UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

M3Sixty Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-934-5550

Date of fiscal year end: 06/30/2016

Date of reporting period: 06/30/2016

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the IMS Family of Funds, series of the 360 Funds (the “registrant”) for the year ended June 30, 2016 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

IMS Capital Value Fund

IMS Strategic Income Fund

IMS Dividend Growth Fund

Annual Report

June 30, 2016

Fund Advisor:

IMS Capital Management, Inc.

8995 S.E. Otty Road

Portland, OR 97086

Toll Free (800) 934-5550

IMS CAPITAL VALUE FUND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report

June 30, 2016

Dear Fellow Shareholders,

The IMS Capital Value Fund (the “Fund”) returned +2.23% while its benchmark, the S&P 500 Total Return Index (the “S&P 500” or “Index”) returned +3.84% over the six-month period ended June 30, 2016. The S&P 500 is 100% invested in large U.S. companies, which happened to be the best-performing category, while the Fund was just 70% in large companies, with the balance in small and midcap companies. This difference in composition made for an especially tough comparison over the one-year period. Stocks and oil prices had dropped together in the first six weeks of 2016, as investors worried that slowing economic growth in China could ripple worldwide and tip the U.S. into recession. As those concerns eased and the Federal Reserve held back on raising interest rates, risky assets rebounded. U.S. oil prices rebounded 84% off the February low on supply disruptions and expectations of falling production. Even with the gains, however, oil prices are still well off their 2008 highs. For the twelve-month period, ended June 30, 2016, the Fund fell 7.08% while the S&P500 gained 3.99%.

The Fund’s 44 holdings were diversified across all of the market’s major sectors with the exception of utilities and basic materials. The three highest sector weightings in the Fund were consumer cyclicals 31.3%, healthcare 19.4%, and technology 18.8%. The three lowest sector weightings were industrials 1.9%, telecommunications 3.9%, and energy 8.4%. Approximately, 70% of the Fund is invested in large cap companies, while 21% is invested in mid cap companies with just 5% in small cap companies.

During the past year, a major contributor to the Fund was Amazon, returning +64.86%. One of Amazon’s key advantages is its low-cost operation. The cost to maintain its scalable fulfillment and distribution network is lower than having a large physical retail presence, allowing Amazon to price below its brick-and-mortar peers while still generating excess economic returns. The second best performer was IDEXX Laboratories, Inc. (IDXX), a manufacturer and distributor of products and services primarily for the companion animal veterinary, livestock and poultry, water testing and dairy markets. The stock rose 44.78% over the last year due to solid global growth. During the first quarter 2016, the company reported double digit organic revenue growth overseas. With respect to its Companion Animal Group segment, IDXX witnessed strong recurring Diagnostic gains across the U.S., Canada, Europe, Asia Pacific and Latin America. The company also holds a strong cash balance position. The third best performer was heart valve manufacturer, Edwards Lifesciences Corp. (EW) up 40.04%. The company posted a positive earnings surprise of +7.58% in Q1 2016 due to robust demand for its transcatheter aortic valve replacement. The company continues to see consistent double-digit top and bottom-line growth.

Companies that detracted from the Fund’s performance over the last year included InVivo Therapeutics (NVIV), -64.21%. This biomaterials company has an innovative, and so far, promising treatment for paralyzing spinal cord injuries. In June, the company reported a loss of $6.62 million for Q1 2016, significantly greater than the loss of $4.73 million for the same period a year ago and higher than analyst expectations. Shares of InVivo, trading under $6, are well below their 12-month high of $17.75 despite excellent clinical results and significant progress towards FDA approval of their product. The second worst performer was Opko Health (OPK) down 41.92%. The company is a diversified provider of healthcare products including diagnostics, pharmaceuticals and biologics. The company recently gained approval for its new vitamin D drug, Rayaldee, however, investors are concerned that Opko will struggle to win reimbursements with insurers or that its sales force will have a tough time convincing doctors to prescribe Rayaldee instead of the vitamin D supplements that are commonly used today. Since last year, the CEO of the company has been an aggressive buyer of the stock. The third worst performer was fast casual restaurant chain operator Noodles & Co. (NDLS) which fell 33.01%, after the company reported a first quarter loss of $0.06 per share, down from a profit of $0.03 a share a year ago. Shares were also negatively impacted when the company recently announced a potential breach of payment data. Third party forensic experts detected malware and suspicious activity on its computer systems that signaled a possible infringement of the customers debit and credit card data. The market has not reacted well to the CEO’s resignation, which we view as a positive, since a change at the top is needed.

The U.S. stock market has risen every calendar year since 2009. We believe this bull market is not done yet. Elections years tend to be positive. Low interest rates and higher corporate earnings should continue to power the market ahead. Regardless, our focus on finding the right undervalued companies remains consistent in both up and down markets. Going forward, we continue to focus on undervalued stocks that have the potential to grow earnings, are down in price, are seasoned and are poised to benefit from one or more of our investment themes. For instance, we have been investing in companies that should benefit from baby boomer spending habits, an eventual rise in interest rates, an eventual rise in oil prices, the pending housing shortage and the trend towards pet ownership and healthy eating. We thank you for continuing to invest alongside us in the IMS Capital Value Fund as we focus on building wealth wisely.

Sincerely,

Carl W. Marker

Portfolio Manager

IMS Capital Value Fund

INVESTMENT RESULTS – (Unaudited)

| | Average Annual Total Returns (for periods ended June 30, 2016) |

| | One Year | Five Year | Ten Year |

| IMS Capital Value Fund* | (7.08)% | 4.69% | 3.18% |

S&P 500® Index** | 3.99% | 12.09% | 7.42% |

| Total annual operating expenses, as disclosed in the Fund’s current prospectus dated October 30, 2015, were 1.74% of average daily net assets. The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2016, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2016 except by the Board of Trustees of 360 Funds. |

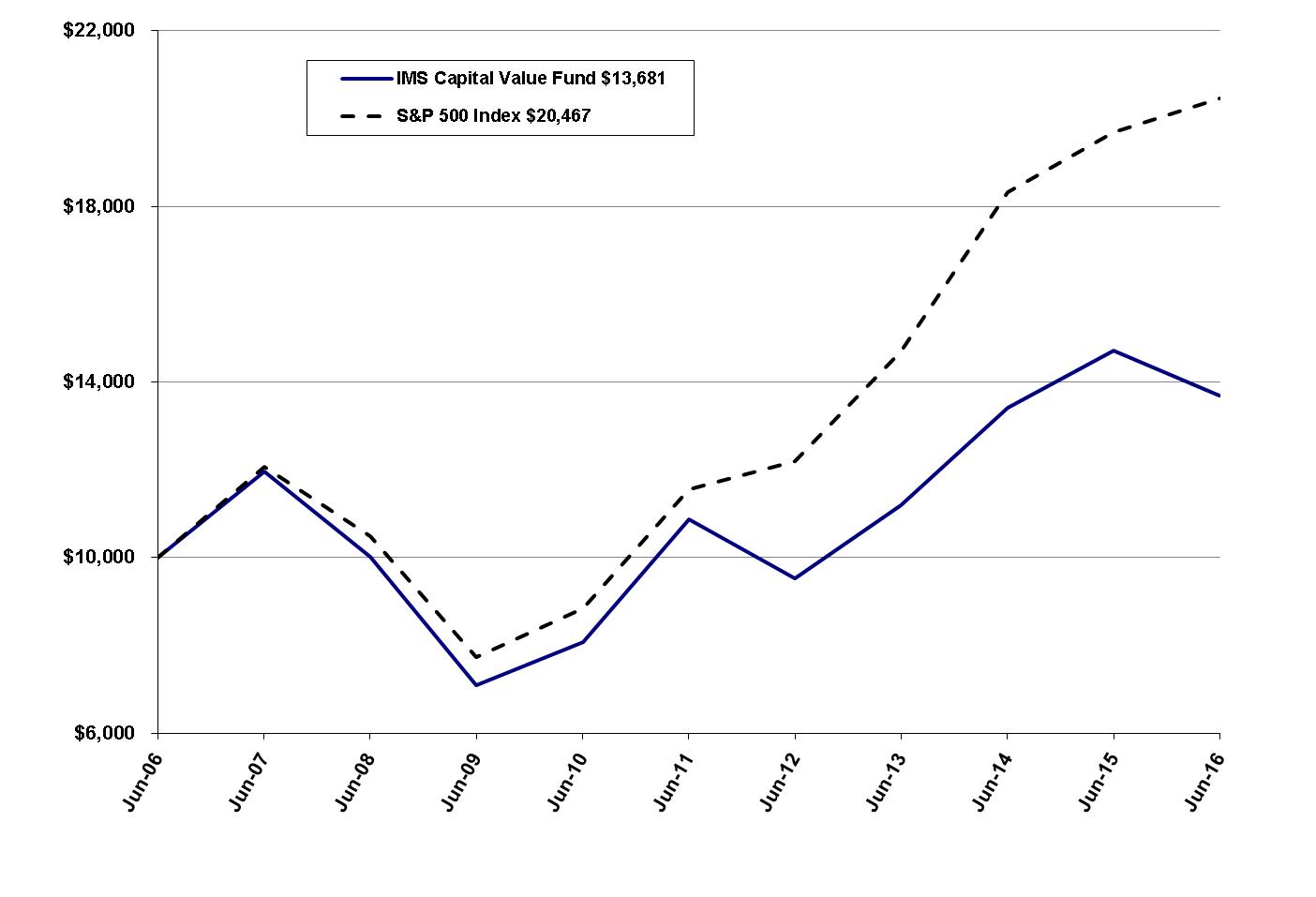

Comparison of the Growth of a $10,000 Investment in the IMS Capital Value Fund and

the S&P 500® Index for the 10 Years Ended June 30, 2016 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2006 and held through June 30, 2016. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

IMS Strategic Income Fund

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report June 30, 2016

Dear Fellow Shareholders,

The U.S. economy continued its long and slow recovery from the 2009 recession lows. While standard measures of economic growth remain in the 2% range, both the labor and real estate markets are fairly strong, and have improved significantly from 2014. Energy is still under pressure from the supply glut that began a few years ago, however it has been encouraging to see oil bounce off its February low of $26 a barrel to end the reporting period on June 30, 2016 at roughly $50. The U.S. economy is good compared to Europe, Japan, and China. All three continue to struggle with weak demand, and in many cases, unemployment. Europe and Japan are experimenting with new forms of monetary stimulation, including buying existing bonds to lower interest rates and stimulate the economy. This has caused government bonds in some developed countries to trade at yields below 0%. That is historic and unprecedented. Negative yields overseas, strong investment flows into U.S. dollars, and the U.S. Fed backing away from increasing rates produced a strong decline in bond yields, with the greatest reaction at longer maturities. The 10-year Treasury bond now pays you just 1.5%, less than the current rate of inflation which is hovering around 2%. While these have been good times for government bonds, many energy and natural resource companies have been hurt by persistently low energy prices, and the selloff in energy bonds negatively impacted our Fund, especially during the first 6 months of the reporting period.

On a year-to-date basis, for the 6-month period ended June 30, 2016, the IMS Strategic Income Fund was essentially flat returning -2.18%. However, because of the steep sell off in energy bonds during the first 6 months of the reporting period from June 30, 2015 to December 31, 2015, the Fund fell 20.99% over the 1-year reporting period ended June 30, 2016. By comparison, the Fund’s benchmark, the Barclay’s Aggregate Bond Index, returned 5.31% and 6.00%, respectively, over the same periods.

We were disappointed in the results, especially during the first half of the reporting period. It should be noted that the holdings that make up the Fund are dramatically different than those of the Fund’s benchmark. For example, the benchmark is made up of 100% investment grade rated bonds, while our Fund held only 26%. 72% of the Fund’s assets were held in high yield bonds and stocks at the beginning of the reporting period, of which the benchmark held 0%. About 19% of the Fund was in energy related stocks and bonds. This was our largest mistake. Energy prices continued to fall until February 2016. Oil prices in the mid 40’s are below replacement cost for all but the most efficient producers in the U.S. Our view is that declines in drilling and exploration will eventually cause oil prices to recover, the question is when. So far it has taken much longer than we anticipated, but we are encouraged by the recent rebound from $26 to $50 in the price per barrel.

The IMS Strategic Income Fund is called “strategic” because we take positions in sectors where we see opportunity. Just as fewer investments in energy exploration and production must eventually lead to higher prices, we also continue to believe that negative real interest rates are not economically sustainable over the long term. However, since June of last year the policy of low or even negative short-term rates has become even more widely implemented around the world. It is hard to see value in government bonds at this level. However, this “lower for longer” environment means that yields curves will still be positive, hence our continuing allocation to investment grade structured bonds. Rising rates tend to favor banks, insurance companies, and brokerages with exposure to money market funds. We are focusing our current research on these opportunities.

As of June 30, 2016, the Fund’s allocations were approximately 7% U.S. dividend stocks, 39% U.S. investment grade bonds, 37% U.S. high yield bonds, 11% international high yield bonds, and 5% international investment grade bonds. We think the Fund is well-positioned for the future where we anticipate slowly rising interest rates and energy prices.

We have very little exposure to emerging markets, traditional investment grade bonds, and U.S. Treasury bonds. Emerging markets suffer during strong U.S. dollar cycles, and weak commodity prices. Traditional corporate and treasury bonds now have some of the lowest yields in history. We focus on opportunities with real yield to support a useful fund dividend. We are proud of the fact that the IMS Strategic Income Fund has paid a dividend every month for over 13 years and has never missed a monthly dividend payment since the Fund’s inception in November of 2002. We continue to look for the best combination of current income, moderate volatility, and appreciation potential as we make strategic long term investments. We thank you for your loyalty and for investing alongside us in the IMS Strategic Income Fund as we continue building wealth wisely.

Sincerely,

Carl W. Marker

Portfolio Manager

IMS Strategic Income Fund

INVESTMENT RESULTS – (Unaudited)

| | Average Annual Total Returns (for periods ended June 30, 2016) |

| | One Year | Five Year | Ten Year |

| IMS Strategic Income Fund* | (20.99)% | (5.33)% | (2.31)% |

| Barclays Capital Aggregate Bond Index** | 6.00% | 3.76% | 5.13% |

| Total annual operating expenses, as disclosed in the Fund’s current prospectus dated October 30, 2015, were 1.92% of average daily net assets (1.96% after fee waivers/expense reimbursements by the Advisor). The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2016, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2016 except by the Board of Trustees of 360 Funds. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling Shareholder Services at 1-800-934-5550.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The Barclays Capital Aggregate Bond Index is a widely-used indicator of the bond market. The index is market capitalization-weighted and is made up of U.S. bonds that are primarily investment grade, which has a greater number of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The annual total returns included for the above Fund are net of the total annual operating expenses for the Fund, while no annual operating expenses are deducted for the Barclays Capital Aggregate Bond Index. |

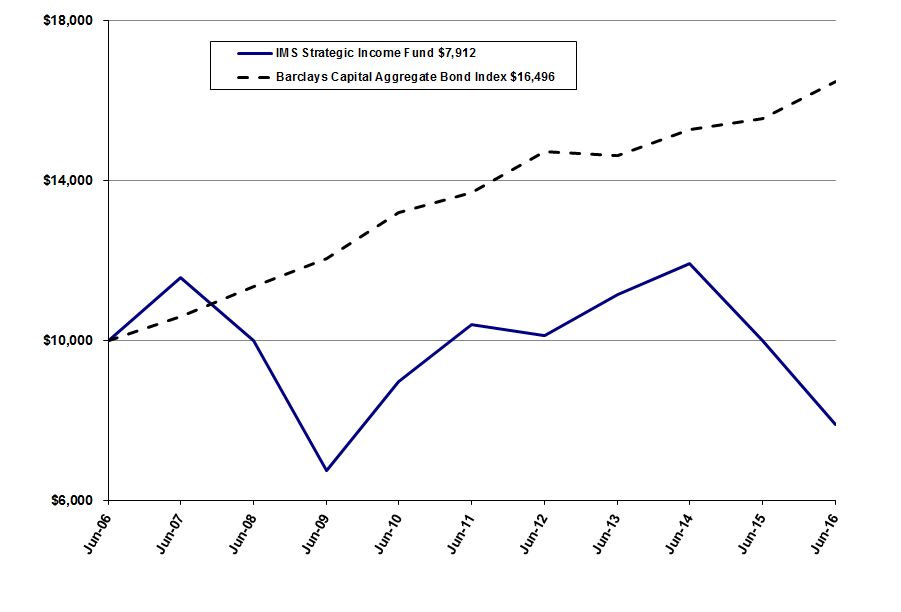

Comparison of the Growth of a $10,000 Investment in the IMS Strategic Income Fund and

the Barclays Captial Aggregate Bond Index for the 10 Years Ended June 30, 2016 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2006 and held through June 30, 2016. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

IMS DIVIDEND GROWTH FUND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Annual Report

June 30, 2016

Dear Fellow Shareholders,

During the first half of 2016, the IMS Dividend Growth Fund (the “Fund”)performed extremely well, beating the S&P 500 Total Return Index (the “S&P 500” or “Index”) handily with a return of +5.68% vs +3.84% for the six-month period ending June 30, 2016. Over the one-year period ending June 30, 2016, the Fund returned -2.27% vs the Index’ s return of +3.99%. While the S&P 500 is the Fund’s benchmark, and is invested 100% in large, U.S. stocks, it should be noted that Fund is invested 12% in international stocks and 30% small and midcap stocks. International stock performance lagged domestic stocks as evidenced by the performance of the MSCI All Country World (excluding USA) Net Total Return Index which declined 10.24% during the year. The Fund is truly all-cap and global in nature, which historically has provided for strong long-term performance but produced mixed results over the last 12 months. For the last 12 months large U.S. stocks were the superior asset class, small stocks measured by the Russell 2000 Total Return Index returned a negative 6.73% and mid-sized stocks performed better returning 1.05%, but still below the S&P 500 return of 3.99%. We are very encouraged by the Fund’s rebound after a tough 2015, and its strong performance so far in 2016, beating its benchmark in both quarters.

The U.S. economy continued its modest improvement while the Federal Open Market Committee (FOMC) remained abundantly cautious about raising interest rates. The U.S. and global economy continue to cope with debt issues, negative interest rates, uncertainty in China and volatile energy markets. The elevated global risks drove the U.S. dollar higher and yields on U.S. Government bonds lower. The U.S. stock market and economy continue to outperform most other mature economies on a variety of metrics. For example, during the one-year period ended June 30, 2016, the S&P 500 was up over 3% while the major non-U.S. stock markets averaged a decline of over 10%.

The primary purpose of the Fund is capital appreciation and dividend income from companies that habitually raise their payouts. Our top three sector weightings as of June 30, 2016 were technology, financial and consumer staples at 19.5%, 16.7% and 15.1%, respectively. Financials are cyclical and tend to perform well as the U.S. and global economies improve and conversely, if the economy slows, these sectors historically underperform. Consumer staples tend to fall into the household necessities category and therefore are less sensitive to changes in the overall economy. The technology sector tends to perform well when businesses are upgrading software and hardware.

The Fund’s best performers over the past year included Lockheed Martin, the defense and aerospace giant which returned 36.97%, Philip Morris International, the tobacco conglomerate which returned 31.97%; Johnson & Johnson, healthcare and consumer firm, which rose 27.59%; and Altria Group, which jumped 45.61%. We continue to see value in large predictable dividend paying businesses in areas like consumer staples, defense and healthcare.

The Fund’s worst performers included PRA Group, Inc., which has declined 61.26% over the last 12 months. The company’s primary business is purchasing and collecting nonperforming consumer loans in the U.S. and Europe. The firm has suffered as result of the strong U.S. Dollar and weaker than expected sales and earnings trends. We continue to see long-term value in the business model and think the firm’s focus on international expansion and municipality outsourcing businesses will provide long-term growth. We admit however we materially underestimated the financial risk and severity of the earnings slowdown. SM Energy Company is an independent natural gas company. The volatility in the energy markets and natural gas supply glut pushed shares down 41.24% over the last year. Copa Holding SA, is an airline passenger and cargo service company in Latin America. Copa has industry leading on-time and flight completion stats, but passenger and freight traffic has declined resulting in a 33.45% decline over the last 12 months. Key markets like Brazil remain weak, which materially impaired Copa passenger and cargo businesses.

Historically, over full market cycles, dividends have contributed a meaningful portion of the stock market’s total returns. While dividend-paying stocks were out of favor most of 2015, the group bounced back strong in the first 6 months of 2016. We continue to think dividend payers will serve investors well over the long run.

We believe the companies in the Fund have unique operating franchises, strong financial positioning and opportunities for long-term future growth. These characteristics increase the likelihood that the companies in our Fund will continue to pay and increase dividends and appreciate over time. We thank you for investing alongside us in the IMS Dividend Growth Fund as we continue to focus on building wealth wisely.

Sincerely,

Carl W. Marker & Christopher L. Magana

Co-Portfolio Managers

IMS Dividend Growth Fund

INVESTMENT RESULTS – (Unaudited)

| | Average Annual Total Returns (for periods ended June 30, 2016) |

| | One Year | Five Year | Ten Year |

| IMS Dividend Growth Fund* | (2.27)% | 7.15% | 3.72% |

S&P 500® Index** | 3.99% | 12.09% | 7.42% |

| Total annual operating expenses, as disclosed in the Fund’s current prospectus dated October 30, 2015, were 2.50% of average daily net assets (1.95% after fee waivers/expense reimbursements by the Advisor). The Advisor has contractually agreed to waive its management fee and/or reimburse expenses so that total annual fund operating expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses such as acquired fund fees and expenses; and 12b-1 fees; and extraordinary litigation expenses) do not exceed 1.95% of the Fund’s average daily net assets through October 31, 2016, subject to the Advisor’s right to recoup payments on a rolling three-year basis so long as the payment would not exceed the 1.95% expense cap. This expense cap may not be terminated prior to October 31, 2016 except by the Board of Trustees of 360 Funds. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling Shareholder Services at 1-800-934-5550.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity prices and has a greater number of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The annual total returns included for the above Fund are net of the total annual operating expenses for the Fund, while no annual operating expenses are deducted for the S&P 500 Index. |

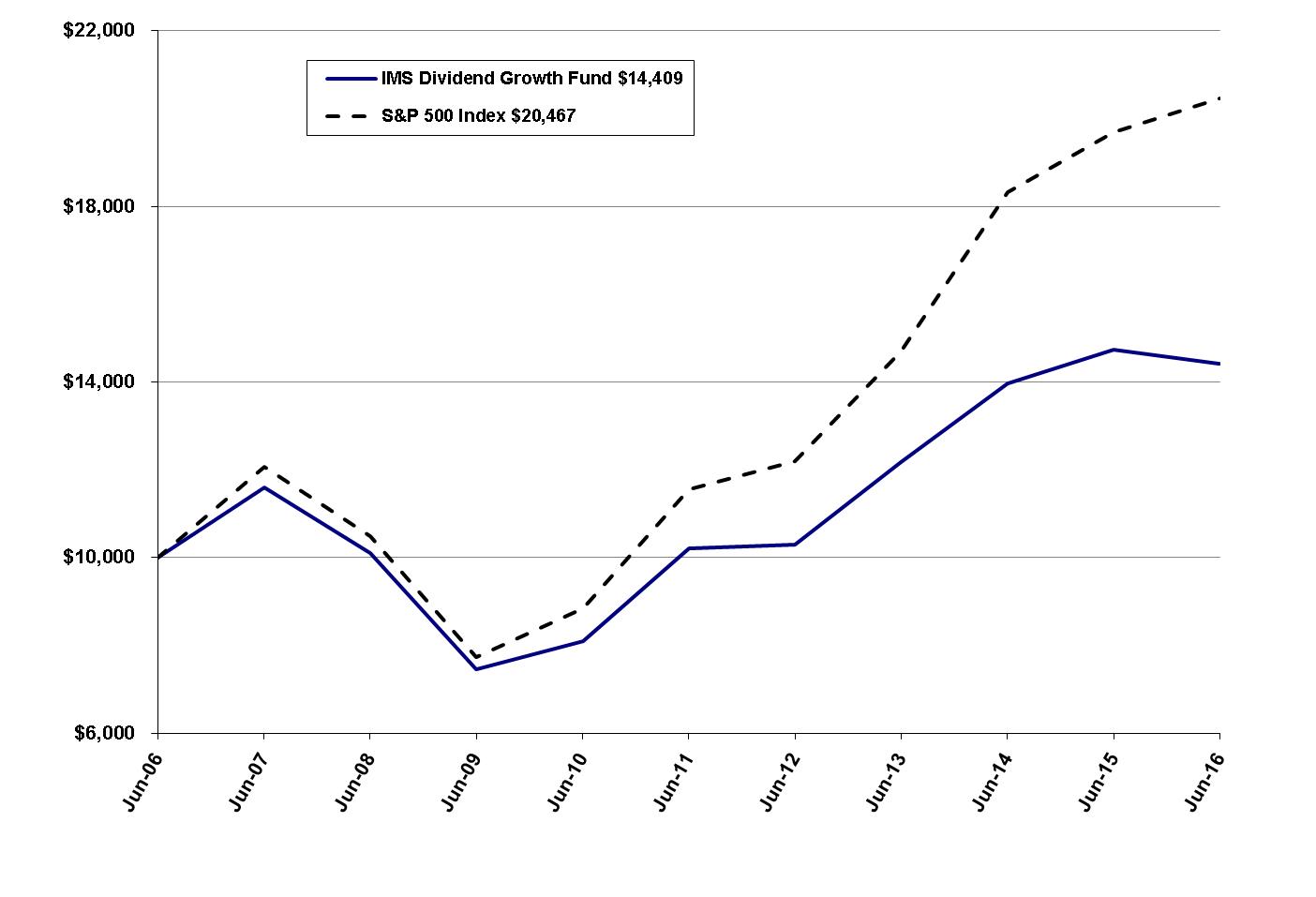

Comparison of the Growth of a $10,000 Investment in the IMS Dividend Growth and

the S&P 500® Index for the 10 years Ended June 30, 2016 (Unaudited)

The chart above assumes an initial investment of $10,000 made on June 30, 2006 and held through June 30, 2016. The chart also assumes reinvestment of all dividends and distributions on the reinvestment dates during the period. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

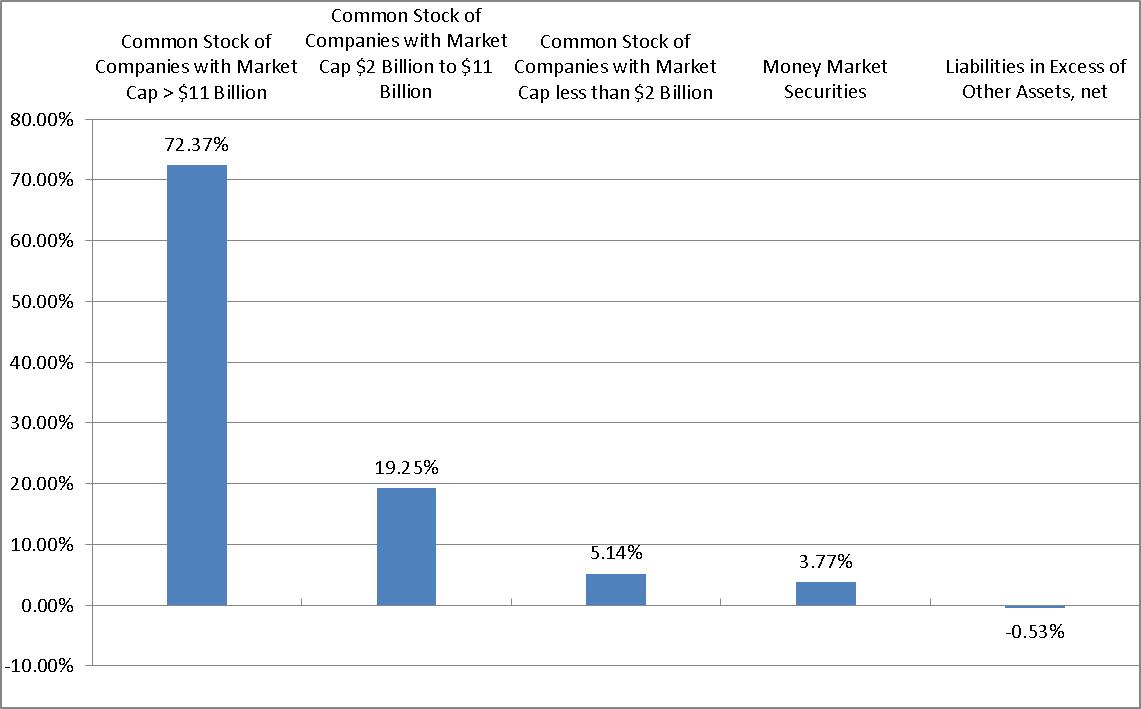

FUND HOLDINGS – (Unaudited)

IMS Capital Value Fund Holdings as of June 30, 20161

| 1 | As a percent of net assets. |

The investment objective of the IMS Capital Value Fund is long-term growth from capital appreciation and, secondarily, income from dividends and interest. The Capital Value Fund invests primarily in the common stocks of mid-cap and large-cap U.S. companies, with mid-cap companies generally having a total market capitalization of $2 billion to $11 billion and large-cap U.S. companies generally having a total market capitalization greater than $11 billion.

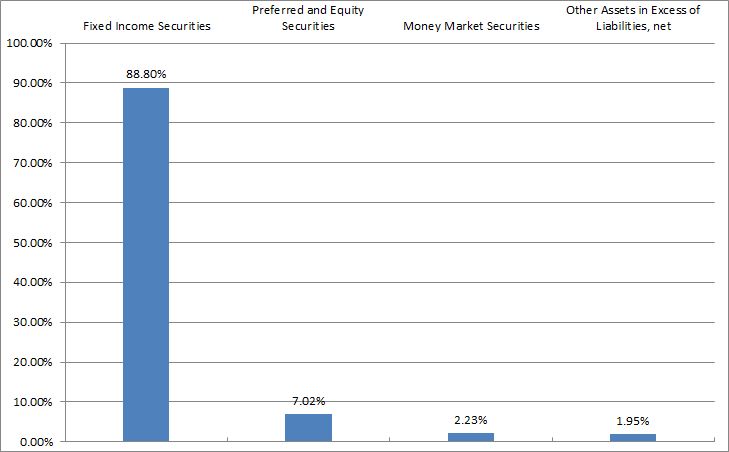

IMS Strategic Income Fund Holdings as of June 30, 20161

| 1 | As a percent of net assets. |

FUND HOLDINGS – (Unaudited) (continued)

The investment objective of the IMS Strategic Income Fund is current income, and a secondary objective of capital appreciation. In pursuing its investment objectives, the Strategic Income Fund generally invests in corporate bonds, government bonds, dividend-paying common stocks, preferred and convertible preferred stocks, income trusts (including business trusts, oil royalty trusts and real estate investment trusts), money market instruments and cash equivalents. The Strategic Income Fund may also invest in structured products, such as reverse convertible notes, a type of structured note, and in 144A securities that are purchased in private placements and thus are subject to restrictions on resale (either as a matter of contract or under federal securities laws), but only where the Adviser has determined that a liquid trading market exists. Under normal circumstances, the Strategic Income Fund will invest at least 80% of its assets in dividend paying or other income producing securities.

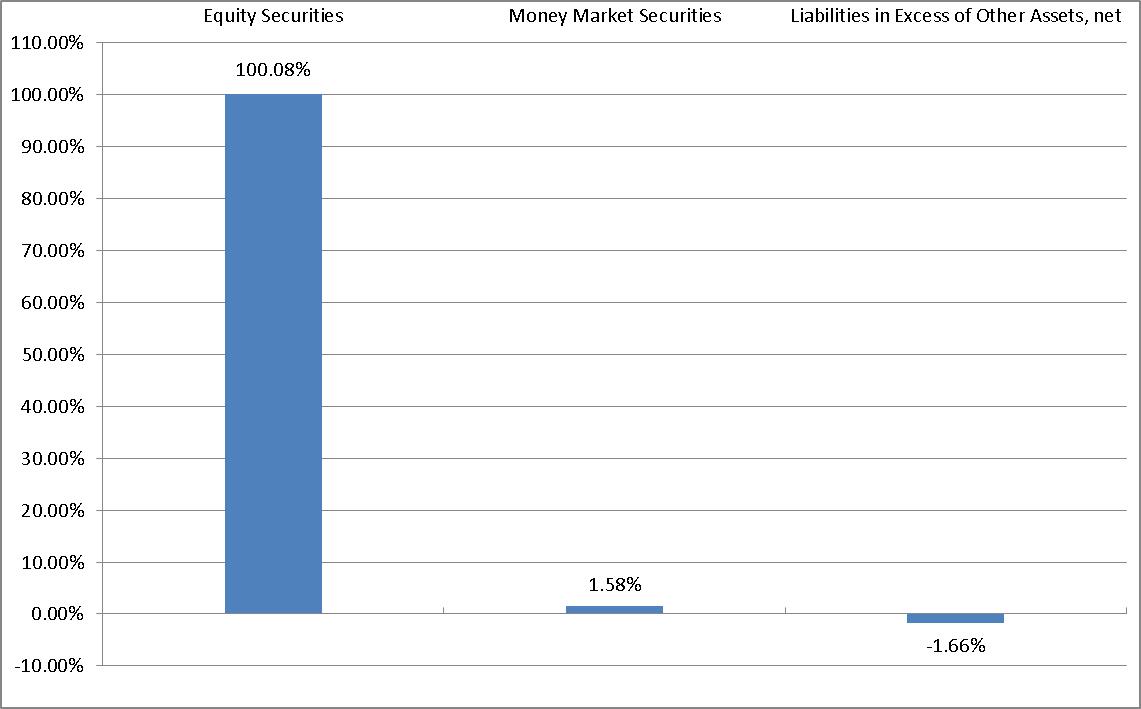

IMS Dividend Growth Fund Holdings as of June 30, 20161

| 1 | As a percent of net assets. |

The investment objective of the IMS Dividend Growth Fund is long-term growth from capital appreciation and dividends. The Dividend Growth Fund invests primarily in a diversified portfolio of dividend–paying common stocks. The Dividend Growth Fund’s advisor, IMS Capital Management, Inc., employs a combination of fundamental, technical and macro market research to identify companies that the Adviser believes have the ability to maintain or increase their dividend payments, because of their significant cash flow production.

Availability of Portfolio Schedules – (Unaudited)

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available at the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Funds’ Expenses – (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2016 through June 30, 2016).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant only to highlight your ongoing costs and do not reflect any transactional costs, such as short-term redemption fees. Therefore, the second line is only useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

| IMS Funds | Beginning Account Value January 1, 2016 | Ending Account Value June 30, 2016 | Expenses Paid During the Period* January 1, 2016 – June 30, 2016 |

Capital Value Fund Actual (+2.23%) Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 1,022.30 $ 1,016.30 | $ 8.65 $ 8.62 |

Strategic Income Fund Actual (-2.18)% Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 978.20 $ 1,015.00 | $ 9.74 $ 9.92 |

Dividend Growth Fund Actual (+5.68%) Hypothetical** | $ 1,000.00 $ 1,000.00 | $ 1,056.80 $ 1,015.10 | $ 10.02 $ 9.82 |

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| COMMON STOCK - 96.76% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 31.27% | | | | | | |

Amazon.com, Inc. (a) | | | 1,920 | | | $ | 1,373,990 | |

AutoZone, Inc. (a) | | | 1,400 | | | | 1,111,376 | |

DISH Network Corp. - Class A (a) | | | 14,500 | | | | 759,800 | |

Dollar Tree, Inc. (a) | | | 15,000 | | | | 1,413,600 | |

| Domino's Pizza, Inc. | | | 9,600 | | | | 1,261,248 | |

| H&R Block, Inc. | | | 50,000 | | | | 1,150,000 | |

| Home Depot, Inc. | | | 5,000 | | | | 638,450 | |

Noodles & Co. (a) | | | 79,895 | | | | 781,373 | |

| Service Corp. International | | | 30,000 | | | | 811,200 | |

| Starbucks Corp. | | | 13,200 | | | | 753,984 | |

| Walt Disney Co. | | | 10,700 | | | | 1,046,674 | |

| Yum! Brands, Inc. | | | 12,000 | | | | 995,040 | |

| | | | | | | | 12,096,735 | |

| Consumer Staples - 2.72% | | | | | | | | |

| Dr Pepper Snapple Group, Inc. | | | 10,900 | | | | 1,053,267 | |

| | | | | | | | | |

| Energy - 8.43% | | | | | | | | |

| Apache Corp. | | | 10,000 | | | | 556,700 | |

| EOG Resources, Inc. | | | 8,200 | | | | 684,044 | |

| Noble Energy, Inc. | | | 15,400 | | | | 552,398 | |

| Occidental Petroleum Corp. | | | 10,200 | | | | 770,712 | |

| Schlumberger, Ltd. | | | 8,800 | | | | 695,904 | |

| | | | | | | | 3,259,758 | |

| Financials - 12.02% | | | | | | | | |

| Bank of America Corp. | | | 64,000 | | | | 849,280 | |

| Capital One Financial Corp. | | | 15,000 | | | | 952,650 | |

| Federated Investors, Inc. - Class B | | | 30,000 | | | | 863,400 | |

| Umpqua Holdings Corp. | | | 66,600 | | | | 1,030,302 | |

| Welltower, Inc. | | | 12,500 | | | | 952,125 | |

| | | | | | | | 4,647,757 | |

| Health Care - 19.52% | | | | | | | | |

Allergan PLC (a) | | | 4,500 | | | | 1,039,905 | |

Celgene Corp. (a) | | | 8,100 | | | | 798,903 | |

Edwards Lifesciences Corp. (a) | | | 6,000 | | | | 598,380 | |

| Gilead Sciences, Inc. | | | 11,800 | | | | 984,356 | |

IDEXX Laboratories, Inc. (a) | | | 6,000 | | | | 557,160 | |

InVivo Therapeutics Holdings Corp. (a) | | | 208,933 | | | | 1,207,633 | |

OPKO Health, Inc. (a) | | | 51,200 | | | | 478,208 | |

| Patterson Cos., Inc. | | | 15,500 | | | | 742,295 | |

| Zimmer Biomet Holdings, Inc. | | | 4,000 | | | | 481,520 | |

| Zoetis, Inc. | | | 14,000 | | | | 664,440 | |

| | | | | | | | 7,552,800 | |

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| COMMON STOCK - 96.76% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials - 1.96% | | | | | | |

| Stanley Black & Decker, Inc. | | | 6,800 | | | $ | 756,296 | |

| | | | | | | | | |

| Information Technology - 18.91% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 1,400 | | | | 968,940 | |

| Apple, Inc. | | | 10,000 | | | | 956,000 | |

| Intel Corp. | | | 23,700 | | | | 777,360 | |

| Paychex, Inc. | | | 16,200 | | | | 963,900 | |

PayPal Holdings, Inc. (a) | | | 25,100 | | | | 916,401 | |

| QUALCOMM, Inc. | | | 15,600 | | | | 835,692 | |

Take-Two Interactive Software, Inc. (a) | | | 14,600 | | | | 553,632 | |

| Western Digital Corp. | | | 20,500 | | | | 968,830 | |

Yahoo!, Inc. (a) | | | 10,000 | | | | 375,600 | |

| | | | | | | | 7,316,355 | |

| Telecommunication Services - 1.93% | | | | | | | | |

| Verizon Communications, Inc. | | | 13,400 | | | | 748,256 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $31,690,992) | | | | | | | 37,431,224 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 3.77% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.37% (b) | | | 1,456,631 | | | | 1,456,631 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $1,456,631) | | | | | | | 1,456,631 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $33,147,623) - 100.53% | | | | | | $ | 38,887,855 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.53%) | | | | | | | (204,806 | ) |

| NET ASSETS - 100.00% | | | | | | $ | 38,683,049 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at June 30, 2016, is subject to change and resets daily. |

See accompanying notes which are an integral part of these schedules of investments.

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| COMMON STOCK - 7.02% | | Shares | | | Fair Value | |

| | | | | | | |

| Financials - 1.97% | | | | | | |

| Umpqua Holdings Corp. | | | 11,300 | | | $ | 174,811 | |

| | | | | | | | | |

| Health Care - 1.74% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 2,100 | | | | 154,455 | |

| | | | | | | | | |

| Information Technology- 1.74% | | | | | | | | |

| Cypress Semiconductor Corp. | | | 14,600 | | | | 154,030 | |

| | | | | | | | | |

| Materials- 1.57% | | | | | | | | |

| Dow Chemical Co. | | | 2,800 | | | | 139,188 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $617,894) | | | | | | | 622,484 | |

| | | | | | | | | |

| CORPORATE BONDS - 29.83% | | Principal Amount | | | Fair Value | |

| | | | | | | | | |

| California Resources Corp., 5.000%, 01/15/2020 | | $ | 725,000 | | | | 382,438 | |

| Clayton Williams Energy, Inc., 7.750%, 04/01/2019 | | | 500,000 | | | | 377,500 | |

| Diamond Offshore Drilling, Inc., 5.70%, 10/15/2039 | | | 750,000 | | | | 568,217 | |

Performance Drilling Co. LLC, 6.000%, 09/30/2022 (b) (f) (g) (i) | | | 1,420,804 | | | | 203,742 | |

Sabine Oil & Gas Corp., 7.250%, 06/15/2019 (e) (g) | | | 1,375,000 | | | | 27,500 | |

| Sanchez Energy Corp., 7.750%, 06/15/2021 | | | 500,000 | | | | 423,750 | |

Thornton Drilling Co., 5.000%, 06/15/2018 (b) (e) (f) (g) | | | 477,977 | | | | 155,247 | |

| Whiting Petroleum Corp., 5.000%, 03/15/2019 | | | 550,000 | | | | 506,000 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $5,767,049) | | | | | | | 2,644,394 | |

| | | | | | | | | |

| FOREIGN BONDS DENOMINATED IN US DOLLARS - 11.07% | | | | | | | | |

Cash Store Financial Services, Inc., 11.500%, 01/31/2017 (b) (d) (f) (g) (i) | | | 1,289,000 | | | | 179,582 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (d) (i) | | | 592,190 | | | | 148,047 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (h) (i) | | | 361,190 | | | | 90,298 | |

Oceanografia SA de CV, 11.250%, 07/15/2015 (b) (e) (f) (g) (h) | | | 1,150,000 | | | | 23,000 | |

Panama Canal Railway Co., 7.000%, 11/01/2026 (h) | | | 541,100 | | | | 540,424 | |

| | | | | | | | | |

| TOTAL FOREIGN BONDS DENOMINATED IN US DOLLARS (Cost $3,583,337) | | | | | | | 981,351 | |

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| | | Principal Amount | | | Fair Value | |

| STRUCTURED NOTES - 43.48% | | | | | | |

| | | | | | | |

Bank of Nova Scotia Callable Steepener Note Series A, 4.172%, 07/29/2033 (c) | | $ | 700,000 | | | $ | 594,440 | |

Barclays Bank PLC Callable Leveraged Steepener Note, 5.512%, 07/31/2034 (c) | | | 250,000 | | | | 222,500 | |

| Citigroup, Inc. Callable Barrier Range Accrual Index Linked Note, 8.000%, 01/30/2023 | | | 448,000 | | | | 432,544 | |

Credit Suisse AG Leveraged CMS Curve and Russell 2000 Index Linked Note, 10.000%, 07/31/2030 ( c ) | | | 450,000 | | | | 394,875 | |

JP Morgan Chase & Co. Callable Range Accrual Rate Linked Note, 10.000%, 05/06/2030 (c) | | | 500,000 | | | | 470,000 | |

Morgan Stanley Fixed to Floating Rate Leveraged CMS and Index Linked Note, 6.355%, 08/30/2028 (c) | | | 350,000 | | | | 307,125 | |

Morgan Stanley Senior Floating Rate Conversion CMS and Index Linked Note, 6.100%, 03/25/2031 (c) | | | 600,000 | | | | 577,500 | |

Natixis US Medium-Term Note Program LLC Callable Fixed-to Floating Capped Range Accrual Note, 7.420%, 10/31/2034 (c) | | | 500,000 | | | | 430,000 | |

SG Structured Products, Inc. Callable Fixed to Variable Barrier Range Dual Index Linked Note, 5.084%, 11/27/2028 (c) | | | 600,000 | | | | 426,060 | |

| | | | | | | | | |

| TOTAL STRUCTURED NOTES (Cost $4,283,716) | | | | | | | 3,855,044 | |

| | | | | | | | | |

| SECURED SUBORDINATED PROMISSORY NOTES - 4.42% | | | | | | | | |

Aequitas Commercial Finance, LLC Secured Subordinated Promissory Note, 11.000%, 07/28/2019 (b) (d) (f) (g) (i) | | | 750,000 | | | | 392,025 | |

| | | | | | | | | |

| TOTAL SECURED SUBORDINATED PROMISSORY NOTES (Cost $750,000) | | | | | | | 392,025 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 2.23% | | Shares | | | | | |

| | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.37% (a) | | | 197,428 | | | | 197,428 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $197,428) | | | | | | | 197,428 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $15,199,424) - 98.05% | | | | | | $ | 8,692,726 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 1.95% | | | | | | | 172,495 | |

| NET ASSETS - 100.00% | | | | | | $ | 8,865,221 | |

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| COMMON STOCK - 100.09% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 8.93% | | | | | | |

| General Motors Co. | | | 9,000 | | | $ | 254,700 | |

| Sturm Ruger & Co., Inc. | | | 3,800 | | | | 243,238 | |

| Twenty-First Century Fox, Inc. - Class B | | | 9,500 | | | | 258,875 | |

| | | | | | | | 756,813 | |

| Consumer Staples - 15.35% | | | | | | | | |

| Altria Group, Inc. | | | 4,100 | | | | 282,736 | |

| Nestle SA - ADR | | | 4,200 | | | | 324,702 | |

| Philip Morris International, Inc. | | | 4,000 | | | | 406,880 | |

| Unilever NV - ADR | | | 6,100 | | | | 286,334 | |

| | | | | | | | 1,300,652 | |

| Energy - 9.59% | | | | | | | | |

| Chevron Corp. | | | 1,800 | | | | 188,694 | |

| Halliburton Co. | | | 6,500 | | | | 294,385 | |

| Helmerich & Payne, Inc. | | | 2,500 | | | | 167,825 | |

| SM Energy Co. | | | 6,000 | | | | 162,000 | |

| | | | | | | | 812,904 | |

| Financials - 17.01% | | | | | | | | |

| Axis Capital Holdings Ltd. | | | 5,300 | | | | 291,500 | |

| CME Group, Inc. | | | 4,000 | | | | 389,600 | |

| M&T Bank Corp. | | | 3,000 | | | | 354,690 | |

| Outfront Media, Inc. | | | 12,000 | | | | 290,040 | |

PRA Group, Inc. (a) | | | 4,800 | | | | 115,872 | |

| | | | | | | | 1,441,702 | |

| Health Care - 12.63% | | | | | | | | |

| Abbott Laboratories | | | 6,500 | | | | 255,515 | |

| AbbVie, Inc. | | | 4,800 | | | | 297,168 | |

| Johnson & Johnson | | | 2,900 | | | | 351,770 | |

| Zoetis, Inc. | | | 3,500 | | | | 166,110 | |

| | | | | | | | 1,070,563 | |

| Industrials - 14.49% | | | | | | | | |

| Copa Holdings SA - Class A | | | 3,000 | | | | 156,780 | |

| Lockheed Martin Corp. | | | 1,700 | | | | 421,889 | |

| Parker-Hannifin Corp. | | | 1,800 | | | | 194,490 | |

| United Technologies Corp. | | | 2,600 | | | | 266,630 | |

Veritiv Corp. (a) | | | 5,000 | | | | 187,900 | |

| | | | | | | | 1,227,689 | |

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

June 30, 2016

| COMMON STOCK - 100.09% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Information Technology - 19.85% | | | | | | |

| Apple, Inc. | | | 2,900 | | | $ | 277,240 | |

| CDK Global, Inc. | | | 6,900 | | | | 382,881 | |

| Microsoft Corp. | | | 7,100 | | | | 363,307 | |

| QUALCOMM, Inc. | | | 5,350 | | | | 286,600 | |

| Sabre Corp. | | | 13,900 | | | | 372,381 | |

| | | | | | | | 1,682,409 | |

| Materials - 2.24% | | | | | | | | |

| FMC Corp. | | | 4,100 | | | | 189,871 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $8,726,591) | | | | | | | 8,482,603 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 1.58% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.37% (b) | | | 134,059 | | | | 134,059 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $134,059) | | | | | | | 134,059 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $8,860,650) - 101.67% | | | | | | $ | 8,616,662 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (1.67)% | | | | | | | (141,154 | ) |

| NET ASSETS - 100.00% | | | | | | $ | 8,475,508 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at June 30, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these schedules of investments.

IMS FAMILY OF FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2016

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| Assets: | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At cost | | $ | 33,147,623 | | | $ | 15,199,424 | | | $ | 8,860,650 | |

| At fair value | | $ | 38,887,855 | | | $ | | | | $ | 8,616,662 | |

| Receivables: | | | | | | | | | | | | |

| Interest | | | 1,012 | | | | 136,580 | | | | 7 | |

| Dividends | | | 52,023 | | | | 21,608 | | | | 9,261 | |

| Fund shares sold | | | 50 | | | | 500 | | | | - | |

| Investments sold | | | - | | | | 295,158 | | | | - | |

| Prepaid expenses | | | 12,479 | | | | 8,656 | | | | 4,345 | |

| Total assets | | | 38,953,419 | | | | 9,400,163 | | | | 8,630,275 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Line of credit borrowings | | | - | | | | 187,000 | | | | - | |

| Fund shares redeemed | | | 201,660 | | | | 71,219 | | | | 126,332 | |

| Due to advisor | | | 38,567 | | | | 2,106 | | | | 4,163 | |

| Due to administrator, fund accountant and transfer agent | | | 9,166 | | | | 3,326 | | | | 3,625 | |

| Accrued expenses | | | 20,977 | | | | 26,356 | | | | 20,647 | |

| Total liabilities | | | 270,370 | | | | 290,007 | | | | 154,767 | |

| Net Assets | | $ | 38,683,049 | | | $ | 8,865,221 | | | $ | 8,475,508 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 37,067,263 | | | $ | 65,147,386 | | | $ | 9,437,931 | |

| Accumulated undistributed net investment income (loss) | | | (21,266 | ) | | | 54,291 | | | | 1,638 | |

| Accumulated net realized loss on investments | | | (4,103,180 | ) | | | (49,829,758 | ) | | | (720,073 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 5,740,232 | | | | (6,506,698 | ) | | | (243,988 | ) |

| Total Net Assets | | $ | 38,683,049 | | | $ | 8,865,221 | | | $ | 8,475,508 | |

| | | | | | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,797,853 | | | | 2,714,734 | | | | 671,481 | |

| Net asset value and offering price per share | | $ | 21.52 | | | $ | 3.27 | | | $ | 12.62 | |

Minimum redemption price per share (a) | | $ | 21.41 | | | $ | 3.25 | | | $ | 12.56 | |

| (a) | A redemption fee of 0.50% will be assessed on shares of the Fund that are redeemed within 90 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

STATEMENTS OF OPERATIONS

For the Year Ended June 30, 2016

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| | | | | | | | | | |

| Investment income: | | | | | | | | | |

| Dividends (net of foreign withholding taxes of $0, $780 and $1,911) | | $ | 577,377 | | | $ | 387,605 | | | $ | 254,000 | |

| Interest | | | 3,868 | | | | 1,079,108 | | | | 359 | |

| Total investment income | | | 581,245 | | | | 1,466,713 | | | | 254,359 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

Investment Advisor fees (a) | | | 470,016 | | | | 166,431 | | | | 113,994 | |

Accounting, administration and transfer agent fees and expenses (a) | | | 106,815 | | | | 43,544 | | | | 39,127 | |

| Registration expenses | | | 18,261 | | | | 19,253 | | | | 7,339 | |

| Miscellaneous expenses | | | 19,197 | | | | 13,336 | | | | 10,454 | |

| Audit expenses | | | 16,400 | | | | 21,900 | | | | 17,400 | |

| Custodian expenses | | | 7,908 | | | | 6,622 | | | | 5,202 | |

| Trustee expenses | | | 9,944 | | | | 11,519 | | | | 9,944 | |

| Pricing expenses | | | 5,069 | | | | 7,829 | | | | 3,645 | |

| Insurance expenses | | | 1,322 | | | | 1,321 | | | | 1,321 | |

| Legal expenses | | | 1,757 | | | | 2,372 | | | | 3,353 | |

| Printing expenses | | | - | | | | - | | | | 1,944 | |

| Interest expenses | | | 249 | | | | 2,940 | | | | 410 | |

| Total expenses | | | 656,938 | | | | 297,067 | | | | 214,133 | |

Less: Fees waived by Advisor (a) | | | - | | | | (36,051 | ) | | | (37,010 | ) |

| Net expenses | | | 656,938 | | | | 261,016 | | | | 177,123 | |

| | | | | | | | | | | | | |

| Net Investment Income (Loss) | | | (75,693 | ) | | | 1,205,697 | | | | 77,236 | |

| | | | | | | | | | | | | |

| Realized and unrealized loss: | | | | | | | | | | | | |

| Net realized loss on investment securities and foreign currency | | | (2,482,555 | ) | | | (3,585,379 | ) | | | (103,303 | ) |

| Change in unrealized depreciation on investment securities and foreign currency | | | (249,635 | ) | | | (1,221,438 | ) | | | (252,790 | ) |

| Net realized and unrealized loss on investment securities and foreign currency | | | (2,732,190 | ) | | | (4,806,817 | ) | | | (356,093 | ) |

| | | | | | | | | | | | | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (2,807,883 | ) | | $ | (3,601,120 | ) | | $ | (278,857 | ) |

| (a) | See Note 4 in the Notes to Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

STATEMENT OF CASH FLOWS

For the Year Ended June 30, 2016

| Increase (decrease) in cash: | | | |

| Cash flows from operating activities: | | | |

| Net decrease in net assets from operations | | $ | (3,601,120 | ) |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided from operating activities: | | | | |

| Accretion of discount/Amortization of premium, net | | | (132,845 | ) |

| Purchase of investment securities | | | (49,831,071 | ) |

| Proceeds from disposition of investment securities | | | 56,862,064 | |

| Sales of short-term investment securities, net | | | 115,673 | |

| Decrease in dividends and interest receivable | | | 152,123 | |

| Increase in receivables for securities sold | | | (256,281 | ) |

| Decrease in prepaid expenses | | | 12,467 | |

| Decrease in accrued expenses | | | (45,688 | ) |

| Net unrealized depreciation on investment securities and foreign currency | | | 1,221,438 | |

| Net realized loss on investment securities | | | 3,588,805 | |

| Net cash provided from operating activities | | | 8,085,565 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from loan | | | 6,814,640 | |

| Payments on loan | | | (6,627,640 | ) |

| Proceeds from Fund shares sold | | | 600,754 | |

| Payment on Fund shares redeemed | | | (8,752,688 | ) |

| Cash distributions paid | | | (120,631 | ) |

| | | | | |

| Net cash used in financing activities | | | (8,085,565 | ) |

| | | | | |

| Net decrease in cash | | $ | - | |

| | | | | |

| Cash: | | | | |

| Beginning of year | | $ | - | |

| End of year | | $ | - | |

Supplemental disclosure of cash flow information:

Noncash financing activities not included herein consist of reinvestment of distributions of $1,030,775, a decrease in receivable for fund shares sold of $67,727 and an increase in payable for Fund shares redeemed of $58,074.

Interest paid by the Fund for outstanding balances on the line of credit amounted to $3,979.

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (75,693 | ) | | $ | (67,864 | ) |

| Net realized gain (loss) on investment securities | | | (2,482,555 | ) | | | 1,957,469 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | (249,635 | ) | | | 1,733,525 | |

| Net increase (decrease) in net assets resulting from operations | | | (2,807,883 | ) | | | 3,623,130 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 5,800,832 | | | | 2,803,048 | |

| Amount paid for shares redeemed | | | (5,026,135 | ) | | | (5,972,903 | ) |

| Proceeds from redemption fees | | | 556 | | | | 40 | |

| Net increase (decrease) in net assets from share transactions | | | 775,253 | | | | (3,169,815 | ) |

| | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | (2,032,630 | ) | | | 453,315 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 40,715,679 | | | | 40,262,364 | |

| | | | | | | | | |

| End of year | | $ | 38,683,049 | | | $ | 40,715,679 | |

| Accumulated net investment loss included in net assets at end of year | | $ | (21,266 | ) | | $ | (82,414 | ) |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 277,553 | | | | 125,688 | |

| Shares issued in reinvestment of distributions | | | - | | | | - | |

| Shares redeemed | | | (237,550 | ) | | | (276,324 | ) |

| Net increase (decrease) in capital shares | | | 40,003 | | | | (150,636 | ) |

See accompanying notes which are an integral part of these financial statements.

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 1,205,697 | | | $ | 2,529,284 | |

| Net realized loss on investment securities and foreign currency | | | (3,585,379 | ) | | | (5,508,272 | ) |

| Change in unrealized depreciation on investment securities and foreign currency | | | (1,221,438 | ) | | | (2,244,701 | ) |

| Net decrease in net assets resulting from operations | | | (3,601,120 | ) | | | (5,223,689 | ) |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (1,151,406 | ) | | | (1,988,609 | ) |

| Return of capital | | | - | | | | (762,390 | ) |

| Total distributions | | | (1,151,406 | ) | | | (2,750,999 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 533,027 | | | | 2,783,020 | |

| Reinvestment of distributions | | | 1,030,775 | | | | 2,497,602 | |

| Amount paid for shares redeemed | | | (8,811,098 | ) | | | (14,247,967 | ) |

| Proceeds from redemption fees | | | 336 | | | | 2,150 | |

| Net decrease in net assets from share transactions | | | (7,246,960 | ) | | | (8,965,195 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (11,999,486 | ) | | | (16,939,883 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 20,864,707 | | | | 37,804,590 | |

| | | | | | | | | |

| End of year | | $ | 8,865,221 | | | $ | 20,864,707 | |

| Accumulated undistributed net investment income included in net assets at end of year | | $ | 54,291 | | | $ | - | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 150,061 | | | | 538,510 | |

| Shares issued in reinvestment of distributions | | | 276,969 | | | | 480,708 | |

| Shares redeemed | | | (2,322,167 | ) | | | (2,760,334 | ) |

| Net decrease in capital shares | | | (1,895,137 | ) | | | (1,741,116 | ) |

See accompanying notes which are an integral part of these financial statements.

| | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | |

| | | | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 77,236 | | | $ | 65,677 | |

| Net realized gain (loss) on investment securities | | | (103,303 | ) | | | 1,091,602 | |

| Change in unrealized depreciation on investment securities | | | (252,790 | ) | | | (704,954 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (278,857 | ) | | | 452,325 | |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (78,680 | ) | | | (66,410 | ) |

| Total distributions | | | (78,680 | ) | | | (66,410 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 540,706 | | | | 2,335,156 | |

| Reinvestment of distributions | | | 78,488 | | | | 66,190 | |

| Amount paid for shares redeemed | | | (2,076,942 | ) | | | (1,167,031 | ) |

| Proceeds from redemption fees | | | 39 | | | | 49 | |

| Net increase (decrease) in net assets from share transactions | | | (1,457,709 | ) | | | 1,234,364 | |

| | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | (1,815,246 | ) | | | 1,620,279 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 10,290,754 | | | | 8,670,475 | |

| | | | | | | | | |

| End of year | | $ | 8,475,508 | | | $ | 10,290,754 | |

| Accumulated undistributed net investment income included in net assets at end of year | | $ | 1,638 | | | $ | 2,658 | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 44,427 | | | | 176,154 | |

| Shares issued in reinvestment of distributions | | | 6,466 | | | | 5,134 | |

| Shares redeemed | | | (169,365 | ) | | | (88,322 | ) |

| Net increase (decrease) in capital shares | | | (118,472 | ) | | | 92,966 | |

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | | | June 30, 2014 | | | June 30, 2013 | | | June 30, 2012 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 23.16 | | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | | | $ | 17.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.04 | ) | | | (0.04 | ) | | | (0.10 | ) | | | 0.01 | | | | (0.07 | )(a) |

| Net realized and unrealized gain (loss) on investments | | | (1.60 | ) | | | 2.10 | | | | 3.58 | | | | 2.62 | | | | (2.05 | ) |

| Total from investment operations | | | (1.64 | ) | | | 2.06 | | | | 3.48 | | | | 2.63 | | | | (2.12 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 21.52 | | | $ | 23.16 | | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | (7.08 | )% | | | 9.76 | % | | | 19.75 | % | | | 17.54 | % | | | (12.39 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 38,683 | | | $ | 40,716 | | | $ | 40,262 | | | $ | 35,031 | | | $ | 40,283 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.69 | % | | | 1.74 | % | | | 2.05 | % | | | 2.06 | % | | | 1.87 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets: | | | (0.19 | )% | | | (0.17 | )% | | | (0.50 | )% | | | 0.12 | % | | | (0.46 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 64.78 | % | | | 62.98 | % | | | 110.42 | % | | | 146.53 | % | | | 98.21 | % |

| (a) | Per share net investment income (loss) has been calculated using the average shares method. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | | | June 30, 2014 | | | June 30, 2013 | | | June 30, 2012 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 4.53 | | | $ | 5.95 | | | $ | 6.11 | | | $ | 6.08 | | | $ | 6.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.35 | | | | 0.45 | | | | 0.56 | | | | 0.59 | | | | 0.62 | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (1.28 | ) | | | (1.37 | ) | | | (0.15 | ) | | | 0.01 | (a) | | | (0.82 | ) |

| Total from investment operations | | | (0.93 | ) | | | (0.92 | ) | | | 0.41 | | | | 0.60 | | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.33 | ) | | | (0.39 | ) | | | (0.57 | ) | | | (0.56 | ) | | | (0.60 | ) |

| Tax return of capital | | | - | | | | (0.11 | ) | | | - | | | | (0.01 | ) | | | (0.01 | ) |

| Total distributions | | | (0.33 | ) | | | (0.50 | ) | | | (0.57 | ) | | | (0.57 | ) | | | (0.61 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 3.27 | | | $ | 4.53 | | | $ | 5.95 | | | $ | 6.11 | | | $ | 6.08 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | (20.99 | )% | | | (16.13 | )% | | | 7.00 | % | | | 10.02 | % | | | (2.59 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 8,865 | | | $ | 20,865 | | | $ | 37,805 | | | $ | 38,945 | | | $ | 34,026 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.98 | %(g) | | | 1.96 | %(f) | | | 1.94 | %(e) | | | 1.95 | %(d) | | | 2.01 | % |

| Ratio of expenses to average net assets before waiver & reimbursement: | | | 2.25 | %(g) | | | 1.92 | %(f) | | | 2.12 | % | | | 2.06 | % | | | 2.01 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 9.13 | %(g) | | | 8.94 | %(f) | | | 9.27 | %(e) | | | 9.27 | %(d) | | | 9.90 | % |

| Ratio of net investment income to average net assets before waiver & reimbursement: | | | 8.85 | %(g) | | | 8.90 | %(f) | | | 9.08 | % | | | 9.16 | % | | | 9.90 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 394.23 | % | | | 562.40 | % | | | 371.35 | % | | | 389.36 | % | | | 392.81 | % |

| (a) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the changes in net assets value per share for the period, and may not reconcile with the aggregate gains and losses in the statement of operations. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (d) | Effective November 1, 2012, the Advisor agreed to waive fees to maintain Fund expenses at 1.89% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

| (e) | Effective November 1, 2013, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

| (f) | The ratios include 0.01% of interest expense during the year ended June 30, 2015. |

| (g) | The ratios include 0.03% of interest expense during the year ended June 30, 2016. |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | June 30, 2016 | | | June 30, 2015 | | | June 30, 2014 | | | June 30, 2013 | | | June 30, 2012 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 13.03 | | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | | | $ | 9.85 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | 0.09 | | | | 0.16 | | | | 0.30 | | | | 0.25 | |

| Net realized and unrealized gain (loss) on investments | | | (0.41 | ) | | | 0.59 | | | | 1.46 | | | | 1.44 | | | | (0.17 | ) |

| Total from investment operations | | | (0.30 | ) | | | 0.68 | | | | 1.62 | | | | 1.74 | | | | 0.08 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.11 | ) | | | (0.09 | ) | | | (0.14 | ) | | | (0.38 | ) | | | (0.20 | ) |

| Tax return of capital | | | - | | | | - | | | | - | | | | (0.13 | ) | | | - | |

| Total distributions | | | (0.11 | ) | | | (0.09 | ) | | | (0.14 | ) | | | (0.51 | ) | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (a) | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 12.62 | | | $ | 13.03 | | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | (2.27 | )% | | | 5.48 | % | | | 14.88 | % | | | 18.10 | % | | | 0.86 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 8,476 | | | $ | 10,291 | | | $ | 8,670 | | | $ | 8,000 | | | $ | 7,881 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.96 | %(d) | | | 1.95 | % | | | 1.96 | % | | | 1.97 | % | | | 2.09 | %(c) |

| Ratio of expenses to average net assets before waiver & reimbursement: | | | 2.37 | %(d) | | | 2.50 | % | | | 2.50 | % | | | 2.43 | % | | | 2.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 0.85 | %(d) | | | 0.69 | % | | | 1.39 | % | | | 2.85 | % | | | 2.51 | %(c) |

| Ratio of net investment income to average net assets before waiver & reimbursement: | | | 0.44 | %(d) | | | 0.14 | % | | | 0.86 | % | | | 2.39 | % | | | 2.35 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 6.63 | % | | | 86.92 | % | | | 240.61 | % | | | 97.55 | % | | | 47.08 | % |

| (a) | Redemption fees resulted in less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (c) | Effective September 1, 2011, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). Prior to that date, the Fund did not have an expense cap. |

| (d) | The ratios include 0.01% of interest expense during the year ended June 30, 2016. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016

NOTE 1. ORGANIZATION

The IMS Family of Funds (the “Funds”), comprising the IMS Capital Value Fund (the “Value Fund”), IMS Strategic Income Fund (the “Income Fund”) and IMS Dividend Growth Fund (the “Dividend Growth Fund”), were each organized as a diversified series of 360 Funds (the “Trust”) on June 20, 2014. The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The investment objective of the Value Fund is to provide long-term growth from capital appreciation and secondarily, income from dividends. The investment objective of the Income Fund is to provide current income and secondarily, capital appreciation. The investment objective of the Dividend Growth Fund is to provide long-term growth from capital appreciation and dividends. The investment advisor of each Fund is IMS Capital Management, Inc. (the “Advisor”).

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by each Fund in the preparation of its financial statements. The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946 applicable to investment companies.

Securities Valuations – All investments in securities are recorded at their estimated fair value as described in Note 3.

Foreign Currency – Investment securities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. Reported net realized foreign exchange gains or losses arise from currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Structured Notes – Structured notes, such as reverse convertible notes, are subject to a number of fixed income risks including general market risk, interest rate risk, as well as the risk that the issuer on the note may fail to make interest and/ or principal payments when due, or may default on its obligations entirely. In addition, as a result of imbedded derivative features in these securities, structured notes generally are subject to more risk than investing in a simple note or bond issued by the same issuer.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

June 30, 2016

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Federal Income Taxes – The Funds make no provision for federal income or excise tax. The Funds intend to qualify each year as regulated investment companies (“RICs”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of their taxable income. The Funds also intend to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

As of and during the year ended June 30, 2016, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the year ended June 30, 2016, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. federal tax authorities for tax years prior to 2013.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Each Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The first in, first out method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Dividend income from real estate investment trusts (REITS) and distributions from limited partnerships are recognized on the ex-date and included in dividend income. The calendar year-end classification of distributions received from REITS during the fiscal year are reported subsequent to year end; accordingly, the Funds estimate the character of REIT distributions based on the most recent information available. Income or loss from limited partnerships is reclassified in the components of net assets upon receipt of K-1’s. Withholding taxes on foreign dividends have been provided for in accordance with each Fund’s understanding of the applicable country’s tax rules and rates. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. For bonds that miss a scheduled interest payment, after the grace period, all interest accrued on the bond is written off and no additional interest will be accrued. However, for illiquid bonds or those bonds fair valued by the Advisor, if the Advisor’s research indicates a high recovery rate in restructuring, and the Fund expects to hold the bond until the issue is restructured, past due interest may not be written off in its entirety. The ability of issuers of debt securities held by the Funds to meet their obligations may be affected by economic and political developments in a specific country or region.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

June 30, 2016

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Dividends and Distributions – The Income Fund intends to distribute substantially all of its net investment income as dividends to its shareholders on a monthly basis. The Value Fund and Dividend Growth Fund intend to distribute substantially all of their net investment income as dividends to their shareholders on at least an annual basis. Each Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Funds.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

June 30, 2016

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (continued)

For the year ended June 30, 2016 the Funds made the following reclassifications to increase (decrease) the components of net assets. The reclassifications are primarily attributable to the writeoff of a net investment loss and expiration of capital loss carryforwards.