Exhibit 99.5

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Harvest Energy Trust should be read in conjunction with our audited consolidated financial statements and accompanying notes for the years ended December 31, 2007 and 2006, our MD&A for the year ended December 31, 2007 as well as our interim consolidated financial statements and notes for the three and nine month periods ended September 30, 2008 and 2007. The information and opinions concerning our future outlook are based on information available at November 12, 2008.

In this MD&A, reference to “Harvest”, “we”, “us” or “our” refers to Harvest Energy Trust and all of its controlled entities on a consolidated basis. All references are to Canadian dollars unless otherwise indicated. Tabular amounts are in thousands of dollars unless otherwise stated. Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis, before deduction of Crown and other royalties. In addition to disclosing reserves under the requirements of National Instrument 51-101, we also disclose our reserves on a company interest basis which is not a term defined under National Instrument 51-101. This information may not be comparable to similar measures by other issuers.

In this MD&A, we use certain financial reporting measures that are commonly used as benchmarks within the petroleum and natural gas industry such as Earnings From Operations, Cash General and Administrative Expenses and Operating Netbacks and with respect to the refining industry, Earnings from Operations and Gross Margin which are each defined in this MD&A. These measures are not defined under Canadian generally accepted accounting principles (“GAAP”) and should not be considered in isolation or as an alternative to conventional GAAP measures. Certain of these measures are not necessarily comparable to a similarly titled measure of another issuer. When these measures are used, they are defined as “Non-GAAP measures” and should be given careful consideration by the reader. Please refer to the discussion under the heading “Non-GAAP Measures” at the end of this MD&A for a detailed discussion of these measures.

FORWARD-LOOKING INFORMATION

This MD&A highlights significant business results and statistics from our consolidated financial statements for the three and nine month periods ended September 30, 2008 and the accompanying notes thereto. In the interest of providing our Unitholders and potential investors with information regarding Harvest, including our assessment of our future plans and operations, this MD&A contains forward-looking statements that involve risks and uncertainties. Such risks and uncertainties include, but are not limited to, risks associated with conventional petroleum and natural gas operations; risks associated with refining and marketing operations, the volatility in commodity prices and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources and such other risks and uncertainties described from time to time in our regulatory reports and filings made with securities regulators.

Forward-looking statements in this MD&A include, but are not limited to the forward looking statements made in the “Outlook” section as well as statements made throughout with reference to, production volumes, refinery throughput volumes, royalty rates, operating costs, commodity prices, administrative costs, price risk management activity, acquisitions and dispositions, capital spending, reserve estimates, distributions, access to credit facilities, capital taxes, income taxes, cash from operating activities and regulatory changes. For this purpose, any statements that are contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expects”, and similar expressions.

1

Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Although we consider such information reasonable, at the time of preparation, it may prove to be incorrect and actual results may differ materially from those anticipated. We assume no obligation to update forward-looking statements should circumstances, estimates or opinions change, except as required by law. Forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement.

Consolidated Financial and Operating Highlights – Third Quarter 2008

| | |

| • | Cash from operating activities was $133.5 million during the Third Quarter of 2008 and $191.0 million for the same period in the prior year compared to the more traditional non-GAAP measure of cash from operating activities before changes in non-cash working capital and settlement of asset retirement obligations of $208.9 million for the Third Quarter of 2008 and $136.2 million for the same period in 2007. |

| | |

| • | During the Third Quarter, monthly distributions were maintained at $0.30 per Trust Unit representing a payout ratio of 104% of cash from operating activities and 66% of cash from operating activities before changes in non-cash working capital and settlement of asset retirement obligations. |

| | |

| • | Upstream operating cash flow of $296.5 million as compared to $149.7 million in the prior year reflects the strength of commodity prices in 2008 with average daily production of 54,926 boe/d as compared to 59,961 boe/d in the prior year. |

| | |

| • | Upstream capital spending of $69.1 million drilling 67 wells with a success ratio of 100% including 18 wells in southeast Saskatchewan and 8 horizontal wells in the Lloydminster/Hayter area. |

| | |

| • | Downstream operating cash flow of $47.2 million reflecting reliable refinery operations with reduced levels of throughput enhancing profitability by minimizing the volume of high sulphur fuel oil produced. |

| | |

| • | Balance sheet liquidity maintained with $400 million of undrawn committed credit lines available and no material debt maturities prior to April 2010. |

2

SELECTED INFORMATION

The table below provides a summary of our financial and operating results for three and nine month periods ended September 30, 2008 and 2007.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

($000s except where noted) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Revenue, net(1) | | | 1,597,195 | | | 1,031,514 | | 55 | % | | 4,596,625 | | | 3,190,476 | | 44 | % |

| | | | | | | | | | | | | | | | | |

Cash From Operating Activities | | | 133,493 | | | 191,049 | | (30 | %) | | 472,147 | | | 553,315 | | (15 | %) |

Per Trust Unit, basic | | $ | 0.87 | | $ | 1.31 | | (34 | %) | $ | 3.11 | | $ | 4.09 | | (24 | %) |

Per Trust Unit, diluted | | $ | 0.84 | | $ | 1.22 | | (31 | %) | $ | 2.95 | | $ | 3.74 | | (21 | %) |

| | | | | | | | | | | | | | | | | |

Net Income(2) | | | 295,788 | | | 11,811 | | 2,404 | % | | 133,379 | | | 87,909 | | 52 | % |

Per Trust Unit, basic | | $ | 1.93 | | $ | 0.08 | | 2,313 | % | $ | 0.88 | | $ | 0.65 | | 35 | % |

Per Trust Unit, diluted | | $ | 1.73 | | $ | 0.08 | | 2,063 | % | $ | 0.88 | | $ | 0.65 | | 35 | % |

| | | | | | | | | | | | | | | | | |

Distributions declared | | | 138,511 | | | 166,271 | | (17 | %) | | 410,678 | | | 465,598 | | (12 | %) |

Distributions declared, per Trust Unit | | $ | 0.90 | | $ | 1.14 | | (21 | %) | $ | 2.70 | | $ | 3.42 | | (21 | %) |

Distributions declared as a percentage Of Cash From Operating Activities | | | 104 | % | | 87 | % | 17 | % | | 87 | % | | 84 | % | 3 | % |

| | | | | | | | | | | | | | | | | |

Bank debt | | | | | | | | | | | 1,199,773 | | | 1,205,119 | | 0 | % |

77/8% Senior Notes | | | | | | | | | | | 260,120 | | | 241,628 | | 8 | % |

Convertible Debentures(3) | | | | | | | | | | | 824,771 | | | 650,440 | | 27 | % |

Total long-term debt(3) | | | | | | | | | | | 2,284,664 | | | 2,097,187 | | 9 | % |

| | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | | | 5,659,227 | | | 5,585,651 | | 1 | % |

| | | | | | | | | | | | | | | | | |

UPSTREAM OPERATIONS | | | | | | | | | | | | | | | | | |

Daily Production | | | | | | | | | | | | | | | | | |

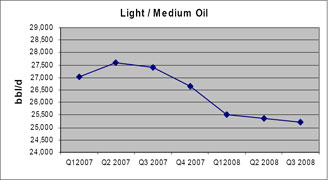

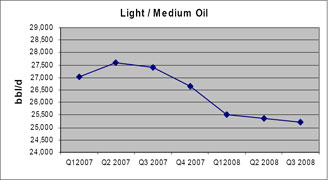

Light to medium oil (bbl/d) | | | 25,210 | | | 27,401 | | (8 | %) | | 25,362 | | | 27,342 | | (7 | %) |

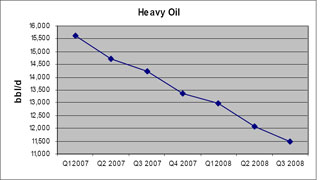

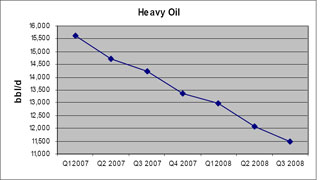

Heavy oil (bbl/d) | | | 11,485 | | | 14,217 | | (19 | %) | | 12,182 | | | 14,845 | | (18 | %) |

Natural gas liquids (bbl/d) | | | 2,627 | | | 2,219 | | 18 | % | | 2,575 | | | 2,350 | | 10 | % |

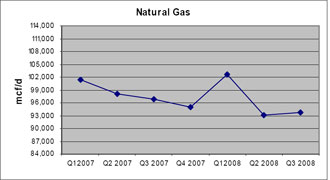

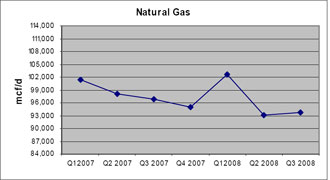

Natural gas (mcf/d) | | | 93,628 | | | 96,737 | | (3 | %) | | 96,394 | | | 98,682 | | (2 | %) |

Total daily sales volumes (boe/d) | | | 54,926 | | | 59,961 | | (8 | %) | | 56,184 | | | 60,984 | | (8 | %) |

| | | | | | | | | | | | | | | | | |

Operating Netback ($/boe) | | | 60.38 | | | 28.69 | | 110 | % | | 56.08 | | | 28.95 | | 94 | % |

| | | | | | | | | | | | | | | | | |

Cash capital expenditures | | | 69,098 | | | 73,323 | | (6 | %) | | 188,337 | | | 270,031 | | (30 | %) |

| | | | | | | | | | | | | | | | | |

DOWNSTREAM OPERATIONS | | | | | | | | | | | | | | | | | |

Average daily throughput (bbl/d) | | | 99,127 | | | 103,983 | | (5 | %) | | 103,832 | | | 111,052 | | (7 | %) |

Aggregate throughput (mbbl) | | | 9,120 | | | 9,566 | | (5 | %) | | 28,449 | | | 30,317 | | (6 | %) |

| | | | | | | | | | | | | | | | | |

Average Refining Margin (US$/bbl) | | | 10.47 | | | 3.08 | | 240 | % | | 8.38 | | | 10.57 | | (21 | %) |

| | | | | | | | | | | | | | | | | |

Cash capital expenditures | | | 17,199 | | | 12,468 | | 38 | % | | 31,845 | | | 27,222 | | 17 | % |

| | | | | | | | | | | | | | | | | | |

| |

(1) | Revenues are net of royalties. |

| |

(2) | Net Income includes a future income tax expense of $149.5 million and $32.5 million for the three and nine months ended September 30, 2008 respectively (future income tax recovery of $54.4 million and future tax expense of $123.3 million for the three and nine months ended September 30, 2007) and an unrealized net gain from risk management activities of $359.7 million and a net loss of $6.3 million for the three and nine months ended September 30, 2008 respectively (loss of $21.9 million and loss of $25.0 million for the three and nine months ended September 30, 2007). |

| |

(3) | Includes current portion of Convertible Debentures. |

3

REVIEW OF OVERALL PERFORMANCE

Harvest is an integrated energy trust with our petroleum and natural gas operations focused on the operation and further development of assets in western Canada (“upstream operations”) and our refining and marketing business focused on the safe operation of a medium gravity sour crude hydrocracking refinery and a retail and wholesale petroleum marketing business both located in the Province of Newfoundland and Labrador (“downstream operations”).

During the Third Quarter of 2008, cash from operating activities of $133.5 million is comprised of cash flow contributions of $296.5 million and $47.2 million from the upstream and downstream operations, respectively, offset by a $72.4 million increase in working capital requirements, $94.5 million of cash settlements from our risk management activities and $43.2 million of financing and other costs. The year-over-year $57.6 million reduction in cash flow from operating activities is primarily attributed to a $130.2 million change in working capital requirements, a $92.7 million increase in cash settlements from our price risk management contracts and a $51.7 million drop in realized foreign exchange gains offset by a $146.8 increase in the contribution from our upstream operations along with a $70.6 million improvement from our downstream operations.

Our monthly distributions of $0.30 per Trust Unit during the Third Quarter represent 104% of our cash from operating activities and 66% of cash from operating activities before changes in non-cash working capital and settlement of asset retirement obligations. We have declared monthly distributions of $0.30 per Trust Unit for November and December of 2008 as well as January and February of 2009. Unitholder participation in our distribution reinvestment programs has generated $35.2 million of equity capital in the Third Quarter reflecting a 25% average level of participation.

Cash flow provided from our upstream operations totaled $296.5 million during the Third Quarter of 2008 as compared to $149.7 million in the prior year. The primary factors associated with the improvement were the strength of Canadian crude oil prices during 2008 which reflected a 57% increase in the WTI benchmark price, a stable Canadian dollar relative to the US dollar and much tighter heavy oil differentials. During the quarter, our average realized price of $90.15 per boe was 3% lower than the $93.29 in the prior quarter and significantly improved compared to $54.15 in the prior year while our average daily production of 54,926 boe/d during the quarter and 55,574 in the Second Quarter of 2008 reflects a natural decline from 59,961 in the Third Quarter of 2007. Midway through the Third Quarter of 2008, we bolstered our production with the acquisition of light/medium oil and natural gas assets producing approximately 2,650 boe/d. Our operating costs averaged $14.51 per boe during the quarter essentially unchanged from $14.45 in the Second Quarter of 2008 with lower spending spread over a reduced volume during the Third Quarter of 2008. Our netback averaged $60.38 per boe during the quarter as compared to $62.99 in the Second Quarter of 2008 and $28.69 in the Third Quarter of the prior year.

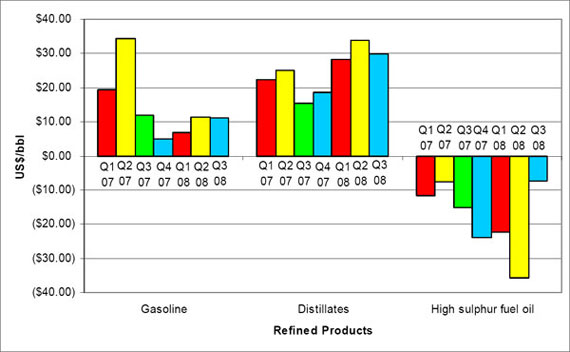

Cash flow from our downstream operations of $47.2 million was a substantial improvement over the breakeven performance in the prior quarter and the cash flow deficiency of $23.4 million in the Third Quarter of 2007. As compared with the prior year, the current quarter reflects a substantial improvement in distillate margins along with an improved yield of distillate products and a reduced yield of lower valued high sulphur fuel oil (“HSFO”). Our average cost of crude oil feedstock relative to the WTI benchmark price was also much improved in the current quarter as compared to the prior year. Offsetting these improvements was a much weaker margin for gasoline products as well as a higher cost for purchased energy to provide heat to the refining processes. During the quarter, our average refining margin was US$10.47 per barrel of throughput, a US$4.81 improvement over the prior quarter and a US$7.39 improvement over the Third Quarter of the prior year. While we achieved very reliable refinery operations with no unplanned disruptions, our throughput averaged 99,127 bbls/d during the quarter as crude oil feedstock was reduced to minimize the production of HSFO as compared to throughput of 103,983 bbls/d in the Third Quarter of the prior year when throughput was constrained as the refinery entered a significant turnaround.

At the end of September 2008, we had $400.2 million of available credit under our $1.6 billion Extendible Revolving Credit Facility with our bank debt to annualized earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratio at 1.5 times.

4

Business Segments

The following table presents selected financial information for our two business segments:

| | | | | | | | | | | | | |

| | |

| | Three Months Ended September 30 | |

| | | | | | |

| | 2008 | | 2007 | |

| | | | | |

| | | | | | | | | | | | | |

(in $000s) | | Upstream | | Downstream | | Total | | Upstream | | Downstream | | Total | |

| | | | | | | | | | | | | | |

Revenue(1) | | 382,297 | | 1,214,898 | | 1,597,195 | | 241,902 | | 789,612 | | 1,031,514 | |

| | | | | | | | | | | | | |

Earnings (Loss) From Operations(2) | | 195,380 | | 30,509 | | 225,889 | | 41,026 | | (39,610 | ) | 1,416 | |

Capital expenditures | | 69,098 | | 17,199 | | 86,297 | | 73,323 | | 12,468 | | 85,791 | |

Total assets(3) | | 3,982,397 | | 1,670,107 | | 5,659,227 | | 4,085,988 | | 1,499,663 | | 5,585,651 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| | Nine Months Ended September 30 | |

| | | | | | |

| | 2008 | | 2007 | |

| | | | | |

| | | | | | | | | | | | | |

(in $000s) | | Upstream | | Downstream | | Total | | Upstream | | Downstream | | Total | |

| | | | | | | | | | | | | | |

Revenue(1) | | 1,092,182 | | 3,504,443 | | 4,596,625 | | 716,432 | | 2,474,044 | | 3,190,476 | |

Earnings From Operations(2) | | 507,059 | | 22,556 | | 529,615 | | 112,726 | | 154,924 | | 267,650 | |

Capital expenditures | | 188,337 | | 31,845 | | 220,182 | | 270,031 | | 27,222 | | 297,253 | |

Total assets(3) | | 3,982,397 | | 1,670,107 | | 5,659,227 | | 4,085,988 | | 1,499,663 | | 5,585,651 | |

| | | | | | | | | | | | | | |

| |

(1) | Revenues are net of royalties. |

| |

(2) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

| |

(3) | Total assets on a consolidated basis as at September 30, 2008 include $6.7 million (2007 - $22.2 million) relating to the fair value of risk management contracts. |

Our upstream and downstream operations are each discussed separately in the sections that follow. Additionally, we have included a section entitled ‘Risk Management, Financing and Other’ that discusses, among other things, our cash flow risk management program.

5

UPSTREAM OPERATIONS

Third Quarter Highlights

| | |

| • | Operating cash flow of $296.5 million, an improvement of $146.8 million over the Third Quarter of the prior year, reflecting the year-over-year strength of crude oil prices as well as a tightening of quality differentials. |

| | |

| • | Average daily production of 54,926 boe/d as compared to production of 55,574 boe/d in the Second Quarter of 2008 reflecting our stable production of light to medium oil and natural gas. |

| | |

| • | Aggregate operating cost expenditures were approximately 9% lower than the Third Quarter of the prior year while our unit operating costs of $14.51 are essentially unchanged from $14.54 in the prior year as the average daily production in the Third Quarter of 2007 was approximately 5,000 boe/d greater than the Third Quarter of 2008. |

| | |

| • | Operating netback of $60.38 per boe, representing a $31.69 (110%) increase over the prior year, attributed primarily to substantially higher commodity prices. |

| | |

| • | Completed two acquisitions for aggregate cash consideration of $167.6 million, acquiring 2,650 boe/d of production representing an average cost per flowing barrel of approximately $63,000 comprised of 1,645 bbls/d of light oil and 6,200 mcf/d of natural gas. |

| | |

| • | Capital spending of $69.1 million included the drilling of 67 wells (34.7 on a net basis) with a 100% success rate which brings the total wells drilled in 2008 to 165 (102.1 net wells) |

Summary of Financial and Operating Results

| | | | | | | | | | | | | | | | | | | |

| | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

(in $000s except where noted) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

|

Revenues | | | 455,565 | | | 298,708 | | | 53 | % | | 1,304,664 | | | 876,435 | | | 49 | % |

Royalties | | | (73,268 | ) | | (56,806 | ) | | 29 | % | | (212,482 | ) | | (160,003 | ) | | 33 | % |

| | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 382,297 | | | 241,902 | | | 58 | % | | 1,092,182 | | | 716,432 | | | 52 | % |

| | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 73,314 | | | 80,189 | | | (9 | %) | | 218,729 | | | 224,818 | | | (3 | %) |

General and administrative | | | 2,148 | | | 4,159 | | | (48 | %) | | 26,766 | | | 30,324 | | | (12 | %) |

Transportation and marketing | | | 3,855 | | | 3,412 | | | 13 | % | | 10,232 | | | 9,599 | | | 7 | % |

Depreciation, depletion, amortization and accretion | | | 107,600 | | | 113,116 | | | (5 | %) | | 329,396 | | | 338,965 | | | (3 | %) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Earnings From Operations(1) | | | 195,380 | | | 41,026 | | | 376 | % | | 507,059 | | | 112,726 | | | 350 | % |

| | | | | | | | | | | | | | | | | | | |

Cash capital expenditures (excluding acquisitions) | | | 69,098 | | | 73,323 | | | (6 | %) | | 188,337 | | | 270,031 | | | (30 | %) |

Property and business acquisitions, net of dispositions | | | 132,130 | | | 139,378 | | | (5 | %) | | 127,581 | | | 148,530 | | | (14 | %) |

| | | | | | | | | | | | | | | | | | | |

Daily sales volumes | | | | | | | | | | | | | | | | | | | |

Light to medium oil (bbl/d) | | | 25,210 | | | 27,401 | | | (8 | %) | | 25,362 | | | 27,342 | | | (7 | %) |

Heavy oil (bbl/d) | | | 11,485 | | | 14,217 | | | (19 | %) | | 12,182 | | | 14,845 | | | (18 | %) |

Natural gas liquids (bbl/d) | | | 2,627 | | | 2,219 | | | 18 | % | | 2,575 | | | 2,350 | | | 10 | % |

Natural gas (mcf/d) | | | 93,628 | | | 96,737 | | | (3 | %) | | 96,394 | | | 98,682 | | | (2 | %) |

Total (boe/d) | | | 54,926 | | | 59,961 | | | (8 | %) | | 56,184 | | | 60,984 | | | (8 | %) |

| | | | | | | | | | | | | | | | | | | | |

(1) These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A.

6

Commodity Price Environment

| | | | | | | | | | | | | | | | | | | |

| | | | | |

|

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | |

Benchmarks | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

|

West Texas Intermediate crude oil (US$ per barrel) | | | 117.98 | | | 75.38 | | | 57 | % | | 113.29 | | | 66.19 | | | 71 | % |

Edmonton light crude oil ($ per barrel) | | | 121.59 | | | 79.66 | | | 53 | % | | 114.94 | | | 72.89 | | | 58 | % |

Bow River blend crude oil ($ per barrel) | | | 105.12 | | | 55.79 | | | 88 | % | | 95.74 | | | 52.20 | | | 83 | % |

AECO natural gas daily ($ per mcf) | | | 7.74 | | | 5.18 | | | 49 | % | | 8.62 | | | 6.55 | | | 32 | % |

Canadian / U.S. dollar exchange rate | | | 0.960 | | | 0.957 | | | 0 | % | | 0.982 | | | 0.907 | | | 8 | % |

| | | | | | | | | | | | | | | | | | | | |

During the Third Quarter 2008 the average West Texas Intermediate (“WTI”) benchmark price increased 57% over the Third Quarter 2007 and for the nine months ended September 30, 2008 the average price was 71% higher than in the prior year. The average Edmonton light crude oil price (“Edmonton Par”) has also increased over the past twelve months to average $121.59 during the Third Quarter, an increase of 53% over the same period of the prior year and $114.94/bbl for the nine months ended September 30, 2008, an increase of 58% over the prior year. On a year-to-date basis, the increase in value of Edmonton Par throughout 2008 has been less dramatic than that of WTI due to the strength of the Canadian dollar relative to the US dollar in 2008, which has increased by 8% for the nine months ended September 30 relative to the first nine months of the prior year.

Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil inventories, pipeline capacity to deliver heavy crude to U.S. markets and the seasonal demand for heavy oil. During the Third Quarter of 2008, the Bow River heavy oil differential relative to Edmonton Par tightened to an average of 13.5% compared to 30.0% in the Third Quarter of 2007. During the nine months ended September 30, 2008, heavy oil differentials have been consistently tighter than the first nine months of the prior year due to reduced supply due to pipeline disruptions early in the year coupled with production shortfalls and strong demand during the following spring and summer months.

| | | | | | | | | | | | | | | | |

| | 2008 | | | | 2007 | | | | 2006 |

| | | | | | | | | | |

Differential Benchmarks | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| | | | | | | | | | | | | | | | | |

Bow River Blend differential to Edmonton Par | | 13.5% | | 17.1% | | 20.2% | | 34.2% | | 30.0% | | 29.4% | | 25.4% | | 30.3% |

| | | | | | | | | | | | | | | | | |

Compared to the prior year, the average AECO natural gas price was 49% and 32% higher during the three and nine months ended September 30, 2008, respectively. Natural gas prices have strengthened in 2008 relative to 2007 due to a general strengthening of commodity prices.

Realized Commodity Prices(1)

The following table summarizes our average realized price by product for the three and nine month periods ended September 30, 2008 and 2007.

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | |

| | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

Light to medium oil ($/bbl) | | | 110.70 | | | 68.10 | | | 63 | % | | 102.15 | | | 62.02 | | | 65 | % |

Heavy oil ($/bbl) | | | 99.21 | | | 48.95 | | | 103 | % | | 87.75 | | | 45.70 | | | 92 | % |

Natural gas liquids ($/bbl) | | | 88.17 | | | 61.63 | | | 43 | % | | 85.16 | | | 57.55 | | | 48 | % |

Natural gas ($/mcf) | | | 8.44 | | | 5.67 | | | 49 | % | | 9.16 | | | 7.10 | | | 29 | % |

Average realized price ($/boe) | | | 90.15 | | | 54.15 | | | 66 | % | | 84.75 | | | 52.64 | | | 61 | % |

| | | | | | | | | | | | | | | | | | | | |

(1) Realized commodity prices exclude the impact of price risk management activities.

During the three and nine months ended September 30, 2008, our average realized price was 66% and 61% higher, respectively, than the comparable periods in 2007 with every product realizing a higher average price than in the prior year.

7

Our realized price for light to medium oil sales increased 63% in the Third Quarter of 2008 compared to the Third Quarter of 2007, reflecting the 53% increase in Edmonton Par pricing coupled with improved quality differentials realized on our light to medium oil production relative to the Edmonton Par price. During the nine months ended September 30, 2008, our realized price for light to medium oil sales was 65% higher than the same period in 2007 which also reflects the 58% increase in Edmonton Par pricing over the prior year as well as improved quality differentials.

Harvest’s heavy oil price increased 103% in the Third Quarter of 2008 relative to the Third Quarter of 2007, reflecting the 88% increase in the average posted Bow River price for the same periods. Similarly, our average heavy oil price for the year-to-date is 92% higher than the prior year, reflecting the increase of 83% in the Bow River posted price for the first nine months of 2008 relative to the first nine months of 2007. Harvest realized an increased heavy oil price relative to the Bow River posted price in the Third Quarter as production shortfalls and increased refinery demand for heavier grades of oil put upward pressure on pricing.

The average realized price for our natural gas production was 49% higher in the Third Quarter of 2008 as compared to the Third Quarter of 2007 reflecting the same increase in AECO daily pricing over the same period, while during the first nine months of 2008, we realized a natural gas sales price that was 29% higher than in the prior year, reflecting the AECO daily pricing increase of 32%.

Sales Volumes

The average daily sales volumes by product were as follows:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30 | | | | |

| | | | | | | |

| | 2008 | | 2007 | | | | |

| | | | | | | | | |

| | Volume | | Weighting | | Volume | | Weighting | | % Volume Change | |

| | | | | | | | | | | | |

Light to medium oil (bbl/d)(1) | | | 25,210 | | | 46 | % | | 27,401 | | 46 | % | | (8 | %) | |

Heavy oil (bbl/d) | | | 11,485 | | | 21 | % | | 14,217 | | 24 | % | | (19 | %) | |

Natural gas liquids (bbl/d) | | | 2,627 | | | 5 | % | | 2,219 | | 4 | % | | 18 | % | |

| | | | | | | | | | | | | | | | | |

Total liquids (bbl/d) | | | 39,322 | | | 72 | % | | 43,837 | | 74 | % | | (10 | %) | |

Natural gas (mcf/d) | | | 93,628 | | | 28 | % | | 96,737 | | 26 | % | | (3 | %) | |

| | | | | | | | | | | | | | | | | |

Total oil equivalent (boe/d) | | | 54,926 | | | 100 | % | | 59,961 | | 100 | % | | (8 | %) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | Nine Months Ended September 30 | | | | |

| | | | | | | |

| | 2008 | | 2007 | | | | |

| | | | | | | | | |

| | Volume | | Weighting | | Volume | | Weighting | | % Volume Change | |

| | | | | | | | | | | | |

Light to medium oil (bbl/d)(1) | | | 25,362 | | | 45 | % | | 27,342 | | 45 | % | | (7 | %) | |

Heavy oil (bbl/d) | | | 12,182 | | | 22 | % | | 14,845 | | 24 | % | | (18 | %) | |

Natural gas liquids (bbl/d) | | | 2,575 | | | 5 | % | | 2,350 | | 4 | % | | 10 | % | |

| | | | | | | | | | | | | | | | | |

Total liquids (bbl/d) | | | 40,119 | | | 72 | % | | 44,537 | | 73 | % | | (10 | %) | |

Natural gas (mcf/d) | | | 96,394 | | | 28 | % | | 98,682 | | 27 | % | | (2 | %) | |

| | | | | | | | | | | | | | | | | |

Total oil equivalent (boe/d) | | | 56,184 | | | 100 | % | | 60,984 | | 100 | % | | (8 | %) | |

| | | | | | | | | | | | | | | | | |

(1) Harvest classifies our oil production, except that produced from Hay River, as light to medium and heavy according to NI 51-101 guidance. The oil produced from Hay River has an average API of 24o (medium grade) and is classified as a light to medium oil, however, it benefits from a heavy oil royalty regime and therefore would be classified as heavy oil according to NI 51-101.

8

Harvest’s Third Quarter 2008 light/medium oil production was 25,210 bbl/d, a 2,191 bbl/d or 8% reduction from the same period in the prior year, and a reduction of 155 bbl/d or 1% from the Second Quarter of 2008. The 8% reduction is mainly attributed to steeper than expected declines experienced as the initial flush production from wells completed in early 2007 stabilized. In the Third Quarter of 2008, light/medium production has continued to remain relatively consistent with the two prior quarters as increased water cuts and production lost to downtime have been substantially offset by new wells and the production from two acquisitions completed during the quarter. Production at our largest area, Hay River, has remained constant over the past two quarters reflecting our First Quarter initiatives to increase water injection and improve recovery. Relative to the first nine months of 2007, Harvest’s year-to-date light/medium oil production has declined by 7% due to steeper than anticipated declines throughout 2007 and a lower level of drilling activity in 2008.

Our heavy oil production has decreased steadily over the past twelve months resulting in a 19% reduction with Third Quarter 2008 production of 11,485 bbl/d as compared to 14,217 bbl/d in the Third Quarter of 2007. This reduction is largely the result of increased water cuts experienced on our larger producing wells in the west central Saskatchewan and Lloydminster areas coupled with normal declines elsewhere. In the Third Quarter of 2008, we continued normal decline. On a year-to-date basis, cold and wet weather related operational problems, as well as shut-ins to accommodate nearby drilling, contributed to the decrease in volumes from 14,845 bbl/d during the first nine months of 2007 to 12,182 bbl/d during the first nine months of 2008.

Our Third Quarter of 2008 natural gas production decreased by 3% relative to the Third Quarter of 2007, averaging 93,628 mcf/d. Relative to the Second Quarter of 2008, our Third Quarter natural gas production has increased by 1%, primarily due to the incremental production associated with the acquisitions completed during the Third Quarter. Relative to the Third Quarter of the prior year our natural gas production has encountered disruptions from various third party processing facility turnarounds, which has been partially offset by flush production from new wells drilled early in 2008 which have since stabilized. Harvest’s 2008 year-to-date production is 2% lower than the same period in 2007 due to continued declines and production disruptions throughout the Fourth Quarter of 2007 and Second Quarter 2008 offset by incremental production resulting from our 2008 winter drilling program and acquisitions completed in the Third Quarter of 2008.

9

Revenues

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | |

| | | | | |

(000s) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

Light to medium oil sales | | $ | 256,744 | | $ | 171,674 | | | 50 | % | $ | 709,825 | | $ | 462,964 | | | 53 | % |

Heavy oil sales | | | 104,826 | | | 64,026 | | | 64 | % | | 292,883 | | | 185,196 | | | 58 | % |

Natural gas sales | | | 72,690 | | | 50,424 | | | 44 | % | | 241,873 | | | 191,357 | | | 26 | % |

Natural gas liquids sales and other | | | 21,305 | | | 12,584 | | | 69 | % | | 60,083 | | | 36,918 | | | 63 | % |

| | | | | | | | | | | | | | | | | | | | |

Total sales revenue | | | 455,565 | | | 298,708 | | | 53 | % | | 1,304,664 | | | 876,435 | | | 49 | % |

Royalties | | | (73,268 | ) | | (56,806 | ) | | 29 | % | | (212,482 | ) | | (160,003 | ) | | 33 | % |

| | | | | | | | | | | | | | | | | | | | |

Net Revenues | | $ | 382,297 | | $ | 241,902 | | | 58 | % | $ | 1,092,182 | | $ | 716,432 | | | 52 | % |

| | | | | | | | | | | | | | | | | | | | |

Our revenue is impacted by changes to production volumes, commodity prices and currency exchange rates. Third Quarter of 2008 total sales revenue of $455.6 million is $156.9 million higher than the same period in the prior year, of which $182.2 million is attributed to higher realized prices offset by a $25.3 million negative variance in respect of lower production volumes. The price increase reflects the 53% increase in Edmonton Par pricing and 49% in AECO natural gas pricing in the Third Quarter of 2008 as compared to the Third Quarter of 2007, while our decreased production volume is attributed to the higher than anticipated decline rates experienced from recently completed wells coupled with various operational difficulties and a reduction in 2008 capital spending. On a year-to-date basis, our total sales revenue of $1,304.7 million is $428.2 million higher than for the comparable period in 2007, comprised of $493.0 million of additional revenue attributed to higher prices offset by a reduction in revenue of $64.8 million resulting from decreased production volumes.

Light to medium oil sales revenue for the Third Quarter of 2008 was $85.1 million higher than in the comparative period due to a $98.8 million favourable price variance offset by a $13.7 million unfavourable volume variance. The price variance reflects a 53% increase in Edmonton par pricing relative to the Third Quarter of the prior year plus improved differentials, while the negative volume variance reflects normal declines coupled with lower drilling activity in the winter of 2008 as compared to the prior year. For the nine months ended September 30, 2008, light to medium oil sales revenue was $246.9 million higher than the prior year-to-date, attributed to $278.8 million in increased revenues resulting from increased commodity pricing offset by a $31.9 million reduction due to a decline in production.

Third Quarter of 2008 heavy oil sales revenue of $104.8 million was $40.8 million higher than in the prior year due to a $53.1 million favourable price variance resulting from a 16.5% improvement in heavy oil differentials relative to the prior year coupled with the impact of the 57% increase in WTI, offset by a $12.3 million unfavourable volume variance reflecting a natural decline rate. The same factors apply to the variances in the first nine months of 2008 relative to 2007, where heavy oil sales revenue has increased by $107.7 million resulting from a favourable price variance of $140.3 million offset by an unfavorable volume variance of $32.6 million.

Natural gas sales revenue increased by $22.3 million in the Third Quarter of 2008 compared to the same period in 2007 due to a $23.9 million favourable price variance offset by a $1.6 million unfavourable volume variance. The favourable price variance reflects the $2.77/mcf increase in our realized natural gas prices resulting from a 49% increase in the AECO daily price relative to the prior year. During the first nine months of 2008, natural gas sales revenue was $50.5 million higher than the first nine months of the prior year, resulting from increased revenue of $54.3 million attributed to the increase in AECO pricing of 32% offset by a reduction in revenue of $3.8 million resulting from lower volumes.

In the Third Quarter of 2008, natural gas liquids and other sales revenue increased by $8.7 million compared to the Third Quarter of the prior year resulting from a $6.4 million favourable price variance and a $2.3 million favourable volume variance. Similarly, year-to-date natural gas liquids and other sales revenues increased by $23.2 million compared to the first nine months of 2007 resulting from a $19.5 million favourable price variance coupled with a $3.7 million favourable volume variance. Generally, the natural gas liquids volume variance will be aligned with our production of natural gas while the price variances will be aligned with the prices realized for our oil production.

10

Royalties

We pay Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and our Crown royalties are based on a sliding scale dependent on production volumes and commodity prices.

For the Third Quarter of 2008 net royalties as a percentage of gross revenue were 16.1% (19.0% in the Third Quarter of 2007) and aggregated to $73.3 million (2007 - $56.8 million). Our royalty rate for the Third Quarter of 2008 was slightly lower than the expected rate of 17% primarily due to reductions in freehold mineral taxes. Our royalties for the first nine months of 2008 were $212.5 million, resulting in a rate of 16.3% compared to $160.0 million and a rate of 18.3%, respectively, for the first nine months of 2007 as the prior year rate had increased in respect of a one-time adjustment of additional crown royalties that were assessed on our Hay River property.

Operating Expenses

| | | | | | | | | | | | | | | | |

| | | |

| | Three Months Ended September 30 | |

| | | | | | | | |

| | | | | | | |

| | 2008 | | 2007 | | Per BOE

Change | |

| | | | | |

(000s except per boe amounts) | | Total | | Per BOE | | Total | | Per BOE | |

| | | | | | | | | | | | |

Operating expense | | | | | | | | | | | | | | | | |

Power and fuel | | $ | 18,622 | | $ | 3.69 | | $ | 19,569 | | $ | 3.55 | | | 4 | % |

Well Servicing | | | 14,474 | | | 2.86 | | | 15,621 | | | 2.83 | | | 1 | % |

Repairs and maintenance | | | 13,356 | | | 2.64 | | | 13,852 | | | 2.51 | | | 5 | % |

Lease rentals and property taxes | | | 6,548 | | | 1.30 | | | 6,032 | | | 1.09 | | | 19 | % |

Processing and other fees | | | 2,629 | | | 0.52 | | | 3,373 | | | 0.61 | | | (15 | %) |

Labour – internal | | | 6,314 | | | 1.25 | | | 5,489 | | | 1.00 | | | 25 | % |

Labour – contract | | | 4,455 | | | 0.88 | | | 3,861 | | | 0.70 | | | 26 | % |

Chemicals | | | 3,115 | | | 0.62 | | | 3,004 | | | 0.54 | | | 15 | % |

Trucking | | | 2,664 | | | 0.53 | | | 2,781 | | | 0.50 | | | 6 | % |

Other | | | 1,137 | | | 0.22 | | | 6,607 | | | 1.21 | | | (82 | %) |

| | | | | | | | | | | | | | | | | |

Total operating expense | | $ | 73,314 | | $ | 14.51 | | $ | 80,189 | | $ | 14.54 | | | 0 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Transportation and marketing expense | | $ | 3,855 | | $ | 0.76 | | $ | 3,412 | | $ | 0.62 | | | 23 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | |

| | Nine Months Ended September 30 | |

| | | | | | | | |

| | | | | | | |

| | 2008 | | 2007 | | Per BOE

Change | |

| | | | | |

(000s except per boe amounts) | | Total | | Per BOE | | Total | | Per BOE | |

| | | | | | | | | | | | |

Operating expense | | | | | | | | | | | | | | | | |

Power and fuel | | $ | 59,756 | | $ | 3.88 | | $ | 49,349 | | $ | 2.96 | | | 31 | % |

Well Servicing | | | 38,875 | | | 2.53 | | | 47,639 | | | 2.87 | | | (12 | %) |

Repairs and maintenance | | | 37,235 | | | 2.42 | | | 38,190 | | | 2.30 | | | 5 | % |

Lease rentals and property taxes | | | 21,161 | | | 1.37 | | | 15,846 | | | 0.96 | | | 43 | % |

Processing and other fees | | | 8,226 | | | 0.53 | | | 11,785 | | | 0.71 | | | (25 | %) |

Labour – internal | | | 18,405 | | | 1.20 | | | 17,615 | | | 1.06 | | | 13 | % |

Labour – contract | | | 12,487 | | | 0.81 | | | 11,656 | | | 0.70 | | | 16 | % |

Chemicals | | | 12,947 | | | 0.84 | | | 11,533 | | | 0.69 | | | 22 | % |

Trucking | | | 8,371 | | | 0.54 | | | 8,906 | | | 0.53 | | | 2 | % |

Other | | | 1,266 | | | 0.09 | | | 12,299 | | | 0.72 | | | (88 | %) |

| | | | | | | | | | | | | | | | | |

Total operating expense | | $ | 218,729 | | $ | 14.21 | | $ | 224,818 | | $ | 13.50 | | | 5 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Transportation and marketing expense | | $ | 10,232 | | $ | 0.66 | | $ | 9,599 | | $ | 0.58 | | | 14 | % |

| | | | | | | | | | | | | | | | | |

11

Third Quarter 2008 operating costs totaled $73.3 million, a decrease of $6.9 million from operating costs incurred in the Third Quarter of 2007. On a per barrel basis, operating costs have remained relatively constant, averaging $14.51 in the Third Quarter of 2008 compared to $14.54 in the prior year. The largest components of operating expense are power and fuel costs, well servicing and repairs and maintenance costs. Well servicing and repairs and maintenance costs continue to reflect the high demand for oilfield services, although with reduced activity compared to the same period in the prior year, these costs have remained relatively stable. On a year-to-date basis, operating costs totaled $218.7 million ($14.21/boe) for the first nine months of 2008, compared to $224.8 million ($13.50/boe) for the first nine months of 2007. This 5% per boe increase is attributed to reduced production volumes.

Power and fuel costs, comprised primarily of electric power costs, represented approximately 25% of our total operating costs during the Third Quarter of 2008. The Alberta electric power price of $80.36/MWh in the Third Quarter of 2008 was 13% lower than the average Third Quarter 2007 price of $92.00/MWh and this reduction is reflected in our 4% per boe reduction in power and fuel costs compared to the same period of the prior year, the total dollar savings offset by lower production volumes. On a year to date basis, the average Alberta electric power price for the first nine months of 2008 was $88.21/MWh as compared to $68.53/MWh during the first nine months of 2007, a 29% increase. To manage our exposure to electric power price fluctuations we have electric power price risk management contracts in place which resulted in a gain of $1.8 million and $7.0 million for the three and nine months ended September 30, 2008, respectively, compared to gains of $2.8 million and $2.7 million in the same periods of the prior year. The following table details the electric power costs per boe before and after the impact of our price risk management program.

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | |

(per boe) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

Electric power and fuel costs | | $ | 3.69 | | $ | 3.55 | | | 4 | % | $ | 3.88 | | $ | 2.96 | | | 31 | % |

Realized gains on electricity risk management contracts | | | (0.36 | ) | | (0.51 | ) | | (29 | %) | | (0.45 | ) | | (0.16 | ) | | 181 | % |

| | | | | | | | | | | | | | | | | | | | |

Net electric power costs | | $ | 3.33 | | $ | 3.04 | | | 10 | % | $ | 3.43 | | $ | 2.80 | | | 23 | % |

| | | | | | | | | | | | | | | | | | | | |

Alberta Power Pool electricity price (per MWh) | | $ | 80.36 | | $ | 92.00 | | | (13 | %) | $ | 88.21 | | $ | 68.53 | | | 29 | % |

| | | | | | | | | | | | | | | | | | | | |

Approximately 52% of our estimated Alberta electricity usage is protected by fixed price purchase contracts at an average price of $56.69/MWh through December 2008. These contracts moderate the impact of future price swings in electric power as will capital projects undertaken that contribute to improving our efficient use of electric power.

Third Quarter 2008 transportation and marketing expense was $3.9 million or $0.76 per boe, an increase of 23% per boe from $3.4 million or $0.62 per boe in the Third Quarter of 2007. On a year-to-date basis, transportation and marketing expense has increased 14% per boe as compared to the first nine months of the prior year, from $9.6 million or $0.58/boe in 2007 to $10.2 million or $0.66/boe in 2008. These costs relate primarily to delivery of natural gas to Alberta’s natural gas sales hub, the AECO Storage Hub, and to a lesser extent, our costs of trucking clean crude oil to pipeline receipt points. As a result, the total dollar amount of costs fluctuate in relation with our natural gas production volumes while the cost per boe typically remains relatively constant. The increased transportation and marketing expense in the Third Quarter of 2008 is primarily due to increased clean oil trucking costs associated with the two acquisitions completed in the quarter.

Operating Netback

| | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | |

(per boe) | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | |

Revenues | | $ | 90.15 | | $ | 54.15 | | $ | 84.75 | | $ | 52.64 | |

Royalties | | | (14.50 | ) | | (10.30 | ) | | (13.80 | ) | | (9.61 | ) |

Operating expense | | | (14.51 | ) | | (14.54 | ) | | (14.21 | ) | | (13.50 | ) |

Transportation and marketing expense | | | (0.76 | ) | | (0.62 | ) | | (0.66 | ) | | (0.58 | ) |

| | | | | | | | | | | | | | |

Operating netback(1) | | $ | 60.38 | | $ | 28.69 | | $ | 56.08 | | $ | 28.95 | |

| | | | | | | | | | | | | | |

| |

(1) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

12

Harvest’s operating netback represents the net amount realized on a per boe basis after deducting directly related costs. In the Third Quarter of 2008, our operating netback increased by $31.69/boe or 110% over the Third Quarter of 2007. The increase in our operating netback is primarily attributed to a $36.00/boe increase in realized commodity prices, reflecting the increase in Edmonton Par, Bow River and AECO pricing over the prior year, offset by an increase in royalties of $4.20/boe resulting from higher realized prices. For the nine months ended September 30, 2008, Harvest’s operating netback was $56.08/boe, an increase of $27.13/boe or 94% compared to the same period in the prior year, attributed to significantly increased commodity prices offset by increased royalties and operating expenses.

General and Administrative (“G&A”) Expense

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | |

| | | | | |

(000s except per boe) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

Cash G&A | | $ | 8,557 | | $ | 8,330 | | | 3 | % | $ | 25,344 | | $ | 24,048 | | | 5 | % |

Unit based compensation expense (recovery) | | | (6,410 | ) | | (4,171 | ) | | 54 | % | | 1,422 | | | 6,276 | | | (77 | %) |

| | | | | | | | | | | | | | | | | | | | |

Total G&A | | $ | 2,148 | | $ | 4,159 | | | (48 | %) | $ | 26,766 | | $ | 30,324 | | | (12 | %) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Cash G&A per boe ($/boe) | | $ | 1.69 | | $ | 1.51 | | | 12 | % | $ | 1.65 | | $ | 1.44 | | | 15 | % |

| | | | | | | | | | | | | | | | | | | | |

For the three months ended September 30, 2008, Cash G&A costs increased by $0.2 million (or 3%) compared to the same period in 2007, reflecting consistent employee costs in a continued tight market for technically qualified staff in the western Canadian petroleum and natural gas industry. Generally, approximately 75% of our Cash G&A expenses are related to salaries and other employee related costs. For the nine months ended September 30, 2008, Harvest’s Cash G&A was $25.3 million, an increase of 5% over the first nine months of the prior year due primarily to increased employee and consulting costs during the First Quarter of 2008.

Our unit based compensation plans provide the employee with the option of settling outstanding awards with cash. As a result, unit based compensation expense is determined using the intrinsic method, being the difference between the Trust Unit trading price and the strike price of the unit awards adjusted for the proportion that is vested. The market price of our Trust Units was $24.75 at June 30, 2008 and on September 30, 2008, the price was $17.92. This decrease in unit trading price resulted in the Third Quarter of 2008 unit based compensation expense reflecting a recovery of $6.4 million. Similarly, total unit based compensation expense decreased $2.2 million in the Third Quarter of 2008 compared to the same period in 2007 as the market price of Harvest Trust Units decreased by $6.83 per unit in the Third Quarter of 2008 which was greater than the $6.18 per unit decrease in the Third Quarter of 2007. For the year-to-date, total unit-based compensation expense of $1.4 million has been recorded, a 77% reduction compared to the same period in the prior year due to a reduced market price of Harvest Trust Units.

Depletion, Depreciation, Amortization and Accretion Expense

| | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | |

(000s except per boe) | | 2008 | | 2007 | | Change | | 2008 | | 2007 | | Change | |

| | | | | | | | | | | | | | |

Depletion, depreciation and amortization | | $ | 99,607 | | $ | 104,643 | | | (5 | %) | $ | 305,231 | | $ | 313,573 | | | (3 | %) |

Depletion of capitalized asset retirement costs | | | 3,295 | | | 3,926 | | | (16 | %) | | 10,273 | | | 11,926 | | | (14 | %) |

Accretion on asset retirement obligation | | | 4,698 | | | 4,546 | | | 3 | % | | 13,892 | | | 13,466 | | | 3 | % |

| | | | | | | | | | | | | | | | | | | | |

Total depletion, depreciation, amortization and accretion | | $ | 107,600 | | $ | 113,115 | | | (5 | %) | $ | 329,396 | | $ | 338,965 | | | (3 | %) |

Per boe | | $ | 21.29 | | $ | 20.51 | | | 4 | % | $ | 21.40 | | $ | 20.36 | | | 5 | % |

| | | | | | | | | | | | | | | | | | | | |

Our overall depletion, depreciation, amortization and accretion (“DDA&A”) expense for the three and nine months ended September 30, 2008 was $5.5 million and $9.6 million lower, respectively, compared to the same periods in the prior year. The decrease is attributed to lower production volumes partially offset by slightly higher finding and development costs that have increased our depletion rate compared to the same periods of the prior year.

13

| | | | | | | | | | | | | |

Capital Expenditures | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | |

(000s) | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | |

Land and undeveloped lease rentals | | $ | 1,183 | | $ | 645 | | $ | 3,331 | | $ | 1,066 | |

Geological and geophysical | | | 1,523 | | | 1,340 | | | 5,470 | | | 7,064 | |

Drilling and completion | | | 45,349 | | | 38,619 | | | 118,635 | | | 133,608 | |

Well equipment, pipelines and facilities | | | 18,317 | | | 30,031 | | | 52,984 | | | 119,607 | |

Capitalized G&A expenses | | | 2,672 | | | 2,440 | | | 7,805 | | | 6,891 | |

Furniture, leaseholds and office equipment | | | 54 | | | 248 | | | 112 | | | 1,795 | |

| | | | | | | | | | | | | | |

Development capital expenditures excluding acquisitions and non-cash items | | | 69,098 | | | 73,323 | | | 188,337 | | | 270,031 | |

Non-cash capital additions (recoveries) | | | (1,294 | ) | | (1,042 | ) | | 61 | | | (1,053 | ) |

| | | | | | | | | | | | | | |

Total development capital expenditures excluding acquisitions | | $ | 67,804 | | $ | 72,281 | | $ | 188,398 | | $ | 268,978 | |

| | | | | | | | | | | | | | |

Drilling activity in the Third Quarter was primarily focused on low risk oil development opportunities in some of our more active areas. At southeast Saskatchewan, Harvest drilled 18 gross (12.0) net wells as we continued to pursue light oil in the Tilston and Souris Valley formations using horizontal wells. At Lloydminster and Hayter, we drilled a total of 8 gross (7.0 net) infill horizontal wells to access incremental heavy oil from both the Lloydminster and Dina formations. In southeast Alberta we drilled 18 gross (4.6 net wells) with the majority of the net wells exploiting gas and oil opportunities in Glauconitic channel sands that traverse the area. At Markerville we drilled 11 gross (5.0 net) gas wells primarily for Edmonton sands allowing us to continue to optimize production into our operated gathering system in the area.

The following summarizes Harvest’s participation in gross and net wells drilled during the three months ended September 30, 2008:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Total Wells | | Successful Wells | | Abandoned Wells | |

Area | | Gross1 | | Net | | Gross | | Net | | Gross | | Net | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Southeast Saskatchewan | | 18.0 | | | 12.0 | | | 18.0 | | | 12.0 | | | - | | | - | | |

Southeast Alberta | | 18.0 | | | 4.6 | | | 18.0 | | | 4.6 | | | - | | | - | | |

Red Earth | | - | | | - | | | - | | | - | | | - | | | - | | |

Suffield | | - | | | - | | | - | | | - | | | - | | | - | | |

Lloydminster/Hayter | | 8.0 | | | 7.0 | | | 8.0 | | | 7.0 | | | - | | | - | | |

Rimbey | | 4.0 | | | 2.5 | | | 4.0 | | | 2.5 | | | - | | | - | | |

Markerville | | 11.0 | | | 5.0 | | | 11.0 | | | 5.0 | | | - | | | - | | |

Other Areas | | 8.0 | | | 3.6 | | | 8.0 | | | 3.6 | | | - | | | - | | |

| | | | | | | | | | | | | | | | | | | | |

Total | | 67.0 | | | 34.7 | | | 67.0 | | | 34.7 | | | - | | | - | | |

| | | | | | | | | | | | | | | | | | | | |

(1) Excludes 4 additional wells that we have an overriding royalty interest in.

The following summarizes Harvest’s participation in gross and net wells drilled during the nine months ended September 30, 2008:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Total Wells | | Successful Wells | | Abandoned Wells | |

Area | | Gross1 | | Net | | Gross | | Net | | Gross | | Net | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Southeast Saskatchewan | | 38.0 | | | 30.0 | | | 38.0 | | | 30.0 | | | - | | | - | | |

Southeast Alberta | | 26.0 | | | 9.9 | | | 26.0 | | | 9.9 | | | - | | | - | | |

Red Earth | | 12.0 | | | 11.3 | | | 12.0 | | | 11.3 | | | - | | | - | | |

Suffield | | 8.0 | | | 8.0 | | | 8.0 | | | 8.0 | | | - | | | - | | |

Lloydminster/Hayter | | 17.0 | | | 16.0 | | | 17.0 | | | 16.0 | | | - | | | - | | |

Rimbey | | 17.0 | | | 5.4 | | | 17.0 | | | 5.4 | | | - | | | - | | |

Markerville | | 34.0 | | | 14.4 | | | 34.0 | | | 14.4 | | | - | | | - | | |

Other Areas | | 13.0 | | | 7.1 | | | 13.0 | | | 7.1 | | | - | | | - | | |

| | | | | | | | | | | | | | | | | | | | |

Total | | 165.0 | | | 102.1 | | | 165.0 | | | 102.1 | | | - | | | - | | |

| | | | | | | | | | | | | | | | | | | | |

(1) Excludes 14 additional wells that we have an overriding royalty interest in.

14

Acquisitions and Divestitures

In late July, we acquired a private oil and natural gas company for cash consideration of $36.8 million. The associated production was approximately 390 bbl/d of light oil in an area immediately adjacent to our existing operations in Red Earth plus 2,300 mcf/d of natural gas from a shallow gas play in north central Alberta. An independent engineering report prepared effective April 1, 2008 estimated proved and probable reserves of 1,800 mboe.

In early September, we acquired conventional oil and gas properties in the Peace River Arch area of northern Alberta with approximately 1,900 boe of daily production for cash consideration of $130.8 million plus the transfer of some minor Alberta gas interests which produced approximately 85 boe/d during the first half of 2008. During the first half of 2008, the acquired properties averaged production of approximately 1,255 barrels of medium gravity oil and natural gas liquids plus 3,900 mcf/d of natural gas. An independent engineering report prepared effective December 31, 2007 estimated proved reserves at 7,260 mboe and proved plus probable reserves at 9,899 mboe.

During the Third Quarter, we disposed of various non-operated properties in the Pouce Coupe area for cash consideration of $36.8 million plus some freehold mineral interests in southeast Saskatchewan. These properties had average daily production of approximately 2,800 mcf/d of natural gas and 14 boe/d of natural gas liquids.

Asset Retirement Obligation (“ARO”)

In connection with property acquisitions and development expenditures, we record the fair value of the ARO as a liability in the same year the expenditures occur. The associated asset retirement costs are capitalized as part of the carrying amount of the assets and are depleted and depreciated over our estimated net proved reserves. Once the initial ARO is measured, it is adjusted at the end of each period to reflect the passage of time as well as changes in the estimated future cash flows of the underlying obligation. Our asset retirement obligation increased by $5.8 million during the Third Quarter of 2008 as a result of accretion expense of $4.7 million, new liabilities recorded of $4.1 million offset by $3.0 million of actual asset retirement expenditures incurred.

15

DOWNSTREAM OPERATIONS

Third Quarter Highlights

| | |

| • | Cash from downstream operations totaled $47.2 million, a substantial improvement from the breakeven performance of the prior quarter and the $23.4 million cash flow deficiency of the Third Quarter in 2007. |

| | |

| • | Refining margin of US$10.47 per barrel reflects a US$7.39 increase over the Third Quarter of the prior year and a US$4.81 increase relative to the Second Quarter of 2008 primarily attributed to higher discounts for our medium sour crude oil feedstock. |

| | |

| • | Our cost of feedstock was US$11.40 per barrel lower than the WTI benchmark price as compared to a US$2.08 discount in the Third Quarter of the prior year and a US$1.52 discount in the Second Quarter of 2008. |

| | |

| • | Refinery operations maintained a reduced level of throughput in July and August in an effort to improve refining margins by minimizing production of high sulphur fuel oil (HSFO) which comprised 26% of our refined product yield as compared to over 29% in the prior year. September’s production averaged 103,650 bbl/d. |

| | |

| • | Operating costs of $2.02 per barrel of throughput as compared to $2.12 in the Third Quarter of the prior year and $2.21 in the Second Quarter of 2008 reflecting a relative reduction in expenditures of approximately $2 million. |

| | |

| • | Our cost of purchased energy of $3.72 per barrel of throughput is trending lower as compared to $4.23 and $3.27 in the First and Second Quarters of this year, respectively and is significantly higher than $2.34 in the Third Quarter of the prior year reflecting a significantly higher commodity price environment. |

| | | | | | | | | | | | | |

Summary of Financial and Operational Results | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | | | | | | | | | |

(in $000’s except where noted below) | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Revenues | | | 1,214,898 | | | 789,612 | | | 3,504,443 | | | 2,474,044 | |

Purchased feedstock for processing and products purchased for resale | | | 1,099,963 | | | 747,010 | | | 3,220,513 | | | 2,087,948 | |

| | | | | | | | | | | | | | |

Gross Margin(1) | | | 114,935 | | | 42,602 | | | 283,930 | | | 386,096 | |

| | | | | | | | | | | | | |

Costs and expenses | | | | | | | | | | | | | |

Operating expense | | | 23,357 | | | 24,775 | | | 74,868 | | | 76,720 | |

Purchased energy expense | | | 33,958 | | | 22,340 | | | 106,985 | | | 64,677 | |

Turnaround and catalyst expense | | | 1,011 | | | 6,622 | | | 1,011 | | | 6,622 | |

Marketing expense | | | 8,560 | | | 10,673 | | | 26,558 | | | 27,075 | |

General and administrative expense | | | 345 | | | 522 | | | 1,514 | | | 1,224 | |

Depreciation and amortization expense | | | 17,195 | | | 17,280 | | | 50,438 | | | 54,854 | |

| | | | | | | | | | | | | | |

Earnings (loss) from operations(1) | | | 30,509 | | | (39,610 | ) | | 22,556 | | | 154,924 | |

| | | | | | | | | | | | | |

Cash capital expenditures | | | 17,199 | | | 12,468 | | | 31,845 | | | 27,222 | |

| | | | | | | | | | | | | |

Feedstock volume (bbl/day)(2) | | | 99,127 | | | 103,983 | | | 103,832 | | | 111,052 | |

| | | | | | | | | | | | | |

Yield (000’s barrels) | | | | | | | | | | | | | |

Gasoline and related products | | | 2,757 | | | 3,073 | | | 8,801 | | | 9,762 | |

Ultra low sulphur diesel and jet fuel | | | 3,985 | | | 3,596 | | | 12,001 | | | 11,829 | |

High sulphur fuel oil | | | 2,348 | | | 2,785 | | | 7,448 | | | 8,480 | |

| | | | | | | | | | | | | | |

Total | | | 9,090 | | | 9,454 | | | 28,250 | | | 30,071 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Average Refining Margin (US$/bbl)(3) | | | 10.47 | | | 3.08 | | | 8.38 | | | 10.57 | |

| | | | | | | | | | | | | | |

| |

(1) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A |

| |

(2) | Barrels per day are calculated using total barrels of crude oil feedstock and Vacuum Gas Oil. |

| |

(3) | Average refining margin is calculated based on per barrel of feedstock throughput |

16

Refining Benchmark Prices

The North American refining industry has numerous pricing indicators against which to compare refinery gross margin performance. Typically, these gross margin indicators include prices for refined products such as Reformulated Blendstock for Oxygenate Blending gasoline (“RBOB gasoline”) and heating oil. The New York Mercantile Exchange (“NYMEX”) “2-1-1 Crack Spread” is such an indicator and is calculated assuming that the processing of two barrels of light sweet crude oil (defined as a WTI quality) yields one barrel of RBOB gasoline and one barrel of heating oil both of which are delivered to the New York market where product prices are set in relation to NYMEX RBOB gasoline and NYMEX heating oil prices. The following average prices, gross margin indicators and currency exchange rates are provided as reference points with which to index our refinery’s performance:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30 | | Nine Months Ended September 30 | |

| | | | | | |

| | 2008 | | 2007 | | | Change | 2008 | | 2007 | | | Change |

| | | | | | | | | | | | | | |

WTI crude oil (US$/bbl) | | 117.98 | | 75.38 | | | 57% | 113.29 | | 66.19 | | | 71% |

Brent crude oil (US$/bbl) | | 116.87 | | 74.87 | | | 56% | 111.07 | | 67.10 | | | 66% |

Basrah Official Sales Price Discount (US$/bbl) | | (6.70) | | (5.03) | | | 33% | (7.52) | | (5.89) | | | 28% |

RBOB gasoline (US$/bbl/gallon) | | 123.91/2.95 | | 87.02/2.07 | | | 42% | 120.57/2.87 | | 83.80/2.00 | | | 44% |

Heating Oil (US$/bbl/gallon) | | 138.66/3.30 | | 87.86/2.09 | | | 58% | 134.13/3.19 | | 79.30/1.89 | | | 69% |

High Sulphur Fuel Oil (US$/bbl) | | 96.03 | | 57.19 | | | 68% | 83.75 | | 49.14 | | | 70% |

2-1-1 Crack Spread (US$/bbl) | | 13.31 | | 12.06 | | | 10% | 14.06 | | 15.36 | | | (9%) |

Canadian / US dollar exchange rate | | 0.960 | | 0.957 | | | 0% | 0.982 | | 0.907 | | | 8% |

| | | | | | | | | | | | | | | | | | | | |

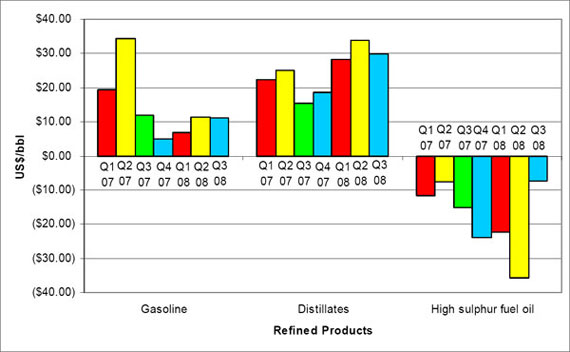

During the Third Quarter of 2008, the 2-1-1 Crack Spread increased US$1.25/bbl as compared to the same period in the prior year reflecting an US$8.20/bbl increase in the Heating Oil Crack Spread to US$20.68/bbl offset by a decrease of US$5.71 in the RBOB Crack Spread to US$5.93/bbl. For the nine month period ended September 30, 2008, the 2-1-1 Crack Spread decreased by US$1.30/bbl as compared to the prior year due to a US$10.33/bbl decrease in the RBOB Crack Spread to US$7.28/bbl offset by a US$7.73/bbl increase in the Heating Oil Crack Spread to US$20.84/bbl.

Harvest’s refining margin differs from that represented by the 2-1-1 Crack Spread indicator due to the refined product mix produced by the refinery as well as the type of crude oil feedstock processed. Our refinery produces approximately 25% - 30% high sulphur fuel oil (“HSFO”), a product not represented in the NYMEX 2-1-1 Crack Spread. HSFO typically sells at a discount to WTI and has a negative contribution to our refining margin. Our refinery also processes a medium gravity sour crude oil, purchased at a discount to WTI, rather than a WTI quality of light sweet crude oil represented in the 2-1-1 Crack Spread. To optimize the throughput of our Isomax hydrocracker unit, we typically purchase approximately 5,000 – 10,000 bbl/d of vacuum gas oil (“VGO”) which may sell at a price that is either a premium or discount to WTI.

17

Downstream Gross Margin

The following summarizes Harvest downstream gross margin contributions for each of the three and nine months ended September 30, 2008 and 2007 segregated between refining activities and marketing and other related businesses.

| | | | | | | | | | | | | |

| | |

| | Three Months Ended September 30 | |

| | | | |

| | 2008 | | 2007 | |

| | | | | | |

(000’s of Canadian dollars) | | Refining | | Marketing | | Total | | Refining | | Marketing | | Total | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Sales revenue(1) | | 1,187,890 | | 220,402 | | 1,214,898 | | 764,075 | | 158,292 | | 789,612 | |

Cost of feedstock for processing and products for resale(1) | | 1,088,455 | | 204,902 | | 1,099,963 | | 733,302 | | 146,463 | | 747,010 | |

| | | | | | | | | | | | | |

Gross margin(2) | | 99,435 | | 15,500 | | 114,935 | | 30,773 | | 11,829 | | 42,602 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Average Refining Margin (US$/bbl) | | 10.47 | | | | | | 3.08 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| | Nine Months Ended September 30 | |

| | | | |

| | 2008 | | 2007 | |

| | | | | | |

(000’s of Canadian dollars) | | Refining | | Marketing | | Total | | Refining | | Marketing | | Total | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Sales revenue(1) | | 3,425,471 | | 544,698 | | 3,504,443 | | 2,404,522 | | 364,986 | | 2,474,044 | |

Cost of feedstock for processing and products for resale(1) | | 3,182,804 | | 503,435 | | 3,220,513 | | 2,051,188 | | 332,224 | | 2,087,948 | |

| | | | | | | | | | | | | |

Gross margin(2) | | 242,667 | | 41,263 | | 283,930 | | 353,334 | | 32,762 | | 386,096 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Average Refining Margin (US$/bbl) | | 8.38 | | | | | | 10.57 | | | | | |

| | | | | | | | | | | | | |

| |

(1) | Downstream sales revenue and cost of products for processing and resale are net of intra-segment sales of $193.4 million and $465.7 million for the three and nine months ended September 30, 2008 respectively ($132.8 million and $295.5 million – three and nine months ended September 30, 2007) reflecting the refined products produced by the refinery and sold by Marketing Division. |

| |

(2) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

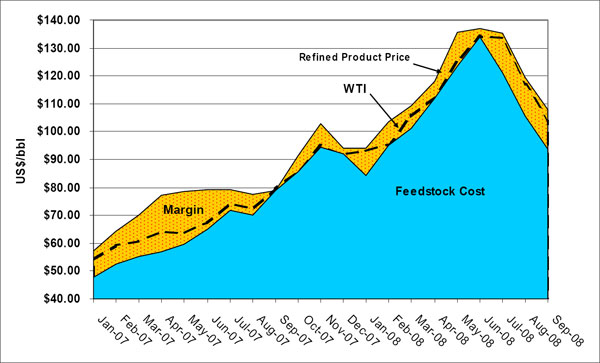

Harvest’s refining margin comprises sales of refined petroleum products that realize a premium price relative to WTI while it purchases crude oil and VGO as feedstock which is typically purchased at a discount relative to WTI. During the Third Quarter of 2008, our refining margin totaled $99.4 million, or US$10.47/bbl which is a 223% increase compared to the margin of $30.8 million or US$3.08/bbl realized during the Third Quarter of 2007. This increase is attributed to a significant improvement in the discount on feedstock costs relative to WTI in the Third Quarter of 2008 as compared to the same period in 2007, marginally offset by a reduction in the refined product sales prices relative to WTI between the Third Quarters of 2008 and 2007.

For the nine months ended September 30, 2008, Harvest’s refining margin totaled $242.7 million, a reduction of $110.7 million compared to the first nine months of the prior year, reflecting an average refining margin of US$8.38/bbl in 2008 as compared to US$10.57/bbl in 2007. The US$2.19/bbl year-over-year decrease in our average refining margin is due to lower gasoline and HSFO crack spreads, only partially offset by improved crack spreads on distillate products and an improved discount on our cost of feedstock relative to WTI.

18

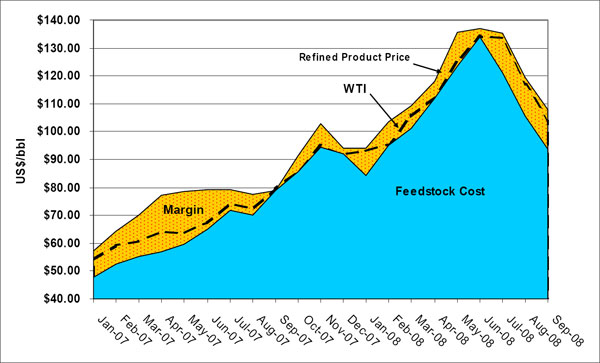

The following summarizes our refining margin per barrel relative to our cost of feedstock and the WTI benchmark from the period January 2007 to September 2008:

Relative to the average Third Quarter 2008 2-1-1 Crack Spread of US$13.31, our average refining margin of US$10.47/bbl is US$2.84/bbl lower as compared to being US$8.98/bbl lower than the 2-1-1 Crack Spread in the Third Quarter of the prior year. The relative improvement in our refining margin is primarily attributed to the higher discount on our purchases of medium gravity sour crude oil feedstock relative to WTI. In the Third Quarter of 2008, the average cost of our crude oil feedstock was US$105.01, a discount of US$12.97/bbl relative to WTI as compared to an average cost of US$71.85/bbl and a discount of US$3.53/bbl in the prior year.

On a year-to-date basis, our average refining margin of US$8.38/bbl was US$5.68/bbl lower than the average 2-1-1 Crack Spread of US$14.06 for the first nine months of 2008. This compares to an average refining margin of US$10.57/bbl which was US$4.79/bbl lower than the 2-1-1 Crack Spread for the nine months ended September 30, 2007. The US$0.89/bbl increase in differential from the 2-1-1 Crack Spread is primarily attributed to increased discounts for HSFO coupled with lower crack spreads on RBOB gasoline, partially offset by higher crack spreads on distillates and increased discounts on our cost of feedstock.

Harvest’s marketing and related businesses is comprised of the retail and wholesale distribution of gasoline, diesel, jet and other transportation fuels as well as home heating fuels and related appliances and the revenues from our marine services including tugboat revenues. During the three and nine months ended September 30, 2008, the gross margin contributed by our marketing division increased by 31% and 26%, respectively, as compared to the prior year primarily due to a significant increase in the price of sulphur, which is sold through a profit sharing agreement with a third party processor. The profit sharing contribution from our sulphur sales is $2.6 million for the three months ended September 30, 2008 (three months ended September 30, 2007 - $0.2 million) and $8.3 million for the nine months ended September 30, 2008 (nine months ended September 30, 2007 - $0.3 million).

19

Refined Product Sales Revenue

All of our gasoline and distillate products are sold to Vitol pursuant to the Supply and Offtake Agreement with the exception of products sold in Newfoundland through our marketing division and effective January 20, 2008, our HSFO which is now sold to a wholly-owned affiliate of one of the world’s largest integrated oil and natural gas producers. Prior to January 20, 2008, our HSFO had also been sold to Vitol. The Supply and Offtake Agreement has pricing terms that reflect market prices based on an average delay of ten days which results in our sales to Vitol and our cost of refinery feedstock purchased from Vitol being priced on a slightly different time period than the prices at the time of delivery. With the exception of the sales to Vitol, our refined products are sold at prices that reflect market prices at the time that the product is delivered to the purchaser. For more information on the Supply and Offtake Agreement with Vitol, see the description in our Annual Information Form for the year ended December 31, 2007 as filed on SEDAR atwww.sedar.com.

A comparison of our refinery yield, product pricing and revenue for each of the three and nine months ended September 30, 2008 and 2007 is presented below.

| | | | | | | | | | | | | |

| | | |

| | Three Months Ended September 30 | |

| | | | |

| | 2008 | | 2007 | |

| | | | | | |

| | Refinery

Revenues | Volume | Sales

Price(1) | | Refinery

Revenues | Volume | Sales

Price(1) | |

| | | | | | | | | | | | | | |

| | (000’s of Cdn $) | (000s of bbls) | (US$ per bbl/

US$ per US gal) | | (000’s of Cdn $) | (000s of bbls) | (US$ per bbl/

US$ per US gal) | |

| | | | | | | | | | | | | |

Gasoline products | | 408,292 | | 3,329 | | 117.74/2.80 | | 249,628 | | 2,800 | | 85.32/2.03 | |

Distillates | | 545,610 | | 3,841 | | 136.37/3.25 | | 344,521 | | 3,719 | | 88.65/2.11 | |

High sulphur fuel oil | | 233,988 | | 2,267 | | 99.09 | | 169,926 | | 2,791 | | 58.27 | |

| | | | | | | | | | | | | |

| | 1,187,890 | | 9,437 | | 120.84 | | 764,075 | | 9,310 | | 78.54 | |

| | | | | | | | | | | | | |

Inventory adjustment | | | | (347 | ) | | | | | 144 | | | |

| | | | | | | | | | | | | |

Total production | | | | 9,090 | | | | | | 9,454 | | | |

Yield (as a % of Feedstock)(2) | | 100 | % | | | | | 99 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | |

|

| | | |

| | Nine Months Ended September 30 | |

| | | | |

| | 2008 | | 2007 | |

| | | | | | |

| | Refinery

Revenues | Volume | Sales

Price(1) | | Refinery

Revenues | Volume | Sales

Price(1) | |

| | | | | | | | | | | | | | |

| | (000’s of Cdn $) | (000s of bbls) | (US$ per bbl/

US$ per US gal) | | (000’s of Cdn $) | (000s of bbls) | (US$ per bbl/

US$ per US gal) | |

| | | | | | | | | | | | | |

Gasoline products | | 1,130,160 | | 9,567 | | 116.00/2.76 | | 861,246 | | 9,343 | | 83.61/1.99 | |

Distillates | | 1,664,774 | | 11,901 | | 137.37/3.27 | | 1,072,177 | | 11,785 | | 82.52/1.96 | |

High sulphur fuel oil | | 630,537 | | 7,235 | | 85.58 | | 471,099 | | 8,484 | | 50.36 | |

| | | | | | | | | | | | | |

| | 3,425,471 | | 28,703 | | 117.19 | | 2,404,522 | | 29,612 | | 73.65 | |

| | | | | | | | | | | | | |

Inventory adjustment | | | | (453 | ) | | | | | 459 | | | |

| | | | | | | | | | | | | |

Total production | | | | 28,250 | | | | | | 30,071 | | | |

Yield (as a % of Feedstock)(2) | | 99 | % | | | | | 99 | % | | |

| | | | | | | | | | | |

| |

(1) | Average product sales prices are based on the deliveries at our refinery loading facilities |

| |