UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21714 |

| MML Series Investment Fund II |

| (Exact name of registrant as specified in charter) |

| | |

| 1295 State Street, Springfield, MA | 01111 |

| (Address of principal executive offices) | (Zip code) |

| Paul LaPiana |

| 1295 State Street, Springfield, MA 01111 | |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (413) 744-1000 | |

| | | | |

| Date of fiscal year end: | 12/31/2022 | | |

| | | | |

| Date of reporting period: | 12/31/2022 | | |

Item 1. Reports to Stockholders.

| (a) | The Report to Stockholders is attached herewith. |

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the MML Series Investment Fund II. Investors should consider a Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

[THIS PAGE INTENTIONALLY LEFT BLANK]

MML Series Investment Fund II Annual Report – President’s Letter to Shareholders (Unaudited) |

To Our Shareholders

Paul LaPiana

“At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow.”

December 31, 2022

Continued market volatility challenges retirement investors

I am pleased to present you with the MML Series Investment Fund II Annual Report. During the fiscal year ended December 31, 2022, U.S. stocks were down over 18%, with many investors concerned about the likelihood of a recession, as the U.S. Federal Reserve Board (the “Fed”) aggressively tightened monetary policy to combat heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, a strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the Fed that were aimed at reducing demand-driven inflationary pressures.

Suggestions for retirement investors under any market conditions

● | You are likely in it for the long term. Retirement planning involves what financial professionals refer to as “long-term investing,” since most people save and invest for retirement throughout their working years. Even in retirement, many individuals will systematically withdraw their retirement savings over a number of years, keeping a portion of their funds invested. Although the financial markets will go up and down, individuals who take a long-term approach to investing don’t focus on current headlines – because they realize that they have time to ride out the downturns. |

● | Keep contributing. While you have no control over the investment markets, you can control how often and how much you contribute to your retirement account. Saving as much as possible and increasing your contributions regularly is one way retirement investors can help boost their retirement savings, regardless of the performance of the stock and bond markets. |

● | Invest continually.1 Financial professionals often advise their clients to stay in the market, regardless of short-term results. Here’s why: Those who can invest in all market conditions have the potential to be rewarded even during market downturns, when more favorable prices may enable them to accumulate larger positions. |

● | Monitor your asset allocation and diversify. Stocks, bonds, and short-term/money market investments are asset classes that tend to behave differently, depending upon the economic and market environment. These broad asset classes contain an even greater array of asset sub-categories (such as small-cap stocks, international stocks, and high-yield bonds). Most financial professionals agree that investors can take advantage of different opportunities in the market and reduce the risk of over-exposure to one or two poorly performing asset types by selecting a number of investments that represent a mix of asset classes and sub-categories. |

Is this a good time to track your progress?

If you work with a financial professional, you may wish to consider checking in with him or her to help you determine if:

● | you are saving enough for retirement – and, if in retirement, you are withdrawing an appropriate amount each year, based on your personal circumstances; |

1 Systematic investing and asset allocation do not ensure a profit or protect against loss in a declining market. Systematic investing involves continuous investment in securities regardless of fluctuating price levels. Investors should consider their ability to continue investing through periods of low price levels.

(Continued)

1

MML Series Investment Fund II Annual Report – President’s Letter to Shareholders (Unaudited) (Continued) |

● | your retirement account is invested appropriately for all market conditions, based on your goals and objectives, as well as your investment time horizon; and |

● | you are taking steps to help reduce your longevity risk, which is the chance that you could “run out” of retirement savings during your lifetime. |

Get to where you want to be

At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow. That’s why we continue to encourage you to maintain perspective when it comes to retirement investing, regardless of any headline-making events. MassMutual’s view is that changing market conditions have the potential to reward patient investors. Thank you for your continued confidence and trust in MassMutual.

Sincerely,

Paul LaPiana

President

MML Series Investment Fund II

MML Investment Advisers, LLC

The information provided is the opinion of MML Investment Advisers, LLC (MML Advisers) and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Past performance does not guarantee future results.

Underwriter: MML Distributors, LLC. (MMLD) Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. MMLD is a wholly-owned subsidiary of MassMutual. Investment advisory services provided to the Funds by MML Advisers, a wholly-owned subsidiary of MassMutual.

©2023 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved

www.MassMutual.com.

MM202401-303982

2

MML Series Investment Fund II Annual Report – Economic and Market Overview (Unaudited) |

Continued market volatility challenges retirement investors

During the fiscal year ended December 31, 2022, U.S. stocks were down over 18%, with many investors concerned about the likelihood of a recession, as the U.S. Federal Reserve Board (the “Fed”) aggressively tightened monetary policy to combat heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, the strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the Fed that were aimed at reducing demand-driven inflationary pressures.

Market Highlights

● | For the reporting period from January 1, 2022 through December 31, 2022, U.S. stocks were down over 18%, in a market environment where the Fed aggressively raised interest rates in an effort to combat heightened inflation. |

● | In the first quarter of 2022, investors in both stocks and bonds were challenged by a sharp rise in energy prices after Russia’s unexpected invasion of Ukraine, a stalled economic stimulus plan, and the Fed raising interest rates for the first time since 2018. |

● | The second quarter of 2022 was another difficult quarter, as the Fed continued to raise interest rates, investor concerns over high inflation, and concerns about the potential of an impending global recession dominated the narrative. |

● | The third quarter of 2022 was an extension of the difficult second quarter, with continued inflationary pressures, weakening economic data, and aggressive Fed interest rate hikes. |

● | In the fourth quarter of 2022, investors experienced a bear market rally, as their concerns persisted regarding high inflation, high interest rates, and the potential of an impending global recession. |

● | Foreign stocks in developed markets and emerging markets also experienced losses in the fiscal year, against the backdrop of Russia’s invasion of Ukraine (and the resulting economic sanctions that kept energy prices elevated), the strengthening U.S. dollar, and threatened consumer spending and corporate earnings growth. |

● | U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by an increase in short-term interest rates, heighted inflationary pressures, and the reversal of monetary and fiscal policy support. |

Market Environment

For the fiscal year beginning on January 1, 2022, global stock investors experienced significant losses. U.S. stocks fell sharply in the period in response, with the S&P 500 Index®* (“S&P 500”) entering bear market territory after declining more than 20% from its previous highs. Investors sought safety from high inflation, rising interest rates, and the increasing possibility of a recession. Consumer sentiment fell sharply, down 15.7% in the period1, as high inflation – driven by rising energy, food, and housing costs – overwhelmed low unemployment and strong wage growth. As of November 2022, consumer loan levels were at record highs, having increased by 11.8% year-over-year2, as more Americans are borrowing to make ends meet in these inflationary times.

As a result, the broad market S&P 500 fell 18.11% for the period. The technology-heavy NASDAQ Composite Index performed even worse, dropping 32.54%. The more economically sensitive Dow Jones Industrial AverageSM was down 6.86%. During the reporting period, small-cap stocks underperformed their larger-cap peers, while value stocks outperformed their growth brethren. The communication services, consumer discretionary, information technology, and real estate sectors were all down by 25% or more for the period. The energy sector was the strongest performer for the fiscal year, up 65.72%, aided by a 6.6% increase in the price of West Texas Intermediate (WTI) crude oil. The utilities sector also ended the period positively, gaining 1.57% for the period.

* Indexes referenced, other than the MSCI Indexes, are unmanaged, do not incur fees, expenses, or taxes, and cannot be purchased directly for investment. The MSCI Indexes are unmanaged, do not incur fees or expenses, and cannot be purchased directly for investment.

1 University of Michigan: Consumer Sentiment (UMCSENT), retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UMCSENT, December 23, 2022.

2 Board of Governors of the Federal Reserve System (US), Consumer Loans, All Commercial Banks [CONSUMER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CONSUMER, December 30, 2022.

3

MML Series Investment Fund II Annual Report – Economic and Market Overview (Unaudited) (Continued) |

Developed international markets, as measured by the MSCI EAFE® Index, generally outperformed their domestic peers, ending the fiscal year down 14.45%. Emerging-market stocks, as measured by the MSCI Emerging Markets Index, also fell sharply, ending down 20.09% for the period. Investors sold off developed international and emerging-market stocks on concerns that higher interest rates and commodity prices would impair consumer spending and corporate earnings growth.

Bond yields rose sharply during the fiscal year, with the 10-year U.S. Treasury bond yield rising from a low of 1.63% on January 1, 2022 to close the period at 3.88%. Rising yields generally produce falling bond prices; consequently, bond index returns suffered. The Bloomberg U.S. Aggregate Bond Index ended the period down 13.01%. Investment-grade corporate bonds fared even worse. The Bloomberg U.S. Corporate Bond Index, which tracks investment-grade corporate bonds, ended the period with a 15.76% loss. The Bloomberg U.S. Corporate High-Yield Bond Index also ended in negative territory, declining 11.19% for the period.

Review and maintain your strategy

MassMutual is committed to putting our clients’ needs first. We use our innovative open-architecture platform to craft solutions that can help deliver in all stages of the investor’s journey. From building potential wealth to retiring comfortably, we work continually to help investors secure their futures and protect the ones they love. While the current market volatility, including the reality of market sell-offs, can test an investor’s mettle, we’d like to remind you that, as a retirement investor, it’s important to maintain perspective and have realistic expectations about the future performance of your investment accounts. As described in this report, financial markets can reverse suddenly with little or no notice. That’s why we continue to believe that retirement investors should create and maintain a plan that focuses on their goals, how long they have to invest, and how comfortable they are with market volatility. Our multi-managed and sub-advised mutual funds tap into the deep expertise of seasoned asset managers who are committed to helping long-term investors prepare for retirement – in all market conditions. As always, we recommend that you work with a personal financial professional, who can help you define an investment strategy that aligns with your comfort level with respect to market volatility, how long you have to save and invest, and your specific financial goals. Thank you for your confidence in MassMutual.

The information provided is the opinion of MML Investment Advisers, LLC (MML Advisers) and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Past performance does not guarantee future results.

Underwriter: MML Distributors, LLC. (MMLD) Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. MMLD is a wholly-owned subsidiary of MassMutual. Investment advisory services provided to the Funds by MML Advisers, a wholly-owned subsidiary of MassMutual.

©2023 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved

www.MassMutual.com.

4

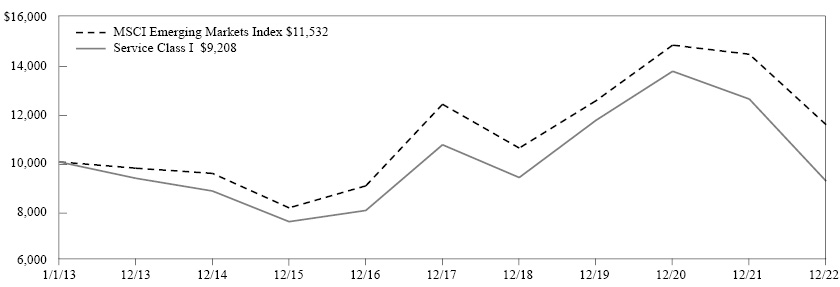

MML Blend Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML Blend Fund, and who is the Fund’s subadviser?

This Fund seeks a high total return. The Fund is a “fund of funds” that seeks to achieve its investment objective by allocating substantially all of its assets among exchange-traded funds (ETFs) providing exposures to various asset classes. The Fund’s subadviser determines the Fund’s asset allocation strategy and implements this strategy by selecting ETFs for investment and determining the amounts of the Fund’s assets to be invested in each. The ETFs the Fund’s subadviser will consider for investment by the Fund will provide exposures to U.S. equity securities or to fixed-income securities. The ETFs are advised by an affiliate of the Fund’s subadviser. The Fund’s subadviser is BlackRock Investment Management, LLC (BlackRock).

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Initial Class shares returned -16.59%, outperforming the -18.11% return of the S&P 500® Index (the “stock component’s benchmark”), which measures the performance of 500 widely held stocks in the U.S. equity market. The Fund underperformed the -13.01% return of the Bloomberg U.S. Aggregate Bond Index (the “bond component’s benchmark”), which measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). The Fund underperformed the -14.36% return of the Lipper Balanced Fund Index, an unmanaged, equally weighted index of the 30 largest mutual funds within the Lipper Balanced Category. Finally, the Fund underperformed the -15.91% return of the Custom Balanced Index (the “blend benchmark”), which comprises the stock component’s benchmark and the bond component’s benchmark. The weightings of each index are 60% and 40%, respectively.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The Fund is designed to achieve the return of a strategic asset allocation to a portfolio comprised of 60% U.S. equities and 40% fixed income securities – and to capture the long-term performance of both the equity and bond markets.

The Fund is rebalanced quarterly to predetermined strategic weights. Because the Fund’s investment approach is implemented with passively managed bond and stock exchange-traded funds (ETFs), Fund management typically does not make underweight or overweight allocations to individual securities, sectors, or asset classes.

For the one-year period ended December 31, 2022, the Fund outperformed the stock component’s benchmark, primarily due to the Fund’s small overweight to small-cap stocks, relative to the benchmark. The Fund also had a small overweight allocation to corporate bonds, which underperformed during the year. Consequently, the Fund underperformed the bond component’s benchmark for the year. The Fund’s strategic overweights were designed to capture the yield premium of corporate bonds versus U.S. Treasuries – as well as the return premium of small-cap versus large-cap stocks.

Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both. For the one-year period ended December 31, 2022, the Fund did not have material exposure to derivatives.

Subadviser outlook

As we enter 2023, Fund management continues to expect a great deal of market volatility moving forward. Fund management observed that a diverse set of macroeconomic and geopolitical headlines throughout 2022 affected global financial markets. In Fund management’s view, most of these headwinds seem likely to persist in 2023. In the coming year, Fund management expects the Fund to achieve somewhat similar performance to that of the blend benchmark, since the Fund’s portfolio allocation is designed to deliver broad exposure to bond and stock markets. As of fiscal year-end, the Fund’s portfolio was allocated 60% to the S&P 500 Index and 40% to the Bloomberg U.S. Aggregate Bond Index.

5

MML Blend Fund – Portfolio Manager Report (Unaudited) (Continued) |

MML Blend Fund

Largest Holdings

(% of Net Assets) on 12/31/22 |

iShares Core S&P Total US Stock Market ETF | 30.0% |

iShares Core S&P 500 ETF | 27.2% |

iShares Core Total USD Bond Market ETF | 15.9% |

iShares Core U.S. Aggregate Bond ETF | 15.8% |

iShares iBoxx High Yield Corporate Bond ETF | 4.0% |

iShares 5-10 Year Investment Grade Corporate Bond ETF | 4.0% |

iShares Core S&P Mid-Cap ETF | 2.2% |

iShares Core S&P Small-Cap ETF | 1.0% |

| 100.1% |

| | |

MML Blend Fund

Sector Table

(% of Net Assets) on 12/31/22 |

Mutual Funds | 100.1% |

Total Long-Term Investments | 100.1% |

Short-Term Investments and Other Assets and Liabilities | (0.1)% |

Net Assets | 100.0% |

| | |

6

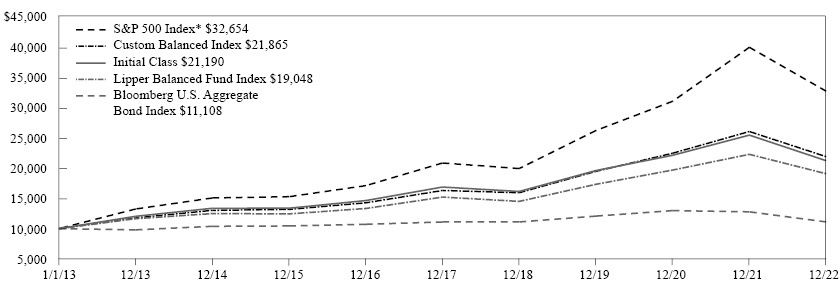

MML Blend Fund – Portfolio Manager Report (Unaudited) (Continued) |

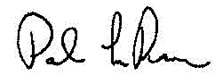

GROWTH OF $10,000 INVESTMENT - INITIAL CLASS

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | 10 Years |

Initial Class | 02/03/1984 | -16.59% | 4.69% | 7.80% |

Service Class | 08/15/2008 | -16.80% | 4.42% | 7.53% |

S&P 500 Index* | | -18.11% | 9.42% | 12.56% |

Bloomberg U.S. Aggregate Bond Index | | -13.01% | 0.02% | 1.06% |

Lipper Balanced Fund Index | | -14.36% | 4.62% | 6.66% |

Custom Balanced Index | | -15.91% | 6.07% | 8.14% |

* Benchmark

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

7

MML Dynamic Bond Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML Dynamic Bond Fund, and who are the Fund’s subadvisers?

The Fund seeks a superior total rate of return by investing in fixed income instruments. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in bonds. Bonds may include fixed income securities and other debt instruments of domestic and foreign entities, including corporate bonds, securities issued or guaranteed as to principal or interest by the U.S. Government or its agencies or instrumentalities, mortgage- and asset-backed securities, bank loans, and money market instruments. The Fund’s subadvisers are Western Asset Management Company, LLC (Western Asset) and its affiliate, Western Asset Management Company Limited (Western Asset Limited). Western Asset Limited manages the non-U.S. dollar denominated investments of the Fund. Effective April 29, 2022, Western Asset and Western Asset Limited replaced DoubleLine Capital LP (DoubleLine) as subadvisers of the Fund.

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Class II shares returned -13.98%, underperforming the -13.01% return of the Bloomberg U.S. Aggregate Bond Index (the “benchmark”), which measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS).

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For the time that DoubleLine served as subadviser of the Fund (January 1, 2022 - April 28, 2022), U.S. investment-grade corporate credit was the worst-performing sector due to its longer duration profile, which was negatively impacted by the swift rise in U.S. Treasury yields. Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the bond or portfolio when interest rates rise or fall. Global bonds also underperformed the benchmark driven by U.S. dollar strengthening and rising global yields during the period. Emerging-market debt posted negative returns and was negatively impacted by the rise in interest rates and geopolitical tensions stemming from the war between Russia and Ukraine. U.S. Treasuries in the Fund’s portfolio underperformed due to the increase in interest rates that occurred during the period. Turning to the positive, floating-rate sectors, such as collateralized loan obligations and bank loans, were the top performers over the period materially outperforming the benchmark in part due to their lower interest rate sensitivity. The Fund’s overweight allocation to structured credit relative to the benchmark also contributed to the Fund’s relative performance, as securitized credit outperformed investment-grade corporate credit during this period. Non-agency residential mortgage-backed securities (RMBS), which are securities issued by private institutions that are not backed by government-sponsored entities, materially outperformed and benefited from strong U.S. housing market fundamentals during the period.

For the time that Western Asset and Western Asset Limited served as subadvisers of the Fund (April 29, 2022 -December 31, 2022), the Fund’s top-down macro strategies, in aggregate, detracted from performance. Throughout the reporting period, the Fund had more interest rate exposure (duration) than the benchmark, which significantly detracted from performance as interest rates rose significantly during the period. The Fund’s yield curve positioning, which was focused on an overweight to the back end of the curve, provided a partial offset and contributed to returns. (The yield curve is a graphical representation of bond yields with very short maturities to the longest available, with the curve indicating whether short-term rates are higher or lower than long-term rates.) The Fund’s overweight allocations to structured products – including non-agency RMBS, CMBS, and ABS – also detracted from performance, as structured spreads widened during the reporting period. Additionally, non-U.S. developed market exposures detracted from results, mainly due to developed market currency exposures, as the U.S. dollar appreciated during the period. Finally, agency MBS positioning detracted from performance, as spreads tightened at the start of the period, when the Fund’s portfolio was underweight, which was gradually trimmed to flat versus the benchmark. (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes.)

8

MML Dynamic Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

In terms of contributors, exposures to emerging markets, which included both local currency and U.S. dollar-denominated positions, significantly contributed to performance during the reporting period, due to favorable selection in both local-currency and hard-currency assets, as USD-denominated emerging-market bond spreads modestly widened. Finally, in aggregate, corporate credit exposures contributed to performance, mainly due to favorable selection within investment-grade corporates, as investment-grade spreads tightened and high-yield spreads widened during the reporting period.

Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both. In aggregate, the Fund’s use of derivatives detracted from performance during the reporting period.

Subadviser outlook

In Western Asset’s view, at fiscal year-end, fundamental headwinds to global growth and inflation remained. These headwinds included the reduction of global fiscal stimulus, the withdrawal of monetary policy accommodation, and the persistence of secular-related headwinds – such as global debt burdens, aging demographics, and technology displacement. If growth and inflation moderate and the risks surrounding central bank policy become more balanced, Western Asset believes that the market environment for fixed-income investors could also moderate. In Western Asset’s view, not only could the rise in government yields likely abate, but lower volatility could have the potential to lead investors to re-engage in fixed income spread sectors, especially given the valuations at fiscal year-end.

MML Dynamic Bond Fund

Portfolio Characteristics

(% of Net Assets) on 12/31/22 |

Corporate Debt | 42.0% |

U.S. Government Agency Obligations and Instrumentalities* | 31.0% |

Non-U.S. Government Agency Obligations | 11.5% |

U.S. Treasury Obligations | 7.4% |

Sovereign Debt Obligations | 6.5% |

Bank Loans | 5.0% |

Mutual Funds | 1.0% |

Purchased Options | 0.0% |

Total Long-Term Investments | 104.4% |

Short-Term Investments and Other Assets and Liabilities | (4.4)% |

Net Assets | 100.0% |

| | |

* | May contain securities that are issued by a U.S. Government Agency, but are unsecured and are not guaranteed by a U.S. Government Agency. |

9

MML Dynamic Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

GROWTH OF $10,000 INVESTMENT - CLASS II

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | Since Inception

05/15/2015 |

Class II | 05/15/2015 | -13.98% | -0.59% | 0.64% |

Service Class I | 05/15/2015 | -14.26% | -0.85% | 0.38% |

Bloomberg U.S. Aggregate Bond Index | | -13.01% | 0.02% | 0.83% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

10

MML Equity Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML Equity Fund, and who are the Fund’s subadvisers?

The Fund’s primary objective is to achieve a superior total rate of return over an extended period of time from both capital appreciation and current income. Its secondary objective is the preservation of capital when business and economic conditions indicate that investing for defensive purposes is appropriate. The Fund invests primarily in common stocks of companies that the subadvisers believe are undervalued in the marketplace. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in common stocks, preferred stocks, securities convertible into common or preferred stocks, and other securities, such as warrants and stock rights, whose value is based on stock prices. The Fund typically invests most of its assets in securities of U.S. companies, but may invest up to 25% of its total assets in foreign securities and American Depositary Receipts (“ADRs”), including emerging market securities. The Fund’s two subadvisers are T. Rowe Price Associates, Inc. (T. Rowe Price), which managed approximately 33% of the Fund’s portfolio; and Brandywine Global Investment Management, LLC (Brandywine Global), which managed approximately 67% of the Fund’s portfolio, as of December 31, 2022.

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Initial Class shares returned -4.65%, outperforming the -7.54% return of the Russell 1000® Value Index (the “benchmark”), which measures the performance of the large-cap value segment of U.S. equity securities. It includes the Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

With respect to the Brandywine Global component of the Fund for the one-year period ended December 31, 2022, the energy sector stood out for the second consecutive year, returning more than 50%, while traditionally defensive sectors outperformed by falling less than their peers. The biggest contributions to the Fund component’s outperformance came from sectors that lagged significantly during the fiscal period. The health care sector was the only sector that acted defensively and did not lose value during the fiscal period. Within the health care sector, the benefit to the Fund component was from its overweight allocations to pharmaceuticals, health care providers, and biotechnology companies during the fiscal period. The communication services sector underperformed throughout the year and was the worst-performing sector in the benchmark in both the third and fourth quarters of 2022. Within the technology sector, the Fund component benefited from strong stock selection in software companies during the fiscal period. Remaining focused on lower-valuation technology companies, such as Oracle and IBM, and cycling out of the smaller low-momentum underperforming holdings earlier in the year is why this sector was the second largest contributor to the Fund component’s relative returns for the year.

Within the T. Rowe Price component of the Fund for the one-year period ended December 31, 2022, the financial and consumer discretionary sectors were the largest contributors to the Fund component’s relative performance, whereas the energy, materials, and health care sectors detracted the most. The financial sector was a notable contributor due to favorable stock picks during the fiscal period. Chubb was one Fund component holding that contributed during the fiscal period, as the company benefited from the continued upcycle in property and casualty (P&C) and strong execution. Fund component holdings in the consumer discretionary sector also boosted the Fund component’s relative returns during the fiscal period, owing to strong stock selection, such as Dollar General. Shares of Dollar General contributed to the Fund component’s performance during the fiscal period, as the company reported revenue and earnings ahead of consensus and same-store sales that exceeded expectations. On the downside, an underweight allocation to the energy sector detracted from the Fund component’s relative performance during the fiscal period. The materials sector also hindered relative results due to detrimental stock choices, such as Nutrien, a Canadian fertilizer company. The health care sector further detracted from the Fund component’s relative returns due to weak security selection, which was partially offset by an overweight allocation. HCA Healthcare detracted over the period, as the company contended with elevated labor costs, along with increased utilization of contract labor.

11

MML Equity Fund – Portfolio Manager Report (Unaudited) (Continued) |

Subadviser outlook

Brandywine Global Fund management began 2023 with concerns about inflation, labor shortages, and anticipating the impact of a rising interest rate environment. In Brandywine Global’s opinion, the equity markets were hit hard in reaction to inflation levels not seen in 40 years and aggressive rate increases by the U.S. Federal Reserve Board (the “Fed”) after over a decade of easy money and two years of excessive economic stimulation. Based on Brandywine Global’s research, Brandywine Global believes that value and large-cap value issues still have significant upside potential.

T. Rowe Price Fund management remains cautious on the direction of the economy and believes there is the likelihood that the Fed could cause an economic slowdown or recession in 2023. While T. Rowe Price has observed that goods inflation seems to be peaking, in T. Rowe Price’s view, services inflation remains high and could be challenging due to structural imbalances in the labor market. T. Rowe Price believes it is likely that the equity markets will remain choppy throughout 2023, as expectations adjust to a slowing economy with tighter financial conditions. Consequently, T. Rowe Price believes a cautious stance remains appropriate, so they are looking to further emphasize company-level fundamentals and quality, while keeping their Fund component positioned for a variety of market environments.

MML Equity Fund

Largest Holdings

(% of Net Assets) on 12/31/22 |

Exxon Mobil Corp. | 4.1% |

JP Morgan Chase & Co. | 3.6% |

Bank of America Corp. | 3.0% |

AbbVie, Inc. | 2.4% |

Elevance Health, Inc. | 2.4% |

Merck & Co., Inc. | 2.1% |

Pfizer, Inc. | 2.0% |

Philip Morris International, Inc. | 1.9% |

Cisco Systems, Inc. | 1.4% |

Chevron Corp. | 1.4% |

| 24.3% |

| | |

MML Equity Fund

Sector Table

(% of Net Assets) on 12/31/22 |

Consumer, Non-cyclical | 29.0% |

Financial | 22.9% |

Energy | 10.1% |

Industrial | 8.2% |

Technology | 7.1% |

Consumer, Cyclical | 7.1% |

Communications | 5.4% |

Utilities | 5.3% |

Basic Materials | 3.0% |

Mutual Funds | 2.3% |

Total Long-Term Investments | 100.4% |

Short-Term Investments and Other Assets and Liabilities | (0.4)% |

Net Assets | 100.0% |

| | |

12

MML Equity Fund – Portfolio Manager Report (Unaudited) (Continued) |

GROWTH OF $10,000 INVESTMENT - INITIAL CLASS

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | 10 Years |

Initial Class | 12/31/1973 | -4.65% | 7.72% | 10.50% |

Service Class | 08/15/2008 | -4.88% | 7.45% | 10.23% |

Russell 1000 Value Index | | -7.54% | 6.67% | 10.29% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

13

MML Equity Rotation Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML Equity Rotation Fund, and who is the Fund’s subadviser?

The Fund seeks growth of capital over the long-term by investing primarily in common stocks of large- and medium-capitalization U.S. companies. The Fund’s subadviser and sub-subadviser invest the Fund’s assets using an indexing strategy. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in the equity securities of companies included within the Russell 1000® Invesco Dynamic Multifactor Index* (the “Index”). The Fund’s subadviser is Invesco Advisers, Inc. (Invesco Advisers) and its sub-subadviser is Invesco Capital Management LLC (ICM) (together with Invesco Advisers, “Invesco”).

* | The Fund is sponsored solely by MassMutual. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies. |

| All rights in the Russell 1000® Invesco Dynamic Multifactor Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “FTSE Russell®,” “Russell 1000®” and “Russell®” are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license. |

| The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put by the Fund. |

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Class II shares returned -14.29%, outperforming the -19.13% return of the Russell 1000 Index (the “benchmark”), which measures the performance of the large-cap segment of U.S. equity securities. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Fund underperformed the -13.57% return of the Index, which reflects a dynamic combination of factor exposures drawn from constituent stocks of the Russell 1000 Index.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

During the one-year period ended December 31, 2022, Fund management utilized all four combinations of factor exposures that the Fund’s design allows for. In late 2021, the leading economic indicators that drive the positioning of the Fund’s underlying strategy suggested that inflation-related concerns were having an increasing effect on sentiment. Consequently, the strategy shifted toward a “slowdown” regime, with significant tilts toward companies with higher-quality earnings and balance sheets, and companies whose stock prices had recently been less volatile (“quality” and “low-volatility” factors).

The Fund, which reevaluates the economic signals on a monthly basis, continued to maintain this position for the entire first quarter of 2022. During that time, there was great geopolitical uncertainty and significant market declines as the Russian invasion of Ukraine began. International exposure was generally a liability for companies and quality companies overall performed poorly, as did companies which had previously experienced positive price momentum due to an easing of COVID-19 -related restrictions in 2021. The Fund’s methodology, which favors companies that exhibit lower volatility as well as quality, benefited the Fund substantially during the period, as lower-volatility companies significantly outperformed.

At the evaluation in the beginning of April 2022, sentiment indicators were notably improving, and economic indicators remained above trend. Because of this, the Fund moved into an “expansion” regime, with tilts toward smaller companies, deeper value companies, and particularly to companies exhibiting positive share price momentum. It remained in this regime for the remainder of the second quarter. During the time in this regime, all the factors the Fund could potentially use (with the exception of momentum) outperformed, as the market declined steeply and the Fund outperformed the benchmark. This decline led to decreasing market sentiment, which caused the Fund to return to the “slowdown” regime, with the aforementioned tilts toward companies with higher-quality earnings and balance sheets, and companies whose stock prices had recently been less volatile (“quality” and “low-volatility” factors) in early July 2022 a position that it only maintained for a month. During this month, markets rallied, and factors broadly underperformed, with only the “quality” factor outperforming the benchmark.

14

MML Equity Rotation Fund – Portfolio Manager Report (Unaudited) (Continued) |

Despite the positive returns in July 2022, leading economic indicators continued to decline, dipping below the long-term trend and causing the Fund to move into a “contraction” regime in early August 2022. This regime, which adds momentum to the factor tilts of “slowdown,” continued until December. During that time, all factors the Fund has available outperformed, and the Fund significantly outperformed the benchmark.

Finally, risk sentiment began to improve towards the end of 2022, and in December 2022, the Fund moved into a “recovery” regime, with tilts toward small size and value. Towards the end of 2022 and year end, value stocks posted the highest return, which caused the Fund to modestly outperform the benchmark.

Although sector weights vary widely from regime to regime, as do the individual securities held within those sectors, underweights on average to, and security selection within, the consumer discretionary and information technology sectors were the largest drivers of outperformance of the Fund. In addition, not holding the electric automobile manufacturer Tesla, which had an average weight of 2.88% in the benchmark, and returned just over -65% for the year, was a major contributor to the Fund’s outperformance.

Subadviser outlook

The Fund reevaluates the economic signals on a monthly basis. Fund management determined at its 2022 year-end evaluation that the short-term economic growth rate was still below the longer-term average, while global risk appetite had begun an upward trend. Based on Fund management’s view, in January 2023, the Fund expects to remain in the “recovery” stance that began in December 2022. Fund management expects to continue to evaluate this decision monthly and modify exposures as the Fund’s regime indicators warrant.

MML Equity Rotation Fund

Largest Holdings

(% of Net Assets) on 12/31/22 |

Hewlett Packard Enterprise Co. | 1.2% |

Cardinal Health, Inc. | 1.1% |

Steel Dynamics, Inc. | 0.9% |

Leidos Holdings, Inc. | 0.7% |

Everest Re Group Ltd. | 0.7% |

Molina Healthcare, Inc. | 0.7% |

Synchrony Financial | 0.7% |

Chesapeake Energy Corp. | 0.7% |

Reliance Steel & Aluminum Co. | 0.7% |

Ovintiv, Inc. | 0.6% |

| 8.0% |

| | |

MML Equity Rotation Fund

Sector Table

(% of Net Assets) on 12/31/22 |

Financial | 22.8% |

Consumer, Cyclical | 18.8% |

Industrial | 16.8% |

Consumer, Non-cyclical | 15.7% |

Technology | 8.2% |

Basic Materials | 6.0% |

Communications | 5.2% |

Energy | 4.1% |

Utilities | 2.4% |

Mutual Funds | 0.2% |

Total Long-Term Investments | 100.2% |

Short-Term Investments and Other Assets and Liabilities | (0.2)% |

Net Assets | 100.0% |

| | |

15

MML Equity Rotation Fund – Portfolio Manager Report (Unaudited) (Continued) |

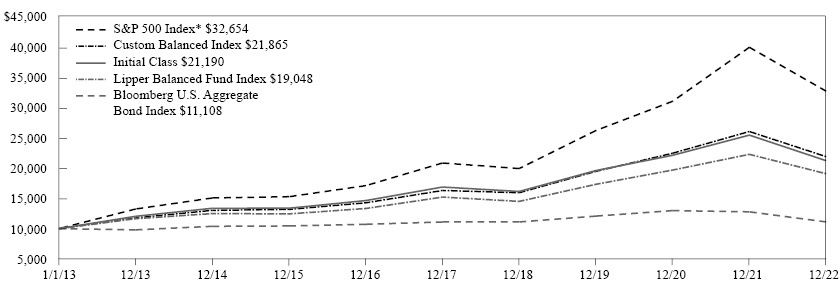

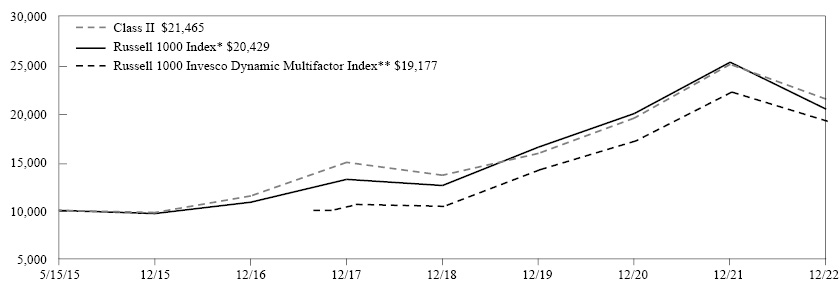

GROWTH OF $10,000 INVESTMENT - CLASS II

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | | |

| Inception Date

of Class | 1 Year | 5 Years | Since Inception

05/15/2015 | Since Inception

10/13/2017 |

Class II | 05/15/2015 | -14.29% | 7.50% | 10.52% | |

Service Class I | 05/15/2015 | -14.46% | 7.25% | 10.25% | |

Russell 1000 Index* | | -19.13% | 9.13% | 9.83% | |

Russell 1000 Invesco Dynamic Multifactor Index** | | -13.57% | 12.52% | | 13.25% |

* Benchmark

** Since 10/13/2017

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

16

MML High Yield Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML High Yield Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities. The Fund invests primarily in lower rated U.S. debt securities (“junk” or “high yield” bonds), including securities in default. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in lower rated fixed income securities (rated below Baa3 by Moody’s, below BBB- by Standard & Poor’s or the equivalent by any nationally recognized statistical rating organization (using the lower rating) or, if unrated, determined to be of below investment grade quality by the Fund’s subadviser or sub-subadviser). The Fund’s subadviser is Barings LLC (Barings). Effective February 1, 2022, Baring International Investment Limited (BIIL) was added as sub-subadviser to the Fund.

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Class II shares returned -11.72%, underperforming the -11.19% return of the Bloomberg U.S. Corporate High-Yield Bond Index (the “benchmark”), which measures the performance of U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, putable, and callable bonds, SEC Rule 144A securities, original issue zeros, pay-in-kind bonds, fixed-rate and fixed-to-floating capital securities.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Rising interest rates throughout the year combined with widening credit spreads to challenge high-yield returns. As corporate fundamentals weakened, albeit from historically strong levels of leverage and interest coverage and record low default rates, performance across the ratings spectrum decompressed.

For the one-year period ended December 31, 2022, the Fund’s overweight allocation, relative to the benchmark, to lower-rated bonds detracted from relative performance, mitigated by strong security selection within CCC and below rated bonds as well as an overweight allocation to BBB rated credits.

Within industries, adverse credit selection within technology, consumer non-cyclical, and consumer cyclical sectors detracted from the Fund’s relative performance for the period, while cash balances at the higher end of normal ranges proved a benefit, given heightened market volatility. The Fund’s overweight allocation to, as well as strong security selection within, the energy sector was the primary contributor to performance during the period.

With respect to specific Fund holdings, the largest detractors from performance during the year were: Bausch Health Companies, a specialty pharmaceutical manufacturer; Avaya, a solutions provider for IT telephony and voice communications; and Radiology Partners, a hospital-based, physician-owned radiology practice. Fund holdings that primarily contributed to performance during the reporting period included: Tourmaline Oil, a Canadian natural gas producer; Transocean, an offshore drilling contractor; and Nabors Industries, an onshore oil and gas driller. The energy sector benefited from rising energy prices, improved balance sheets, and positive ratings momentum. Elsewhere, the Fund’s positioning and selection within communications and basic industries also contributed to returns during the reporting period.

Subadviser outlook

Given the sell-off across markets in 2022, in Fund management’s view, valuations as of December 31, 2022 more accurately reflected elevated levels of uncertainty arising from persistent inflation, the U.S. Federal Reserve Board’s removal of policy accommodation, and associated impacts on economic growth. While Fund management believes that corporate default rates could tick higher in 2023, sufficient liquidity and cash flow generation among high-yield borrowers, combined with extended maturity walls and the lack of excess accumulated in any particular sector following the 2022 downturn, could constrain overall default rates at lower levels than in prior cycles. Fund management opines that, with much of the rise in interest rates in the

17

MML High Yield Fund – Portfolio Manager Report (Unaudited) (Continued) |

rearview mirror, high levels of coupon income could accrue benefits to investors. Meanwhile, Fund management also believes that increased dispersion has the potential to pose challenges – but also create opportunities – for active managers to add value through fundamental credit analysis and selection.

MML High Yield Fund

Portfolio Characteristics

(% of Net Assets) on 12/31/22 |

Corporate Debt | 92.8% |

Mutual Funds | 4.3% |

Bank Loans | 2.6% |

Total Long-Term Investments | 99.7% |

Short-Term Investments and Other Assets and Liabilities | 0.3% |

Net Assets | 100.0% |

| | |

18

MML High Yield Fund – Portfolio Manager Report (Unaudited) (Continued) |

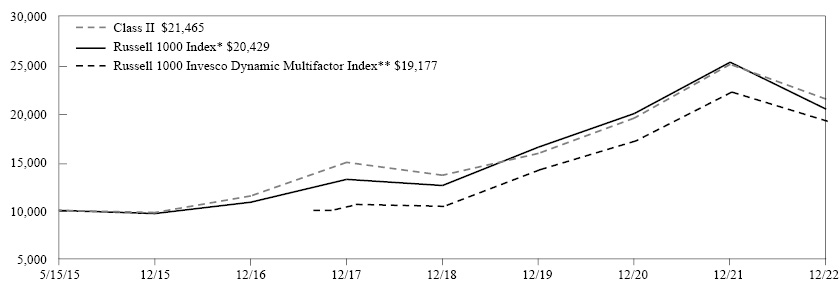

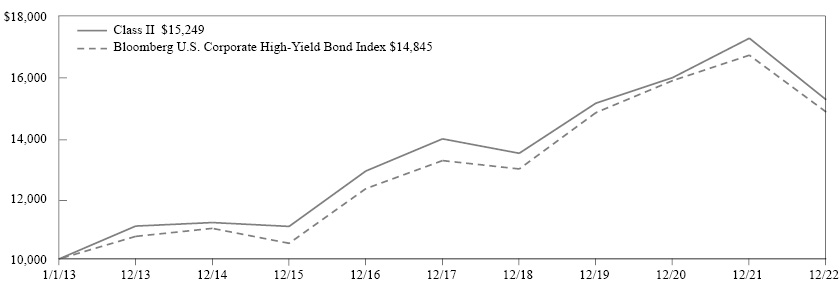

GROWTH OF $10,000 INVESTMENT - CLASS II

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | 10 Years |

Class II | 05/03/2010 | -11.72% | 1.79% | 4.31% |

Service Class I | 05/03/2010 | -11.97% | 1.55% | 4.05% |

Bloomberg U.S. Corporate High-Yield Bond Index | | -11.19% | 2.31% | 4.03% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

19

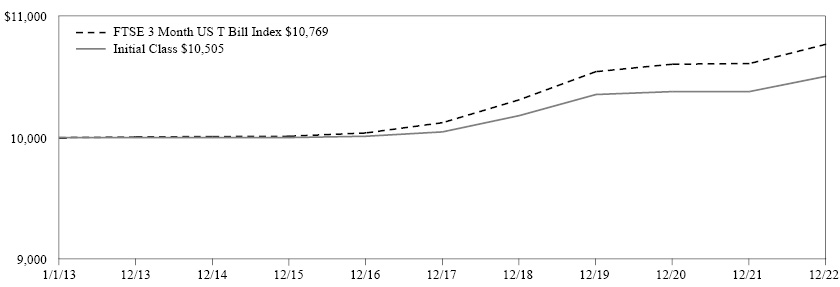

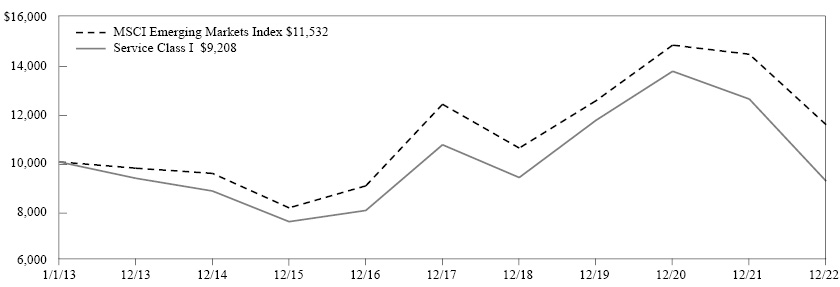

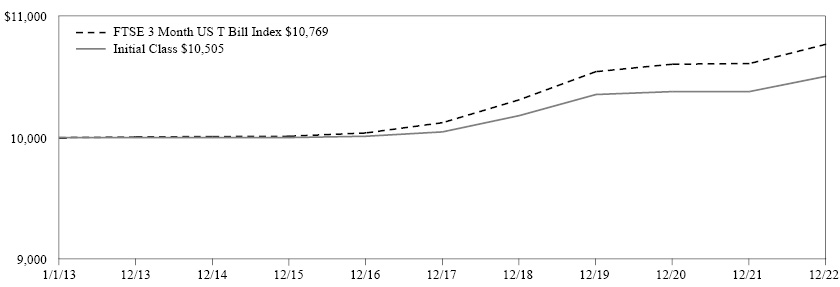

MML Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML Inflation-Protected and Income Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve as high a total rate of real return on an annual basis as is considered consistent with prudent investment risk and the preservation of capital by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in inflation-indexed bonds and other income-producing securities. The Fund’s subadviser is Barings LLC (Barings) and its sub-subadviser is Baring International Investment Limited (BIIL).

How did the Fund perform during the 12 months ended December 31, 2022?

The Fund’s Initial Class shares returned -13.35%, underperforming the -11.85% return of the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L) (the “benchmark”), which measures the performance of rules-based, market value-weighted inflation-protected securities issued by the U.S. Treasury. It is a subset of the Global Inflation-Linked Index (Series-L).

How do inflation-indexed bonds protect against inflation?

Like many other fixed-income securities, inflation-indexed bonds pay income twice a year, based on a stated coupon rate. However, both the principal and the interest payment are adjusted for the level of inflation. The inflation rate – as measured by the Consumer Price Index for All Urban Consumers (CPI-U) – results in an adjustment to the principal amount of an inflation-protected security. The coupon rate is then applied to the adjusted principal amount to determine the interest payment. For example, assuming an inflation rate of 3%, a security with a par value of $1,000 and an annual coupon rate of 1.75%, the adjusted principal amount after one year would be $1,030 ($1,000 increased by 3%). The semi-annual interest payment would be calculated by multiplying $1,030 by 1.75% and dividing by 2 instead of using the original $1,000 par value to calculate the amount of interest.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Consumer prices as measured by the U.S. Bureau of Labor Statistics were up for the last 12 months for the period ending November 2022, as unadjusted Headline Consumer Price Index (CPI) came in at 7.1%. (CPI measures changes in the price of a market basket of consumer goods and services. Core CPI does not include food and energy prices. Headline CPI includes food and energy.) The prices of used vehicles and medical care services were major contributors to inflation during this time frame. As of November 2022, Core CPI (excluding energy and food prices) increased 6.0% from 12 months before. Core CPI is running well above the 2% inflation objective of the Federal Open Market Committee (FOMC).

For the one-year period ended December 31, 2022, TIPS positioning in aggregate detracted from Fund performance. An underweight allocation to short-maturity inflation securities was offset by allocations to high-quality income-producing assets that earned higher yields than U.S. Treasuries. The Fund’s positioning in 5-year and 10-year inflation securities detracted the most from performance.

The Fund invested in high-quality income-producing securities, including asset-backed securities and money market securities during the reporting period. The income earned by these asset classes contributed positively to the Fund’s performance during the reporting period. Asset-backed securities contributed substantially to performance, as security selections in auto loans and insurance receivables within the sector were the primary contributors. Commercial mortgage-backed securities contributed to performance, while residential mortgage-backed securities detracted.

The Fund may use derivative instruments for yield curve and duration management, as well as for replicating cash bonds and gaining market exposure in order to implement manager views. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Overall, these derivative positions modestly contributed to performance.

20

MML Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited) (Continued) |

Subadviser outlook

The U.S. Federal Reserve Board (the “Fed”) hiked rates by 0.50% at their December meeting, the highest level in 15 years. As we entered 2023, Fed Chairman Powell signaled that the Fed would continue to raise rates with no reductions until 2024. The FOMC anticipates that ongoing increases in the target range will be appropriate to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time. In Fund management’s view, what the market may fail to appreciate is the impact those higher price pressures may have on consumer demand. As such, Fund management believes that much of this bullish inflation sentiment has largely been priced into the inflation market. Fund management expects to maintain a constructive, but more balanced, view on the potential impact to inflation markets. Fund management believes that valuations will likely remain well anchored into the first half of 2023, given the December 2022 employment and labor force growth trends for the U.S. economy. Further, as a result of the introduction of seasonal pricing pressures into early 2023, Fund management expects to maintain an overweight constructive tilt to inflation markets.

MML Inflation-Protected

and Income Fund

Portfolio Characteristics

(% of Net Assets) on 12/31/22 |

Non-U.S. Government Agency Obligations | 53.9% |

U.S. Treasury Obligations | 23.8% |

U.S. Government Agency Obligations and Instrumentalities* | 11.6% |

Mutual Funds | 0.6% |

Total Long-Term Investments | 89.9% |

Short-Term Investments and Other Assets and Liabilities | 10.1% |

Net Assets | 100.0% |

| | |

* | May contain securities that are issued by a U.S. Government Agency, but are unsecured and are not guaranteed by a U.S. Government Agency. |

21

MML Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited) (Continued) |

GROWTH OF $10,000 INVESTMENT - INITIAL CLASS

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | 1 Year | 5 Years | 10 Years |

Initial Class | 08/30/2002 | -13.35% | 1.84% | 1.02% |

Service Class | 08/15/2008 | -13.59% | 1.58% | 0.77% |

Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L) | | -11.85% | 2.11% | 1.12% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

22

MML iShares® 60/40 Allocation Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MML iShares® 60/40 Allocation Fund, and who is the Fund’s investment adviser?

This Fund seeks to achieve as high a total return over time as is considered consistent with prudent investment risk, preservation of capital and recognition of the Fund’s stated asset allocation. The Fund is a “fund of funds” that seeks to achieve its investment objective by allocating substantially all of its assets among exchange-traded funds (ETFs) providing exposures to various asset classes. The Fund’s investment adviser, MML Investment Advisers, LLC (MML Advisers), determines the Fund’s asset allocation strategy and implements this strategy by selecting ETFs for investment and determining the amounts of the Fund’s assets to be invested in each. The ETFs MML Advisers will consider for investment by the Fund will provide exposures to equity securities or to fixed-income securities. BlackRock Investment Management, LLC (BlackRock) is the Fund’s subadviser, and is responsible solely for the trading and execution of MML Advisers’ investment and allocation decisions. Under normal circumstances, the Fund invests at least 80% (and, typically, substantially all) of its net assets (plus the amount of any borrowings for investment purposes) in iShares® ETFs*. iShares ETFs are advised by an affiliate of BlackRock. The Fund typically invests approximately 60% of its net assets in equity ETFs and approximately 40% of its net assets in fixed income ETFs.

* | iShares® and BlackRock® are registered trademarks of BlackRock, Inc. and its affiliates and are used under license. |

How did the Fund perform from its inception date on February 11, 2022, through December 31, 2022?

The Fund’s Class II shares returned -12.14%, outperforming the -13.47% return of the S&P 500® Index (the “benchmark”), which measures the performance of 500 widely held stocks in the U.S. equity market. The Fund underperformed the -9.34% return of the Bloomberg U.S. Aggregate Bond Index, which measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). For the period beginning March 1, 2022 and ending December 31, 2022, the Fund’s Class II shares returned -9.98%, underperforming the -9.64% return of the Lipper Balanced Fund Index, an unmanaged, equally weighted index of the 30 largest mutual funds within the Lipper Balanced Category.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2022, please see the Economic and Market Overview, beginning on page 3.

Investment adviser discussion of factors that contributed to the Fund’s performance

For the period beginning at Fund inception (February 11, 2022) and ending on December 31, 2022, the Fund delivered a negative return, as stocks underperformed fixed-income investments, although the Fund did outperform the benchmark.

For the period beginning at Fund inception (February 11, 2022) and ending on December 31, 2022, global stock investors experienced significant losses. During that time, investors sought safety from high inflation, rising interest rates, and the increasing possibility of a recession. As a result, the broad market S&P 500 Index fell 13.47% for the period. The technology-heavy NASDAQ Composite Index performed even worse, dropping 25.64% for the period. The more economically sensitive Dow Jones Industrial AverageSM was down 4.09% for the period.

Small-cap stocks underperformed their larger-cap peers during the reporting period, while value stocks outperformed their growth brethren. Developed international markets, as measured by the MSCI EAFE® Index, outperformed their domestic peers, ending the fiscal year down 13.08%. Emerging-market stocks, as measured by the MSCI Emerging Markets Index, also fell sharply, ending down 21.36% for the period. Some investors sold off developed international and emerging-market stocks on concerns that higher interest rates and commodity prices would impair consumer spending and corporate earnings growth.

Bond yields rose sharply during the reporting period, with the 10-year U.S. Treasury bond yield rising from a low of 1.72% on March 1, 2022 to close the period at 3.88%. Rising yields generally produce falling bond prices; consequently, bond index returns suffered. The Bloomberg U.S. Aggregate Bond Index ended the period down 9.34%. Investment-grade corporate bonds fared even worse. The Bloomberg U.S. Corporate Bond Index, which tracks investment-grade corporate bonds, ended the period with a 10.87% loss. The Bloomberg U.S. Corporate High-Yield Bond Index also ended in negative territory, declining 8.02% during the period.

23

MML iShares® 60/40 Allocation Fund – Portfolio Manager Report (Unaudited) (Continued) |

Manager selection contributed to overall performance in 2022. Strong performance by the iShares Core Dividend Growth, iShares Core S&P Mid-Cap, and iShares 1-5 Year Investment Grade Corporate Bond ETFs helped overall performance. Weak performance by the iShares 20+ Year Treasury Bond and iShares Core MSCI Emerging Markets ETFs were significant drivers of underperformance.

Investment adviser outlook

Despite the stock market sell-off in 2022, we view the stock markets as extended and valuations high relative to market history. In MML Advisers’ view, while the prospect of positive economic and corporate earnings growth supports a bull case, MML Advisers’ believes that more clarity on the slowing of economic growth, persistency of inflation, labor costs, China’s COVID-19 policy, and the impact of monetary policy tightening is needed for the allocation to stocks to increase. Against this backdrop, we believe that diversification across global assets for investors could be a sensible approach for what, in our view, we believe could be a bumpy economic ride.

MML iShares 60/40 Allocation Fund

Largest Holdings

(% of Net Assets) on 12/31/22 |

iShares Core S&P Total US Stock Market ETF | 31.3% |

iShares Core U.S. Aggregate Bond ETF | 31.2% |

iShares Core MSCI International Developed Markets ETF | 13.0% |

iShares Core S&P 500 ETF | 9.1% |

iShares 1-5 Year Investment Grade Corporate Bond ETF | 5.0% |

iShares Core Dividend Growth ETF | 3.0% |

iShares Core S&P Mid-Cap ETF | 2.0% |

iShares Core MSCI Emerging Markets ETF | 2.0% |

iShares 20+ Year Treasury Bond ETF | 2.0% |

iShares Broad USD High Yield Corporate Bond ETF | 1.0% |

| 99.6% |

| | |

MML iShares 60/40 Allocation Fund

Sector Table

(% of Net Assets) on 12/31/22 |

Mutual Funds | 100.0% |

Total Long-Term Investments | 100.0% |

Short-Term Investments and Other Assets and Liabilities | 0.0% |

Net Assets | 100.0% |

| | |

24

MML iShares® 60/40 Allocation Fund – Portfolio Manager Report (Unaudited) (Continued) |

GROWTH OF $10,000 INVESTMENT - CLASS II

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 12/31/2022) | | |

| Inception Date

of Class | Since Inception

02/11/2022 | Since Inception

03/01/2022 |

Class II | 02/11/2022 | -12.14% | |

Service Class I | 02/11/2022 | -12.37% | |

S&P 500 Index* | | -13.47% | |

Bloomberg U.S. Aggregate Bond Index | | -9.34% | |

Lipper Balanced Fund Index** | | | -9.64% |

| | | | |

* Benchmark

** Since 03/01/2022