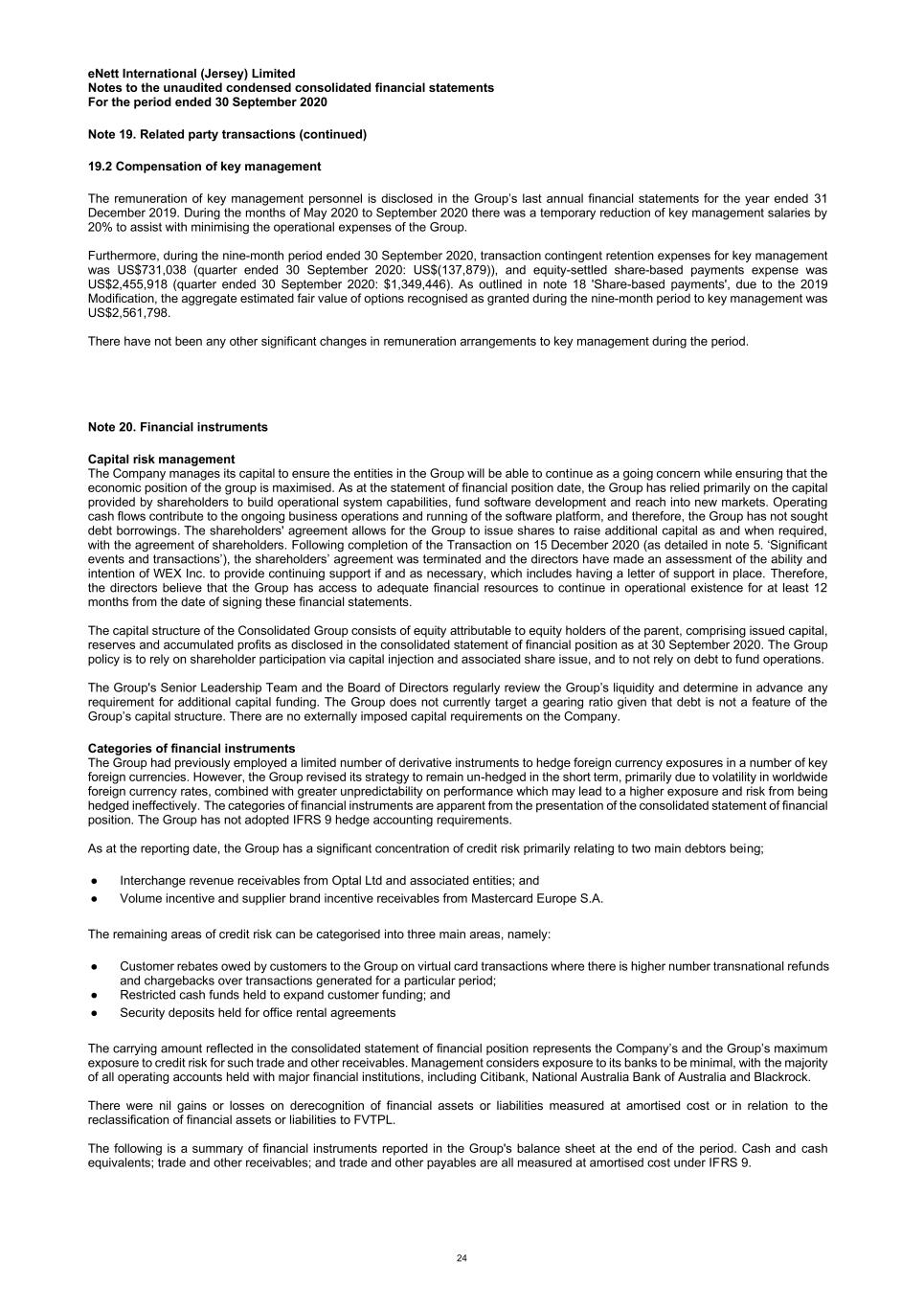

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 18. Share-based payments (continued) 23 Weighted average for options granted due to 2019 Modification 9 month period ended 30 September 2020 Grant date share price US$20.57 Exercise price US$12.05 Expected volatility 24.46% Expected life 1 year Risk-free rate 1.56% Expected dividend yields 0% Expected volatility was based on the historical share price volatility of a comparable set of publicly traded organisations over the expected period at the time of grant. As outlined in note.5 ‘Significant events and transactions’, on 15 December 2020, WEX completed the Transaction to acquire all of the issued shares in the Company other than the A Class shares held by Optal Limited. The vesting date of all unvested options granted has therefore been assumed to be 15 December 2020 to give a share-based payment expense on D options during the 9 month period ended 30 September 2020 of US$2,455,918 (2019: US$311,005) and the quarter ended 30 September 2020 of US$1,349,446 (2019 quarter: US$20,881). Note 19. Related party transactions 19.1 Trading transactions Group Group Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Charges to related parties Optal Limited and related entities (Shareholder) - bank charges (474,943) (523,972) (1,394,059) (1,534,368) Optal Limited and related entities (Shareholder) - interchange revenue 35,673,231 80,442,656 107,179,682 213,819,588 Optal Limited and related entities (Shareholder) - legal charges (119,989) (91,237) (554,022) (363,976) Optal Limited and related entities (Shareholder) - professional fee charges (1,679,330) (381,848) (3,652,019) (977,849) Travelport Limited & related entities (commonly controlled entity of the ultimate Parent) - IT hosting and administrative support (985,888) (999,777) (3,162,481) (2,978,976) David Yates (Director) - consultancy professional fees (76,142) (117,384) (251,142) (150,689) Adam Coyle (Director) - consultancy professional fees (25,000) (31,250) (83,333) (42,352) 32,311,939 78,297,188 98,082,626 207,771,378 The Group previously engaged Travelport Finance Ltd to place forward foreign exchange contracts to manage the profit and loss exposure of changes in foreign currency exchange rates associated with operational forecasted foreign currency requirements. The Group has revised its strategy to being un-hedged in the short term as outlined in note 20 'Financial instruments'. As at 30 September 2020, there are no outstanding forward exchange contracts (31 December 2019: US$35,130,549). Any existing forward exchange contracts previously held were settled at respective maturity dates and were all settled by 31 May 2020. Total realised foreign currency gains for the nine months ending September 2020 period were US$192,442 (30 September 2019: US$205,442 gain) and the total realised foreign currency losses for the quarter period were US$nil (September 2019 quarter: US$53,403 gain). In addition, during the nine months ending September 2020 period the Group utilised the services of Travelport Finance Ltd to buy or sell a number of foreign currencies at spot conversion. The total value of currencies sold to Travelport Finance Ltd for the 9 months ending September 2020 period was US$3,078,063 (30 September 2019: US$27,214,547) and the value of currencies bought was US$nil (30 September 2019: US$1,287,354). During the quarter ended 30 September 2020, there were no further spot foreign currency contracts entered into. For the quarter ended 30 September 2019, the total value of currencies sold to Travelport Finance Ltd was US$9,304,618 and the value of currencies bought was US$nil.

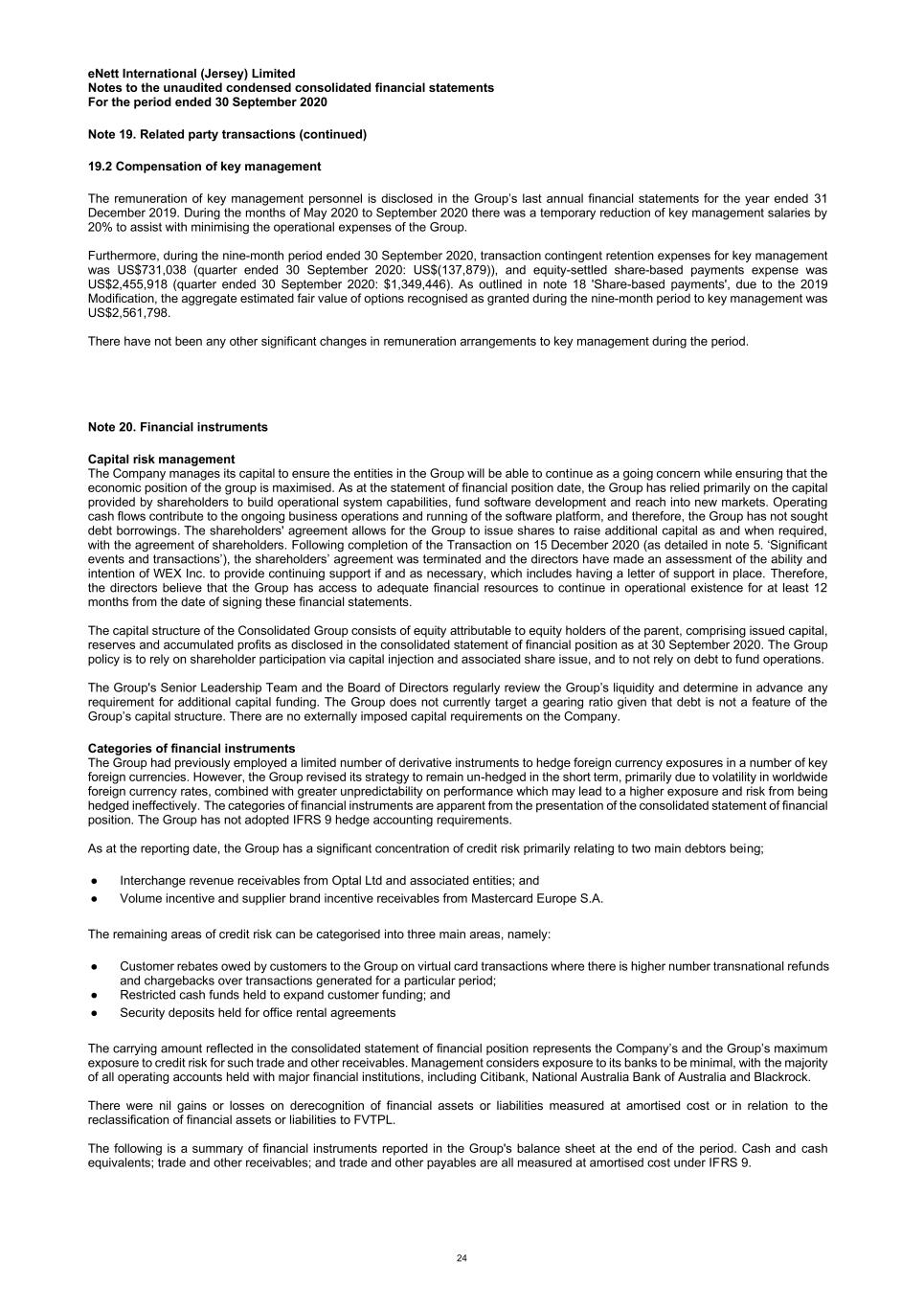

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 19. Related party transactions (continued) 24 19.2 Compensation of key management The remuneration of key management personnel is disclosed in the Group’s last annual financial statements for the year ended 31 December 2019. During the months of May 2020 to September 2020 there was a temporary reduction of key management salaries by 20% to assist with minimising the operational expenses of the Group. Furthermore, during the nine-month period ended 30 September 2020, transaction contingent retention expenses for key management was US$731,038 (quarter ended 30 September 2020: US$(137,879)), and equity-settled share-based payments expense was US$2,455,918 (quarter ended 30 September 2020: $1,349,446). As outlined in note 18 'Share-based payments', due to the 2019 Modification, the aggregate estimated fair value of options recognised as granted during the nine-month period to key management was US$2,561,798. There have not been any other significant changes in remuneration arrangements to key management during the period. Note 20. Financial instruments Capital risk management The Company manages its capital to ensure the entities in the Group will be able to continue as a going concern while ensuring that the economic position of the group is maximised. As at the statement of financial position date, the Group has relied primarily on the capital provided by shareholders to build operational system capabilities, fund software development and reach into new markets. Operating cash flows contribute to the ongoing business operations and running of the software platform, and therefore, the Group has not sought debt borrowings. The shareholders' agreement allows for the Group to issue shares to raise additional capital as and when required, with the agreement of shareholders. Following completion of the Transaction on 15 December 2020 (as detailed in note 5. ‘Significant events and transactions’), the shareholders’ agreement was terminated and the directors have made an assessment of the ability and intention of WEX Inc. to provide continuing support if and as necessary, which includes having a letter of support in place. Therefore, the directors believe that the Group has access to adequate financial resources to continue in operational existence for at least 12 months from the date of signing these financial statements. The capital structure of the Consolidated Group consists of equity attributable to equity holders of the parent, comprising issued capital, reserves and accumulated profits as disclosed in the consolidated statement of financial position as at 30 September 2020. The Group policy is to rely on shareholder participation via capital injection and associated share issue, and to not rely on debt to fund operations. The Group's Senior Leadership Team and the Board of Directors regularly review the Group’s liquidity and determine in advance any requirement for additional capital funding. The Group does not currently target a gearing ratio given that debt is not a feature of the Group’s capital structure. There are no externally imposed capital requirements on the Company. Categories of financial instruments The Group had previously employed a limited number of derivative instruments to hedge foreign currency exposures in a number of key foreign currencies. However, the Group revised its strategy to remain un-hedged in the short term, primarily due to volatility in worldwide foreign currency rates, combined with greater unpredictability on performance which may lead to a higher exposure and risk from being hedged ineffectively. The categories of financial instruments are apparent from the presentation of the consolidated statement of financial position. The Group has not adopted IFRS 9 hedge accounting requirements. As at the reporting date, the Group has a significant concentration of credit risk primarily relating to two main debtors being; ● Interchange revenue receivables from Optal Ltd and associated entities; and ● Volume incentive and supplier brand incentive receivables from Mastercard Europe S.A. The remaining areas of credit risk can be categorised into three main areas, namely: ● Customer rebates owed by customers to the Group on virtual card transactions where there is higher number transnational refunds and chargebacks over transactions generated for a particular period; ● Restricted cash funds held to expand customer funding; and ● Security deposits held for office rental agreements The carrying amount reflected in the consolidated statement of financial position represents the Company’s and the Group’s maximum exposure to credit risk for such trade and other receivables. Management considers exposure to its banks to be minimal, with the majority of all operating accounts held with major financial institutions, including Citibank, National Australia Bank of Australia and Blackrock. There were nil gains or losses on derecognition of financial assets or liabilities measured at amortised cost or in relation to the reclassification of financial assets or liabilities to FVTPL. The following is a summary of financial instruments reported in the Group's balance sheet at the end of the period. Cash and cash equivalents; trade and other receivables; and trade and other payables are all measured at amortised cost under IFRS 9.

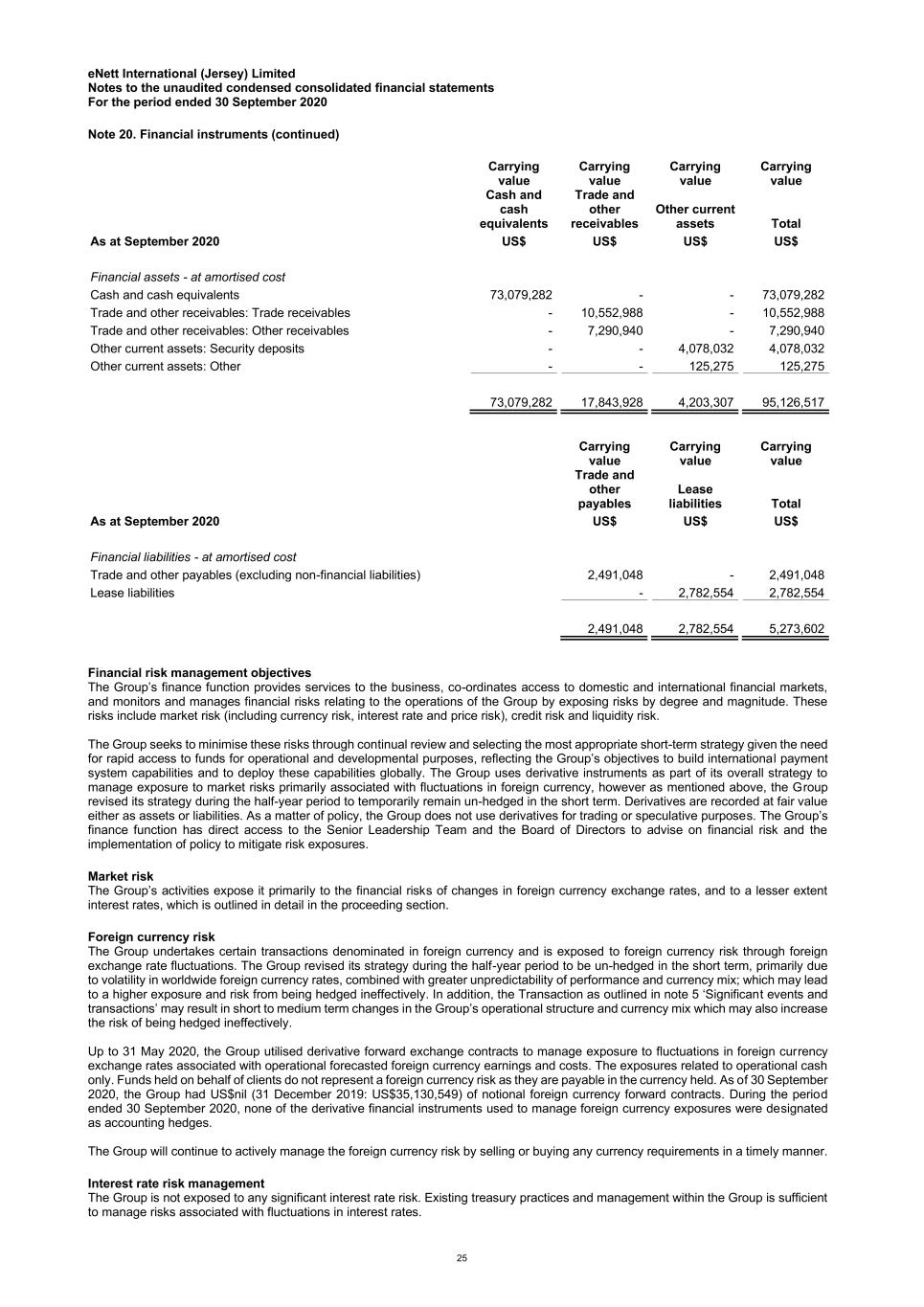

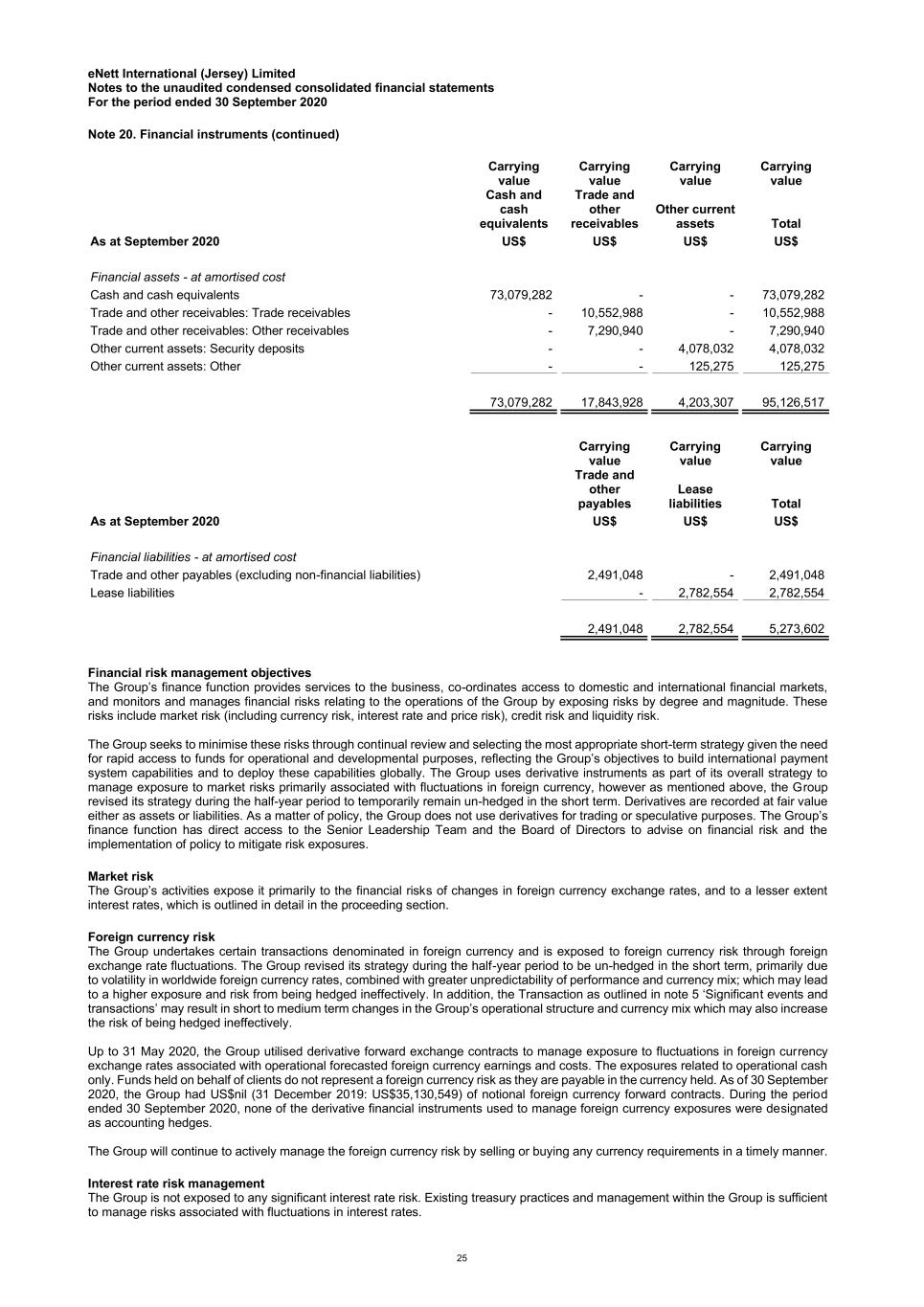

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 20. Financial instruments (continued) 25 Carrying value Carrying value Carrying value Carrying value Cash and cash equivalents Trade and other receivables Other current assets Total As at September 2020 US$ US$ US$ US$ Financial assets - at amortised cost Cash and cash equivalents 73,079,282 - - 73,079,282 Trade and other receivables: Trade receivables - 10,552,988 - 10,552,988 Trade and other receivables: Other receivables - 7,290,940 - 7,290,940 Other current assets: Security deposits - - 4,078,032 4,078,032 Other current assets: Other - - 125,275 125,275 73,079,282 17,843,928 4,203,307 95,126,517 Carrying value Carrying value Carrying value Trade and other payables Lease liabilities Total As at September 2020 US$ US$ US$ Financial liabilities - at amortised cost Trade and other payables (excluding non-financial liabilities) 2,491,048 - 2,491,048 Lease liabilities - 2,782,554 2,782,554 2,491,048 2,782,554 5,273,602 Financial risk management objectives The Group’s finance function provides services to the business, co-ordinates access to domestic and international financial markets, and monitors and manages financial risks relating to the operations of the Group by exposing risks by degree and magnitude. These risks include market risk (including currency risk, interest rate and price risk), credit risk and liquidity risk. The Group seeks to minimise these risks through continual review and selecting the most appropriate short-term strategy given the need for rapid access to funds for operational and developmental purposes, reflecting the Group’s objectives to build international payment system capabilities and to deploy these capabilities globally. The Group uses derivative instruments as part of its overall strategy to manage exposure to market risks primarily associated with fluctuations in foreign currency, however as mentioned above, the Group revised its strategy during the half-year period to temporarily remain un-hedged in the short term. Derivatives are recorded at fair value either as assets or liabilities. As a matter of policy, the Group does not use derivatives for trading or speculative purposes. The Group’s finance function has direct access to the Senior Leadership Team and the Board of Directors to advise on financial risk and the implementation of policy to mitigate risk exposures. Market risk The Group’s activities expose it primarily to the financial risks of changes in foreign currency exchange rates, and to a lesser extent interest rates, which is outlined in detail in the proceeding section. Foreign currency risk The Group undertakes certain transactions denominated in foreign currency and is exposed to foreign currency risk through foreign exchange rate fluctuations. The Group revised its strategy during the half-year period to be un-hedged in the short term, primarily due to volatility in worldwide foreign currency rates, combined with greater unpredictability of performance and currency mix; which may lead to a higher exposure and risk from being hedged ineffectively. In addition, the Transaction as outlined in note 5 ‘Significant events and transactions’ may result in short to medium term changes in the Group’s operational structure and currency mix which may also increase the risk of being hedged ineffectively. Up to 31 May 2020, the Group utilised derivative forward exchange contracts to manage exposure to fluctuations in foreign currency exchange rates associated with operational forecasted foreign currency earnings and costs. The exposures related to operational cash only. Funds held on behalf of clients do not represent a foreign currency risk as they are payable in the currency held. As of 30 September 2020, the Group had US$nil (31 December 2019: US$35,130,549) of notional foreign currency forward contracts. During the period ended 30 September 2020, none of the derivative financial instruments used to manage foreign currency exposures were designated as accounting hedges. The Group will continue to actively manage the foreign currency risk by selling or buying any currency requirements in a timely manner. Interest rate risk management The Group is not exposed to any significant interest rate risk. Existing treasury practices and management within the Group is sufficient to manage risks associated with fluctuations in interest rates.

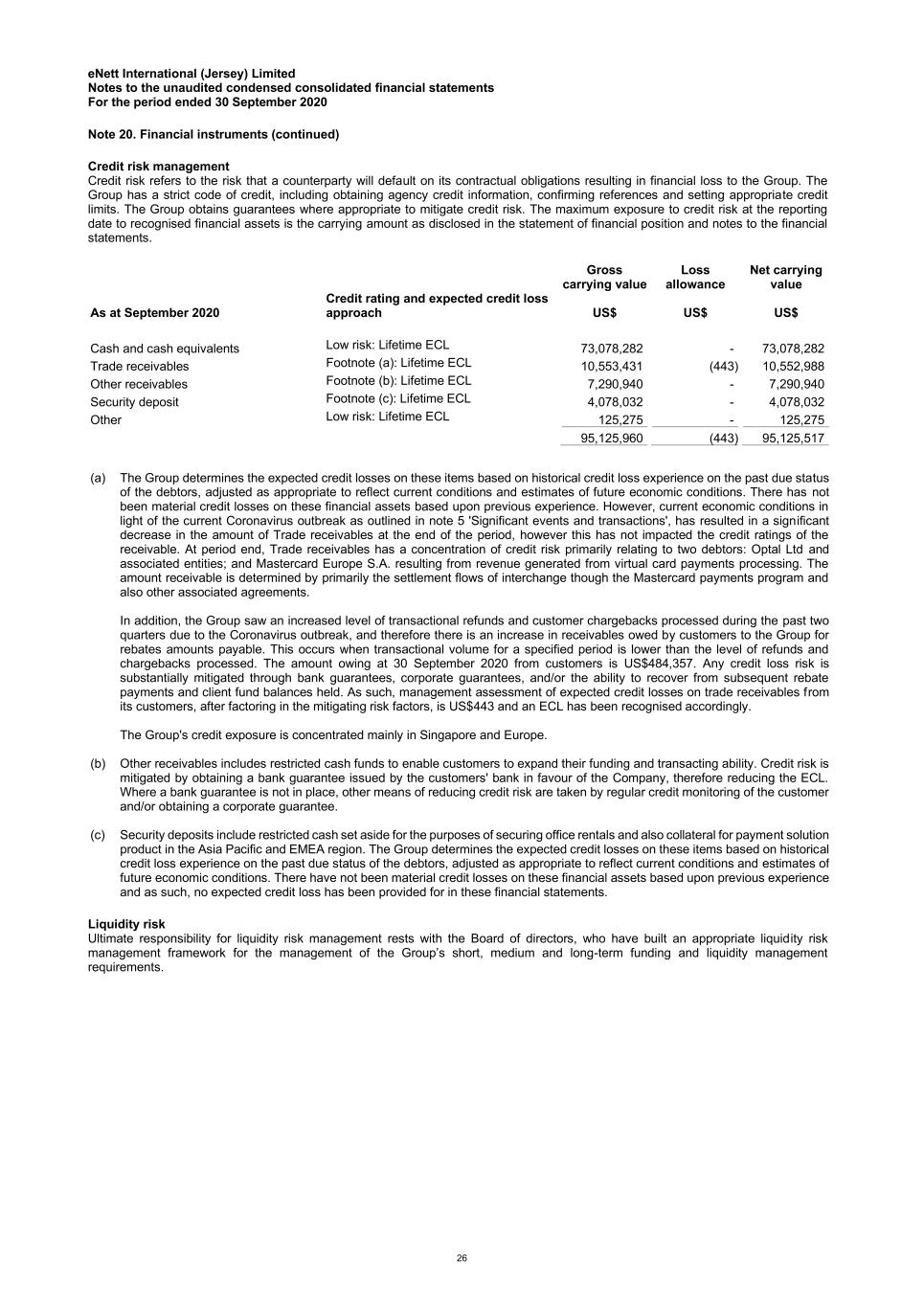

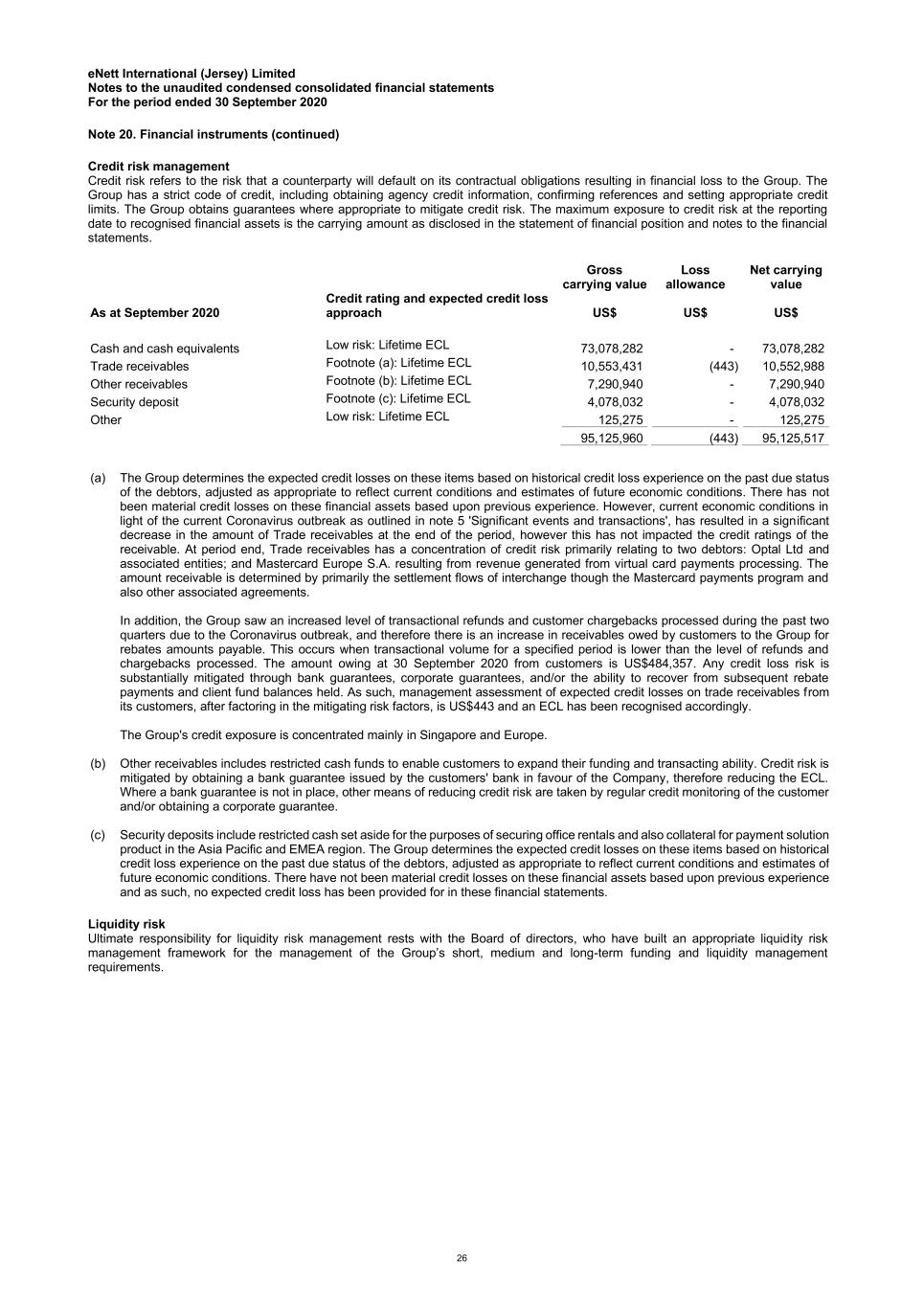

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 20. Financial instruments (continued) 26 Credit risk management Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to the Group. The Group has a strict code of credit, including obtaining agency credit information, confirming references and setting appropriate credit limits. The Group obtains guarantees where appropriate to mitigate credit risk. The maximum exposure to credit risk at the reporting date to recognised financial assets is the carrying amount as disclosed in the statement of financial position and notes to the financial statements. Gross carrying value Loss allowance Net carrying value As at September 2020 Credit rating and expected credit loss approach US$ US$ US$ Cash and cash equivalents Low risk: Lifetime ECL 73,078,282 - 73,078,282 Trade receivables Footnote (a): Lifetime ECL 10,553,431 (443) 10,552,988 Other receivables Footnote (b): Lifetime ECL 7,290,940 - 7,290,940 Security deposit Footnote (c): Lifetime ECL 4,078,032 - 4,078,032 Other Low risk: Lifetime ECL 125,275 - 125,275 95,125,960 (443) 95,125,517 (a) The Group determines the expected credit losses on these items based on historical credit loss experience on the past due status of the debtors, adjusted as appropriate to reflect current conditions and estimates of future economic conditions. There has not been material credit losses on these financial assets based upon previous experience. However, current economic conditions in light of the current Coronavirus outbreak as outlined in note 5 'Significant events and transactions', has resulted in a significant decrease in the amount of Trade receivables at the end of the period, however this has not impacted the credit ratings of the receivable. At period end, Trade receivables has a concentration of credit risk primarily relating to two debtors: Optal Ltd and associated entities; and Mastercard Europe S.A. resulting from revenue generated from virtual card payments processing. The amount receivable is determined by primarily the settlement flows of interchange though the Mastercard payments program and also other associated agreements. In addition, the Group saw an increased level of transactional refunds and customer chargebacks processed during the past two quarters due to the Coronavirus outbreak, and therefore there is an increase in receivables owed by customers to the Group for rebates amounts payable. This occurs when transactional volume for a specified period is lower than the level of refunds and chargebacks processed. The amount owing at 30 September 2020 from customers is US$484,357. Any credit loss risk is substantially mitigated through bank guarantees, corporate guarantees, and/or the ability to recover from subsequent rebate payments and client fund balances held. As such, management assessment of expected credit losses on trade receivables from its customers, after factoring in the mitigating risk factors, is US$443 and an ECL has been recognised accordingly. The Group's credit exposure is concentrated mainly in Singapore and Europe. (b) Other receivables includes restricted cash funds to enable customers to expand their funding and transacting ability. Credit risk is mitigated by obtaining a bank guarantee issued by the customers' bank in favour of the Company, therefore reducing the ECL. Where a bank guarantee is not in place, other means of reducing credit risk are taken by regular credit monitoring of the customer and/or obtaining a corporate guarantee. (c) Security deposits include restricted cash set aside for the purposes of securing office rentals and also collateral for payment solution product in the Asia Pacific and EMEA region. The Group determines the expected credit losses on these items based on historical credit loss experience on the past due status of the debtors, adjusted as appropriate to reflect current conditions and estimates of future economic conditions. There have not been material credit losses on these financial assets based upon previous experience and as such, no expected credit loss has been provided for in these financial statements. Liquidity risk Ultimate responsibility for liquidity risk management rests with the Board of directors, who have built an appropriate liquidity risk management framework for the management of the Group’s short, medium and long-term funding and liquidity management requirements.

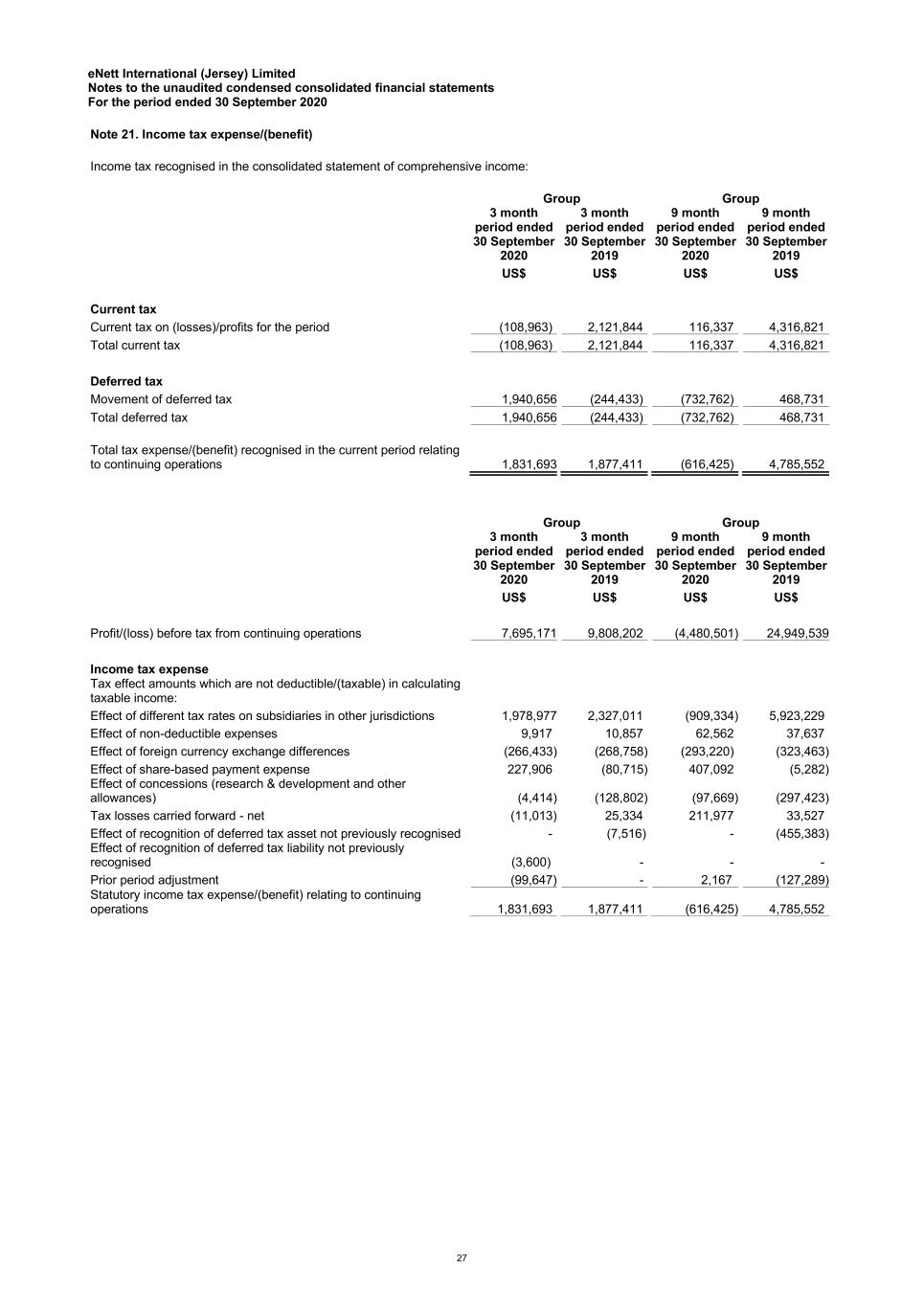

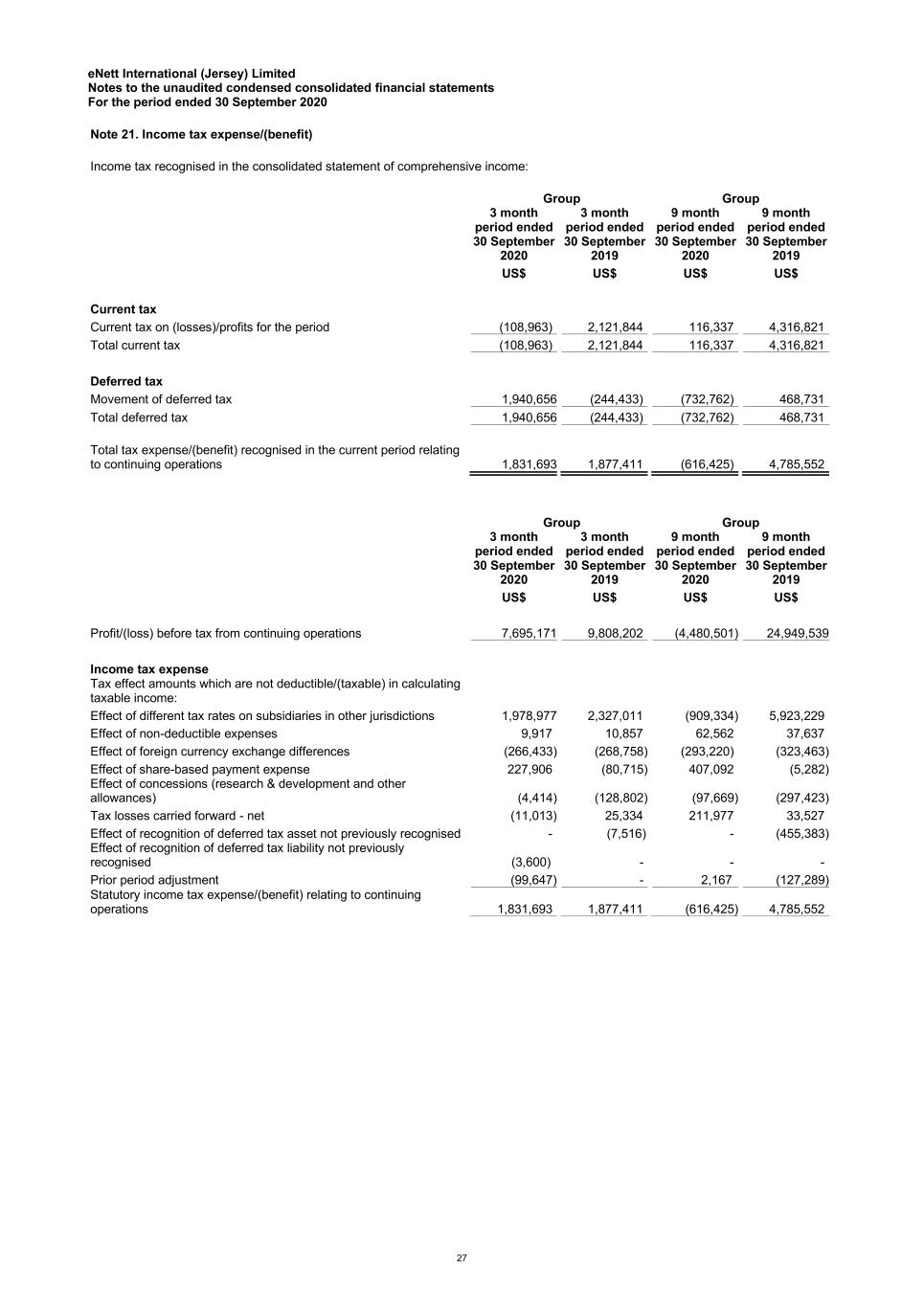

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 27 Note 21. Income tax expense/(benefit) Income tax recognised in the consolidated statement of comprehensive income: Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Current tax Current tax on (losses)/profits for the period (108,963) 2,121,844 116,337 4,316,821 Total current tax (108,963) 2,121,844 116,337 4,316,821 Deferred tax Movement of deferred tax 1,940,656 (244,433) (732,762) 468,731 Total deferred tax 1,940,656 (244,433) (732,762) 468,731 Total tax expense/(benefit) recognised in the current period relating to continuing operations 1,831,693 1,877,411 (616,425) 4,785,552 Group Group 3 month period ended 30 September 2020 3 month period ended 30 September 2019 9 month period ended 30 September 2020 9 month period ended 30 September 2019 US$ US$ US$ US$ Profit/(loss) before tax from continuing operations 7,695,171 9,808,202 (4,480,501) 24,949,539 Income tax expense Tax effect amounts which are not deductible/(taxable) in calculating taxable income: Effect of different tax rates on subsidiaries in other jurisdictions 1,978,977 2,327,011 (909,334) 5,923,229 Effect of non-deductible expenses 9,917 10,857 62,562 37,637 Effect of foreign currency exchange differences (266,433) (268,758) (293,220) (323,463) Effect of share-based payment expense 227,906 (80,715) 407,092 (5,282) Effect of concessions (research & development and other allowances) (4,414) (128,802) (97,669) (297,423) Tax losses carried forward - net (11,013) 25,334 211,977 33,527 Effect of recognition of deferred tax asset not previously recognised - (7,516) - (455,383) Effect of recognition of deferred tax liability not previously recognised (3,600) -- - - Prior period adjustment (99,647) -- 2,167 (127,289) Statutory income tax expense/(benefit) relating to continuing operations 1,831,693 1,877,411 (616,425) 4,785,552

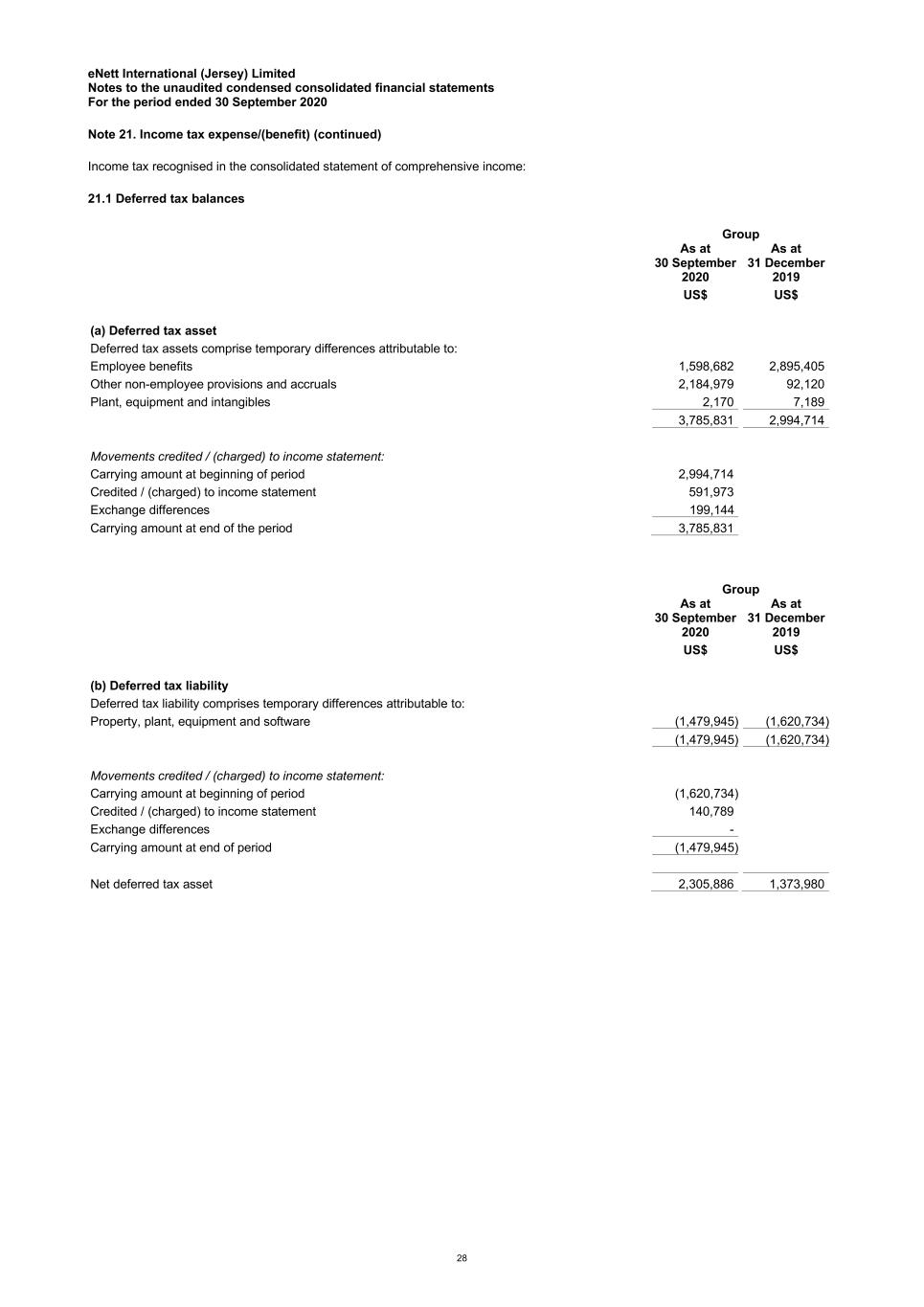

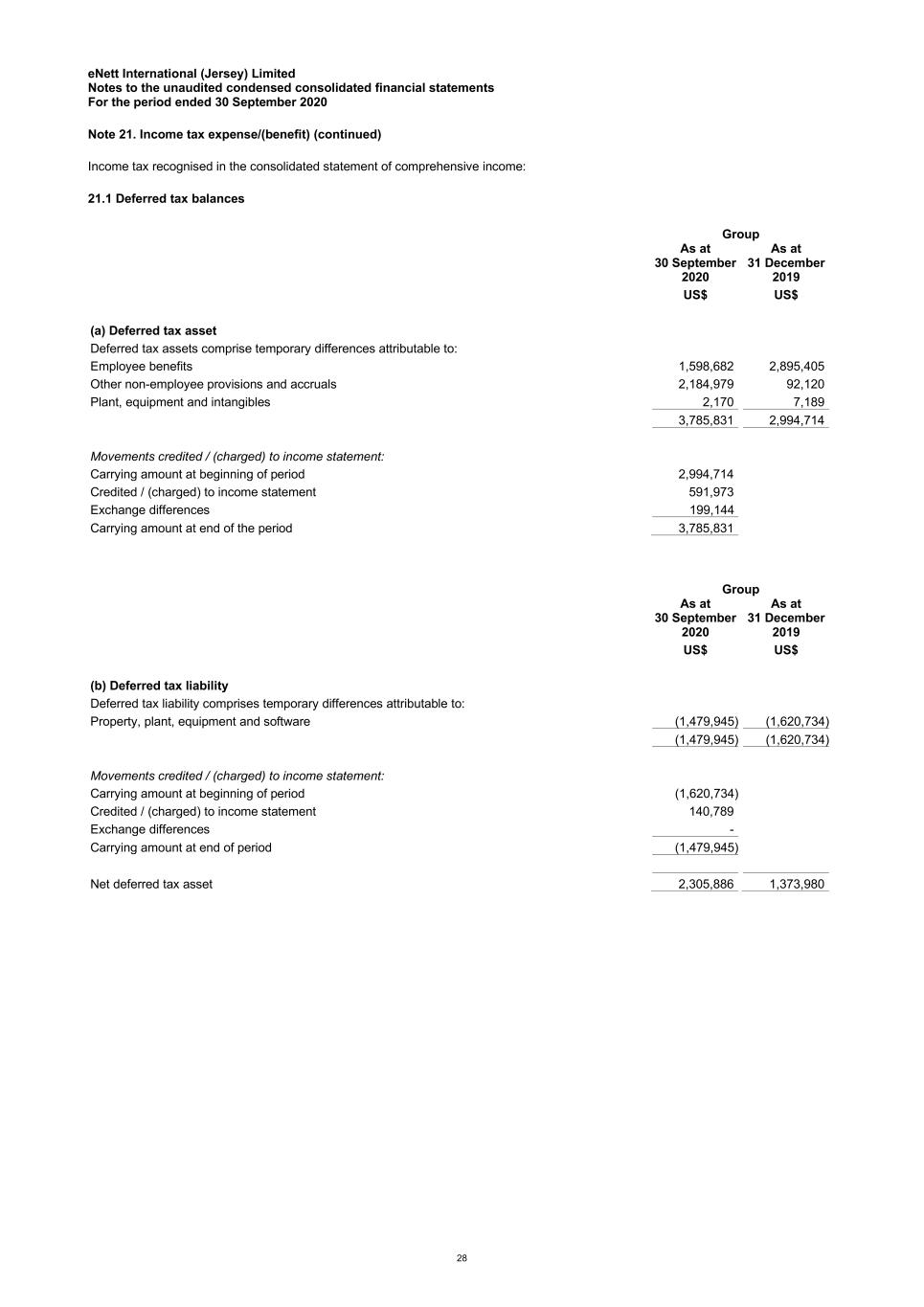

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 28 Note 21. Income tax expense/(benefit) (continued) Income tax recognised in the consolidated statement of comprehensive income: 21.1 Deferred tax balances Group As at 30 September 2020 As at 31 December 2019 US$ US$ (a) Deferred tax asset Deferred tax assets comprise temporary differences attributable to: Employee benefits 1,598,682 2,895,405 Other non-employee provisions and accruals 2,184,979 92,120 Plant, equipment and intangibles 2,170 7,189 3,785,831 2,994,714 Movements credited / (charged) to income statement: Carrying amount at beginning of period 2,994,714 Credited / (charged) to income statement 591,973 Exchange differences 199,144- Carrying amount at end of the period 3,785,831 Group As at 30 September 2020 As at 31 December 2019 US$ US$ (b) Deferred tax liability Deferred tax liability comprises temporary differences attributable to: Property, plant, equipment and software (1,479,945) (1,620,734) (1,479,945) (1,620,734) Movements credited / (charged) to income statement: Carrying amount at beginning of period (1,620,734) Credited / (charged) to income statement 140,789 Exchange differences - Carrying amount at end of period (1,479,945) Net deferred tax asset 2,305,886 1,373,980

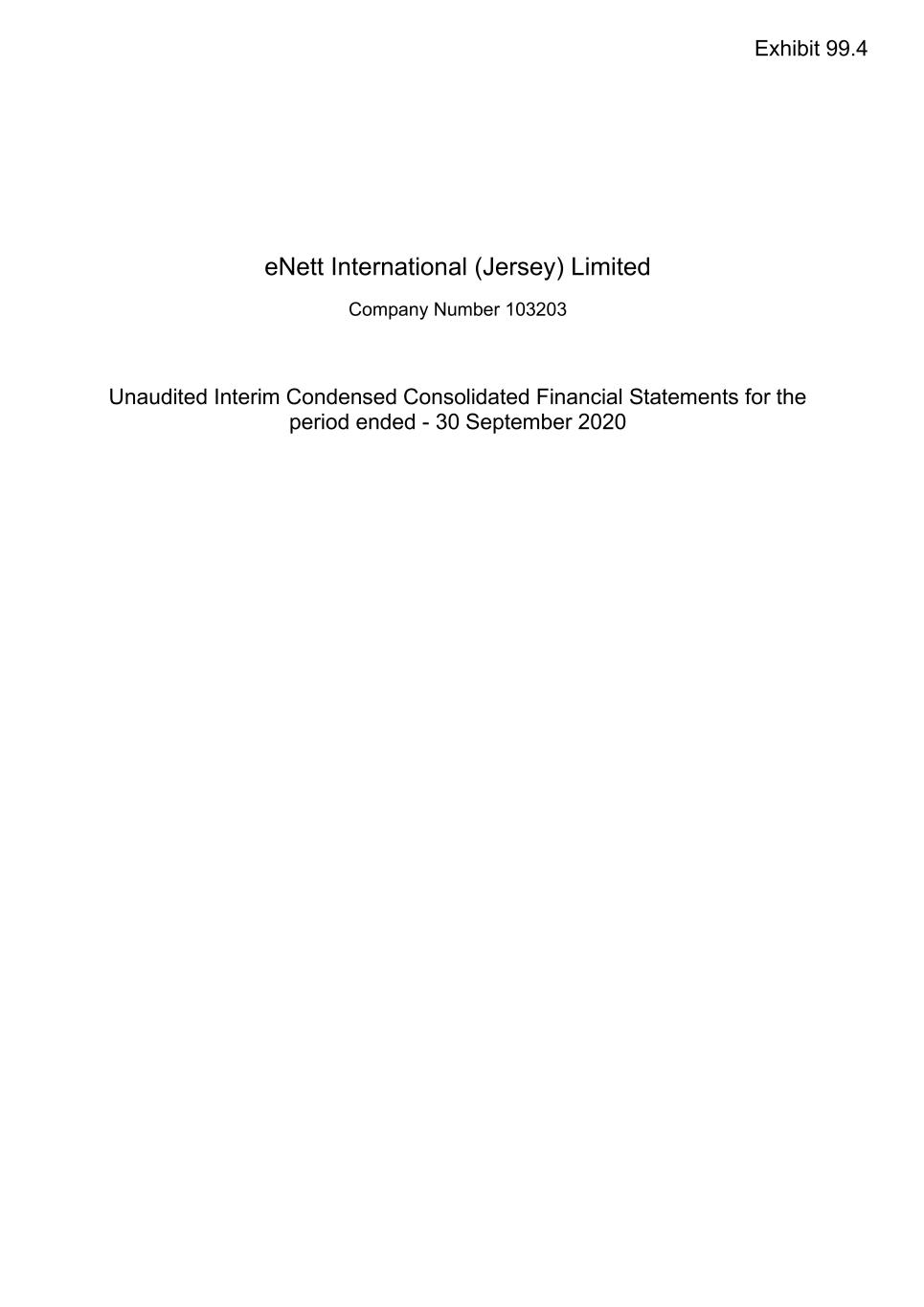

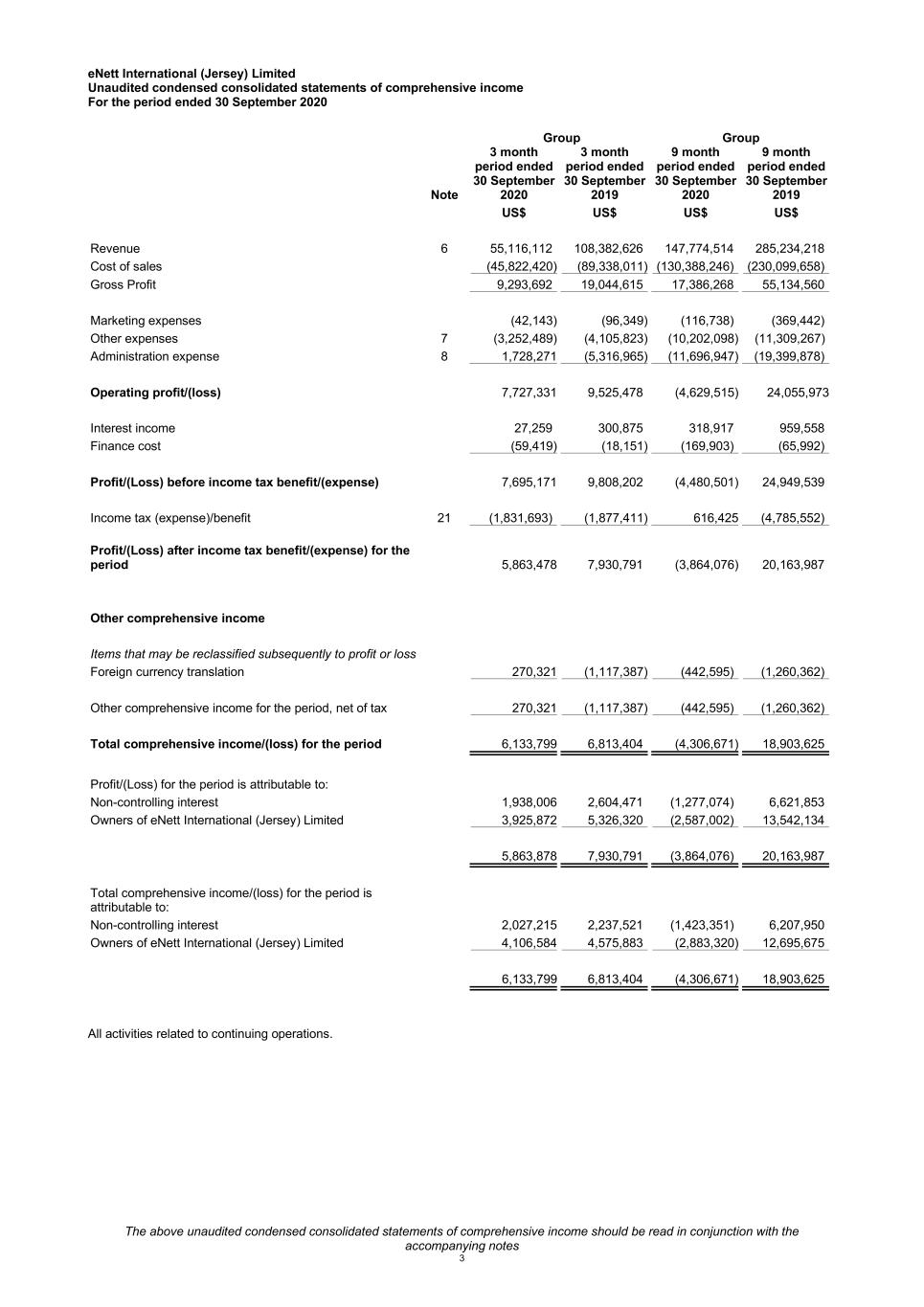

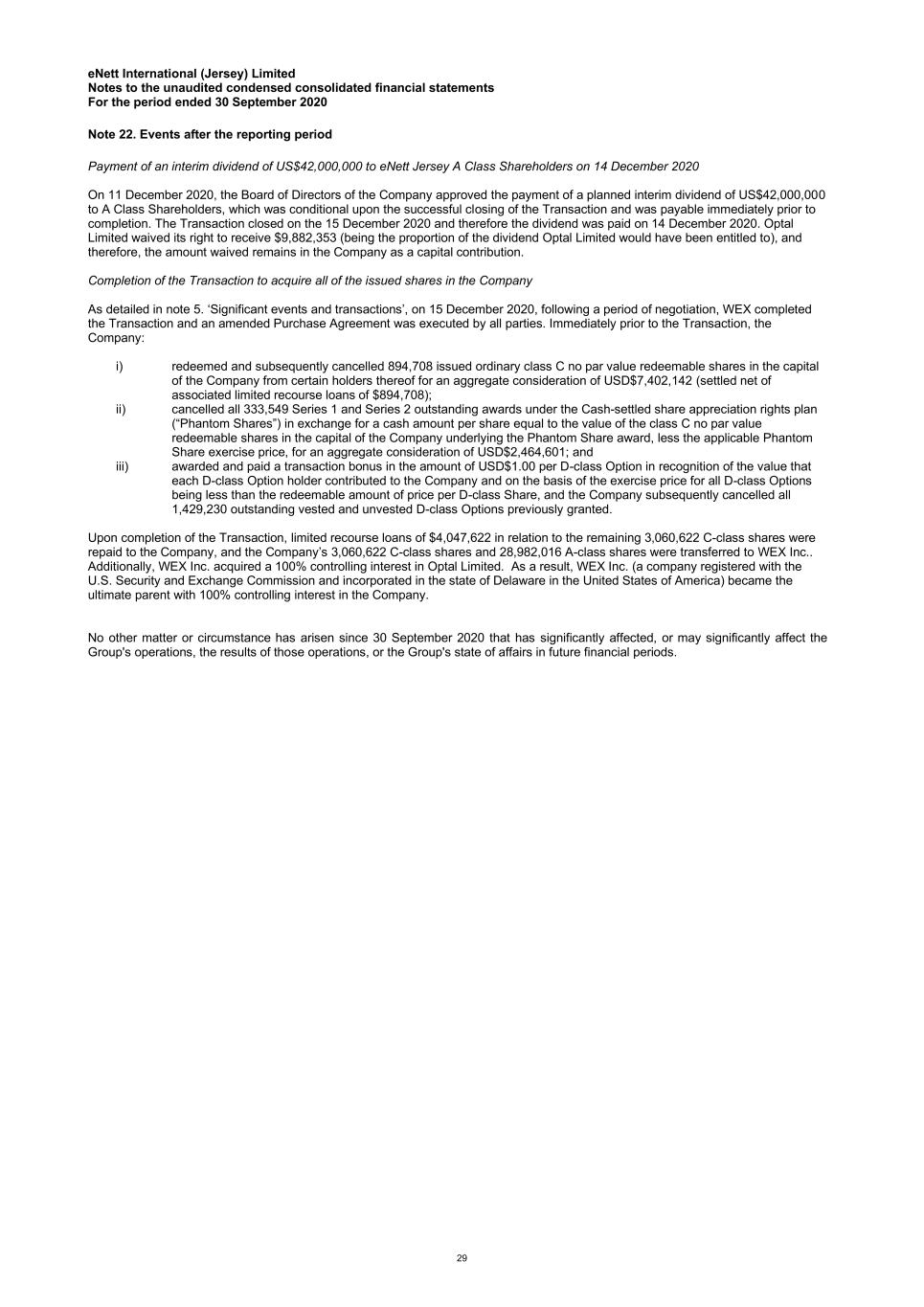

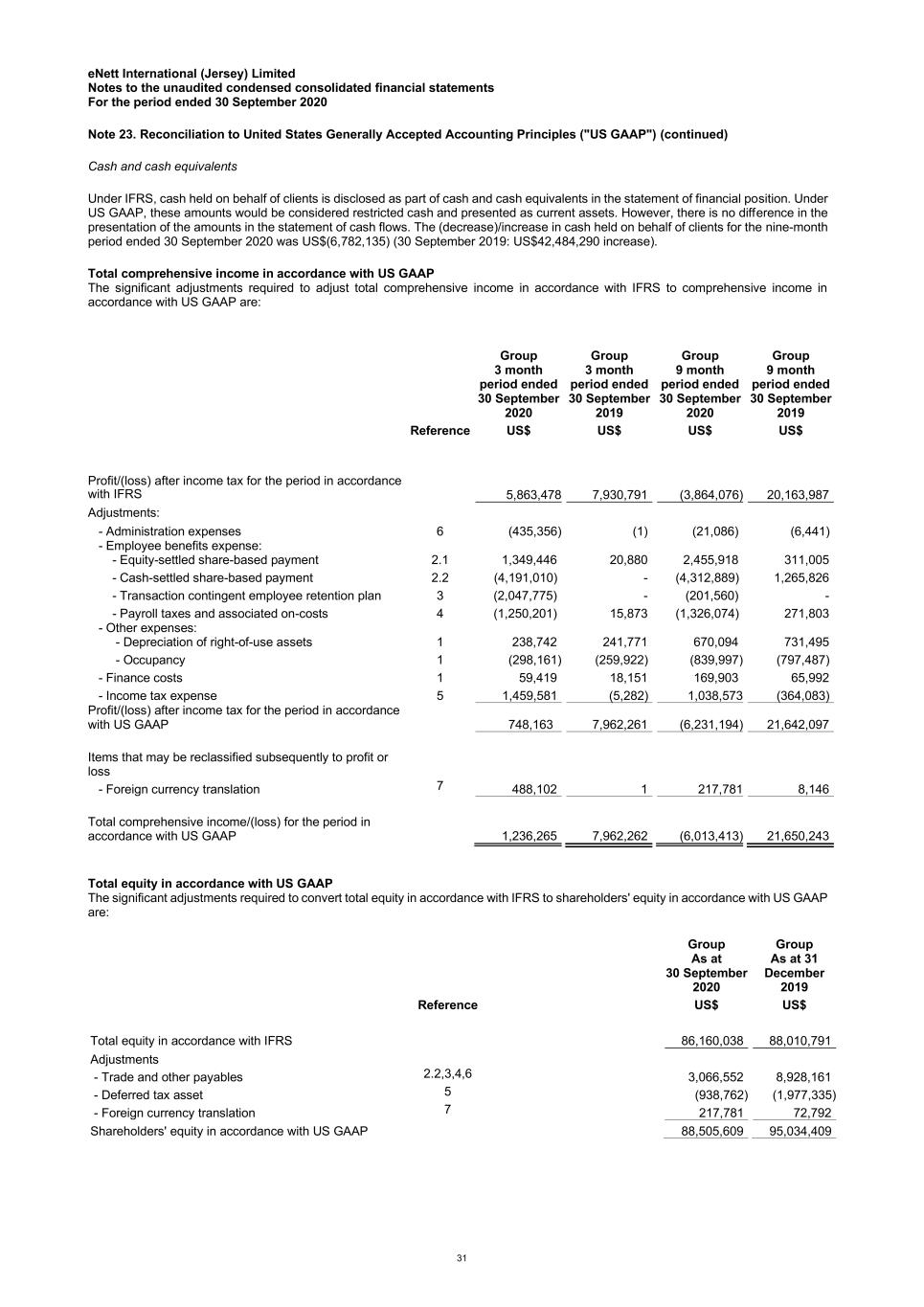

eNett International (Jersey) Limited Notes to the unaudited condensed consolidated financial statements For the period ended 30 September 2020 Note 22. Events after the reporting period 29 Payment of an interim dividend of US$42,000,000 to eNett Jersey A Class Shareholders on 14 December 2020 On 11 December 2020, the Board of Directors of the Company approved the payment of a planned interim dividend of US$42,000,000 to A Class Shareholders, which was conditional upon the successful closing of the Transaction and was payable immediately prior to completion. The Transaction closed on the 15 December 2020 and therefore the dividend was paid on 14 December 2020. Optal Limited waived its right to receive $9,882,353 (being the proportion of the dividend Optal Limited would have been entitled to), and therefore, the amount waived remains in the Company as a capital contribution. Completion of the Transaction to acquire all of the issued shares in the Company As detailed in note 5. ‘Significant events and transactions’, on 15 December 2020, following a period of negotiation, WEX completed the Transaction and an amended Purchase Agreement was executed by all parties. Immediately prior to the Transaction, the Company: i) redeemed and subsequently cancelled 894,708 issued ordinary class C no par value redeemable shares in the capital of the Company from certain holders thereof for an aggregate consideration of USD$7,402,142 (settled net of associated limited recourse loans of $894,708); ii) cancelled all 333,549 Series 1 and Series 2 outstanding awards under the Cash-settled share appreciation rights plan (“Phantom Shares”) in exchange for a cash amount per share equal to the value of the class C no par value redeemable shares in the capital of the Company underlying the Phantom Share award, less the applicable Phantom Share exercise price, for an aggregate consideration of USD$2,464,601; and iii) awarded and paid a transaction bonus in the amount of USD$1.00 per D-class Option in recognition of the value that each D-class Option holder contributed to the Company and on the basis of the exercise price for all D-class Options being less than the redeemable amount of price per D-class Share, and the Company subsequently cancelled all 1,429,230 outstanding vested and unvested D-class Options previously granted. Upon completion of the Transaction, limited recourse loans of $4,047,622 in relation to the remaining 3,060,622 C-class shares were repaid to the Company, and the Company’s 3,060,622 C-class shares and 28,982,016 A-class shares were transferred to WEX Inc.. Additionally, WEX Inc. acquired a 100% controlling interest in Optal Limited. As a result, WEX Inc. (a company registered with the U.S. Security and Exchange Commission and incorporated in the state of Delaware in the United States of America) became the ultimate parent with 100% controlling interest in the Company. No other matter or circumstance has arisen since 30 September 2020 that has significantly affected, or may significantly affect the Group's operations, the results of those operations, or the Group's state of affairs in future financial periods.