United States

Securities and Exchange Commission

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 001-32954

CLEVELAND BIOLABS, INC.

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 20-0077155 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 73 High Street, Buffalo, NY 14203 | | (716) 849-6810 |

| (Address of principal executive offices) | | Telephone No. |

Securities Registered Pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange which registered |

| Common Stock, par value $0.005 per share | | NASDAQ Capital Market |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | x |

Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $65,171,586. There were 50,919,820 shares of common stock outstanding as of March 14, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’s 2014 Annual Meeting of Stockholders is incorporated by reference in Part III to the extent described therein.

Cleveland BioLabs, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2013

INDEX

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. Forward-looking statements give our current expectations of forecasts of future events. All statements other than statements of current or historical fact contained in this annual report, including statements regarding our future financial position, business strategy, new products, budgets, liquidity, cash flows, projected costs, regulatory approvals or the impact of any laws or regulations applicable to us, and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “should,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements on our current expectations about future events. While we believe these expectations are reasonable, such forward-looking statements are inherently subject to risks and uncertainties, many of which are beyond our control. Our actual future results may differ materially from those discussed here for various reasons. When you consider these forward-looking statements, you should keep in mind these risk factors and other cautionary statements in this annual report including in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Item 1A “Risk Factors.”

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this report are made only as of the date hereof. We do not undertake any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments. When used in the report, unless otherwise stated or the context otherwise requires, the terms “Cleveland BioLabs” and “CBLI” refer to Cleveland BioLabs, Inc., but not its consolidated subsidiaries and “the Company,” “we,” “us” and “our” refer to Cleveland BioLabs, Inc. together with its consolidated subsidiaries.

ii

PART I

Item 1. Business

GENERAL OVERVIEW

We are an innovative drug development company seeking to develop first-in-class pharmaceuticals designed to address diseases with significant unmet medical need. We combine our proven scientific expertise and our depth of knowledge about our products’ mechanisms of action into a passion for developing drugs to save lives. Our programs are focused on the implementation of novel pharmacological approaches to control cell death. Our proprietary drug candidates act via unique mechanisms and targets to kill cancer and protect healthy cells. We conduct business in the United States and the Russian Federation and have worldwide development and commercialization rights to all of our product candidates, subject to certain financial obligations to our current licensors. Our lead product candidates are Entolimod, which we are developing as a radiation countermeasure and an oncology drug, and Curaxin CBL0137, our lead oncology product candidate. We also have an additional clinical stage program and multiple innovative projects in different stages of preclinical drug development (see “Product Development Pipeline – Other Compounds”).

Entolimod, our most advanced product candidate, is a Toll-like receptor 5, or TLR5, agonist, which we are developing as a radiation countermeasure for prevention of death from Acute Radiation Syndrome, or ARS, and as an oncology drug. We believe that Entolimod is the most efficacious radiation countermeasure currently in development. Following is a summary of the clinical development of Entolimod to date and regulatory status:

Entolimod is being developed under the U.S. Food & Drug Administration’s, or FDA’s, Animal Efficacy Rule, or the Animal Rule, for the indication of reducing the risk of death following total body irradiation (see “Government Regulation – Animal Rule”). We have completed two dose escalation clinical studies designed to evaluate the safety, pharmacokinetics and pharmacodynamics in a total of 150 healthy volunteers. Administration of Entolimod was not associated with irreversible harm at any of the doses evaluated in these two studies. We have completed a Good Laboratory Practices, or GLP, randomized, blinded, placebo-controlled, pivotal study designed to evaluate the dose-dependent effect of Entolimod on survival and biomarker induction in 179 non-human primates exposed to 7.2 Gy total body irradiation when Entolimod or placebo were administered at 25 hours after radiation exposure. We have completed a GLP, randomized, open-label, placebo-controlled, pivotal study designed to evaluate the dose-dependent effect of Entolimod on biomarker induction in 160 non-irradiated non-human primates. We were granted Fast Track and Orphan Drug designations by the FDA. We plan to meet with the FDA regarding our human dose-conversion and our intent to submit a pre-Emergency Use Application, or pre-EUA, and, if appropriate after such meeting, plan to submit a pre-EUA in 2014.

Additionally, we are conducting a Phase 1 open-label, dose-escalation trial of Entolimod in patients with advanced cancer in the United States. In 2014, we plan to initiate, in the Russian Federation, a placebo-controlled, randomized trial of Entolimod in healthy volunteers to define optimal innate stimulatory dose and to support the safety database for our radiation countermeasure development program.

Curaxin CBL0137, our lead oncology product candidate, acts through a novel mechanism enabling this compound to simultaneously target three molecular pathways within cancer cells. We believe that CBL0137 has the potential to be a broadly-marketed cancer treatment that will address the unmet needs of treating diseases such as glioblastoma, lymphoma and treatment resistant neuroblastoma in children. CBL0137 inhibits Nuclear Factor kappa-B, or NF-kB, and Heat Shock Factor Protein-1, or HSF-1, transcription factors that are essential for viability of many types of tumors and activates tumor suppressor protein p53 by modulating intracellular localization and activity of chromatin remodeling complex Facilitates Chromatin Transcription, or FACT. CBL0137 has demonstrated reproducible anti-tumor effects in animal models of colon, breast, renal, pancreatic, head and neck and prostate cancers, melanoma, non-small cell lung cancer, glioblastoma, lymphoma, leukemia and neuroblastoma. We are currently enrolling two Phase 1 trials of CBL0137: (i) a multi-center, single agent, dose escalation study evaluating oral administration of CBL0137 in subjects with advanced solid tumors that are

1

resistant or refractory to standard of care treatment in the Russian Federation; and (ii) a multi-center, single agent dose escalation study in the United States, evaluating intravenous administration of CBL0137 in patients with metastatic or unresectable advanced solid cancers and lymphomas in the United States. We are conducting parallel evaluation of oral and intravenous routes of administration and continuous low-dose versus interrupted high-dose schedules to reduce our developmental risk by fully characterizing the clinical pharmacology of CBL0137.

CORPORATE INFORMATION

We were incorporated in Delaware in June 2003 as a spin-off company from the Cleveland Clinic Foundation, or CCF. We exclusively license our founding intellectual property from CCF. In 2007, we relocated the company to Buffalo, New York and became affiliated with Roswell Park Cancer Institute, or RPCI, through technology licensing and research collaboration relationships. Our common stock is listed on the NASDAQ Capital Market under the symbol “CBLI.”

Our principal executive offices are located at 73 High Street, Buffalo, New York 14203, and our telephone number at that address is (716) 849-6810.

The CBLI logo and CBLI product names are proprietary trade names of CBLI or its subsidiaries. We may indicate U.S. trademark registrations and U.S. trademarks with the symbols “®” and “TM”, respectively. Other third-party logos and product/trade names are registered trademarks or trade names of their respective owners.

PRODUCT DEVELOPMENT PIPELINE

Our product development programs arise from internally developed and in-licensed intellectual property from our innovation partners, CCF and RPCI. For instance, Entolimod emerged from our strategic licensing arrangement with CCF and CBL0137 emerged from our internal research efforts. In building our product development pipeline, we have intentionally pursued drug targets with applicability across multiple therapeutic areas and indications. This approach gives us multiple product opportunities and ensures that our success is not dependent on any single product or indication.

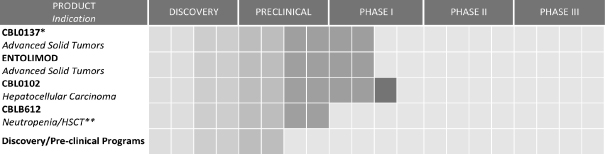

Our primary product development programs and their respective development stages are illustrated below:

| * | Lead product development program |

| ** | HSCT means hematopoietic stem cell transplant |

2

Our product development efforts were initiated by discoveries related to apoptosis, a tightly regulated form of cell death that can occur in response to internal stresses or external events such as exposure to radiation or toxic chemicals. Apoptosis is a major determinant of the tissue damage that occurs in a variety of medical conditions involving ischemia, or temporary loss of blood flow, such as cerebral stroke, heart attack and acute renal failure. In addition, apoptotic loss of cells of the hematopoietic, or HP, system and gastrointestinal, or GI, tract is largely responsible for the acute lethality of high-dose radiation exposure. On the other hand, apoptosis is also an important protective mechanism that allows the body to eliminate defective cells such as those with cancer-forming potential.

We have developed novel strategies to target the molecular mechanisms controlling apoptotic cell death for therapeutic benefit. These strategies take advantage of the fact that tumor and normal cells respond to apoptosis-inducing stresses differently due to tumor-specific defects in cellular signaling pathways such as inactivation of p53 (a pro-apoptosis regulator) and constitutive activation of NF-kB (a pro-survival regulator).

Thus, we designed two oppositely-directed general therapeutic concepts:

| | (a) | Temporary and reversible suppression of apoptosis in normal cells to protect healthy tissues from stress-induced damage using compounds we categorize as Protectans, which include Entolimod and CBLB612; and |

| | (b) | Reactivation of apoptosis in tumor cells to eliminate cancer using compounds we categorize as Curaxins, which include CBL0137 and CBL0102. |

Entolimod Biodefense Indication

Our lead Protectan product candidate is Entolimod, an engineered derivative of theSalmonella flagellin protein that was designed to retain its specific TLR5-activating capacity while increasing its stability, reducing its immunogenicity and enabling high-yield production. We are developing Entolimod for dual indications: (i) as a radiation countermeasure for prevention of death from ARS, which we refer to as a Biodefense Indication; and (ii) as an oncology drug (discussed in “Product Development Pipeline – Other Programs”).

The market for radiation countermeasures grew dramatically following the September 11, 2001 terrorist attacks and the subsequent use of anthrax in a biological attack in the United States. Terrorist activities worldwide have continued in the intervening years and the possibility of chemical, biological, radiation and nuclear attacks continues to represent a perceived threat for governments world-wide. In addition to the U.S. government, we believe the potential markets for the sale of radiation countermeasures include U.S. and foreign state and local governments, including both defense and public health agencies, non-governmental organizations and multinational companies, transportation and security companies, healthcare providers, hospitals and clinics, and nuclear power facilities.

Acute high-dose whole body or significant partial body radiation exposure induces massive apoptosis of cells of the HP system and GI tract, which leads to ARS, a potentially fatal condition for which there are currently no FDA-approved treatments. The threat of ARS is primarily limited to emergency/defense scenarios and is significant given the possibility of nuclear/radiological accidents, warfare or terrorist incidents. The scale of possible exposure (number of people affected) has been estimated by the U.S. government to be in the range of 500,000 based on a modeled 10-kiloton device detonation in New York City. And we believe the current lack of approved efficacious treatments to deal with such an event makes Entolimod a compelling product candidate. It is not feasible or ethical to test the efficacy of Entolimod as a radiation countermeasure in humans. Therefore, we are developing Entolimod under the FDA’s Animal Rule guidance (see “Government Regulation – Animal Rule”). The Animal Rule authorizes the FDA to rely on data from animal studies to provide evidence of a product’s effectiveness under circumstances where there is a reasonably well-understood mechanism for the activity of the product. Under these requirements, and with the FDA’s prior agreement, medical countermeasures, like Entolimod, may be approved for use in humans based on evidence of effectiveness derived from appropriate animal studies, evidence of safety derived from studies in humans and any additional supporting data.

3

In 2014, we plan to meet with the FDA regarding human dose-conversion and our intent to file a pre-EUA. If appropriate after such meeting, we will submit a pre-EUA using the human dose of Entolimod that we determined through our proprietary dose conversion methodology, which utilizes the data from our pivotal non-human primate studies and our clinical studies of Entolimod in healthy volunteers. If authorized, pre-EUA status will allow Entolimod to be sold into the National Stockpile and used under a state of emergency. Such authorization is not equivalent to full licensure through approval of a biologic license application, or BLA, but precedes full licensure, and, importantly, would position Entolimod for potential sales in advance of full licensure in the United States. We further believe pre-EUA status will position us to explore sales opportunities with foreign governments.

Our pivotal efficacy study conducted in 179 non-human primates demonstrated with a high degree of statistical significance that injection of a single dose of Entolimod given to rhesus macaques 25 hours after exposure to a 70% lethal dose of total body irradiation improved animal survival by nearly three-fold compared to the control group. Dose-dependence of Entolimod’s efficacy was demonstrated with doses above the minimal efficacious dose establishing a plateau at approximately 75% survival at 60 days after irradiation, as compared to 27.5% survival in the placebo-treated group.

Our pivotal study conducted in 160 non-human primates established the dose-dependent effect of Entolimod on biomarkers for efficacy in non-irradiated non-human primates.

Our clinical studies of Entolimod in 150 healthy human subjects demonstrated the safety profile of Entolimod and established the dose-dependent effect of Entolimod on efficacy biomarkers in humans. In these studies, and in our currently ongoing Phase 1 oncology study, transient decrease in blood pressure and elevation of liver enzymes were observed along with transient mild to moderate flu-like syndrome. Such effects are the most common adverse events and they are linked to up-regulation of cytokines that are also biomarkers for efficacy.

The FDA has granted Fast Track status to Entolimod (see “Government Regulation – Fast Track Designation”) and Orphan Drug status for prevention of death following a potentially lethal dose of total body irradiation during or after a radiation disaster (see “Government Regulation – Orphan Drug Designation”).

We have worldwide development and commercialization rights to Entolimod.

Curaxin CBL0137

Our lead Curaxin product candidate is CBL0137, a small molecule with a multi-targeted mechanism of action that may be broadly useful for treatment of many different types of cancer with greater efficacy and substantially lower risk for patients developing drug resistance than conventional chemotherapeutic agents. CBL0137 inhibits NF-kB and HSF-1 transcription factors that are essential for viability of many tumor types of tumors and activates tumor suppressor protein p53 by modulating intracellular localization and activity of chromatin remodeling complex FACT. CBL0137 has been shown to be efficacious in pre-clinical models of colon, breast, renal, pancreatic, head and neck and prostate cancers, melanoma, non-small cell lung cancer, glioblastoma, lymphoma, leukemia and neuroblastoma.

We are currently enrolling patients in a Phase 1 multi-center, single agent, dose escalation study of an oral administration of CBL0137 in subjects with advanced solid tumors that are resistant or refractory to the standard of care in the Russian Federation. We are also currently enrolling patients in a Phase 1 multi-center, single agent, dose escalation study of an intravenous administration of CBL0137 in subjects with metastatic or unresectable advanced solid cancers and lymphomas in the United States. These studies are designed to evaluate safety, pharmacokinetics, and document any objective tumor response. The exploratory objectives of these trials are to examine (i) the relationship between tumor expression of FACT and response to CBL0137, and (ii) the effect of CBL0137 on the expression of biomarkers in peripheral blood mononuclear cells, or PBMCs, and on soluble

4

factors in serum. We are conducting parallel evaluation of oral and intravenous routes of administration and continuous low-dose versus interrupted high-dose schedules to reduce our developmental risk by fully characterizing the clinical pharmacology of CBL0137.

Our majority-owned subsidiary, Incuron, holds worldwide development and commercialization rights to CBL0137.

Other Programs

In addition to our Entolimod and CBL0137 development programs, we have an additional clinical stage program and multiple earlier stage development programs. The most advanced of these programs and projects are described below.

Curaxin CBL0102, a non-proprietary molecule that is a relative of 9-aminoacridine, a compound that is the core structure of many existing drugs. CBL0102 is a Quinacrine, a compound with a long history of use in humans as a treatment for malaria, osteoarthritis and autoimmune disorders. Quinacrine was not, however, previously used as an anti-cancer agent. In 2008, we completed a Phase 2 study in 31 patients with late stage, hormone refractory (androgen-independent) prostate cancer that had not responded to or relapsed following previous hormonal therapy and/or chemotherapy. The study results showed that one patient had a partial response, while 50% of the patients exhibited a decrease or stabilization in the rate of prostate cancer progression. CBL0102 was well-tolerated and there were no serious adverse events attributed to the drug. Therefore, the trial provided indications of anti-cancer activity and demonstrated safety for CBL0102 treatment for the cancer patients who were in the trial. In late 2013, we completed a Phase 1 safety and tolerability study of CBL0102 in patients with liver metastases from solid tumors of epithelial origin or primary advanced hepatic carcinoma for which standard therapy had failed or did not exist in the Russian Federation and we are in the process of finalizing the reports for this study. An investigator-initiated Phase 1/2 trial evaluating the tolerability of CBL0102 in combination with erlotinib in patients with stage 3B-4 non-small cell lung cancer is currently enrolling patients at the Case Comprehensive Cancer Center. The FDA has granted CBL0102 Orphan Drug status for treatment of hepatocellular carcinoma. Our majority owned subsidiary, Incuron, holds worldwide development and commercialization rights to CBL0102.

Entolimodis an engineered derivative of theSalmonella flagellin protein that was designed to retain its specific TLR5-activating capacity while increasing its stability, reducing its immunogenicity and enabling high-yield production. In addition to developing Entolimod as a radiation countermeasure for prevention of death from ARS, we are also developing Entolimod as an oncology drug. We believe that Entolimod has the potential to treat cancer by activating the innate and adaptive immune response in patients. In preclinical studies, Entolimod produced tissue-specific activation of innate immune responses via interaction with its receptor, TLR5, and the liver was identified as a primary mediator of Entolimod activity. Entolimod has also been shown to have a direct cytotoxic effect on tumors expressing TLR5 in animal models. Evaluations of local administration of Entolimod in organs expressing TLR5, such as the bladder, have also been performed in pre-clinical models. We are currently enrolling patients in a Phase 1, open-label, dose-escalation study designed to evaluate the safety, pharmacokinetics, pharmacodynamics and clinical activity of Entolimod in advanced cancer patients. In the second half of 2014 we plan to initiate a placebo-controlled, randomized trial of Entolimod in healthy subjects to define an optimal immunostimulatory dose. The study will be performed in the Russian Federation as the first of two planned studies under a 149 million ruble matching funds development contract that we received in October 2013 from the Ministry of Industry and Trade of the Russian Federation, or MPT (see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

Protectan CBLB612 is a proprietary compound based upon a natural activator of another tissue-specific component of the innate immune system, the TLR2/TLR6 heterodimeric receptor. CBLB612 is a pharmacologically optimized synthetic molecule that structurally mimics naturally occurring lipopeptides of Mycoplasma (a genus of parasitic bacteria) and activates NF-kB pro-survival and immunoregulatory signaling

5

pathways via specific binding to TLR2 on a subset of body tissues and cell types that express this receptor. Preclinical studies have shown that the efficacy of CBLB612 exceeds that of granulocyte colony-stimulating factor, or G-CSF (Amgen’s Neupogen®), the market-leading drug used for stimulation of white blood cell regeneration. CBLB612’s hematopoietic stem cell, or HSC, stimulatory activity outweighed that of G-CSF when the drugs were administered either as monotherapies, in either mice or non-human primates, or in combination with Plerixafor (Genzyme’s Mozobil®, a chemokine receptor antagonist approved by the FDA as an HSC mobilizer). However, the highest degree of HSC mobilization, 12-fold greater than that induced by the current clinical standard ofG-CSF+Plerixafor, was observed when CBLB612 was added to that combination. The strong synergistic effect of this triple drug combination provides further support for development of CBLB612 as a valuable stem cell mobilizing agent. In 2014, we plan to initiate a Phase 1, single-center, blind, placebo-controlled, single ascending dose study in the Russian Federation to evaluate the safety and tolerability of CBLB612 in healthy volunteers and measure response of various HP stem and progenitor cell types in order to gain a preliminary estimate of the drug’s HSC stimulatory efficacy under a 139 million ruble matching funds development contract that we received in July 2012 from MPT (see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”). We have licensed CBLB612 to Zhejiang Hisun Pharmaceutical Co., Ltd. for the territories of China, Taiwan, Hong Kong and Macau. We have rest-of-world development and commercialization rights to CBLB612.

Mobilan is our most advanced discovery/pre-clinical stage program. Mobilan is a nanoparticle-formulated recombinant non-replicating adenovirus that directs expression of TLR5 and its agonistic ligand, flagellin. In pre-clinical studies, delivery of Mobilan to tumor cells results in constitutive autocrine TLR5 signaling and strong activation of the innate immune system with subsequent development of adaptive anti-tumor immune responses. Mobilan is in the pre-clinical stage of development as a universal anti-cancer therapy. In 2014, we plan to file an IND in the Russian Federation under a 149 million ruble matching funds development contract that we received in October 2013 from MPT (see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”). Our majority owned subsidiary, Panacela, holds worldwide development and commercialization rights to Mobilan.

STRATEGIC PARTNERSHIPS

Since our inception, strategic alliances and collaborations have been integral to our business. We have leveraged the experience, contacts and knowledge of our founders to engage funding partners in the Russian Federation and to develop and maintain academic-corporate innovation partnerships with CCF and RPCI. Through these partnerships we have collaborated with world-class scientists to develop our novel technologies and accessed non-traditional funding sources, including federal and foreign government contracts and project-oriented funding to support the development of certain of our technologies. We have received project-oriented funding from Russian Federation based venture funds BioProcess Capital Partners, or BCP, and Open Joint Stock Company “Rusnano”, or Rusnano, through the formation of our majority owned subsidiaries, Incuron and Panacela, both of which are co-located in the Russian Federation and the United States. We believe that these companies, as well as our wholly-owned subsidiary BioLab 612, may benefit from programs supporting domestic pharmaceutical industry development in the Russian Federation as well as the relative ease of enrolling patients as compared to western markets. We have negotiated exclusive licenses to rights in each of our technologies from CCF and RPCI.

BioProcess Capital Partners

In December 2009, we entered into our Incuron joint venture with BCP to develop Curaxin compounds for treatment of oncological diseases. According to the terms of the agreement, we transferred rights in the Curaxin molecules to the new joint venture company, Incuron, in which BCP agreed to contribute an aggregate of 549,497,000 Russian rubles (approximately $17.2 million as noted below) to support development of the compounds. As of December 31, 2013, Incuron had received from BCP payments of 369,570,000 Russian rubles (approximately $11.7 million) and BCP will make the balance of its contribution of 179,927,000 Russian rubles

6

(approximately $4.9 million, based on the March 11, 2014 exchange rate) upon the achievement of predetermined development milestones, which are expected in early 2014. As of December 31, 2013, we had a 59.2% ownership interest in Incuron. After the remaining contractual investments, CBLI expects to own approximately 47% of Incuron. CBLI has an option to maintain a majority ownership stake by investing $3.0 million in Incuron within 60 days of the last contribution by BCP.

Rusnano

In October 2011, we entered into our Panacela joint venture with Rusnano to carry out a complete cycle of development and commercialization in the Russian Federation for the treatment of oncological, infectious or other diseases. We invested $3.0 million in Panacela preferred shares and warrants, and, together with certain third-party owners, assigned and/or provided exclusive licenses, as applicable, to Panacela to provide Panacela with worldwide development and commercialization rights to five preclinical product candidates in exchange for Panacela common shares. Rusnano invested $9.0 million in Panacela preferred shares and warrants. In 2013, Rusnano loaned Panacela $1.5 million through a convertible term loan, or the Panacela Loan, and revised their original investment agreement to provide that Rusnano may invest an additional $15.5 million at their option and to remove the predetermined development milestones and timelines for further investment. As of December 31, 2013, we had an ownership stake of approximately 54.6% in Panacela. However, we may have a less than majority ownership interest in Panacela if Panacela raises additional capital through dilutive financing with a third-party or by Rusnano exercising their options to invest an additional $15.5 million, exercising their warrants in Panacela or converting the Panacela Loan into additional shares of Panacela preferred stock, which may be at a discounted price based upon the terms of the Panacela Loan.

Cleveland Clinic Foundation

In July 2004, CBLI entered into an exclusive license agreement with CCF, or the CCF License, pursuant to which CBLI was granted an exclusive license to CCF’s research base underlying our therapeutic platform including Entolimod, CBLB612, Curaxin CBL0102, Mobilan and several earlier stage compounds that are not currently material to our business. In consideration for the CCF License, we agreed to issue CCF common stock and make certain milestone, royalty and sublicense royalty payments as described below.

The CCF License requires milestone payments, which may be credited against future royalties owed to CCF, as described in the table below. CBLI has also agreed to make milestone payments of up to approximately $6.5 million for each Panacela Product that achieves certain developmental and regulatory milestones, provided that if CBLI or an affiliate of CBLI and CCF jointly own the Panacela Product, the milestone amounts will be reduced by 50%.

| | | | | | | | |

Milestone Description | | For Products Limited to

Biodefense Uses | | | For All Other Products

(Maximum amount)* | |

For any IND filing for a product | | $ | 50,000 | | | $ | 50,000 | |

For any product entering Phase II clinical trials or similar registration | | | 100,000 | | | | 250,000 | |

For any product entering Phase III clinical trials | | | — | | | | 700,000 | |

For any product license application, BLA or NDA Filing for a product | | | 350,000 | | | | 1,500,000 | |

Upon regulatory approval permitting any product to be sold to the commercial market | | | 1,000,000 | | | | 4,000,000 | |

| * | Maximum amounts listed for achievement of milestone in United States. If milestones are reached in another country first, milestone payments will be prorated for certain products under the license based on the market size for the product in such country as that market relates to the then current U.S. market. |

7

The CCF license requires royalty payments of (a) 2% of net sales of any product candidate under a licensed patent solely owned by CCF; and (b) 1% of net sales of any product candidate under a licensed patent that is jointly owned by CCF and CBLI or an affiliate of CBLI. Further, if CBLI receives upfront sublicense fees or sublicense royalty payments for sublicenses granted by CBLI to third parties for any licensed patents solely owned by CCF, CBLI will pay CCF (i) 35% of such fees if the sublicense is granted prior to filing an IND application, (ii) 20% of such fees if the sublicense is granted after an IND filing but prior to final approval of the Product License Application or NDA, or (iii) 10% of such fees if the sublicense is granted after final approval of the relevant Product License Application or NDA, provided that such sublicense fees shall not be less than 1% of net sales. The above sublicense fees and sublicense royalty payments are reduced by 50% if CCF and CBLI or an affiliate of CBLI jointly own the licensed patent.

Through December 31, 2013, CBLI had paid CCF $150,000 for milestone payments on products limited to biodefense uses, and $400,000 for all other products.

CCF may terminate the CCF License upon a material breach by us, as specified in the agreement. However, we may avoid such termination if we cure the breach within 90 days of receipt of a termination notice. CBLI may terminate the CCF License in its entirety or any specific patent licensed under the agreement by giving at least 90 days written notice of such termination to CCF. The agreement will, subject to certain exceptions, automatically terminate with respect to a licensed product if CCF does not receive a royalty payment for more than one-year after the payment of royalties has begun.

Roswell Park Cancer Institute

We have entered into a number of agreements with RPCI relating to the licensure and development of our product candidates including:

| | • | | Two exclusive license and option agreements effective December 2007 and September 2011; |

| | • | | Various sponsored research agreements; and |

| | • | | Clinical trial agreements for the conduct of the Phase 1 Entolimod oncology study and the Phase 1 CBL0137 intravenous administration study. |

In December 2007, CBLI entered into an agreement with RPCI pursuant to which CBLI has an option to exclusively license any technological improvements to our foundational technology developed by RPCI for the term of the agreement. We believe our option to license additional technology under the agreement potentially provides us with access to technology that may supplement our product pipeline in the future. In consideration for this option and exclusive license, we agreed to make certain milestone, royalty and sublicense royalty payments. Additionally, RPCI may terminate the license upon a material breach by us. However, we may avoid such termination if we cure the breach within 90 days of receipt of a termination notice. The license does not have a specified term; however, as each patent covered by this license agreement expires, the royalties to be paid on each product relating to the licensed patent shall cease.

In September 2011, Panacela entered into an agreement with RPCI, or the Panacela-RPCI License, to exclusively license certain rights Panacela Products, including Mobilan and several earlier stage compounds that are not currently material to our business, and to non-exclusively license certain know-how relating to the aforementioned product candidates for the limited purposes of research and development and regulatory, export and other government filings. Additionally, under the Panacela-RPCI License, Panacela has a right to exclusively license (i) any technological improvements to the Panacela Products developed by RPCI before September 2016, and (ii) any technology jointly developed by Panacela and RPCI. In consideration for the Panacela-RPCI License, Panacela agreed to issue RPCI common stock and to make certain milestone, royalty and sublicense royalty payments as described below.

8

The Panacela-RPCI License requires milestone payments for developmental and regulatory milestones reached in the United States of up to approximately $2.5 million for each Panacela Product that achieves certain developmental and regulatory milestones. Additionally, Panacela will owe additional payments of up to approximately $275,000 for each other country where a licensed Panacela Product achieves similar milestones. Through December 31, 2013, Panacela had not made any milestone payments to RPCI related to the above mentioned license agreement.

The Panacela-RPCI License requires royalty payments on net sales based on percentages in the low single digits. In addition, if Panacela sublicenses any of the licensed Panacela Products, Panacela will owe sublicensing fees ranging from 5% to 15% of fees received from sublicense by Panacela or an affiliate depending upon whether or not an IND has been filed or final approval of the relevant NDA has been obtained for such licensed product.

As each patent covered by the Panacela-RPCI License expires, the license agreement will terminate as to such patent. In addition, the license agreement will terminate with respect of the licensed know-how after 20 years. RPCI may terminate the license upon a material breach by us, as specified in the agreement. However, we may avoid such termination if we cure the breach within 90 days of receipt of a termination notice (or 30 days if notice relates to non-payment of amounts due to RPCI). Panacela may terminate the license agreement in whole or as to any specific patent licensed under the agreement by giving at least 60 days written notice of such termination to RPCI. The agreement will, subject to certain exceptions, automatically terminate with respect to a licensed Panacela Product if Panacela fails to market, promote and otherwise exploit the licensed technology so that RPCI does not receive a royalty payment during any 12-month period after the first commercial sale of such licensed product.

We have also entered into a number of sponsored research agreements with RPCI pursuant to which we have sponsored research to be conducted by RPCI. Under these agreements, we own any invention that is described in our research plan, co-own any inventions not described in our research plan that are made by Dr. Andrei Gudkov, our Chief Scientific Officer who is also the Senior Vice President of Basic Science at RPCI, and RPCI owns any other inventions not described in our research plan. We further have a right to exclusively license RPCI’s ownership in any invention developed under such sponsored research agreements that are owned by RPCI. These agreements with RPCI expire in 2014, although we expect to enter into similar future arrangements.

We entered into an asset transfer and clinical trial agreement with RPCI for the conduct, by RPCI, of our Phase 1 clinical trial to evaluate the safety and pharmacokinetic profile of Entolimod in patients with advanced cancers and a clinical trial agreement for RPCI to conduct, as one site in a multi-site trial, our Phase 1 clinical trial to evaluate the safety, pharmacokinetics and pharmacodynamics of intravenous administration of CBL0137 in patients with metastatic or unresectable advanced solid cancers and lymphomas. Either party may terminate these agreements upon 30 days’ notice to the other party.

INTELLECTUAL PROPERTY

Our intellectual property consists of patents, trademarks, trade secrets and know-how. Our ability to compete effectively depends in large part on our ability to obtain patents for our technologies and products, maintain trade secrets, operate without infringing the rights of others and prevent others from infringing our proprietary rights. We will be able to protect our proprietary technologies from unauthorized use by third parties only to the extent that they are covered by valid and enforceable patents, or are effectively maintained as trade secrets. As a result, patents or other proprietary rights are an essential element of our business. Our patent portfolio includes patents and patent applications with claims directed to compositions of matter, pharmaceutical formulations and methods of use. Some of our issued patents, and the patents that may be issued based on our patent applications, may be eligible for patent life extension under the Drug Price Competition and Patent Term Restoration Act of 1984 in the United States, supplementary protection certificates in the European Union or similar mechanisms in other countries or territories. The following are the patent positions relating to our product candidates as of December 31, 2013.

9

In the United States, we have 10 issued or allowed patents relating to our clinical-stage programs expiring on various dates between 2024 and 2030 as well as numerous pending patent applications and foreign counterpart patent filings which relate to our proprietary technologies. These patents and patent applications include claims directed to compositions of matter and methods of use.

We have 7 issued U.S. patents covering Entolimod, which expire between 2024 and 2029. These patents include method of use claims relating to our biodefense indication, reducing effects of chemotherapy and treatment of reperfusion injuries. In addition, we have pending U.S. patent applications related to compositions of matter and oncology methods of use, which, if issued, will expire between 2025 and 2032.

We have 1 issued U.S. patent covering CBL0137, which expires in 2030. This patent includes method of use claims relating to apoptosis induction along with inhibition of adaptive heat shock response. In addition, we have a pending U.S. patent application that includes CBL0137 composition of matter and method of use claims, which, if issued, will expire in 2029.

We have 2 issued U.S. patents covering CBLB612 and related agents, which expire between 2026 and 2027. These patents include composition of matter and methods of use claims. In addition, we have a pending U.S. patent application that includes method of use claims relating to increasing mobility of hematopoietic stem cells, which, if issued, will expire in 2028.

We have 1 pending U.S. patent application covering CBL0102, which, if issued, will expire in 2025. This patent includes method of use claims related to treatment of liver cancer.

In addition, as of December 31, 2013, we had more than a hundred additional patents and patent applications filed worldwide. Any patents that may issue from our pending patent applications would expire between 2024 and 2035, excluding patent term extensions. These patents and patent applications disclose compositions of matter and methods of use.

Our policy is to seek patent protection for the inventions that we consider important to the development of our business. We intend to continue to file patent applications to protect technology and compounds that are commercially important to our business, and to do so in countries where we believe it is commercially reasonable and advantageous to do so. We also rely on trade secrets to protect our technology where patent protection is deemed inappropriate or unobtainable. We protect our proprietary technology and processes, in part, by confidentiality agreements with our employees, consultants, collaborators and contractors.

RESEARCH AND DEVELOPMENT

In 2013, we transferred 26 laboratory and preclinical employee positions to Buffalo BioLabs, LLC, or BBL, an entity owned in part by our Chief Scientific Officer and director, Dr. Andrei Gudkov, to enable us to better focus our on clinical development activities. In connection with this transaction, we entered into a Master Services Agreement with BBL, pursuant to which BBL agreed to perform laboratory and preclinical research services for us. As of December 31, 2013, our research and development group, including Russian-based personnel, consisted of 18 individuals. Our research and development focuses on management of outsourced preclinical research, clinical trials and manufacturing technologies. We invested $19.5 million, $22.5 million and $22.8 million in research and development in the years ended December 31, 2013, 2012 and 2011, respectively.

SALES AND MARKETING

We currently do not have marketing, sales or distribution capabilities. We do, however, currently have worldwide development and commercialization rights for products arising out of substantially all of our programs. In order to commercialize any of these drugs, if and when they are approved for sale, we will need to enter into partnerships for the commercialization of the approved product(s) or develop the necessary marketing, sales and distribution capabilities.

10

COMPETITION

The biotechnology and biopharmaceutical industries are characterized by rapid technological developments and intense competition. This competition comes from both biotechnology and major pharmaceutical companies. Many of these companies have substantially greater financial, marketing and human resources than we do, including, in some cases, considerably more experience in clinical testing, manufacturing and marketing of pharmaceutical products. There are also academic institutions, governmental agencies and other research organizations that are conducting research in areas in which we are working. They may also develop products that may be competitive with our product candidates, either on their own or through collaborative efforts. We expect to encounter significant competition for any products we develop. Our product candidates’ competitive position among other biotechnology and biopharmaceutical companies will be based on, among other things, time to market, patent position, product efficacy, safety, reliability, availability, patient convenience, delivery devices and price. Additionally, competitive products may have superior safety or efficacy, be manufactured less expensively, or have better concept of operations, or CONOPs, usability for biodefense products. In these cases, we may not be able to commercialize our product candidates or achieve a competitive position in the market. This would adversely affect our business.

Specifically, the competition for Entolimod, CBL0137 and our other product candidates includes the following:

Entolimod Biodefense Indication

Product candidates for treatment of ARS face significant competition for U.S. government funding for both development and procurement of medical countermeasures and must satisfy government procurement requirements for biodefense products. Currently there are no FDA-approved drugs for the efficacious treatment of ARS. However, we are aware of a number of companies also developing radiation countermeasures to treat the effects of ARS including Aeolus Pharmaceuticals, Araim Pharmaceuticals, Inc., Cellerant Therapeutics, Exponential Biotherapies Inc., Humanetics Corporation, ImmuneRegen BioSciences, Inc., Neumedicines, Inc., Onconova Therapeutics, Inc., Pluristem Therapeutics, RxBio, Inc., Soligenix, Inc., and the University of Arkansas Medical Sciences Centers. Although their approaches to treatment of ARS are different, we compete with these companies for U.S. government development funding and may ultimately compete with them for U.S. and foreign government purchase and stockpiling of radiation countermeasures. Additionally, our ability to sell to the government also can be influenced by indirect competition from other products, such as Neupogen® (Amgen, Inc.) and potassium iodide, both of which were recently purchased for use as a radiation countermeasure.

Curaxins CBL0137 and CBL0102

Chemotherapy is a large cancer drug category. These treatments are the foundation for treatment of all cancer types and used in most combination regimens. Drugs in this category include, among others, irinotecan, carboplatin, taxanes and doxorubicin. These drugs act on various cell division pathways and ultimately cause cell death. This cell division pathway may not always be specific to the cancer cell but often effects normal cells such as red blood cells, white blood cells and other healthy tissues. Although these drugs as a treatment category in general carry higher toxicities than targeted therapies, they are nonetheless an important drug category for improving patient survival.

Entolimod Oncology Program

The number of cancer therapies is extremely large, numbering in the thousands. Immunotherapies and targeted therapies are primary drivers of growth in this segment. Examples of marketed drugs in these categories include: Avastin® (Roche) for a range of solid tumors including colorectal, lung, breast, renal and gastric cancers, Rituximab® (Roche) for CD20 positive, B-cell non-Hodgkin’s lymphoma and Arzerra® (GSK) and Campath® (Bayer Healthcare Pharmaceuticals) for CD20 positive chronic lymphocytic leukemia; Yervoy® (Bristol-Myers Squibb) for melanoma, Herceptin® (Roche) for human epidermal growth factor receptor-2, or HER-2, positive

11

tumors, Gleevec® (Novartis) for Philadelphia chromosome tumor mutations, Erbitux® (Eli Lilly) and Iressa® (AstraZeneca) for epidermal growth factor receptor, or EGRF, expressing tumors and Zelboraf® (Genentech) for BRAF mutated tumors.

CBLB612

Stem cell mobilization is a significant therapeutic category within oncology. G-CSF, marketed as Neupogen® (Amgen, Inc.), is the current standard against which all other mobilization agents for stem cells are measured. Its primary use was established in cancer patients with neutropenia (low white blood cells) due to chemotherapy. In recent years a long-acting release formulation of G-CSF, Neulasta® (Amgen, Inc.), was approved and is prescribed to approximately 50% of U.S. cancer patients with neutropenia. However, Neupogen® is still widely prescribed due to stronger reimbursement and is more often used in Europe. Mozobil® (Genzyme Corporation) is a more recent FDA approved drug designed to help increase the number of stem cells collected from a patient’s blood before being transplanted back into the body after chemotherapy.

MANUFACTURING

Our product candidates are biologics and small molecules that can be readily synthesized by processes that we have developed. We do not own or operate manufacturing facilities for the production of our product candidates for pre-clinical, clinical or commercial quantities. We rely on third-party manufacturers, and in most cases only one third-party, to manufacture critical raw materials, drug substance and final drug product for our research, pre-clinical development and clinical trial activities. Commercial quantities of any drugs we seek to develop will have to be manufactured in facilities and by processes that comply with the FDA and other regulations, and we plan to rely on third parties to manufacture commercial quantities of products we successfully develop.

GOVERNMENT REGULATION

Government authorities in the U.S. and in other countries, regulate the research, development, testing, manufacture, packaging, storage, record-keeping, promotion, advertising, distribution, marketing, quality control, labeling and export and import of pharmaceutical products such as those that we are developing. We cannot provide assurance that any of our product candidates will prove to be safe or effective, will receive regulatory approvals or will be successfully commercialized.

U.S. Drug Development Process

In the U.S., the FDA regulates drugs and drug testing under the Federal Food, Drug, and Cosmetic Act and in the case of biologics, also under the Public Health Service Act. Our product candidates must follow an established process before they may be marketed in the U.S.:

| | • | | Preclinical laboratory and animal tests performed in compliance with Good Laboratory Practices, or GLP; |

| | • | | Development of manufacturing processes which conform to current Good Manufacturing Practices, or cGMP; |

| | • | | Submission and acceptance of an IND application which must become effective before human clinical trials may begin; |

| | • | | Performance of adequate and well-controlled human clinical trials in compliance with current Good Clinical Practices, or cGCP, to establish the safety and efficacy of the proposed drug for its intended use; provided, however, that for Entolimod development under the Animal Rule, we are required to perform pivotal animal studies in compliance with GLP to establish efficacy; |

| | • | | Submission to and review and approval by the FDA of a NDA or BLA prior to any commercial sale or shipment of a product; |

12

Nonclinical testing.Nonclinical testing includes laboratory evaluation of a product candidate, its chemistry, formulation, safety and stability, as well as animal studies to assess the potential safety and efficacy of the product candidate. The conduct of the nonclinical tests must comply with federal regulations and requirements including cGMP and GLP. Prior to the initiation of GLP animal studies, including our pivotal studies for development of Entolimod under the Animal Rule, an Institutional Animal Care and Use Committee, or IACUC, at each testing site must review and approve each study protocol and any amendments thereto.

We must submit to the FDA the results of nonclinical studies, which may include laboratory evaluations and animal studies, together with manufacturing information and analytical data, and the proposed clinical protocol for the first clinical trial of the drug as part of an IND. An IND is a request for FDA authorization to administer an investigational drug to humans. Such authorization must be secured prior to the interstate shipment and administration of any new drug that is not the subject of an approved NDA or BLA. Nonclinical tests and studies can take several years to complete, and despite completion of those tests and studies, the FDA may not permit clinical testing to begin.

The IND process.The FDA requires a 30-day waiting period after the submission of each IND application before clinical trials may begin. This waiting period is designed to allow the FDA to review the IND to determine whether human research subjects will be exposed to unreasonable health risks. At any time during this 30-day period or at any time thereafter, the FDA may raise concerns or questions about the conduct of the trials as outlined in the IND and impose a “clinical hold” that may affect one or more specific studies or all studies conducted under the IND. In the case of a clinical hold, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials placed on hold can begin or continue. The IND application process may be extremely costly and could substantially delay development of our products. Moreover, positive results of preclinical animal tests do not necessarily indicate positive results in clinical trials.

Prior to the initiation of clinical studies, each clinical protocol must be submitted to the IND and to an independent Institutional Review Board, or IRB, at each medical site proposing to conduct the clinical trial. The IRB must review and approve each study protocol, and any amendments thereto, and study subjects must sign an informed consent. Protocols include, among other things, the objectives of the study, dosing procedures, subject selection and exclusion criteria and the parameters to be used to monitor patient safety. Progress reports of work performed in support of IND studies must be submitted at least annually to the FDA. Reports of serious and unexpected adverse events must be submitted to the FDA and the investigators in a timely manner.

Clinical trials.Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

| | • | | Phase 1: The drug is introduced into healthy human subjects or patients (in the case of certain inherently toxic products for severe or life-threatening diseases such as cancer) and tested for safety, dosage tolerance, absorption, distribution, metabolism and excretion. |

| | • | | Phase 2: Involves studies in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. |

| | • | | Phase 3: Clinical trials are undertaken to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical study sites. These studies are intended to establish the overall risk-benefit ratio of the product and provide, if appropriate, an adequate basis for product labeling. |

We cannot be certain that we will successfully complete any phase of clinical testing of our product candidates within any specific time period, if at all. Clinical testing must meet requirements of IRB oversight, informed consent and cGCP. The FDA, the sponsor, or the IRB at each institution at which a clinical trial is being performed may suspend a clinical trial at any time for various reasons, including a belief that the subjects are being exposed to an unacceptable health risk.

13

During the development of a new drug, sponsors are given an opportunity to meet with the FDA at certain points. These meetings typically occur prior to submission of an IND, at the end of Phase 2 and before NDA or BLA submission. These meetings can provide an opportunity for the sponsor to share information about the data gathered to date, for the FDA to provide advice, and for the sponsor and FDA to reach agreement on the next phase of development. Sponsors typically use the end-of-Phase 2 meeting to discuss their Phase 2 clinical results and present their plans for the pivotal Phase 3 clinical trial that they believe will support approval of the new drug.

The NDA or BLA process. If clinical trials are successful, the next step in the drug regulatory approval process is the preparation and submission to the FDA of an NDA or BLA, as applicable. The NDA or BLA, as applicable, is a vehicle through which drug sponsors formally propose that the FDA approve a new pharmaceutical for marketing and sale in the U.S. The NDA or BLA, as applicable, must contain a description of the manufacturing process and quality control methods, as well as results of preclinical tests, toxicology studies, clinical trials and proposed labeling, among other things. A substantial user fee must also be paid with the application, unless an exemption applies. Every newly marketed pharmaceutical must be the subject of an approved NDA or BLA.

Upon submission of an NDA or BLA, the FDA will make a threshold determination of whether the application is sufficiently complete to permit review, and, if not, will issue a refuse-to-file letter. If the application is accepted for filing, the FDA will attempt to review and take action on the application in accordance with performance goal commitments the FDA has made in connection with the prescription drug user fee law in effect at that time. Current timing commitments under the user fee law vary depending on whether an NDA or BLA is for a priority drug or not, and in any event are not a guarantee that an application will be approved or even acted upon by any specific deadline. The review process is often significantly extended by FDA requests for additional information or clarification. The FDA may refer the NDA or BLA to an advisory committee for review, evaluation and recommendation as to whether the application should be approved, but the FDA is not bound by the recommendation of an advisory committee. The FDA may deny or delay approval of applications that do not meet applicable regulatory criteria or if the FDA determines that the data do not adequately establish the safety and efficacy of the drug. In addition, the FDA may approve a product candidate subject to the completion of post-marketing studies, commonly referred to as Phase 4 trials, to monitor the effect of the approved product. The FDA may also grant approval with restrictive product labeling, or may impose other restrictions on marketing or distribution such as the adoption of a special risk management plan. The FDA has broad post-market regulatory and enforcement powers, including the ability to issue warning letters, levy fines and civil penalties, suspend or delay issuance of approvals, seize or recall products, and withdraw approvals.

Manufacturing and post-marketing requirements. If approved, a pharmaceutical may only be marketed in the dosage forms and for the indications approved in the NDA or BLA, as applicable. Special requirements also apply to any samples that are distributed in accordance with the Prescription Drug Marketing Act. The manufacturers of approved products and their manufacturing facilities are subject to continual review and periodic inspections by the FDA and other authorities where applicable, and must comply with ongoing requirements, including the FDA’s cGMP requirements. Once the FDA approves a product, a manufacturer must provide certain updated safety and efficacy information, submit copies of promotional materials to the FDA, and make certain other required reports. Product and labeling changes, as well as certain changes in a manufacturing process or facility or other post-approval changes, may necessitate additional FDA review and approval. Failure to comply with the statutory and regulatory requirements subjects the manufacturer to possible legal or regulatory action, such as untitled letters, warning letters, suspension of manufacturing, seizure of product, voluntary recall of a product, injunctive action or possible criminal or civil penalties. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval. Because we intend to contract with third parties for manufacturing of our products, our ability to control third party compliance with FDA requirements will be limited to contractual remedies and rights of inspection. Failure of third party manufacturers to comply with cGMP or other FDA requirements applicable to our products may result in, among other things, total or partial suspension of production, failure of the government to grant approval for marketing, and withdrawal, suspension,

14

or revocation of marketing approvals. With respect to post-market product advertising and promotion, the FDA imposes a number of complex regulations on entities that advertise and promote pharmaceuticals, which include, among others, standards for direct-to-consumer advertising, promoting drugs for uses or in patient populations that are not described in the drug’s approved labeling (known as “off-label use”), industry-sponsored scientific and educational activities, and promotional activities involving the internet. Failure to comply with FDA requirements can have negative consequences, including adverse publicity, enforcement letters from the FDA, mandated corrective advertising or communications with doctors, and civil or criminal penalties. Although physicians may prescribe legally available drugs for off-label uses, manufacturers may not market or promote such off-label uses.

The FDA’s policies may change, and additional government regulations may be enacted which could prevent or delay regulatory approval of our potential products. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the United States or abroad.

Animal Rule

In 2002, the FDA amended its requirements applicable to BLAs/NDAs to permit the approval of certain drugs and biologics that are intended to reduce or prevent serious or life-threatening conditions based on evidence of safety from clinical trial(s) in healthy subjects and effectiveness from appropriate animal studies when human efficacy studies are not ethical or feasible. These regulations, which are known as the “Animal Rule”, authorize the FDA to rely on animal studies to provide evidence of a product’s effectiveness under circumstances where there is a reasonably well-understood mechanism for the activity of the agent. Under these requirements, and with the FDA’s prior agreement, drugs used to reduce or prevent the toxicity of chemical, biological, radiological or nuclear substances may be approved for use in humans based on evidence of effectiveness derived from appropriate animal studies and any additional supporting data. Products evaluated for under this rule must demonstrate effectiveness through pivotal animal studies, which are generally equivalent in design and robustness to Phase 3 clinical studies. The animal study endpoint must be clearly related to the desired benefit in humans and the information obtained from animal studies must allow for selection of an effective dose in humans. Safety under this rule is established under preexisting requirements, including safety studies in both animals (toxicology) and humans. Products approved under the Animal Rule are subject to additional requirements including post-marketing study requirements, restrictions imposed on marketing or distribution or requirements to provide information to patients.

We intend to utilize the Animal Rule in seeking marketing approval for Entolimod as a radiation countermeasure because we cannot ethically expose humans to lethal doses of radiation. Other countries may not at this time have established criteria for review and approval of these types of products outside their normal review process, i.e. there is no “Animal Rule” equivalent in countries other than the U.S., but some may have similar policy objectives in place for these product candidates. Given the nature of nuclear and radiological threats, we do not believe that the lack of established criteria for review and approval of these types of products in other countries will significantly inhibit us from pursuing sales of Entolimod to foreign countries.

All data obtained from the pre-clinical studies and clinical trials of Entolimod, in addition to detailed information on the manufacture and composition of the product, would be submitted in a BLA to the FDA for review and approval for the manufacture, marketing and commercial shipments of Entolimod.

15

Emergency Use Authorization

The Commissioner of the FDA, under delegated authority from the Secretary of the Department of Health and Human Services, or HHS, may, under certain circumstances, issue an Emergency Use Authorization, or EUA, that would permit the use of an unapproved drug product or unapproved use of an approved drug product. Before an EUA may be issued, the Secretary must declare an emergency based on one of the following grounds:

| | • | | a determination by the Secretary of Department of Homeland Security that there is a domestic emergency, or a significant potential for a domestic emergency, involving a heightened risk of attack with a specified biological, chemical, radiological or nuclear agent or agents; |

| | • | | a determination by the Secretary of the Department of Defense, or DoD, that there is a military emergency, or a significant potential for a military emergency, involving a heightened risk to United States military forces of attack with a specified biological, chemical, radiological, or nuclear agent of agents; or |

| | • | | a determination by the Secretary of HHS of a public health emergency that effects or has the significant potential to affect, national security, and that involves a specified biological, chemical, radiological, or nuclear agent or agents, or a specified disease or condition that may be attributable to such agent or agent. |

In order to be the subject of an EUA, the FDA Commissioner must conclude that, based on the totality of scientific evidence available, it is reasonable to believe that the product may be effective in diagnosing, treating or preventing a disease attributable to the agents described above; that the product’s potential benefits outweigh its potential risks; and that there is no adequate, approved alternative to the product.

Although an EUA cannot be issued until after an emergency has been declared by the Secretary of HHS, the FDA strongly encourages an entity with a possible candidate product, particularly one at an advanced stage of development, to contact the FDA center responsible for the candidate product before a determination of actual or potential emergency. Such an entity may submit a request for consideration that includes data to demonstrate that, based on the totality of scientific evidence available, it is reasonable to believe that the product may be effective in diagnosing, treating, or preventing the serious or life-threatening disease or condition. This is called a pre-EUA submission and its purpose is to allow FDA review considering that during an emergency, the time available for the submission and review of an EUA request may be severely limited. In 2014, we plan to meet with the FDA regarding human dose-conversion of Entolimod and, if appropriate after such meeting, submit a pre-EUA in order to inform and expedite the FDA’s issuance of an EUA, should one become necessary in the event of an emergency. The FDA does not have review deadlines with respect to pre-EUA submissions. Additionally, if we submit a pre-EUA, there is no guarantee that the FDA will agree that Entolimod meets the criteria for EUA, or, if they do agree, that such agreement by the FDA will lead to procurement by the U.S. or other governments or further development funding.

Public Readiness and Emergency Preparedness Act

The Public Readiness and Emergency Preparedness Act, or PREP Act, provides immunity for manufacturers from all claims under state or federal law for “loss” arising out of the administration or use of a “covered countermeasure.” However, injured persons may still bring a suit for “willful misconduct” against the manufacturer under some circumstances. “Covered countermeasures” include security countermeasures and “qualified pandemic or epidemic products”, including products intended to diagnose or treat pandemic or epidemic disease, such as pandemic vaccines, as well as treatments intended to address conditions caused by such products. For these immunities to apply, the Secretary of HHS must issue a declaration in cases of public health emergency or “credible risk” of a future public health emergency. Since 2007, the Secretary of HHS has issued 8 declarations and six amendments under the PREP Act to protect countermeasures that are necessary to prepare the nation for potential pandemics or epidemics from liability.

16

Fast Track Designation

Entolimod has been granted Fast Track designation by the FDA for reducing the risk of death following total body irradiation. The FDA’s Fast Track designation program is designed to facilitate the development and review of new drugs, including biological products that are intended to treat serious or life-threatening conditions and that demonstrate the potential to address unmet medical needs for the conditions. Fast Track designation applies to a combination of the product and the specific indication for which it is being studied. Thus, it is the development program for a specific drug for a specific indication that receives Fast Track designation. The sponsor of a product designated as being in a Fast Track drug development program may engage in early communication with the FDA, including timely meetings and early feedback on clinical trials and may submit portions of an NDA or BLA on a rolling basis rather than waiting to submit a complete application. Products in Fast Track drug development programs also may receive priority review or accelerated approval, under which an application may be reviewed within six months after a complete NDA or BLA is accepted for filing or sponsors may rely on a surrogate endpoint for approval, respectively. The FDA may notify a sponsor that its program is no longer classified as a Fast Track development program if the Fast Track designation is no longer supported by emerging data or the designated drug development program is no longer being pursued. Receipt of Fast Track Status does not guarantee that we will experience a faster development process, review or approval as compared to conventional FDA procedures or that we will qualify or be able to take advantage of the FDA’s expedited review procedures.

Orphan Drug Designation

Entolimod and CBL0102 have been granted Orphan Drug designation by the FDA for prevention of death following a potentially lethal dose of total body irradiation and treatment of hepatocellular carcinoma, respectively. Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug intended to treat a rare disease or condition which is defined as one affecting fewer than 200,000 individuals in the United States or more than 200,000 individuals where there is no reasonable expectation that the product development cost will be recovered from product sales in the United States. Orphan drug designation must be requested before submitting an NDA or BLA and does not convey any advantage in, or shorten the duration of, the regulatory review and approval process.

If an orphan drug-designated product subsequently receives the first FDA approval for the disease for which it has such designation, the product will be entitled to orphan product exclusivity, which means that the FDA may not approve any other applications to market the same drug for the same indication, except in very limited circumstances for seven years as compared to five years for a standard new drug approval. As referenced above, we have received Orphan Drug status for two of our products. We intend to seek Orphan Drug status for our other products as appropriate, but an Orphan Drug designation may not provide us with a material commercial advantage.

Foreign Regulation

In addition to regulations in the United States, we are and will be subject to a variety of foreign regulations governing clinical trials and will be subject to a variety of foreign regulation governing commercial sales and distribution of our products. Whether or not we obtain FDA approval for a product, we must obtain approval by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country. Other countries, at this time, do not have an equivalent to the Animal Rule and, as a result, do not have established criteria for review and approval of these types of products outside their normal review process, but some countries may have similar policy objectives in place for these product candidates.

17

As in the United States, the European Union may grant orphan drug status for specific indications if the request is made before an application for marketing authorization is made. The European Union considers an orphan medicinal product to be one that affects less than five of every 10,000 people in the European Union. A company whose application for orphan drug designation in the European Union is approved is eligible to receive, among other benefits, regulatory assistance in preparing the marketing application, protocol assistance and reduced application fees. Orphan drugs in the European Union also enjoy economic and marketing benefits, including up to ten years of market exclusivity for the approved indication, unless another applicant can show that its product is safer, more effective or otherwise clinically superior to the orphan designated product.