UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended June 30, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission File Number 1-33094

AMERICAN CARESOURCE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 20-0428568 |

| (State or other jurisdiction of | (I.R.S. employer |

| incorporation or organization) | identification no.) |

| |

| 5429 LYNDON B. JOHNSON FREEWAY |

| SUITE 850 |

| DALLAS, TEXAS |

| 75240 |

| (Address of principal executive offices) |

| (Zip code) |

(972) 308-6830

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Non-accelerated filer o |

Accelerated filer o (do not check if a smaller reporting company) | Smaller Reporting Company x |

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: The number of shares of common stock of registrant outstanding on August 10, 2009 was 15,431,391.

TABLE OF CONTENTS

AMERICAN CARESOURCE HOLDINGS, INC.

FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2009

| Part I | | Financial Information | 1 |

| | Item 1. | | 1 |

| | | | 1 |

| | | | 2 |

| | | | 3 |

| | | | 4 |

| | | | 5 |

| | Item 2. | | 12 |

| | Item 3. | | 21 |

| Part II | | Other Information | 22 |

| | Item 1. | | 22 |

| | Item 2. | | 22 |

| | Item 3. | | 23 |

| | Item 4. | | 23 |

| | | | 24 |

| ITEM 1. | Financial Statements |

AMERICAN CARESOURCE HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Net revenues | | $ | 17,134,653 | | | $ | 13,012,528 | | | $ | 33,190,303 | | | $ | 24,518,203 | |

| Cost of revenues: | | | | | | | | | | | | | | | | |

Provider payments | | | 12,879,496 | | | | 9,554,966 | | | | 24,815,332 | | | | 17,945,576 | |

Administrative fees | | | 778,146 | | | | 751,018 | | | | 1,593,672 | | | | 1,452,694 | |

Claims administration and provider development | | | 1,131,167 | | | | 804,609 | | | | 2,135,740 | | | | 1,513,445 | |

| Total cost of revenues | | | 14,788,809 | | | | 11,110,593 | | | | 28,544,744 | | | | 20,911,715 | |

Contribution margin | | | 2,345,844 | | | | 1,901,935 | | | | 4,645,559 | | | | 3,606,488 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 1,980,887 | | | | 1,194,504 | | | | 3,881,565 | | | | 2,307,358 | |

| Depreciation and amortization | | | 132,315 | | | | 96,606 | | | | 245,112 | | | | 188,672 | |

Total operating expenses | | | 2,113,202 | | | | 1,291,110 | | | | 4,126,677 | | | | 2,496,030 | |

Operating income | | | 232,642 | | | | 610,825 | | | | 518,882 | | | | 1,110,458 | |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

Interest income | | | 35,706 | | | | 31,240 | | | | 76,668 | | | | 71,908 | |

Interest expense | | | - | | | | (1,606 | ) | | | (312 | ) | | | (3,444 | ) |

Unrealized gain on warrant derivative | | | 278,591 | | | | - | | | | 254,109 | | | | - | |

Total other income, net | | | 314,297 | | | | 29,634 | | | | 330,465 | | | | 68,464 | |

| | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 546,939 | | | | 640,459 | | | | 849,347 | | | | 1,178,922 | |

| Income tax provision | | | 13,163 | | | | 19,019 | | | | 36,512 | | | | 36,064 | |

| Net income | | $ | 533,776 | | | $ | 621,440 | | | $ | 812,835 | | | $ | 1,142,858 | |

| Earnings per common share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.08 | |

Diluted | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.07 | |

| | | | | | | | | | | | | | | | | |

| Basic weighted average common shares outstanding | | | 15,425,774 | | | | 15,069,007 | | | | 15,422,144 | | | | 14,973,213 | |

Diluted weighted average common shares outstanding | | | 18,054,976 | | | | 17,435,365 | | | | 18,171,233 | | | | 17,343,860 | |

| |

| CONSOLIDATED BALANCE SHEETS | |

| | |

| | | June 30, | | | | |

| | | 2009 | | | December 31, | |

| | | (Unaudited) | | | 2008 | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

Cash and cash equivalents | | $ | 9,906,816 | | | $ | 10,577,829 | |

Accounts receivable, net | | | 6,875,211 | | | | 5,788,457 | |

Prepaid expenses and other current assets | | | 775,916 | | | | 489,928 | |

Deferred income taxes | | | 5,886 | | | | 5,886 | |

Total current assets | | | 17,563,829 | | | | 16,862,100 | |

| | | | | | | | | |

| Property and equipment, net | | | 1,508,935 | | | | 915,224 | |

| | | | | | | | | |

| Other assets: | | | | | | | | |

Deferred income taxes | | | 243,959 | | | | 243,959 | |

Other non-current assets | | | 887,744 | | | | 883,155 | |

Intangible assets, net | | | 1,216,623 | | | | 1,280,656 | |

Goodwill | | | 4,361,299 | | | | 4,361,299 | |

| | | $ | 25,782,389 | | | $ | 24,546,393 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

Due to service providers | | $ | 6,750,646 | | | $ | 5,964,392 | |

Accounts payable and accrued liabilities | | | 2,029,555 | | | | 3,111,862 | |

Total current liabilities | | | 8,780,201 | | | | 9,076,254 | |

| | | | | | | | | |

| Warrant derivative liability | | | 87,693 | | | | - | |

| Long-term debt | | | - | | | | 3,053 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Shareholders' equity: | | | | | | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized, | | | | | | | | |

none issued | | | - | | | | - | |

Common stock, $0.01 par value; 40,000,000 shares authorized; | | | | | | | | |

15,432,338 and 15,406,972 shares issued and outstanding in | | | 154,323 | | | | 154,069 | |

2009 and 2008, respectively | | | | | | | | |

Additional paid-in capital | | | 19,738,507 | | | | 19,046,367 | |

Accumulated deficit | | | (2,978,335 | ) | | | (3,733,350 | ) |

Total shareholders' equity | | | 16,914,495 | | | | 15,467,086 | |

| | | $ | 25,782,389 | | | $ | 24,546,393 | |

| |

| CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY | |

| (Unaudited) | |

| | |

| | | | | | | | | Additional | | | | | | Total | |

| | | Common Stock | | | Paid-in | | | Accumulated | | | Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| Balance at December 31, 2008 | | | 15,406,972 | | | $ | 154,069 | | | $ | 19,046,367 | | | $ | (3,733,350 | ) | | $ | 15,467,086 | |

| Cumulative effect of change in accounting principle- | | | | | | | | | | | | | | | | | | | | |

| January 1, 2009 reclassification of embedded feature | | | | | | | | | | | | | | | | | |

of equity-linked financial instrument to derivative | | | | | | | | | | | | | | | | | | | | |

warrant liability | | | - | | | | - | | | | (316,376 | ) | | | (57,820 | ) | | | (374,196 | ) |

| Net income | | | - | | | | - | | | | - | | | | 812,835 | | | | 812,835 | |

| Stock-based compensation expense | | | - | | | | - | | | | 616,969 | | | | - | | | | 616,969 | |

| Issuance of common stock upon | | | | | | | | | | | | | | | | | | | | |

exercise of stock options | | | 11,922 | | | | 119 | | | | (3,742 | ) | | | - | | | | (3,623 | ) |

| Issuance of common stock warrants | | | | | | | | | | | | | | | | | | | | |

for payment of client management fees | | | - | | | | - | | | | 311,259 | | | | - | | | | 311,259 | |

| Issuance of common stock upon | | | | | | | | | | | | | | | | | | | | |

exercise of stock warrants | | | 13,444 | | | | 135 | | | | 84,030 | | | | - | | | | 84,165 | |

| Balance at June 30, 2009 | | | 15,432,338 | | | $ | 154,323 | | | $ | 19,738,507 | | | $ | (2,978,335 | ) | | $ | 16,914,495 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Six months ended June 30, | |

| | | 2009 | | | 2008 | |

| Cash flows from operating activities: | | | | | | |

Net income | | $ | 812,835 | | | $ | 1,142,858 | |

Adjustments to reconcile net income to net cash | | | | | | | | |

| provided by operations: | | | | | | | | |

Stock-based compensation expense | | | 616,969 | | | | 316,147 | |

Depreciation and amortization | | | 245,112 | | | | 188,672 | |

Unrealized gain on warrant derivative | | | (254,109 | ) | | | - | |

Amortization of long-term client agreement | | | 125,000 | | | | - | |

Client administration fee expense related to warrants | | | 56,022 | | | | 26,455 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | (1,086,754 | ) | | | (770,020 | ) |

Prepaid expenses and other assets | | | (168,312 | ) | | | 13,876 | |

Accounts payable and accrued liabilities | | | (1,047,071 | ) | | | 285,403 | |

Due to service providers | | | 786,254 | | | | 881,081 | |

Net cash provided by operating activities | | | 85,946 | | | | 2,084,472 | |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

Investment in software development costs | | | (329,347 | ) | | | (284,085 | ) |

Additions to property and equipment | | | (437,471 | ) | | | (105,461 | ) |

Net cash used in investing activities | | | (766,818 | ) | | | (389,546 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

Payments on long-term debt | | | (5,501 | ) | | | (27,360 | ) |

Proceeds from exercise of stock warrants | | | 12,650 | | | | - | |

Proceeds from exercise of stock options | | | 2,710 | | | | 137,331 | |

Net cash provided by financing activities | | | 9,859 | | | | 109,971 | |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | (671,013 | ) | | | 1,804,897 | |

| Cash and cash equivalents at beginning of period | | | 10,577,829 | | | | 4,272,498 | |

| | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 9,906,816 | | | $ | 6,077,395 | |

| | | | | | | | | |

| Supplemental non-cash activity: | | | | | | | | |

| Warrants issued as payment of client administrative fees | | $ | 311,259 | | | $ | 161,311 | |

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(tables in thousands, except per share data)

| (1) | Description of Business and Basis of Presentation |

American CareSource Holdings, Inc. (“ACS,” “Company,” the “Registrant,” “we,” “us,” or “our,”) is an ancillary benefits management company that offers cost effective access to a comprehensive national network of ancillary healthcare service providers. The Company’s healthcare payor customers, which include preferred provider organizations (“PPOs”), third party administrators (“TPAs”), insurance companies, large self-funded organizations and Taft-Hartley union plans (i.e., employee benefit plans that are self-administered under collective bargaining agreements), engage the Company to provide them with a complete outsourced solution designed to manage each customer’s obligations to its covered persons. The Company offers its customers this solution by:

| | · | providing payor customers with a comprehensive network of ancillary healthcare services providers that is tailored to each payor customer’s specific needs and is available to each payor customer’s covered persons for covered services; |

| | · | providing payor customers with claims management, reporting, and processing and payment services; |

| | · | performing network/needs analysis to assess the benefits to payor customers of adding additional/different service providers to the payor customer-specific provider networks; and |

| | · | credentialing network service providers for inclusion in the payor customer-specific provider networks. |

ACS was incorporated in Delaware in 2003 as a wholly-owned subsidiary of Patient Infosystems, Inc. (“Patient Infosystems”) in order to facilitate Patient Infosystems’ acquisition of substantially all of the assets of American CareSource Corporation. American CareSource Corporation had been in operation since 1997, and its predecessor company, Physician’s Referral Network, had been in operation since 1995. In December 2005, Patient Infosystems distributed substantially all of its shares of the Company to its then-current stockholders through a dividend, and since that time ACS has been an independent, publicly-traded company.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) interim reporting requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the rules and regulations of the Securities and Exchange Commission (“SEC”). Consequently, financial information and disclosures normally included in financial statements prepared annually in accordance with GAAP have been condensed or omitted. Balance sheet amounts are as of June 30, 2009 and December 31, 2008 and operating result amounts are for the three and six months ended June 30, 2009 and 2008, and include all normal and recurring adjustments that we consider necessary for the fair, summarized presentation of our financial position and operating results. As these are condensed financial statements, readers of this report should, therefore, refer to the consolidated financial statements and the notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2008, filed with the SEC on March 31, 2009.

In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 131, “Disclosures About Segments of an Enterprise and Related Information,” the Company uses the “management approach” for reporting information about segments in annual and interim financial statements. The management approach is based on the way the chief operating decision-maker organizes segments within a company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure and any other manner in which management disaggregates a company. Based on the “management approach” model, the Company has determined that its business is comprised of a single operating segment.

Our interim results of operations are not necessarily indicative of results of operations that will be realized for the full fiscal year.

The Company recognizes revenue on the services that it provides, which includes (i) providing payor clients with a comprehensive network of ancillary healthcare providers, (ii) providing claims management, reporting, processing and payment services, (iii) providing network/need analysis to assess the benefits to payor clients of adding what additional/different service providers to the client-specific provider networks and (iv) providing credentialing of network services providers for inclusion in the client payor-specific provider networks. Revenue is recognized when services are delivered, which occurs after processed claims are billed to the client payors and collections are reasonably assured. The Company estimates revenues and costs of revenues using average historical collection rates and average historical margins earned on claims. Periodically, revenues are adjusted to reflect actual cash collections so that revenues recognized accurately reflect cash collected.

The Company presents its revenues in accordance with EITF No. 99-19 “Reporting Gross Revenue as a Principal vs. Net as an Agent” (EITF 99-19), which requires the determination of whether the Company is acting as a principal or an agent in the fulfillment of the services rendered. After careful evaluation of the key indicators detailed in EITF No. 99-19, the Company acknowledges that while the determination of gross versus net reporting is highly judgmental in nature, the Company has concluded that its circumstances are most consistent with those key indicators that support gross revenue reporting.

Following are the key indicators that support the Company’s conclusion that it acts as a principal under EITF No. 99-19 when settling claims for service providers through its contracted service provider network:

| | · | The Company is the primary obligor in the arrangement. The Company has assessed its role as primary obligor as a strong indicator of gross reporting as described in EITF No. 99-19. The Company believes that it is the primary obligor in its transactions because it is responsible for providing the services desired by its client payors. The Company has distinct, separately negotiated contractual relationships with its client payors and with the ancillary health care providers in its networks. The Company does not negotiate “on behalf of” its client payors and does not hold itself out as the agent of the client payors when negotiating the terms of the Company’s ancillary healthcare service provider agreements. The Company’s agreements contractually prohibit client payors and service providers to enter into direct contractual relationships with one another. The client payors have no control over the terms of the Company’s agreements with the service providers. In executing transactions, the Company assumes key performance-related risks. The client payors hold the Company responsible for fulfillment, as the provider, of all of the services the client payors are entitled to under their contracts; client payors do not look to the service providers for fulfillment. In addition, the Company bears the pricing/margin risk as the principal in the transactions. Because the contracts with the client payors and service providers are separately negotiated, the Company has complete discretion in negotiating both the prices it charges its client payors and the financial terms of its agreements with the service providers. Since the Company’s profit is the spread between the amounts received from the client payors and the amount paid to the service providers, it bears significant pricing/margin risk. There is no guaranteed mark-up payable to the Company on the amount the Company has contracted. Thus, the Company bears the risk that amounts paid to the service provider will be greater than the amounts received from the client payors, resulting in a loss or negative claim. |

| | · | The Company has latitude in establishing pricing. As stated above, the Company has complete latitude in negotiating the price to be paid to the Company by each client payor and the price to be paid to each contracted service provider. This type of pricing latitude indicates that the Company has the risks and rewards normally attributed to a principal in the transactions. |

| | · | The Company changes the product or performs part of the services. The Company provides the benefits associated with the relationships it builds with the client payors and the services providers. While the parties could deal with each other directly, the client payors would not have the benefit of the Company’s experience and expertise in assembling a comprehensive network of service providers, in claims management, reporting and processing and payment services, in performing network/needs analysis to assess the benefits to client payors of adding additional/different service providers to the client payor-specific provider networks, and in credentialing network service providers. |

| | · | The Company has discretion in supplier selection. The Company has complete discretion in supplier selection. One of the key factors considered by client payors who engage the Company is to have the Company undertake the responsibility for identifying, qualifying, contracting with and managing the relationships with the ancillary healthcare service providers. As part of the contractual arrangement between the Company and its client payors, the payors identify their obligations to their respective covered persons and then work with the Company to determine the types of ancillary healthcare services required in order for the payors to meet their obligations. The Company may select the providers and contract with them to provide services at its discretion. |

| | · | The Company is involved in the determination of product or service specifications. The Company works with its client payors to determine the types of ancillary healthcare services required in order for the payors to meet their obligations to their respective covered persons. In some respects, the Company is customizing the product through its efforts and ability to assemble a comprehensive network of providers for its customers that is tailored to each client payor’s specific needs. In addition, as part of its claims processing and payment services, the Company works with the client payors, on the one hand, and the providers, on the other, to set claims review, management and payment specifications. |

| | · | The supplier (and not the Company) has credit risk. The Company believes it has some level of credit risk, but that risk is mitigated because the Company does not remit payment to providers unless and until it has received payment from the relevant client payors following the Company’s processing of a claim. |

| | · | The amount that the Company earns is not fixed. The Company does not earn a fixed amount per transaction nor does it realize a per person per month charge for its services. |

The Company has evaluated the other indicators under EITF 99-19, including whether or not the Company has general inventory risk. The Company does not have any general inventory risk, as its business is not related to the manufacture, purchase or delivery of goods and it does not purchase in advance any of the services to be provided by the ancillary healthcare service providers. While the absence of this risk would be one indicator in support of net revenue reporting, as described in detail above, the Company has carefully evaluated all of the key indicators detailed in EITF No. 99-19 and has concluded that its circumstances are most consistent with those key indicators that support gross revenue reporting.

If the Company were to report its revenues net of provider payments rather than on a gross reporting basis, for the three and six months ended June 30, 2009, its net revenues would have been approximately $4.3 million and $8.4 million, respectively. For the three and six months ended June 30, 2008, its net revenues would have been approximately $3.5 million and $6.6 million, respectively.

During the three and six months ended June 30, 2009 and 2008, two of the Company’s customers comprised a significant portion of the Company’s revenues. The following is a summary of the approximate amounts of the Company’s revenue and accounts receivable contributed by each of those customers as of the dates and for the periods presented (amounts in thousands):

| | | | | | Periods ended June 30, 2009 | | | | | | Periods ended June 30, 2008 | |

| | | As of June | | | | | | | | | | | | | | | As of June | | | | | | | | | | | | | |

| | | 30, 2009 | | | Three months | | | Six months | | | 30, 2008 | | | Three months | | | Six months | |

| | | Accounts | | | | | | % of Total | | | | | | % of Total | | | Accounts | | | | | | % of Total | | | | | | % of Total | |

| | | receivable | | | Revenue | | | Revenues | | | Revenue | | | Revenues | | | receivable | | | Revenue | | | Revenues | | | Revenue | | | Revenues | |

| Customer A | | $ | 3,353 | | | $ | 8,179 | | | | 48 | % | | $ | 16,917 | | | | 51 | % | | $ | 2,183 | | | $ | 7,880 | | | | 60 | % | | $ | 14,947 | | | | 61 | % |

| Customer B | | | 2,401 | | | | 6,851 | | | | 40 | % | | | 13,297 | | | | 40 | % | | | 2,183 | | | | 5,025 | | | | 39 | % | | | 9,040 | | | | 37 | % |

| Others | | | 1,121 | | | | 2,105 | | | | 12 | % | | | 2,976 | | | | 9 | % | | | 55 | | | | 108 | | | | 1 | % | | | 531 | | | | 2 | % |

| | | $ | 6,875 | | | $ | 17,135 | | | | 100 | % | | $ | 33,190 | | | | 100 | % | | $ | 4,421 | | | $ | 13,013 | | | | 100 | % | | $ | 24,518 | | | | 100 | % |

The following table details the reconciliation of basic earnings per share to diluted earnings per share (amounts in thousands except per share amounts):

| | | Three months ended | | | Six months ended | |

| | | June 30, | | | June 30, | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Numerator for basic and diluted earnings per share: | | | | | | | | | | | | |

Net income | | $ | 534 | | | $ | 621 | | | $ | 813 | | | $ | 1,143 | |

| Denominator: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Weighted-average basic common shares outstanding | | | 15,426 | | | | 15,069 | | | | 15,422 | | | | 14,973 | |

Assumed conversion of dilutive securities: | | | | | | | | | | | | | | | | |

Stock options | | | 889 | | | | 806 | | | | 970 | | | | 833 | |

Warrants | | | 1,733 | | | | 1,560 | | | | 1,775 | | | | 1,538 | |

Restricted Stock Units | | | 7 | | | | - | | | | 4 | | | | - | |

| Potentially dilutive common shares | | | 2,629 | | | | 2,366 | | | | 2,749 | | | | 2,371 | |

| | | | | | | | | | | | | | | | | |

| Denominator for diluted earnings | | | | | | | | | | | | | | | | |

per share - Adjusted weighted - average shares | | | 18,055 | | | | 17,435 | | | | 18,171 | | | | 17,344 | |

| Earnings per common share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.08 | |

| Diluted | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.07 | |

| (4) | Significant Client Agreements |

On December 31, 2008, we entered into an amendment (the “Amendment”) to our Provider Service Agreement with one of our significant clients. The purpose of the Amendment is, among other things, to facilitate and accelerate the integration into the Company’s business model of one of the client’s affiliates, adjust the administrative fees outlined in the previous amendment, define and clarify the exclusivity and levels of cooperation contemplated by the previous amendments, and extend the partnership between the Company and the client and the duration of their Provider Service Agreement to December 31, 2012. Under a strategic contracting plan that the Amendment requires the parties to develop, the Company will be the exclusive outsourced ancillary contracting and network management provider for the client’s group health clients and any third party administrators (TPAs).

As part of the Amendment, the Company agreed to pay to the client $1,000,000 for costs incurred in connection with the integration of and access to the Company’s network by members of the affiliate’s network, including, but not limited to, costs associated with salaries, benefits, and third party contracts. The payment was made in April 2009. The Company will continue to pay an administrative fee to the client designed to reimburse and compensate for the work that it is required to perform to support the Company’s program. The Company recognized the $1,000,000 fee as a prepaid expense which is being amortized over the term of the agreement. During the three and six months ended June 30, 2009, we recorded amortization related to the agreement of $62,500 and $125,000, respectively. At June 30, 2009, $250,000 was classified as a current asset on the consolidated balance sheet representing the amount to be amortized during the subsequent twelve-month period. The remaining $625,000 balance was classified as a long-term other asset at June 30, 2009.

In June 2008, the Financial Accounting Standards Board (“FASB”) ratified Emerging Issues Task Force (“EITF”) Issue No. 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to Entity’s Own Stock (“EITF 07-5”). EITF 07-5 mandates a two-step process for evaluating whether an equity-linked financial instrument or embedded feature is indexed to the entity’s own stock. Warrants to purchase 109,095 shares of common stock issued by the Company contain a strike price adjustment feature, which upon adoption of EITF 07-5, resulted in the instruments no longer being considered indexed to the Company’s own stock. Accordingly, adoption of EITF 07-5 changed the current classification (from equity to liability) and the related accounting for these warrants outstanding as of January 1, 2009. As of that date, we reclassified the warrants, based on a fair value of $3.43 per warrant, as calculated using the Black–Scholes–Merton valuation model. During the first six months of 2009, the liability was adjusted for warrants exercised and the change in fair value of the warrants. In accordance with EITF 07-5, a liability of $87,693 related to the stock warrants is included as a warrant derivative liability in our consolidated balance sheet as of June 30, 2009. During the three and six months ended June 30, 2009, we recorded an unrealized gain on warrant derivative of $278,591 and $254,109, respectively, related to the change in fair value of the warrants.

Effective May 21, 2007, the Company signed an Ancillary Care Services Network Access Agreement (“the agreement”) with Texas True Choice, Inc. (“TTC”). As partial compensation under the agreement, the Company issued to an affiliate of TTC, warrants to purchase a total of 225,000 shares of the Company’s common stock at an exercise price of $1.84, the closing price of our stock on May 21, 2007. As of June 30, 2009, 75%, or 168,750 warrants had vested with the remaining 25% vesting in May 2010. According to the agreement, TTC must provide two years notice in the event of termination. Since the measurement date for the fourth and final tranche of warrants had been reached as of June 30, 2009, we recorded the fair value of 25% of the warrants, or 56,250 warrants, which were recorded as other non-current assets and will be amortized over the related contract period. The total fair value of the fourth tranche of warrants was $311,259, which was recorded based on the Black-Scholes-Merton method.

As a result of the adoption of EITF 07-5, the Company is required to disclose the fair value measurements required by SFAS No. 157, “Fair Value Measurements.” The warrant derivative liability recorded at fair value in the balance sheet as of June 30, 2009 is categorized based upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels, defined by SFAS No. 157 are directly related to the amount of subjectivity associated with the inputs to fair valuation of these liabilities is as follows:

Level 1 — Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date;

Level 2 — Inputs other than Level 1 inputs that are either directly or indirectly observable; and

Level 3 — Unobservable inputs, for which little or no market data exist, therefore requiring an entity to develop its own assumptions.

The following table summarizes the financial liabilities measured at fair value on a recurring basis as of June 30, 2009, segregated by the level of the valuation inputs within the fair value hierarchy utilized to measure fair value (amounts in thousands):

| | | Total | | | Quoted prices in active markets for identical assets (Level 1) | | | Significant other observable inputs (Level 2) | | | Significant unobservable inputs (Level 3) | |

| Warrant derivative liability | | $ | 88 | | | $ | — | | | $ | — | | | $ | 88 | |

Equity-linked financial instruments consist of stock warrants issued by the Company that contain a strike price adjustment feature, as described in Note 5 in the Notes to the Consolidated Financial Statements. In accordance with EITF 07-5, we calculated the fair value of the warrants using the Black–Scholes–Merton valuation model. During the three and six months ended June 30, 2009, we recognized $278,591 and $254,109, respectively, of unrealized gains related to the change in the fair value of the warrant derivative liability.

The assumptions used in the Black-Scholes-Merton valuation model were as follows:

| | | January 1, | | | March 31, | | | June 30, | |

| | | 2009 | | | 2009 | | | 2009 | |

| Fair value | | $ | 3.43 | | | $ | 3.64 | | | $ | 0.88 | |

| Expected volatility | | | 73.4 | % | | | 68.6 | % | | | 70.5 | % |

| Expected life (years) | | | 2.13 | | | | 1.89 | | | | 1.65 | |

| Risk free interest rate | | | 0.8 | % | | | 0.8 | % | | | 0.9 | % |

| Forfeiture rate | | | - | | | | - | | | | - | |

| Dividend rate | | | - | | | | - | | | | - | |

The following table reflects the activity for liabilities measured at fair value using Level 3 inputs for the six months ended June 30, 2009 (amounts in thousands):

| Initial recognition of warrant derivative as of January 1, 2009 | | $ | 374 | |

| Transfers into level 3 | | | — | |

| Transfers out of level 3 | | | — | |

| Sales of warrant derivative | | | (32 | ) |

| Unrealized gains related to the change in fair value | | | (254 | ) |

| Balance as of June 30, 2009 | | $ | 88 | |

In addition, the Company’s financial instruments consist primarily of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and long-term debt. The fair value of instruments is determined by reference to various market data and other valuation techniques, as appropriate. Unless otherwise disclosed, the fair value of short-term financial instruments approximates their recorded values due to the short-term nature of the instruments. Based on the borrowing rates currently available to the Company for bank loans with similar terms and average maturities, the fair value of long-term debt approximates its carrying value.

On July 21, 2009, David A. George was appointed to the Board of Directors (the “Board”) of the Company. Mr. George was also appointed to serve as non-executive Chairman of the Board. In connection with his appointment to the Board, Mr. George was granted (i) a stock option to purchase 100,000 shares of common stock and (ii) 3,333 restricted stock units. The stock option and restricted stock units vest in equal successive annual installments over a 5-year period. Edward B. Berger, the previous Chairman, will continue to serve on the Board.

Effective July 31, 2009, the Company has entered into a Release and Acknowledgement Agreement (the “Agreement”) with Kurt Fullmer, in connection with Mr. Fullmer’s resignation as the Company’s Vice President of Client Development. The Agreement provides for, among other things, cash payments by the Company to Mr. Fullmer of an aggregate of approximately $112,500 over the next six months. The Agreement also provides that restricted stock units exercisable for 8,761 shares of common stock that Mr. Fullmer had previously received as a bonus for 2008 vest immediately, that options to purchase 17,500 shares that Mr. Fullmer had previously received will vest through September 24, 2009 as compensation for consulting services to be rendered through such time, and that all other unvested options and grants shall expire. The Company’s offer remains outstanding through August 21, 2009.

On August 3, 2009, an announcement was made that one of our significant customers will be acquired by a national provider of healthcare cost management solutions. The transaction is expected to be closed by the end of 2009, subject to the satisfaction of closing conditions including customary regulatory approvals. During the three and six months ended June 30, 2009, $6.9 million and $13.3 million of revenue was generated from this customer.

| (8) | Recent Accounting Pronouncements |

In June 2009, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 168, The “FASB Accounting Standards Codification” and the Hierarchy of Generally Accepted Accounting Principles. This standard replaces SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles, and establishes only two levels of U.S. GAAP, authoritative and non-authoritative. The FASB Accounting Standards Codification (the “Codification”) will become the source of authoritative, nongovernmental GAAP, except for rules and interpretive releases of the SEC, which are sources of authoritative GAAP for SEC registrants. All other non-grandfathered, non-SEC accounting literature not included in the Codification will become non-authoritative. This standard is effective for financial statements for interim or annual reporting periods ending after September 15, 2009. We will begin to use the new guidelines and numbering system prescribed by the Codification when referring to GAAP in the third quarter of fiscal 2009. As the Codification was not intended to change or alter existing GAAP, it will not have any impact on our consolidated financial statements.

In May 2009, the FASB issued SFAS No. 165, Subsequent Events. This standard is intended to establish general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. Specifically, this standard sets forth the period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements, the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements, and the disclosures that an entity should make about events or transactions that occurred after the balance sheet date. Management of the Company has evaluated the period after the balance sheet date up through August 11, 2009, which is the date that the consolidated financial statements were issued, and determined that there were no subsequent events or transactions that required recognition or disclosure in the consolidated financial statements.

FORWARD-LOOKING STATEMENTS

This discussion includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify these statements by forward-looking words such as “may,” “will,” “expect,” “intend”, “anticipate,” “believe,” “estimate” and “continue” or similar words. You should read statements that contain these words carefully because they discuss our future expectations, contain projections of our future operating results or of our financial condition or state other “forward-looking” information.

We believe it is important to communicate to our stockholders and potential investors not only the Company’s current condition, but management’s forecasts about the Company’s future opportunities, performance and results, including, for example, information with respect to potential margin expansion, cash reserves and other financial items, and our strategies and prospects. However, forward-looking statements are based on current expectations and assumptions and are subject to substantial risks and uncertainties, including, but not limited to, risks of market acceptance of, or preference for, the Company’s systems and services, competitive forces, the impact of geopolitical events and changes in government regulations, general economic conditions and economic factors in the country and the healthcare industry, including the recent economic downturns and increases in unemployment and other risk factors as may be listed from time to time in the Company’s filings with the SEC. In evaluating such forward-looking statements, investors should specifically consider the matters set forth under the caption “Risk Factors” appearing in our Annual Report on Form 10-K for the year ended December 31, 2008 which was filed with the SEC on March 31, 2009, as well as any other cautionary language contained in this quarterly report, any of which could cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Except to the extent required by applicable securities laws and regulations, we disclaim any obligation to update or revise information contained in any forward-looking statement contained herein to reflect events or circumstances occurring after the date of this quarterly report.

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

GENERAL

Management’s discussion and analysis provides a review of the Company’s operating results for the three and six months ended June 30, 2009 and its financial condition at June 30, 2009. The focus of this review is on the underlying business reasons for significant changes and trends affecting the revenues, net income and financial condition of the Company. This review should be read in conjunction with the accompanying unaudited consolidated financial statements and the audited consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2008.

OVERVIEW

American CareSource Holdings, Inc. (the “Company”, “ACS”, “we”, “us”, or “our”) is an ancillary benefits management company that offers cost effective access to a comprehensive national network of ancillary healthcare service providers. The Company’s healthcare payor customers, which include preferred provider organizations (“PPOs”), third party administrators (“TPAs”), insurance companies, large self-funded organizations and Taft-Hartley union plans (i.e., employee benefit plans that are self-administered under collective bargaining agreements), engage the Company to provide them with a complete outsourced solution designed to manage each customer’s obligations to its covered persons. The Company offers its customers this solution by:

| | · | providing payor customers with a comprehensive network of ancillary healthcare services providers that is tailored to each payor customer’s specific needs and is available to each payor customer’s covered persons for covered services; |

| | · | providing payor customers with claims management, reporting, and processing and payment services; |

| | · | performing network/needs analysis to assess the benefits to payor customers of adding additional/different service providers to the payor customer-specific provider networks; and |

| | · | credentialing network service providers for inclusion in the payor customer-specific provider networks. |

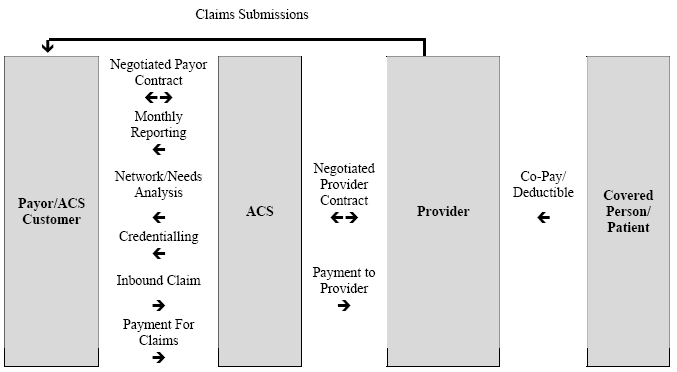

The Company’s business model, illustrating the relationships among the persons involved, directly or indirectly, in the Company’s business and its generation of revenue and expenses is depicted below:

Our clients route healthcare claims to us after service has been performed by participant providers in our network. We process those claims and charge the client/payor according to its contractual rate for the services according to our contract with the client/payor. In processing the claim, we are paid directly by the client or the insurer for the service. We then pay the provider of service according to its independently-negotiated contractual rate. We assume the risk of generating positive margin, the difference between the payment we receive for the service and the amount we are obligated to pay the provider of service.

The Company recognizes revenues for ancillary healthcare services when services by providers have been authorized and performed, the claim has been billed to the payor and collections from payors are reasonably assured. Cost of revenues for ancillary healthcare services consist of amounts due to providers for providing ancillary health care services, client administration fees paid to our client payors to reimburse them for routing the claims to us for processing, and the Company’s related direct labor and overhead of processing invoices, collections and payments. The Company is not liable for costs incurred by independent contract service providers until payment is received by us from the payors. The Company recognizes actual or estimated liabilities to independent contract service providers as the related revenues are recognized.

The Company markets its products to preferred provider organizations (“PPOs”), third party administrators (“TPAs”), insurance companies, large self-funded organizations and Taft-Hartley union plans, such as employee benefit plans that are self-administered under collective bargaining agreements.

The Company is seeking continuing growth in the number of client payor and service provider relationships by focusing on providing in-network services for its payors and aggressively pursuing additional PPOs, TPAs and other direct payors as its primary sales target. The Company believes that this strategy should increase the volume of claims the Company can process in addition to the expansion in the number of lives that are eligible to receive ancillary health care benefits. No assurances can be given that the Company can expand its service provider or payor relationships, nor that any such expansion will result in an improvement in the results of operations of the Company.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s discussion and analysis of our financial condition and results of operations is based upon our condensed consolidated financial statements. These condensed consolidated financial statements have been prepared following the requirements of accounting principles generally accepted in the United States (“GAAP”) for interim periods and require us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to revenue recognition, provider cost recognition, the resulting contribution margins, amortization and potential impairment of intangible assets and goodwill and stock-based compensation expense. As these are condensed consolidated financial statements, you should also read expanded information about our critical accounting policies and estimates provided in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the heading “Critical Accounting Policies,” included in our Annual Report on Form 10-K for the year ended December 31, 2008. There have been no material changes to our critical accounting policies and estimates from the information provided in our Form 10-K for the year ended December 31, 2008.

ANALYSIS OF RESULTS OF OPERATIONS

Revenues

The following table sets forth a comparison of our revenues for the periods presented ended June 30:

| | | Second Quarter | | | Six Months | |

| | | | | | | | | Change | | | | | | | | | Change | |

| ($ in thousands) | | 2009 | | | 2008 | | | $ | | | % | | | 2009 | | | 2008 | | | $ | | | % | |

| Net revenues | | $ | 17,135 | | | $ | 13,013 | | | $ | 4,122 | | | | 32 | % | | $ | 33,190 | | | $ | 24,518 | | | $ | 8,672 | | | | 35 | % |

The Company’s net revenues are generated from ancillary healthcare service claims. Revenue is recognized when we bill our client payors for services performed. Overall, the increase in revenue for the three and six months ended June 30, 2009 as compared to the same periods in 2008 was due to the progression of our client relationships, which allowed the Company access to a greater number of payors and allowed us to benefit from the external growth and expansion of our clients. In addition, revenues were positively impacted by growth in our ancillary service provider network.

Revenues generated from clients with whom we had relationships commencing in 2007 and prior (which consist primarily of our two significant customers as described in Note 2, “Revenue Recognition” of the Notes to the Condensed Financial Statements), increased $2.1 million, or 16%, in the second quarter of 2009 compared to the same prior year period, and $5.9 million or 24% for the first six months of 2009 compared to the same period in 2008. The increase is due to the progression and development of our client relationships, which resulted in an increased number of payors and increased claims volume. In addition, during 2008, we implemented seven new clients (one of which is an affiliate of one of our two existing significant customers), which were responsible for approximately $919,000 and $1.7 million of incremental revenues in the three and six months ended June 30, 2009. Five new clients implemented in 2009 contributed incremental revenues of $1.1 million in the three and six months ended June 30, 2009.

The following table details revenues generated by clients and the periods in which those clients were added for the periods presented ended June 30 (amounts in thousands):

| Year of implementation | | 2007 and prior | | | 2008 | | | 2009 | | | Total | |

| Second quarter 2009 | | $ | 15,144 | | | $ | 928 | | | $ | 1,063 | | | $ | 17,135 | |

| Second quarter 2008 | | | 13,004 | | | | 9 | | | | - | | | | 13,013 | |

| | | | | | | | | | | | | | | | | |

| Six months 2009 | | $ | 30,393 | | | $ | 1,724 | | | $ | 1,073 | | | $ | 33,190 | |

| Six months 2008 | | | 24,509 | | | | 9 | | | | - | | | | 24,518 | |

The Company will continue to seek growth in the number of client payor and service provider relationships by focusing on providing in-network services for its payors and aggressively pursuing additional PPOs, TPAs and other direct payors as its primary sales target. The Company believes that this strategy should increase the volume of claims the Company can process, as well as expand the number of lives that are eligible to receive ancillary health care benefits. No assurances can be given that the Company can expand its service provider or payor relationships, nor that any such expansion will result in an improvement in the results of operations of the Company.

In addition, during the three and six months ended June 30, 2009, the number of billed claims increased by 53% and 51%, respectively, compared to the same prior year periods. The increase in claim volume was driven by the expansion of existing client relationships, new clients implemented during the first half of 2009 as well as through expansion of our network of service providers.

Revenue per claim declined for the periods presented due to lower than estimated collection rates related to our new client relationships, limited benefits offered by certain recently implemented clients and the change in mix of provider specialties driving our claim volume during the first six months of 2009. In particular, we have experienced accelerated growth in categories such as laboratory services with a lower average revenue per claim while other higher average revenue per claim categories such as dialysis services have not grown as rapidly. Revenue per claim can vary significantly depending upon factors including the types of services consumed by clients members, the quantity of services delivered, client negotiated pricing, provider negotiated service rates, the rate of collections based upon the client and members financial responsibility and other factors. The following table provides information with respect to claims processed, claims billed and the associated revenue per claim metrics for the periods ended June 30 (claim amounts in thousands):

| | | Three months ended | | | Six months ended | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Claims processed | | | 121 | | | | 72 | | | | 211 | | | | 132 | |

| Claims billed | | | 101 | | | | 66 | | | | 181 | | | | 120 | |

| | | | | | | | | | | | | | | | | |

| Revenue per processed claim | | $ | 142 | | | $ | 180 | | | $ | 157 | | | $ | 186 | |

| Revenue per billed claim | | | 169 | | | | 197 | | | | 183 | | | | 204 | |

Cost of Revenues and Contribution Margin

The following table sets forth a comparison of the components of our cost of revenues, for the periods presented ended June 30:

| | | Second Quarter | |

| | | | | | | | | | | | | | | Change | |

| | | | | | % of | | | | | | % of | | | | | | | |

| ($ in thousands) | | 2009 | | | revenues | | | 2008 | | | revenues | | | $ | | | % | |

| Provider payments | | $ | 12,880 | | | | 75.2 | % | | $ | 9,555 | | | | 73.4 | % | | $ | 3,325 | | | | 34.8 | % |

| Administrative fees | | | 778 | | | | 4.5 | | | | 751 | | | | 5.8 | | | | 27 | | | | 3.6 | |

| Claims administration and | | | | | | | | | | | | | | | | | | | | | | | | |

| provider development | | | 1,131 | | | | 6.6 | | | | 805 | | | | 6.2 | | | | 326 | | | | 40.5 | |

| Total cost of revenues | | $ | 14,789 | | | | 86.3 | % | | $ | 11,111 | | | | 85.4 | % | | $ | 3,678 | | | | 33.1 | % |

The following table sets forth a comparison of the components of our cost of revenues, for the periods presented ended June 30:

| | | Six Months | |

| | | | | | | | | | | | | | | Change | |

| | | | | | % of | | | | | | % of | | | | | | | |

| ($ in thousands) | | 2009 | | | revenues | | | 2008 | | | revenues | | | $ | | | % | |

| Provider payments | | $ | 24,815 | | | | 74.8 | % | | $ | 17,946 | | | | 73.2 | % | | $ | 6,869 | | | | 38.3 | % |

| Administrative fees | | | 1,594 | | | | 4.8 | | | | 1,453 | | | | 5.9 | | | | 141 | | | | 9.7 | |

| Claims administration and | | | | | | | | | | | | | | | | | | | | | | | | |

| provider development | | | 2,136 | | | | 6.4 | | | | 1,513 | | | | 6.2 | | | | 623 | | | | 41.2 | |

| Total cost of revenues | | $ | 28,545 | | | | 86.0 | % | | $ | 20,912 | | | | 85.3 | % | | $ | 7,633 | | | | 36.5 | % |

Cost of revenues is comprised of payments to our providers, administrative fees paid to our client payors for converting claims to electronic data interchange and routing them to both the Company for processing and to their payors for payment, and the costs of our claims administration and provider development organizations. Payments to providers is the largest component of our cost of revenues and it consists of our payments for ancillary care services in accordance with contracts negotiated separately with providers for specific ancillary services.

In the second quarter of 2009, cost of revenues related to payments to providers increased as compared to the second quarter of 2008 as a result of increased claims volume and increased revenues, and the fluctuation in the mix of types of services provided by the Company. Payments made to providers as a percent of net revenues were 75.2% during the second quarter of 2009 and 73.4% during the same period in 2008. Provider payments as a percent of revenues increased due primarily to lower margins in our dialysis services and infusion services specialties. These category margins were impacted by the execution of new provider agreements, pricing for associated services on recently implemented and existing client contracts, the mix of services delivered in each category, and the mix of providers delivering the services.

Further, in the second quarter of 2009, administrative fees increased due to increased claim volume as a result of expanded relationships with existing clients as well as recently implemented clients. Administrative fees paid to clients as a percent of net revenues were 4.5% during the second quarter of 2009 and 5.8% during the same period in 2008. The decrease in administrative fees as a percent of net revenues was due to a shift in revenues to clients that carry lower contracted administrative fee rates.

During the six months ended June 30, 2009, provider payments were 74.8% of revenues, compared to 73.2% for the same prior year period. Provider payments as a percent of revenues increased due primarily to lower margins in our dialysis and infusion services specialties. These category margins were impacted by the execution of new provider agreements, pricing for associated services on recently implemented and existing client contracts, the mix of services delivered in each category, and the mix of providers delivering the services.

Further, in the first half of 2009, administrative fees increased due to increased claim volume as a result of expanded relationships with existing clients as well as recently implemented clients. Administrative fees paid to clients as a percent of net revenues were 4.8% during the first half of 2009 and 5.9% during the same period in 2008. The decrease in administrative fees as a percent of net revenues was due to a shift in revenues to clients that carry lower contracted administrative fee rates.

The detail of the costs of our claims administration and provider development organizations are as follows for the periods presented ending June 30 (amounts in thousands):

| | | Second Quarter | |

| | | Claims Administration | | | Provider Development | | | Total | |

| | | | | | | | | Increase | | | | | | | | | Increase | | | | | | | | | Increase | |

| | | 2009 | | | 2008 | | | (Decrease) | | | 2009 | | | 2008 | | | (Decrease) | | | 2009 | | | 2008 | | | (Decrease) | |

| Total wages, incentives and benefits | | $ | 608 | | | $ | 430 | | | $ | 178 | | | | 41 | % | | $ | 372 | | | $ | 216 | | | $ | 156 | | | | 72 | % | | $ | 980 | | | $ | 646 | | | $ | 334 | | | | 52 | % |

| Contract labor and consulting fees | | | 172 | | | | 240 | | | | (68 | ) | | | -28 | % | | | 69 | | | | 10 | | | | 59 | | | | 590 | % | | | 241 | | | | 250 | | | | (9 | ) | | | -4 | % |

| Capitalized development costs | | | (215 | ) | | | (203 | ) | | | (12 | ) | | | 6 | % | | | - | | | | - | | | | - | | | | 0 | % | | | (215 | ) | | | (203 | ) | | | (12 | ) | | | 6 | % |

| Other | | | 37 | | | | 34 | | | | 3 | | | | 9 | % | | | 6 | | | | 5 | | | | 1 | | | | 20 | % | | | 43 | | | | 39 | | | | 4 | | | | 10 | % |

| Allocation of shared overheads | | | (18 | ) | | | 8 | | | | (26 | ) | | | -325 | % | | | 100 | | | | 65 | | | | 35 | | | | 54 | % | | | 82 | | | | 73 | | | | 9 | | | | 12 | % |

| | | $ | 584 | | | $ | 509 | | | $ | 75 | | | | 15 | % | | $ | 547 | | | $ | 296 | | | $ | 251 | | | | 85 | % | | $ | 1,131 | | | $ | 805 | | | $ | 326 | | | | 40 | % |

Our claims administration organization consists of our operations and information technology groups. Our operations group is responsible for all aspects of the claims management and processing including billing, quality assurance and collections efforts. Our information technology group is responsible for maintaining and enhancing the technological capabilities and applications with the claims management process. Our provider development group is responsible for developing our network of ancillary healthcare service providers, which includes contracting with providers to be included in the network, credentialing new service providers and maintaining a relationship with existing providers, all for the purpose of enhancing our ancillary service provider network offering to our client payors.

The increase in costs during the second quarter of 2009 as compared to the same prior year period is due primarily to the following:

| | · | Investments in our claims administration and provider development organizations. Wages, incentives and benefits increased due to resource additions. Headcount as of June 30, 2009 and 2008 were as follows: Operations -- 20 and 15, respectively; Information Technology -- 11 and 7, respectively; and Provider Development -- 17 and 10, respectively. The increases in headcount were made to facilitate growth through the enhancement of our network of ancillary care providers, and to grow our claims processing and management capabilities consistent with growth in claims volume; |

| | · | We incurred incremental costs in our provider development organization; consultants were hired which assisted us in improving the integrity of our provider data, creating mechanisms to manage provider credentialing to facilitate greater quality in our network and supplementing our provider data. In addition, consulting fees includes administrative fees paid to a third-party which manages and maintains a national imaging network; and |

| | · | The aforementioned cost increases were offset by a decrease in consulting fees related to an information technology initiative in which a platform was developed to create data analysis efficiencies. The fees were primarily incurred during the second quarter of 2008. |

The detail of the costs of our claims administration and provider development organizations are as follows for the periods presented ending June 30 (amounts in thousands):

| | | Six Months | |

| | | Claims Administration | | | Provider Development | | | Total | |

| | | | | | | | | Increase | | | | | | | | | Increase | | | | | | | | | Increase | |

| | | 2009 | | | 2008 | | | (Decrease) | | | 2009 | | | 2008 | | | (Decrease) | | | 2009 | | | 2008 | | | (Decrease) | |

| Total wages, incentives and benefits | | $ | 1,142 | | | $ | 827 | | | $ | 315 | | | | 38 | % | | $ | 680 | | | $ | 374 | | | $ | 306 | | | | 82 | % | | $ | 1,822 | | | $ | 1,201 | | | $ | 621 | | | | 52 | % |

| Contract labor and consulting fees | | | 289 | | | | 346 | | | | (57 | ) | | | -16 | % | | | 119 | | | | 10 | | | | 109 | | | | 1090 | % | | | 408 | | | | 356 | | | | 52 | | | | 15 | % |

| Capitalized development costs | | | (329 | ) | | | (284 | ) | | | (45 | ) | | | 16 | % | | | - | | | | - | | | | - | | | | 0 | % | | | (329 | ) | | | (284 | ) | | | (45 | ) | | | 16 | % |

| Other | | | 63 | | | | 58 | | | | 5 | | | | 9 | % | | | 32 | | | | 6 | | | | 26 | | | | 433 | % | | | 95 | | | | 64 | | | | 31 | | | | 48 | % |

| Allocation of shared overheads | | | (47 | ) | | | 65 | | | | (112 | ) | | | -172 | % | | | 187 | | | | 111 | | | | 76 | | | | 68 | % | | | 140 | | | | 176 | | | | (36 | ) | | | -20 | % |

| | | $ | 1,118 | | | $ | 1,012 | | | $ | 106 | | | | 10 | % | | $ | 1,018 | | | $ | 501 | | | $ | 517 | | | | 103 | % | | $ | 2,136 | | | $ | 1,513 | | | $ | 623 | | | | 41 | % |

The increase in costs during the second quarter of 2009 as compared to the same prior year period is due primarily to the following:

| | · | Investments in our claims administration and provider development organizations. Wages, incentives and benefits increased due to resource additions as described above; |

| | · | The utilization of consultants by our provider development organization which assisted us in improving the integrity of our provider data, creating mechanisms to manage provider credentialing to facilitate greater quality in our network and supplementing our provider data. In addition, consulting fees includes administrative fees paid to a third-party which manages and maintains a national imaging network. These costs were incremental compared to the prior year period; and |

| | · | The aforementioned cost increases were offset by a decrease in consulting fees related to an information technology initiative in which a platform was developed to create data analysis efficiencies. The fees were primarily incurred during the second quarter of 2008. |

The following table sets forth a comparison of contribution margin percentage for the periods presented ending June 30:

| | | Second Quarter | | | Six months | |

| | | | | | | | | Change | | | | | | | | | Change | |

| | | 2009 | | | 2008 | | | % pts | | | 2009 | | | 2008 | | | % pts | |

| Contribution margin percentage | | | 13.7 | % | | | 14.6 | % | | | (0.9 | )% | | | 14.0 | % | | | 14.7 | % | | | (0.7 | ) % |

Contribution margin percentage is calculated by dividing the difference between net revenues and total cost of revenues by net revenues. The components of contribution margin changed for the three and six month periods as follows: Provider payments – declines of 1.8% and 1.6%, respectively; administrative fees – increases of 1.3% and 1.1%, respectively; and cost of claims administration and provider development – declines of 0.4% and 0.4%, respectively. The overall decline in contribution margin percentage was discussed in detail in the preceding comments. Our contribution margin percentage fluctuates from quarter to quarter due to changes in the prices we charge our client payors as compared to the financial terms of our provider agreements, changes in costs of our claims administration and provider development organizations and changes in the mix of services we provide. There can be no assurances that we will be able to maintain contribution margin at current levels, either in absolute or in percentage terms.

Selling, General and Administrative Expenses

The following table sets forth a comparison of our selling, general and administrative (“SG&A”) expenses for the periods presented ending June 30:

| | | Second Quarter | | | Six Months | |

| | | | | | | | | Change | | | | | | | | | Change | |

| ($ in thousands) | | 2009 | | | 2008 | | | $ | | | % | | | 2009 | | | 2008 | | | $ | | | % | |

| Selling, general and | | $ | 1,981 | | | $ | 1,195 | | | $ | 786 | | | | 66 | % | | $ | 3,882 | | | $ | 2,307 | | | $ | 1,575 | | | | 68 | % |

administrative expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Percentage of total net revenues | | | 11.6 | % | | | 9.2 | % | | | | | | | | | | | 11.7 | % | | | 9.4 | % | | | | | | | | |

Selling, general and administrative (“SG&A”) expenses consist primarily of salaries and related benefits, travel costs, sales commissions, sales materials, other marketing related expenses, costs of corporate operations, finance and accounting, human resources and other general operating expenses of the Company.

Selling, general and administrative expenses represent the following costs for the periods presented ending June 30 (amounts in thousands):

| | | Second Quarter | |

| | | Finance & Administration | | | Sales & Marketing | | | Total | |

Selling, general and administrative expenses | | 2009 | | | 2008 | | | Increase (Decrease) | | | 2009 | | | 2008 | | | Increase (Decrease) | | | 2009 | | | 2008 | | | Increase (Decrease) | |

Total wages, commissions, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

incentives and benefits | | $ | 453 | | | $ | 381 | | | $ | 72 | | | | 19 | % | | $ | 440 | | | $ | 114 | | | $ | 326 | | | | 286 | % | | $ | 893 | | | $ | 495 | | | $ | 398 | | | | 80 | % |

Professional fees (legal, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

accounting and consulting) | | | 173 | | | | 103 | | | | 70 | | | | 68 | % | | | 40 | | | | 18 | | | | 22 | | | | 122 | % | | | 213 | | | | 121 | | | | 92 | | | | 76 | % |

Stock-based compensation expense | | | 285 | | | | 159 | | | | 126 | | | | 79 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 285 | | | | 159 | | | | 126 | | | | 79 | % |

Investor relations costs | | | 64 | | | | 42 | | | | 22 | | | | 52 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 64 | | | | 42 | | | | 22 | | | | 52 | % |

Recruiting costs | | | 35 | | | | 76 | | | | (41 | ) | | | -54 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 35 | | | | 76 | | | | (41 | ) | | | -54 | % |

Marketing costs | | | - | | | | - | | | | - | | | | 0 | % | | | 76 | | | | 10 | | | | 66 | | | | 660 | % | | | 76 | | | | 10 | | | | 66 | | | | 660 | % |

Banking fees | | | 41 | | | | 31 | | | | 10 | | | | 32 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 41 | | | | 31 | | | | 10 | | | | 32 | % |

Other | | | 87 | | | | 89 | | | | (2 | ) | | | -2 | % | | | 95 | | | | 11 | | | | 84 | | | | 764 | % | | | 182 | | | | 100 | | | | 82 | | | | 82 | % |

Allocation of shared overheads | | | 122 | | | | 137 | | | | (15 | ) | | | -11 | % | | | 70 | | | | 24 | | | | 46 | | | | 192 | % | | | 192 | | | | 161 | | | | 31 | | | | 19 | % |

| Total selling, general and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

administrative expenses | | $ | 1,260 | | | $ | 1,018 | | | $ | 242 | | | | 24 | % | | $ | 721 | | | $ | 177 | | | $ | 544 | | | | 307 | % | | $ | 1,981 | | | $ | 1,195 | | | $ | 786 | | | | 66 | % |

The increase in SG&A, reflected in the above table is related to the following:

| | · | Increased headcount in our sales and marketing group. Wages, commissions, incentives and benefits during the second quarter of 2009 reflect the addition of five resources (one of whose costs were included in cost of revenues during 2008 as this employee was assigned to the sales & marketing group in late 2008). These resources were added during late-2008 and the first quarter of 2009. In addition, during the first quarter of 2009, we added three administrative resources that contributed to the increase in compensation costs. Headcount as of June 30, 2009 and 2008 were as follows: Finance & Administration – 12 and 7, respectively; and Sales & Marketing – 10 and 5, respectively. |

| | · | Increased compensation costs related to our stock-based incentive plans. The increase in these costs are the direct result of the increase in the fair value of our common stock (as calculated under the Black-Scholes-Merton valuation model) which is directly related to the increase in the value of our common stock. As a result, stock-based awards made in late-2008 and early-2009 had higher associated costs than those awarded during the same prior year periods. |

| | · | Increased professional fees. During the three months ended June 30, 2009, fees for our audit-related activities increased over the same prior year period, we implemented an enhanced compensation plan for our Board of Directors and we incurred costs related to strategic marketing initiatives related to branding and product identification. We do not anticipate our consulting costs to continue at these levels during the last six months of 2009 as we incurred a disproportionate amount of costs during the six months ended June 30, 2009. |

| | · | Marketing costs included $62,500 of amortization of the amendment of our client agreement with one of our significant clients. The $1 million payment is being amortized over a four-year period, which is the term of the amended agreement. |

| | · | Other costs increased primarily due to a one-time payment of $50,000 paid to one of our executive officers for relocation costs. |

Selling, general and administrative expenses represent the following costs for the periods presented ending June 30 (amounts in thousands):

| | | Six Months | |

| | | Finance & Administration | | | Sales & Marketing | | | Total | |

Selling, general and administrative expenses | | 2009 | | | 2008 | | | Increase (Decrease) | | | 2009 | | | 2008 | | | Increase (Decrease) | | | 2009 | | | 2008 | | | Increase (Decrease) | |

Total wages, commissions, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

incentives and benefits | | $ | 823 | | | $ | 728 | | | $ | 95 | | | | 13 | % | | $ | 863 | | | $ | 236 | | | $ | 627 | | | | 266 | % | | $ | 1,686 | | | $ | 964 | | | $ | 722 | | | | 75 | % |

Professional fees (legal, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

accounting and consulting) | | | 442 | | | | 313 | | | | 129 | | | | 41 | % | | | 100 | | | | 18 | | | | 82 | | | | 456 | % | | | 542 | | | | 331 | | | | 211 | | | | 64 | % |

Stock-based compensation expense | | | 528 | | | | 316 | | | | 212 | | | | 67 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 528 | | | | 316 | | | | 212 | | | | 67 | % |

Investor relations costs | | | 136 | | | | 62 | | | | 74 | | | | 119 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 136 | | | | 62 | | | | 74 | | | | 119 | % |

Recruiting costs | | | 65 | | | | 82 | | | | (17 | ) | | | -21 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 65 | | | | 82 | | | | (17 | ) | | | -21 | % |

Marketing costs | | | - | | | | - | | | | - | | | | 0 | % | | | 155 | | | | 13 | | | | 142 | | | | 1092 | % | | | 155 | | | | 13 | | | | 142 | | | | 1092 | % |

Banking fees | | | 76 | | | | 58 | | | | 18 | | | | 31 | % | | | - | | | | - | | | | - | | | | 0 | % | | | 76 | | | | 58 | | | | 18 | | | | 31 | % |

Other | | | 160 | | | | 142 | | | | 18 | | | | 13 | % | | | 158 | | | | 20 | | | | 138 | | | | 690 | % | | | 318 | | | | 162 | | | | 156 | | | | 96 | % |

Allocation of shared overheads | | | 241 | | | | 273 | | | | (32 | ) | | | -12 | % | | | 135 | | | | 46 | | | | 89 | | | | 193 | % | | | 376 | | | | 319 | | | | 57 | | | | 18 | % |

| Total selling, general and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

administrative expenses | | $ | 2,471 | | | $ | 1,974 | | | $ | 497 | | | | 25 | % | | $ | 1,411 | | | $ | 333 | | | $ | 1,078 | | | | 324 | % | | $ | 3,882 | | | $ | 2,307 | | | $ | 1,575 | | | | 68 | % |

The increase in SG&A, reflected in the above table is related to the following:

| | · | Increased headcount in our sales and marketing group. Wages, commissions, incentives and benefits during the six months ended June 30, 2009 reflect the addition of resources as described above; |

| | · | Increased compensation costs related to our stock-based incentive plans. The increase in these costs are the direct result of the increase in the fair value of our common stock (as calculated under the Black-Scholes-Merton valuation model) which is directly related to the increase in the value of our common stock. As a result, stock-based awards made in late-2008 and early-2009 had higher associated costs than those awarded during the same prior year periods. |

| | · | Increased professional fees. During the six months ended June 30, 2009, fees for our audit-related activities increased over the same prior year period, we implemented an enhanced compensation plan for our Board of Directors and we incurred costs related to strategic marketing initiatives related to branding and product identification. We do not anticipate our consulting costs to continue at these levels during the last six months of 2009 as we incurred a disproportionate amount of costs during the six months ended June 30, 2009. |

| | · | Marketing costs included $125,000 of amortization of the amendment of our client agreement with one of our significant clients. The $1 million payment is being amortized over a four-year period, which is the term of the amended agreement. |

| | · | Other costs increased primarily due to increased travel expenses related to client and investor relations activities during the first six months of 2009 compared to the same prior year period and a one-time payment of $75,000 paid to one of our executive officers for relocation costs. |

Unrealized Gain on Warrant Derivative

During the three and six months ended June, 30, 2009, we had unrealized gains of $278,591 and $254,109, respectively, related to warrants that are accounted for under Emerging Issues Task Force (“EITF”) Issue No. 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to Entity’s Own Stock (“EITF 07-5”). In June 2008, the Financial Accounting Standards Board (“FASB”) ratified EITF 07-5. It mandates a two-step process for evaluating whether an equity-linked financial instrument or embedded feature is indexed to the entity’s own stock. Warrants to purchase 109,095 shares of common stock issued by the Company contain a strike price adjustment feature, which upon adoption of EITF 07-5, resulted in the instruments no longer being considered indexed to the Company’s own stock. Accordingly, adoption of EITF 07-5 changed the current classification (from equity to liability) and the related accounting for these warrants outstanding as of January 1, 2009. As of that date, we reclassified the warrants, based on a fair value of $3.43 per warrant, as calculated using the Black–Scholes–Merton valuation model. During the first six months of 2009, the liability was adjusted for warrants exercised and the change in fair value of the warrants. In accordance with EITF 07-5, a liability of $87,693 related to the stock warrants is included as a warrant derivative liability in our consolidated balance sheet as of June 30, 2009. The unrealized gain on the warrant derivative reflects the change in fair value of the warrants.

Depreciation and Amortization

The following table sets forth a comparison of depreciation and amortization for the periods presented ending June 30:

| | | Second Quarter | | | Change | | | Six Months | | | Change | |

| ($ in thousands) | | 2009 | | | 2008 | | | $ | | | % | | | 2009 | | | 2008 | | | $ | | | % | |

| Depreciation | | $ | 100 | | | $ | 44 | | | $ | 56 | | | | 127% | | | $ | 181 | | | $ | 83 | | | $ | 98 | | | | 118 | % |

| Amortization | | | 32 | | | | 53 | | | | (21 | ) | | | (40 | )% | | | 64 | | | | 106 | | | | (42 | ) | | | (40 | )% |