UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-21720 |

| | |

| Northern Lights Fund Trust |

| (Exact name of registrant as specified in charter) |

| |

| 225 Pictoria Drive, Suite 450, Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

| | |

| The Corporation Trust Company |

| 1209 Orange Street Wilmington, DE 19801 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 631-470-2633 | |

| | | |

| Date of fiscal year end: | 10/31 | |

| | | |

| Date of reporting period: | 10/31/24 | |

Item 1. Reports to Stockholders.

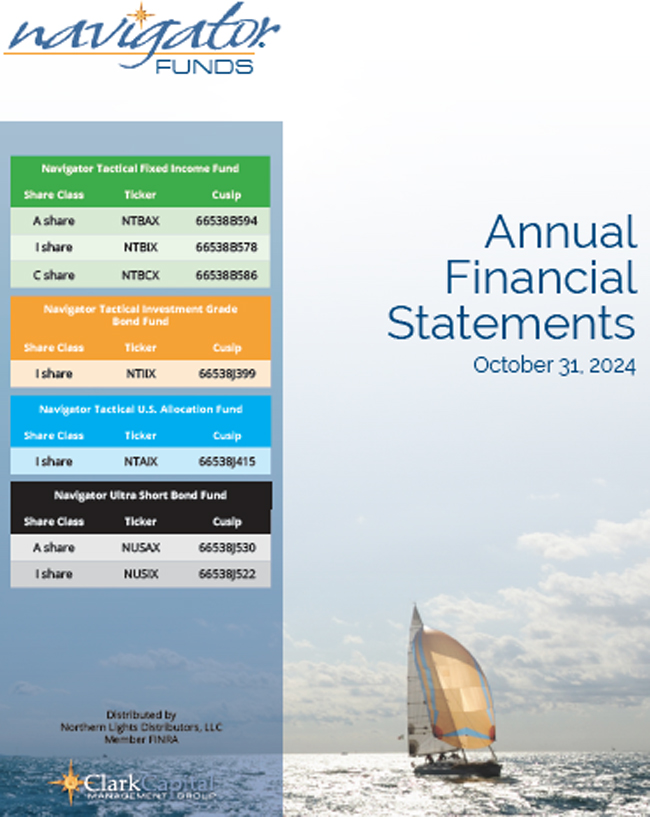

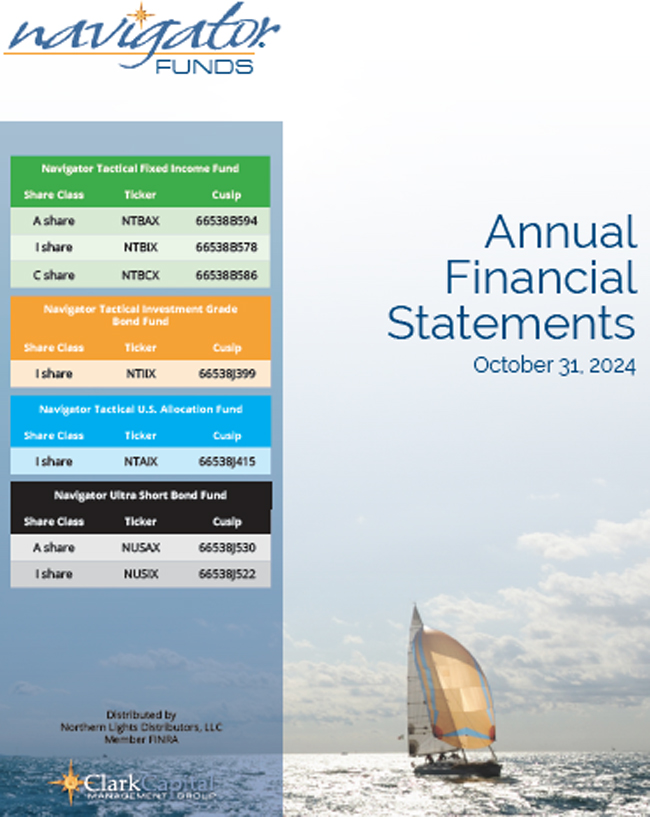

Navigator Tactical Fixed Income Fund - Class A (NTBAX )

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Tactical Fixed Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $128 | 1.21% |

How did the Fund perform during the reporting period?

For the fiscal year ending October 31, 2024 the Navigator Tactical Fixed Income Fund Class A shares (the “Fund”) gained 11.73%, compared to the Bloomberg Barclays US Corporate High Yield Index gain of 16.47% and the Bloomberg Barclays US Aggregate Bond Index 10.55% gain. The primary driver of performance in the Fund has always been the Fund’s sector exposure and the modeling processes that drives the allocation between High Yield Bonds, US Treasuries, and cash equivalents. The Fund has been invested in High Yield bonds since November 6, 2023, as credit remains solid, buoyed by the strength of the U.S. economy and risk assets.

• High yield bond spreads contracted, ending the annual period at 282 basis points, near the bottom end of their range for this cycle. Low spreads indicate a lack of underlying stress in the asset class.

• Treasuries advanced throughout the period as yields declined in advance of the Federal Reserve’s first rate cut. The Bloomberg 7-10 Year Treasury Index gained 9.38%, underperforming the High Yield Index and broader fixed income.

• The Federal Reserve embarked on a new rate-cutting cycle by lowering the overnight lending rate on September 18, 2024, by 0.50% in response to inflation trends falling near the Fed’s 2.0% target zone. In the post FOMC meeting press conference, Chairman Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

• Interest rate sensitivity of the High Yield market has decreased with the duration of the index hitting its lowest level on record (2.91 on September 19, 2004).

How will the market respond to the Fed rate cut? Don’t fight the Fed. History shows no recession equals gains. Of the last twelve rate cut cycles dating back to 1971, seven occurred with the economy in expansion and five when the economy was either in recession or shortly thereafter tipped into recession. In the seven expansionary rate cuts, the S&P 500 posted gains each time 3-months, 6-months, and 12-months later, with better than average returns of 8.40%, 12.85%, and 15.8% respectively.

Geopolitical issues remain top of mind as a risk to the intermediate-term outlook. Political rhetoric in the U.S. has been amplified with the Presidential Election. Other risks include the escalation in the Middle East and Russia / Ukraine, natural disaster in the Southeastern U.S., and the mounting debt burden and deteriorating fiscal position of the U.S. federal government. As long as credit trends remain strong and supportive, which they have all year, we would view any volatility and associated market weakness as a buying opportunity and a pause that refreshes.

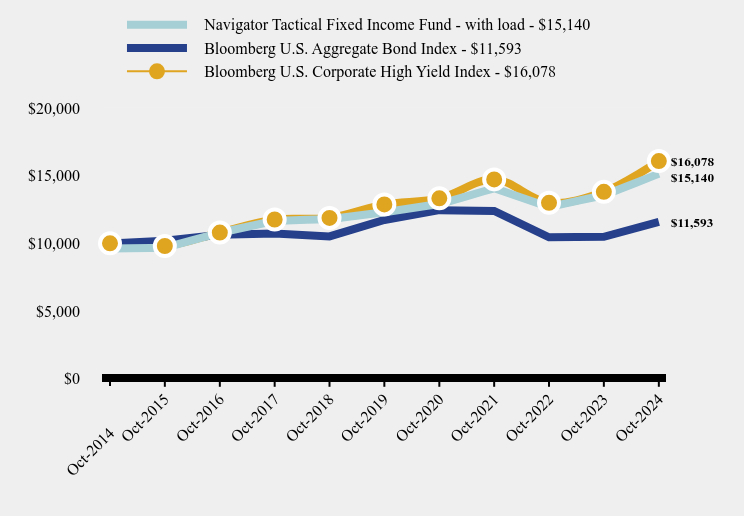

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Navigator Tactical Fixed Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Corporate High Yield Index |

|---|

| Oct-2014 | $9,623 | $10,000 | $10,000 |

| Oct-2015 | $9,680 | $10,196 | $9,806 |

| Oct-2016 | $10,783 | $10,641 | $10,800 |

| Oct-2017 | $11,666 | $10,737 | $11,763 |

| Oct-2018 | $11,785 | $10,517 | $11,878 |

| Oct-2019 | $12,296 | $11,727 | $12,874 |

| Oct-2020 | $12,905 | $12,453 | $13,323 |

| Oct-2021 | $14,066 | $12,393 | $14,726 |

| Oct-2022 | $12,689 | $10,450 | $12,994 |

| Oct-2023 | $13,550 | $10,487 | $13,804 |

| Oct-2024 | $15,140 | $11,593 | $16,078 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Navigator Tactical Fixed Income Fund | | | |

| Without Load | 11.73% | 4.25% | 4.64% |

| With Load | 7.52% | 3.45% | 4.23% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg U.S. Corporate High Yield Index | 16.47% | 4.55% | 4.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $7,672,168,410 |

| Number of Portfolio Holdings | 131 |

| Advisory Fee | $58,011,883 |

| Portfolio Turnover | 34% |

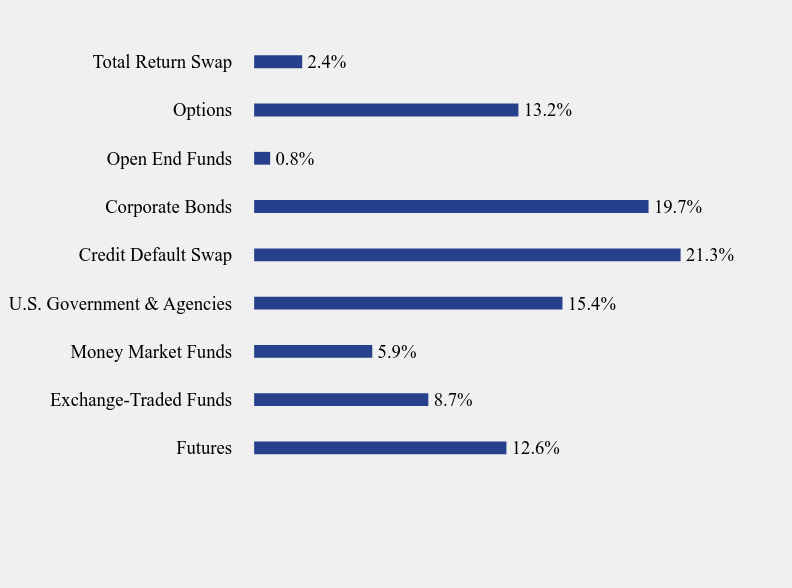

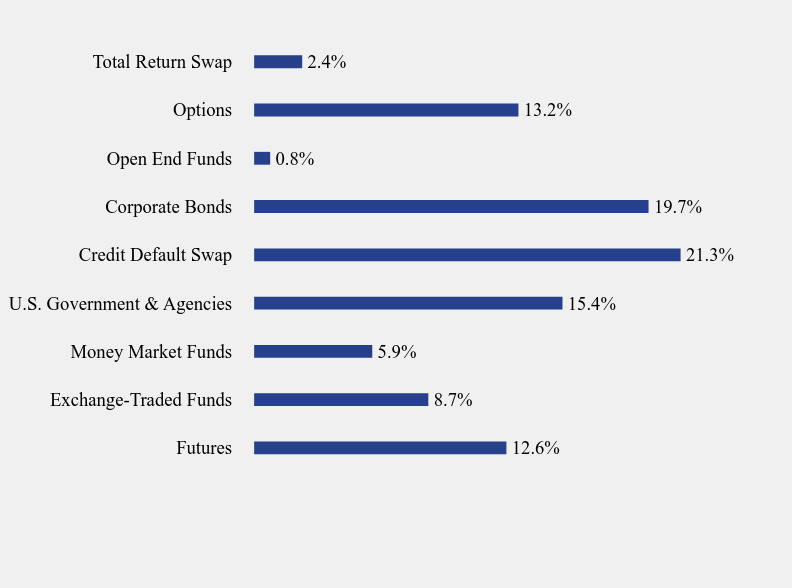

What did the Fund invest in?

Security Type Weighting (% of total exposure)*

| Value | Value |

|---|

| Futures | 12.6% |

| Exchange-Traded Funds | 8.7% |

| Money Market Funds | 5.9% |

| U.S. Government & Agencies | 15.4% |

| Credit Default Swap | 21.3% |

| Corporate Bonds | 19.7% |

| Open End Funds | 0.8% |

| Options | 13.2% |

| Total Return Swap | 2.4% |

Top 10 Holdings (% of net assets)**

| Holding Name | % of Net Assets |

| iShares iBoxx High Yield Corporate Bond ETF | 13.9% |

| United States Treasury Floating Rate Note, 4.687%, 07/31/25 | 6.1% |

| United States Treasury Note, 4.125%, 10/31/29 | 5.9% |

| United States Treasury Bill, 4.050%, 11/07/24 | 3.3% |

| United States Treasury Bill, 4.390%, 11/14/24 | 3.3% |

| United States Treasury Bill, 4.520%, 11/29/24 | 3.2% |

| United States Treasury Bill, 4.540%, 12/05/24 | 3.2% |

| United States Treasury Note, 3.500%, 09/30/29 | 3.2% |

| SPDR Bloomberg High Yield Bond ETF | 2.4% |

| United States Treasury Bill, 4.580%, 12/26/24 | 1.3% |

*Presented as a percentage of the total notional value of all investments in the Fund.

**Presented as a percentage of net assets, including derivative instruments valued at the value used for determining the Fund's NAV. The notional exposure of such derivative instruments may be greater.

No material changes occurred during the year ended October 31, 2024.

Navigator Tactical Fixed Income Fund - Class A (NTBAX )

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Tactical Fixed Income Fund - Class C (NTBCX )

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Tactical Fixed Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $207 | 1.96% |

How did the Fund perform during the reporting period?

For the fiscal year ending October 31, 2024 the Navigator Tactical Fixed Income Fund Class C shares (the “Fund”) gained 10.94%, compared to the Bloomberg Barclays US Corporate High Yield Index gain of 16.47% and the Bloomberg Barclays US Aggregate Bond Index 10.55% gain. The primary driver of performance in the Fund has always been the Fund’s sector exposure and the modeling processes that drives the allocation between High Yield Bonds, US Treasuries, and cash equivalents. The Fund has been invested in High Yield bonds since November 6, 2023, as credit remains solid, buoyed by the strength of the U.S. economy and risk assets.

• High yield bond spreads contracted, ending the annual period at 282 basis points, near the bottom end of their range for this cycle. Low spreads indicate a lack of underlying stress in the asset class.

• Treasuries advanced throughout the period as yields declined in advance of the Federal Reserve’s first rate cut. The Bloomberg 7-10 Year Treasury Index gained 9.38%, underperforming the High Yield Index and broader fixed income.

• The Federal Reserve embarked on a new rate-cutting cycle by lowering the overnight lending rate on September 18, 2024, by 0.50% in response to inflation trends falling near the Fed’s 2.0% target zone. In the post FOMC meeting press conference, Chairman Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

• Interest rate sensitivity of the High Yield market has decreased with the duration of the index hitting its lowest level on record (2.91 on September 19, 2004).

How will the market respond to the Fed rate cut? Don’t fight the Fed. History shows no recession equals gains. Of the last twelve rate cut cycles dating back to 1971, seven occurred with the economy in expansion and five when the economy was either in recession or shortly thereafter tipped into recession. In the seven expansionary rate cuts, the S&P 500 posted gains each time 3-months, 6-months, and 12-months later, with better than average returns of 8.40%, 12.85%, and 15.8% respectively.

Geopolitical issues remain top of mind as a risk to the intermediate-term outlook. Political rhetoric in the U.S. has been amplified with the Presidential Election. Other risks include the escalation in the Middle East and Russia / Ukraine, natural disaster in the Southeastern U.S., and the mounting debt burden and deteriorating fiscal position of the U.S. federal government. As long as credit trends remain strong and supportive, which they have all year, we would view any volatility and associated market weakness as a buying opportunity and a pause that refreshes.

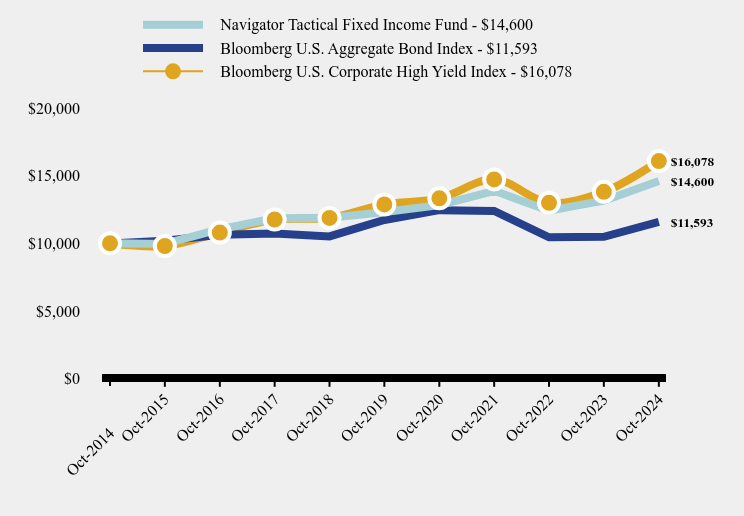

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Navigator Tactical Fixed Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Corporate High Yield Index |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

| Oct-2015 | $9,974 | $10,196 | $9,806 |

| Oct-2016 | $11,044 | $10,641 | $10,800 |

| Oct-2017 | $11,853 | $10,737 | $11,763 |

| Oct-2018 | $11,886 | $10,517 | $11,878 |

| Oct-2019 | $12,309 | $11,727 | $12,874 |

| Oct-2020 | $12,820 | $12,453 | $13,323 |

| Oct-2021 | $13,878 | $12,393 | $14,726 |

| Oct-2022 | $12,416 | $10,450 | $12,994 |

| Oct-2023 | $13,159 | $10,487 | $13,804 |

| Oct-2024 | $14,600 | $11,593 | $16,078 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Navigator Tactical Fixed Income Fund | 10.94% | 3.47% | 3.86% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg U.S. Corporate High Yield Index | 16.47% | 4.55% | 4.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $7,672,168,410 |

| Number of Portfolio Holdings | 131 |

| Advisory Fee | $58,011,883 |

| Portfolio Turnover | 34% |

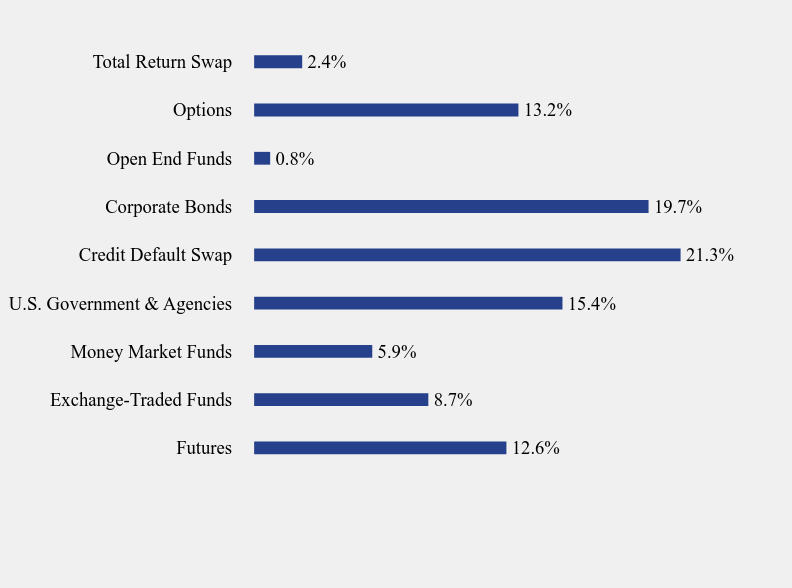

What did the Fund invest in?

Security Type Weighting (% of total exposure)*

| Value | Value |

|---|

| Futures | 12.6% |

| Exchange-Traded Funds | 8.7% |

| Money Market Funds | 5.9% |

| U.S. Government & Agencies | 15.4% |

| Credit Default Swap | 21.3% |

| Corporate Bonds | 19.7% |

| Open End Funds | 0.8% |

| Options | 13.2% |

| Total Return Swap | 2.4% |

Top 10 Holdings (% of net assets)**

| Holding Name | % of Net Assets |

| iShares iBoxx High Yield Corporate Bond ETF | 13.9% |

| United States Treasury Floating Rate Note, 4.687%, 07/31/25 | 6.1% |

| United States Treasury Note, 4.125%, 10/31/29 | 5.9% |

| United States Treasury Bill, 4.050%, 11/07/24 | 3.3% |

| United States Treasury Bill, 4.390%, 11/14/24 | 3.3% |

| United States Treasury Bill, 4.520%, 11/29/24 | 3.2% |

| United States Treasury Bill, 4.540%, 12/05/24 | 3.2% |

| United States Treasury Note, 3.500%, 09/30/29 | 3.2% |

| SPDR Bloomberg High Yield Bond ETF | 2.4% |

| United States Treasury Bill, 4.580%, 12/26/24 | 1.3% |

*Presented as a percentage of the total notional value of all investments in the Fund.

**Presented as a percentage of net assets, including derivative instruments valued at the value used for determining the Fund's NAV. The notional exposure of such derivative instruments may be greater.

No material changes occurred during the year ended October 31, 2024.

Navigator Tactical Fixed Income Fund - Class C (NTBCX )

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Tactical Fixed Income Fund - Class I (NTBIX )

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Tactical Fixed Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $102 | 0.96% |

How did the Fund perform during the reporting period?

For the fiscal year ending October 31, 2024 the Navigator Tactical Fixed Income Fund Class I shares (the “Fund”) gained 12.00%, compared to the Bloomberg Barclays US Corporate High Yield Index gain of 16.47% and the Bloomberg Barclays US Aggregate Bond Index 10.55% gain. The primary driver of performance in the Fund has always been the Fund’s sector exposure and the modeling processes that drives the allocation between High Yield Bonds, US Treasuries, and cash equivalents. The Fund has been invested in High Yield bonds since November 6, 2023, as credit remains solid, buoyed by the strength of the U.S. economy and risk assets.

• High yield bond spreads contracted, ending the annual period at 282 basis points, near the bottom end of their range for this cycle. Low spreads indicate a lack of underlying stress in the asset class.

• Treasuries advanced throughout the period as yields declined in advance of the Federal Reserve’s first rate cut. The Bloomberg 7-10 Year Treasury Index gained 9.38%, underperforming the High Yield Index and broader fixed income.

• The Federal Reserve embarked on a new rate-cutting cycle by lowering the overnight lending rate on September 18, 2024, by 0.50% in response to inflation trends falling near the Fed’s 2.0% target zone. In the post FOMC meeting press conference, Chairman Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

• Interest rate sensitivity of the High Yield market has decreased with the duration of the index hitting its lowest level on record (2.91 on September 19, 2004).

How will the market respond to the Fed rate cut? Don’t fight the Fed. History shows no recession equals gains. Of the last twelve rate cut cycles dating back to 1971, seven occurred with the economy in expansion and five when the economy was either in recession or shortly thereafter tipped into recession. In the seven expansionary rate cuts, the S&P 500 posted gains each time 3-months, 6-months, and 12-months later, with better than average returns of 8.40%, 12.85%, and 15.8% respectively.

Geopolitical issues remain top of mind as a risk to the intermediate-term outlook. Political rhetoric in the U.S. has been amplified with the Presidential Election. Other risks include the escalation in the Middle East and Russia / Ukraine, natural disaster in the Southeastern U.S., and the mounting debt burden and deteriorating fiscal position of the U.S. federal government. As long as credit trends remain strong and supportive, which they have all year, we would view any volatility and associated market weakness as a buying opportunity and a pause that refreshes.

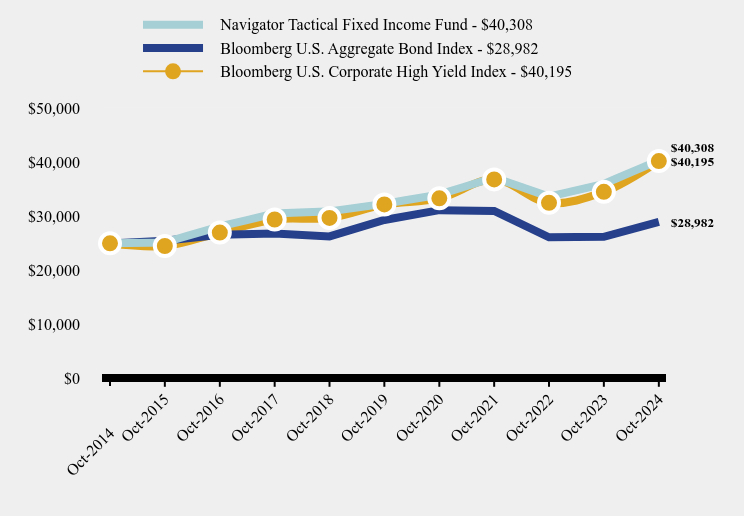

How has the Fund performed over the last ten years?

Total Return Based on $25,000 Investment

| Navigator Tactical Fixed Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Corporate High Yield Index |

|---|

| Oct-2014 | $25,000 | $25,000 | $25,000 |

| Oct-2015 | $25,174 | $25,489 | $24,514 |

| Oct-2016 | $28,132 | $26,603 | $27,000 |

| Oct-2017 | $30,509 | $26,843 | $29,409 |

| Oct-2018 | $30,910 | $26,292 | $29,695 |

| Oct-2019 | $32,296 | $29,318 | $32,184 |

| Oct-2020 | $34,007 | $31,132 | $33,308 |

| Oct-2021 | $37,165 | $30,983 | $36,814 |

| Oct-2022 | $33,617 | $26,124 | $32,486 |

| Oct-2023 | $35,988 | $26,217 | $34,510 |

| Oct-2024 | $40,308 | $28,982 | $40,195 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Navigator Tactical Fixed Income Fund | 12.00% | 4.53% | 4.89% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| Bloomberg U.S. Corporate High Yield Index | 16.47% | 4.55% | 4.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $7,672,168,410 |

| Number of Portfolio Holdings | 131 |

| Advisory Fee | $58,011,883 |

| Portfolio Turnover | 34% |

What did the Fund invest in?

Security Type Weighting (% of total exposure)*

| Value | Value |

|---|

| Futures | 12.6% |

| Exchange-Traded Funds | 8.7% |

| Money Market Funds | 5.9% |

| U.S. Government & Agencies | 15.4% |

| Credit Default Swap | 21.3% |

| Corporate Bonds | 19.7% |

| Open End Funds | 0.8% |

| Options | 13.2% |

| Total Return Swap | 2.4% |

Top 10 Holdings (% of net assets)**

| Holding Name | % of Net Assets |

| iShares iBoxx High Yield Corporate Bond ETF | 13.9% |

| United States Treasury Floating Rate Note, 4.687%, 07/31/25 | 6.1% |

| United States Treasury Note, 4.125%, 10/31/29 | 5.9% |

| United States Treasury Bill, 4.050%, 11/07/24 | 3.3% |

| United States Treasury Bill, 4.390%, 11/14/24 | 3.3% |

| United States Treasury Bill, 4.520%, 11/29/24 | 3.2% |

| United States Treasury Bill, 4.540%, 12/05/24 | 3.2% |

| United States Treasury Note, 3.500%, 09/30/29 | 3.2% |

| SPDR Bloomberg High Yield Bond ETF | 2.4% |

| United States Treasury Bill, 4.580%, 12/26/24 | 1.3% |

*Presented as a percentage of the total notional value of all investments in the Fund.

**Presented as a percentage of net assets, including derivative instruments valued at the value used for determining the Fund's NAV. The notional exposure of such derivative instruments may be greater.

No material changes occurred during the year ended October 31, 2024.

Navigator Tactical Fixed Income Fund - Class I (NTBIX )

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Tactical Investment Grade Bond Fund - Class I (NTIIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Tactical Investment Grade Bond Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $106 | 1.01% |

How did the Fund perform during the reporting period?

For the fiscal year ending October 31, 2024, the Navigator Tactical Investment Grade Bond Fund Class I shares (the “Fund”) gained 9.99% compared to the Bloomberg Barclays US Aggregate Bond Index 10.55% gain. The primary driver of performance in the Fund is its sector exposure and the modeling processes that drives the allocation between Investment Grade Bonds, US Treasuries, and cash equivalents.

• The Fund’s alpha is driven by the Credit Risk Management models that determine its allocation. When risk-on the Fund will invest in Investment Grade Corporate Bonds, when risk-off the Fund will invest in U.S. Treasuries or T-bills.

• After 525 basis points of rate hikes during 2022 and 2023, the Federal Reserve embarked on a new rate cutting cycle by lowering the overnight lending rate on September 18, 2024, by 0.50% in response to inflation trends falling near the Fed’s 2.0% target zone. In the post FOMC meeting press conference, Chairman Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

• Treasuries advanced throughout the period as yields declined in advance of the Federal Reserve’s first rate cut. The Bloomberg 7-10 Year Treasury Index gained 9.38%, underperforming broader fixed income.

• The Treasury yield (10-Year Treasury Yield minus 2-Year Treasury Yield) curve steepened through the annual period and turned positive in early September on expectations of Federal Reserve rate cuts. It is the first time since July 2022 that the curve was positively sloped.

How will the market respond to the Fed rate cut? Don’t fight the Fed. History shows no recession equals gains. Of the last twelve rate cut cycles dating back to 1971, seven occurred with the economy in expansion and five when the economy was either in recession or shortly thereafter tipped into recession. In the seven expansionary rate cuts, the S&P 500 posted gains each time 3-months, 6-months, and 12-months later, with better than average returns of 8.40%, 12.85%, and 15.8% respectively.

Geopolitical issues remain top of mind as a risk to the intermediate-term outlook. Political rhetoric in the U.S. has been amplified with the Presidential Election. Other risks include the escalation in the Middle East and Russia / Ukraine, natural disaster in the Southeastern U.S., and the mounting debt burden and deteriorating fiscal position of the U.S. federal government. As long as credit trends remain strong and supportive, which they have all year, we would view any volatility and associated market weakness as a buying opportunity and a pause that refreshes.

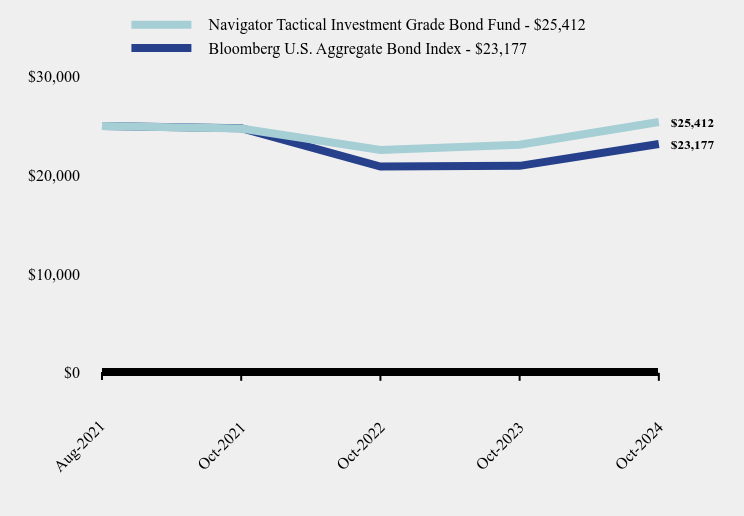

How has the Fund performed since inception?

Total Return Based on $25,000 Investment

| Navigator Tactical Investment Grade Bond Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| Aug-2021 | $25,000 | $25,000 |

| Oct-2021 | $24,743 | $24,777 |

| Oct-2022 | $22,578 | $20,891 |

| Oct-2023 | $23,103 | $20,965 |

| Oct-2024 | $25,412 | $23,177 |

Average Annual Total Returns

| 1 Year | Since Inception (August 31, 2021) |

|---|

| Navigator Tactical Investment Grade Bond Fund | 9.99% | 0.52% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -2.36% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $1,319,254,455 |

| Number of Portfolio Holdings | 10 |

| Advisory Fee (net of waivers) | $9,442,728 |

| Portfolio Turnover | 360% |

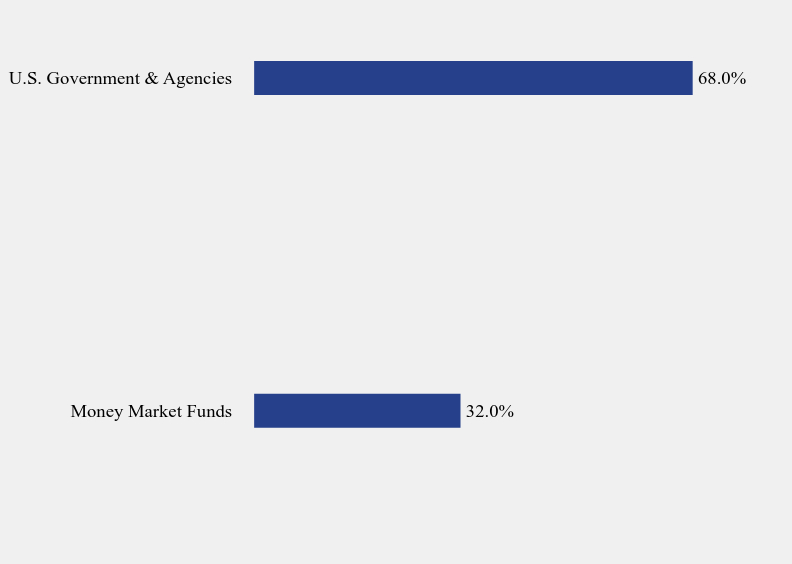

What did the Fund invest in?

Security Type Weighting (% of total exposure)*

| Value | Value |

|---|

| Money Market Funds | 32.0% |

| U.S. Government & Agencies | 68.0% |

Top 10 Holdings (% of net assets)**

| Holding Name | % of Net Assets |

| United States Treasury Bill, 4.330%, 11/12/24 | 7.6% |

| United States Treasury Bill, 4.480%, 11/19/24 | 7.6% |

| United States Treasury Bill, 4.510%, 11/26/24 | 7.6% |

| United States Treasury Bill, 4.540%, 12/05/24 | 7.5% |

| United States Treasury Bill, 4.560%, 12/17/24 | 7.5% |

| United States Treasury Bill, 4.590%, 12/24/24 | 7.5% |

| United States Treasury Bill, 4.540%, 01/09/25 | 7.5% |

| United States Treasury Bill, 4.540%, 01/16/25 | 7.5% |

| United States Treasury Bill, 4.540%, 01/30/25 | 7.5% |

*Presented as a percentage of the total notional value of all investments in the Fund.

**Presented as a percentage of net assets, including derivative instruments valued at the value used for determining the Fund's NAV. The notional exposure of such derivative instruments may be greater.

No material changes occurred during the year ended October 31, 2024.

Navigator Tactical Investment Grade Bond Fund - Class I (NTIIX)

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Tactical U.S. Allocation Fund - Class I (NTAIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Tactical U.S. Allocation Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $117 | 1.01% |

How did the Fund perform during the reporting period?

For the fiscal year ending October 31, 2024, the Navigator Tactical U.S. Allocation Fund Class I shares (the “Fund”) gained 31.19% compared to the S&P 500 Index gain of 38.02%. The primary driver of performance in the Fund is its allocation exposure and the modeling processes that drives the allocation between U.S. Equities, US Treasuries, and cash equivalents. The Fund has been invested in U.S. Equities since November 6, 2023, as credit remains solid, buoyed by the strength of the U.S. economy and risk assets.

• Risk assets remained strong throughout the annual period with the S&P 500 hitting new all-time highs. The market has broadened more recently, evidenced by the fact that the Equal Weight S&P 500 and NYSE Cumulative Advance-Decline Lines also made new all-time highs.

• High yield bond spreads contracted, ending the annual period at 282 basis points, near the bottom end of their range for this cycle. Low spreads indicate a lack of underlying stress in the asset class.

• The Federal Reserve embarked on a new rate-cutting cycle by lowering the overnight lending rate on September 18, 2024, by 0.50% in response to inflation trends falling near the Fed’s 2.0% target zone. In the post FOMC meeting press conference, Chairman Powell said, “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

How will the market respond to the Fed rate cut? Don’t fight the Fed. History shows no recession equals gains. Of the last twelve rate cut cycles dating back to 1971, seven occurred with the economy in expansion and five when the economy was either in recession or shortly thereafter tipped into recession. In the seven expansionary rate cuts, the S&P 500 posted gains each time 3-months, 6-months, and 12-months later, with better than average returns of 8.40%, 12.85%, and 15.8% respectively.

Geopolitical issues remain top of mind as a risk to the intermediate-term outlook. Political rhetoric in the U.S. has been amplified with the Presidential Election. Other risks include the escalation in the Middle East and Russia / Ukraine, natural disaster in the Southeastern U.S., and the mounting debt burden and deteriorating fiscal position of the U.S. federal government. As long as credit trends remain strong and supportive, which they have all year, we would view any volatility and associated market weakness as a buying opportunity and a pause that refreshes.

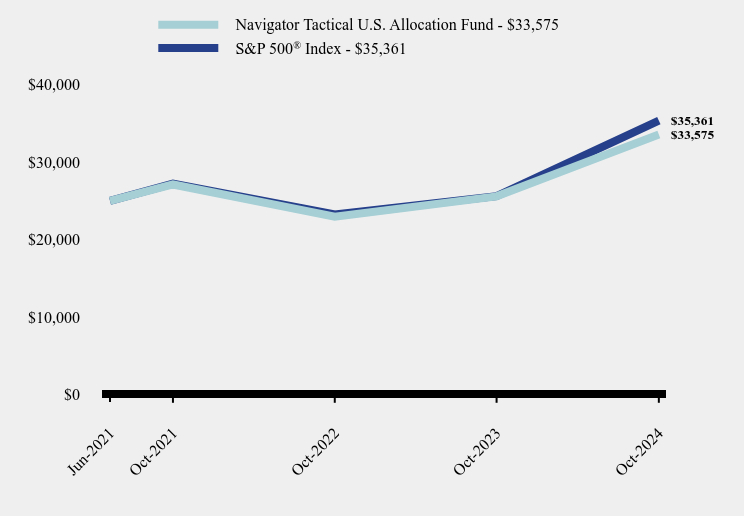

How has the Fund performed since inception?

Total Return Based on $25,000 Investment

| Navigator Tactical U.S. Allocation Fund | S&P 500® Index |

|---|

| Jun-2021 | $25,000 | $25,000 |

| Oct-2021 | $27,125 | $27,242 |

| Oct-2022 | $22,981 | $23,262 |

| Oct-2023 | $25,593 | $25,621 |

| Oct-2024 | $33,575 | $35,361 |

Average Annual Total Returns

| 1 Year | Since Inception (June 11, 2021) |

|---|

| Navigator Tactical U.S. Allocation Fund | 31.19% | 9.09% |

S&P 500® Index | 38.02% | 10.77% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $67,151,419 |

| Number of Portfolio Holdings | 54 |

| Advisory Fee (net of waivers) | $413,717 |

| Portfolio Turnover | 4% |

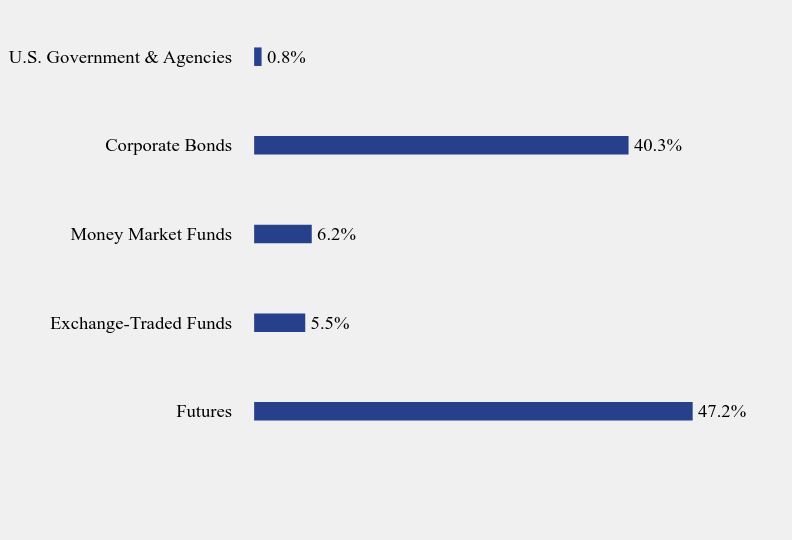

What did the Fund invest in?

Security Type Weighting (% of total exposure)*

| Value | Value |

|---|

| Futures | 47.2% |

| Exchange-Traded Funds | 5.5% |

| Money Market Funds | 6.2% |

| Corporate Bonds | 40.3% |

| U.S. Government & Agencies | 0.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Vanguard S&P 500 ETF | 10.5% |

| Oracle Corporation, 2.950%, 11/15/24 | 2.4% |

| Altria Group, Inc., 2.350%, 05/06/25 | 2.2% |

| Campbell Soup Company, 3.950%, 03/15/25 | 2.1% |

| Goldman Sachs Group, Inc. (The), 5.798%, 08/10/26 | 1.5% |

| JPMorgan Chase & Company, 6.148%, 04/26/26 | 1.5% |

| Nasdaq, Inc., 5.650%, 06/28/25 | 1.5% |

| Morgan Stanley Bank NA, 5.615%, 07/16/25 | 1.5% |

| Georgia Power Company, 5.877%, 05/08/25 | 1.5% |

| American Honda Finance Corporation, 5.706%, 08/14/25 | 1.5% |

No material changes occurred during the year ended October 31, 2024.

Navigator Tactical U.S. Allocation Fund - Class I (NTAIX)

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Ultra Short Bond Fund - Class A (NUSAX )

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Ultra Short Bond Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $67 | 0.65% |

How did the Fund perform during the reporting period?

For the fiscal period ending October 31st, 2024, the Navigator Ultra Short Bond Fund (“the Fund”) Class A shares returned 5.50%, compared to the Bloomberg Barclays U.S Treasury Bellwethers 1 Year Index return of 5.73%. Below, we highlight notable events that occurred within the ultra-short duration fixed income space over the previous fiscal year, along with the Fund’s positioning relative to its benchmark and the outlook moving forward.

Although it did not happen until late in the fiscal year, 2024 finally saw the first rate cut by the Federal Reserve since this hiking cycle began in early 2022. On September 18th, 2024, the Fed delivered a “jumbo” 50 basis point cut, lowering the upper bound of the federal funds target rate to 5.0% from 5.50%.1 Despite significant fluctuations in expectations over the last 12 months, the fiscal year began with markets anticipating just over two cuts to the federal funds rate, and in the end, that’s exactly what happened.2 Furthermore, market participants were kept on their toes headed into the September Federal Open Market Committee (FOMC) meeting with the probability of a 25 versus a 50 basis points cut considered nearly a tossup.3 Ultimately, Chairman Powell made a splash with a half-point cut, demonstrating the Fed’s view that risks to inflation and risks to the economy have come into balance. Consequently, rates headed lower across the front end of the US Treasury curve, illustrated by the one-year government bill rate dropping by over one percent.4 The Fund remained underweight duration,5 but benefited from resilient credit as spreads tightened notably.6 Furthermore, the Fund experience no meaningful credit events during the reporting period.

The current outlook according to federal funds futures markets suggests over four additional cuts to the Fed’s target rate for the next fiscal year.7 As inflation trends towards 2%, we expect the Federal Reserve to prioritize both sides of its dual mandate. We will continue to monitor fluctuations in interest rate expectations and navigate new developments. Accordingly, the Fund aims to find relative value opportunities through strategic investments across short-term debt markets.

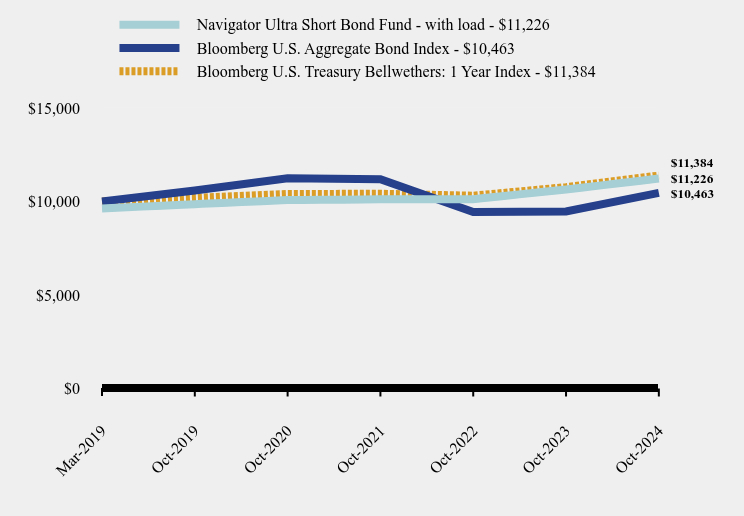

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Navigator Ultra Short Bond Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Treasury Bellwethers: 1 Year Index |

|---|

| Mar-2019 | $9,625 | $10,000 | $10,000 |

| Oct-2019 | $9,856 | $10,584 | $10,197 |

| Oct-2020 | $10,076 | $11,239 | $10,397 |

| Oct-2021 | $10,114 | $11,185 | $10,414 |

| Oct-2022 | $10,121 | $9,431 | $10,308 |

| Oct-2023 | $10,641 | $9,465 | $10,767 |

| Oct-2024 | $11,226 | $10,463 | $11,384 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (3/25/2019) |

|---|

| Navigator Ultra Short Bond Fund | | | |

| Without Load | 5.50% | 2.64% | 2.78% |

| With Load | 1.52% | 1.85% | 2.09% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 0.81% |

| Bloomberg U.S. Treasury Bellwethers: 1 Year Index | 5.73% | 2.23% | 2.34% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $71,034,403 |

| Number of Portfolio Holdings | 66 |

| Advisory Fee (net of waivers) | $33,862 |

| Portfolio Turnover | 21% |

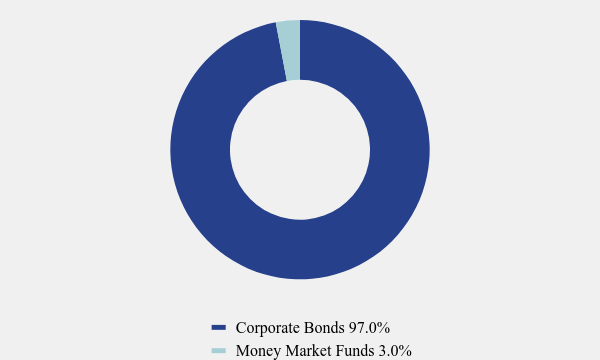

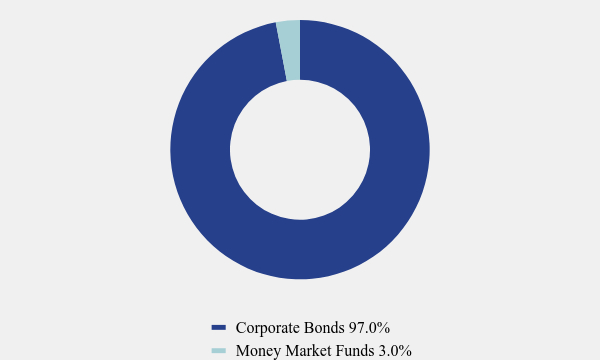

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 97.0% |

| Money Market Funds | 3.0% |

What did the Fund invest in?

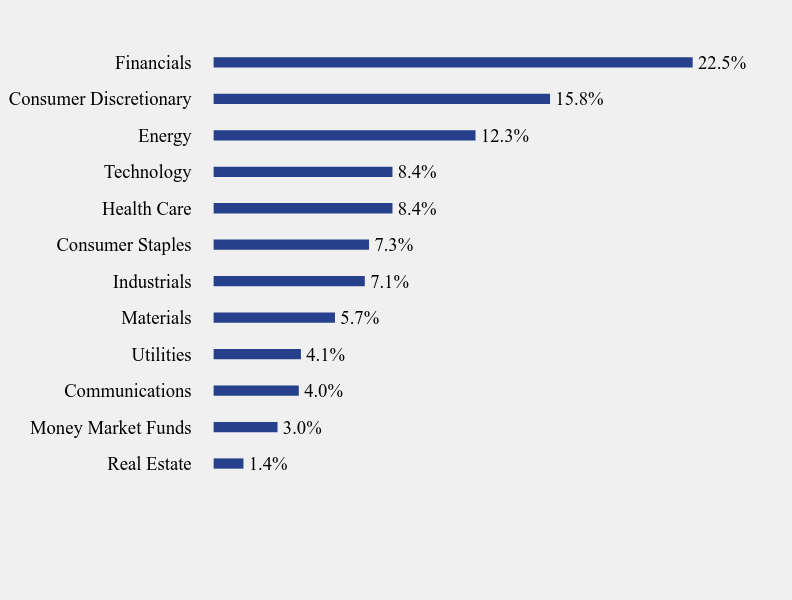

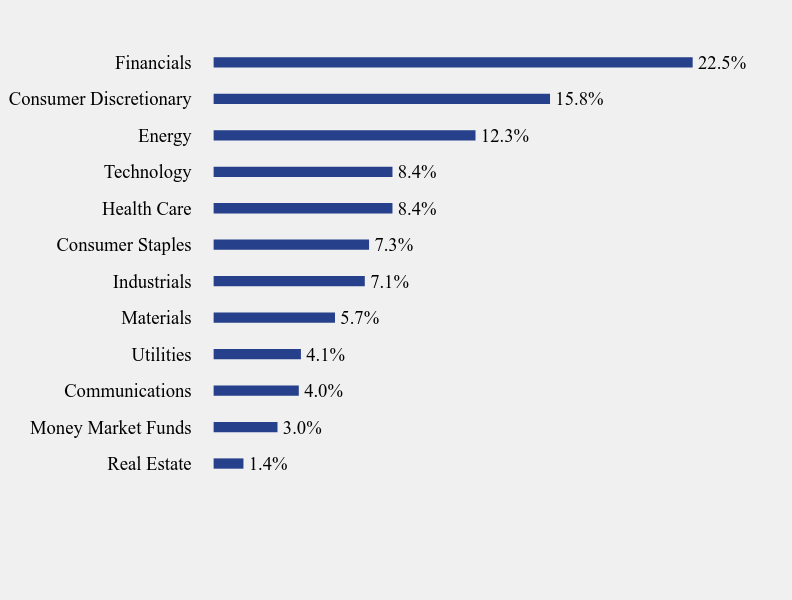

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Real Estate | 1.4% |

| Money Market Funds | 3.0% |

| Communications | 4.0% |

| Utilities | 4.1% |

| Materials | 5.7% |

| Industrials | 7.1% |

| Consumer Staples | 7.3% |

| Health Care | 8.4% |

| Technology | 8.4% |

| Energy | 12.3% |

| Consumer Discretionary | 15.8% |

| Financials | 22.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Morgan Stanley Bank NA, 5.615%, 07/16/25 | 2.8% |

| Citibank NA, 5.410%, 04/30/26 | 2.8% |

| Wells Fargo & Company, 2.164%, 02/11/26 | 2.8% |

| American Honda Finance Corporation, 5.706%, 08/14/25 | 2.1% |

| Altria Group, Inc., 2.350%, 05/06/25 | 2.1% |

| Omnicom Group, Inc. / Omnicom Capital, Inc., 3.650%, 11/01/24 | 2.1% |

| Campbell Soup Company, 3.950%, 03/15/25 | 2.0% |

| Expedia Group, Inc., 6.250%, 05/01/25 | 1.9% |

| Mondelez International, Inc., 1.500%, 05/04/25 | 1.8% |

| Enbridge Energy Partners, L.P., 5.875%, 10/15/25 | 1.4% |

No material changes occurred during the year ended October 31, 2024.

Navigator Ultra Short Bond Fund - Class A (NUSAX )

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Navigator Ultra Short Bond Fund - Class I (NUSIX )

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Navigator Ultra Short Bond Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://navigatorfunds.com/. You can also request this information by contacting us at (877) 766-2264.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $41 | 0.40% |

How did the Fund perform during the reporting period?

For the fiscal period ending October 31st, 2024, the Navigator Ultra Short Bond Fund (“the Fund”) Class I shares returned 5.79%, compared to the Bloomberg Barclays U.S Treasury Bellwethers 1 Year Index return of 5.73%. Below, we highlight notable events that occurred within the ultra-short duration fixed income space over the previous fiscal year, along with the Fund’s positioning relative to its benchmark and the outlook moving forward.

Although it did not happen until late in the fiscal year, 2024 finally saw the first rate cut by the Federal Reserve since this hiking cycle began in early 2022. On September 18th, 2024, the Fed delivered a “jumbo” 50 basis point cut, lowering the upper bound of the federal funds target rate to 5.0% from 5.50%.1 Despite significant fluctuations in expectations over the last 12 months, the fiscal year began with markets anticipating just over two cuts to the federal funds rate, and in the end, that’s exactly what happened.2 Furthermore, market participants were kept on their toes headed into the September Federal Open Market Committee (FOMC) meeting with the probability of a 25 versus a 50 basis points cut considered nearly a tossup.3 Ultimately, Chairman Powell made a splash with a half-point cut, demonstrating the Fed’s view that risks to inflation and risks to the economy have come into balance. Consequently, rates headed lower across the front end of the US Treasury curve, illustrated by the one-year government bill rate dropping by over one percent.4 The Fund remained underweight duration,5 but benefited from resilient credit as spreads tightened notably.6 Furthermore, the Fund experience no meaningful credit events during the reporting period.

The current outlook according to federal funds futures markets suggests over four additional cuts to the Fed’s target rate for the next fiscal year.7 As inflation trends towards 2%, we expect the Federal Reserve to prioritize both sides of its dual mandate. We will continue to monitor fluctuations in interest rate expectations and navigate new developments. Accordingly, the Fund aims to find relative value opportunities through strategic investments across short-term debt markets.

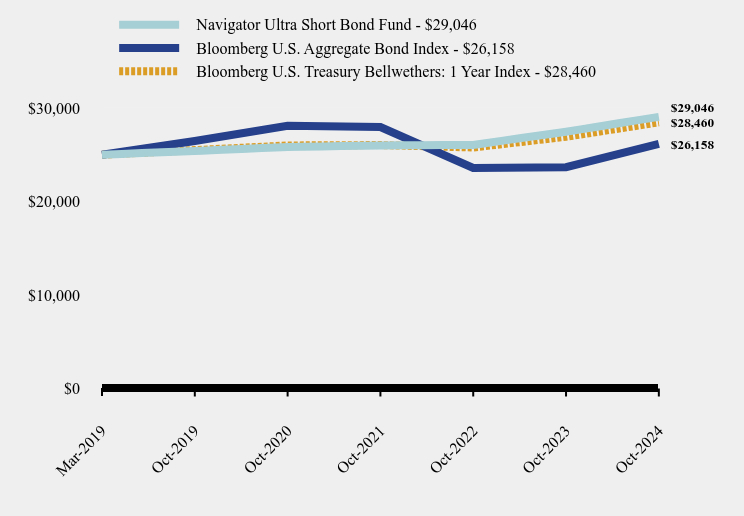

How has the Fund performed since inception?

Total Return Based on $25,000 Investment

| Navigator Ultra Short Bond Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Treasury Bellwethers: 1 Year Index |

|---|

| Mar-2019 | $25,000 | $25,000 | $25,000 |

| Oct-2019 | $25,404 | $26,461 | $25,492 |

| Oct-2020 | $25,829 | $28,098 | $25,993 |

| Oct-2021 | $25,991 | $27,963 | $26,034 |

| Oct-2022 | $26,051 | $23,578 | $25,770 |

| Oct-2023 | $27,456 | $23,662 | $26,918 |

| Oct-2024 | $29,046 | $26,158 | $28,460 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (March 25, 2019) |

|---|

| Navigator Ultra Short Bond Fund | 5.79% | 2.72% | 2.71% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 0.81% |

| Bloomberg U.S. Treasury Bellwethers: 1 Year Index | 5.73% | 2.23% | 2.34% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $71,034,403 |

| Number of Portfolio Holdings | 66 |

| Advisory Fee (net of waivers) | $33,862 |

| Portfolio Turnover | 21% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 97.0% |

| Money Market Funds | 3.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Real Estate | 1.4% |

| Money Market Funds | 3.0% |

| Communications | 4.0% |

| Utilities | 4.1% |

| Materials | 5.7% |

| Industrials | 7.1% |

| Consumer Staples | 7.3% |

| Health Care | 8.4% |

| Technology | 8.4% |

| Energy | 12.3% |

| Consumer Discretionary | 15.8% |

| Financials | 22.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Morgan Stanley Bank NA, 5.615%, 07/16/25 | 2.8% |

| Citibank NA, 5.410%, 04/30/26 | 2.8% |

| Wells Fargo & Company, 2.164%, 02/11/26 | 2.8% |

| American Honda Finance Corporation, 5.706%, 08/14/25 | 2.1% |

| Altria Group, Inc., 2.350%, 05/06/25 | 2.1% |

| Omnicom Group, Inc. / Omnicom Capital, Inc., 3.650%, 11/01/24 | 2.1% |

| Campbell Soup Company, 3.950%, 03/15/25 | 2.0% |

| Expedia Group, Inc., 6.250%, 05/01/25 | 1.9% |

| Mondelez International, Inc., 1.500%, 05/04/25 | 1.8% |

| Enbridge Energy Partners, L.P., 5.875%, 10/15/25 | 1.4% |

No material changes occurred during the year ended October 31, 2024.

Navigator Ultra Short Bond Fund - Class I (NUSIX )

Annual Shareholder Report - October 31, 2024

Additional information is available on the Fund's website ( https://navigatorfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

Item 3. Audit Committee Financial Expert.

The Registrant’s board of trustees has determined that Anthony J. Hertl, Mark H. Taylor and Mark Gersten are audit committee financial experts, as defined in Item 3 of Form N-CSR. Mr. Hertl, Mr. Taylor and Mr. Gersten are independent for purposes of this Item 3.

(a)(2) Not applicable.

(a)(3) Not applicable.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

2024 - $67,500

2023 –$78,800

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

2024 - None

2023 - None

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

2024 - $12,000

2023 –$15,000

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended October 31, 2024 and 2023 respectively. |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not applicable. The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was zero percent (0%). |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended October 31, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

Item 5. Audit Committee of Listed Registrants. Not applicable.

Item 6. Investments. The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2024 |

| |

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 17.3% | | | | |

| | | | | FIXED INCOME - 17.3% | | | | |

| | 2,000,000 | | | iShares Broad USD High Yield Corporate Bond ETF | | $ | 74,260,000 | |

| | 13,512,091 | | | iShares iBoxx High Yield Corporate Bond ETF(g) | | | 1,069,346,881 | |

| | 1,912,965 | | | SPDR Bloomberg High Yield Bond ETF | | | 184,218,530 | |

| | | | | | | | 1,327,825,411 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $1,263,591,601) | | | 1,327,825,411 | |

| | | | | | | | | |

| | | | | OPEN-END FUNDS — 1.6% | | | | |

| | | | | FIXED INCOME - 0.7% | | | | |

| | 5,504,264 | | | Navigator Ultra Short Bond Fund, Class I(i) | | | 55,482,977 | |

| | | | | | | | | |

| | | | | MIXED ALLOCATION - 0.9% | | | | |

| | 5,854,382 | | | Navigator Tactical US Allocation Fund, Class I(i) | | | 67,149,761 | |

| | | | | | | | | |

| | | | | TOTAL OPEN-END FUNDS (Cost $113,649,686) | | | 122,632,738 | |

| | | | | | | | | |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | | |

| | | | | CORPORATE BONDS — 38.9% | | | | | | | | | | |

| | | | | AUTOMOTIVE — 6.1% | | | | | | | | | | |

| | 16,500,000 | | | American Honda Finance Corporation(a) | | SOFRINDX + 0.780% | | 5.6090 | | 04/23/25 | | | 16,542,831 | |

| | 9,795,000 | | | American Honda Finance Corporation | | | | 5.0000 | | 05/23/25 | | | 9,811,533 | |

| | 57,500,000 | | | American Honda Finance Corporation(a) | | SOFRRATE + 0.600% | | 5.7060 | | 08/14/25 | | | 57,637,695 | |

| | 41,868,000 | | | American Honda Finance Corporation(a) | | SOFRRATE + 0.500% | | 5.3360 | | 10/10/25 | | | 41,922,062 | |

| | 25,000,000 | | | American Honda Finance Corporation(a) | | SOFRRATE + 0.500% | | 5.3350 | | 01/12/26 | | | 24,999,466 | |

| | 14,700,000 | | | BMW US Capital, LLC(a),(b) | | SOFRINDX + 0.800% | | 5.9170 | | 08/13/26 | | | 14,779,613 | |

| | 48,857,000 | | | Ford Motor Credit Company, LLC | | | | 4.0630 | | 11/01/24 | | | 48,857,000 | |

| | 18,098,000 | | | Ford Motor Credit Company, LLC | | | | 5.1250 | | 06/16/25 | | | 18,053,804 | |

| | 39,000,000 | | | Ford Motor Credit Company, LLC(a) | | SOFRRATE + 1.450% | | 6.4450 | | 11/05/26 | | | 39,063,349 | |

| | 20,000,000 | | | Mercedes-Benz Finance North America, LLC(a),(b) | | SOFRRATE + 0.630% | | 5.4600 | | 07/31/26 | | | 20,016,713 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | AUTOMOTIVE — 6.1% (Continued) | | | | | | | | | | |

| | 21,000,000 | | | Toyota Motor Credit Corporation(a) | | SOFRRATE + 0.600% | | 5.4340 | | 06/09/25 | | $ | 21,046,737 | |

| | 30,000,000 | | | Toyota Motor Credit Corporation(a) | | SOFRRATE + 0.450% | | 5.2860 | | 04/10/26 | | | 30,021,363 | |

| | 55,500,000 | | | Toyota Motor Credit Corporation(a) | | SOFRRATE + 0.450% | | 5.5530 | | 05/15/26 | | | 55,519,051 | |

| | 43,000,000 | | | Volkswagen Group of America Finance, LLC(a),(b) | | SOFRRATE + 0.830% | | 5.6970 | | 03/20/26 | | | 43,055,452 | |

| | 23,688,000 | | | Volkswagen Group of America Finance, LLC(a),(b) | | SOFRRATE + 1.060% | | 6.1630 | | 08/14/26 | | | 23,803,991 | |

| | | | | | | | | | | | | | 465,130,660 | |

| | | | | BANKING — 9.9% | | | | | | | | | | |

| | 87,538,000 | | | Bank of America Corporation Series N(c) | | SOFRRATE + 0.650% | | 1.5300 | | 12/06/25 | | | 87,212,748 | |

| | 32,250,000 | | | Bank of America Corporation(c) | | TSFR3M + 1.072% | | 3.3660 | | 01/23/26 | | | 32,103,340 | |

| | 20,266,000 | | | Bank of America Corporation(c) | | TSFR3M + 0.902% | | 2.0150 | | 02/13/26 | | | 20,082,102 | |

| | 51,335,000 | | | Bank of America Corporation(c) | | SOFRRATE + 1.330% | | 3.3840 | | 04/02/26 | | | 50,979,794 | |

| | 14,000,000 | | | Bank of New York Mellon(a) | | SOFRRATE + 0.450% | | 5.3900 | | 03/13/26 | | | 14,014,360 | |

| | 56,000,000 | | | Citibank NA(a) | | SOFRINDX + 0.590% | | 5.4100 | | 04/30/26 | | | 56,093,809 | |

| | 30,000,000 | | | Citibank NA(a) | | SOFRINDX + 0.708% | | 5.8480 | | 08/06/26 | | | 30,096,211 | |

| | 9,156,000 | | | Citigroup, Inc.(c) | | SOFRRATE + 1.528% | | 3.2900 | | 03/17/26 | | | 9,093,127 | |

| | 11,567,000 | | | Citigroup, Inc.(c) | | SOFRRATE + 2.842% | | 3.1060 | | 04/08/26 | | | 11,467,079 | |

| | 38,000,000 | | | Cooperatieve Rabobank UA(a) | | SOFRRATE + 0.620% | | 5.6670 | | 08/28/26 | | | 38,074,214 | |

| | 64,609,000 | | | JPMorgan Chase & Company(c) | | SOFRRATE + 0.605% | | 1.5610 | | 12/10/25 | | | 64,344,367 | |

| | 12,825,000 | | | JPMorgan Chase & Company(a) | | SOFRRATE + 0.600% | | 5.5800 | | 12/10/25 | | | 12,832,642 | |

| | 17,040,000 | | | JPMorgan Chase & Company(a) | | SOFRRATE + 0.920% | | 5.9860 | | 02/24/26 | | | 17,073,750 | |

| | 18,246,000 | | | JPMorgan Chase & Company(c) | | SOFRRATE + 1.850% | | 2.0830 | | 04/22/26 | | | 17,993,767 | |

| | 16,096,000 | | | JPMorgan Chase & Company(c) | | SOFRRATE + 1.320% | | 4.0800 | | 04/26/26 | | | 16,017,723 | |

| | 11,415,000 | | | JPMorgan Chase & Company(a) | | SOFRRATE + 1.320% | | 6.1480 | | 04/26/26 | | | 11,469,966 | |

| | 32,000,000 | | | Morgan Stanley Bank NA(a) | | SOFRRATE + 0.780% | | 5.6150 | | 07/16/25 | | | 32,106,876 | |

| | 51,327,000 | | | Toronto-Dominion Bank | | | | 3.7660 | | 06/06/25 | | | 51,025,394 | |

| | 42,445,000 | | | Toronto-Dominion Bank | | | | 1.1500 | | 06/12/25 | | | 41,522,415 | |

| | 50,000,000 | | | Toronto-Dominion Bank(a) | | SOFRRATE + 0.480% | | 5.3160 | | 10/10/25 | | | 50,073,764 | |

| | 70,807,000 | | | Wells Fargo & Company(c) | | TSFR3M + 1.012% | | 2.1640 | | 02/11/26 | | | 70,209,220 | |

| | 11,704,000 | | | Wells Fargo & Company(c) | | SOFRRATE + 1.320% | | 3.9080 | | 04/25/26 | | | 11,635,640 | |

| | 13,240,000 | | | Wells Fargo & Company(c) | | SOFRRATE + 2.000% | | 2.1880 | | 04/30/26 | | | 13,050,819 | |

| | | | | | | | | | | | | | 758,573,127 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | BEVERAGES — 0.2% | | | | | | | | | | |

| | 19,000,000 | | | PepsiCo, Inc.(a) | | SOFRINDX + 0.400% | | 5.5200 | | 11/12/24 | | $ | 19,002,020 | |

| | | | | | | | | | | | | | | |

| | | | | BIOTECH & PHARMA — 1.4% | | | | | | | | | | |

| | 33,222,000 | | | Amgen, Inc. | | | | 5.2500 | | 03/02/25 | | | 33,260,594 | |

| | 14,068,000 | | | Biogen, Inc. | | | | 4.0500 | | 09/15/25 | | | 13,969,745 | |

| | 65,525,000 | | | Royalty Pharma plc | | | | 1.2000 | | 09/02/25 | | | 63,557,371 | |

| | | | | | | | | | | | | | 110,787,710 | |

| | | | | CABLE & SATELLITE — 0.0%(d) | | | | | | | | | | |

| | 1,200,000 | | | Cequel Communications Holdings I, LLC / Cequel(b) | | | | 7.5000 | | 04/01/28 | | | 786,000 | |

| | | | | | | | | | | | | | | |

| | | | | CHEMICALS — 0.2% | | | | | | | | | | |

| | 12,052,000 | | | International Flavors & Fragrances, Inc.(b) | | | | 1.2300 | | 10/01/25 | | | 11,655,170 | |

| | | | | | | | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES — 0.4% | | | | | | | | | | |

| | 15,872,000 | | | Block Financial, LLC | | | | 5.2500 | | 10/01/25 | | | 15,906,058 | |

| | 15,000,000 | | | Garda World Security Corporation(b) | | | | 9.5000 | | 11/01/27 | | | 15,022,755 | |

| | | | | | | | | | | | | | 30,928,813 | |

| | | | | CONTAINERS & PACKAGING — 0.5% | | | | | | | | | | |

| | 37,221,000 | | | Amcor Flexibles North America, Inc. | | | | 4.0000 | | 05/17/25 | | | 37,023,226 | |

| | | | | | | | | | | | | | | |

| | | | | ELECTRIC UTILITIES — 0.9% | | | | | | | | | | |

| | 40,116,000 | | | Duke Energy Corporation | | | | 0.9000 | | 09/15/25 | | | 38,791,055 | |

| | 8,000,000 | | | Entergy Corporation | | | | 0.9000 | | 09/15/25 | | | 7,729,357 | |

| | 23,000,000 | | | Georgia Power Company(a) | | SOFRINDX + 0.750% | | 5.8770 | | 05/08/25 | | | 23,070,788 | |

| | | | | | | | | | | | | | 69,591,200 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT — 0.3% | | | | | | | | | | |

| | 19,494,000 | | | Trane Technologies Financing Ltd. | | | | 3.5500 | | 11/01/24 | | $ | 19,494,000 | |

| | | | | | | | | | | | | | | |

| | | | | GAS & WATER UTILITIES — 0.1% | | | | | | | | | | |

| | 9,000,000 | | | National Fuel Gas Company | | | | 5.2000 | | 07/15/25 | | | 8,987,467 | |

| | | | | | | | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 3.2% | | | | | | | | | | |

| | 35,719,000 | | | Cardinal Health, Inc. | | | | 3.5000 | | 11/15/24 | | | 35,696,829 | |

| | 66,911,000 | | | CVS Health Corporation | | | | 3.8750 | | 07/20/25 | | | 66,377,713 | |

| | 79,319,000 | | | HCA, Inc. | | | | 5.3750 | | 02/01/25 | | | 79,328,555 | |

| | 10,810,000 | | | Humana, Inc. | | | | 4.5000 | | 04/01/25 | | | 10,790,463 | |

| | 23,837,000 | | | Laboratory Corp of America Holdings | | | | 2.3000 | | 12/01/24 | | | 23,778,371 | |

| | 27,403,000 | | | Laboratory Corp of America Holdings | | | | 3.6000 | | 02/01/25 | | | 27,286,808 | |

| | 4,000,000 | | | Quest Diagnostics, Inc. | | | | 3.5000 | | 03/30/25 | | | 3,976,996 | |

| | | | | | | | | | | | | | 247,235,735 | |

| | | | | HOME CONSTRUCTION — 0.4% | | | | | | | | | | |

| | 13,279,000 | | | DR Horton, Inc. | | | | 2.6000 | | 10/15/25 | | | 13,025,290 | |

| | 8,000,000 | | | Fortune Brands Home & Security, Inc. | | | | 4.0000 | | 06/15/25 | | | 7,954,228 | |

| | 11,576,000 | | | Lennar Corporation | | | | 4.7500 | | 05/30/25 | | | 11,561,275 | |

| | | | | | | | | | | | | | 32,540,793 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES — 1.6% | | | | | | | | | | |

| | 24,847,000 | | | Bank of New York Mellon Corporation(c) | | SOFRRATE + 1.345% | | 4.4140 | | 07/24/26 | | | 24,750,236 | |

| | 18,532,000 | | | Goldman Sachs Group, Inc.(c) | | SOFRRATE + 1.075% | | 5.7980 | | 08/10/26 | | | 18,650,542 | |

| | 28,000,000 | | | Jefferies Financial Group, Inc. | | | | 5.1500 | | 09/15/25 | | | 28,002,831 | |

| | 53,961,000 | | | Morgan Stanley(c) | | SOFRRATE + 0.940% | | 2.6300 | | 02/18/26 | | | 53,552,489 | |

| | | | | | | | | | | | | | 124,956,098 | |

| | | | | INSURANCE — 0.3% | | | | | | | | | | |

| | 20,000,000 | | | New York Life Global Funding(a),(b) | | SOFRRATE + 0.580% | | 5.6220 | | 08/28/26 | | | 20,018,712 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES — 0.1% | | | | | | | | | | |

| | 5,000,000 | | | Uber Technologies, Inc.(b) | | | | 8.0000 | | 11/01/26 | | $ | 5,000,000 | |

| | 5,000,000 | | | VeriSign, Inc. | | | | 5.2500 | | 04/01/25 | | | 4,996,349 | |

| | | | | | | | | | | | | | 9,996,349 | |

| | | | | LEISURE FACILITIES & SERVICES — 0.1% | | | | | | | | | | |

| | 9,929,000 | | | McDonald’s Corporation Series MTN B | | | | 3.3750 | | 05/26/25 | | | 9,853,688 | |

| | | | | | | | | | | | | | | |

| | | | | LEISURE PRODUCTS — 0.5% | | | | | | | | | | |

| | 38,869,000 | | | Hasbro, Inc. | | | | 3.0000 | | 11/19/24 | | | 38,815,241 | |

| | | | | | | | | | | | | | | |

| | | | | MACHINERY — 1.5% | | | | | | | | | | |

| | 28,000,000 | | | Caterpillar Financial Services Corporation(a) | | SOFRRATE + 0.460% | | 5.5220 | | 02/27/26 | | | 28,023,702 | |

| | 42,000,000 | | | Caterpillar Financial Services Corporation(a) | | SOFRRATE + 0.690% | | 5.5250 | | 10/16/26 | | | 42,273,919 | |

| | 48,000,000 | | | John Deere Capital Corporation(a) | | SOFRRATE + 0.440% | | 5.4850 | | 03/06/26 | | | 48,060,807 | |

| | | | | | | | | | | | | | 118,358,428 | |

| | | | | MEDICAL EQUIPMENT & DEVICES — 0.2% | | | | | | | | | | |

| | 15,178,000 | | | Zimmer Biomet Holdings, Inc. | | | | 1.4500 | | 11/22/24 | | | 15,143,985 | |

| | | | | | | | | | | | | | | |

| | | | | METALS & MINING — 0.2% | | | | | | | | | | |

| | 18,073,000 | | | Freeport-McMoRan, Inc. | | | | 4.5500 | | 11/14/24 | | | 18,087,364 | |

| | | | | | | | | | | | | | | |

| | | | | OIL & GAS PRODUCERS — 5.3% | | | | | | | | | | |

| | 8,386,000 | | | Enbridge Energy Partners, L.P. | | | | 5.8750 | | 10/15/25 | | | 8,449,529 | |

| | 55,876,000 | | | Energy Transfer, L.P. | | | | 2.9000 | | 05/15/25 | | | 55,247,921 | |

| | 45,676,000 | | | Kinder Morgan, Inc. | | | | 4.3000 | | 06/01/25 | | | 45,510,521 | |

| | 38,819,000 | | | Marathon Petroleum Corporation | | | | 4.7000 | | 05/01/25 | | | 38,774,216 | |

| | 54,406,000 | | | MPLX, L.P. | | | | 4.8750 | | 12/01/24 | | | 54,386,425 | |

| | 65,221,000 | | | Occidental Petroleum Corporation | | | | 5.8750 | | 09/01/25 | | | 65,504,190 | |

| | 51,107,000 | | | Plains All American Pipeline, L.P. | | | | 3.6000 | | 11/01/24 | | | 51,107,000 | |

| | 5,000,000 | | | Range Resources Corporation | | | | 4.8750 | | 05/15/25 | | | 4,988,568 | |

| | 29,524,000 | | | Williams Companies, Inc. | | | | 3.9000 | | 01/15/25 | | | 29,452,374 | |

| | 54,005,000 | | | Williams Companies, Inc. | | | | 4.0000 | | 09/15/25 | | | 53,598,648 | |

| | | | | | | | | | | | | | 407,019,392 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 1.3% | | | | | | | | | | |

| | 45,988,000 | | | Equinix, Inc. | | | | 2.6250 | | 11/18/24 | | $ | 45,927,975 | |

| | 53,714,000 | | | Realty Income Corporation | | | | 4.6250 | | 11/01/25 | | | 53,672,528 | |

| | | | | | | | | | | | | | 99,600,503 | |

| | | | | RETAIL - DISCRETIONARY — 0.3% | | | | | | | | | | |

| | 8,000,000 | | | AutoZone, Inc. | | | | 3.6250 | | 04/15/25 | | | 7,953,926 | |

| | 11,576,000 | | | Genuine Parts Company | | | | 1.7500 | | 02/01/25 | | | 11,477,288 | |

| | | | | | | | | | | | | | 19,431,214 | |

| | | | | SEMICONDUCTORS — 0.5% | | | | | | | | | | |

| | 7,874,000 | | | Intel Corporation | | | | 3.4000 | | 03/25/25 | | | 7,821,484 | |

| | 33,043,000 | | | NXP BV / NXP Funding, LLC / NXP USA, Inc. | | | | 2.7000 | | 05/01/25 | | | 32,657,584 | |

| | | | | | | | | | | | | | 40,479,068 | |

| | | | | SOFTWARE — 1.1% | | | | | | | | | | |

| | 46,196,000 | | | Oracle Corporation | | | | 2.5000 | | 04/01/25 | | | 45,739,056 | |

| | 30,000,000 | | | Oracle Corporation | | | | 2.9500 | | 11/15/24 | | | 29,972,111 | |

| | 7,209,000 | | | VMware, Inc. | | | | 4.5000 | | 05/15/25 | | | 7,192,725 | |

| | | | | | | | | | | | | | 82,903,892 | |

| | | | | STEEL — 0.1% | | | | | | | | | | |

| | 5,537,000 | | | Steel Dynamics, Inc. | | | | 2.8000 | | 12/15/24 | | | 5,521,036 | |

| | | | | | | | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE — 0.2% | | | | | | | | | | |

| | 8,000,000 | | | HP, Inc. | | | | 2.2000 | | 06/17/25 | | | 7,864,884 | |

| | 5,092,000 | | | NetApp, Inc. | | | | 1.8750 | | 06/22/25 | | | 4,996,113 | |

| | | | | | | | | | | | | | 12,860,997 | |

| | | | | TECHNOLOGY SERVICES — 0.2% | | | | | | | | | | |

| | 12,135,000 | | | Equifax, Inc. | | | | 2.6000 | | 12/01/24 | | | 12,110,381 | |

| | | | | | | | | | | | | | | |

| | | | | TELECOMMUNICATIONS — 0.5% | | | | | | | | | | |

| | 41,386,000 | | | T-Mobile USA, Inc. | | | | 3.5000 | | 04/15/25 | | | 41,117,837 | |

| | | | | | | | | | | | | | | |

| | | | | TOBACCO & CANNABIS — 0.9% | | | | | | | | | | |

| | 16,345,000 | | | Altria Group, Inc. | | | | 2.3500 | | 05/06/25 | | | 16,131,643 | |

| | 50,348,000 | | | Reynolds American, Inc. | | | | 4.4500 | | 06/12/25 | | | 50,176,561 | |

| | | | | | | | | | | | | | 66,308,204 | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 38.9% (Continued) | | | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS — 0.4% | | | | | | | | | | |

| | 31,539,000 | | | Canadian Pacific Railway Company | | | | 1.3500 | | 12/02/24 | | $ | 31,442,638 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $2,982,120,556) | | | | | | | | | 2,985,760,948 | |

| | | | | | | | | | | | | | | |

| | | | | U.S. GOVERNMENT & AGENCIES — 30.5% | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 30.5% | | | | | | | | | | |

| | 250,000,000 | | | United States Treasury Bill(e) | | | | 4.0500 | | 11/07/24 | | | 249,806,083 | |

| | 250,000,000 | | | United States Treasury Bill(e) | | | | 4.3900 | | 11/14/24 | | | 249,579,703 | |

| | 79,650,000 | | | United States Treasury Bill(e) | | | | 4.4700 | | 11/21/24 | | | 79,445,777 | |

| | 250,000,000 | | | United States Treasury Bill(e) | | | | 4.5200 | | 11/29/24 | | | 249,105,265 | |

| | 250,000,000 | | | United States Treasury Bill(e) | | | | 4.5400 | | 12/05/24 | | | 248,916,250 | |

| | 100,000,000 | | | United States Treasury Bill(e) | | | | 4.5800 | | 12/26/24 | | | 99,302,906 | |

| | 470,000,000 | | | United States Treasury Floating Rate Note(a),(j) | | USBMMY3M + 0.125% | | 4.6870 | | 07/31/25 | | | 469,777,032 | |

| | 250,000,000 | | | United States Treasury Note | | | | 3.5000 | | 09/30/29 | | | 242,792,970 | |

| | 450,000,000 | | | United States Treasury Note | | | | 4.1250 | | 10/31/29 | | | 449,419,922 | |

| | | | | | | | | | | | | | 2,338,145,908 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $2,339,862,398) | | | | | | | | | 2,338,145,908 | |

| | | | | | | | | | | | | | | |

| Shares | | | | | | |

| | | | | COLLATERAL FOR SECURITIES LOANED — 14.3% | | | | |

| | 1,094,061,373 | | | Goldman Sachs Financial Square Government Fund, Institutional Class, 4.65% (f),(h) | | | 1,094,061,373 | |

| | | | | TOTAL COLLATERAL FOR SECURITIES LOANED (Cost - $1,094,061,373) | | | | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 10.0% | | | | |

| | | | | MONEY MARKET FUND - 10.0% | | | | |

| | 771,128,573 | | | Dreyfus Treasury Obligations Cash Management Fund, Institutional Class, 4.73% (Cost $771,128,573)(f) | | | 771,128,573 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 112.6% (Cost $8,564,414,187) | | $ | 8,639,554,951 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS – (12.6)% | | | (967,386,541 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 7,672,168,410 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| OPEN FUTURES CONTRACTS |

Number of

Contracts | | | Open Long Futures Contracts | | Expiration | | Notional

Amount | | | Unrealized

Appreciation

(Depreciation) | |

| | 15,875 | | | CBOT 5 Year US Treasury Note | | 01/01/2025 | | $ | 1,702,345,703 | | | $ | (39,728,287 | ) |

| | 723 | | | CME E-Mini Standard & Poor’s 500 Index Futures | | 12/23/2024 | | | 207,446,775 | | | | 1,580,635 | |

| | | | | TOTAL FUTURES CONTRACTS | | | | | | | | $ | (38,147,652 | ) |

| | | | | | | | | | | | | | | |

| ETF | - Exchange-Traded Fund |

| | |

| LLC | - Limited Liability Company |

| | |

| LP | - Limited Partnership |

| | |

| LTD | - Limited Company |

| | |

| PLC | - Public Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| | |

| SPDR | - Standard & Poor’s Depositary Receipt |

| | |

| SOFRINDX | Secured Overnight Financing Rate Index |

| | |

| SOFRRATE | United States SOFR Secured Overnight Financing Rate |

| | |

| TSFR3M | 3-Month CME Term SOFR |

| | |

| USBMMY3M | US Treasury 3 Month Bill Money Market Yield |

| | |

| (a) | Floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (b) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2024 the total market value of 144A securities is $154,138,406 or 2.0% of net assets. |

| (c) | Variable rate security; the rate shown represents the rate on October 31, 2024. |

| (d) | Percentage rounds to less than 0.1%. |

| (e) | Zero coupon bond; rate disclosed is the effective yield as of October 31, 2024. |

| (f) | Rate disclosed is the seven-day effective yield as of October 31, 2024. |

| (g) | All or a portion of the security is on loan. Total loaned securities had a value of $1,072,313,590 at October 31, 2024. |

| (h) | Security purchased with cash proceeds of securities lending collateral. |

| (j) | All or a portion of this security is pledged as collateral for swap. |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL FIXED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| |

| SWAPTIONS PURCHASED |

| | | | | | | | | | | | | | | | | | | | | | Unrealized | |

| | | | | | | Exercise | | Number of | | | | | | | | | | Upfront | | | Appreciation | |

| Reference Entity | | Put/Call | | Counterparty | | Rate | | Contracts | | Expiration Date | | Notional Value | | | Fair Value | | | Premiums Paid | | | (Depreciation) | |

| CDX North American High Yield Series 43 | | PUT | | GS | | 106.50 | | 5,000,000 | | 11/20/2024 | | $ | 500,000,000 | | | $ | 1,979,500 | | | $ | 2,550,000 | | | $ | (570,500 | ) |

| CDX North American High Yield Series 43 | | PUT | | GS | | 107.00 | | 5,000,000 | | 11/20/2024 | | | 500,000,000 | | | | 3,096,000 | | | | 3,000,000 | | | | 96,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | | | | | | | | | | | $ | 1,000,000,000 | | | $ | 5,075,500 | | | $ | 5,550,000 | | | $ | (474,500 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SWAPTIONS WRITTEN |

| | | | | | | | | | | | | | | | | | | Upfront | | | Unrealized | |

| | | | | | | Exercise | | Number of | | | | | | | | | | Premiums | | | Appreciation | |

| Reference Entity | | Put/Call | | Counterparty | | Rate | | Contracts | | Expiration Date | | Notional Value | | | Fair Value | | | Received | | | (Depreciation) | |

| CDX North American High Yield Series 43 | | PUT | | GS | | 103.50 | | (5,000,000) | | 11/20/2024 | | $ | (500,000,000 | ) | | $ | (419,000 | ) | | $ | (450,000 | ) | | $ | 31,000 | |

| CDX North American High Yield Series 43 | | PUT | | GS | | 104.00 | | (5,000,000) | | 11/20/2024 | | | (500,000,000 | ) | | | (491,500 | ) | | | (500,000 | ) | | | 8,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | | | | | | | | | | | $ | (1,000,000,000 | ) | | $ | (910,500 | ) | | $ | (950,000 | ) | | $ | 39,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

GS - Goldman Sachs

OPEN CREDIT DEFAULT SWAP AGREEMENTS (1)

OPEN CREDIT DEFAULT SWAP AGREEMENTS - SELL PROTECTION (2)

| | | | | Termination | | Interest Rate | | Notional Value at | | | | | | Upfront | | | Unrealized | |

| Reference Entity | | Counterparty | | Date | | Payable | | October 31, 2024 | | | Value | | | Premiums Paid | | | Appreciation | |

| CDX North American High Yield Series 41 | | GS | | 12/20/2028 | | 5.00% | | $ | 209,880,000 | | | $ | 16,830,557 | | | $ | 13,482,072 | | | $ | 3,348,485 | |

| CDX North American High Yield Series 41 | | MS | | 12/20/2028 | | 5.00% | | | 40,590,000 | | | | 3,254,966 | | | | 445,752 | | | | 2,809,214 | |

| CDX North American High Yield Series 42 | | GS | | 6/20/2029 | | 5.00% | | | 1,173,800,000 | | | | 93,249,410 | | | | 70,072,078 | | | | 23,177,332 | |

| CDX North American High Yield Series 42 | | MS | | 6/20/2029 | | 5.00% | | | 148,100,000 | | | | 11,765,410 | | | | 9,235,266 | | | | 2,530,144 | |

| CDX North American High Yield Series 43 | | GS | | 12/20/2029 | | 5.00% | | | 1,669,500,000 | | | | 125,500,706 | | | | 118,853,724 | | | | 6,646,982 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | | | | | | | | | | | $ | 250,601,049 | | | $ | 212,088,892 | | | $ | 38,512,157 | |

| | | | | | | | | | | | | | | | | | | | | | | |

GS - Goldman Sachs

MS - Morgan Stanley

| (1) | For centrally cleared swaps, the notional amounts represent the maximum potential the Fund may pay/receive as a seller/buyer of credit protection if a credit event occurs, as defined under the terms of the swap contract, for each security included in the reference entity. |

| (2) | For centrally cleared swaps, when a credit event occurs as defined under the terms of the swap contract, the Fund as a seller of credit protection will either (i) pay a net amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) pay a net amount equal to the par value of the defaulted reference entity less its recovery value. |

| TOTAL RETURN SWAPS | |

| | |

| Number of | | | | | Notional Amount at | | | | | Termination | | | | Unrealized | |

| Shares | | | Reference Entity | | October 31, 2024 | | | Interest Rate Payable (1) | | Date | | Counterparty | | (Depreciation) | |

| Long Position: | | | | | | |

| | 3,000,000 | | | iShares iBoxx $High Yield Corporate Bond ETF | | $ | 238,110,000 | | | USD-Federal Fund minus 175 bp | | 1/10/2025 | | GS | | $ | (1,015,946 | ) |

| | 1,500,000 | | | iShares iBoxx $High Yield Corporate Bond ETF | | | 119,115,000 | | | USD-Federal Fund minus 150 bp | | 1/10/2025 | | GS | | | (467,833 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | | | Total: | | | $ | (1,483,779 | ) |

| | | | | | | | | | | | | | | | | | | |

GS - Goldman Sachs

| (1) | Interest rate is based upon predetermined notional amounts, which may be a multiple of the number of shares plus a specified spread. |

The accompanying notes are an integral part of these financial statements.

| NAVIGATOR TACTICAL INVESTMENT GRADE BOND FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2024 |

| |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | U.S. GOVERNMENT & AGENCIES — 67.8% | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 67.8% | | | | | | | | |

| | 100,000,000 | | | United States Treasury Bill(a) | | 4.3300 | | 11/12/24 | | $ | 99,857,764 | |