"Final Maturity Date" means the latest stated maturity date of any of the Senior Secured Notes.

"Financing Documents" means the Senior Secured Notes, the Guarantees, the Indenture, the Security Documents, the Note Purchase Agreement, the Registration Rights Agreement, the exchange notes, the Letters of Credit and any other credit or security agreement executed by a Financing Entity in respect of a Project.

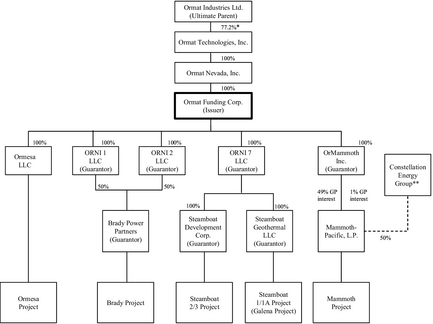

"Financing Entity" means us, the Guarantors and Ormat Nevada.

"Fleetwood Geothermal Resources Sublease" means that certain Geothermal Resources Sublease, dated May 31, 1991, between Steamboat Development, as subtenant, and Fleetwood Corporation, as sublandlord, as amended by the amendment dated June 11, 1991.

"Fluid Supply Agreement" means that certain Fluid Supply Agreement, dated December 15, 2003, between Brady and Western States Geothermal Company.

"GAAP" means generally accepted accounting principles set forth in the opinions and pronouncements of the Accounting Principles Board of the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board or in such other statements by such other entity as have been approved by a significant segment of the accounting profession, which are in effect as of the relevant date of determination.

"Galena Power Purchaser" means the party purchasing power from Steamboat Geothermal under the Galena Power Purchase Agreement.

"Galena Power Purchase Agreement" means a power purchase agreement between ORNI 7 LLC and either Sierra Pacific Power Company providing for a price of not less than $.052 kWh (escalating by one percent (1%) on an annual basis) and containing terms no less favorable than those set forth under "Description of Our Principal Contracts—Steamboat Complex—Galena Re-powering Documents—Galena Power Purchase Agreement," including without limitation, the obligation of ORNI 7 LLC to deliver electrical energy in the amounts consistent with an expected generation based on a nominal net capacity of 18 MW.

"Galena Re-powering" means the upgrading of the Steamboat Geothermal Plant with the intent to achieve a minimum net electrical output of 18 MW through the replacement of certain equipment at the Steamboat Geothermal Plant and the possible addition of geothermal resources from the Steamboat Development Plant.

"Galena Re-powering Contract" means the Engineering, Procurement and Galena Re-powering Contract dated as of the Closing Date between the Contractor and ORNI 7.

"Galena Re-powering Letter of Credit" means an Acceptable Letter of Credit having, at all times while such letter of credit is in effect, an amount available to be drawn that, when added to that amount then on deposit in the Galena Re-powering Account, is not less than the Galena Re-powering Requirement at such time.

"Galena Re-powering Requirement" means $19.4 million, or if amounts have been previously withdrawn from the Galena Re-powering Account pursuant to the Depositary Agreement the greater of an amount equal to (i) $19.4 million less the sum of the amounts that have been previously withdrawn from the Galena Re-powering Account and (ii) the remaining amount the Independent Engineer certifies is necessary to achieve the Final Completion Date with respect to the Galena Re-powering; provided, however, that if additional amounts are required to be deposited within the Galena Re-powering Account as a result of this clause (ii), we shall be permitted to transfer amounts from the Distribution Suspense Account into the Galena Re-powering Account in order to satisfy such requirement.

"Geothermal Consultant" means Geothermex, Inc. or another widely recognized independent geothermal engineering firm retained by us as Geothermal Consultant.

"Geothermal Resources Leases" means the Sierra Pacific Geothermal Resources Lease, the Guisti Geothermal Resources Lease, the Fleetwood Geothermal Resources Sublease, the Magma

Geothermal Resources Lease, the Mammoth-BLM Geothermal Resources Lease CA 11667, the Mammoth-BLM Geothermal Resources Lease CA 14408, the Ormesa-BLM Geothermal Resources Lease CA 964, the Ormesa-BLM Geothermal Resources Lease CA 966, the Ormesa-BLM Geothermal Resources Lease CA 1903, the Ormesa-BLM Geothermal Resources Lease CA 6217, the Ormesa-BLM Geothermal Resources Lease CA 6218, the Ormesa-BLM Geothermal Resources Lease CA 6219, the Ormesa-BLM Geothermal Resources Lease CA 17568, the Railway Geothermal Resources Lease, the ConAgra Lease, the Brady-BLM Geothermal Resources Lease N-10922, the Brady-BLM Geothermal Resources Lease N-46566, the Brady-BLM Geothermal Resources Lease N-40353, and the Brady-BLM Geothermal Resources Lease N-40355.

"G1 Power Purchase Agreement" means that certain Amended and Restated Power Purchase and Sales Agreement, dated December 2, 1986, between Mammoth-Pacific and Southern California Edison, as amended by that certain Amendment No. 1 to the Amended and Restated Power Purchase and Sales Agreement, dated May 18, 1990.

"G2 Interconnection Facilities Agreement" means that certain Interconnection Facilities Agreement, attached to that certain Amendment No. 1 — Power Purchase Contract as Appendix A, dated October 27, 1989, between Mammoth-Pacific and Southern California Edison.

"G2 Power Purchase Agreement" means that certain Power Purchase Contract, dated April 15, 1985, between Mammoth-Pacific and Southern California Edison, as amended by that certain Amendment No. 1 — Power Purchase Contract, dated October 27, 1989, and as amended further by that certain Amendment No. 2 — Power Purchase Contract, dated December 20, 1989.

"G3 Interconnection Facilities Agreement" means that certain Interconnection Facilities Agreement, dated October 27, 1989, between Mammoth-Pacific and Southern California Edison.

"G3 Power Purchase Agreement" means that certain Power Purchase Contract, dated April 16, 1985, between Mammoth-Pacific (as successor to Santa Fe Geothermal, Inc.), and Southern California Edison, as amended by that certain Amendment No. 1 to the Power Purchase Contract, dated October 27, 1989, between Mammoth-Pacific and Southern California Edison and as amended further by that certain Amendment No. 2 — Power Purchase Contract, dated December 20, 1989.

"Governmental Approvals" means all governmental approvals, authorizations, consents, decrees, permits, waivers, privileges and filings with all or from Governmental Authorities required to be obtained or made for the ownership, construction, operation and maintenance of a Project.

"Guarantee" means each guarantee by a Guarantor of our obligations under the Financing Documents.

"Guarantor" means (i) each of Brady, Steamboat Development, Steamboat Geothermal, OrMammoth, the ORNI Entities and their respective successors and assigns and (ii) from and after the date of such execution, any of our other direct or indirect Subsidiaries that execute a Guarantee (including without limitation, in connection with the acquisition of a Qualified Project) in accordance with the provisions of the Indenture and their respective successors and assigns.

"Guisti Geothermal Resources Lease" means that certain Geothermal Resources Lease, dated June 27, 1988 among Steamboat Development, Bernice Guisti, Judith Harvey and Karen Thompson, as Trustees and Beneficiaries of the Guisti Trust, as amended by that certain Amendment to Geothermal Resources Lease dated January 1992, and that certain Second Amendment to Geothermal Resources Lease dated June 25, 1993.

"Holder" means a Person in whose name a Senior Secured Note is registered.

"IID Water Supply Agreement" means that certain Amended and Restated Water Supply Agreement, dated March 6, 1990, between Ormesa (as successor to Trigor Geothermal Corporation) and the Imperial Irrigation District.

"Indebtedness" of any Person means, at any date, without duplication:

(i) all obligations of such Person for borrowed money;

151

(ii) all obligations of such Person evidenced by bonds, debentures, notes or other similar instruments (excluding "deposit only" endorsements on checks payable to the order of such Person);

(iii) all obligations of such Person to pay the deferred purchase price of property or services (except accounts payable and similar obligations arising in the ordinary course of business shall not be included herein);

(iv) all obligations of such Person as lessee under capital leases to the extent required to be capitalized on the books of such Person in accordance with GAAP;

(v) all obligations of such Person under conditional sale or other title retention agreements relating to property or assets purchased by such Person;

(vi) all Indebtedness of others secured by (or for which the holder of such indebtedness has an existing right, contingent or otherwise, to be secured by) any Lien on property owned or acquired by such Person, whether or not the obligations secured thereby have been assumed;

(vii) all obligations of such Person in respect of interest rate swaps, collars or caps and other interest rate protection arrangements, foreign currency exchange agreements, commodity exchange, commodity future, commodity forward or commodity option agreements, or other interest or exchange rate or commodity hedging arrangements;

(viii) all obligations of such Person as an account party in respect of letters of credit and bankers' acceptances; and

(ix) all obligations of others of the type referred to in clauses (i) through (viii) above guaranteed by such Person, whether or not secured by a Lien or other security interest on any asset of such Person.

"Indenture" means the Indenture, dated as of the Closing Date, among us, the Guarantors and the Trustee providing for the issuance of Senior Secured Notes and the Guarantees.

"Independent Engineer" means Stone & Webster Management Consultants, Inc., or another widely recognized independent engineering firm or engineer retained as Independent Engineer by us.

"Initial Galena Re-powering Withdrawal Conditions" has the meaning set forth under "Description of Principal Financing Agreements—Galena Re-powering Account."

"Initial Purchaser" means Lehman Brothers Inc.

"Insurance Consultant" means Marsh USA, Inc., or its successors; provided that such successor is another nationally recognized independent insurance consultant.

"Interconnection Agreements" means the Steamboat 1/1A Interconnection Agreement, Steamboat 2/3 Interconnection Agreement, the Mammoth Interconnection Facilities Agreements, the Ormesa Interconnection Agreements, and the Brady/Desert Peak 1 Interconnection Agreement.

"Investment Grade" means a rating of Baa3 or better by Moody's Investors Services, Inc. and BBB− or better by S&P (or an equivalent rating by another nationally recognized credit rating agency if one or more of such corporations are not in the business of rating long-term obligations of commercial banks at the time of issuance); provided, that such rating is not on review for possible downgrade or on negative watch by any such agency.

"Letter of Credit" means the Debt Service Reserve Letter of Credit, the Galena Re-powering Letter of Credit or the Ormesa Repayment Letter of Credit, as the case may be.

"Lien" means any mortgage, pledge, hypothecation, assignment, mandatory deposit arrangement, encumbrance, security interest, charge, lien (statutory or other), preference, priority or other collateral agency agreement of any kind or nature whatsoever which has the substantial effect of constituting a security interest, including, without limitation, any conditional sale or other title retention agreement, any financing lease having substantially the same effect as any of the foregoing and the filing of any financing statement or similar instrument under the Uniform Commercial Code or comparable law of any jurisdiction, domestic or foreign.

152

"Loss Proceeds" means all proceeds from an Event of Loss received by us or any Guarantor, including, without limitation, insurance proceeds or other amounts actually received, except proceeds of business interruption insurance.

"Loss Proceeds Account" means the account of such name created under the Depositary Agreement.

"Magma Geothermal Resources Lease" means that certain Geothermal Lease, dated August 31, 1983, between Mammoth-Pacific and Magma Power Company, as amended by amendments dated April 30, 1987, January 1, 1990, and April 12, 1991.

"Make-Whole Premium" means a premium equal to the excess, if any, of (a) the present value of all scheduled principal and interest payments on all Senior Secured Notes to be redeemed (discounted at a rate equal to the yield to maturity of U.S. Treasury securities having an average life equal to the remaining average life of the Senior Secured Notes, plus 50 basis points) over (b) the principal amount of the Senior Secured Notes to be redeemed.

"Mammoth-BLM Geothermal Resources Lease CA 11667" means that certain Geothermal Resources Lease CA 11667, dated March 1, 1982, between Mammoth-Pacific and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Mammoth-BLM Geothermal Resources Lease CA 14408" means that certain lease for Geothermal Resources CA 14408, dated February 1, 1985, between Mammoth-Pacific and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Mammoth-BLM Site License" means that certain License for Electric Power Plant Site CA 21918, dated July 26, 1989, between Mammoth-Pacific and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Mammoth Enhancement" means the investment in additional equipment and other enhancements at the Mammoth Project that are designed to increase output at the Mammoth Plant by 3.6 MW.

"Mammoth Interconnection Facilities Agreements" means the G2 Interconnection Facilities Agreement and the G3 Interconnection Facilities Agreement.

"Mammoth Operation and Maintenance Agreement" means that certain Plant Operating Services Agreement, dated January 1, 1995, between Ormat Nevada (as successor to Pacific Power Plant Operations) and Mammoth-Pacific.

"Mammoth-Pacific" means Mammoth-Pacific, L.P. (California), a California limited partnership.

"Mammoth-Pacific LP Agreement" means that certain Amended and Restated Agreement of Limited Partnership of Mammoth-Pacific dated January 26, 1990, among CD Mammoth Lakes I, Inc., CD Mammoth Lakes II, Inc. and OrMammoth, as amended by the amendment dated June 13, 1995.

"Mammoth Plant" means the three geothermal power generating plants, denominated the G1, G2 and G3 plants located in Mammoth Lakes, California that are owned by Mammoth-Pacific (and in which OrMammoth has a 50% partnership interest) and having a gross generating capacity of 35 MW.

"Mammoth Power Purchase Agreements" means the G1 Power Purchase Agreement, the G2 Power Purchase Agreement and the G3 Power Purchase Agreement.

"Material Adverse Effect" means a material adverse effect on (i) our or any of our Subsidiaries' results of operations or financial condition, taken as a whole, (ii) the validity or priority of the Liens on the Collateral or Guarantees, (iii) our or any of our Subsidiaries' ability, taken as a whole, to observe and perform any of our or their material obligations under the Project Documents and the Financing Documents to which we or they are a party or (iv) the ability of the Trustee or the Collateral Agent to enforce any of the payment or other material obligations of us, any Guarantor or Ormat Nevada under the Financing Documents to which we, the Guarantors or Ormat Nevada are parties, as the case may be.

"Material Project Documents" means the Power Purchase Agreements, the Operation and Maintenance Agreements, the Interconnection Agreements, the Geothermal Resources Leases, the

153

Site Licenses, the Mammoth-Pacific LP Agreement, the IID Water Supply Agreement, the Fluid Supply Agreement, the Desert Peak Sublease, the Brady Settlement Agreement, the Galena Re-powering Contract and any Additional Project Document.

"Megawatt" or "MW" means one million watts.

"Meyburg Geothermal Resources Lease" means that certain Geothermal Resources Lease, between ORNI 7 LLC, as lessee, and ORNI 6 LLC, as lessor.

"Net Available Amount" means, with respect to any proceeds, such proceeds net of the related Collection Expenses.

"Note Purchase Agreement" means the Note Purchase Agreement among us, the Guarantors and the Initial Purchaser for the sale and purchase of the Senior Secured Notes.

"Offering" means the offering of the Senior Secured Notes described herein.

"Officer's Certificate" means a certificate signed by our Authorized Representative.

"OG I Plant Connection Agreement" means that certain Plant Connection Agreement for the Ormesa Geothermal Plant, dated October 1, 1985, between Ormesa (as successor to Ormesa Geothermal) and the Imperial Irrigation District.

"OG I Power Purchase Agreement" means that certain Power Purchase Contract, dated July 18, 1984, between Ormesa (as successor to Republic Geothermal, Inc.) and Southern California Edison, as amended by that certain Amendment No. 1 to the Power Purchase Contract, dated December 23, 1988, between Ormesa (as successor to Ormesa Geothermal) and Southern California Edison.

"OG I Transmission Service Agreement" means that certain Transmission Service Agreement for the Ormesa I, Ormesa IE and Ormesa IH Geothermal Power Plants, dated October 3, 1989, between Ormesa (as successor to Ormesa Geothermal) and the Imperial Irrigation District.

"OG IE Plant Connection Agreement" means that certain Plant Connection Agreement for the Ormesa IE Geothermal Power Plant, dated October 21, 1988, between Ormesa (as successor to Ormesa IE) and the Imperial Irrigation District.

"OG IH Plant Connection Agreement" means that certain Plant Connection Agreement for the Ormesa IH Geothermal Power Plant, dated October 3, 1989, between Ormesa (as successor to Ormesa IH) and the Imperial Irrigation District.

"OG II Plant Connection Agreement" means that certain Plant Connection Agreement for the Ormesa Geothermal Plant No. 2, dated May 26, 1987, between Ormesa (as successor to Ormesa Geothermal II) and the Imperial Irrigation District.

"OG II Power Purchase Agreement" means that certain Power Purchase Contract, dated June 13, 1984, between Ormesa (as successor to Ormat Systems Inc.) and Southern California Edison.

"OG II Transmission Service Agreement" means that certain Transmission Service Agreement for the Ormesa II Geothermal Power Plant, dated August 25, 1987, between Ormesa (as successor to Ormesa Geothermal II) and the Imperial Irrigation District.

"Operating Account" means the account of such name created under the Depositary Agreement.

"Operating and Maintenance Expenses" means, for any period, all amounts disbursed by or on behalf of us or any Subsidiary in such period for operation, maintenance, administration, repair (other than repair done in response to a casualty event), or improvement of a Project, including, without limitation, premiums on insurance policies, property and other taxes, litigation expenses and costs, payments under leases, royalty and other land use agreements, and fees, expenses, and any other payments required under the Project Documents; provided, "Operating and Maintenance Expenses" shall not include (i) any payment made in respect of the Financing Documents or with respect to any Indebtedness, (ii) any payment or dividends or other distributions to Ormat Nevada or any of our other Affiliates other than payments under Project Documents, (iii) any tax paid or payable by any of our direct or indirect equity owners with respect to our income or receipts or (iv) any amounts for construction related to the Galena Re-powering.

154

"Operating Subsidiaries" means all of our Subsidiaries other than OrMammoth unless OrMammoth purchases the partnership interests of Mammoth-Pacific that it does not currently own.

"Operation and Maintenance Agreements" means the Steamboat Complex Operation and Maintenance Agreement, the Mammoth Operation and Maintenance Agreement, the Ormesa Operation and Maintenance Agreement, and the Brady Operation and Maintenance Agreement.

"OrMammoth" means OrMammoth Inc., a Delaware corporation.

"Ormat Nevada" means Ormat Nevada Inc., a Delaware corporation.

"Ormat Nevada Subordinated Loan" means a subordinated Credit Agreement between us and Ormat Nevada that constitutes Subordinated Debt.

"Ormesa" means Ormesa LLC, a Delaware limited liability company.

"Ormesa-BLM Geothermal Resources Lease CA 964" means the Geothermal Resources Lease CA 964, dated September 1, 1974, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 966" means the Geothermal Resources Lease CA 966, dated August 1, 1974, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 1903" means the Geothermal Resources Lease CA 1903, dated September 1, 1974, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 6217" means the Geothermal Resources Lease CA 6217, dated July 1, 1979, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 6218" means the Geothermal Resources Lease CA 6218, dated July 1, 1979, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 6219" means the Geothermal Resources Lease CA 6219, dated July 1, 1979, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Geothermal Resources Lease CA 17568" means the Geothermal Resources Lease CA 17568, dated July 1, 1979, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Site License CA 17129" means that certain License for Electric Power Plant Site CA 17129, dated August 21, 1985, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Site License CA 20172" means that certain License for Electric Power Plant Site CA 20172, dated July 21, 1987, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Site License CA 22079" means that certain License for Electric Power Plant Site CA 22079, dated July 24, 1989, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Site License CA 22405" means that certain License for Electric Power Plant Site CA 22405, dated June 7, 1988, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

"Ormesa-BLM Site License CA 24678" means that certain License for Electric Power Plant Site CA 24678, dated September 18, 1989, between Ormesa and the United States of America through the Bureau of Land Management of the Department of the Interior.

155

"Ormesa Credit Agreement" means the Credit Agreement dated December 31, 2002 among Ormesa, United Capital as Administrative Agent and Collateral Agent, and the lenders party thereto from time to time.

"Ormesa Interconnection Agreements" means the Consolidated OG I Plant Connection Agreements, the OG I Transmission Service Agreement, the OG II Plant Connection Agreement, the OG II Transmission Service Agreement and the Energy Services Agreement.

"Ormesa Loan Repayment Account" means the account of such name created under the Depositary Agreement.

"Ormesa Operation and Maintenance Agreement" means that certain Operation and Maintenance Agreement, dated April 15, 2002, between Ormesa and Ormat Nevada.

"Ormesa Plant" means the six geothermal power generating plants located in East Mesa, Imperial Valley, California, owned by Ormesa and having a gross generating capacity of 94 MW.

"Ormesa Power Purchase Agreements" means the OG I Power Purchase Agreement and the OG II Power Purchase Agreement.

"Ormesa Repayment Letter of Credit" means an Acceptable Letter of Credit having, at all times such letter of credit is in effect, an amount available to be drawn that, when added to the amount then on deposit in the Ormesa Loan Repayment Account, is in an amount not less than the Ormesa Repayment Requirement.

"Ormesa Repayment Requirement" means an amount equal to $15.5 million, which is equal to the aggregate principal amount outstanding under the Ormesa Credit Agreement on the Closing Date less cash on deposit in the "debt service reserve account" under the Ormesa Credit Agreement and amounts actually repaid under the Ormesa Credit Agreement in 2004; provided, however, that with respect to the aggregate principal amount paid on September 30, 2004, such amount shall not be reduced to an amount less than 102% of the remaining aggregate principal amount outstanding under the Ormesa Credit Agreement less cash on deposit in the "debt service reserve account" under the Ormesa Credit Agreement on such date.

"Ormesa Support Date" means the earliest to occur of (i) January 31, 2005; (ii) any other date as of which amount payable in respect of the Ormesa Credit Agreement has been paid in full; and (iii) any other date as of which Ormesa is no longer prohibited from granting liens pursuant to the Ormesa Credit Agreement.

"ORNI Entities" means ORNI 1 LLC, a Delaware limited liability company, ORNI 2 LLC, a Delaware limited liability company and ORNI 7 LLC, a Delaware limited liability company.

"Outstanding," in connection with the Senior Secured Notes, means, as of the time in question, all Senior Secured Notes authenticated and delivered under the Indenture, except (i) Senior Secured Notes theretofore canceled or required to be canceled under the Indenture; (ii) Senior Secured Notes for which provision for payment shall have been made in accordance with the Indenture; and (iii) Senior Secured Notes in substitution for which other Senior Secured Notes have been authenticated and delivered pursuant to the Indenture.

"Performance Guarantee Tests" means the performance tests conducted in accordance with the Galena Re-powering Contract to demonstrate and verify that the Steamboat Geothermal Facility has satisfied the Performance Guarantees and certain other performance criteria.

"Performance Guarantees" has the meaning given in the Galena Re-powering Contract.

"Performance Liquidated Damages" means the liquidated damages payable by the Contractor to Steamboat Geothermal pursuant to the Galena Re-powering Contract as a consequence of the failure of the Steamboat Geothermal Facility to meet certain of the Performance Guarantees.

"Permitted Additional Senior Lender" means a holder of any Senior Secured Obligations other than the Senior Secured Notes.

"Permitted Investments" means an investment in any of the following: (i) direct obligations of the Department of the Treasury of the United States of America; (ii) obligations of any federal agencies

156

which obligations are backed by the full faith and credit of the United States of America; (iii) commercial paper rated in any one of the two highest rating categories by Moody's or S&P; (iv) investment agreements with banks (foreign and domestic), broker/dealers, and other financial institutions rated at the time of bid in any one of the three highest rating categories by Moody's and S&P; (v) repurchase agreements with banks (foreign and domestic), broker/dealers, and other financial institutions rated at the time of bid in any one of the three highest rating categories by Moody's and S&P, provided, that (1) collateral is limited to the securities specified in clauses (i) and (ii) above, (2) the margin levels for collateral must be maintained at a minimum of 102% including principal and interest, (3) the Collateral Agent shall have a first priority perfected security interest in the collateral, (4) the collateral will be delivered to a third party custodian, designated by us, acting for the benefit of the Collateral Agent and all fees and expenses related to collateral custody will be the responsibility of us, (5) the collateral must have been or will be acquired at the market price and marked to market weekly and collateral level shortfalls cured within 24 hours and (6) unlimited right of substitution of collateral is allowed provided that substitution collateral must be permitted collateral substituted at a current market price and substitution fees of the custodian shall be paid by us; (vi) forward purchase agreements delivering securities specified in clauses (i) and (iii) above with banks (foreign and domestic), broker/dealers, and other financial institutions maintaining a long-term rating on the day of bid no lower than investment grade by both S&P and Moody's (such rating may be at either the parent or subsidiary level); and (vii) money market funds rated "AAAm" or "AAAm-G" or better by S&P.

"Permitted Liens" means (a) the rights and interests of the Collateral Agent and any other Secured Party as provided in the Financing Documents; (b) Liens for any tax, either secured by a bond or other reasonable security or not yet due or being contested in good faith and by appropriate proceedings, so long as (i) such proceedings shall not involve any substantial danger of the sale, forfeiture or loss of the Projects, the sites of the Project or any easements, as the case may be, title thereto or any interest therein and shall not interfere in any material respect with the use of any Project, any Project sites or any easements, (ii) a bond or other reasonable security has been posted or provided in such manner and amount as to assure that any taxes determined to be due will be promptly paid in full when such contest is determined or (iii) adequate reserves have been provided therefor to the extent required by and in accordance with GAAP; (c) materialmen's, mechanics', workers', repairmen's, employees' or other like Liens, arising in the ordinary course of business or in connection with the development, construction, operation and/or maintenance of any Project, either for amounts not yet due or for amounts being contested in good faith and by appropriate proceedings so long as (i) we reasonably determine that such proceedings shall not involve any substantial danger of the sale, forfeiture or loss of any Project, any Project sites or any easements, as the case may be, title thereto or any interest therein and shall not interfere in any material respect with the use or disposition of any Project, any Project sites or any easements, or (ii) a bond or adequate cash reserves have been provided therefor to the extent required by and in accordance with GAAP; (d) Liens arising out of judgments or awards so long as enforcement of such Lien has been stayed and an appeal or proceeding for review is being prosecuted in good faith and for the payment of which adequate reserves, bonds or other reasonable security have been provided or are fully covered by insurance; (e) title exceptions as reflected in the Title Policies other than delinquent taxes and monetary liens which are to be paid on the Closing Date; (f) Liens, deposits or pledges to secure statutory obligations; (g) Liens, deposits or pledges to secure performance of bids, tenders, contracts (other than for the repayment of borrowed money) or leases, or for purposes of like general nature in the ordinary course of its business, not to exceed $5 million in the aggregate at any time, and with any such Lien to be released as promptly as practicable; (h) other Liens incident to the ordinary course of business that are not incurred in connection with the obtaining of any loan, advance or credit and that do not in the aggregate materially impair the use of our or our Subsidiaries' property or assets or the value of such property or assets for the purposes of such business; (i) involuntary Liens as contemplated by the Financing Documents and the Project Documents (including a lien of an attachment or execution) securing a charge or obligation on any of our property, either real or personal, whether now or hereafter owned, in the aggregate sum of less than $3 million; (j) until the Ormesa Support Date, the Liens in favor of the lenders under the Ormesa Credit Agreement; and (k)

157

servitudes, easements, rights-of-way, restrictions, minor defects or irregularities in title and such other encumbrances or charges against real property or interests therein as of a nature generally existing with respect to properties of similar character and which do not in a material way interfere with the value or use thereof or our business.

"Person" means any individual, sole proprietorship, corporation, partnership, joint venture, limited liability partnership, limited liability company, trust, unincorporated association, institution, Governmental Authority or any other entity.

"Plants" means the Brady Plant, the Ormesa Plant, the Steamboat Geothermal Plant, the Steamboat Development Plant, the Mammoth Plant and geothermal power generating facilities acquired after the Closing Date that constitute Qualified Projects.

"Pledge and Security Agreements" means each of the Pledge and Security Agreements, as amended, executed by us, certain of our Subsidiaries and the Collateral Agent.

"Power Purchase Agreements" means the Steamboat 1 Plant Power Purchase Agreement, the Steamboat 1A Plant Power Purchase Agreement, the Steamboat 2/3 Project Power Purchase Agreements, the Galena Power Purchase Agreement, the Mammoth Power Purchase Agreements, the Ormesa Power Purchase Agreements, the Brady Project Power Purchase Agreement and any power purchase agreements relating to a Qualified Project at the time such Qualified Project is acquired by us or a Guarantor.

"Project" means each Plant together with the related Project Documents, governmental approvals relating to the Plant or Project Documents, and any other item relating to the Plant, including any improvements to, and the operation of the Plant and all activities related thereto.

"Project Costs" means, with respect to the Galena Re-powering, without duplication, all costs and expenses paid, incurred or to be incurred by Steamboat Geothermal to complete the development, design, engineering, acquisition, construction, assembly, inspection, testing, completion and start-up of the Galena Re-powering in the manner contemplated under the Galena Re-powering Contract, including, without limitation, (i) Operating and Maintenance Expenses of the Galena Re-powering prior to Final Acceptance, (ii) amounts payable in respect of options for, or the granting of, necessary easements, (iii) amounts payable in respect of obtaining or maintaining Governmental Approvals, and (iv) amounts payable in respect of acquiring initial spare parts.

"Project Documents" means the Material Project Documents and any additional agreements relating to the Projects.

"Projections" means certain projections at the Closing Date of the Projects' revenues and the costs associated therewith including certain assumptions by us.

"Qualified Project" means (a) a fully constructed and operational geothermal power plant located within the United States of America (other than the Mammoth Project), (b) as to which electricity will be sold under long-term power purchase agreements that have been approved by the applicable public utility commission or similar governmental body with a counterparty that has a long-term issuer rating of not less than BBB- by S&P and Baa3 by Moodys (provided, that if such counterparty is rated by only Moody's or only S&P, then such counterparty may have one long-term issuer rating of not less than BBB- by S&P or Baa3 by Moody's, as the case may be, so long as no nationally recognized credit rating agency rates such counterparty less than Investment Grade) and (c) is acquired by us or a Guarantor and the Collateral Agent is granted a first priority pledge of all of the Capital Stock of any Guarantor that acquires such Qualified Project or the Guarantor acquiring such Qualified Project provides a first priority lien with respect to collateral with respect to such Qualified Project that is consistent with that set forth under the second paragraph of "Description of the Notes—Security."

"Quarterly Period" means each calendar quarter; provided, however, that the first Quarterly Period shall commence on the Closing Date and shall end on March 31, 2004.

"Railway Geothermal Resources Lease" means that certain Geothermal Resource Lease (SPL-6292), dated October 10, 1984, between Brady, as tenant, and The Burlington Northern and Santa Fe Railway Company, as landlord, as amended by the amendment dated December 5, 1991.

158

"Redemption Account" means the account of such name created under the Depositary Agreement.

"Redemption Date" means the date on which we redeem or shall redeem any Senior Secured Notes in accordance with the Indenture.

"Regulation S" means Regulation S under the Securities Act.

"Related Party" means (a) Ormat Industries, Ltd. and OTec., (b) any direct or indirect controlling stockholder or controlling member or a more than 50% owned subsidiary of Ormat Nevada or (c) any trust, corporation, partnership, limited liability company or other entity, of which the beneficiaries, stockholders, partners, members or Persons holding more than a 50% controlling interest are Ormat Nevada and/or such other Persons referred to in the immediately preceding clause (a) or (b).

"Renewable Energy Credits" means all renewable energy credits, offsets or other benefits allocated, assigned or otherwise awarded or certified to us or any of our Subsidiaries by any governmental authority in connection with any of the Projects; provided, that the foregoing shall not include any federal, state, and/or local production tax credits and/or investment tax credits specific to investments in renewable energy production and delivery facilities (if any) or any environmental credits, offsets, or other similar benefits allocated, assigned or otherwise awarded to us or any of our Subsidiaries by any governmental authority or received in any other manner based in whole or in part on the fact that any of the Projects constitutes a "renewable energy system" (as defined under any Applicable Law) or the like, including emissions credits or allowances, such as credits available because such Project does not produce carbon dioxide or other emissions when generating electric energy.

"Required Holders" means, at any time, Persons that at such time hold not less than 51% in aggregate principal amount of the Outstanding Senior Secured Notes.

"Resource Lease Consents" means (i) with respect to ORNI 1, LLC, ORNI 2, LLC, and Brady the consents of each of David P. Frase, Timothy Frase and Stacey Frase, and James W. Roberts, Trustee of the James W. Roberts Revocable Trust dated August 24, 1996 under the Grant of Easement Agreement, dated March 27, 1998; and of The Burlington Northern and Santa Fe Railway Company under the Railway Geothermal Resources Lease, and (ii) with respect to ORNI 7, LLC and Steamboat Development the consents of each of Fleetwood Corporation under the Fleetwood Geothermal Resources Lease; Dorothy A. Towne and the Trust of Dorothy A. Towne under a geothermal resources lease dated May 31, 1991; and Bernice Guisti, Judith Harvey, and Karen Thompson, Trustees and Beneficiaries of the Guisti Trust under the Guisti Geothermal Resources Lease.

"Responsible Officer" means, with respect to knowledge of any default under the Indenture, the chief executive officer, president, chief financial officer, general counsel, principal accounting officer, treasurer, assistant treasurer, or any vice president of us, or other officer of ours who in the normal performance of his or her operational duties would have knowledge of the subject matter relating to such default.

"Restoration Sub-Account" means one or more accounts of such name created under the Depositary Agreement in connection with an Event of Loss or Event of Eminent Domain.

"Restricted Payment" means, with respect to any Person, (i) the declaration and payment of distributions, dividends or any other payment made in cash, property, obligations or other notes, (ii) any payment of the principal of, or interest or premium, if any, on, any Subordinated Debt, (iii) the making of any loans or advances to any Affiliate (other than Permitted Indebtedness), (iv) any purchase, redemption, acquisition or retirement for value (including, without limitation in connection with any merger or consolidation of us) of any of our Capital Stock or (v) any Investment in any Person other than a Guarantor; provided, however, that the term "Restricted Payments" shall not include (v) proceeds of this offering in the amounts set forth under "Use of Proceeds", utilized for the acquisition of Steamboat Development, the acquisition of a 50% interest in Mammoth-Pacific and the

159

repayment of amounts due to Ormat Nevada, (w) cash released from any Account as a result of the provision of an Acceptable Letter of Credit as provided for in the Financing Documents, (x) cash released from the Ormesa Loan Repayment Account as described under "—Depositary Agreement—Ormesa Loan Repayment Account," (y) payments made to any Affiliate of such Person for goods and services purchased or procured in accordance with the terms of the Indenture or (z) the use of proceeds from Indebtedness incurred in accordance with (I) clause (ii) under "—Principal Covenants—Limitation on Indebtedness" to purchase that portion of the Capital Stock of Mammoth-Pacific that we do not own as of the Closing Date or (II) clause (viii) under "—Principal Covenants—Limitation on Indebtedness" to purchase a Qualified Project.

"Revenue Account" means the account of such name created under the Depositary Agreement.

"Rule 144A" means Rule 144A promulgated under the Securities Act.

"Scheduled Payment Date" means each June 30 and December 30, commencing on June 30, 2004 and ending on December 30, 2020.

"SEC" means the United States Securities and Exchange Commission.

"Secured Parties" means the Trustee, the Holders, the Collateral Agent, the holders of additional Permitted Indebtedness (other than Permitted Indebtedness of the type described in clause (vi) in the definition thereof), in each case to the extent such party (or an agent on such party's behalf) is or becomes a party to the Collateral Agency Agreement.

"Securities Act" means the United States Securities Act of 1933, as amended.

"Security Documents" means, collectively, the Depositary Agreement, the Deeds of Trust, the Collateral Agency Agreement, the Pledge and Security Agreements, the Control Agreements, the Third Party Consents and any other document providing for any lien of the Secured Parties, pledge, encumbrance, mortgage or security interest on any or all of our assets or the ownership interests thereof or our Subsidiaries' assets and the ownership interests thereof.

"Senior Secured Notes" means the 8¼% Senior Secured Notes due December 30, 2020, the exchange notes and any other securities authenticated and delivered under the Indenture and in accordance with the terms of the Indenture, which are intended to be treated as a single class of securities under the Indenture.

"Senior Secured Obligations" means, collectively, without duplication: (i) all of our Indebtedness, financial liabilities and obligations, of whatsoever nature and however evidenced (including, but not limited to, principal, interest, premium, fees, reimbursement obligations, penalties, indemnities and legal and other expenses, whether due after acceleration or otherwise) to the Secured Parties in their capacity as such under the applicable Financing Document or any other agreement, document or instrument evidencing, securing or relating to such Indebtedness, financial liabilities or obligations, in each case, direct or indirect, primary or secondary, fixed or contingent, now or hereafter arising out of or relating to any such agreements; (ii) any and all sums advanced by the Collateral Agent in order to preserve the Collateral or preserve its security interest in the Collateral; and (iii) in the event of any proceeding for the collection or enforcement of the obligations described in clauses (i) and (ii) above, after an Event of Default has occurred and is continuing and unwaived, the expenses of retaking, holding, preparing for sale or lease, selling or otherwise disposing of or realizing on the Collateral, or of any exercise by the Collateral Agent of its rights under the Security Documents, together with reasonable attorneys' fees and court costs.

"Sierra Pacific Geothermal Resources Lease" means that certain Geothermal Resources Lease, dated November 18, 1983, between Steamboat Geothermal and Sierra Pacific Power Company, as amended by the amendments dated January 7, 1985, October 29, 1988, and October 2, 1989.

"Site Licenses" means the Mammoth-BLM Site License, the Ormesa-BLM Site License CA 17129, the Ormesa-BLM Site License CA 22405, the Ormesa-BLM Site License CA 24678, the Ormesa-BLM Site License CA 22079, and the Ormesa-BLM Site License CA 20172.

160

"Steamboat Complex Operation and Maintenance Agreement" means that certain Amended and Restated Operation and Maintenance Agreement, dated December 8, 2003, among ORNI 7, LLC, Steamboat Geothermal LLC, Steamboat Development (as of the closing of this offering) and Ormat Nevada, Inc.

"Steamboat Development" means Steamboat Development, a Utah corporation.

"Steamboat Development Plant" means the two geothermal power generating plants located in Steamboat Hills, Nevada, having a gross generating capacity of 32 MW and owned by Steamboat Development

"Steamboat Geothermal" means Steamboat Geothermal LLC, a Delaware limited liability company.

"Steamboat Geothermal Plant" means the two geothermal power generating plants located in Steamboat Hills, Nevada, having a gross generating capacity of 10 MW and owned by Steamboat Geothermal.

"Steamboat 1 Plant Power Purchase Agreement" means that certain Agreement for the Purchase and Sale of Electricity, dated November 18, 1983, between Steamboat Geothermal LLC (as successor to Geothermal Development Associates) and Sierra Pacific Power Company, as amended by that certain Amendment to Agreement for the Purchase and Sale of Electricity, dated March 6, 1987.

"Steamboat 1A Plant Power Purchase Agreement" means that certain Long-Term Agreement for the Purchase and Sale of Electricity, dated October 29, 1988, between Steamboat Geothermal LLC (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company.

"Steamboat 2 Plant Power Purchase Agreement" means that certain Long-Term Agreement, dated January 24, 1991, between Steamboat Development (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company, as amended by that certain Amendment to Long-Term Agreement, dated October 29, 1991, and as further amended by that certain Amendment to Long-Term Agreement, dated October 29, 1992.

"Steamboat 1/1A Interconnection Agreement" means that certain Special Facilities Agreement, dated October 29, 1988, between Sierra Pacific Power Company and Steamboat Geothermal (as successor to Far West Capital, Inc.).

"Steamboat 2/3 Interconnection Agreement" means that certain Special Facilities Agreement, dated April 24, 1992, between Sierra Pacific Power Company and Steamboat Development (as successor to Far West Capital, Inc.).

"Steamboat 2/3 Project Power Purchase Agreements" means the Steamboat 2 Plant Power Purchase Agreement and the Steamboat 3 Plant Power Purchase Agreement.

"Steamboat 3 Plant Power Purchase Agreement" means that certain Long-Term Agreement for the Purchase and Sale of Electricity, dated January 18, 1991, between Steamboat Geothermal Development (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company.

"Subordinated Debt" means Indebtedness incurred pursuant to a Subordinated Loan Agreement.

"Subsidiary" means, with respect to any specified Person:

(1) any corporation, association or other business entity of which more than 50% of the total voting power of shares of Capital Stock entitled (without regard to the occurrence of any contingency and after giving effect to any voting agreement or stockholders' agreement that effectively transfers voting power) to vote in the election of directors, managers or trustees of the corporation, association or other business entity is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person (or a combination thereof); and

(2) any partnership (a) the sole general partner of which is such Person or a Subsidiary of such Person or (b) the only general partners of which are that Person or one or more Subsidiaries of that Person (or any combination thereof).

161

"Supplemental Galena Re-powering Account" means the account of such name created under the Depositary Agreement.

"Third Party Consents" means each consent to assignment, among certain counterparties to a Material Project Document, us and/or our applicable Subsidiary and the Collateral Agent.

"Title Event" means the existence of any defect of title or Lien or encumbrance on a Project (other than Permitted Liens) in effect on the Closing Date that entitles the Collateral Agent to make a claim under the policy or policies of title insurance required pursuant to the Financing Documents.

"Title Event Proceeds" means all amounts and proceeds (including instruments) in respect of any Title Event.

"Title Policies" means each of (i) the mortgagee title insurance policies delivered by a title company of national standing or its affiliates insuring to the Lien of the Deeds of Trust or (ii) for those Projects which do not have Deeds of Trust, the preliminary title report delivered by a title company of national standing or its affiliates.

"Trustee" means Union Bank of California, N.A, until a successor replaces it in accordance with the applicable provisions of the Indenture, and thereafter means the successor serving thereunder in such capacity.

"Unassigned Leases" means (i) that certain Grant of Easement between David P. Frase, Timothy Frase and Stacey Frase, and James W. Roberts, Trustee of the James W. Roberts Revocable Trust, dated August 24, 1996, as grantor, and Brady Power, as grantee, dated March 27, 1998; (ii) the Railway Geothermal Resources Lease; (iii) the Fleetwood Geothermal Resources Sublease; (iv) that certain Geothermal Resources Lease dated May 31, 1991 between Dorothy A. Towne and the Trust of Dorothy A. Towne, as landlord, and Fleetwood Corporation, as tenant; and (v) that certain Geothermal Resources Lease dated June 27, 1988, as amended by that certain Amendment to Geothermal Resources Lease dated January 1992, and that certain Second Amendment to Geothermal Resources Lease dated June 25, 1993 between Bernice Guisti, Judith Harvey, and Karen Thompson, Trustees and Beneficiaries of the Guisti Trust, as landlord, and Steamboat Development Corp., as tenant.

"Wholly-Owned Subsidiary" of any specified Person means a Subsidiary of such Person all of the outstanding Capital Stock or other ownership interests of which (other than directors' qualifying shares) will at the time be awarded by such Person or by one or more Wholly-Owned Subsidiaries of such Person and one or more Wholly-Owned Subsidiaries of such Person.

"Work" means all obligations, duties and responsibilities undertaken by the Contractor and its Subcontractors in accordance with the Galena Re-powering Contract, including the design, engineering, manufacturing, procurement, construction, start-up and performance testing of the Galena Plant in connection with the Galena Re-powering.

162

BOOK-ENTRY, DELIVERY AND FORM

The exchange notes will be represented by one or more global notes in registered form without interest coupons (the "Global Notes").

The Global Notes will be deposited upon issuance with the trustee as custodian for The Depository Trust Company ("DTC"), in New York, New York, and registered in the name of DTC or its nominee, in each case for credit to an account of a direct or indirect participant in DTC including the Euroclear System ("Euroclear") and Clearstream Banking, S.A. ("Clearstream") as described below.

Except as set forth below, the Global Notes may be transferred, in whole but not in part, only to another nominee of DTC or to a successor of DTC or its nominee. Beneficial interests in the Global Notes may not be exchanged for notes in certificated form except in the limited circumstances described below. See "—Exchange of Global Notes for Certificated Notes." Except in the limited circumstances described below, owners of beneficial interests in the Global Notes will not be entitled to receive physical delivery of notes in certificated form.

Transfers of beneficial interests in the Global Notes will be subject to the applicable rules and procedures of DTC and its direct or indirect participants (including, if applicable, those of Euroclear and Clearstream), which may change from time to time.

Depository Procedures

The following description of the operations and procedures of DTC, Euroclear and Clearstream are provided solely as a matter of convenience. These operations and procedures are solely within the control of the respective settlement systems and are subject to changes by them. We take no responsibility for these operations and procedures and urge investors to contact the system or their participants directly to discuss these matters.

DTC has advised us that DTC is a limited-purpose trust company created to hold securities for its participating organizations (collectively, the "Participants") and to facilitate the clearance and settlement of transactions in those securities between Participants through electronic book-entry changes in accounts of its Participants. The Participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations. Access to DTC's system is also available to other entities such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a Participant, either directly or indirectly (collectively, the "Indirect Participants"). Persons who are not Participants may beneficially own securities held by or on behalf of DTC only through the Participants or the Indirect Participants. The ownership interests in, and transfers of ownership interests in, each security held by or on behalf of DTC are recorded on the records of the Participants and Indirect Participants.

DTC has also advised us that, pursuant to procedures established by it:

|  |

| (1) | upon deposit of the Global Notes, DTC will credit the accounts of Participants with portions of the principal amount of the Global Notes; and |

|  |

| (2) | ownership of these interests in the Global Notes will be shown on, and the transfer of ownership of these interests will be effected only through, records maintained by DTC (with respect to the Participants) or by the Participants and the Indirect Participants (with respect to other owners of beneficial interest in the Global Notes). |

Investors in the Global Notes who are Participants in DTC's system may hold their interests therein directly through DTC. Investors in the Global Notes who are not Participants may hold their interests therein indirectly through organizations (including Euroclear and Clearstream) which are Participants in such system. Euroclear and Clearstream will hold interests in the Global Notes on behalf of their participants through customers' securities accounts in their respective names on the books of their respective depositories, which are Euroclear Bank S.A./N.V., as operator of Euroclear, and Citibank, N.A., as operator of Clearstream. All interests in a Global Note, including those held through Euroclear or Clearstream, may be subject to the procedures and requirements of DTC. Those

163

interests held through Euroclear or Clearstream may also be subject to the procedures and requirements of such systems. The laws of some states require that certain Persons take physical delivery in definitive form of securities that they own. Consequently, the ability to transfer beneficial interests in a Global Note to such Persons will be limited to that extent. Because DTC can act only on behalf of Participants, which in turn act on behalf of Indirect Participants, the ability of a Person having beneficial interests in a Global Note to pledge such interests to Persons that do not participate in the DTC system, or otherwise take actions in respect of such interests, may be affected by the lack of a physical certificate evidencing such interests.

Except as described below, owners of interest in the Global Notes will not have notes registered in their names, will not receive physical delivery of notes in certificated form and will not be considered the registered owners or "holders" thereof under the Indenture for any purpose. Only registered holders will have rights under the Indenture.

Payments in respect of the principal of, and interest and premium and Liquidated Damages, if any, on a Global Note registered in the name of DTC or its nominee will be payable to DTC in its capacity as the registered holder under the Indenture. Under the terms of the Indenture, we and the Trustee will treat the Persons in whose names the notes, including the Global Notes, are registered as the owners of the notes for the purpose of receiving payments and for all other purposes. Consequently, neither we, the Trustee nor any agent of ours or the Trustee has or will have any responsibility or liability for:

|  |

| (1) | any aspect of DTC's records or any Participant's or Indirect Participant's records relating to or payments made on account of beneficial ownership interest in the Global Notes or for maintaining, supervising or reviewing any of DTC's records or any Participant's or Indirect Participant's records relating to the beneficial ownership interests in the Global Notes; or |

|  |

| (2) | any other matter relating to the actions and practices of DTC or any of its Participants or Indirect Participants. |

DTC has advised us that its current practice, upon receipt of any payment in respect of securities such as the notes (including principal and interest), is to credit the accounts of the relevant Participants with the payment on the payment date unless DTC has reason to believe it will not receive payment on such payment date. Each relevant Participant is credited with an amount proportionate to its beneficial ownership of an interest in the principal amount of the relevant security as shown on the records of DTC. Payments by the Participants and the Indirect Participants to the beneficial owners of notes will be governed by standing instructions and customary practices and will be the responsibility of the Participants or the Indirect Participants and will not be the responsibility of DTC, the Trustee or us. Neither we nor the Trustee will be liable for any delay by DTC or any of its Participants in identifying the beneficial owners of the notes, and we and the Trustee may conclusively rely on and will be protected in relying on instructions from DTC or its nominee for all purposes.

Transfers between Participants in DTC will be effected in accordance with DTC's procedures, and will be settled in same-day funds, and transfers between participants in Euroclear and Clearstream will be effected in accordance with their respective rules and operating procedures.

Subject to compliance with the transfer restrictions applicable to the notes described herein, cross-market transfers between the Participants in DTC, on the one hand, and Euroclear or Clearstream participants, on the other hand, will be effected through DTC in accordance with DTC's rules on behalf of Euroclear or Clearstream, as the case may be, by its respective depositary; however, such cross-market transactions will require delivery of instructions to Euroclear or Clearstream, as the case may be, by the counterparty in such system in accordance with the rules and procedures and within the established deadlines (Brussels time) of such system. Euroclear or Clearstream, as the case may be, will, if the transaction meets its settlement requirements, deliver instructions to its respective depositary to take action to effect final settlement on its behalf by delivering or receiving interests in the relevant Global Note in DTC, and making or receiving payment in accordance with normal procedures for same-day funds settlement applicable to DTC. Euroclear participants and Clearstream participants may not deliver instructions directly to the depositories for Euroclear or Clearstream.

164

DTC has advised us that it will take any action permitted to be taken by a holder of notes only at the direction of one or more Participants to whose account DTC has credited the interests in the Global Notes and only in respect of such portion of the aggregate principal amount of the notes as to which such Participant or Participants has or have given such direction. However, if there is an Event of Default under the notes, DTC reserves the right to exchange the Global Notes for legended notes in certificated form, and to distribute such notes to its Participants.

Although DTC, Euroclear and Clearstream have agreed to the foregoing procedures to facilitate transfers of interests in the Global Notes among participants in DTC, Euroclear and Clearstream, they are under no obligation to perform or to continue to perform such procedures, and may discontinue such procedures at any time. Neither we nor the Trustee nor any of their respective agents will have any responsibility for the performance by DTC, Euroclear or Clearstream or their respective participants or indirect participants of their respective obligations under the rules and procedures governing their operations.

Exchange of Global Notes for Certificated Notes

A Global Note is exchangeable for definitive notes in registered certificated form ("Certificated Notes") if:

|  |

| (1) | DTC (a) notifies us that it is unwilling or unable to continue as depository for the Global Notes and we fail to appoint a successor depository or (b) has ceased to be a clearing agency registered under the Exchange Act; |

|  |

| (2) | we, at our option, notify the Trustee in writing that it elects to cause the issuance of the Certificated Notes; or |

|  |

| (3) | there has occurred and is continuing a Default or Event of Default with respect to the notes. |

In addition, beneficial interests in a Global Note may be exchanged for Certificated Notes upon prior written notice given to the Trustee by or on behalf of DTC in accordance with the Indenture. In all cases, Certificated Notes delivered in exchange for any Global Note or beneficial interests in Global Notes will be registered in the names, and issued in any approved denominations, requested by or on behalf of the depositary (in accordance with its customary procedures).

Exchange of Certificated Notes for Global Notes

Certificated Notes may not be exchanged for beneficial interests in any Global Note unless the transferor first delivers to the Trustee a written certificate in the form provided in the Indenture.

Same Day Settlement and Payment

We will make payments in respect of the notes represented by the Global Notes (including principal, premium, if any, interest and liquidated damages, if any) by wire transfer of immediately available funds to the accounts specified by the Global Note Holder. We will make all payments of principal, interest and premium, with respect to Certificated Notes by wire transfer of immediately available funds to the accounts specified by the Holders of the Certificated Notes or, if no such account is specified, by mailing a check to each such Holder's registered address. The notes represented by the Global Notes are expected to be eligible to trade in DTC's Same-Day Funds Settlement System, and any permitted secondary market trading activity in such notes will, therefore, be required by DTC to be settled in immediately available funds. We expect that secondary trading in any Certificated Notes will also be settled in immediately available funds.

Because of time zone differences, the securities account of a Euroclear or Clearstream participant purchasing an interest in a Global Note from a Participant in DTC will be credited, and any such crediting will be reported to the relevant Euroclear or Clearstream participant, during the securities settlement processing day (which must be a business day for Euroclear and Clearstream) immediately following the settlement date of DTC. DTC has advised us that cash received in Euroclear or Clearstream as a result of sales of interests in a Global Note by or through a Euroclear or

165

Clearstream participant to a Participant in DTC will be received with value on the settlement date of DTC but will be available in the relevant Euroclear or Clearstream cash account only as of the business day for Euroclear or Clearstream following DTC's settlement date.

DESCRIPTION OF OUR PRINCIPAL CONTRACTS

The following is a summary of the projects' principal agreements and is not considered to be a full statement of the terms of such agreements. Accordingly, the following summaries of the agreements are qualified by reference to each agreement and are subject to the terms of the full text of each agreement. Unless otherwise stated, any reference in this prospectus to any agreement shall mean that agreement and all schedules, exhibits and attachments thereto as amended, supplemented or otherwise modified and in effect as of the date of this prospectus. Copies of all such agreements may be obtained from us, subject to certain confidentiality restrictions. See "Available Information."

STEAMBOAT COMPLEX

POWER PURCHASE AGREEMENTS

STEAMBOAT 1/1A PROJECT

Steamboat 1 Plant Power Purchase Agreement

Steamboat Geothermal sells all of the electricity generated from the Steamboat 1 plant and delivered to Sierra Pacific Power Company pursuant to the terms of that certain Agreement for the Purchase and Sale of Electricity, dated November 18, 1983, between Steamboat Geothermal (as successor to Geothermal Development Associates) and Sierra Pacific Power Company, as amended by that certain Amendment to Agreement for the Purchase and Sale of Electricity, dated March 6, 1987, which we refer to collectively as the "Steamboat 1 Plant PPA."

Term

The original term of the Steamboat 1 Plant PPA expires on December 5, 2006, and the term shall continue thereafter from year to year unless terminated by one of the parties. The Steamboat 1 Plant PPA is subject to earlier termination if there is a force majeure event.

Payments

Currently, and to the extent that the term of the Steamboat 1 Plant PPA extends beyond December 5, 2006, Sierra Pacific Power Company pays Steamboat Geothermal for energy delivered, on a time-differentiated basis, the short-term avoided cost rates for energy in effect for the relevant billing period. The average price paid for the first nine months of 2003 was $0.04282/kWh.

Maintenance

Steamboat Geothermal is responsible, at its sole cost and expense, to maintain the Steamboat 1 plant, including all control and protective devices. Steamboat Geothermal agrees to provide Sierra Pacific Power Company with 60 days' written notice of all scheduled maintenance periods.

Additional Resources

Under the Steamboat 1 Plant PPA, Sierra Pacific Power Company has the right to purchase up to a 75% interest in any additional geothermal rights that Steamboat Geothermal purchases or leases within the Steamboat Springs KGRA within 90 days after receipt of notice from Steamboat Geothermal of its proposed acquisition of such additional geothermal resource. For each 25% interest that Sierra Pacific Power Company purchases under this option, Sierra Pacific Power Company shall pay Steamboat Geothermal an amount equal to one-third of Steamboat Geothermal's total cost of any parcel or right or any portion thereof.

166

Force Majeure

If the performance of any obligations under the Steamboat 1 Plant PPA is prevented by casualty, accident, strike, labor dispute, political disturbance; or other violence; any law, proclamation or regulation or any governmental agency; inability to secure environmental permits; or any other condition beyond the control of the party affected thereby, that party shall be excused from performance and either party shall be entitled to terminate the Steamboat 1 Plant PPA.

Indemnification

Under the Steamboat 1 Plant PPA, each party has agreed to indemnify and hold harmless the other party and the directors, officers, and employees of the other party against and from any and all loss and liability for injuries to persons and damages, including property damage of either party, resulting from or arising out of the engineering, design, construction, maintenance or operation of, or the making of replacements, additions, or betterments to, the indemnitor's facilities. Neither party shall be indemnified for liability or loss resulting from its sole negligence or willful misconduct.

Insurance

Steamboat Geothermal is obligated to obtain and maintain specified insurance coverages.

Assignment

Neither party shall voluntarily assign the Steamboat 1 Plant PPA without the prior written consent of the other party. Either party has the right to collaterally assign the Steamboat 1 Plant PPA upon 30 days' prior written notice to the other party.

Governing Law

The Steamboat 1 Plant PPA is governed by the laws of the State of Nevada.

Steamboat 1A Plant Power Purchase Agreement

Steamboat Geothermal sells all of the electricity generated from the Steamboat 1A plant and delivered to Sierra Pacific Power Company, pursuant to the terms of that certain Long-Term Agreement for the Purchase and Sale of Electricity, dated October 29, 1988, between Steamboat Geothermal (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company, which we refer to as the "Steamboat 1A Plant PPA."

Term

The term of the Steamboat 1A Plant PPA expires on December 14, 2018. The Steamboat 1A Plant PPA is subject to earlier termination by Sierra Pacific Power Company in the event that Steamboat Geothermal fails to deliver energy for 180 continuous days, regardless of whether such failure is due to an event of force majeure, as defined below, and Steamboat Geothermal is not exercising reasonable efforts to resume operation of the project.

Payments

Under the Steamboat 1A Plant PPA, Sierra Pacific Power Company pays to Steamboat Geothermal, on a monthly basis, energy payments equal to the short-term avoided cost rates for energy in effect for the relevant billing period. The average price paid for the first nine months of 2003 was $0.04282/kWh.

Maintenance

Steamboat Geothermal shall provide Sierra Pacific Power Company with a list of scheduled maintenance periods by July 1 of each calendar year, but no later than six months prior to beginning

167

any proposed scheduled maintenance. Sierra Pacific Power Company shall provide Steamboat Geothermal with scheduled maintenance periods on equipment that will impact the delivery of capacity and energy from the Steamboat 1A plant as soon as reasonably practicable. The parties shall coordinate scheduled maintenance in order to minimize the impact on the parties' systems.

In the event that the Steamboat 1A plant must be shut down for unscheduled maintenance, Steamboat Geothermal shall notify Sierra Pacific Power Company as soon as practicable of the necessity of the shutdown, the time the shutdown occurred or will occur, and the anticipated duration of the shutdown. Steamboat Geothermal shall take all reasonable measures and exercise reasonable efforts to avoid unscheduled maintenance and limit the duration of the shutdown.

Force Majeure

Each party to the Steamboat 1A Plant PPA is relieved from its obligations under the relevant power purchase agreement when and to the extent that it is rendered wholly or partly unable to perform its obligations by force majeure, provided that (1) the non-performing party promptly gives the other party oral notice, followed by written communication, describing the particulars of the occurrence, (2) the suspension of performance is of no greater scope and of no longer duration than is required by the force majeure, (3) the non-performing party uses its best efforts to remedy its inability to perform and (4) when the non-performing party is able to resume performance of its obligations, it gives the other party written notice to that effect. Force majeure under the Steamboat 1A Plant PPA is defined as unforeseeable causes beyond the reasonable control of and without the fault or negligence of the party claiming force majeure including, but not limited to, acts of God; labor disputes; sudden actions of the elements; actions by federal, state, and municipal agencies; and actions of legislative, judicial or regulatory bodies which prohibit or seriously impede performance under or compliance with the terms of the Steamboat 1A Plant PPA.

Indemnification

Under the Steamboat 1A Plant PPA, each party has agreed to indemnify and hold harmless the other party against and from any and all loss and liability for personal injury or property damage, resulting from or arising out of the engineering, design, construction, maintenance or operation of, or the making of replacements, additions, or betterments to, the indemnitor's facilities. Neither party shall be indemnified for liability or loss to the extent such liability or loss results from, or is contributed to by, that party's negligence or willful misconduct.

Insurance

Steamboat Geothermal is obligated to obtain and maintain specified insurance coverages. If Steamboat Geothermal fails to obtain or maintain such insurance, Steamboat Geothermal shall not deliver capacity and energy to Sierra Pacific Power Company and Sierra Pacific Power Company shall have no obligation to accept any capacity or energy until appropriate insurance is obtained or reinstated.

Assignment

Neither party shall voluntarily assign the Steamboat 1A Plant PPA without the prior written consent of the other party. Either party has the right to collaterally assign the Steamboat 1A Plant PPA upon 30 days' prior written notice to the other party.

Governing Law

The Steamboat 1A Plant PPA is governed by the laws of the State of Nevada.

STEAMBOAT 2/3 PROJECT

Steamboat 2/3 Project Power Purchase Agreements

Steamboat Development sells capacity and energy generated from the Steamboat 2/3 project and delivered to Sierra Pacific Power Company, pursuant to the terms of two substantially similar power

168

purchase agreements: (1) that certain Long-Term Agreement, dated January 24, 1991, between Steamboat Development (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company, as amended by that certain Amendment to Long-Term Agreement, dated October 29, 1991, and as further amended by that certain Amendment to Long-Term Agreement, dated October 29, 1992, and (2) that certain Long-Term Agreement for the Purchase and Sale of Electricity, dated January 18, 1991, between Steamboat Development (as successor to Far West Capital, Inc.) and Sierra Pacific Power Company. We refer to these power purchase agreements as the "Steamboat 2/3 Project PPAs."

Term

The term of each of the Steamboat 2/3 Project PPAs expires on December 19, 2022. The Steamboat 2/3 Project PPAs are subject to earlier termination in the event that Steamboat Development fails to deliver energy for 180 continuous days unless due to force majeure, as defined below, and Steamboat Development is not exercising reasonable efforts to resume operation of the plant.

Payments

Under the Steamboat 2/3 Project PPAs, Sierra Pacific Power Company pays to Steamboat Development capacity payments and energy payments.

Capacity Payments

Under the Steamboat 2/3 Project PPAs, Sierra Pacific Power Company pays to Steamboat Development, on a monthly basis, capacity payments equal to:

|  |

| • | $19.04/kW-month for the period from the commercial operation date until December 19, 2007; and |

|  |

| • | $14.00/kW-month thereafter. |

At the end of each contract year, Sierra Pacific Power Company shall calculate the three-year rolling average of the peak period capacity for each unit for the three immediately preceding contract years. If the average peak period capacity is greater than or equal to 95%, then the capacity rate shall be as set forth above. If the average peak period capacity is less than 95% but greater than 85% during the first fifteen years of the term, the capacity rate shall be reduced by 1% for each 1% or portion thereof that such average is below 100%, and if the average peak period capacity is less than 95% but greater than 85% during the remaining fifteen years of the term, the capacity rate shall be reduced by 1.3% for each 1% or portion thereof that such average is below 100%. If the average peak period capacity is less than 85% of the peak period capacity, then Steamboat Development shall pay a sum of $1 million (in 1992 dollars) to Sierra Pacific Power Company, and the required capacity under the Steamboat 2/3 Project PPAs shall be reduced to the average capacity rate calculated during such three-year period.

Energy Payments

Under the Steamboat 2/3 Project PPAs, Sierra Pacific Power Company pays to Steamboat Development, on a monthly basis, an energy payment of $0.0363/kWh with respect to the Steamboat 2 plant and $0.03595/kWh with respect to the Steamboat 3 plant. This energy payment rate is adjusted annually by the following multipliers:

|  |