2

Privileged and Confidential / Not to be Copied or Distributed

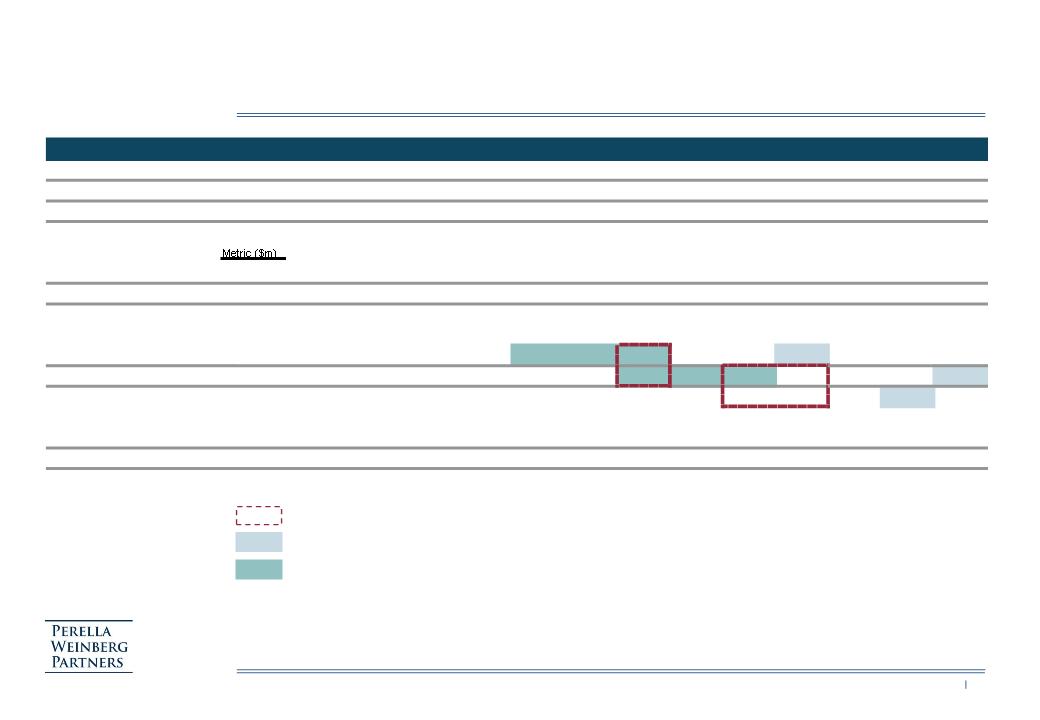

§ Perella Weinberg Partners have prepared a preliminary valuation analysis of Osaka and a preliminary value range

recommendation for communication to Osaka

– We believe the objective of this initial communication should be to ensure Osaka will engage into discussions while (i)

providing a value range consistent with the company’s performance and industry valuation metrics and (ii) retaining

flexibility with regards to valuation (notably to incorporate due diligence findings)

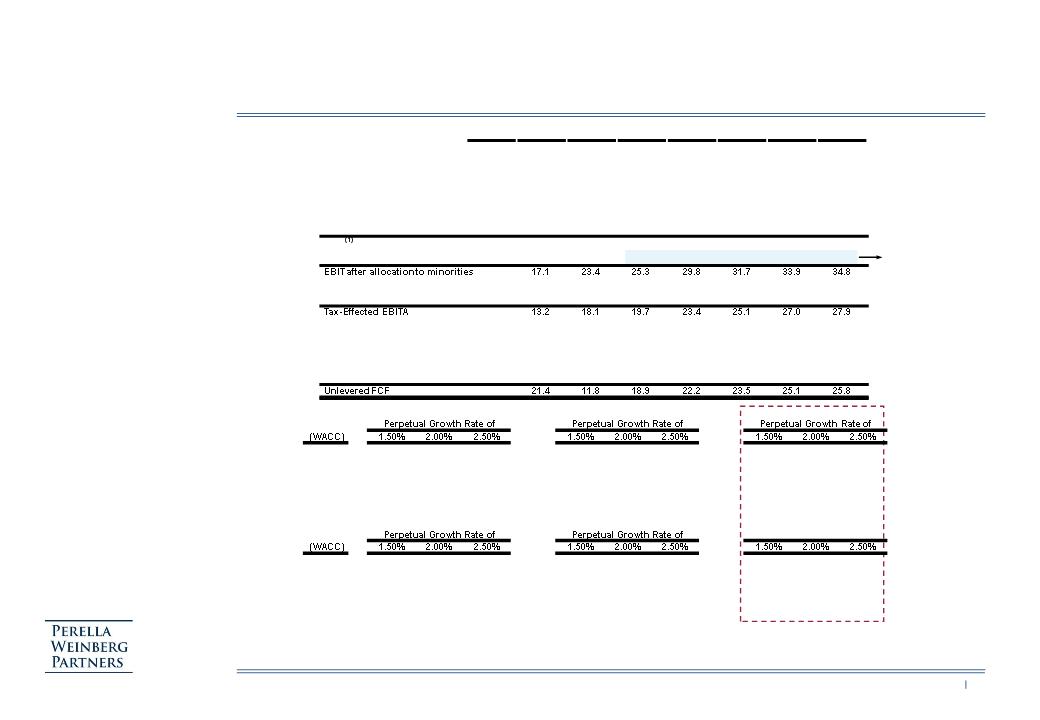

§ Our valuation analysis is solely based on Osaka’s 2009 performance and 2010-2014 forecasts excluding acquisitions, as

provided by Osaka management

– Moderate top line growth

• 2009-2014 revenue CAGR of 8.1%, driven in part by 2010 - thereafter growth around 5-7%

– Significant margin improvement: 18.6% to 20.8% EBITDA margin from 2009 to 2014

• Significant expansion of gross margin in 2010 a key driver (from 53.7% to 55.4%)

– Top line growth and margin improvement in 2010 will require thorough investigation during due diligence

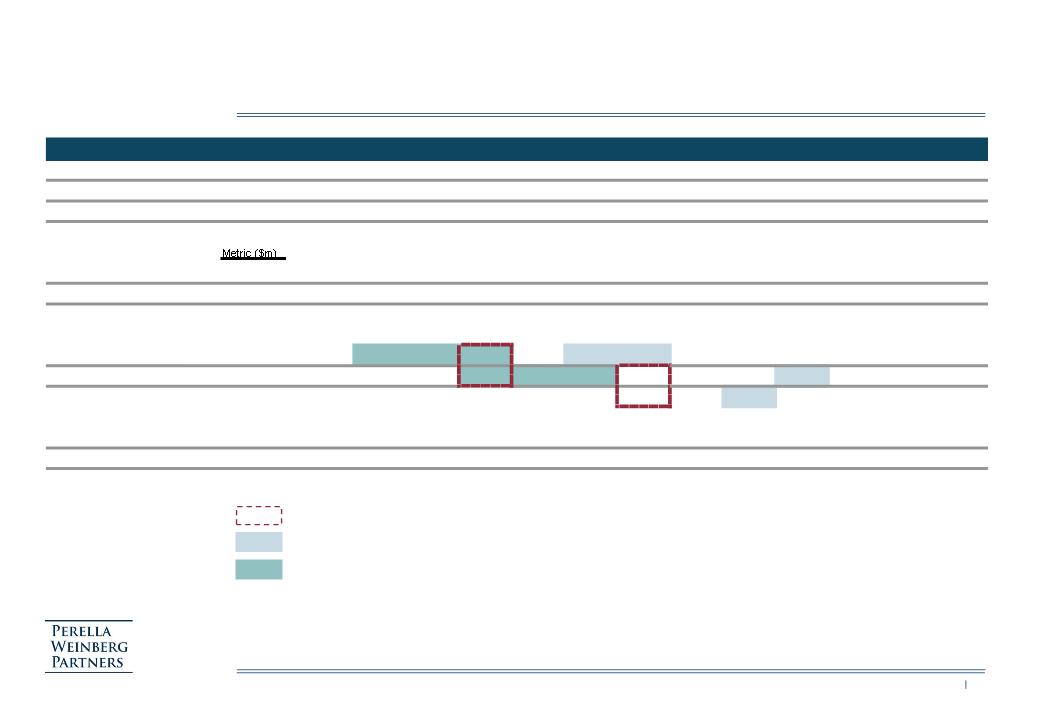

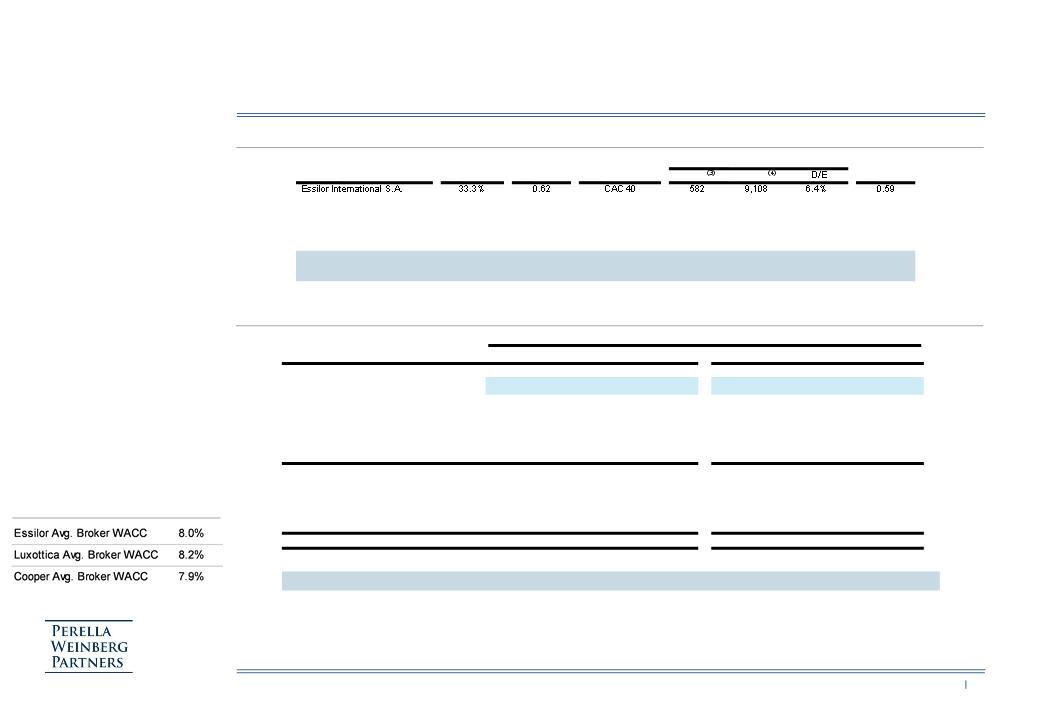

§ Valuation approach

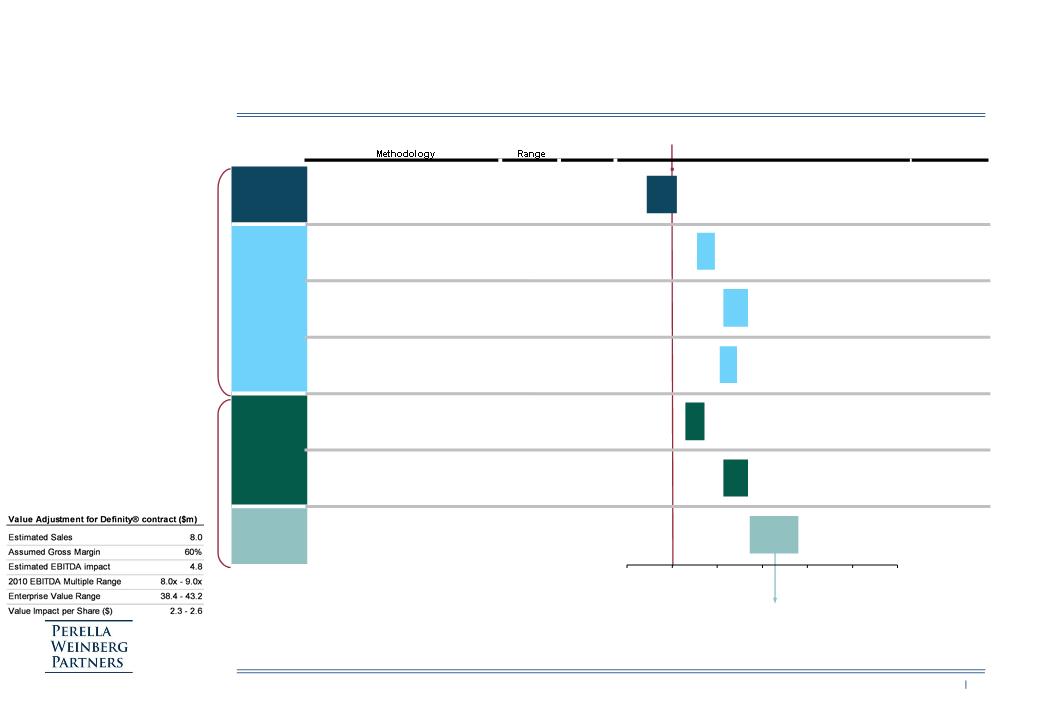

– Valuation must factor in significant uncertainty around the Definity® business, a material contract between Osaka and

Essilor in the US market meant to expire in 2010

• Contract represents c. US$8m in annual sales for Osaka, at a gross margin estimated at a minimum of 60% (EBITDA

contribution of c. US$5m)

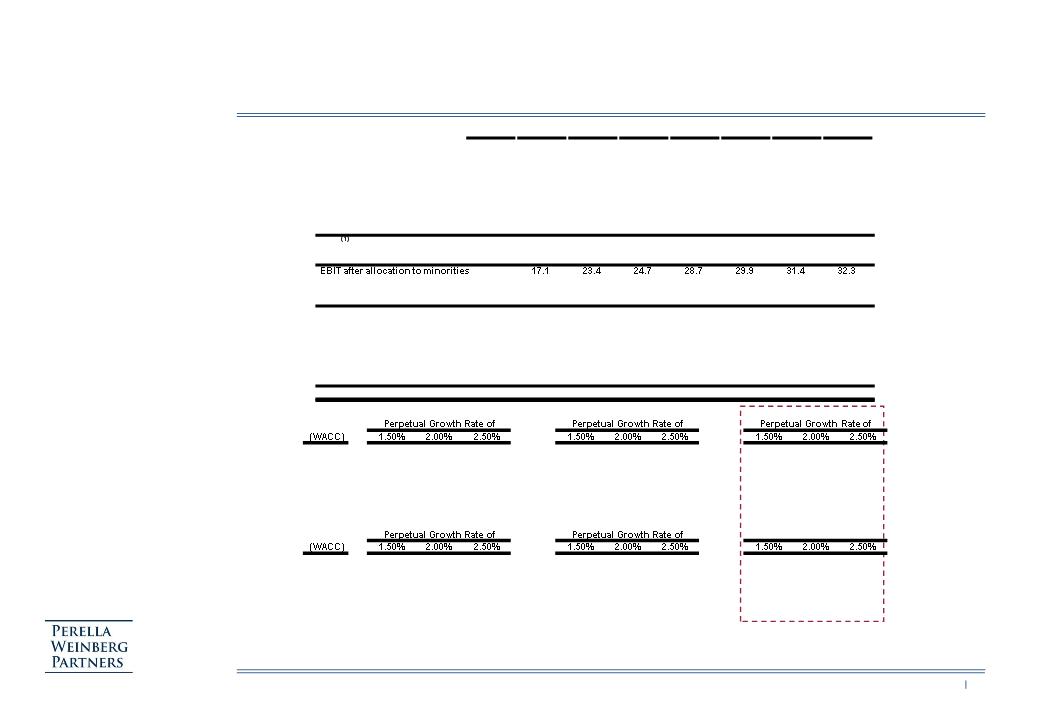

– DCF is used to derive intrinsic value of the business, but significant discount required given (i) execution risks associated

with high growth in cash flows, and (ii) absence of control

– Comparable company analysis and precedent transactions provide consistent benchmark to calibrate the DCF approach

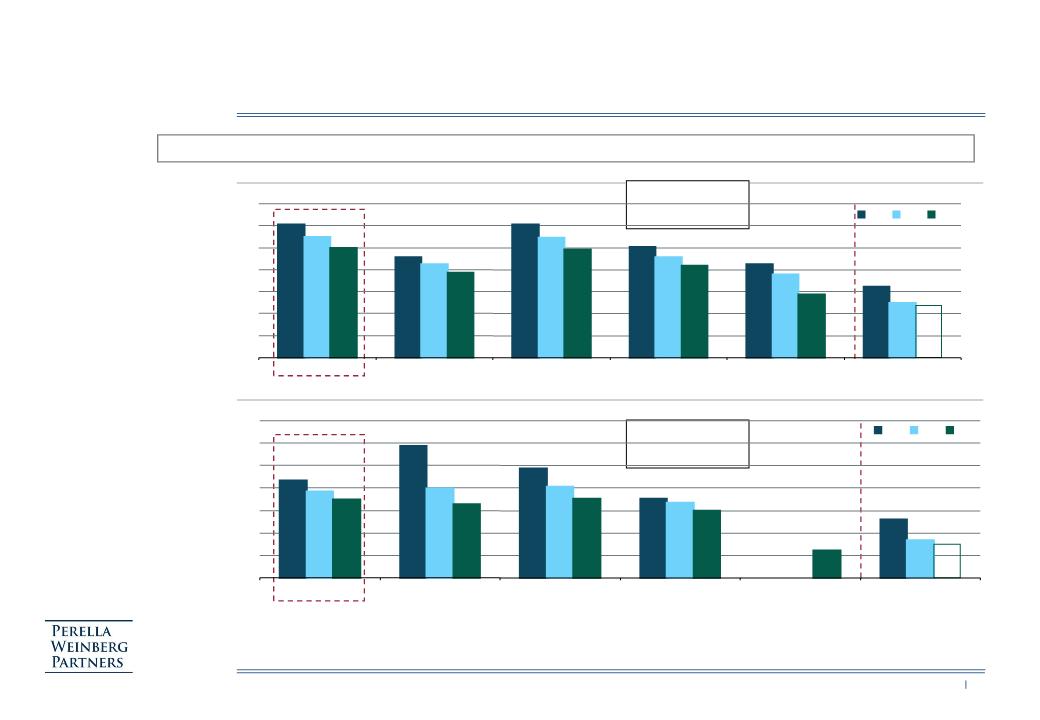

• 2009 EBITDA multiple of 9.0-10.0x supported by both comparables and precedent transactions

• 2010 EBITDA multiple of 8.0-9.0x supported by both comparables and precedent transactions

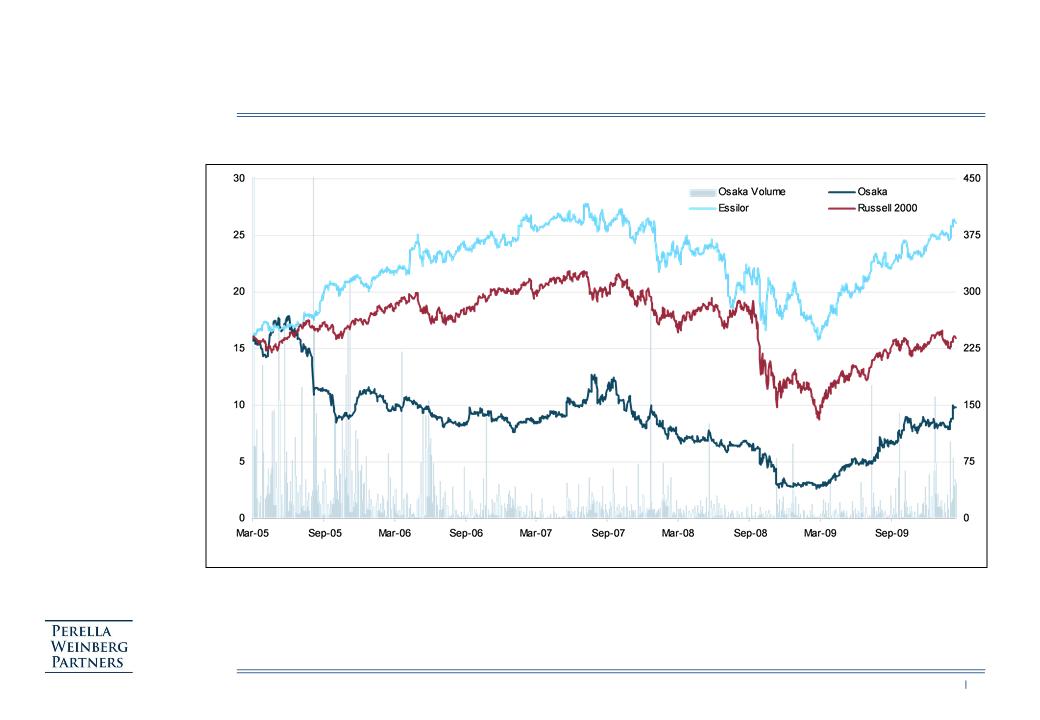

– Current share price does not constitute a reliable valuation benchmark

• Limited free float, lack of analyst coverage and share price underperformance have resulted in very limited trading

volumes

INTRODUCTION