UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

M3Sixty Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 02/29/2016

Date of reporting period: 02/29/2016

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Snow Capital Funds, series of the 360 Funds (the “registrant”) for the period ended February 29, 2016 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

Snow Capital Focused Value Fund Class A Shares (Ticker Symbol: SFOAX) Class I Shares (Ticker Symbol: SFOIX) Snow Capital Hedged Equity Fund Class A Shares (Ticker Symbol: SHEAX) Class I Shares (Ticker Symbol: SHEIX) Snow Capital Market Plus Fund Class A Shares (Ticker Symbol: SPLAX) Class I Shares (Ticker Symbol: SPLIX) Snow Capital Inflation Advantaged Equities Fund Class A Shares (Ticker Symbol: SIAAX) Class I Shares (Ticker Symbol: SIAIX) Snow Capital Dividend Plus Fund Class A Shares (Ticker Symbol: SDPAX) Class I Shares (Ticker Symbol: SDPIX) Snow Capital Mid Cap Value Fund Class A Shares (Ticker Symbol: SNMAX) Class I Shares (Ticker Symbol: SNMIX) each a series of the 360 Funds |

ANNUAL REPORT

February 29, 2016

Investment Adviser

Snow Capital Management L.P.

2000 Georgetowne Drive, Suite 200

Sewickley, Pennsylvania 15143

TABLE OF CONTENTS

| LETTER TO SHAREHOLDERS | 1 |

| INVESTMENT HIGHLIGHTS | 17 |

| SCHEDULES OF INVESTMENTS | 26 |

| STATEMENTS OF ASSETS AND LIABILITIES | 41 |

| STATEMENTS OF OPERATIONS | 43 |

| STATEMENTS OF CHANGES IN NET ASSETS | 45 |

| FINANCIAL HIGHLIGHTS | 51 |

| NOTES TO FINANCIAL STATEMENTS | 63 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 75 |

| ADDITIONAL INFORMATION | 76 |

| EXPENSE EXAMPLES | 80 |

| BOARD APPROVAL OF RENEWAL OF INVESTMENT ADVISORY AGREEMENT | 83 |

Dear Shareholder:

The S&P 500 Index delivered a -6.19% return for the 12-month period ended February 29, 2016 as concerns over a persistently strong dollar, sluggish global growth and plunging commodity prices have caused stocks to tumble as investors scaled back risk exposure.

In our semi-annual letter, we wrote about the performance differential between value and growth as well as discussed the valuation difference between the two styles. Now, we believe the value style of investment may be reaching the bottom of its cycle and the market appears ready for a fundamental shift from growth to value. As we enter 2016, we have been seeing signs of a rotation from growth to value and we believe this trend should continue. While our observations indicate that value stocks can often outperform over the long run, growth stocks have enjoyed phases of outperformance that have lasted for several years with the most recent period lasting since the financial crisis.

In 2015, market performance was driven by a narrow leadership with big growth stocks such as Netflix and Amazon masking broad market declines. Regardless of business quality, balance sheet strength and valuation, the market in general sought relative safety in a handful of stocks with the perceived growth and familiarity that provided some sense of security for investors. As we entered 2016, many of the previous leaders, the big growth stocks, have declined by wide margins while value stocks have held up, dampening some of the downside. We believe this may be indicative of an inflection point where value could outpace growth over the coming market cycle.

We believe part of the reason for the shift has been the narrowing of what continued to be very wide valuation differentials; investors have had to pay a large premium to buy growth stocks. In an economic environment that has been lacking growth, investors have been paying up for growth but the gap has become extreme. Furthermore, after years of underperformance, value stocks look like relative bargains compared to growth stocks, with valuation spreads supporting the prospect of the beginning of the value style of investing being in favor.

In an environment of slower global growth and declining earnings, investors have indiscriminately sold risk assets without regard for valuation. This has created attractive investment opportunities for us. As of this writing, our stocks sell at substantial discounts to their benchmarks based on earnings, book value and cash flow, while also offering competitive growth in forecasted earnings.

While valuations appear stretched in certain sectors, there are areas with favorable valuations including stocks in the Industrials, Consumer Discretionary and Technology sectors. Within Industrials, investor sentiment has priced the entire sector for a recession with the most pessimistic scenario reflected in current valuations. The Consumer Discretionary sector should benefit from rising employment, wage growth, and lower gasoline prices. Stocks in the Technology sector have relatively strong top line growth, high profit margins, large cash reserves, strong balance sheets and low levels of debt. We continue to favor select stocks in the Financials sector where even in the current low interest rate environment the combination of low valuations and depressed but healthy returns on capital support a compelling investment opportunity even as the prospect of rising interest rates provides further upside optionality.

Meanwhile, we believe the greatest opportunity is in energy stocks. On the supply side, natural gas production is down in most plays including low cost regions like Appalachia, and producers are throttling back capital budgets for the coming year. Unfortunately, these positive trends have been undermined by an unseasonably warm winter in the Midwest and Northeast, where heating degree days are 25% below normal. Assuming a return to normal weather in the next 12-18 months, we are increasingly confident that natural gas prices can stage a recovery, which should ultimately benefit North American producers and service providers. Fundamentals in the natural gas market have continued to improve. Within the oil market, we believe there should be a supply response given the reduction in capital expenditures over the next year. If we see definitive data points confirming this thesis we may increase our allocation to this sector.

In other sectors, including Utilities, Telecomm, Consumer Staples and REITS, bloated valuations coupled with rising interest rates may lead to price-to-earnings ("P/E") compression. We have little exposure to these sectors and we believe we have finally seen an inflection point, which could prove to be a source of positive relative performance in the future.

We believe some of the higher beta, more volatile stocks that are inexpensive may be more stable in their earnings than lower beta and less volatile stocks. Many of these companies have solid balance sheets, with strong cash flows. These companies have the wherewithal to perform well in a low growth and more volatile economic environment.

1

Company Spotlight

Abercrombie & Fitch (ANF)

Abercrombie & Fitch (ANF) is a specialty retailer that operates stores that sell casual sportswear apparel. ANF became a candidate for investment after several poor management decisions were exacerbated by weak apparel industry sales. The company’s two primary concepts, Abercrombie & Fitch and Hollister, became too similar over time leading to sales cannibalization and weak competitive positioning. Aggressive and costly expansion into international markets delivered mixed results. Overall teen retail apparel sales trailed expectations, exacerbating the impact of poor management.

The Board’s decision to fire founding CEO Mike Jefferies provided a significant catalyst for change. New brand leadership has been empowered to separate and distinguish their respective concepts. International store growth has moderated, and results have improved. The new management team has continued a series of closures designed to right-size the U.S. store footprint in light of increased online sales, which now represent over 25% of total company sales. Reduced overhead expenses and a focus on conservatively managing working capital have led to improved margins.

Sales and margins offer a significant opportunity for earnings recovery. The Hollister concept has shown signs of a sales turnaround, but ANF same store sales remain negative. The consolidated operating margin in 2015 was 3.9%, well below 10 year average of 8.5% for the S&P 500 Index specialty retail sector and 9.1% average for ANF.

In spite of abnormally negative analyst sentiment, the stock has risen 88% from its August 2015 low through February 29, 2016. Improving sentiment might offer a tailwind to valuation if management execution continues to improve. There is no net debt on the balance sheet, an open authorization to repurchase 10% of shares and the company recently paid a quarterly dividend currently yielding 2.5%.

Triumph Group (TGI)

Aerospace and defense manufacturer Triumph Group (TGI), faced significant headwinds in 2015. Investors have long doubted the company’s ability to grow its topline due to heavy exposure to maturing commercial and defense program platforms like the Boeing 747, the Boeing 777, and the C-17. Poor execution further hindered stock performance as cost overruns resulted in forward charges, meager free cash flow generation, and depressed margins. In addition, a long history of acquisitions and a decentralized operational approach created a bloated, inefficient organization. The board of directors fired TGI’s CEO in February 2015, with founder Richard Ill stepping in as interim CEO.

Despite a difficult year, green shoots of a turnaround may be starting to appear. We believe TGI is well positioned and should benefit from the robust, slow ramp of the commercial aerospace cycle, with enough levers for self-help that operations should improve in any type of macro climate. The company continued to win new business with over $735 million in revenue added in the current fiscal year. Backlog is a healthy $5 billion. At the same time, with over 60+ manufacturing facilities, TGI has ample opportunity to lower its fixed cost base. The company has embarked upon a major cost reduction initiative and a full strategic review. In late December, shares spiked after TGI announced the hiring of a new CEO, suggesting renewed confidence in the company and warming investor sentiment.

At seven times earnings, we believe that TGI is attractively valued. The company should be able to generate ample free cash flow through current headwinds, with potential for growth. TGI is a “show-me” story that has much to prove, but the company can improve results without much help from macro-economic data, the dollar, China, currency, or interest rates in our view. In addition, because of the company’s own internal issues, we expect TGI to grow earnings even as many investors begin to question the sustainability of current commercial aerospace supply and demand trends.

2

In Closing

At Snow Capital Management L.P., we are bottom-up fundamental stock pickers. We do not attempt to time the market. We stay nearly fully invested at all times, holding minimal cash balances in order to service fund redemptions. Being fully invested when an unexpected market moving event produces short-term losses can be difficult to endure, but we believe one does not maximize long-term returns by continually trying to guess the next market move. In our opinion, real wealth is built over long periods of time by sticking to an investment discipline, both in good times and bad. We continue to have a positive outlook for long-term equity returns. Our investments have near-term catalysts with attractive valuations, solid balance sheets and strong cash flows. Collectively, we believe our Funds offer favorable valuations compared to their benchmarks. As of February 29, 2016, our stocks sell at a 20% to 40% discount to their benchmarks on earnings, book value, and cash flow while, we believe, also offering superior growth potential in forecasted earnings. Over our three to five year investment horizon, we continue to believe our Funds should be well positioned to benefit from long-term growth opportunities.

Snow Capital offers mutual funds that provide an investor the opportunity to leverage the Firm’s value investing process, our resources as an institutional investor, and our professional investment discipline. The funds all employ the same investment process. Your financial professional can help you determine which fund may be best suited to you.

Thank you for choosing the Snow Capital Family of Funds.

3

Snow Capital Market Plus Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -19.62% compared to a return of -9.73% for the Russell 3000 Value Index. For the six-month period ended February 29th, 2016, the Snow Capital Market Plus Fund I Shares recorded a return of -12.00% compared to a return of -3.18% for the Russell 3000 Value Index.

How is the Fund managed?

The Snow Capital Market Plus Fund typically maintains a portfolio of 50 to 80 U.S.-listed securities. The Fund invests approximately 50% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Index. The Fund invests in each of the top 20 securities by weighting in the Russell 3000 Value Index. We use fundamental analysis and valuation techniques to determine an optimum weight for each position.

With respect to its remaining 50% of assets, the Fund mirrors the Snow Capital Focused Value strategy. Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Focused Value strategy’s portfolio includes a concentrated group of 18 to 24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Top Positive Contributors to the Fund’s Return

For the full year, the Utilities and Telecomm Service sectors added to overall performance.

Despite suppressed energy prices, Chevron Corporation (CVX) added to performance as the company shed assets, lowering sustained capital requirements. Investors were pleased to hear about plans for capital preservation during this period of commodity price uncertainty. General Electric (GE) outperformed after disclosing their intentions to exit most of GE Capital, the company’s financial services arm, and refocus efforts on their core industrial business. Nabors Industries (NBR) did well to curb spending ahead of the anticipated rig count drop spurred by falling energy prices. The Fund exited the position early in the fiscal year over concerns surrounding the duration of the lower rig count relative to years prior. Spirit AeroSystems (SPR), a tier 1 aerospace supplier, executed well during the fiscal year, initiating a share repurchase program and outperforming on free-cash-flow expectations. Higher production rates in the first half of the fiscal year combined with cost reductions boosted margins for the company. Microsoft Corporation (MSFT) outperformed driven by results from its cloud segment that exceeded expectations as the company continues to transition past the PC.

Top Detractors from the Fund’s Return

For the full year, the Financials, Energy, Materials, Consumer Discretionary, Information Technology, Health Care, Industrials, and Consumer Staples sectors detracted from overall performance.

Chesapeake Energy (CHK) underperformed due to weakness in oil and gas prices. The industry continues to work through a supply/demand imbalance. Shares of Triumph Group (TGI) detracted from performance as sales slowed on maturing commercial aerospace programs along with softer aftermarket sales. However, with a new CEO on board and a strategic review in the works, we expect investors to regain confidence in TGI once management details its comprehensive plan to right the ship and begins to execute. Shares remain extremely cheap at just six times earnings. Community Health Systems (CYH) negatively impacted performance due to continued difficulties integrating Health Management Associates (HMA), a hospital chain acquired in late 2013, and pricing concerns following a structural shift away from commercial payers and towards Medicaid. Rio Tinto PLC (RIO) fell with global iron ore prices, which reached historic lows during the fiscal year on a global supply glut driven by slowing development in China. Viacom (VIAB) sold off during the period due to continued weakness in domestic advertising, while general industry concerns around consumers ‘cutting the cable cord’ resulted in steep declines for all media stocks.

Portfolio Positioning

As of February 29th, 2016, the Fund held an overweight position in the Information Technology, Consumer Discretionary , Materials, Health Care, and Energy sectors and an underweight in the Utilities, Industrials, Consumer Staples, Telecomm Service, and Financials sectors compared to the Russell 3000 Value Index.

We reduced our exposure to the Industrials, Energy, Consumer Discretionary, and Financials sectors and increased our investments in the Information Technology, Materials, Consumer Staples, Telecomm Service, Health Care, and Utilities during the year.

4

Snow Capital Market Plus Fund (continued)

Comments on the Fund’s Five Largest Holdings

JPMorgan Chase (JPM)

Under the leadership of CEO Jamie Dimon, JPM was able to navigate through the financial crisis and achieve appropriate levels of capitalization to appease regulators in the years following. Credit trends have normalized, the core loan book is growing, and litigation issues are largely behind the company. The company remains focused on capital generation, cost reduction, regulatory compliance and shareholder returns. Because of its market leading position, we believe that JPM shares will command a premium multiple compared to other banks.

Bank of America Corporation (BAC)

One of the largest financial institutions in the United States, we believe that BAC will benefit from less competition and greater economies of scale over the long-term. Capital levels have been bolstered and the business model has been simplified under the direction of CEO Brian Moynihan.

Chevron Corp (CVX)

One of the largest integrated oil companies in the world, the Fund was provided an opportunity to enter the position following the global drop in oil prices. With manageable debt levels and a dividend paying over 4%, CVX is well positioned to weather the commodity price downturn.

MetLife, Inc (MET)

The second largest U.S. life insurer, MET should benefit from rising demand for life insurance for the growing middle class in emerging markets, baby boomers choosing variable annuity products as a way to help mitigate volatile equity markets, and increasing demand for companies to "annuitize" large, unfunded corporate pensions. Recently the company has announced that it will spin off part of its retail life business to satisfy increasing regulatory and compliance requirements. MET is expected to deploy excess capital to shareholders or for possible acquisitions.

Merck & Co (MRK)

With product offerings that includes prescription medicines, vaccines, biologic therapies, and animal health, MRK offers a diverse portfolio with long term growth potential. The company has a strong balance sheet, actively repurchases shares, and has executed on cost savings plans.

5

Snow Capital Mid Cap Value Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -22.60% compared to a return of -12.06% for the Russell 2500 Value Index and -11.72% for the Russell Midcap Value Index. For the six-month period ended February 29th, 2016, the Snow Capital Mid Cap Value Fund I Shares recorded a return of -13.76% compared to a return of -5.93% for the Russell 2500 Value Index and -5.17% for the Russell Midcap Value Index.

How is the Fund managed?

We employ a contrarian value process rooted in the fundamental analysis of individual companies to build a portfolio of investments. The Snow Capital Mid Cap Value Fund typically maintains a portfolio between 30 to 50 U.S.-listed equities. We weight position sizes based upon our assessment of upside potential and near-term catalysts. The Fund draws at least 80% of its investments from companies with market capitalizations between $3 billion and $25 billion.

Top Positive Contributors to the Fund’s Return

For the full year, no single sector added to overall performance.

Abercrombie & Fitch (ANF) outperformed due to earnings releases that exceeded expectations, driven by higher sales and margins. The positive momentum can be attributed to the company’s Hollister brand, which continues to make progress on its turnaround. First Niagara Financial Group (FNFG) added to performance following an announcement that KeyBank (KEY) planned to acquire the company in a cash and stock transaction that valued the company at more than $4 Billion. Broadcom Corporation (BRCM) was acquired by Avago Technologies, now Broadcom Limited (AVGO), in a cash and stock deal worth nearly $30 Billion, a 17% premium at the time. Open Text Corporation (OTEX), a software and services provider in the Enterprise Information Management market, delivered on previously announced restructuring initiatives while announcing a forward outlook for 2016 that investors cheered. Despite weak end markets and depressed volumes, Eaton Corporation (ETN) added to performance by delivering earnings above expectations through higher margins, expense control, and a continued commitment to aggressively repurchase shares.

Top Detractors from the Fund’s Return

For the full year, the Materials, Industrials, Energy, Health Care, Financials, Consumer Discretionary, Information Technology, Consumer Staples, and Utilities sectors detracted from overall performance.

Community Health Systems (CYH) negatively impacted performance due to continued difficulties integrating Health Management Associates (HMA), a hospital chain acquired in late 2013, and pricing concerns following a structural shift away from commercial payers and towards Medicaid. Shares of Triumph Group (TGI) detracted from performance as sales slowed on maturing commercial aerospace programs along with softer aftermarket sales. However, with a new CEO on board and a strategic review in the works, we expect investors to regain confidence in TGI once management details its comprehensive plan to right the ship and begins to execute. Shares remain extremely cheap at just six times earnings. Owens-Illinois (OI), a glass bottle and packaging manufacturer, disappointed as the macro environment, specifically in Brazil and the strong US Dollar, weighed on results. Macro factors also negatively impacted Kennametal Inc (KMT), which reduced their forward outlook multiple times on concerns surrounding China, coal, and oil/gas headwinds. Axiall Corporation (AXLL) pulled back on weak caustic prices and lower PVC volumes. The company received a takeover off from Westlake Chemical (WLK) late in the fiscal year that should offer downside protection for the company.

Portfolio Positioning

As of February 29th, 2016, the Fund held an overweight position in the Information Technology, Materials, Consumer Discretionary, and Industrials sectors and an underweight in the Financials, Utilities, Health Care, and Energy sectors compared to the Russell 2500 Value Index. The Fund held no position in the Telecomm Service or Consumer Staples sectors.

We reduced our exposure to the Energy, Industrials, Financials, Health Care, and Consumer Staples sectors and increased our investments in the Consumer Discretionary, Materials, Information Technology, and Utilities sectors during the year. The Fund maintained no position in the Telecomm Service sector.

6

Snow Capital Mid Cap Value Fund (continued)

Comments on the Fund’s Five Largest Holdings

Macy’s, Inc (M)

One of country’s leading retailers, Macy’s is adapting to the evolving retail industry by selectively closing stores and consolidating regions while simultaneously embracing the online sales channel. A steady dividend, active share repurchases, and robust cash-flow generation should continue to support shares.

Voya Financial, Inc (VOYA)

Spun out of ING in 2013, VOYA provides retirement solutions, investment management, and insurance solutions to more than 13 million customers.

Hartford Financial Services Group (HIG)

HIG is one of the oldest life insurance companies in the United States and one of the largest in terms of variable annuity assets under management. The new management team brought in after the financial crisis has worked to transform the business, lowering risk and increase return-on-equity while returning excess capital to shareholders.

International Paper Company (IP)

A stronger, restructured paper company poised to capitalize on a cyclical recovery, IP has exited underperforming, low margin business to focus on segments where they are the #1 or #2 market share position. Growth in BRIC (Brazil, Russia, India, and China) countries will help to offset mature markets in the US and Europe.

KeyCorp (KEY)

Midwestern regional bank KEY boasts nearly $100 Billion in assets while providing deposit, lending, cash management, and investment services to small, medium, and large-sized business across 12 states. The pending acquisition of First Niagara (FNFG) will add $30 Billion in assets and expand the company’s footprint.

7

Snow Capital Hedged Equity Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -20.80% compared to a return of -6.19% for the S&P 500 Index, -9.73% for the Russell 3000 Value Index, and -9.22% for the HFRX Equity Hedge Index. For the six-month period ended February 29th, 2016, the Snow Capital Hedged Equity Fund I Shares recorded a return of -14.26% compared to a return of -0.92% for the S&P 500 Index, -3.18% for the Russell 3000 Value Index, and -6.78% for the HFRX Equity Hedge Index.

How is the Fund managed?

We employ a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Hedged Equity Fund will invest primarily in equity securities, that Snow Capital believes are undervalued and selling short equity securities the Firm believes are overvalued.

Under normal market conditions, the Fund will invest approximately 80-100% of its net assets in long equity securities, or other similar investments. Using a bottom-up approach that seeks to identify companies that the Firm believes are undervalued and are likely to experience a rebound in earnings due to an event or series of events that creates a price to earnings expansion leading to higher stock price valuations. The fund may invest in securities of companies of any size and is not managed toward sector or industry weights.

The Fund will also sell securities short. Under normal market conditions, short sales will typically represent 20-40% of net assets. The Fund will employ short positions in an attempt to increase returns and/or to reduce risk. Short sales are placed after performing a bottom-up approach, and it is believed that the price of a particular security is overvalued.

Top Positive Contributors to the Fund’s Return

For the full year, the Consumer Staples and Utilities sectors added to overall performance.

Despite suppressed energy prices, Chevron Corporation (CVX) added to performance as the company shed assets, lowering sustained capital requirements. Investors were pleased to hear about plans for capital preservation during this period of commodity price uncertainty. Spirit AeroSystems (SPR) a tier 1 aerospace supplier, executed well during the fiscal year, initiating a share repurchase program and outperforming on free-cash-flow expectations. Higher production rates in the first half of the fiscal year combined with cost reductions boosted margins for the company. Despite weak end markets and depressed volumes, Eaton Corporation (ETN) added to performance by delivering earnings above expectations through higher margins, expense control, and a continued commitment to aggressively repurchase shares. PBF Energy (PBF), an independent petroleum refiner, benefitted from lower oil and gas prices along with wider crack spreads. Investors are pleased with the optionality of the asset base and the company’s ability to remain flexible depending on what the commodity price environment dictates. Nabors Industries (NBR) did well to curb spending ahead of the anticipated rig count drop spurred by falling energy prices. The Fund exited the position early in the fiscal year over concerns surrounding the duration of the lower rig count relative to years prior.

Top Detractors from the Fund’s Return

For the full year, the Financials, Information Technology, Consumer Discretionary, Energy, Materials, Industrials, and Health Care sectors detracted from overall performance.

Viacom (VIAB) sold off during the period due to continued weakness in domestic advertising, while general industry concerns around consumers ‘cutting the cable cord’ resulted in steep declines for all media stocks. Shares of Triumph Group (TGI) detracted from performance as sales slowed on maturing commercial aerospace programs along with softer aftermarket sales. However, with a new CEO on board and a strategic review in the works, we expect investors to regain confidence in TGI once management details its comprehensive plan to right the ship and begins to execute. Shares remain extremely cheap at just six times earnings. NetApp (NTAP), a provider of storage and data management solutions, underperformed as price competition, shifts in enterprise IT spending, and increased macro concerns led management to temper the 2016 outlook. Chesapeake Energy (CHK) underperformed due to weakness in oil and gas prices. The industry continues to work through a supply/demand imbalance. Bank of America (BAC) detracted following investor concerns surrounding energy exposure along with costs that exceeded expectations.

8

Snow Capital Hedged Equity Fund (continued)

Portfolio Positioning

As of February 29th, 2016, the Fund held a net overweight position in Financials, Consumer Discretionary, Materials, Information Technology, and Utilities sectors and a net underweight position in the Consumer Staples, Telecomm Service, Energy, Health Care, and Industrials sectors compared to the S&P 500 Index. As of February 29th, 2016, The Fund’s long exposure was 94.2%, short exposure was -27.5%, and net exposure was 66.7% relative to the total value of the portfolio, including cash.

We reduced our exposure to the Energy, Financials, Industrials, Consumer Discretionary, Consumer Staples, and Telecomm Service sectors and increased our investments in the Information Technology, Utilities, Health Care, and Materials sectors during the year. The Fund maintained its negative net exposure to the Telecomm Service sector.

Comments on the Fund’s Five Largest Holdings

Eaton Corporation (ETN)

As a leading industrial player in both the US and abroad, ETN is poised to benefit from many global trends, including energy-efficient, environmentally friendly power; recovery in truck and automotive markets; aerospace cycles; power transmission; non-residential recovery; and growth in data centers.

Teva Pharmaceutical Industries (TEVA)

TEVA is the world’s largest generic pharmaceuticals company featuring an expanding specialty drug portfolio focused on the CNS and respiratory therapeutic areas. The company’s robust portfolio is positioned to benefit from the expansion of generic pharmaceuticals worldwide along with the maturing biosimilar market.

Qualcomm (QCOM)

In addition to being the second largest semiconductor supplier in the world, QCOM boasts an extensive patent licensing business which stabilizes cash flow. The company will benefit from continued smartphone growth across the planet.

Macy’s, Inc. (M)

One of the country’s leading retailers, Macy’s is adapting to the evolving retail industry by selectively closing stores and consolidating regions while simultaneously embracing the online sales channel. A steady dividend, active share repurchases, and robust cash-flow generation should continue to support shares.

NetApp, Inc. (NTAP)

As the second largest external storage vendor worldwide with leading market share positions, NTAP is well positioned to benefit from the continued growth of digital information. The company’s strong presence with large enterprises coupled with partnerships with leading IT providers such as Amazon (AMZN), Cisco (CSCO), Microsoft (MSFT) and Verizon (VZ) serves as an anchor for the business.

9

Snow Capital Inflation Advantaged Equities Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -27.59% compared to a return of -7.84% for the Russell 3000 Index. For the six-month period ended February 29th, 2016, the Snow Capital Inflation Advantaged Equities Fund I Shares recorded a return of -17.49% compared to a return of -2.68% for the Russell 3000 Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance, seeking to yield a portfolio that is amply diversified across a wide spectrum of economic classifications and sectors. The Snow Capital Inflation Advantaged Equities Fund typically maintains a portfolio between 30 and 50 securities with a focus on companies who may prosper from inflation, evidenced by growing revenues, expanding margins, or other drivers of income. Inflation may be driven by macroeconomic factors, but it can also be company or sector specific, enabling a broad array of investment candidates in any economic environment. Under normal market conditions, at least 80% of the Fund’s net assets are invested in equity securities of companies with market capitalizations greater than $1 billion, and up to 15% of its net assets may be invested in U.S. Government or U.S agency obligations.

Top Positive Contributors to the Fund’s Return

For the full year, the Consumer Staples, Telecom Service, and Utilities sectors added to overall performance.

Tyson Foods (TSN) added to performance as management showed signs of execution on their turnaround plan, including expanding EBITDA margins to the highest level in the modern era of the company. PBF Energy (PBF), an independent petroleum refiner, benefitted from lower oil and gas prices along with wider crack spreads. Investors are pleased with the optionality of the asset base and the company’s ability to remain flexible depending on what the commodity price environment dictates. General Electric (GE) outperformed after disclosing their intentions to exit most of GE Capital, the company’s financial services arm, and refocus efforts on their core industrial business. Newmont Mining (NEM), a gold miner, added to performance as expectations for interest rate increases fell and global macro risks increased, pushing gold prices higher. Verizon Communications (VZ) posted strong results, driven by lower capital expenditures and an increase in demand for subsidized handsets. Capacity continues to expand and the company continues to optimize its network as it prepares to begin testing 5G technology in 2016.

Top Detractors from the Fund’s Return

For the full year, the Materials, Energy, Financials, Health Care, Consumer Discretionary, Industrials, and Information Technology detracted from overall performance.

Ultra Petroleum (UPL) shares fell in response to weak prices for natural gas. Natural gas demand this winter was well below normal due to record temperatures throughout the Northeast. Chesapeake Energy (CHK) underperformed due to weakness in oil and gas prices. The industry continues to work through a supply/demand imbalance. Community Health Systems (CYH) negatively impacted performance due to continued difficulties integrating Health Management Associates (HMA), a hospital chain acquired in late 2013, and pricing concerns following a structural shift away from commercial payers and towards Medicaid. Rio Tinto PLC (RIO) fell with global iron ore prices, which reached historic lows during the fiscal year on a global supply glut driven by slowing development in China. Another miner that was one of the Fund’s top detractors, Freeport-McMoRan (FCX), fell with the prices of copper, oil, and gas in addition to slowing demand from China.

Portfolio Positioning

As of February 29th, 2016, the Fund held an overweight position in the Materials, Financials, Energy, and Telecomm Service sectors and an underweight in the Information Technology, Health Care, Consumer Discretionary, Consumer Staples, Industrials, and Utilities sectors compared to the Russell 3000 Index.

We reduced our exposure to the Energy, Health Care, Industrials, Materials, and Consumer Staples sectors and increased our investments in the Consumer Discretionary, Telecomm Service, Information Technology, Utilities, and Financials sectors during the year.

10

Snow Capital Inflation Advantaged Equities Fund (continued)

Comments on the Fund’s Five Largest Holdings

American International Group (AIG)

AIG is a multi-line insurance company with operations spanning more than 100 countries, boasting one of the most extensive property and casualty networks of any insurer worldwide. Domestically, the company is a leading provider of life insurance and retirement services.

JPMorgan Chase (JPM)

Under the leadership of CEO Jamie Dimon, JPM was able to navigate through the financial crisis and achieve appropriate levels of capitalization to appease regulators in the years following. Credit trends have normalized, the core loan book is growing, and litigation issues are largely behind the company. The company remains focused on capital generation, cost reduction, regulatory compliance and shareholder returns. Because of its market leading position, we believe that JPM shares will command a premium multiple compared to other banks.

MetLife, Inc. (MET)

The second largest U.S. life insurer, MET should benefit from rising demand for life insurance for the growing middle class in emerging markets, baby boomers choosing variable annuity products as a way to help mitigate volatile equity markets, and increasing demand for companies to "annuitize" large, unfunded corporate pensions. Recently the company has announced that it will spin off part of its retail life business to satisfy increasing regulatory and compliance requirements. MET is expected to deploy excess capital to shareholders or for possible acquisitions.

Hartford Financial Services Group (HIG)

HIG is one of the oldest life insurance companies in the United States and one of the largest in terms of variable annuity assets under management. The new management team brought in after the financial crisis has worked to transform the business, lowering risk and increase return-on-equity while returning excess capital to shareholders.

Macy’s, Inc. (M)

One of the country’s leading retailers, Macy’s is adapting to the evolving retail industry by selectively closing stores and consolidating regions while simultaneously embracing the online sales channel. A steady dividend, active share repurchases, and robust cash-flow generation should continue to support shares.

11

Snow Capital Dividend Plus Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -20.67% compared to a return of -9.41% for the Russell 1000 Value Index. For the six-month period ended February 29th, 2016, the Snow Capital Dividend Plus Fund I Shares recorded a return of -8.49% compared to a return of -2.87% for the Russell 1000 Value Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Snow Capital Dividend Plus Fund builds on our bottom-up value process with an emphasis on both income and capital appreciation. The portfolio consists of 40-70 investments that are weighted according to total expected return with up to 25% invested in foreign equity or fixed income.

Top Positive Contributors to the Fund’s Return

For the full year, the Consumer Discretionary, Utilities, and Telecomm Service sectors added to overall performance.

Abercrombie & Fitch (ANF) outperformed due to earnings releases that exceeded expectations, driven by higher sales and margins. The positive momentum can be attributed to the company’s Hollister brand, which continues to make progress on its turnaround. Coach, Inc (COH) added to performance as the company’s brand transformation continues positive momentum, with strength across product sales, store initiatives, and marketing efforts. First Niagara Financial Group (FNFG) added to performance following an announcement that KeyBank (KEY) planned to acquire the company in a cash and stock transaction that valued the company at more than $4 Billion. Exelon Corporation (EXC) is an integrated utility with a north-east footprint. The company and its small carbon footprint will benefit from coal retirements, while on a sum-of-the-parts basis EXC’s share price is implying very little improvement in electricity fundamentals over numerous years. General Electric (GE) outperformed after disclosing their intentions to exit most of GE Capital, the company’s financial services arm, and refocus efforts on their core industrial business.

Top Detractors from the Fund’s Return

For the full year, the Energy, Materials, Information Technology, Industrials, Consumer Staples, Financials, and Health Care sectors detracted from overall performance.

Tidewater, Inc. (TDW), an operator of offshore service vessels used by the energy industry, fell in response to lower oil prices and reduced activity levels. The company continues to cut costs in response to lower spending in offshore markets. Axiall Corporation (AXLL) pulled back on weak caustic prices and lower PVC volumes. The company received a takeover offer from Westlake Chemical (WLK) late in the fiscal year that should offer downside protection for the company. Rio Tinto PLC (RIO) fell with global iron ore prices, which reached historic lows during the fiscal year on a global supply glut driven by slowing development in China. Southwestern Energy (SWN) underperformed due to weakness in oil and gas prices. The industry continues to work through a supply/demand imbalance. Hi-Crush Partners LP (HCLP), a frac sand provider, fell with oil and gas prices. When margins came under pressure for drillers, providers such as HCLP were leaned on for price and volume concessions.

Portfolio Positioning

As of February 29th, 2016, the Fund held an overweight position in the Consumer Discretionary, Materials, Financials, Telecomm Service, Energy, and Information Technology sectors and an underweight in the Health Care, Utilities, and Industrials sectors compared to the Russell 1000 Value Index. The Fund held no position in the Consumer Staples sector.

We reduced our exposure to the Industrials, Consumer Staples, Financials, Health Care, Telecomm Service, and Materials sectors and increased our investments in the Consumer Discretionary, Information Technology, Utilities, and Energy sectors during the year.

12

Snow Capital Dividend Plus Fund (continued)

Comments on the Fund’s Five Largest Holdings

Bank of America Corporation Preferred (BAC Pfd)

One of the largest financial institutions in the United States, we believe that BAC will benefit from less competition and greater economies of scale over the long-term. Capital levels have been bolstered and the business model has been simplified under the direction of CEO Brian Moynihan.

Verizon Communications (VZ)

Facing increased competition in the US wireless market, VZ’s valuation has compressed. Free-cash-flow is substantial, and should only grow as capital expenditures decline following a cyclical infrastructure build out. The company stands to benefit from further LTE penetration and the development of the internet of things.

International Paper Company (IP)

A stronger, restructured paper company poised to capitalize on a cyclical recovery, IP has exited underperforming, low margin business to focus on segments where they are the #1 or #2 market share position. Growth in BRIC (Brazil, Russia, India, and China) countries will help to offset mature markets in the US and Europe.

Annaly Capital Management Preferred (NLY Pfd)

NLY is a real estate investment trust, meaning the company must distribute at least 90% of its taxable income to shareholders annually in the form of dividends. The portfolio is comprised mostly of residential agency mortgage-backed securities with exposure to Texas, North Carolina, Florida, and Ohio. The Fund owns the 7.625% series C shares.

Hatteras Financial Corporation Preferred (HTS Pfd)

HTS, a real estate investment trust, has a portfolio of primarily residential agency mortgage-backed securities, with about 70% exposure to California. The Fund owns the 7.625% series A shares.

13

Snow Capital Focused Value Fund

How did the Fund perform?

For the full year ended February 29th, 2016, the Class I Shares return was -28.37% compared to a return of -9.41% for the Russell 1000 Value Index. For the six-month period ended February 29th, 2016, the Snow Capital Focused Value Fund I Shares recorded a return of -19.80% compared to a return of -2.87% for the Russell 1000 Value Index.

How is the Fund managed?

Snow Capital invests using a contrarian relative value process that is rooted in fundamental analysis and behavioral finance. The Snow Capital Focused Value Fund portfolio includes a concentrated group of 18-24 stocks that is assembled using a collaborative approach, with weekly input from analysts and portfolio managers. Positions are conviction weighted to reflect potential upside and near-term catalysts.

Top Positive Contributors to the Fund’s Return

For the full year, the Utilities sector added to overall performance.

Despite suppressed energy prices, Chevron Corporation (CVX) added to performance as the company shed assets, lowering sustained capital requirements. Investors were pleased to hear about plans for capital preservation during this period of commodity price uncertainty. Nabors Industries (NBR) did well to curb spending ahead of the anticipated rig count drop spurred by falling energy prices. The Fund exited the position early in the fiscal year over concerns surrounding the duration of the lower rig count relative to years prior. Despite weak end markets and depressed volumes, Eaton Corporation (ETN) added to performance by delivering earnings above expectations through higher margins, expense control, and a continued commitment to aggressively repurchase shares. Spirit AeroSystems (SPR), a tier 1 aerospace supplier, executed well during the fiscal year, initiating a share repurchase program and outperforming on free-cash-flow expectations. Higher production rates in the first half of the fiscal year combined with cost reductions boosted margins for the company. PBF Energy (PBF) an independent petroleum refiner, benefitted from lower oil and gas prices along with wider crack spreads. Investors are pleased with the optionality of the asset base and the company’s ability to remain flexible depending on what the commodity price environment dictates.

Top Detractors from the Fund’s Return

For the full year, the Financials, Energy, Materials, Information Technology, Consumer Discretionary, Industrials, and Health Care sectors detracted from overall performance.

Chesapeake Energy (CHK) underperformed due to weakness in oil and gas prices. The industry continues to work through a supply/demand imbalance. Community Health Systems (CYH) negatively impacted performance due to continued difficulties integrating Health Management Associates (HMA), a hospital chain acquired in late 2013, and pricing concerns following a structural shift away from commercial payers and towards Medicaid. Shares of Triumph Group (TGI) detracted from performance as sales slowed on maturing commercial aerospace programs along with softer aftermarket sales. However, with a new CEO on board and a strategic review in the works, we expect investors to regain confidence in TGI once management details its comprehensive plan to right the ship and begins to execute. Shares remain extremely cheap at just six times earnings. Rio Tinto PLC (RIO) fell with global iron ore prices, which reached historic lows during the fiscal year on a global supply glut driven by slowing development in China. Viacom, Inc. (VIAB) sold off during the period due to continued weakness in domestic advertising, while general industry concerns around consumers ‘cutting the cable cord’ resulted in steep declines for all media stocks.

Portfolio Positioning

As of February 29th, 2016, the Fund held an overweight position in the Consumer Discretionary, Materials, Information Technology, and Energy sectors and an underweight in the Utilities, Health Care, Industrials, and Financials sectors compared to the Russell 1000 Value Index. The Fund held no position in the Consumer Staples or Telecomm Service sectors.

We reduced our exposure to the Industrials, Financials, and Consumer Discretionary sectors and increased our investments in the Information Technology, Utilities, Materials, Health Care, and Energy sectors during the year. The Fund maintained no position in the Consumer Staples or Telecomm Service sectors.

14

Snow Capital Focused Value Fund (continued)

Comments on the Fund’s Five Largest Holdings

JPMorgan Chase (JPM)

Under the leadership of CEO Jamie Dimon, JPM was able to navigate through the financial crisis and achieve appropriate levels of capitalization to appease regulators in the years following. Credit trends have normalized, the core loan book is growing, and litigation issues are largely behind the company. The company remains focused on capital generation, cost reduction, regulatory compliance and shareholder returns. Because of its market leading position, we believe that JPM shares will command a premium multiple compared to other banks.

Bank of America Corporation (BAC)

One of the largest financial institutions in the United States, we believe that BAC will benefit from less competition and greater economies of scale over the long-term. Capital levels have been bolstered and the business model has been simplified under the direction of CEO Brian Moynihan.

MetLife, Inc. (MET)

The second largest U.S. life insurer, MET should benefit from rising demand for life insurance for the growing middle class in emerging markets, baby boomers choosing variable annuity products as a way to help mitigate volatile equity markets, and increasing demand for companies to "annuitize" large, unfunded corporate pensions. Recently the company has announced that it will spin off part of its retail life business to satisfy increasing regulatory and compliance requirements. MET is expected to deploy excess capital to shareholders or for possible acquisitions.

Eaton Corporation (ETN)

As a leading industrial player in both the US and abroad, ETN is poised to benefit from many global trends, including energy-efficient, environmentally friendly power; recovery in truck and automotive markets; aerospace cycles; power transmission; non-residential recovery; and growth in data centers.

Teva Pharmaceutical Industries (TEVA)

TEVA is the world’s largest generic pharmaceuticals company featuring an expanding specialty drug portfolio focused on the CNS and respiratory therapeutic areas. The company’s robust portfolio is positioned to benefit from the expansion of generic pharmaceuticals worldwide along with the maturing biosimilar market.

Past performance is not a guarantee of future results.

The views expressed herein are solely the opinions of Snow Capital Management L.P. We make no representations as to their accuracy. This communication is intended for informational purposes only and does not constitute a solicitation to invest money nor a recommendation to buy or sell certain securities. Equity investments are not appropriate for all investors. Individual investment decisions should be discussed with a financial advisor.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Snow Capital Market Plus Fund, Snow Capital Mid Cap Value Fund, Snow Capital Hedged Equity Fund, Snow Capital Inflation Advantage Fund, Snow Capital Dividend Plus Fund, and Snow Capital Focused Value Fund may use options or futures contracts which have the risks of unlimited losses and the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates, and currency exchange rates. These investments may not be suitable for all investors.

Please see the Total Return Tables on the following pages for performance information on the Funds’ Class A and Class I shares. The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about each Fund can be found in each Fund’s prospectus. Please read it carefully before investing.

15

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of fund holdings.

The S&P 500 Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Russell 3000 Value Index is an unmanaged index of those Russell 3000 companies chosen for their value orientation.

The Russell 3000 Index is an unmanaged index of those Russell 3000 companies based on total market capitalization which represents approximately 98% of the investable U.S. equity market.

The Russell 2000 Value Index is an unmanaged index of those Russell 2000 companies chosen for their value orientation.

The Russell 2500 Value Index is an unmanaged index of those Russell 2500 companies chosen for their value orientation.

The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe.

Indexes are unmanaged. You cannot invest directly in an index.

Beta measures the volatility of the fund, as compared to that of the overall market. The Market's beta is

set at 1.00; a beta higher than 1.00 is considered to be more volatile than the market, while a beta lower

than 1.00 is considered to be less volatile.

Active Share measures the degree of difference between a fund portfolio and its benchmark index.

The Price-to-Earnings (P/E) ratio is calculated as the current price of a of stock divided by its trailing twelve month operating earnings per diluted share of equity

The Price/Book ratio is calculated as the current share price of a stock divided by its book value per diluted share of equity

Valuation Spreads are the differences between the growth and value indexes relative multiples including but not limited to Price-to-Earnings, Price-to-Sales, Price-to-book and Free Cash Flow.

Book value is the net asset value of a company, calculated by subtracting total liabilities from total assets.

Tangible Book Value is what an investor would expect to receive if the company liquidated all of its assets. For example, the tangible book value of company “XYZ” would be the liquidation value of all of its assets combined if they were valued on the accounting books today, including all land, capital, inventory, etc.

Cash flow is calculated as the most recent four quarters of income before extraordinary and discontinued items plus accumulated depreciation and amortization

Free cash flow is earnings before depreciation, amortization, and non-cash charges minus maintenance capital expenditures.

Earnings per diluted share is a performance metric used to gauge the quality of a company's earnings per share (EPS) if all convertible securities were exercised.

Market Cap is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share.

Dividend yield is calculated by annualizing the last quarterly dividend paid and dividing it by the current share price. The dividend yield is that of the securities held in the portfolio; it is not reflective of the yield distributed to shareholders.

16

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

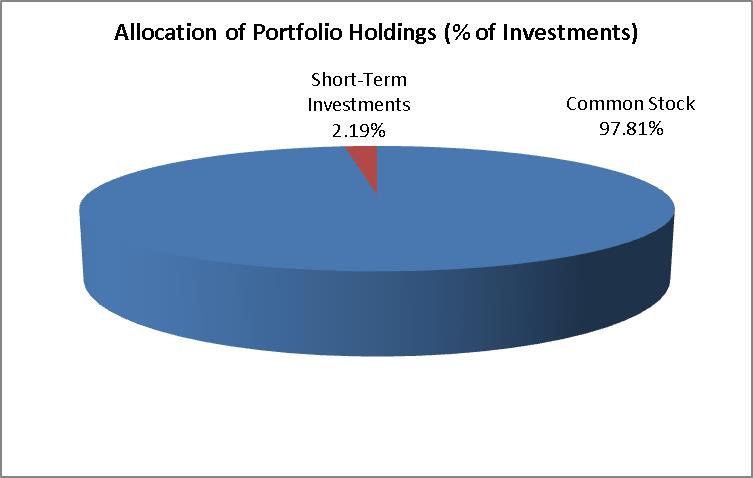

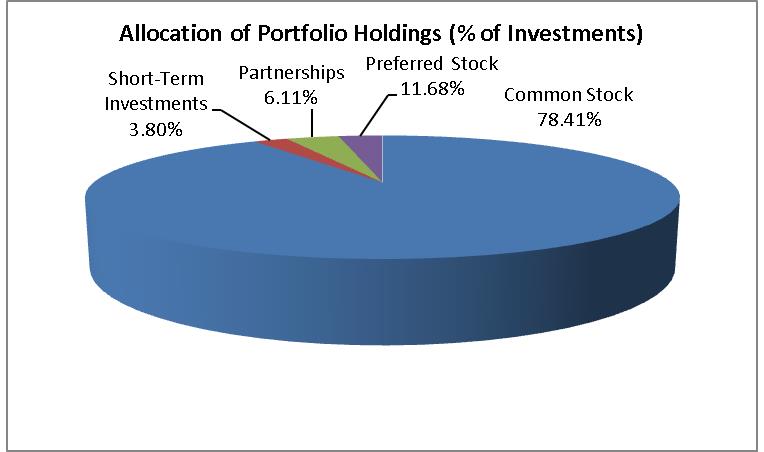

Snow Capital Focused Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities, fixed income securities, or other similar investments. Under normal market conditions the Fund will invest at least 80% of its net assets in equity securities of companies with market capitalizations greater than $1 billion.

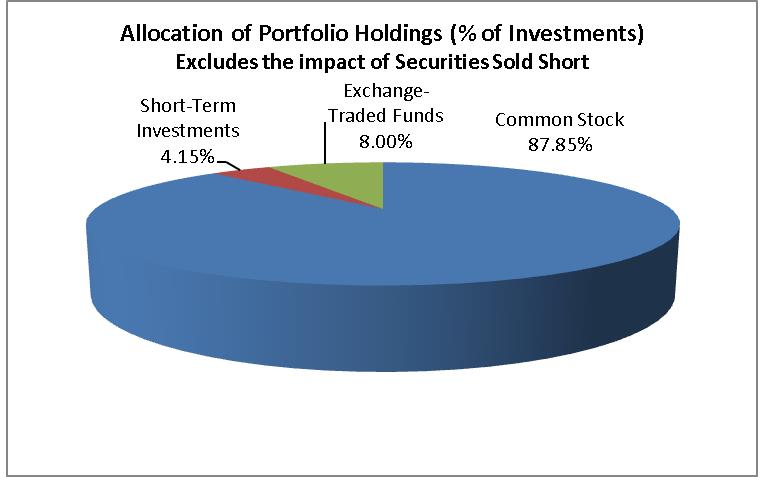

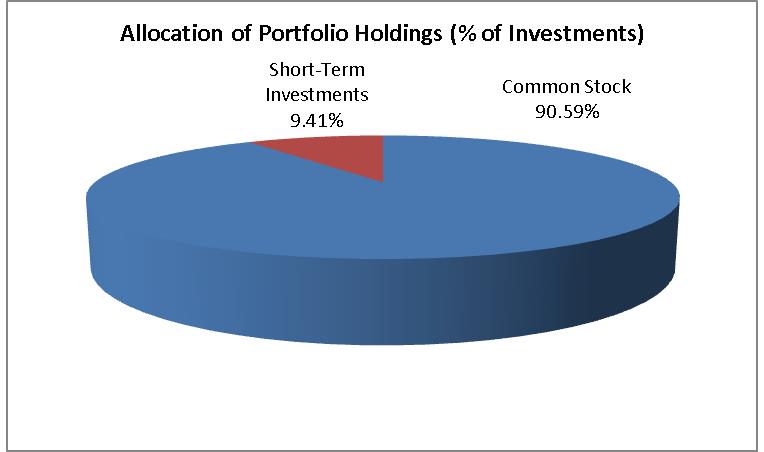

Snow Capital Hedged Equity Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal with lower volatility than the U.S. equity market. The Fund’s principal investment strategy is to invest at least 80% of long net assets in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities. The Adviser will utilize short equity positions in individual equity securities and ETFs to reduce the portfolio’s overall market exposure. The Fund may borrow money from banks or other financial institutions to purchase securities, commonly known as “leveraging,” in an amount not to exceed one-third of its total assets, as permitted by the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may invest in equity and/or fixed income securities of companies of any size. In addition to domestic securities, the Fund may also directly or indirectly invest in foreign equity, including investments in emerging markets.

The percentages in the above graphs are based on the portfolio holdings of the Funds as of February 29, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

17

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

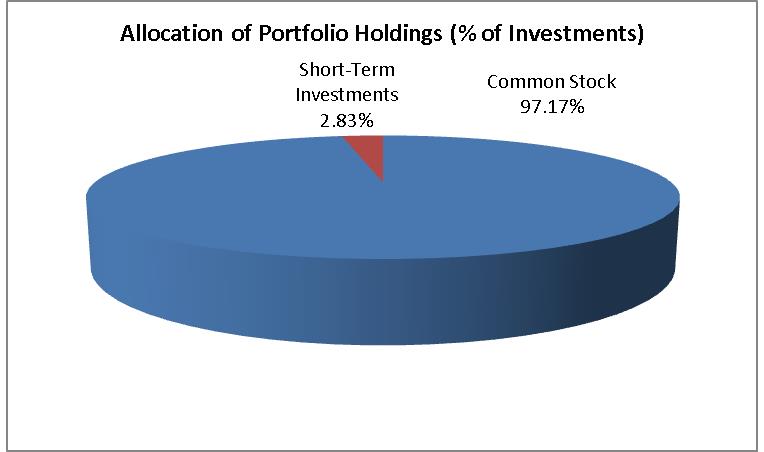

Snow Capital Market Plus Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities. Under normal market conditions, the Fund will invest approximately 80% of its net assets in equity securities of companies that are among the top 300 securities by weighting in the Russell 3000 Value Index. The Fund will invest in each of the top 20 securities by weighting in the Russell 3000 Value Index. The Adviser will use fundamental analysis and valuation techniques to determine an appropriate weight for each position.

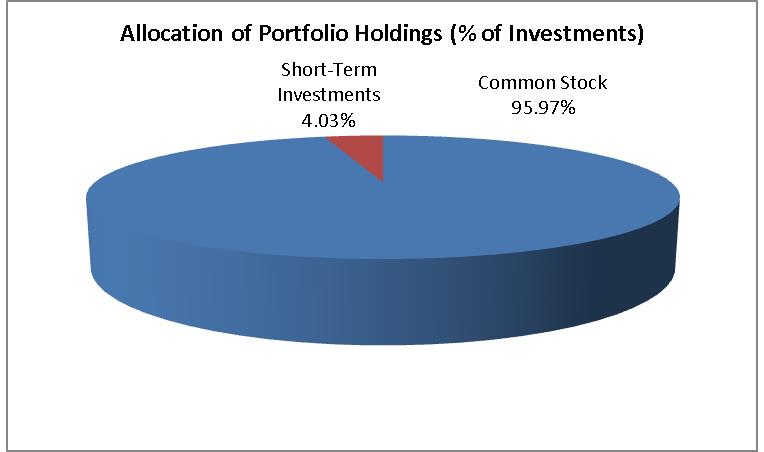

Snow Capital Inflation Advantaged Equities Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities.

The percentages in the above graphs are based on the portfolio holdings of the Funds as of February 29, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

18

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

Snow Capital Dividend Plus Fund

The investment objective of the Fund is long-term growth of capital and income. The Fund’s principal investment strategy is to invest in a diversified portfolio of equities, bonds, preferred stock, and options. Under normal market conditions, the Fund will invest at least 80% of its net assets in equity securities that pay a dividend and are within the market capitalization range of the Russell 1000 Value Index. With respect to its remaining assets, the Fund may invest in corporate bonds, sovereign bonds, convertible bonds, preferred stocks, or other securities or instruments whose prices are linked to the value of the underlying common stock of the issuer of the securities. The Fund may have up to 25% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

Snow Capital Mid Cap Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest at least 80% of its net assets in equity securities of companies within the market capitalizations range of the Russell Mid Cap Value Index (“mid-cap securities”). The Fund’s investments in equity securities may include common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities of mid-cap companies. In addition to equity securities, the Fund may also invest up to 15% of its net assets in U.S. Government or U.S. agency obligations. The Fund may have up to 20% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

The percentages in the above graphs are based on the portfolio holdings of the Funds as of February 29, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

19

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

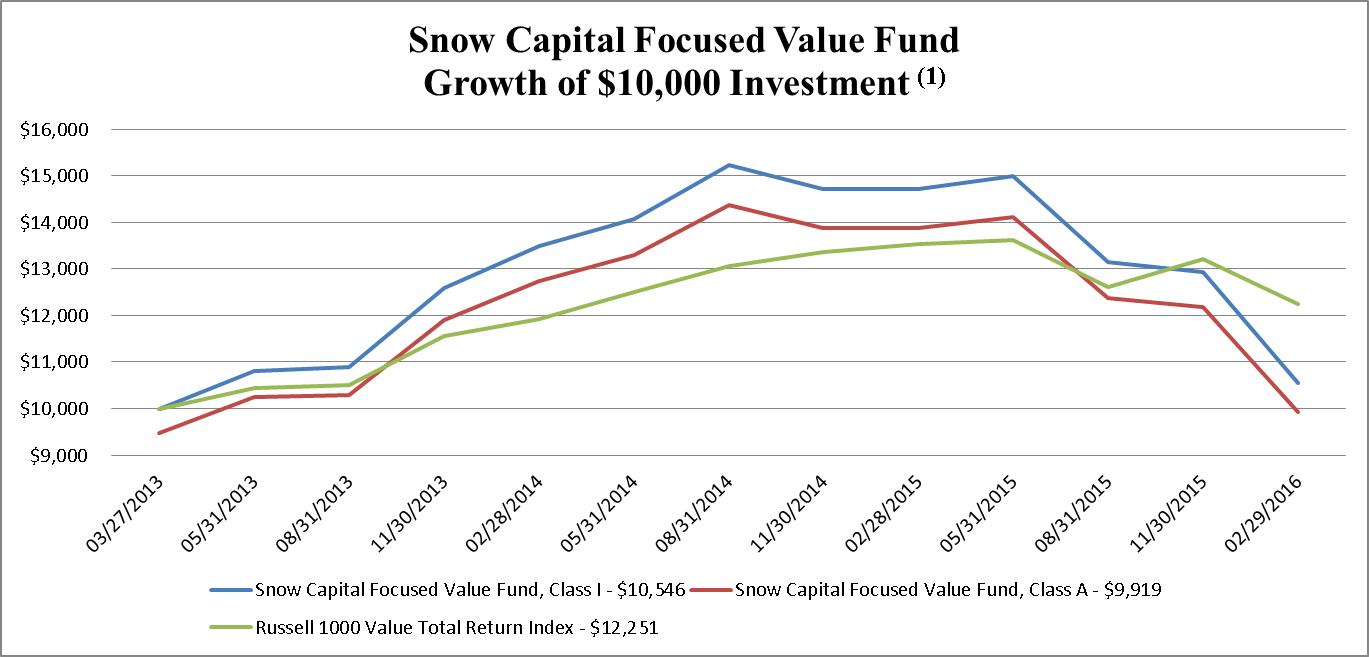

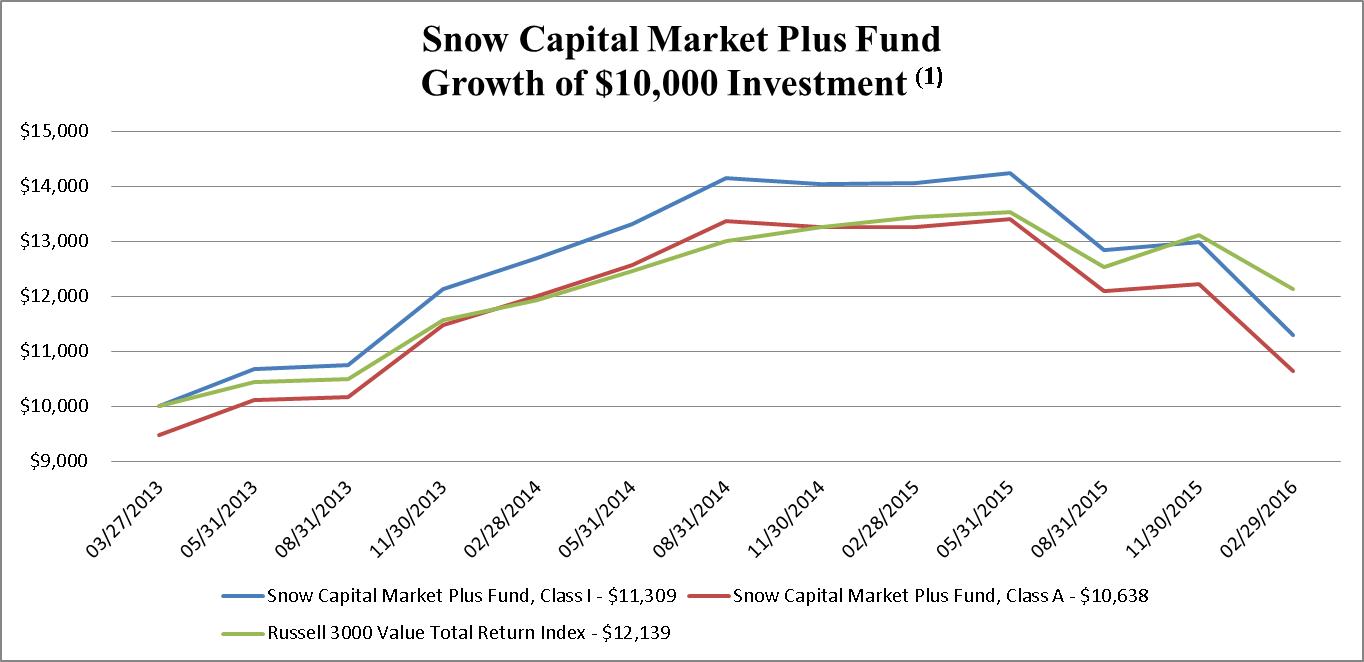

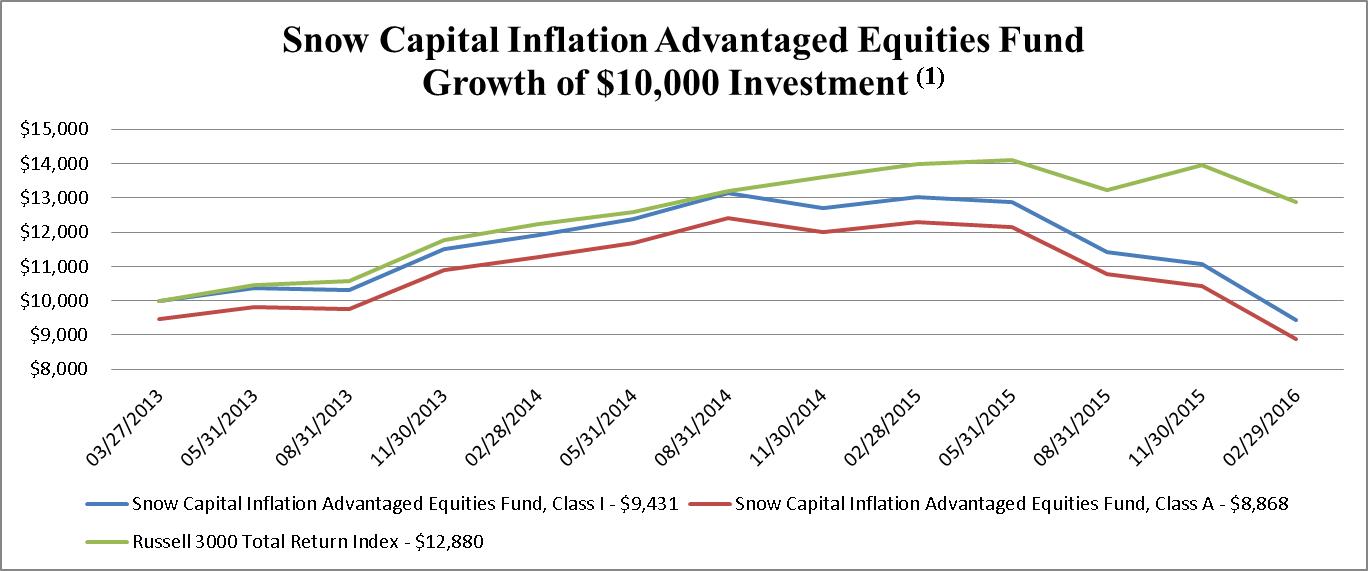

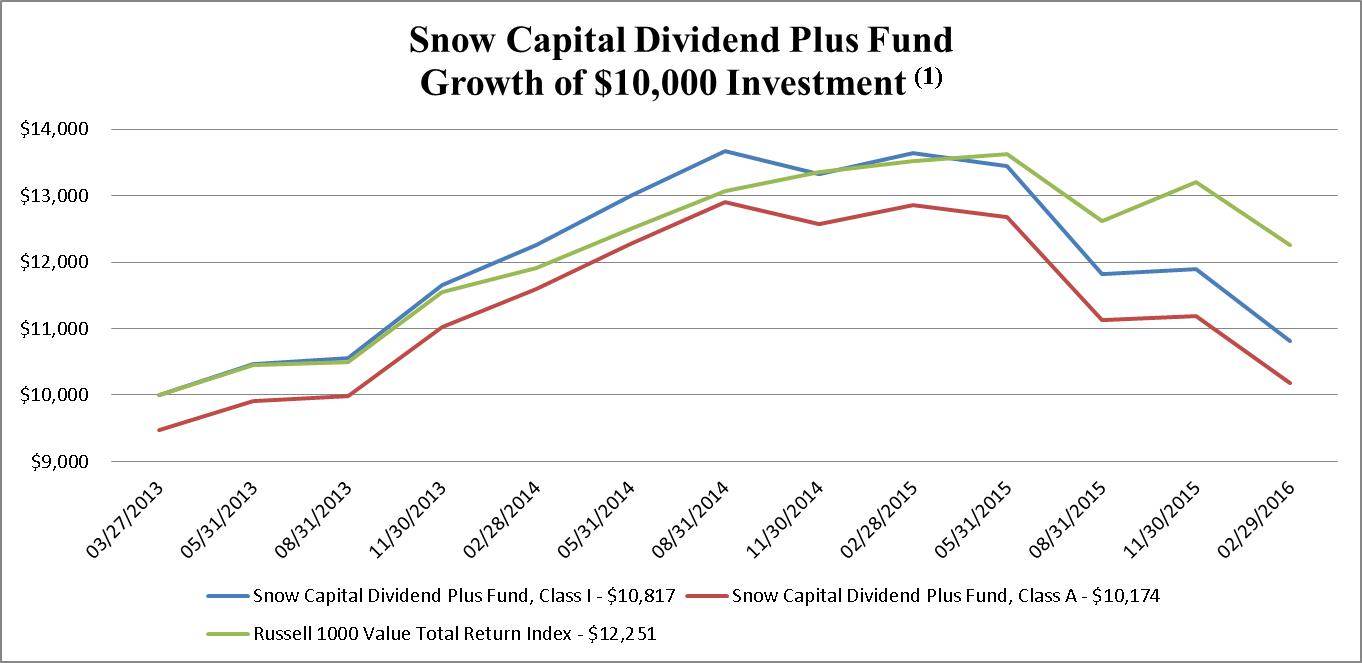

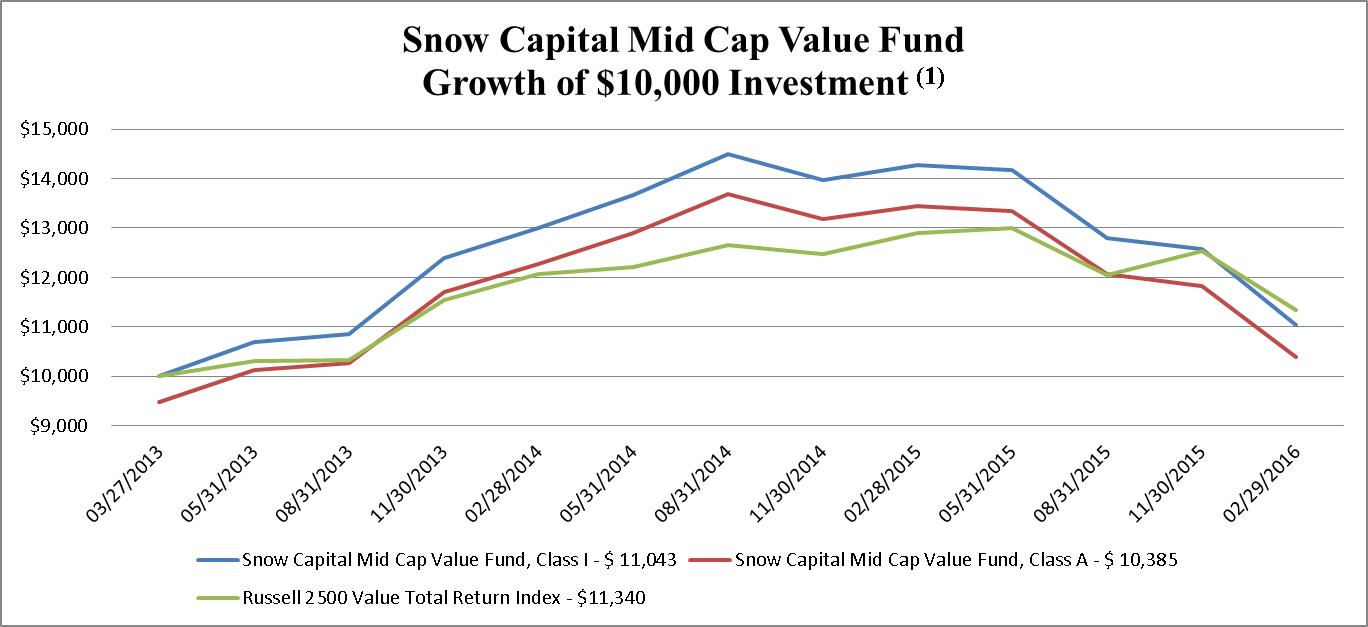

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

| Snow Capital Focused Value Fund Class A without sales charge | (28.52)% | 1.58% |

| Snow Capital Focused Value Fund Class A with sales charge | (32.27)% | (0.28)% |

| Snow Capital Focused Value Fund Class I | (28.37)% | 1.83% |

| Russell 1000 Value Total Return Index | (9.41)% | 7.18% |

(2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Focused Value Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Focused Value Fund, which will generally not invest in all the securities comprising the index.

20

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

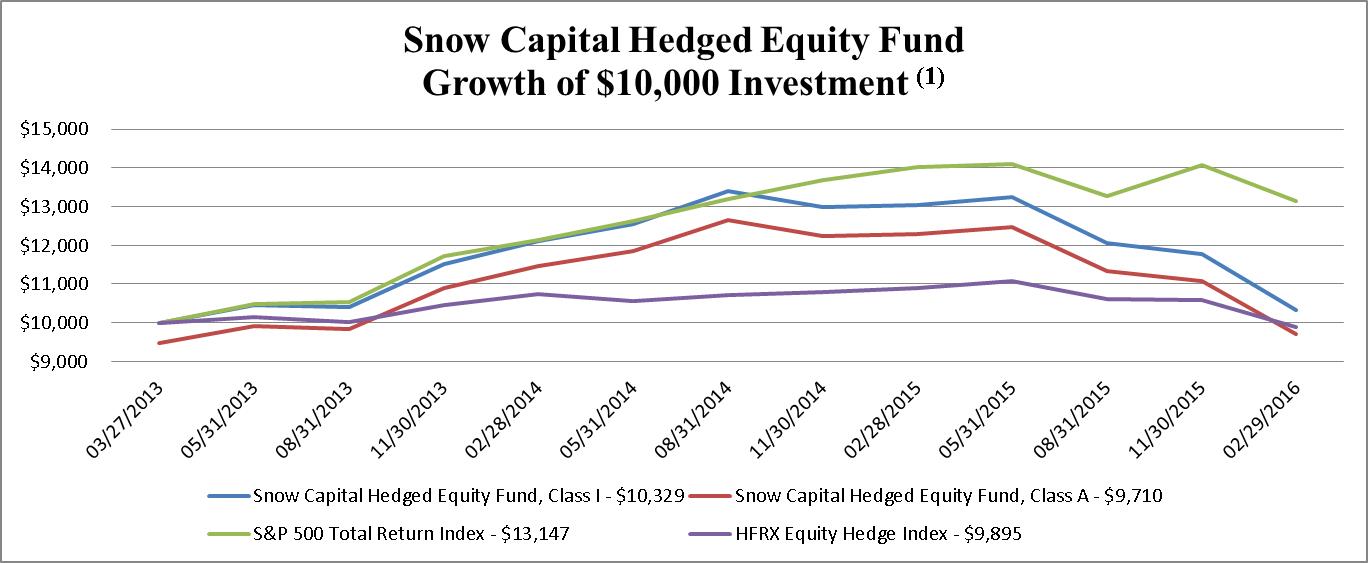

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

Snow Capital Hedged Equity Fund Class A without sales charge | (21.00)% | 0.84% |

Snow Capital Hedged Equity Fund Class A with sales charge | (25.14)% | (1.00)% |

Snow Capital Hedged Equity Fund Class I | (20.80)% | 1.11% |

S&P 500 Total Return Index | (6.19)% | 9.79% |

HFRX Equity Hedge Index | (9.22)% | (0.36)% |

(2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Hedged Equity Fund versus the S&P 500 Total Return Index and the HFRX Equity Hedge Index. The S&P 500 Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The HFRX Equity Hedge Index uses quantitative techniques to maximize representation of the Hedge Fund Universe. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index and the HFRX Equity Hedge Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the indices; so too with the Snow Hedged Equity Fund, which will generally not invest in all the securities comprising the indices.

21

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

| Snow Capital Market Plus Fund Class A without sales load | (19.80)% | 4.04% |

Snow Capital Market Plus Fund Class A with sales load (2) | (24.01)% | 2.14% |

| Snow Capital Market Plus Fund Class I | (19.62)% | 4.29% |

| Russell 3000 Value Total Return Index | (9.73)% | 6.84% |

(2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Market Plus Fund versus the Russell 3000 Value Total Return Index. The Russell 3000 Value Index is an unmanaged index of those Russell 3000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Market Plus Fund, which will generally not invest in all the securities comprising the index.

22

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

| Snow Capital Inflation Advantaged Equities Fund Class A without sales charge | (27.78)% | (2.23)% |

Snow Capital Inflation Advantaged Equities Fund Class A with sales charge (2) | (31.57)% | (4.02)% |

| Snow Capital Inflation Advantaged Equities Fund Class I | (27.59)% | (1.98)% |

| Russell 3000 Total Return Index | (7.84)% | 9.03% |

(2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Inflation Advantaged Equities Fund versus the Russell 3000 Total Return Index. The Russell 3000 Index is an unmanaged index of those Russell 3000 companies based on total market capitalization which represents approximately 98% of the investable U.S. equity market. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 3000 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Inflation Advantaged Equities Fund, which will generally not invest in all the securities comprising the index.

23

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

| Snow Capital Dividend Plus Fund Class A without sales charge | (20.87)% | 2.46% |

Snow Capital Dividend Plus Fund Class A with sales charge (2) | (25.02)% | 0.59% |

| Snow Capital Dividend Plus Fund Class I | (20.67)% | 2.72% |

| Russell 1000 Value Total Return Index | (9.41)% | 7.18% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Dividend Plus Fund versus the Russell 1000 Value Total Return Index. The Russell 1000 Value Index is an unmanaged index of those Russell 1000 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 1000 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Dividend Plus Fund, which will generally not invest in all the securities comprising the index.

24

| Snow Family of Funds | ANNUAL REPORT |

Investment Highlights

February 29, 2016 (Unaudited)

(1) | The Class A shares includes the deduction of the current maximum initial sales charge of 5.25%. The minimum initial investment for Class I shares is $1,000,000. |

| Returns as of February 29, 2016 | One Year ended February 29, 2016 | Since Inception from March 27, 2013 through February 29, 2016 |

| Snow Capital Mid Cap Value Fund Class A without sales charge | (22.80)% | 3.18% |

Snow Capital Mid Cap Value Fund Class A with sales charge (2) | (26.85)% | 1.30% |

| Snow Capital Mid Cap Value Fund Class I | (22.60)% | 3.45% |

| Russell 2500 Value Total Return Index | (12.06)% | 4.39% |

| (2) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Snow Capital Mid Cap Value Fund versus the Russell 2500 Value Total Return Index. The Russell 2500 Value Index is an unmanaged index of those Russell 2500 companies chosen for their value orientation. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the Russell 2500 Value Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Snow Capital Mid Cap Value Fund, which will generally not invest in all the securities comprising the index.

25

| SNOW FAMILY OF FUNDS | ANNUAL REPORT |

Snow Capital Focused Value Fund

SCHEDULE OF INVESTMENTS

February 29, 2016