OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2007

Estimated average burden hours per response...19.4

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21713

Madison Strategic Sector Premium Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1

Annual Report

December 31, 2006

Madison Strategic Sector

Premium Fund (MSP)

Active Equity Management combined with a

Covered Call Option Strategy

Madison Investment Advisors, Inc.

www.madisonfunds.com

MSP/Madison Strategic Sector Premium Fund

Table of Contents

| Management's Discussion of Fund Performance | 1 |

| Report of Independent Registered Public Accounting Firm | 4 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statement of Changes in Net Assets | 10 |

| Financial Highlights | 11 |

| Notes to Financial Statements | 12 |

| Management Information | 15 |

| Dividend Reinvestment Plan | 17 |

Annual Report/December 31, 2006

MSP/Madison Strategic Sector Premium Fund

Management's Discussion of Fund Performance

We at Madison Asset Management LLC are pleased to address the progress of our fund, the Madison Strategic Sector Premium Fund ("MSP") for the year ending December 31, 2006. Introduced in April of 2005, MSP continues to pursue its investment objectives by investing in high-quality, large-capitalization common stocks that are, in our view, selling at a reasonable price with respect to their long-term earnings growth rates. Our option-writing strategy has provided a steady income return from option premiums which help achieve our goal of providing enhanced risk-adjusted returns with a secondary objective of long-term capital appreciation.

Despite a lackluster first half, 2006 proved a profitable year for stock investors. The S&P 500 Index returned 15.79%. From a capitalization perspective, this represented performance roughly the same as mid cap stocks (the Russell Midcap(R) Index returned 15.26%). However, from a style perspective, value once again stole the spotlight as growth continued to lag. A number of factors contributed to positive returns for the market. The primary focus of investors remained the activities of the Federal Reserve. During the first half, stock returns were soft as the Fed continued raising short-term interest rates. However, in the second half of the year, the Fed held firm at a 5.25% Fed funds rate. As the prospect for further rate increases dwindled and a soft economic landing looked more likely, equities gained momentum. Specifically, despite weak housing data for most of the year, real estate has shown some signs of bottoming. Energy prices dropped in the second half as well, easing the burden at the pump for consumers and reducing fears of out-of-control inflation. Finally, 2006 witnessed a pickup in merger and acquisition activity, providing additional fuel for the stock market.

As of December 31, 2006, MSP held 49 common stocks and MSP managers wrote options which resulted in $10.3 million in premiums. Although MSP generally writes "out-of-the-money" options, as of December 31, 2006, 56% of MSP's 75 outstanding written (sold) stock options were "in-the-money" because of price appreciation of the underlying stock. This provides MSP with some downside protection should the market sell off.

We are pleased to report that MSP generated sufficient income in 2006 to return $1.80 per share to our shareholders in dividends by declaring $0.15 per share dividends every month. At MSP's traded market price of $20.60 per share on December 31, 2006 our dividend yield was 8.7%. Dividends during 2006 represented a combination of earned net income and long-term and short-term capital gains. As MSP shareholders complete their 2006 tax returns, they will be pleased to note that their annual distributions did not include a return of capital.

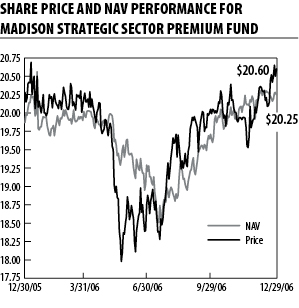

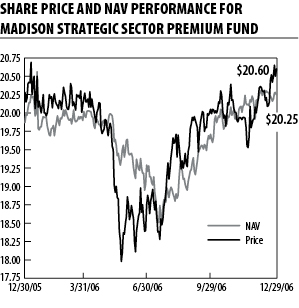

MSP's NAV (net asset value per share) increased $0.38 in 2006 from $19.87 to $20.25. This represented an NAV total return of 11.61%, including the reinvestment of dividends. At year end, MSP traded at $20.60 a 1.7% premium to its NAV of $20.25. The total return on a market price basis for MSP was 11.30%, including the reinvestment of dividends for the year 2006.

Since inception, MSP has paid a total $2.70 per share in dividends and produced a total return on NAV of 21.7%, compared to an 18.8% increase for the CBOE Buy Write ("BXM") Index during the same period. We believe MSP has achieved solid results and provided us with considerable confidence in meeting MSP's longer term goals.

Annual Report/December 31, 2006/1

MSP/Madison Strategic Sector Premium Fund/Management's Discussion of Fund Performance/continued

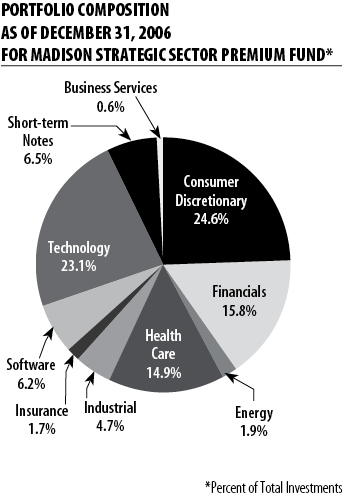

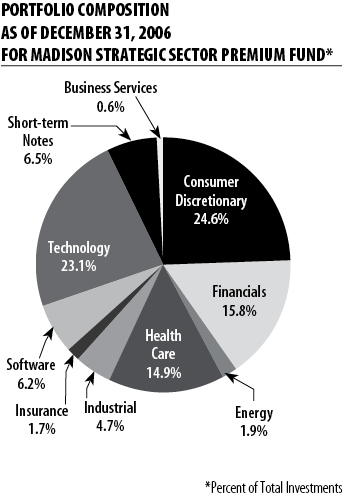

From a sector perspective, MSP's largest exposure was in the Consumer Discretionary Sector, followed by Technology, Financials and Health Care. We continue to remain absent from the Materials and Utilities Sectors, but did take a small position in Energy this year.

Madison Asset Management's stock picking strategy involves seeking a portfolio of common stocks that have favorable "PEG" ratios (price-earnings ratio to growth rate) as well as financial strength and industry leadership. As bottom-up investors, we focus on the fundamental businesses of our companies. Our stock selection philosophy stays away from the "beat the street" objective, as we look for companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management teams. By concentrating on long-term prospects and circumventing the "instant gratification" school of thought, we believe we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for MSP, we employ our option writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price, so that MSP can participate in some stock appreciation. By receiving option premiums, MSP receives a high level of investment income and adds an element of downside protection. In addition, we believe our concentration in the Consumer Discretionary and Retail, Technology, Medical Health and Pharmaceutical and Financial sectors provides opportunities for larger premiums than those that would come from other sectors or from writing index options. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value of the strategy and spread income evenly throughout the year.

Volatility of stocks in 2006 peaked in June as measured by the CBOE S&P 500 Volatility ("VIX") Index, but then continued its multi-year decline hitting a twelve year low in November. Despite facing a low volatility environment, which is a negative for option premiums, we have continued to find stocks offering attractive option premiums through our bottom up research process.

While it is hard to make short-term predictions about volatility, the VIX index is now at its lowest level since 1995. Given that we have been able to find attractive options in this low volatility environment, we are confident we should be able to earn even better premiums if volatility reverts to the mean levels we have seen over the last 20 years.

Our outlook for stocks remains positive despite the rally in the second half of 2006. We believe there are a number of factors that can continue to drive positive returns, although some volatility is likely in the near term. While the economy has clearly slowed from its heady post-Katrina pace, GDP has held up at a more trend-like pace. This benefits our style of investing since a slower economy should lead to slower earnings growth, which should shift attention to higher quality companies, such as those we own.

Furthermore, with the economy growing at a solid but slower pace and the market unconcerned about inflation, interest rates have been low and stable. This would generally be a good environment for P/E expansion; at the very least we believe the headwind of multiple contraction is gone. While we continue to believe that profit margins have likely peaked, absolute earnings remain strong. As a corollary effect, as profit levels have fattened over the years, corporate balance sheets have been cleaned up and companies have rewarded shareholders with increased dividends and share repurchase programs. We expect this type of activity to continue. Although the strength in stocks in the latter half of the year may be followed by a pause sometime in the first part of 2007, we are prepared to take advantage of opportunities as they become available. Finally, we are optimistic that we will continue to be able to find call writing opportunities that will provide shareholders meaningful income.

Annual Report/December 31, 2006/2

MSP/Madison Strategic Sector Premium Fund/Management's Discussion of Fund Performance/concluded

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2006 FOR MADISON STRATEGIC SECTOR PREMIUM FUND

% of net assets |

| Merrill Lynch & Co. | 4.01% |

| Home Depot Inc | 3.80% |

| Lowe's Cos Inc. | 3.75% |

| Cisco Systems Inc. | 3.53% |

| Amgen Inc. | 3.53% |

| Morgan Stanley | 3.50% |

| Bed Bath & Beyond Inc. | 3.49% |

| Citigroup Inc | 3.35% |

| Target Corporation | 3.19% |

| Best Buy Co. | 3.17% |

Annual Report/December 31, 2006/3

MSP/Madison Strategic Sector Premium Fund

Report of Independent Registered Public Accounting Firm -- December 31, 2006

To the Board of Trustees and Shareholders of Madison Strategic Sector Premium Fund

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments of the Madison Strategic Sector Premium Fund (the "Fund"), as of December 31, 2006 and the related statement of operations for the year then ended and the statements of changes in net assets and financial highlights for the year then ended and for the period from April 27, 2005 (commencement of operations) through December 31, 2005. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2006 by correspondence with the Fund's custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2006, and the results of its operations for the year then ended and the changes in its net assets and financial highlights for the year then ended and for the period from April 27, 2005 (commencement of operations) through December 31, 2005, in conformity with accounting principles generally accepted in the United States of America.

(signature)

Chicago, Illinois

February 2, 2007

Annual Report/December 31, 2006/4

MSP/Madison Strategic Sector Premium Fund

Portfolio of Investments -- December 31, 2006

Number of Shares | | Value |

| | Common Stocks - 101.5% | |

| | Business Services - 0.6% | |

17,600 | Cintas Corp. | $698,896 |

| | Consumer Discretionary - 26.7% | |

40,000 | Abercrombie & Fitch Co. - CL A | 2,785,200 |

53,333 | Aeropostale Inc* | 1,646,390 |

19,650 | American Eagle Outfitters, Inc | 613,276 |

106,600 | Bed Bath & Beyond Inc.* | 4,061,460 |

75,000 | Best Buy Co, Inc. | 3,689,250 |

40,000 | Coach, Inc | 1,718,400 |

110,000 | Home Depot Inc. | 4,417,600 |

30,000 | Kohl's Corp.* | 2,052,900 |

140,000 | Lowe's Cos, Inc. | 4,361,000 |

10,000 | Ross Stores, Inc. | 293,000 |

65,000 | Target Corporation | 3,708,250 |

55,000 | Willams-Sonoma Inc | 1,729,200 |

| | Energy - 2.1% | |

30,000 | Transocean Inc* | 2,426,700 |

| | Financials - 17.1% | |

11,100 | Affiliated Managers Group, Inc.* | 1,166,943 |

35,000 | Capital One Financial Corp | 2,688,700 |

70,000 | Citigroup, Inc. | 3,899,000 |

80,000 | Countrywide Financial Corp. | 3,396,000 |

50,000 | Merrill Lynch & Co., Inc. | 4,655,000 |

50,000 | Morgan Stanley | 4,071,500 |

| | Health Care - 16.2% | |

60,000 | Amgen, Inc.* | 4,098,600 |

40,000 | Biogen Idec Inc.* | 1,967,600 |

80,000 | Biomet Inc. | 3,301,600 |

61,500 | Boston Scientific Co.* | 1,056,570 |

100,000 | Health Management Associates, Inc. | 2,111,000 |

35,000 | Medtronic Inc | 1,872,850 |

50,000 | Patterson Companies, Inc* | 1,775,500 |

20,000 | Stryker Corporation | 1,102,200 |

20,000 | Zimmer Holdings Inc* | 1,567,600 |

| | Industrial - 5.1% | |

43,000 | Apache Corp | 2,859,930 |

94,235 | FLIR Systems, Inc* | 2,999,500 |

| | Insurance - 1.9% | |

35,000 | MGIC Investment Corp. | 2,188,900 |

| | Software - 6.8% | |

140,000 | Check Point Software Technologies Ltd.* | 3,068,800 |

120,000 | Symantec Corp.* | 2,502,000 |

70,000 | Transactions Systems Architects Inc* | 2,279,900 |

| | Technology - 25.0% | |

40,000 | Altera Corp* | 787,200 |

125,600 | Applied Materials, Inc. | 2,317,320 |

150,000 | Cisco Systems, Inc.* | 4,099,500 |

90,000 | Dell Inc* | 2,258,100 |

75,000 | eBay Inc.* | 2,255,250 |

190,000 | Flextronics International Ltd.* | 2,181,200 |

2,000 | Google, Inc-Class A | 920,960 |

60,000 | Hewlett-Packard Co. | 2,471,400 |

140,000 | Intel Corp. | 2,835,000 |

55,000 | Linear Technology Co. | 1,667,600 |

120,000 | Microsoft Corp | 3,583,200 |

14,000 | Qlogic Corp.* | 306,880 |

65,000 | Qualcomm Inc | 2,456,350 |

40,000 | Xilinx Inc | 952,400 |

| Total Long-Term Investments | |

| | (Cost $109,372,013) | 117,923,575 |

| | United States Treasury Note - 0.3% | |

| | Issued 2/15/2005 at 2.25%, due 2/15/2007. Proceeds at maturity are $400,000 (Cost $398,654). | 398,654 |

| Repurchase Agreement - 6.7% Morgan Stanley issued 12/29/06 at 4.65%, due 1/3/07, collateralized by $7,962,884 in United States Treasury Notes due 5/15/09. Proceeds at maturity are $7,811,041 (Cost $7,806,000). | 7,806,000 |

| | Total Investments - 108.5% | |

| | (Cost $117,576,667) | 126,128,229 |

| | Cash and other assets less liabilities - 0.0% | 2,367 |

| | Total Call Options Written - (8.5%) | (9,907,555) |

| | Total Put Options Written - (0.0%) | (45) |

| | Net Assets - 100% | $116,222,996 |

*Non-income producing.

Annual Report/December 31, 2006/5

MSP/Madison Strategic Sector Premium Fund/Portfolio of Investments/continued

Contracts (100 shares per contract) | Call Options Written | Expiration Date | Exercise Price | Market Value |

400 | Abercrombie & Fitch Co. - CL A | May 2007 | $70.00 | $256,000 |

111 | Affiliated Managers Group, Inc. | January 2007 | 80.00 | 282,495 |

400 | Altera Corp | March 2007 | 20.00 | 42,000 |

131 | American Eagle Outfitters, Inc.* | January 2007 | 18.38 | 168,990 |

303 | Amgen, Inc. | January 2007 | 70.00 | 15,907 |

245 | Amgen, Inc. | January 2007 | 80.00 | 1,225 |

52 | Amgen, Inc. | April 2007 | 80.00 | 1,950 |

200 | Apache Corp | January 2007 | 60.00 | 134,000 |

230 | Apache Corp | April 2007 | 65.00 | 123,050 |

600 | Applied Materials, Inc | January 2007 | 17.50 | 67,500 |

300 | Applied Materials, Inc | April 2007 | 18.00 | 45,000 |

356 | Applied Materials, Inc | April 2007 | 19.00 | 33,820 |

436 | Bed Bath & Beyond, Inc. | January 2007 | 40.00 | 4,360 |

330 | Bed Bath & Beyond, Inc. | February 2007 | 40.00 | 17,325 |

300 | Bed Bath & Beyond, Inc. | May 2007 | 42.50 | 25,500 |

150 | Best Buy | March 2007 | 55.00 | 11,625 |

240 | Biogen Idec Inc. | January 2007 | 50.00 | 18,600 |

160 | Biogen Idec Inc. | April 2007 | 45.00 | 96,000 |

650 | Biomet, Inc | January 2007 | 40.00 | 97,500 |

150 | Biomet, Inc | April 2007 | 35.00 | 100,500 |

400 | Boston Scientific Corp. | January 2007 | 25.00 | 2,000 |

171 | Capital One Financial Corp | January 2007 | 80.00 | 9,833 |

179 | Capital One Financial Corp | January 2007 | 85.00 | 1,790 |

1,100 | Check Point Software Technologies Ltd. | January 2007 | 20.00 | 222,750 |

260 | Check Point Software Technologies Ltd. | January 2007 | 22.50 | 7,150 |

176 | Cintas Corp. | February 2007 | 40.00 | 14,960 |

300 | Cisco Systems, Inc. | January 2007 | 17.50 | 295,500 |

700 | Cisco Systems, Inc. | January 2007 | 20.00 | 514,500 |

500 | Cisco Systems, Inc. | January 2007 | 22.50 | 242,500 |

400 | Coach Inc | January 2007 | 30.00 | 520,000 |

800 | Countrywide Financial Corp. | January 2007 | 37.50 | 408,000 |

500 | Dell Inc | January 2007 | 25.00 | 33,750 |

400 | Dell Inc | May 2007 | 27.50 | 45,000 |

200 | eBay Inc. | January 2007 | 35.00 | 1,000 |

450 | eBay Inc. | April 2007 | 35.00 | 45,000 |

100 | Flextronics International Ltd. | January 2007 | 10.00 | 15,250 |

700 | Flextronics International Ltd. | January 2007 | 12.50 | 5,250 |

1,000 | Flextronics International Ltd. | April 2007 | 12.50 | 37,500 |

942 | FLIR Systems, Inc | January 2007 | 27.50 | 419,190 |

10 | Google, Inc | January 2007 | 330.00 | 131,350 |

10 | Google, Inc | January 2007 | 410.00 | 52,200 |

600 | Hewlett Packard Co | January 2007 | 30.00 | 675,000 |

See notes to financial statements

Annual Report/December 31, 2006/6

MSP/Madison Strategic Sector Premium Fund/Portfolio of Investments/concluded

Contracts (100 shares per contract) | Call Options Written | Expiration Date | Exercise Price | Market Value |

600 | Home Depot, Inc | January 2007 | 45.00 | 3,000 |

200 | Home Depot, Inc | February 2007 | 37.50 | 65,000 |

600 | Intel Corp | January 2007 | 20.00 | 40,500 |

300 | Intel Corp | January 2007 | 22.50 | 2,250 |

500 | Intel Corp | April 2007 | 20.00 | 71,250 |

300 | Kohl's Corp. | January 2007 | 50.00 | 558,000 |

250 | Linear Technology Co. | February 2007 | 35.00 | 3,125 |

400 | Lowe's Cos, Inc. | January 2007 | 32.50 | 6,000 |

1,000 | Lowe's Cos, Inc. | April 2007 | 32.50 | 125,000 |

350 | Medtronic Inc | January 2007 | 55.00 | 13,125 |

500 | Merrill Lynch & Co., Inc. | January 2007 | 75.00 | 917,500 |

250 | MGIC Investment Corp. | January 2007 | 65.00 | 13,750 |

500 | Microsoft Corp | January 2007 | 22.50 | 370,000 |

700 | Microsoft Corp | January 2007 | 24.50 | 381,500 |

428 | Morgan Stanley | January 2007 | 65.00 | 704,060 |

72 | Morgan Stanley | April 2007 | 80.00 | 36,000 |

270 | Patterson Cos | April 2007 | 35.00 | 66,150 |

230 | Patterson Cos | April 2007 | 40.00 | 11,500 |

140 | Qlogic Corp. | January 2007 | 17.50 | 62,300 |

100 | Qualcomm Inc | April 2007 | 40.00 | 20,500 |

100 | Ross Stores, Inc. | February 2007 | 27.50 | 26,000 |

200 | Stryker Corporation | March 2007 | 50.00 | 122,000 |

690 | Symantec Corp. | January 2007 | 20.00 | 170,850 |

510 | Symantec Corp. | January 2007 | 17.50 | 74,175 |

200 | Target Corporation | January 2007 | 55.00 | 50,000 |

450 | Target Corporation | April 2007 | 57.50 | 136,125 |

40 | Transactions Systems Architects Inc | May 2007 | 35.00 | 8,700 |

50 | Transocean, Inc | January 2007 | 70.00 | 55,750 |

250 | Transocean, Inc | February 2007 | 80.00 | 125,000 |

550 | Willams-Sonoma Inc | February 2007 | 32.50 | 42,625 |

400 | Xilinx Inc | January 2007 | 25.00 | 14,000 |

200 | Zimmer Holdings Inc | January 2007 | 60.00 | 369,000 |

| | Total Call Options Written

(Premiums Received $6,731,230) | | | $9,907,555 |

| | Put Options Written

(Premiums Received $39,590) | | | |

9 | Google | January 2007 | $340.00 | $ 45 |

| Total Options Written

(Premiums Received $6,770,820) | | | $9,907,600 |

See notes to financial statements

Annual Report/December 31, 2006/7

MSP/Madison Strategic Sector Premium Fund

Statement of Assets and Liabilities -- December 31, 2006

| ASSETS | |

| Investments, at value (Note 2) | |

| Investment securities | $117,923,575 |

| Repurchase agreement | 7,806,000 |

| United States Treasury Note | 398,654 |

| Total investments (cost $117,576,667) | 126,128,229 |

| Cash | 224 |

| Dividends and interest | 24,715 |

| Total assets | 126,153,168 |

| | |

| LIABILITIES | |

| Options written, at value (premiums received of $6,770,820) | 9,907,600 |

| Independent trustee fees | 4,500 |

| Auditor fees | 15,700 |

| Other expenses | 2,372 |

| Total liabilities | 9,930,172 |

| | |

| NET ASSETS | $116,222,996 |

| Net assets consists of: | |

| Paid in capital | 109,537,837 |

| Accumulated net realized gain on investments and options transactions | 1,270,377 |

| Net unrealized appreciation on investments and options transactions | 5,414,782 |

| Net Assets | $116,222,996 |

| | |

| CAPITAL SHARES ISSUED AND OUTSTANDINGAn unlimited number of capital shares authorized, $.01 par value per share (Note 7) | 5,738,486 |

| | |

| NET ASSET VALUE PER SHARE | $20.25 |

See notes to financial statements.

Annual Report/December 31, 2006/8

MSP/Madison Strategic Sector Premium Fund

Statement of Operations -- For the year ended December 31, 2006

| INVESTMENT INCOME (Note 2) | |

| Interest income | $660,592 |

| Dividend income | 730,332 |

| Accretion of discount | 69,537 |

| Total investment income | 1,460,461 |

| | |

| EXPENSES (Note 3) | |

| Investment advisory | 892,917 |

| Administration | 27,904 |

| Fund accounting | 26,714 |

| Independent trustee fees | 18,000 |

| Auditor fees | 23,800 |

| Other | 104,488 |

| Total expenses | 1,093,823 |

| | |

| NET INVESTMENT INCOME | 366,638 |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain on: | |

| Investments | 5,737,879 |

| Options | 3,821,881 |

| Net unrealized appreciation (depreciation) on: | |

| Investments | 5,203,155 |

| Options | (2,734,414) |

| | |

| NET GAIN ON INVESTMENTS AND OPTIONS TRANSACTIONS | 12,028,501 |

| | |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $12,395,139 |

See notes to financial statements.

Annual Report/December 31, 2006/9

MSP/Madison Strategic Sector Premium Fund

Statement of Changes in Net Assets

| | For the Year Ended December 31, 2006 | For the Period April 27, 20051 through December 31, 2005 |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | |

| Net investment income | $366,638 | $184,886 |

| Net realized gain on investments and options transactions | 9,559,760 | 6,360,345 |

| Net unrealized appreciation on investments and options transactions | 2,468,741 | 2,946,041 |

| Total increase in net assets resulting from operations | 12,395,139 | 9,491,272 |

| | | |

| DISTRIBUTION TO SHAREHOLDERS | | |

| From net investment income | (366,638) | (184,886) |

| From net capital gains | (9,838,624) | (4,811,104) |

| Total distributions | (10,205,262) | (4,995,990) |

| | | |

| CAPITAL SHARE TRANSACTIONS | | |

| Proceeds from issuance of common shares | -- | 105,050,000 |

| Reinvestment of dividends | 2,526,145 | 1,831,589 |

| Common share offering costs charged to paid-in-capital | -- | (220,000) |

| Total increase in net assets resulting from capital share transactions | 2,526,145 | 106,661,589 |

| | | |

| TOTAL INCREASE IN NET ASSETS | 4,716,022 | 111,156,871 |

| | | |

| NET ASSETS | | |

| Beginning of period | $111,506,974 | $350,103 |

| End of period | $116,222,996 | $111,506,974 |

1 Commencement of operations

See notes to financial statements.

Annual Report/December 31, 2006/10

MSP/Madison Strategic Sector Premium Fund

Financial Highlights

Per Share Operating Performance for One Share Outstanding Throughout the Period

| | For the Year Ended December 31, 2006 | For the Period April 27, 20051 through December 31, 2005 |

| Net Asset Value, Beginning of Period | $19.87 | $19.102 |

| Investment Operations | | |

| Net Investment Income | 0.06 | 0.03 |

| Net realized and unrealized gain on investments and options transactions | 2.12 | 1.68 |

| Total from investment operations | 2.18 | 1.71 |

| Less distributions from: | | |

| Net investment income | (0.06) | (0.03) |

| Capital gains | (1.74) | (0.87) |

| Total distributions | (1.80) | (0.90) |

| Offering Costs Charged to Paid-in-Capital | -- | (0.04) |

| Net Asset Value, End of Period | $20.25 | $19.87 |

| Market Value, End of Period | $20.60 | $20.28 |

| Total Investment Return | | |

| Net asset value (%) | 11.61 | 8.83 |

| Market value (%) | 11.30 | 5.29 |

| Ratios and Supplemental Data | | |

| Net assets, end of period (thousands) | $116,223 | $111,507 |

| Ratio of expenses to average net assets (%) | 0.98 | 0.973 |

| Ratio of net investment Income to average net assets (%) | 0.33 | 0.253 |

| Portfolio turnover (%) | 64 | 49 |

1Commencement of operations

2Before deduction of offering costs charged to capital

3Annualized

See notes to financial statements.

Annual Report/December 31, 2006/11

MSP/Madison Strategic Sector Premium Fund

Notes to Financial Statements -- December 31, 2006

Note 1 -- Organization.

Madison Strategic Sector Premium Fund (the "Fund") was organized as a Delaware statutory trust on February 4, 2005. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended. The Fund commenced operations on April 27, 2005. The Fund's primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation.

The Fund will pursue its investment objectives by investing in a portfolio consisting primarily of common stocks of large and mid-capitalization issuers that are, in the view of the Fund's Investment Advisor, selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund's investment objectives are considered fundamental and may not be changed without shareholder approval.

Note 2 -- Significant Accounting Policies.

(a) Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

(b) Valuation of Investments

Readily marketable portfolio securities listed on an exchange or traded in the over-the counter market are generally valued at their last reported sale price. If no sales are reported, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day, then the security is valued by such method as the Fund's Board of Trustees shall determine in good faith to reflect its fair value. Portfolio securities traded on more than one securities exchange are valued at the last sale price at the close of the exchange representing the principal market for such securities. Debt securities are valued at the last available bid price for such securities or, if such prices are not available, at the mean between the last bid and asked price. Exchange-traded options are valued at the mean of the best bid and best asked prices across all option exchanges.

Short-term debt securities having a remaining maturity of sixty days or less are valued at amortized cost, which approximates market value.

(c) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis.

(d) Repurchase Agreement

The Fund may invest in repurchase agreements, which are short-term investments in which the Fund acquires ownership of a debt security and the seller agrees to repurchase the security at a future time and specified price. Repurchase agreements are fully collateralized by the underlying debt security. The Fund will make payment for such securities only upon physical delivery or evidence of book entry transfer to the account of the custodian bank. The seller is required to maintain the value of the underlying security at not less than the repurchase proceeds due the Fund.

Note 3 -- Investment Advisory Agreement and Other Transactions with Affiliates.

Pursuant to an Investment Advisory Agreement between the Fund and Madison Asset Management, LLC, a wholly-owned subsidiary of Madison Investment Advisors, Inc. (collectively "the Advisor"), the Advisor, under the supervision of the Fund's Board of Trustees, will provide a continuous investment program for the Fund's portfolio; provide investment research and make and execute recommendations for the purchase and sale of securities; and provide certain facilities and personnel, including officers required for the Fund's administrative management and compensation of all officers and trustees of the Fund who are its affiliate. For these services, the Fund will pay the Advisor a fee, payable monthly, in an amount equal to 0.80% of the Fund's average daily net assets.

Under a separate Services Agreement, effective April 26, 2005, the Advisor provides fund administration services, fund accounting services, and arranges to have all other necessary operational and support services, for a fee, to the Fund. Such services include Transfer Agent, Custodian, Legal, and other operational expenses. These fees are accrued daily and shall not exceed 0.18% of the Fund's average daily net assets. The Advisor assumes responsibility for payment of all expenses greater than 0.18% of average net assets for the first five years of the Fund's operations.

Annual Report/December 31, 2006/12

MSP/Madison Strategic Sector Premium Fund/Notes to Financial Statements/continued

Note 4 -- Federal Income Taxes.

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of investments, excluding option contracts, as of December 31, 2006 is as follows:

| Aggregate Cost | $117,576,667 |

| Gross unrealized appreciation | 12,275,410 |

| Gross unrealized depreciation | (3,723,848) |

| Net unrealized appreciation | $8,551,562 |

Net realized gains or losses may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions and post-October transactions.

Due to inherent differences in the recognition of income, expenses, and realized gains/losses under U.S. generally accepted accounting principles and federal income tax purposes, permanent differences between book and tax basis reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities. A permanent book and tax difference relating to short-term and long-term capital gains in the amounts of $8,988,554 and $850,070, respectively were reclassified from accumulated net realized gain to accumulated undistributed net investment income.

For the periods ended December 31, 2006 and 2005, the tax character of distributions paid to shareholders was $9,355,192 of ordinary income and $850,070 of long-term capital gains for 2006 and $4,995,990 of ordinary income for 2005, respectively. The Fund designates 7.78% of dividends declared from net investment income and short-term capital gains during the year ended December 31, 2006 as qualified income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Note 5 -- Investment Transactions.

During the year ended December 31, 2006, the cost of purchases and proceeds from sales of investments, excluding short-term investments were $72,719,405 and $65,308,903, respectively. No U.S. Government securities were purchased or sold during the period.

Note 6 -- Covered Call Options.

The Fund will pursue its primary objective by employing an option strategy of writing (selling) covered call options on common stocks. The number of call options the Fund can write (sell) is limited by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) "naked" or uncovered call options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or "strike" price. The writer of an option on a security has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or to pay the exercise price upon delivery of the underlying security (in the case of a put).

There are several risks associated with transactions in options on securities. As the writer of a covered call option, the Fund forgoes, during the option's life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call but has retained the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

Transactions in option contracts during the year ended December 31, 2006 were as follows:

| | Number of Contracts | Premiums Received |

| Options outstanding beginning of period | 23,386 | $5,990,194 |

| Options written | 39,606 | 10,320,580 |

| Options two for one split | 870 | -- |

| Options expired | (14,698) | (3,494,068) |

| Options closed | (4,432) | (1,428,505) |

| Options assigned | (17,751) | (4,617,381) |

| Options outstanding end of period | 26,981 | $6,770,820 |

Annual Report/December 31, 2006/13

MSP/Madison Strategic Sector Premium Fund/Notes to Financial Statements/concluded

Note 7 -- Capital.

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 5,738,486 shares issued and outstanding as of December 31, 2006.

In connection with the Fund's dividend reinvestment plan, the Fund issued 127,720 shares for a total reinvestment of $2,526,145 for the year ended December 31, 2006.

Note 8 -- Indemnifications.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and, therefore cannot be estimated; however, the risk of material loss from such claims is considered remote.

Note 9 -- Leverage.

The Fund has a $25 million revolving credit facility with a bank to permit it to leverage its portfolio under favorable market conditions. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. During the year ended December 31, 2006, the Fund did not borrow on its credit facility and, as such, did not engage in leverage.

Note 10 -- New Accounting Pronouncements.

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes -- an Interpretation of FASB Statement No. 109" ("FIN 48"), which clarifies the accounting for uncertainty in tax positions taken or expected to be taken in a tax return. FIN 48 provides guidance on the measurement, recognition, classification and disclosure of tax positions, along with accounting for the related interest and penalties. FIN 48 is effective for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the date of effectiveness. The Fund is currently evaluating the impact, if any, of applying the various provisions of FIN 48.

On September 15, 2006, the Financial Accounting Standards Board issued Standard No. 157, "Fair Value Measurements" ("FAS 157"). FAS 157 addresses how companies should measure fair value when specified assets and liabilities are measured at fair value for either recognition or disclosure purposes under generally accepted accounting principles (GAAP). FAS 157 is intended to make the measurement of fair value more consistent and comparable and improve disclosures about those measures. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007. At this time, management believes the adoption of FAS 157 will have no material impact on the financial statements of the Fund.

Results of Shareholder Vote (unaudited). The Annual Meeting of shareholders of the Fund was held on July 25, 2006. At the meeting, shareholders voted on the election of a trustee, Philip E. Blake. The votes cast in favor of election were 5,543,147 with 51,944 shares withheld. The other trustees of the Fund whose terms did not expire in 2006 are Frank Burgess, James Imhoff, Jr., Lorence Wheeler and Katherine L. Frank.

Additional Information. Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that from time to time the Fund may purchase shares of its common stock in the open market at prevailing market prices.

In January 2007, the Fund announced it will be making its regular distributions on a quarterly rather than monthly basis.

This report is sent to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or any securities mentioned in the report.

Annual Report/December 31, 2006/14

MSP/Madison Strategic Sector Premium Fund

Management Information -- December 31, 2006

Independent Trustees

| Name, Address and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

Philip E. Blake

550 Science Drive

Madison, WI 53711

Born 1944 | Trustee | Indefinite Term since April 2005 | Retired investor; formerly Vice President - Publishing, Lee Enterprises Inc. | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | Madison Newspapers, Inc. of Madison, WI; Trustee of the Madison Claymore Covered Call Fund; Nerites Corp. |

James R. Imhoff, Jr.

550 Science Drive

Madison, WI 53711

Born 1944 | Trustee | Indefinite Term since April 2005 | Chairman and CEO of First Weber Group, Inc. (real estate brokers) of Madison, WI. | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | Trustee of the Madison Claymore Covered Call Fund; Park Bank, FSB. |

Lorence D. Wheeler

550 Science Drive

Madison, WI 53711

Born 1938 | Trustee | Indefinite Term since April 2005 | Retired investor; formerly Pension Specialist for CUNA Mutual Group (insurance) and President of Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide). | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | Trustee of the Madison Claymore Covered Call Fund; Grand Mountain Bank, FSB. |

Interested Trustees*

Frank E. Burgess

550 Science Drive

Madison, WI 53711

Born 1942 | Trustee and Vice President | Indefinite Terms since April 2005 | Founder, President and Director of Madison Investment Advisors, Inc. | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | Trustee of the Madison Claymore Covered Call Fund; Capitol Bank, FSB. |

Katherine L. Frank

550 Science Drive

Madison, WI 53711

Born 1960 | Trustee and President | Indefinite Terms since April 2005 | Principal and Vice President of Madison Investment Advisors, Inc. and President of Madison Mosaic, LLC | President of all 11 Madison Mosaic Funds. Trustee of all Madison Mosaic Funds except Equity Trust; President and Trustee of the Madison Strategic Sector Premium Fund. | None |

Officers*

Jay R. Sekelsky

550 Science Drive

Madison, WI 53711

Born 1959 | Vice President | Indefinite Term since April 2005 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | None |

Christopher Berberet

550 Science Drive

Madison, WI 53711

Born 1959 | Vice President | Indefinite Term since April 2005 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | None |

W. Richard Mason

8777 N. Gainey Center Drive, #220

Scottsdale, AZ 85258

Born 1960 | Secretary, General Counsel and Chief Compliance Officer | Indefinite Terms since April 2005 | Principal of Mosaic Funds Distributor, LLC; General Counsel and Chief Compliance Officer for the Advisor, Madison Scottsdale, LC and Madison Mosaic, LLC; General Counsel for Concord Asset Management, LLC. | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | None |

Greg Hoppe

550 Science Drive

Madison, WI 53711

Born 1969 | Chief Financial Officer | Indefinite Term since April 2005 | Vice President of Madison Mosaic, LLC | All 11 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund. | None |

*All interested Trustees and Officers of the Trust are employees and/or owners of Madison Investment Advisors, Inc. Since Madison Investment Advisors, Inc. serves as the investment advisor to the Trust, each of these individuals is considered an "interested person" of the Trust as the term is defined in the Investment Company Act of 1940.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Mosaic Funds at 1-800-368-3195.

Forward-Looking Statement Disclosure.

One of our most important responsibilities as investment company managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information.

The Fund adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund's portfolios. Additionally, information regarding how the Fund voted proxies related to portfolio securities, if applicable, during the period ended December 31, 2006 is available to you upon request and free of charge, by writing to Madison Strategic Sector Premium Fund, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. The Fund's proxy voting policies and voting information may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Fund will respond to shareholder requests for copies of our policies and voting information within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure.

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the "Commission") for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available on the Commission's website. The Fund's Forms N-Q may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-551-8090. Form N-Q and other information about the Fund are available on the EDGAR Database on the Commission's Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the Commission's Public Reference Section, Washington, DC 20549-0102. Finally, you may call the Fund at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Annual Report/December 31, 2006/16

MSP/Madison Strategic Sector Premium Fund

Dividend Reinvestment Plan -- December 31, 2006

Unless the registered owner of common shares elects to receive cash by contacting the Plan Administrator, all dividends declared on common shares of the Fund will be automatically reinvested by Computershare Trust Company, Inc. (the "Plan Administrator"), Administrator for shareholders in the Fund's Dividend Reinvestment Plan (the "Plan"), in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all dividends declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder's common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a "Dividend") payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants' accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund ("Newly Issued Common Shares") or (ii) by purchase of outstanding common shares on the open market ("Open-Market Purchases") on the New York Stock Exchange or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant's account will be determined by dividing the dollar amount of the Dividend by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Dividend, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Dividend amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders' accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Dividends.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, Computershare Trust Company, Inc., 250 Royall St., Canton, MA 02021, Phone Number: (800) 727-0196.

Annual Report/December 31, 2006/17

MSP/Madison Strategic Sector Premium Fund

Board of Trustees

Philip E. Blake

Frank Burgess

James Imhoff, Jr.

Katherine Frank

Lorence Wheeler

Officers

Katherine L. Frank

President

Frank Burgess

Senior Vice President

Ray DiBernardo

Vice President

Jay Sekelsky

Vice President

Greg Hoppe

Chief Financial Officer

& Treasurer

W. Richard Mason

Secretary, General Counsel &

Chief Compliance Officer

Investment Advisor

Madison Asset Management, LLC

550 Science Drive

Madison, WI 53711

Administrator

Madison Investment Advisors, Inc.

550 Science Drive

Madison, WI 53711

Custodian

US Bank NA

Milwaukee, Wisconsin

Transfer Agent

Computershare Investor Services, LLC

Chicago, Illinois

Legal Counsel

Skadden, Arps, Slate, Meagher &

Flom, LLP

Chicago, Illinois

Independent Registered

Public Accounting Firm

Grant Thornton LLP

Chicago, Illinois

Privacy Principles of Madison Strategic Sector Premium Fund for Shareholders

The Fund is committeed to maintaining the privacy of shareholders and to safeguarding its non-public information. The following information is provided to help you understand what personal information the Fund collects, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, the Fund does not receive any nonpublic personal information relating to its shareholders, alther certainnonpublic personal information of its shareholders may become available to the Fund. The Fund does not disclose any nonpublic personal informatin about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator).

The Fund restricts access to nonpublic personal information about the shareholders to Madison Asset Management, LLC and Madison Investment Advisors, Inc. employees with a legitimate business need for the information. The Fund maintains physical, electronic and procedural safeguards designed to protect the nonbpublic personal information of its shareholders.

Question concerning your shares of Madison Strategic Sector Premium Fund?

If your shares are held in a Brokerage Account, contact your broker

If you have physical possession of your shares in certificate form, contact the Fund's Transfer Agent:

Computershare Investor Services, LLC, 2 North LaSalle Street, Chicago, Illinois 60602 1-800-727-0196

This report is sent to shareholders of Madison Strategic Sector Premium Fund for their information. It is not a Prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

Annual Report/December 31, 2006/18

Madison Investment Advisors, Inc.

550 SCIENCE DRIVE

MADISON, WISCONSIN 53711

1-800-767-0300

www.madisonfunds.com

Item 2. Code of Ethics.

(a) The Trust has adopted a code of ethics that applies to the Trust’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the Trust or a third party. The code was first adopted during the fiscal year ended December 31, 2005.

(c) The code has not been amended since it was initially adopted.

(d) The Trust granted no waivers from the code during the period covered by this report.

(f) Any person may obtain a complete copy of the code without charge by calling the Trust at 800-767-0300 and requesting a copy of the "Madison Strategic Sector Premium Fund Sarbanes Oxley Code of Ethics."

Item 3. Audit Committee Financial Expert.

At a meeting held during the period covered by this report, the Trust’s Board of Trustees elected James Imhoff, an “independent” Trustee and a member of the Trust’s audit committee, to serve as the Trust’s audit committee financial expert among the three Trust independent Trustees who so qualify to serve in that capacity.

Item 4. Principal Accountant Fees and Services.

(a) Total audit fees paid to the registrant's principal accountant for the fiscal year ended December 31, 2005 were approved not to exceed $28,000 (plus typical expenses in connection with the audit such as postage, photocopying, etc.). For the fiscal year ended December 31, 2006, this amount was $23,800.

(b) Audit-Related Fees. None.

(c) Tax-Fees. None incurred during the period covered by this report.

(d) All Other Fees. None.

(e) (1) Before any accountant is engaged by the registrant to render audit or non-audit services, the engagement must be approved by the audit committee as contemplated by paragraph (c)(7)(i)(A) of Rule 2-01of Regulation S-X.

(2) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act (15 U.S.C. 78c(a)(58)(A)). The members of the committee include all the disinterested Trustees of the registrant, namely, Philip Blake, James Imhoff and Lorence Wheeler.

(b) Not applicable.

Item 6. Schedule of Investments

Included in report to shareholders (Item 1) above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The following discloses our current policies and procedures that we use to determine how to vote proxies relating to portfolio securities. Because we manage portfolios for clients in addition to the registrant, the policies and procedures are not specific to the registrant except as indicated.

Proxy Voting Policies

Our policies regarding voting the proxies of securities held in client accounts depend on the nature of our relationship to the client. When we are an ERISA fiduciary of an account, there are additional considerations and procedures than for all other (regular) accounts. In all cases, when we vote client proxies, we must do so in the client's best interests as described below by these policies.

Regular Accounts

We do not assume the role of an active shareholder when managing client accounts. If we are dissatisfied with the performance of a particular company, we will generally reduce or terminate our position in the company rather than attempt to force management changes through shareholder activism.

Making the Initial Decision on How to Vote the Proxy

As stated above, our goal and intent is to vote all proxies in the client's best interests. For practical purposes, unless we make an affirmative decision to the contrary, when we vote a proxy as the Board of Directors of a company recommends, it means we agree with the Board that voting in such manner is in the interests of our clients as shareholders of the company for the reasons stated by the Board. However, if we believe that voting as the Board of Directors recommends would not be in a client's best interests, then we must vote against the Board's recommendation.

As a matter of standard operating procedure, all proxies received shall be voted (by telephone or Internet or through a proxy voting service), unless we are not authorized to vote proxies. When the client has reserved the right to vote proxies in his/her/its account, we must make arrangements for proxies to be delivered directly to such client from its custodian and, to the extent any such proxies are received by us inadvertently, promptly forward them to the client.

Documenting our Decisions

In cases where a proxy will NOT be voted or, as described below, voted against the Board of Directors recommendation, our policy is to make a notation to the file containing the records for such security (e.g., Corporation X research file, since we may receive numerous proxies for the same company and it is impractical to keep such records in the file of each individual client) explaining our action or inaction, as the case may be. Alternatively, or in addition to such notation, we may include a copy of the rationale for such decision in the appropriate equity correspondence file.

Why would voting as the Board recommends NOT be in the client's best interests?

Portfolio management must, at a minimum, consider the following questions before voting any proxy:

1. Is the Board of Directors recommending an action that could dilute or otherwise diminish the value of our position? (This question is more complex than it looks: We must consider the time frames involved for both the client and the issuer. For example, if the Board of Directors is recommending an action that might initially cause the position to lose value but will increase the value of the position in the long-term, we would vote as the Board recommended for if we are holding the security for clients as a long-term investment. However, if the investment is close to our valuation limits and we are anticipating eliminating the position in the short-term, then it would be in our clients' best interests to vote against management's recommendation.)

2. If so, would we be unable to liquidate the affected securities without incurring a loss that would not otherwise have been recognized absent management's proposal?

3. Is the Board of Directors recommending an action that could cause the securities held to lose value, rights or privileges and there are no comparable replacement investments readily available on the market? (For example, a company can be uniquely positioned in the market because of its valuation compared with otherwise comparable securities such that it would not be readily replaceable if we were to liquidate the position. In such a situation, we might vote against management's recommendation if we believe a "No" vote could help prevent future share price depreciation resulting from management's proposal or if we believe the value of the investment will appreciate if management's proposal fails. A typical recent example of this type of decision is the case of a Board recommendation not to expense stock options, where we would vote against management's recommendation because we believe expensing such options will do more to enhance shareholder value going forward.)

4. Would accepting the Board of Directors recommendation cause us to violate our client's investment guidelines? (For example, a Board may recommend merging the company into one that is not permitted by client investment guidelines, e.g. a tobacco product company, a foreign security that is not traded on any US exchange or in US dollars, etc., restrictions often found in client investment guidelines. This would be an unusual situation and it is possible we would, nevertheless, vote in favor of a Board's recommendation in anticipation of selling the investment prior to the date any vote would effectively change the nature of the investment as described. Moreover, this does not mean we will consider any client-provided proxy voting guidelines. Our policy is that client investment guidelines may not include proxy voting guidelines if our firm will vote account proxies. Rather, we will only vote client proxies in accordance with these guidelines. Clients who wish their account proxies to be voted in accordance with their own proxy voting guidelines must retain proxy voting authority for themselves.)

Essentially, we must "second guess" the Board of Directors to determine if their recommendation is in the best interests of our clients, regardless of whether the Board thinks their recommendation is in the best interests of shareholders in general. The above questions should apply no matter the type of action subject to the proxy. For example, changes in corporate governance structures, adoption or amendments to compensation plans (including stock options) and matters involving social issues or corporate responsibility should all be reviewed in the context of how it will affect our clients' investment.

In making our decisions, to the extent we rely on any analysis outside of the information contained in the proxy statements, we must retain a record of such information in the same manner as other books and records (2 years in the office, 5 years in an easily accessible place). Also, if a proxy statement is NOT available on the SEC's EDGAR database, we must keep a copy of the proxy statement.

Addressing Conflicts of Interest

Although it is not likely, in the event there is a conflict of interest between us and our client in connection with a material proxy vote (for example, (1) the issuer or an affiliate of the issuer is also a client or is actively being sought as a client or (2) we have a significant business relationship with the issuer such that voting in a particular manner could jeopardize this client and/or business relationship), our policy is to alert affected client(s) of the conflict before voting and indicate the manner in which we will vote. In such circumstances, our client(s) may instruct us to vote in a different manner. In any case, we must obtain client consent to vote the proxy when faced with a conflict of interest. If the conflict involves a security held by a mutual fund we manage, then we must present the material conflict to the Board of the applicable fund for consent or direction to vote the proxies. If the conflict involves a security held by wrap accounts, then we may present the conflict to the wrap sponsor, as our agent, to obtain wrap client consent or direction to vote the proxies. Note that no conflict generally exists for routine proxy matters such as approval of the independent auditor (unless, of course, the auditor in question is a client, we are seeking the auditor as a client or we have a significant business relationship with the auditor), electing an uncontested Board of Directors, etc.

In the event it is impractical to obtain client consent to vote a proxy when faced with a conflict of interest, or at the request of the applicable fund Board, the firm will employ the services of an independent third party "proxy services firm" to make the proxy voting decision in accordance with Rule 206(4)-6 under the Investment Advisors Act of 1940, as amended. The firm has retained the firm of Glass Lewis & Co. to serve in this capacity. All investment company Boards for which we provide investment management services have requested we utilize the recommendations of Glass Lewis & Co. in cases of conflicts of interest.

Once any member of the relevant portfolio management team determines that it would be in our clients' best interests to vote AGAINST management recommendations (or, for Madison Scottsdale and Concord Asset Management, any particular portfolio manager makes such determination), then the decision should be brought to the attention of the Investment Committee, or any subcommittee appointed by the Investment Committee from among its members (such subcommittee may be a single person), to ratify the decision to stray from our general policy of voting with management. Such ratification need not be in writing.

The Investment Committee or any subcommittee appointed by the Investment Committee from among its members (such subcommittee may be a single person) shall monitor potential conflicts of interest between our firm and clients that would affect the manner by which we vote a proxy. We maintain a "conflicted list" for proxy voting purposes.

As of January 1, 2004, Jay Sekelsky represents the Investment Committee subcommittee described above...

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a) (1) Frank E. Burgess, the President and founder of Madison Investment Advisors, Inc., is responsible for the day-to-day management of the registrant. The Advisor to the registrant, Madison Asset Management, LLC, is a wholly owned subsidiary of Madison Investment Advisors, Inc., founded by Mr. Burgess in 1974.

(a) (2) Other portfolios managed.

As of the end of the registrant's most recent fiscal year, Mr. Burgess was involved in the management of the following accounts:

| Name of manager | Category of other accounts managed | Number managed in category | Total assets in category | Material conflicts of interest that may arise in connection with the manager's management of the Trust's investments and the investments of the other accounts |

| Frank Burgess | Registered investment companies | 4* (including the Trust) | $415,046,000 | None identified. Note that of the four funds managed, the Madison Institutional Equity Option Fund, an open-end series of Madison Mosaic Equity Trust ("MADOX"), with investment strategies similar to the Trust, contains a fulcrum fee that rewards Madison Asset Management, LLC if MADOX outperforms the BXM Index and penalizes the advisor for underperforming such index. As of the date of this filing, MADOX assets were approximately $11 million. The advisor's compliance program includes procedures to monitor trades by MADOX, the Trust and other funds managed by the portfolio manager. |

| | Other pooled investment vehicles | None | None | None identified |

| | Other accounts | None | Not applicable | None identified |

*Except as disclosed above with regard to MADOX, the advisory fee was not based on the performance of any of these accounts.

(a) (3) Compensation.

All compensation is measured and paid on an annual, calendar year basis. The portfolio manager is a majority owner of the registrant's investment advisor and does not receive "incentive" compensation.

| Name of manager | Structure of compensation for managing Mosaic Equity Trust portfolios | Specific criteria | Difference in methodology of compensation with other accounts managed (relates to the "Other Accounts" mentioned in the chart above) |

| Frank Burgess | We believe investment professionals should receive compensation for the performance of our client's accounts, their individual effort, and the overall profitability of the firm. The manager is a controlling shareholder of Madison Investment Advisors, Inc. and participate in the overall profitability of the firm through his individual ownership in the firm. Madison Investment Advisors, Inc. also offers an Employee Stock Ownership Plan (ESOP) in which all employees are eligible to participate in after one year of employment. All the members of our portfolio management teams have significant investments in either the firm or the Madison Mosaic Fund accounts we manage with the same general style and philosophy as our individual client accounts. We believe our portfolio managers' goals are aligned with those of long-term investors, recognizing client goals to outperform over the long-term, rather than focused on short-term performance contests. | Not applicable. | None. Compensation is based on the entire employment relationship, not based on the performance of any single account or type of account. |

(a) (4) Ownership of Securities.

As of December 31, 2006, the portfolio manager beneficially owned the following amounts of the registrant:

| Name of Manager | Name of Registrant | Range of Ownership Interest |

| Frank Burgess | Madison Strategic Sector Premium Fund | $100,001 - $500,000 |

(b) Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

(a) During the period covered by this report, a total of 14,792 shares in the amount of $280,168.87 were purchased by on or behalf of the registrant or any "affiliated purchaser," as defined in Rule 10b-18(a)(3) under the Exchange Act of shares or other units of any class of the registrant's equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act.

(b)

REGISTRANT PURCHASES OF EQUITY SECURITIES

| Period | (a) Total Number of Shares (or Units) Purchased | (b)Average Price Paid per Share (or Unit) | (c)Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d)Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

| Month #1 (July 1 to July 31, 2006) | 14,092* | 18.879 | 14,092* | Unlimited for dividend reinvestment plan (see footnote below) |

| Month #2 (August 1 to August 30, 2006) | 0 | 0 | 0 | Unlimited for dividend reinvestment plan (see footnote below) |

| Month #3 (September 1 to September 30, 2006) | 0 | 0 | 0 | Unlimited for dividend reinvestment plan (see footnote below) |

| Month #4 (October 1 to October 31, 2006) | 0 | 0 | 0 | Unlimited for dividend reinvestment plan (see footnote below) |

| Month #5 (November 1 to November 30, 2006) | 0 | 0 | 0 | Unlimited for dividend reinvestment plan (see footnote below) |

| Month #6 (December 1 to December 31, 2006) | 700* | 20.18* | 700* | Unlimited for dividend reinvestment plan (see footnote below) |

| Total | 14,792* | 18.941* | 14,792* | Unlimited for dividend reinvestment plan (see footnote below) |

*Note to Item 9: As announced and disclosed in the registrant's prospectus, the registrant maintains a Dividend Reinvestment Plan. The plan has no expiration date and no limits on the dollar amount of securities that may be purchased by the registrant to satisfy the plan's dividend reinvestment requirements. All shares purchased were purchased on the open market for shareholder benefit in the Dividend Reinvestment Plan.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the registrant’s disclosure controls and procedures are effective, based on their evaluation of these controls and procedures within 90 days of the date of this report. There were no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There have been no changes in the registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) None.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Madison Strategic Sector Premium Fund

By: (signature)

W. Richard Mason, Secretary

Date: February 16, 2007