UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

Commission file number 1-32737

KOPPERS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 20-1878963 |

| (State of incorporation) | | (IRS Employer Identification No.) |

| | |

436 Seventh Avenue Pittsburgh, Pennsylvania 15219 | | (412) 227-2001 |

| (Address of principal executive offices) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Exchange on which registered |

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the registrant, based on the closing sales price of the Common Stock on the New York Stock Exchange on June 30, 2006 was $267.7 million (affiliates, for this purpose, have been deemed to be Directors and executive officers of Koppers Holdings Inc. and certain significant shareholders).

As of January 31, 2007, 20,729,823 shares of Common Stock of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2007 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

2

FORWARD-LOOKING INFORMATION

Certain statements in this report are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and may include, but are not limited to, statements about sales levels, restructuring, profitability and anticipated expenses and cash outflows. All forward-looking statements involve risks and uncertainties. All statements contained herein that are not clearly historical in nature are forward-looking, and words such as “believe”, “anticipate”, “expect”, “estimate”, “may”, “will”, “should”, “continue”, “plans”, “intends”, “likely” or other similar words or phrases are generally intended to identify forward-looking statements. Any forward-looking statement contained herein, in press releases, written statements or other documents filed with the SEC, or in Koppers’ communications with and discussions with investors and analysts in the normal course of business through meetings, phone calls and conference calls, regarding expectations with respect to sales, earnings, cash flows, operating efficiencies, product introduction or expansion, the benefits of acquisitions and divestitures or other matters as well as financings and repurchases of debt of equity securities, are subject to known and unknown risks, uncertainties and contingencies. Many of these risks, uncertainties and contingencies are beyond our control, and may cause actual results, performance or achievements to differ materially from anticipated results, performance or achievements. Factors that might affect such forward-looking statements include, among other things:

| | • | | general economic and business conditions; |

| | • | | demand for the Company’s goods and services; |

| | • | | competitive conditions in the industries in which Koppers operates; |

| | • | | the ratings on our debt and our ability to repay or refinance our outstanding indebtedness as it matures; |

| | • | | our ability to operate within the limitations of our debt covenants; |

| | • | | interest rate fluctuations and other changes in borrowing costs; |

| | • | | other capital market conditions, including foreign currency rate fluctuations; |

| | • | | availability of and fluctuations in the prices of key raw materials, including coal tar and timber; |

| | • | | economic and political conditions in international markets, including governmental changes and restrictions on the ability to transfer capital across countries; |

| | • | | potential impairment of our goodwill and/or long-lived assets; |

| | • | | parties who are obligated to indemnify us for legal and environmental liabilities fail to perform under their legal obligations; and |

| | • | | unfavorable resolution of litigation against us. |

3

PART I

General

(Please note that, unless otherwise indicated or the context requires otherwise, when we use the terms “we”, the “Company”, “our” or “us”, we mean Koppers Inc., formerly known as Koppers Industries, Inc., and its subsidiaries on a consolidated basis for periods up until November 18, 2004 and Koppers Holdings Inc., or Koppers Holdings, formerly known as KI Holdings Inc., and its subsidiaries on a consolidated basis for periods from and including November 18, 2004, when Koppers Holdings became the parent of Koppers Inc. The use of these terms is not intended to imply that Koppers Holdings and Koppers Inc. are not separate and distinct legal entities.)

We are a leading integrated global provider of carbon compounds and commercial wood treatment products. Our products are used in a variety of niche applications in a diverse range of end-markets, including the aluminum, railroad, specialty chemical, utility, rubber and steel industries. We serve our customers through a comprehensive global manufacturing and distribution network, including 33 manufacturing facilities located in North America, Australasia, China, Europe and South Africa. For the twelve months ended December 31, 2006, we generated net sales of $1,159.5 million and net income of $15.2 million.

We operate two principal businesses, Carbon Materials & Chemicals and Railroad & Utility Products. Through our Carbon Materials & Chemicals business (63% of 2006 net sales), we believe we are the largest distiller of coal tar in North America, Australia, the United Kingdom and Scandinavia. We process coal tar into a variety of products, including carbon pitch, creosote and phthalic anhydride, which are critical intermediate materials in the production of aluminum, the pressure treatment of wood and the production of plasticizers and specialty chemicals, respectively. Through our Railroad & Utility Products business (37% of 2006 net sales), we are the largest North American supplier of railroad crossties. Our other commercial wood treatment products include utility poles for the electric and telephone utility industries.

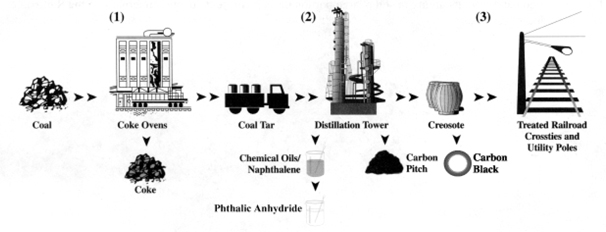

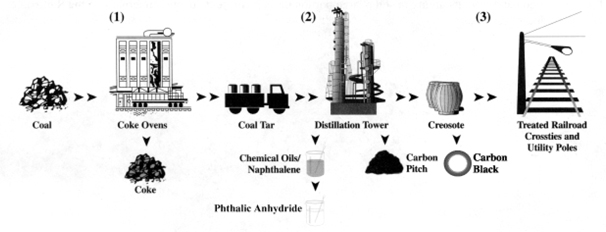

Our operations are, to a substantial extent, vertically integrated and employ a variety of processes, as illustrated in the following flow diagram:

We were formed in November 2004 by Saratoga Partners III, L.P. and its affiliates and certain of our employees and members of our board of directors as a holding company for Koppers Inc. in a transaction in which all of the capital stock of Koppers Inc. was converted into shares of common and preferred stock of Koppers Holdings and Koppers Inc. became a wholly owned subsidiary of Koppers Holdings. Koppers Holdings does not have any operations independent of Koppers Inc., except as to administrative matters and except that Koppers Holdings is the sole obligor on its 9 7/8% Senior Discount Notes due 2014 (the “Senior Discount Notes”). Koppers Inc. was formed in 1988 to facilitate the acquisition of certain assets of the company now known as Beazer East, Inc. Our principal shareholders are Saratoga Partners III, L.P. and its affiliates (“Saratoga”), a New York based investment firm managed by Saratoga Management Company LLC. On February 6, 2006 we completed an initial public offering in which we issued and sold 8,700,000 shares and Saratoga sold 2,800,000 of its existing shares (after converting their preferred shares into common shares on a 3.9799 for one basis) at an initial selling price to shareholders of $14.00 per share. We used the majority of the proceeds to redeem $101.7 million of the Koppers Inc. Senior Secured Notes due 2013 (the “Senior Secured Notes”). In December 2006 Saratoga sold an additional 2,012,500 of its shares in Koppers in a block trade, thereby reducing its ownership share in Koppers to approximately 19%.

4

Industry Overview

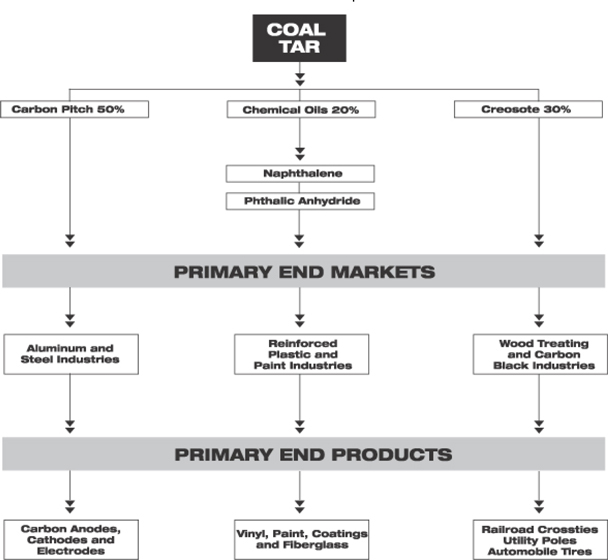

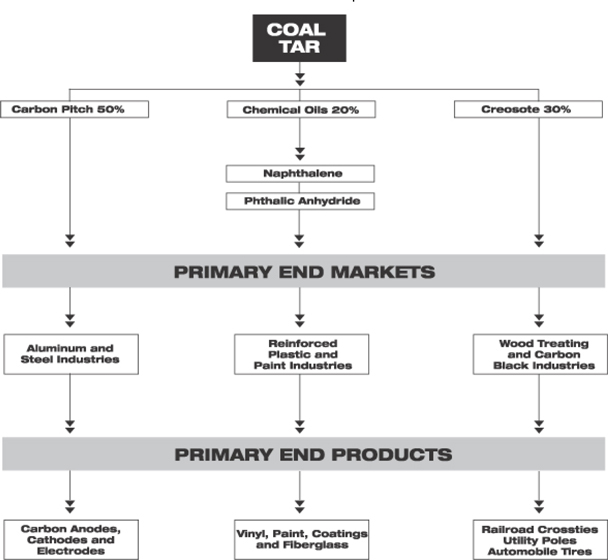

Coal tar is a by-product generated through the processing of coal into coke for use in steel and iron manufacturing. We produce and distribute a variety of intermediate chemical products derived from the coal tar distillation process, including the co-products of the distillation process. During the distillation process, heat and vacuum are utilized to separate coal tar into three primary components: carbon pitch (approximately 50%), creosote oils (approximately 30%) and chemical oils (approximately 20%). Because all coal tar products are produced in relatively fixed proportion to carbon pitch, the level of carbon pitch consumption generally determines the level of production of other coal tar products.

We believe that demand for aluminum and railroad track maintenance substantially drive growth in our two principal businesses. Through our leading market positions and global presence, we believe we are uniquely well-positioned to capitalize on favorable trends within our end-markets. According to the King Report, worldwide aluminum production increased 6.1% to 33.9 million metric tons in 2006 and was expected to grow by 6.5% in 2007 and 3.4% in 2008. Carbon pitch requirements for the aluminum industry were 3.2 million metric tons in 2006 and are expected to grow as a function of growth in aluminum production.

The railroad crosstie business is benefiting and will likely continue to benefit from positive general economic conditions in the railroad industry and from expected increases in spending on both new track and existing track maintenance. The Railway Tie Association (“RTA”) estimates that approximately 16.0 million wood crossties for Class 1 railroads were purchased in the United States and Canada in 2006 and approximately 16.3 million wood crossties are projected to be purchased in 2007.

Carbon Materials & Chemicals

Our Carbon Materials & Chemicals business manufactures six principal products: (a) carbon pitch, used in the production of aluminum and steel; (b) phthalic anhydride, used in the production of plasticizers and polyester resins; (c) creosote, used in the treatment of wood or as a feedstock in the production of carbon black; (d) carbon black, used in the manufacture of rubber tires; (e) naphthalene, used primarily as a surfactant in the production of concrete; and (f) furnace coke, used in steel and iron production. Carbon pitch, phthalic anhydride, creosote and naphthalene are produced through the distillation of coal tar, a by-product of the transformation of coal into coke. The Carbon Materials & Chemicals business’ profitability is impacted by the cost of purchasing coal tar in relation to its prices realized for carbon pitch, phthalic anhydride, creosote, and naphthalene. We have three tar distillation facilities in the United States, one in Australia, one in China, one in Denmark and two in the United Kingdom, strategically located to provide access to coal tar and to facilitate better service to our customers with a consistent supply of high-quality products. For 2006, 2005 and 2004, respectively, principal products comprised the following percentages of net sales for Carbon Materials & Chemicals (excluding intercompany sales): (i) carbon pitch, 37%, 33% and 36%; (ii) phthalic anhydride, 13%, 14% and 14%; (iii) creosote (including carbon black feedstock), 9%, 7% and 7%; (iv) carbon black, 5%, 5% and 5%; (v) naphthalene, 5%, 5% and 5%; and (vi) furnace coke, 8%, 10% and 9%.

We believe we have a strategic advantage over our competitors based on our ability to access coal tar from many global suppliers and subsequently blend such coal tars to produce carbon pitch with the consistent quality important in the manufacturing of quality anodes for the aluminum industry. Our eight coal tar distillation facilities- four of which have port access- and five carbon pitch terminals give us the ability to offer customers multiple sourcing and a consistent supply of high quality products. In anticipation of potential reductions of U.S. coke capacity, we have secured coal tar supply through long-term contracts. We also entered into a joint venture agreement in December 2006 to construct a second coal tar distillation facility in China in order to access the carbon pitch that will be generated by the joint venture (See “Business-Acquisitions/Joint Ventures”).

Coal tar distillation involves the conversion of coal tar into a variety of intermediate chemical products in processes beginning with distillation. During the distillation process, heat and vacuum are utilized to separate coal tar into three primary components: carbon pitch (approximately 50%), creosote oils (approximately 30%) and chemical oils (approximately 20%).

5

Our Carbon Materials & Chemicals business manufactures its primary products and sells them directly to our customers through long-term contracts and purchase orders negotiated by our regional sales personnel and coordinated through our global marketing officer in the United States. We maintain inventories at our plant locations and do not factor our inventories or receivables to third parties.

Carbon Pitch

On a global basis, we produce carbon pitch through the tar distillation process. Sales terms are negotiated by centralized sales departments in the United States, Australia and Europe and are generally evidenced by long-term sales contracts and purchase orders which are coordinated through our global marketing group at corporate headquarters.

Over 75% of our carbon pitch is sold to the aluminum industry under long-term contracts typically ranging from three to five years, many with provisions for periodic pricing reviews. Demand for carbon pitch generally fluctuates with production of primary aluminum. Because all coal tar products are produced in relatively fixed proportion to carbon pitch, the level of carbon pitch consumption generally determines the level of production of other coal tar products. The commercial carbon industry, the second largest user of carbon pitch, uses carbon pitch to produce electrodes and other specialty carbon products for the steel industry. There are currently no known viable substitutes for carbon pitch in the production of carbon anodes used in the aluminum production process.

We believe we are the largest producer of carbon pitch for the aluminum industry. Competitive factors in the carbon pitch market include price, quality, service, and security of supply. We believe we have a competitive advantage based on our global presence and long-term raw material supply contracts.

6

Chemical Oils

Chemical oils are further processed to producenaphthalene. In Australia, China and Europe, naphthalene is sold into the industrial sulfonate market for use as dispersants or in the concrete additive and gypsum board markets. Additional end-uses include oil field additives, agricultural emulsifiers, synthetic tanning agents and dyestuffs.

In the United States, we use naphthalene as a feedstock in the manufacture ofphthalic anhydride. We manufacture phthalic anhydride using both naphthalene and externally-sourced orthoxylene, which is a petroleum derivative. The primary markets for phthalic anhydride are in the production of plasticizers, unsaturated polyester resins and alkyd resins. Sales terms for phthalic anhydride are negotiated by a centralized sales department in the United States and are generally evidenced by long-term sales contracts and purchase orders.

On a global basis, naphthalene and orthoxylene are both used as feedstock for the production of phthalic anhydride. However, we are the only North American phthalic anhydride producer capable of utilizing both orthoxylene and naphthalene for this production. Our ability to utilize naphthalene as a by-product of coal tar distillation gives us a stable supply of feedstock. We believe that our ability to utilize our internally produced naphthalene gives us a lower-cost feedstock for the production of phthalic anhydride because historically our cost to produce naphthalene has been lower than our cost to purchase orthoxylene. We have two primary competitors in the North American phthalic anhydride merchant market.

Creosote

We produce creosote as a co-product of the tar distillation process. Sales terms for external creosote sales are negotiated by centralized sales departments in the United States, Australia and Europe and are generally evidenced by long-term sales contracts and purchase orders.

In the United States, creosote is used as a commercial wood treatment to preserve railroad crossties and lumber, utility poles and piling. The majority of our domestically produced creosote is sold to our Railroad & Utility Products business. In Australia, China and Europe, creosote is sold into the carbon black market for use as a feedstock in the production of carbon black. In Australia, the majority of creosote generated at our tar distillation facility is sold to our carbon black facility. In Europe and China creosote is sold to wood treaters as well as various carbon black producers.

Globally, approximately 47% of our total creosote production was sold internally in 2006. Our wood treating plants in the United States and our carbon black facility in Australia purchase substantially all of their creosote from our tar distillation plants. We believe we are the only major competitor in these markets that is integrated in this fashion. The remainder of our creosote is sold to railroads, other wood treaters and carbon black manufacturers. We have several competitors in the creosote market.

Other Products

Carbon Black. We manufacture carbon black at our plant in Australia using both petroleum oil and coal tar based feedstocks, which are subjected to heat and rapid cooling within a reactor. During 2006 we initiated a capital project to expand our capacity at our carbon black facility by approximately 40%; the additional capacity is expected to come online in the first quarter of 2007. Coal tar based carbon black is used in the manufacture of rubber tires as well as other specialty applications.

Furnace Coke. We produce furnace coke at one plant in the United States using coal as the primary raw material. Sales terms are negotiated by a centralized sales department in the United States, and all coke is currently sold to one customer under a three-year sales contract which expires December 31, 2009. The contract also has certain renewal provisions beyond the three year term.

Furnace coke is a carbon and fuel source required in the manufacturing of steel. Coal, the primary raw material, is carbonized in oxygen-free ovens to obtain the finished product. Coke manufacturers are either an integrated part of a steel company or, as in our case, operate independently and are known as “merchant producers.”

Our coke business consists of one production facility located in Monessen, Pennsylvania, which produces furnace coke. The plant consists of two batteries with a total of 56 ovens and has a total capacity of approximately 360,000 tons of furnace coke per year. All of the ovens were rebuilt in 1980 and 1981, which, together with recent improvements, makes our Monessen facility one of the most modern coking facilities in the United States.

7

Tax Relief and Health Care Act of 2006. In December 2006, the Tax Relief and Health Care Act of 2006 was signed into law. While the legislation extends (and in some cases expands) several business-favorable provisions that had expired at the end of 2005, it includes a particular provision that affects our ability to claim non-conventional fuel tax credits. Prior to this new legislation, our ability to claim non-conventional fuel tax credits as a result of the production and sale of coke at our Monessen facility was limited by a phase-out provision that reduced or eliminated the non-conventional fuel tax credit if the reference price of oil was within (or exceeded) a phase-out range. The application of the phase-out provision, however, was revised to no longer apply to facilities producing coke or coke gas otherwise eligible for the credit by the Tax Relief and Health Care Act of 2006. This revision applied to coke or coke gas produced and sold after December 31, 2005, allowing us to earn tax credits for the entire 2006 year without having the credits be subject to the phase-out.

Timber Preservation Chemicals. We are also a 51% owner of a timber preservation chemicals business that operates throughout Australia, New Zealand, Southeast Asia and South Africa. Timber preservation chemicals are used to impart durability to timber products used in building and construction, agricultural and heavy-duty industrial markets. The most commonly used chemicals are copper chrome arsenates, light organic solvent preservatives, copper co-biocides, sapstain control products and creosote.

Roofing Pitch andRefined Tars.Roofing pitch and refined tars are also produced in smaller quantities and are sold into the commercial roofing and pavement sealer markets, respectively. Koppers Inc. sells roofing warranties to certain customers for its built-up roofing systems which are installed by third party contractors, approved by Koppers Inc., who use its roofing products.

Benzole.Benzole is produced in the United Kingdom and at our Monessen facility and is used in the production of benzene, toluene and xylene.

We have several global competitors in the carbon pitch market, primarily in Europe and Asia.

Coal tar is purchased from a number of outside sources as well as from our Monessen facility. Primary suppliers are United States Steel Corporation, Mittal Steel USA, China Steel Chemical Corporation, Bluescope Steel (AIS) Pty. Limited, OneSteel Manufacturing Pty. Ltd., Corus Group PLC and Mountain States Carbon.

Management believes that our ability to source coal tar and carbon pitch from overseas markets through our foreign operations, as well as our research of petroleum feedstocks, will assist in securing an uninterrupted supply of carbon pitch feedstocks. However, we may experience shortages of coal tar due to unforeseen circumstances. For example, we declared force majeure in July 2006 with respect to certain North American customer contracts as a result of an extended strike and reduced coke production at certain suppliers, which resulted in a shortage of raw materials needed to fulfill customer commitments. We subsequently declared an end to the force majeure declaration in December 2006.

Seasonality

Demand for certain products such as roofing pitch and refined tars may decline during winter months due to weather conditions. As a result, operating results may vary from quarter to quarter depending on the severity of weather conditions and other variables affecting our products.

Acquisitions/Joint Ventures

Reilly Acquisition. On April 28, 2006 we acquired certain assets of Reilly Industries, Inc.’s (“Reilly”) carbon materials business. The purchased assets consist primarily of inventories, customer sales contracts, raw material supply contracts, rail car leases and a non-compete agreement. We have integrated the additional tar distillation production at our existing facilities in the U.S. Net sales from the date of acquisition to December 31, 2006 totaled $55.8 million.

Lambson Acquisition.In the second quarter of 2005, our subsidiary located in the United Kingdom purchased the specialty chemical business and certain related assets of Lambson Speciality Chemicals Limited (“Lambson”). Net sales for the years ended December 31, 2006 and 2005 amounted to $18.0 million and $11.2 million, respectively.

8

China Joint Venture.In December 2006, we entered into a joint venture agreement with two Chinese companies to construct a tar distillation facility in the Hebei Province near the Jingtang Port. The plant will be capable of distilling approximately 300,000 metric tons of tar into various products including carbon pitch, carbon black feedstock oils, and naphthalene. We will own a 30% interest in the facility and will partner with Kailuan Clean Coal Company, Ltd and Tangshan Iron & Steel Group Company, Limited. Tangshan Iron & Steel is our joint venture partner for our existing Chinese tar distillation facility, Koppers (China) Carbon & Chemical Co., Ltd. The plant will be located near Kailuan’s coke batteries, which will provide coal tar to the plant for use as a raw material. The plant will also be located near our other joint venture in Tangshan, which includes a port facility to provide export capabilities. We will be responsible for export sales of carbon pitch, naphthalene and carbon black feedstock oils from the facility. We expect to use carbon pitch produced at this facility to help us meet expanding global aluminum industry demands. Carbon black feedstock oils and naphthalene are expected to be sold primarily into the local Chinese carbon black and superplasticizer markets, respectively. Other related coal tar products will be sold locally as well. The startup of the new plant is planned for 2008.

Railroad & Utility Products

We market commercial wood treatment products primarily to the railroad and public utility markets in the United States and Australasia. The Railroad & Utility Products business’ profitability is influenced by the demand for railroad products by Class 1 railroads, demand for transmission and distribution poles by electric and telephone utilities and its cost to procure wood. For the year ended December 31, 2006, sales of railroad products and services represented approximately 81% of the Railroad & Utility Products business’ net sales. Railroad products include procuring and treating items such as crossties, switch ties and various types of lumber used for railroad bridges and crossings. Utility products include transmission and distribution poles for electric and telephone utilities and piling used in industrial foundations, beach housing, docks and piers. The Railroad & Utility Products business operates 16 wood treating plants, one co-generation facility and pole distribution yards located throughout the United States and Australia. Our network of plants is strategically located near timber supplies to enable us to access raw materials and service customers effectively. In addition, our crosstie treating plants typically abut railroad customers’ track lines, and our pole distribution yards are typically located near our utility customers.

Our Railroad & Utility Products business manufactures its primary products and sells them directly to our customers through long-term contracts and purchase orders negotiated by our regional sales personnel and coordinated through our marketing group at corporate headquarters. We maintain inventories at our plant locations and procurement yards and do not factor our inventories or receivables to third parties.

The Railroad & Utility Products business’ largest customer base is the Class 1 railroad market, which buys approximately 84% of all crossties produced in the United States and Canada. We have also been expanding key relationships with some of the approximately 550 short-line and regional rail lines. The railroad crosstie market is a mature market with approximately 21 million replacement crossties purchased during 2006, representing an estimated $700 million in sales. We currently have contracts with six of the seven North American Class 1 railroads and have enjoyed long-standing relationships with this important customer base. These relationships have been further strengthened recently due to our ability to absorb additional treating volumes into our existing infrastructure, with such additional volumes resulting from the exit of a major competitor from the wood treating business. We intend to focus on integrating this additional treating volume while capitalizing on our relationships with railroads by offering an expanded list of complementary product offerings that the railroads may be interested in outsourcing.

We believe we are the largest supplier of railroad crossties in North America. Competitive factors in the railroad crosstie market include price, quality, service and security of supply. We believe we have a competitive advantage due to our national network of treating plants and direct access to our major customers’ rail lines, which provide for security of supply and logistics advantages for our customers.

Historically, investment trends in track maintenance by domestic railroads have been linked to general economic conditions in the country. During recessions, the railroads have typically deferred track maintenance until economic conditions improve. Recently, the Class 1 railroads have increased their spending on track maintenance, which has caused an increase in demand for railroad crossties. Management believes this increase in demand will continue for the near term.

Hardwoods, such as oak and other species, are the major raw materials in wood crossties. Hardwood prices, which account for approximately 65% of a finished crosstie’s cost, fluctuate with the demand from competing hardwood lumber markets, such as oak flooring, pallets and other specialty lumber products. Normally, raw material price fluctuations are passed through to the customer according to the terms of the applicable contract. Weather conditions can be a factor in the supply of raw material, as unusually wet conditions may make it difficult to harvest timber.

9

In the United States, hardwood lumber is procured by us from hundreds of small sawmills throughout the northeastern, midwestern and southern areas of the country. The crossties are shipped via rail car or trucked directly to one of our eleven crosstie treating plants, all of which are on line with a major railroad. The crossties are either air-stacked for a period of six to twelve months or artificially dried by a process called boultonizing. Once dried, the crossties are pressure treated with creosote, a product of our Carbon Materials & Chemicals business.

Our sales to the railroad industry are coordinated through our office in Pittsburgh, Pennsylvania, and are primarily from long-term contracts from one to seven years on a requirements basis. There are several principal regional competitors in this North American market.

10

We believe that the threat of substitution for the wood crosstie is low due to the higher cost of alternative materials. Concrete crossties, however, have been identified by the railroads as a feasible alternative to wood crossties in limited circumstances. In 1991, we acquired a 50% partnership interest in KSA Limited Partnership, a concrete crosstie manufacturing facility in Portsmouth, Ohio, in order to take advantage of this growth opportunity. In 2006, an estimated 1.4 million concrete crossties, or 8% of total tie insertions, were installed by Class 1 railroads. We believe that concrete crossties will continue to command approximately this level of market share. While the cost of material and installation of a concrete crosstie is much higher than that of a wood crosstie, the average lives of wood and concrete crossties are similar.

Seasonality

Demand for railroad crossties may decline during winter months due to inclement weather conditions which make it difficult to install railroad crossties. As a result, operating results may vary from quarter to quarter depending on the severity of weather conditions and other variables affecting our products.

Utility poles are produced mainly from softwoods such as pine and fir in the United States and from hardwoods of the eucalyptus species in Australia. Most of these poles are purchased from large timber owners and individual landowners and shipped to one of our pole-peeling facilities. While crossties are treated exclusively with creosote, we treat poles with a variety of preservatives, including pentachlorophenol, copper chrome arsenates and creosote.

In the United States the market for utility pole products is characterized by a large number of small, highly competitive producers selling into a price-sensitive industry. The utility pole market is highly fragmented domestically, with over 200 investor-owned electric and telephone utilities and 2,900 smaller municipal utilities and rural electric associations. Approximately 2.25 million poles are purchased annually in the United States, with a smaller market in Australia. In recent years we have seen our utility pole volumes decrease due to industry deregulation, its impact on maintenance programs, and overcapacity in the pole treating business. We expect demand for utility poles to remain at low levels. In Australia, in addition to utility poles, we market smaller poles to the agricultural, landscape and vineyard markets.

During 2006, sales of pole products accounted for approximately 19% of Railroad & Utility Products’ net sales. We have nine principal competitors in the utility products market. There are few barriers to entry in the utility products market, which consists of regional wood treating companies operating small to medium-size plants and serving local markets.

Equity Investments

Domestic Joint Venture: KSA Limited Partnership

KSA Limited Partnership, located in Portsmouth, Ohio, produces concrete crossties, a complementary product to our wood treatment crosstie business. We own 50% of KSA, with the other 50% owned by subsidiaries of Lehigh Cement Company. KSA Limited Partnership also provides concrete turnouts, used in rail traffic switching, and used crosstie rehabilitation.

Research and Development

As of December 31, 2006, we had 12 full-time employees engaged in research and development and technical service activities. Our research efforts are directed toward new product development regarding alternate uses for coal tar and technical service efforts to promote the use of creosote. We believe the research and technical efforts provided in these areas are adequate to maintain a leadership position in the technology related to these products. Expenditures for research and development for 2006, 2005 and 2004 were $2.5 million, $2.8 million and $2.2 million, respectively.

Technology and Licensing

In 1988, we acquired certain assets from Koppers Company, Inc., including the patents, patent applications, trademarks, copyrights, transferable licenses, inventories, trade secrets and proprietary processes used in the businesses acquired. The most important trademark acquired was the name “Koppers.” The association of the name with the chemical, building, wood preservation and coke industries is beneficial to our company, as it represents long-standing, high quality products. As long as we continue to use the name “Koppers” and comply with applicable registration requirements, our right to use the name “Koppers” should continue without expiration. The expiration of other intellectual property rights is not expected to materially affect our business.

11

Backlog

Generally, Koppers does not manufacture its products against a backlog of orders. Inventory and production levels are typically driven by expectations of future demand based on contractual obligations.

Segment Information

Reference is made to Note 9, “Segment Information,” under Item 8 of this Form 10-K for financial information relating to business segments.

Non-U.S. Operations

Koppers has a significant investment in non-U.S. operations. Therefore, we are subject to certain risks that are inherent to foreign operations, including political and economic conditions in international markets and fluctuations in foreign exchange rates. While a significant majority of our sales and income is generated by operations in the United States, Canada, the United Kingdom, Scandinavia and Australia, our remaining sales and income are generated from operations in developing regions, such as Asia.

Environmental Matters

Our operations and properties are subject to extensive federal, state, local and foreign environmental laws and regulations relating to protection of the environment and human health and safety, including those concerning the treatment, storage and disposal of wastes, the investigation and remediation of contaminated soil and groundwater, the discharge of effluents into waterways, the emission of substances into the air, as well as various health and safety matters. Environmental laws and regulations are subject to frequent amendment and have historically become more stringent. We have incurred and could incur in the future significant costs as the result of our failure to comply with, and liabilities under, environmental laws and regulations, including cleanup costs, civil and criminal penalties, injunctive relief and denial or loss of, or imposition of significant restrictions on, environmental permits. In addition, we have been and could in the future be subject to suit by private parties in connection with alleged violations of, or liabilities under, environmental laws and regulations.

We accrue for environmental liabilities when a determination can be made that they are probable and reasonably estimable. Total environmental reserves at December 31, 2006 and 2005 were approximately $5.6 million and $3.8 million, respectively, which include provisions primarily for environmental fines and soil remediation. For the last three years, our annual capital expenditures in connection with environmental control facilities averaged approximately $3.3 million, and annual operating expenses for environmental matters, excluding depreciation, averaged approximately $10.5 million. Management estimates that capital expenditures in connection with matters relating to environmental control facilities will be approximately $11 million for 2007. We believe that we will have continuing significant expenditures associated with compliance with environmental laws and regulations and, to the extent not covered by insurance or available recoveries under third-party indemnification arrangements, for present and future remediation efforts at plant sites and third-party waste sites and other liabilities associated with environmental matters. There can be no assurance that these expenditures will not exceed current estimates and will not have a material adverse effect on our business, financial condition, cash flow and results of operations. See Note 19 of the Notes to Consolidated Financial Statements, “Environmental and Other Litigation Matters.”

Employees and Employee Relations

As of December 31, 2006, we employed 675 salaried employees and 1,308 non-salaried employees. Listed below is a breakdown of employees by our businesses, including administration.

| | | | | | |

Business | | Salaried | | Non-Salaried | | Total |

Carbon Materials & Chemicals | | 366 | | 630 | | 996 |

Railroad & Utility Products | | 229 | | 678 | | 907 |

Administration | | 80 | | — | | 80 |

| | | | | | |

Total Employees | | 675 | | 1,308 | | 1,983 |

| | | | | | |

12

Of our employees, approximately 67% are represented by 21 different labor unions and are covered under numerous labor contracts. The United Steelworkers of America currently represents more than 500 of our employees at ten of our facilities and, therefore, represents the largest number of our unionized employees. Labor contracts that expire in 2007 cover approximately 12% of our total labor force.

Internet Access

Our Internet address iswww.koppers.com. Our recent filings on Form 10-K, 10-Q and 8-K and any amendments to those documents can be accessed without charge on our website under Investor Relations-SEC Filings.

13

You should carefully consider the risks described below before investing in our publicly traded securities. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as competition, technological obsolescence, labor relations, general economic conditions, geopolitical events and international operations. Additional risks not currently known to us or that we currently believe are immaterial may also impair our business operations and our liquidity.

RISKS RELATING TO OUR BUSINESS

We may not be able to compete successfully in any or all of the industry segments in which we operate.

The markets in which we operate are highly competitive, and this competition could harm our business, results of operations, cash flow and financial condition. If we are unable to respond successfully to changing competitive conditions, the demand for our products could be affected. We believe that the most significant competitive factor for our products is selling price. Additionally, some of the purchasers of our coke are capable of supplying a portion of their needs from their own coke production as well as from suppliers outside the United States who are able to import coke into the United States and sell it at prices competitive with those of U.S. suppliers. Some of our competitors have greater financial resources and larger capitalization than we do.

Demand for our products is cyclical and we may experience prolonged depressed market conditions for our products.

Our products are sold primarily in mature markets which historically have been cyclical, such as the aluminum, specialty chemical and utility industries.

| | • | | The principal consumers of our carbon pitch are primary aluminum smelters. Although the aluminum industry has experienced growth on a long-term basis, there may be cyclical periods of weak demand which could result in decreased primary aluminum production. Our pitch sales have historically declined during such cyclical periods of weak global demand for aluminum. |

| | • | | The principal use of our phthalic anhydride is in the manufacture of plasticizers and flexible vinyl, which are used mainly in the housing and automobile industries. Therefore, a decline in remodeling and construction or global automobile production could reduce the demand for phthalic anhydride. |

| | • | | The principal customers for our coke are U.S. integrated steel producers. The prices at which we will be able to sell our coke in the future will be greatly affected by the demand for coke from the steel industry and the supply of coke from the U.S. integrated steel producers’ own coke production and from foreign sources. |

| | • | | Over the last several years, utility pole demand has declined as utilities in the United States and Australia have reduced spending due to competitive pressures arising from deregulation. Deregulation may continue to negatively affect both the new and replacement pole installation markets. |

We are dependent on major customers for a significant portion of our net sales, and the loss of one or more of our major customers could result in a significant reduction in our profitability.

For the year ended December 31, 2006, our top ten customers accounted for approximately 44% of our net sales. During this period, our two largest customers each accounted for approximately 10% and 8%, respectively, of our total net sales. Additionally, an integrated steel company representing approximately 6% of total net sales is the only customer for our furnace coke, with a contract to take 100% of our coke production through 2009. The permanent loss of, or a significant decrease in the level of purchases by, one or more of our major customers could result in a significant reduction in our profitability.

Fluctuations in the price, quality and availability of our primary raw materials could reduce our profitability.

Our operations depend on an adequate supply of quality raw materials being available on a timely basis. The loss of a key source of supply or a delay in shipments could cause a significant increase in our operating expenses. For example, our operations are highly dependent on a relatively small number of freight transportation services. We are also dependent on utilizing specialized ocean-going transport vessels, several of which we own or lease, to deliver raw materials to our facilities and finished goods to our customers. Interruptions in such freight services could impair our ability to receive raw materials and ship finished products in a timely manner. We are also exposed to price and quality risks associated with raw material purchases. Such risks include:

14

| | • | | The primary raw material used by our Carbon Materials & Chemicals business is coal tar, a by-product of coke production. A shortage in the supply of domestic coal tar or a reduction in the quality of coal tar could require us to increase coal tar and carbon pitch imports, as well as the use of petroleum substitutes to meet future carbon pitch demand. This could cause a significant increase in our operating expenses if we are unable to pass these costs on to our customers. |

| | • | | We experienced a shortage of coal tar that caused us to issue force majuere letters to our North American carbon materials customers in July 2006. Although we declared an end of force majuere by December 31, 2006, the events which caused the shortage were beyond our control. We may experience similar shortages of coal tar in the future. |

| | • | | In certain circumstances coal tar may also be used as an alternative to fuel. Recent increases in energy prices have resulted in higher coal tar costs which we attempt to pass through to our customers. If these costs cannot be passed through, it could result in margin reductions for our coal tar-based products. |

| | • | | The availability and cost of softwood and hardwood lumber are critical elements in our production of pole products and railroad crossties, respectively. The supply of trees of acceptable size for the production of utility poles has decreased in recent years in relation to the demand, and we have been required to pay a higher price for these materials. Historically, the supply and cost of hardwood for railroad crossties have also been subject to availability and price pressures. We may not be able to source wood raw materials at economical prices in the future. |

| | • | | Metallurgical coal is the primary raw material used in the production of coke. An increase in the price of metallurgical coal, or a prolonged interruption in its supply, could increase our operating expenses. |

| | • | | Our price realizations and profit margins for phthalic anhydride have historically fluctuated with the price of orthoxylene and its relationship to our cost to produce naphthalene; however, during periods of excess supplies of phthalic anhydride, margins may be reduced despite high levels for orthoxylene prices. |

If the costs of raw materials increase significantly and we are unable to offset the increased costs with higher selling prices, our profitability will decline.

Our products may be rendered obsolete or less attractive by changes in regulatory, legislative or industry requirements.

Changes in regulatory, legislative or industry requirements may render certain of our products obsolete or less attractive. Our ability to anticipate changes in these requirements, especially changes in regulatory standards, will be a significant factor in our ability to remain competitive. We may not be able to comply in the future with new regulatory, legislative and/or industrial standards that may be necessary for us to remain competitive and certain of our products may, as a result, become obsolete or less attractive to our customers.

The development of new technologies or changes in our customers’ products could reduce the demand for our products.

Our products are used for a variety of applications by our customers. Changes in our customers’ products or processes may enable our customers to reduce consumption of the products we produce or make our products unnecessary. Customers may also find alternative materials or processes that no longer require our products. For example, in 2000 our largest carbon pitch customer announced that it was actively pursuing alternative anode technology that would eliminate the need for carbon pitch as an anode binder. The potential development and implementation of this new technology could seriously impair our ability to profitably market carbon pitch and related co-products. A substantial portion of our carbon pitch is sold to the aluminum industry under long-term contracts typically ranging from three to five years. If a new technology were developed that replaced the need for carbon pitch in the production of carbon anodes, it is possible that these contracts would not be renewed in the future.

Hazards associated with chemical manufacturing may cause suspensions or interruptions of our operations.

Due to the nature of our business, we are exposed to the hazards associated with chemical manufacturing and the related storage and transportation of raw materials, products and wastes in our manufacturing facilities or our distribution centers, such as fires, explosions and accidents that could lead to an interruption or suspension of operations. Any disruption could reduce the productivity and profitability of a particular manufacturing facility or of our company as a whole. Other hazards include:

| | • | | piping and storage tank leaks and ruptures; |

15

| | • | | exposure to hazardous substances; and |

| | • | | chemical spills and other discharges or releases of toxic or hazardous substances or gases. |

These hazards, among others, may cause personal injury and loss of life, damage to property and contamination of the environment, which could lead to government fines or work stoppage injunctions, cleanup costs and lawsuits by injured persons. While we are unable to predict the outcome of such matters, if determined adversely to us, we may not have adequate insurance to cover related costs or liabilities and, if not, we may not have sufficient cash flow to pay for such costs or liabilities. Such outcomes could harm our customer goodwill and reduce our profitability.

We are subject to extensive environmental laws and regulations and may incur significant costs as a result of continued compliance with, violations of or liabilities under environmental laws and regulations.

Like other companies involved in environmentally sensitive businesses, our operations and properties are subject to extensive federal, state, local and foreign environmental laws and regulations, including those concerning, among other things:

| | • | | the treatment, storage and disposal of wastes; |

| | • | | the investigation and remediation of contaminated soil and groundwater; |

| | • | | the discharge of effluents into waterways; |

| | • | | the emission of substances into the air; |

| | • | | the marketing, sale, use and registration of our chemical products, such as creosote; and |

| | • | | other matters relating to environmental protection and various health and safety matters. |

We have incurred, and expect to continue to incur, significant costs to comply with environmental laws and as a result of remedial obligations. We could incur significant costs, including cleanup costs, fines, civil and criminal sanctions and claims by third parties for property damage and personal injury, as a result of violations of or liabilities under environmental laws and regulations. We accrue for environmental liabilities when a determination can be made that they are probable and reasonably estimable. Total environmental reserves at December 31, 2006 and December 31, 2005 were approximately $5.6 million and $3.8 million, respectively, which include provisions primarily for environmental fines and remediation. For the last three fiscal years, our annual capital expenditures in connection with environmental control facilities averaged approximately $3.3 million, and annual operating expenses for environmental matters, excluding depreciation, averaged approximately $10.5 million. Management estimates that capital expenditures in connection with matters relating to environmental control facilities will be approximately $11.0 million for 2007. Contamination has been identified and is being investigated and remediated at many of our sites by us or other parties.

Actual costs and liabilities to us may exceed forecasted amounts. Moreover, currently unknown environmental issues, such as the discovery of additional contamination or the imposition of additional cleanup obligations with respect to our sites or third party sites, may result in significant additional costs, and potentially significant expenditures could be required in order to comply with future changes to environmental laws and regulations or the interpretation or enforcement thereof. We also are involved in various litigation and proceedings relating to environmental matters and toxic tort claims which are described in detail in Note 19 of the consolidated financial statements.

Beazer East and Beazer Limited may not continue to meet their obligations to indemnify us.

Under the terms of the asset purchase agreement between us and Koppers Company, Inc. (now known as Beazer East, Inc.) upon the formation of Koppers Inc. in 1988, subject to certain limitations, Beazer East assumed the liability for and indemnified us against (among other things) certain clean-up liabilities for contamination occurring prior to the purchase date at sites acquired from Beazer East and third-party claims arising from such contamination (the “Indemnity”). Beazer East and Beazer Limited may not continue to meet their obligations. In addition, Beazer East could in the future choose to challenge its obligations under the Indemnity or our satisfaction of the conditions to indemnification imposed on us thereunder. In addition, the government and other third parties also have the right under applicable environmental laws to seek relief directly from us for any and all such costs and liabilities. In July 2004, we entered into an agreement with Beazer East to amend the December 29, 1988 asset purchase agreement to provide, among other things, for the continued tender of pre-closing environmental liabilities to Beazer East under the Indemnity through July 2019. As consideration for the agreement, we agreed to pay Beazer East a total of $7.0 million in four installments over three years and to share toxic tort litigation defense costs arising from any sites acquired from Beazer East. The first three payments of $2.0 million each were made in July 2004, July 2005 and July 2006. Qualified expenditures under the Indemnity are not subject to a monetary limit.

16

The Indemnity provides for the resolution of issues between Koppers Inc. and Beazer East by an arbitrator on an expedited basis upon the request of either party. The arbitrator could be asked, among other things, to make a determination regarding the allocation of environmental responsibilities between Koppers Inc. and Beazer East. Arbitration decisions under the Indemnity are final and binding on the parties. Periodically, issues have arisen between Koppers Inc. and Beazer East and/or other indemnitors that have been resolved without arbitration. Koppers Inc. and Beazer East are currently in discussions that involve, among other things, the allocation of environmental costs related to certain operating and closed facilities.

Without reimbursement under the Indemnity, the obligation to pay the costs and assume the liabilities relating to these matters would have a significant impact on our net income. Furthermore, without reimbursement, we could be required to record a contingent liability on our balance sheets with respect to environmental matters covered by the Indemnity, which could result in our having significant additional negative net worth. Finally, the Indemnity does not afford us indemnification against environmental costs and liabilities attributable to acts or omissions occurring after the closing of the acquisition of assets from Beazer East under the asset purchase agreement, nor is the Indemnity applicable to liabilities arising in connection with other acquisitions by us after that closing.

The insurance that we maintain may not fully cover all potential exposures.

We maintain property, casualty and workers’ compensation insurance but such insurance may not cover all risks associated with the hazards of our business and is subject to limitations, including deductibles and maximum liabilities covered. We may incur losses beyond the limits, or outside the coverage, of our insurance policies, including liabilities for environmental compliance and remediation. In addition, from time to time, various types of insurance for companies in our industry have not been available on commercially acceptable terms or, in some cases, have not been available at all. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

Adverse weather conditions may reduce our operating results.

Our quarterly operating results fluctuate due to a variety of factors that are outside our control, including inclement weather conditions, which in the past have caused a decline in our operating results. For example, adverse weather conditions have at times negatively impacted our supply chain as wet conditions impacted logging operations, reducing our ability to procure crossties. In addition, adverse weather conditions have had a negative impact on our customers in the roofing and pavement sealer businesses, resulting in a negative impact on our sales of these products. Moreover, demand for many of our products declines during periods of inclement weather.

We are subject to risks inherent in foreign operations, including changes in social, political and economic conditions.

We have operations in the United States, Australasia, China, Europe and South Africa, and sell our products in many foreign countries. For the year ended December 31, 2006, net sales from our products sold by Koppers Europe ApS and Koppers Australia Pty Ltd. (“Koppers Australia”) accounted for approximately 35% of our total net sales. Like other global companies, we are exposed to market risks relating to fluctuations in interest rates and foreign currency exchange rates. Our international revenues could be reduced by currency fluctuations or devaluations. Changes in currency exchange rates could lower our reported revenues and could require us to reduce our prices to remain competitive in foreign markets, which could also reduce our profitability. We have not historically hedged our financial statement exposure and, as a result, we could incur unanticipated losses. We are also subject to potentially increasing transportation and shipping costs associated with international operations.

Furthermore, we are also exposed to risks associated with changes in the laws and policies governing foreign investments in countries where we have operations as well as, to a lesser extent, changes in U.S. laws and regulations relating to foreign trade and investment.

Our strategy to selectively pursue complementary acquisitions may present unforeseen integration obstacles or costs.

Our business strategy includes the potential acquisition of businesses and entering into joint ventures and other business combinations that we expect would complement and expand our existing products and the markets where we sell our products and improve our market position. We may not be able to successfully identify suitable acquisition or joint venture opportunities or complete any particular acquisition, combination, joint venture or other transaction on acceptable terms. We cannot predict the timing and success of our efforts to acquire any particular business and integrate the acquired business into our existing operations. Also, efforts to acquire other businesses or the implementation of other elements of this business strategy may divert managerial resources away from our business operations. In addition, our ability to engage in strategic acquisitions may depend on our ability to raise substantial capital and we may not be able to raise the funds necessary to implement our acquisition strategy on terms satisfactory to

17

us, if at all. Our failure to identify suitable acquisition or joint venture opportunities may restrict our ability to grow our business. In addition, we may not be able to successfully integrate businesses that we acquire in the future, which could lead to increased operating costs, a failure to realize anticipated operating synergies or both.

We are the subject of ongoing investigations regarding our competitive practices, which may result in fines or other penalties.

In April 2005, the New Zealand Commerce Commission (the “NZCC”), filed a Statement of Claim in the High Court of New Zealand against a number of corporate and individual defendants, including Koppers Arch Wood Protection (NZ) Limited (“KANZ”), Koppers Arch Investments Pty Limited (“KAI”), Koppers Australia and a number of other corporate and individual defendants. This followed an investigation by the NZCC into the competitive practices of the wood preservative industry in New Zealand. KANZ and Koppers Arch Australia are majority-owned subsidiaries of Koppers Arch Investments Pty Limited, which is an Australian joint venture owned 51% by World-Wide Ventures Corporation (our indirect subsidiary) and 49% by Hickson Nederland BV. KANZ and Koppers Arch Australia manufacture and market wood preservative products throughout New Zealand and Australia, respectively.

In February 2006, the NZCC, KANZ, KAI and Koppers Australia executed a cooperation agreement (the “Cooperation Agreement”) which was subsequently approved by the New Zealand High Court on April 6, 2006. The Cooperation Agreement provided, among other things, that KANZ, KAI and Koppers Australia cooperate with the NZCC until such time as the NZCC’s investigation and any related court proceedings have been concluded. It also provided that the NZCC discontinue all proceedings against Koppers Australia and that the NZCC assess penalties against KANZ and KAI for breaches of the New Zealand Commerce Act of 1986 (the “Commerce Act”). Total accruals in 2006 and 2005 for the penalties, costs and proposed settlements of other certain contingent liabilities totaled $3.0 million of which $2.6 million was paid in the second quarter of 2006. As ordered by the High Court, the NZCC has discontinued all proceedings against Koppers Australia.

In January 2007, Timtech Chemicals Limited (“Timtech”) filed a Statement of Claim in the High Court of New Zealand against a number of corporate and individual defendants, including KANZ, KAI, Koppers Australia and a number of other corporate and individual defendants. The Statement of Claim alleges various causes of action against the defendants including claims related to breaches of the Commerce Act. Timtech is seeking damages against all defendants in the amount of $3.3 million plus exemplary damages and pre-judgment interest in an unspecified amount. We have not provided a reserve for this lawsuit because, at this time, we cannot reasonably determine the probability of loss, and the amount of loss, if any, cannot be reasonably estimated. Although the case will be vigorously defended, an unfavorable resolution of this matter may have a material adverse effect on our business, financial condition, cash flows and results of operations. It is possible that other civil claims could be filed against us. Such other claims, if filed and resolved unfavorably, could have a material adverse effect on our business, financial condition, cash flows and results of operations.

Koppers Arch Australia has made an application for leniency under the Australian Competition and Consumer Commission’s (the “ACCC”) policy for cartel conduct. The ACCC has granted immunity to Koppers Arch Australia, subject to the fulfillment of certain conditions, such as, but not limited to, continued cooperation. If the conditions are not fulfilled, Koppers Arch Australia may be penalized for any violations of the competition laws of Australia. Such penalties, if assessed against Koppers Arch Australia, could have a material adverse effect on its business, financial condition, cash flows and results of operations. No civil claims related to competitive practices in Australia have been filed against us.

Litigation against us could be costly and time consuming to defend, and due to the nature of our business and products, we may be liable for damages arising out of our acts or omissions, which may have a material adverse affect on us.

We produce hazardous chemicals that require appropriate procedures and care to be used in handling them or using them to manufacture other products. As a result of the hazardous nature of some of the products we use and produce, we may face product liability, toxic tort and other claims relating to incidents involving the handling, storage and use of and exposure to our products.

For example, we are a defendant in a significant number of lawsuits in which the plaintiffs claim they have suffered a variety of illnesses (including cancer) and/or property damage as a result of exposure to coal tar pitch, benzene, wood treatment chemicals and other chemicals, including certain cases in state and federal court relating to our Grenada, Mississippi facility. In April 2006, in the first Grenada case to be tried, a jury returned a verdict against us of 20% of $845,000, which was subsequently reduced to 20% of $785,000, for compensatory damages and no liability for punitive damages. We have appealed the judgment but the appellate court has not yet ruled on our appeal. Although we intend to vigorously defend the remaining Grenada and other similar claims against us, an unfavorable verdict or other resolution of these or any future claims against us could have a

18

material affect on our business, financial condition, cash flows and results of operations. A further description of the material claims against us are included in Note 19 of the consolidated financial statements.

We are indemnified for certain product liability exposures under the Indemnity with Beazer East related to products sold prior to the Acquisition. Beazer East and Beazer Limited, pursuant to the Guarantee, may not continue to meet their obligations. In addition, Beazer East could choose to challenge its obligations under the Indemnity or our satisfaction of the conditions to indemnification imposed on us thereunder.

If for any reason (including disputed coverage or financial incapability) one or more of such parties fail to perform their obligations and we are held liable for or otherwise required to pay all or part of such liabilities without reimbursement, the imposition of such liabilities on us could have a material adverse effect on our business, financial condition, cash flows and results of operations. Furthermore, we could be required to record a contingent liability on our balance sheets with respect to such matters, which could result in us having significant additional negative net worth.

In addition to the above, we are regularly subject to legal proceedings and claims that arise in the ordinary course of business, such as workers’ compensation claims, governmental investigations, employment disputes, and customer and supplier disputes arising out of the conduct of our business. Litigation could result in substantial costs and may divert management’s attention and resources away from the day-to-day operation of our business.

Labor disputes could disrupt our operations and divert the attention of our management and may cause a decline in our production and a reduction in our profitability.

Of our employees, approximately 67% are represented by 21 different labor unions and are covered under numerous labor contracts. The United Steelworkers of America currently represents approximately 500 of our employees at ten of our facilities and, therefore, represents the largest number of our unionized employees. Labor contracts that expire in 2007 cover approximately 12% of our total workforce. We may not be able to reach new agreements without union action or on terms satisfactory to us. Any future labor disputes with any such unions could result in strikes or other labor protests, which could disrupt our operations and divert the attention of our management from operating our business. If we were to experience a strike or work stoppage, it may be difficult for us to find a sufficient number of employees with the necessary skills to replace these employees. Any such labor disputes could cause a decline in our production and a reduction in our profitability.

Our pension obligations are currently underfunded. We expect to make significant cash payments to our pension plans, which will reduce the cash available for our business.

As of December 31, 2006, our projected benefit obligation under our defined benefit pension plans exceeded the fair value of plan assets by approximately $34.5 million. The underfunding was caused, in part, by fluctuations in the financial markets that have caused the valuation of the assets in our defined benefit pension plans to be lower than anticipated. During the year ended December 31, 2006 and the year ended December 31, 2005, we contributed $13.3 million and $11.3 million, respectively, to our pension plans. Management expects that any future obligations under our pension plans that are not currently funded will be funded from our future cash flow from operations. If our contributions to our pension plans are insufficient to fund the pension plans adequately to cover our future pension obligations, the performance of the assets in our pension plans does not meet our expectations or other actuarial assumptions are modified, our contributions to our pension plans could be materially higher than we expect, which would reduce the cash available for our business.

We have a substantial amount of indebtedness, which could harm our ability to operate our business, remain in compliance with debt covenants, make payments on our debt and pay dividends.

As of December 31, 2006, we and our subsidiaries had approximately $475.9 million of indebtedness (excluding trade payables and intercompany indebtedness), consisting primarily of our Senior Discount Notes, Koppers Inc.’s Senior Secured Notes and $96.5 million of indebtedness under our senior secured credit facility.

The degree to which we are leveraged could have important consequences, including:

| | • | | our ability to satisfy our obligations under our debt could be affected and any failure to comply with the requirements, including financial and other restrictive covenants, of any of our debt agreements could result in an event of default under the agreements governing such indebtedness; |

| | • | | a substantial portion of our cash flow from operations will be required to make interest and principal payments and may not be available for operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other purposes; |

| | • | | our ability to obtain additional financing in the future may be impaired; |

| | • | | we may be more highly leveraged than our competitors, which may place us at a competitive disadvantage; |

| | • | | our flexibility in planning for, or reacting to, changes in our business and industry may be limited; |

| | • | | our degree of leverage may make us more vulnerable in the event of a downturn in our business, our industry or the economy in general; and |

| | • | | our ability to pay dividends to our shareholders may be impaired. |

Furthermore, we and our subsidiaries may be able to incur substantial additional indebtedness in the future. If we incur additional indebtedness, the magnitude of the risks associated with our substantial leverage, including our ability to service our debt, would increase.

19

Restrictions in our debt agreements could limit our growth and our ability to respond to changing conditions and, in the event of a default, all of these borrowings become immediately due and payable.

Koppers Inc.’s senior secured credit facility and the indentures governing our Senior Discount Notes and Koppers Inc.’s Senior Secured Notes contain a number of significant covenants in addition to covenants restricting the incurrence of additional debt. These covenants limit our ability, among other things, to:

| | • | | incur or guarantee additional debt and issue certain types of preferred stock; |

| | • | | pay dividends on our capital stock or redeem, repurchase or retire our capital stock or subordinated debt; |

| | • | | create liens on our assets; |

| | • | | enter into sale and leaseback transactions; |

| | • | | engage in transactions with our affiliates; |

| | • | | create restrictions on the ability of our restricted subsidiaries to pay dividends or make other payments to us; |

| | • | | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries; and |

| | • | | transfer or issue shares of stock of subsidiaries. |

In addition, Koppers Inc.’s senior secured credit facility contains other and more restrictive covenants. Additionally, it requires us to maintain certain financial ratios and satisfy certain financial condition tests and require us to take action to reduce our debt or take some other action to comply with them.

These restrictions could limit our ability to obtain future financings, make needed capital expenditures, withstand a future downturn in our business or the economy in general or otherwise conduct necessary corporate activities. We may also be prevented from taking advantage of business opportunities that arise because of the limitations that the restrictive covenants under Koppers Inc.’s senior secured credit facility and the indentures governing our senior discount notes and Koppers Inc.’s senior secured notes impose on us.

A breach of any of these covenants would result in a default under the applicable debt agreement. A default, if not waived, could result in acceleration of the debt outstanding under the agreement and in a default with respect to, and acceleration of, the debt outstanding under our other debt agreements and the indentures governing our Senior Discount Notes and Senior Secured Notes. The accelerated debt would become immediately due and payable. If that should occur, we may not be able to pay all such debt or to borrow sufficient funds to refinance it. This would result in a significant interruption in our business operations, which would negatively impact the market price of our common stock. Even if new financing were then available, it may not be on terms that are acceptable to us.

Our substantial negative net worth may require us to maintain additional working capital.

As of December 31, 2006, we had negative net worth of approximately $92.4 million, resulting primarily from the use of borrowings to fund dividends. Our negative net worth may make it difficult for us to obtain credit from suppliers, vendors and other parties. In addition, some of our suppliers and vendors may require us to prepay for services or products or may impose less advantageous terms on timing of payment. Our ability to enter into hedging transactions may also be limited by our negative net worth. As a result, we may require additional working capital, which may negatively affect our cash flow and liquidity.

We may incur significant charges in the event we close all or part of a manufacturing plant or facility.

We periodically assess our manufacturing operations in order to manufacture and distribute our products in the most efficient manner. Based on our assessments, we may make capital improvements to modernize certain units, move manufacturing or distribution capabilities from one plant or facility to another plant or facility, discontinue manufacturing or distributing certain products or close all or part of a manufacturing plant or facility.

20

We depend on our senior management team and the loss of any member could adversely affect our operations.

Our success is dependent on the management, experience and leadership skills of our senior management team. Our senior management team has an average of 25 years of industry experience. The loss of any of these individuals or an inability to attract, retain and maintain additional personnel with similar industry experience could prevent us from implementing our business strategy. We cannot assure you that we will be able to retain our existing senior management personnel or to attract additional qualified personnel when needed.

RISKS RELATING TO OUR COMMON STOCK

Our stock price may be extremely volatile.

There has been significant volatility in the market price and trading volume of equity securities, which is unrelated to the financial performance of the companies issuing the securities. These broad market fluctuations may negatively affect the market price of our common stock.

Some specific factors that may have a significant effect on our common stock market price include: