Table of Contents

As filed with the Securities and Exchange Commission on December 11, 2006

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HOST HOTELS & RESORTS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 7011 | 52-2095412 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

For Co-Registrants, see “Table of Co-Registrants” on following page.

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817

(240) 744-1000

(Address, including zip code, telephone number, including area code, of registrant’s principal executive offices)

Elizabeth A. Abdoo

Executive Vice President and

General Counsel

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817

(240) 744-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Scott C. Herlihy

Latham & Watkins LLP

555 11th Street, N.W., Suite 1000

Washington, D.C. 20004

(202) 637-2200

Approximate date of commencement of proposed sale to the public: as soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Note(1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||

6 7/8% Series S Senior Notes Due 2014 (2) | $ | 500,000,000 | 100.0 | % | $ | 500,000,000 | $ | 53,500 | ||||

Guarantees of the 6 7/8% Series S Senior Notes due 2014 (3) | N/A | N/A | N/A | N/A | ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) of the Securities Act. |

| (2) | The 6 7/8% Series S senior notes due 2014 will be the obligations of Host Hotels & Resorts, L.P. |

| (3) | Each of the Co-Registrants listed on the “Table of Co-Registrants” on the following page will guarantee on an unconditional basis the obligations of Host Hotels & Resorts, L.P. under the 6 7/8% Series S senior notes due 2014. Pursuant to Rule 457(n), no additional registration fee is being paid in respect of the guarantees. The guarantees are not paid separately. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Co-Registrants

Name | State of other Jurisdiction of Formation | Primary Standard Industrial Classification Code Number | IRS Employer Number | |||

HMH Rivers, L.P | Delaware | 7011 | 52-2126158 | |||

HMH Marina LLC | Delaware | 7011 | 52-2095412 | |||

HMC SBM Two LLC | Delaware | 7011 | 52-2095412 | |||

HMC PLP LLC | Delaware | 7011 | 52-2095412 | |||

HMC Retirement Properties, L.P. | Delaware | 7011 | 52-2126159 | |||

HMH Pentagon LLC | Delaware | 7011 | 52-2095412 | |||

Airport Hotels LLC | Delaware | 7011 | 52-2095412 | |||

HMC Capital Resources LLC | Delaware | 7011 | 52-2095412 | |||

YBG Associates LLC | Delaware | 7011 | 52-2059377 | |||

PRM LLC | Delaware | 7011 | 52-2095412 | |||

Host Park Ridge LLC | Delaware | 7011 | 52-2095412 | |||

Host of Boston, Ltd. | Massachusetts | 7011 | 59-0164700 | |||

Host of Houston, Ltd. | Texas | 7011 | 52-1874034 | |||

Host of Houston 1979 | Texas | 7011 | 95-3552476 | |||

Philadelphia Airport Hotel LLC | Delaware | 7011 | 52-2095412 | |||

HMC Hartford LLC | Delaware | 7011 | 52-2095412 | |||

HMC Park Ridge LLC | Delaware | 7011 | 52-2095412 | |||

HMC Suites LLC | Delaware | 7011 | 52-2095412 | |||

HMC Suites Limited Partnership | Delaware | 7011 | 52-1632307 | |||

Wellsford-Park Ridge HMC Hotel Limited Partnership | Delaware | 7011 | 52-6323494 | |||

HMC Burlingame LLC | Delaware | 7011 | 52-2095412 | |||

HMC Capital LLC | Delaware | 7011 | 52-2095412 | |||

HMC Grand LLC | Delaware | 7011 | 52-2285954 | |||

HMC Hotel Development LLC | Delaware | 7011 | 52-2095412 | |||

HMC Mexpark LLC | Delaware | 7011 | 52-2095412 | |||

HMC Polanco LLC | Delaware | 7011 | 52-2095412 | |||

HMC NGL LLC | Delaware | 7011 | 52-2095412 | |||

HMC OLS I L.P | Delaware | 7011 | 52-2095412 | |||

HMC Seattle LLC | Delaware | 7011 | 52-2095412 | |||

HMC Swiss Holdings LLC | Delaware | 7011 | 52-2095412 | |||

HMH Restaurants LLC | Delaware | 7011 | 52-2095412 | |||

HMH Rivers LLC | Delaware | 7011 | 52-2095412 | |||

HMH WTC LLC | Delaware | 7011 | 52-2095412 | |||

Host La Jolla LLC | Delaware | 7011 | 52-2095412 | |||

City Center Hotel Limited Partnership | Minnesota | 7011 | 41-1449758 | |||

PM Financial LLC | Delaware | 7011 | 52-2095412 | |||

PM Financial LP | Delaware | 7011 | 52-2131022 | |||

HMC Chicago LLC | Delaware | 7011 | 52-2095412 | |||

HMC HPP LLC | Delaware | 7011 | 52-2095412 | |||

HMC Desert LLC | Delaware | 7011 | 52-2095412 | |||

HMC Hanover LLC | Delaware | 7011 | 52-2095412 | |||

HMC Diversified LLC | Delaware | 7011 | 52-2095412 | |||

HMC Properties I LLC | Delaware | 7011 | 52-2095412 | |||

HMC Potomac LLC | Delaware | 7011 | 52-2095412 | |||

HMC East Side II LLC | Delaware | 7011 | 52-2095412 | |||

HMC Manhattan Beach LLC | Delaware | 7011 | 52-2095412 | |||

Chesapeake Hotel Limited Partnership | Delaware | 7011 | 52-1373476 |

Table of Contents

Name | State of other Jurisdiction Formation | Primary Standard Industrial Classification Code Number | IRS Employer Number | |||

HMH General Partner Holdings LLC | Delaware | 7011 | 52-2095412 | |||

HMC IHP Holdings LLC | Delaware | 7011 | 52-2095412 | |||

HMC OP BN LLC | Delaware | 7011 | 52-2095412 | |||

S.D. Hotels LLC | Delaware | 7011 | 52-2095412 | |||

HMC Gateway LLC | Delaware | 7011 | 52-2095412 | |||

HMC Pacific Gateway LLC | Delaware | 7011 | 52-2095412 | |||

HMC Market Street LLC | Delaware | 7011 | 52-2095412 | |||

New Market Street LP | Delaware | 7011 | 52-2131023 | |||

Times Square LLC | Delaware | 7011 | 52-2095412 | |||

Times Square GP LLC | Delaware | 7011 | 52-2095412 | |||

HMC Atlanta LLC | Delaware | 7011 | 52-2095412 | |||

Ivy Street LLC | Delaware | 7011 | 52-2095412 | |||

HMC Properties II LLC | Delaware | 7011 | 52-2138453 | |||

Santa Clara HMC LLC | Delaware | 7011 | 52-2095412 | |||

HMC BCR Holdings LLC | Delaware | 7011 | 52-2095412 | |||

HMC Palm Desert LLC | Delaware | 7011 | 52-2095412 | |||

HMC Georgia LLC | Delaware | 7011 | 52-2095412 | |||

HMC SFO LLC | Delaware | 7011 | 52-2095412 | |||

Market Street Host LLC | Delaware | 7011 | 52-2091669 | |||

HMC Property Leasing LLC | Delaware | 7011 | 52-2095412 | |||

HMC Host Restaurants LLC | Delaware | 7011 | 52-2095412 | |||

Durbin LLC | Delaware | 7011 | 52-2095412 | |||

HMC HT LLC | Delaware | 7011 | 52-2095412 | |||

HMC JWDC LLC | Delaware | 7011 | 52-2095412 | |||

HMC OLS I LLC | Delaware | 7011 | 52-2095412 | |||

HMC OLS II L.P. | Delaware | 7011 | 52-2095412 | |||

HMC/Interstate Manhattan Beach, L.P. | Delaware | 7011 | 52-2033807 | |||

Ameliatel | Florida | 7011 | 58-1861162 | |||

HMC Amelia I LLC | Delaware | 7011 | 52-2095412 | |||

HMC Amelia II LLC | Delaware | 7011 | 52-2095412 | |||

Rockledge Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Fernwood Hotel LLC | Delaware | 7011 | 52-2095412 | |||

HMC Copley LLC | Delaware | 7011 | 52-2095412 | |||

HMC Headhouse Funding LLC | Delaware | 7011 | 52-2095412 | |||

Ivy Street Hopewell LLC | Delaware | 7011 | 52-2095412 | |||

HMC Diversified American Hotels, L.P. | Delaware | 7011 | 52-1646207 | |||

Potomac Hotel Limited Partnership | Delaware | 7011 | 52-1240223 | |||

HMC AP GP LLC | Delaware | 7011 | 52-2171352 | |||

HMC AP LP | Delaware | 7011 | 52-2171371 | |||

HMC AP Canada Company | Nova Scotia | 7011 | 89-8505540 | |||

HMC Toronto Airport GP LLC | Delaware | 7011 | 52-2187400 | |||

HMC Toronto Airport LP | Delaware | 7011 | 52-2187401 | |||

HMC Toronto EC GP LLC | Delaware | 7011 | 52-2187402 | |||

HMC Toronto EC LP | Delaware | 7011 | 52-2187404 | |||

HMC Charlotte GP LLC | Delaware | 7011 | 52-2171369 | |||

HMC Charlotte LP | Delaware | 7011 | 52-2171370 | |||

HMC Charlotte (Calgary) Company | Nova Scotia | 7011 | 86-9552752 | |||

Calgary Charlotte Holdings Company | Nova Scotia | 7011 | 89-9552752 | |||

HMC Grace (Calgary) Company | Nova Scotia | 7011 | 87-1258026 | |||

HMC Maui LLC | Delaware | 7011 | 52-2095412 | |||

Calgary Charlotte Partnership | Alberta | 7011 | 86-9552752 |

Table of Contents

Name | State of other Jurisdiction of Formation | Primary Standard Industrial Classification Code Number | IRS Employer Number | |||

HMC Chicago LakeFront LLC | Delaware | 7011 | 52-2095412 | |||

HMC East Side LLC | Delaware | 7011 | 52-2171365 | |||

HMC Kea Lani LLC | Delaware | 7011 | 52-2095412 | |||

East Side Hotel Associates, L.P. | Delaware | 7011 | 52-1892518 | |||

HMC O’Hare Suites Ground LLC | Delaware | 7011 | 52-2095412 | |||

HMC Toronto Air Company | Nova Scotia | 7011 | 89-4596683 | |||

HMC Toronto EC Company | Nova Scotia | 7011 | 12-1597207 | |||

HMC Lenox LLC | Delaware | 7011 | 52-2095412 | |||

Host Realty Partnership, L.P. | Delaware | 7011 | 52-2095412 | |||

Host Houston Briar Oaks, LP | Delaware | 7011 | 52-2095412 | |||

Cincinnati Plaza LLC | Delaware | 7011 | 52-2095412 | |||

Host Cincinnati II LLC | Delaware | 7011 | 52-2095412 | |||

Host Cincinnati Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Host Financing LLC | Delaware | 7011 | 52-2095412 | |||

Host Fourth Avenue LLC | Delaware | 7011 | 52-2095412 | |||

Host Indianapolis I LLC | Delaware | 7011 | 52-2095412 | |||

Host Los Angeles LLC | Delaware | 7011 | 52-2095412 | |||

Host Mission Hills, L.L.C. | Delaware | 7011 | 52-2095412 | |||

Host Mission Hills II LLC | Delaware | 7011 | 52-2095412 | |||

Host Mission Hills Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Host Needham LLC | Delaware | 7011 | 52-2095412 | |||

Host Needham II LLC | Delaware | 7011 | 52-2095412 | |||

Host Needham Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Host Realty LLC | Delaware | 7011 | 52-2095412 | |||

Host Realty Company LLC | Delaware | 7011 | 52-2095412 | |||

Host Realty Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Host Tucson LLC | Delaware | 7011 | 52-2095412 | |||

Host Waltham LLC | Delaware | 7011 | 52-2095412 | |||

Host Waltham II LLC | Delaware | 7011 | 52-2095412 | |||

Host Waltham Hotel LLC | Delaware | 7011 | 52-2095412 | |||

HST LT LLC | Delaware | 7011 | 52-2095412 | |||

HST I LLC | Delaware | 7011 | 52-2095412 | |||

South Coast Host Hotel LLC | Delaware | 7011 | 52-2095412 | |||

Starlex LLC | Delaware | 7011 | 52-2095412 |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(3)

Registration No.: 333-135077

Subject to completion, dated December 11, 2006

Prospectus

Offer to Exchange all Outstanding

6 7/8% Series R Senior Notes due 2014

for

6 7/8% Series S Senior Notes due 2014

of

HOST HOTELS & RESORTS, L.P.

We are offering to exchange all of our outstanding 6 7/8% Series R senior notes for our 6 7/8% Series S senior notes. The terms of the Series S senior notes are substantially identical to the terms of the Series R senior notes except that the Series S senior notes are registered under the Securities Act of 1933, as amended, and are therefore freely transferable. The Series R senior notes were issued on November 2, 2006 and, as of the date of this prospectus, an aggregate principal amount of $500 million is outstanding.

Please consider the following:

| • | Our offer to exchange the notes expires at 5:00 p.m., New York City time, on , 2007 unless extended. |

| • | You should carefully review the procedures for tendering the Series R senior notes. If you do not follow those procedures, we may not exchange your Series R senior notes for Series S senior notes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | If you fail to tender your Series R senior notes, you will continue to hold unregistered securities and your ability to transfer them could be adversely affected. |

| • | There is currently no public market for the Series S senior notes. We do not intend to list the Series S senior notes on any securities exchange. Therefore, we do not anticipate that an active public market for these notes will develop. |

Information about the Series S senior notes:

| • | The notes will mature on November 1, 2014. We will pay interest on the notes semi-annually in cash in arrears at the rate of 6 7/8% per year payable on May 1 and November 1, commencing May 1, 2007. |

| • | The notes are equal in right of payment with all of our unsubordinated indebtedness and senior to all of our subordinated obligations, subject to certain limitations set forth in the section entitled “Description of Series S Senior Notes.” For further information on ranking, see also the section entitled “Risk Factors.” |

| • | The Series S senior notes will be guaranteed by certain of our subsidiaries, comprising all of our subsidiaries that have also guaranteed our credit facility and other indebtedness. |

| • | As security for the notes, we have pledged the common equity interests of those of our direct and indirect subsidiaries which also secure, on an equal and ratable basis, our credit facility and approximately $3.3 billion of our other outstanding existing senior notes (excluding our Series R senior notes as of September 8, 2006). |

Broker-dealers receiving Series S senior notes in exchange for Series R senior notes acquired for their own account through market-making or other trading activities must deliver a prospectus in any resale of the Series S senior notes.

Investing in the Series S senior notes involves risks. See “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2006.

Table of Contents

Each broker-dealer that receives the Series S senior notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Series S senior notes. The letter of transmittal delivered with this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Series S senior notes received in exchange for Series R senior notes where such Series R senior notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the earlier to occur of (1) the date when all the Series S senior notes held by a broker-dealer have been sold and (2) 180 days after consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in this prospectus. You must not rely upon any information or representation not contained in this prospectus as if we had authorized it. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus contains registered trademarks that are the exclusive property of their respective owners, which are companies other than us, including Marriott®, Ritz-Carlton®, Hyatt®, Four Seasons®, Fairmont®, Hilton®, Swissôtel®, Westin®, Sheraton®, W Hotels®, The Luxury Collection® and St. Regis®. None of the owners of these trademarks, their affiliates or any of their respective officers, directors, agents or employees, is an issuer or underwriter of the Series S Senior Notes being offered. In addition, none of such persons has or will have any responsibility or liability for any information contained in this prospectus.

| Page | ||

| 1 | ||

| 11 | ||

| 27 | ||

| 29 | ||

| 36 | ||

Ratios of Earnings to Fixed Charges and Preferred OP Unit Distributions | 36 | |

| 37 | ||

| 39 | ||

Management’s Discussion and Analysis of Results of Operations and Financial Condition | 40 | |

| 92 | ||

| 94 | ||

| 112 | ||

Security Ownership of Certain Beneficial Owners and Management | 124 | |

| 126 | ||

| 130 | ||

| 138 | ||

| 144 | ||

| 194 | ||

| 195 | ||

| 196 | ||

| 196 | ||

| 196 | ||

| F-1 |

Table of Contents

This summary contains a general summary of the information contained in this prospectus. The summary may not contain all of the information that is important to you, and it is qualified in its entirety by the more detailed information and financial statements, including the notes to those financial statements, that are part of this registration statement. You should carefully consider the information contained in this entire prospectus including the information set forth in the section entitled “Risk Factors,” beginning on page 11 of this prospectus. In this prospectus we use the terms “operating partnership” or “Host LP” to refer to Host Hotels & Resorts, L.P. and its consolidated subsidiaries and “Host” to refer to Host Hotels & Resorts, Inc., a Maryland corporation in cases where it is important to distinguish between Host and Host LP. The terms “we” or “our” refer to Host and Host LP together, unless the context indicates otherwise.

Host Hotels & Resorts, L.P.

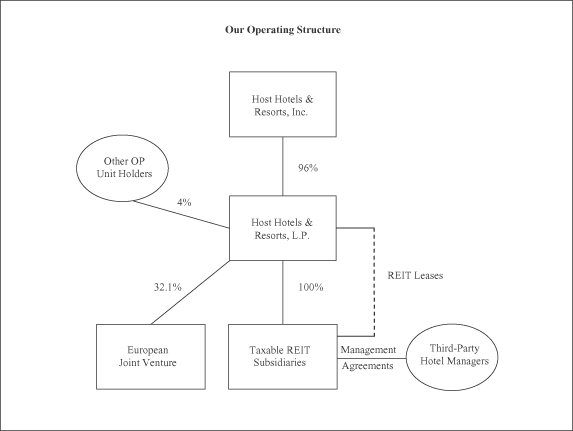

Host LP is a Delaware limited partnership operating through an umbrella partnership structure with Host as the sole general partner. Together with Host, we operate as a self-managed and self-administered real estate investment trust, or REIT. In addition to being the sole general partner, Host holds approximately 96% of our partnership interests.

As of December 1, 2006, our lodging portfolio consisted of 128 full-service hotel properties containing approximately 67,000 rooms. Our portfolio is geographically diverse with hotels in most of the major metropolitan areas in 28 states, Washington, D.C., Toronto and Calgary, Canada, Mexico City, Mexico and Santiago, Chile. Our locations include central business districts of major cities, near airports and resort/convention locations. Our hotels are operated under such brand names as Marriott, Ritz-Carlton, Hyatt, Four Seasons, Fairmont, Hilton, Swissôtel, Westin, Sheraton, W Hotels, The Luxury Collection and St. Regis.

The address of our principal executive office is 6903 Rockledge Drive, Suite 1500, Bethesda, Maryland, 20817. Our phone number is (240) 744-1000. Host’s Internet website address is www.hosthotels.com.

The Starwood Transactions

Starwood Acquisition

On April 10, 2006, we acquired 25 domestic hotels and three foreign hotels from Starwood Hotels & Resorts Worldwide, Inc., or Starwood, through a series of transactions, including the merger of Starwood Hotels & Resorts, a Maryland real estate investment trust, or Starwood Trust, with and into a subsidiary of Host, the acquisition of the capital stock of Sheraton Holding Corporation and the acquisition of four domestic hotels in a purchase structured to allow Host’s subsidiaries to complete like-kind exchange transactions for federal income tax purposes. These transactions were completed pursuant to the Master Agreement and Plan of Merger, dated as of November 14, 2005, and amended as of March 24, 2006 (the “Master Agreement”), among Host, Host LP, Starwood, Starwood Trust and certain of their respective affiliates. A joint venture in Europe, in which we own a 32.1% general and limited partner interest, acquired four European hotels on May 3, 2006 and one European hotel on June 13, 2006. We also contributed one hotel we acquired from Starwood, the Sheraton Warsaw Hotel & Towers, Warsaw, Poland, to the joint venture. See the below discussion of the European joint venture. Collectively, we refer to these transactions throughout this prospectus as the Starwood Transactions.

For the 28 hotels included in the initial closing, the total consideration paid by Host to Starwood and its shareholders included the issuance of $2.27 billion of equity (133,529,412 shares of Host common stock) to Starwood stockholders, the assumption of $77 million in debt and the cash payment of approximately $748 million, which includes closing costs. The exchange price of Host common stock of $16.97 per share was

1

Table of Contents

calculated based on guidance set forth in Emerging Issues Task Force Issue No. 99-12, as the average of the closing prices of Host common stock during the range of trading days from two days before and after the November 14, 2005 announcement date. The amount of cash consideration paid under the Master Agreement is subject to adjustments for, among other things, the amount of working capital at the applicable closings and certain capital expenditures. For each share of Host common stock issued in the transaction, we issued an equivalent OP unit to Host.

At the closing of the Starwood Transactions, Host and Starwood entered into certain agreements to govern their relationship going forward. In particular, Host and Starwood, through their respective subsidiaries, entered into operating agreements (pursuant to which Starwood provides management services for the hotels acquired by Host) and license agreements (which address rights to use service marks, logos, symbols and trademarks, such as Westin®, Sheraton® and W®). The combined terms of the operating and license agreements with Starwood are structured to be generally comparable to Host’s established management agreements with its other third-party managers (such as Marriott International, Hyatt and Hilton).

Under each operating agreement, Starwood provides comprehensive management services for the hotels for an initial term of 20 years each, with two renewal terms of 10 years each at Starwood’s option and subject to certain conditions. Starwood will receive compensation in the form of a base fee of 1% of annual gross revenues, and an incentive fee of 20% of annual gross operating profit, after Host has received a priority return of 10.75% on its purchase price and other investments in the hotels. In addition, the operating agreements require Host to provide funding up to 5% of the gross operating revenue of each hotel for any required capital expenditures (including replacements of furniture, fixtures and equipment) and building capital improvements.

In addition to rights relating to the subject brand, the license agreement addresses matters relating to compliance with certain standards and policies and the provisions of certain system program and centralized services. The license agreements have an initial term of 20 years each, with two renewal terms of 10 years each at Starwood’s option and subject to certain conditions. Starwood will receive compensation in the form of a license fee of 5% of gross operating revenue attributable to room sales and 2% of gross operating revenue attributable to food and beverage sales. In addition, the license agreements limit Host’s ability to sell, lease or otherwise transfer any hotel by requiring that the transferee assume the related operating agreement and meet other specified conditions.

European Joint Venture

In conjunction with the Starwood Transactions, we entered into an Agreement of Limited Partnership, forming a joint venture in The Netherlands with Stichting Pensioenfonds ABP, the Dutch pension fund (“ABP”), and Jasmine Hotels Pte Ltd, a subsidiary of GIC Real Estate Pte Ltd (“GIC RE”), the real estate investment company of the Government of Singapore Investment Corporation Pte Ltd (GIC). The purpose of the joint venture is the acquisition and ownership of hotels located in Europe.

The current aggregate size of the joint venture is approximately €952 million, including total capital contributions of approximately €353 million, of which a total of approximately €103 million was contributed by us in the form of cash and through the contribution of the Sheraton Warsaw Hotel & Towers, which we contributed on May 2, 2006. Through newly-formed Dutch BVs (private companies with limited liability), we are a limited partner in the joint venture (together with ABP and GIC RE, the “Limited Partners”) and also serve as the general partner for the joint venture. The percentage interest of the parties in the joint venture are 19.9% for ABP, 48% for GIC RE and 32.1% for Host LP (including our limited and general partner interests).

On May 3, 2006, the joint venture acquired from Starwood the following four hotels: the Sheraton Roma Hotel & Conference Center, Rome, Italy; The Westin Palace, Madrid, Spain; the Sheraton Skyline Hotel &

2

Table of Contents

Conference Centre, Hayes, United Kingdom; and The Westin Palace, Milan, Italy. The Westin Europa & Regina, Venice, Italy was acquired by the joint venture on June 13, 2006.

On August 4, 2006, the joint venture purchased the Hotel Arts Barcelona for approximately €417 million ($537 million), including the assumption of approximately €277 million ($357 million) of mortgage debt with an interest rate of approximately 5%. The 483-room Ritz-Carlton managed hotel is located in Barcelona, Spain.

The partners recently finalized an additional amendment to further expand the joint venture. Under the amended agreement, the partners agreed to increase the aggregate size of the joint venture to approximately €533 million of equity (of which a total of approximately €171 million would be contributed by Host LP) and, after giving effect to indebtedness the joint venture would be expected to incur, the aggregate size of the joint venture, once all funds are invested, would be approximately €1.5 billion. In connection with the expanded joint venture, the partners agreed that they would make investments that are consistent with the joint venture’s investment parameters for a period of two years (three years in the case of Host LP) until at least 90% of the joint venture’s committed capital is called or reserved for use prior to such date.

Pursuant to the agreements, distributions to partners will be made on a pro-rata basis (based on their limited partnership interests) until certain return thresholds are met. As those thresholds are met, our general partnership interest will receive an increasing percentage of the distributions. An affiliate of Host LP has entered into an asset management agreement with the joint venture to provide asset management services in return for a quarterly asset management fee. Host LP or its affiliates will be responsible for paying certain expenses related to asset management, including all salaries and benefits of employees and related overhead, including rent, utilities, office equipment, necessary administrative and clerical functions and other similar overhead expenses. The initial term of the joint venture is ten years subject to two one-year extensions with partner approval. Due to the ownership structure of the joint venture described above and the non-Host limited partners’ rights to cause the dissolution and liquidation of the joint venture at any time, the joint venture is not consolidated in our financial statements.

3

Table of Contents

THE EXCHANGE OFFER

Securities to be exchanged | On November 2, 2006, we sold $500 million in aggregate principal amount of Series R senior notes in a transaction exempt from the registration requirements of the Securities Act of 1933, or the Securities Act. The terms of the Series R senior notes and the Series S senior notes are substantially identical in all material respects, except that the Series S senior notes will be freely transferable by the holders thereof except as otherwise provided in this prospectus. |

The exchange offer | We are offering to exchange $500 million principal amount of Series R senior notes for a like principal amount of Series S senior notes. Series R senior notes may be exchanged only in multiples of $1,000 principal amount. |

Registration rights agreement | We sold the Series R senior notes on November 2, 2006 in a private placement in reliance on Section 4(2) of the Securities Act. The Series R senior notes were immediately resold by their initial purchasers in reliance on Securities Act Rule 144A and Regulation S under the Securities Act. In connection with the sale, we entered into a registration rights agreement with the initial purchasers requiring us to make this exchange offer. Under the registration rights agreement, we are required to cause the registration statement, of which this prospectus forms a part, to become effective on or before the 230th day following the date on which we issued the Series R senior notes, and we are obligated to consummate the exchange offer on or before the 260th day following the issuance of the Series R senior notes. |

Expiration date | Our exchange offer will expire at 5:00 p.m., New York City time, , 2007, or at a later date and time to which we may extend it. |

Withdrawal | You may withdraw a tender of Series R senior notes pursuant to our exchange offer at any time before 5:00 p.m., New York City time, on , 2007, or such later date and time to which we extend the offer. We will return any Series R senior notes that we do not accept for exchange for any reason as soon as practicable after the expiration or termination of our exchange offer. |

Interest on the Series S senior notes and Series R senior notes | Interest on the Series S senior notes will accrue from the date of the original issuance of the Series R senior notes or from the date of the last payment of interest on the Series R senior notes, whichever is later. We will not pay interest on Series R senior notes tendered and accepted for exchange. |

Conditions to our exchange offer | Our exchange offer is subject to customary conditions, which are discussed in the section entitled “The Exchange Offer.” As described in that section, we have the right to waive some of the conditions. |

4

Table of Contents

Procedures for tendering Series R senior notes | We will accept for exchange any and all Series R senior notes that are properly tendered (and not withdrawn) in the exchange offer prior to 5:00 p.m., New York City time, on , 2007. The Series S senior notes issued pursuant to our exchange offer will be delivered promptly following the expiration date. |

If you wish to accept our exchange offer, you must complete, sign and date the letter of transmittal, or a copy, in accordance with the instructions contained in this prospectus and therein, and mail or otherwise deliver the letter of transmittal, or the copy, together with the Series R senior notes and all other required documentation, to the exchange agent at the address set forth in this prospectus. If you are a person holding Series R senior notes through the Depository Trust Company, or DTC, and wish to accept our exchange offer, you may do so pursuant to the DTC’s Automated Tender Offer Program, or ATOP, by which you will agree to be bound by the letter of transmittal. By executing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things:

| • | the Series S senior notes that you acquire pursuant to the exchange offer are being obtained by you in the ordinary course of your business, whether or not you are the registered holder of the Series S senior notes; |

| • | you are not engaging in and do not intend to engage in a distribution of Series S senior notes; |

| • | you do not have an arrangement or understanding with any person to participate in a distribution of Series S senior notes; and |

| • | you are not our “affiliate,” as defined under Securities Act Rule 405. |

Under the registration rights agreement we may be required to file a “shelf” registration statement for a continuous offering pursuant to Rule 415 under the Securities Act in respect of the Series R senior notes, if:

| • | we determine that we are not permitted to effect the exchange offer as contemplated by this prospectus because of any change in law or Securities and Exchange Commission policy; or |

| • | we have commenced and not consummated the exchange offer within 260 days following the date on which we issued the Series R senior notes. |

Exchange agent | The Bank of New York is serving as exchange agent in connection with the exchange offer. |

5

Table of Contents

Federal income tax considerations | We believe the exchange of Series R senior notes for Series S senior notes pursuant to our exchange offer will not constitute a sale or an exchange for Federal income tax purposes. For further information, see the section entitled “Certain United States Federal Tax Consequences.” |

Effect of not tendering | If you do not tender your Series R senior notes or if you do tender them but they are not accepted by us, your Series R senior notes will continue to be subject to the existing restrictions upon transfer. Except for our obligation to file a shelf registration statement under the circumstances described above, we will have no further obligation to provide for the registration under the Securities Act of Series R senior notes. |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Series S senior notes. |

6

Table of Contents

THE SERIES S SENIOR NOTES

The summary below describes the principal terms of the Series S senior notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. For a more detailed description of the terms and conditions of the Series S senior notes, see the section entitled “Description of Series S Senior Notes.”

Issuer | Host Hotels & Resorts, L.P. |

Securities Offered | $500,000,000 aggregate principal amount of 6 7/8% Series S senior notes due 2014. |

Maturity | November 1, 2014. |

Interest | Interest on the Series S senior notes will accrue at an annual rate of 6 7/8%. Interest will be paid semi-annually in arrears on May 1 and November 1 of each year, beginning on May 1, 2007. |

Ranking | The Series S senior notes are senior to all of our subordinated obligations and are equal in right of payment to our credit facility, our outstanding series of senior notes issued pursuant to our Amended and Restated Indentures dated August 5, 1998, as supplemented (which we refer to as our “existing senior notes”) set forth below: |

| • | $242 million 9 1/4% Series G senior notes due October 2007; |

| • | $725 million 7 1/8% Series K senior notes due November 2013; |

| • | $350 million 7% Series M senior notes due August 2012; |

| • | $650 million 6 3/8% Series O senior notes due March 2015; |

| • | $800 million of 6 7/8% Series Q senior notes due June 2016; and |

| • | $500 million 3.25% Exchangeable Senior Debentures due April 2024. |

The series S senior notes will also be senior to our other unsubordinated indebtedness under the indenture terms governing the Series S senior notes and our outstanding Series K, Series M, Series O and Series Q senior notes, we and the subsidiary guarantors are permitted to incur up to $300 million ($400 million in the case of the Series Q senior notes and the Series S senior notes) of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the terms of our Series G senior notes, we may not be permitted to incur this indebtedness while any of such existing senior notes remain outstanding. The Series S senior notes and the existing senior notes effectively will be subordinated to all secured indebtedness that may be incurred under the indenture, to the extent of the value of the collateral securing such

7

Table of Contents

indebtedness. For further information on ranking, see “Risk Factors—The Series S senior notes and the related subsidiary guarantees effectively will be junior in right of payment to some other liabilities” and “Description of Series S Senior Notes—General.” |

As of September 8, 2006, as adjusted to give effect to the offering of the Series R senior notes and the application of proceeds therefrom and certain other transactions that have occurred since the balance sheet date, we and our restricted subsidiaries would have had approximately $5.9 billion of total debt, of which approximately $2.0 billion would have been secured by mortgage liens on various of our hotel properties and related assets of ours and our restricted subsidiaries. See “Capitalization.” |

Guarantors | The Series S senior notes are guaranteed by certain of our direct and indirect subsidiaries, representing all of our subsidiaries that have also guaranteed our credit facility, our existing senior notes and certain of our other indebtedness. The guarantees may be released under certain circumstances. We are generally not required to cause future subsidiaries to become guarantors unless they secure our credit facility, the existing senior notes or certain of our other indebtedness. |

For more detail, see the section entitled “Risk Factors—The Series S senior notes and the related subsidiary guarantees effectively will be junior in right of payment to some other liabilities.” |

Security | The Series S senior notes will be secured by a pledge of the common equity interests of certain of our direct and indirect subsidiaries, which common equity interests also secure, on an equal and ratable basis, our credit facility, and approximately $3.3 billion of our outstanding existing senior notes and will secure certain other future unsubordinated indebtedness ranking equal in right of payment with the Series S senior notes. Under the indenture terms governing the Series S senior notes and our outstanding Series K, Series M, Series O and Series Q senior notes, we and the subsidiary guarantors may incur up to $300 million ($400 million in the case of the Series Q senior notes and the Series S senior notes) of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the terms of several series of our existing senior notes, we may not be permitted to incur this indebtedness while any such existing senior notes remain outstanding. See “Description of Series S Senior Notes—Ranking.” The Series S senior notes and our existing senior notes effectively will be subordinated to all secured indebtedness that may be incurred under the indenture, to the extent of the value of the collateral securing such indebtedness. |

8

Table of Contents

Under the credit facility, we have the right to release all pledges of capital stock in the event that our leverage ratio is below 6:00 to 1:00 for two consecutive quarters and no event of default exists. Because our leverage ratio is currently below 6:00 to 1:00, effective October 12, 2005, we exercised this right for pledges of capital stock that would have been otherwise required subsequent to this date. Hence, since October 12, 2005, no new pledges of capital stock have been made for the benefit of the credit facility banks and holders of senior notes. In certain cases, a requirement to pledge additional capital stock can otherwise result from the acquisition of entities owning hotel properties.

We have not, however, released pledges of capital stock existing as of October 12, 2005, although we have the right to do so at any time and no assurances can be made that we will not exercise this right at any time. The credit facility also requires us to reinstate the pledges of capital stock should our leverage ratio subsequently exceed 6:00 to 1:00 for two consecutive quarters.

For more detail, see the section entitled “Risk Factors—The Series S senior notes and the related subsidiary guarantees effectively will be junior in right of payment to some other liabilities.” |

Optional Redemption | At any time prior to November 1, 2010, the Series S senior notes will be redeemable at our option, in whole, but not in part, for 100% of their principal amount, plus the make-whole premium described in this prospectus, plus accrued and unpaid interest to the applicable redemption date. For more details, see the section entitled “Description of Series S Senior Notes—Optional Redemption.” |

Beginning November 1, 2010, we may redeem, in whole or in part, the Series S senior notes at any time at the prices set forth in the section entitled “Description of Series S Senior Notes—Optional Redemption.”

In addition, prior to November 1, 2009, we may redeem up to 35% of the aggregate principal amount of the Series S senior notes at the price set forth in the section entitled “Description of Series S Senior Notes—Optional Redemption” together with any accrued and unpaid interest to the applicable redemption date with the net cash proceeds of certain sales of our or Host’s equity securities.

Mandatory Offer to Repurchase | If we sell certain assets or undergo certain kinds of changes of control, we must offer to repurchase the Series S senior notes as described in the section entitled “Description of Series S Senior Notes—Repurchase of Notes at the Option of the Holder upon a Change of Control Triggering Event.” |

9

Table of Contents

Basic Covenants of the Indenture | The indenture governing the Series S senior notes, among other things, restricts our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness; |

| • | pay dividends on, redeem or repurchase our equity interests; |

| • | make investments; |

| • | permit payment or dividend restrictions on certain of our subsidiaries; |

| • | sell assets; |

| • | in the case of our restricted subsidiaries, guarantee indebtedness; |

| • | create certain liens; and |

| • | sell certain assets or merge with or into other companies. |

All of these limitations are subject to important exceptions and qualifications described in the section entitled “Description of Series S Senior Notes—Covenants.”

The covenants and restrictions under the indenture that are applicable to the Series S senior notes provide us with more flexibility in a number of important ways. For a summary of the material ways that the terms of the Series S senior notes differ from those applicable to our Existing Senior Notes, see the discussion under “Description of Other Indebtedness—Senior Notes and Debentures.” Notwithstanding this flexibility provided to us, so long as any of our Existing Senior Notes remain outstanding, our ability to fully benefit from the additional flexibility is likely to be limited.

Risk Factors | Investment in the Series S senior notes involves risks. You should carefully consider the information under the section entitled “Risk Factors” and all other information included in this prospectus before investing in the Series S senior notes. |

10

Table of Contents

You should carefully consider the following risk factors, in addition to the other information contained in this prospectus, before deciding to tender Series R senior notes in the exchange offer.

Risks Relating to this Offering

We have substantial leverage.

We have significant indebtedness and we will continue to have significant indebtedness after the exchange of the Series R senior notes. As adjusted to give effect to the issuance of Series R senior notes and the application of proceeds therefrom, and certain other debt transactions that have occurred since the balance sheet date, we would have had total indebtedness of approximately $5.9 billion (of which approximately $3.8 billion would have consisted of senior notes, approximately $2.0 billion would have been secured by mortgage liens on various of our hotel properties and related assets, and the balance would have consisted of other debt).

Our substantial indebtedness has important consequences. It currently requires us to dedicate a substantial portion of our cash flow from operations to payments of principal and interest on our indebtedness, which reduces the availability of our cash flow to fund working capital, capital expenditures, expansion efforts, distributions to our partners and other general purposes. Additionally, it could:

| • | make it more difficult for us to satisfy our obligations with respect to the Series S senior notes offered hereby; |

| • | limit our ability in the future to undertake refinancings of our debt or obtain financing for expenditures, acquisitions, development or other general business purposes on terms and conditions acceptable to us, if at all; or |

| • | affect adversely our ability to compete effectively or operate successfully under adverse economic conditions. |

Because Host must distribute 90% of its taxable income (other than net capital gains) in order to maintain its qualification as a REIT, we depend upon external sources of capital for future growth. If our cash flow and working capital were not sufficient to fund our expenditures or service our indebtedness, we would have to raise additional funds through:

| • | sales of operating partnership common units, or OP units; |

| • | the incurrence of additional permitted indebtedness by us; or |

| • | the sale of our assets. |

We cannot assure you that any of these sources of funds would be available to us or, if available, would be on terms that we would find acceptable or in amounts sufficient for us to meet our obligations or fulfill our business plan.

The Series S senior notes and the related subsidiary guarantees effectively will be junior in right of payment to some other liabilities.

Only our subsidiaries that have guaranteed or will be required to guarantee payment of certain of our indebtedness ranking equal in priority to the Series S senior notes, including the credit facility, the existing senior notes and future indebtedness that is similarly guaranteed, have guaranteed, and are required to guarantee, our obligations under the Series S senior notes. Although the indenture governing the terms of the Series S senior notes places limits on the overall level of indebtedness that non-guarantor subsidiaries may incur, the Series S senior notes effectively will be junior in right of payment to liabilities of our non-guarantor subsidiaries and to any debt of ours or our subsidiaries that is secured by assets other than the equity interests in our subsidiaries

11

Table of Contents

securing the Series S senior notes, to the extent of the value of such assets. Since only those subsidiaries that guarantee the credit facility, the existing senior notes or certain of our other indebtedness are required to guarantee the Series S senior notes, there can be no assurance as to the number of subsidiaries that will be guarantors of the Series S senior notes at any point in time or as to the value of their assets or significance of their operations.

Under the terms of the indenture applicable to the Series S senior notes, subject to satisfaction of certain other requirements, we, the subsidiary guarantors and our respective restricted subsidiaries may incur debt secured by our respective assets (other than the equity interests of our subsidiaries securing the credit facility, the existing senior notes and the Series S senior notes). For a discussion of our ability to incur such secured debt, see “Description of Series S Senior Notes—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock.” Neither the Series S senior notes nor the related subsidiary guarantees thereof will be secured by those assets and the Series S senior notes and such subsidiary guarantees effectively will be junior in right of payment to this secured debt to the extent of the value of the assets securing such debt. As of September 8, 2006, after giving effect to the issuance of the Series R senior notes and the application of proceeds therefrom, and certain other debt transactions that have occurred since the balance sheet date, we and our subsidiaries would have had approximately $2.0 billion of debt secured by mortgages on 29 of our hotels and related assets.

In addition, under the indenture covenants that are applicable to the Series K, Series M, Series O and Series Q senior notes, and that will be applicable to the Series S senior notes, we and the subsidiary guarantors may also incur up to $300 million ($400 million in the case of the Series S senior notes) of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the indenture covenants applicable to our outstanding Series G senior notes, we may not be permitted to incur this indebtedness while any of such existing senior notes remain outstanding. See “Description of Series S Senior Notes—Ranking.” The Series S senior notes will be subordinated to this and to all other secured indebtedness that may be incurred under the indenture governing the Series S senior notes, to the extent of the value of the collateral securing such secured indebtedness.

The terms of our debt place restrictions on us and our subsidiaries, reducing operational flexibility and creating default risks.

The documents governing the terms of the Series S senior notes, our existing senior notes and our credit facility contain covenants that place restrictions on us and our subsidiaries. These covenants restrict, among other things, our ability and the ability of our subsidiaries to:

| • | conduct acquisitions, mergers or consolidations unless the successor entity in such transaction assumes our indebtedness; |

| • | incur additional debt in excess of certain thresholds and without satisfying certain financial metrics; |

| • | create liens securing indebtedness, unless effective provision is made to secure our other indebtedness by such liens; |

| • | sell assets without using the proceeds from such sales for certain permitted uses or to make an offer to repay or repurchase outstanding indebtedness; |

| • | make capital expenditures in excess of certain thresholds; |

| • | raise capital; |

| • | make distributions without satisfying certain financial metrics; and |

| • | conduct transactions with affiliates other than on an arms length basis and, in certain instances, without obtaining opinions as to the fairness of such transactions. |

12

Table of Contents

In addition, certain covenants in the credit facility require us and our subsidiaries to meet financial performance tests. The restrictive covenants in the applicable indenture(s), the credit facility and the documents governing our other debt (including our mortgage debt) will reduce our flexibility in conducting our operations and will limit our ability to engage in activities that may be in our long-term best interest. Our failure to comply with these restrictive covenants could result in an event of default that, if not cured or waived, could result in the acceleration of all or a substantial portion of our debt. For a detailed description of the covenants and restrictions imposed by the documents governing our indebtedness, see “Description of Our Other Indebtedness.”

We will be permitted to make distributions to Host under certain conditions even when we cannot otherwise make restricted payments under the indenture and the credit facility.

Under the indenture terms governing the Series S senior notes and our existing senior notes, we are only allowed to make restricted payments if, at the time we make such a restricted payment, we are able to incur at least $1.00 of indebtedness under the “Limitation on Incurrences of Indebtedness and Issuance of Disqualified Stock” covenant. This covenant requires us to meet certain conditions in order to incur additional debt, including that we have a consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0 in order to make a restricted payment; except that, in the case of a preferred stock distribution, the covenant applicable to the Series S senior notes and our outstanding Series K, Series M, Series O and Series Q senior notes provides that we are only required to have a consolidated coverage ratio of at least 1.7 to 1.0. For a more complete discussion of the restricted payment and debt incurrence covenants of the indenture applicable to the Series S senior notes, see the following sections of this prospectus: “Description of Series S Senior Notes—Limitation on Restriction Payments”; and “Description of Series S Senior Notes—Limitation on Incurrences of Indebtedness and Issuance of Disqualified Stock.”

Even when we are unable to make restricted payments during a period in which we are unable to incur $1.00 of indebtedness, the indenture terms governing the Series S senior notes and our outstanding Series K, Series M, Series O and Series Q senior notes permit us, so long as Host believes in good faith after reasonable diligence that Host qualifies as a REIT under the Internal Revenue Code of 1986, as amended, or the Code, to make permitted REIT distributions, which are any distributions (1) to Host equal to the greater of (a) the amount estimated by Host in good faith after reasonable diligence to be necessary to permit Host to distribute to its shareholders with respect to any calendar year (whether made during such year or after the end thereof) 100% of the “real estate investment trust taxable income” of Host within the meaning of Section 857(b)(2) of the Code, determined without regard to deductions for dividends paid and the exclusions set forth in Code Sections 857(b)(2)(C), (D), (E) and (F) but including all net capital gains and net recognized built-in gains within the meaning of Treasury Regulations 1.337(d)-6 (whether or not such gains might otherwise be excluded or excludable therefrom); or (b) the amount that is estimated by Host in good faith after reasonable diligence to be necessary either to maintain Host’s status as a REIT under the Code for any calendar year or to enable Host to avoid the payment of any tax for any calendar year that could be avoided by reason of a distribution by Host to its shareholders, with such distributions to be made as and when determined by Host, whether during or after the end of the relevant calendar year; in either the case of (a) or (b) above if: (x) the aggregate principal amount of all our outstanding indebtedness and that of our restricted subsidiaries, on a consolidated basis, at such time is less than 80% of our Adjusted Total Assets (as defined in the indenture) and (y) no Default or Event of Default (as defined in the indenture) shall have occurred and be continuing, and (2) to certain other holders of our partnership units where such distribution is required as a result of, or a condition to, the payment of distributions to Host.

The indenture terms governing our Series G senior notes permit us to make permitted REIT distributions, which are defined therein as any distributions (1) to Host that are necessary to maintain Host’s status as a REIT under the Code or to satisfy the distributions required to be made by reason of Host’s making of the election provided for in Notice 88-19 (or Treasury regulations issued pursuant thereto) if the aggregate principal amount of all of our outstanding indebtedness and that of our restricted subsidiaries, on a consolidated basis, at such time is less than 80% of Adjusted Total Assets (as defined in the indenture) and (2) to certain other holders of our

13

Table of Contents

partnership units where such distribution is required as a result of, or a condition to, the payment of distributions to Host. We refer to the distribution that we are permitted to make which are summarized in this and the previous paragraph as “permitted REIT distributions.”

We intend, during any future period in which we are unable to make restricted payments under the indenture, and under similar restrictions under the credit facility, to continue our practice of distributing quarterly, based on our estimates of taxable income for any year, an amount of our available cash sufficient to enable Host to pay quarterly dividends on its preferred and common stock in an amount necessary to satisfy the requirements applicable to REITs under the Code. In the event that we make distributions to Host in amounts in excess of those necessary for Host to maintain its status as a REIT, we will be in default under the indenture terms governing our Series G senior notes. A default under any series of our existing senior notes could lead to a default under the Series S senior notes and the Series K, Series M, Series O and Series Q senior notes. See “Description of Series S Senior Notes—Events of Default.”

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture.

Upon the occurrence of certain change of control events, we will be required to offer to repurchase all outstanding series of existing senior notes and the Series S senior notes offered hereby. However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of senior notes or that restrictions in our credit facility will not allow us to make such repurchases. See “Description of Series S Senior Notes—Repurchase of Notes at the Option of the Holder Upon a Change of Control Triggering Event.”

Our failure to repurchase any of the Series S senior notes would be a default under the indenture for all series of senior notes issued thereunder and also under our credit facility.

The Series S senior notes or a guarantee thereof may be deemed a fraudulent transfer.

Under the Federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a guarantee of the Series S senior notes could be voided, or claims on a guarantee of the Series S senior notes could be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

| (1) | received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; and |

| (2) | either: |

| (a) | was insolvent or rendered insolvent by reason of such incurrence; |

| (b) | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| (c) | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

If such circumstances were found to exist, or if a court were to find that the guarantee were issued with actual intent to hinder, delay or defraud creditors, the court could cause any payment by that guarantor pursuant to its guarantee to be voided and returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

In addition, our obligations under the Series S senior notes may be subject to review under the same laws in the event of our bankruptcy or other financial difficulty. In that event, if a court were to find that when we issued the Series S senior notes the factors in clauses (1) and (2) above applied to us, or that the Series S senior notes

14

Table of Contents

were issued with actual intent to hinder, delay or defraud creditors, the court could void our obligations under the

Series S senior notes, or direct the return of any amounts paid thereunder to us or to a fund for the benefit of our creditors.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, the operating partnership or a guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets; or |

| • | the present fair value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

On the basis of historical financial information, recent operating history and other factors, we believe that we and each of our guarantors, after giving effect to the guarantee of the Series S senior notes, will be solvent, will have a reasonable amount of capital for the business in which we or it is engaged and will not have incurred debts beyond our or its ability to pay such debts as they mature. We can offer no assurance, however, as to what standard a court would apply in making such determinations or that a court would agree with our conclusions in this regard.

An active trading market may not develop for the notes.

The Series R senior notes are not listed on any securities exchange. Since their issuance, there has been a limited trading market for such notes. To the extent that Series R senior notes are tendered and accepted in the exchange offer, the trading market for untendered and tendered but unaccepted Series R senior notes will be adversely affected. We cannot assure you that this market will provide liquidity for you if you want to sell your Series R senior notes.

We will not list the Series S senior notes on any securities exchange. These notes are new securities for which there is currently no market. The Series S senior notes may trade at a discount from their initial offering price, depending upon prevailing interest rates, the market for similar securities, our performance and other factors. We have been advised by the initial purchasers of the Series R senior notes that they intend to make a market in the Series S senior notes, as well as the Series R senior notes, as permitted by applicable laws and regulations. However, they are not obligated to do so and their market making activities may be discontinued at any time without notice. In addition, their market making activities may be limited during our exchange offer. Therefore, we cannot assure you that an active market for Series S senior notes will develop.

Financial Risks and Risks of Operation

We depend on external sources of capital for future growth and we may be unable to access capital when necessary.

Unlike corporations, our ability to reduce our debt and finance our growth largely must be funded by external sources of capital because Host is required to distribute to its stockholders at least 90% of its taxable income (other than net capital gains) in order to qualify as a REIT, including taxable income it recognizes for federal income tax purposes but with regard to which it does not receive corresponding cash. Our ability to access the external capital we require could be hampered by a number of factors, many of which are outside of our control, including declining general market conditions, unfavorable market perception of our growth potential, decreases in our current and estimated future earnings, excessive cash distributions or decreases in the market price of Host’s common stock. In addition, our ability to access additional capital may also be limited by the terms of our existing indebtedness, which, among other things, restricts our incurrence of debt and the payment of distributions. The occurrence of any of these above-mentioned factors, individually or in

15

Table of Contents

combination, could prevent us from being able to obtain the external capital we require on terms that are acceptable to us or at all and the failure to obtain necessary external capital could have a material adverse effect on our ability to finance our future growth.

Our revenues and the value of our properties are subject to conditions affecting the lodging industry.

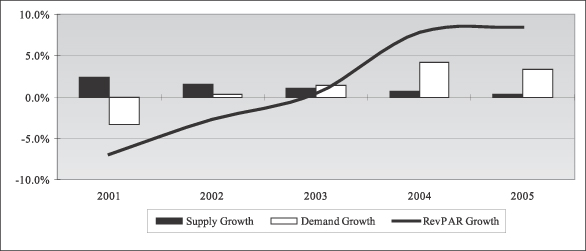

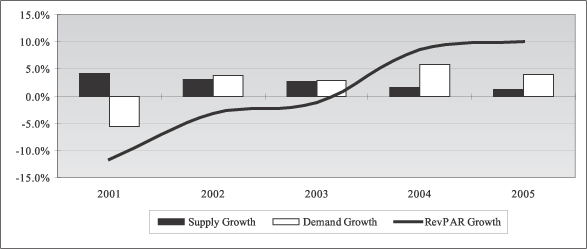

The lodging industry experienced a down-turn from 2001 to 2003, and operations generally declined during this period. The decline was attributed to a number of factors including a weak economy, the effect of terrorist attacks, terror alerts in the United States and the war in Iraq, all of which changed the travel patterns of both business and leisure travelers. While our operations improved in 2004, 2005 and 2006, we cannot provide assurance that changes in travel patterns of both business and leisure travelers will be permanent or whether they will continue to evolve creating new opportunities or difficulties for the industry. Any forecast we make regarding our results of operations may be affected and can change based on the following risks:

| • | changes in the national, regional and local economic climate; |

| • | changes in business and leisure travel patterns; |

| • | local market conditions such as an oversupply of hotel rooms or a reduction in lodging demand; |

| • | the attractiveness of our hotels to consumers relative to our competition; |

| • | the performance of the managers of our hotels; |

| • | changes in room rates and increases in operating costs due to inflation and other factors; and |

| • | unionization of the labor force at our hotels. |

Future terrorist attacks or changes in terror alert levels could adversely affect us.

Previous terrorist attacks in the United States and subsequent terrorist alerts have adversely affected the travel and hospitality industries over the past several years. The impact which terrorist attacks in the United States or elsewhere could have on our business in particular and the U.S. economy, the global economy and global financial markets in general is indeterminable. It is possible that such attacks or the threat of such attacks could have a material adverse effect on our business, our ability to finance our business, our ability to insure our properties and/or our results of operations and financial condition as a whole.

Our expenses may not decrease if our revenue drops.

Many of the expenses associated with owning and operating hotels, such as debt payments, property taxes, insurance, utilities, and employee wages and benefits, are relatively inflexible and do not necessarily decrease in tandem with a reduction in revenue at the hotels. Our expenses will also be affected by inflationary increases, and in the case of certain costs, such as wages, benefits and insurance, may exceed the rate of inflation in any given period. Our managers may be unable to offset any such increased expenses with higher room rates. Any of our efforts to reduce operating costs or failure to make scheduled capital expenditures could adversely affect the growth of our business and the value of our hotel properties.

Our ground lease payments may increase faster than the revenues we receive on the hotels situated on the leased properties.

As of December 1, 2006, 39 of our hotels are subject to third-party ground leases (encumbering all or a portion of the hotel). These ground leases generally require increases in ground rent payments every five years. Our ability to service our debt could be adversely affected to the extent that our revenues do not increase at the same or a greater rate than the increases in rental payments under the ground leases. In addition, if we were to sell a hotel encumbered by a ground lease, the buyer would have to assume the ground lease, which may result in a lower sales price.

16

Table of Contents

We do not control our hotel operations and we are dependent on the managers of our hotels.

Because federal income tax laws restrict REITs and their subsidiaries from operating a hotel, we do not manage our hotels. Instead, we lease substantially all of our hotels to subsidiaries which qualify as “taxable REIT subsidiaries” under applicable REIT laws, and our taxable REIT subsidiaries retain third-party managers to operate our hotels pursuant to management agreements. Our cash flow from the hotels may be adversely affected if our managers fail to provide quality services and amenities or if they or their affiliates fail to maintain a quality brand name. While our taxable REIT subsidiaries monitor the hotel managers’ performance, we have limited specific recourse under our management agreements if we believe that the hotel managers are not performing adequately. In addition, from time to time, we have had, and continue to have, differences with the managers of our hotels over their performance and compliance with the terms of our management agreements. We generally resolve issues with our managers through discussions and negotiations. However, if we are unable to reach satisfactory results through discussions and negotiations, we may choose to litigate the dispute or submit the matter to third-party dispute resolution. Failure by our hotel managers to fully perform the duties agreed to in our management agreements could adversely affect our results of operations. In addition, our hotel managers or their affiliates manage, and in some cases own or have invested in, hotels that compete with our hotels, which may result in conflicts of interest. As a result, our hotel managers have in the past made and may in the future make decisions regarding competing lodging facilities that are not or would not be in our best interests.

We are subject to risks associated with the employment of hotel personnel, particularly with hotels that employ unionized labor.

We have entered into management agreements with third-party managers to operate our hotel properties. Our third-party managers are responsible for hiring and maintaining the labor force at each of our hotels. Although we generally do not directly employ or manage the labor force at our hotels, we are subject to many of the costs and risks generally associated with the hotel labor force, particularly those hotels with unionized labor. From time to time, hotels operations may be disrupted through strikes, lockouts, public demonstrations or other negative actions and publicity. We may also incur increased legal costs and indirect labor costs as a result of contract disputes or other events. Additionally, hotels where our managers have collective bargaining agreements with employees (approximately 18% of our current portfolio, by revenues) are more highly affected by labor force activities than others. In addition, the resolution of labor disputes or re-negotiated labor contracts could lead to increased labor costs, either by increases in wages or benefits or by changes in work rules that raise hotel operating costs. Because collective bargaining agreements are negotiated between the managers of our hotels and labor unions, we do not have the ability to control the outcome of these negotiations.

Foreclosure on our mortgage debt could adversely affect our business.

As of September 8, 2006, after giving effect to the issuance of the Series R senior notes and the application of the proceeds therefrom, and certain other debt transactions that have occurred since September 8, 2006, certain of our hotels and related assets would have been subject to various mortgages in an aggregate amount of approximately $2.0 billion. Although the debt is generally non-recourse to us, if these hotels do not produce adequate cash flow to service the debt secured by such mortgages, the mortgage lenders could foreclose on these assets. We may opt to allow such foreclosure rather than make the necessary mortgage payments with funds from other sources. However, our senior notes indenture and credit facility contain cross default provisions, which, depending upon the amount of secured debt defaulted on, could cause a cross default under these agreements. Our credit facility, which contains the more restrictive cross default provision as compared to our senior notes indenture, provides that it is a credit facility default in the event we default on non-recourse secured indebtedness in excess of 1% of our total assets (using undepreciated real estate values) or default on other indebtedness in excess of $50 million. For this and other reasons, permitting a foreclosure could adversely affect our long-term business prospects.

Our mortgage debt contains provisions that may reduce our liquidity.

Certain of our mortgage debt requires that, to the extent cash flow from the hotels which secure such debt drops below stated levels, we escrow cash flow after the payment of debt service until operations improve above

17

Table of Contents

the stated levels. In some cases, the escrowed amount may be applied to the outstanding balance of the mortgage debt. When such provisions are triggered, there can be no assurance that the affected properties will achieve the minimum cash flow levels required to trigger a release of any escrowed funds. The amounts required to be escrowed may be material and may negatively affect our liquidity by limiting our access to cash flow after debt service from these mortgaged properties.

Rating agency downgrades may increase our cost of capital.

Both our senior notes and Host’s preferred stock are rated by Moody’s Investors’ Service and Standard & Poor’s. These independent rating agencies may elect to downgrade their ratings on our senior notes and Host’s preferred stock at any time. Such downgrades may negatively affect our access to the capital markets and increase our cost of capital.

Our management agreements could impair the sale or financing of our hotels.

Under the terms of our management agreements, we generally may not sell, lease or otherwise transfer the hotels unless the transferee is not a competitor of the manager and the transferee assumes the related management agreements and meets specified other conditions. Our ability to finance or sell our properties, depending upon the structure of such transactions, may require the manager’s consent. If, in these circumstances, the manager does not consent, we may be precluded from taking actions in our best interest without breaching the applicable management agreement.

The acquisition contracts relating to some hotels limit our ability to sell or refinance those hotels.

For reasons relating to federal and state income tax considerations of the former and current owners of five hotels, we have agreed to restrictions on selling the hotels, or repaying or refinancing the mortgage debt for varying periods depending on the hotel. We have also agreed not to sell more than 50% of the original allocated value attributable to a portfolio of 10 additional hotels, or to take other actions that would result in the recognition and allocation of gain to the former owners of such hotels for federal and state income tax purposes prior to January 1, 2009. As a result, even if it were in our best interests to sell these hotels or repay or otherwise reduce the level of the mortgage debt on such hotels, it may be difficult or costly to do so during their respective lock-out periods. We anticipate that, in specified circumstances, it may agree to similar restrictions in connection with future hotel acquisitions.

We may be unable to sell properties because real estate investments are illiquid.