UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-32737

KOPPERS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 20-1878963 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

436 Seventh Avenue

Pittsburgh, Pennsylvania 15219

(Address of principal executive offices)

(412) 227-2001

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of Exchange on which registered |

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report) and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2005, the registrant did not have a class of voting shares held by non-affiliates.

As of February 28, 2006, approximately 20.7 millions shares of Common Stock of the registrant were issued and outstanding.

Documents incorporated by reference: None

TABLE OF CONTENTS

2

PART I

General

(Please note that, unless otherwise indicated or the context requires otherwise, when we use the terms “we”, the “Company”, “our” or “us”, we mean Koppers Inc., formerly known as Koppers Industries, Inc., and its subsidiaries on a consolidated basis for periods up until November 18, 2004 and Koppers Holdings Inc., or Koppers Holdings, formerly known as KI Holdings Inc., and its subsidiaries on a consolidated basis for periods from and including November 18, 2004, when Koppers Holdings became the parent of Koppers Inc. The use of these terms is not intended to imply that Koppers Holdings and Koppers Inc. are not separate and distinct legal entities.)

Koppers Holdings Inc. (“we”, “Koppers” or the “Company”) is a leading integrated global provider of carbon compounds and commercial wood treatment products. Our products are used in a variety of niche applications in a diverse range of end-markets, including the aluminum, railroad, specialty chemical, utility, rubber and steel industries. We provide products which represent only a small portion of our customers’ costs but are essential inputs into the products they produce and the services they provide. We serve our customers through a comprehensive global manufacturing and distribution network, including 35 manufacturing facilities located in North America, Australasia, China, Europe and South Africa. For the twelve months ended December 31, 2005, we generated net sales of $1,030.2 million and net income of $9.9 million.

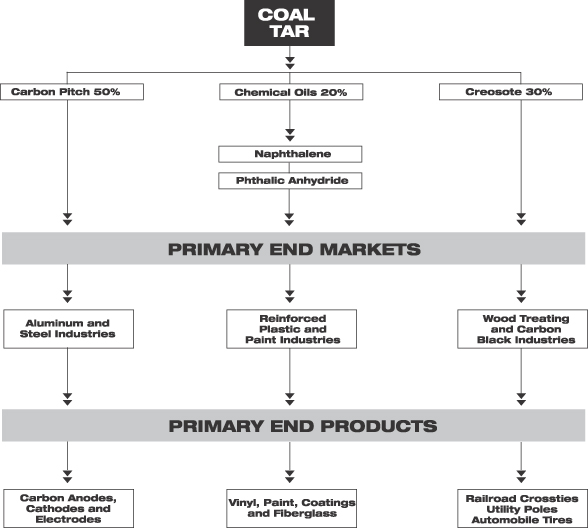

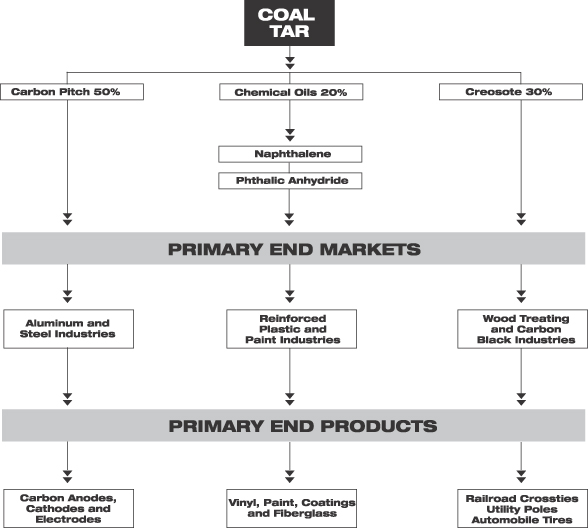

We operate two principal businesses, Carbon Materials & Chemicals and Railroad & Utility Products. Through our Carbon Materials & Chemicals business (60% of 2005 net sales), we believe we are the largest distiller of coal tar in North America, Australia, the United Kingdom and Scandinavia. We process coal tar into a variety of products, including carbon pitch, creosote and phthalic anhydride, which are critical intermediate materials in the production of aluminum, the pressure treatment of wood and the production of plasticizers and specialty chemicals, respectively. Through our Railroad & Utility Products business (40% of 2005 net sales), we are the largest North American supplier of railroad crossties. Our other commercial wood treatment products include the provision of utility poles to the electric and telephone utility industries.

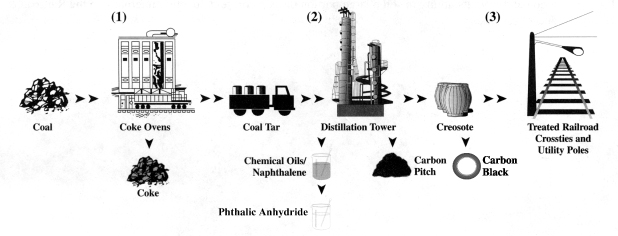

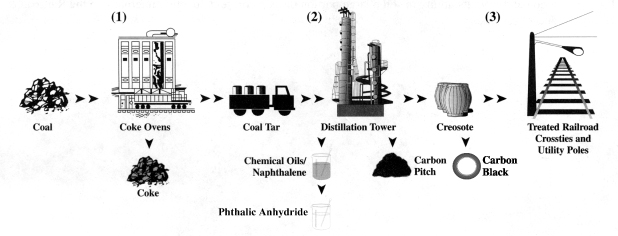

Our operations are, to a substantial extent, vertically integrated and employ a variety of processes, as illustrated in the following flow diagram:

3

We were formed in November 2004 by Saratoga Partners III, L.P. and its affiliates and certain of our employees and members of our board of directors as a holding company for Koppers Inc. in a transaction in which all of the capital stock of Koppers Inc. was converted into shares of common and preferred stock of Koppers Holdings and Koppers Inc. became a wholly owned subsidiary of Koppers Holdings. Koppers Holdings does not have any operations independent of Koppers Inc., except as to administrative matters and except that Koppers Holdings is the sole obligor on its Senior Discount Notes due 2014. Koppers Inc. was formed in 1988 to facilitate the acquisition of certain assets of the company now known as Beazer East, Inc. Our principal shareholders are Saratoga Partners III, L.P. and its affiliates (“Saratoga”), a New York based investment firm managed by Saratoga Management Company LLC. On February 6, 2006 we completed an initial public offering in which we issued and sold 8,700,000 shares and Saratoga sold 2,800,000 of its existing shares (after converting their preferred shares into common shares on a 3.9799 for one basis) at an initial selling price to shareholders of $14.00 per share. We used the majority of the proceeds to redeem $101.7 million of the Koppers Inc. Senior Secured Notes due 2013.

Industry Overview

Coal tar is a by-product generated through the processing of coal into coke for use in steel and iron manufacturing. We produce and distribute a variety of intermediate chemical products derived from the coal tar distillation process, including the co-products of the distillation process. During the distillation process, heat and vacuum are utilized to separate coal tar into three primary components: carbon pitch (approximately 50%), creosote oils (approximately 30%) and chemical oils (approximately 20%). Because all coal tar products are produced in relatively fixed proportion to carbon pitch, the level of carbon pitch consumption generally determines the level of production of other coal tar products.

We believe that demand for aluminum and railroad track maintenance substantially drive growth in our two principal businesses. Through our leading market positions and global presence, we believe we are uniquely well-positioned to capitalize on favorable trends within our end-markets. According to the King Report, worldwide aluminum production increased 6.8% to 31.9 million metric tons in 2005 and was expected to grow by 4.0% in 2006 and 5.0% in 2007. Carbon pitch requirements for the aluminum industry were 3.0 million metric tons in 2005 and are expected to grow as a function of growth in aluminum production.

The North American phthalic anhydride industry has production capacity of approximately 1.2 billion pounds and is a feedstock for plasticizers, unsaturated polyester resins, alkyd resins and other miscellaneous chemicals.

The railroad crosstie business is benefiting and will likely continue to benefit from positive general economic conditions in the railroad industry and from expected increases in spending on both new track and existing track maintenance. The RTA estimates that approximately 15.0 million crossties for Class 1 railroads, were installed in the United States and Canada in 2005 and approximately 16.5 million crossties are projected to be installed in 2006.

The U.S. market for treated wood utility pole products is characterized by a large number of small producers selling into a price-sensitive industry. The utility pole market is highly fragmented domestically with over 200 investor-owned electric and telephone utilities and 2,800 smaller municipal utilities and rural electric associations.

On August 10, 2005, the President signed a federal transportation bill into law that provides $286.5 billion of funding for various projects in the transportation industry. This legislation is the most comprehensive legislation for the transportation industry since the last transportation bill expired in 2003. Although it is difficult to estimate the impact of this legislation on our business, we believe that it

4

is likely to benefit us directly by increased sales related to projects identified in the legislation or indirectly as additional railroad capital can be reallocated to infrastructure maintenance priorities.

Our Business Strategy

Capitalize on Attractive Growth Opportunities. We believe our existing key end-markets, especially the aluminum and railroad industries, and geographic focus provide attractive growth opportunities. We are well positioned to capitalize on these opportunities. In addition, we intend to pursue growth opportunities in three ways:

| | • | | New Regional Expansion: We intend to leverage our global reach by capitalizing on opportunities in high-growth regions such as China, the Middle East, India and Eastern Europe and expect demand for our products in these regions to grow faster than in our core markets. For example, in 1999 we entered into a joint venture with Tangshan Iron & Steel Co., or TISCO, in Tangshan, China to establish a platform in the fast growing Asian markets. |

| | • | | Selective Acquisitions: We intend to continue to selectively pursue complementary opportunities in areas that enable us to build upon our product portfolio, expand our customer base and leverage our existing customer relationships. For example, in April 2005, we acquired the business and assets of U.K. based Lambson Speciality Chemicals Limited. This acquisition provides us with an opportunity to expand and enhance our relationships with existing suppliers and customers and enables us to further diversify our product lines through the production and sale of various specialty chemicals. |

| | • | | Development of New Products: We expect to expand many of our product lines through the development of related products to meet new end-use applications. For example, we have introduced a coal tar and petroleum pitch blend that results in up to a 60% reduction in the regulated constituents in air emissions from aluminum smelters utilizing the Soderberg process. In addition, we have recently introduced a new carbon foam product that has wide-ranging applications in the telecommunication and transportation markets. We also have patents pending for, and we are in the developmental stage of, new pitch products to be used in friction materials (brakes), carbon, graphite and rubber products. |

Maximize Cash Flow and Reduce Financial Leverage. We reduced our financial leverage by using a portion of our net proceeds from our initial public offering which was consummated in February 2006 and a portion of cash flow from operations after required capital expenditures. We will maintain a disciplined approach to our capital spending and working capital management in order to maximize free cash flow, while continuing to support our well maintained fixed asset base and deliver superior service to our customers. We have historically generated substantial cash flow from operations and have funded our capital expenditure and working capital requirements through internal cash flow generation.

Continue Productivity and Cost Reduction Initiatives. We are focused on improving our profitability and cash flows by achieving productivity enhancements and by improving our cost platform. For example, in 2003 we implemented a number of initiatives to rationalize our capacity, streamline operations and improve productivity.

During the fourth quarter of 2003 we determined that capacity rationalization was required in our U.S. Carbon Materials & Chemicals business to increase competitiveness within the North American aluminum market. Accordingly, in December 2003 we ceased production at our carbon materials facility in Woodward, Alabama. Additionally, during the fourth quarter of 2003 we concluded that our carbon materials port operation in Portland, Oregon was an impaired facility based on its current and long-term economic prospects as a result of recent negotiations with a significant customer. In

5

September 2003, we closed our Logansport, Louisiana wood treating plant due to deteriorating local market conditions for utility products. These initiatives were completed on schedule and within budget and have improved our annual profitability by approximately $4.9 million.

During the fourth quarter of 2005, we incurred an impairment charge of $0.6 million related to assets at our wood treating facility in Superior, Wisconsin. We will make a determination during the first half of 2006 as to the future of this facility. During 2005, we also incurred $0.8 million related to the closure of our wood treating facility in Montgomery, Alabama. The ceasing of production and closure of the facility is expected to increase capacity utilization at certain other wood treating plants and provide for improved operating efficiencies and profitability for the business. We continually review under-performing assets with the purpose of improving productivity and enhancing our return on invested capital.

Carbon Materials & Chemicals

Our Carbon Materials & Chemicals business manufactures five principal products: (a) carbon pitch, used in the production of aluminum and steel; (b) phthalic anhydride, used in the production of plasticizers and polyester resins; (c) creosote, used in the treatment of wood; (d) carbon black (and carbon black feedstock), used in the manufacture of rubber tires; and (e) furnace coke, used in steel production. Carbon pitch, phthalic anhydride, creosote and carbon black feedstock are produced through the distillation of coal tar, a by-product of the transformation of coal into coke. The Carbon Materials & Chemicals business’ profitability is impacted by its cost to purchase coal tar in relation to its prices realized for carbon pitch, phthalic anhydride, creosote and carbon black. We have three tar distillation facilities in the United States, one in Australia, one in China, one in Denmark and two in the United Kingdom, strategically located to provide access to coal tar and to facilitate better service to our customers with a consistent supply of high-quality products. For 2005, 2004 and 2003, respectively, principal products comprised the following percentages of net sales for Carbon Materials & Chemicals (excluding intercompany sales): (i) carbon pitch, 33%, 36% and 38%; (ii) phthalic anhydride, 14%, 14% and 12%; (iii) carbon black (and carbon black feedstock), 9%, 9% and 10%; (iv) furnace coke, 10%, 9% and 8%; and (v) creosote, 3%, 3% and 4%.

We believe we have a strategic advantage over our competitors based on our ability to access coal tar from many global suppliers and subsequently blend such coal tars to produce carbon pitch with the consistent quality important in the manufacturing of quality anodes for the aluminum industry. Our eight coal tar distillation facilities, four of which have port access, and three carbon pitch terminals give us the ability to offer customers multiple sourcing and a consistent supply of high quality products. In anticipation of potential reductions of U.S. coke capacity, we have secured coal tar supply through long-term contracts.

Coal tar distillation involves the conversion of coal tar into a variety of intermediate chemical products in processes beginning with distillation. During the distillation process, heat and vacuum are utilized to separate coal tar into three primary components: carbon pitch (approximately 50%), creosote oils (approximately 30%) and chemical oils (approximately 20%).

6

Our Carbon Materials & Chemicals business manufactures its primary products and sells them directly to our customers through long-term contracts and purchase orders negotiated by our regional sales personnel and coordinated through our global marketing officer in Australia. We maintain inventories at our plant locations and do not factor our inventories or receivables to third parties.

Carbon Pitch

We produce carbon pitch through the tar distillation process. Sales terms are negotiated by centralized sales departments in the United States, Australia and Europe and are generally evidenced by long-term sales contracts and purchase orders which are coordinated through our global marketing group at corporate headquarters and in Australia.

Over 75% of our carbon pitch is sold to the aluminum industry under long-term contracts typically ranging from three to five years, many with provisions for periodic pricing reviews. Demand for carbon pitch generally has fluctuated with production of primary aluminum. However, global restructuring in the electrode and aluminum markets during the past several years has resulted in reduced volumes in domestic markets. Because all coal tar products are produced in relatively fixed proportion to carbon pitch, the level of carbon pitch consumption generally determines the level of production of other coal

7

tar products. The commercial carbon industry, the second largest user of carbon pitch, uses carbon pitch to produce electrodes and other specialty carbon products for the steel industry. There are currently no known viable substitutes for carbon pitch in the production of carbon anodes used in the aluminum production process.

Creosote

We produce creosote as a co-product of the tar distillation process. Sales terms for external creosote sales are negotiated by centralized sales departments in the United States, Australia and Europe and are generally evidenced by long-term sales contracts and purchase orders.

Creosote is used as a commercial wood treatment to preserve railroad crossties and lumber, utility poles and piling. To the extent that we have excess creosote that is not sold for use in treating wood products, distillate oils are sold into the carbon black market rather than being blended to creosote specifications.

Globally, approximately 79% of our total creosote production was sold to our Railroad & Utility Products business in 2005. The Railroad & Utility Products business purchases substantially all of its creosote from the Carbon Materials & Chemicals business. We are the only major competitor in this market that is integrated in this fashion. The remainder of our creosote is sold to railroads or to other wood treaters. We have several competitors in the creosote market.

Carbon Black

Carbon black is manufactured in Australia at a carbon black facility using both petroleum oil and coal tar based feedstocks, which are subjected to heat and rapid cooling within a reactor. Additionally, tar-based carbon black feedstock is manufactured as a co-product of the tar distillation process and can be produced at our three domestic, one Australian, one Chinese, and three European tar distillation facilities. Sales terms are negotiated by centralized sales departments in Australia, the United States and Europe and are generally evidenced by long-term sales contracts and purchase orders.

Phthalic Anhydride

We manufacture phthalic anhydride using both internally-sourced naphthalene, a by-product of the tar distillation process, and externally-sourced orthoxylene. Sales terms are negotiated by a centralized sales department in the United States and are generally evidenced by long-term sales contracts and purchase orders.

Chemical oils resulting from the distillation of coal tars are further refined by us into naphthalene, which is the primary feedstock used by us for the production of phthalic anhydride. The primary markets for phthalic anhydride are in the production of plasticizers, unsaturated polyester resins and alkyd resins. Naphthalene is also sold into the industrial sulfonate market for use as dispersants in the concrete additive and gypsum board markets. Additional end-uses include oil field additives, agricultural emulsifiers, synthetic tanning agents and dyestuffs.

On a worldwide basis, naphthalene and orthoxylene, a refined petroleum derivative, are both used as feedstock for the production of phthalic anhydride. We are the only North American phthalic anhydride producer capable of utilizing both orthoxylene and naphthalene for this production. Our ability to utilize naphthalene as a by-product of coal tar distillation gives us a stable supply of feedstock. We believe that our ability to utilize our internally produced naphthalene gives us a lower-cost feedstock for the production of phthalic anhydride since historically our cost to produce

8

naphthalene has been lower than our cost to purchase orthoxylene. However, prior to 2004 there were difficult market conditions and corresponding low operating rates for most producers. Market conditions for phthalic anhydride improved in 2004 and have remained stable.

Furnace Coke

We produce furnace coke using its primary raw material, coal. Sales terms are negotiated by a centralized sales department in the United States, and all coke is currently sold to one customer under a three year sales contract which expires December 31, 2006. The contract can be renewed for an additional two years if the parties agree by the end of the second quarter of 2006.

Furnace coke is a carbon and fuel source required in the manufacturing of steel. Coal, the primary raw material, is carbonized in oxygen-free ovens to obtain the finished product. Coke manufacturers are either an integrated part of a steel company or, as in our case, operate independently and are known as “merchant producers.”

Our coke business consists of one production facility located in Monessen, Pennsylvania, which produces furnace coke. The plant consists of two batteries with a total of 56 ovens and has a total capacity of approximately 360,000 tons of furnace coke per year. All of the ovens were rebuilt in 1980 and 1981, which, together with recent improvements, makes our Monessen facility one of the most modern coking facilities in the United States.

Before the expiration of the related tax law at December 31, 2002, our Monessen facility qualified for a tax credit based on its production of coke as a non-conventional fuel and the sale thereof to unrelated third parties. The tax credit generated per ton of coke sold was tied to a per barrel of oil equivalent determined on a BTU basis and adjusted annually for inflation. The value of this tax credit per ton of coke was approximately $28.00 in 2002. In December 1999, we entered into a transaction with a third party which resulted in substantially all tax credits generated as a result of the production and sale of coke at our Monessen facility being transferred to the third party. In 2003 and 2002, we earned $0.1 million and $9.8 million, respectively, for the transfer of tax credits (the 2003 amount was a retroactive inflation adjustment). The tax credits expired at the end of 2002. Prior to the Monessen transaction, we earned these credits.

On August 8, 2005, the President signed the Energy Policy Act of 2005 into law. Included in this legislation are non-conventional fuel tax credits earned for the production and sale of coke to a third party. These credits against federal income tax will be earned in conjunction with the coke operations at our Monessen, Pennsylvania facility. The tax credit generated per ton of coke sold is tied to a per barrel of oil equivalent on a BTU basis and adjusted annually for inflation. The credits are effective January 2006, expire December 2009 and can be carried forward for 20 years. Based on our understanding of the Energy Policy Act of 2005 and subject to final determination of an oil price range, and also further legislation with respect to non-conventional fuel tax credits expected in 2006, we have the potential to earn up to $4 million per year of credits that will reduce federal income taxes.

Other Products

We are also a 51% owner of a timber preservation chemicals business that operates throughout Australia, New Zealand, Southeast Asia and South Africa. Timber preservation chemicals are used to impart durability to timber products used in building/construction, agricultural and heavy-duty industrial markets. The most commonly used chemicals are copper chrome arsenates, light organic solvent preservatives, copper co-biocides, sapstain control products and creosote.

Roofing pitch and refined tars are also produced in smaller quantities and are sold into the commercial roofing and pavement sealer markets, respectively. Koppers Inc. sells roofing warranties to

9

certain customers for its built-up roofing systems which are installed by third party contractors, approved by Koppers Inc., who use its roofing products.

The Carbon Materials & Chemicals business’ ten largest customers represented approximately 42%, 44% and 44% of the business’ net sales for 2005, 2004 and 2003, respectively. We have a number of global competitors in the carbon pitch market.

Coal tar is purchased from a number of outside sources as well as from our Monessen facility. Primary suppliers are United States Steel Corporation, Mittal Steel USA, China Steel Chemical Corporation, Bluescope Steel (AIS) Pty. Limited, OneSteel Manufacturing Pty. Ltd., Corus Group PLC and Mountain States Carbon.

Management believes that our ability to source coal tar and carbon pitch from overseas markets through our foreign operations, as well as our research of petroleum feedstocks, will assist in securing an uninterrupted supply of carbon pitch feedstocks.

In 1999, we entered into a joint venture agreement with TISCO to rehabilitate and operate a tar distillation facility in China. The joint venture, Koppers China, is 60% owned by us and began production of coal tar products in 2001. On January 1, 2004, we resumed operating control of Koppers China and began to consolidate its results in the first quarter of 2004. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Matters.”

Railroad & Utility Products

We market commercial wood treatment products primarily to the railroad and public utility markets, primarily in the United States and Australasia. The Railroad & Utility Products business’ profitability is influenced by the demand for railroad products by Class 1 railroads, demand for transmission and distribution poles by electric and telephone utilities and its cost to procure wood. For the year ended December 31, 2005, sales of railroad products and services represented approximately 80% of the Railroad & Utility Products business’ net sales. Railroad products include procuring and treating items such as crossties, switch ties and various types of lumber used for railroad bridges and crossings. Utility products include transmission and distribution poles for electric and telephone utilities and piling used in industrial foundations, beach housing, docks and piers. The Railroad & Utility Products business operates 17 wood treating plants, one specialty trackwork facility, one co-generation facility and pole distribution yards located throughout the United States and Australia. Our network of plants is strategically located near timber supplies to enable us to access raw materials and service customers effectively. In addition, our crosstie treating plants typically abut railroad customers’ track lines, and our pole distribution yards are typically located near our utility customers.

Our Railroad & Utility Products business manufactures its primary products and sells them directly to our customers through long-term contracts and purchase orders negotiated by our regional sales personnel and coordinated through our marketing group at corporate headquarters. We maintain inventories at our plant locations and procurement yards and do not factor our inventories or receivables to third parties.

The Railroad & Utility Products business’ largest customer base is the Class 1 railroad market, which buys 79% of all crossties produced in the United States and Canada. We have also been expanding key relationships with some of the approximately 550 short-line and regional rail lines. The railroad crosstie market is a mature market with approximately 19 million replacement crossties purchased during 2005, representing an estimated $551 million in sales. We currently have contracts with six of the seven North American Class 1 railroads and have enjoyed long-standing relationships with this important customer base. These relationships have been further strengthened recently due to

10

our ability to absorb additional treating volumes into our existing infrastructure, with such additional volumes resulting from the exit of a major competitor from the wood treating business. We intend to focus on integrating this additional treating volume while capitalizing on our relationships with railroads by offering an expanded list of complementary product offerings that the railroads may be interested in outsourcing.

Historically, investment trends in track maintenance by domestic railroads have been linked to general economic conditions in the country. During recessions, the railroads have typically deferred track maintenance until economic conditions improve. Recently, however, the Class 1 railroads have increased their spending on track maintenance, which has caused an increase in demand for railroad crossties. Management believes this increase in demand will continue for the near term.

Hardwoods, such as oak and other species, are the major raw materials in wood crossties. Hardwood prices, which account for approximately 61% of a finished crosstie’s cost, fluctuate with the demand from competing hardwood lumber markets, such as oak flooring, pallets and other specialty lumber products. Normally, raw material price fluctuations are passed through to the customer according to the terms of the applicable contract. Weather conditions can be a factor in the supply of raw material, as unusually wet conditions may make it difficult to harvest timber.

In the United States, hardwood lumber is procured by us from hundreds of small sawmills throughout the northeastern, midwestern and southern areas of the country. The crossties are shipped via rail car or trucked directly to one of our eleven crosstie treating plants, all of which are on line with a major railroad. The crossties are either air-stacked for a period of six to twelve months or artificially dried by a process called boultonizing. Once dried, the crossties are pressure treated with creosote, a product of our Carbon Materials & Chemicals business.

Our top ten Railroad & Utility Products accounts comprised approximately 67%, 68% and 70% of Railroad & Utility Products’ net sales for 2005, 2004 and 2003, respectively, and many are serviced through long-term contracts ranging from one to seven years on a requirements basis. Our sales to the railroad industry are coordinated through our office in Pittsburgh, Pennsylvania. There are several principal regional competitors in this market.

We believe that the threat of substitution for the wood crosstie is low due to the higher cost of alternative materials. Concrete crossties, however, have been identified by the railroads as a feasible alternative to wood crossties in limited circumstances. In 1991, we acquired a 50% partnership interest in KSA Limited Partnership, a concrete crosstie manufacturing facility in Portsmouth, Ohio, in order to take advantage of this growth opportunity. In 2005, an estimated 1.1 million concrete crossties, or 6% of total tie insertions, were installed by Class 1 railroads. We believe that concrete crossties will continue to command approximately this level of market share. While the cost of material and installation of a concrete crosstie is much higher than that of a wood crosstie, the average lives of wood and concrete crossties are similar.

Utility poles are produced mainly from softwoods such as pine and fir in the United States and from hardwoods of the eucalyptus species in Australia. Most of these poles are purchased from large timber owners and individual landowners and shipped to one of our pole-peeling facilities. While crossties are treated exclusively with creosote, we treat poles with a variety of preservatives, including pentachlorophenol, copper chrome arsenates and creosote.

In the United States the market for utility pole products is characterized by a large number of small, highly competitive producers selling into a price-sensitive industry. The utility pole market is highly fragmented domestically, with over 200 investor-owned electric and telephone utilities and 2,800 smaller municipal utilities and rural electric associations. Approximately 2.25 million poles are

11

purchased annually in the United States, with a smaller market in Australia. In recent years we have seen our utility pole volumes decrease due to industry deregulation, its impact on maintenance programs, and overcapacity in the pole treating business. We expect demand for utility poles to remain at low levels. In Australia, in addition to utility poles, we market smaller poles to the agricultural, landscape and vineyard markets.

During 2005, sales of pole products accounted for approximately 20% of Railroad & Utility Products’ net sales. We have nine principal competitors in the utility products market. There are few barriers to entry in the utility products market, which consists of regional wood treating companies operating small to medium-size plants and serving local markets.

Equity Investments and Related Parties

Domestic Joint Venture: KSA Limited Partnership

KSA Limited Partnership, located in Portsmouth, Ohio, produces concrete crossties, a complementary product to our wood treatment crosstie business. We own 50% of KSA, with the other 50% owned by subsidiaries of Lehigh Cement Company. KSA Limited Partnership also provides concrete turnouts, used in rail traffic switching, and used crosstie rehabilitation.

Research and Development

As of December 31, 2005, we had 11 full-time employees engaged in research and development and technical service activities. Our research efforts are directed toward new product development regarding alternate uses for coal tar and technical service efforts to promote the use of creosote. We believe the research and technical efforts provided in these areas are adequate to maintain a leadership position in the technology related to these products. Expenditures for research and development for 2005, 2004 and 2003 were $2.8 million, $2.2 million and $2.3 million, respectively.

Technology and Licensing

In 1988, we acquired certain assets from Koppers Company, Inc., including the patents, patent applications, trademarks, copyrights, transferable licenses, inventories, trade secrets and proprietary processes used in the businesses acquired. The most important trademark acquired was the name “Koppers.” The association of the name with the chemical, building, wood preservation and coke industries is beneficial to our company, as it represents long-standing, high quality products. As long as we continue to use the name “Koppers” and comply with applicable registration requirements, our right to use the name “Koppers” should continue without expiration. The expiration of other intellectual property rights is not expected to materially affect our business.

Environmental Matters

Our operations and properties are subject to extensive federal, state, local and foreign environmental laws and regulations relating to protection of the environment and human health and safety, including those concerning the treatment, storage and disposal of wastes, the investigation and remediation of contaminated soil and groundwater, the discharge of effluents into waterways, the emission of substances into the air, as well as various health and safety matters. Environmental laws and regulations are subject to frequent amendment and have historically become more stringent. We have incurred and could incur in the future significant costs as the result of our failure to comply with, and liabilities under, environmental laws and regulations, including cleanup costs, civil and criminal penalties, injunctive relief and denial or loss of, or imposition of significant restrictions on, environmental permits. In addition, we have been and could in the future be subject to suit by private parties in connection with alleged violations of or liabilities under environmental laws and regulations.

12

We accrue for environmental liabilities when a determination can be made that they are probable and reasonably estimable. Total environmental reserves at December 31, 2005 and 2004 were approximately $3.8 million and $4.7 million, respectively, which include provisions primarily for environmental fines and soil remediation. For the last three years, our annual capital expenditures in connection with environmental control facilities averaged approximately $4.4 million, and annual operating expenses for environmental matters, excluding depreciation, averaged approximately $9.7 million. Management estimates that capital expenditures in connection with matters relating to environmental control facilities will be approximately $9 million for 2006. We believe that we will have continuing significant expenditures associated with compliance with environmental laws and regulations and, to the extent not covered by insurance or available recoveries under third-party indemnification arrangements, for present and future remediation efforts at plant sites and third-party waste sites and other liabilities associated with environmental matters. There can be no assurance that these expenditures will not exceed current estimates and will not have a material adverse effect on our business, financial condition, cash flow and results of operations. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental and Other Liabilities Retained or Assumed by Others” and “—Other Environmental Matters.”

Segment Information. Information regarding our segment revenues, profits, assets and geographical information is incorporated by reference to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations”.

Seasonality. Information regarding the seasonality of our businesses is incorporated by reference to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Matters”.

Employees and Employee Relations

As of December 31, 2005, we employed 691 salaried employees and 1,335 non-salaried employees. Listed below is a breakdown of employees by our businesses, including administration.

| | | | | | |

Business | | Salaried | | Non-Salaried | | Total |

Carbon Materials & Chemicals | | 365 | | 619 | | 984 |

Railroad & Utility Products | | 239 | | 716 | | 955 |

Administration | | 87 | | 0 | | 87 |

| | | | | | |

Total Employees | | 691 | | 1,335 | | 2,026 |

| | | | | | |

Of our employees, approximately 57% are represented by 20 different labor unions and are covered under numerous labor contracts. The United Steelworkers of America, or the USWA, which had represented more than 300 employees at six of our facilities, recently merged with the Paper, Allied-Industrial, Chemical & Energy Workers’ International Union, or PACE, which had represented nearly 200 employees at four of our facilities. The USWA currently represents more than 500 of our employees at ten of our facilities and, therefore, represents the largest number of our unionized employees. Labor contracts that expire in 2006 cover approximately 13% of our total labor force.

You should carefully consider the risks described below before investing in our publicly traded securities. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as competition, technological obsolescence, labor relations, general economic conditions, geopolitical events and international operations. Additional

13

risks not currently known to us or that we currently believe are immaterial may also impair our business operations and our liquidity.

Risks Relating to Our Business

We may not be able to compete successfully in any or all of the industry segments in which we operate.

The markets in which we operate are highly competitive, and this competition could harm our business, results of operations, cash flow and financial condition. If we are unable to respond successfully to changing competitive conditions, the demand for our products could be affected. We believe that the most significant competitive factor for our products is selling price. Additionally, some of the purchasers of our coke are capable of supplying a portion of their needs from their own coke production as well as from suppliers outside the United States who are able to import coke into the United States and sell it at prices competitive with those of U.S. suppliers. Some of our competitors have greater financial resources and larger capitalization than we do.

Demand for our products is cyclical and we may experience prolonged depressed market conditions for our products.

Our products are sold primarily in mature markets which historically have been cyclical, such as the aluminum, specialty chemical and utility industries.

| | • | | The principal consumers of our carbon pitch are primary aluminum smelters. Although the aluminum industry has experienced growth on a long-term basis, there may be cyclical periods of weak demand which could result in decreased primary aluminum production. Our pitch sales have historically declined during such cyclical periods of weak global demand for aluminum. |

| | • | | The principal use of our phthalic anhydride is in the manufacture of plasticizers and flexible vinyl, which are used mainly in the housing and automobile industries. Therefore, a decline in remodeling and construction or global automobile production could reduce the demand for phthalic anhydride. |

| | • | | The principal customers for our coke are U.S. integrated steel producers. The prices at which we will be able to sell our coke in the future will be greatly affected by the demand for coke from the steel industry and the supply of coke from the U.S. integrated steel producers’ own coke production and from foreign sources. |

| | • | | Over the last several years, utility pole demand has declined as utilities in the United States and Australia have reduced spending due to competitive pressures arising from deregulation. Deregulation may continue to negatively affect both the new and replacement pole installation markets. |

We are dependent on major customers for a significant portion of our net sales, and the loss of one or more of our major customers could result in a significant reduction in our profitability.

For the year ended December 31, 2005, our top ten customers accounted for approximately 45% of our net sales. During this period, our two largest customers each accounted for approximately 9% and 8%, respectively, of our total net sales. Additionally, an integrated steel company is the only customer for our furnace coke, with a contract to take 100% of our coke production in 2006. The permanent loss of, or a significant decrease in the level of purchases by, one or more of our major customers could result in a significant reduction in our profitability.

14

Fluctuations in the price, quality and availability of our primary raw materials could reduce our profitability.

Our operations depend on an adequate supply of quality raw materials being available on a timely basis. The loss of a key source of supply or a delay in shipments could cause a significant increase in our operating expenses. For example, our operations are highly dependent on a relatively small number of freight transportation services. Interruptions in such freight services could impair our ability to receive raw materials and ship finished products in a timely manner. We are also exposed to price and quality risks associated with raw material purchases. Such risks include:

| | • | | The primary raw material used by our Carbon Materials & Chemicals business is coal tar, a by-product of coke production. A shortage in the supply of domestic coal tar or a reduction in the quality of coal tar could require us to increase coal tar and carbon pitch imports, as well as the use of petroleum substitutes to meet future carbon pitch demand. This could cause a significant increase in our operating expenses. |

| | • | | In certain circumstances coal tar may also be used as an alternative to fuel. Recent increases in energy prices could result in higher coal tar costs which would have to be passed through to our customers. If these costs cannot be passed through, it could result in margin reductions for our coal tar based products. |

| | • | | The availability and cost of softwood and hardwood lumber are critical elements in our production of pole products and railroad crossties, respectively. The supply of trees of acceptable size for the production of utility poles has decreased in recent years in relation to the demand, and we accordingly have been required to pay a higher price for these materials. Historically, the supply and cost of hardwood for railroad crossties have also been subject to availability and price pressures. We may not be able to source wood raw materials at economical prices in the future. |

| | • | | Metallurgical coal is the primary raw material used in the production of coke. An increase in the price of metallurgical coal, or a prolonged interruption in its supply, could increase our operating expenses. |

| | • | | Our price realizations and profit margins for phthalic anhydride have historically fluctuated with the price of orthoxylene and its relationship to our cost to produce naphthalene; however, during periods of excess supplies of phthalic anhydride margins may be reduced despite high levels for orthoxylene prices. |

If the costs of raw materials increase significantly and we are unable to offset the increased costs with higher selling prices, our profitability will decline.

Our products may be rendered obsolete or less attractive by changes in regulatory, legislative or industry requirements.

Changes in regulatory, legislative or industry requirements may render certain of our products obsolete or less attractive. Our ability to anticipate changes in these requirements, especially changes in regulatory standards, will be a significant factor in our ability to remain competitive. We may not be able to comply in the future with new regulatory, legislative and/or industrial standards that may be necessary for us to remain competitive and certain of our products may, as a result, become obsolete or less attractive to our customers.

The development of new technologies or changes in our customers’ products could reduce the demand for our products.

Our products are used for a variety of applications by our customers. Changes in our customers’ products or processes may enable our customers to reduce consumption of the products we produce

15

or make our products unnecessary. Customers may also find alternative materials or processes that no longer require our products. For example, in 2000 our largest carbon pitch customer announced that it was actively pursuing alternative anode technology that would eliminate the need for carbon pitch as an anode binder. The potential development and implementation of this new technology could seriously impair our ability to profitably market carbon pitch and related co-products. Over 75% of our carbon pitch is sold to the aluminum industry under long-term contracts typically ranging from three to five years. If a new technology were developed that replaced the need for carbon pitch in the production of carbon anodes, it is possible that these contracts would not be renewed in the future.

Hazards associated with chemical manufacturing may cause suspensions or interruptions of our operations.

Due to the nature of our business, we are exposed to the hazards associated with chemical manufacturing and the related storage and transportation of raw materials, products and wastes in our manufacturing facilities or our distribution centers, such as fires, explosions and accidents that could lead to an interruption or suspension of operations. Any disruption could reduce the productivity and profitability of a particular manufacturing facility or of our company as a whole. Other hazards include:

| | • | | piping and storage tank leaks and ruptures; |

| | • | | exposure to hazardous substances; and |

| | • | | chemical spills and other discharges or releases of toxic or hazardous substances or gases. |

These hazards, among others, may cause personal injury and loss of life, damage to property and contamination of the environment, which could lead to government fines or work stoppage injunctions, cleanup costs and lawsuits by injured persons. While we are unable to predict the outcome of such matters, if determined adversely to us, we may not have adequate insurance to cover related costs or liabilities and, if not, we may not have sufficient cash flow to pay for such costs or liabilities. Such outcomes could harm our customer goodwill and reduce our profitability.

We are subject to extensive environmental laws and regulations and may incur significant costs as a result of continued compliance with, violations of or liabilities under environmental laws and regulations.

Like other companies involved in environmentally sensitive businesses, our operations and properties are subject to extensive federal, state, local and foreign environmental laws and regulations, including those concerning, among other things:

| | • | | the treatment, storage and disposal of wastes; |

| | • | | the investigation and remediation of contaminated soil and groundwater; |

| | • | | the discharge of effluents into waterways; |

| | • | | the emission of substances into the air; |

| | • | | the marketing, sale, use and registration of our chemical products, such as creosote; and |

| | • | | other matters relating to environmental protection and various health and safety matters. |

We have incurred, and expect to continue to incur, significant costs to comply with environmental laws and as a result of remedial obligations. We could incur significant costs, including cleanup costs, fines, civil and criminal sanctions and claims by third parties for property damage and personal injury, as a result of violations of or liabilities under environmental laws and regulations. We accrue for

16

environmental liabilities when a determination can be made that they are probable and reasonably estimable. Total environmental reserves at December 31, 2005 and December 31, 2004 were approximately $3.8 million and $4.7 million, respectively, which include provisions primarily for environmental fines and soil remediation. For the last three years, our annual capital expenditures in connection with environmental control facilities averaged approximately $5.5 million, and annual operating expenses for environmental matters, excluding depreciation, averaged approximately $9.7 million. Management estimates that capital expenditures in connection with matters relating to environmental control facilities will be approximately $9 million for 2006. Contamination has been identified and is being investigated and remediated at many of our sites by us or other parties. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental and Other Liabilities Retained or Assumed by Others” and “—Other Environmental Matters.”

Actual costs and liabilities to us may exceed forecasted amounts. Moreover, currently unknown environmental issues, such as the discovery of additional contamination or the imposition of additional cleanup obligations with respect to our sites or third party sites, may result in significant additional costs, and potentially significant expenditures could be required in order to comply with future changes to environmental laws and regulations or the interpretation or enforcement thereof. We also are involved in various litigation and proceedings relating to environmental matters and toxic tort claims. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Legal Matters” and “Business—Legal Proceedings.”

Beazer East and Beazer Limited may not continue to meet their obligations to indemnify us.

Under the terms of the asset purchase agreement between us and Koppers Company, Inc. (now known as Beazer East, Inc.) upon the formation of Koppers Inc. in 1988, subject to certain limitations, Beazer East assumed the liability for and indemnified us against (among other things) certain clean-up liabilities for contamination occurring prior to the purchase date at sites acquired from Beazer East and third-party claims arising from such contamination, which we refer to herein as the Indemnity. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Environmental and Other Liabilities Retained by Other” and “Business—Legal Proceedings.” Beazer East and Beazer Limited may not continue to meet their obligations. In addition, Beazer East could in the future choose to challenge its obligations under the Indemnity or our satisfaction of the conditions to indemnification imposed on us thereunder. In addition, the government and other third parties also have the right under applicable environmental laws to seek relief directly from us for any and all such costs and liabilities. In July 2004, we entered into an agreement with Beazer East to amend the December 29, 1988 asset purchase agreement to provide, among other things, for the continued tender of pre-closing environmental liabilities to Beazer East under the Indemnity through July 2019. As consideration for the agreement, we agreed to pay Beazer East a total of $7.0 million in four installments over three years and to share toxic tort litigation defense costs arising from any sites acquired from Beazer East. The first two payments of $2.0 million each were made in July 2004 and 2005. Qualified expenditures under the Indemnity are not subject to a monetary limit.

Without reimbursement under the Indemnity, the obligation to pay the costs and assume the liabilities relating to these matters would have a significant impact on our net income. Furthermore, without reimbursement, we could be required to record a contingent liability on our balance sheets with respect to environmental matters covered by the Indemnity, which could result in our having significant additional negative net worth. Finally, the Indemnity does not afford us indemnification against environmental costs and liabilities attributable to acts or omissions occurring after the closing of the acquisition of assets from Beazer East under the asset purchase agreement, nor is the Indemnity applicable to liabilities arising in connection with other acquisitions by us after that closing.

17

The insurance that we maintain may not fully cover all potential exposures.

We maintain property, casualty and workers’ compensation insurance but such insurance may not cover all risks associated with the hazards of our business and is subject to limitations, including deductibles and maximum liabilities covered. We may incur losses beyond the limits, or outside the coverage, of our insurance policies, including liabilities for environmental compliance and remediation. In addition, from time to time, various types of insurance for companies in our industry have not been available on commercially acceptable terms or, in some cases, have not been available at all. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

Adverse weather conditions may reduce our operating results.

Our quarterly operating results fluctuate due to a variety of factors that are outside our control, including inclement weather conditions, which in the past have caused a decline in our operating results. For example, adverse weather conditions have at times negatively impacted our supply chain as wet conditions impacted logging operations, reducing our ability to procure crossties. In addition, adverse weather conditions have had a negative impact on our customers in the roofing and pavement sealer businesses, resulting in a negative impact on our sales of these products. Moreover, demand for many of our products declines during periods of inclement weather.

We are subject to risks inherent in foreign operations, including changes in social, political and economic conditions.

We have operations in the United States, Australasia, China, Europe and South Africa, and sell our products in many foreign countries. In 2005 and 2004, net sales from our products sold by Koppers Europe ApS and Koppers Australia Pty Ltd. accounted for approximately 34% of our total net sales in both years. Like other global companies, we are exposed to market risks relating to fluctuations in interest rates and foreign currency exchange rates. Our international revenues could be reduced by currency fluctuations or devaluations. Changes in currency exchange rates could lower our reported revenues and could require us to reduce our prices to remain competitive in foreign markets, which could also reduce our profitability. We have not historically hedged our financial statement exposure and, as a result, we could incur unanticipated losses. We are also subject to potentially increasing transportation and shipping costs associated with international operations. Furthermore, we are also exposed to risks associated with changes in the laws and policies governing foreign investments in countries where we have operations as well as, to a lesser extent, changes in U.S. laws and regulations relating to foreign trade and investment.

Our strategy to selectively pursue complementary acquisitions may present unforeseen integration obstacles or costs.

Our business strategy includes the potential acquisition of businesses and entering into joint ventures and other business combinations that we expect would complement and expand our existing products and the markets where we sell our products and improve our market position. We may not be able to successfully identify suitable acquisition or joint venture opportunities or complete any particular acquisition, combination, joint venture or other transaction on acceptable terms. We cannot predict the timing and success of our efforts to acquire any particular business and integrate the acquired business into our existing operations. Also, efforts to acquire other businesses or the implementation of other elements of this business strategy may divert managerial resources away from our business operations. In addition, our ability to engage in strategic acquisitions may depend on our ability to raise substantial capital and we may not be able to raise the funds necessary to implement our acquisition strategy on terms satisfactory to us, if at all. Our failure to identify suitable acquisition or joint venture

18

opportunities may restrict our ability to grow our business. In addition, we may not be able to successfully integrate businesses that we acquire in the future, which could lead to increased operating costs, a failure to realize anticipated operating synergies or both.

We are the subject of ongoing investigations regarding our competitive practices, which may result in fines or other penalties.

In April 2005, the New Zealand Commerce Commission, or the NZCC, filed a statement of claim in the High Court of New Zealand against a number of corporate and individual defendants, including Koppers Arch Wood Protection (NZ) Limited, or KANZ, and Koppers Arch Investments Pty Limited, or KAI. KANZ and KAI have entered into a cooperation agreement (the “Cooperation Agreement”) with the NZCC for the resolution of these proceedings pursuant to which KANZ, KAI and the NZCC have agreed to make a joint submission to the court that it would be appropriate to impose a joint aggregate penalty of approximately $2.5 million plus costs of $0.1 million on KANZ and KAI for breaches of the Commerce Act. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Legal Matters—Government Investigations.” Except as set forth above, we are not currently aware of any other claims (civil or governmental) related to competitive practices in New Zealand.

Koppers Arch Wood Protection (Aust) Pty Limited, or Koppers Arch Australia, has made an application for leniency under the Australian Competition and Consumer Commission’s, or the ACCC, policy for cartel conduct. The ACCC has granted immunity to Koppers Arch Australia, subject to the fulfillment of certain conditions, such as, but not limited to, continued cooperation. If the conditions are not fulfilled, Koppers Arch Australia may be penalized for any violations of the competition laws of Australia. We are not currently aware of any civil claims related to competitive practices in Australia.

We have reserved approximately $2.6 million for these penalties and costs as of December 31, 2005. This amount is included in cost of sales. The amount reserved is based upon the penalties and costs set forth in the Cooperation Agreement.

KANZ and Koppers Arch Australia are majority-owned subsidiaries of Koppers Arch Investments, which is an Australian joint venture owned 51% by World-Wide Ventures Corporation (our indirect subsidiary) and 49% by Hickson Nederland BV. KANZ and Koppers Arch Australia manufacture and market wood preservative products throughout New Zealand and Australia, respectively.

We are not currently aware of any other government investigations or other claims related to these investigations of industry competitive practices.

Litigation against us could be costly and time consuming to defend, and due to the nature of our business and products, we may be liable for damages arising out of our acts or omissions.

We produce hazardous chemicals that require appropriate procedures and care to be used in handling them or using them to manufacture other products. As a result of the hazardous nature of some of the products we use and produce, we may face product liability claims relating to incidents involving the handling, storage and use of and exposure to our products. For example:

| | • | | Koppers Inc., along with other defendants, has been named as a defendant in 24 cases filed in state court in Pennsylvania and two cases filed in state court in Texas in which the plaintiffs claim they suffered a variety of illnesses (including cancer) as a result of exposure to coal tar pitch sold by Koppers Inc. There are a total of approximately 82 plaintiffs in these cases. Of the 82 plaintiffs, 80 plaintiffs do not assert any specific amount of damages. These 80 plaintiffs seek compensatory and punitive damages in unspecified amounts in excess of the minimum jurisdictional limits (in most cases $25,000) of the applicable courts. Of the 82 plaintiffs, two |

19

| | plaintiffs (in the same case) assert damages not to exceed a combined total of $10.0 million. The cases are in the early stages of discovery. Koppers Inc. has not provided a reserve for these lawsuits because, at this time, Koppers Inc. cannot reasonably determine the probability of a loss, and the amount of loss, if any, cannot be reasonably estimated. Although Koppers Inc. is vigorously defending these cases, an unfavorable resolution of these matters may result in substantial costs. |

All Cases

Koppers Inc., together with various co-defendants (including Beazer East), has been named as a defendant in toxic tort lawsuits in state court in Mississippi (seeState Court Cases below) and in federal court in Mississippi (seeFederal Court Cases below) arising from the operation of the Grenada facility. The complaints allege that plaintiffs were exposed to harmful levels of various toxic chemicals, including creosote, pentachlorophenol, polycyclic aromatic hydrocarbons and dioxin, as a result of soil, surface water and groundwater contamination and air emissions from the Grenada facility and, in some cases, from an adjacent manufacturing facility operated by Heatcraft, Inc. Based on the experience of Koppers Inc. in defending previous toxic tort cases, Koppers Inc. does not believe that the damages sought by the plaintiffs in the state and federal court cases are supported by the facts of the cases. Koppers Inc. has not provided a reserve for these lawsuits because, at this time, it cannot reasonably determine the probability of a loss, and the amount of loss, if any, cannot be reasonably estimated. Although Koppers Inc. intends to vigorously defend these cases, there can be no assurance that an unfavorable resolution of these matters will not result in substantial cost to Koppers Inc.

Federal Court Cases

Beck Case—The complaint in this case was originally filed by approximately 110 plaintiffs. Pursuant to an order granting defendants’ motion to sever, the court dismissed the claims of 98 plaintiffs in the Beck case without prejudice to their right to re-file their complaints. In December 2005, 94 of the 98 plaintiffs in the Beck case whose claims were dismissed re-filed their complaints. The plaintiffs in the 94 re-filed cases seek compensatory damages from the defendants of at least $5.0 million for each of eight counts and punitive damages of at least $10.0 million for each of three counts (in addition to damages for an unspecified amount for trespass and nuisance). No discovery orders have been issued with respect to the 94 additional cases. The claims of the 12 plaintiffs whose claims were not dismissed are still pending. The 12 remaining plaintiffs seek compensatory damages from the defendants in an unspecified amount and punitive damages of $20.0 million for each of four counts. The court ordered that the claims of the 12 remaining Beck plaintiffs must be tried separately. The first of these trials is scheduled to commence on April 17, 2006. The remaining 11 trials are scheduled to commence at the rate of approximately one trial per calendar quarter beginning upon the conclusion of the first trial.

Ellis Case—There are approximately 1,130 plaintiffs in this case. Each plaintiff seeks compensatory damages from the defendants of at least $5.0 million for each of seven counts and punitive damages of at least $10.0 million for each of three counts (in addition to damages for an unspecified amount for trespass and nuisance). The Ellis complaint also requests injunctive relief. Discovery in this case has been stayed pending the completion of the trials for the 12 plaintiffs in the Beck case.

State Court Cases

In the state court cases, which currently include a total of approximately 235 plaintiffs, each plaintiff seeks compensatory damages from the defendants of at least $5.0 million for each of

20

up to eight counts and punitive damages of at least $10.0 million for each of three counts. Certain plaintiffs also seek damages for trespass and private nuisance in unspecified amounts together with injunctive relief. The state court cases which were not originally filed in Grenada County are in the process of being transferred to Grenada County pursuant to an order of the Mississippi Supreme Court granting the defendants’ motions for a change of venue and severance. Discovery in the state court cases not originally filed in Grenada County is currently stayed. After such cases have been transferred to Grenada County, the stay of discovery in such cases is expected to be lifted. With respect to the state court case that was originally filed on behalf of 95 plaintiffs in Grenada County, the court granted the defendants’ motion to sever the claims of these plaintiffs for improper joinder and set a period of time for the plaintiffs to re-file individual complaints or have their complaints dismissed. These plaintiffs (together with a small number of new plaintiffs) have filed their individual complaints in Grenada County. These plaintiffs are included in the total of approximately 235 plaintiffs shown above.

For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Legal Matters” and “Business—Legal Proceedings.”

In addition, we are regularly subject to legal proceedings and claims that arise in the ordinary course of business, such as workers’ compensation claims, governmental investigations, employment disputes, and customer and supplier disputes arising out of the conduct of our business. Litigation could result in substantial costs and may divert management’s attention and resources away from the day-to-day operation of our business.

Labor disputes could disrupt our operations and divert the attention of our management and may cause a decline in our production and a reduction in our profitability.

Of our employees, approximately 57% are represented by 20 different labor unions and are covered under numerous labor contracts. The United Steelworkers of America, or the USWA, which had represented more than 300 employees at six of our facilities, recently merged with the Paper, Allied-Industrial, Chemical & Energy Workers’ International Union, or PACE, which had represented nearly 200 employees at four of our facilities. The USWA currently represents more than 500 of our employees at ten of our facilities and, therefore, represents the largest number of our unionized employees. Labor contracts that expire in 2006 cover approximately 13% of our total labor workforce. We may not be able to reach new agreements without union action or on terms satisfactory to us. Any future labor disputes with any such unions could result in strikes or other labor protests which could disrupt our operations and divert the attention of our management from operating our business. If we were to experience a strike or work stoppage, it may be difficult for us to find a sufficient number of employees with the necessary skills to replace these employees. Any such labor disputes could cause a decline in our production and a reduction in our profitability.

Our pension obligations are currently underfunded. We may have to make significant cash payments to our pension plans, which would reduce the cash available for our business.

As of December 31, 2005, our projected benefit obligation under our defined benefit pension plans exceeded the fair value of plan assets by approximately $49.4 million. The underfunding was caused, in part, by fluctuations in the financial markets that have caused the valuation of the assets in our defined benefit pension plans to be lower than anticipated. During the year ended December 31, 2005, we contributed $11.3 million to our pension plans. Management expects that any future obligations under our pension plans that are not currently funded will be funded from our future cash flow from operations. If our contributions to our pension plans are insufficient to fund the pension plans adequately to cover our future pension obligations, the performance of the assets in our pension plans does not meet our expectations or other actuarial assumptions are modified, our contributions to our

21

pension plans could be materially higher than we expect, which would reduce the cash available for our business.

We have a substantial amount of indebtedness, which could harm our ability to operate our business, remain in compliance with debt covenants, make payments on our debt and pay dividends.

As of December 31, 2005, we and our subsidiaries had approximately $519.4 million of indebtedness (excluding trade payables, intercompany indebtedness and the effect of redeeming $101.7 million of the Koppers Inc. senior secured notes using proceeds from the initial public offering), consisting primarily of our senior discount notes, Koppers Inc.’s senior secured notes and $44.5 million of indebtedness under our senior secured credit facility.

The degree to which we are leveraged could have important consequences, including:

| | • | | our ability to satisfy our obligations under our debt could be affected and any failure to comply with the requirements, including financial and other restrictive covenants, of any of our debt agreements could result in an event of default under the agreements governing such indebtedness; |

| | • | | substantial portion of our cash flow from operations will be required to make interest and principal payments and may not be available for operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other purposes; |

| | • | | our ability to obtain additional financing in the future may be impaired; |

| | • | | we may be more highly leveraged than our competitors, which may place us at a competitive disadvantage; |

| | • | | our flexibility in planning for, or reacting to, changes in our business and industry may be limited; |

| | • | | our degree of leverage may make us more vulnerable in the event of a downturn in our business, our industry or the economy in general; and |

| | • | | our ability to pay dividends to our shareholders. |

Furthermore, we and our subsidiaries may be able to incur substantial additional indebtedness in the future. If we incur additional indebtedness, the magnitude of the risks associated with our substantial leverage, including our ability to service our debt, would increase.

Restrictions in our debt agreements could limit our growth and our ability to respond to changing conditions and, in the event of a default, all of these borrowings become immediately due and payable.

Koppers Inc.’s senior secured credit facility and the indentures governing our senior discount notes and Koppers Inc.’s senior secured notes contain a number of significant covenants in addition to covenants restricting the incurrence of additional debt. These covenants limit our ability, among other things, to:

| | • | | incur or guarantee additional debt and issue certain types of preferred stock; |

| | • | | pay dividends on our capital stock or redeem, repurchase or retire our capital stock or subordinated debt; |

| | • | | create liens on our assets; |

22

| | • | | enter into sale and leaseback transactions; |

| | • | | engage in transactions with our affiliates; |

| | • | | create restrictions on the ability of our restricted subsidiaries to pay dividends or make other payments to us; |

| | • | | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries; and |

| | • | | transfer or issue shares of stock of subsidiaries. |

In addition, Koppers Inc.’s senior secured credit facility contains other and more restrictive covenants. Additionally, it requires us to maintain certain financial ratios and satisfy certain financial condition tests and require us to take action to reduce our debt or take some other action to comply with them.

These restrictions could limit our ability to obtain future financings, make needed capital expenditures, withstand a future downturn in our business or the economy in general or otherwise conduct necessary corporate activities. We may also be prevented from taking advantage of business opportunities that arise because of the limitations that the restrictive covenants under Koppers Inc.’s senior secured credit facility and the indentures governing our senior discount notes and Koppers Inc.’s senior secured notes impose on us.

A breach of any of these covenants would result in a default under the applicable debt agreement. A default, if not waived, could result in acceleration of the debt outstanding under the agreement and in a default with respect to, and acceleration of, the debt outstanding under our other debt agreements and the indentures governing our senior discount notes and senior secured notes. The accelerated debt would become immediately due and payable. If that should occur, we may not be able to pay all such debt or to borrow sufficient funds to refinance it. This would result in a significant interruption in our business operations, which would negatively impact the market price of our common stock. Even if new financing were then available, it may not be on terms that are acceptable to us.

Our substantial negative net worth may require us to maintain additional working capital.

As of December 31, 2005, we had negative net worth of approximately $206.7 million, resulting primarily from the use of borrowings to fund dividends. Our negative net worth may make it difficult for us to obtain credit from suppliers, vendors and other parties. In addition, some of our suppliers and vendors may require us to prepay for services or products or may impose less advantageous terms on timing of payment. Our ability to enter into hedging transactions may also be limited by our negative net worth. As a result, we may require additional working capital, which may negatively affect our cash flow and liquidity.

We may incur significant charges in the event we close all or part of a manufacturing plant or facility.